Matrix calculations for inhomogeneous Markov reward processes, with applications to life insurance and point processes

Abstract

A multi–state life insurance model is naturally described in terms of the intensity matrix of an underlying (time–inhomogeneous) Markov process which describes the dynamics for the states of an insured person. Between and at transitions, benefits and premiums are paid, defining a payment process, and the technical reserve is defined as the present value of all future payments of the contract. Classical methods for finding the reserve and higher order moments involve the solution of certain differential equations (Thiele and Hattendorf, respectively). In this paper we present an alternative matrix–oriented approach based on general reward considerations for Markov jump processes. The matrix approach provides a general framework for effortlessly setting up general and even complex multi–state models, where moments of all orders are then expressed explicitly in terms of so–called product integrals (matrix–exponentials) of certain matrices. As Thiele and Hattendorf type of theorems can be retrieved immediately from the matrix formulae, this methods also provides a quick and transparent approach to proving these classical results. Methods for obtaining distributions and related properties of interest (e.g. quantiles or survival functions) of the future payments are presented from both a theoretical and practical point of view (via Laplace transforms and methods involving orthogonal polynomials).

1 Introduction

In this paper we consider the distribution and moments of the total reward generated by an time inhomogeneous Markov process with a finite state space. Rewards may be earned in three different ways. During sojourns in a fixed state, rewards can be earned at a deterministic (time–dependent) rate and as deterministic (time–dependent) lump sums which arrive according to a non–homogeneous Poisson process. Finally, at the times of transition deterministic (time-dependent) lump sums, which also depends on the type of transition, may be earned w.p. 1 or at random with some probability. We are particularly interested in the case of discounted rewards which have applications in life insurance. Here the rewards (premiums and benefits) are discounted by a deterministic (though time–dependent) interest rate. This setting is slightly more general than the standard life insurance set–up, and is inspired by the parametrisation of the general Markovian Arrival Process (MAP). In this way we also achieve the calculation of rewards and moments in the MAP and its time–inhomogeneous extension.

Our method for deriving distributions and moments uses probabilistic (sample path) arguments and matrix algebra. In particular, the matrices of interest are readily derived from the intensity matrix of the underlying Markov process and a matrix of payments. This is true for both pure and discounted rewards, where in the latter case the interest rate may be accommodated conveniently into the intensity matrix. The Laplace transform for the total (discounted) reward is obtained as a product integral (which is a matrix exponential in the time–homogeneous case) involving these matrices. Concerning the moments, all moments up to order are obtained by a product integral of a block matrix build upon the aforementioned matrices. The product integrals may be evaluated in a number of ways. Generally, the product integral satisfies a system of linear differential equation of the Kolmogorov type from which we retrieve both Thiele’s differential equation and Hattendorff type of theorems. If the intensities and payments are piecewise constant, which may often be the case in practical implementations, the product integral reduces to a product of matrix–exponentials which may be evaluated numerically by efficient methods like e.g. uniformisation.

While higher order moments are rarely used in life insurance, our approach to general accessibility of all orders and their numerical computability up to quite high orders suggest that they can also be used for approximating the cumulative distribution function (c.d.f.) of the distribution, and thereby the calculation of quantiles (values at risk or confidence intervals) which could provide valuable information concerning the actual risk. We provide a first example along this line by proposing a Gram-Charlier expansion to approximating both the density (p.d.f.) and the c.d.f. of the discounted future payment distribution when this is absolutely continuous. While this requires at least one continuous payment stream (e.g. a premium) to be present, we will see that shape of the distribution can be challenging, particularly for the case of the p.d.f.

The idea of using multi-state (time inhomogeneous) Markov processes as a model in life insurance dates back at least to the 1960’s and was put into a modern context by Hoem (1969), in which also Thiele’s differential equations for the state–wise reserves are derived. Variance formulas for the future payments can e.g. be found in Ramlau-Hansen (1988) whereas for higher order moments we refer to Norberg (1994). A differential equation (Thiele) approach to calculating the c.d.f. of the discounted future payments has been considered in Hesselager and Norberg (1996). If one considers only unit rewards on all jumps and Poisson arrivals (no continuous rewards) in a time–homogeneous Markov jump process, then the total undiscounted reward up to time defines a point process which is known as a Markovian Arrival Process (MAP). The moments in the MAP have been shown to satisfy certain integral equations (which are equivalent to the differential equations from life insurance) as shown in Nielsen et al. (2007). Apart from defining a tractable class of point process with numerous applications in applied probability, the MAPs form a simple dense class of point processes on on the positive reals (see Asmussen and Koole (1993)).

The specific contributions of the paper are as follows. The Laplace transform of the total rewards (Theorem 6.1) generalises a similar result of Bladt et al. (2002) for time–homogeneous Markov processes. The matrix representation of moments depends on a crucial result given in Lemma 5.1, which generalises a similar result proved in Van Loan (1978) for the case of constant matrices. The reserves and moments we deal with in the analysis are the so–called partial reserves and moments, which are defined as the expected value of the (powers) of the future (discounted) payments contingent on the terminal state. These reserves and moments may well be of interest on their own. The matrix representation of all moments provides a unifying approach to the explicit solution of Thiele’s and Hattendorff type of theorems. Working with solutions rather than the corresponding differential equations may greatly simplify subsequent analysis and applications.

The rest of the paper is organised as follows. In Section 2 we review the basic properties of the product integral, which will play an important role in the paper. The basic model and notation is set up in Section 3 and in Section 4 we use a probabilistic argument to prove a slightly extended version of Thiele’s differential equation. An important technical result regarding the calculation of certain ordinary integrals via product integrals is proved in Section 5. The main construction takes place in Sections 6 and 7 where we derive explicit matrix representations for the Laplace transform and higher order moments of the discounted future payments (total reward). An slightly extended version of Hattendorff’s theorem is derived as a consequence in the end of Section 7. As an example, we also calculate the higher order moments and factorial moments in a (time–homogeneous) Markovian Arrival Process. Since the moments of up to high orders are easily calculated, in Section 9 we explore the possibility of calculating the p.d.f. and c.d.f. for the total discounted future payments by means of orthogonal polynomial expansions based on central moments. In Section 9 we provide a numerical example, and in Section 10 we conclude the paper.

2 Some relevant background

Let be a matrix function. The product integral of , written as

where denotes the identity matrix, may be defined in a number of equivalent ways. It is e.g. the solution to Kolmogorov forward differential equation

which by integration and repeated substitutions also yields the Peano–Baker series representation

| (2.1) |

The product integral exists if is Riemann integrable, which will henceforth be assumed. From the Peano–Baker representation one may prove that

| (2.2) |

holds true for any order of and (not only ). In particular, the inverse of a product integral then exists and is given by

| (2.3) |

If the matrices all commute, then

| (2.4) |

In particular, if for all , then

| (2.5) |

This last observation may be useful in connection with piecewise constant matrices

for and where . Then, using (2.2),

| (2.6) |

, where and are such that and .

Matrix–exponentials can be calculated in numerous ways (see Moler and Loan (1978) and Loan and Moler (2003)) and are typically available in standard software package though at varying level of sophistication. If the exponent is an intensity (or sub–intensity matrix, i.e. row sums are non–positive) then either a Runge–Kutta method or uniformisation (see e.g. Bladt and Nielsen (2017), p. 51) are competitive and among the most efficient.

Product integrals may also be used in the construction of time–inhomogeneous Markov processes if the primitive is the intensity matrices. Indeed, if are intensity matrices (i.e. off diagonal elements are non–negative and rows sum to 0), then their product integrals are transition matrices, and by (2.2), Chapman–Kolmogorov’ equations are then satisfied which implies the Markov property. For further details we refer to Johansen (1986).

3 The general model

Consider a time–inhomogeneous Markov process with state space and intensity matrices . Let denote the corresponding transition matrix. Assume that

where denote a matrix with and is a sub–intensity matrix, i.e. its rows sums are non–positive. We define a reward structure on the Markov process in the following way. At jumps from to , lump sums of are obtained with probability . When there may be two kind of rewards: a continuous rate of , so that is earned during , and lump sums of at the events of a Poisson process with rate while in state . The total reward obtained during is then given by

| (3.1) | ||||

| where | ||||

| (3.2) | ||||

| (3.3) | ||||

and where is the counting process which increases by upon transition from to in for , or a Poisson process with rate if .

Our principal application is to life insurance, where the states are the different conditions of an insured individual (e.g. active, unemployed, disabled or dead). Here we are interested in studying the discounted rewards, , during a time interval defined by

where is a deterministic (instantaneous) interest rate at time and is a payment process

Here the continuous rates may e.g. be premiums (negative) or compensations (periodic unemployment payments). Lump sums will be paid out at transitions to at time with probability , while other lump sums of will be paid out while the insured is in condition at random times that will appear according to a time–inhomogeneous Poisson process at rate .

Remark 3.1.

We are interested in calculating the moments of and more generally of . To this end we define the slightly more general quantities

| (3.4) |

and

| (3.5) |

and more generally,

| (3.6) |

and

| (3.7) |

for . Define

| (3.8) | |||||

| (3.9) | |||||

| (3.10) | |||||

| (3.11) |

where denotes the diagonal matrix with the vector as diagonal, is the Schur (entrywise) matrix product, i.e. and ( terms).

The state–wise prospective reserves are defined as for all , which are then the elements of the vector , where is the column vector of ones (see (3.7)). We shall say that the matrix contains the partial (state–wise prospective) reserves and the refer to matrix itself as such. Though the partial reserve may have its own merit, it is introduced primarily for mathematical convenience.

4 Partial reserves and Thiele’s differential equations

First we start with an integral representation of the first order moment .

Lemma 4.1.

.

Proof.

The probability that there is a jump from to in given that is

Hence, the probability that there is a jump from to in and that , given that , is consequently

This serves as the density for a jump at . The reward is the value to be paid out with probability

Hence the expected reward in due to jumps from to amount to

This settles the case for the jumps. Concerning the linear rewards, consider state . Here its contribution amounts to

For the case of lump sums from Poisson arrivals in state , the contribution is

The total reward is then obtained by summing over all three different types of reward, which in matrix notation exactly yields the result. ∎

Next we consider the partial reserve. For a fixed time horizon (the terminal date) we define

| (4.1) |

From Lemma 4.1 we have that

We denote the elements of by . Then we have the following Thiele type of differential equation for the partial reserve.

Theorem 4.2 (Thiele).

satisfies

with terminal condition .

Proof.

First we see that

In matrix notation,

| (4.2) |

Thus

i.e.

| (4.3) |

with obvious boundary condition . ∎

As an immediate consequence, using that being a transition probability matrix, we recover the usual Thiele differential equation.

Corollary 4.3.

The vector of prospective reserves satisfies

with terminal condition .

5 Matrix representation of the reserve

In this section we will provide a matrix representation of the reserve. We start with an important general result which extends a result by Van Loan (1978) from matrix–exponentials to product integrals. Here the matrices and must be square but not necessarily of the same dimension.

Lemma 5.1.

For matrix functions , and , we have that

Proof.

First notice that

Let denote the matrix on the right hand side in the Lemma. Then

Also, . Therefore,

∎

Consider an block matrix on the form

and write

Then Lemma 5.1 implies that

so that

which can be written as

Applying Lemma 5.1 to from downwards and up, we then get that

and more generally,

| (5.1) |

Theorem 5.2.

The partial reserve defined in (4.1), , (and the transition matrix) can be calculated through the product integral

So both the partial reserve and are calculated trough one single calculation of the product integral. This is convenient if we are interested in the calculating of the expected future payments conditional on and , since

6 Laplace transform of rewards and future payments

Recall the definition (3.1) of the total reward which is the undiscounted future payments in an insurance context. Let

and

which is assumed to exist. Define

Theorem 6.1.

The distribution of the total reward has Laplace–Stieltjes transform given by

Proof.

Conditioning on the time of the first jump, if any, in , we get

Here the first line corresponds to the case where there are no Poisson arrivals or jumps in , the second line corresponds to a jump with reward for or a Poisson arrival rewards for , while the third line corresponds to a jump without rewards. Consider the Laplace transform

Then the contribution from the first term amounts to

The second term contributes to the Laplace transform by

The third term contributes similarly by

Thus

For the corresponding Laplace–Stieltjes transform

we then get

so

Now differentiate with respect to to get

which implies that

or, in matrix notation,

| (6.1) |

with boundary condition of . Thus the solution is given by

∎

7 Higher order moments

Define the matrices

| (7.1) |

and

| (7.7) |

Then we have the following main result.

Theorem 7.1.

Proof.

From the Laplace–Stieltjes transform it is now possible to derive higher order moments. First we notice that , and we can obtain (recall (3.5))

by

Now

( factors) whereas for (no differentiation, only evaluation at ) it equals the matrix which has all entrances equal to one. From (6.1) we get by differentiation with respect to that

Recalling that

and since

we get that

| (7.8) |

where

Multiplying from the left on both sides with (see also (2.3)) we get

Integrating the equation then gives

| (7.9) | |||||

Now we employ an induction argument to prove the identity of the product integral of the above matrix indeed equals . For the results amounts to

which indeed holds true since Lemma 5.1 implies that

which has been previously established in Lemma 4.1. Assume that the results hold true for dimension . Partition the matrix as

where

Then use Lemma 5.1, the induction hypothesis and (7.9) to verify the correct form of the first block row. ∎

Remark 7.2.

Example 7.3 (Markovian Arrival Process).

Let be a time–homogeneous Markov jump process with state–space and intensity matrix

where is a sub–intensity matrix and a non–negative matrix. A Markovian Arrival Process is a point process which is constructed in the following way. Upon transitions from to of , an arrival of is produced with probability , and during during sojourns in state , there are Poisson arrivals at rate . Let denote the number of arrivals in the MAP during . Then we may calculate the moments of by the use of Theorem 7.1. We identify , (the matrix of ones), , , and

Then the moments

are obtained through the matrix–exponential of as

In particular, the conditional moments

The factorial moments

are similarly obtained by the formula

Integral representations of the moments and factorial moments in a MAP has been considered in Nielsen et al. (2007).∎

Next we turn to the case of discounted rewards (future payments). In principle we may calculate the moments of the future discounted payments by applying Theorem 7.1 to the discounted rewards

We may however obtain an explicit matrix representation which also involves the interest rate in a more convenient way and which is closer to standard intuition in life insurance (like e.g. Hattenforffs theorem). We define as the matrix

| (7.12) |

and let

The matrix is a block–partitioned matrix with blocks of sizes . Thus is also a matrix, and we define a similar block partitioning as for , letting denote the ’th block which corresponds to the ’th block of . Then we have the following main result.

Theorem 7.4.

For we have that

whereas

The theorem states that the right block–column of contains the moments , starting with the highest moment in the upper right corner and finishing with the transition matrix in the lower right corner (which may be considered as the zeroth moment). Symbolically,

| (7.13) |

The idea of the general proof is most easily explained through the following example, which proves the result of Theorem 7.4 for the case , which is the lowest non–trivial order.

Example 7.5 (quadratic moment).

First we consider the product integral

Employing Lemma 5.1 inductively, by first partioning the matrix as

we see that

whereas

so that

and

Now assume that we are concerned with the discounted prices. Then at any time , we discount the price by

In the above expression for ,

while

In the expression for , produces a discount of

a discount of

while produces a discount of

Thus we may write

Let

and

Then

In particular,

∎

We now turn to the general proof.

Proof of Theorem 7.4.

We apply Theorem 7.1 to the discounted prices

This will indeed provide us with the correct result (for fixed ), and as in Example 7.5 we redistribute the discounted terms into the block diagonal matrices. For simplicity of identification of the individual blocks of the matrix, we write on a black partitioned way as

and

For example, and . The matrix is then scaled by

For it is clear that

has scaling factor , while in Example 7.5 we saw that has scaling factor . Now assume (induction) that all , have scaling factors . From the recursion (5.1),

we see that will produce a scaling factor , while can be written as another integral over to with integration variable , say, which will then have scaling factors (induction) of size . Now write

and pull out the factor to get a scaling factor of

This scaling factor can then be put together with , which in turn is the block level entrance which is simply . ∎

We may then obtain a slightly generalised version of Hattendorff’s theorem.

Theorem 7.6.

with terminal condition .

Proof.

This theorem reduces to the state–wise standard Hattendorff theorem for th order moments, which is achieved by post–multiplying the differential equation by the vector .

8 Gram-Charlier expansions of the full distribution

The c.d.f. or density of can of course be evaluated by Laplace transform inversion from Theorem 6.1, say implementing via the Euler or Post–Widder methods (see Abate and Whitt (1995)). However, the procedure is somewhat tedious and given the availability of all moments, an attractive alternative is Gram-Charlier expansions via orthogonal polynomials.

The method can briefly be summarized as follows. Consider a reference density having all moments well-defined and finite, and a target density for which all moments can be computed. Consider with inner product and let be a set of orthonormal polynomials, i.e. . If this set is complete in and

| (8.1) |

we can then expand in the to get

| (8.2) |

If the emphasis is on the c.d.f. or the quantiles, simply integrate this to get an expansion of .

For fast convergence of the series (8.2), should be chosen as much alike as possible. The most popular choice is the normal density with the same mean and variance as , in which case (one has always ). This implies for where is the th (probabilistic) Hermite polynomial defined by . In particular, with

we have

| (8.3) | ||||

| (8.4) |

The conditions for (8.4) to be a valid expansion are in fact just

| (8.5) |

cf. (Cramér, 1946, p. 223). Truncated versions of (8.2) or (8.4) go under the name of Edgeworth expansions; the examples with the whole series not converging simply arise when conditions (8.1) or (8.5) is violated (whereas completeness holds when is normal). See, e.g., Szegö (1939), (Cramér, 1946, p. 133, 222ff.) and Barndorff-Nielsen and Cox (2013) for more detail. Actuarial applications of the method can be found, e.g., in Bowers (1966), Albrecher et al. (2001), Goffard et al. (2016), Goffard et al. (2017), Asmussen et al. (2019), Goffard and Laub (2019).

8.1 The insurance implementation

When implementing the method in the insurance context , a difficulty is that absolute continuity typically fails. More precisely, the target distribution will be a mixture of atoms at , with probability for , and a part having a density. One then has to take as the density of the absolutely continuous part,

Most often, there is only one atom with easily computable.

Examples of atoms:

1) the initial state is held throughout , occuring w.p. , so that

.

2) No discounting and equal lump sum payments, , .

Then is a linear combination of the .

These are more or less the only natural ways to get atoms that occur to us,

but see Remark 8.5 below.

For simplicity of notation, we assume there is only one atom and write ,

(the modifications in the case of several atoms are trivial).

To implement the Gram-Charlier expansion of , define

Obviously,

| (8.6) |

whereas for ,

| (8.7) |

The program for computing an -quantile is then the following:

-

1.

Compute via Theorem 7.1 with and compute

-

2.

Choose and compute for via Theorem 7.1. To this end, replace the drift parameter by . Solve next (8.6) for the to get

-

3.

Take as the normal density with mean and variance . Write and compute the

-

4.

Approximate the conditional density and the unconditional c.d.f. by

-

5.

Solve to get a candidate for

-

6.

Repeat from step 2) with a larger until stabilizes.

At the formal mathematical level, one needs to verify (8.1). This seems easier for feed forward systems, since then has finite support and because a normal is bounded below on compact intervals, it would suffice that is bounded. This may occur highly plausible, but Remark 8.6 below shows that in fact (8.1) may fail in complete generality. The following, result seems, however, sufficient for all practical purposes. We call a model with constant intensities feed-forward if there are no loops, i.e. no chain with and all .

Theorem 8.1.

Assume as in Section x that all intensities and rewards are piecewise constant, that the distribution of has an absolutely continuous part with conditional density and that is normal.. Then the condition (8.1) holds for if either (i) the model is feed-forward, (ii) for all or, more generally, (iii) implies that there is no path from to , i.e. no chain with and all .

Proof.

Let be the unconditional density and

where are the absolutely, resp. atomic parts (due to the special structure, there can be no singular but non-atomic part). Let be the density of so that when . Let . and assume it shown that , . We then get

so that . Thus we may assume that and simply write etc.

The stated conditions imply in all three cases that has finite support. Indeed, the support is contained in where in cases (i) or (iii) and in case (ii). Since is bounded below on for any , it thus suffices to show that is bounded.

Assume first that all , , and let be fixed. Define as and for , , . A path contributes to only if and then by

where . Thus the contribution from all paths of length is at most . Summing over gives the bound for which is independent of . ∎

Remark 8.2.

Condition (iii) is not far from being necessary. Consider as an example the disability model with states 0: active, 1: disabled, 2: dead and recovery in the interval time interval withthe same intensity for transitions from 0 to 1 as from 1 to 0 and (for simplicity) mortality rate and discounting rate . The benefits are a lump sum upon transition from 0 to 1 and the contributions a constant payment rate when active.

When , the total number of transitions in is Poisson, the total benefits are , and the total contributions equal times the total time spent in state 0. Thus Obviously, is concentrated on the interval with a density which is bounded away from 0, say .

Assuming, again for simplicity, that , the intervals overlap and so for a given , at least one of them contribute to . One candidate is the one with . This gives

But using Stirling’s approximation to estimate the Poisson probability, it follows after a little calculus that for all large , say , and some (in fact the 4 can be replaced by any ). This gives for a normal that

That is, (8.1) fails.

The obvious way out is of course to take with a heavier tail than the normal, say doubly exponential (Laplacian) with density for . Given that this example and other cases where condition (iii) is violated do not seem very realistic, we have not exploited this further.

Example 8.3.

Consider again the disability model with states 0: active, 1: disabled, 2: dead and no recovery. As in BuchM, we assume that the payment stream has the form for and for ,111Here and in the following, a - subscript mimics ‘before ’ and a + ‘after ’. for all . For example could be the retirement age, say 65. Without recovery, the only non-zero transition rates are the , , . With the values used in BuchM, these are bounded away from 0 and on for any (say 75 or 80), and this innocent assumption is all that matters for the following.

Define the stopping times

with the usual convention that the stopping time is if there is no meeting the requirement in the definition. One then easily checks that the sets defined in Fig. 1 defines a partition of the sample space. Here (corresponding to zero transitions in ) contributes with an atom at

and the remaining 7 events with absolutely continuous parts, say with (defective) densities . It is therefore sufficient to show that each of these is bounded. In obvious notation, the contribution to of the first 4 of these 7 events (corresponding to precisely one transition in ) are

The desired boundedness of therefore follows from the following lemma, where may be improper () so that :

Lemma 8.4.

If a r.v. has a bounded density and the function is monotone and differentiable with bounded away from 0, then the density of is bounded as well.

Proof.

The assumptions imply the existence of . Now just note that the density of is if is increasing and if it is decreasing. ∎

The cases of . (corresponding to precisely two transitions in ) is slightly more intricate. Consider first . The contribution to is here

Now the joint density of at a point with is

so that is bounded. Consider now the transformation taking into . The inverse of the Jacobiant is

which is uniformly bounded away from 0 when . Therefore also the joint density of is bounded. Integrating w.r.t. over the finite region finally gives that is bounded.

The argument did not use that and hence also applies to . Finally note that the contribution to from is just a constant, whereas the one from has the same structure as used for . Hence also is bounded.

Remark 8.5.

The calculations show that also is an atom if . However, since the contribution rate is calculated via the equivalence principle given the benefits and the transition intensities, this would be a very special case. The somewhat less special situation (same annuity to an disabled as to someone retired as active) also gives an atom, now at . In fact, is assumed in BuchM.

Remark 8.6.

For a counterexample to (8.1), consider again the disability model with the only benefit being a lump sum of size being paid out at where , cf. Fig. 2.

Then has an atom at (corresponding to ) and an absolutely continuous part on . Letting be the inverse of , satisfies

where the minus sign after the first follows since is decreasing. With the density of , we get as in Lemma 8.4 that the conditional density of the absolutely continuous part is given by

But there are such that on and on , and so we get

meaning that (8.1) does not hold.

9 A numerical example

By (2.6), we may (essentially) assume without loss of generality that the parameters are constant. Thus we shall consider a disability–unemployment model, defined in terms of a time–homogeneous Markov process , with state space , where state 1 corresponds to active (premium paying), 2 unemployed, 3 disabled, 4 re–employed and 5 death. Death rates from all states are assumed to be the same and equal to , and all other possible transitions happen at rate as illustrated in Figure 3. The interest rate is , and the only lump sum payment (of quantity 2) is when entering the disability state from either state , or . In state premium is paid at rate and in state a benefit of rate is obtained. A parametrisation of the model is given by

and

It is clear from this example that parametrisations may be ambiguous. Indeed, for all with a corresponding we could equally have moved these values into the matrix instead.

A comparison of the first eight moments calculated respectively by a matrix exponential and by simulation is given in Table 1.

| Order | Matrix exp | Simulation |

|---|---|---|

| 1 | -0.8240 | -0.8247 |

| 2 | 2.8630 | 2.8639 |

| 3 | -6.751 | -6.797 |

| 4 | 33.21 | 33.33 |

| 5 | -122.4 | -124.5 |

| 6 | 708.9 | 716.6 |

| 7 | -3233 | -3323 |

| 8 | 20633 | 21024 |

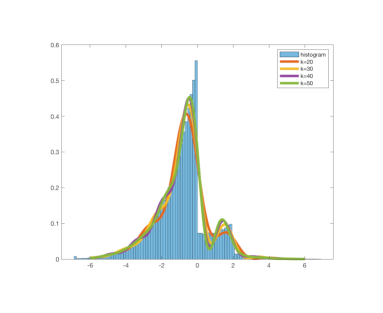

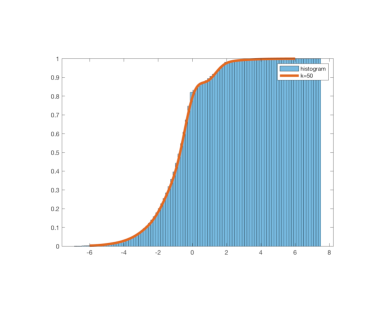

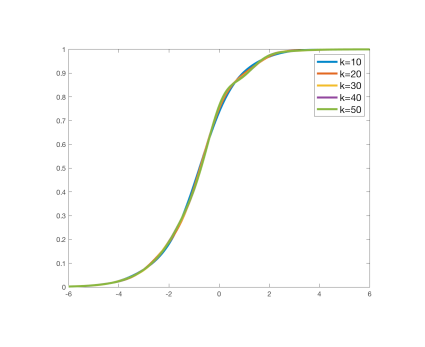

In Figure 4 we show a histogram of 300,000 simulated data as compared to estimated densities (and one cdf) based on a different number of moments. It is clear that the challenging shape of the density will in general require a high number of moments in order to obtain a good approximation. The cdf, which has a smoother behaviour and therefore is easier to approximate, seems to provide a good fit to the simulated data. How sensitive the cdf approximation is to the number of moments used is shown in Figure 5. The method seems at first eye to be pretty robust, which is also confirmed in Table 2, where quantiles which are obtained from the approximating cdfs for different numbers of moments, are all within a sensible range from each other.

| Number of moments | quantile | quantile |

|---|---|---|

| 10 | -4.05 | 2.15 |

| 20 | -3.95 | 2.10 |

| 30 | -4.00 | 2.05 |

| 40 | -3.95 | 2.05 |

| 50 | -4.00 | 2.05 |

10 Conclusion

In this paper we have established a matrix oriented approach for calculating the (discounted) rewards of time–inhomogeneous Markov processes with finite state–space. In particular, for applications to multi–state Markov models in life insurance our approach provides an alternative to standard derivations in the literature, which are usually based on case–by–case derivations involving differential or integral equations. In the slightly more general set–up in this paper we provide a unifying approach to deriving reserves and moments (of, in principle, arbitrary orders) which has a simple numerical implementation. The Laplace–Stieltjes transform of the (discounted) future payments, which plays an important role in the derivation of the moments and whose derivation is based on probabilistic (sample path) arguments, has a strikingly simple form which would allow for a numerical inversion in order to obtain the cdf or density of the future payments as well. However, since the moments of all orders, in principle, are available we propose an alternative method involving approximation of the cdf and densities via orthogonal polynomial expansions based on central moments. While this method seems to be very robust concerning the cdf, the approximation of the density itself is more involved which stems from the fact that presence of lump sums mixed with continuous rates implies that the densities can have a very challenging form.

References

- Abate and Whitt (1995) Joseph Abate and Ward Whitt. Numerical inversion of laplace transforms of probability distributions. INFORMS Journal on Computing, 7:36–43, 1995.

- Albrecher et al. (2001) Hansjörg Albrecher, Jozef L. Teugels, and Robert F. Tichy. On a gamma series expansion for the time-dependent probability of collective ruin. Insurance: Mathematics and Economics, 29(3):345 – 355, 2001.

- Asmussen and Koole (1993) Søren Asmussen and G Koole. Marked point processes as limits of Markovian arrival streams. Journal of Applied Probability, 30(2):365–372, 1993.

- Asmussen et al. (2019) Søren Asmussen, Pierre-Olivier Goffard, and Patrick J. Laub. Orthonormal Polynomial Expansions and Lognormal Sum Densities, chapter 6, pages 127–150. 2019.

- Barndorff-Nielsen and Cox (2013) O.E. Barndorff-Nielsen and D.R. Cox. Asymptotic Techniques for Use in Statistics. Monographs on Statistics and Applied Probability. Springer US, 2013.

- Bladt and Nielsen (2017) Mogens Bladt and Bo Friis Nielsen. Matrix-Exponential Distributions in Applied Probability. Springer Verlag, 2017.

- Bladt et al. (2002) Mogens Bladt, Beatrice Meini, Marcel Neuts, and Bruno Sericola. Distributions of reward functions on continuous-time Markov chains. In 4th International Conference on Matrix Analytic Methods in Stochastic Models (MAM4), 2002.

- Bowers (1966) N.L. Bowers. Expansion of probability density functions as a sum of gamma densities with applications in risk theory. Trans. Soc. Actuar., 18(52):125 – 137, 1966.

- Cramér (1946) H. Cramér. Mathematical Methods of Statistics. (Almqvist & Wiksells Akademiska Handböcker). Princeton University Press, 1946.

- Goffard and Laub (2019) Pierre-Olivier Goffard and Patrick J. Laub. Two numerical methods to evaluate stop-loss premiums. Journal of Computational and Applied Mathematics, 2019. to appear.

- Goffard et al. (2016) Pierre-Olivier Goffard, Stéphane Loisel, and Denys Pommeret. A polynomial expansion to approximate the ultimate ruin probability in the compound poisson ruin model. Journal of Computational and Applied Mathematics, 296:499 – 511, 2016.

- Goffard et al. (2017) Pierre-Olivier Goffard, Stéphane Loisel, and Denys Pommeret. Polynomial approximations for bivariate aggregate claims amount probability distributions. Methodology and Computing in Applied Probability, 19(1):151–174, Mar 2017.

- Hesselager and Norberg (1996) Ole Hesselager and Ragnar Norberg. On probability distributions of present values in life insurance. Insurance: Mathematics and Economics, 18(1):35 – 42, 1996. ISSN 0167-6687.

- Hoem (1969) Jan M. Hoem. Markov chain models in life insurance. Blätter der DGVFM, 9(2):91–107, Oct 1969.

- Johansen (1986) Søren Johansen. Product integrals and markov processes. CWI Newsletter, 12:3–13, 1986.

- Loan and Moler (2003) Charles van Loan and Cleve Moler. Nineteen Dubious Ways to Compute the Exponential of a Matrix, Twenty-Five Years Later. SIAM Review, 45:1–46, January 2003.

- Moler and Loan (1978) Cleve Moler and Charles van Loan. Nineteen dubious ways to compute the exponential of a matrix. SIAM Review, 20(4):801–836, 1978.

- Nielsen et al. (2007) Bo Friis Nielsen, L. A. Fredrik Nilsson, Uffe Høgsbro Thygesen, and Jan E. Beyer. Higher order moments and conditional asymptotics of the batch markovian arrival process. Stochastic Models, 23(1):1–26, 2007.

- Norberg (1991) Ragnar Norberg. Reserves in life and pension insurance. Scandinavian Actuarial Journal, 1991(1):3–24, 1991.

- Norberg (1994) Ragnar Norberg. Differential equations for moments of present values in life insurance, 1994.

- Ramlau-Hansen (1988) Henrik Ramlau-Hansen. Hattendorff’s theorem: A markov chain and counting process approach. Scandinavian Actuarial Journal, 1988(1-3):143–156, 1988.

- Schmidt (1933) Erhard Schmidt. Über die charlier-jordansche entwicklung einer willkürlichen funktion nach der poissonschen funktion und ihren ableitungen. ZAMM - Journal of Applied Mathematics and Mechanics / Zeitschrift für Angewandte Mathematik und Mechanik, 13(2):139–142, 1933.

- Szegö (1939) G. Szegö. Orthogonal Polynomials. American Mathematical Society Colloquium Publications, 23. Providence, RI: American Mathematical Society, 1939.

- Van Loan (1978) Charles Van Loan. Computing integrals involving the matrix exponential. IEEE Transactions on Automatic Control, 23(3):395–404, 1978.