citnum

Estimating a multivariate Lévy density

based on discrete observations

Abstract

Existing results for the estimation of the Lévy measure are mostly limited to the onedimensional setting. We apply the spectral method to multidimensional Lévy processes in order to construct a nonparametric estimator for the multivariate jump distribution. We prove convergence rates for the uniform estimation error under both a low- and a high-frequency observation regime. The method is robust to various dependence structures. Along the way, we present a uniform risk bound for the multivariate empirical characteristic function and its partial derivatives. The method is illustrated with simulation examples.

Keywords: Lévy processes, jump processes, multivariate density estimation, spectral methods,

low-frequency, high-frequency

MSC 2020: 62G05, 62G07, 62M15, 60G51

1 Introduction

Lévy processes are a staple to model continuous-time phenomena involving jumps, for instance in physics and finance, see Woyczyński, (2001) and Cont & Tankov, (2004), respectively. Naturally, manifold such applications call for multivariate processes which significantly complicates the theoretical analysis compared to the onedimensional case. Matters worsen as practitioners often only have time-discrete data at their disposal which obstructs the identification of the jumps and hence the calibration of such models. Statistical results in this setting are typically limited to the onedimensional case or omit the estimation of the jump distribution, despite the practical relevance. In the present work, we study exactly this problem: estimating the jump distribution of a multivariate Lévy process based on discrete observations.

On a theoretical level, the distribution of the Lévy process is uniquely determined by its characteristic triplet, that is, the volatility-matrix, the drift and the Lévy measure. The latter characterizes the jump distribution we are interested in. From a statistical point of view, the estimation of the Lévy measure is most challenging as we are faced with a nonparametric problem.

The literature commonly distinguishes the following two observation regimes for a Lévy process observed at equidistant time points : Under the low-frequency regime, is fixed as , whereas under the high-frequency regime. Our estimation method is robust across sampling frequencies.

Motivated by the clearer separation between the jumps themselves and the Gaussian component as under the high-frequency regime, threshold-based estimators have been applied extensively. Beyond the overview given by Aït-Sahalia & Jacod, (2012), Duval & Mariucci, (2021) apply such an approach to the estimation of the Lévy measure, Gegler & Stadtmüller, (2010) study the estimation of the entire Lévy triplet and Mies, (2020) estimates the Blumenthal-Getoor index. However, these references are restricted to the onedimensional case and multidimensional extensions seem tedious due to the multitude of directions in which the process can jump. A notable exception is the work by Bücher & Vetter, (2013), who estimate the tail-integrals of a multivariate Lévy process.

Under the low-freqency regime, we cannot identify the intermittent jumps even in the absence of a Gaussian component resulting in an ill-posed inverse problem, see Neumann & Reiß, (2009). A popular way out is the spectral method, see Belomestny & Reiß, (2015), which leverages the relationship of the Lévy triplet with the characteristic function of the process at any time point. Turning the observations of the process into increments, this characteristic function is estimated and then used to draw inference on parts of the Lévy triplet. The method was first considered by Belomestny & Reiß, (2006) in the context of exponential Lévy models and has since been studied extensively, see Belomestny, (2010), Gugushvili, (2012), Nickl & Reiß, (2012), Reiß, (2013), Trabs, (2015).

We adapt this approach to the multivariate setting by constructing a nonparametric estimator for the Lévy density , assuming that it exists. Our estimator requires no knowledge of the volatility and drift parameters and works uniformly over fully nonparametric classes of Lévy processes with mild assumptions. In particular, Lévy processes with infinite jump activity are allowed. The uniform rates we achieve naturally extend those from the onedimsional case and optimality in our setting is discussed.

When estimating the Lévy density close to the origin, we enhance our method with an estimator for the volatility. The estimation of the volatility matrix itself has previously been studied, see Papagiannouli, (2020, high-frequency) and Belomestny & Trabs, (2018, low-frequency). A related issue is the estimation of the covariance matrix in deconvolution problems, see Belomestny et al., (2019). However, even the proven minimax-optimal rates of convergence are too slow as to not affect our overall rates under the low-frequency regime. It is sufficient to estimate the trace of the volatility matrix and we show that this can be done with a much faster rate. With this enhancement, there is no additional loss in the rate for the estimation of the Lévy density.

An effect emerging for multivariate processes is the possibility of different dependence structures between the components which can be in disagreement with the existence of a Lévy density in the form of a Lebesgue density on the whole state space. Statistical results in such settings are even rarer. Belomestny, (2011) estimates the Lévy density for a time changed Lévy process with independent components. We propose a quantification of the estimation error when integrating against regular test functions under various forms of dependence structures without modifications to our method.

The paper is organized as follows. In Section 2, we introduce the estimation method and state our main results along with a short outline of the proof and the key tools used. The empirical performance of our estimator is illustrated in a simulation examples in Section 3. The full proofs are postponed to Section 4.

2 Estimation method and main results

We begin by introducing some notation: Throughout, an -valued Lévy process with Lévy measure is observed in the form of of increments at equidistant time points with time difference and overall time horizon :

For and , set , , , and . For a multi-index , we set , .

If , then the characteristic function of is given by

for some drift parameter and some positive semidefinite volatility matrix , see Sato, (1999). Denoting by the Laplace operator, i.e.

for a function which is twice differentiable in every direction, we have

| (1) | ||||

| (2) |

where the integral in the first line is component-wise and .

To motivate our estimator for , suppose . In view of 2, we then have and can naturally be estimated using the empirical characteristic function leading to

| (3) |

with the indicator ensuring a well-defined expression. Therefore, granted has a Lévy density also denoted by , it is reasonable to propose the estimator

| (4) |

where is kernel a limited by bandwidth () satisfying for some order that for any multi-index with we have

| (5) |

For , we recover the jump density estimator by Trabs, (2015) to estimate quantiles of Lévy measures.

A suitable kernel can be constructed as from an integrable even function with support contained in , and vanishing mixed partial derivatives of order up to at . For the theoretical analysis, it will be useful to consider a kernel with product structure for kernels on , each with order , i.e. for all ,

Obviously, such a product kernel also fulfills 5.

2.1 Convergence rates

To control the estimation error, we need to impose smoothness and moment conditions on the Lévy density. To this end, we introduce for a number of moments , a regularity index , an open subset and a universal constant

| (6) | ||||

| (7) |

where

denotes the Hölder norm with regularity index for any function which has derivatives of order up to on . denotes the set of all Hölder-regular functions on with regularity index . Since we will require regularity of the Lévy density in a small -neighborhood beyond for a uniform rate, we set for some radius .

In view of 3 it is natural, that the estimation error will also depend on the decay behavior of the characteristic function, which in turn, is affected by the presence of a Gaussian component. Therefore, we distinguish the following two classes of Lévy processes. First, is the so-called mildly ill-posed case for a decay exponent

As alluded to in the introduction, a Gaussian component overclouds the jumps in addition to the discrete observations and is therefore treated as the severely ill-posed case for

The parameters and control the exponential decay of the characteristic funtion. Note that already implies .

In the mildly ill-posed case, the Blumenthal-Getoor index of the Lévy process is at most , whereas in the severely ill-posed case it is at most , where we set and for .

For these regularity classes, we are able to quantify the estimation error as follows.

test 1.

Let and let the kernel satisfy 5 with order . Let be an open set which is bounded away from . We have for , :

-

(M)

If is bounded and , then uniformly in

If with , the choice yields the rate

-

(S)

If , and , then uniformly in

If with , the choice yields the rate .

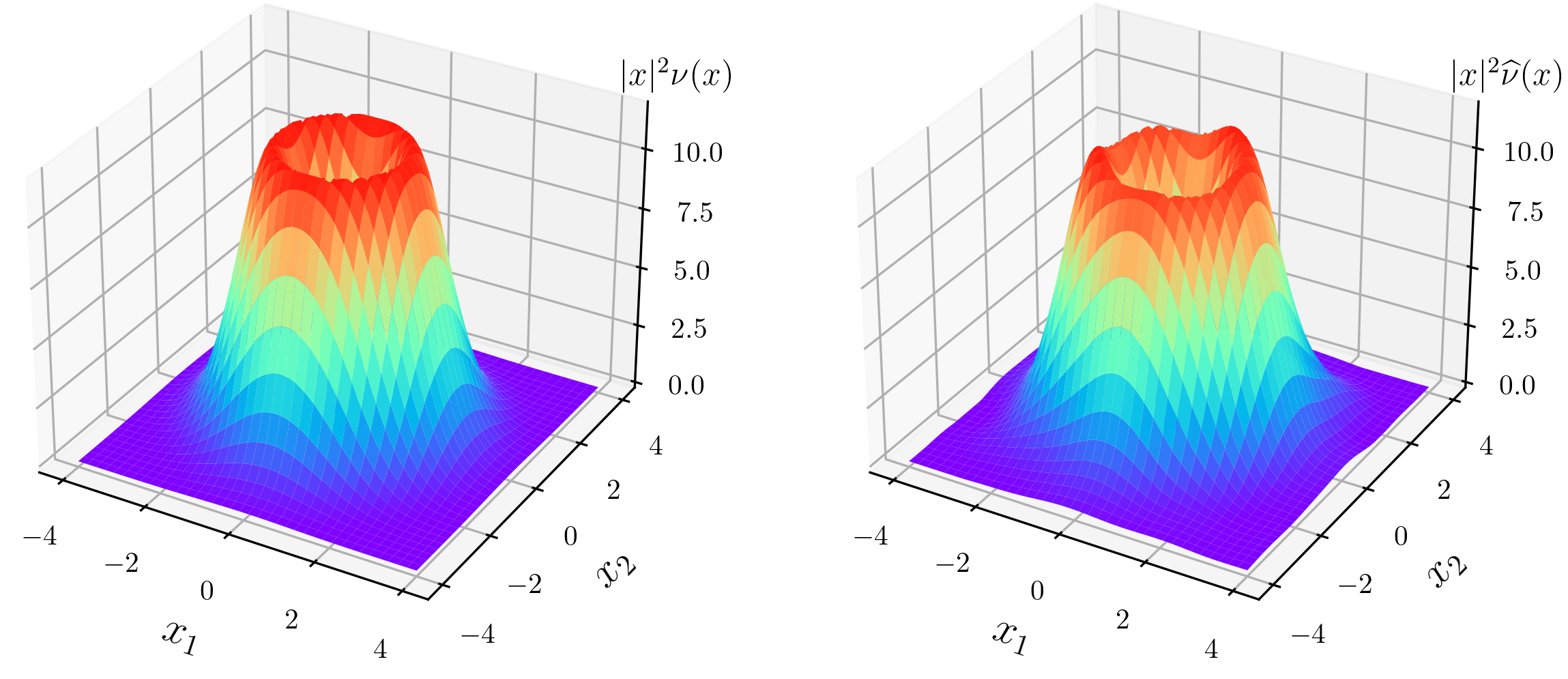

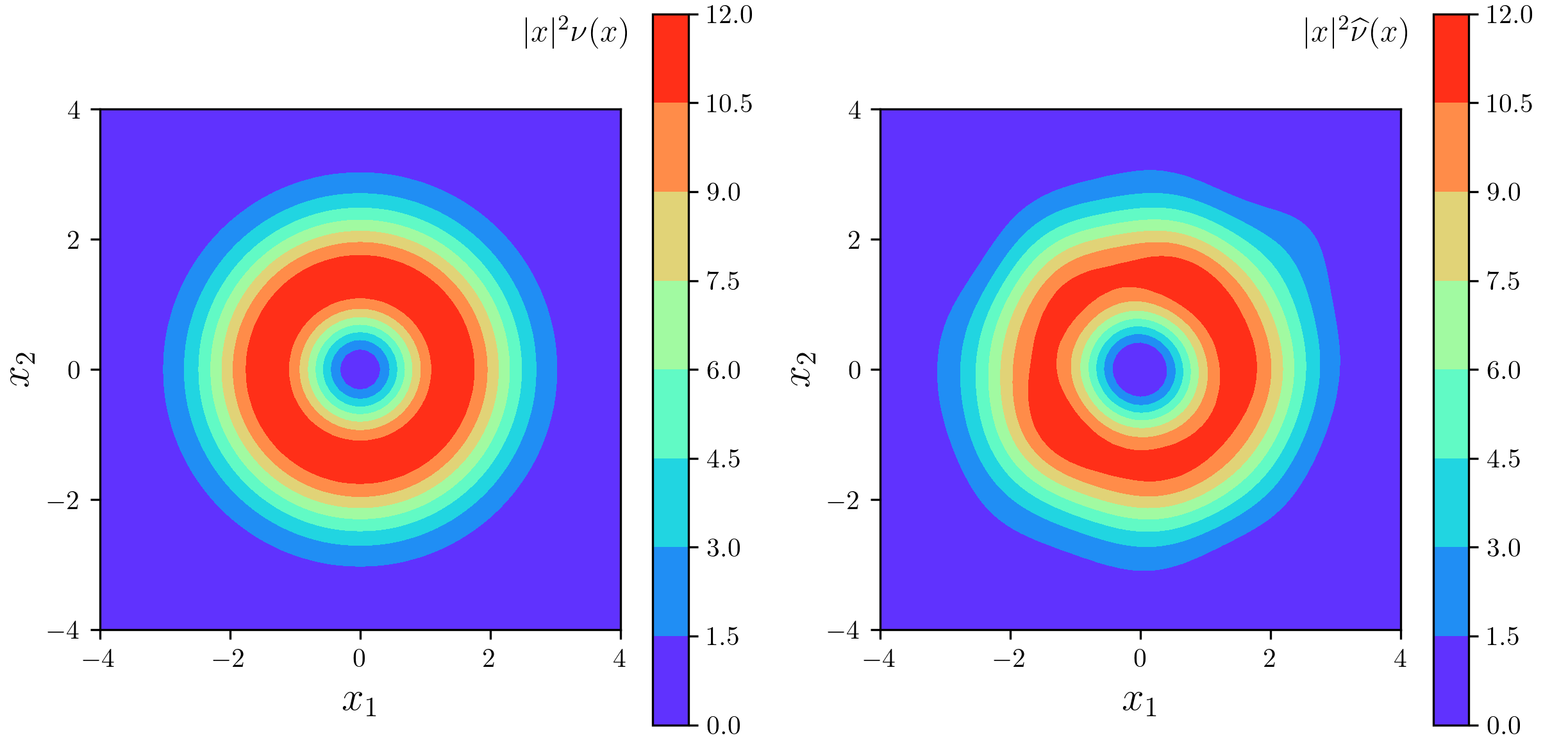

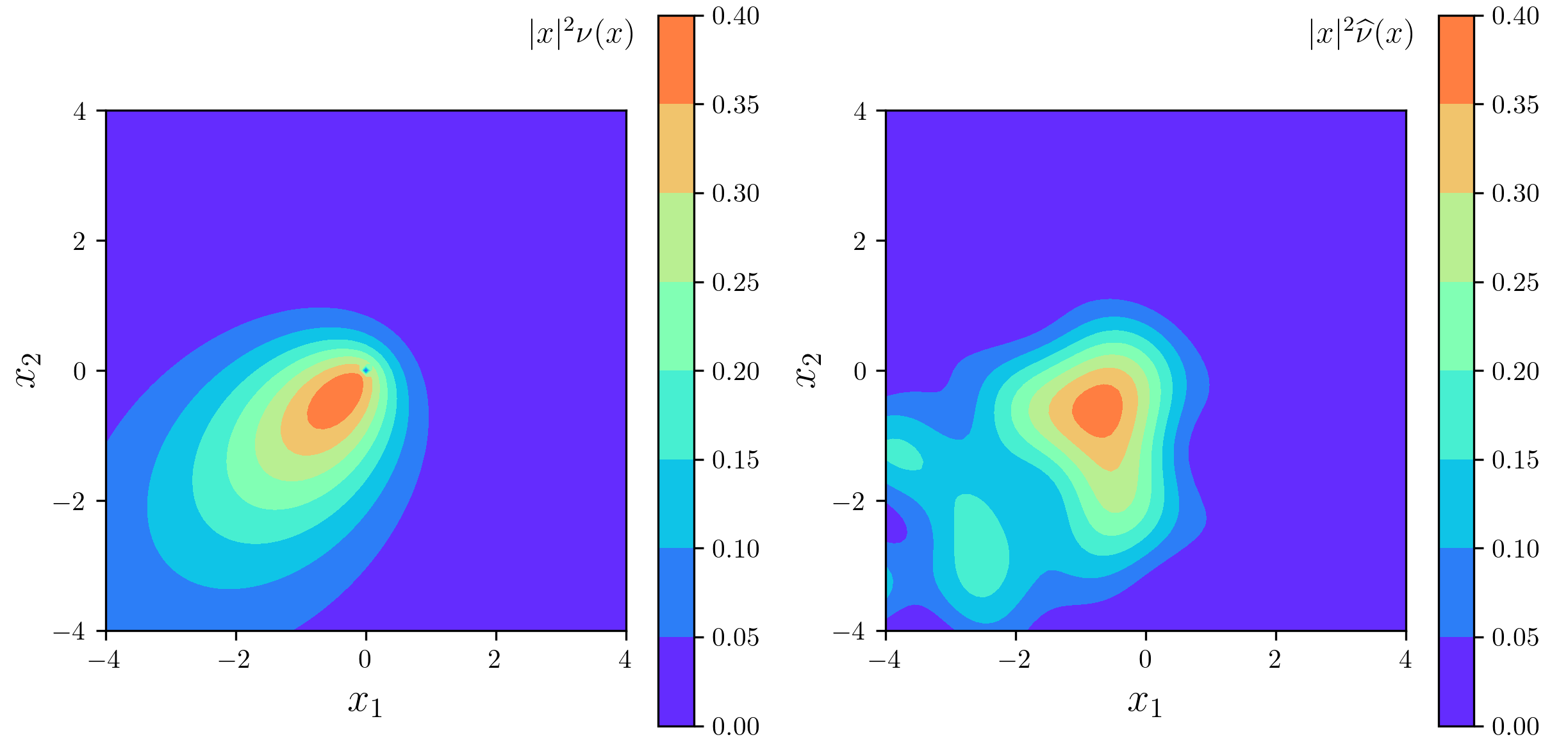

This theorem generalizes Trabs, (2015, Proposition 2) to the multivariate case and additionally allows for high-frequency observations. Figs. 1 and 2 illustrate a simulation example of the estimation method.

In the mildly ill-posed case, one can easily attain the same rates without the logarithm when considering the pointwise loss.

We first discuss the low-frequency regime: For , our rates coincide with the proven minimax-optimal rates in the corresponding nonparametric deconvolution problems, see Fan, (1991). In the mildly ill-posed case with , the pointwise variant of our rate has been shown to be minimax-optimal under the assumption that is -Sobolev-regular, see Kappus, (2012). In the severely ill-posed case with and , our rates coincide with the minimax-optimal rates of Neumann & Reiß, (2009), who consider the integrated risk in the estimation of against test functions with Sobolev regularity . This measure has an atom in and is therefore not smooth. Hence, the regularity in the rate comes purely from the test function. By considering bounded away from , we can profit from the regularity of the Lévy density outside the origin. We do not even suffer an additional loss for the dimension in the rate, only in the constant. Therefore, the above suggests its optimality.

One sees that the rates improve as the time grid narrows. If this refinement happens at an appropriate order compared to the growth of the sample, the ill-posedness vanishes completely in the mildly ill-posed case and the rate becomes polynomial in the severely ill-posed case. In the mildly ill-posed case with high-frequency observations, the rate corresponds to the minimax-optimal rate in a nonparametric regression.

It is straightforward to see from our proof, that when estimating , we can forgo the exclusion of the origin from while achieving the same rates in the mildly-ill-posed case. In the severely ill-posed case, the unknown volatility of the Brownian component of the Lévy process obstructs the observation of the small jumps. Hence, we can benefit from a pilot estimator for . As discussed earlier, even a with minimax-optimal estimator for , we would suffer a loss in the overall rate. However, in view of 2, it suffices to estimate the onedimensional parameter which is easier compared to the -matrix . Following the spectral approach again, we propose the estimator

where for a bandwidth (correspoding to the threshold ) and a weight function with

This estimator achieves a rate of and is incorporated into the estimator for via

leading to the following extension of 1.

test 0.

Let and let the kernel satisfy 5 with order as well as . Assume for some . Choosing we have uniformly in

2.2 Independent components

Compared to the onedimensional case, we need to take the dependence structure of the components of the process into account. In particular, our previous assumption about having a Lebesgue-density on , rules out Lévy processes where all components are independent, since the corresponding Lévy measure would only have mass on the coordinate cross. Similarly, Lévy processes consisting of multiple mutually independent blocks of components, where the components within the same block depend on each other, are not covered.For the sake of notational simplicity, we focus on the case of two equisized independent blocks: Let be even and , where and are two independent Lévy processes on with characteristic triplets and , respectively. Denoting by the Dirac-measure in , it holds that

| (8) |

We summarize the class of such Lévy processes as

| (11) | ||||

| (12) |

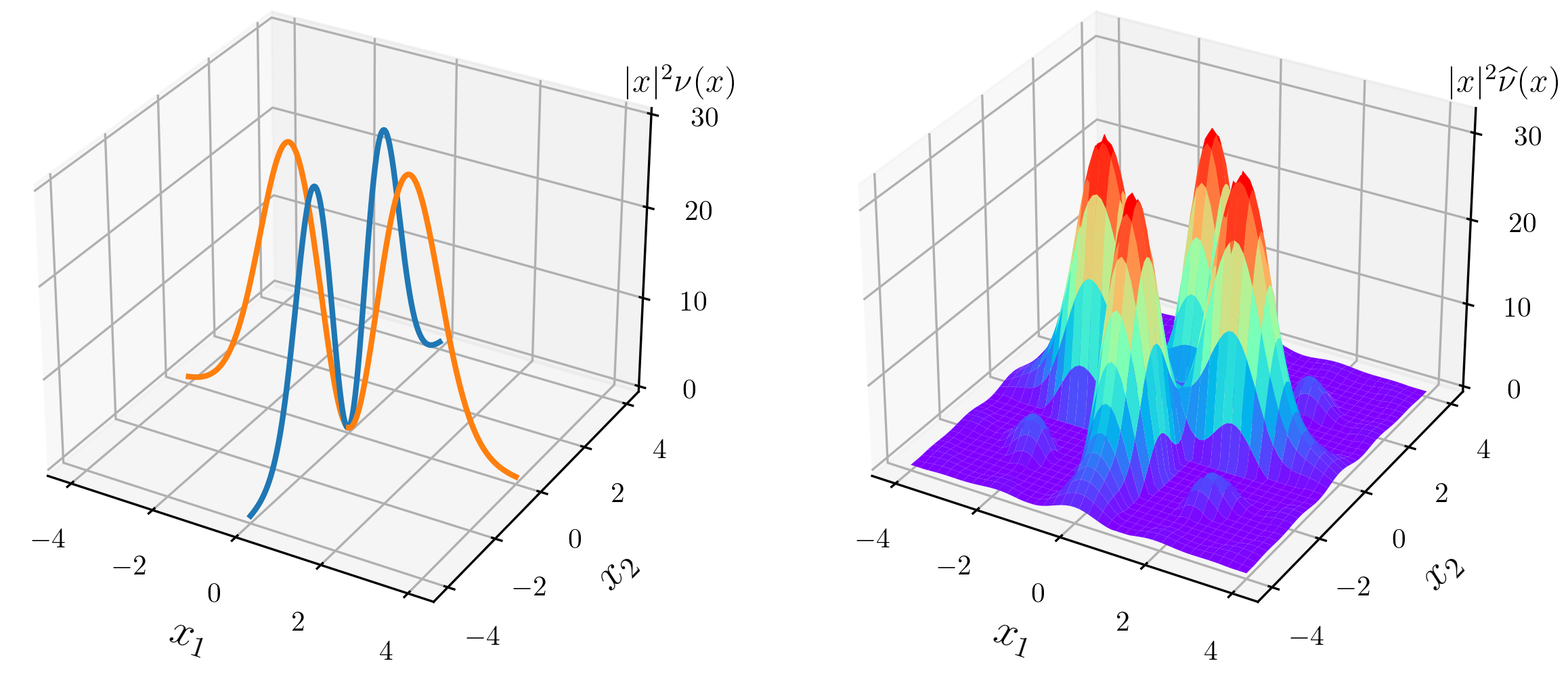

for . A simple example of such a Lévy measure and its estimate are illustrated in Fig. 3.

As before, we distinguish between the mildly ill-posed case with

and the severely ill-posed case with

based on the decay behavior of the characteristic function and the presence of a Gaussian component.

If this dependence structure were known, we could seperate the blocks in the observations, apply our method to each block and obtain an estimator for the overall Lévy measure. Since this is not the case, we are left with applying our initial method. In spite of the unknown dependence structure, we will be able to quantify the estimation error. Due to the structure of the Lévy measure, we cannot hope for a pointwise quantitative bound. Instead, we consider the error in a functional sense. To this end, we introduce the following class of test functions for and

test 3.

Let , let the kernel have product structure and satisfy 5 with order . Then, we have for :

-

(M)

If is bounded and , then uniformly in

-

(S)

If is bounded away from , , and , then uniformly in

Note that the regularity parameter in the rates comes from the smoothness of the test functions as compared to the smoothness of the Lévy measure in 1. In the severely ill-posed case, the result is analogous to the well-specified. In the mildly ill-posed case, we pay for the dependence structure with an in the rate. Morally, one can interpret this as the model dimension being instead of .

Remark 4.

The product kernel is compatible with any dependence structure of blocks, regardless of their size. For instance, if all components of the process are independent, one gets still gets the analogous result in severely ill-posed case. In the mildly ill-posed case, the dimension appearing in the rate is instead of . Comparing the dependence structures, one finds that the two independent blocks are an in-between case of no independent blocks and fully independent components.

2.3 A uniform risk-bound for the characteristic function and linearization

A key ingredient in the proofs of our preceeding results is the following moment-uniform risk bound for the multivariate characteristic function and its partial derivatives. It generalizes the existing results in the univariate case (see Kappus & Reiß, 2010, Theorem 1) and the multivariate non-uniform case (see Belomestny & Trabs, 2018, Proposition A.1).

test 0.

Let be -valued i.i.d. random variables with characteristic function and empirical characteristic function such that and for some multi-index and . For the inverse softplus-type weight function with , we have

As a direct consequence of 5, the indicator in the definition 3 equals one on the support of , with probability converging to one for the bandwidths we consider.

To prove our rates for , 2 lets us decompose the error

| (13) |

into a bias term , the linearized stochastic error , the error due to the volatility and a remainder term . 5 applied to the increments of the Lévy process leads to the following linearization.

test 0.

Let for some . If as for , it holds

| (14) |

As a direct consequence, the remainder term is of the order

| (15) |

After treating the four terms in 13, the asserted rates follow from our bandwidth choices.

3 Simulation examples

We demonstrate the estimation of the Lévy density for with three examples: a compound Poisson process, a variance gamma process and two independent compound Poisson processes.

A challenge is to find examples of multivariate Lévy processes for which paths can be simulated and the true Lévy measure is accessible (at least numerically). To allow for plotable results, we consider the case and compensate for the possible singularity of the Lévy density at the origin, i.e. we plot and its estimate. Throughout, we use the flat-top-kernel , see McMurry & Politis, (2004), as defined by its Fourier transform

whose decay behaviour is controlled by and . In our simulations, deliver stable results. While a product kernel is convenient for theoretical reasons in Section 2.2, it did not seem necessary in practice. Throughout, we simulate increments of the processes with a time difference of and fix the bandwidth at . To conquer this ill-posed problem, we use large samples of increments. From the definition 4 of the estimator, it is not guaranteed that and for numerical reasons even is possible in practice. Therefore, we consider the estimator in our simulations.

The most straightforward example under consideration is the compound Poisson process with intensity and twodimensional standard-Gaussian jumps. In this case, the Lévy density is just the standard normal density, rescaled with the intensity . Fig. 1 illustrates that the method captures the overall shape of the density. The heatmap in Fig. 2 provides a more detailed view especially around the origin. We observe that the decay for and is well-estimated, with slight problems only arising on an annulus around the origin.

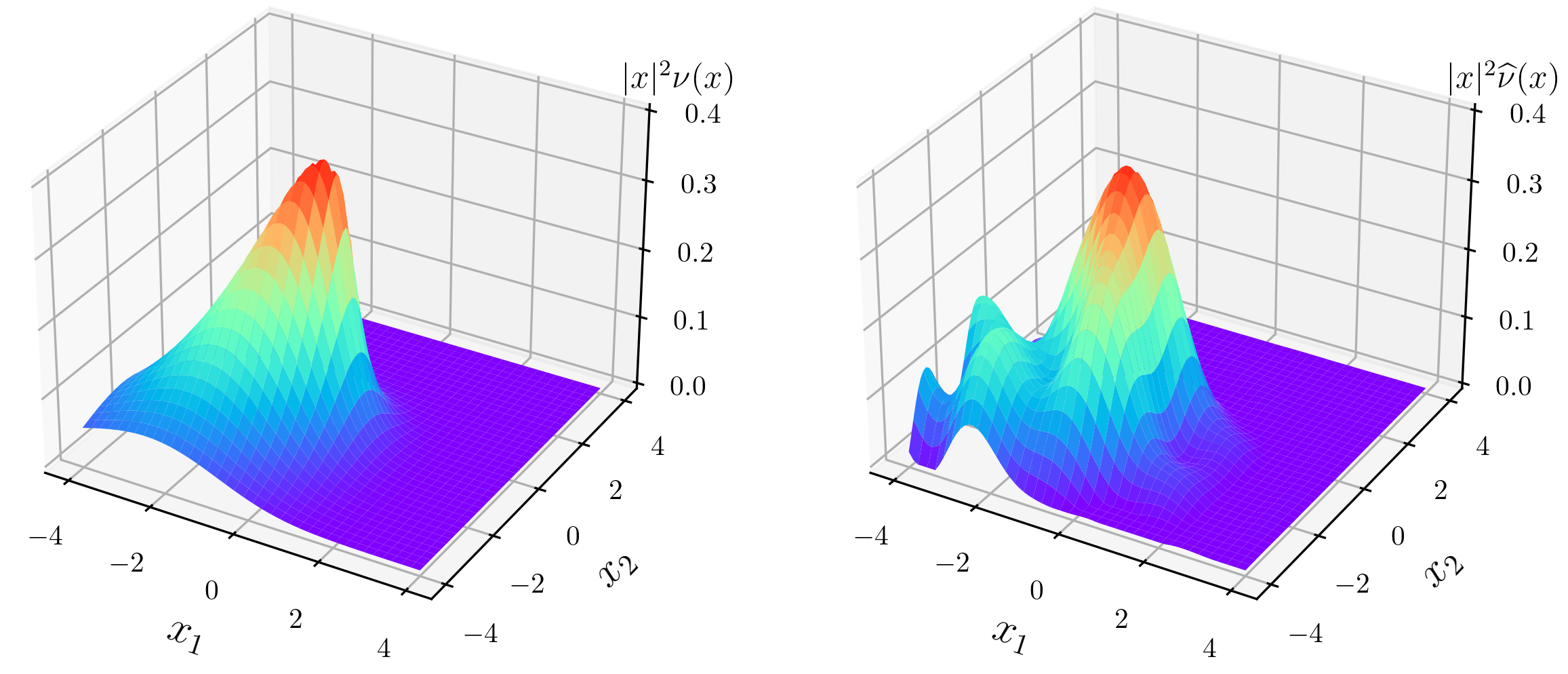

A practical way to construct easy-to-simulate multivariate Lévy processes is to subordinate multivariate Brownian motion. In particular, we use a gamma process with variance to subordinate a twodimensional standard Brownian motion. To access the Lévy measure of the resulting variance gamma process, we approximate the theoretical expression from Cont & Tankov, (2004, Theorem 4.2) numerically. The results are again illustrated in a 3D plot (Fig. 4) and as a heatmap ((Fig. 5)). In this example, the estimator suffers from oscillations around the true density which are to be expected from spectral-based methods.

To demonstrate the method under the depencence structure discussed in (Section 2.2), we consider a Lévy process comprised of two independent compound Poisson processes, each with intensity and onedimensional standard-Gaussian jumps. In contrast to the twodimensional compound Poisson process at the considered at the beginnung of this section, the jumps in both components are driven by independent Poisson processes. The corresponding Lévy measure takes the form 8, where and are onedimensional standard-Gaussian densities, rescaled with , as illustrated on the left hand side of Fig. 3. It is important to emphasize, that the blue and the orange line represent the Lebesgue-densities of both components on , not . The right hand side of the aforementioned figure reveals a strong performance of the estimator on the coordinate cross. Around the axes, we observe a smearing effect due to the singularity of the true Lévy measure on the coordinate cross before the estimate drops off as we move away.

4 Proofs

Throughout, set for . Note that and do not change if we consider increments based on the Lévy process for some . Hence, no generality is lost if we choose such that in the mildly ill-posed case

| (16) |

and in the severely ill-posed case , see Nickl et al., (2016, Lemma 12) for a similar argument in the onedimensional case.

Further, due to the infinite divisibility of , the decay behavior of governs that of . In particular, we have for

in the mildly and the severely ill-posed case, respectively.

4.1 Proof of 1

We extend the proof strategy by Trabs, (2015) to accomodate for the multivariate setting. To allow for the application to high-frequency observations, we carefully keep track of throughout. Subsequently, we will analyze the four terms in 13.

4.1.1 Controlling the linearized stochastic error

To control

we need to get a grip on the partial derivatives of in the Laplacian of . In particular, we will show that

| (17) |

Since

where denotes the -th entry of , the case is obvious and for it remains to show

In the mildly ill-posed case

and in the severely ill-posed case

The product rule for higher order derivatives yields

| (18) | ||||

| (19) |

where all emerging partial derivatives can again be absolutely and uniformly bounded using our assumptions on .

To simplify the notation, set and recall for .

For the severely ill-posed case, we have and that implies . Together with 17, we obtain

| (20) |

which will be dominated by the bias.

In the mildly ill-posed case, the stochastic error needs to be decomposed further into the main stochastic error

| (21) |

To control the difference 21, note that and imply , , . Further, the support of and the decay behavior of ensure

| (22) |

Hence, 17 and the Cauchy-Schwarz inequality together with 16 and the Plancherel theorem and 16 lead to

| (23) |

Being the sum of centered i.i.d. random variables, the main stochastic error for fixed is controlled by Bernstein’s inequality as summarized in the following lemma.

test 0.

Let and and let the kernel satisfy 5 for . If , then there exists some constant depending only on and such that for any and any

To establish a uniform bound for , a union bound extends this lemma to a discretization of the bounded set and Lipschitz continuity of allows us to control the discretization error. In particular, a standard covering argument yields a discretization of such that , and with some indepedent of . Since

| (24) |

the fundamental theorem of calculus together with the order of the kernel ensures the Lipschitz continuity of via

| (25) | ||||

| (26) |

Therefore, the discretization error is upper bounded by

Combining the above with Markov’s inequality yields for any such that with from 7 and with

| (27) |

The second term obviously converges to as . For the first term, implies

and the right hand side converges to by our choice of bandwidth.

4.1.2 Controlling the error owed to the volatility

We now consider the last term in 13. The mildly ill-posed case is trivial since . Turning to the severely ill-posed case, we first aim to bound . To this end, consider

It follows from the equivalence of norms that

| (28) |

Thus,

and since is bounded away from , this gives a uniform bound in of the order as .

4.1.3 Controlling the bias

For and , we use a multivariate Taylor expansion of around to obtain

for some . The order of the kernel and the Hölder regularity of yield

| (29) | ||||

| (30) | ||||

| (31) | ||||

| (32) | ||||

| (33) | ||||

| (34) |

The second and the third term are clearly of the order . To establish the same for the first term, we proceed slightly differently for the two cases of ill-posedness.

In the severely ill-posed case, we separate the behavior of the small and the large jumps. On the one hand, 28 yields

| (35) | ||||

| (36) |

On the other hand, the assumption for and 28 gives

| (37) | ||||

| (38) |

In the mildly ill-posed case, one uses and the triangle inequality to find

4.1.4 Controlling the remainder term

To bound in 13, we first show that with from 6

Let . Owing to 6 we can choose (wlog. ) such that the probability of the event with is less than for . Due to the support of , we have on

In the mildly ill-posed case, we have and 16 implies . Thus, we have

In the severely ill-posed case, holds and 1 implies Hence,

In both cases, the remainder term is dominated by the linearized stochastic error.

This completes the proof of 1. ∎

4.2 Proof of 2

For the modified estimator, we have to replace with in the decomposition 13. All other terms are treated as before. Since we can bound by uniformly in and is fixed, we only need to prove

Similarly to 13, the error for estimating the trace of can be decomposed into

| (39) | ||||

| (40) |

with the linearized stochastic error , the bias and a remainder term . Using the techniques from Section 4.1.1, it is straightforward to see

| (41) | ||||

| (42) | ||||

| (43) |

which is of the order by our choice of and will be dominated by the bias.

Using the Plancherel theorem in a similar fashion to Belomestny & Reiß, (2015, Section 4.2.1), we have for and with

By substitution

and therefore

Together with 6, we have

| (44) | ||||

| (45) |

which is dominated by the linearized stochastic error. ∎

4.3 Proof of 3

The distributional analogon to 13 is

| (46) | ||||

| (47) | ||||

| (48) | ||||

| (49) | ||||

| (50) | ||||

with the same and , for which we will derive uniform upper bounds on which directly translate into bounds when integrating against test functions due to their regularity. For the integrated bias, we use Fubini’s theorem to obtain

| (51) | ||||

| (52) | ||||

| (53) | ||||

| (54) |

is of the order which follows from the arguments in 13 with , and instead of , and , respectively. Therefore,

A key tool to control linearized stochastic error in Section 4.1.1 was 17, which we can still establish here by bounding the first four partial derivatives of at the origin. Indeed, by 2 we have and similarly

In the severely ill-posed case, we can still bound the gradient of by

and then apply the arguments from 20. Hence, the linearized stochastic error is of the same order as before.

In the severely ill-posed case, 55 holds even for and therefore . Continuing from 17 in the mildly ill-posed case requires the most significant changes. 16 now reads as

and the main crux is that

| (56) |

are constant in half of their arguments. Therefore, they cannot be finitely integrable as functions on . In 21, a way out is to consider

| (57) |

Then, we apply the Cauchy-Schwarz inequality and Plancherel’s theorem only on to obtain

| (58) | ||||

| (59) | ||||

Analogously, the second summand in 57 has the same order. As a direct consequence,

and similarly to 59 and 57 the same holds for . Recalling 21, we have

| (60) | ||||

| (61) | ||||

| (62) |

Note that we pay for the dependence struture with an additional compared to 23. The same happens when applying Bernstein’s inequality to obtain the following adaptation of 7.

test 0.

Let and , let the kernel have product structure and satisfy 5 for . If , then there exists some constant depending only on and such that for any and any

Carrying out the discretization argument from before, the linearized stochastic error in the mildly ill-posed case is of the order

The term is treated as in Section 4.1.2 just with instead of . No changes are necessary to treat the remainder term compared to Section 4.1.4. This is because when treating the linearized stochstic error, we already showed that still in the mildly ill-posed case and in the severely ill-posed case. This concludes the proof of 3. ∎

4.4 Remaining proofs

4.4.1 Proof of 5

The proof uses empirical process theory and is a combination of Kappus & Reiß, (2010) and Belomestny & Trabs, (2018).

To simplify the notation, write

so that the assertion reads

We decompose into its real and its imaginary part to obtain

As both parts can be treated analogously, we focus on the real part. To this end, introduce the class of

Since is an envelope function for , van der Vaart, (1998, Corollary 19.35) yields

where is the minimal number of -brackets (with respect to the distribution of ) needed to cover .

Since , the set is covered by the bracket

| (63) | |||

| (64) |

To cover , we use for some grid the functions

where . Owing to , we have

for some . Denote by the Lipschitz constant of and use the triangle inequality to see

Thus, as soon as . It takes at most -balls of radius to cover the -ball of radius around . For , denote their centers by . To translate this into a cover of , we fix some with . By construction, we can pick such that . The previous calculations show that is a -bracket containing and therefore

It is straightforward to see ). Further, is sufficient for

and thus for some . Hence,

implying

4.4.2 Proof of 6

Setting (ie. and , we use

and to obtain for that

| (65) |

because

The latter statement holds, since . For the former statement, consider the expansion

to see

Noting , 65 implies on the event

To control the -terms, we invoke 5 applied to the increments of the Lévy process with after verifying that the moments are of the appropriate order. Owing to the equivalence of norms, it is sufficient to show that with

| (66) |

where is the -th entry of and thus an increment with time difference based on the Lévy process with Lévy measure . For , it follows from Figueroa-López, (2008, Theorem 1.1) that

For , holds by our moment assumptions. The second condition in 66 was already checked at the beginning of Section 4.1.1.

4.4.3 Proof of 7

For fixed , we want to apply Bernstein’s inequality to

Similar arguments to 22 reveal , and with the quotient rule one finds the same order for and paving a deterministic bound of via

| (68) | ||||

| (69) | ||||

| (70) | ||||

| (71) | ||||

| (72) |

To bound the variance of , note that for the distribution of , we have

and therefore with . It follows that

Again, using similar arguments to 22 and the quotient rule, we also have . Thus, the Cauchy-Schwarz inequality and the Plancherel theorem imply

| (73) | ||||

| (74) | ||||

| (75) | ||||

| (76) | ||||

| (77) | ||||

| (78) |

Now, Bernstein’s inequality, e.g. van der Vaart, (1998, Lemma 19.32) yields for a constant and any that

which reads as the assertion if we choose for any and set . ∎

4.4.4 Proof of 8

Fix for and analogously split into its first and last entries and with characteristic functions and , respectively. Due to the product kernel, we obtain

with

| (79) | |||

| (80) |

and are the same terms that appeared in the proof of 7 just with half the dimension and therefore

| (81) | ||||

| (82) |

In a similar vain, and can be treated be treated like with half the dimension leading to

Note that

Together, we have the deterministic bound . Further, since and as well as and are independent, we obtain

| (83) | ||||

| (84) |

Overall, Bernstein’s inequality gives for a constant and any that

The assertion follows by choosing for any and setting . ∎

References

- Aït-Sahalia & Jacod, (2012) Aït-Sahalia, Y. & Jacod, J. (2012). Analyzing the spectrum of asset returns: Jump and volatility components in high frequency data. Journal of Economic Literature, 50(4), 1007–50.

- Belomestny, (2010) Belomestny, D. (2010). Spectral estimation of the fractional order of a Lévy process. The Annals of Statistics, 38(1), 317–351.

- Belomestny, (2011) Belomestny, D. (2011). Statistical inference for time-changed Lévy processes via composite characteristic function estimation. The Annals of Statistics, 39(4), 2205–2242.

- Belomestny & Reiß, (2006) Belomestny, D. & Reiß, M. (2006). Spectral calibration of exponential Lévy models. Finance and Stochastics, 10(4), 449–474.

- Belomestny & Reiß, (2015) Belomestny, D. & Reiß, M. (2015). Estimation and calibration of Lévy models via Fourier methods, In: Lévy Matters IV - Estimation for Discretely Observed Lévy Processes. (pp. 1–76).

- Belomestny & Trabs, (2018) Belomestny, D. & Trabs, M. (2018). Low-rank diffusion matrix estimation for high-dimensional time-changed Lévy processes. Annales de l’Institut Henri Poincaré Probabilités et Statistiques, 54(3), 1583–1621.

- Belomestny et al., (2019) Belomestny, D., Trabs, M., & Tsybakov, A. B. (2019). Sparse covariance matrix estimation in high-dimensional deconvolution. Bernoulli, 25(3), 1901–1938.

- Bücher & Vetter, (2013) Bücher, A. & Vetter, M. (2013). Nonparametric inference on Lévy measures and copulas. The Annals of Statistics, 41(3), 1485–1515.

- Cont & Tankov, (2004) Cont, R. & Tankov, P. (2004). Financial modelling with jump processes. Chapman & Hall/CRC.

- Duval & Mariucci, (2021) Duval, C. & Mariucci, E. (2021). Spectral-free estimation of Lévy densities in high-frequency regime. Bernoulli, 27(4), 2649–2674.

- Fan, (1991) Fan, J. (1991). On the optimal rates of convergence for nonparametric deconvolution problems. The Annals of Statistics, 19(3), 1257–1272.

- Figueroa-López, (2008) Figueroa-López, J. E. (2008). Small-time moment asymptotics for Lévy processes. Statistics & Probability Letters, 78(18), 3355–3365.

- Gegler & Stadtmüller, (2010) Gegler, A. & Stadtmüller, U. (2010). Estimation of the characteristics of a Lévy process. Journal of Statistical Planning and Inference, 140(6), 1481–1496.

- Gugushvili, (2012) Gugushvili, S. (2012). Nonparametric inference for discretely sampled Lévy processes. Annales de l’Institut Henri Poincaré Probabilités et Statistiques, 48(1), 282–307.

- Kappus, (2012) Kappus, J. (2012). Nonparametric adaptive estimation for discretely observed Lévy processes. Dissertation, Humboldt-Universität zu Berlin, Mathematisch-Naturwissenschaftliche Fakultät II.

- Kappus & Reiß, (2010) Kappus, J. & Reiß, M. (2010). Estimation of the characteristics of a Lévy process observed at arbitrary frequency. Statistica Neerlandica. Journal of the Netherlands Society for Statistics and Operations Research, 64(3), 314–328.

- McMurry & Politis, (2004) McMurry, T. L. & Politis, D. N. (2004). Nonparametric regression with infinite order flat-top kernels. Journal of Nonparametric Statistics, 16(3-4), 549–562.

- Mies, (2020) Mies, F. (2020). Rate-optimal estimation of the Blumenthal-Getoor index of a Lévy process. Electronic Journal of Statistics, 14(2), 4165–4206.

- Neumann & Reiß, (2009) Neumann, M. H. & Reiß, M. (2009). Nonparametric estimation for Lévy processes from low-frequency observations. Bernoulli, 15(1), 223–248.

- Nickl & Reiß, (2012) Nickl, R. & Reiß, M. (2012). A Donsker theorem for Lévy measures. Journal of Functional Analysis, 263(10), 3306–3332.

- Nickl et al., (2016) Nickl, R., Reiß, M., Söhl, J., & Trabs, M. (2016). High-frequency Donsker theorems for Lévy measures. Probability Theory and Related Fields, 164(1-2), 61–108.

- Papagiannouli, (2020) Papagiannouli, K. (2020). Minimax rates for the covariance estimation of multi-dimensional Lévy processes with high-frequency data. Electronic Journal of Statistics, 14(2), 3525–3562.

- Reiß, (2013) Reiß, M. (2013). Testing the characteristics of a Lévy process. Stochastic Processes and their Applications, 123(7), 2808–2828.

- Sato, (1999) Sato, K.-I. (1999). Lévy processses and infinitely divisible distributions. Cambridge University Press.

- Trabs, (2015) Trabs, M. (2015). Quantile estimation for Lévy measures. Stochastic Processes and their Applications, 125(9), 3484–3521.

- van der Vaart, (1998) van der Vaart, A. W. (1998). Asymptotic statistics, volume 3 of Cambridge Series in Statistical and Probabilistic Mathematics. Cambridge University Press.

- Woyczyński, (2001) Woyczyński, W. A. (2001). Lévy processes in the physical sciences. Springer.