and

t2Supported by Natural Sciences and Engineering Research Council of Canada

Improved Gaussian Mean Matrix Estimators in high-dimensional data

Abstract

In this paper, we introduce a class of improved estimators for the mean parameter matrix of a multivariate normal distribution with an unknown variance-covariance matrix. In particular, the main results of Chételat and Wells (2012)[Improved Multivariate Normal Mean Estimation with Unknown Covariance when is Greater than . Annals of Statistics, 2012, 40(6), 3137–3160] are established in their full generalities and we provide the corrected version of their Theorem 2. Specifically, we generalize the existing results in three ways. First, we consider a parameter matrix estimation problem which enclosed as a special case the one about the vector parameter. Second, we propose a class of James-Stein matrix estimators and, we establish a necessary and a sufficient condition for any member of the proposed class to have a finite risk function. Third, we present the conditions for the proposed class of estimators to dominate the maximum likelihood estimator. On the top of these interesting contributions, the additional novelty consists in the fact that, we extend the methods suitable for the vector parameter case and the derived results hold in the classical case as well as in the context of high and ultra-high dimensional data.

keywords:

[class=MSC]keywords:

1 Introduction

Inspired by the work in Chételat and Wells (2012), we consider an estimation problem concerning the mean matrix of a Gaussian random matrix in the context where the variance-covariance matrix is unknown. In the realm of multivariate statistical analysis, the estimation of the matrix mean plays a pivotal role, especially when dealing with covariance or correlation matrices. Traditional methods of matrix mean estimation have been effective for low-dimensional datasets. However, with the advent of big data and the increasing dimensionality of datasets in fields such as genomics (see Tzeng et al. (2008), Pardy et al. (2018)), finance (see Fan et al. (2011)), and neuro-imaging data analysis (see Zhou et al. (2013)), these traditional techniques often fall short. High-dimensional data, where the number of variables can exceed the number of observations, presents unique challenges, including increased computational complexity and the curse of dimensionality.

High-dimensional data analysis plays a pivotal role in statistical inference, enabling researchers and analysts to extract valuable insights, build precise models, and draw meaningful conclusions from intricate and extensive datasets. By addressing the distinctive challenges posed by high-dimensional data, where the number of features exceeds the number of observations, this approach equips us with essential tools to gain a comprehensive understanding across diverse real-world applications. These applications span various fields, such as text mining, image and video analysis, genomic, and financial analytic.

The need for improved matrix mean estimation techniques in the context of high-dimensional data has become increasingly evident. Such techniques aim to provide more accurate and computationally efficient estimates, even when faced with the intricacies of high-dimensional spaces. By leveraging advancements in optimization, regularization, and matrix theory, researchers are developing innovative approaches to address the challenges posed by high-dimensional multivariate models. These enhanced methods not only promise better statistical properties but also open the door to more sophisticated analyses in various scientific and technological domains. This exploration delves into the cutting-edge methodologies for improved matrix mean estimation in high-dimensional settings, elucidating their theoretical underpinnings, practical applications, and potential impact on multivariate data analysis.

In this paper, we improve the results in Chételat and Wells (2012) in three ways. First, we propose a class of matrix James-Stein estimators in the context of high-dimensional data. In the special case of parameter vector, the proposed class of estimators yields the class of estimators given in Chételat and Wells (2012). Second, we derive a necessary and sufficient condition for the members of the proposed class of James-Stein estimators to have a finite risk. For the special case of vector estimators, the established result provides a corrected version of Theorem 2 of Chételat and Wells (2012). Third, we establish a sufficient condition for the proposed class of James-Stein estimators to dominate the classical maximum likelihood estimator (MLE).

The remainder of this paper is structured as follows. In Section 2, we present the statistical model and the primary results. Namely, we present in this section crucial propositions and lemma which play a vital role in deriving the main results of this paper. In Section 3, we present the main results of this paper. In Section 4, we present some simulation results which corroborate the main findings of this paper. Further, in Section 5, we present some concluding remarks. Finally, for the convenience of the reader, technical results and some proofs are given in Appendix A and Appendix B.

2 Statistical model and some fundamental results

In this section, we present the statistical model and set up some notations used in this paper. We also present some fundamental results which are useful in deriving the main results of this paper. To set up some notations, let denote -dimensional identity matrix, let be a positive definite matrix and let be a -matrix. For a given -matrix , let stand for a vectorization operator that transforms the matrix into a column vector by vertically stacking the columns of the matrix . Further, let denote the Kronecker product of the matrices and , let denote a -column Gaussian random vector with means and covariance and, for a random matrix , let to stand for . We also denote to stand for -random matrix that follows Wishart distribution with degrees of freedom and non-centrality parameter . For matrices and , let , define

In the sequel, despite the fact that the target parameter is a matrix, we generally use the same notations/symbols as in Chételat and Wells (2012). In particular, we consider the scenario where we observe a -random matrix with a positive definite matrix.

Our objective is to estimate the mean matrix in the context of high or ultra-high-dimensional data with unknown nuisance parameter. We also consider that the random matrix is observed along with the matrix , and we consider the scenario where and are independent in context where , with . To better connect to the data collection, we consider the case where observations of -matrices , , …, which are independent and identically distributed as . For , let . Under this sampling plan, the maximum likelihood estimators (MLE) of and are respectively given by

| (2.1) |

To rewrite under the form of a simple quadratic form, let and let be -column vector with all components equal to 1. From these notations, the sample variance-covariance can be rewritten as

| (2.2) |

and then, using the properties of multivariate normal distributions along with the fact that is idempotent matrix with the rank , one can verify that or equivalently . Further, there exists an orthogonal matrix such that

Let . We have and

| (2.6) |

with . In the similar way as in Chételat and Wells (2012), in the sequel, we let and . We also let , i.e. we let . In classical inference where , the problem studied can be solved by using the results in Stein (1981), Bilodeau and Kariya (1989), Konno (1990), Konno (1991) and references therein. To give another closely related reference, in the case where is a vector with , we also quote Marchand and Perron (2001) in the context of a bounded normal mean and Fourdrinier et al. (2004) in the context of elliptically symmetric distributions. We also quote Bodnar et al. (2019) who studied the similar estimation problem of in the case where in the large-samples context.

Nevertheless, more research needs to be done for the cases of high and ultra-high dimensional data i.e. the case where the total number of features (or ). The problem studied here is more general that the one where the total number of features is bigger than the which does not need to tend to infinity as considered in Bodnar et al. (2019). In this paper, not only we solve the problem in the context of high and ultra-high dimensional data, we push the boundaries further by considering the more general case of ultra-high dimensional data. Specifically, we consider the scenario where . Indeed, if , as this holds in our case, then whenever . With (2.1) and (2.6) in mind, to simplify the derivation of the main results of this paper, we consider the statistical model that satisfies the following assumption.

Assumption 1.

We observe two independent random matrices and with and where with a -symmetric and positive definite matrix.

Note that for the special case where , the problem becomes the one studied in Chételat and Wells (2012). Nevertheless, there is a major mistake in one of their main result. Thus, on the top of generalizing the problem studied in Chételat and Wells (2012), we also revise their main result. One of the main difficulty consists in the fact that, in cases where , the estimator of , denoted as , is singular almost surely. Since is singular almost surely, the traditional inverse does not exist, with probability one, while for the cases where , such inverse of the matrix is used in James-Stein type estimators. Because of that, we need to adopt whenever needed the generalized inverse also known as Moore-Penrose inverse. Thus, let denote the Moore-Penrose inverse of the matrix . We also let

| (2.7) |

Further, for some real-valued function defined on , let

| (2.8) |

Note that the classical MLE . Further, note that for the special case where , the estimator in (2.8) yields the one given in Chételat and Wells (2012). In this paper, we derive the necessary and sufficient conditions for the estimator in (2.8) to have a finite quadratic risk function. As mentioned above, beyond the generalisation of the methods given in Chételat and Wells (2012), the additional novelty consists in the fact that we also revise some main results in the above quoted paper. To this end, we also derive some important mathematical results which have interest in their own. Nevertheless, we are very pleased to acknowledge that our work was strongly inspired by that of Chételat and Wells (2012).

Proposition 2.1.

Suppose that 1 holds and let be a -matrix valued function defined on . Then

, provided that ;

.

The proof of this proposition is given in Appendix A. By using Proposition 2.1, we derive the following result which is very useful in deriving the main result of this paper.

The proof of this result is given in the Appendix A. It should be noticed that, for the special case where , Part (i) of Proposition 2.2 yields Lemma 2 of Chételat and Wells (2012).

3 Main results

In this section, we present the main result of this paper. In particular, we derive a theorem which demonstrates that, for the special case where , if the additional assumption is not taken into account, Theorem 2 of Chételat and Wells (2012) does not hold. To illustrate this point, we prsent a counterexample that contradicts Theorem 2 of Chételat and Wells (2012). Moreover, we derive a result which revise Theorem 2 of Chételat and Wells (2012). On the top of that, we generalize the corrected version of Theorem 2 in Chételat and Wells (2012).

The proof of this lemma is given in the Appendix B. We also derive the following lemma which is crucial in revising Theorem 2 of Chételat and Wells (2012).

Proof.

Assume that and let . We have

| (3.1) |

Since , thus . Then,

| (3.2) |

Let be -matrix of the form and let . We have

Then,

Therefore,

| (3.3) |

Let and be the smallest and biggest nonzero eigenvalues of respectively. Since is semi-positive definite we have

| (3.4) |

Therefore, together with (3.1), we get

| (3.5) |

where is the biggest nonzero eigenvalue of . Note that depends on and depends on and . Since, and are independent we get

Further, we have

where . Therefore, we get

Hence

| (3.6) |

Since , we get

| (3.7) |

where .

Let be a random variable such that . By (3.7) We have

Further, since and , we have with probability one and then,

and then, since with probability one,

almost surely. Therefore, together with (3.5) and (3.6), we get

Hence,

Conversely, assume that . From (3.4), we have

where is the smallest nonzero eigenvalue of . Again, note that depends on and depends on and . Since, and are independent we get

Then,

| (3.8) |

Since , we have , and then

Therefore, by (3.7) we get this implies that , which completes the proof. ∎

It should be noted that although Theorem 2 of Chételat and Wells (2012) does not require the condition that , the main step of their proof consists in proving that . However, the result of Lemma 3.2 shows that without requiring that (or for the case studied in Chételat and Wells (2012) where ), it is impossible to have . The fact is, as mentioned in Foroushani and Nkurunziza (2023), the proof given in the quoted paper has a major mistake which resulted in the incorrect use of the Cauchy-Schwarz inequality. In particular, the misuse of this inequality on their page 3153, led to an incorrect bound for the quantity . By using Lemma 3.2, we derive the following theorem which represents a generalisation of the corrected version of Theorem 2 of Chételat and Wells (2012). The established theorem is useful in deriving the domination of over .

Theorem 3.1.

Proof.

By Lemma A.5 and triangle inequality, we get

then

and then

Therefore, since almost surely, we have

| (3.9) | ||||

Since is semi-positive definite, from Lemma A.1, we have . Then,

| (3.10) |

Hence,

| (3.11) |

Therefore,

| (3.12) |

Then, by (3.11) and (3.12) together with (3.9) we get

| (3.13) |

Further, since then by Lemma 3.2, we get .

Similarly to Part , by Part Proposition A.1, we get

this proves Part .

Since , by Part , we get . Therefore, from Part of Proposition A.2, we have

Further, from Proposition A.5, we have

Hence,

which completes the proof. ∎

It should be noted that Part (i) of Theorem 3.1 corresponds to Theorem 2 of Chételat and Wells (2012) in the special case where . Nevertheless, Chételat and Wells (2012) omitted to impose the condition, about the rank of , as required in Theorem 3.1. In this section, we give a counter-example which shows that if , the above result as well as Theorem 2 of Chételat and Wells (2012) do not hold i.e. .

Corollary 3.1.

Suppose that the conditions of Theorem 3.1 hold and suppose that . Then, for all and , .

Proof.

Since and a.s., we have a.s. Therefore, . Then, by Theorem 3.1, we get , which completes the proof. ∎

Corollary 3.2.

Suppose that the conditions of Theorem 3.1 hold with

for some , for all and suppose that . Then,

if and only if .

Proof.

If then, by Theorem 3.1, we get . Conversely, suppose that . We have

Then, since and , we get

.

Therefore, since , we get

Therefore

In the following example, we consider a positive function such that . This emphasizes the significance of the assumption regarding with probability one, where . In particular, we demonstrate that when , it is possible to have . This finding renders obsolete one of the crucial steps in the proof of Theorem 2 of Chételat and Wells (2012).

Example 1.

Let and where and are independent random variable distributed as i.e. . let . Let be the spectral decomposition of where . Since

Therefore

Note that and are functions of and note that . Then,

where Therefore,

almost surely. Then,

with probability one. Hence,

| (3.14) |

Further, we have

where . Therefore, we get

Then,

and then,

By using Theorem 3.1 and Proposition 2.2, we derive the following result which establishes the risk dominance of over . In the special case where , the established result yields Theorem 1 of Chételat and Wells (2012).

Theorem 3.2.

Proof.

Let . Thus . The risk difference under the quadratic loss between and is

This gives

| (3.16) |

From Proposition 2.2 and Part (iii) of Theorem 3.1, we have

Since is non-negative and non-decreasing, and since , we have

| (3.17) |

Under the condition (i) on and since almost surely, we have

and equivalently

Therefore, by (3.17), we get

therefore , which completes the proof. ∎

4 Numerical study

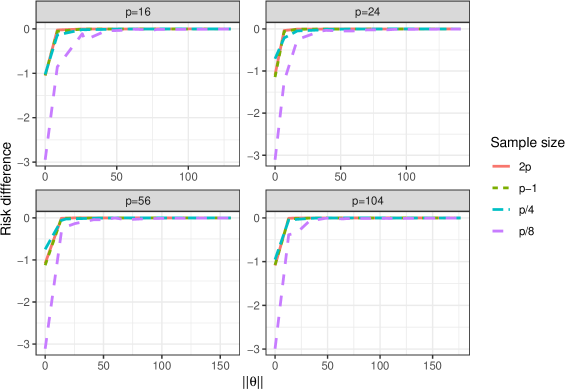

In this section, we present some numerical results which corroborate the established theoretical results. In this simulation study, we consider and and the proposed estimator is Further, we generate samples for various values of equals to along with 11 different matrix configurations for fixed and we set for the first case, and for the second case. We obtained similar results for both cases and thus, to save the space of this paper, we only report the results of the first case. For each value of , we explore four distinct sample sizes: . This comprehensive approach allows us to investigate the impact of different , and combinations on the results of the simulation. Figure 1 shows the simulation results. One can see that the simulation study supports the theoretical findings. As established theoretically, the risk difference between the proposed estimator and the classical estimator is not positive. This leads to the dominance of over .

Furthermore, as presented in Figure 1, a consistent pattern becomes evident across all four cases: the risk difference between the two estimators diminishes as the norm of the mean matrix, , increases. This intriguing observation serves as a compelling incentive for potential future research. Further exploring how the mean matrix is related to the difference in risk between these estimators under the invariant quadratic loss opens up an interesting path for further investigation.

5 Concluding remark

In this paper, we introduced a class of James-Stein type estimators for the mean parameter matrix of a multivariate normal in the context where the covariance-variance is unknown. The problem studied is more general than the one considered in Chételat and Wells (2012) and we established the revised version of their Theorem 2. In particular, we generalized the existing results in three ways. First, we studied estimation problem concerning the parameter matrix in the context of high-dimensional data. Second, we proposed a class of matrix shrinkage estimators and, we established the conditions for any member of the proposed class to have a finite risk. Third, we analysed the risk dominance of the proposed class of estimators versus the classical maximum likelihood estimator. To this end, we establish some mathematical results which are interesting in their own. The additional novelty consists in the fact that, in the context of matrix estimation problem, the derived results hold in the classical case as well as in the context of high-dimensional data. We also present some numerical results which corroborate the theoretical findings. As a direction for future research, it would be interesting to relax the conditions for the established Theorem 3.2 to hold.

Appendix A Proofs of some fundamental results

Lemma A.1.

Let be a symmetric and positive semi-definite matrix. Then,

.

Proof.

Let be the eigenvalues of . Then, are the eigenvalues of . Therefore, since , , we have , this completes the proof. ∎

Proof of Proposition 2.1.

Let where is a symmetric positive definite square root of . Then, . Therefore, . Let . Then, we have and then,

| (A.1) |

Therefore, by (A.1) we have

Therefore, by Lemma 1 of Stein (1981), we get

Then,

| (A.2) |

Now, by applying the chain rule in (A.2), we have

| (A.3) |

Since , we have then,

| (A.4) |

Therefore, by replacing (A.4) in (A.3), we get

and then,

Hence,

We have . Then

,which completes the proof.

∎

Proof of Proposition 2.2.

From Part of Proposition 2.1, we get

and by Part of Lemma 3.1, we have

, this proves Part .

From Part of Proposition 2.1, we have

and from Part , we have

and then, , this proves Part , and which completes the proof. ∎

The proof follows from algebraic computations.

Proof.

Since , we have . Then, . Therefore, . Also, we have

Therefore, we have

where . Hence, by Lemma 1 of Stein (1981), we get

Then,

and then,

From Part to , we have

and then,

which completes the proof. ∎

Proof.

For the sake of simplicity, in the sequel, we write to stand for .

Proof.

By Proposition 1 of Chételat and Wells (2012), we have

where is Kronecker delta. Therefore,

Then, , and then

this proves Part .

We have

Further, from Theorem 4.3 in Golub and Pereyra (1973), we get

Now, by Part , we get

Further, we have

Then,

this proves Part .

By Part , we get

Therefore,

this proves Part (iii).

We have

Then,

Now, by using Part , we get

| (A.9) |

| (A.10) |

Since , we get

| (A.11) |

| (A.12) |

Since , we get

| (A.13) |

Since we get

| (A.14) |

and letting , , we have

and then,

| (A.15) |

Therefore, from , we get

which completes the proof. ∎

By using Lemma A.2, we establish below a lemma which is crucial in deriving the main result of this paper. As intermediate step, we derive first the following proposition. To simplify some mathematical expressions, let

Proposition A.4.

Let , , and be as defined in Theorem 3.1. Then,

;

;

;

; ;

;

; ;

.

Proof.

We have . Then,

This gives and then,

| (A.16) |

We have

Hence,

| (A.17) |

We have then,

Then

| (A.18) |

We have . Then,

Hence,

| (A.19) |

We have,

Then,

| (A.20) |

We have

Then, , and then,

| (A.21) |

(vii) We have

Then,

| (A.22) |

We have

Therefore,

| (A.23) |

(ix) We have and then,

Then

and then,

| (A.24) |

this completes the proof. ∎

By combining Lemma A.2 and Proposition A.4, we derive the following result.

Lemma A.3.

Proof.

We have . Then,

Hence,

this proves Part .

Proof.

Part follows from algebraic computations.

From (A.8), . Hence, by Part of Lemma A.3, we get

this proves Part .

By Parts - along with Proposition A.3, . Then,

and then,

which completes the proof. ∎

It should be noted that Part of Proposition A.5 generalizes Lemma 1 in Chételat and Wells (2012). Indeed, in the special case where , we and then, we get the result established in Lemma 1 of Chételat and Wells (2012).

Appendix B On the derivation of the main results

Proof of Lemma 3.1.

(i) The proof of Part (i) follows from classical differential calculus along with some algebraic computations.

(ii) We have . Then,

this proves Part .

(iii) By Parts and , we get

this proves the statement in .

(iv) By Part , we have

Then, and then,

this gives . Hence,

this completes the proof. ∎

Proposition B.1.

Let , , and be as defined in Theorem 3.1. Then

Proof.

Let . By Part of Theorem 3.1, we get

Then

and then

Further, since , we get . Then, and then

Hence,

this completes the proof. ∎

References

- Bilodeau and Kariya [1989] M. Bilodeau and T. Kariya. Minimax estimators in the normal manova model. Journal Of Multivariate Analysis, 28:260–270, 1989.

- Bodnar et al. [2019] T. Bodnar, O. Okhrin, and N. Parolya. Optimal shrinkage estimator for high-dimensional mean vector. Journal of Multivariate Analysis, 170:63–79, 2019.

- Chételat and Wells [2012] D. Chételat and M. T. Wells. Improved multivariate normal mean estimation with unknown covariance when is greater than . The Annals of Statistics, 40(6):3137–3160, 2012.

- Fan et al. [2011] J. Fan, J. Lv, and L. Qi. Sparse high dimensional models in economics. Annu Rev Econom., 3:291–317, 2011.

- Foroushani and Nkurunziza [2023] A. A. Foroushani and S. Nkurunziza. A note on improved multivariate normal mean estimation with unknown covariance when is greater than . arXiv:2311.13140v1, pages 1–5, 2023. URL https://arxiv.org/abs/2311.13140.

- Fourdrinier et al. [2004] D. Fourdrinier, W. E. Strawderman, and M. T. Wells. Minimax estimators in the normal manova model. Journal Of Multivariate Analysis, 85:24–39, 2004.

- Golub and Pereyra [1973] G. H. Golub and V. Pereyra. The differentiation of pseudo-inverses and nonlinear least squares problems whose variables separate. SIAM J. Numer. Anal., 10:413–432, 1973.

- Konno [1990] Y. Konno. Families of minimax estimators of matrix of normal means with unknown covariance matrix. Journal of Japan Statist. Soc., 20:191–201, 1990.

- Konno [1991] Y. Konno. On estimation of a matrix of normal means with unknown covariance matrix. Journal of Multivariate Analysis, 36:44–55, 1991.

- Marchand and Perron [2001] E. Marchand and F. Perron. Improving on the mle of a bounded normal mean. The Annals of Statistics, 29(4):1078–1093, 2001.

- Pardy et al. [2018] C. Pardy, S. Galbraith, and S. W. Wilson. Integrative exploration of large high-dimensional datasets. The Annals of Applied Statistics, 12(1):178–199, 2018.

- Stein [1981] C. M. Stein. Estimation of the mean of a multivariate normal distribution. Ann. Statist., 9(6):1135–1151, 1981.

- Tzeng et al. [2008] J. Tzeng, H. Lu, and W. Li. Multidimensional scaling for large genomic data sets. BMC Bioinformatics, 9(179):1–17, 2008.

- Zhou et al. [2013] H. Zhou, L. Li, and H. Zhu. Tensor regression with applications in neuroimagingdata analysis. Journal of American Statistical Association, 108(502):540–552, 2013.