Power variations and testing for co-jumps: the small noise approach††thanks: This version: .

Abstract

In this paper we study the effects of noise on bipower variation (BPV), realized volatility (RV) and testing for co-jumps in high-frequency data under the small noise framework. We first establish asymptotic properties of BPV in this framework. In the presence of the small noise, RV is asymptotically biased and the additional asymptotic conditional variance term appears in its limit distribution. We also propose consistent estimator for the asymptotic conditional variances of RV. Second, we derive the asymptotic distribution of the test statistic proposed in Jacod and Todorov (2009) under the presence of small noise for testing the presence of co-jumps in a two dimensional Itô semimartingale. In contrast to the setting in Jacod and Todorov (2009), we show that the additional conditional asymptotic variance terms appear, and propose consistent estimator for the asymptotic conditional variances in order to make the test feasible. Simulation experiments show that our asymptotic results give reasonable approximations in the finite sample cases.

Key Words: High-Frequency Financial Data, Market Microstructure Noise, Small Noise Asymptotics, Bipower Variation, Realized Volatility, Co-jump test.

1 Introduction

Recently, a considerable interest has been paid on estimation and testing for underlying continuous time stochastic processes based on high-frequency financial data. In the analysis of high-frequency data, it is important to take into account the influence of market microstructure noise. The market microstructure noise captures a variety of frictions inherent in trading processes such as bid-ask bounce and discreteness of price changes (Aït-Sahalia and Yu, 2009). There are a large number of papers on the high-frequency data analysis in the presence of noise. For example, Zhang, Mykland and Aït-Sahalia (2005), Bandi and Russel (2006) and Bibinger and Reiss (2014) investigate the case when the log-price follows a diffusion process observed with an additive noise. They assume that the size of noise dose not depend on the observation frequency. To be precise, they assume that observed log-prices are of the form

| (1) |

where is the underlying -dimensional continuous time log-price process and are -dimensional i.i.d. random noise vectors of which each component has mean and constant variance independent of the process . Zhang, Mykland and Aït-Sahalia (2005) and Bandi and Russel (2006) study the one dimensional () case, and Bibinger and Reiss (2014) study the multi-dimensional case. Intuitively, the assumption of the constant noise variance means that the noise is dominant to the log-price when the observation frequency increases. In this paper, we instead assume that the effect of noise depends on the frequency of the observation, and the observed log-prices are of the form

| (2) |

where is a -dimensional nonstochastic sequence satisfying as for each . We call this assumption small noise. Under the small noise assumption, the noise is vanishing as the observation frequency increases. Hence the small noise assumption is interpreted as an intermediate assumption between the no noise assumption and the constant noise variance assumption. Related literature that considers small noise includes Gloter and Jacod (2001a,b), Barndorff-Nielsen, et al. (2008), Li, Xie and Zheng (2014), Li, Zhang and Li (2015) and among others. Hansen and Lunde (2006) give an empirical evidence that the market microstructure noise is small.

The first purpose of the paper is to investigate the effect of small noise on bipower variation (BPV) proposed in Barndorff-Nielsen and Shephard (2004, 2006) and the estimation of the integrated volatility. We establish the asymptotic properties of BPV when the latent process is a one dimensional Itô semimaringale. We also propose procedures to estimate integrated volatility using realized volatility (RV) and the asymptotic conditional variances which appear in the limit distribution of RV under the small noise assumption. In contrast to the no noise model, RV is asymptotically biased and an additional asymptotic conditional variance term appears in its limit distribution (see also Bandi and Russel (2006), Hansen and Lunde (2006), Li, Zhang and Li (2015), Kunitomo and Kurisu (2015) and amang others). In the recent related literature, Li, Zhang and Li (2015) proposed the unified approach for estimating the integrated volatility of a diffusion process when both small noise and asymptotically vanishing rounding error are present. In this paper, we only consider the additive noise but we assume that the log-price process is a -dimensional Itô semimartingale which includes a diffusion process as a special case.

The second purpose of this paper is to propose a procedure to test the existence of co-jumps in two log-prices when the small noise exists. Examining whether two asset prices have contemporaneous jumps (co-jumps) or not is one of the effective approaches toward distinguishing between systematic and idiosyncratic jumps of asset prices and also important in option pricing and risk management. From the empirical side, Gilder, Shackleton and Taylor (2014) investigate co-jumps and give a strong evidence for the presence of co-jumps. Bollerslev, Todorov and Li (2013) provide another empirical evidence for the dependence in the extreme tails of the distribution governing jumps of two stock prices. In spite of the importance of this problem, a testing procedure for co-jumps is not sufficiently studied. Jacod and Todorov (2009) is the seminal paper in this literature and other important contributions include Mancini and Gobbi (2012) and Bibinger and Winkelmann (2015). Mancini and Gobbi (2012) study the no noise model. Bibinger and Winkelmann (2015) is a recent important contribution to co-jump test for the model (1). Their co-jump test is based on the wild bootstrap-type approach and for testing the null hypothesis that observed two log-prices have no co-jumps. On the other hand, a grate variety of testing methods for detecting the presence of jumps in the one dimensional case have been developed. See, for example, Barndorff-Nielsen and Shephard (2006), Fan and Wang (2007), Jiang and Oomen (2008), Bollerslev, Law and Tauchen (2008), Jacod (2008), Mancini (2009), and Aït-Sahalia and Jacod (2009) for the no noise model, and Aït-Sahalia, Jacod and Li (2012) and Li (2013) for the model (1) with, conditionally on , mutually independent noise.

Our idea of estimating integrated volatility and the asymptotic conditional variance of RV is based on the SIML method developed in Kunitomo and Sato (2013) for correcting the bias of RV and the truncation method developed in Mancini (2009). For a construction of a co-jump test, we assume that the process in the model (2) is a two dimensional Itô semimartingale and investigate the asymptotic properties of the test statistic proposed in Jacod and Todorov (2009). We show that, because of the presence of the small noise, the asymptotic distribution of the test statistic is different from their result. In fact, the additional asymptotic conditional variance appears in its limit distribution. We develop a fully data-driven procedure to estimate the asymptotic variance of the test statistics based on similar technique used in the estimation of integrated volatility and the asymptotic variance of RV.

The numerical experiments show that our proposed method gives a good approximation of the limit distribution of RV and reasonable result for the estimation of integrated volatility. Our proposed testing procedure of co-jumps also improves the empirical size in the presence of noise compared with the test in Jacod and Todorov (2009).

This paper is organized as follows. In Section 2 we describe the theoretical settings of the underlying Itô semimartingale and market microstructure noise. In Section 3 we investigate the effects of noise on the asymptotic properties of BPV, and give some comments on the stable limit theorems of RV. We also propose an estimation method of the integrated volatility in the small noise framework. In Section 4 we study statistics related to the detection of co-jumps in the two dimensional setting when the noise satisfy the small noise assumption. Then we propose a testing procedure for the presence of co-jumps. In Section 5 we give estimation methods of asymptotic conditional variances which appear in the limit theorems of RV and co-jump test statistic studied in the previous sections. We report some simulation results in Section 6 and we give some concluding remarks in Section 7. Proofs are collected in Appendix A.

2 Setting

We consider a continuous-time financial market in a fixed terminal time . We set without loss of generality. The underlying log-price is a -dimensional Itô semimartingale. We observe the log-price process in high-frequency contaminated by the market microstructure noise.

Let

the first filtered probability space be

on which the -dimensional Itô semimartingale

is defined, and let the second filtered probability space be

on which the market microstructure noise terms are defined for the discrete time points .

Then

we consider the filtered probability space

where

and

for .

We consider the following model for the observed log-price at as

where are -dimensional i.i.d. random noise and noise coefficient is a sequence of -dimensional vector which depends on sample size and for each , . We assume that these terms satisfy Assumptions 2 and 3 described below. Moreover, let be an Itô semimartingale of the form

| (3) |

where is a -dimensional standard Brownian motion, is a -dimensional adapted process, is a -(instantaneous) predictable volatility process and we define the process . Furthermore, is a predictable function on , is a continuous truncation function with compact support and , is a Poisson random measure on and is a predictable compensator or intensity measure of . We partially follow the notation used in Jacod and Protter (2012). We assume that the observed times are such that . When (bivariate case), let

and for , define

We also make the following assumptions.

Assumption 1.

-

(a)

The path is locally bounded.

-

(b)

The process is continuous.

-

(c)

We have is locally bounded for a deterministic nonnegative function satisfying . for some .

-

(d)

For each , and , the path is locally bounded on the interval .

-

(e)

We have a.s. for all .

If does not have the last two terms of the right hand side of (2) (these are jump parts of ), then we say that is continuous. Otherwise, we say that is discontinuous. For the noise term, we assume the following conditions.

Assumption 2.

There exist some and , such that

Assumption 3.

is a sequence of i.i.d. -dimensional standard normal random variables.

When , Assumption 2 coincides with the small noise assumption in Kunitomo and Kurisu (2015). If the noise coefficient does not depend on the sampling scheme, that is, for each component there exist some positive constants such that in the model (2), then the effect of noise is asymptotically dominant. This case corresponds to the assumption that the variance of noise is constant. Assumption 2 means that the effect of noise depends on a sample number . Hence the effect of noise gets smaller if the observation frequency increases.

3 The Effects of Small Noise on BPV and RV

In this section, we assume that the process is one dimensional (), and give the asymptotic properties of BPV and give some remarks on the problem of an estimation of integrated volatility and the asymptotic conditional variance of RV under the presence of small noise.

3.1 Asymptotic Properties of BPV and RV

Bipower variation (BPV) and realized volatility (RV) are often used for estimating integrated volatility. We give some results on asymptotic properties of BPV and RV. Let and define the following statistics:

According to the above definition, is the realized volatility () and is the bipower variation (). First we give asymptotic properties of above statistics. The following result describes the effect of small noise.

Proposition 1.

Suppose Assumptions 1, 2 and 3 are satisfied. Let and be positive integers, then

In the following results, we freely use the stable convergence arguments and -conditionally Gaussianity, which have been developed and explained by Jacod (2008) and Jacod and Protter (2012), and use the notation as stable convergence in law. For the general reference on stable convergence, we also refer to Häusler and Luschgy (2015). The following proposition describes the case when the effect of noise does not matter asymptotic properties of BPV. The result follows immediately from Proposition 1.

Proposition 2.

Suppose Assumptions 1,2 and 3 are satisfied. Let be continuous, and and be positive integers such that is integral. If , then we have the following convergence in probability:

and if , then we have the following stable convergence in law:

where for and is -conditionally Gaussian with mean and -conditional variance .

From the remark of Theorem 2.5 in Barndorff-Nielsen et al. (2006), if is continuous, then

where has the same distribution as in Proposition 2 (replacing ). The latter part of Proposition 2 implies that if , we can replace as . In such a case we can use BPV as the consistent estimator of integrated volatility.

Next we consider the asymptotic properties of RV. When the underlying process is continuous, the is often used for estimating integrated volatility in the no noise case. In this case, to construct a confidence interval of integrated volatility or construct a jump test proposed in Barndorff-Nielsen and Shephard (2006) for example, we must consistently estimate the asymptotic conditional variance of the limit distribution of RV and jump test statistics. In place of BPV, multipower variation (MPV) is often used for estimating volatility functionals for which appear in the limit distribution of RV. When log-price is contaminated by small noise, by the similar argument in Proposition 1, it is possible to obtain the asymptotic property for the special case of MPV:

Therefore, when the asymptotic order of noise is sufficiently higher (), MPV is a consistent estimator of . In this case, we can use the same procedure as that of the no noise case.

If small nose satisfy the condition in Assumption 2, the effect of noise cannot be ignored. From the first part of Proposition 1, if and , then . Kunitomo and Kurisu (2015) proved that RV is asymptotically biased and derived the following two stable convergence results under Assumptions 1, 2 and 3 with in Assumption 2. If is continuous, then

| (4) | ||||

where for are -conditionally mutually independent Gaussian random variables with mean and -conditional variances , and .

If is the Itô semimartingale of the form (2), then

| (5) | ||||

where for are -conditionally mutually independent Gaussian random variables with mean and -conditional variances and .

To construct a feasible procedure to estimate RV, we need to estimate the noise parameter and the asymptotic conditional variance of its limit distribution. In Section 5, we construct estimators of the asymptotic conditional variances of RV.

3.2 Estimation of Integrated Volatility under Small Noise

In the model (1) with constant noise variance, it is well known that the variance of noise can be estimated by . However, under the small noise assumption, for example , this estimation does not work. In fact for the small noise case, regardless of the value of . Thus we must consider another procedure for estimating . The separated information maximum likelihood (SIML) method investigated in Kunitomo and Sato (2013) can be used to estimate . The SIML estimator is a consistent estimator of quadratic variation of the process under both models (1) and (2). Therefore, under Assumptions 1, 2 and 3, we have

| (6) |

where is the SIML estimator discussed in Section 5. From (4), (5) and (6), we obtain

| (7) |

We consider two types of the truncated version RV:

| TRVC |

where and . When have jumps, we can estimate the jump part of quadratic variation by TRVJ when Assumptions 1, 2 and 3 are satisfied:

| TRVJ |

Then, integrated volatility (IV) can be estimated consistently:

Proposition 3.

Suppose Assumptions 1, 2 and 3 are satisfied. Then

Proposition 3 implies that is robust to jumps and small noise. In particular, if in Assumption 2, then we can rewrite . Therefore, from the remark in Section 3.1 and (7), we can estimate integrated volatility by the bias correction of RV.

In this section we considered only one dimensional case, however, an extension to the multivariate case is straightforward for the estimation of the covolatility, where is the component of the volatility process defined in Section 2.

4 Co-jump test under small noise

One of the interesting problems in high-frequency financial econometrics is whether two asset prices have co-jumps or not. To the best of our knowledge, none of the existing literature has so far proposed a co-jump test in the small noise framework. In this section, we consider two dimensional case and propose a testing procedure to detect the existence of co-jumps for discretely observed processes contaminated by small noise. For this purpose, we study the asymptotic property of the following test statistic proposed in Jacod and Todorov (2009):

where , for , , and is the integer part of . To describe our result, we first decompose the sample space into three disjoint sets

We test the null hypothesis that observed two log-prices have co-jumps, that is, we are on against the alternative hypothesis that observed two log-prices have no co-jumps but each log-price have jumps, that is, we are on .

We first provide the asymptotic property of under the null hypothesis. For this purpose, we consider the asymptotic property of . Evaluating the discretization error of the process, in restriction to the set , for , we have

| (8) |

where

| (9) | ||||

| (10) |

Then it suffices to evaluate the three terms , and . We also have, in restriction to the set ,

and . Finally we obtain the joint stable convergence of these three terms:

where , for are -conditionally mutually independent Gaussian random variables with mean and the following variances:

and where

See the proof of Theorem 1 in Appendix A for details. Therefore, we obtain the following theorem which plays an important role in the construction of our co-jump test.

Theorem 1.

Suppose Assumptions 1, 2 and 3 are satisfied with in Assumption 2. Let and or . Then, in restriction to , we have

Now we propose a co-jump test for two-dimensional high-frequency data under the presence of small noise. From Theorem 1, we have under the null hypothesis. Since

we must have the asymptotic distribution of . Considering the decomposition of in (8), the asymptotic distribution can be derived from the joint limit distribution of , where , and . In restriction to the set , we have

See the proof of Theorem 2 in Appendix A for details. Hence we obtain the asymptotic property of the test statistics under the null hypothesis.

Theorem 2.

Suppose Assumptions 1, 2 and 3 are satisfied with in Assumption 2. Then under the null hypothesis , we have

where , and , for are -conditionally mutually independent Gaussian random variables appearing in Theorem 1.

We notice that in contrast to Theorem 4.1 in Jacod and Todorov (2009), additional asymptotic variance terms appear in the limit distribution of the test statistics that must be estimated for the construction of a co-jump test under the small noise assumption. If (no noise case), the result in Theorem 2 corresponds to their result. Hence, Theorem 2 includes their result as a special case. We propose methods to estimate the asymptotic variance of the test statistic in Section 5.

Next we consider the asymptotic property of the test statistic under the alternative hypothesis . In restriction to the set , because of the presence of small noise, we have

It is possible to obtain a joint limit theorem of , where and in restriction to the set . This yields

where is a random variable which is almost surely different from 1. The detailed description of and proof is given in Appendix A. Then we obtain the following proposition.

Proposition 4.

Suppose Assumptions 1, 2 and 3 are satisfied with in Assumption 2. Then the test statistic has asymptotic size under the null hypothesis and is consistent under the alternative hypothesis , that is,

where is the asymptotic conditional variance of the random variable given in Theorem 2, and are conditional probabilities with respect to the sets and , and be the -quantile of standard normal distribution.

Proposition 4 implies that if we have a consistent estimator of , then we can carry out the co-jump test. The procedures to estimate the asymptotic variance of test satistics are discussed in Section 5.

5 Consistent estimation of the asymptotic conditional variances

In this section, we first construct an estimator of the noise parameter . Then we propose estimation procedures of the asymptotic conditional variance of RV and the co-jump test statistics.

5.1 Estimation of the noise variances

The most important characteristic of the SIML is its simplicity compared with the pre-averaging method in Jacod et al. (2009) and the spectral method in Bibinger and Winkelmann (2015) for estimating the quadratic variation consistently, and have asymptotic robustness for the rounding-error (Kunitomo and Sato, 2010, 2011). It is also quite easy to deal with the multivariate high-frequency data in this approach as demonstrated in Kunitomo and Sato (2011).

Let be a matrix where is the th observation of the process and be matrix,

| (21) |

We consider the spectral decomposition of , that is,

where is a diagonal matrix with the th element

and

We transform to by

where . The SIML estimator of the quadratic variation is defined by

| (22) |

From the straightforward extension of Theorem 1 of Kunitomo and Sato (2013), we obtain

| (23) |

Proposition 5.

Suppose Assumptions 1, 2 and 3 with in Assumption 2 are satisfied. Then

where is the component of the SIML estimator.

The SIML estimator can be regarded as a modification of the standard maximum likelihood (ML) method under the Gaussian process and an extension for the multivariate case of the ML estimation of the univariate diffusion process with market microstrucure noise by Gloter and Jacod (2001b) (see Kunitomo and Sato (2013)). In stead of the SIML estimator, we can also use the quasi maximum likelihood estimator studied in Xiu (2010) for the noise robust estimation of quadratic variation.

5.2 Estimation of the asymptotic conditional variances of RV and the test statistic

We propose procedures to estimate the the asymptotic conditional variances of co-jump test statistics studied in Section 4, and RV when the process has continuous path or discontinuous path. We introduce some notations. For ,

To estimate the asymptotic conditional variance of the co-jump test statistic, we consider following statistics. For and ,

where , , as , and .

Although we can construct the consistent estimators of the asymptotic variances based on the truncated functionals (see also Mancini (2009) and Jacod and Todorov (2009)) for the no noise case, the truncation method gives us biased estimators since we now assume the presence of the small noise. In fact, since the size of noise gets smaller as the observation frequency increases, truncation is not sufficient to distinguish the continuous part of process with the noise. To be precise, from the similar argument of Theorem 9.3.2 in Jacod and Protter (2012), we have

where and is the th component of .

Since and for all , where is a Dirac’s delta function, it follows that

Therefore, we obtain

Then, for ,

is an estimator of the spot volatility . By the simple extension of Theorem 2 in Kunitomo and Kurisu (2015), it can be obtained that is an unbiased estimator of . Hence, for estimating the asymptotic conditional variance of RV, we consider following statistics:

Then we obtain the next result.

Proposition 6.

Suppose Assumptions 1, 2 and 3 are satisfied with in Assumption 2. Then, for and , we have

From Propositions 5 and 6, we can construct the consistent estimator of the asymptotic variance of co-jump test statistics

and for consistent estimators of the asymptotic variances of RV,

Therefore, we obtain the next two central limit theorems.

Corollary 1.

Suppose Assumptions 1, 2 and 3 are satisfied with in Assumption 2. Then we have the following convergence in law:

-

(i)

If is continuous, then

where .

- (ii)

Corollary 2.

Suppose Assumptions 1, 2 and 3 are satisfied with in Assumption 2. Then, under the null hypothesis , we have

6 Numerical Experiments

In this section, we report several results of numerical experiment. We simulate a data generating process according to the procedure in Cont and Tankov (2004). First we consider the estimation of integrated volatility. We used following data generating processes:

| (24) | ||||

| (25) |

where is a standard Brownian motion. is a compound Poisson process in where the intensity of the Poisson process is and the jump size is a uniform distribution on . is a -stable process with . We also set the truncate level as and . These values are also used in the simulation of the co-jump test. As a stochastic volatility model, we use

| (26) |

where , and . For the market microstructure noise, we have adopted the three types of Gaussian noise with and (we call these cases as (i), (ii) and (iii)). To estimate , we used SIML with in (22) and we also use this value in the following simulations. We also consider following cases:

CJ and SJ correspond to a finite activity jump case and an infinite activity jump case respectively. We present the root mean square errors (RMSE) for each case in Table 1. Compared with CJ, the RMSEs in SJ tends to be large. This is because of the difficulty in a finite sample case to distinguish infinite activity jumps and the other part of the observed process.

Next we check the performance of the proposed feasible CLT of RV. We use following data generating processes:

| (27) |

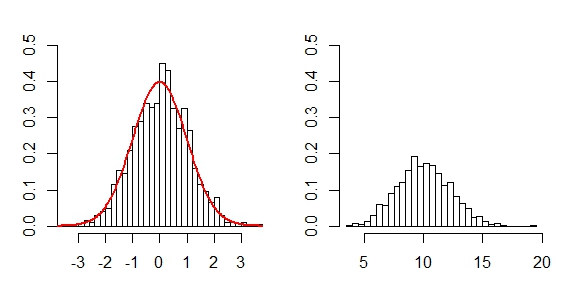

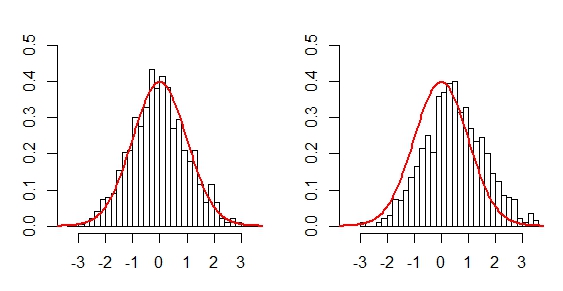

where the process (27) and are the same processes as (26) and (24). Figures 1 and 2 give the standardized empirical densities when the small noise is . The simulation size is and the number of the observations is . The red line is the density of standard normal distribution. The left figure corresponds to the bias-variance corrected case implied by the Corollary 1 and the right figure corresponds to the no correction case. We found that contamination of small noise still has the significant effect on the distribution of the limiting random variables when in the continuous case. We can see this in Figure 1. However we have a good approximation for the finite sample distribution of statistics if we correct the effect of noise by using the small noise asymptotics.

Finally we give simulation results of the co-jump test. We simulate a two dimensional Itô semimaritingale by the following model:

where is a two dimensional Brownian motion and for are Poisson processes with intensities which are mutually independent and also independent of . is the vector of jump sizes, cross-sectionally and serially independently distributed with laws . In this simulation, we set and , and jump size distributions are , . For the volatility process , we set

where and are independent and , , , , and . For the market microstructure noise, we use the four types of Gaussian noise for each component with mean and the same variance where , , and (we call these cases as I, II, III and IV). We consider the 5% significant level for following cases:

-

•

C1 : , co-jump.

-

•

C2 : , co-jump.

-

•

D1 : , no co-jump.

-

•

D2 : , no co-jump.

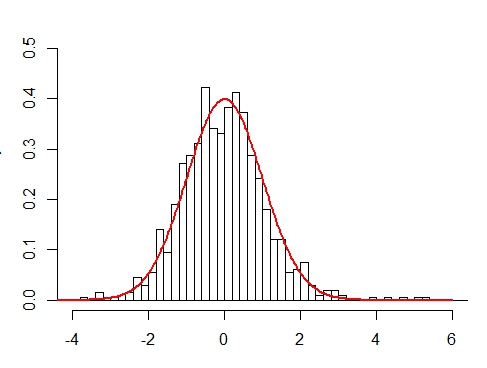

In Figure 4, we plot the empirical distribution obtained from Corollary 2 in the case C1-IV. It is interesting to see that our proposed testing procedure gives a good approximation of the limit distribution of test statistics even in large noise case (). In Table 2 we also give the empirical size and power of the proposed co-jump test and the test proposed in Jacod and Todorov (2009) (we call this JT test). We find that JT test is sensitive to the small noise. Theorem 2 implies that in the presence of small noise, the critical value of the test is larger than that of no noise case. Hence the critical value of JT test is small compared with that of the proposed test and the empirical size of JT test tends to be larger than the significant level. In particular, when the effect of noise is large (C1-III, C1-IV, C2-III and C2-IV), we can see the size distortion of the JT test. On the other hand, the empirical size of the proposed test is close to . This result shows that we need to correct the asymptotic variance of JT test in the presence of small noise. Additionally, the empirical power of our proposed test is very close to 1 in each case.

7 Concluding Remarks

In this paper, we developed the small noise asymptotic analysis when the size of the market microstructure noise depends on the frequency of the observation. By using this approach, we can identify the effects of jumps and noise in high-frequency data analysis. We investigated the asymptotic properties of BPV and RV in one dimensional case in the presence of small noise. We proposed methods to estimate integrated volatility and the asymptotic conditional variance of RV. As a result, feasible central limit theorems of RV is established under the small noise assumption when the latent process is an Itô semimartingale. Our method gives a good approximation of the limiting distributions of the sequence of random variables.

We also proposed a testing procedure of the presence of co-jumps when the two dimensional latent process is observed with small noise for testing the null hypothesis that the observed two latent processes have co-jumps. Our proposed co-jump test is an extension the co-jump test in Jacod and Todorov (2009) for the noisy observation setting. Estimators of the asymptotic conditional variance of the test statistics can be constructed in a simple way. We found that the empirical size of the proposed test works well in finite sample. In particular, proposed co-jump test has a good performance even when the effect of noise is large.

Appendix A Proofs

A.1 Proofs for Section 3

Throughout Appendix, denotes a generic constant which may change from line to line. We use the techniques developed in Jacod and Protter (2012). We can replace Assumption 1 to the local boundedness assumption below and such a replacement can be established by the localizing procedure provided in Jacod and Protter (2012).

Assumption 4.

We have Assumption 1 and there are a constant and a nonnegative function on for all such that

Under Assumption 4, we can obtain following inequalities for Itô semimartingale. First we consider the decomposition of ,

where

For all , , we obtain the following inequalities:

| (28) | ||||

| (29) | ||||

| (30) |

See Section 2.1.5 of Jacod and Protter (2012) for details of the derivation of these inequalities.

Proof of Proposition 1.

Proof of Proposition 2.

By Proposition 1,

Therefore, if , then converges in probability to . If , then from Theorem 2.3 of Barndorff-Nielsen et al. (2006), the first part of above decomposition converges in probability to , and the second part converges stably to defined in Proposition 2. Then we obtain the desired result. ∎

A.2 Proofs for Section 4

Proof of Theorem 1.

We decompose as follows:

| (31) |

where

and where , , and are defined in (9) and (10). For the proof of Theorem 1, we first prove the stable convergence of , and . Then we prove the joint convergence of these terms. Finally, we will prove that and in the decomposition of in (31) is asymptotically negligible.

Evaluation of By Theorem 3.3.1 and Proposition 15.3.2 in Jacod and Protter (2012), we have , and

Evaluation of and Let and be the mutually independent sequences of i.i.d. standard normal random variables defined on the second filtered probability space , and be the co-jump times of the first and second component of the process . We will prove the following result:

For the first step of the proof, we prove our result in a simple case when the process has at most finite jumps in the interval . Then we prove the general case when may have infinite jumps in the interval .

(Step1) : In this step, we introduce some notations. Let be the reordering of the double sequence . A random variable is the successive jump time of the Poisson process where . Let denote the set of all indices such that for some and some . For , we define following random variables:

We also set following stochastic processes:

Let denote the set of all such that each interval contains at most one jump of , and that for all and . Moreover, let

By the above notations, on the set , we have

| (32) |

(Step 2) : In this step, we will prove the stable convergence of and . A Taylor expansion of yields . By Proposition 4.4.10 in Jacod and Protter (2012), we have

| (33) |

The sequence for consists of correlated Gaussian random variables with mean and has the covariance structure

Using the inequalities (28), (29) and (30), if , then we have where . Therefore, the correlation between and when is asymptotically negligible. Since the set is finite, it follows that

| (34) |

where is the sequence of i.i.d. standard normal random variables introduced before (Step 1).

(Step 3) : We will prove the joint stable convergence of in this step. From a slight modification of the proof of Theorem 5.1.2 in Jacod and Protter (2012), it is possible to prove

| (35) |

| (36) |

Combining these with (32) and (34), and by Proposition 2.2.4 in Jacod and Protter (2012), we obtain . We also have in the same way. Since , and are -conditionally mutually independent by the definition of small noise, we obtain the joint convergence

Therefore, we also obtain .

Proof of Theorem 2.

We first prove a technical tool for the proof of Theorem 2. The result of Theorem 2 follows immediately from the following proposition.

Proposition 7.

Suppose Assumptions 1, 2 and 3 are satisfied with in Assumption 2. Let

Then, in restriction to the set , we have

Proof of Proposition 7.

By using the inequalities (28), (29) and (30), we have

where are definded in (9). We decompose into three leading terms:

Because of the independence of the noise and , the three terms , and are asymptotically mutually independent. Therefore, it suffices to evaluate each term. We can rewrite by using the estimation inequalities (28), (29) and (30),

By the application of Proposition 15.3.2 in Jacod and Protter (2012) to and the similar argument of the evaluation of in the proof of Theorem 1, we obtain that converge stably to . ∎

Finally, we prove the stable convergence of . From the definition of , we have

Then by Proposition 7, we obtain the desired result. ∎

Proof of Proposition 4.

Since the asymptotic size of the test statistic follows from Theorem 2, we prove the consistency of the test here. To describe the limit variable of under the alternative hypothesis , we introduce some notations. We use some notations in Jacod and Todorov (2009).

-

•

a sequence of uniform variables on .

-

•

a sequence of uniform variables on , that is, .

-

•

four sequences , , , of two-dimensional variables.

-

•

two sequences , of two-dimensional variables.

The variables introduced above are defined on . Then we define two dimensional variables:

We also define following variables:

By using (28), (29) and (30), in restriction to the set , we have

where is defined in (9). Moreover, from similar argument of the proof of Theorem 3.1 in Jacod and Todorov (2009), in restriction to the set , it is possible to have

Therefore, we obtain

Since admits a density conditionally on and on being in , a.s. on . ∎

A.3 Proofs for Section 5

Proof of Proposition 5.

For the consistency of the SIML, see the proof of Theorem 1 in Kunitomo and Sato (2013). ∎

Proof of Proposition 6.

We only give the proof of a consistency of and . The proofs of consistency of the other estimators are similar. Under the assumptions of Proposition 6, for any , , , we have

Then Therefore, we obtain

Moreover, for ,

where

Now we evaluate the last three terms in the above inequality. By Hölder’s inequality and the inequalities of Itô semimartingale, we have . Therefore,

From the similar argument, for , we have

Hence we have

Then Therefore, from Theorem 9.4.1 and Theorem 9.5.1 in Jacod and Protter (2012), we have

Therefore we obtain the desired results. ∎

Appendix B Figures and tables

| Case | CJ1-(i) | CJ1-(ii) | CJ1-(iii) | CJ2-(i) | CJ2-(ii) | CJ2-(iii) |

|---|---|---|---|---|---|---|

| RMSE | 2.137 | 2.192 | 2.349 | 1.701 | 1.735 | 1.878 |

| Case | SJ1-(i) | SJ1-(ii) | SJ1-(iii) | SJ2-(i) | SJ2-(ii) | SJ2-(iii) |

| RMSE | 11.45 | 11.47 | 11.40 | 9.501 | 9.496 | 9.470 |

| Case | C1-I | C1-II | C1-III | C1-IV | C2-I | C2-II | C2-III | C2-IV |

| Size | 0.068 | 0.064 | 0.065 | 0.071 | 0.058 | 0.053 | 0.052 | 0.046 |

| 0.082 | 0.078 | 0.139 | 0.253 | 0.069 | 0.070 | 0.128 | 0.237 | |

| Case | D1-I | D1-II | D1-III | D1-IV | D2-I | D2-II | D2-III | D2-IV |

| Power | 0.989 | 0.992 | 0.990 | 0.982 | 0.995 | 0.996 | 0.995 | 0.988 |

| 0.986 | 0.994 | 0.989 | 0.985 | 0.987 | 0.984 | 0.986 | 0.990 |

Acknowlegement

The author would like to thank Professor Naoto Kunitomo and Associate Professor Kengo Kato for their suggestions and encouragements, as well as Professor Yasuhiro Omori for his constructive comments.

References

- Aït-Sahalia and Jacod (2009) Aït-Sahalia, Y. and J. Jacod (2009), Testing for jumps in a discretely observed process. Ann. Statist. 37-1, 184-222.

- Aït-Sahalia, Jacod and Li (2012) Aït-Sahalia, Y., J. Jacod and J. Li (2012), Testing for jumps in noisy high-frequency data. J.Econometrics 168-2, 207-222.

- Aït-Sahalia and Yu (2009) Aït-Sahalia, Y. and J. Yu (2009), High-frequency market microstructure noise estimated and liquidity measures. Ann. Appl. Statist. 3-1, 422-457.

- Bandi and Russel (2006) Bandi, F. M. and J. R. Russel (2006), Separating microstructure noise from volatility. J. Financial Econometrics 79-3, 655-692.

- Barndorff-Nielsen et al. (2006) Barndorff-Nielsen, O. E., S. E. Graversen, J. Jacod, M. Podolskij and N. Shephard (2006), A central limit theorem for realised power and bipower variations of continuous semimartingales. in: From Stochastic Analysis to Mathematical Finance, Festschrift for Albert Shiryaev, Springer, 2006.

- Barndorff-Nielsen and Shephard (2004) Barndorff-Nielsen, O. E. and N. Shephard (2004), Power and bipower variation with stochastic volatility and jumps. J. Financial Econometrics 2-1, 1-48.

- Barndorff-Nielsen and Shephard (2006) Barndorff-Nielsen, O. E. and N. Shephard (2006), Economatrics of testing for jumps on financial econometrics using bipower variation. J. Econometrics 4-1, 1-30.

- Barndorff-Nielsen, et al. (2008) Barndorff-Nielsen, O. E., P. R. Hansen, A. Lunde and N. Shephard (2008), Designing realized kernels to measure the ex post variation of equity prices in the presence of noise. Econometrica, 76, 1481-1536.

- Bibinger and Reiss (2014) Bibinger, M. and M. Reiss (2014), Spectral estimation of covolatility from noisy observations using local weights. Scand. J. Statist. 41, 23-50.

- Bibinger and Winkelmann (2015) Bibinger, M. and L. Winkelmann (2015), Econometrics of co-jumps in high-frequency data with noise. J. Econometrics 184-2, 361-378.

- Bollerslev, Law and Tauchen (2008) Bollerslev, T., T. H. Law, G. Tauchen (2008), Risk, jumps, and diversification. J. Econometrics 144-1, 234-256.

- Bollerslev, Todorov and Li (2013) Bollerslev. T., V. Todorov and S. Z. Li (2013), Jump tails, extreme dependencies, and the distribution of stock returns. J. Econometrics 172-2, 307-324.

- Cont and Tankov (2004) Cont, R. and P. Tankov (2004), Financial Modeling with Jump Process, Chapman & Hall.

- Fan and Wang (2007) Fan, J. and Y. Wang (2007), Multi-scale jump and volatility analysis for high-frequency data. J. Amer. Statist. Assoc. 102-480, 1349-1362.

- Gilder, Shackleton and Taylor (2014) Glider, D., M. B. Shackleton and S. J. Taylor (2014), Cojumps in stock prices: Empirical evidence. J. Banking. Finance 40, 443-459.

- Gloter and Jacod (2001a,b) Gloter, A. and J. Jacod (2001a), Diffusions with measurement errors. I-Local asymptotic normality. ESAIM: Probability and Statistics 5, 225-242.

- Gloter and Jacod (2001b) Gloter, A. and J. Jacod (2001b), Diffusions with measurement errors. II-Optimal estimators. ESAIM: Probability and Statistics 5, 243-260.

- Hansen and Lunde (2006) Hansen, P. R. and A. Lunde (2006), Realized variance and market microstructure noise. J. Business. Econ. Statist. 24-2, 127-161.

- Häusler and Luschgy (2015) Häusler, E. and H. Luschgy (2015), Stable Convergence and Stable Limit Theorems. Springer.

- Jacod (2008) Jacod, J. (2008), Asymptotic properties of realized power variations and related functionals of semimartingales. Stochastic Process. Appl. 118-4, 517-559.

- Jacod et al. (2009) Jacod, J., Y. Li, P. A. Mykland, A. Podolskij and M. Vetter (2009), Microstructure noise in the continuous case: the preaveraging approach. Stochastic Process. Appl. 119-7, 2249-2276.

- Jacod and Protter (2012) Jacod, J. and P. Protter, (2012), Discretization of Processes, Springer.

- Jacod and Todorov (2009) Jacod, J. and V. Todorov (2009), Testing for common arrivals of jumps for discretely observed multidimensional processes. Ann. Statist. 37-4, 1792-1838.

- Jiang and Oomen (2008) Jiang, G. J. and R. C. A. Oomen (2008), Testing for jumps when asset prices are observed with noise-a ”swap variance” approach. J. Econometrics 144-2, 352-370.

- Kunitomo and Kurisu (2015) Kunitomo, N. and D. Kurisu (2015), On effects of jump and noise in high-frequency financial econometrics. Discussion Paper, CIRJE-F-996, University of Tokyo.

- Kunitomo and Sato (2010) Kunitomo, N. and S. Sato (2010), Robustness of the separating information maximum likelihood method estimation of realized volatility with micro-market noise. CIRJE Discussion Paper F-733, University of Tokyo.

- Kunitomo and Sato (2011) Kunitomo, N. and S. Sato (2011), The SIML estimation of realized volatility of Nikkei-225 futures and hedging coefficient with micro-market noise. Mathematics and Computers in Simulation, 81-7, 1272-1289.

- Kunitomo and Sato (2013) Kunitomo, N. and S. Sato (2013), Separating information maximum likelihood estimation of the integrated volatility and covariance with micro-market noise. The North Amer. J. Economics. Finance 26, 282-309.

- Li (2013) Li, J. (2013), Robust estimation and inference for jumps in noisy high-frequency data: A local-to-continuity theory for the pre-averaging method. Econometrica 81-4, 1673-1693.

- Li, Xie and Zheng (2014) Li, Y., S. Xie and X. Zheng (2014), Efficient estimation of integrated volatility incorporating trading information. working paper.

- Li, Zhang and Li (2015) Li, Y., Z. Zhang and Y. Li (2015), A unified approach to volatility estimation in the presence of both rounding and random market microstructure noise. working paper.

- Mancini (2009) Mancini, C. (2009), Non-parametric threshold estimation for models with stochastic diffusion coefficient and jumps. Scand. J. Statist. 36-2, 270-296.

- Mancini and Gobbi (2012) Mancini, C. and F. Gobbi (2012), Identifying the Brownian covariation from the co-jumps given discrete observations. Econometric Theory 28-2, 249-273.

- Xiu (2010) Xiu, D. (2010), Quasi-maximum likelihood estimation of volatility with high frequency data. J. Econometrics 159, 235-250.

- Zhang, Mykland and Aït-Sahalia (2005) Zhang, L., P. A. Mykland and Y. Aït-Sahalia (2005), A tale of two time series: determining integrated volatility with noisy high-frequency data. J. Amer. Statist. Assoc. 100-472, 1394-1411.