Econophysics Through Computation

Abstract

We introduce here very briefly, through some selective choices of problems and through the sample computer simulation programs (following the request of the editor for this invited review in the Journal of Physics Through Computation), the newly developed field of econophysics. Though related attempts could be traced much earlier (see the Appendix), the formal researches in econophysics started in 1995. We hope, the readers (students & researchers) can start themselves to enjoy the excitement, through the sample computer programs given, and eventually can undertake researches in the frontier problems, through the indicated survey literature provided.

I Introduction

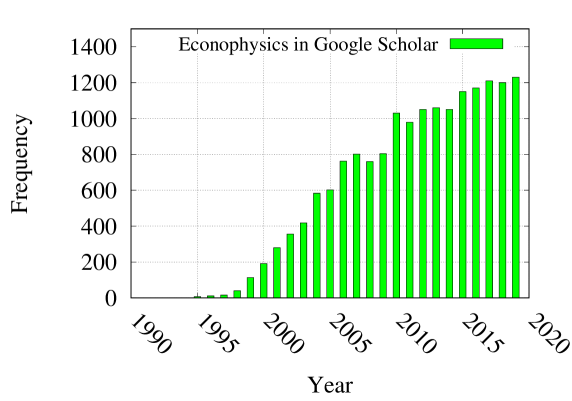

The research field of econophysics has emerged recently as economics-inspired statistical physics. Though the attempts are not new and in fact almost a century old (see the Appendix), the institutionalization of this research field, where (statistical) physicists can and do regular researches in their own departments and publish their relevant results in traditional and contemporary physics journals, is new (see e.g., kishore_sudip19 ; stanley2000introduction_sudip ; sinha2010econophysics_sudip ; yakovenko2009colloquium_sudip ; chakrabarti2013econophysics ; sen2014sociophysics ). Indeed the term econophysics had been formally coined in 1995 (see the Appendix and Fig. 1) and we are now in the silver jubilee celebration year! This review is intended for interested students for self-studies and self-learning through computational modelings of a few selected problems in econophysics. Some elementary computer programs or codes (in Fortran or Python) are added for ready support. We first introduce a few popular research problems in econophysics and continue discussion on them in the following.

Inequality in income or acquired wealth has been ubiquitous: not only today, even in the earliest days of the human civilization. It is hard to find any society with fare amount of equality in income or wealth for everyone. It has continued to exist and sometimes have grown enormously in societies for centuries, and even today threatening our existence and wellbeing. Studies on inequality in wealth has a long history and has fascinated generations of philosophers, economists, social scientists and thinkers alike. Analysis of real data on wealth distribution is not new: with the advent of digital era, researchers from social science, even from interdisciplinary branches have been studying the recorded bulk amount of human social interaction data to explore the hidden structure of these data and also investigate the reason behind such inequality and so on. There are many ways to quantify inequality present in some social context or opportunity, e.g. income, wealth, as we know income is taken as a measure of economic growth of any country. The popular measures, summarized in one value, are Gini, Pietra indices etc. We will also discuss the recently introduced Kolkata index for measuring social inequality. All these make use of the Lorenz curve plot. On the other hand, one can also study the probability distribution and find the trend present in empirical data. Interestingly, the above mentioned indices computed from the Lorenz curve which is also plotted using the cumulative probability distribution of some context data against number of occurences. The study can also be extended to uncover the temporal pattern of social inequality from those data spread over years.

Along with income or wealth inequality, we also put together inequality indices values measured over several other social context, e.g., academic citation count, city size or population, voting data, human death counts from social conflict which can be man-made like war, battle or natural disasters like earthquake, flood etc. These studies, sometimes done over couple of century-wide data (which are publicly available), have helped to uncover interesting patterns (of the presence of higher inequality but not highest inequality).

Next we study about the Kolkata Paise Restaurant (KPR) problem. KPR is a repeated many-player many-choice game played by a large number of players (). Every day each player will choose a restaurant and visit there for lunch. Each restaurant prepares a single dish that costs the same at any restaurant. Player can only make single choice per day, and lunch at chosen restaurant is guaranteed if visited alone there for that day. Any day if more than one player choose the same restaurant then only one of them gets the dish and others arriving there would miss their lunch. Information about the restaurant occupations for few finite previous days (depending on the memory capacity of the players) will be publicly available. But players do not interact with others while making decision i.e. choosing a restaurant for lunch that day. In such set up, how the players should set individual choice towards socially optimal solution i.e. no food waste as well as no player staying hungry that day. A simple solution could be to hire a non playing captain (dictator) who would assign some restaurant to the players, thus all of them get their food from first day and following this setting till end. But in a democratic setup, players would like to make their own choice following some collectively learning strategy. Here the objective is to achieve maximum social utilization of the scarce resources in absence of some external coordinator. This makes the KPR game interesting. Some results on statistics of KPR dynamics over variety of strategies developed, as well as an interesting phase transition phenomena have been discussed in respective section.

Another important and popular research-work deals with the economic/social networks evolved due to social interactions through market dynamics and game. In this context we will discuss about the Indian Railway network (IRN) as a complex (transport) network where each railway station is vertex and track between any two connecting stations is the edge between them. Study reveals IRN as a small world network, a popular network model where mean distance between any two nodes becomes constant as network size grows. Thus the graph like study has successfully answered several interesting questions like how many trains one passenger would require to switch to reach any destination station within country while traveling by train etc.

We discuss the attempts made in the developments of the microscopic dynamical models (mainly based on kinetic theory), which can explore the underline dynamics behind the making of the real-world income or wealth distribution. We also highlight few models which show the possible ways of minimizing the socioeconomic inequality.

II Measuring Social Inequality and the Kolkata Index

Inequality present in socio-economic data can be quantified in several ways. Mostly used is the Gini index () introduced by Italian statistician and sociologist Corrado Gini in 1912 gini1921measurement . There are others as well like Kolkata index (), Pietra index () etc. Usually we plot histogram or frequency distribution to get the initial idea of any data in hand. And those indices mentioned above are easily measurable scalars from the cumulative probability distribution of the respective quantity. This distribution when plotted is known as Lorenz curve. Study of real data on the socio-economic context has been reported to follow fat tail, lognormal or gamma like distribution, see. Below we discuss some standard measures and techniques to get a general idea on how to measure inequality present in some quantity.

Lorenz curve:

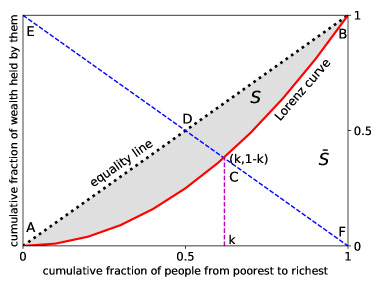

Lorenz curve was proposed by Max O. Lorenz in . The curve always begins from point and ends in point as seen in Fig. 2.

If one plots the fraction of population or household in increasing order of -axis against fraction of wealth held by them gives the cumulative probability distribution function . Thus, the fraction of total wealth held by bottom x% population is represented by . More the fractions grow close to each other, i.e. if % % then the Lorenz curve becomes a straight line representing perfect equality in wealth or income distribution. Far the curve deviates from the diagonal or line mean presence of greater inequality in the distribution. Intuitively, the curve never rise above the equality line ( = ). We also discuss about some inequality measuring indices, to be obtained using the Lorenz curve.

Gini index ():

Gini index () is a standard measure of inequality, used not only by economists but also researchers across other disciplines e.g. physicist, social scientists etc. For computing the Gini index (), one can fit Lorenz curve in a unit square, where the ratio of area between the Lorenz curve and equality line to the area below the equality line gives the Gini index () value. In Fig. 2, represents the area between the Lorenz curve and equality line and represents the area below the equality line, then . It ranges from to where denotes perfect equality, say every individual has same income and plotting this should give the equality line (see Fig. 2). And when , it represents maximum possible inequality where in a society only one person has every wealth and rest left with none. But then, Gini index () is a summary measure. Below we discuss Kolkata index (),

Pietra index () etc. to be estimated using the same Lorenz curve plot.

Kolkata index (): Ghosh et al. has recently proposed ‘Kolkata index’() ghosh2014inequality , another inequality measuring index to be obtained from the same Lorenz curve plot. The value can be estimated from the -axis point where the Lorenz curve intersects the diagonal line perpendicular to the line of equality, see Fig. 2. So, the -index ranges from to . Interestingly the complementary Lorenz function, represented as , denotes -index as a non-trivial fixed point on -coordinate such that = where intersects the diagonal line spanning between and , see Fig. 2.

Another popular measure of inequality is the Pietra index (see, Eliazar et al. eliazar2010measuring for further discussion). It can be measured as the maximal vertical distance of the Lorenz curve from line of equality. So more the Lorenz curve deviates from the equality line greater is the inequality. Similar to Gini-index, the Pietra-index value also varies between to , where represents complete equality and denotes extreme inequality. However we will consider Gini and Kolkata indices for our further discussion over inequality in social events.

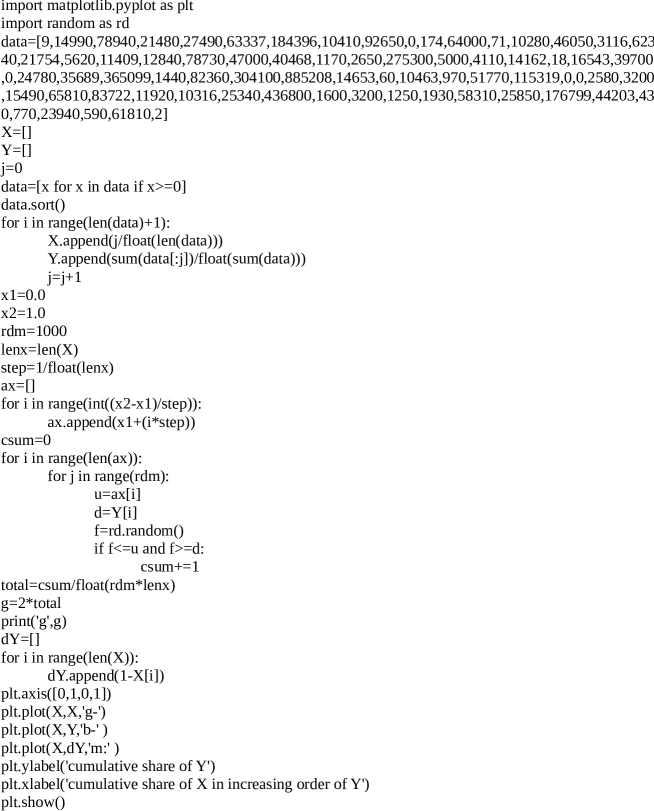

To measure inequality, Gini index () is frequently used by the economist. Note that the -index represents the overall summary of inequality, whereas -index is the indicator of the fraction of quantity held by fraction of population. Already mentioned that, varies between to , whereas ranges from to . One can obtain the Lorenz curve plot as well as the measure of indices from some real data using program given in Fig. 3.

II.1 and index values for several types of real data:

Here we discuss results from various kinds of social events where inequality is measured (for e.g., citations, income, expenditure, vote, city size, human-death counts from social conflicts etc.) and some interesting results are observed. Chatterjee and Chakrabarti, 2016 chatterjee2017fat studied probability distribution of many publicly available (by several universities and peace research institutes) data on human death counts occured from wars, armed-conflicts as man-made disasters as well as natural disasters like earthquake, forest fires etc. The distribution plots showed up to follow power law, in the fat-tail region, with exponent around -, see TABLE 1. Extending their work, Sinha and Chakrabarti in sinha2019inequality measured the corresponding and index values by plotting Lorenz curves using many of the data discussed in chatterjee2017fat and the and values were found to be very high, see TABLE 2 and TABLE 3. Such high values indicates severe inequalities which is rarely seen in economic states of different countries (presumably because of deliberate supports to economically weaker groups, etc.). Those indices are also measured for the physical quantities (in case of natural disasters only, e.g., Richter magnitudes for earthquake, areas affected in sq. km. for floods, maximum water height in m for tsunami) causing such unequal occurences of human deaths TABLE 4. Surprisingly not much inequality is observed in this case in comparison to those social effects caused by them. To establish the ‘similarity classes’ of social inequality, these results were compared against those inequality measures found from man-made competitive societies like academic institution (paper citation counts), see TABLE 5. And the study indicated the growing recent trend of economic inequality across the world, may be because of encouraging competitiveness in societies as well as due to fast disappearance of social welfare measures in recent years.

| Type of conflicts/disasters | Time period | |

| conflict | 1946-2008 | |

| war | 1816-2007 | |

| battle | 1989-2014 | |

| earthquakes | 1900-2013 | |

| storms | 1900-2013 | |

| wildfires | 1900-2013 |

| Type of conflicts | Time period | -index | -index |

| war | 1816-2007 | 0.02 | 0.02 |

| battle | 1989-2017 | 0.02 | 0.02 |

| armed-conflict | 1946-2008 | 0.02 | 0.02 |

| terrorism | 1970-2017 | 0.03 | 0.02 |

| murder | 1967-2016 | 0.02 | 0.02 |

| Type of disasters | Social Damage measures | ||

| Time period | -index | -index | |

| earthquake | 1000-2018(July) | 0.02 | 0.02 |

| flood | 1900-2018(July) | 0.02 | 0.02 |

| tsunami | 1000-2018(July) | 0.02 | 0.02 |

| Type of disasters | Physical Damage measures | ||

| Time period | -index | -index | |

| earthquake | 2013-2018(July) | 0.35 | 0.64 |

| flood | 1900-2018(July) | 0.76 | 0.79 |

| tsunami | 1000-2018(July) | 0.53 | 0.69 |

| Inst./Univ.* | Year | Index values for | Inst./Univ.* | Year | Index values for | ||

| Gini () | Kolkata () | Gini () | Kolkata () | ||||

| Cambridge | 1980 | 0.74 | 0.78 | BHU | 1980 | 0.68 | 0.76 |

| 1990 | 0.74 | 0.78 | 1990 | 0.71 | 0.77 | ||

| 2000 | 0.71 | 0.77 | 2000 | 0.64 | 0.74 | ||

| 2010 | 0.70 | 0.76 | 2010 | 0.63 | 0.73 | ||

| Harvard | 1980 | 0.73 | 0.78 | Calcutta | 1980 | 0.74 | 0.78 |

| 1990 | 0.73 | 0.78 | 1990 | 0.64 | 0.74 | ||

| 2000 | 0.71 | 0.77 | 2000 | 0.68 | 0.74 | ||

| 2010 | 0.69 | 0.76 | 2010 | 0.61 | 0.73 | ||

| MIT | 1980 | 0.76 | 0.79 | Delhi | 1980 | 0.67 | 0.75 |

| 1990 | 0.73 | 0.78 | 1990 | 0.68 | 0.76 | ||

| 2000 | 0.74 | 0.78 | 2000 | 0.68 | 0.76 | ||

| 2010 | 0.69 | 0.76 | 2010 | 0.66 | 0.74 | ||

| Oxford | 1980 | 0.70 | 0.77 | IISC | 1980 | 0.73 | 0.78 |

| 1990 | 0.73 | 0.78 | 1990 | 0.70 | 0.76 | ||

| 2000 | 0.72 | 0.77 | 2000 | 0.67 | 0.75 | ||

| 2010 | 0.71 | 0.76 | 2010 | 0.62 | 0.73 | ||

| Stanford | 1980 | 0.74 | 0.78 | Madras | 1980 | 0.69 | 0.76 |

| 1990 | 0.70 | 0.76 | 1990 | 0.68 | 0.76 | ||

| 2000 | 0.73 | 0.80 | 2000 | 0.64 | 0.73 | ||

| 2010 | 0.70 | 0.76 | 2010 | 0.78 | 0.79 | ||

| Stockholm | 1980 | 0.70 | 0.76 | SINP | 1980 | 0.72 | 0.74 |

| 1990 | 0.66 | 0.75 | 1990 | 0.66 | 0.73 | ||

| 2000 | 0.69 | 0.76 | 2000 | 0.77 | 0.79 | ||

| 2010 | 0.70 | 0.76 | 2010 | 0.71 | 0.76 | ||

| Tokyo | 1980 | 0.69 | 0.76 | TIFR | 1980 | 0.70 | 0.76 |

| 1990 | 0.68 | 0.76 | 1990 | 0.73 | 0.77 | ||

| 2000 | 0.70 | 0.76 | 2000 | 0.74 | 0.77 | ||

| 2010 | 0.70 | 0.76 | 2010 | 0.78 | 0.79 | ||

II.2 Relationship between Gini () and Kolkata () index

In Fig 2, the Lorenz curve is represented by the red color line obtained using a probability distribution function . Assume, denotes the cumulative fraction of taking lowest to highest order and as the cumulative fraction of . The Lorenz curve cuts the anti-diagonal at point C (). This gives the -index defined as: fraction of wealth is possessed by fraction of people. Here, the shaded area is enclosed by the Lorenz curve and the equality line , and the The Gini index is represented by:

| (1) |

Here we would study some approximate ways to measure . In Fig. 2, we can assume the Lorenz curve to be given by two broken straight lines and . Here, , , = , thus . And the area of triangle is

| (2) |

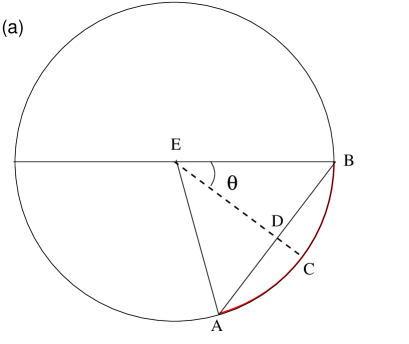

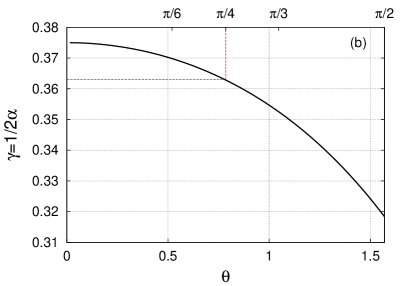

Note that this is an exact result where equality in the relation holds for = at = = 1. Thinking other way, consider that the Lorenz curve is represented by the arc of a circle with radius , see Fig. 4(a). Find that is perpendicular to base with . And the area of arc is the difference between the sector and the triangle . The area of sector is . And, the area of triangle is given by = . Thus the required area representing the Lorenz curve is given by:

| (3) |

Now if we write = = , then

| (4) |

where is a fraction incorporated to get the approximate result of as . Thus one gets 2 = 2 = using Eq. 2, and this gives:

| (5) |

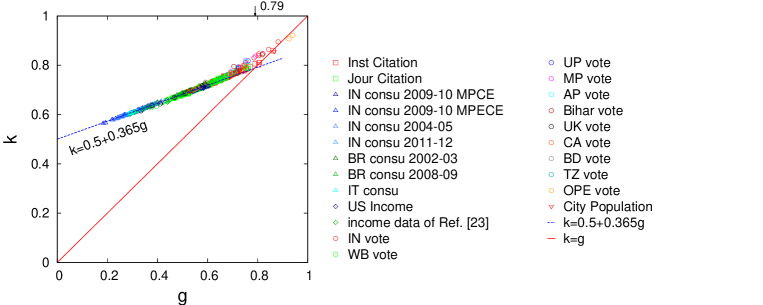

This is the general result of and relationship with slope . Fig. 4(b) also shows variation of against . From Fig. 5, one can find the observed approximate value of = 0.365 which corresponds to = (see Fig. 4(b)). This means that the Lorenz curve can be approximated as a quadrant arc of an unit circle centered at such that (compare Fig. 4(a) with Fig. 2). The readers are hereby encouraged to calculate the approximated value using Eq. 5 that should come as .

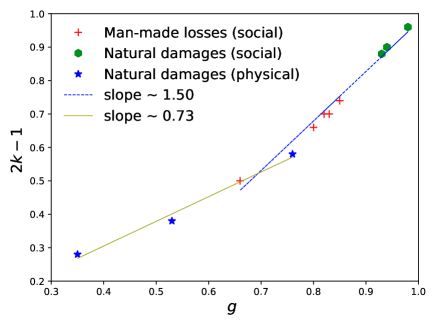

Interestingly, the results discussed in above para matches well with extensively studied real data taken from several publicly available sources e.g., citation data (from Web of Science), consumption expenditure data (for India, Brazil, Italy), income (for USA) voting data (for Italy, Sweden, India, UK, Bangladesh, Canada etc.), city size etc. The dotted straight line represents . For more details see chatterjee2017socio ; inoue2015measuring . As the -index ranges from to , a normalized estimate 2-1 is also considered which represents the maximum vertical distance between the equality line and Lorenz curve. This is how done as alike -index, the estimate also ranges between . In sinha2019inequality , both of and are calculated for human death count data occurred from social conflict like battle, war, natural calamities etc. Two slope is observed when is plotted against : about (for lower range of ) and (for higher range of ). Though for both the cases, values are observed to be higher than corresponding values; see Figs. 5 and 6 for details.

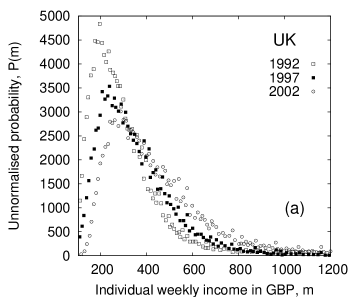

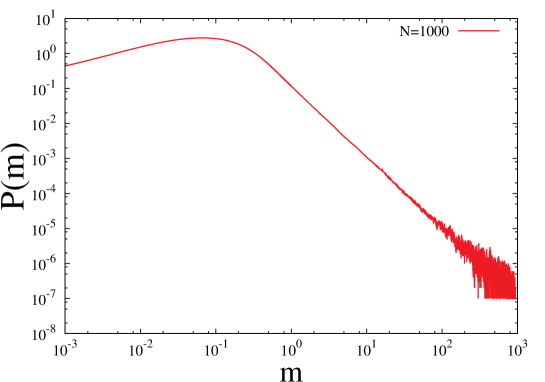

III Econophysics of income and wealth distribution

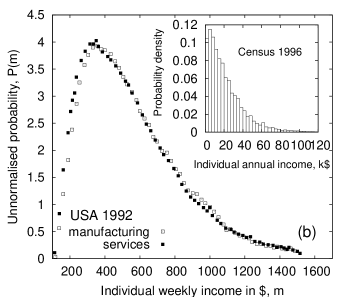

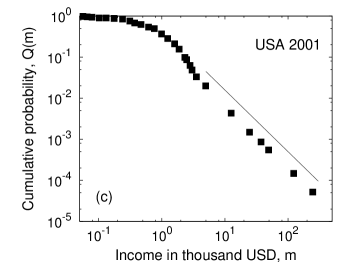

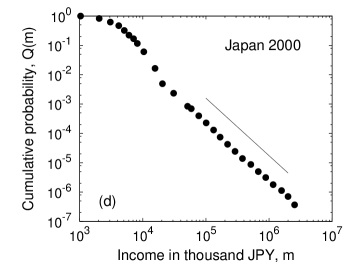

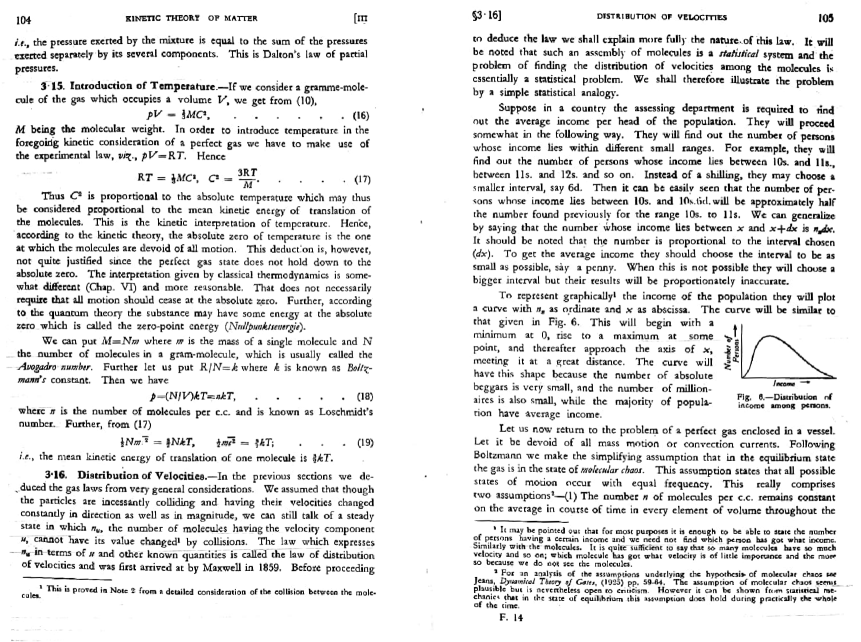

As discussed already, irrespective of history, culture and economic policies followed, socioeconomic inequalities are found to be omnipresent across the globe and throughout the ages. Indeed some robust features of such unequal distributions of income or wealth are already established (see e.g., chatterjee2007kinetic ; chakrabarti2013econophysics ): While the overall the income or wealth distribution fits generally a Gamma-like curve (see some typical income distribution in Fig. 7; whereas economists still like to fit it to a log-normal curve). The tail end of the distribution (for large income or wealth) decays following a robust power law, called the Pareto law (see Fig. 7). Physicists today have been trying to capture such generic features of the income or wealth distribution, using models based on the kinetic theory of ideal gases, where the interactions among the ‘social-atoms’ or agents (traders) due to a trade (involving money exchanges), are considered as a two-body scattering problem where the total money (like energy) before and after the trade, remains conserved. To best of our knowledge, the first text book (‘A Treatise on Heat’) on the statistical thermodynamics, which discussed the application of the kinetic theory (of ideal gas od ‘social-atoms’) to the derive the income or wealth distribution, was written by Saha and Srivastava sudip_saha_book .

III.1 Saha and Srivastava’s Kinetic Theory for ideal gases with ‘atoms’ and ‘social agents’

In thermodynamic systems, the number atoms or molecules is typically of the order of Avogadro number () whereas the number of social agents even in a global market is about . Still one can imply the statistical physics principles in such economic systems. In their famous book, Saha and Srivastava had put a discussion in the section Maxwell-Boltzmaan velocity distribution of ideal gas, which highlights the idea of applying kinetic theory in market to evaluate the income distribution of a society (see Fig. 8).

In case of an ideal gas, at temperature , the number density of particles (atoms or molecules) having energy between to is given by . Here the density of states gives the number of possible dynamical states between the energy to . The energy distribution function is denoted by . We should mention that, in case of an ideal gas, the particle can only have the kinetic energy , where and are the momentum and mass of the particle respectively. Since momentum is a vector, one can clearly understand that the particle can have same energy for different momentum vector . The density of states can be written as . As the energy is conserved during any energy exchanging process, then the energy distribution should satisfy (for any arbitrary values of energy , ). Therefore one can expect the exponential form of the energy distribution function, which is , where we will identify later . This essentially gives and from such expression one can evaluate the pressure of an ideal gas having volume and temperature . Comparing such result with the equation of state of ideal gas , one can identify .

In their chosen example in the section velocity distribution, Saha and Shrivastava indicated that in a closed economic system (where no migration of labour, no growth etc are considered) the money distribution of the agents of the system should have the similar form of the energy distribution function of ideal gas atoms or molecules. This is evident because in a closed economic system the money is conserved. Hence the money distribution should also satisfy the condition . Like the collision (the energy exchange process) between the particles, the money exchange (due to any kind of trading) between the agents are also random. Therefore, one can expect the money distribution should be , where is constant. As in the economic system there is no quantity which is equivalent to the momentum vector of the gas particle, in this case the density of states is constant. Hence the number density of agents having money should be . Here is another constant. Both and can be evaluated using two conditions. One of the condition is , where is the total number of agents. There is another condition . Calculating these two integrations one would get where , which is actually the average money per agent. Therefore instead of Maxwell-Bolzmann or Gamma distribution of energy in the ideal gas, the money distribution becomes an exponentially decaying function (like Gibbs distribution). Here most number of agents have zero money. For the students, Saha and Shrivastva left the task of making this exponential distribution more like Gamma distribution.

III.2 Data analysis of Income and Wealth distributions

Italian scientist Pareto, from his socioeconomic study in Europe sudip_pareto showed that the income distribution contains a power law tail (). Such an observation is often called Pareto’s law ( the Pareto exponent). Later another economist Gibrat sudip_gibrat showed that the part of the income distribution which corresponds to the higher income range actually fits well with power law type function whereas the rest of the distribution can be characterized by the log-normal function . From the analysis of Japanese personal income distribution data ranging from 1887 to 1908, Souma souma_sudip reported about the two type nature of income distribution. also indicated both Pareto index () and Gibrat index () varies with time.

Several physicists have been rigorously studied the financial data of many countries to capture the form of the income distribution. From the investigation of the Japanese income tax data of the year 1998, Aoyama et al. aoyama_sudip observed the power law decay of the income distribution. Drăgulescu and Yakovenko analyzed the USA druagulescu2001a_sudip and UK druagulescu2001b_sudip income tax data. From the examinations of such data, they conjectured that the major part of the income distribution fits with the exponential function whereas in the higher income range the distribution follows power law decay. Drăgulescu and Yakovenko explained the exponential nature of the income distribution in the basis of statistical mechanics dragulescu2000_sudip . They treated the closed economic system as a closed thermodynamic ideal gas system where the money in the economic system is equivalent to the energy in the idea gas system. They considered the financial transaction between any two agents is equivalent to the scattering between the two gas molecules or atoms in which they exchange energy. Like total energy of ideal gas system, the total money is also conserved in the closed economic system. Therefore the money distribution should follow the Gibbs distribution (exponential) if the density of state is constant. There are many suggestions on the shape of income distribution. Ferrero ferrero_sudip proposed that the income distribution follows Gamma distribution , where and are the fitting parameters. Clementi clementi_sudip proposed generalized function for the income distribution. Here is the deformation parameter and , are fitting parameters. Using generalized function, they found good data fit with USA income data. In their analysis the low income part of the distribution is exponential, which is retrieved by taking the limit . The low income part is actually corresponds to the low energy regime of the physical system, where one can treat such system non-relativistically. As a result of that the nature of the income distribution in the low income part is exponential. On the other hand the high income part is associated with the physical system in high energy scale. Therefore the physical system should be treated relativistically and one could not expect exponential distribution in the high income regime. The Pareto’s law can be obtained by taking the limit with .

Analyzing the 1996 Forbes magazine data Levy and Solomon levy_sudip found the existence of Pareto’s law in the wealth distribution. The Forbes[1] 11footnotetext: Forbes magazine annually published the lists of the top 400 rich people of USA. The electronic data is available in www.forbes.com/lists. magazine data from year 1988 to 2003 was investigated by Klass et al. klass_sudip . They ordered rich Americans according to their wealth where the wealth of the -th person is . They found a power law , where the Pareto exponent . The exponent is called Zipf exponent. The existence of power law in the wealth distribution of India was reported by Sinha sinha_sudip .

From the analysis of Internal Revenue Service data of USA, Silva and Yakovenko silva_sudip studied the time evolution of the income distribution. They found that the form of the income distribution qualitatively remains similar throughout the entire period of the observation. Most interestingly the nature of the time evolutions of the lower and the upper parts of the income distribution are different. The lower income part of the distribution for all the years can be fitted with a single exponential curve, which actually indicates the thermal equilibrium in this part of the income distribution. On the other hand Silva and Yakovenko noticed that the power law tail in high income regime evolves significantly with time. They found the Pareto’s exponent changes from to during the year 1983-2003 (see also gupta2006_sudip ; sinha_sudip ; saif2007_sudip ; saif2009_sudip ). In this context of Pareto law see, however, Neda et al. neda2019-sudip for a recent review and extensive analysis of income inequality data.

III.3 Models of the Income and Wealth distributions

There are several attempts have been made to model the observed universal income or wealth distributions of various countries. Physicists try to make models which can highlight the basic mechanism behind the formation of such universal income or wealth distribution in the society. Their another motivation is to explain the global economic inequality using the elementary ideas of physics.

There are few works on the modeling of wealth distribution based on generalized Lotka-Volterra model (e.g., richmond_sudip ; solomon_sudip ). Following the model, the time evolution equation of can be written as

| (6) |

where is the money of the -th agent at time . Here is the total number of agents and , are two parameters. The variance of the distribution of random number (always positive) is . Due to the presence of the second term in the right hand side of the equation (6), the money of any agent should not go to zero at any instant of time. Such term may be considered as the effect of some kind of social security policy. The overall growth of the total money is controlled by the the parameter . Since the total money of the system can change with time, the equation 6 does not have any stationary solution. The relative money of an agent can be defined as , here is the average money per agent at any instant of time . The becomes independent of time if the ratio is constant. As a result of that, even in a non-stationary system, after some amount of time, one can eventually get a time invariant relative money distribution. In mean field approximation the distribution function has the following form

| (7) |

Here (positive exponent) is the ratio of and . For large value of , the form of equation (7) eventually becomes power-law-like.

Bouchaud and Mézard bouchaud2000_sudip proposed a generalized model for the growth and redistribution of wealth. Their model (BM) able to reproduce the Pareto law. They used the physics of directed polymers in economical framework. In the BM model, the dynamics of the wealth of the -th is governed by the set of stochastic equation,

Here follows a Gaussian distribution which has mean and variance . The Gaussian multiplicative process simulates the investment dynamics. The is the linear exchange rate of between -th and -th agents. Employing Fokker-Planck equation under mean field approximation, one can obtain a stationary solution of the distribution function , where is the mean wealth. Here is the total number of agents. The form of the is given by

where and . For large value of , the decays in a power law with exponent . The BM model indicates about the two phases, in one phase only a few number of agents hold the entire amount of wealth. Such phase appears when . In the another phase the wealth is distributed among the finite number of agents. Under mean field approximation the agents in BM model exchange the same percentage of wealth they have. That means a relatively poor agent receives an unrealistic amount of wealth from the rich agent. In the field approximation, the wealth of the individual agents asymptotically converges to the mean wealth . That means after long time, all the agents have same amount of wealth, which is again an unrealistic situation. To introduce economic inequality, Scafetta et al. scafetta2004_sudip modulate the investment term of BM model. Garlaschelli and Loffredo garlaschelli2008_sudip accounted BM model in different types of networks.

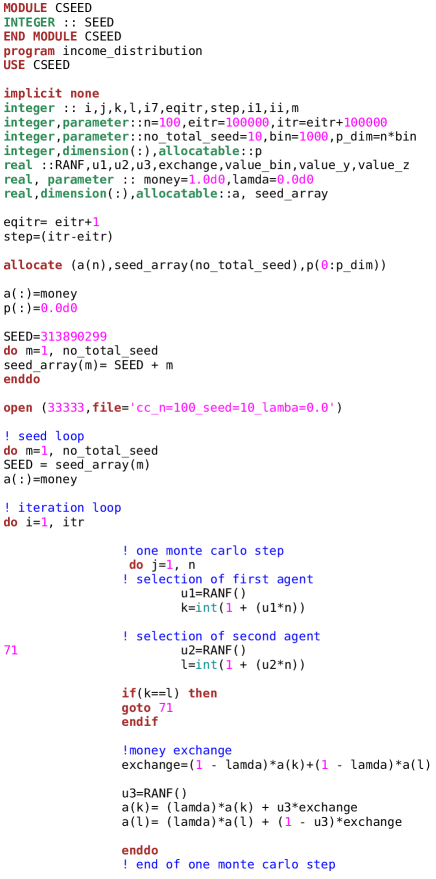

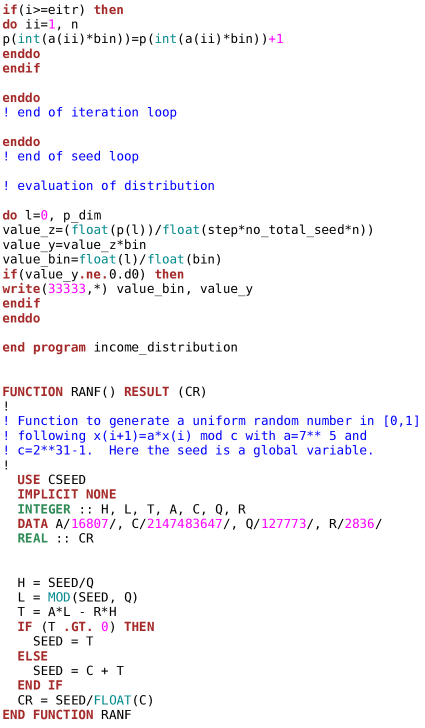

Employing kinetic theory, physicists built models which can reproduce the income or wealth distribution of the society. Chakraborti and Chakrabarti chakraborti_sudip proposed a generalized model (CC model) of income distribution. In their proposed money exchange dynamics, during the economic transaction the participating agents (two people) always keep some fraction of their money and the sum of their remaining money is distributed randomly among them. The dynamical equations of CC model are given by

| (8) |

Here is the saving propensity and is random fraction. Both and are ranging from zero to unity. One can simulate the dynamics of CC model using the Fortran code given in the Fig. 9. The money distribution for different values of are shown in the Fig. 10. For any non-zero value of the most probable position of the will be located at the non-zero value of the money. For zero value of the distribution is essentially exponential whereas for non-zero value of the fits approximately to a Gamma function. Patriarca and Chakraborti patriarca_sudip numerically evaluated the mathematical form of the which is given by

We can see in the limit , the distribution function becomes sharply peaked about some non-zero value of money, which indicates the money is uniformly distributed among the agents. Almost simultaneous to the CC model, Drăgulescu and Yakovenko dragulescu2000_sudip proposed another model (DY model), in which they mapped the two body collision process (exchange energy in the collision) into the economic system, where in each financial transaction (equivalent to collision) between two agents, they exchange money (equivalent to energy). The stochastic equations of money exchange DY model are given by,

| (9) |

where at time the -th agent contains amount of money. The financial transaction is only allowed if both and are greater than zero. Here is the random fraction of the average money of the two participating agents. There is no provision of saving propensity in the DY model, which is the fundamental difference with the CC model. Using the dynamical money exchange equation of DY model, one will get a exponential money distribution, which appears as a special case in the CC model. Therefore one would get an equivalent dynamics of DY model by putting in the CC model.

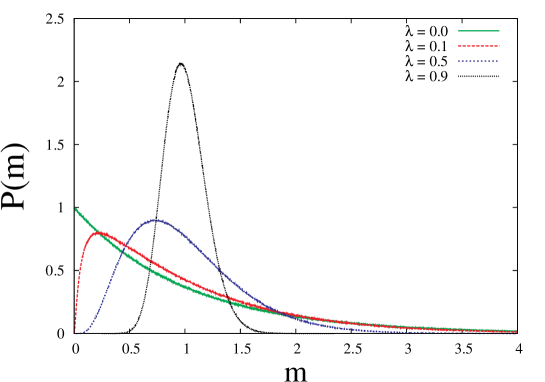

Although we observe power law tail in the income distributions of various countries, both CC and DY models fail to generate such power law tail by using their proposed dynamical rules. We find in the CC model, the value of is same for every agent but in realistic situation the saving propensity should vary from agent to agent. Chatterjee et al. chatterjee2004_sudip discussed the CC model in more general way. Instead of constant value of saving propensity, they consider is distributed among the agents. Therefore the modified dynamical equations of their model (CCM model) can be written as

| (10) |

The values of the saving propensities of -th and -th agents are and respectively and they are in general different. Employing the dynamical equations (III.3), Chatterjee et al. chatterjee2004_sudip numerically found a money distribution which contains a power tail. Such power law tail actually reveals the Pareto law. The existence of the power law tail is robust to the type of the distribution function of saving propensities but the power law exponent depends on the nature of the . In fact for the distribution function , the Pareto exponent value becomes unity for all values for . For uniformly distributed , the money distribution decays as . The money distribution for system size is shown in Fig. 11, here the relaxation time is of order of . Chatterjee et al. chatterjee2004_sudip reported another important result regarding the fluctuation in money of individual agent. They showed that in case of CC model the fluctuation in the money of individual agent increases with the decrease in the value of whereas in case of CCM model exactly opposite trend is observed. Patriarca et al. patriarca2007_sudip investigated the relaxation behavior of income or wealth distribution. They found the equilibrium time is proportional to the number of agents. They also noticed that for a given value of , the equilibrium time . Chakraborty and Manna chakraborty2010_sudip found a distribution with power law tail by using the dynamics of CC model and their power law exponent is similar with the result obtained in the CCM model. In contrast to the CC model, Chakraborty and Manna chakraborty2010_sudip considered the probability of an agent in participating in a financial transaction is proportional to the positive power of his/her money. That means they evoked a dynamics where the richer class of people essentially get more opportunity in trading rather than the low-income people. Reduction of the Cobb-Douglas utilization maximization principle to the CC model of exchange dynamics form was shown by Chakrabarti and Chakrabarti chakrabarti2009_bkc (see also huli_bkc for a recent discussion).

Heinsalu and Patriarca heinsalu2014kinetic_sudip introduced another gas like model of income or wealth distribution. Their model is often called immediate exchange (IE) model. Their proposed dynamical equations of exchanging money between -th and -th agents are given by

| (11) |

where and are the money of any agent before and after the exchange respectively. Here and are two random numbers, uniformly distributed in . Heinsalu and Patriarca heinsalu2014kinetic_sudip numerically found the equilibrium money distribution has the shape of -function.

| (12) |

Here the shape parameter . Heinsalu and Patriarca heinsalu2014kinetic_sudip assert that for small values of wealth, the distribution function obtained from IE model matches better with the real data than the earlier models. Along with new dynamics, they introduced an acceptance criterion of trading for the agents. The acceptance probability of -th agent for making transaction with the -th agent is a function of . Moreover, the equilibrium money distribution does not affected by the introduction of acceptance criterion. There are few analytical works on the IE model. Katriel katriel2014immediate_sudip performed analytical investigations on the IE model. He analytically showed the equilibrium money distribution of IE model converges to -function in infinite population limit. Lanchier and Reed lanchier2018_sudip realized the IE model on connected graph, where agents are located at the vertex set of the graph and they can interact only with their neighbors. Lanchier and Reed lanchier2018_sudip analytically proved the conjectures made by Heinsalu and Patriarca heinsalu2014kinetic_sudip .

III.4 A Kinetic Exchange Model with self-organized poverty-line

Along with the modeling of the observed income or wealth data, there are few attempts made on illustrating intriguing models which indicate the potential way of reducing economic inequality in the society. Pianegonda et al. pianegonda2003_sudip proposed conservative exchange market (CEM) model where a group of agents is realized in one dimensional lattice. According to their proposed dynamics, in each transaction one of the participating agent is necessarily the poorest agent of the group. Due to the transaction the poorest agent may gain (or lose) some amount of wealth. Such amount of wealth is equally deducted (or distributed) from the two nearest neighbors of the poorest agent. In the mean field version of the model (globally coupled), such deduction (or addition) of wealth is done from two randomly chosen agents. Considering the nearest neighbors interactions, they found a wealth distribution in which almost all agents are beyond a certain threshold . Their numerical results indicated the value of where in the initial configuration the wealth is a random number between to , distributed uniformly among the agents. In the mean field case the value of . They noticed the probability of an agent becoming wealthier decreases with time and finally it converges to a value . Pianegonda et al. pianegonda2003_sudip observed the fraction of rich agents is independent of the size of the market. The CEM model reveals an exponential distribution (beyond ) in case of nearest neighbors interactions whereas such distribution has almost linear form in the mean field limit. Iglesias iglesias2010_sudip simulated the dynamics of the CEM model through inclusion of several types of taxes. He considered a situation where the amount of wealth gain (or lose) by the poorest agent is equally collected from the all agents. Such kind of deduction of wealth can be treated as an implementation of tax (uniform for every agent) in the society for the development of the poor class of the people. The distribution obtained by imposing such global-uniform tax is similar with the distribution acquired in case of the mean field version of the CEM model but in this case the value of . It should be noted that in case of mean field CEM model the value of Gini coefficient whereas such value becomes for the wealth distribution extracted from the global-uniform tax version of CEM model. Iglesias iglesias2010_sudip also introduced proportional tax in the CEM model. In this case the deduction of wealth is not uniform for all the agents rather it is proportional to the wealth of the agents. Iglesias iglesias2010_sudip also simulated the effect of the proportional tax when it is deducted locally (i.e., from the neighbors). In the local case of the proportional tax he considered four neighbors and he got whereas such value for the global case is approximately . The value of the Gini coefficient is nearly for the wealth distribution (exponential in nature) obtained considering the local-proportional tax which is similar to the value of in the original local version of the CEM model. In case of global-proportional tax, the nature of the wealth distribution is power law and the value of . Ghosh et al. ghosh2011_sudip proposed gas-like model which shows an effective way of improving the financial condition of poor people. In their model they initially set an threshold value of money or wealth. Like the CEM model, in each interaction one of the agent must have the money below the and the other -th agent is randomly selected (mean field case) from the rest of the agents. The dynamical equation of money exchange are given by

| (13) |

Here , the money of the -th agent before the interaction whereas is the money after the interaction. The is a random number between to . Each financial transaction is considered as unit time . The dynamical exchange of money continues until the money of the all agents cross the threshold or poverty line . After sufficiently long time (relaxation time) one will get a steady state distribution, in which a small perturbation cannot affect the distribution. Such perturbation is implemented by forcibly bringing down a agent below the level and to ensure the money conservation his/her money is given to anyone else. Addition of such perturbation cannot alter the relevant results obtained in the steady state.

The equilibrium money distribution is independent of the initial states of agents which essentially reflects the ergodicity of the system. Ghosh et al. ghosh2011_sudip computed , the average number of agents below the threshold , which is certainly zero in steady state up to a critical value of the threshold . That means for one will never get a distribution where is zero (see Fig. 12). Interestingly the relaxation time divergences at . These outcomes essentially indicate a phase transition in the system, where is the order parameter. In the mean field case the of and values of the critical exponents are , and . These exponents , and are obtained from the power fit of , and respectively. Ghosh et al. ghosh2011_sudip studied their model in one dimension. In this case during a financial transaction one of the agent contains money . The other agent is randomly selected from the two nearest neighbors (which can contain any money whatsoever) of the -th agent. The variation of in the one dimension is shown in the Fig. 12. The value of and the obtained values of critical exponents are , and . Ghosh et al. ghosh2011_sudip also simulated the model in two dimension where again in a financial transaction one of the agent has money and the other agent is one of the four nearest neighbors of the -th agent. The nearest neighbors can have any money whatsoever. The values of the critical point and exponents are , , and . In should be mentioned that except the value of , the values of and in mean field, one dimension and two dimensional cases are very close to the values of these exponents in the Manna model lubeck2004_sudip ; manna1991_sudip ; manna1991two_sudip in the respective dimensions. Ghosh et al. ghosh2011_sudip commented that the mismatch in the values of may arise due to the limitation in the system size and they conjectured that their model might belong to the Manna universality class.

III.5 The Yard-Sale Model and effects of taxes

Another kinetic exchange model considered had been (see Chakraborti chak_2002_sudip ) that

when . In many economic transactions this may be a natural feature, particularly for Yard-Sale model and hence the name. Here, the wealthier agent saves exactly the excess amount and trading takes place with double the poorer agent’s money or wealth. The attractive and stable fixed point for the dynamic corresponds to wealth condensation in the land of one agent. This is obvious, as at any becomes zero, the agent gets isolated from any further trade and this continues for all others until one agent grabs all! This absolute level of condensation or inequality in the model made it unrealistic[1]11footnotetext: The model was studied by the group members in Saha Institute of Nuclear Physics during 2000-2005 and income/wealth condensation phenomenon was taken initially as a signature of the absurdity of the model and the study was temporarily abandoned. Later, however, some interesting slow dynamical behavior of the model was observed chak_2002_sudip . It was also noted that a ‘mixed kinetic exchange strategy’ (see e.g., Pradhan pradhan2005random_sudip ) can destabilize the condensation (with Gini coefficient ) and can lead to some extreme but realistic distributions, having .. However, as discussed in the footnote, several strategies could save the model from such condensation with extreme inequality (), and one suggested recently bruce_2019_sudip to impose the natural tax collection by government, eventually to redistribute it among all the agents in the form of public goods and services, e.g., road construction etc, is extremely successful and gives very good fit to the data.

IV Kolkata Paise Restaurant Problem

The city Kolkata was once the capital of India and till date continues to be one of the oldest trading centre of this country. This old city has attracted large number of labors migrating from all parts of India. A century has passed since this city lost its preeminent position, but the migrant inflow has made Kolkata highly populated till date. Most of the migrants belongs to unorganized labor class, generally lacking secure wages even without fixed working hours. Sometime in Kolkata, there used to be an array of cheap restaurants at road side, namely ‘Paise Hotels’: Paise is the smallest Indian currency. Everyday, each of those restaurant would prepare limited number of dishes, that costs very low (at rate of basic cost of cooking). And this cost matches well with the affordability of those labors. Budget is also not a constraint while choosing any restaurant. Thus the Paise hotels become much popular among the poor labors during their lunch hour. Everyday without discussing with others, they themselves would choose some restaurant for lunch that day. During lunch hour, they would walk down the street and visit his chosen restaurant for lunch. And, only one choice can be afforded per agent per day due to strict lunch hour.

For simplicity, we assume that only one dish would get prepared by each of those restaurants. If some day, only one labor arrives at some restaurant during lunch hour, he will be served the only dish prepared there. And he would go back to work happily. Problem arises if more than one people visit any one restaurant for lunch. Then the restaurant would choose one of them randomly and he gets the lunch. Others arrived there would miss their lunch for that day and report back to work staying hungry for rest of the working hour. Nobody would like to starve. Choosing restaurants intelligently could guarantee lunch for every labor that day. But how to choose in that way makes this problem interesting.

So every day, these labors face a decision making problem. They do not discuss with peers while making his choice. Only information they have is the crowd distribution of every restaurants for some finite number of past days. End of the day, no one would like to continue work skipping lunch. Ideal case would be: if every labor arrives at a restaurant where nobody else visit for that day to assure his lunch. The maximum possible social utilization fraction is (assuming number of restaurants is same as number of labors), meaning no dish gets waste that day.

One simple solution is: a central coordinator would ask the labors to form a queue and assign one of the restaurant to the first one in queue. Rest would follow him since then. Thus full social utilization is achieved and that too from first day. This solution is even valid if the restaurants are ranked (may be because of quality of service or taste of dish prepared there) which is commonly agreed upon by all labors though the cost of dish remain the same as previous.

But presence of a dictator is not always practical. Say in a democratic society, each individual will have his own choice and would hardly like to compromise by listening to some dictator. Rather one would prefer to choose a restaurant on his own. So how any labor would choose some restaurant without knowing the choice of others for that day, may be e.g. choosing randomly per day or evolving some strategy to improve social utilization fraction over time. The objective is to find some strategy following which maximum social utilization can be achieved. For that one needs to study the steady state dynamics of the strategy undertaken. Memory is limited and the labors only have last few days crowd distribution at every restaurant. And mutual interaction among some subset of labors i.e. grouping or some kind of fixing is not allowed.

Here we discuss Kolkata Paise Restaurant (KPR) problem as a repeated many-player many-choice game problem as introduced by Chakrabarti in chakrabarti2007kolkata : there are agents choosing among restaurants (however we will consider = 1) for lunch every day. Agents do not interact with others while making his decision any day. Information regarding last day’s restaurant fill up statistics is available publicly. With this, agents choose and visit the chosen restaurant during lunch hour. Dish is guaranteed only if a restaurant is visited by some agent alone that day. Any day if some restaurant is visited by more than one agents then only one of them gets the food and others return remaining hungry for that day. But, lunch hour is strict. Visiting another restaurant would delay to return back to work and hence only one choice can be made per day per agent. End of the day, the social utilization fraction (number of restaurants visited by at least one agent by total number of restaurant) will be calculated. Maximum possible social utilization fraction is unity. This is when every agent is able get lunch at some restaurant, and no dish gets wasted that day. The dictatorial solution, as discussed in previous para, though works well though we will encourage the readers to evolve some strategy following which those agents will learn to make decision their own and also social utilization fraction can be maximized as much as possible. Below we discuss few interesting strategies along with their results developed by several econophysics researchers.

IV.1 Learning Strategies

Here we will study the dynamics of Kolkata Paise Restaurant game problem following several strategies proposed in chakrabarti2009kolkata ; ghosh2010statistics ; martin2019 . They are: No Learning (NL), Limited Learning (LL), One Period Repetition (OPR), Crowd Avoiding strategy (CA), Stochastic Crowd Avoiding strategy (SCA). Among them No Learning strategy is considered to be the base strategy throughout, often compared with other mentioned strategy.

IV.1.1 No Learning (NL)

In this strategy, agents randomly chooses among restaurants. We consider no past history i.e. memory. For simpilicity, restaurant occupying density is considered to be throughout study. The probability of choosing a restaurant by agents is:

| (14) |

The restaurants being equi-probable, the probability of choosing one restaurant among is and for one gets (using Poisson Limit theorem):

| (15) |

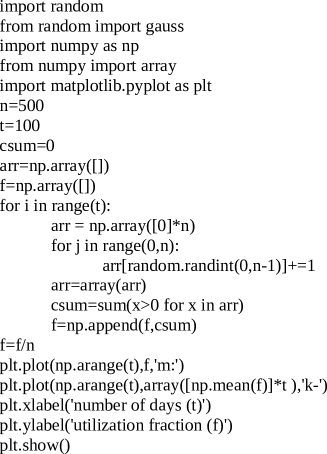

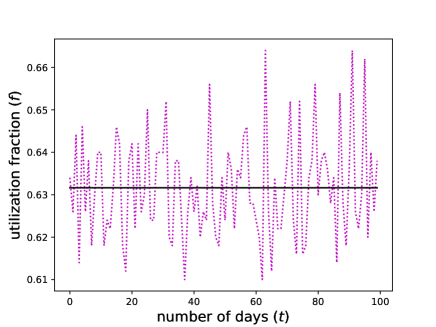

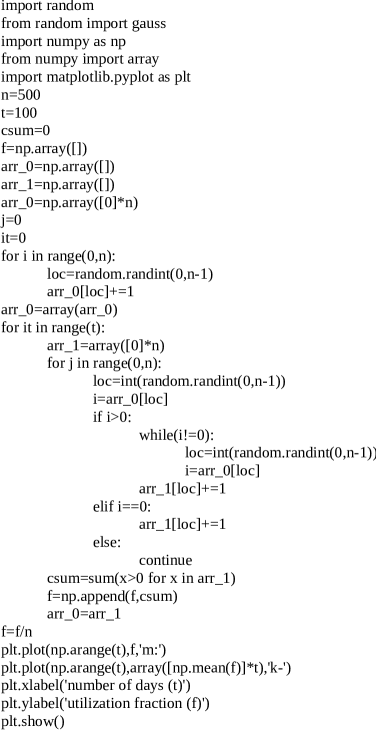

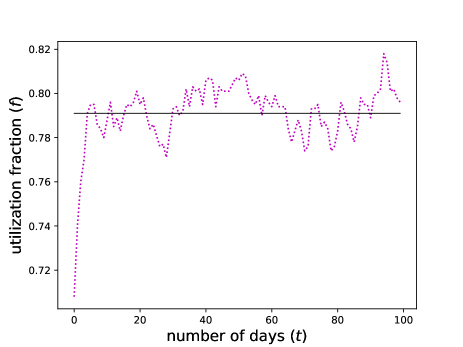

So, fraction of restaurants not chosen by any agent is , and this gives the average fraction of restaurants chosen by at least one agent on that day is . This we will consider as the base strategy and will compare with remaining cases for improvement in . Results Following No Learning strategy given in Fig. 14 can be obtained using program given in Fig. 13.

IV.1.2 Limited Learning (LL)

On first day, agents will randomly choose some restaurant similar to No Learning strategy with . Next day onwards, they will make individual choice depending upon their last day lunch availability: below we discuss the LL(1) inspired strategy proposed in chakrabarti2009kolkata . If an agent gets lunch from some restaurant on -th day, then he opts for the best restaurant on day . If he did not get lunch on any -th day, then next day he randomly choose one among the other restaurant with equal probability. Say fraction of agents or rather number of agents ( is utilization fraction at -th day) on getting their lunch on some day will visit the best restaurant (restaurant 1), and only one of them will get lunch there and others will not get their lunch for that day. Remaining () agents will try from the remaining restaurant following no learning case. And the recursion relation will be:

| (16) |

The first term of the summand will contribute 0 as , and one gets the steady state utilization fraction . This also matches well with numerical simulation result as reported in chakrabarti2009kolkata .

IV.1.3 One Period Repetition (OPR)

On first day say , agents will randomly choose a restaurant following NL strategy. If an agent gets his lunch on day from some restaurant, he will revisit there on day . This is one period repeat. If some agent got his lunch from same restaurant for two consecutive days and , then he will compete for the best restaurant (ranking of restaurant is agreed upon by all agents) on day . For any day if an agent fails to get lunch, next day he will randomly choose one among restaurants which remained vacant yesterday.

Here the fraction (representing social utilization at day ) is made of two parts: fraction of agents who will continue their lunch at last day chosen restaurant, and rest of the fraction who have chosen today:

| (17) |

The fraction of agents who have chosen today is given by NL strategy where left out agents finds one out of yesterday’s vacant restaurants, so .

On next day, the fraction will be:

| (18) |

fraction would be very small and gets ignored, and replacing with one gets,

| (19) |

At stable state convergence, = = = and = = , so dropping the subscript and equating = one calculates to be 0.19 and = 0.71. So this strategy is an improvement over NL case, though an agent after getting lunch at some restaurant revisits there the very next day with probability 1. The fluctuations in the social utilization fraction is found to be Gaussian in the simulation results reported by chakrabarti2009kolkata .

IV.1.4 Crowd Avoiding strategy (CA)

As the name suggests, agents following this strategy will randomly choose some restaurant on day where nobody had visited last day i.e. day(). We provide a sample program in Fig. 16 to calculate the steady state utilization fraction following Crowd Avoiding strategy. Computer simulation results the distribution of social utilization fraction to be Gaussian with peak around 0.46. It can be understood following way: as the fraction of restaurants filled last day will strictly get avoided by agents today, so the number of available restaurants today is which will be chosen randomly by all agents. With , the recursion relation becomes:

| (20) |

Solving above equation, we get = 0.46, which fits well along the simulation result (Fig. 16).

IV.1.5 Stochastic Crowd Avoiding strategy (SCA)

We consider the strategy be following: if an agent arrives at restaurant for getting his lunch on day (-1), then next day (i.e. day ) probability of visiting back to the same restaurant for that agent to have his lunch will depend on how crowded was the last day’s restaurant. So, probability of visiting restaurant on day is =. And the probability of visiting any other restaurant goes as =. Both the numerical and analytical results of average utilization fraction following this strategy is found to be . The distribution is Gaussian with peak around chakrabarti2009kolkata .

The approximate estimation for the steady state behavior of following the above strategy can be made as: Suppose denotes the fraction of restaurants having exactly number of agents ( = ) arrived on day . And also assume that = 0 for 3 for large as the dynamics gets stabilized in steady state. Thus, = 1, = 1 for large gives = . Following the strategy, fraction of agents will try to leave their last day’s visited (each with a probability of 1/2) restaurant on day and of course, no such activity will take place in some restaurant where nobody (fraction ) or only one agent (fraction ) visited last day. Fraction of agents with successful leave attempt will now get equally distributed into remaining restaurants. Out of this , fraction visiting any vacant restaurant () of last day is , at present fraction of vacant restaurant is = . In this process, the vacancy which will also pop up in those restaurants where exactly two agents visited last day is . At steady state one can write:

| (21) |

Using , we get , and also . Thus, social utilization fraction becomes = 0.8. This is an approximate result considering nil contribution from with over large , as seen numerically. Simulation results also confirm the approximated result of steady state utilization fraction, see Fig. 17.

IV.2 Phase Transition in KPR game

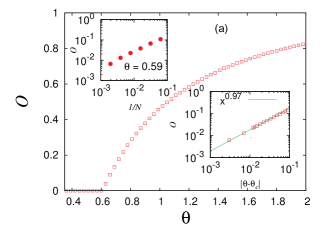

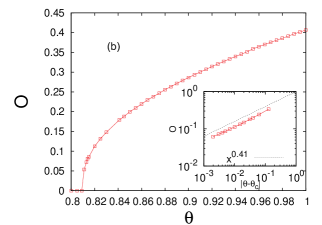

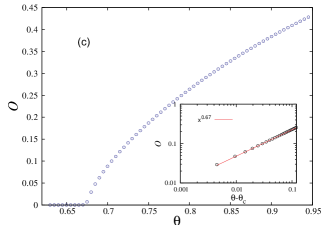

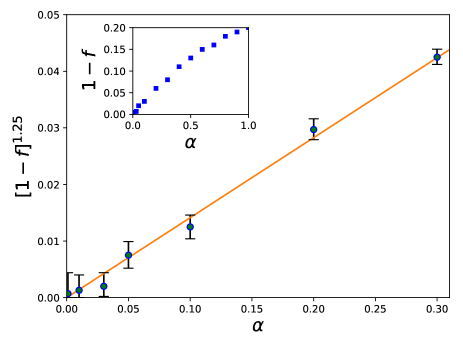

Recently, a novel phase transition phenomena is reported in Kolkata Paise restaurant game problem sinha2019phase if number of agents revisit their last day visited restaurant with weight and for any other restaurant, then the steady state ( independent) utilization fraction becomes = . Here, the critical point is found near point where is found to vary as where . See Fig. 18, where () is plotted against , fitting is done using maximum likelihood estimation. Inset plot shows the direct functional relationship between () and .

IV.3 Application of KPR: Vehicle for Hire problem in mobility market

KPR game model has been applied in competitive resource allocation systems where scarce resources need to be allocated effectively for repeated times. Areas like dynamic matching in mobility markets martin2019 , mean field equilibrium study for resource competitive platform reported in yang2018mean are such examples. In mobility market, agents generally have their individual preference/ranking towards resources. Vehicle for hire markets is one of such platform where drivers individually decide some pick up location to increase their own utilization and accordingly offer individual transportation to customers by car. Martin & Karaenke martin2017vehicle has extended the KPR game model to generalize the Vehicle for Hire Problem (VFHP) and applied playing strategies discussed in previous section assuming drivers as agents and customers as resources in hire market. Below we discuss some of the results where drivers will have their individual ranking over customers unlike original KPR game model having commonly agreed resource ranking.

IV.3.1 No Learning (NL)

drivers,independent of their individual preference ranking and any last trip history, choosing randomly among customers for their next ride. For simplicity is considered as 1. The probability of choosing any particular customer by drivers is:

| (22) |

Assuming each of the customers to be equi-probable with probability and for one gets (using Poisson Limit theorem):

| (23) |

Thus fraction of customers not chosen by any driver is , and one obtains the average fraction of customers chosen by at least one driver for ride is . This result is exactly similar to NL or base strategy of KPR and again we will compare this result with other strategies.

IV.3.2 Limited Learning (LL)

Following LL strategy of KPR, drivers choose a customer randomly for ride at time and go to their most preferred customer at time if they got a tour at time . otherwise they choose randomly again. One obtains the utilization fraction by following formula:

| (24) |

The left summand of above equation represents all those drivers who are successful in choosing their most preferred customer at time after choosing randomly at time or earlier. The right summand models those who choose randomly or successful in choosing their top priority customer at time and return there. On solving the above equation, one gets the steady state utilization . It is quite higher than the same strategy applied in original KPR game model. Drivers having self preference over top customer choice, may have different customer as his best choice. Thus the effective fraction of top customers becomes much higher than having one commonly agreed top rank resource. This is making LL strategy in Vehicle for hire market superior to original KPR LL strategy utilization.

IV.3.3 One Period Repetition (OPR)

At time , drivers will randomly choose customers for trip. For the next ride he will repeat trip with the same customer of time , if successful in previous ride choosing any customer. For drivers with two consecutive successful trip with same customer, would go for individual best ranked customer at time . Any driver follows NL strategy for next trip if fails in getting a successful ride at any time slot. So, overall utilization fraction at time , say , comprises of two parts: fraction of drivers who continues riding with last time chosen customer and rest of the fraction who choose any customer at current time slot. So becomes:

| (25) |

The utilization fraction for fraction of drivers who have chosen in current trip will be given by NL strategy where left out drivers finds one out of the customers waiting for a ride.

On next trip, utilization fraction will be:

| (26) |

substituting with one gets,

| (27) |

At stable state convergence, = = = and = = , so dropping the subscript and equating = one calculates to be and .

IV.4 Application of KPR: Resource allocation in wireless IoT system

Recently, Park et al. has proposed and analyzed a KPR inspired learning framework park2017kolkata for resource allocation in the IoT environment. Here, the IoT devices has been modeled as non-cooperative agents choosing their preferred resource block with limited past information made available by their neighbors. However, socially optimal solution is reported for denser as well as lesser dense IoT environment, discussed below.

Internet of Things (IoT) technology is behind many smart city application. In an IoT environment, huge number of devices gets deployed for task and given limited source of energy (battery) for each device makes it challenging to ensure efficient resource allocation per time slot. The transmissions are often random and infrequent in nature. Now, up link of such an IoT system in time division multi-access way is considered with one base station (BS) to serve IoT devices transmitting short packets whenever they want to. For each time slot , the channel will be divided into resource blocks (RB), each of which to be used by exactly one transmitting device: multiple devices choosing same RB end up transmission failure. At time slot , the probability of devices transmitting with probability is:

| (28) |

Generally in an IoT system, is much larger than . In order to obtain maximum socially optimal solution, the trivial solution could be a centralized solution where the BS allocates RBs to transmitting devices. But for several reasons this solution is impractical. The simple solution is to let the transmitting device randomly choose a RB with equal probability. Let be a random variable representing number of successful transmission with support function supp() as [0,] for and [0,-1] when . Taken , the probability of having minimum successful transmission is:

| (29) |

From equation and , one gets probability of having successful transmission as:

| (30) |

Following park2017kolkata , Park et al. has modeled the one to one association between RBs and IoT devices as a KPR game where each player has a set of actions of selecting set of RBs. Also the RBs have different channel gain and a device would prefer to transmit using a channel block with higher gain. Let the utility function for an IoT device choosing an action of selecting RB with channel gain at slot is:

| (31) |

Unlike original KPR game model, multiple transmitting devices choosing single RB results into zero utility. Within certain communication range (), during time slot each transmitting device learns from their neighbor’s RB usage; on () slot, if neighbor’s transmission is successful then choose some better ranked RB else transmit with less preferable RB than neighbor’s last preference, otherwise transmit randomly. Nash equilibrium is reported for certain values of for even denser IoT network with service rate of %, which is about threefold higher than respective baseline.

V Social Networks

Society evolves in to many complex network structures in the hyperspace of inter-agent interactions (viewed as links) among the agents (viewed as nodes). Examples may be transport networks, bank networks, etc. Geometrically defined, for example, if one puts random dots (nodes) on an unit area the minimum distance of separation between any two dots or nodes will decays as . The same problem in an unit three dimensional volume will give the inter-node separation decaying as , and decays as for a dimensional system. For complex social networks such inter-node distance (for a fixed embedding volume) will decay as , as in an effective infinite-dimensional space. This indicates the minimum contact number required for the spread of disease or information in a society. In other words, the number of transits for transport between any two nodes can be much lower than naively expected for two or three dimensional world!

V.1 Indian Railway network analysis

Here we discuss one of the highly cited research work from Kolkata: the structural properties of the years’ old Indian Railway network (IRN) as complex network. Indian Railway is the largest medium of transport in the country. Question is, how many trains one passenger would need to change while reaching any destination within country while traveling by train. Passengers would not like to change many trains to avoid the hassle and latency. How would if a train runs between every stations (junction, regular as well as remote) to make journey hassle-free i.e. switching trains during journey become less; considering trains running between stations. But it will end up incurring too much latency. In sen2003small , for the first time Indian Railway network has been studied by Sen et al. as a graph where each railway-station is considered a node and the physical track joining any two stations as the edge so that there exist minimum one train running between them using the track. For simplicity, edges are considered to be one unit distant, ignoring actual geographical distance between the two stations it connect as an unweighted graph. Rigorous investigation of the structural properties of IRN as a complex network are discussed below.

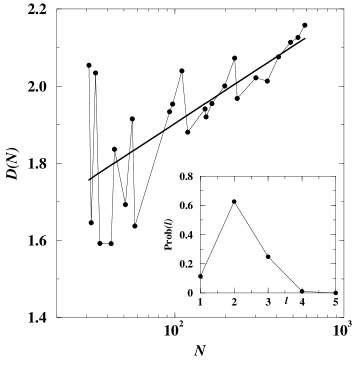

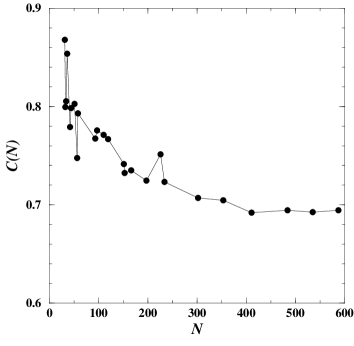

With a motive of being fast and economic, railways run several trains covering short as well as long route. IRN is quite a large network consisting more than stations over which almost trains run over the country. For the purpose of coarse-grained study of IRN, sen2003small has considered only stations () with tracks () represented as a grant rectangular matrix such that if train has a stop at station . In , Watts and Strogatz proposed a model of network in watts1998collective with properties like: diameter of the network changes very slowly as the size of the network grows over time and the network will possess dense connectivity among the neighbors of a node, termed as clustering coefficient . They named this network type as Small World Network (SWN) arguing it’s diameter growth is similar to random network i.e. as with large value of clustering coefficients . Sen et al. has measured both of the metric over different subsets of IRN and concluded it to behave similar to a small world network (see Figs. 19, 20). Practically this implied that over the years IRN has grown up to be economic, fast i.e. very few trains need to be changed to reach any arbitrary station over the whole network.

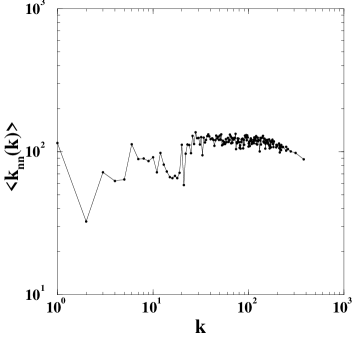

As per Graph theory, how well connected a node is primarily agreed upon by the number of neighbor it has i.e. degree of the node. Hence it is important to study the degree distribution of IRN. The cumulative degree distribution = of IRN when plotted on a semi-logarithmic scale, has been found to fit an exponentially decaying distribution with . But does not tell much about how well connected are the neighbors of a high degree station i.e. the correlation (whether positive or negative) of the average degree of neighbors to that of the respective node. Fig. 21 shows the plot of against respective vertex’s degree to find the general assortative behavior of the network. Using rigorous measure discussed in sen2003small , the value came for IRN is very small ().

VI Summary and Discussion

Unequal distribution of income, wealth and other social features are not only common, they have been the persistent feature throughout the world and through the history of human civilization. Apart from the thinkers and philosophers, the economists and other social scientists have studied extensively about it. Recently, physicists are trying to measure and explore the cause of such inequalities.

We first discuss (in Section II) about measures of social inequalities, including the Kolkata index , giving the fraction of wealth possessed by fraction of the reach population: As such it generalizes the Pareto’s ‘80/20 law’. We have discussed in this section about the Gini and Kolkata index values measured in various social contexts, e.g., of the income and wealth, deaths in social conflicts and natural disasters, citations of papers across the institutions and journals etc.

Next, in section III we investigate the nature of income and wealth distribution in various societies, and find a dominant feature in that typically more the ninety percent of the population in any society has a distribution which fits a Gamma distribution, while the upper tail part (for the super-rich fraction of the population) fits a robust power law or Pareto law. We show, the kinetic theory of ideal gas, where the trading agents are like ‘social atoms’ of the gas as in two person trading of scattering process with conserved money (like the conserved energy for the gas atoms) and saving a fraction of respective money in each trading indeed gives a Gamma-like distribution which crosses over to Pareto-like power law when the saving fractions are inhomogeneous.

Econophysics is interdisciplinary by nature, contributed by physicists, economists, statisticians, social scientists, computer scientists etc. Here, an effort has been put to give a glimpse of recent studies from Econophysics by computation. Inequality measuring techniques starting from simple histogram to standard gini index as well as Kolkata index and others (see e.g., ghosh2014inequality ; chatterjee2017socio ; inoue2015measuring ; banerjee2019kolkata ). One of the major goal of econophysics has been to search for a successful theory or model which can capture the behavior of the real economic data of income or wealth distribution. In this review we briefly discuss some of the models inspired by the kinetic theory of ideal gases which are able to give some insights into the mechanisms of the income distributions. For application of kinetic exchange models to social opinion formation, see lallouache_bkc ; biswas2012_bkc ; mukherjee2016_bkc . There are a few extensive reviews and books yakovenko2009colloquium_sudip ; chakrabarti2013econophysics ; pareschi2013interacting_sudip highlighting these developments of the econophysics (of income and wealth distribution) as well as in sociophysics. Beside this field of study there are many applications of physical laws in financial and stock markets (see e.g., stanley2000introduction_sudip ; sinha2010econophysics_sudip ; bhadola2017_sudip ; bertschinger2018reality ). Social resource allocation models (see for e.g., chakrabarti2017econophysics ,dhar2011_bkc ) along with several intelligent collective learning strategies are discussed along with their programs. We also discussed the connectivity structures of social networks (see e.g., sen2014sociophysics ; chakrabarti2007econophysics ). In particular we discussed here for the Indian Railway network, how the minimum number of train connections (links) one need to hop for going from one destination to another within India (or, for that matter, any other country), grows with the total number of service stations (nodes) in India (network of the respective country). Such shortest number of links in any network gives the idea for the time required to spread rumor or contact diseases, etc. in a networked society.

In order to give a birds’-eye-view of the developments of econophysics, we give the chronological entries in ‘Timeline of econophysics’ (Appendix) for the major developments in the initial phase. For further studies and search of research problems in these and related fields, see Refs stanley2000introduction_sudip ; sinha2010econophysics_sudip ; yakovenko2009colloquium_sudip ; chakrabarti2013econophysics ; sen2014sociophysics ; chakrabarti2007econophysics ; chakrabarti2017econophysics ; slanina2013essentials_sudip ; pareschi2013interacting_sudip ; aoyama2017macro_sudip ; jovanovic2017econophysics_sudip .

VII Acknowledgement

We are grateful to Muktish Acharyya for the invitation to write this review. BKC is grateful to J. C. Bose fellowship (DST, Govt. India) for financial support.

References

- (1) K C Dash. The Story of Econophysics. Cambridge Scholars Publishing, Newcastle upon Tyne, (2019).

- (2) R N Mantegna and H E Stanley. An Introduction to Econophysics. Cambridge University Press, Cambridge, (2000).

- (3) S Sinha, A Chatterjee, A Chakraborti, and B K Chakrabarti. Econophysics: An Introduction. Wiley, Berlin, (2010).

- (4) V M Yakovenko and J Barkley Rosser Jr. Colloquium: Statistical mechanics of money, wealth, and income. Reviews of Modern Physics, 81:1703, (2009).

- (5) B K Chakrabarti, A Chakraborti, S R Chakravarty, and A Chatterjee. Econophysics of Income and Wealth Distributions. Cambridge University Press, Cambridge, (2013).

- (6) P Sen and B K Chakrabarti. Sociophysics: An Introduction. Oxford University Press, Oxford, (2014).

- (7) C Gini. Measurement of inequality of incomes. The Economic Journal, 31:124–126, (1921).

- (8) A Ghosh, N Chattopadhyay, and B K Chakrabarti. Inequality in societies, academic institutions and science journals: Gini and -indices. Physica A: Statistical Mechanics and its Applications, 410:30–34, (2014).

- (9) I I Eliazar and I M Sokolov. Measuring statistical heterogeneity: The pietra index. Physica A: Statistical Mechanics and its Applications, 389:117–125, (2010).

- (10) A Chatterjee and B K Chakrabarti. Fat tailed distributions for deaths in conflicts and disasters. Reports in Advances of Physical Sciences, 1:1740007, (2017).

- (11) A Sinha and B K Chakrabarti. Inequality in death from social conflicts: A gini & kolkata indices-based study. Physica A: Statistical Mechanics and its Applications, page 121185, (2019).

- (12) A Chatterjee, A Ghosh, and B K Chakrabarti. Socio-economic inequality: Relationship between gini and kolkata indices. Physica A: Statistical Mechanics and its Applications, 466:583, (2017).

- (13) J Inoue, A Ghosh, A Chatterjee, and B K Chakrabarti. Measuring social inequality with quantitative methodology: analytical estimates and empirical data analysis by gini and indices. Physica A: Statistical Mechanics and its Applications, 429:184–204, (2015).

- (14) A Chatterjee and B K Chakrabarti. Kinetic exchange models for income and wealth distributions. The European Physical Journal B, 60:135–149, (2007).

- (15) M Saha and B Srivastava. A Treatise on Heat. Indian Press, Allahabad, (1931).

- (16) V Pareto. Cours d’Économie Politique. Rouge, Lausanne, (1897).

- (17) R Gibrat. Les Inégalités Économiques. Libraire du Recueil Sirey, Paris, (1931).

- (18) W Souma. Universal structure of the personal income distribution. Fractals, 9:463–470, (2001).

- (19) H Aoyama, W Souma, Y Nagahara, M P Okazaki, H Takayasu, and M Takayasu. Pareto’s law for income of individuals and debt of bankrupt companies. Fractals, 8:293–300, (2000).

- (20) A Drăgulescu and V M Yakovenko. Eevidence for the exponential distribution of income in the usa. The European Physical Journal B-Condensed Matter and Complex Systems, 20:585–589, (2001).

- (21) A Drăgulescu and V M Yakovenko. Exponential and power-law probability distributions of wealth and income in the united kingdom and the united states. Physica A: Statistical Mechanics and its Applications, 299:213–221, (2001).

- (22) A Drăgulescu and V M Yakovenko. Statistical mechanics of money. The European Physical Journal B-Condensed Matter and Complex Systems, 17:723–729, (2000).

- (23) J C Ferrero. The statistical distribution of money and the rate of money transference. Physica A: Statistical Mechanics and its Applications, 341:575–585, (2004).

- (24) F Clementi, T Di M, M Gallegati, and G Kaniadakis. The -generalized distribution: A new descriptive model for the size distribution of incomes. Physica A: Statistical Mechanics and its Applications, 387:3201–3208, (2008).

- (25) M Levy and S Solomon. New evidence for the power-law distribution of wealth. Physica A: Statistical Mechanics and its Applications, 242:90–94, (1997).

- (26) O S Klass, O Biham, M Levy, O Malcai, and S Solomon. The forbes 400, the pareto power-law and efficient markets. The European Physical Journal B, 55:143–147, (2007).