notecount 11institutetext: AIT Austrian Institute of Technology 22institutetext: IOHK 33institutetext: Chainalysis

Stake Shift in Major Cryptocurrencies: An Empirical Study

Abstract

In the proof-of-stake (PoS) paradigm for maintaining decentralized, permissionless cryptocurrencies, Sybil attacks are prevented by basing the distribution of roles in the protocol execution on the stake distribution recorded in the ledger itself. However, for various reasons this distribution cannot be completely up-to-date, introducing a gap between the present stake distribution, which determines the parties’ current incentives, and the one used by the protocol.

In this paper, we investigate this issue, and empirically quantify its effects. We survey existing provably secure PoS proposals to observe that the above time gap between the two stake distributions, which we call stake distribution lag, amounts to several days for each of these protocols. Based on this, we investigate the ledgers of four major cryptocurrencies (Bitcoin, Bitcoin Cash, Litecoin and Zcash) and compute the average stake shift (the statistical distance of the two distributions) for each value of stake distribution lag between 1 and 14 days, as well as related statistics. We also empirically quantify the sublinear growth of stake shift with the length of the considered lag interval.

Finally, we turn our attention to unusual stake-shift spikes in these currencies: we observe that hard forks trigger major stake shifts and that single real-world actors, mostly exchanges, account for major stake shifts in established cryptocurrency ecosystems.

Keywords:

cryptocurrencies, blockchain, stake shift, proof of stake1 Introduction

The introduction of Bitcoin [1] represented the first practically viable design of a cryptocurrency capable of operating in the so-called permissionless setting, without succumbing to the inherently threatening Sybil attacks. In the decade following Bitcoin’s appearance, cryptocurrencies have arguably become the main use case of the underlying blockchain technology. Most deployed cryptocurrencies such as Bitcoin are relying on proofs of work (PoW) to prevent Sybil attacks and provide a robust transaction ledger. However, the PoW approach, also has its downsides, most importantly the associated energy waste (see e.g. [2]).

A promising alternative approach to maintaining a ledger in a permissionless environment is based on so-called proof of stake (PoS), where Sybil attacks are prevented by, roughly speaking, attributing to each participant in the consensus protocol a weight that is proportional to his stake as recorded in the ledger itself. Several PoS protocols embracing this idea have been shown to achieve provable security guarantees in various models [3, 4, 5, 6, 7, 8].

More concretely, in all these PoS schemes, whenever a protocol participant needs to be selected for a certain role in the protocol, he is chosen with a probability that is proportional to his stake share in some stake distribution , by which we mean a record of ownership of all the assets maintained on the ledger at a given time, allowing to determine what proportion of this stake is in control by any given party. In other words, the stake distribution is a snapshot of the ownership of the ledger-based asset at a given time (for simplicity of exposition, we assume only a single-asset ledger in this discussion).

Ideally, the selection of a party for any security-relevant role in the protocol at time should be based on a stake distribution that is as up-to-date as possible. However, for various security-related reasons that we detail in Section 2.1, the protocols cannot use the “current” distribution of assets and are forced to use that is recorded in the ledger up to the point in time for some time interval that we call the stake distribution lag of the protocol. However, roughly speaking, the security of the protocol is determined by—and relies on a honest-majority assumption about—the present stake distribution . To account for this difference, existing protocols assume that not too much money has changed hands during the past time interval of length , and hence the distributions and are close. Their distance, called stake shift in [4], is the focus of our present investigation.

Our Contributions.

Up until now, the notion of stake shift has only been discussed on a theoretical level and not yet quantified based on real-world data; we set up to fill this gap. We conjecture that the stake shift statistics of a cryptocurrency are mostly influenced by its proliferation, market cap and daily trading volumes, rather than its underlying consensus algorithm. Therefore, in an effort to understand the stake shift characteristics of a mature cryptocurrency, we focus our analysis on PoW ledgers with a strong market dominance such as Bitcoin.111As of September 13, 2019, about of the total market capitalization of cryptocurrencies is stored in Bitcoin (cf. https://coinmarketcap.com). We perform a systematic, empirical study of the stake shift phenomenon. More concretely, our contributions can be summarized as follows:

-

1.

We adjust the formal definition of stake shift given in [4] to be applicable to studying the execution of the protocol in retrospect, based only on the stabilized ledger produced, without access to the states held by the parties during its execution.

-

2.

We provide a scalable algorithmic method for computing stabilized stake shift over the entire history of PoW ledgers following the UTXO model. We computed it in ledgers of four major cryptocurrencies (Bitcoin, Bitcoin Cash, Litecoin, and Zcash) from their inception until July 31st, 2019.

-

3.

We study the evolution of stabilized stake shift in all ledgers and found that hard forks may trigger major stake shifts. We also fitted a simple quadratic polynomial model that mimics the real-world sublinear growth of stake shift with respect to the considered stake distribution lag.

-

4.

We pick top spikes occurring within the last two years, and determine the likely real-world identities behind them. We can observe that exchanges are behind those spikes, at least in established cryptocurrencies such as Bitcoin or Bitcoin Cash.

Our results show that the stake-shift phenomenon has a noticeable impact on the provable-security guarantees provided by PoS protocols from the literature. We argue in Section 2.1 that the stake shift over the stake distribution lag period of a PoS protocol counts directly against the threshold of adversarial stake it can tolerate (typically 1/2 or 1/3), and the values of stake shift that we observe are clearly significant on this scale, as we detail in Section 6.

While our initial intention was to inform the design of PoS protocols, we believe that our results can be interesting to a wider community and shed some light on the real-life use of the studied cryptocurrencies as tools for value transfer. Therefore, we make our research reproducible by releasing the implementation of our stake shift computation method. It can be used for computing stabilized stake shifts with configurable lag for any other cryptocurrency that follows Bitcoin’s UTXO model.

Finally, note that all measurements were performed on UTXO-based currencies and some of the mentioned PoS protocols envision an account-based ledger. This aspect, however, is completely irrelevant to our investigation. Also, while our motivation comes from PoS protocols, we believe that most robust and useful data can be obtained from mature blockchains and hence we focus our measurements on PoW ledgers. To reemphasize, it seems reasonable to believe that the maturity (age, market cap, trading volume, etc.) of a blockchain are more determining for its stake shift behavior than the underlying consensus mechanism, hence justifying our choice.

We start by providing more details on the relevance of stake shift for PoS security, and survey the stake distribution lags in existing proof-of-stake protocols in Section 2. Then we provide a formal definition of stabilized stake shift in Section 3 and describe our datasets and computation methods in Section 4. We present our findings in Section 5 and discuss them in Section 6.

2 Background

In this section we provide a more detailed discussion of the relevance of stake shift for PoS protocols, and survey stake distribution lags of several known PoS proposals.

2.1 Importance of Stake Shift for Security of PoS-Based Blockchains

As mentioned in Section 1, the selection of a party for any security-relevant role in a PoS protocol should ideally be based on a stake distribution that is as up-to-date as possible. However, this is often difficult, as we detail next.

First, in the eventual-consensus PoS protocols such as [4, 5, 6, 7, 8], there is no consensus about the inclusion of the most recently created blocks into the stable ledger, such a consensus is only achieved gradually by adding more and more blocks on top of them. Consequently, during the protocol execution, the view of the current stake distribution at time by different honest parties might actually differ and hence cannot be used for electing protocol actors.

On the other hand, in PoS protocols based on Byzantine Agreement such as [3], where the consensus about a block is achieved before proceeding to further blocks, the most recent stake distribution still cannot be used for sampling protocol participants. The reason is that the security of the protocol requires the stake distribution to be old enough so that it was fully determined before the adversary could have any information about the bits of randomness used to sample from this distribution (which are also produced by the protocol).

Therefore, in all these protocols, participants that are allowed to act at some time are sampled according to a distribution recorded in the ledger up to the point in time for some stake distribution lag . This is done with the intention that is both

-

•

stable (in the case of eventual-consensus protocols), and

-

•

recent enough so that it can be assumed that it does not differ too much from the current distribution .

However, the incentives of the participants are, of course, shaped by the current distribution of the stake: For example, a party that used to own a significant portion of the stake, but has just transferred (e.g., sold) all of it in time , has no longer any stake in the system and hence no direct motivation to contribute to its maintenance. Nonetheless, at any time during the time interval , the stake distribution will still attribute some stake to and hence will be allowed (and expected) to act accordingly in the protocol. This discrepancy is present in all PoS protocols listed above, and in fact in all provably-secure PoS protocols in the literature.

The security of these PoS protocols is typically argued based on the assumption that at any point during the execution, less than a fraction of the total stake in the system is controlled by adversarial parties (for in [4, 5, 6, 7, 8] and in [3]). To formally account for the above mismatch, one has to choose between the following two approaches:

-

(i)

Directly assume that, at every point during the execution, less than a -fraction of stake in the old distribution is controlled by parties that are adversarial at time .

-

(ii)

Make an additional assumption that, at any point during the execution, some (normalized) “difference” between and the current factual distribution of stake in the system is bounded by a constant ; i.e., that not too much money has changed hands between and . This assumption allows to conclude security as long as the current adversarial stake ratio in satisfies

(1) for some (see e.g. [4, Theorem 6], respectively Theorem 5.3 in the full version of [4]).

All of the provably secure PoS protocols adopt one of these two approaches. While the assumption in approach (i) is formally sufficient, it is arguably cumbersome and counter-intuitive, making the reasoning (ii) preferable. As evidenced by equation (1), in the approach (ii) the quantity , called stake shift, plays a significant role for the protocols’ security.

Let us clarify that our primary motivation for investigating stake shift pertains to the distributions and as described above and defined by individual PoS protocols, and does not aim at addressing the dangers of long-range attacks (see e.g. [9] for an overview of those). In a typical long-range attack setting, the considered time interval would be much longer and one could hardly expect a limited stake shift over it.

Finally, following the above motivation, below we focus on provably secure PoS proposals. All these protocols use all existing coins for staking, not distinguishing between “staked” and “unstaked” coins, and so we don’t consider this distinction below. It is worth mentioning that practical implementations of these protocols, as well as other PoS blockchains such as EOS222https://eos.io and Tezos333https://tezos.com, often deviate from this approach and allow for coins that do not participate in staking.

2.2 Stake Distribution Lag in Existing PoS Protocols

Here we survey the value of stake distribution lag in several provably secure PoS protocol proposals.

Ouroboros.

The Ouroboros PoS protocol [4] divides its execution into so-called epochs, where each epoch is a sequence of slots for a parameter (this structure is dictated by the inner workings of the protocol). The stake distribution used for sampling slot leaders in epoch is the one reflected in the current chain up to slot of the preceding epoch . Therefore, the stake distribution lag amounts to at most slots.

In the deployment of the Ouroboros protocol in the Cardano project 444https://www.cardano.org, each slot takes seconds and is chosen to be . Therefore, the above upper bound on the stake distribution lag corresponds to exactly days.

Ouroboros Praos and Ouroboros Genesis.

These protocols, which are defined in [6, 7], also divide their execution into epochs. However, the stake distribution used for sampling slot leaders in epoch is the one reflected in the current chain up to the last slot of the epoch . Hence the stake distribution lag amounts to at most epochs. Assuming the same epoch length as above, this would result in a stake distribution lag of exactly days.

Algorand and Vault.

Snow White.

The Snow White protocol employs a “look-back” of blocks for a parameter that is sufficient to invoke the common-prefix and chain-quality properties (see [5]). The authors do not propose a concrete value of , however, given that the requirements put on are similar to other protocols (common prefix, chain quality), it is safe to assume that an implementation of Snow White would also lead to a stake distribution lag between 1 and 10 days.

3 Stabilized Stake Shift Definition

We are interested in executions of blockchain ledger protocols, and will be assuming a model in the spirit of [13] to formalize such executions. In particular, we assume there is an environment orchestrating the execution, a set of parties executing the protocol, and an adversary allowed to corrupt the parties upon approval from the environment; parties yet uncorrupted are called honest. We assume that the protocol execution is divided into a sequence of disjoint, consecutive time intervals called slots, indexed by natural numbers (starting with ). The set of honest parties at each slot is denoted by . Finally, we denote by the chain held by an honest party at the beginning of slot .

Finally, let denote the stake distribution recorded in the chain up to slot , seen as a probability distribution (i.e., normalized to sum to ). As a notational convenience, let denote the initial stake distribution recorded in the genesis block.

To define stake shift, we use the standard notion of statistical distance of two discrete probability distributions.

Definition 1 (Statistical distance)

For two discrete probability distributions and with support and respectively, the statistical distance (sometimes also called the total variation distance) of and is defined as

Seeing stake distributions as probability distributions allows for the following definition inspired by [4, Definition 5.1].

Definition 2 (Stake shift)

Consider an execution of a blockchain protocol for slots, and let . The -stake shift in slot is the maximum, over all parties honest in slot and all parties honest in slot , of the statistical distance between the stake distributions in slots and as perceived by and , respectively. Formally,

Naturally, we extend this notion over the whole execution and define the -stake shift of to be

Finally, note that the quantity , and consequently also , cannot be determined based solely on the final stabilized ledger that was created by the protocol, as it does not contain the views of the participants during the protocol execution. For this reason, any long-term empirical study that is only based on the preserved stabilized ledger (e.g. the Bitcoin blockchain) has to aim for an analogous quantity capturing stake shift in , as defined next.

For a stable ledger , we denote by the stake distribution as recorded in up to slot .

Definition 3 (Stabilized stake shift)

Consider an execution of a blockchain protocol for slots, let denote the resulting stable ledger produced by during , and let . The stabilized -stake shift in slot is defined as

and similarly, the stabilized -stake shift of is

For the reasons noted above, we will focus on stabilized stake shift in our empirical analysis; whenever we use the term stake shift below, we refer to its stabilized variant as per Definition 3.

4 Data and Methods

Before we can empirically investigate stake shifts in deployed cryptocurrencies, we first need to translate the definition of stake shift into a scalable algorithmic procedure that can compute stake shift with configurable lags over a currency’s entire history, which in the case of Bitcoin spans more than 440M transactions and 0.5B addresses. In this section, we describe how we prepare the required datasets from the underlying blockchains and the technical details of our stabilized stake shift computation method.

4.1 Dataset Preparation and Structure

We consider datasets from four different cryptocurrency ledgers: first, we take Bitcoin (BTC), which is still the cryptocurrency with the strongest market dominance. Additionally, we take three alternatives derived from the Bitcoin Core code base: Bitcoin Cash (BCH), which is a hard fork from the Bitcoin blockchain to increase the block size limit, which took effect in August 2017; Litecoin (LTC), which was an early altcoin, starting in October 2011, and is very similar to Bitcoin. The key differences to Bitcoin are its choice of the proof-of-work algorithm (scrypt) and the network’s average block creation time, which is roughly 2.5 minutes. Finally, we also consider Zcash (ZEC), which is a cryptocurrency with enhanced privacy features, initially released in October 2016. Zcash coins are either in a transparent or a shielded pool. The transparent (unshielded) pool contains ZEC in transparent addresses (so-called t-addresses). Due to the anonymity features in Zcash, our analysis is limited to the transparent transactions in the unshielded pool. However, as observed in [14], a large proportion of the activity on Zcash does not use the shielded pools. A summary of the used datasets is provided in Table 1.

| Currency | # Blocks | Last timestamp | # Txs | # Addresses | # Clusters | # Entities |

| BTC | 588,007 | 2019-07-31 23:55:05Z | 440,487,974 | 540,942,127 | 50,162,316 | 260,182,367 |

| BCH | 593,795 | 2019-07-31 23:54:09Z | 275,765,798 | 302,098,643 | 31,173,961 | 142,884,996 |

| LTC | 1,677,479 | 2019-07-31 23:57:21Z | 36,009,400 | 44,256,812 | 3,052,978 | 23,304,076 |

| ZEC | 577,390 | 2019-07-31 23:59:54Z | 5,052,970 | 3,488,294 | 206,506 | 1,680,481 |

For each cryptocurrency ledger, we partition these addresses into maximal subsets (clusters) that are likely to be controlled by the same entity using the well-known and efficient multiple-input clustering heuristics [15]. The underlying intuition is that if two addresses (e.g., and ) are used as inputs in the same transaction while one of these addresses along with another address (e.g., and ) are used as inputs in another transaction, then the three addresses (, and ) must somehow be controlled by the same entity, who conducted both transactions and therefore possesses the private keys corresponding to all three addresses. Being aware that this heuristic fails when CoinJoin transactions [16] are involved, we filtered those transactions before applying the multiple-input heuristics.

Before describing our stake shift computation method in more detail, we introduce the following notation for key entities in our dataset: we consider a blockchain with its associated set of addresses and set of transactions at time .

The multiple-input heuristics algorithm is applied to the complete transaction dataset at time to obtain a set of clusters . Each cluster is represented by a set of addresses, where . The set of entities is represented by the union of with the remaining single address clusters, i.e., . The (cumulative) balance for entity at time is denoted by , and the total balance over all entities at time is given by .

The last three columns in Table 1 show the number of addresses in each ledger, the number of computed clusters, as well as the number of entities holding the corresponding private keys of one or more addresses.

For further inspecting the real-world identities behind entities causing major stake shifts, we rely on Chainalysis555https://www.chainalysis.com/, which is a proprietary online tool that facilitates the tracking of Bitcoin transactions by annotating Bitcoin addresses with potential owners.

4.2 Stake Shift Computation

Given the dimensionality of our dataset, the challenge lies in finding a method that follows Definition 3 and can compute the distances in a scalable, distributed and memory-efficient manner.

In a naïve approach one would calculate the cumulative balance for each entity at every time period (e.g., days). The stake distribution is represented by the relative frequencies, which are the result of dividing the cumulative balances at time by the total balance . This approach would result in huge temporary datasets that must be persisted in memory for subsequent computation steps. For instance, for the computation of the stabilized stake shift in Bitcoin, a grid of 3,862 260,182,367 (number of days number of entities) data points needs to be cached, which is computationally inefficient and hardly feasible in practice given today’s hardware limitations.

Therefore, we propose an iterator-based approach coupled with a custom aggregation method, which can be executed on a distributed, horizontally scalable data processing architecture: First, we join the transaction data with the relevant entity information, and use the entity IDs for partitioning. Then, for calculating the cumulative balances, we sort every partition by time period. The iterator represents basically a loop over the grid of predefined time periods for a given entity. Internally, we build up a data structure that holds the following information in each iteration step: (i) entity ID , (ii) time period , (iii) the cumulative balance , (iv) the contribution of the current entity to the stake distribution at time ; and (v) the absolute difference of the stake distribution contributions at time and :

To compute the stake shift for arbitrary lag values , a FIFO (first in, first out) structure is needed to hold at most instances of the above data structure for the last periods. That data structure can efficiently be partitioned across computation nodes and requires zero communication costs. An aggregation method then collects all partial results to obtain the stake shift value at time period .

We implemented our stake shift computation method as single Apache Spark666https://spark.apache.org/ job operating directly on a pre-computed dataset provisioned by the GraphSense Cryptocurrency Analytics Platform777https://graphsense.info. For further technical details, we refer to the source code, which will be released with this paper.

5 Analysis and Results

In the following, we first report results on the longitudinal evolution of stake shifts in all considered cryptocurrencies (BTC, BCH, LTC, ZEC). Then we handpick past stake shift spikes and analyze them in more detail, in order to gain a better understanding on the factors causing those shifts. We also elaborate on cross-ledger similarities and differences.

5.1 Evolution of Stabilized Stake Shifts

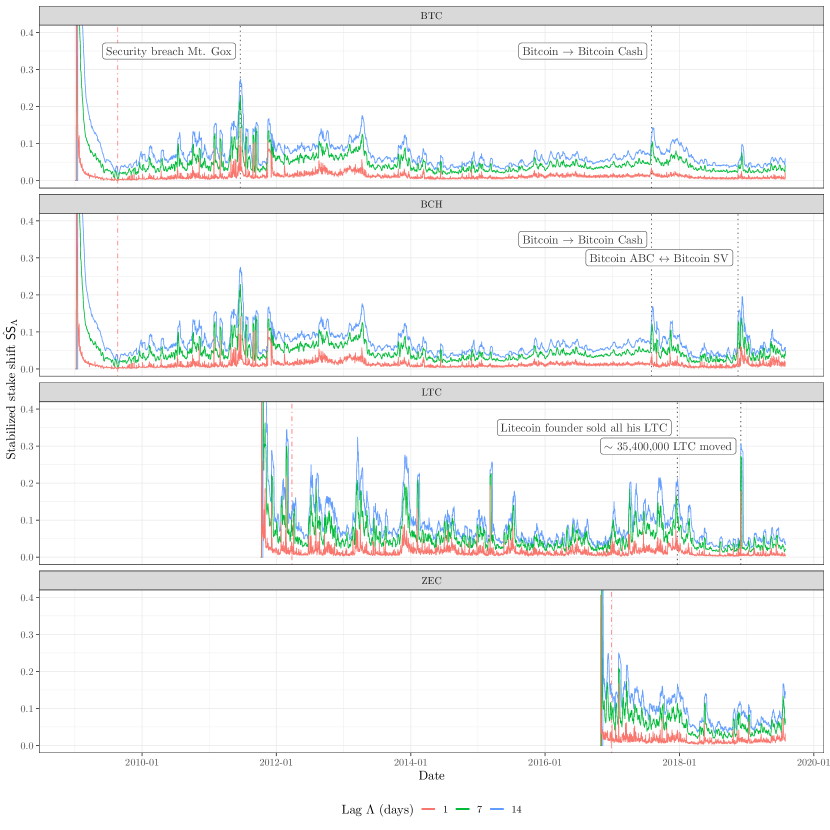

Figure 1 depicts the evolution of Bitcoin stake shifts over the observation period for three different lag settings : 1 day, 7 days, and 14 days. We can observe huge spikes (0.933 for ) right after the generation of the genesis block and another major spike occurring on June 19th, 2011. That spike is most likely related to a security breach on Mt. Gox, at this time one of the dominating Bitcoin exchanges. After an attacker illegally transferred a large amount of Bitcoins, 424,242 BTC were moved from a cold storage to a Mt. Gox address on June 23rd 2011888https://en.wikipedia.org/wiki/Mt.˙Gox. We can also observe that hard forks trigger major stake shifts: Bitcoin Cash, for instance, hard forked on August 1, 2017.

Due to the lack of space, we will in the following refrain from depicting stake evolutions for the other investigated currencies and focus on reporting key observations and findings instead. For further visual inspection, we refer the interested reader to the Appendix of this paper. We also restrict subsequent discussions to because we can observe that stake shifts evolve synchronously and differ only in lag amplitudes.

Bitcoin Cash shows similar behavior to Bitcoin: since it is a hard fork of Bitcoin, stake shifts run synchronous to Bitcoin until the hard fork date. Stake shift values in Bitcoin Cash also show a higher variability after November 15, 2018. On this date a hard fork was activated by Bitcoin ABC999https://www.bitcoinabc.org/ (at the time the largest software client for Bitcoin Cash) and Bitcoin SV101010https://bitcoinsv.io/ (Satoshi’s Vision).

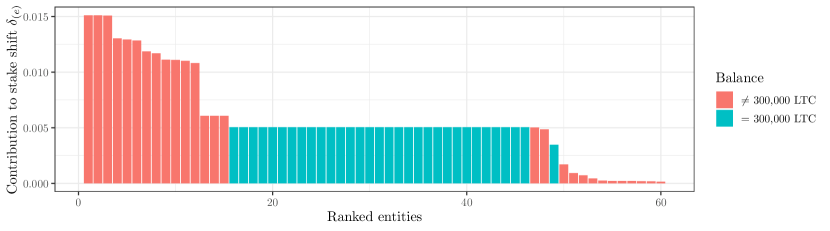

In general, the variability of stake shifts in Litecoin ($4.7B market capitalization) appears to be higher than the one in Bitcoin. The biggest spikes appear on the following dates: 2014-02-05, 2015-03-08, and 2018-11-30. The first two spikes are represented by a couple of dominating entities. We observed either a direct currency flow between them, or a indirect flow via some intermediary cluster or address. One exception is the spike on November 30th, 2018: on that day, approximately 35.4M LTC were transferred within a 24 hour period, with a total value of $1.1B at that time. This is extraordinary, because the Litecoin network has recorded approximately $100M of trading volume per day, on average. After investigating involved transactions, we noted that a significant portion of the transaction volume appears to originate from a single entity, which was not captured by the multiple-input clustering heuristic. At least 40 new wallets have entered the list of the richest Litecoin addresses, each with a balance of 300,000 LTC ($10M). In total, the addresses account for 12.9M LTC (approximately $372M). The reason for the movement is still unclear, but, as we will discuss later in Section 5.3, we can observe that the entities involved in those stake shifts were controlled by Coinbase, which is a major cryptocurrency exchange.

Figure 2 provides a more detailed view on that single Litecoin spike. It shows the top 60 contributions to the stake shift for Litecoin on November 30th, 2018. A block of consecutive addresses sharing a certain transaction behavior becomes visible between rank 16 to 46. They share the following common characteristics: (i) the number of incoming transaction is either 40 or 41; (ii) transactions are executed in chunks of 7,500 LTC; and (iii) the total balance is 300,000 LTC.

The remaining 11 addresses of this entity appear in the tail of the distribution. The reason is that the transactions already started on the day before (2018-11-29 21:18:59Z). Therefore, these 11 addresses do not (fully) account to the stabilized stake shift of November 30th, 2018.

When regarding the stake shift evolution of Zcash ($366M market capitalization), we can, as in Litecoin, observe higher variability than in Bitcoin or Bitcoin Cash. This could be explained by the differences in market capitalization ($5.5B BCH vs. $177B BTC) in these two currencies111111https://coinmarketcap.com/all/views/all/, retrieved on 2019-09-19..

| BTC | BCH | LTC | ZEC | |||||||||

| Lag (in days) | Mean | Median | Std Dev | Mean | Median | Std Dev | Mean | Median | Std Dev | Mean | Median | Std Dev |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.013 | 0.010 | 0.0098 | 0.013 | 0.011 | 0.0102 | 0.014 | 0.011 | 0.0123 | 0.014 | 0.012 | 0.0102 |

| 2 | 0.020 | 0.017 | 0.0129 | 0.020 | 0.017 | 0.0134 | 0.022 | 0.017 | 0.0177 | 0.023 | 0.020 | 0.0146 |

| 3 | 0.026 | 0.022 | 0.0155 | 0.026 | 0.023 | 0.0161 | 0.030 | 0.023 | 0.0219 | 0.031 | 0.027 | 0.0181 |

| 4 | 0.031 | 0.027 | 0.0177 | 0.032 | 0.027 | 0.0183 | 0.036 | 0.029 | 0.0255 | 0.038 | 0.034 | 0.0211 |

| 5 | 0.036 | 0.031 | 0.0196 | 0.037 | 0.032 | 0.0203 | 0.042 | 0.034 | 0.0289 | 0.045 | 0.040 | 0.0238 |

| 6 | 0.040 | 0.035 | 0.0213 | 0.041 | 0.036 | 0.0221 | 0.048 | 0.039 | 0.0319 | 0.051 | 0.047 | 0.0262 |

| 7 | 0.045 | 0.039 | 0.0229 | 0.045 | 0.039 | 0.0238 | 0.053 | 0.044 | 0.0347 | 0.058 | 0.053 | 0.0286 |

| 8 | 0.049 | 0.042 | 0.0244 | 0.050 | 0.043 | 0.0253 | 0.058 | 0.048 | 0.0374 | 0.063 | 0.059 | 0.0308 |

| 9 | 0.053 | 0.045 | 0.0257 | 0.053 | 0.046 | 0.0267 | 0.063 | 0.052 | 0.0399 | 0.069 | 0.065 | 0.0328 |

| 10 | 0.056 | 0.049 | 0.0270 | 0.057 | 0.050 | 0.0281 | 0.068 | 0.057 | 0.0423 | 0.074 | 0.070 | 0.0346 |

| 11 | 0.060 | 0.052 | 0.0282 | 0.061 | 0.053 | 0.0293 | 0.073 | 0.060 | 0.0446 | 0.079 | 0.075 | 0.0364 |

| 12 | 0.063 | 0.055 | 0.0294 | 0.064 | 0.056 | 0.0305 | 0.077 | 0.064 | 0.0469 | 0.084 | 0.081 | 0.0380 |

| 13 | 0.067 | 0.058 | 0.0305 | 0.068 | 0.059 | 0.0317 | 0.082 | 0.068 | 0.0490 | 0.089 | 0.085 | 0.0395 |

| 14 | 0.070 | 0.061 | 0.0316 | 0.071 | 0.062 | 0.0329 | 0.086 | 0.072 | 0.0510 | 0.094 | 0.090 | 0.0410 |

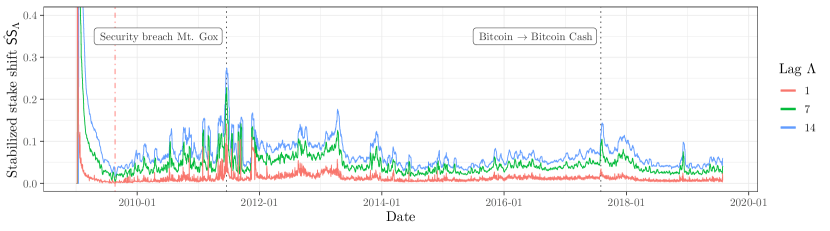

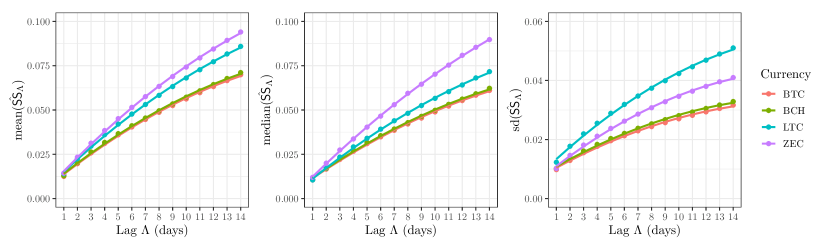

More detailed statistics for stake distribution lag ranging from 1 to 14 days are summarized in Table 2, which shows the mean, median, and standard deviation of resulting stake shift values. Since the estimators for the arithmetic mean and standard deviation are not robust against outliers, we did not consider the initial parts of the time line and disregarded the first 6% of the total number of days in our estimation (marked with red dash-dotted vertical line in Figure 1 and Figure 5, respectively). The gradually increasing mean and median stake shift values confirm our previous observation of growing amplitudes.

5.2 Modeling Stake Shift

Having observed that stake shifts for different lags evolve synchronously and vary in amplitudes, we next fitted regression models to the computed mean, median, and standard deviations (Figure 3). We can observe that estimated values show a clear, strictly monotonic increasing trend with growing lag. More specifically, we found that quadratic polynomials capture well the relation between the location/scale estimators and lag (coefficient of determination ).

5.3 Attributing Selected Stake Shift Spikes

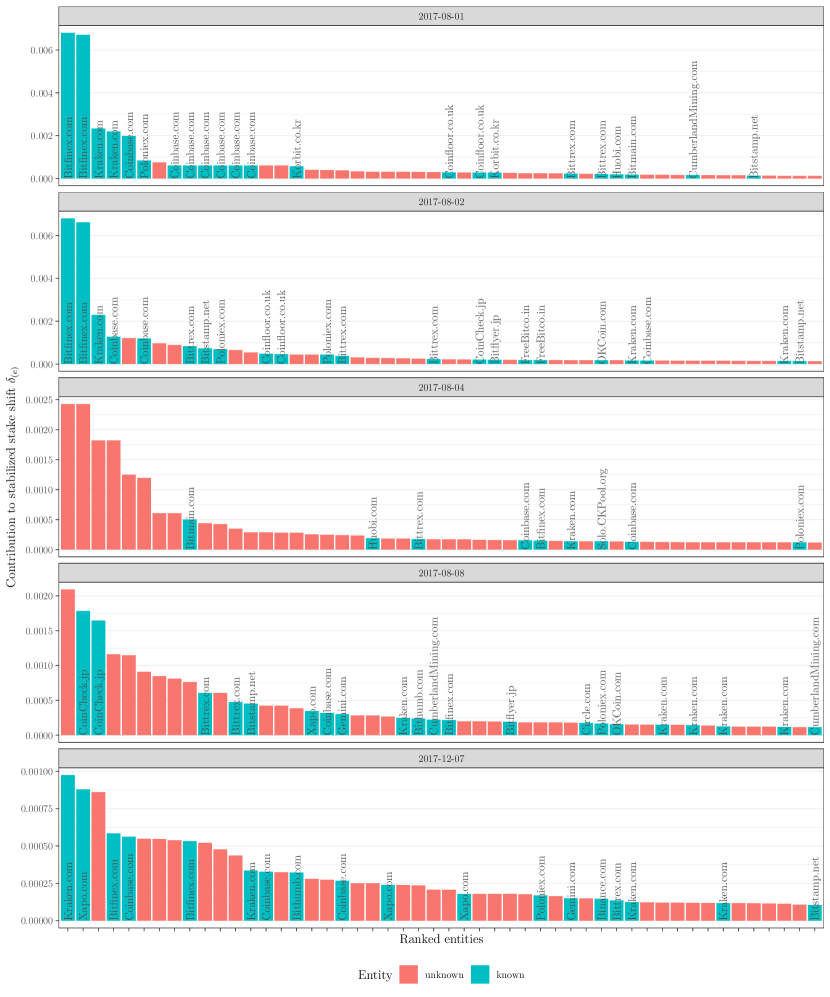

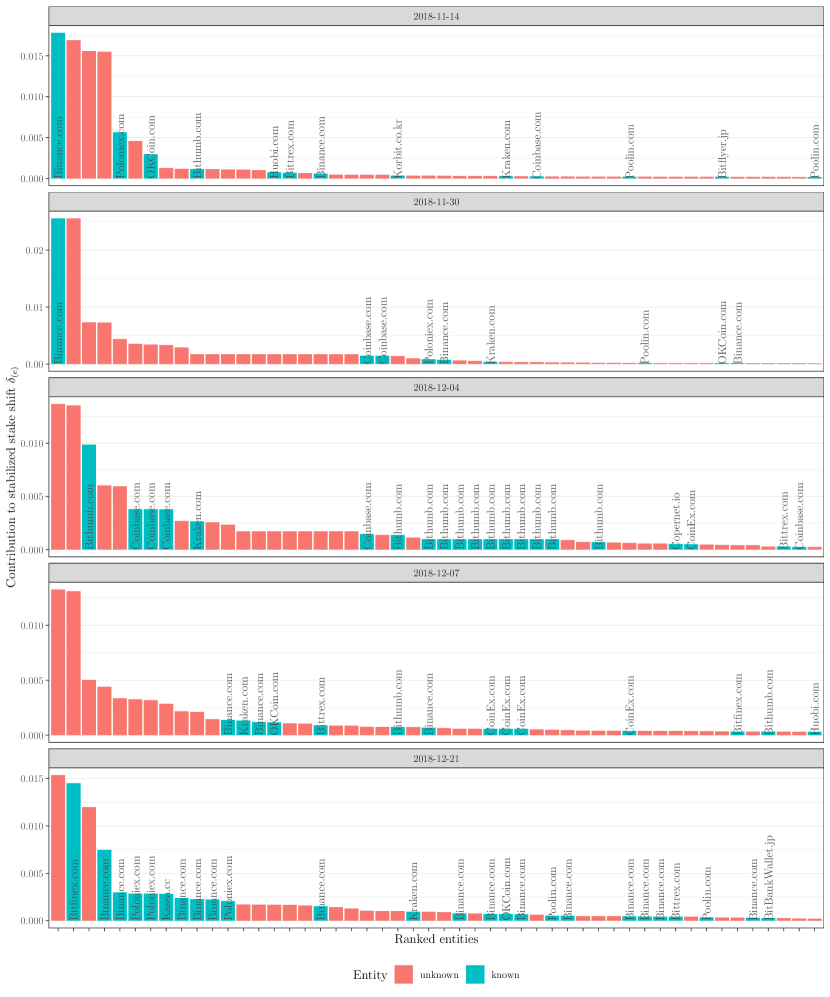

In order to shed some more light on the real-world actors behind observable stake shift spikes, we selected the top five spikes in each currency and attributed them to real-world identities using the Chainalysis API. Due to the limited availability of attribution tags, we focus only on the period between August 1, 2017 and July 31, 2019. Before continuing, we note that a fully fledged systematic analysis of real-world entities and their motivation for transferring large amounts is out of scope in this paper.

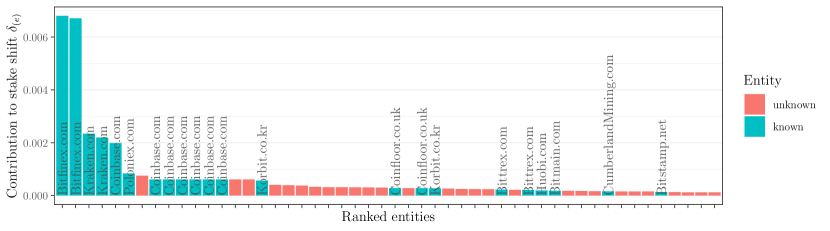

Figure 4 shows the distribution of stake shift contributions at the spike that occurred during the Bitcoin Cash hard fork (cf. Section 5.1). We can clearly see that known exchanges such as Bitfinex, Kraken, Coinbase, and Korbit were the major entities behind those stake shifts. The largest stake shift was caused by a transfer from a Bitfinex operated address to some multisig wallet, which is not a public deposit address but known to be operated by Bitfinex as well. This suggest that this spike represents a major hot-to-cold wallet transfer. However, it remains unclear why this co-occurs with the Bitcoin Cash hard-fork date.

We also attributed the top five Bitcoin Cash and Litecoin spikes and see that exchanges play a major role in stake shifts, however to a lesser extent than in Bitcoin. In the selected Litecoin spike the identity of involved entities is unknown. However, we note that only limited attribution tags are available for that currency. For further details on intra-spike stake shift distributions, we refer to the plots in the Appendix of this paper (Figures 6–8).

The underlying cause and motivation for being involved in a major stake shift is not always apparent. Possible reasons are migration of funds between hot and/or cold wallets, or institutional investors taking a serious long position. Summarizing the results, we can conclude that, at least in established cryptocurrencies such as Bitcoin, a small number of real-world entities – usually exchanges – may account for major stake shifts in cryptocurrency ecosystems.

6 Discussion

Key Findings.

Our analysis of stabilized stake shift presented in Sections 5.1 and 5.2 leads us to the following conclusions:

-

•

The two main observable reasons for extreme stake-shift spikes are hacks and migration of funds to different wallets. Large stake shifts resulting from hacks are clearly problematic for a proof-of-stake based cryptocurrency, as the entity getting control of these funds can be reasonably considered adversarial, with unpredictable future actions.

-

•

When considering the levels of adversarial stake ratio that a proof-of-stake protocol can provably tolerate, one needs to be aware that this threshold is affected by the assumed maximal stake shift as per Equation (1). Our measurements, summarized in Table 2, show that depending on the protocol’s stake distribution lag, this effect may decrease the guaranteed resilience bound by several percent even for lag intervals where the stake shift achieves average values (as the most extreme example, consider the average stabilized stake shift for a (hypothetical) two-week lag interval in ZEC, which amounts to ). Note that, as captured in Figure 1 and the standard deviation values in Figure 2, the stake shift value can deviate considerably from this average. This is particularly noteworthy for protocols that only aim for the threshold in Equation (1) such as [3].

-

•

Unsurprisingly, our data confirms that with increasing stake distribution lag also the corresponding stake shift increases, the precise (empirical) sublinear dependence is captured in Figure 3. This advocates for the need to make the stake distribution lag as small as possible in any future PoS protocol design. More importantly, knowing the exact slope of this function (and hence the price being paid for longer stake distribution lag in terms of increased expected stake shift) allows the designers of existing and future proof-of-stake protocols to weigh these costs against the benefits of longer lag intervals, leading to more informed design decisions.

-

•

Our results empirically support the natural assumption that high stake shift mostly appears at the beginning of the lifetime of a cryptocurrency, and hence older, more established cryptocurrencies experience lower average and median stake shift for a given lag interval, as well as less occurrences of extreme stake shift spikes. This observation allows for some optimism on the side of PoS-protocol designers, as the role of stake-shift-related weakening of the proven security guarantees should diminish during the lifetime of the system. On the other hand, the initial vulnerability of a new, bootstrapping PoS cryptocurrency could be prevented for example by the “merged staking” mechanism discussed in [17].

Additionally, our investigation of the extremal stake-shift spikes conducted in Section 5.3 results in the following observations:

-

•

The spikes motivated by migration of funds can be assumed to be often triggered by a single entity, we conjecture that the main reason of these transfers was moving the considerable funds to a more secure, multisig-protected wallet. In such cases, it is natural to assume that the funds are controlled by the same party after the transfer, making these spikes benign from the perspective of our considered PoS scenario.

Limitations.

The main limitation of our results with respect to the question motivating our investigation lies in the imperfections of clustering techniques and incompleteness of attribution tags linking entities to real-world identities (despite using the best currently known). Having a better understanding of which keys are controlled by the same real-world entity would give us a more precise picture of the experienced stake shift. However, it appears likely that more realistic clustering would lead to more keys being clustered, and hence lower stake-shift estimates. One can thus see our results as reasonable upper bounds of these quantities.

Future Work.

One clear area of future work is to devise new and better address-clustering and attribution data sharing techniques. On top of that, it might be interesting to expand our investigation in time and considered cryptoassets. After more data is available, future studies should also include assets or currencies built on top of PoS protocols. Such studies should also investigate the role of exchanges, which typically hold major stakes and might become important players in a PoS-based consensus. This is particularly interesting for PoS protocols where coins must be explicitly “staked” to participate in the consensus, and hence the total participating stake is typically much smaller than the overall stake. Finally, it would be interesting to perform a more careful and detailed investigation of the activity behind the five considered major stake shift spikes, as well as other unusually large spikes uncovered by our work.

Acknowledgments

We thank Patrick McCorry for reviewing and commenting on the final draft, and our AIT colleagues Hannes Koller and Melitta Dragaschnig for insightful discussions regarding the Apache Spark implementation. Work on this topic is supported inter alia by the European Union’s Horizon 2020 research and innovation programme under grant agreement No. 740558 (TITANIUM) and the Austrian FFG’s KIRAS programme under project VIRTCRIME (No. 860672).

References

- [1] Nakamoto, S.: Bitcoin: A peer-to-peer electronic cash system (2009)

- [2] Digiconomist: Bitcoin energy consumption index. https://digiconomist.net/bitcoin-energy-consumption Accessed: 2019-09-15.

- [3] Chen, J., Micali, S.: ALGORAND. arXiv e-prints (Jul 2016) arXiv:1607.01341

- [4] Kiayias, A., Russell, A., David, B., Oliynykov, R.: Ouroboros: A provably secure proof-of-stake blockchain protocol. (2017) 357–388

- [5] Bentov, I., Pass, R., Shi, E.: Snow white: Provably secure proofs of stake. Cryptology ePrint Archive, Report 2016/919 (2016) http://eprint.iacr.org/2016/919.

- [6] David, B., Gazi, P., Kiayias, A., Russell, A.: Ouroboros praos: An adaptively-secure, semi-synchronous proof-of-stake blockchain. (2018) 66–98

- [7] Badertscher, C., Gazi, P., Kiayias, A., Russell, A., Zikas, V.: Ouroboros genesis: Composable proof-of-stake blockchains with dynamic availability. (2018) 913–930

- [8] Badertscher, C., Gaži, P., Kiayias, A., Russell, A., Zikas, V.: Ouroboros chronos: Permissionless clock synchronization via proof-of-stake. Cryptology ePrint Archive, Report 2019/838 (2019) https://eprint.iacr.org/2019/838.

- [9] Gaži, P., Kiayias, A., Russell, A.: Stake-bleeding attacks on proof-of-stake blockchains. Cryptology ePrint Archive, Report 2018/248 (2018) https://eprint.iacr.org/2018/248.

- [10] Gilad, Y., Hemo, R., Micali, S., Vlachos, G., Zeldovich, N.: Algorand: Scaling byzantine agreements for cryptocurrencies. Cryptology ePrint Archive, Report 2017/454 (2017) http://eprint.iacr.org/2017/454.

- [11] Chen, J., Gorbunov, S., Micali, S., Vlachos, G.: ALGORAND AGREEMENT: Super fast and partition resilient byzantine agreement. Cryptology ePrint Archive, Report 2018/377 (2018) https://eprint.iacr.org/2018/377.

- [12] Leung, D., Suhl, A., Gilad, Y., Zeldovich, N.: Vault: Fast bootstrapping for cryptocurrencies. Cryptology ePrint Archive, Report 2018/269 (2018) https://eprint.iacr.org/2018/269.

- [13] Garay, J.A., Kiayias, A., Leonardos, N.: The Bitcoin backbone protocol: Analysis and applications. (2015) 281–310

- [14] Kappos, G., Yousaf, H., Maller, M., Meiklejohn, S.: An empirical analysis of anonymity in Zcash. In: 27th USENIX Security Symposium (USENIX Security 18), Baltimore, MD, USENIX Association (2018) 463–477

- [15] Meiklejohn, S., Pomarole, M., Jordan, G., Levchenko, K., McCoy, D., Voelker, G.M., Savage, S.: A fistful of Bitcoins: characterizing payments among men with no names. In: Proceedings of the 2013 conference on Internet measurement conference, ACM (2013) 127–140

- [16] Möser, M., Böhme, R.: Join me on a market for anonymity. In: Proceedings of the Workshop on the Economics of Information Security (WEIS), University of California at Berkeley (2016)

- [17] Gaži, P., Kiayias, A., Zindros, D.: Proof-of-stake sidechains. In: 2019 IEEE Symposium on Security and Privacy (SP), Los Alamitos, CA, USA, IEEE Computer Society (May 2019) 677–694

Appendix 0.A Additional Figures

In this section, we provide additional plots for visual inspection of our findings reported in Section 5. Figure 5 depicts the evolution of stake shifts for Bitcoin (BTC), Bitcoin (BCH), Litecoin (LTC), and Zcash (ZEC). Afterwards, in Figures 6–8 we present more details on the contributions of real-world actors to the top-five spikes in each currency within the past two years.