A Scenario-oriented Approach to Energy-Reserve Joint Procurement and Pricing

Abstract

We consider some crucial problems related to the secure and reliable operation of power systems with high renewable penetrations: how much reserve should we procure, how should reserve resources distribute among different locations, and how should we price reserve and charge uncertainty sources. These issues have so far been largely addressed empirically. In this paper, we first develop a scenario-oriented energy-reserve co-optimization model, which directly connects reserve procurement with possible outages and load/renewable power fluctuations without the need for empirical reserve requirements. Accordingly, reserve can be optimally procured system-wide to handle all possible future uncertainties with the minimum expected system total cost. Based on the proposed model, marginal pricing approaches are developed for energy and reserve, respectively. Locational uniform pricing is established for energy, and the similar property is also established for the combination of reserve and re-dispatch. In addition, properties of cost recovery for generators and revenue adequacy for the system operator are also proven.

Index Terms:

electricity market, reserve, energy-reserve co-optimization, uncertainty pricing, locational marginal prices.I Introduction

I-A Backgrounds

The integration of more renewable generations in power systems is an important way to achieve carbon neutrality. However, the increasing uncertainty brought by renewable generations also brings challenges to the secure and reliable operation of power systems. To handle this, the reserve is procured system-wide and deployed for generation re-dispatch when contingencies happen, or loads/renewable generations deviate from their predictions. Reserve and energy are strongly coupled both in generation and transmission capacity limits. A fair, efficient, and transparent energy-reserve co-optimization model and the associated market mechanism are of crucial importance.

I-B Literature Review

Energy and reserve markets are cleared either sequentially or jointly to deal with their coupling in generation capacities. Currently, most of the independent system operators (ISOs) in the U.S. adopt a joint clearing process[2, 3], stylistically defined by:

| (1) | ||||

| subject to | ||||

| (2) | ||||

| (3) | ||||

| (4) |

The objective function (1) aims to minimize the total bid-in cost of energy , upward reserve , and downward reserve . Constraints (2)-(4) represent energy balancing and transmission capacity constraints, reserve requirement constraints, and generator capacity and ramping-rate limits, respectively. Reserve clearing prices will be set as the Lagrange multipliers , representing the increase of total bid-in cost when there is one additional unit of upward/downward reserve requirement.

Several important issues arise from model (I). First, the reserve requirements and are empirical and subjective, sometimes specified as the capacity of the biggest online generator as in PJM[4] or a certain proportion of system loads as in CAISO[5]. Their values, however, can significantly affect the market clearing results and prices of both the energy and reserve products. Second, the deliverability of reserve in non-base scenarios with contingencies and load/renewable power fluctuations is not considered in (I). A common solution is to partition the entire system into different zones, each with zonal reserve requirements and prices[6], which is again ad hoc. Third, the objective function (1) uses the base-case bid-in cost without taking into account possible re-adjustment costs. Fourth, it is not clear how the cost of procuring reserve should be afforded among all consumers. Some ISOs let all load serving entities share this cost proportionally[2, 3].

In light of these problems, many studies aim to improve the traditional model (I). For reserve requirement selection, parametric and non-parametric probabilistic forecasting techniques are incorporated in (I) by characterizing the underlying probability distribution of future situations [7, 8, 9, 10]. Scenario-based approaches have also been proposed in[11, 12]. In addition, on the deliverability of reserve, a statistical clustering method is proposed in [13] that partitions the network into reserve zones. In [14], a generalized reserve disqualification approach is developed.

Stochastic co-optimization models have also been proposed. In [15], a robust stochastic optimization model is adopted for the co-optimization of energy and possible re-dispatch. Moreover, the uncertainty marginal price is defined as the marginal cost of immunizing the next unit increment of the worst point in the uncertainty set. Such marginal cost is used to price both reserve resources and uncertainty sources. In [16], a chance-constrained stochastic optimization model is adopted, where statistical moments of uncertainties are considered to generate chance constraints, and an algorithm is proposed to transform the original problem to a convex formulation. In [17, 18, 19, 20, 21, 22, 23, 24], a scenario-oriented stochastic optimization model structure is adopted. Some non-base scenarios with occurrence probabilities are modelled to represent possible loads/renewable power fluctuations and contingencies. The energy balancing and transmission capacity constraints in all non-base scenarios are considered to analyze the re-adjustment procedures. Among those scenario-based solutions, some adopt the energy-only model structure [17, 18, 19]; others consider the energy-reserve co-optimization structure [20, 21, 22, 23, 24]. In [21], the nodal marginal prices of energy and security are derived to settle energy and all tiers of regulating reserve, respectively.

On the design of a pricing approach, the revenue adequacy of the operator and the cost recovery of market participants are necessary. In [17] and [20], both properties are established in expectation. In [18], cost recovery is established in expectation, and revenue adequacy is established for every scenario. In [19], an equilibrium model is adopted to achieve both revenue adequacy and cost recovery for each scenario with increased system costs and the loss of social welfare.

I-C Contributions, Organizations and Nomenclature

The main contributions of this paper are listed as follows:

(1) A scenario-oriented energy-reserve co-optimization model is proposed. Reserve procured from a generator is modelled as the maximum range of its power re-dispatch in all scenarios. The proposed model no longer relies on empirical parameters of (zonal) reserve requirements. The deliverability of all reserve resources under all scenarios is ensured by incorporating the network constraints in non-base scenarios into the co-optimization model.

(2) Marginal prices of energy and reserve are derived as by-products of the co-optimization model. The associated settlement process is also presented. We show that energy prices are locational uniform, and a proportional uniform pricing property can be established for re-dispatch.

(3) Cost recovery for generators is established for every scenario, and revenue adequacy for the system operator is established in expectation. We show that revenue from load payments, credits to generators including energy, reserve, and re-dispatches, and congestion rent will reach their balance for both the base case and each non-base scenario.

The rest of this paper is organized as follows. The proposed model is formulated in Section II. The pricing approach and the settlement process are presented in Section III. Some properties are established in Section IV. Some of the assumptions are further discussed in Section V. Case studies are presented in Section VI. Section VII concludes this paper. A list of major designated symbols are listed in Table I.

| : | bid-in prices of energy, upward reserve |

|---|---|

| and downward reserve. | |

| : | upward/downward generation re-dispatch |

| prices and load shedding prices. | |

| : | basic load/load fluctuation in scenario . |

| : | load shedding in scenario . |

| : | generation upward and downward |

| re-dispatches in scenario . | |

| : | occurrence probability of scenario . |

| : | energy marginal prices of generators and loads. |

| : | upward and downward reserve marginal prices. |

| : | transmission capacity limit in the base case |

| and in scenario . | |

| : | objective function. |

| : | generations, upward and downward reserve. |

| : | base-case/non-base component of energy |

| prices. | |

| : | shift factor matrices in the base case |

| and in scenario |

II Model Formulation

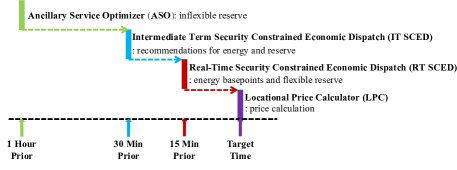

We consider a scenario-oriented co-optimization model. In the current market design, with PJM as an example, the reserve market consists of several look-ahead stages to procure reserve resources with different flexibility levels as shown in Fig. 1. We abstract the real-time operations in Fig. 1 into a look-ahead energy-reserve co-optimization model with the following assumptions:

i) A shift factor-based lossless DCOPF model with linear cost functions for energy and reserve is adopted, which is consistent with the current electricity market design.

ii) A single-period problem is considered for simplicity.

iii) Renewable generations are modelled as negative loads.

iv) Non-base scenarios may have line outages, load or renewable power fluctuations, etc. Generator outages, however, are not considered.

v) The objective of the proposed model is to guard against a set of mutually exclusive non-base scenarios, and the occurrence probability of each scenario is assumed to be given.

We will have further discussions on assumptions (ii)-(iv) in Section V.

Based on assumptions (i)-(v), the proposed co-optimization model is given by:

| (5) | ||||

| subject to | ||||

| (6) | ||||

| (7) | ||||

| (8) | ||||

| for all : | ||||

| (9) | ||||

| (10) | ||||

| (11) | ||||

| (12) | ||||

| (13) |

where the objective function (5) is the expected system total cost, including the base-case bid-in cost as in (1) and the expectation of re-adjustment costs in all scenarios111It should be noted that coefficients and in re-adjustment costs respectively represent the true marginal cost of upward re-dispatch and the true marginal cost reduce of generation downward re-dispatch. In some papers e.g. [17], and are set as the energy bid-in prices . In this paper, in case some generators may incur extra costs for fast ramping, we set and as independent coefficients from . Note that no matter how we set these two coefficients, all the qualitative analyses in this paper will always hold.. If one generator’s downward reserve is deployed, its output will decrease, so will its generation cost. Therefore, there is a negative sign before the term in (5). Constraints (6)-(8) are base-case constraints in the same form as (2)-(4) in model (I), except for the shift factor matrices used in network constraints. The two matrices, and are shift factor matrices associated with generators and loads. Constraints (9)-(10) are the energy balancing constraints and transmission capacity limits in all non-base scenarios. Note that transmission capacities in non-base scenarios may not be the same as the base-case . The impact of line outages on network topology is reflected in and compared with the base-case and . Constraints (11)-(12) indicate that the procured reserve will be modelled as the maximum range of generation re-dispatches in all scenarios. In constraints (9)-(10) and (13), is the vector of load fluctuation parameter in non-base scenario forecast by the system operator. Therefore, constraint (13) represents that load shedding in each scenario must be non-negative and cannot exceed forecast load power in scenario .222We assume that and are non-negative. If they are negative for some resources in scenario , it means that these resources are uncontrollable renewable generations and represents renewable curtailment. To consider this, we only need to add one more constraint and one associated dual variable, and all the qualitative analyses will still hold.

In some market implementations, the one-step ramping constraint from the previous dispatch set point will be considered as , where is actual generator outputs at the last interval from state estimation, and are the maximum upward and downward ramping rates of generators[25]. Note that this constraint can be easily incorporated into the generation capacity limit (7).

In addition, the proposed co-optimization model (II) is a standard linear programming. In this paper, we do not go into its detailed solution method, except mentioning that some distributed optimization techniques can be employed to solve it efficiently, see [26] and [27].

Moreover, from the proposed model (II) we can derive marginal prices of energy and reserve, and design the associated market settlement process, as in the next section.

III Pricing and Settlement

III-A Energy and Reserve Prices

The proposed pricing approach for energy and reserve is based on their marginal contributions to the expected system total cost in (5). Namely, consider any generator , we first fix at their optimal values and consider them as parameters instead of decision variables. Such a modified model is referred to as model (III)

where represent all the decision variables of model (II) except for and , is the overall cost excluding the bid-in cost of generator , and are the constraints (6)-(13) excluding the row of all constraints in (7)-(8), which are the internal constraints of generator . Subsequently, we evaluate the sensitivity of the optimal objective function of model (III) , which represents the sensitivity of the expected cost of all other market participants except for generator , with respect to parameters and . According to the envelope theorem, the marginal energy price of generator is

| (14) |

where is the index of the bus where generator is located. The term , denoted by , corresponds to the base-case contribution to the energy prices of generators. The term , denoted by , corresponds to the contribution to the generator energy prices of scenario . They both follow the same form as the standard LMP, as the sum of an energy component and a congestion component.

Similarly, the energy marginal price of load is

| (15) |

which is consistent with the energy marginal prices of generators in (III-A) except for the last term . Here are the multipliers associated with the upper bound of load shedding in (13). is non-zero only if load will be totally shed in scenario . If a load is completely shed for a particular customer whereas other loads are not, then in fact these consumers have different reliability priorities. In other words, electricity is no longer a homogeneous good for all customers. Nevertheless, we consider such cases rarely happen and introduce the following assumption in some of our analysis:

vi): are assumed to be zero in (III-A).

Although the energy prices of generators and loads are defined separately in (III-A) and (III-A) at the resource level, with the new assumption (vi), the property of locational uniform pricing can be established for energy as follows:

Theorem 1 (Locational Uniform Pricing for Energy):

Consider any two generators and any load at the same bus, i.e., . Under assumptions (i)-(vi), they have the same energy price, i.e., .

Furthermore, for the upward reserve marginal price, according to the envelop theorem, there is

| (16) |

From (16) we can see that for each generator , if its upward generation re-dispatch reaches its procured reserve in scenario , i.e., , then the corresponding multiplier may be positive and contribute to its upward reserve marginal price . The upward reserve marginal price in (16) is discriminatory because reserve capacities procured from different generators at the same bus may not be homogeneous good due to their possible different re-dispatch prices.

Similarly, the downward reserve marginal price is

| (17) |

which is also discriminatory.

Based on the proposed pricing approach, the market settlement process will be presented in the next subsection.

III-B Market Settlement Process

The proposed settlement process includes two stages: in the ex-ante stage, without knowing which scenario will happen, we solve the co-optimization problem (II) to guard against all possible non-base scenarios; and in the ex-post stage, with the realization of one specific scenario, re-adjustment strategies will be deployed according to the results from model (II), and the ex-post settlement depends on the realized scenario.

III-B1 ex-ante stage

Settlement in the ex-ante stage includes the following credits and payments:

-

•

Base-case contribution to generator ’s energy credit:

(18) -

•

Non-base contributions to generator ’s energy credit:

(19) -

•

Base-case contribution to load ’s energy payment:

(20) -

•

Non-base contributions to load ’s energy payment:

(21) -

•

Load ’s fluctuation payment:

(22) which is contributed from its possible load fluctuations in all non-base scenarios;

-

•

generator ’s upward and downward reserve credit:

(23) (24)

Remark 1:

The co-optimization model (II) is proposed to guard against all possible non-base scenarios. Although only one scenario will be realized, other ones have also contributed to the cost of procuring reserve. How to properly distribute the cost of guarding against scenarios that do not actually happen is thus a key issue. In the proposed settlement process, consumers pay for their possible fluctuations in all non-base scenarios as in (22).

An alternative is letting consumers pay only for their actual fluctuations in the realized scenario. In this case, the fluctuation payment is ex-post and formulated as

| (25) |

and the SO will afford the cost of other hypothetical scenarios. As shown in [17] and in this paper, both approaches can achieve the revenue adequacy for the SO in expectation. However, we argue that load payments and merchandise surplus of the SO are much more volatile in the approach in (25). The reason is that the reserve cost in the co-optimization model (II) mainly comes from some severe but rare scenarios. In most cases where these extreme scenarios are not realized, the load payment will be relatively low, and the net revenue of the system operator will be negative. However, if one of the extreme scenarios happens, load payment will increase significantly, leading to large amounts of SO’s net revenue that can offset negative values in normal scenarios. Such drastic increases in load payment under rare but extreme scenarios, however, are sometimes unacceptable, as in the Texas power crisis in early 2021. This is an important reason for us to adopt the ex-ante settlement for possible load fluctuations. Simulations in Section VI also verify our intuitions above.

III-B2 ex-post stage

In this stage, if the base case happens, no adjustment is needed. Otherwise, assume non-base scenario happens, then the generation re-dispatch of each generator will be either or , and will be settled with re-dispatch prices and . Load shedding will be settled with shedding prices . Therefore, the ex-post stage includes the following payments:

-

•

upward re-dispatch credit:

(26) -

•

downward re-dispatch pay-back:

(27) -

•

load shedding compensation:

(28)

Note that ex-post re-dispatches and load shedding must be implemented in a very short period of time, sometimes automatically. We therefore do not introduce another round of optimizations or auctions. Re-dispatch prices and load shedding prices in (5) will be used as settlement prices instead of marginal prices, which makes the ex-post settlement paid-as-bid.

With the proposed model, the pricing approach and the settlement process, some attractive properties can be established, as in the next section.

IV Properties

In this section, we investigate several key properties of the proposed co-optimization and pricing scheme: proportional uniform pricing for re-dispatch, individual rationality, cost recovery for generators for each scenario, and revenue adequacy for the system operator in expectation.

IV-A Proportional Uniform Pricing for Re-dispatch

In the proposed settlement process, the revenue of a generator consists of three parts: (i) the ex-ante energy credit in (18) and (19), (ii) the ex-ante upward reserve credit in (23) and downward reserve credit in (24), and (iii) the ex-post upward re-dispatch credit in (26) and downward re-dispatch pay-back in (27). With Theorem 1 in Section III, the property of locational uniform pricing has been established for the generator energy credit. Next we will consider establishing this property for the second and third part of generator credit as a whole. For simplicity, we only analyze the upward reserve and re-dispatch credit in this subsection, and the analysis can be easily applied to downward reserve and re-dispatch.

Note that the generator reserve revenue in (23) and the expectation of the generator re-dispatch credit in (26) are written in a scenario-wise form as follows:

| (29) |

Each term in (29) can be interpreted as the fractional contribution of scenario to the reserve and expected re-dispatch revenue of generator . Next, we show that such fractional revenues of different generators in the same scenario are proportional to their re-dispatch quantities, which are referred to as the proportional locational uniform pricing property in this paper:

Theorem 2 (Proportional Uniform Pricing for Re-dispatch):

For any given scenario , consider any two generators at the same bus. Under assumptions (i)-(v) and assume that ,

| (30) |

Please check the Appendix A for the proof. Note that neither the reserve revenue in (23) nor the re-dispatch credit in (26) alone has similar uniform pricing property. Essentially, the property of uniform pricing is a result of “the law of one price”: Under certain conditions, identical goods should have the same price. However, reserve procured from different generators at the same bus may not be identical, due to their different re-dispatch costs. Such a property is only true if we consider the entire re-dispatch process (23) and (26) as a whole.

IV-B Cost Recovery

We review properties of market participants in the proposed co-optimization model and pricing mechanism. To establish the properties in this subsection, we introduce another assumption to get rid of the non-zero lower bound issue of generators, which may lead to uplifts. The additional assumption is presented as follows:

vii) The lower bound of each generator’s energy output is assumed to be zero.

First, we establish the property of individual rationality as the following:

Theorem 3 (Individual Rationality):

In other words, if generator were able to freely adjust its supply of energy and reserve with given prices , then the solution to the co-optimization model (II) would have been maximized its profit.

Please check the Appendix B for the proof. Although Theorem 3 is established for the ex-ante stage only, it is still valid considering the ex-post stage. This is because the ex-post settlement is true-cost based and will not affect the profit of generators.

A natural corollary of Theorem 3 is the property of cost recovery for generators:

Corollary 1 (Cost Recovery):

Under assumptions (i)-(v) and (vii), with the realization of any scenario, the total credit of any generator is no less than its total bid-in cost of energy, reserve, and re-dispatch, i.e.,

| (33) |

The properties of individual rationality and cost recovery for generators are established from the perspective of market participants. Next we will take the system operator’s point of view and establish the revenue adequacy property.

IV-C Revenue Adequacy

For the system operator, its total congestion rent from the proposed model (II) will be the sum of the contribution from the base case and the contributions form all non-base scenarios. and are calculated by the following equations:

| (34) |

| (35) |

For the proposed settlement process, the following property regarding the SO’s revenue adequacy can be established:

Theorem 4 (Revenue Adequacy):

Under assumptions (i)-(vi), in expectation, total load payment is equal to the sum of total generator credit and total congestion rent .

Moreover, the property of revenue adequacy can be decomposed scenario-wise. Namely, the base-case load energy payment (20) is equal to the sum of the base-case generator energy credit (18) and the base-case congestion rent (34):

| (36) |

And for each non-base scenario , the sum of its contribution to load payment in (21)-(22) is equal to the sum of its contribution to generator ex-ante energy credit in (19) and reserve credit in (23)-(24), the expected generator ex-post re-dispatch payment in (26)-(27), the expected load shedding compensation in (28) , and the congestion rent in (35):

| (37) |

Please refer to the Appendix C for the proof. With (4), it can be observed that in expectation, ex-ante reserve procurement cost and ex-post re-adjustment cost will be allocated scenario-wise to loads based their load fluctuation severity.

Some existing works also consider the scenario-oriented model and pricing scheme, see [17] or [21]. Regarding pricing approaches, there is no absolute right or wrong. We argue that the proposed method is attractive because (i) it strictly follows the marginal pricing principle, and (ii) many important properties have been established.

V Discussions

In this section, we will revisit assumptions (ii)-(iv) and discuss their implications.

In assumption (ii), we assume that a single-period problem is considered for simplicity, whereas practical reserve markets may follow a multi-period setting. The biggest challenge in a multi-period problem is the coupling between reserve and ramping, which is a highly complicated issue, see [28] as an example. Since the main purpose of this paper is to focus on the reserve issue, studying properties of the co-optimization and associated market mechanism, we will leave the multi-period problem to our future works.

In assumption (iii), we assume that renewable generations are modelled as negative loads. In essence, we assume that the system always accommodates all renewable energy available in the ex-ante energy procurement. Consequently, renewable generators will have the same effects as loads from the perspective of the co-optimization model (II).

In assumption (iv), we ignore generator outages in non-base scenarios to establish the property of locational uniform pricing for energy. If generator outages are considered, the co-optimization model and prices can be obtained similarly. In particular, the objective function (5) and base-case constraints (6)-(8) will remain the same, while non-base constraints (9)-(12) will be modified as

| (38) | ||||

| (39) | ||||

| (40) | ||||

| (41) |

where are the vectors of available generations and reserve capacities in scenario considering possible generator outages in that scenario. With these modifications, the proposed model can efficiently model generator outages and optimally procure reserve to guard against them.

Moreover, considering the prices of energy and reserve, for generator , its energy and reserve prices in (III-A) and (16)-(17) will be modified as

| (42) | ||||

| (43) | ||||

| (44) |

where is the set of generators that are shut down in scenario . Compared with the original price formulations in (III-A) and (16)-(17), it can observed that if generator is shut down in scenario , then this scenario should be excluded from the calculation of energy and reserve prices in (V)-(44).

With the energy and reserve prices in (V)-(44), we also establish revenue adequacy for the system operator in expectation with the similar procedure in the Appendix C. However, considering generator outages will bring in the complicated issue of non-uniform pricing. For energy, considering different generators at the same bus with different outage probabilities, they will receive different energy marginal prices because their generations are no longer homogeneous goods. In addition, for reserve, considering different generators at the same bus, even if they have the same upward and downward re-dispatch price, their reserve marginal prices will be different if they have different outage probabilities. Furthermore, other counter-intuitive results have been found in our simulations. For example, for two generators at the same bus with the same outage probability, the generator with higher output will receive lower energy marginal price because its possible outage is more severe. These complicated issues cannot be fully addressed as a part of this paper, therefore more efforts will be made to digest these results in our future studies.

VI Case Study

Case studies were performed both on a 2-bus system and modified IEEE 118-bus system.

VI-A Two-Bus System

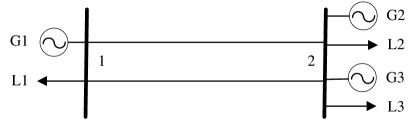

First, a simple two-bus system was adopted to illustrate the proposed co-optimization and pricing mechanism, as well as properties thereof. The one-line diagram was presented in Fig. 2. There are two parallel and identical transmission lines, each with a capacity of 1MW. For non-base scenarios, one of the two parallel lines may be cut off. In addition, in non-base scenarios, the power flow limit on each transmission line is set as 1.2MW. Furthermore, generator parameters of this 2-bus case were presented in Table II, and the base load vector for L1, L2 and L3 is (6,15,4)MW. In addition, all possible non-base scenarios for this 2-bus case were given in Table III, and the probability of the base case happening is .

| Generator | |||

|---|---|---|---|

| G1 | |||

| G2 | |||

| G3 |

| NO. | Line outage | Load | Probability |

|---|---|---|---|

| 1 | Yes | (6,15,4) | |

| 2/3 | Yes | (8,21,3)/(9,17,1) | / |

| 4/5 | No | (8,21,3)/(9,17,1) | / |

Market clearing results and prices of the 2-bus case with the proposed model (II) were presented in Table IV. For cleared quantities, note that although G1 offers the cheapest upward reserve and still has extra generation capacity and ramping rate, the SO does not clear G1’s entire upward reserve. Instead, the more expensive upward reserve resources G2 and G3 are cleared. The reason is that the extra upward reserve from G1 will not be deliverable in scenarios with line outages. In addition, from the column of Table IV, it can be confirmed that the energy prices are locational uniform. Furthermore, from the columns it can be observed that G2 receives higher upward reserve price but lower downward reserve price compared with G3 because G2’s upward and downward re-dispatch prices are both lower.

| Generator | ||||||

|---|---|---|---|---|---|---|

| G1 | ||||||

| G2 | ||||||

| G3 |

Moreover, the proportional locational uniform pricing property for re-dispatch was illustrated in Table V. We have for G2 and G3 in scenario 2 and 4, and in these two scenarios we have , validating Theorem 2.

| Scenario | Generator | ||||

|---|---|---|---|---|---|

| Scenario 2 | G2 | ||||

| G3 | |||||

| Scenario 4 | G2 | ||||

| G3 |

Furthermore, with the realization of any non-base scenario, profits of G1, G2 and G3 are , respectively, which confirms the property of cost recovery. In addition, in Table VI, the money flow in this 2-bus case was presented. We can see that in expectation, payments from loads, credits to generators and congestion rent can reach their balance for the base case as in the column, for each scenario as in the columns, and in total as in the last column, validating the property of revenue adequacy.

| Base | S1 | S2 | S3 | S4 | S5 | Total | |

VI-B IEEE 118-Bus System

Simulations on modified IEEE 118-bus system were also recorded. The transmission capacities are modified as 1.5 times of the DCOPF results of the original IEEE 118-bus system. In addition, transmission capacities that are smaller than 10MW will be set as 10MW. In non-base scenarios, power flow limits on transmission lines are set as 1.3 times of the base-case values. The generation cost of each generator is modified as linear term, and its upward and downward reserve bid-in price are set as 1/5 of its energy bid-in price. Moreover, the upward and downward ramping rate of each generator is set as 0.1 times of its generation capacity upper bound. In addition, the original load 59 is equally separated into two loads: new load 59 and load 119. Furthermore, minor modifications are also applied to some load capacities. We uploaded our Matlab case file onto Github as in [29]. In addition, all possible non-base scenarios in this case were given in Table VII.

| NO. | Outage | Load Situation | Probability |

|---|---|---|---|

| 1 | No outage | d119 by 3%, others by 3% | |

| 2 | No outage | d119 by 3%, others by 3% | |

| 3 | Line 21 | d119 by 3%, others by 3% | |

| 4 | Line 21 | d119 by 3%, others by 3% | |

| 5 | Line 21 | basic load | |

| 6 | Line 55 | d119 by 3%, others by 3% | |

| 7 | Line 55 | d119 by 3%, others by 3% | |

| 8 | Line 55 | basic load | |

| 9 | Line 102 | d119 by 3%, others by 3% | |

| 10 | Line 102 | d119 by 3%, others by 3% | |

| 11 | Line 102 | basic load |

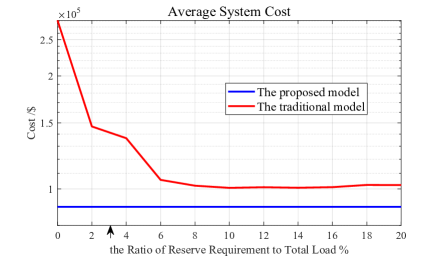

In Fig. 3, with Monte Carlo Simulation, the average system cost of the proposed model was compared with that of the traditional model under different reserve requirement settings, with the following steps:

(i) We selected different reserve requirements as different ratios of the system total load for the traditional model;

(ii) We calculated the energy and reserve clearing results and base-case procurement costs of the modified 118-bus case with the traditional model under these different reserve requirement settings from step (i);

(iii) We generated 50000 Monte Carlo Samples based on the occurrence probabilities of non-base scenarios in Table VII;

(iv) We calculated the average re-adjustment costs of the traditional model under different reserve requirement settings in all Monte Carlo Samples. If in one Monte Carlo Sample, the re-adjustment problem is infeasible, then the re-adjustment cost in that case will be set as 20000, while the expected system total cost from the proposed model (II) is 89651.6.

(v) We obtained the average system costs of the traditional model under different reserve requirement settings by adding the base-case procurement costs from step (ii) to the average re-adjustment costs from step (iv), and presented them in Fig. 3 as the red curve. Note that with the increasing reserve requirement, the red curve first goes down because of the decreasing load shedding cost, and then goes up because of the increasing reserve procurement cost.

(vi) We repeated steps (ii)-(v) for the proposed model (II), and presented the average system cost of the proposed model in Fig. 3 as the blue curve. On top of that, the overall upward and downward reserve procurement of the modified 118-bus case with the proposed model and are both about 3% of system total load, indicated by an arrow in Fig. 3. It can be observed that the proposed model can efficiently reduce reserve procurement, and can reduce the average system cost by - in this test compared with the traditional model.

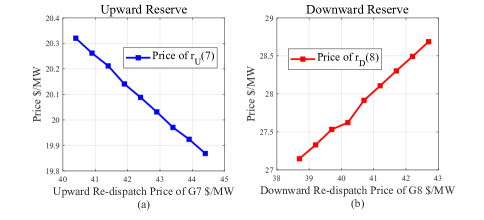

In addition, in Fig. 4, the relationships between reserve marginal prices and re-dispatch prices were presented. In Fig. 4(a), with the increasing upward re-dispatch price of G7, the upward reserve price of G7 will decrease. At the same time, In Fig. 4(b), with the increasing downward re-dispatch price of G8, the downward reserve price of G8 will increase because of the negative sign before the term in (5).

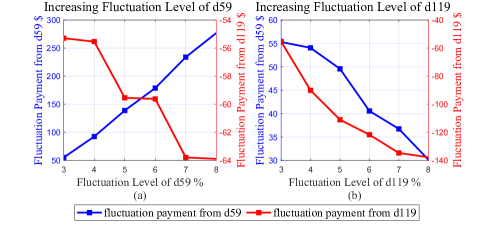

In addition, from Table VII, it can be observed that in non-base scenarios with load fluctuations, the fluctuation levels of all loads are 3%. We fixed the fluctuation levels of all other loads except for d59 and d119, and showed how the fluctuation payments from d59 and d119 in (22) changed with the increasing fluctuation level of d59 in Fig. 5(a), and how they changed with the increasing fluctuation level of d119 in Fig. 5(b), where the blue curve represents the fluctuation payment from d59, and the red curve represents the fluctuation payment from d119. In both Fig. 5(a) and Fig. 5(b), the fluctuation payment from d119 is always negative because d119’s fluctuation can offset the fluctuations of other loads in non-base scenarios as shown in Table VII. In Fig. 5(a), with the rising fluctuation level of d59, both the fluctuation payment from d59 and the fluctuation credit to d119 increase: For d59, its rising fluctuation level brings in more uncertainties to the system; At the same time, for d119, considering the increasing uncertainty brought by d59, the value of its possible load fluctuation has become higher, so the fluctuation credit to d119 increases. In Fig. 5(b), while the fluctuation credit to d119 increases with its rising fluctuation level because its rising fluctuation level can enhance the offset, note that the fluctuation payment from d59 decreases because the rising fluctuation level of d119 can reduce the impact of d59’s fluctuation on system balance.

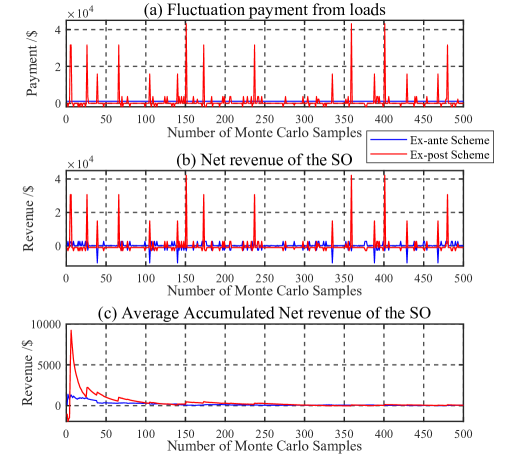

Furthermore, to validate what we have discussed in Remark 1, the fluctuation payment from loads and the net revenue of the SO under the ex-ante scheme in (22) are compared with that under the ex-post scheme in (25), with the following steps:

(i) We generated 500 Monte Carlo Samples based on the occurrence probabilities of non-base scenarios in Table VII;

(ii) We calculated the fluctuation payment in each Monte Carlo Sample under the ex-post scheme, and presented it with the red curve in Fig. 6(a). At the same time, under the ex-ante scheme, the fluctuation payment is fixed at $1081.67 in all Monte Carlo Samples, and we presented it with the blue curve in Fig. 6(a);

(iii) We calculated the net revenue of the SO in each Monte Carlo Sample under the ex-post scheme, and presented it with the red curve in Fig. 6(b). At the same time, under the ex-ante scheme, we calculated the net revenue of the SO in each Monte Carlo Sample and presented it with the blue curve in Fig. 6(b);

(iv) We calculated the average accumulated net revenue of the SO under the ex-post scheme among different numbers of Monte Carlo samples from 1, 2, … to 500, and presented it with the red curve in Fig. 6(c). At the same time, under the ex-ante scheme, we calculated the average accumulated net revenue of the SO and presented it with the blue curve in Fig. 6(c). It can be observed that under the ex-ante scheme, the fluctuation payment from loads is fixed at $1081.67. On the contrary, under the ex-post scheme, the fluctuation payment from loads are extremely high in some Monte Carlo Samples where one of the extreme scenario happens. For example, in the Monte Carlo Sample, the fluctuation payment under the ex-post scheme is $43178.64, which is about 40 times as much as the fluctuation payment under the ex-ante scheme. This reveals the financial risk of consumers under the ex-post scheme. In addition, from Fig. 6(b), it can be observed that under the ex-ante scheme, the net revenue of the SO is very closed to zero in most Monte Carlo Samples. On the contrary, under the ex-post scheme, the net revenue of the SO is negative in most Monte Carlo Samples. In those Monte Carlo Samples where one of the extreme scenario happens and the fluctuation payment is large, the SO will earn much money. This reveals the financial risk of the SO under the ex-post scheme. Moreover, from Fig. 6(c), it can be observed that with the increasing number of Monte Carlo Samples, the average accumulated net revenue of the SO will converge to 0 under both the ex-ante scheme and the ex-post scheme, but the convergence speed under the ex-ante scheme will be faster.

Furthermore, considering more numbers of Monte Carlo samples, i.e., 50000, the average accumulated net revenue of the SO under the ex-ante scheme is $6.00, which is extremely small considering the expected system total cost of this modified 118-bus case $89648.5. Therefore, we can further confirm the property of revenue adequacy.

VII Conclusions

Traditional energy-reserve co-optimization highly relies on empirical reserve zones and zonal reserve requirements. In this paper, a scenario-oriented energy-reserve co-optimization model is developed, considering congestions and re-adjustment costs of all non-base scenarios. As a result, reserve resources can be optimally procured system-wide to guard against possible contingencies and load/renewable fluctuations.

In addition, prices of energy and reserve have been derived based on their marginal costs/benefits to the joint clearing of energy and reserve. A key question is that should energy, reserve, and re-dispatch at the same bus be considered as homogeneous goods. If they are, under given assumptions, they will be settled at uniform prices. We have also established properties of cost recovery for generators and revenue adequacy for the system operator.

In future studies, more efforts will be made to the coupling of reserve and ramping in multi-period operation and the modelling and pricing of generator outages.

References

- [1] J. Shi, Y. Guo, L. Tong, W. Wu, and H. Sun, “A scenario-oriented approach for energy-reserve joint procurement and pricing,” in 2021 IEEE Power Energy Society General Meeting (PESGM), Accepted.

- [2] J. Ellison, V. W. Loose, and L. Tesfatsion, “Project report: A survey of operating reserve markets in U.S. ISO/RTO-managed electric energy regions,” Sandia Natl Labs Publications, 2012.

- [3] Z. Zhou, T. Levin, and G. Conzelmann, “Survey of U.S. ancillary services markets,” Argonne Natl Labs Publications, 2016.

- [4] PJM, “Manual 11: Energy & ancillary services market operations.” https://www.pjm.com/~/media/documents/manuals/m11.ashx, 2020.

-

[5]

CAISO, “CAISO corporation fifth replacement electronic tariff.”

http://www.caiso.com/Documents/2019AnnualReportonMarketIssuesand

Performance.pdf, 2019. -

[6]

ISO-NE, “ISO new england manual for forward reserve and real-time reserve.”

https://www.iso-ne.com/static-assets/documents/2018/10/manual_36_forward_reserve_and_realtime

_reserve_rev22_20181004.pdf, 2018. - [7] D. Gezer, A. Nadar, C. Şahin, and N. Özay, “Determination of operating reserve requirements considering geographical distribution of wind power plants,” in 2011 International Conference on Clean Electrical Power (ICCEP), pp. 797–801, 2011.

- [8] F. Partovi, B. Mozafari, and M. Ranjbar, “An approach for daily assessment of active power reserve capacity and spinning reserve allocation in a power system,” in 2010 International Conference on Power System Technology, pp. 1–8, 2010.

- [9] M. Bucksteeg, L. Niesen, and C. Weber, “Impacts of dynamic probabilistic reserve sizing techniques on reserve requirements and system costs,” IEEE Transactions on Sustainable Energy, vol. 7, no. 4, pp. 1408–1420, 2016.

- [10] M. A. Matos and R. J. Bessa, “Setting the operating reserve using probabilistic wind power forecasts,” IEEE Transactions on Power Systems, vol. 26, no. 2, pp. 594–603, 2011.

- [11] J. Saez-Gallego, J. M. Morales, H. Madsen, and T. Jónsson, “Determining reserve requirements in dk1 area of nord pool using a probabilistic approach,” Energy, vol. 74, pp. 682 – 693, 2014.

- [12] A. Papavasiliou, S. S. Oren, and R. P. O’Neill, “Reserve requirements for wind power integration: A scenario-based stochastic programming framework,” IEEE Transactions on Power Systems, vol. 26, no. 4, pp. 2197–2206, 2011.

- [13] F. Wang and K. W. Hedman, “Dynamic reserve zones for day-ahead unit commitment with renewable resources,” IEEE Transactions on Power Systems, vol. 30, no. 2, pp. 612–620, 2015.

- [14] J. D. Lyon, M. Zhang, and K. W. Hedman, “Locational reserve disqualification for distinct scenarios,” IEEE Transactions on Power Systems, vol. 30, no. 1, pp. 357–364, 2015.

- [15] H. Ye, Y. Ge, M. Shahidehpour, and Z. Li, “Uncertainty marginal price, transmission reserve, and day-ahead market clearing with robust unit commitment,” IEEE Transactions on Power Systems, vol. 32, no. 3, pp. 1782–1795, 2017.

- [16] Y. Dvorkin, “A chance-constrained stochastic electricity market,” IEEE Transactions on Power Systems, vol. 35, no. 4, pp. 2993–3003, 2020.

- [17] J. M. Morales, A. J. Conejo, K. Liu, and J. Zhong, “Pricing electricity in pools with wind producers,” IEEE Transactions on Power Systems, vol. 27, no. 3, pp. 1366–1376, 2012.

- [18] J. M. Morales, M. Zugno, S. Pineda, and P. Pinson, “Electricity market clearing with improved scheduling of stochastic production,” European Journal of Operational Research, vol. 235, no. 3, pp. 765–774, 2014.

- [19] J. Kazempour, P. Pinson, and B. F. Hobbs, “A stochastic market design with revenue adequacy and cost recovery by scenario: Benefits and costs,” IEEE Transactions on Power Systems, vol. 33, no. 4, pp. 3531–3545, 2018.

- [20] S. Wong and J. D. Fuller, “Pricing energy and reserves using stochastic optimization in an alternative electricity market,” IEEE Transactions on Power Systems, vol. 22, no. 2, pp. 631–638, 2007.

- [21] F. D. Galiana, F. Bouffard, and J. M. Arroyo, “Scheduling and pricing of coupled energy and primary, secondary, and tertiary reserves,” Proceedings of the IEEE, vol. 93, no. 11, pp. 1970–1983, 2005.

- [22] J. Wang, M. Shahidehpour, and Z. Li, “Contingency-constrained reserve requirements in joint energy and ancillary services auction,” IEEE Transactions on Power Systems, vol. 24, no. 3, pp. 1457–1468, 2009.

- [23] J. M. Arroyo and F. D. Galiana, “Energy and reserve pricing in security and network-constrained electricity markets,” IEEE Transactions on Power Systems, vol. 20, no. 2, pp. 634–643, 2005.

- [24] G. Zhang, E. Ela, and Q. Wang, “Market scheduling and pricing for primary and secondary frequency reserve,” IEEE Transactions on Power Systems, vol. 34, no. 4, pp. 2914–2924, 2019.

- [25] H. Chen (PJM), “Security constrained economic dispatch (sced) overview – prepared by hong chen (PJM) for AESO.” https://www.aeso.ca/assets/Uploads/3.3-SCED-Overview-by-PJM.pdf, 2020.

- [26] A. N. Madavan, S. Bose, Y. Guo, and L. Tong, “Risk-sensitive security-constrained economic dispatch via critical region exploration,” in 2019 IEEE Power Energy Society General Meeting (PESGM), pp. 1–5, 2019.

- [27] Y. Guo, S. Bose, and L. Tong, “On robust tie-line scheduling in multi-area power systems,” IEEE Transactions on Power Systems, vol. 33, no. 4, pp. 4144–4154, 2018.

- [28] Y. Guo, C. Chen, and L. Tong, “Pricing multi-interval dispatch under uncertainty part I: Dispatch-following incentives,” IEEE Transactions on Power Systems, pp. 1–1, 2021.

- [29] J. Shi, “modified case118 data.” https://github.com/TBSI-SJT/modified_case118_data, 2021.

Appendix A Proof of Theorem 2 (Proportional Locational Uniform Pricing for Re-dispatch)

According to the KKT conditions and ignoring as mentioned in assumption (vi), we have:

| (45) |

| (46) |

| (47) |

With respectively multiplied to both the left-hand side and the right-hand side of (45)-(A), combined with the complementary slackness of (11)-(13) we have:

| (48) |

| (49) |

| (50) |

With (49), for generator we have:

| (51) |

Similarly, for generator we have:

| (52) |

In addition, apparently we know that , then with (51)-(52), we can prove Theorem 2.

Appendix B Proof of Theorem 3 (Individual Rationality)

| (53) |

We present the Lagrangian of the proposed model (II) in (B). Furthermore, the Lagrangian of the profit maximization model (IV) of each generator is

| (54) |

With the formulations of in (III-A), (16) and (17), we can observe that the Lagrangian of model (IV) in (B) is a part of the Lagrangian of model (II) in (B). Since these two models are both LP models, according to the KKT conditions we can conclude that, for each generator , its optimal energy and reserve procurement solved from model (II) is also the solution to its profit maximization model (IV), which proves Theorem 3.

Appendix C Proof of Theorem 4 (Revenue Adequacy)

To prove revenue adequacy, the phase angle-based form of the proposed co-optimization model is presented as follows:

| subject to | ||||

| (55) | ||||

| (56) | ||||

| for all : | ||||

| (57) | ||||

| (58) |

where represents the objective function of the phase angle-based model (V), which is the same as in shift factor-based model (II). and are matrices that connect generators and loads with nodes, respectively. Vectors and are the phase angle vectors in the base case and in scenario , respectively. Matrices and denote the coefficient matrices of DC power flow equations in the base case and in scenario , respectively. Matrices and are the branch-node admittance matrices in the base case and in scenario , respectively. With the equivalence of the shift factor-based model (II) and the phase angle-based model (V), for loads we have

| (59) |

and for generators we have

| (60) |

Where and are the numbers of loads and generators, respectively. In addition, we denote the Lagrangian of model (V) as , with the KKT conditions we have:

| (61) | ||||

| (62) |

In addition, for the base case we have:

| (63) |

and . Considering revenue adequacy for the base case, we have:

| (64) |

These four equations are based on equations (59)-(60), the complementary slackness of (55), equation (61), and the complementary slackness of (56), respectively. With above equations, we have

| (65) |

which proves revenue adequacy for the base case.

In addition, the congestion rent contributed from any non-base scenario is:

| (66) |

These six equations are based on the complementary slackness of (58), equation (62), the complementary slackness of (57), equations (59)-(60), the complementary slackness of (9), and some reorganizations, respectively. On top of that, with the complementary slackness of (9) we have:

| (67) |

Moreover, with equation (48) we have:

| (68) |

which can be reorganized according to (49)-(50) and (C) as follows:

| (69) |

If we add term and its opposite to the right-hand side of (C) and reorganize the equation, we have:

| (70) |

The term on the left-hand side of (C) is the contribution of scenario to load payment, including energy payment (21) and load fluctuation payment (22). The right-hand side of equation (C) include the contribution of scenario to energy credit (19) in the row, its contribution to upward and downward reserve credit (23)-(24) in the row, its contribution to expected re-dispatch payment (26)-(27) and expected load shedding compensation (28) in the row, and its contribution to congestion rent in the - rows. Therefore, equation (C) can prove revenue adequacy for any scenario . Along with revenue adequacy for the base case in (65), we can prove Theorem 4.