Q-Gaussian diffusion in stock markets

Abstract

We analyze the Standard & Poor’s 500 stock market index from the last years. The probability density function of price returns exhibits two well-distinguished regimes with self-similar structure: the first one displays strong super-diffusion together with short-time correlations, and the second one corresponds to weak super-diffusion with weak time correlations. Both regimes are well-described by q-Gaussian distributions. The porous media equation is used to derive the governing equation for these regimes, and the Black-Scholes diffusion coefficient is explicitly obtained from the governing equation.

Price fluctuations in stock markets exhibit remarkable features such as strong short-time correlations, weak long-time correlations, power law tails, and slow convergence to the normal distribution vasconcelos2004guided . In the earliest stock market model, Bachelier proposed classical Brownian motion to represent price fluctuations. This model was the cornerstone for the well-established Black-Scholes equations for stock markets. Mandelbrot suggested that classical diffusion was not appropriate for modeling real stock markets mandelbrot1963variation . His conclusion was based on the analysis of price variations of the cotton index whose probability density function (pdf) was better described by a Lévy distribution. Later, Mantegna and Stanley proposed that this Lévy distribution should be truncated to achieve consistency with the slow convergence to normality, and to guarantee that the standard deviation of price variations remains finite mantegna1994stochastic . Most recent developments have suggested that the q-Gaussian distribution —an extension of the Gaussian distribution for correlated fluctuations— is more appropriate to account for the correlations of price increments in the NASDAQ stock market index borland2002option and NYSE index tsallis2003nonextensive . Time correlations lead to anomalous diffusion, a phenomenon that is pervasive in strongly correlated classical systems, such as silo discharge arevalo2007anomalous and sheared granular flow combe2015experimental .

In this Letter we have analyzed the Standard & Poor’s (S&P500) stock market data during the -year period from January to May , with an interval span of min. The stock market index at time is denoted by . The price return in a time interval from to is defined by

| (1) |

The stock market index fluctuates over time in a random fashion. The main interest of economists is to predict the price return at any future time . Here we adopt the probabilistic approach: we assume that the price return X is a random variable with probability density function (pdf) . Then we formulate the governing equation for this distribution. The standard diffusion process is an oversimplification, as the price fluctuations strongly correlate for times of the order of minutes, and they weakly correlate for longer times mantegna1999introduction . A candidate for such a distribution function is the q-Gaussian distribution. The q-Gaussian is a generalization of the Gaussian distribution, and is defined as umarov2008q :

| (2) |

where is the q-exponential function. For , the q-Gaussian has asymptotic heavy-tail power law given by . The “q-Gauss” is a special case of q-Gaussian distribution defined as . The exponential and Gaussian functions can be recovered by taking the limit . For , the normalizing constant is given by:

| (3) |

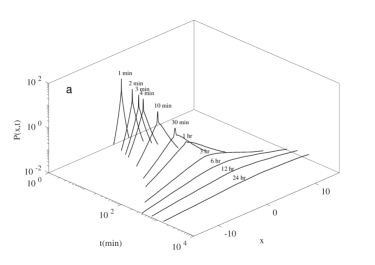

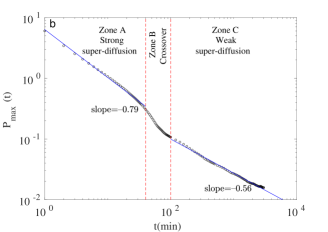

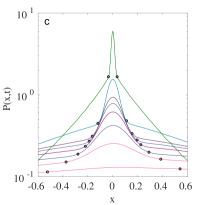

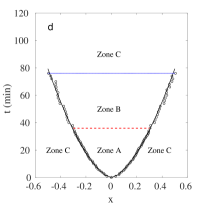

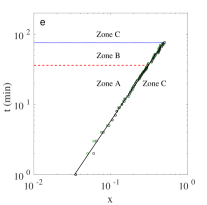

The so-called q-Central Limit Theorem states that the q-Gaussian is the limit of the distributions of specially correlated random processes umarov2008q . Thus, it is reasonable to propose the q-Gaussian as a candidate to fit the pdf distribution of stock markets. With this aim, we construct the pdf of the S&P500 stock market index using the kernel density estimator. The bandwidth of the kernel is set to that is small enough to capture the non-trivial structure of the pdfs. Figures 1a and 1b show the time evolution of the pdf and its height from minute to hours of active market time. The initial distribution at minute consists of heavy tails and a pronounced bump at the center. This bump is easily distinguished from the rest of the distribution by an abrupt change of the slope of the distribution, see Figure 1c. The points where the abrupt change of the slope occurs are plotted against the time in Figures 1d and 1e. These points define the top and bottom boundary of what we called the domain of the bump. As time evolves, the bump diffuses and completely disappears after minutes.

As shown in Figure 1b, the time variation of the height of the bump obeys a power law with exponent with in the strong super-diffusion regime. This is different from the exponent expected in classical diffusion processes. Between mins and mins, we observe a crossover region. The end of the crossover corresponds to the region where the bump fully disappears, which is shown in Fig 1d and 1e. After the end of the crossover, the new height of the distribution obeys a different power law with exponent which is closer to the exponent of classical diffusion. Mantegna and Stanley’s analysis on a more limited data-set of the S&P500 index led to the exponent mantegna1995scaling . This is in reasonable agreement with our exponents, considering that they used a single exponent to fit the entire time evolution of the height.

Based on the domain of the bump and the time evolution of the height of the pdf, we partition the two-dimensional space (price and time) into three zones as shown in the Figure 1d: Zone A is the domain of the bump where the power law holds, zone B is the area of the bump’s domain where the power law smoothly changes to another power law, and zone C is the remaining space. In zones A and C we propose a self-similar distribution given by

| (4) |

Where is a normalized distribution. The exponent defines the diffusion process as follows: The second moment of the distribution in Eq. 4 is . Then corresponds to super-diffusion, whereas leads to sub-diffusion. The exponent scales the height of the distribution as as the previous fitting in Figure 1b. The present favorite alternative is the Lévy distribution, as proposed by Mandelbrot mandelbrot1963variation , and Mantegna and Stanley mantegna1995scaling . They obtained as a fitted parameter, indicating super-diffusion. Here we propose a different approach by seeking a self-similar fitting for both weak and strong super-diffusion regime using the q-Gauss function in Eq. 4. In both models the classical diffusion can be recovered by taking and . This limit corresponds to the self-similar solution of the diffusion equation that does not fit well to the stock market data.

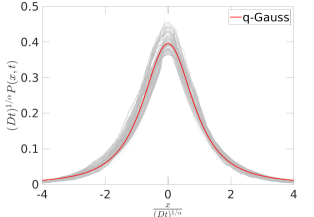

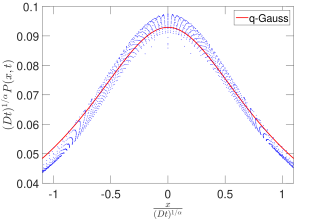

The self-similar fitting in zones A and C is performed as follows: First we fit each pdf to Eq. 2 using and as fitted parameters. We evaluate the time dependence of the fitting parameters. For each zone, we found that is approximately constant while follows a power law relation that is written as , where and are fitting parameters of this power law. Then, we collapse the pdfs for both weak and strong super-diffusion, as shown in Figures 2 and 3.

To collapse the pdfs in the weak super-diffusion regime —zone C in Figure 1d— we use the data from minute to minutes. The data is detrended by subtracting from the time series the average value within a time window of one month. This removes the effect of the drift on the pdf. We obtain an excellent agreement for the collapsed data with the q-Gauss distribution (Eq. 2 with ). The q-exponent in this regime is which is larger than the value expected for uncorrelated random processes. This is consistent with the weak correlation of the price fluctuations in this regime that is given by an auto-correlation of price fluctuating around . The exponent is the same as the one calculated in Figure 1b and is lower than the value of expected for classic diffusion. The collapse of the pdfs in the strong super-diffusion regime —zone A in Figure 1d— is shown in Figure 3 Like in the weak super-diffusion case, the collapse fits well to the q-Gauss distribution. However, in this case the exponent is larger and is lower than the exponents in the week super-diffusion regime. This indicates stronger deviation from classical diffusion. As in the previous case, these exponents should be considered as independent exponents. Note that in Figure 3 we collapse only the bump of the distribution, while its tail is fitted in Figure 2 because it belongs to the weak super-difussion regime (zone C).

Next we construct the evolution equation of the pdf based on the q-Gaussian fitting. It is natural to relate the super-diffusion processes with a well-known anomalous diffusion model, which is given by a non-linear Fokker-Planck equation borland2002option , also known as the porous media equation tsallis2009introduction :

| (5) |

The Barenblatt solution of Eq. 5 for and is given by vasquez2007porus

| (6) |

Where C is an integration constant. There is only one exponent in Eq. 5 while we have two independent exponents and in the fitting of the collapsed data (see Figures 2 and 3). An additional exponent is introduced and proposing we write

| (7) |

The scale parameter is obtained as follows: By placing Eq. 7 into Eq. 6 we obtain,

This equation can be writen as:

| (8) |

in which is the normalization constant in Eq. 3. The and values are related to and by

| (9) |

and is calculated in terms of and by

| (10) |

The parameters , and are derived by fitting the collapse data. Eq. 8 corresponds to Eq. 4 with defined by Eq. 2. Finally, the governing equation of is obtained by first taking the partial time derivative in Eq. 7

| (11) |

Placing Eq. 11 into Eq. 5 the governing equation is obtained

| (12) |

Eq. 12 is of great importance as it is the evolution equation of the distribution of price returns of the S&P500 index. The parameters , and take different values depending on whether we are in the weak or strong super-diffusion regime. Eq. 12 reflects a distinct feature of stock markets, namely that the diffusion coefficient depends on the diffused quantity itself, a feature that is observed also in many biological and physical systems Bogachev2015FPE ; Till2005nonlinear . Also, the Black-Scholes coefficient of diffusion can be calculated by comparing Eq. 12 to the linear Fokker-Planck equation vasconcelos2004guided . The direct comparison leads to . Replacing Eqs. 8 and 10 into this equation we obtain an explicit expression for the coefficient of diffusion:

| (13) |

For a fixed time and large price fluctuations, the scaling of the Black-Scholes equation for geometric Brownian motion is recovered vasconcelos2004guided . Our extension introduces the power law dependency with time into this relation that accounts for super-diffusion.

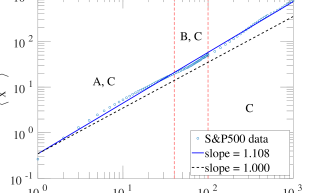

The strong super-diffusion regime occurs in a very small zone in the phase space, so that it only contributes to the moments of the pdf distributions to a small extent. We characterize the global diffusion by plotting the second moment of the full pdf as a function of time, and fitting it to the best power law. The result is shown in Figure 4. The second moment is almost linear with time, suggesting that the global diffusion is weakly super-diffusive.

We have identified two regimes in the time evolution of the pdfs of the price return of the S&P500 index that account for strong and weak super-diffusion. Both regimes are described by the family of self-similar q-Gaussian distributions that accurately capture the tail distributions, needed for financial risk estimates, by accounting for the strong super-diffusion in the centre of the distribution. The time evolution of the pdf is consistent with the central limit theorem for correlated fluctuations. The strong correlations in the short-time regime is reflected in a strong super-diffusive q-Gaussian regime that has not previously been reported, and the weak correlation in the long-time regime corresponds to the weak super-diffusive q-Gaussian regime. We demonstrated that these regimes are well-described by a non-linear Fokker Plank equation that is used to obtain an explicit formula for the Black-Scholes diffusion coefficient.

HJH thanks CAPES and FUNCAP for support. MH acknowledges Australian Research Council grant DP170102927.

References

- (1) G. L. Vasconcelos, Brazilian Journal of Physics 34, 1039 (2004).

- (2) B. Mandelbrot, The Journal of Business 36, 394 (1963).

- (3) R. N. Mantegna and H. E. Stanley, Physical Review Letters 73, 2946 (1994).

- (4) L. Borland, Physical Review Letters 89, 098701 (2002).

- (5) C. Tsallis, C. Anteneodo, L. Borland, and R. Osorio, Physica A: Statistical Mechanics and its Applications 324, 89 (2003).

- (6) R. Arévalo, A. Garcimartin, and D. Maza, The European Physical Journal E 23, 191 (2007).

- (7) G. Combe, V. Richefeu, M. Stasiak, and A. P. Atman, Physical Review Letters 115, 238301 (2015).

- (8) R. N. Mantegna and H. E. Stanley, Introduction to econophysics: correlations and complexity in finance (Cambridge university press, London, 1999).

- (9) S. Umarov, C. Tsallis, and S. Steinberg, Milan Journal of Mathematics 76, 307 (2008).

- (10) R. N. Mantegna and H. E. Stanley, Nature 376, 46 (1995).

- (11) C. Tsallis, Introduction to nonextensive statistical mechanics: approaching a complex world (Springer Science & Business Media, New York City, 2009).

- (12) J. L. Vazquez, The porous medium equation: mathematical theory (Clarendon, Oxford, 2007).

- (13) V. I. Bogachev, N. V. Krylov, M. Röckner, and S. V. Shaposhnikov, Fokker-Planck-Kolmogorov equations (American Mathematical Society, Providence, Rhode Island, 2015), Vol. 207.

- (14) T. D. Frank, Nonlinear Fokker-Planck Equations: Fundamentals and Applications (Springer Berlin Heidelberg, Berlin, Heidelberg, 2005).