Trading Location Data with Bounded Personalized Privacy Loss

Abstract.

As personal data have been the new oil of the digital era, there is a growing trend perceiving personal data as a commodity. Although some people are willing to trade their personal data for money, they might still expect limited privacy loss, and the maximum tolerable privacy loss varies with each individual. In this paper, we propose a framework that enables individuals to trade their personal data with bounded personalized privacy loss, which raises technical challenges in the aspects of budget allocation and arbitrage-freeness. To deal with those challenges, we propose two arbitrage-free trading mechanisms with different advantages.

1. Introduction

Personal data, the new oil of the digital era, are extraordinarily valuable for individuals and organizations to discover knowledge and improve products or services. However, data owners’ personal data have been exploited without appropriate compensations. Very recently, there is a growing trend towards personal data trading perceiving personal data as a commodity, which meets the demand of both data buyers and data owners. Some companies also consider personal data trading platform that connects data owners and buyers directly as a new business model.

Several studies (Ghosh and Roth, 2015)(Koutris et al., 2013)(Koutris et al., 2015)(Li et al., 2014)(Niu et al., 2018) in the literature investigated privacy preserving query-based data trading. There are three parties in the data trading: data owners, data buyers, and a market maker. Data owners contribute their personal data and get monetary compensations from the market maker in return. Data buyers request queries over the data and purchase perturbed query answers, i.e., noisy versions of aggregate statistical results where some random noises are injected. The market maker acts as a trustworthy intermediary between data owners and data buyers, in charge of computing perturbed query answers, pricing data for data buyers and compensating data owners. A major challenge in the line of works is how to determine the price of data. A seminal work of Li et al. (Li et al., 2014) made the connection between privacy loss and the price of data by pricing function. Specifically, data owners who suffer higher privacy loss (when less noises are injected into the query answer) should be compensated with more money. They proposed an important property of pricing function: arbitrage-freeness, which means the consistency of a set of priced queries. Intuitively, a buyer should not obtain the answer to a query more cheaply by deriving the answer from a less expensive set of queries.

However, there are several insufficiencies in such a marketplace where each data owner contributes their location data. First, data owners should be able to bound their privacy loss given the high sensitivity of locations. In the traditional data marketplace (Li et al., 2014), a buyer can purchase raw data and data owners cannot control the upper bound of their privacy loss. Second, the existing studies (Ghosh and Roth, 2015)(Li et al., 2014)(Niu et al., 2018) guarantee uniform privacy loss from each data owner; however, it is more natural that different data owners have quite diverse expectations on tolerable privacy loss (Jorgensen et al., 2015).

We proposed a new trading framework where each owner is enabled to set her own personalized bound of privacy loss. In order to achieve better utility for data buyers under the constraint of arbitrage-freeness, we proposed a budget allocation algorithm called -Grouping for the Sample mechanism (Jorgensen et al., 2015) which achieves personalized differential privacy (Jorgensen et al., 2015). To easily design arbitrage-free pricing functions, we proposed a theorem presenting the sufficient conditions in which the patterned utility function of some perturbation mechanism will result in an arbitrage-free pricing function.

2. Problem Formulation

In this section, we introduce the basic settings in our framework.

Privacy Definition

As we are going to trade personal data, first we should define the privacy metric in our framework. To preserve data owners’ privacy, the true query answer cannot be returned to the buyer and the market maker should perturb the answer by some perturbation mechanism achieving a formal privacy standard. We follow the setting of (Li et al., 2014) to use differential privacy as privacy metric.

In -differential privacy, the value of privacy protection metric is uniform for all data owners. However, the setting that data owners are allowed to set their maximum tolerable privacy losses requires personalized privacy protection level. In personalized differential privacy (PDP) (Jorgensen et al., 2015), a privacy loss is a personalized privacy protection metric, and a privacy specification is a mapping from data owners to their privacy losses .

Definition 2.1 (Personalized Differential Privacy (Jorgensen et al., 2015)).

Given a privacy specification , a perturbation mechanism () satisfies -personalized differential privacy, if for any pair of neighboring databases , with , and for any possible output , we have:

Two databases are neighboring if can be derived from by replacing one data point (row) with another, denoted as . We write to denote and are neighboring and differ on the value of data point corresponding to the data owner .

Participants in Data Marketplace

There are three parties of participants in our marketplace: data owners, data buyers, and a market maker. Each party has its own interests and goals.

Data owners are the source of location data stored in the marketplace. A database consists of data points, where each data point corresponds to a unique data owner and its value is a location . Each data owner should specify her maximum tolerable privacy loss leaked totally for query answers over a database .

Data buyers can request a histogram query (where is an order number) over the database with a specific utility , and get a perturbed query answer . The perturbed query answer is a vector where each element represents the sum of data owners in the location .

The market maker acts as a trustworthy profit-making intermediary between data owners and data buyers: for the sake of data owners’ privacy, the maker is in charge of perturbing the histogram query by some perturbation mechanism which satisfies PDP (i.e., Definition 2.1); for buyers, the maker should guarantee that the variance of each element in the perturbed query answer is no more than , i.e., .

As a profit-making intermediary, the maker sells histogram queries to buyers and compensates data owners according to their privacy losses. Each data owner should make a contract with the market maker that the latter compensates the former according to a compensation function . Let be the data owner ’s privacy loss due to the query answer . Each owner’s compensation depends on her privacy loss where is a constant compensation rate stipulated in the contract. We also define our utility function as which takes as input a vector of privacy losses (or budgets) and outputs the histogram variance mentioned above. According to the Composition theorem of PDP (Jorgensen et al., 2015), in order to achieve PDP, for each data owner , we should make sure: , which means for each data owner , the sum of privacy losses should be no more than her maximum tolerable privacy loss. For the sake of data owners, we try to make full use of their maximum tolerable privacy losses so that they can gain more compensations.

The maker always charges a brokerage fee as her profit, where is a constant rate for all queries. However, we set the query price determined only by the histogram variance . The maker should guarantee that the pricing function is arbitrage-free to prevent arbitrage behaviors. Arbitrage-freeness intuitively requires that, the buyer should not obtain the answer to a query more cheaply by deriving this answer from a less expensive set of query answers. On the other hand, because the price of a query answer should consist of all the compensations to data owners and the maker’s profit, we should make sure that the price for all . For the sake of data buyers, we endeavor to provide more choices of the value of and lower the by improving the perturbation mechanism.

Definition 2.2 (Arbitrage-freeness (Li et al., 2014)).

A pricing function () is arbitrage-free if: for every multiset where , if there exists such that and , then .

3. Data Trading Framework

In this section, we give an overview of our trading framework. We summarize some important notations in Table 1.

| Notation | Description |

|---|---|

| data owner | |

| total number of users, or database size | |

| order number of a query | |

| perturbed query answer of | |

| histogram variance of | |

| minimum affordable variance for | |

| ’s maximum tolerable privacy loss | |

| ’s remaining tolerable privacy loss for | |

| privacy budget for | |

| ’s privacy loss for | |

| ’s compensation function | |

| perturbation mechanism | |

| utility function of | |

| patterned utility function of in -pattern | |

| pricing function of in -pattern |

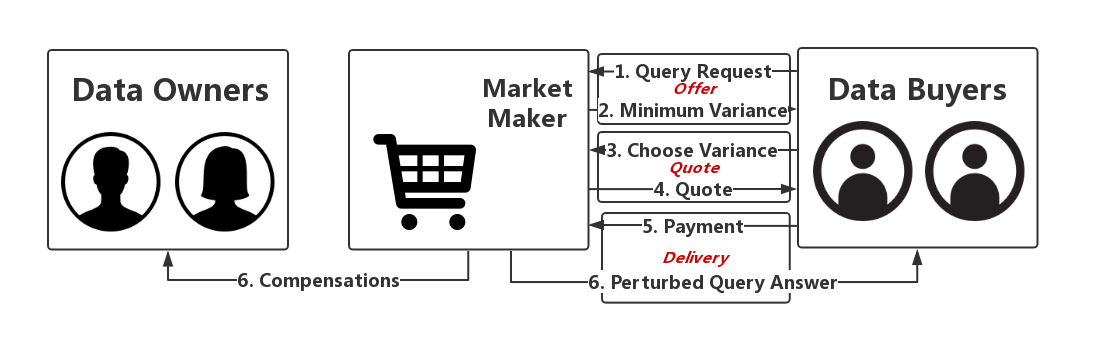

Figure 1 illustrates our trading framework containing three phases: Offer, Quote, and Delivery. As depicted in Alg. 1, for each query , the transaction follows those phases; the maker sells query answers until some data owner’s privacy loss reaches her maximum tolerable privacy loss, i.e., .

Offer: In the phase of Offer, at the beginning, the buyer requests a query over the database . Then, the market maker executes the process of budget allocation (BudgetAlloc). That is, given remaining tolerable privacy losses , the maker calculates privacy budget for each by some budget allocation algorithm. Finally, the maker inputs the budgets into the utility function to return the minimum affordable variance for .

Quote: Given the , the buyer should choose a histogram variance . Then, the maker quotes a price for the query answer . Because we should guarantee that the price is also equal to the sum of all the compensations and the maker’s profit, i.e., , the ideal way to design a pricing function is to establish a mapping from the set of to the set of , which requires the existence of the inverse function . To make existent, we introduce the notion Pattern to ”shape” privacy losses (or budgets) and constrain the utility function’s domain.

Definition 3.1 (-Pattern).

A pattern is a vector where for all and . A vector is in -pattern, if for all , where for all and . is the patterned utility function in -pattern such that for all . is the pricing function in -pattern such that for all .

If the domain of is the set of vectors in -pattern, we can use a scalar to represent the vector . Therefore, we establish a mapping from the set of to the set of , i.e., (the patterned utility function in -pattern). Our budget allocation algorithm guarantees is a decreasing function and thus exists. Then, the market maker can derive the price as follows:

As for arbitrage-freeness, intuitively, if the price decreases rapidly as the variance increases, it is more worthwhile to buy a query answer with high variance. Thus, to avoid arbitrage behaviors, we can find a pattern by budget allocation algorithm, such that decreases smoothly to some extent as increases and decreases slow enough, as implied mathematically by the second condition in Theorem 4.4.

Delivery: In the phase of Delivery, the buyer pays the price to the market maker and receives a perturbed query answer with the histogram variance in return, i.e., . The maker calculates each owner’s privacy loss for this variance by the inverse function , and then compensates data owners. The answer is perturbed by (an instance of PerturbMech) which achieves -PDP, where .

4. Arbitrage-free Trading Mechanism

In this section, we propose two arbitrage-free trading mechanisms by combining instances of two key modules in Alg. 1: BudgetAlloc (budget allocation), and PerturbMech (perturbation mechanism).

Laplace-base Mechanism: Laplace + Uniform

In the Laplace-base mechanism, we use the Laplace mechanism for PerturbMech and the Uniform algorithm for BudgetAlloc. According to Theorem 4.1, because the Laplace mechanism always controls the privacy protection level by the minimum of , it is waste to allocate privacy budgets . Thus, we use Uniform to allocate uniform privacy budgets for the Laplace mechanism.

Theorem 4.1 (Laplace Mechanism (Jorgensen et al., 2015)).

Given a function , a database , and privacy budgets , the Laplace mechanism which returns satisfies -PDP, where are random variables drawn from the Laplace distribution () and .

Definition 4.1 (Uniform).

Given a query , the Uniform algorithm allocates to for each .

We can easily observe that allocated by Uniform is in -pattern where for all , and the patterned utility function . Also, is arbitrage-free. However, the Laplace-base mechanism cannot essentially achieve our goal, i.e., to enable each owner’s privacy loss to be personalized.

Sample-base Mechanism: Sample + Grouping

In order to personalize privacy loss for each data owner, we propose the Sample-base mechanism which is the combination of the Sample mechanism for PerturbMech and the -Grouping algorithm for BudgetAlloc. According to Theorem 4.2, under the Sample mechanism, each ’s privacy loss can be personalized rather than only uniform.

Theorem 4.2 (Sample Mechanism (Jorgensen et al., 2015)).

Given a function , a database , and privacy budgets , the Sample mechanism samples each data point with probability , and then executes the Laplace mechanism to return where and is the sampled database of . The Sample mechanism satisfies -PDP privacy, where .

The utility function , and if its domain is constrained to be the set of vectors in -pattern, we can derive the patterned utility function as: . We can find some pattern such that is decreasing and therefore the inverse function exists. However, the pricing function might be not arbitrage-free as depicted in Example 4.3. That is because, in some -pattern, might decrease too slow as increases; in other words, and also the price might decrease too quick as increases, which allows arbitrage behaviors.

Example 4.3 (Arbitrage: Sample Mechanism).

Let for all , and . If , , and ; if , then but . Thus, the buyer can buy two independent query answers with , and then derive a new query answer with by combining the former two answers. Because the total price of the two query answers with is equal to (lower than the price of the query answer with ), arbitrage behaviors are allowed in this case.

Unfortunately, since the inverse function is much complicated, it is difficult to prove the arbitrage-freeness of . Thus, we propose Theorem 4.4 to help to prove the arbitrage-freeness, where the first condition makes the pricing function decreasing, the second guarantees a smooth decreasing speed, and the third means a zero price corresponds to infinitely high variance.

Theorem 4.4.

The pricing function is arbitrage-free, if the utility function satisfies the following conditions:

-

(1)

decreasing, which means , ;

-

(2)

, ;

-

(3)

.

We propose the -Grouping algorithm to allocate privacy budgets such that the pricing function is arbitrage-free. Simply speaking, since there might be multiple values of resulting in arbitrage-freeness, -Grouping finds a pattern by mathematical optimization where the elements can be grouped into sections by their values, and it allocates privacy budgets in such -pattern.

Based on Theorem 4.4, -Grouping also converts the task of finding an arbitrage-free pricing function into finding the such that: , s.t. , and , which is a semi-infinite programming problem. That is, -Grouping finds by minimizing the Manhattan distance between and , subject to the first two sufficient conditions in Theorem 4.4. is a initial pattern pre-defined by some function. To utilize more privacy losses, we set to make similar to the pattern of data owners’ maximum tolerable privacy losses. As depicted in Alg. 2, -Grouping allocates privacy budgets in the following steps:

-

•

1-3: Calculate to divide groups; get the initial pattern based on the maximum tolerable privacy losses ; sort in ascending order of value temporarily.

-

•

4-6: Divide the elements of into groups; for each group, make all the values of its members equal to the minimum one.

-

•

7-9: Recover the order of elements in by their corresponding data owners’ identities; process semi-infinite non-linear programming; allocate half of the remaining tolerable privacy losses as the initial privacy budgets.

-

•

10-15: Shave the base privacy budget . Because there might be cases where some privacy budget is lower than , we have to lower so that the initial privacy budgets can cover the privacy budgets .

-

•

16: Output as privacy budgets.

Each of the Laplce-base mechanism and Sample-base mechanism has its own advantages. On the one hand, the Sample-base mechanism is sensitive to the size of database . We note that the output of the utility function is sensitive to the while the output of only depends on , i.e., the minimum privacy loss among data owners. Thus, even if the privacy budgets are uniform, with the size of database increasing, the performance of the Sample-base mechanism in the aspect of utility is becoming worse while the Laplace-base mechanism remains the same. On the other hand, the Sample-base mechanism can provide lower variance and make more use of the maximum tolerable privacy losses. Under the Sample-base mechanism, as each data owner’s privacy loss is able to be personalized, a lower minimum affordable variance can be provided, so that the buyer can have more space of choices. Also, since the Laplace-base mechanism computes uniform privacy losses, a portion of each owner’s maximum tolerable privacy loss might be waste; meanwhile, under the Sample-base mechanism, such portion of privacy loss can be utilized so that data owners can gain more compensations.

References

- (1)

- Ghosh and Roth (2015) Arpita Ghosh and Aaron Roth. 2015. Selling privacy at auction. Games and Economic Behavior 91 (2015), 334–346.

- Jorgensen et al. (2015) Zach Jorgensen, Ting Yu, and Graham Cormode. 2015. Conservative or liberal? Personalized differential privacy. In 2015 IEEE 31St international conference on data engineering. IEEE, 1023–1034.

- Koutris et al. (2013) Paraschos Koutris, Prasang Upadhyaya, Magdalena Balazinska, Bill Howe, and Dan Suciu. 2013. Toward practical query pricing with QueryMarket. In proceedings of the 2013 ACM SIGMOD international conference on management of data. ACM, 613–624.

- Koutris et al. (2015) Paraschos Koutris, Prasang Upadhyaya, Magdalena Balazinska, Bill Howe, and Dan Suciu. 2015. Query-based data pricing. Journal of the ACM (JACM) 62, 5 (2015), 43.

- Li et al. (2014) Chao Li, Daniel Yang Li, Gerome Miklau, and Dan Suciu. 2014. A theory of pricing private data. ACM Transactions on Database Systems (TODS) 39, 4 (2014), 34.

- Niu et al. (2018) Chaoyue Niu, Zhenzhe Zheng, Fan Wu, Shaojie Tang, Xiaofeng Gao, and Guihai Chen. 2018. Unlocking the Value of Privacy: Trading Aggregate Statistics over Private Correlated Data. In Proceedings of the 24th ACM SIGKDD International Conference on Knowledge Discovery & Data Mining. ACM, 2031–2040.