Explosion in the quasi-Gaussian HJM model

Abstract.

We study the explosion of the solutions of the SDE in the quasi-Gaussian HJM model with a CEV-type volatility. The quasi-Gaussian HJM models are a popular approach for modeling the dynamics of the yield curve. This is due to their low dimensional Markovian representation which simplifies their numerical implementation and simulation. We show rigorously that the short rate in these models explodes in finite time with positive probability, under certain assumptions for the model parameters, and that the explosion occurs in finite time with probability one under some stronger assumptions. We discuss the implications of these results for the pricing of the zero coupon bonds and Eurodollar futures under this model.

Key words and phrases:

HJM model, stochastic modeling, multidimensional diffusions, explosion1. Introduction

The quasi-Gaussian Heath-Jarrow-Morton (HJM) models [3, 4, 5, 8, 31] are frequently used in financial practice for modeling the dynamics of the yield curve [3]. They were introduced as a simpler alternative to the HJM model [16], which describe the dynamics of the yield curve as the stochastic differential equation

| (1) |

where is a vector Brownian motion under the risk-neutral measure , and is a family of vector processes. The dynamical variable in the HJM models is the forward rate for maturity .

The quasi-Gaussian HJM models assume a separable form for the volatility function where is a deterministic vector function and is a matrix stochastic process. Such models admit a Markov representation of the dynamics of the yield curve in terms of state variables. This simplification aids considerably with the simulation of these models, which can be performed using Monte Carlo or finite difference methods [6, 11].

We consider in this paper the one-factor quasi-Gaussian HJM model with volatility specification where , and is the volatility of the short rate . This model admits a two-state Markov representation.

It has been noted in [26, 16] that in HJM models with log-normal volatility specification, that is for which , the rates explode to infinity with probability one, and zero coupon bond prices approach zero. See also [34] for a general study of the conditions for the existence of strong solutions to stochastic differential equations (SDEs) of HJM type. A similar explosion appears in a two-dimensional model studied in [17]. It is natural to ask if such explosions are present also in the quasi-Gaussian HJM models. Models of this type with parametric volatility are used in financial practice for modeling the swaption volatility skew [9, 10, 6]. Non-parametric forms have been also considered recently in the literature [15, 7].

We recall that singular behavior is also observed for certain derivatives prices in short rate log-normal interest rates models [2, 3]. It was observed by Hogan and Weintraub [18] that Eurodollar futures prices are infinite in the Dothan and Black-Karasinski models. A milder singularity is also present in finite tenor log-normal models, such as the Black-Derman-Toy model, manifested as a rapid increase of the Eurodollar futures convexity adjustment as the volatility increases above a threshold value [29]. This singularity can be avoided by formulating the models by specifying the distributional properties of rates with finite tenor [32]. This line of argument led to the formulation of the LIBOR Market Models which are free of singularities [3].

In a recent work [30], we studied the small-noise limit of the log-normal quasi-Gaussian model, using a deterministic approximation, and showed rigorously that the short rate may explode to infinity in a finite time. More precisely, it was shown in [30] that for sufficiently small mean-reversion parameter , the small-noise approximation for the short rate has an explosion in finite time, and an upper bound is given on the explosion time, which is saturated in the flat forward rate limit.

In this paper, we extend these results in two directions:

(i) We consider a wider class of quasi-Gaussian HJM models with a constant elasticity of variance (CEV)-type volatility specification. This includes the log-normal model as a special case. We also consider the case of the displaced log-normal model. These volatility specifications are widely used by practitioners [9, 3].

(ii) The Brownian noise is taken into account. This requires the study of the explosion of the solutions of a two-dimensional stochastic differential equation. Mathematically, it is well known that for one-dimensional diffusion processes there is the celebrated Feller criterion [14, 25] for explosion/non-explosion, see e.g. [22, 28] for overviews. This is a sufficient and necessary condition under which there is an explosion in finite time. We note that the distribution of the explosion time has been also studied recently [23].

For -dimensional stochastic differential equations with , to the best of our knowledge, there is no sufficient and necessary condition for explosion. Several sufficient conditions for explosions have been presented in the literature for multi-dimensional diffusions [33]. The Khasminskii criterion for explosion is presented in [25, 28]. The method of the Lyapunov function was presented in [12, 24]. This was extended to a non-linear Lyapunov method by [35]. The application of these conditions is non-trivial, and checking that the conditions required hold is sometimes very challenging.

We rely on the sufficient conditions for explosion with positive probability and explosion with probability one given in [12, 24]. The main tool is the construction of some delicate Lyapunov functions that satisfy certain non-trivial conditions [12, 24].

We show rigorously that under certain conditions, in the CEV-type model with exponent in a certain range , including the log-normal case, the short rate explodes in finite time with positive probability. We also show rigorously that under additional assumptions, the explosion occurs with probability one.

The explosion phenomenon that we prove rigorously has implications for the practical use of the model for pricing and simulation. Such explosions are observed in practical applications of the model, and we illustrate them on a numerical example in the log-normal quasi-Gaussian HJM model in Section 2.1. This phenomenon implies the collapse of the zero coupon bond prices, similar to that occurring in the log-normal HJM model [16], and an explosion of interest rate derivatives linked to the LIBOR rate, in particular the Eurodollar futures prices. This introduces a limitation in the applicability of the model for pricing these products to maturities smaller than the explosion time.

The paper is organized as follows. In Section 2, we introduce the model, and discuss its use in the literature. In Section 3, we present rigorous results giving sufficient conditions for explosion in finite time with positive probability in the quasi-Gaussian HJM model with CEV-like volatility specification. Furthermore, under stronger assumptions, we can show that the explosion occurs in some finite time with probability one. In Section 4, we discussion the implications of our results to the pricing of the zero coupon bond and the Eurodollar futures. Finally, the proofs are collected in the Appendix.

2. One factor quasi-Gaussian HJM model

We will consider in this paper a class of one-factor quasi-Gaussian HJM models, defined by the volatility specification

| (2) |

Several parametric choices for the short rate volatility function have been considered in the literature, including:

The simulation of the model with the volatility specification (2) can be reduced to simulating the stochastic differential equation for the two variables [31, 3]

| (3) | |||

with initial condition . Here is the forward short rate, giving the initial yield curve. The price of the zero coupon bond with maturity is

| (4) |

with a non-negative deterministic function [3]. The short rate is .

Under the CEV-type volatility , the equations (3) can be expressed in terms of the short rate as

| (5) | |||

with the initial condition and .

One potential complication with the usual CEV volatility specification is related to the non-uniqueness of the solution of the SDE (5) for [14]. Recall that for the usual CEV model [13], given by the SDE with ,

| (6) |

the origin is a regular boundary for , and an exit boundary for . For the geometric Brownian motion case , the point zero is a natural boundary. For , the solution of the SDE is not unique, and an additional boundary condition must be imposed at in order to ensure uniqueness.

In order to avoid singular behavior near the origin , practitioners use various modifications of the quasi-Gaussian model with CEV volatility specification near the point, see e.g. Section 4.3 of [19]. This work describes three possible modifications: (a) ; (b) for ; (c) for with a small cutoff.

In this paper, following [1], we consider the modified quasi-Gaussian HJM model with a CEV-type volatility specification

| (7) |

with small and . We call this the CEV quasi-Gaussian HJM model.

Note that as , this reduces to the usual CEV volatility specification , see e.g. [6]. The modification impacts only the region of small , where the process is identical with the log-normal model with the volatility , and leaves unchanged the behavior of the process for large , which is relevant for the study of the explosions of . The modification is only required for . When , the equation (7) reduces to , which coincides with the log-normal model.

With the volatility specification (7), we will study the 2-dimensional SDE with

| (8) | ||||

| (9) |

with the initial condition and .

In the special case , (8),(9) reduces to the log-normal model

| (10) | |||

| (11) |

with the initial condition and .

Assume that and . Then the solutions of (10), (11) are positive with probability one

| (12) |

The result follows by noting that

| (13) |

almost surely for every , and then follows by an application of the comparison theorem (Theorem 1.1 in [36] and Theorem 5.2.18 in [22]). See also the Appendix D in [27] for a proof of this result.

This implies that the origin is a natural boundary for this diffusion. For the time-homogeneous case we use a similar argument to prove the same result for the CEV model with general , see the argument around Eq. (46).

The SDE for the displaced log-normal model reduces to that for the log-normal case by the substitutions . Expressed in terms of , this is

| (14) | |||

| (15) |

with initial conditions . Defining the shifted short rate, we have

| (16) | |||

| (17) |

started at . Redefining , the shift parameter disappears, and the resulting SDE is identical to that for the log-normal model.

Under this model negative values for can also be accommodated, with a floor on the short rate . We will assume that , and then for any . All the results for apply also to the displaced log-normal model with minimal substitutions.

In [30], we studied the small-noise deterministic limit of the SDE (8),(9) in the log-normal case

| (18) | |||

with and . In the small-noise limit, it is proved rigorously in [30] that for sufficiently large or sufficiently small , the short rate is uniformly bounded, and hence there is no explosion. When , the short rate explodes in a finite time, and an upper bound is given for the explosion time (Proposition 4 in [30]). Under the further assumption that , the upper bound for the explosion time given in Proposition 4 of [30] is sharp. The case is also considered, under the simpler setting of a time homogeneous model . For this case it is shown in [30] that when , the explosion occurs at a finite time and when , we have , and there is no explosion.

In this paper we would like to study directly the original stochastic system (8),(9) in the presence of random noise. We will show rigorously that the solutions of the stochastic system (8), (9) may explode with non-zero probability for , and under some additional assumptions with probability one.

2.1. Numerical example for

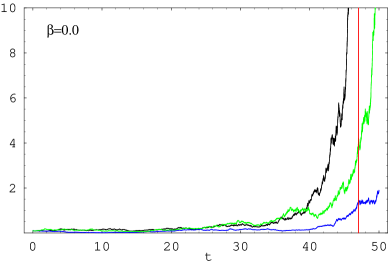

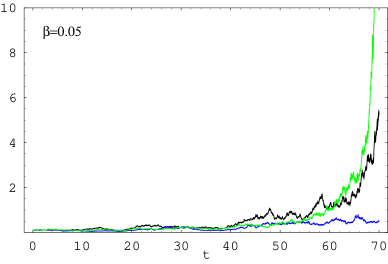

Such explosions are indeed observed in numerical simulations of the stochastic system (8),(9). We illustrate this phenomenon for the log-normal model in Figure 1, which shows sample paths for for several choices of the model parameters , . These results were obtained by numerical simulation of the stochastic differential equations (8),(9) by Euler discretization with time step .

In Figure 1, we fix and consider two values of . The left plot shows sample paths for with . The paths explode at various times, which is expected in the presence of the Brownian noise. In the small-noise limit studied in [30], the explosion time is deterministic. The corresponding explosion time can be found in closed form for , and is given in Proposition 4 of [30]. The prediction is shown in Figure 1 (left) as the red vertical line.

The right plot in Figure 1 shows sample paths for . There is still explosion, but the explosion tends to occur at longer maturities. This is in qualitative agreement with the behavior expected in the small-noise limit [30] where it was shown that increasing delays the explosion time, and suppresses it completely for . For the parameters considered in Figure 1 the small-noise critical value is . In the stochastic case, taking (not shown) the explosion is further delayed to longer maturities, or completely suppressed.

3. Explosion of the CEV-type quasi-Gaussian HJM model

Assume that the forward rate satisfies the inequality,

| (19) |

By a comparison argument, the solutions of (8),(9) are bounded from below by the solutions of the time-homogeneous SDE obtained by replacing . Thus, for the purpose of studying the explosions of the solutions of the SDE (8),(9) it is sufficient to study the corresponding time-homogeneous SDE with constant

| (20) | ||||

| (21) |

with the initial condition and .

The coefficients of this SDE satisfy a local Lipschitz condition. For they also satisfy a sublinear growth condition and global Lipschitz condition. Thus we can apply the standard result, see for example Theorem 5.2.9 in [22], to conclude that the SDE has a unique strong solution, which is furthermore square integrable and thus non-explosive. On the other hand we show that for the solution can explode to infinity in finite time with non-zero probability.

The infinitesimal generator of this diffusion is

We would like to study the explosion time of this diffusion, defined as

| (23) |

We present a few preliminary results which will be used in our proof. The following theorem was proved in [12], see Theorem 1.

Proposition 1 (Theorem 1, [12]).

Let be a bounded open set with regular boundary and let be the complement of . Consider the -dimensional diffusion where the coefficients are Lipschitz continuous on any compact subset of for any . Moreover, there exists a positive function and positive constants , and such that

(A.1) .

(A.2) , for some set .

(A.3) for every , , where is the infinitesimal generator of .

Then, the explosion eventually occurs with positive probability if the process starts at a future time at a point .

Proposition 2 (Theorem 2 in [12]).

Assume the conditions in Proposition 1 are satisfied. Then, we have the almost sure explosion provided the additional assumptions hold:

(A.4) ;

(A.5) For any , , , where is the first hitting time of the set .

Theorem 1 in [12] is a generalization of Theorem 3.6 in [24]. Intuitively, it relates the explosion of the solution of a stochastic differential equation to the behavior of an appropriately defined Lyapunov function for large values in the space domain.

Unlike the case of one-dimensional diffusion processes, where a sufficient and necessary condition for explosion is given by Feller’s criterion [25], for multidimensional diffusions, there are many different theoretical results giving sufficient conditions for explosions [25, 12, 24]. For our purpose, Theorem 1 in [12] suffices. The strategy of the proof will be to construct an appropriate Lyapunov function, and show that for the two-dimensional SDE model (20), (21), explosion occurs with positive probability. The main result of this paper follows.

Theorem 1.

Assume and .

(b) For the solution of the SDE (20),(21) explodes with non-zero probability provided that any one of the following conditions is satisfied for at least one set of , where are positive constants satisfying .

(i) where the function is defined by

| (24) |

(ii) where the function is defined by

| (25) |

Remark 1.

Under the assumptions in Theorem 1, , , , and from the conditions in Proposition 1 are given by

| (26) | |||

| (27) | |||

| (28) | |||

| (29) | |||

| (30) | |||

| (31) |

where , is sufficiently small, are positive constants satisfying , and are determined separately for each case as follows (this is a restatement of the inequalities for following from Lemma 2).

Remark 2.

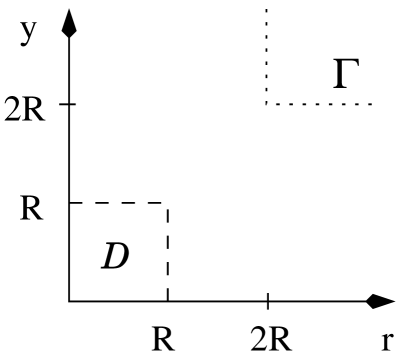

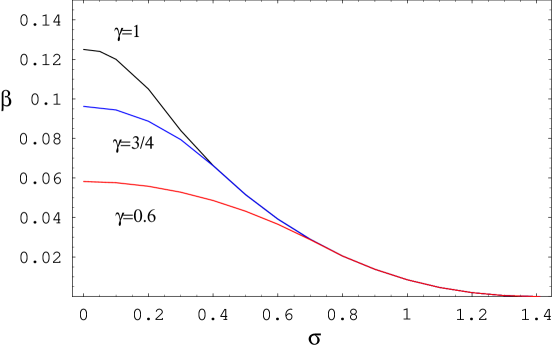

3.1. Numerical study

We study here the regions for allowed by Theorem 1. We discuss only the condition (ii) which is more amenable to an analytical treatment. The resulting region for includes all the typical values of these parameters which are relevant for applications and , see for example [6]. The constraint on can be weakened further, see Remark 2.

The condition (ii) of Theorem 1 is satisfied in the region below the curves shown in Figure 3. For each there is one curve, corresponding to taking values in .

We outline the main steps in the derivation of these regions. The function with has the following properties.

(i) vanishes for and . The function increases for and decreases for , with .

(ii) has a maximum at . At this point the value of the function is

| (35) |

Fix the values of and . By scanning over , find the maximum of the expression

| (36) |

Then the values of allowed by the condition (ii) of Theorem 1 (for given ) are

| (37) |

where is given by (36). This region for is shown in Fig. 3 for several values of . The region becomes smaller as approaches and disappears at this point.

The value decreases with , at fixed . (Recall that this determines also the range of allowed values for , which includes the point .) In a range of sufficiently small , the maximum in (36) is realized at the maximally allowed value . In this region the curves for maximally allowed with different values of are distinct, as seen in Figure 3. For above a certain value, which depends on , the value of decreases from to zero. In this region the maximal curves are overlapping, since is independent of .

There is a maximum value of for which positive values of are allowed. At this maximum value, which depends on , reaches zero. For , this maximum value is . This follows from the small- expansion

| (38) |

Substituting into (37) gives

| (39) |

Requiring the cancellation of the term gives the maximal value .

3.2. Almost sure explosion

In Theorem 1, we showed that under certain conditions, the explosion occurs with positive probability. Under some additional assumptions, one can further prove the almost sure explosion, that is, that explosion occurs with probability one.

Theorem 2.

4. Implications for zero coupon bond prices and Eurodollar futures

The explosion of is equivalent to the explosion of due to the explicit form of in terms of . The explosion of thus implies that the prices of zero coupon bonds become zero almost surely for all , with the explosion time of .

This follows from Eq. (4) for the zero coupon bond price, which gives

| (42) |

where we recall that . Suppose the assumptions in Theorem 1 are satisfied, then , which implies that for sufficiently large , . As a result, with positive probability, and sufficiently large , the zero coupon bond price collapses to zero.

This implies that interest rates explode for all . Recall that the rate is related to as , see e.g. [3].

The prices of any derivatives depending on such as interest rate caps, swaptions, CMS swaps, and Eurodollar futures also become infinite. We will show this explicitly for the prices of Eurodollar futures contracts. Using Eq. (42) for the zero coupon bond price we get 111Note that in Eq. (43) in [30], there is a typo: the factor on the right-hand side of this equation should be .

| (43) |

Suppose the assumptions in Theorem 1 are satisfied, then with positive probability for sufficiently large . It follows that the Eurodollar futures price explodes to infinity, that is, , for sufficiently large .

In practical applications the explosions of the short rate could be avoided by capping the short rate volatility to a finite value , possibly using a prescription of the same type as that proposed in [16], . With this change, the diffusion coefficients satisfy the sub-linear growth condition of Theorem 5.2.9 in [22], which ensures that the solution exists and is non-explosive.

5. Appendix: Proofs

Proof of Theorem 1.

(a) For the coefficients of the 2-d diffusion (20), (21) satisfy the conditions of Theorem 5.2.9 in [22], which we recall here briefly for convenience.

Consider the SDE for the dimensional vector

| (44) |

where and is a -dimensional Brownian motion. Assume that the coefficients satisfy the global Lipschitz and linear growth conditions

| (45) | |||

for every and is a positive constant. Under these conditions, there exists a continuous, adapted process which is a strong solution of the SDE (44) with initial condition , and is furthermore square-integrable.

The SDE (20), (21) with satisfies the conditions (45), and thus does not explode. We study next the case , where the linear growth condition does not hold.

(b) The boundary , is unattainable. Indeed, for , we have with

| (46) |

and since the term and in the drift term of , by comparing with a geometric Brownian motion, we have . Therefore, . This generalizes to the result of (12) and (13). Although this is proved here for the time-homogeneous case , the result is easily seen to hold also under the weaker assumption by a comparison argument.

Let us take , with , where we define . It is clear that is a bounded open set. The boundary is regular since in the drift term of . It is also easy to see that, for , on any compact subset of , the coefficients of the SDE (20),(21), are continuous and Lipschitz.

Assume the following form for the Lyapunov function

| (47) |

with and are positive constants satisfying the condition

| (48) |

We would like to test the conditions (A.1),(A.2) and (A.3) of Proposition 1.

(1) Condition (A.1). For any , we have

| (49) |

provided that we take

| (50) |

Thus defined on is a positive function. Since , it is clear that . Thus the condition (A.1) is satisfied.

(2) Condition (A.2). Note that . Thus, we have

| (51) |

On the other hand, taking , we obtain

| (52) |

Hence, the condition (A.2) holds.

(3) Condition (A.3). Finally, let us check the condition (A.3). Note that

| (53) | |||

Therefore,

Furthermore, for , we have

| (54) | |||

| (55) |

( is small, say less than ) such that we have

Let us choose to be a fixed constant so that

| (56) |

Then we have

Recall that for , we have either or , and we chose .

(I) If and , then we have for both and , by positivity of the first term,

(II) If and , then we have (since )

(III) If and , then we have (again by )

| (57) |

where we denoted

| (58) |

The condition was used to reduce the dependence on to a function of in the last step.

The sum of the first two terms is bounded from below by the following Lemma.

Lemma 1.

The infimum of the function defined as

| (59) |

is given by

| (60) |

where

| (61) |

Proof of Lemma 1.

The minimum of is achieved at , which gives

| (62) |

which implies that

| (63) |

To see that is larger than for , let us define . We will show that is decreasing in , that is due to

| (64) |

Hence, is decreasing in . We can compute that at , we have . Hence, is larger than . ∎

Therefore, following (57), we have

Hence, from (I), (II) and (III), we conclude that for any if we have

| (65) | ||||

To summarize, in order to have the Lyapunov function to be bounded, positive and satisfy (A.1), (A.2), (A.3), we need the conditions (50), (56) and (65) to hold simultaneously. Taking

| (66) | |||

| (67) |

then (50) and (56) are satisfied. This can be simplified by replacing since for all we have .

The condition (65) is satisfied as well if we have

| (68) | ||||

The study of the inequality (68). We study next the conditions for for which the inequality (68) is satisfied in a region of , at least for one value of . We start by writing it in an equivalent way as

| (69) |

where

| (70) |

satisfying , and we defined the new variables

| (71) |

and denoted the constants

| (72) | |||

| (73) | |||

| (74) |

We would like to obtain the region in the plane where the inequality (69) holds, and find conditions on (or equivalently ) for which this region is non-empty, at least for one value of . These regions are given by the following Lemma.

Lemma 2.

The inequality

| (75) |

with and , holds in two regions of the plane:

(i) A wedge-like region of the positive quadrant of the plane, contained between the two straight lines passing through origin

| (76) |

(ii) A wedge-like region of the positive quadrant of the plane, below a straight line passing through origin given by

| (77) |

Proof of Lemma 2.

The line

| (78) |

divides the first quadrant of the plane into two regions:

-

(i)

Region 1 with ;

-

(ii)

Region 2 with .

We show that the inequality (69) simplifies in each of these regions as follows.

(i) Region 1 with .

In this region we have clearly

| (79) |

Furthermore, we have

| (80) | ||||

since as noted above. Thus the inequality (69) reduces in this region to a linear inequality

| (81) |

This gives the upper bound on in (76).

(ii) Region 2 with .

In this region we have clearly

| (82) |

Furthermore, we have the lower bound

| (83) |

since . Thus the inequality (69) reduces in this region to the linear inequality

| (84) |

This gives an upper bound on

| (85) |

which is useful only if , or equivalently if

| (86) |

This is obtained using the expression (74) for .

If this condition is satisfied, then we get that (69) is satisfied in the subset of region 2

| (87) |

This is either the entire region 2, or a subset, bounded by the real axis and the line . ∎

Finally, let us get back to the proof of Theorem 1. In order for the region (76) to be non-empty, the following inequality must hold

| (88) |

Substituting here the expressions (73), (74) for , this becomes

| (89) |

In order for the region (77) to be non-empty one requires which gives the inequality

| (90) |

Proof of Theorem 2.

We would like to test the conditions (A.4) and (A.5) of Proposition 2.

(1) Condition (A.4). Let be the Lyapunov function (47) defined in our Theorem 1. We have to check that its infimum on is positive. We can compute that

| (91) | ||||

By (50) we have which gives . Thus, (A.4) holds.

(2) Condition (A.5). According to Theorem 3.9. and the discussion at the beginning of Chapter 3.7. in [24], it suffices to show that there exists a non-negative function for that is twice differentiable in such that

| (92) |

where is some constant. We use the notation to distinguish it from the Lyapunov function defined in Theorem 1.

Let us recall from the proof of Theorem 1 that . Therefore, . Let us define

| (93) |

Then is non-negative and twice differentiable. We can compute that

| (94) |

For , either one of the inequalities or holds.

(a) If , we distinguish between and . In the latter case we have

for any sufficiently large such that

| (95) |

where we assumed that .

For we get by a similar argument

for any sufficiently large such that

| (96) |

Since , the condition (95) implies (96). Thus for as long as (95) holds.

(b) If , then we must have . Then, we have

For we have

| (97) |

where we used the fact that for every and . Moreover, for any , we have so that

| (98) |

Hence, by plugging (98) into (97), we get

| (99) |

Denote , . Let us give a lower bound of over . For , we have , and for , we have since . Denote , and we can compute that

| (100) |

which is negative for and positive for . Thus

| (101) |

Hence,

| (102) |

Hence, we conclude that

| (103) |

if is sufficiently large so that

| (104) |

which holds if

| (105) |

For both cases (a) and (b), for sufficiently large the inequality is satisfied. The proof is complete. ∎

Acknowledgements

We would like to thank Camelia Pop for discussions about boundary conditions of SDEs. The authors are also grateful to the REU students Ruby Oates, Alex Pollack and Kelsey Paetschow for their help with Figure 1. Lingjiong Zhu acknowledges the support from NSF Grant DMS-1613164.

References

- [1] Andersen, L. and J. Andreasen. (2000). Volatility skews and extensions of the LIBOR market model. Applied Mathematical Finance 7(1), 1-32.

- [2] Andersen, L. and V. Piterbarg. (2007). Moment explosions in stochastic volatility models. Finance and Stochastics. 11, 29-50.

- [3] Andersen, L. and V. Piterbarg. (2010). Interest Rate Modeling. Atlantic Press, London.

- [4] Andreasen, J. (2010). Markovian term structure models, in Encyclopedia of Quantitative Finance, Ed. R. Cont, Wiley, New York.

- [5] Babbs, S. (1993) Generalized Vasicek models of the term structure, Applied Stochastic Models and Data Analysis. 1, 49-62.

- [6] Cakici, N. and J. Zhu. (2001) Pricing Eurodollar futures options with the Heath-Jarrow-Morton model. Journal of Futures Markets. 21, 655-680.

- [7] Cao, L. and P. Henry-Labordere. (2016) Interest rate models enhanced with local volatility. SSRN id=2793125.

- [8] Cheyette, O. (1992) Markov representation of the Heath-Jarrow-Morton model. Working paper, Barra.

- [9] Chibane, M. (2012) Explicit volatility specification for the linear Cheyette model. Working paper, Shinsei Bank Ltd.

- [10] Chibane, M. and D. Law. (2013) A quadratic volatility Cheyette model. Risk, 60-63 (July)

- [11] Chien, H. H. (2001) On the complexity of the Ritchken Sankarasubramanian interest rate model. Ph.D. Thesis, National Taiwan University.

- [12] Chow, P.-L., and R. Khasminskii. (2014) Almost sure explosion of solutions to stochastic differential equations. Stoch. Processes and their Applications 124, 639-645

- [13] Cox, J. (1996) Notes on option pricing I: Constant elasticity of diffusion. J. Portfolio Management 124, 639-645.

- [14] Feller, W. (1952) The parabolic differential equations and the associated groups of transformations. Annals of Mathematics 55, 468-519.

- [15] Gatarek, D., J. Jablecki and D. Qu. (2016) Non-parametric local volatility formula for interest rate swaptions. Risk, 1-5 (February)

- [16] Heath, D., R. Jarrow and A. Morton. (1992) Bond pricing and the term structure of interest rates: A new methodology for contingent claim valuation. Econometrica 60, 77-105.

- [17] Hogan, M. (1993) Problems in certain two-factor term structure models. Ann. Appl. Prob. 3(2), 576-581.

- [18] Hogan, M. and K. Weintraub. (1998). The lognormal interest rate model and Eurodollar futures. Citibank Working Paper.

- [19] Hoorens, B. (2011). On the Cheyette short rate model with stochastic volatility, MSc Thesis, Delft University of Technology.

- [20] Hunt, P. J. and J. E. Kennedy. (2004) Financial Derivatives in Theory and Practice. Wiley Series in Probability and Statistics, Chichester.

- [21] Jamshidian, F. (1991) Bond and option evaluation in the Gaussian interest rate model. Research in Finance 8, 131-170.

- [22] Karatzas, I. and S. Shreve. (1991) Brownian Motion and Stochastic Calculus. Graduate Texts in Mathematics, Volume 113, Springer Science & Business Media, Second Edition, New York.

- [23] Karatzas, I. and J. Ruf. (2016) Distribution of the time to explosion for one-dimensional diffusions. Prob. Theory and Related Fields. 164, 1027-1069.

- [24] Khasminskii, R. (2012) Stochastic Stability of Differential Equations. Springer, New York.

- [25] McKean, H.P.Jr. (1969) Stochastic Integrals. Academic Press, New York.

- [26] Morton, A. J. (1989) Arbitrage and martingales. Doctoral dissertation, Cornell University.

- [27] Natcheva-Acar, K., S.K. Acar and M. Krekel (2015). Modeling credit spreads with the Cheyette model and its applications to credit default swaptions. Journal of Credit Risk 5, 47-71.

- [28] Pinsky, R. G. (2008) Positive Harmonic Functions and Diffusion. Cambridge Studies in Advanced Mathematics v. 45, Cambridge University Press, Cambridge.

- [29] Pirjol, D. (2014) Hogan-Weintraub singularity and explosive behaviour in the Black-Derman-Toy model. Quantitative Finance 15, 1243-1257.

- [30] Pirjol, D. and L. Zhu. (2017) Small-noise limit of the quasi-Gaussian lognormal HJM model. Operations Research Letters. 45, 6-11.

- [31] Ritchken, P. and L. Sankarasubramanian. (1995) Volatility structures of forward rates and the dynamics of the term structure. Math. Finance 5, 55-72.

- [32] Sandmann, K. and D. Sondermann. (1997) A note on the stability of lognormal interest rate models and the pricing of Eurodollar futures. Math. Finance 7(2), 119-125.

- [33] Stroock, D. W. and S. R. S. Varadhan. (1979) Multidimensional Diffusion Processes. Grundlehren der mathematischen Wissenschaften, Volume 233. Springer-Verlag, Berlin.

- [34] Wissel, J. (2007) Some results on strong solutions of SDEs with applications to interest rate models. Stochastic Processes and their Applications 117, 720-741.

- [35] Xing, J., and Y. Li. (2016) Nonlinear Lyapunov criteria for stochastic explosive solutions, Stat. Prob. Lett. 109 63-67.

- [36] Yamada, T. (1973) On a comparison theorem for solutions of stochastic differential equations and its applications. J. Math. Kyoto Univ. 13 497-512.