A Bayesian Dirichlet Auto-Regressive Moving Average Model for Compositional Time Series

A Bayesian Dirichlet Auto-Regressive Moving Average Model for Forecasting Lead Times

Abstract

In the hospitality industry, lead time data is a form of compositional data that is crucial for business planning, resource allocation, and staffing. Hospitality businesses accrue fees daily, but recognition of these fees is often deferred. This paper presents a novel class of Bayesian time series models, the Bayesian Dirichlet Auto-Regressive Moving Average (B-DARMA) model, designed specifically for compositional time series. The model is motivated by the analysis of five years of daily fees data from Airbnb, with the aim of forecasting the proportion of future fees that will be recognized in 12 consecutive monthly intervals. Each day’s compositional data is modeled as Dirichlet distributed, given the mean and a scale parameter. The mean is modeled using a Vector Auto-Regressive Moving Average process, which depends on previous compositional data, previous compositional parameters, and daily covariates. The B-DARMA model provides a robust solution for analyzing large compositional vectors and time series of varying lengths. It offers efficiency gains through the choice of priors, yields interpretable parameters for inference, and produces reasonable forecasts. The paper also explores the use of normal and horseshoe priors for the VAR and VMA coefficients, and for regression coefficients. The efficacy of the B-DARMA model is demonstrated through simulation studies and an analysis of Airbnb data.

Keywords: Additive Log Ratio, Finance, Lead time, Simplex, Compositional data, Dirichlet distribution, Bayesian multivariate time series, Airbnb, Vector ARMA model, Markov Chain Monte Carlo (MCMC), Hospitality Industry, Revenue Forecasting, Generalized ARMA model

1 Introduction

Travel, entertainment, and hospitality businesses earn fees each day, however these fees cannot be recognized until later. The lead time is the amount of time until fees earned on a given day can be recognized. Future dates that fees may be recognized are allocated into regular intervals forming a partition of the future, often weekly, monthly or annual time intervals. Each day, another vector of fee allocations is observed. The distribution of fees into future intervals can be analyzed separately from the total amount of fees; fractional allocations into future intervals sum to one and form a compositional time series. The basic compositional observation is a continuous vector of probabilities that a dollar earned today can be recognized in each future interval. We wish to understand the process generating the compositional time series and forecast the series on into the future. This information can be used by businesses for the allocation of resources, for business planning, and for staffing.

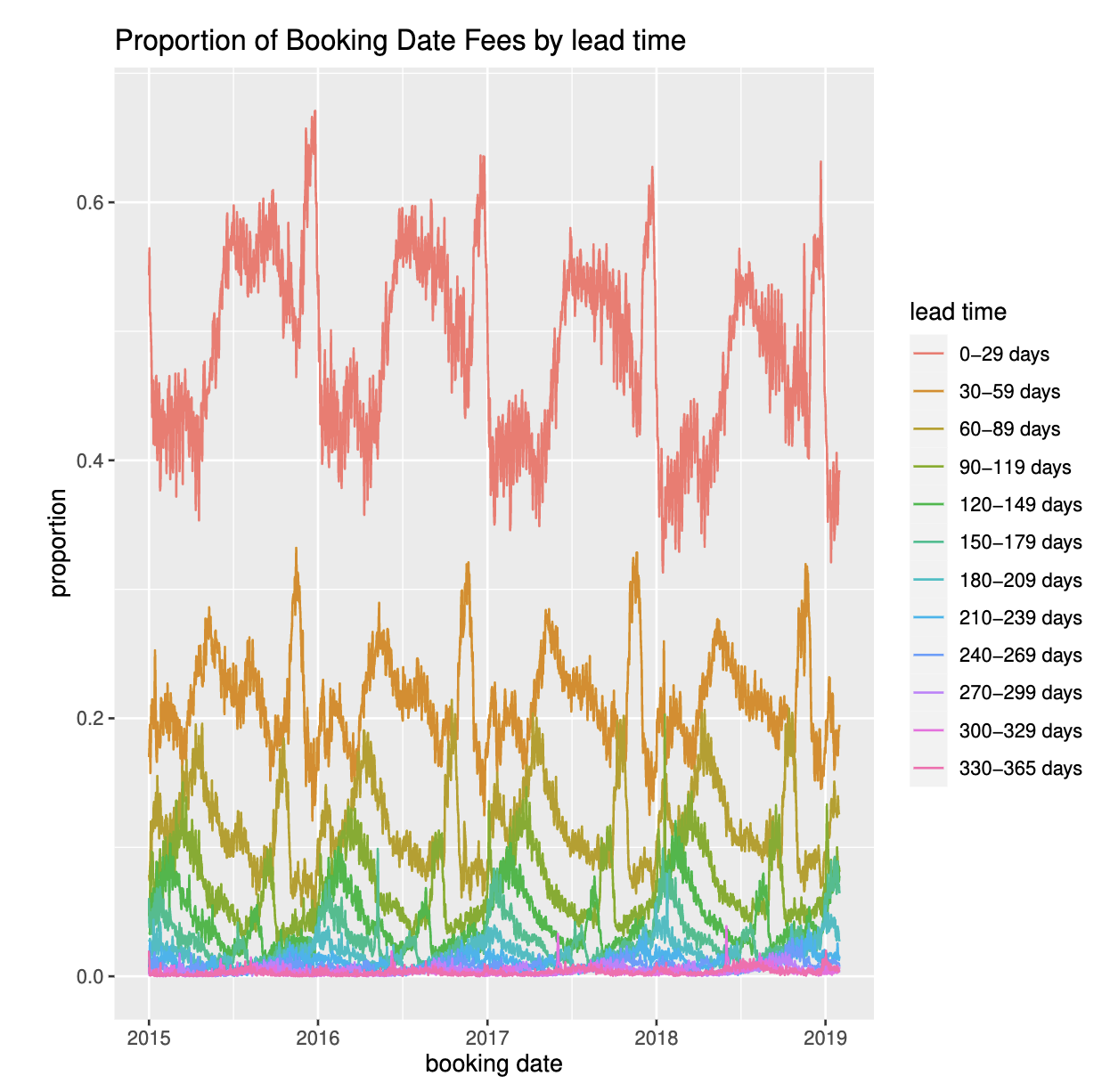

We analyze five years of daily fees billed at Airbnb that will be recognized in the future. Future fees are allocated to one of 12 consecutive monthly intervals; fees beyond this range are small and ignored in this analysis. More granular inference on lead time of revenue recognition would not improve business planning or resource allocation though it substantially complicates modeling, model fitting, and communication of results. To forecast a current day’s allocations we have all prior days’ data and we have deterministic characteristics of days such as day of the week, season, and sequential day of the year.

A lead time compositional time series is a multivariate -vector time series with observed data where , indexes consecutive days or other time units, indexes the future revenue recognition intervals, and for all . A natural model for compositional data is the Dirichlet distribution which is in the exponential family of distributions and thus Dirichlet time series are special cases of generalized linear time series. Benjamin et al. (2003) proposed a univariate Generalized ARMA data model in a frequentist framework.

There are numerous books on Bayesian Analysis of Time Series Data (Barber et al., 2011; Berliner, 1996; Pole et al., 2018; Koop and Korobilis, 2010; West, 1996; Prado and West, 2010) as well as papers on Bayesian vector auto-regressive (AR) (VAR) moving average (MA) (VMA) (ARMA)(VARMA) time series models (Spencer, 1993; Uhlig, 1997; Bańbura et al., 2010; Karlsson, 2013); and on Bayesian generalized linear time series models (Brandt and Sandler, 2012; Roberts and Penny, 2002; Nariswari and Pudjihastuti, 2019; Chen and Lee, 2016; McCabe and Martin, 2005; Berry and West, 2020; Nariswari and Pudjihastuti, 2019; Fukumoto et al., 2019; Silveira de Andrade et al., 2015; West, 2013).

Dirichlet time series data are less commonly modeled in the literature. Grunwald et al. (1993) proposed a Bayesian compositional state space model with data modeled as Dirichlet given a mean vector, with the current mean given the prior mean also modeled as Dirichlet. Grunwald does not use Markov chain Monte Carlo (MCMC) for model fitting. Similarly, da Silva et al. (2011) proposed a state space Bayesian model for a time series of proportions, extended in da Silva and Rodrigues (2015) to Dirichlets with a static scale parameter. Zheng and Chen (2017) propose a frequentist Dirichlet ARMA time series. Much of the prior work on modeling compositional data and compositional time series transforms from the original -dimensional simplex to a Euclidean space where the data is now modeled as normal (Aitchison, 1982; Cargnoni et al., 1997; Ravishanker et al., 2001; Silva and Smith, 2001; Mills, 2010; Barcelo-Vidal et al., 2011; Koehler et al., 2010; Kynčlová et al., 2015; Snyder et al., 2017; AL-Dhurafi et al., 2018).

It would seem preferable to not transform the raw data before modeling and instead model the data directly as Dirichlet distributed. Thus we propose a new class of Bayesian Dirichlet Auto-Regressive Moving Average models (B-DARMA) for compositional time series. We model the data as Dirichlet given the mean and scale, then transform the -dimensional mean parameter vector to a -dimensional vector. The distributional parameters are then modeled with vector auto-regressive moving average structure. We also model the Dirichlet scale parameter as a log linear function of time-varying predictors.

We give a general framework, and present submodels motivated by our Airbnb lead time data. The B-DARMA model can be applied to data sets with large compositional vectors or few observations, offers efficiency gains through choice of priors and/or submodels, and provides sensible forecasts on the Airbnb data.

We consider normal and horseshoe priors for the VAR and VMA coefficients, and for regression coefficients. Normal priors have long been a default for coefficients while the horseshoe is a newer choice which allows for varying amounts of shrinkage (Carvalho et al., 2009, 2010; Huber and Feldkircher, 2019; Kastner and Huber, 2020; Bańbura et al., 2010) depending on the magnitude of the coefficients.

2 A Bayesian Dirichlet Auto-Regressive Moving Average Model

2.1 Data model

We observe a -component multivariate compositional time series , observed at consecutive integer valued times up to the most recent time , where , where is a vector of ones. We model as Dirichlet with mean vector , with , , and scale parameter

| (1) |

with density .

We model as a function of prior observations , prior means and known covariates in a generalized linear model framework. As and are constrained, we model after reducing dimension using the additive log ratio (alr) link

| (2) |

where is a chosen reference component , and the element of that would correspond to the th element is omitted. The linear predictor is a -vector taking values in . Given , is defined by the inverse of equation (2) where for , and for , .

We model as a Vector Auto-Regressive Moving Average (VARMA) process

| (3) |

for where , and are coefficient matrices of the respective Vector Auto-Regressive (VAR) and Vector Moving Average (VMA) terms, is a known matrix of deterministic covariates including an intercept, and including seasonal variables and trend as needed, and is an vector of regression coefficients. The form of an intercept in is the identity matrix as columns in . Given an vector of covariates for day , the simplest form of is and . The additive log ratio in (3) is a multivariate logit link and leads to elements of matrices and and vector that are log odds ratios. Given , gives the expected allocations of fees to components.

Scale parameter is modeled with log link as a function of an -vector of covariates ,

| (4) |

where is an -vector of coefficients. In the situation of no covariates for , for all .

Define the consecutive observations for positive integers . To be well defined, linear predictor (3) requires having previous observations , and corresponding linear predictors . In computing posteriors, we condition on the first observations which then do not contribute to the likelihood. For the corresponding first linear predictors, on the right hand side of (3), we set equal to which effectively omits the VMA terms from (3) when . In contrast, in (3) the VAR terms and are well defined for .

Define the -vector of all unknown parameters , where index all elements of matrices and , , and . Prior beliefs about are updated by Bayes’ theorem to give the posterior

where , is the density of the Dirichlet in (1), and the normalizing constant . We wish to forecast the next observations . These have joint predictive distribution

The joint predictive distribution can be summarized for example by the mean or median against time to communicate results to business managers.

Our data model can be viewed as a Bayesian multivariate Dirichlet extension of the Generalized ARMA model by Benjamin et al. (2003). Similarly, Zheng and Chen (2017) propose a DARMA data model whose link function in (2) does not have an analytical inverse, so needs to be approximated numerically. They view our data model as an approximation to theirs, noting that the resulting noise sequence from having the analytical inverse isn’t a martingale difference sequence (MDS). This lack of an MDS complicates the investigation of the probabilistic properties of the series and the asymptotic behavior of their estimators.

From a Bayesian perspective, the need for an MDS for making inference is circumvented. Bayesian inference is based on the posterior distribution of the parameters, which combines the likelihood function (dependent on the data) and the prior distribution (representing our prior beliefs about the parameters). This allows us to make inferences regardless of whether the data form an MDS.

Furthermore, the concept of a “noise sequence” or residuals is somewhat different in the context of generalized linear models (GLMs) compared to location-scale models like linear regression. In GLMs, residuals are not explicitly defined, and the noise sequence discussed in the context of Zheng and Chen’s model is an approximation. In our Bayesian approach, we do not need to define or consider the noise sequence at all, which simplifies the model and the analysis.

2.2 Choice of link function

The link function in (2) and (3) can be replaced with other common simplex transformations such as the Centered Log-Ratio (CLR)

where . Alternatively, the Isometric Log-Ratio (ILR) transformation can be used, with -th component

where is the geometric mean of a subset of , is the complement of , and is the number of elements in . The choice of subsets and can vary depending on the specific problem and interpretation requirements. Egozcue et al. (2003) show that the coefficient matrices of the ALR, CLR, and ILR are linear transformations of each other. This means that the DARMA data models with these three link functions are equivalent, provided the same transformation is applied to the priors.

2.3 Model selection

For model selection, we use the approximate calculation of the leave-future-out (LFO) estimate of the expected log pointwise predictive density (ELPD) for each model which measures predictive performance (Bernardo and Smith, 2009; Vehtari and Ojanen, 2012),

where

| (5) |

where is the number of step ahead predictions and is a chosen minimum number of observations from the time series needed to make predictions. We use Monte-Carlo methods to approximate (5) with random draws from the posterior and estimate as

for draws from the posterior distribution . Calculating the ELPD LFO requires refitting the model for each , to get around this, we use approximate M-step ahead predictions using Pareto smoothed importance sampling (Bürkner et al., 2020).

2.4 Priors

A useful vague prior for the individual coefficients in is a proper independent normal with varying ’s and ’s depending on prior beliefs about the coefficients. We take in our data analysis when we believe a priori that the coefficients will be positive and when we are unsure. For elements and of and matrices, we take as we expect those elements to be between . For elements of , we might for example let vary with the standard deviation of the covariate.

It may be thought that many elements of might be at or near zero. In this case, rather than a normal prior, we might consider a shrinkage prior like that proposed by Carvalho et al. (2010), who propose a horseshoe prior of the form

for some , , and . Each belongs to one of groups and each group gets its own shrinkage parameter applied to it. We apply this with component specific shrinkage parameters in our data analysis.

3 Simulation study

In two simulation studies, we study the B-DARMA model’s capacity to accurately retrieve true parameter values, a critical aspect for reliable forecasting. By comparing B-DARMA with established models on a number of metrics, we provide a robust assessment of both its estimation and forecasting potential. Each simulation study has data sets indexed by with observations , with components, as the reference component for all models, and . We split the observations into a training set of the first observations and a test set of the last observations, the holdout data, which the model is not trained on and which is used to show the models’ forecasting performance.

In both studies, we compare B-DARMA to a non-Bayesian DARMA data model and to a non-Bayesian transformed-data normal VARMA (tVARMA) model that transforms to and models , where is an unknown positive semi-definite matrix, and is defined in (3). We use the VARMA function from the MTS package (Tsay et al., 2022) in R (R Core Team, 2022) to fit the tVARMA models with maximum likelihood. For the non-Bayesian DARMA data model, the BFGS algorithm as implemented in optim in R is used for optimization. To compute the parameters’ standard errors, the negative inverse Hessian at the mode is calculated.

The data generating model (DGM) is a DARMA model in simulation 1 and a tVARMA model in simulation 2. We set , for a DARMA (simulation 1) or tVARMA (simulation 2) data generating model.

To keep the parameterization of the B-DARMA model consistent with the parameterization of the MTS package, we remove , from the VAR term in (3) and set , where and we drop the asterisk on for the remainder of this section.

All B-DARMA models are fit with STAN (Stan Development Team, 2022) in R. We run chains with iterations each with a warm up of iterations for a posterior sample of . Initial values are selected randomly from the interval .

In all simulations, the covariate matrix , the identity matrix. Unknown coefficient matrices and have dimension . The shared parameters of interest for the DARMA, B-DARMA, and tVARMA are , , and , and . We use the out of sample Forecast Root Mean Squared Error, , and Forecast Mean Absolute Error, for each component as a measure of forecasting performance

where is the posterior mean of or the maximum likelihood estimate in the th data set. The tVARMA model has additional unknown covariance matrix a function of 3 unknown parameters, two standard deviations , , and correlation , while the B-DARMA and DARMA have a single unknown scale parameter . For the tVARMA data generating simulations we set , , and for DARMA generating models, we set .

Priors in simulations 1 and 2 for the B-DARMA are independent for all coefficients in , and a priori with mean and variance .

For each parameter, generically , with true value in simulation , for Bayesian models we take the posterior mean as the point estimate. For the 95% Credible Interval (CI) we take the endpoints to be 2.5% and 97.5% quantiles of the posterior. For the tVARMA and DARMA models, we use the maximum likelihood estimates (MLE) as the parameter estimate, and 95% confidence intervals (CI) calculated as maximum likelihood estimate plus or minus 1.96 standard errors.

For each parameter in turn, for the B-DARMA, tVARMA, and DARMA models, we assess bias, root mean squared error (RMSE), length of the CI (CIL), and the fraction of simulations % IN where falls within the CI

| bias | |||

| RMSE | |||

| CIL | |||

| % IN |

for the B-DARMA models and replace with the MLE for the tVARMA and DARMA models.

For all simulations, elements of are set to be

3.1 Comparing B-DARMA, DARMA, and tVARMA Models in simulations 1-2

Supplementary tables 4 and 5 provide summarized parameter recovery results, while table 1 gives the and for each component. When the data generating model is a DARMA(1,1), B-DARMA consistently outperforms tVARMA, with the B-DARMA(1,1) yielding an RMSE averaging at smaller, especially for the matrix coefficients. The B-DARMA’s performance aligns with that of the frequentist DARMA, each excelling in half of the ten considered coefficients. Both DARMA models showcase coverage superior to the tVARMA.

For a tVARMA(1,1) data generating model, the tVARMA generally exhibits the smallest RMSE for all coefficients, barring . The difference in RMSE is marginal, averaging at . The B-DARMA and frequentist DARMA compare similarly for and , but the DARMA performs worse for . B-DARMA has better coverage than both tVARMA and frequentist DARMA for most coefficients excepting , , and .

The out-of-sample prediction results are summarized in table 1. When the DGM is a DARMA(1,1), the B-DARMA outperforms both the frequentist DARMA model and the tVARMA in FRMSE and FMAE across all components, most notably for . When the DGM is a tVARMA, for and the B-DARMA performs comparably to the tVARMA and outperforms the DARMA. For , the B-DARMA significantly outperforms both the tVARMA and DARMA.

4 Airbnb Lead Time Data Analysis

The Airbnb lead time data, , is a compositional time series for a specific single large market where each component is the proportion of fees booked on day that are to be recognized in 11 consecutive 30 day windows and 1 last consecutive 35 day window to cover 365 days of lead times.

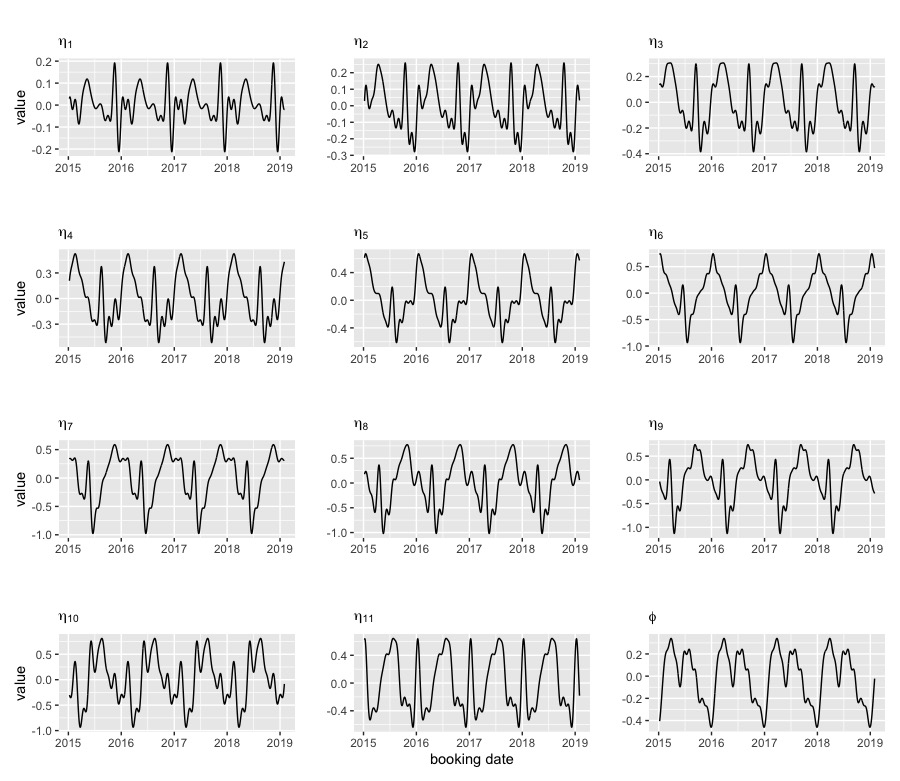

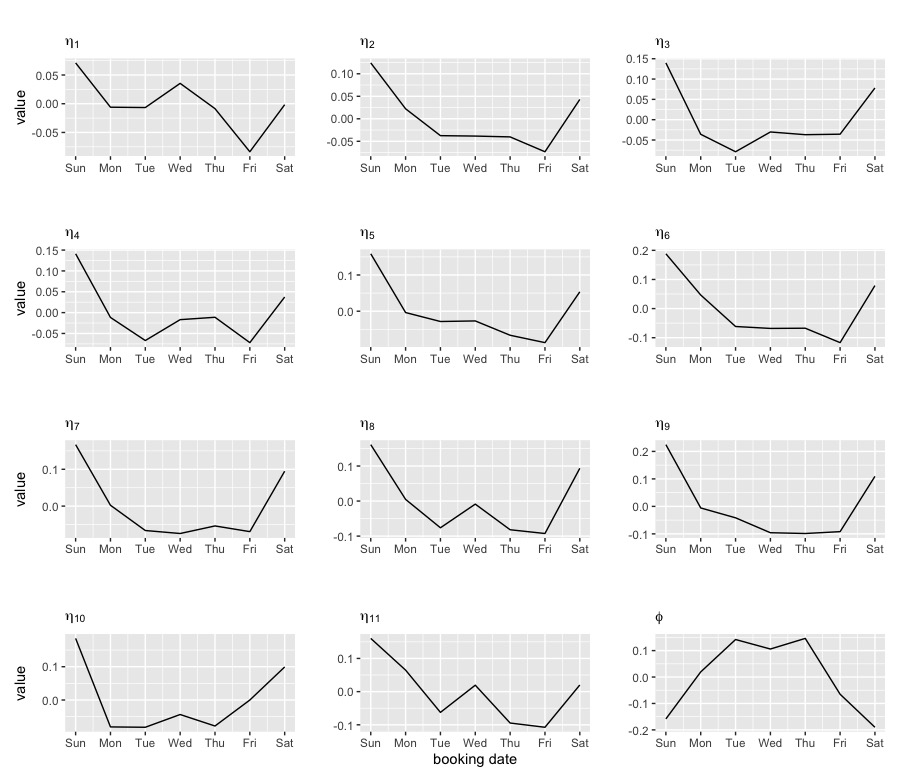

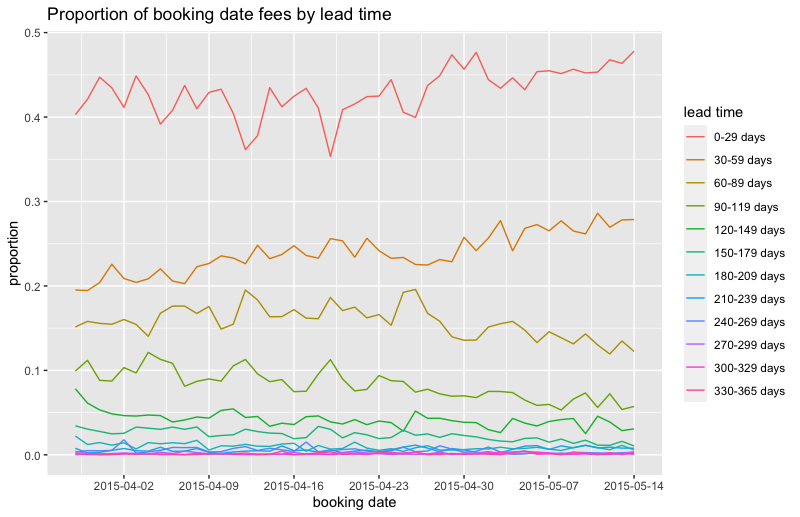

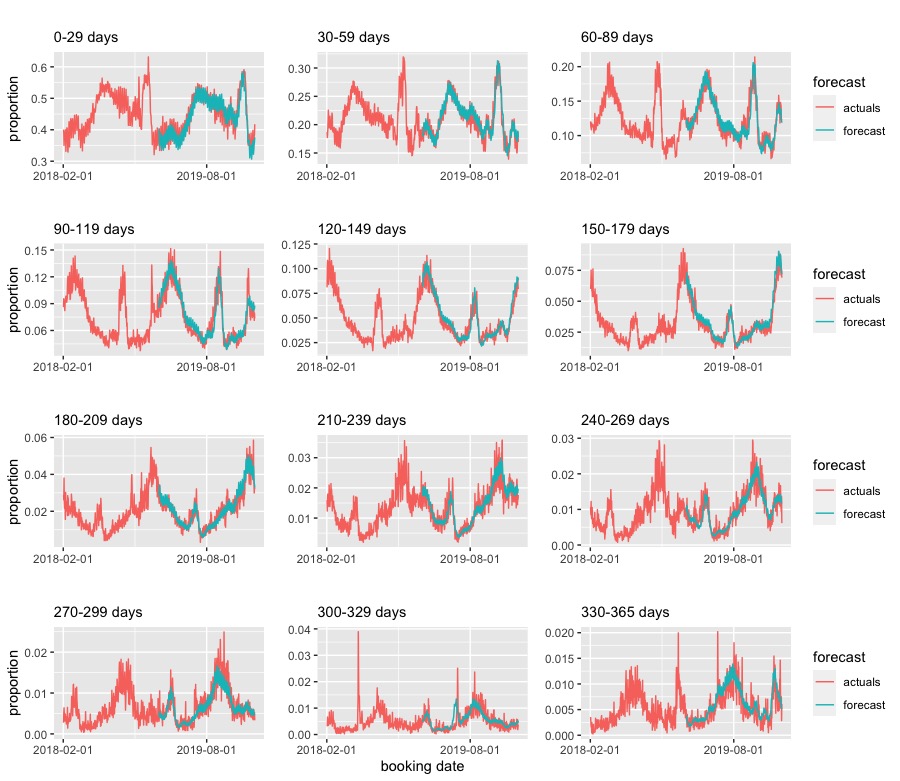

Figures 1 and 2 plot the Airbnb lead time data from 01/01/2015 to 01/31/2019 and 03/26/2015 to 05/14/2015 respectively. There is a distinct repeated yearly shape in figure 1 and a clear weekly seasonality in figure 2. Figure 1 shows a gradual increase/decrease in component sizes, most notably a decrease for the first window of days. The levels are driven by the attractiveness of certain travel periods with guests booking earlier and paying more for peak periods like summer and the December holiday season. The weekly variation shows a pronounced contrast between weekdays and weekends. Thus we want to include weekly and yearly seasonal variables and a trend variable in the predictors in (3). We model each component with its own linear trend and use Fourier terms for our seasonal variables, pairs of for where we take for weekly seasonality and for yearly seasonality. The orthogonality of the Fourier terms helps with convergence which is why we prefer it to other seasonal representations.

We train the model on data from 01/01/2015 to 1/31/2019, choose a forecast window of 365, and use 02/01/2019 to 01/31/2020 as the test set. All B-DARMA models are fit with STAN using the R interface where we run chains with iterations each with a warm up of iterations for a total of posterior samples. Initial values are selected randomly from the interval .

4.1 Model

We use the approximate LFO ELPD of candidate models to first decide on the number of yearly Fourier terms, given initial choices of and , then given the number of Fourier terms we decide on the orders and . We fix , the pairs of Fourier terms for modeling weekly seasonality, for all models. We use an intercept and the same seasonal variables and linear trend for . To define LFO ELPD, we take the step ahead predictions to be , the minimum number of observations from the time series to make predictions to be , and the threshold for the Pareto estimates to be (Bürkner et al., 2020; Vehtari et al., 2015) which resulted in needing to refit models at most times.

For all of the model selection process, we set independent priors for each and , independent priors on the Fourier coefficients, priors on the linear trend coefficients, and a prior on the intercepts. We use these same priors for the seasonal, intercept and trend coefficients in in (4).

We fixed , and let take on increasing values starting with then sequentially with increasing values of LFO ELPD until 10 had worse LFO ELPD, so we stopped and took (table 2). We fixed and similarly took first then and with performing best (table 2).

We compare four different B-DAR(1) models plus a DAR(1) model and a tVAR(1) model. Model 1 (Horseshoe Full) has a horseshoe () prior on the coefficients in and with a separate shrinkage parameter for the elements of that correspond to each or to .

As we expect the AR elements to diminish in magnitude as the time difference increases, the other three models have varying prior mean and sd for as functions of . Model 2 (Normal Full) has an prior on its diagonal elements , a prior on its two nearest neighbors, and respectively and a prior on the remaining elements of the matrix.

In contrast to models 1 and 2, where all parameters in are allowed to vary, models 3 and 4 fix some of the parameters to . Model 3 (Normal Nearest Neighbor) only allows and to vary and model 4 (Normal Diagonal) only allows to vary. The remaining elements in model 3 for or in the matrix are set equal to 0. For model 4 all off diagonal elements, , are set to 0. The non-zero coefficients have the same priors as the Normal Full.

All 3 Normal models have the same priors on coefficients and : and for the coefficients of the Fourier and trend terms respectively. The scale model predictors include the same seasonal and trend terms and the corresponding priors on the coefficients are the same as for the ’s. The prior on the intercepts in and is .

Model 5 (DAR(1)) is the frequentist counterpart to our B-DAR(1) Normal Full model with the same seasonal and trend terms for and . Model 6 (tVAR(1)) is a frequentist transformed VAR model which models . It has the same seasonal and trend variables in . Both models 5 and 6 are fit in R, model 5 with the BFGS algorithm as implemented in optim and model 6 with the VARX function in the MTS package.

4.2 Results

In the training set, the Horseshoe Full model has the largest LFO ELPD (supplementary table 8). The LFO ELPD for the Normal Full model and the Normal Nearest Neighbor model are close to the Horseshoe Full model with the Normal Diagonal model having a much worse LFO ELPD than the other models.

For the test set, the Forecast Root Mean Squared Error () and the Forecast Mean Absolute Error () for each component is in table 3 as well as the total Forecast Root Mean Squared Error and Forecast Mean Absolute Error for each model. The Normal Full model performs best on the test set for most components and has the lowest total Forecast Root Mean Squared Error and smallest total Forecast Mean Absolute Error, with the Horseshoe Full model about and worse respectively. The differences between the two full models (Model 1 and 2) and Models 3 and 4 are largest for the larger components as the FRMSE’s for the smaller components are closer. For example, for the largest component , the Normal Diagonal model performs over worse than the Normal Full model. The Normal Nearest Neighbor model performs well considering it has fewer parameters than the Normal Full model, performing worse in total than the Normal Full model.

When compared to the frequentist models, the Normal Full models exhibit superior performance in the largest components and , having a smaller FMAE and a smaller . For the smaller components through , the differences in among the models are subtler, although the FMAE values continue to show a more pronounced difference across all components. The DAR(1) does perform better than the subsetted B-DAR(1) models with a total FRMSE roughly smaller than the Normal Nearest-Neighbor model and less than the Normal Diagonal model. The tVAR(1) performs significantly worse than all the DAR models, with a total FRMSE about larger than the worst performing DAR data model, suggesting the time invariant nature of is inappropriate for the data.

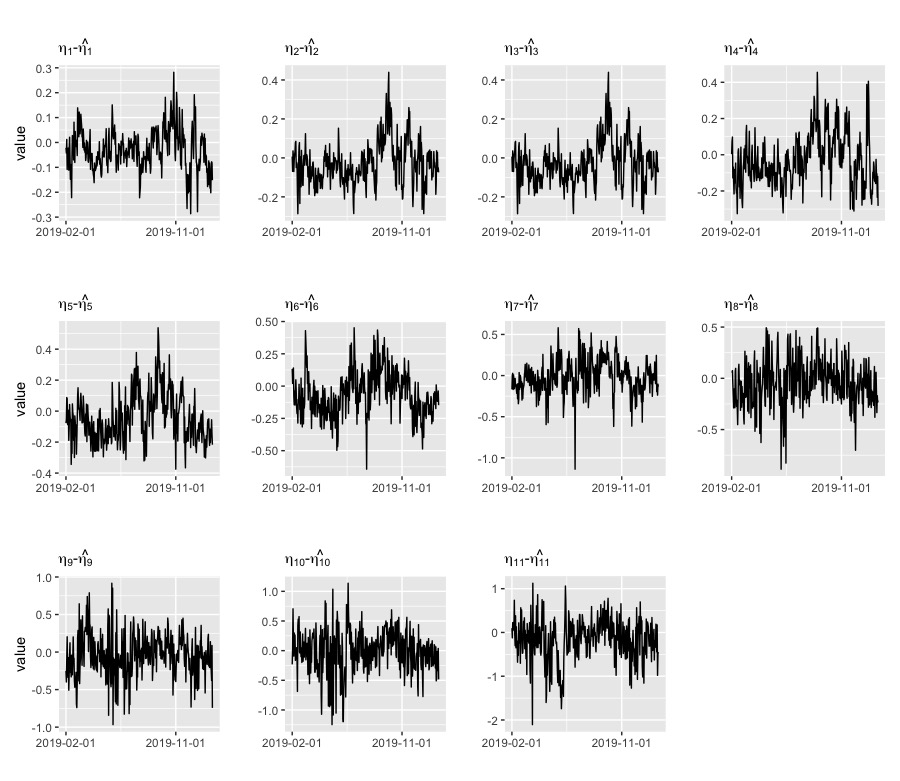

Figures 3 and 4 plot out of sample forecasts () and residuals of for the Normal Full model. The model captures most of the yearly seasonality and the residual terms exhibit no consistent positive or negative bias for any of the components as they are all centered near . Much of the remaining residual structure may be explained by market specific holidays which are not incorporated in the current model.

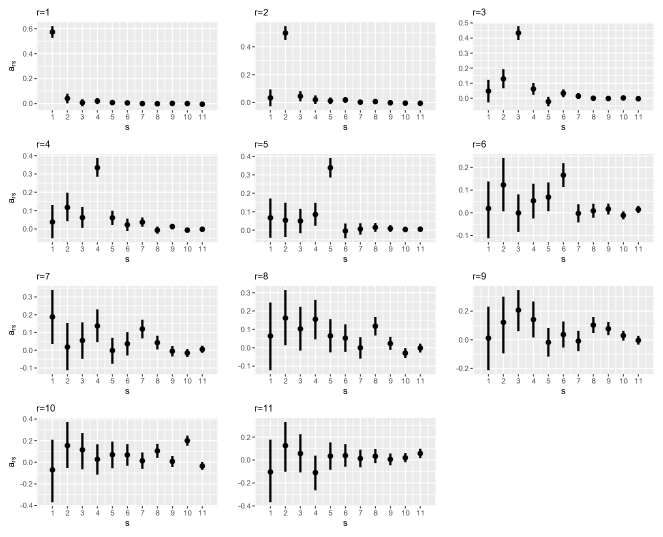

The estimated yearly and weekly seasonality for each of the ’s (ALR scale) and (log scale) in the Normal Full model are detailed in supplementary figures 5 and 6. Yearly variation is pronounced in larger components, with peaking in late December and troughing before the new year, while exhibits a simpler pattern with two high and one low period. Weekly seasonality displays a consistent weekday versus weekend behavior across all components, showing higher values on weekends. Supplementary table 9 summarizes the posterior statistics for the intercepts and linear growth rates of s and , showing a monotonic decrease in the intercepts and larger growth rates for smaller components. The growth rate of indicates less compositional variability over time. Lastly, the posterior densities for the elements of the matrix, shown in supplementary figure 7, reveal that larger components have pronounced coefficients on their own lag, , with diminishing magnitude for distant trip dates, while smaller components exhibit more uncertainty but generally maintain a strong positive coefficient on their own lag.

5 Discussion

There are distinct differences in the computational costs in fitting our DARMA model using frequentist or Bayesian methodologies, as well as the tVARMA model using the MTS package in R. Firstly, fitting the tVARMA model using the MTS package was fastest, attributable to its implementation of conditional maximum likelihood estimation with a multivariate Gaussian likelihood. This approach benefits from the mathematical simplicity of estimation under the normal model and its unconstrained optimization problem, resulting in significantly less computational overhead. This is in addition to the built-in performance optimizations found in specialized packages like MTS.

In contrast, the Bayesian DARMA model, implemented using Hamiltonian Monte Carlo (HMC), had higher computational costs. This is to be expected, given that HMC requires running many iterations to generate a representative sequence of samples from the posterior distribution. However, the B-DARMA fit faster than the frequentist DARMA. The frequentist DARMA model, fitted using the Broyden–Fletcher–Goldfarb–Shanno (BFGS) optimization method, was the most computationally demanding in our study. The complexity arises from the calculation of the Hessian matrix estimates, the computation of gamma functions in the Dirichlet likelihood, and the constraint of positive parameters. Notably, around 25% of model fitting attempts in the simulation studies initially failed and required regenerating data and refitting the model, underscoring the computational challenges of this approach.

This paper presented a new class of Bayesian compositional time series models assuming a Dirichlet conditional distribution of the observations, with time varying Dirichlet parameters which are modeled with a VARMA structure. The B-DARMA outperforms the frequentist tVARMA and DARMA when the underlying data generating model is a DARMA and does comparably well to the tVARMA and outperforms the DARMA when tVARMA is the data generating model in the simulation studies. By choice of prior and model subsets, we can reduce the number of coefficients needing to be estimated and better handle data sets with fewer observations. This class of models effectively models the fee lead time behavior at Airbnb, outperforming the DAR and tVAR with the same covariates, and provides an interpretable, flexible framework.

Further development is possible. Common compositional time series have components with no ordering while the 12 lead time components in the Airbnb data set are time ordered. This suggests can be modeled hierarchically. The construction of the Nearest Neighbor and Diagonal models for are examples of using time ordering in model specification. While the distributional parameters and are time-varying, the elements of are static and thus the seasonality is constant over time, which may not be appropriate for other data sets. We model with exogenous covariates, but our approach is flexible enough to allow for it to have a more complex AR structure itself. While not an issue for the Airbnb data set, the model’s inability to handle 0’s would need to be addressed for data sets with exact zeroes.

Acknowledgement

The authors thank Sean Wilson, Jackson Wang, Tom Fehring, Jenny Cheng, Erica Savage, and George Roumeliotis for helpful discussions.

References

- Aitchison (1982) Aitchison, J. (1982). The statistical analysis of compositional data. Journal of the Royal Statistical Society: Series B (Methodological) 44(2), 139–160.

- AL-Dhurafi et al. (2018) AL-Dhurafi, N. A., N. Masseran, and Z. H. Zamzuri (2018). Compositional time series analysis for air pollution index data. Stochastic Environmental Research and Risk Assessment 32(10), 2903–2911.

- Bańbura et al. (2010) Bańbura, M., D. Giannone, and L. Reichlin (2010). Large Bayesian vector auto regressions. Journal of Applied Econometrics 25(1), 71–92.

- Barber et al. (2011) Barber, D., A. T. Cemgil, and S. Chiappa (2011). Bayesian Time Series Models. Cambridge University Press.

- Barcelo-Vidal et al. (2011) Barcelo-Vidal, C., L. Aguilar, and J. A. Martín-Fernández (2011). Compositional varima time series. Compositional Data Analysis: Theory and Applications, 87–101.

- Benjamin et al. (2003) Benjamin, M. A., R. A. Rigby, and D. M. Stasinopoulos (2003). Generalized autoregressive moving average models. Journal of the American Statistical association 98(461), 214–223.

- Berliner (1996) Berliner, L. M. (1996). Hierarchical Bayesian time series models. In Maximum Entropy and Bayesian Methods, pp. 15–22. Springer.

- Bernardo and Smith (2009) Bernardo, J. M. and A. F. Smith (2009). Bayesian theory, Volume 405. John Wiley & Sons.

- Berry and West (2020) Berry, L. R. and M. West (2020). Bayesian forecasting of many count-valued time series. Journal of Business & Economic Statistics 38(4), 872–887.

- Brandt and Sandler (2012) Brandt, P. T. and T. Sandler (2012). A Bayesian Poisson vector autoregression model. Political Analysis 20(3), 292–315.

- Bürkner et al. (2020) Bürkner, P.-C., J. Gabry, and A. Vehtari (2020). Approximate leave-future-out cross-validation for Bayesian time series models. Journal of Statistical Computation and Simulation 90(14), 2499–2523.

- Cargnoni et al. (1997) Cargnoni, C., P. Müller, and M. West (1997). Bayesian forecasting of multinomial time series through conditionally Gaussian dynamic models. Journal of the American Statistical Association 92, 640–647.

- Carvalho et al. (2009) Carvalho, C. M., N. G. Polson, and J. G. Scott (2009). Handling sparsity via the horseshoe. In Proceedings of the Twelth International Conference on Artificial Intelligence and Statistics, pp. 73–80. Proceedings of Machine Learning Research 5.

- Carvalho et al. (2010) Carvalho, C. M., N. G. Polson, and J. G. Scott (2010). The horseshoe estimator for sparse signals. Biometrika 97(2), 465–480.

- Chen and Lee (2016) Chen, C. W. and S. Lee (2016). Generalized Poisson autoregressive models for time series of counts. Computational Statistics & Data Analysis 99, 51–67.

- da Silva et al. (2011) da Silva, C. Q., H. S. Migon, and L. T. Correia (2011). Dynamic Bayesian beta models. Computational Statistics & Data Analysis 55(6), 2074–2089.

- da Silva and Rodrigues (2015) da Silva, C. Q. and G. S. Rodrigues (2015). Bayesian dynamic Dirichlet models. Communications in Statistics-Simulation and Computation 44(3), 787–818.

- Egozcue et al. (2003) Egozcue, J. J., V. Pawlowsky-Glahn, G. Mateu-Figueras, and C. Barcelo-Vidal (2003). Isometric logratio transformations for compositional data analysis. Mathematical geology 35(3), 279–300.

- Fukumoto et al. (2019) Fukumoto, K., A. Beger, and W. H. Moore (2019). Bayesian modeling for overdispersed event-count time series. Behaviormetrika 46(2), 435–452.

- Grunwald et al. (1993) Grunwald, G. K., A. E. Raftery, and P. Guttorp (1993). Time series of continuous proportions. Journal of the Royal Statistical Society: Series B (Methodological) 55(1), 103–116.

- Huber and Feldkircher (2019) Huber, F. and M. Feldkircher (2019). Adaptive shrinkage in Bayesian vector autoregressive models. Journal of Business & Economic Statistics 37(1), 27–39.

- Karlsson (2013) Karlsson, S. (2013). Forecasting with Bayesian vector autoregression. Handbook of Economic Forecasting 2, 791–897.

- Kastner and Huber (2020) Kastner, G. and F. Huber (2020). Sparse Bayesian vector autoregressions in huge dimensions. Journal of Forecasting 39(7), 1142–1165.

- Koehler et al. (2010) Koehler, A. B., R. D. Snyder, J. K. Ord, A. Beaumont, et al. (2010). Forecasting compositional time series with exponential smoothing methods. Technical report, Monash University, Department of Econometrics and Business Statistics.

- Koop and Korobilis (2010) Koop, G. and D. Korobilis (2010). Bayesian Multivariate Time Series Methods for Empirical Macroeconomics. Now Publishers Inc.

- Kynčlová et al. (2015) Kynčlová, P., P. Filzmoser, and K. Hron (2015). Modeling compositional time series with vector autoregressive models. Journal of Forecasting 34(4), 303–314.

- McCabe and Martin (2005) McCabe, B. P. and G. M. Martin (2005). Bayesian predictions of low count time series. International Journal of Forecasting 21(2), 315–330.

- Mills (2010) Mills, T. C. (2010). Forecasting compositional time series. Quality & Quantity 44(4), 673–690.

- Nariswari and Pudjihastuti (2019) Nariswari, R. and H. Pudjihastuti (2019). Bayesian forecasting for time series of count data. Procedia Computer Science 157, 427–435.

- Pole et al. (2018) Pole, A., M. West, and J. Harrison (2018). Applied Bayesian forecasting and time series analysis. Chapman and Hall/CRC.

- Prado and West (2010) Prado, R. and M. West (2010). Time series: modeling, computation, and inference. Chapman and Hall/CRC.

- R Core Team (2022) R Core Team (2022). R: A Language and Environment for Statistical Computing. Vienna, Austria: R Foundation for Statistical Computing.

- Ravishanker et al. (2001) Ravishanker, N., D. K. Dey, and M. Iyengar (2001). Compositional time series analysis of mortality proportions. Communications in Statistics-Theory and Methods 30(11), 2281–2291.

- Roberts and Penny (2002) Roberts, S. J. and W. D. Penny (2002). Variational Bayes for generalized autoregressive models. IEEE Transactions on Signal Processing 50(9), 2245–2257.

- Silva and Smith (2001) Silva, D. and T. Smith (2001). Modelling compositional time series from repeated surveys. Survey Methodology 27(2), 205–215.

- Silveira de Andrade et al. (2015) Silveira de Andrade, B., M. G. Andrade, and R. S. Ehlers (2015). Bayesian garma models for count data. Communications in Statistics: Case Studies, Data Analysis and Applications 1(4), 192–205.

- Snyder et al. (2017) Snyder, R. D., J. K. Ord, A. B. Koehler, K. R. McLaren, and A. N. Beaumont (2017). Forecasting compositional time series: A state space approach. International Journal of Forecasting 33(2), 502–512.

- Spencer (1993) Spencer, D. E. (1993). Developing a Bayesian vector autoregression forecasting model. International Journal of Forecasting 9(3), 407–421.

- Stan Development Team (2022) Stan Development Team (2022). RStan: the R interface to Stan. R package version 2.21.5.

- Tsay et al. (2022) Tsay, R. S., D. Wood, and J. Lachmann (2022). MTS: All-Purpose Toolkit for Analyzing Multivariate Time Series (MTS) and Estimating Multivariate Volatility Models. R package version 1.2.1.

- Uhlig (1997) Uhlig, H. (1997). Bayesian vector autoregressions with stochastic volatility. Econometrica: Journal of the Econometric Society, 59–73.

- Vehtari and Ojanen (2012) Vehtari, A. and J. Ojanen (2012). A survey of Bayesian predictive methods for model assessment, selection and comparison. Statistics Surveys 6, 142–228.

- Vehtari et al. (2015) Vehtari, A., D. Simpson, A. Gelman, Y. Yao, and J. Gabry (2015). Pareto smoothed importance sampling. arXiv preprint arXiv:1507.02646.

- West (1996) West, M. (1996). Bayesian time series: Models and computations for the analysis of time series in the physical sciences. In Maximum Entropy and Bayesian Methods, pp. 23–34. Springer.

- West (2013) West, M. (2013). Bayesian dynamic modelling. Bayesian Inference and Markov Chain Monte Carlo: In Honour of Adrian FM Smith, 145–166.

- Zheng and Chen (2017) Zheng, T. and R. Chen (2017). Dirichlet ARMA models for compositional time series. Journal of Multivariate Analysis 158, 31–46.

Figures and tables

| DGM: | DARMA(1,1) | tVARMA(1,1) | |||||

|---|---|---|---|---|---|---|---|

| Model: | B-DARMA | DARMA | tVARMA | B-DARMA | DARMA | tVARMA | |

| FRMSE | 0.1054 | 0.1091 | 0.1063 | 0.0566 | 0.0794 | 0.0566 | |

| 0.1342 | 0.1367 | 0.1356 | 0.0748 | 0.0775 | 0.0748 | ||

| 0.1015 | 0.1082 | 0.1470 | 0.0548 | 0.0640 | 0.0787 | ||

| FMAE | 0.0770 | 0.0777 | 0.0800 | 0.0432 | 0.0633 | 0.0432 | |

| 0.1004 | 0.1009 | 0.1020 | 0.0574 | 0.0652 | 0.0574 | ||

| 0.0766 | 0.0775 | 0.1102 | 0.0422 | 0.0529 | 0.0617 |

| (P,Q) | pairs of Fourier terms | ELPD diff | LFO ELPD |

|---|---|---|---|

| (1,0) | 9 | 0.0 | 70135.3 |

| (1,0) | 10 | -23.3 | 70112.0 |

| (1,0) | 8 | -83.2 | 70052.0 |

| (1,0) | 6 | -594.7 | 69540.6 |

| (1,0) | 3 | -1190.1 | 68945.2 |

| (1,1) | 9 | -101.7 | 70033.6 |

| (2,0) | 9 | -123.7 | 70011.5 |

| Normal | Horseshoe | Normal | Normal | ||||

| Full | Full | Nearest-Neighbor | Diagonal | DAR(1) | tVAR(1) | ||

| FRMSE | 0.0211 | 0.0213 | 0.0216 | 0.0225 | 0.0213 | 0.0301 | |

| 0.0122 | 0.0124 | 0.0129 | 0.0132 | 0.0124 | 0.0145 | ||

| 0.0101 | 0.0101 | 0.0103 | 0.0106 | 0.0101 | 0.0118 | ||

| 0.0094 | 0.0094 | 0.0097 | 0.0099 | 0.0094 | 0.0110 | ||

| 0.0061 | 0.0061 | 0.0062 | 0.0063 | 0.0061 | 0.0076 | ||

| 0.0050 | 0.0050 | 0.0051 | 0.0052 | 0.0050 | 0.0056 | ||

| 0.0037 | 0.0037 | 0.0039 | 0.0040 | 0.0037 | 0.0042 | ||

| 0.0029 | 0.0029 | 0.0030 | 0.0031 | 0.0029 | 0.0033 | ||

| 0.0023 | 0.0023 | 0.0023 | 0.0023 | 0.0023 | 0.0026 | ||

| 0.0022 | 0.0022 | 0.0023 | 0.0023 | 0.0022 | 0.0023 | ||

| 0.0025 | 0.0023 | 0.0025 | 0.0025 | 0.0025 | 0.0025 | ||

| 0.0022 | 0.0022 | 0.0022 | 0.0022 | 0.0022 | 0.0030 | ||

| Total | 0.0796 | 0.0800 | 0.0821 | 0.0841 | 0.0801 | 0.0983 | |

| FMAE | 0.0170 | 0.0171 | 0.0174 | 0.0181 | 0.0172 | 0.0247 | |

| 0.0090 | 0.0094 | 0.0099 | 0.0111 | 0.0096 | 0.0113 | ||

| 0.0076 | 0.0079 | 0.0081 | 0.0083 | 0.0079 | 0.0090 | ||

| 0.0067 | 0.0068 | 0.0070 | 0.0079 | 0.0070 | 0.0085 | ||

| 0.0048 | 0.0049 | 0.0049 | 0.0051 | 0.0049 | 0.0059 | ||

| 0.0039 | 0.0039 | 0.0042 | 0.0042 | 0.0039 | 0.0044 | ||

| 0.0027 | 0.0027 | 0.0027 | 0.0030 | 0.0027 | 0.0032 | ||

| 0.0021 | 0.0021 | 0.0022 | 0.0023 | 0.0022 | 0.0025 | ||

| 0.0018 | 0.0018 | 0.0018 | 0.0019 | 0.0018 | 0.0019 | ||

| 0.0016 | 0.0016 | 0.0016 | 0.0016 | 0.0016 | 0.0017 | ||

| 0.0017 | 0.0017 | 0.0017 | 0.0017 | 0.0017 | 0.0018 | ||

| 0.0016 | 0.0016 | 0.0016 | 0.0017 | 0.0016 | 0.0022 | ||

| Total | 0.0605 | 0.0615 | 0.0631 | 0.0669 | 0.0621 | 0.0771 |

| par | model | true | RMSE | bias | coverage | length |

|---|---|---|---|---|---|---|

| B-DARMA | -.07 | 0.0083 | -0.0019 | 0.9450 | 0.0312 | |

| DARMA | 0.0088 | -0.0015 | 0.9225 | 0.0312 | ||

| tVARMA | 0.0112 | -0.0038 | 0.9000 | 0.0354 | ||

| B-DARMA | .10 | 0.0081 | -0.0012 | 0.9425 | 0.0313 | |

| DARMA | 0.0083 | -0.0007 | 0.9425 | 0.0312 | ||

| tVARMA | 0.0096 | -0.0035 | 0.9425 | 0.0361 | ||

| B-DARMA | .95 | 0.0113 | -0.0021 | 0.9250 | 0.0385 | |

| DARMA | 0.0108 | -0.0025 | 0.9600 | 0.0395 | ||

| tVARMA | 0.0145 | -0.0036 | 0.8950 | 0.0428 | ||

| B-DARMA | -.18 | 0.0074 | -0.0014 | 0.9400 | 0.0287 | |

| DARMA | 0.0079 | -0.0009 | 0.9400 | 0.0294 | ||

| tVARMA | 0.0133 | -0.0013 | 0.8500 | 0.0316 | ||

| B-DARMA | .30 | 0.0101 | -0.0020 | 0.9500 | 0.0373 | |

| DARMA | 0.0101 | -0.0009 | 0.9500 | 0.0382 | ||

| tVARMA | 0.0127 | -0.0041 | 0.9225 | 0.0436 | ||

| B-DARMA | .95 | 0.0086 | -0.0021 | 0.9300 | 0.0311 | |

| DARMA | 0.0084 | -0.0018 | 0.9300 | 0.0316 | ||

| tVARMA | 0.0108 | -0.0028 | 0.9050 | 0.0323 | ||

| B-DARMA | .65 | 0.0309 | -0.0064 | 0.9450 | 0.1244 | |

| DARMA | 0.0308 | -0.0011 | 0.9500 | 0.1286 | ||

| tVARMA | 0.1012 | -0.0759 | 0.5025 | 0.1593 | ||

| B-DARMA | .20 | 0.0314 | 0.0003 | 0.9475 | 0.1168 | |

| DARMA | 0.0297 | 0.0018 | 0.9425 | 0.1162 | ||

| tVARMA | 0.0907 | -0.0485 | 0.5650 | 0.1768 | ||

| B-DARMA | .15 | 0.0286 | 0.0010 | 0.9525 | 0.1145 | |

| DARMA | 0.0289 | 0.0031 | 0.9525 | 0.1139 | ||

| tVARMA | 0.0900 | -0.0514 | 0.5425 | 0.1645 | ||

| B-DARMA | .65 | 0.0321 | -0.0040 | 0.9500 | 0.1283 | |

| DARMA | 0.0341 | 0.0013 | 0.9350 | 0.1272 | ||

| tVARMA | 0.1135 | -0.0868 | 0.4550 | 0.1575 |

| par | model | true | RMSE | bias | coverage | length |

|---|---|---|---|---|---|---|

| B-DARMA | -.07 | 0.0063 | -0.0012 | 0.9650 | 0.0254 | |

| DARMA | 0.0065 | -0.0008 | 0.9275 | 0.0336 | ||

| tVARMA | 0.0061 | -0.0013 | 0.9450 | 0.0238 | ||

| B-DARMA | .10 | 0.0069 | -0.0010 | 0.9625 | 0.0254 | |

| DARMA | 0.0065 | -0.0007 | 0.9400 | 0.0334 | ||

| tVARMA | 0.0062 | -0.0010 | 0.9550 | 0.0241 | ||

| B-DARMA | .95 | 0.0125 | -0.0035 | 0.9525 | 0.0461 | |

| DARMA | 0.0125 | -0.0038 | 0.9300 | 0.0604 | ||

| tVARMA | 0.0115 | -0.0022 | 0.9525 | 0.0431 | ||

| B-DARMA | -.18 | 0.0086 | -0.0004 | 0.9650 | 0.0344 | |

| DARMA | 0.0091 | -0.0007 | 0.9225 | 0.0595 | ||

| tVARMA | 0.0084 | -0.0007 | 0.9600 | 0.0321 | ||

| B-DARMA | .30 | 0.0115 | -0.0010 | 0.9600 | 0.0454 | |

| DARMA | 0.0112 | -0.0009 | 0.9375 | 0.0453 | ||

| tVARMA | 0.0111 | -0.0007 | 0.9500 | 0.0437 | ||

| B-DARMA | .95 | 0.0090 | -0.0025 | 0.9475 | 0.0347 | |

| DARMA | 0.0096 | -0.0040 | 0.9275 | 0.0456 | ||

| tVARMA | 0.0086 | -0.0016 | 0.9450 | 0.0325 | ||

| B-DARMA | .65 | 0.0342 | -0.0050 | 0.9475 | 0.1320 | |

| DARMA | 0.0365 | -0.0015 | 0.9300 | 0.1728 | ||

| tVARMA | 0.0348 | 0.0002 | 0.9350 | 0.1287 | ||

| B-DARMA | .20 | 0.0342 | -0.0027 | 0.9275 | 0.1318 | |

| DARMA | 0.0357 | 0.0032 | 0.9150 | 0.1718 | ||

| tVARMA | 0.0337 | -0.0007 | 0.9475 | 0.1315 | ||

| B-DARMA | .15 | 0.0325 | -0.0011 | 0.9600 | 0.1320 | |

| DARMA | 0.0346 | -0.0005 | 0.9125 | 0.1707 | ||

| tVARMA | 0.0319 | 0.0012 | 0.9475 | 0.1278 | ||

| B-DARMA | .65 | 0.0354 | -0.0077 | 0.9375 | 0.1317 | |

| DARMA | 0.0366 | 0.0003 | 0.8850 | 0.1717 | ||

| tVARMA | 0.0344 | -0.0008 | 0.9475 | 0.1318 |

| Parameter | Model | Net Bias | RMSE Ratio | Net Coverage | Length Ratio |

|---|---|---|---|---|---|

| DARMA | -0.0004 | 1.06 | -0.0225 | 1.00 | |

| tVARMA | -0.0019 | 1.35 | -0.0450 | 1.13 | |

| DARMA | 0.0005 | 1.02 | 0.0000 | 0.99 | |

| tVARMA | -0.0023 | 1.18 | 0.0000 | 1.15 | |

| DARMA | -0.0004 | 0.96 | 0.0350 | 1.03 | |

| tVARMA | -0.0015 | 1.28 | -0.0300 | 1.11 | |

| DARMA | 0.0005 | 1.07 | 0.0000 | 1.02 | |

| tVARMA | 0.0001 | 1.80 | -0.0900 | 1.10 | |

| DARMA | 0.0011 | 1.00 | 0.0000 | 1.02 | |

| tVARMA | -0.0021 | 1.26 | -0.0275 | 1.17 | |

| DARMA | 0.0003 | 0.98 | 0.0000 | 1.02 | |

| tVARMA | -0.0007 | 1.26 | -0.0250 | 1.04 | |

| DARMA | 0.0053 | 1.00 | 0.0050 | 1.03 | |

| tVARMA | -0.0695 | 3.27 | -0.4425 | 1.28 | |

| DARMA | 0.0006 | 0.95 | -0.0050 | 0.99 | |

| tVARMA | -0.0482 | 2.89 | -0.3825 | 1.51 | |

| DARMA | 0.0001 | 1.01 | 0.0000 | 0.99 | |

| tVARMA | -0.0504 | 3.15 | -0.4100 | 1.44 | |

| DARMA | 0.0073 | 1.06 | -0.0150 | 0.99 | |

| tVARMA | -0.0828 | 3.54 | -0.4950 | 1.23 |

| Parameter | Model | Net Bias | RMSE Ratio | Net Coverage | Length Ratio |

|---|---|---|---|---|---|

| DARMA | -0.0004 | 1.03 | -0.0375 | 1.32 | |

| tVARMA | -0.0001 | 0.97 | -0.0200 | 0.94 | |

| DARMA | 0.0003 | 0.94 | -0.0225 | 1.31 | |

| tVARMA | 0.0000 | 0.90 | -0.0075 | 0.95 | |

| DARMA | -0.0003 | 1.00 | -0.0225 | 1.31 | |

| tVARMA | 0.0013 | 0.92 | 0.0000 | 0.93 | |

| DARMA | -0.0003 | 1.06 | -0.0425 | 1.73 | |

| tVARMA | -0.0003 | 0.98 | -0.0050 | 0.93 | |

| DARMA | 0.0001 | 0.97 | -0.0225 | 1.00 | |

| tVARMA | 0.0003 | 0.97 | -0.0100 | 0.96 | |

| DARMA | -0.0015 | 1.07 | -0.0200 | 1.31 | |

| tVARMA | 0.0009 | 0.96 | -0.0025 | 0.94 | |

| DARMA | 0.0035 | 1.07 | -0.0175 | 1.31 | |

| tVARMA | 0.0052 | 1.02 | -0.0125 | 0.98 | |

| DARMA | 0.0059 | 1.04 | -0.0125 | 1.30 | |

| tVARMA | 0.0020 | 0.98 | 0.0200 | 1.00 | |

| DARMA | 0.0006 | 1.06 | -0.0475 | 1.29 | |

| tVARMA | 0.0023 | 0.98 | -0.0125 | 0.97 | |

| DARMA | 0.0080 | 1.03 | -0.0525 | 1.30 | |

| tVARMA | 0.0069 | 0.97 | 0.0100 | 1.00 |

| model | ELPD diff | LFO ELPD |

|---|---|---|

| Horseshoe Full | 0.0 | 70149.2 |

| Normal Full | -8.9 | 70140.3 |

| Normal Nearest-Neighbor | -37.3 | 70112.0 |

| Normal Diagonal | -186.2 | 69963.1 |

| par | Mean | SD | Q2.5 | Q97.5 | |

|---|---|---|---|---|---|

| intercept | -0.228 | 0.055 | -0.337 | -0.121 | |

| -0.526 | 0.071 | -0.666 | -0.389 | ||

| -0.719 | 0.091 | -0.897 | -0.545 | ||

| -1.033 | 0.112 | -1.254 | -0.811 | ||

| -1.483 | 0.136 | -1.750 | -1.215 | ||

| -2.409 | 0.169 | -2.740 | -2.070 | ||

| -2.791 | 0.209 | -3.200 | -2.384 | ||

| -2.819 | 0.249 | -3.299 | -2.330 | ||

| -2.999 | 0.301 | -3.592 | -2.417 | ||

| -3.064 | 0.349 | -3.743 | -2.380 | ||

| -4.879 | 0.354 | -5.572 | -4.176 | ||

| 6.746 | 0.023 | 6.701 | 6.791 | ||

| linear growth | 0.238 | 0.080 | 0.085 | 0.395 | |

| 0.607 | 0.100 | 0.411 | 0.804 | ||

| 0.778 | 0.125 | 0.533 | 1.024 | ||

| 1.104 | 0.154 | 0.800 | 1.402 | ||

| 1.674 | 0.189 | 1.306 | 2.050 | ||

| 2.235 | 0.239 | 1.766 | 2.702 | ||

| 2.669 | 0.304 | 2.077 | 3.268 | ||

| 2.627 | 0.366 | 1.905 | 3.341 | ||

| 2.404 | 0.449 | 1.529 | 3.285 | ||

| 3.547 | 0.520 | 2.531 | 4.564 | ||

| 7.297 | 0.512 | 6.295 | 8.314 | ||

| 6.824 | 0.268 | 6.297 | 7.347 |