Optimal liquidation under stochastic price impact

Abstract

We assume a continuous-time price impact model similar to Almgren-Chriss but with the added assumption that the price impact parameters are stochastic processes modeled as correlated scalar Markov diffusions. In this setting, we develop trading strategies for a trader who desires to liquidate his inventory but faces price impact as a result of his trading. For a fixed trading horizon, we perform coefficient expansion on the Hamilton-Jacobi-Bellman equation associated with the trader’s value function. The coefficient expansion yields a sequence of partial differential equations that we solve to give closed-form approximations to the value function and optimal liquidation strategy. We examine some special cases of the optimal liquidation problem and give financial interpretations of the approximate liquidation strategies in these cases. Finally, we provide numerical examples to demonstrate the effectiveness of the approximations.

1 Introduction

When institutional traders execute large market orders, they are faced with transactional frictions. Direct frictions, such as exchange and brokerage fees, are known in advance and can be incorporated into a trading strategy. Traders also incur indirect costs, and such costs are, in general, unknown in advance and may be difficult to quantify even after the trading is complete. The opportunity cost that arises from waiting to execute trades and the price impact that results from trading are both examples of indirect costs. Price impact typically affects traders adversely. Selling an asset puts downward pressure on the price thereby lowering revenues while purchasing an asset pushes its price upward, resulting in higher costs. We focus on price impact costs in this paper. Specifically, we examine how a trader should optimally liquidate a large position in a market in which price impact is stochastic.

The optimal liquidation problem under price impact has been studied extensively in the literature. Bertsimas and Lo (1998) use a linear price impact model and solve a discrete optimal control problem to minimize expected trading costs. Almgren and Chriss (1999, 2001); Huberman and Stanzl (2005) also use a linear price impact model but consider the variance in trading costs. Almgren (2003) employs nonlinear impact functions and discusses the continuous-time limit of the models in Almgren and Chriss (1999, 2001) in more detail. Almgren (2012) considers optimal liquidation in a market with stochastic liquidity and stochastic volatility. Obizhaeva and Wang (2005) include price impact by modeling the limit order book directly (see also the published version, Obizhaeva and Wang (2013)). Alfonsi et al. (2010) extend the work of Obizhaeva and Wang (2005) to allow for general limit order book shapes. Cartea and Jaimungal (2016) use a continuous time linear impact model and incorporate stochastic order flow. For an overview of continuous-time price impact models, see Cartea et al. (2015) and the references therein.

In this paper, we assume a continuous-time price impact model where the price impact parameters are stochastic. Specifically, the temporary and permanent price impact parameters are modeled as scalar Markov diffusions. We allow the temporary and permanent price impact parameters to be correlated, as empirical evidence suggests they are (see Cartea and Jaimungal (2016)). In this setting, we define a trader’s value function and formulate the associated Hamilton-Jacobi-Bellman (HJB) partial differential equation (PDE). We find an approximate solution of the HJB equation by applying coefficient expansion techniques that were first developed for one-dimensional linear parabolic PDEs in Pagliarani and Pascucci (2012) and later extended to -dimensions in Lorig et al. (2015) and nonlinear problems in Lorig and Sircar (2016); Lorig (2016). This, in turn, yields approximations to the associated optimal trading strategy. The resulting optimal strategy approximations are explicit and do not require numerical integration.

The zeroth order approximation to the optimal strategy can be interpreted as an Almgren-Chriss strategy for which the price impact parameters are recalibrated in continuous time. Successive terms in higher-order approximations can therefore be viewed as corrections to the strategy of Almgren and Chriss. Higher-order strategy approximations are influenced by the geometry of the stochastic differential equation (SDE) coefficients modeling the impact parameter’s dynamics, allowing traders to take advantage of periods of relatively high or low price impact.

The rest of the paper is organized as follows. In Section 2, we state our modeling assumptions, define the trader’s value function, and provide the associated HJB equation. In Section 3, we develop an asymptotic expansion for solutions of the HJB equation. This expansion leads to a sequence of PDEs, which we solve recursively in Section 3.2. The solution of these PDEs allows us to construct approximations to the optimal liquidation strategy. We discuss limiting cases of the optimal strategy approximations in Section 3.3. In Section 4, we demonstrate the effectiveness of the approximate optimal strategies by performing a Monte Carlo study. Some concluding remarks are offered in Section 5.

2 Market model and trader’s value function

To begin, we fix a trading horizon and filtered probability space . We suppose an institutional trader holds shares of a stock that he wishes to liquidate. The trader does not post limit orders but trades exclusively via market orders. He must choose the speed at which he sends market orders with the aim of liquidating all shares by the end of a trading horizon . We assume that the trader trades in continuous time, and we denote by the rate at which the trader sends market orders (i.e., the liquidation speed). The inventory depends on the the trading strategy and is given by

| (2.1) |

A positive trading rate at a time corresponds to selling shares of , and a negative rate corresponds to buying shares of . Although we shall restrict ourselves to the liquidation problem in this paper, we mention that the set up for the acquisition problem is similar. The trader wishes to choose such that he minimizes the indirect costs he incurs as a result of his trading. We incorporate price impact in the model by explicitly including temporary and permanent price impact parameters.

2.1 Permanent price impact

We assume that when the trader sends market orders there is a permanent impact on the midprice of the stock. Sell orders put downward pressure on the midprice of the stock, and, conversely, buy orders put upward pressure on the midprice. For example, suppose that a trader submits a large sell order for , and suppose further that other traders on the market have similar signals and also post market orders to sell. Liquidity providers fill the gap in the book by posting limit orders to sell at lower prices, thus moving the midprice down.

We model the midprice of the stock as a stochastic process with the dynamics

| (2.2) |

where the constant is positive, the function is continuous and real-valued, the Markov diffusion has the dynamics

| (2.3) |

and the standard Brownian motions and are uncorrelated.

We think of the Brownian motion as market noise due to the reshuffling of limit orders. Permanent price impact is modeled by the process , the magnitude of which corresponds the severity of the impact. We require that for all because a negative permanent price impact would imply that selling shares of an asset would push the midprice upwards, which is unrealistic. Asymptotic expansions are performed in Section 3 for general , but we give the linear model special attention in Section 4.

2.2 Temporary impact

In addition to permanent price impact, the trader also faces a temporary price impact. Temporary price impact is the cost directly associated with each trade, and, unlike the permanent impact, temporary impact does not carry over into subsequent trades. Temporary impact can be understood as follows: the number of shares available at the best bid is limited, and if the trader’s market order is large enough then the trader walks the book (i.e., depletes the outstanding limit orders nearest the midprice). We include temporary price impact in the model by defining the execution price of the asset to be

| (2.4) |

where the function is continuous and real-valued and the Markov diffusion has the dynamics

| (2.5) |

Here, the standard Brownian motion is uncorrelated with the Brownian motion that drives the midprice but is correlated with the Brownian motion that drives the permanent price impact where . Taking the temporary price impact to be a stochastic process allows us to incorporate stochastic liquidity into our model.

We require that for all to reflect the fact that traders are not compensated for posting market orders. Assuming the trader wishes to minimize the cost associated with temporary price impact, if the temporary price impact ever reached zero, the trader would liquidate his entire inventory immediately resulting in blowup in the optimal strategy. The magnitude of the process describes the severity of the temporary price impact. We note that Cartea and Jaimungal (2016) suggests that temporary and permanent price impact are correlated, so we allow temporary and permanent price impact to be correlated with parameter . Generally, temporary and permanent price impact are positively correlated, although our model does not require that.

The above framework stipulates that the temporary impact is only felt by the trader who initiates the market order. Furthermore, the limit order book rebalances infinitely fast to the state before the arrival of the market order. This assumption is known as order book resilience. See Alfonsi et al. (2010), Almgren (2003), Gatheral et al. (2012), Kharroubi and Pham (2010), and Schied (2013) for further study and relaxations of the resilience assumption. Asymptotic expansions are performed in Section 3 for general , but we give special attention to the linear case in Section 4.

In the framework described above, one easily derives that the trader’s cash position is given by

| (2.6) |

2.3 Trader’s value function

We consider a trader who wishes to liquidate shares of under the model described in Section 2. We assume that the trader wishes to maximize his expected cash at the terminal time subject to penalties for holding inventory. For a given trading strategy , we define the trader’s performance criteria to be

| (2.7) |

where the constants and are positive and is shorthand for expectation conditioned on . From left to right, the following three terms are present in the trader’s performance criteria (2.7): terminal cash, the proceeds of liquidating the remaining shares at the terminal time , and an integral term penalizing the holding of inventory. The proceeds from liquidation at time are subject to temporary price impact, which is incorporated through the parameter . The third term imposes a running penalty for holding inventory. When is large, optimal strategies will trade quickly at the beginning of the trading horizon rather than face holding large inventories. In Cartea et al. (2014), the authors show that including the inventory penalty term is equivalent to the trader considering alternate models with stochastic drifts but penalizing models that are far from the reference model in the sense of relative entropy. In that context, larger values of correspond to an trader who is less confident about the drift of the . The authors of Cartea and Jaimungal (2015) introduce the inventory penalty term heuristically and justify it by showing that it is proportional to the variance of the book value of the inventory over the trading horizon.

The trader’s value function is given by

| (2.8) |

where is the set of admissible strategies.

2.4 The Hamilton-Jacobi-Bellman equation

In this section, we give the HJB equation associated with the value function . Let denote the infinitesimal generator for the process with fixed. Explicitly,

| (2.9) | ||||

| (2.10) |

As we shall see in later in this section, it is convenient to write as the sum of two operators

| (2.11) | ||||||

| (2.12) | ||||||

The operator is the infinitesimal generator of the process and the operator is the infinitesimal generator of with fixed. When the process is constant (i.e., ), we have , and the model reduces to the continuous-time Almgren-Chriss model.

The HJB equation associated with the trader’s value function is

| (2.13) |

where and are given by (2.11) and (2.12), respectively. We assume that (2.13) admits a unique classical solution which coincides with the trader’s value function (see Pham (2009)).

Following Cartea and Jaimungal (2016), we make the following ansatz

| (2.14) |

for some function to be determined. We refer to as the transformed value function. Inserting (2.14) into (2.13) yields the following PDE problem for :

| (2.15) |

The optimal strategy , obtained by maximizing the supremum in (2.15), is given in feedback form as

| (2.16) |

Inserting (2.16) into (2.15) we obtain

| (2.17) | ||||||

| (2.18) | ||||||

Note that we have reduced the HJB equation (2.13) to a PDE that involves only three variables: .

3 Asymptotics

For general , there is no closed-form solution to (2.17). In this section, we develop a formal asymptotic expansion for the transformed value function and the corresponding optimal execution strategy by performing polynomial expansions on the coefficients of (2.17). The authors of Lorig et al. (2015) use this approach for the European option pricing problem in a general local-stochastic volatility setting. One key difference here is that, unlike classical option pricing PDEs, which are linear, the PDE (2.17) is nonlinear. Our approach is similar to that of Lorig and Sircar (2016) and Lorig (2016), who apply the polynomial coefficient expansion method to the Merton problem and indifference pricing problem, both of which are nonlinear.

3.1 Coefficient Taylor series expansions

For the sake of simplicity, we assume in the following formal computations that the coefficients of (2.17) are analytic. We shall see later that the th-order approximation we obtain for and require only that the coefficients of (2.17) belong to where is some open set in .

Let be a placeholder for any of the coefficients appearing in PDE (2.17)

| (3.1) |

and fix a point . For any , we define

| (3.2) |

Formally, Taylor expanding in about the point gives

| (3.3) | ||||||

| (3.4) |

In particular, evaluating (3.3) at yields the Taylor series expansion of about the point . Consider now the family of PDEs indexed by :

| (3.5) |

where and are the operators obtained by replacing the coefficients of and in (2.12) and (2.18), respectively, with their -counterparts. Explicitly, we make the replacements

| (3.6) |

in (2.17) to obtain (3.5). Using (3.3), the linear operator in the PDE (3.5) can be written as

| (3.7) |

where we have defined

| (3.8) |

and the subscript notation is as described in (3.4). The expansion of the nonlinear operator is more involved, and we handle it below.

We construct an expansion for the function , the solution to the PDE (3.5), as the power series in

| (3.9) |

Here, the sequence of functions are not polynomials in but rather functions to be determined which, in particular, are independent of . We shall eventually construct the asymptotic approximation to the transformed value function by truncating (3.9) for some and setting .

We insert (3.7) and (3.9) into (3.5), expand the terms in in powers of , and collect terms of like order in . As the equality in (3.5) holds for all for all , we obtain the following sequence of PDEs:

| (3.10) | |||||||

| (3.11) |

where we have defined the differential operator

| (3.12) |

and the functions

| (3.13) |

Equation (3.11) holds for all . We are now in position to define the th order approximation for .

Definition 3.1.

We now focus on developing an th order approximation for the optimal liquidation strategy . To this end, recalling the expression (2.16) for the optimal execution strategy we define

| (3.15) |

Definition 3.2.

Let be a non-negative integer, and assume that the coefficients of (2.16) are where is an open set in . For any , we define the define the th-order approximation of the optimal control as

| (3.16) |

where, for every , the function is the th-order coefficient in the Taylor series expansion of about .

Remark 3.3.

As we noted at the beginning of Section 3.1, for a given , the analyticity of the coefficients of and is not required to construct the approximation . Indeed, to construct the -th order approximations and one only needs that the coefficients are for some .

Remark 3.4.

Observe that we have set in (3.14) and (3.16). As a result, this parameter plays no role in the approximations and (as it should not, as does not appear in the dynamics of nor in the performance criteria ). Indeed, was introduced merely as an accounting tool in the formal asymptotic expansion performed above.

Remark 3.5.

Note that we have set in both (3.14) and (3.16). This is often a point of confusion, and we wish to make it clear how this is handled. First, we solve the sequence of PDE problems (3.11) with fixed. Let us make explicit the dependence of the solution of the problem (3.11) on by writing . When we wish to compute the approximate value of at a point , we evaluate for each appearing in the sum (3.14). Similarly, we can make explicit the dependence on of the -th order component of by writing . To compute the approximation for at a point we evaluate for each term in the series (3.16). The reason for choosing is as follows. The small-time behavior of a diffusion is predominantly determined by the geometry of the diffusion coefficients near the starting point of the diffusion . In turn, the most accurate Taylor series expansion of any function near the point is the Taylor series centered at .

We now give a representation of the approximate strategy (3.16) in terms of the functions , which are solutions of the sequence of PDEs (3.11).

Proposition 3.6.

3.2 Expressions for

We begin this section by solving (3.10) explicitly for , which yields explicit representation of the operator . We then give a recursive, integral expression for and evaluate the integral explicitly for . We use the expressions for and to construct and . For readability, we opt not to give or higher order approximations to the transformed value function. However, while tedious to obtain, their explicit computation is straightforward.

Proposition 3.7.

[Proof]As both the forcing term and the terminal condition in (3.10) are independent of , we conclude that is a function of only. Therefore, . The PDE (3.10) thus reduces to the constant coefficient ODE

| (3.24) |

The reader will recognize (3.24) as a Ricatti equation. We check by direct substitution that (3.22) satisfies (3.24).

Corollary 3.8.

With an explicit expression for in hand, we are able to write the zeroth order approximation to the optimal liquidation strategy . By (3.16) and (3.22), we have

| (3.26) |

where and are given in (3.23). The strategy (3.26) has the same form as the continuous time Almgren and Chriss (2001) strategy , which we denote by . The difference between the strategies is that the level of the stochastic process is an input of zeroth order approximation while in the Almgren-Chriss strategy the price impact parameters are constants. Thus, the strategy can be viewed as an implementation of in which the price impact parameters are recalibrated in continuously time.

Before we give an expression for , let us review Duhamel’s principle. Let be the fundamental solution of the operator . That is, satisfies the PDE

| (3.27) |

where is the Dirac delta function on centered at . By Duhamel’s principle, the unique classical solution to a PDE of the form

| (3.28) |

is given by

| (3.29) |

where we have introduced the semigroup generated by , which is defined as

| (3.30) |

for .

We now give a recursive expression for .

Proposition 3.9.

[Proof]Let be the solution to the PDE (3.27). As the coefficients of the operator are constant in we have

| (3.35) |

where and are given in (3.33). Using (3.22), we compute explicitly

| (3.36) |

which yields the expression (3.32). Applying Duhamel’s principle to (3.11) gives (3.31).

Corollary 3.10.

[Proof]See Appendix A. With an explicit expression for in hand, we are able to construct the first order approximation to the optimal liquidation strategy . By (3.17) and (3.26), we have

| (3.39) |

Higher order approximations to the transformed value function can be computed explicitly. For the sake of readability, we do not carry out these calculations and instead focus on zero and first order approximations, which are sufficient to capture the lowest order effects of stochastic price impact.

3.3 Analysis of some limiting cases

The asymptotic approximations of the transformed value function (and hence the approximations to ) developed in Section 3 depend on the parameters , which controls the penalty for liquidation occurring at the trading horizon , and , which controls the penalty for holding shares of throughout trading. In this section, we develop strategies that are independent of one or both of these parameters by taking the limit of the optimal strategy approximations as the parameters and tend to and , respectively. One motivation for considering such strategies is financial. Taking the limit of the optimal strategy as corresponds to a setting in which the trader is adamant about his entire inventory being liquidated before . Then, taking corresponds to a setting in which the trader both demands complete liquidation by the trading horizon and is indifferent about holding inventory. Another motivation for developing limiting strategies is analytic tractability. We shall see later in this section that the limiting strategy approximations and have far fewer terms than their corresponding nonlimiting case strategies, thereby facilitating a financial interpretation of the resulting expressions.

For the remainder of this section, we make the dependence on parameters and of the PDE solutions and strategies explicit with the superscipt notation

| (3.40) |

We refer to the strategies with and as nonlimiting strategies. Let us define the limiting strategies

| (3.41) | ||||||

| (3.42) | ||||||

| (3.43) |

Below, we provide explicit expressions for and for . In order to construct and , it will be helpful to define

| (3.44) |

As the strategies depend on only through the functions , we can obtain the strategies and by replacing in (3.17) with and , respectively. From (3.22), a straightforward computation yields

| (3.45) |

We compute and in Appendix B to obtain

| (3.46) | ||||

| (3.47) |

where and are given in (3.37) and (B.2), respectively. For , replacing with in (3.17) yields the strategies

| (3.48) | ||||

| (3.49) |

and replacing in (3.17) with in (3.17) yields the strategies

| (3.50) | ||||

| (3.51) |

The reader will recognize (3.50) as the time-weighted average strategy. We can thus view equation (3.51) as a first order correction to the time-weighted average strategy. The second term in (3.51) instructs the trader to adjust his trading speed in proportion to the product of the slope of the temporary impact function and the drift of the process . For instance, suppose that at time , and . In that case, the temporary price impact process is drifting downwards, and the price impact will decrease with . The second term in (3.51) instructs the trader to slow down liquidation because he expects a lower temporary impact in the near future. If and , then a trader following will speed up trading as he expects higher price impact soon. Of course, if is small relative to , then the contributions from this term are small. The third term instructs the trader to adjust his trading speed proportional to the product . Like the second term, the adjustments of the third term are weighted relative to the temporary price impact. But unlike the second term, the third term’s influence on the trading speed diminishes as time approaches the trading horizon. This is intuitive as permanent impact matters not to a trader who is soon to exit the market. We note that the third term in strategy (3.51) causes more dramatic deviations from the time-weighted strategy when the permanent price impact is large relative to the temporary price impact early in the trading period.

4 Numerical examples

In this section, we provide examples of simulated trading using the strategies we developed in Sections 3.2 and 3.3. In Example 4.1, we simulate a single trading day to illustrate the effects of the correction terms present in the first order limiting strategy . In Example 4.2, we simulate a large number of trading days to demonstrate the improvement over the Almgren-Chriss strategy our approximations give in the nonlimiting and limiting cases. Furthermore, we demonstrate an improvement of the first order strategies over the zeroth order strategies in the nonlimiting and limiting cases.

Throughout this section, we assume the price impact processes and are Cox-Ingersoll-Ross (Cox et al. (1985)) processes with the dynamics

| (4.1) | ||||||

| (4.2) |

where the constants and are all positive, and the Brownian motions and are correlated with parameter . Furthermore, we require that the coefficients and satisfy the Feller condition

| (4.3) |

so that and are strictly positive processes. Explicitly, we have

| (4.4) |

We also take

| (4.5) |

Note that because we require the Feller condition (4.3) to be satisfied we have and for all . Thus, both temporary and permanent price impact processes and remain strictly positive.

Example 4.1.

Let us suppose the trader demands complete liquidation by and is indifferent to holding inventory. In this case, the zeroth order strategy is equal to time-weighted average strategy (3.50) and thus does not depend on . Under the dynamics (4.4), the first order strategy is given by

| (4.6) |

The second and third terms in (4.6) are a time-dependent linear combination of the distance of the price impact processes from their respective long-run means relative to . The mean reversion parameters and control the aggressiveness of the adjustment. When the mean reversion parameters are large, we expect that deviations of and from their respective means and to be short lived. In this case, the strategy adjusts quickly to take advantage of these deviations.

When a trader is following the time-weighted average strategy, at each instant he sells a fraction of his inventory that is inversely proportional to the remaining time . As such for all in the trading period. In some instances, however, the strategy instructs the trader to purchase shares of This occurs in times of relatively large price impact. Although it may seem counter-intuitive for a trader who wishes to liquidate a position to buy shares, this strategy can increase the objective function if, for example, the trader buys shares of during a period of relatively high price impact, putting upward pressure on the midprice , then subsequently sells shares rapidly during a period of low price impact.

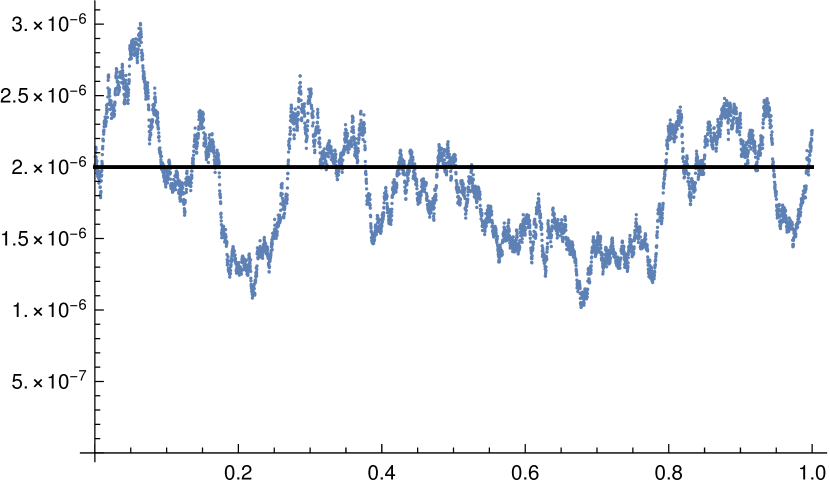

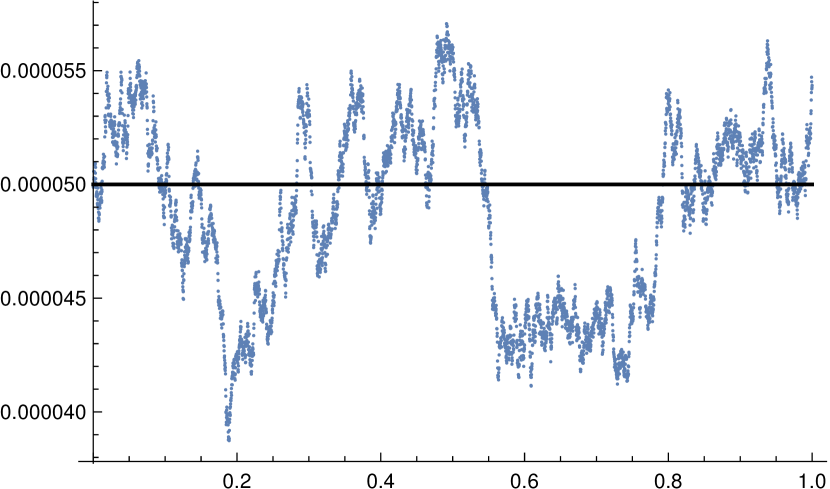

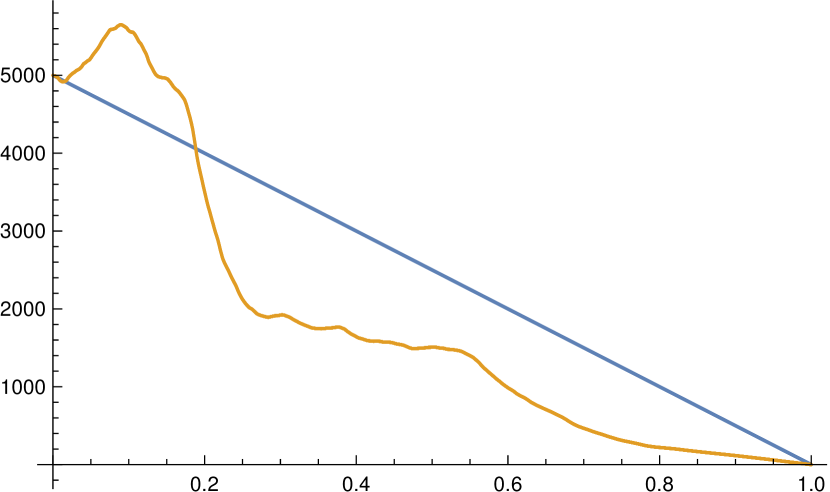

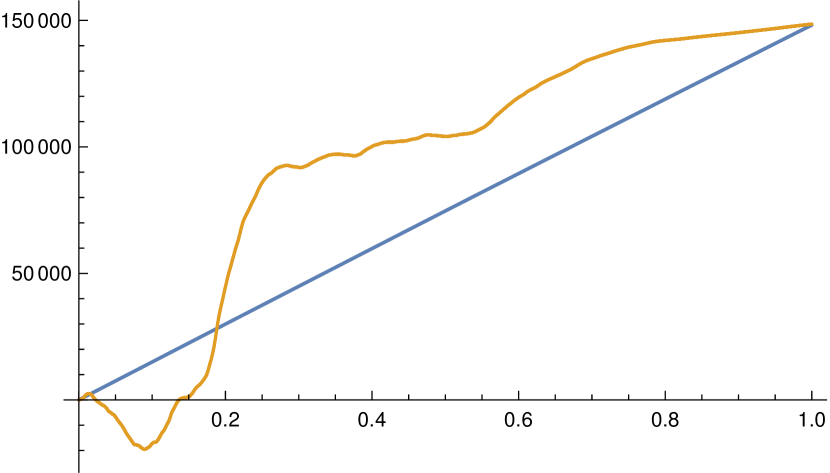

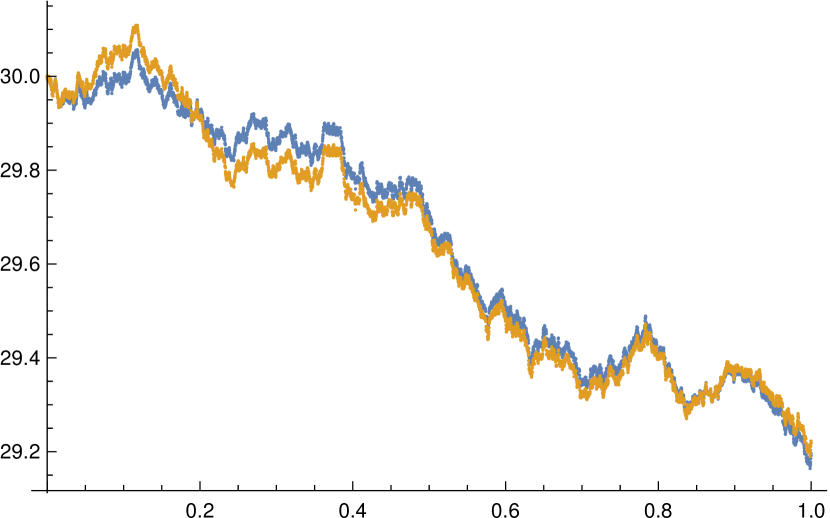

In Figure C, we provide a simulated path of and the paths that result from following strategies and using parameters

| (4.7) |

This simulation demonstrates how the first order strategy responds to the high and low price impact values encountered early in the trading period. The strategy instructs the trader to purchase shares of when price impact is relatively high early in the trading period. The price impact processes subsequently decrease below their long run means, and the trader following liquidates shares at rate in excess of the trading speed dictated by . In this example, is more profitable than .

While the the optimal strategy approximations we have developed in this paper suggest that, under certain market conditions, the trader should buy shares of the stock when the price impact is high, the authors of Bertsimas et al. (1999) note that in practice, if a trader wants to sell a block of securities then it is usually antithetical to their stance as a seller to purchase shares of the security during the trading period. In some cases, it is a violation of a manager’s fiduciary responsibility to their client and is hence illegal. As such, a liquidation strategy that can sometimes instruct a trader to buy could be modified to be . A truncated strategy may not be optimal with respect to the objective functional that we have defined, but in our numerical simulations the periods in which our approximate strategies instruct the trader to buy are short-lived.

Example 4.2.

In this example, we carry out a number of Monte Carlo simulations to evaluate the performance of the liquidation strategies as well as the limiting strategies and for . We demonstrate the relative improvement a trader gains by following over and the relative improvement a trader gains by following over . We repeat this experiment in the limiting case . We see from (3.50) that in the limiting case , both and are equal to the time-weighted average strategy (i.e. ). So, we demonstrate the relative performance increase a trader gains by following over .

To this end, let us define

| (4.8) | ||||||

| (4.9) | ||||||

For a fixed strategy , the random variables , and give the value a trader following achieves on a single path of . In both of the limiting cases and , the optimal strategies ensure liquidation by the terminal time . Therefore, the term that accounts for liquidation of the remaining shares at time does not appear in either or . Let us also define the sample mean of our Monte carlo simulations as follows

| (4.10) |

where is the value of obtained by the -th independent path of . Observe that is a statistical estimate of the performance criteria . The definitions for and , our statistical estimators for in the limiting cases and , are analogous.

In this example, we take the following parameters

| (4.11) |

We note that the processes and under the parameter choice (4.11) both satisfy the Feller condition (4.3). Furthermore, we choose the initial conditions

| (4.12) |

The price impact parameters in the Almgren-Chriss strategy are constant, and we take them to be . In total, we run sample paths.

In our Monte Carlo simulations, we obtain

| (4.13) |

in the nonlimiting case,

| (4.14) | ||||

| (4.15) |

in the limiting case , and

| (4.16) |

in the limiting case .

Equations (4.13), (4.14), (4.15) and (4.16) demonstrate that in the nonlimiting case and both limiting cases, the trader gains a relative value increase from following the zeroth order strategy approximation over the Almgren-Chriss strategy and from following the first order strategy approximation over the zeroth order strategy approximation.

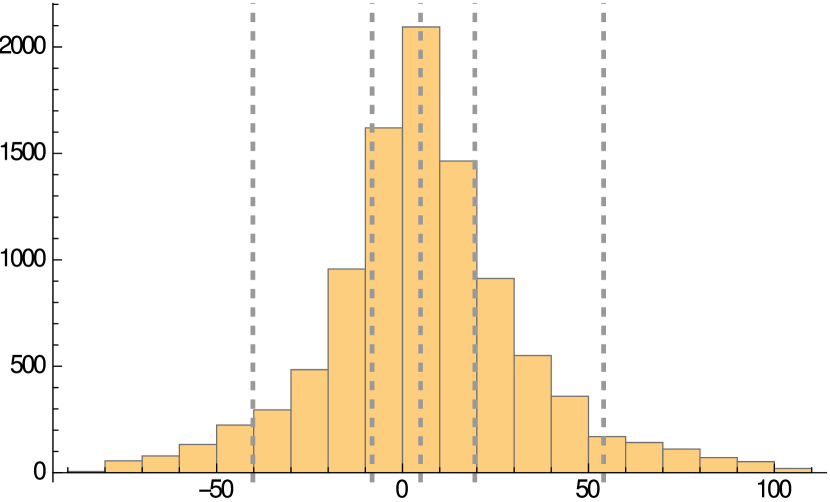

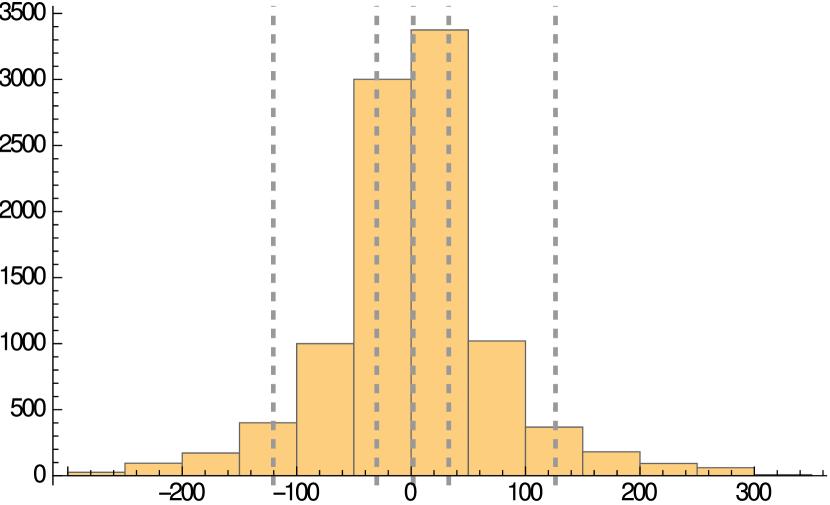

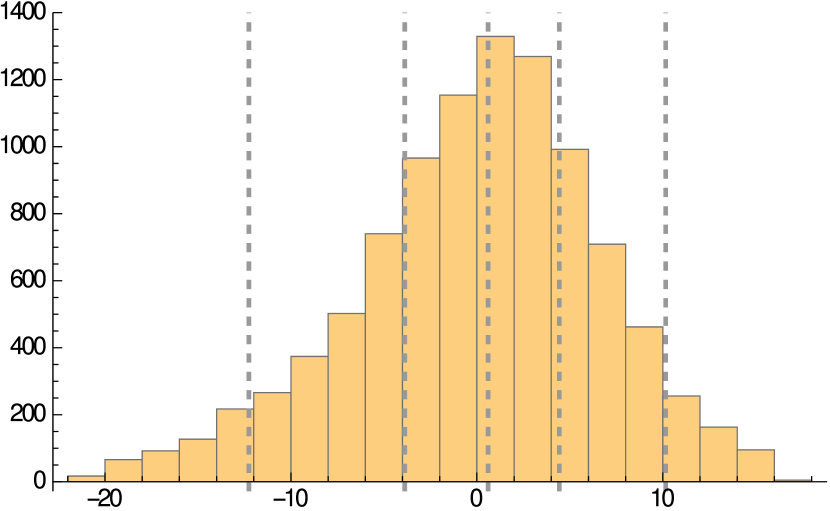

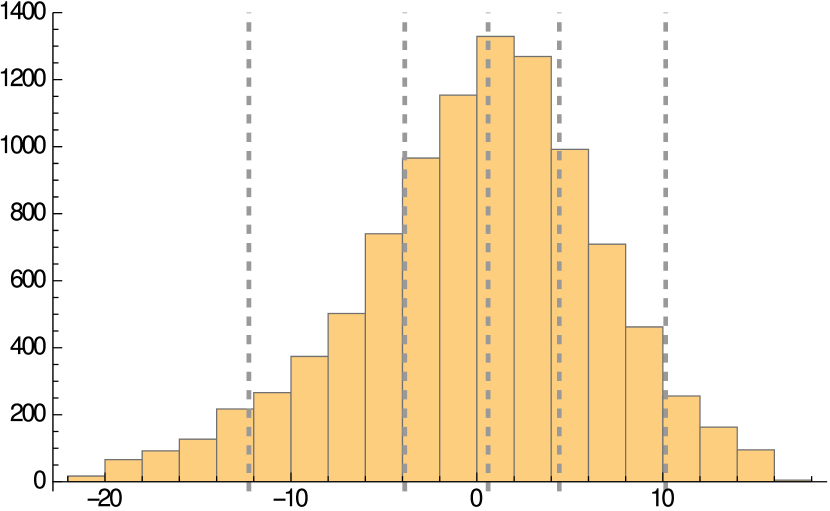

In Figures 2(a) and 2(b), we plot histograms of the relative performance

| (4.17) |

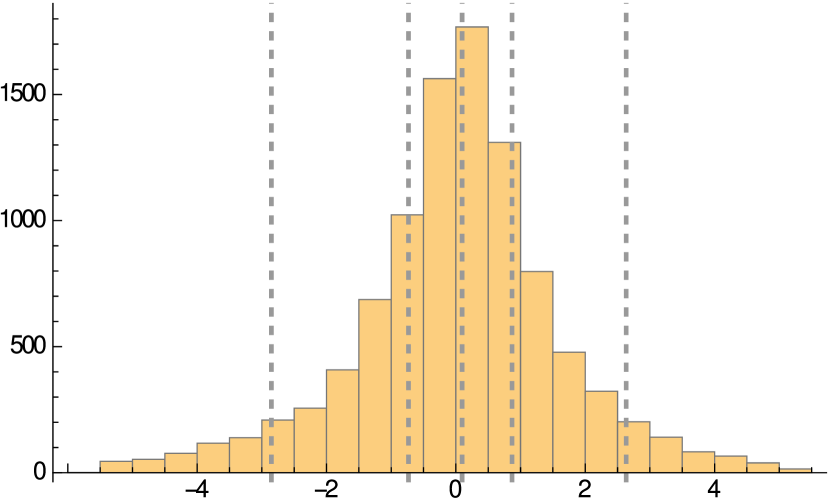

respectively, in Figures 3(a) and 3(b) we plot histograms of the relative performance

| (4.18a) | |||

| (4.18b) | |||

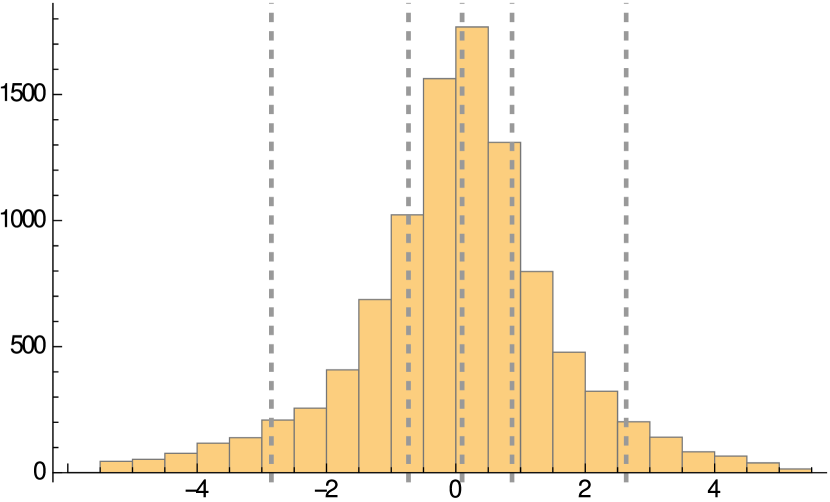

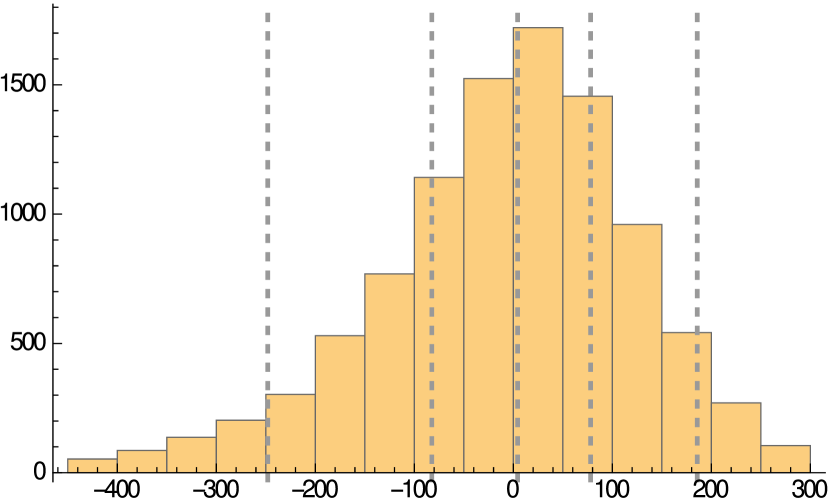

respectively, and in Figure 5, we plot a histogram of the relative performance

| (4.19) |

Figures 2(a) and 2(b) show that in addition to the expected value increases seen in (4.13), and more often than not. We see the same result in both the limiting cases and .

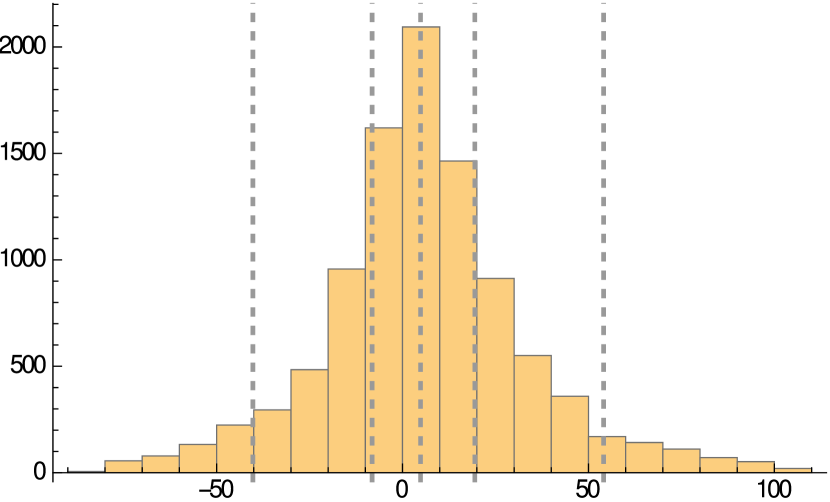

For the chosen parameters (4.11) and initial conditions (4.12), the relative improvement gained by following a first order strategy approximation is muted compared to the relative improvement of the zeroth order strategy over Almgren-Chriss. When , the price impact parameters typically hover around their respective long-run means, keeping the correction terms in , and small. Let us keep the parameter values (4.11) but modify the initial conditions as follows

| (4.20) |

We note that the difference between the initial conditions (4.12) and (4.20) are the values of and . With the initial conditions (4.20), the price impact processes and start above their long-run means and and will typically float downwards towards their respective means throughout the trading period. When the price impact parameters begin away from their long-run means, the correction terms present in the first order strategy approximations have a more pronounced influence on the trading strategy, and we see a larger relative improvement of the first order strategies over the zeroth order strategies.

We repeat the above experiments with the initial conditions (4.20) and obtain

| (4.21) | ||||||

| (4.22) | ||||||

The relative performance of the first order strategies increases by an order of magnitude when going from the initial conditions (4.12) to (4.20). In Figures 5, 7 and 7, we plot histograms of the relative performance (4.17) (right), (4.18) and (4.19), respectively, with the initial conditions (4.20). We see that in all three cases, the first order strategy out-performs the zeroth order strategy more often than not.

5 Conclusion

In this paper, we present a formal approximation to the optimal trading strategy for a trader facing the liquidation problem under a market model in which the price impact factors are stochastic. Our model supposes general diffusion dynamics of the price impact factors and and allows for the price impact processes and to be nonlinear functions of the diffusions and . The continuous-time Almgren-Chriss strategy is encapsulated in our model, and the zeroth order approximation to the optimal liquidation strategy is interpreted as the Almgren-Chriss strategy where the price impact parameters are continuously recalibrated. Higher-order strategy approximations take into account the geometry of the price impact processes diffusion coefficients, allowing a trader to adjust his trading strategy for times of relatively high and low price impact. We also demonstrate numerically that higher-order strategy approximations outperformed lower order approximations.

References

- Alfonsi et al. (2010) Alfonsi, A., A. Fruth, and A. Schied (2010). Optimal execution strategies in limit order books with general shape functions. Quantitative Finance 10(2), 143–157.

- Almgren (2012) Almgren, R. (2012). Optimal trading with stochastic liquidity and volatility. SIAM Journal on Financial Mathematics 3(1), 163–181.

- Almgren and Chriss (1999) Almgren, R. and N. Chriss (1999). Value under liquidation. Risk 12(12), 61–63.

- Almgren and Chriss (2001) Almgren, R. and N. Chriss (2001). Optimal execution of portfolio transactions. Journal of Risk 3, 5–40.

- Almgren (2003) Almgren, R. F. (2003). Optimal execution with nonlinear impact functions and trading-enhanced risk. Applied mathematical finance 10(1), 1–18.

- Bertsimas et al. (1999) Bertsimas, D., P. Hummel, and A. W. Lo (1999). Optimal control of execution costs for portfolios. Computing in Science & Engineering 1(6), 40–53.

- Bertsimas and Lo (1998) Bertsimas, D. and A. W. Lo (1998). Optimal control of execution costs. Journal of Financial Markets 1(1), 1–50.

- Cartea et al. (2014) Cartea, A., R. F. Donnelly, and S. Jaimungal (2014). Algorithmic trading with model uncertainty.

- Cartea and Jaimungal (2015) Cartea, Á. and S. Jaimungal (2015). Risk metrics and fine tuning of high-frequency trading strategies. Mathematical Finance 25(3), 576–611.

- Cartea and Jaimungal (2016) Cartea, Á. and S. Jaimungal (2016). Incorporating order-flow into optimal execution. Mathematics and Financial Economics 10(3), 339–364.

- Cartea et al. (2015) Cartea, Á., S. Jaimungal, and J. Penalva (2015). Algorithmic and high-frequency trading. Cambridge University Press.

- Cox et al. (1985) Cox, J. C., J. E. Ingersoll Jr, and S. A. Ross (1985). A theory of the term structure of interest rates. Econometrica: Journal of the Econometric Society, 385–407.

- Gatheral et al. (2012) Gatheral, J., A. Schied, and A. Slynko (2012). Transient linear price impact and fredholm integral equations. Mathematical Finance 22(3), 445–474.

- Huberman and Stanzl (2005) Huberman, G. and W. Stanzl (2005). Optimal liquidity trading. Review of Finance 9(2), 165–200.

- Kharroubi and Pham (2010) Kharroubi, I. and H. Pham (2010). Optimal portfolio liquidation with execution cost and risk. SIAM Journal on Financial Mathematics 1(1), 897–931.

- Lorig (2016) Lorig, M. (2016). Indifference prices and implied volatilities. Mathematical Finance, n/a–n/a.

- Lorig et al. (2015) Lorig, M., S. Pagliarani, and A. Pascucci (2015). Analytical expansions for parabolic equations. SIAM Journal on Applied Mathematics 75, 468–491.

- Lorig and Sircar (2016) Lorig, M. and R. Sircar (2016). Portfolio optimization under local-stochastic volatility: Coefficient taylor series approximations and implied sharpe ratio. SIAM Journal on Financial Mathematics 7(1), 418–447.

- Obizhaeva and Wang (2005) Obizhaeva, A. and J. Wang (2005, June). Optimal trading strategy and supply/demand dynamics. Working Paper 11444, National Bureau of Economic Research.

- Obizhaeva and Wang (2013) Obizhaeva, A. A. and J. Wang (2013). Optimal trading strategy and supply/demand dynamics. Journal of Financial Markets 16(1), 1–32.

- Pagliarani and Pascucci (2012) Pagliarani, S. and A. Pascucci (2012). Analytical approximation of the transition density in a local volatility model. Cent. Eur. J. Math. 10(1), 250–270.

- Pham (2009) Pham, H. (2009). Continuous-time stochastic control and optimization with financial applications, Volume 61. Springer Science & Business Media.

- Schied (2013) Schied, A. (2013). Robust strategies for optimal order execution in the almgren–chriss framework. Applied Mathematical Finance 20(3), 264–286.

Appendix A Proof of Corollary 3.10

[Proof]

By (3.31), we have

| (A.1) | ||||

| (A.2) |

Using (3.4), we see that

| (A.3) |

and

| (A.4) |

Additionally, by (3.32),

| (A.5) | ||||

| (A.6) |

where is given in (3.34). Recalling the expression (3.22) for and applying (A.3), (A.4), (A.5) and (A.6) to (A.2), we evaluate the integrals with respect and present in (A.2) to obtain

| (A.7) | ||||

| (A.8) |

We can rewrite the integrand of (A.8) as

| (A.9) | ||||

| (A.10) | ||||

| (A.11) |

where the are defined in (3.37). From (A.8) and (A.10), we see–with the arguments of suppressed–that

| (A.12) | ||||

| (A.13) |

where the are defined in (3.37). We have thus established (3.38).

Appendix B Computation of , and

In Corollary 3.10, we gave a representation of as an integral in time. We begin this section by computing the aforementioned integral, yielding an explicit formula for . Afterwards, we take the limits of that correspond to the limiting strategies discussed in Section 3.3 i.e. we compute and .

Appendix C Figures

Figure 1: Here we plot a single sample path of and the paths of that result from following (blue) and (orange) with dynamics (4.4) and parameters (4.7). In Figure 1(a), we plot the temporary price impact , and in Figure 1(b) we plot the permanent price impact . We plot the trader’s inventory in Figure 1(c) and the trader’s cash in Figure 1(d). In Figure 1(e), we plot the stock prices .