[1]thibaut.lux@mail.tu-berlin.de \eMail[2]papapan@math.tu-berlin.de

[t] We thank Peter Bank, Carole Bernard, Alfred Müller, Ludger Rüschendorf and Peter Tankov for useful discussions during the work on these topics.

Moreover, we are grateful to Paulo Yanez and three anonymmous referees for the detailed comments that have significantly improved this manuscript.

TL gratefully acknowledges the financial support from the DFG Research Training Group 1845 “Stochastic Analysis with Applications in Biology, Finance and Physics”.

In addition, both authors gratefully acknowledge the financial support from the PROCOPE project “Financial markets in transition: mathematical models and challenges”.

Improved Fréchet–Hoeffding bounds on -copulas and applications in model-free finance

Abstract

We derive upper and lower bounds on the expectation of under dependence uncertainty, i.e. when the marginal distributions of the random vector are known but their dependence structure is partially unknown. We solve the problem by providing improved Fréchet–Hoeffding bounds on the copula of that account for additional information. In particular, we derive bounds when the values of the copula are given on a compact subset of , the value of a functional of the copula is prescribed or different types of information are available on the lower dimensional marginals of the copula. We then show that, in contrast to the two-dimensional case, the bounds are quasi-copulas but fail to be copulas if . Thus, in order to translate the improved Fréchet–Hoeffding bounds into bounds on the expectation of , we develop an alternative representation of multivariate integrals with respect to copulas that admits also quasi-copulas as integrators. By means of this representation, we provide an integral characterization of orthant orders on the set of quasi-copulas which relates the improved Fréchet–Hoeffding bounds to bounds on the expectation of . Finally, we apply these results to compute model-free bounds on the prices of multi-asset options that take partial information on the dependence structure into account, such as correlations or market prices of other traded derivatives. The numerical results show that the additional information leads to a significant improvement of the option price bounds compared to the situation where only the marginal distributions are known.

Improved Fréchet–Hoeffding bounds, quasi-copulas, stochastic dominance for quasi-copulas, model-free option pricing.

1602.08894 \keyAMSClassification62H05, 60E15, 91G20.

1 Introduction

In recent years model uncertainty and uncertainty quantification have become ever more important topics in many areas of applied mathematics. Where traditionally the focus was on computing quantities of interest given a certain model, one today faces more frequently the challenge of estimating quantities in the absence of a fully specified model. In a probabilistic setting, one is interested in the expectation of , where is a function and is a random vector whose probability distribution is partially unknown. In this paper we consider the problem of finding upper and lower bounds on the expectation of when the marginal distributions of are known while the dependence structure of is partially unknown. This setting is referred to in the literature as dependence uncertainty. The problem has an extensive history and several approaches to its solution have been developed. In the two-dimensional case, Makarov [14] solved the problem for the quantile function of , while Rüschendorf [24] considered more general functions fulfilling some monotonicity requirements. Both focused on the situation of complete dependence uncertainty, i.e. when no information on the dependence structure of is available. Since then, solutions to this problem have evolved predominantly along the lines of optimal transportation, optimization theory and Fréchet–Hoeffding bounds.

In this paper we take the latter approach to solving the problem in dimensions and for functions satisfying certain monotonicity properties. Assuming that the marginal distributions of are known and applying Sklar’s Theorem, the problem can be reformulated as a minimization or maximization problem over the class of copulas that are compatible with the available information on . Using results from the theory of multivariate stochastic orders, bounds on the set of copulas can then be translated into bounds on the expectation of .

In the case of complete dependence uncertainty, that is, when only the marginals are known and no information on the joint behavior of the constituents of is available, the bounds on the set of copulas are given by the well-known Fréchet–Hoeffding bounds. They can however be improved in the presence of additional information on the copula. In case , Nelsen [17] derived improved Fréchet–Hoeffding bounds if the copula of is known at a single point. Similar improvements of the bivariate Fréchet–Hoeffding bounds were provided by Rachev and Rüschendorf [21] when the copula is known on an arbitrary set and by Nelsen et al. [18] for the case in which a measure of association such as Kendall’s or Spearman’s is prescribed. Tankov [28] recently generalized these results by improving the bivariate Fréchet–Hoeffding bounds if the copula is known on a compact set or the value of a monotonic functional of the copula is prescribed. Since the bounds are in general not copulas but quasi-copulas, Tankov also provided sufficient conditions under which the improved bounds are copulas.

In Sections 3 and 4 we establish improved Fréchet–Hoeffding bounds on the set of -dimensional copulas whose values are known on an arbitrary compact subset of . Moreover, we provide analogous improvements when the value of a functional of the copula is prescribed or different types of information are available on the lower-dimensional margins of the copula. We further show that the improved bounds are quasi-copulas but fail to be copulas under fairly general assumptions. This constitutes a significant difference between the high-dimensional and the bivariate case, in which Tankov [28] and Bernard et al. [1] showed that the improved bounds are copulas under quite relaxed conditions.

Since our improved Fréchet–Hoeffding bounds are merely quasi-copulas, results from stochastic order theory which translate bounds on the copula of into bounds on the expectation of do not apply. Even worse, the integrals with respect to quasi-copulas are not well-defined. Therefore, we derive in Section 5 an alternative representation of multivariate integrals with respect to copulas which admits also quasi-copulas as integrators, and establish integrability and continuity properties of this representation. Moreover, we provide an integral characterization of the lower and upper orthant order on the set of quasi-copulas, analogous to previous results on integral stochastic orders for copulas. These orders generalize the concept of first order stochastic dominance for multvariate distributions. Our results show that the representation of multivariate integrals is monotonic with respect to the upper or lower orthant order on the set of quasi-copulas for a large class of integrands. This enables us to compute bounds on the expectation of that account for the available information on the marginal distributions and the copula of .

Finally, we apply our results in order to compute bounds on the prices of European, path-independent options in the presence of dependence uncertainty. These bounds are typically called model-free or model-independent in the literature, since no probabilistic model is assumed for the marginals or the dependence structure. More specifically, we assume that models the terminal value of financial assets whose risk-free marginal distributions can be inferred from market prices of traded vanilla options on its constituents. Moreover, we suppose that additional information on the dependence structure of can be obtained from prices of traded derivatives on or a subset of its components. This could be, for instance, information about the pairwise correlations of the components or prices of traded multi-asset options. Then, the improved Fréchet–Hoeffding bounds and the integral characterization of orthant orders allow us to efficiently compute bounds on the set of arbitrage-free prices of that are compatible with the available information on the distribution of . The payoff function should satisfy certain monotonicity conditions that hold for a plethora of options, such as digitals and options on the mininum or maximum of several assets, however basket options are excluded. In addition, the obtained bounds are not sharp in general. However, the numerical results show that the improved Fréchet–Hoeffding bounds that take additional dependence information into account lead to a significant improvement of the option price bounds compared to the ones obtained from the ‘standard’ Fréchet–Hoeffding bounds.

2 Notation and preliminary results

In this section we introduce the notation and some basic results that will be used throughout this work. Let be an integer. In the sequel, denotes the unit interval , denotes the vector with all entries equal to one, i.e. , while boldface letters, e.g. , or , denote vectors in , or . Moreover, denotes the inclusion between sets and the proper inclusion, while we refer to functions as increasing when they are not decreasing.

The finite difference operator will be used frequently. It is defined for a function and with via

Definition.

A function is called -increasing if for all rectangular subsets it holds that

| (2.1) |

Analogously, a function is called -decreasing if is -increasing. Moreover, is called the -volume of .

Definition.

A function is a -quasi-copula if the following properties hold:

-

satisfies, for all , the boundary conditions

-

is increasing in each argument.

-

is Lipschitz continuous, i.e. for all

Moreover, is a -copula if

-

is -increasing.

We denote the set of all -quasi-copulas by and the set of all -copulas by . Obviously . In the sequel, we will simply refer to a -(quasi-)copula as (quasi-)copula if the dimension is clear from the context. Furthermore, we refer to elements in as proper quasi-copulas.

Let be a -copula and consider univariate probability distribution functions . Then , for all , defines a -dimensional distribution function with univariate margins . The converse also holds by Sklar’s Theorem, cf. Sklar [27]. That is, for each -dimensional distribution function with univariate marginals , there exists a copula such that for all . In this case, the copula is unique if the marginals are continuous. A simple and elegant proof of Sklar’s Theorem based on the distributional transform can be found in Rüschendorf [26]. Sklar’s Theorem establishes a fundamental link between copulas and multivariate distribution functions. Thus, given a random vector we will refer to its copula, i.e. the copula corresponding to the distribution function of this random vector.

Let be a copula. We define its survival function as follows:

The survival function is illustrated for below:

A well-known result states that if is a copula then the function , , is again a copula, namely the survival copula of ; see e.g. Georges et al. [10]. In contrast, if is a quasi-copula then is not a quasi-copula in general; see Example Example for a counterexample. We will refer to functions as quasi-survival functions when is a quasi-copula. Let us point out that for a distribution function of a random vector with marginals and a corresponding copula such that it holds that

| (2.2) |

Definition.

Let be -quasi-copulas. is larger than in the lower orthant order, denoted by , if for all . Analogously, is larger than in the upper orthant order, denoted by if for all . Moreover, the concordance order is defined via and , namely is larger than in concordance order if and .

Remark.

The lower and the upper orthant orders coincide when . Hence, they also coincide with the concordance order.

The well-known Fréchet–Hoeffding theorem establishes the minimal and maximal bounds on the set of copulas or quasi-copulas in the lower orthant order. In particular, for each or , it holds that

for all , i.e. , where and are the lower and upper Fréchet–Hoeffding bounds respectively. The upper bound is a copula for all , whereas the lower bound is a copula only if and a proper quasi-copula otherwise. A proof of this theorem can be found in Genest et al. [9].

A bound over a set of copulas, resp. quasi-copulas, is called sharp if it belongs again to this set. Thus, the upper Fréchet–Hoeffding bound is sharp for the set of copulas and quasi-copulas. Although the lower bound is not sharp for the set of copulas unless , it is (pointwise) best-possible for all in the following sense:

cf. Theorem 6 in Rüschendorf [25].

Since the properties of the Fréchet–Hoeffding bounds carry over to the set of survival copulas in a straightforward way, one obtains similarly for any bounds with respect to the upper orthant order as follows:

Example.

Consider the lower Fréchet–Hoeffding bound in dimension 3, i.e. . Then, is a quasi-copula, however is not a quasi-copula again. To this end, notice that quasi-copulas take values in , while

3 Improved Fréchet–Hoeffding bounds under partial information on the dependence structure

In this section we develop bounds on -copulas that improve the classical Fréchet–Hoeffding bounds by assuming that partial information on the dependence structure is available. This information can be the knowledge either of the copula on a subset of , or of a measure of association, or of some lower-dimensional marginals of the copula. Analogous improvements can be obtained for the set of survival copulas in the presence of additional information and the respective results are presented in Appendix A. The first result provides improved Fréchet–Hoeffding bounds assuming that the copula is known on a subset of . The corresponding bounds for have been provided by Rachev and Rüschendorf [21], Nelsen [17] and Tankov [28].

Theorem.

Let be a compact set and be a -quasi-copula. Consider the set

Then, for all , it holds that

| (3.1) | ||||

where the bounds and are provided by

| (3.2) | ||||

Furthermore, the bounds are -quasi-copulas, hence they are sharp.

Proof.

We start by considering a prescription at a single point, i.e. we let for , and show that and , provided by (3.2) for , satisfy (3.1) for all . In this case, analogous results were provided by Rodríguez-Lallena and Úbeda-Flores [22]. We present below a simpler, direct proof. Let be arbitrary and , , then it follows from the Lipschitz property of and the fact that is increasing in each coordinate that

Using the telescoping sum

we arrive at

which is equivalent to

The prescription yields further that , from which follows that

while incorporating the Fréchet–Hoeffding bounds yields

| (3.3) |

showing that the inequalities in (3.1) are valid for . Moreover, since it holds that

showing that the equalities in (3.1) are valid for .

Next, let be a compact set which is not a singleton and consider a . We know from the arguments above that for all , therefore

| (3.4) |

Analogously we get for the upper bound that

| (3.5) |

hence the inequalities in (3.1) are valid. Moreover, if then for all and using the Lipschitz property of quasi-copulas we obtain

Hence, using again that satisfies the Fréchet–Hoeffding bounds we arrive at

Finally, it remains to show that both bounds are -quasi-copulas.

-

In order to show that holds, first consider the case . Let with for one . Then is obviously zero, and because , i.e. for all . Moreover for with for all , the upper bound equals and since

it follows that , hence . Similarly, the lower bound amounts to which equals because . The boundary conditions hold analogously for containing more than one element due to the continuity of the maximum and minimum functions and relationships (3.4) and (3.5).

Remark.

The bounds in Theorem Theorem hold analogously for prescriptions on copulas, i.e. for all in where and are as above, it holds that for all . Let us point out that the set may possibly be empty, depending on the prescription. We will not investigate the requirements on the prescription for to be non-empty. A detailed discussion of this issue in the two-dimensional case can be found in Mardani-Fard et al. [15].

Next, we derive improved bounds on -quasi-copulas when values of real-valued functionals of the quasi-copulas are prescribed. Examples of such functionals are the multivariate generalizations of Spearman’s rho and Kendall’s tau given in Taylor [29]. Moreover, in the context of multi-asset option pricing, examples of such functionals are prices of spread or digital options. Analogous results for are provided by Nelsen [17] and Tankov [28].

Theorem.

Let be increasing with respect to the lower orthant order on and continuous with respect to the pointwise convergence of quasi-copulas. Define

for . Then the following bounds hold

and

and these are again quasi-copulas. Here

while the quasi-copulas and are given in Theorem Theorem for .

Proof.

We will show that the upper bound is valid, while the proof for the lower bound follows analogously. First, note that due to the continuity of w.r.t. the pointwise convergence of quasi-copulas and the compactness of , we get that the set is compact, hence

Next, let , then due to the construction of . Moreover it holds that since is increasing and continuous, therefore . Hence, we can conclude that whenever .

Now, let , then . Consider , for , then and . Since is continuous there exists an with . Since for all it follows that , while the reverse inequality holds due to the upper Fréchet–Hoeffding bound.

Finally, using Theorem 2.1 in Rodríguez-Lallena and Úbeda-Flores [22] we get immediately that the bounds are again quasi-copulas.

Remark.

Remark.

The bounds and do not belong to the set in general. A counterexample in dimension 2 is provided by combining Tankov [28, Theorem 2] with Nelsen et al. [18, Corollary 3(h)]. Indeed, from the first reference we get that

while the second one shows that neither of these bounds belongs to when , where stands for Kendall’s tau in this case.

In the next theorem we construct improved Fréchet–Hoeffding bounds assuming that information only on some lower-dimensional marginals of a quasi-copula is available. This result corresponds to the situation where one is interested in a high-dimensional random vector, however information on the dependence structure is only available for lower-dimensional vectors thereof. As an example, in mathematical finance one is interested in options on several assets, however information on the dependence structure—stemming e.g. from other liquid option prices—is typically available only on pairs of those assets.

Let us introduce a convenient subscript notation for the lower-dimensional marginals of a quasi-copula. Consider a subset and define the projection of a vector to the lower-dimensional space via . Moreover, define the lift of the vector to the higher-dimensional space by where if and if . Then, we can define the -margin of the -quasi-copula via with

Remark.

Theorem.

Let be subsets of with for and for , . Let be -quasi-copulas with for , and consider the set

where are the -margins of . Then is non-empty and the following bounds hold

Moreover , hence the bounds are sharp.

Proof.

Let and . We first show that the upper bound is valid. It follows directly from Remark Remark that

hence . Incorporating the upper Fréchet–Hoeffding bound yields . Moreover, and follow immediately since are quasi-copulas for , while is a composition of Lipschitz functions and hence Lipschitz itself, i.e. also holds. Thus is indeed a quasi-copula.

As for the lower bound, using once more the projection and lift operations and the Lipschitz property of quasi-copulas we have

Therefore,

| (3.6) |

and including the lower Fréchet–Hoeffding bound yields . In order to verify that is a quasi-copula, first consider with for at least one . Then ,

and

for all . Hence . In addition, for with , it follows that and

while clearly if , for all . Hence , showing that fulfills . is immediate, while noting that is a composition of Lipschitz functions and hence Lipschitz itself shows that the lower bound is also a -quasi-copula.

Finally, knowing that are quasi-copulas it remains to show that both bounds are in , i.e. we need to show that for all . For the upper bound it holds by definition that for . Moreover since it follows that , hence for and . By the same argument it holds for the lower bound that for , thus for , showing that holds indeed.

4 Are the improved Fréchet–Hoeffding bounds copulas?

An interesting question arising now is under what conditions the improved Fréchet–Hoeffding bounds are copulas and not merely quasi-copulas. This would allow us, for example, to translate those bounds on the copulas to bounds on the expectations with respect to the underlying random variables. Tankov [28] showed that if , then and are copulas under certain constraints on the set . In particular, if is increasing (also called comonotone), that is if then holds, then the lower bound is a copula. Conversely, if is decreasing (also called countermonotone), that is if then holds, then the upper bound is a copula. Bernard et al. [1] relaxed these constraints and provided minimal conditions on such that the bounds are copulas. The situation however is more complicated for . On the one hand, the notion of a decreasing set is not clear. On the other hand, the following counterexample shows that the condition of being an increasing set is not sufficient for to be a copula.

Example.

Let and be the independence copula, i.e. for . Then is clearly an increasing set, however is not a copula. To this end, it suffices to show that the -volume of some subset of is negative. Indeed, for after some straightforward calculations we get that

In the trivial case where and is a -copula, then both bounds from Theorem Theorem are copulas for since they equate to . Moreover, the upper bound is a copula for if it coincides with the upper Fréchet–Hoeffding bound. The next result shows that essentially only in these trivial situations are the bounds copulas for . Out of instructive reasons we first discuss the case , and defer the general result for to Appendix B.

Theorem.

Consider the compact subset of

| (4.1) |

for , and let be a -copula (or a -quasi-copula) such that

| (4.2) | |||

| (4.3) |

where . Then is a proper quasi-copula.

Proof.

Assume that is a -copula and choose such that

| (4.4) | |||

| (4.5) |

such a exists due to (4.2). In order to show that is not 3-increasing, and thus not a (proper) copula, it suffices to prove that . By the definition of we have

Analyzing the summands we see that:

-

•

because .

- •

-

•

Using the same argumentation, it follows that

while the expressions for the terms involving and are analogous.

-

•

Moreover, , which follows from (4.3).

Therefore, putting the pieces together and using (4.4) we get that

Hence is indeed a proper quasi-copula.

The following result shows that the requirements in Theorem Theorem are minimal, in the sense that if the prescription set is contained in a set of the form (4.1) then the lower bound is indeed a proper quasi-copula.

Corollary.

Let be a 3-copula and be compact. If there exists a compact set such that and satisfy the assumptions of Theorem Theorem, then is a proper quasi-copula.

Proof.

Since and fulfill the requirements of Theorem Theorem, it follows that is a proper quasi-copula. Now, in order to prove that is also a proper quasi-copula we will show that . Note first that is the pointwise lower bound of the set , i.e.

for all . Analogously, is the pointwise lower bound of . Using the properties of the bounds and the fact that , it follows that for all . Hence, , therefore it holds that for all . For the reverse inequality, note that for all it follows from the definition of that , hence such that for all . Therefore, and is indeed a proper quasi-copula.

The next example illustrates Corollary Corollary in the case where is a singleton.

Example.

Let , be the independence copula, i.e. , and . Then, the bound is a proper quasi-copula since its volume is negative, for example . However Theorem Theorem does not apply since is not of the form (4.1). Nevertheless, using Corollary Corollary, we can embed in a compact set such that and fulfill the conditions of Theorem Theorem. To this end let , then it follows

| and |

Hence, and fulfill conditions (4.2) and (4.3) of Theorem Theorem, thus it follows from Corollary Corollary that is a proper quasi-copula.

Remark.

5 Stochastic dominance for quasi-copulas

The aim of this section is to establish a link between the upper and lower orthant order on the set of quasi-copulas and expectations of the associated random variables. Let be an -valued random vector with joint distribution and marginals . Using Sklar’s theorem, there exists a -copula such that for all . Consider a function ; we are interested in the expectation , in particular in its monotonicity properties with respect to the lower and upper orthant order on the set of quasi-copulas. Assuming that the marginals are given, the expectation becomes a function of the copula and the expectation operator is defined via

| (5.1) |

This definition however no longer applies when is merely a quasi-copula since the integral in (5), and in particular the term , are no longer well defined. This is due to the fact that a quasi-copula does not necessarily induce a (signed) measure to integrate against. Therefore, we will establish a multivariate integration-by-parts formula which allows for an alternative representation of that is suitable for quasi-copulas. Similar representations were obtained by Rüschendorf [24] for -monotonic functions fulfilling certain boundary conditions, and by Tankov [28] for general -monotonic functions . In addition, we will establish properties of the function such that the extended map is monotonic with respect to the lower and upper orthant order on the set of quasi-copulas.

Rüschendorf [24] and Müller and Stoyan [16] showed that for being -antitonic, resp. -monotonic, the map is increasing with respect to the lower, resp. upper, orthant order on the set of copulas. -antitonic and -monotonic functions are defined as follows.

Definition.

A function is called -antitonic if for every subset with and every hypercube with for it holds that

Analogously, is called -monotonic if for every subset with and every hypercube with for it holds

Remark.

If is -monotonic then it also -increasing, while if is -monotonic then it is also -decreasing.

As a consequence of Theorem 3.3.15 in [16] we have that for with it follows that for all bounded -antitonic functions . Moreover if it follows that for all bounded -monotonic functions .

In order to formulate analogous results for the case when are quasi-copulas, let us recall that a function is called measure inducing if its volume induces a measure on the Borel -algebra of . Each (componentwise) right-continuous -monotonic or -antitonic function induces a signed measure on the Borel -Algebra of , which we denote by ; see Lemma 3.5 and Theorem 3.6 in Gaffke [8]. In particular, it holds that

| (5.2) |

for every hypercube .

Next, we define for a subset the -margin of via

and the associated -marginal measure by

Note that if then equals , while if then can be viewed as a marginal measure of . Now, we define iteratively

| (5.3) | |||||

where denotes the survival function of the -margin of . The following Proposition shows that is an alternative representation of the map , in the sense that for all copulas .

Proposition.

Let be measure inducing and be a -copula. Then

Proof.

Assume first that for all . An application of Fubini’s Theorem yields directly that

| (5.4) |

where the last equality follows from (2.2). Next, we drop the assumption and show that the general statement holds by induction over the dimension . By Proposition 2 in [28] we know that the statement is valid for . Now, assume it holds true for , then for we have that

Noting that is a sum of functions each with domain with , it follows

where we have applied equation (Proof) to to obtain the third equality, and used the induction hypothesis for the last equality as for each the domain of is with .

Proposition Proposition enables us to extend the notion of the expectation operator to quasi-copulas and establish monotonicity properties for the generalized mapping.

Definition.

Let be measure inducing. Then, the quasi-expectation operator for is defined via

Theorem.

Let , then it holds

| s.t. the integrals exist; | |||

| s.t. the integrals exist. |

Moreover, if are continuous then the converse statements are also true.

Proof.

We prove the statements assuming that the condition holds. The general case follows then by induction as in the proof of Proposition Proposition. Let be -antitonic and , then it follows

where for the last equality we used that is -antitonic, hence has alternating signs. A similar representation holds for , thus

since . Hence assertion (i) is true. Regarding (ii), we have directly that

where we used that is -monotonic, hence is a positive measure, as well as .

As for the converse statements, assume that are continuous. If holds for all -antitonic , then it holds in particular for functions of the form , for arbitrary . For such and any quasi-copula it holds that ; cf. Lux [13, Lemma 3.1.4]. Hence

while from the fact that holds for all choices of and the continuity of the marginals it follows that (i) holds. Assertion (ii) follows by an analogous argument. Note that if holds for all -monotonic , it holds in particular for functions of the form for arbitrary . For such and any quasi-copula , it holds that and so (ii) follows as above.

Remark.

Consider the setting of Theorem Theorem and assume that is -antitonic, resp. -monotonic. Then, the inequalities on the right hand side of () and () are reversed, i.e.

Remark.

Let us point out that the class of -antitonic functions is the maximal generator of the lower orthant order on the set of copulas, i.e. every such that

is -antitonic; see [16, Theorem 3.3.15]. Hence, statement (i) in the theorem above cannot be further weakened. Conversely, the set of -monotonic functions is the maximal generator of the upper orthant order, thus statement (ii) in the theorem can also not be further relaxed.

Finally, we provide an integrability condition for the extended map based on the marginals and the properties of the function . In particular, the finiteness of is independent of being a copula or a proper quasi-copula.

Proposition.

Let be right-continuous, -antitonic or -monotonic such that

| (5.5) |

Then the map is well-defined and continuous with respect to the pointwise convergence of quasi-copulas.

Proof.

First, we show that for the expectation is finite by induction over the dimension . By Proposition 2 in [28] we know that the statement is true for . Assume that the statement holds for , then for we have

| (5.6) |

where the second inequality follows from the definition of and . Now, note that for is a function with domain where , hence by the induction hypothesis and (5.5) we get that

for each , where . Hence

Finally, from (5.5) and (Proof) we obtain

Hence the assertion is true for . Now for the extended map, let be a proper quasi-copula and assume that is -antitonic. Then it follows from Theorem Theorem and the properties of the upper Fréchet–Hoeffding bound that , where the finiteness of follows from the fact that . By the same token, since all quasi-copulas are bounded from above by the upper Fréchet–Hoeffding bound and the integrals with respect to exist, the dominated convergence theorem yields that is continuous with respect to the pointwise convergence of quasi-copulas. The well-definedness of for -monotonic follows analogously.

6 Applications in model-free finance

A direct application of our results is the computation of bounds on the prices of multi-asset options assuming that the marginal distributions of the assets are fully known while the dependence structure between them is only partially known. This situation is referred to in the literature as dependence uncertainty and the resulting bounds as model-free bounds for the option prices. The literature on model-free bounds for multi-asset option prices focuses almost exclusively on basket options, see e.g. Hobson et al. [11, 12], d’Aspremont and El Ghaoui [5], Chen et al. [4] and Peña et al. [19], while Tankov [28] considers general payoff functions in a two-dimensional setting. See also Dhaene et al. [6, 7] for applications of model-free bounds in actuarial science.

We consider European-style options whose payoff depends on a positive random vector . The constituents of represent the values of the option’s underlyings at the time of maturity. In the absence of arbitrage opportunities, the existence of a risk-neutral probability measure for is guaranteed by the fundamental theorem of asset pricing. Then, the price of an option on equals the discounted expectation of its payoff under a risk-neutral probability measure. We assume that all information about the risk-neutral distribution of or its constituents comes from prices of traded derivatives on these assets, and that single-asset European call options with payoff for and for all strikes are liquidly traded in the market. Assuming zero interest rates, the prices of these options are given by . Using these prices, one can fully recover the risk neutral marginal distributions of as shown by Breeden and Litzenberger [2].

Let be the payoff of a European-style option on . Given the marginal risk-neutral distributions of , the price of becomes a function of the copula of and is provided by the expectation operator as defined in (5), i.e.

Assuming that the only available information about the risk-neutral distribution of is the marginal distributions, the set of all arbitrage-free prices for equals . Moreover, if additional information on the copula is available, one can narrow the set of arbitrage-free prices by formulating respective constraints on the copula. Let therefore represent any of the constrained sets of copulas from Section 3 or Appendix A, and define the set of arbitrage-free prices compatible with the respective constraints via . Since we have immediately that .

Theorem Theorem yields that if the payoff is -antitonic, then is monotonically increasing in with respect to the lower orthant order. Conversely if is -monotonic, then is monotonically increasing in with respect to the upper orthant order. In the following result, we exploit this fact to compute bounds on the sets and . Let us first define the dual of the operator on the set of survival functions, via .

Proposition.

Let be -antitonic and be a lower and an upper bound on the constrained set of copulas with respect to the lower orthant order. Then

for all , in case the respective integrals exist, while if . In this setting, if is -antitonic, then all inequalities in the above equation are reversed.

Moreover, if is -monotonic, is a constrained set of copulas and are a lower and an upper bound on with respect to the upper orthant order, then

for all , if the respective integrals exist, while holds if . In this setting, if is -monotonic, then all inequalities in the equation above are reversed.

Proof.

Let , then it holds that

and the result follows from Theorem Theorem(i) for a -antitonic function . Note that since the upper Fréchet–Hoeffding bound is again a copula. The second statement follows analogously from the properties of the improved Fréchet–Hoeffding bounds on survival functions, which are provided in Appendix A, and an application of Theorem Theorem(ii). The statements for being -antitonic or -monotonic follow using the same arguments combined with Remark Remark.

Remark.

Let us point out that is an upper bound on the set of prices even under weaker assumptions on the payoff function than -motonocity or -antitonicity. This is due to the fact that the upper Fréchet–Hoeffding bound is a copula, thus a sharp bound on the set of all copulas. Hobson et al. [11], for example, derived upper bounds on basket options and showed that these bounds are attained by a comonotonic random vector having copula . Moreover, Carlier [3] obtained bounds on for being monotonic of order 2 using an optimal transport approach. He further showed that these bounds are attained for a monotonic rearrangement of a random vector, which in turn leads to the upper Fréchet–Hoeffding bound.

Remark.

Let be any of the improved Fréchet–Hoeffding bounds from Section 3. Then, the inequality

| (6.1) |

does not hold in general. In particular, the sharp bound without additional dependence information might exceed the price bound obtained using . A sufficient condition for (6.1) to hold is the existence of a copula such that . This condition is however difficult to verify in practice. In many cases cannot be computed analytically, hence a direct comparison of the bounds is usually not possible. On the other hand, one can resort to computational approaches in order to check whether (6.1) is satisfied. A numerical method to compute for continuous payoff functions fulfilling a minor growth condition, based on the assignment problem, is presented in Preischl [20]. This approach thus lends itself to a direct comparison of the bounds.

Let us recall that by Proposition Proposition the computation of amounts to an integration with respect to the measure that is induced by the function . The following table provides some examples of measure inducing payoff functions along with explicit representations of the integrals with respect to . More specifically, for a -motononic or -antitonic function , the expression refers to the summands of for ; see again Definition Definition and (5). An important observation here is that the multi-dimensional integrals with respect to the copula reduce to one-dimensional integrals with respect to the induced measure, which makes the computation of option prices very fast and efficient.

| Payoff | -tonicity | |

|---|---|---|

| Digital put on maximum | antitonic | |

| Digital call on minimum | monotonic | |

| Call on minimum | monotonic | |

| Put on minimum | monotonic | |

| Call on maximum | antitonic | |

| Put on maximum | antitonic |

Remark (Differentiable payoffs).

Assume that the payoff function is differentiable, i.e. the partial derivatives of the function exist. Then, we obtain the following representation for the integral with respect to :

The formula holds, because from the definition of the volume we get that

for every -box in . Differentiable -antitonic functions occur in problems related to utility maximization; see, for example, the definition of Mixex utility functions in Tsetlin and Winkler [30].

Remark (Basket and spread options).

Although basket options on two underlyings are -monotonic, their higher-dimensional counterparts, i.e. for , are neither -monotonic nor -antitonic in general. However, from the monotonicity of bivariate basket options it follows that their expectation is monotonic with respect to the lower and upper orthant order on the set of 2-copulas. Therefore, prices of bivariate basket options provide information that can be accounted for by Theorems Theorem or Theorem. In particular, if then is -monotonic for , thus is increasing with respect to the lower and upper orthant order on . Analogously, if is a spread option, i.e. , then is increasing with respect to the lower and upper orthant order on . Thus, by means of Theorem Theorem one can translate market prices of basket or spread options into improved Fréchet–Hoeffding bounds for 2-copulas which may then serve as information to compute higher-dimensional bounds by means of Theorem Theorem.

An interesting question arising naturally is under what conditions the bounds in Proposition Proposition are sharp, in the sense that

| (6.2) |

and similarly for and . In Section 4 we showed that the improved Fréchet–Hoeffding bounds fail to be copulas, hence they are not sharp in general. However, by introducing rather strong conditions on the function , we can obtain the sharpness of the integral bounds in the sense of (6.2) when and are the improved Fréchet–Hoeffding bounds. In order to formulate such conditions we introduce the notion of an increasing -track as defined by Genest et al. [9].

Definition.

Let be continuous, univariate distribution functions on , such that and for . Then, is an (increasing) -track in .

The following result establishes sharpness of the option price bounds, under conditions which are admitedly rather strong for practical applications.

Proposition.

Let be a right-continuous, -monotonic function that satisfies . Assume that

for some -track . Moreover, consider the upper and lower bounds from Corollary Proposition. Then, if it follows that

Proof.

Since and are quasi-copulas and is a subset of a -track , it follows from the properties of a quasi-copula, see Rodriguez-Lallena and Ubeda-Flores [23], that there exist survival copulas and which coincide with and respectively on . Hence, it follows for the lower bound

where we used the fact that for the first equality and that for the second one. The third equality follows from and being equal on and thus also on .

In addition, using that is a copula that coincides with on and for , it follows that , hence by the -monotonicity of we get that . The proof for the upper bound can be obtained in the same way.

Finally, we are ready to apply our results in order to compute bounds on prices of multi-asset options when additional information on the dependence structure of is available. The following examples illustrate this approach for different payoff functions and different kinds of additional information.

Example.

Consider an option with payoff on three assets . We are interested in computing bounds on the price of assuming that partial information on the dependence structure of is available. In particular, we assume that the marginal distributions are implied by the market prices of European call options. Moreover, we assume that partial information on the dependence structure stems from market prices of liquidly traded digital options of the form for and . The prices of such options are immediately related to the copula of since

and analogously for , for some martingale measure .

Considering a set of strikes , one can recover the values of the copula of at several points. Let denote the market price of a digital option on with strike . These market prices imply then the following prescription on the copula of :

| (6.3) | |||

for . Therefore, the collection of strikes induces a prescription on the copula on a compact subset of of the form

The set of copulas that are compatible with this prescription is provided by

see again (Example). Hence, we can now employ Theorem Theorem in order to compute the improved Fréchet–Hoeffding bounds on the set as follows:

Observe that the minimum and maximum in the equations above are taken over the set , using simply a more convenient parametrization. Using these improved Fréchet–Hoeffding bounds, we can now apply Proposition Proposition and compute bounds on the price of an option with payoff depending on all three assets. That is, we can compute bounds on the set of arbitrage-free option prices which are compatible with the information stemming from pairwise digital options.

As an illustration of our results, we derive bounds on a digital option depending on all three assets, i.e. . In order to generate prices of pairwise digital options, we use the multivariate Black–Scholes model, therefore is multivariate log-normally distributed with where with

Let us point out that this model is used to generate ‘traded’ prices of pairwise digital options, but does not enter into the bounds. The bounds are derived solely on the basis of the ‘traded’ prices.

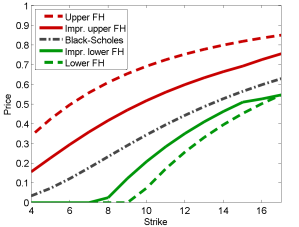

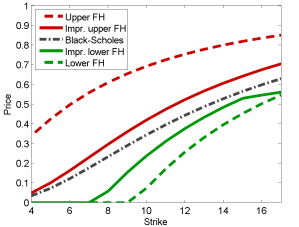

The following figures show the improved price bounds on the 3-asset digital option as a function of the strike as well as the price bounds using the ‘standard’ Fréchet–Hoeffding bounds, where we have fixed the initial values to . As a benchmark, we also include the prices in the Black–Scholes model. We consider two scenarios for the pairwise correlations: in the left plot and in the right plot , , .

Observe that the improved Fréchet–Hoeffding bounds that account for the additional information from market prices of pairwise digital options lead in both cases to a considerable improvement of the option price bounds compared to the ones obtained with the ‘standard’ Fréchet–Hoeffding bounds. The improvement seems to be particularly pronounced if there are negative and positive correlations among the constituents of ; see the right plot.

Example.

As a second example, we assume that digital options on of the form for only two strikes are observed in the market. Their market prices are denoted by , and immediately imply a prescription on the survival copula of as follows:

for . This is a prescription on two points, hence , and we can employ Proposition Proposition to compute the lower and upper bounds and on the set of copulas which are compatible with this prescription. We have that

Using these bounds, we can now apply Proposition Proposition and compute improved bounds on the set of arbitrage-free prices for a call option on the minimum of , whose payoff is . The set of prices for that are compatible with the market prices of given digital options is denoted by and, since is -monotonic, it holds that for all . The computation of reduces to

see Table 1, which is an integral over a subset of the 3-track

Hence, Lemma Proposition yields that the price bounds and are sharp, that is

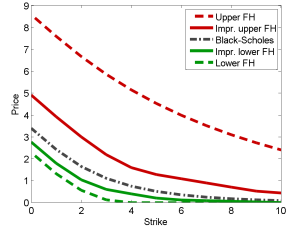

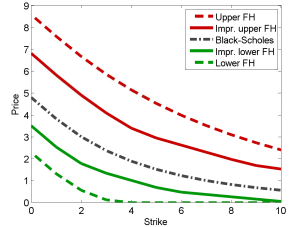

Analogously to the previous example we assume, for the sake of a numerical illustration, that follows the multivariate Black–Scholes model and the pairwise correlations are denoted by . The parameters of the model remain the same as in the previous example. We then use this model to generate prices of digital options that determine the prescription. Figure 2 depicts the bounds on the prices of a call on the minimum of stemming from the improved Fréchet–Hoeffding bounds as a function of the strike , as well as those from the ‘standard’ Fréchet–Hoeffding bounds. The price from the multivariate Black–Scholes model is also included as a benchmark. Again we consider two scenarios for the pairwise correlations: in the left plot and in the right one . We can observe once again, that the use of the additional information leads to a significant improvement of the bounds relative to the ‘standard’ situation, although in this example the additional information is just two prices.

7 Conclusion

This paper provides upper and lower bounds on the expectation of where is a function and is a random vector with known marginal distributions and partially unknown dependence structure. The partial information on the dependence structure can be incorporated via improved Fréchet–Hoeffding bounds that take this into account. These bounds are typically quasi-copulas, and not (proper) copulas. Therefore, we provide an alternative representation of multivariate integrals with respect to copulas that allows for quasi-copulas as integrators, and new integral characterizations of orthant orders on the set of quasi-copulas. As an application of these results, we derive model-free bounds on the prices of multi-asset options when partial information on the dependence structure between the assets is available. Numerical results demonstrate the improved performance of the price bounds that utilize the improved Fréchet–Hoeffding bounds on copulas.

Appendix A Improved Fréchet–Hoeffding bounds for survival copulas

In this section we establish improved Fréchet–Hoeffding bounds in the presence of additional information for survival copulas, analogous to those derived in Section 3 for copulas. The first Proposition establishes improved bounds if the survival copula is prescribed on a compact set.

Proposition.

Let be a compact set and be a quasi-survival function. Consider the set

Then, for all , it holds that

| (A.1) | ||||

where the bounds are provided by

with .

Proof.

Let . Since is a copula we know that is also a copula. Defining , the prescription holds for all by assumption. Thus by Theorem Theorem we obtain

which by a transformation of variables equals

The next result establishes improved bounds if the value of a functional which is increasing with respect to the upper orthant order is prescribed. The proof is analogous to the proof of Theorem Theorem and is therefore omitted.

Proposition.

Let denote the set of continuous functions on , be increasing with respect to the upper orthant order on and continuous with respect to the pointwise convergence of copulas. Define

Then for all it holds

where the bounds are provided by

and

where

while the quasi-copulas and are given in Proposition Proposition for .

Finally, the subsequent Proposition is a version of Theorem Theorem for survival copulas. Its proof is analogous to the proof of Theorem Theorem and is therefore also omitted. Recall the definitions of the projection and lift operations on a vector and the definition of the -margin of a copula. Moreover, recall that denotes the survival function of .

Proposition.

Let be subsets of with for and for , . Let be -quasi-copulas with for and consider the set

where is the -margin of . Then it holds for all

where

while are provided by Theorem Theorem.

Appendix B The improved Fréchet–Hoeffding bounds are not copulas: the general case

The following Theorem is a generalization of Theorem Theorem for .

Theorem.

Consider the compact subset of

| (B.1) |

for and . Moreover, let be a -copula (or a -quasi-copula) such that

| (B.2) | |||

| (B.3) |

where and , are defined by the lift operation. Then is a proper quasi-copula.

Proof.

A general version of Corollary Corollary also holds.

Corollary.

Let be a -copula and be compact. If there exists a compact set such that and satisfy the assumptions of Theorem Theorem, then is a proper quasi-copula.

The next result establishes similar conditions for the upper bound to be a proper-quasi copula.

Theorem.

Consider the compact subset of in (Theorem) for and . Let be a -copula (or -quasi-copula) such that

| (B.4) | |||

| (B.5) |

where and and are defined by the lift operation. Then is a proper quasi-copula.

Proof.

We show that the result holds for . The general case for follows as in the proof of Theorem Theorem. Let be a 3-copula and for some and , . Moreover, choose such that

| (B.6) | |||

| (B.7) |

such a exists due to (B.4). Now, in order to show that is not -increasing, and thus a proper quasi-copula, it suffices to prove that . By the definition of we have

Analyzing the summands we see that

- •

- •

-

•

Using similar argumentation it follows that , and .

-

•

In addition, because .

Therefore, putting the pieces together and using (B.6), we get

Thus is indeed a proper quasi-copula.

The following Corollary shows that the requirements in Theorem Theorem are minimal in the sense that if the prescription set is contained in a set of the form (Theorem) then the upper bound is a proper-quasi-copula. Its proof is analogous to the proof of Corollary Corollary and therefore omitted.

Corollary.

Let be a -copula and be compact. If there exists a compact set such that and satisfy the assumptions of Theorem Theorem, then is a proper quasi-copula.

References

- Bernard et al. [2012] C. Bernard, X. Jiang, and S. Vanduffel. A note on ‘Improved Fréchet bounds and model-free pricing of multi-asset options’ by Tankov (2011). J. Appl. Probab., 49:866–875, 2012.

- Breeden and Litzenberger [1978] D. Breeden and R. Litzenberger. Prices of state-contingent claims implicit in options prices. J. Business, 51:621–651, 1978.

- Carlier [2003] G. Carlier. On a class of multidimensional optimal transportation problems. J. Convex Anal, 10:517–529, 2003.

- Chen et al. [2008] X. Chen, G. Deelstra, J. Dhaene, and M. Vanmaele. Static super-replicating strategies for a class of exotic options. Insurance Math. Econom., 42:1067–1085, 2008.

- d’Aspremont and El Ghaoui [2006] A. d’Aspremont and L. El Ghaoui. Static arbitrage bounds on basket option prices. Math. Program., 106(3, Ser. A):467–489, 2006.

- Dhaene et al. [2002a] J. Dhaene, M. Denuit, M. J. Goovaerts, R. Kaas, and D. Vyncke. The concept of comonotonicity in actuarial science and finance: theory. Insurance Math. Econom., 31:3–33, 2002a.

- Dhaene et al. [2002b] J. Dhaene, M. Denuit, M. J. Goovaerts, R. Kaas, and D. Vyncke. The concept of comonotonicity in actuarial science and finance: applications. Insurance Math. Econom., 31:133–161, 2002b.

- [8] N. Gaffke. Maß- und Integrationstheorie. Lecture Notes, University of Magdeburg.

- Genest et al. [1999] C. Genest, J. J. Quesada-Molina, J. A. Rodriguez-Lallena, and C. Sempi. A characterization of quasi-copulas. J. Multivariate Anal., 69:193–205, 1999.

- Georges et al. [2001] P. Georges, A.-G. Lamy, E. Nicolas, G. Quibel, and T. Roncalli. Multivariate survival modelling: a unified approach with copulas. Preprint, ssrn:1032559, 2001.

- Hobson et al. [2005a] D. Hobson, P. Laurence, and T.-H. Wang. Static-arbitrage upper bounds for the prices of basket options. Quant. Finance, 5:329–342, 2005a.

- Hobson et al. [2005b] D. Hobson, P. Laurence, and T.-H. Wang. Static-arbitrage optimal subreplicating strategies for basket options. Insurance Math. Econom., 37:553–572, 2005b.

- Lux [2017] T. Lux. Model uncertainty, improved Fréchet–Hoeffding bounds and applications in mathematical finance. PhD thesis, TU Berlin, 2017.

- Makarov [1981] G. D. Makarov. Estimates for the distribution function of the sum of two random variables with given marginal distributions. Teor. Veroyatnost. i Primenen, 26:815–817, 1981.

- Mardani-Fard et al. [2010] H. A. Mardani-Fard, S. M. Sadooghi-Alvandi, and Z. Shishebor. Bounds on bivariate distribution functions with given margins and known values at several points. Comm. Statist. Theory Methods, 39:3596–3621, 2010.

- Müller and Stoyan [2002] A. Müller and D. Stoyan. Comparison Methods for Stochastic Models and Risks. Wiley, 2002.

- Nelsen [2006] R. B. Nelsen. An Introduction to Copulas. Springer, 2nd edition, 2006.

- Nelsen et al. [2001] R. B. Nelsen, J. J. Quesada-Molina, J. A. Rodriguez-Lallena, and M. Ubeda-Flores. Bounds on bivariate distribution functions with given margins and measures of associations. Comm. Stat. Theory Methods, 30:1155–1162, 2001.

- Peña et al. [2010] J. Peña, J. C. Vera, and L. F. Zuluaga. Static-arbitrage lower bounds on the prices of basket options via linear programming. Quant. Finance, 10:819–827, 2010.

- Preischl [2016] M. Preischl. Bounds on integrals with respect to multivariate copulas. Depend. Model., 4:277–287, 2016.

- Rachev and Rüschendorf [1994] S. T. Rachev and L. Rüschendorf. Solution of some transportation problems with relaxed or additional constraints. SIAM J. Control Optim., 32:673–689, 1994.

- Rodríguez-Lallena and Úbeda-Flores [2004] J. A. Rodríguez-Lallena and M. Úbeda-Flores. Best-possible bounds on sets of multivariate distribution functions. Comm. Statist. Theory Methods, 33:805–820, 2004.

- Rodriguez-Lallena and Ubeda-Flores [2009] J. A. Rodriguez-Lallena and M. Ubeda-Flores. Some new characterizations and properties of quasi-copulas. Fuzzy Sets and Systems, 160:717–725, 2009.

- Rüschendorf [1980] L. Rüschendorf. Inequalities for the expectation of -monotone functions. Z. Wahrsch. Verw. Gebiete, 54:341–349, 1980.

- Rüschendorf [1981] L. Rüschendorf. Sharpness of the Fréchet-bounds. Z. Wahrsch. Verw. Gebiete, 57:293–302, 1981.

- Rüschendorf [2009] L. Rüschendorf. On the distributional transform, Sklar’s theorem, and the empirical copula process. J. Statist. Plann. Inference, 139:3921–3927, 2009.

- Sklar [1959] M. Sklar. Fonctions de repartition a -dimensions et leurs marges. Publ. Inst. Statist. Univ. Paris, 8:229–231, 1959.

- Tankov [2011] P. Tankov. Improved Fréchet bounds and model-free pricing of multi-asset options. J. Appl. Probab., 48:389–403, 2011.

- Taylor [2007] M. D. Taylor. Multivariate measures of concordance. Ann. Inst. Stat. Math., 59:789–806, 2007.

- Tsetlin and Winkler [2009] I. Tsetlin and R. L. Winkler. Multiattribute utility satisfying a preference for combining good with bad. Manag. Sci., 55:1942–1952, 2009.