∎

22email: Dorje.Brody@brunel.ac.uk 33institutetext: Stala Hadjipetri 44institutetext: Department of Mathematics, Imperial College London, London SW7 2AZ, UK

44email: Stala.Hadjipetri08@imperial.ac.uk

Coherent Chaos Interest Rate Models

Abstract

The Wiener chaos approach to interest rate modelling arises from the observation that the pricing kernel admits a representation in terms of the conditional variance of a square-integrable random variable, which in turn admits a chaos expansion. When the expansion coefficients factorise into multiple copies of a single function, then the resulting interest rate model is called coherent, whereas a generic interest rate model will necessarily be incoherent. Coherent representations are nevertheless of fundamental importance because incoherent ones can always be expressed as a linear superposition of coherent elements. This property is exploited to derive general expressions for the pricing kernel and the associated bond price and short rate processes in the case of an th order chaos model for each . The pricing formulae for bond options and swaptions are obtained in closed forms for a number of examples. An explicit representation for the pricing kernel of a generic—incoherent—model is then obtained by use of the underlying coherent elements. Finally, finite-dimensional realisations of the coherent chaos models are investigated in detail. In particular, it is shown that a class of highly tractable models can be constructed having the characteristic feature that the discount bond price is given by a piecewise flat (simple) process.

Keywords:

Pricing kernel Conditional variance representation Wiener chaos expansion Fock space Coherent states1 Introduction

For more than three decades now, interest rate modelling has been developed notably, generating a wide range of approaches embodying different emphases (see, e.g., James & Webber 2000, Cairns 2004, Brigo & Mercuiro 2006, Filipovic 2009, Björk 2009, Carmona & Tehranchi 2010). One of the more recent approaches that has attracted some attention is based on the specification of the pricing kernel, from which interest rate dynamics are deduced. The main advantage of the pricing kernel methodology is that it allows a wide range of derivatives, across different asset classes, to be treated and priced in a consistent and transparent manner (cf. Cochrane 2005). An early example is Flesaker & Hughston (1996, 1997, 1998), who introduced an approach that incorporates interest rate positivity in a canonical way. Extensions of the positive interest approach include Rutkowski (1997) and Jin & Glasserman (2001). Also within the positive-interest context, Rogers (1997, 2004) developed a ‘potential approach’ for the modelling of the pricing kernel, based on the observation that the pricing kernel belongs to a certain class of probabilistic potentials.

The purpose of the present paper is to develop a new class of interest-rate models, called ‘coherent interest-rate models’, within the pricing kernel formalism. Coherent interest rate models emerge in the context of the Wiener-chaos expansion for the pricing kernel, originally introduced by Hughston & Rafailidis (2004) who made the observation that the class of potentials adequate for the characterisation of the pricing kernel admits a representation in terms of the conditional variance of a certain random variable, and proposed the use of the Wiener-Ito chaos expansion to model and calibrate the underlying random variable. The chaotic approach to interest-rate modelling was extended further in Brody & Hughston (2004), where the most general forms of positive-interest arbitrage-free term-structure dynamics, within the context of Brownian filtration, are obtained by exploiting calculus on function spaces. See also Grasselli & Hurd (2005) and Grasselli & Tsujimoto (2011) for further important contributions in the ‘chaotoc’ approach to interest rate modelling.

In the present paper, we shall extend the chaos-based models for the pricing kernel in two distinct ways: (a) by working out the general representations for the chaos models at each chaos order; and (b) by introducing finite-dimensional realisations of chaos models based on function spaces. With these objectives in mind, the paper is organised as follows. In sections 2–4 we shall briefly review the background material for the benefit of readers less acquainted with the material, so as to make the present paper reasonably self-contained. Specifically, in section 2 we give a brief description of the pricing kernel and its role in financial modelling, based on the axiomatic framework of Hughston & Rafailidis (2004). Section 3 summarises the argument leading to the conditional variance representation of Hughston & Rafailidis (2004) (see also Björk 2007) and the associated chaos expansion for calibration. In section 4 we explain the definition of the coherent chaos representation introduced in Brody & Hughston (2004), and its role in interest-rate modelling.

In section 5 we introduce the notion of an -order coherent chaos model, and derive the general representation for the pricing kernel, the short rate, the bond price, and the risk premium in this model. Explicit examples of derivative pricing formulae are then obtained in section 6 for coherent interest rate models. Specifically, bond option and swaption prices are obtained in closed form. Coherent chaos models are important because they form the building block for general interest rate models. Specifically, a generic interest rate model can be expressed in the form of a linear superposition of the underlying coherent components (in the sense explained in section 4), and thus are incoherent. By exploiting the linearity structure we are able to derive a generic expression in section 7 for the pricing kernel for -order incoherent chaos models.

In section 8 we shift the gear slightly by investigating finite-dimensional realisations of the coherent chaos models. We note that a chaos coefficient is given by an element of an infinite-dimensional Hilbert space of square-integrable functions. When this coefficient is replaced by the square-root of a finite number of Dirac delta functions, then the resulting system can in effect be treated in a finite-dimensional Hilbert space. The corresponding interest rate models are ‘simple’ in the sense that the pricing kernel and the bond price processes are given by piecewise step functions, where step sizes are sampled from nonlinear functions of independent Gaussian random variables. The idea of the finite-dimensional realisation example is that it can be used to fit a finite-number of initial bond prices, without relying on interpolation methods. Although the resulting models are rather elementary, we found them to be nevertheless of some interests. We conclude in section 9 with a brief discussion and further comments.

2 The pricing kernel approach to interest rate modelling

The pricing kernel approach to valuation and risk management provides perhaps the most direct route towards deriving various familiar results in financial modelling. It also provides an insight into understanding the relation between risk, risk aversion, and return arising from risky investments when asset prices can jump—an idea that is perhaps difficult to grasp from other approaches available (Brody et al. 2012). For these reasons here we shall adapt the pricing kernel approach to interest rate modelling. We shall begin in this section with a brief review of the idea of a pricing kernel. In particular, we find it convenient to follow the axiomatic approach introduced in Hughston & Rafailidis (2004).

The axioms listed below are neither minimum nor unique (see also Brody & Hughston 2004, Rogers 2004, Hughston & Mina 2012), however, we find that the approach taken in Hughston & Rafailidis (2004) leads to the desired representation of the pricing kernel needed for our purpose in the most expedient manner, and thus we shall take this as our starting point.

We proceed as follows. We model the economy with a fixed probability space , where the probability measure is the physical probability measure. We equip this space with the standard augmented filtration generated by a system of one or more independent Wiener processes , . We also assume that asset prices are continuous semimartingales on , which will enable us to utilise various standard results of stochastic calculus. With this setup in mind, Hughston & Rafailidis (2004) characterises the absence of arbitrage in the economy by assuming the existence of a pricing kernel, a strictly positive Ito process on , such that the following set of axioms hold:

-

(a)

There exists a strictly increasing absolutely continuous asset with price process that represents the money market account.

-

(b)

Given any asset with price process and with -adapted dividend rate process , the process defined by

(1) is a -martingale.

-

(c)

There exists an asset—a floating rate note—that offers a continuous dividend rate such that its value remains constant over time.

-

(d)

There exists a system of discount bonds with the transversal property that

(2)

From axiom (a), we deduce the existence of an -adapted short rate process such that for all and that

| (3) |

Since the money market account is an asset that pays no dividend, it follows from axiom (b) that the process defined by

| (4) |

is a martingale. Note that at most one process satisfying (a) and (b) can exist. Due to the fact that and , is also strictly positive for all . Therefore, is a positive martingale and we can write

| (5) |

for some -adapted vector-valued process . Here and in what follows, for simplicity of notation we shall write to denote the vector inner product . As a consequence of (3), (4), and (5), the dynamical equation satisfied by the pricing kernel takes the form

| (6) |

or equivalently we can write

| (7) |

Since the pricing kernel is a product of a martingale and a strictly decreasing process, it follows that is a supermartingale satisfying .

Consider now a system of default-free discount (zero coupon) bonds. We assume, in accordance with axiom (d), that the economy supports such a system of discount bonds over all time horizons. We write for the value at time of a default-free -maturity discount bond that pays one unit of currency at maturity . Since a discount bond pays no dividend, we deduce from axiom (b) that for each maturity the process is a martingale, which we shall denote by . It then follows from equation (4) that

| (8) |

Since is a parametric family of martingales, there exists a vector-valued family of processes such that we can write

| (9) |

Using Ito’s product and quotient rules, it follows from equations (3), (5), (8) and (9) that the dynamical equation satisfied by the discount-bond system is given by

| (10) |

which can alternatively be written in the form

| (11) |

We therefore recognise the process for a fixed as the -maturity discount bond volatility, while measures the excess rate of return above the short rate arising from risky investments per volatility.

As remarked above, the pricing kernel approach also provides an effective way for the valuation of a contingent claim. Thus, for example, if is the payout of a derivative at time , then on account of axiom (b) we find that the value of the derivative at time is given by

| (12) |

In particular, for a unit cash flow we obtain the bond pricing formula

| (13) |

If we now take the limit in (13), and make use of (2), we find that

| (14) |

This shows that the pricing kernel is a potential, i.e. a right-continuous positive supermartingale whose expectation value vanishes asymptotically as . More specifically, is a type-D potential (in the language of Meyer 1966). This observation led Rogers (1997) to introduce the so-called potential approach to interest rate modelling (see also Rogers 2004, Björk 2007).

The specification of therefore leads on the one hand to the bond price dynamics as well as the associated short rate process, while on the other hand to the pricing of general contingent claims. It is for these reasons that we prefer to model directly. One such approach, as indicated above, is to consider certain types of potentials for the basis of interest rate modelling; another approach, which we shall consider here, is to employ the Wiener chaos expansion technique to build interest rate models.

3 Conditional variance and Wiener chaos expansion

To proceed we shall follow the observation made in Hughston & Rafailidis (2004) that the pricing kernel can be expressed in the form of a conditional variance of an -measurable square-integrable random variable. The idea is as follows. We write (6) in the integral form

| (15) |

and take the -conditional expectation on each side of (15) to obtain

| (16) |

Now taking the limit we deduce the following implicit relation for the pricing kernel:

| (17) |

Note that since and are both -adapted, the vector valued process defined by the relation

| (18) |

is also -adapted. Evidently, the vector for each is unique only up to SO()-rotational degrees of freedom. For any given representative element of this equivalence class we define an -martingale according to the following prescription:

| (19) |

Then we have

| (20) |

from which, on account of the conditional Wiener-Ito isometry we deduce that

| (21) |

We shall refer to this identity as the conditional-variance representation for the pricing kernel.

The foregoing analysis shows that to model the pricing kernel, it suffices to model the random variable that is an element of the Hilbert space of square integrable random variables—more precisely, an element of the subspace of consisting of -measurable random variables. The proposal of Hughston & Rafailidis (2004) is to employ the Wiener chaos expansion to ‘parameterise’ the random variable , work out the pricing kernel , and use the result to obtain pricing formulae for various derivatives; which in turn allows one to calibrate the functional parameters in the chaos expansion. Specifically, the random variable admits a unique expansion of the form

| (22) |

where , is a square-integrable function of one variable, is a (symmetric) square-integrable function of two variables, and so on.

We remark incidentally that the idea of a chaos expansion was introduced by Wiener in his seminal paper titled “Homogeneous chaos” (Wiener 1938); whereas the representation (22) in terms of the stochastic integral is due to Ito (1951). We refer to Ikeda & Watanabe (1989), Nualart (1995), Janson (1997), Malliavin (1997), Øksendal (1997), and Di Nunno et al. (2009) for further discussion of the chaos expansion technique and its role in stochastic analysis.

For interest-rate modelling, therefore, we see that by substituting (22) in (21), the pricing kernel is parameterised by a vector of a set of deterministic quantities:

| (23) |

where is itself an element of a Fock space of the direct sum of the Hilbert spaces of square-integrable functions. The elements of are called the Wiener chaos coefficients, or Wiener-Ito chaos coefficients, and these coefficients fully characterise the information in . Since determines the pricing kernel , which in turn determines the bond price process , each interest rate model can be viewed as depending on the specification of its Wiener-Ito chaos coefficients.

4 Coherent chaos expansion

There is a special class of vectors in the Fock space called ‘coherent vectors’ that admit a number of desirable characteristics. Let us consider the tensor product of copies of Hilbert spaces. A generic element of may be written in the form ; whereas a coherent vector of is generated by a map from an element of to an element of . Specifically, given , we consider an element of of the degenerate form

| (24) |

The importance of coherent vectors is that the totality of such vectors in constitutes a resolution of the identity, i.e. these vectors are in general not orthogonal but nevertheless are complete. Therefore, an arbitrary element of can be expressed in the form of a linear combination of (possibly uncountably many) coherent vectors.

More generally, given an element we can generate a coherent Fock vector of the form

| (25) |

Then an arbitrary element of can likewise be expressed as a linear combination of coherent vectors. The significance of the completeness of coherent vectors for the chaos expansion, noted in Brody & Hughston (2004), is as follows. We observe first that if is coherent, then the associated random variable arising from the chaos expansion (22) takes the form

| (26) |

where the term is assumed to be unity. We now make use of the following identity due to Ito (1951):

| (27) |

where

| (28) |

and where

| (29) |

denotes the Hermite polynomials, satisfying the generating function relation

| (30) |

The role of Hermite polynomials in relation to Gaussian random variables is well known (see, e.g., Schoutens 2000). Here we merely remark the property that if and are standard normal random variables, then

| (31) |

which follows from the fact that Hermite polynomials are orthogonal with respect to the standard normal density function.

By comparing (27) and (30) we thus deduce that

| (32) |

On account of the completeness of the coherent vectors and linearity, therefore, it follows that an arbitrary -measurable square-integrable random variable admits a simple representation

| (33) |

where are constants satisfying , where for each is a deterministic square-integrable function, and where the summation in (33) is formal and may be replaced by an appropriate integration in the uncountable case. It should be evident that an analogous result holds more generally for an arbitrary -measurable square-integrable random variable—that is, any such random variable can be expressed in terms of a linear combination of log-normally distributed random variables. Putting the matter differently, log-normal random variables are dense in the space of square-integrable random variables. This remarkable fact was applied in Brody & Hughston (2004) to identify the general expressions for the pricing kernel and other quantities (such as the bond price, risk premium, and the various interest rates) in the Brownian-based setting, owing to the fact that the conditional variance of in (33) is easily calculated in closed form.

5 Coherent chaos interest-rate models

The point of departure in the present investigation is to examine more closely the -order chaos models for each . That is to say, we are concerned with interest-rate models that arise from the chaos expansion of the form

| (34) |

for each , where . As indicated above, any such function can be expressed as a linear combination of (possibly uncountable) coherent functions of the form . Our strategy therefore is to first work out the interest rate model arising from such a coherent element of , which we shall refer to as the -order coherent chaos model, and then consider their linear combinations for more general -order chaos models for the pricing kernel.

To proceed, we recall that from (27) it follows that for a coherent element we have

| (35) |

where we have written . Note that the argument appearing here in the Hermite polynomial is, for each , a standard normally distributed random variable; hence on account of (31) we find that the martingales are mutually orthogonal. This property will be exploited in a calculation below when we analyse the more general ‘incoherent’ models.

Let us now turn to the determination of the pricing kernel:

| (36) |

To analyse these expressions, we make use of the following product identity for a pair of Hermite polynomials of different order (see, e.g., Janson 1997, p.28):

| (41) |

where . Setting we obtain

| (46) |

Since, from (29), we have

| (47) |

it follows that by squaring of (35) and making use of (46), we deduce that

| (48) |

Taking the limit in (48) and substituting the result in (36) we obtain

| (49) |

where we have unit-normalised the function so that . This is the desired expression for the pricing kernel associated with -order coherent chaos models. We observe from (35) that in this case is given by a polynomial of order of the Gaussian process .

Having obtained the expression for the pricing kernel we are in the position to determine the representations for the various quantities of interest. To this end, let us first derive expressions for the short rate and risk premium processes in this model. Specifically, on account of (6) we observe that these processes are given by the drift and the volatility of the pricing kernel. A short calculation then shows that

| (50) |

and that

| (51) |

where we have made use of the relation

| (52) |

in obtaining (51).

As for the discount bonds, it follows from (13) that the bond price process takes the form of a ratio of polynomials of the Gaussian process :

| (53) |

with the initial term structure

| (54) |

This shows, in particular, that in the case of a single-factor setup, coherent chaos models are fully characterised by the initial term structure. Such a strong constraint, of course, is expected in the case of a single factor model for which the only model ‘parameter’ is a deterministic scalar function , and it is indeed natural that this functional degrees of freedom should be fixed unambiguously by the initial yield curve. On the other hand, the general cases are obtained merely by taking linear superpositions of the coherent chaos models in an appropriate manner. Before we examine these general cases, let us first work out a number of derivative-pricing formulae in the case of single-factor coherent chaos models.

6 Derivative pricing formulae in coherent chaos models

We recall expression (12) for the pricing of a generic derivative. The purpose of this section is to derive bond option and swaption pricing formulae in a number of example models. Specifically, we shall examine the pricing of bond options and swaptions for the second and third order coherent chaos models.

6.1 Bond option pricing for second-order coherent chaos models

In the case of a second-order coherent chaos model, it follows from (49) that the pricing kernel is given by the following quadratic function of a single Gaussian state variable :

| (55) |

The bond price process can then be written as the following fraction:

| (56) |

We shall make use of (55) and (56) to find the pricing formula for a European-style call option on the discount bond. In particular, we let be the option maturity on a bond that matures at , and be the option strike. Then bearing in mind that under the convention that we have chosen here, the initial price of the option is given by

| (57) | |||||

where is a standard normal random variable, and where

| (58) |

and

| (59) |

The problem of pricing the call option in this model thus reduces to finding the roots of a quadratic equation . Letting denote the roots:

| (60) |

we must consider different scenarios depending on the signatures of the coefficients and . We shall proceed to examine this case by case.

-

(i)

If then since , so the option is always in the money and we have

(61) which is just , as is evident from (57).

-

(ii)

If then . This follows from the fact that implies . Since , the bound on implies but since , we have . In this case, is always positive, so again the call option will always expire in the money. The price of such an option is thus

(62) which is just .

-

(iii)

If and , then the payoff is never positive, resulting in a worthless option whose value is zero.

-

(iv)

The only nontrivial case is when we have that and . Then the quadratic polynomial is positive over the interval , and we have

(63) where denotes the standard cumulative normal distribution function, and the associated density function. A short calculation also shows that the option delta that gives the position on the underlying bond required to hedge the option, in this case, is given by

(64)

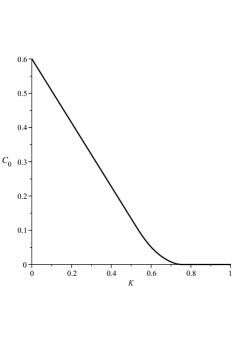

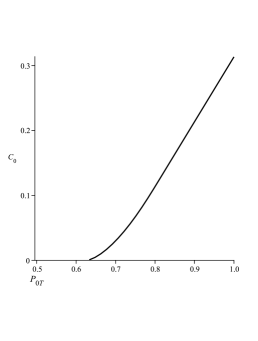

We see, therefore, that in a coherent chaos model of the second order, the pricing of options on discount bonds, as well as the determination of the associated hedge portfolio, are entirely tractable. As an illustrative example, let us consider the case in which we choose for some constant . As indicated above, in a coherent chaos model, this is all we need in order to calculate both initial bond prices and call prices. In Figure 1 on the left panel we show the relation between the call price and its strike. Here, the bond maturity is fixed at and the option maturity at , and we set . On the right-side of Figure 1 we show how the call price changes with respect to the bond values for different maturities. Here, the option maturity has been chosen to be , the bond maturities vary from 100 to zero, the strike has been fixed at , and we have set .

6.2 Pricing swaptions in second-order coherent chaos models

It turns out that swaptions can also be valued in closed form, in a manner analogous to the factorisable second-order chaos models of Hughston & Rafailidis (2004). In this case, the payout of the contract can be expressed as follows:

| (65) |

where , are specified future payment dates. The initial value of the swaption is then given by the expectation:

| (66) | |||||

where is defined as before. In the present case, however, we have

| (67) |

and

| (68) |

In other words, the valuation of a swaption proceeds exactly in the same manner as that of a call option, except that the coefficients defined as and are a little more complicated. Writing and for the roots of , we thus have the following:

-

(i)

When and , the swaption is evidently worthless.

-

(ii)

If and , then we have

(69) -

(iii)

If and so that , then we have

(70) -

(iv)

If and so that , then we have

(71)

6.3 Bond option pricing for third-order coherent chaos models

The pricing kernel for a third-order pure coherent chaos model can be expressed in the form

| (72) |

and consequently the bond price process is given by

| (73) |

The value at time zero of a European-style call option on a discount bond in this model is thus expressible as

| (74) | |||||

where we have defined

| (75) |

| (76) |

and

| (77) | |||||

The roots of the quartic polynomial can easily be obtained:

| (78) |

where . Thus, we have the following:

-

(i)

If then and . Since the option is always in the money and we have

(79) -

(ii)

If and then this implies that . For , we have that . It is necessary that , since there are four roots and the call option in this case is

(80) -

(iii)

If and but then the initial value of the call option is

(81) Performing the integration and noting that , we find that

(82) -

(iv)

If and then and the value of the option is zero.

-

(v)

If and then

(83) (84) -

(vi)

If and but then

(85) (86) -

(vii)

Finally, if and then

(87)

In summary, we observe that in general for a coherent chaos model of order the pricing kernel is just a polynomial of order in the single Gaussian process . It follows that for the valuation of an option or a swaption, the relevant calculation reduces to that of taking the expectation of the positive part of a polynomial of the same order in the standard normal random variable . In other words, the problem reduces to the identification of the roots of a polynomial of order . Since such an elementary root-finder can easily be carried out numerically, we therefore find that semi-analytic expressions for both option and swaption prices are always available in the case of an -order coherent chaos model.

7 Incoherent chaos models

We have examined the coherent chaos interest-rate models in some detail with the view to generalise them to more generic cases, which we might call incoherent chaos models. As indicated above, our key observation is that an arbitrary -measurable square-integrable random variable associated with an -order chaos expansion can be expressed as a linear combination of the ‘coherent’ log-normal random variables for different structure functions . Putting the matter differently, we have the representation

| (88) |

where for clarity we have written

| (89) |

for each for the coherent random variables. The pricing kernel associated with an arbitrary -order chaos model can thus be obtained by calculating:

| (90) |

The second term in the right side of (90) can easily be evaluated on account of the martingale relation . Calculating the first term on the right side of (90) is evidently a little more complicated. We proceed as follows. First, observe from (89) that the random variable can be written in the following recursive form:

| (91) |

It follows, by use of the conditional form of the Wiener-Ito isometry, that

| (92) | |||||

An application of the recursion relation (91) on together with another use of the conditional form of the Wiener-Ito isometry then shows that what remains in the conditional expectation on the right side of (92) is reduced to order . By iteration, we then find that

| (93) |

where for simplicity of notation we have written

| (94) |

with . Putting these together, we thus deduce the following expression:

| (95) | |||||

for the pricing kernel in the incoherent model.

Example 1: As an illustrative example, consider the case in which , and suppose that the chaos expansion involves the superposition of a pair of functions:

| (96) |

In this case, after some elementary calculation, we obtain the following expression for the pricing kernel:

| (97) | |||||

Here, we have written for the two Gaussian processes.

We see therefore that the pricing kernel in this case is a simple quadratic cross-polynomial of

the two Gaussian state variables and . Analogous results

naturally hold for higher and for a larger number of terms in the expansion.

Example 2: More generally, we may consider an ‘incoherent’ model that consists of a combination of coherent terms of different chaos orders. As an illustrative example, suppose that is given by a combination of the first order and an order coherent chaos element:

| (98) |

Taking the conditional variance and making use of (93), the associated pricing kernel takes the following form:

| (99) |

from which the corresponding term-structure dynamics can easily be derived.

8 Finite dimensional realisations of coherent chaos models

In this section we consider the case in which the Hilbert space of square-integrable functions is approximated by (or replaced with) a finite-dimensional Hilbert space. To facilitate the calculation, we make use of the Dirac delta function so that the function is given by the square root of a weighted sum of a finite number of delta functions. The idea of finite-dimensional realisations is to generate a set of models that can be calibrated purely in terms of a finite number of available market data, without evoking the assumption of hypothetical initial bond prices across all maturities that do not exist.

To proceed, we recall first that we have made the normalisation convention such that

| (100) |

Hence, can be interpreted as defining a probability density function, except that now in effect in a finite-dimensional space. More precisely, and strictly speaking, we continue to work in the infinite-dimensional Hilbert space, but by facilitating a finite number of distributions rather than functions, the analysis in effect reduces to that based on a finite-dimensional Hilbert space. We therefore choose to take the following form:

| (101) |

where denotes the standard Dirac delta function, and the represent different maturity dates of bonds for which prices are available in the market; indicates how many of these there are. The coefficients are probability weights so that and that . For this choice of the integral then takes the following form of a piecewise step function:

| (102) |

We remark that in (101) and (102) we have introduced an arbitrary such that the bond price is assumed to become zero at this point. Note that is not an expiry date, but rather an arbitrary time that is beyond the maturity date of the bond in the market with the longest lifetime. The choice of will not affect the valuation of contracts whose maturities are ; thus the analysis below will not be affected by the arbitrariness of the choice of . The reason for introducing is merely to fulfil the asymptotic condition (2) of axiom (d) in the finite-dimensional setup. Conversely, had we not introduced , the discussion below would not be affected.

Let us now consider the -order coherent chaos model associated with the positive square-root of (101). A short calculation using expression (102) in the result (54) for shows that the corresponding initial bond prices with maturity admit the following representation:

| (103) |

To illustrate the initial term structure in the present model we sketch in Figure 2 an example of the initial bond prices as a function of the maturity time for . Three maturities have been used here: , and the ‘artificially’ chosen . According to (103) the initial value of a bond expiring at time (where the first jump occurs) is , the price at time is , and so on. Hence in the pure second-order coherent chaos model with only two data points specified, we have the values , , and .

Since it is assumed that the maturities are the points where we have market data for the bond prices, we see that the probability weights can be calibrated from the initial market prices of the discount bonds. This in turn determines the function , which in turn determines the subsequent dynamics for the term structure. Let us proceed to analyse the term structure dynamics in the finite-dimensional models. To begin, recall that , so in order to determine the Gaussian process whose probabilistic characteristics are identical to that of , where is of the form (101), let us consider a family of independent Gaussian random variables

| (104) |

Then we can represent the Gaussian process according to

| (105) |

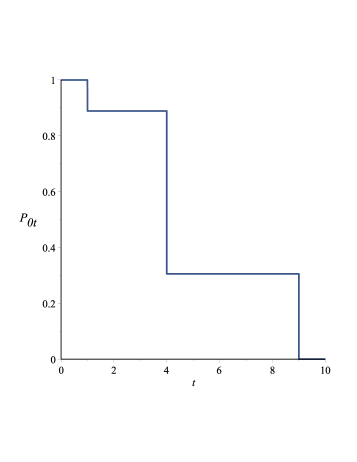

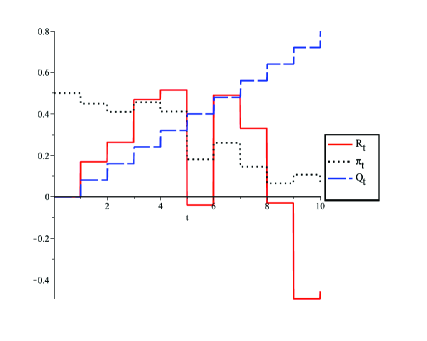

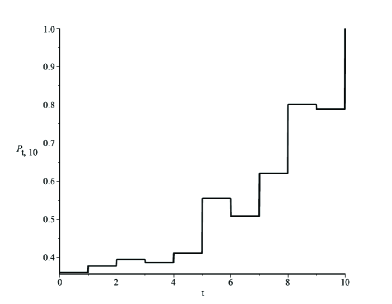

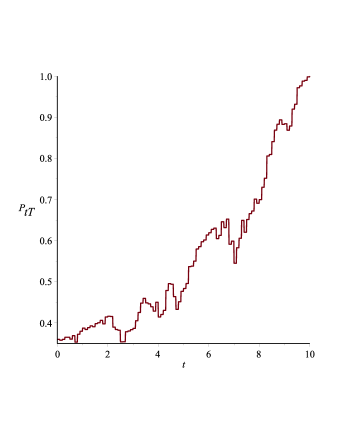

where equality here holds of course in probability. By making use of (47) and (49), the corresponding pricing kernel can be identified in the finite-dimensional models. In figure 3 we illustrate typical sample paths of , , and for and . For simplicity we have chosen a uniform probability and equal spacing: and for . Similarly, in figure 4, we show a sample path of a corresponding bond price process, where we have again chosen for with bond maturity .

Summing up the section, we see that using the finite-dimensional approach, a class of elementary, highly tractable and easily calibrated models can be constructed. These models have the characteristic feature that the discount bond process is piecewise flat and that the distribution of the bond price at any time is determined by a ratio of polynomials of standard normal random variables. The bond price processes emerging in these models can alternatively be viewed as representing ‘simple’ approximations to more sophisticated continuous processes. To illustrate how a typical bond price in these models behaves, in figure 5 we show an example of the bond price dynamics where the ‘grid size’ is made ten times finer than the one sketched in figure 4. It is interesting to note in this connection that although the Gaussian process formally appears to be continuous, owing to the appearance of distributions in (101) the resulting process contains jumps, as shown in figure 3.

9 Conclusion and discussion

The purpose of the present paper is to offer an in-depth analysis of the coherent chaos interest-rate models of each order with the view that they form the basis for generic (incoherent) interest-rate models. We have found that for a pure order coherent chaos model, the pricing kernel is given by a polynomial of order of a Gaussian state variable. This leads to fairly simple expressions for the bond price, the risk premium, and the short rate processes. Additionally, we have shown that in all these models it is possible to derive either analytic or semianalytic formulae for the pricing of both bond options and swaptions, involving at most numerical determination of roots of basic polynomials.

Single-factor coherent chaos models, although are themselves considerably richer than elementary Gaussian interest rate models, are nevertheless too restrictive on account of the fact that each coherent chaos model depends on just a single functional degree of freedom. For more realistic models, however, it suffices to take linear superpositions of coherent chaos elements in the sense described in Section 4. The resulting expression for the pricing kernel, in the most generic case, is somewhat cumbersome, although is nevertheless tractable. However, for practical purposes it seems sufficient to consider just a small number of (two or three) coherent vectors so as to generate rich and flexible interest-rate models. We hope that the results presented here will form a foundation for further investigation into this direction.

By means of comparison, we draw attention to the fact that implementation of chaos models has recently been carried out in Grasselli & Tsujimoto (2011) in the case of a third-order chaos model, with the choices , , and . Their model has been shown to fit the forward curve more closely, and with less parameters, as compared to currently preferred models employed in the industry. An interesting extension would therefore be to consider the implementation of the following generalisation: , , and , in line with the foregoing discussion, and examine how well the generalised model fits both the forward and volatility curves.

In relation to the analysis on finite-dimensional models, it is worth making the following observation. For simplicity, if we set , then formally we are led to an expression of the form

| (106) |

for the Gaussian process , the meaning of which a priori is not easily interpreted. In the present paper we have circumvented the direct handling of processes of the form (106) and its generalisations by means of identifying for each an alternative random variable whose probability law is identical to that of , and used this alternative representation to characterise interest-rate dynamics. For a more direct analysis of stochastic integrals of the form (106), calculus on the multiplication of distributions due to Colombeau (1990) might prove useful. We defer such an analysis to another occasion.

References

- (1) Björk, T.: Arbitrage Theory in Continuous Time, 3rd ed. Oxford: Oxford University Press (2009)

- (2) Björk, T.: Topics in interest rate theory. In Handbooks in Operations Research and Management Science, J. R. Birge & V. Linetsky, eds. 15, 377-435 (2007)

- (3) Brigo, D., Mercurio, F.: Interest Rate Models-Theory and Practice: with Smile, Inflation and Credit. Springer (2007)

- (4) Brody, D.C., Hughston, L.P.: Chaos and coherence: a new framework for interest rate modelling. Proceedings of the Royal Society. 460, 85-110 (2004)

- (5) Brody, D.C., Hughston, L.P., Mackie, E.: General theory of geometric Lévy models for dynamic asset pricing. Proceedings of the Royal Society. 468, 1778- 1798 (2012)

- (6) Cairns, A.J.: Interest Rate Models: an Introduction (Vol. 10). Princeton University Press (2004)

- (7) Cochrane, J.H.: Asset Pricing. Princeton University Press (2005)

- (8) Colombeau, J.F.: Multiplication of distributions. American Mathematical Society. 23(2), 251-268 (1990)

- (9) Carmona, R., Tehranchi, M.R.: Interest Rate Models: an Infinite Dimensional Stochastic Analysis Perspective. Springer (2007)

- (10) Di Nunno, G., Oksendal, B., Proske, F.: Malliavin Calculus for Levy Processes with Applications to Finance. Springer (2009)

- (11) Filipovic, D.:Term-Structure Models: A Graduate Course. Springer (2009)

- (12) Flesaker, B., Hughston, L. P.: International models for interest rates and foreign exchange. Net exposure. 55-79 (1997)

- (13) Flesaker, B.,Hughston, L.P.: Positive interest. Risk Magazine January. 46-49 (1996)

- (14) Flesaker, B., Hughston, L.P.: Positive interest: an afterword. Risk Magazine. 120-124 (1998)

- (15) Grasselli, M.R., Hurd, T.R.: Wiener chaos and the Cox-Ingersoll-Ross model. Proceedings of the Royal Society. 461(2054), 459-479 (2005)

- (16) Grasselli, M.R., Tsujimoto T.: Calibration of chaotic models for interest rates. arXiv preprint arXiv:1106.2478 (2011)

- (17) Hughston, L.P., Mina, F.: On the representation of general interest rate models as square-integrable Wiener functionals. In: Recent Advances in Financial Engineering 2011 (Y. Muromachi, H. Nakaoka & A. Takahashi, eds.). World Scientific Publishing Company (2012)

- (18) Hughston, L.P., Rafailidis, A.: A chaotic approach to interest rate modelling. Finance and Stochastics. 9, 43-65 (2004)

- (19) Ikeda, N., Watanabe, S.: Malliavin calculus of Wiener functionals and its applications. From local times to global geometry, control and physics. 150, 132-178 (1987)

- (20) Itô, K.: Multiple Wiener integral. Journal of Mathematical Society Japan. 3(1), 157-169 (1951)

- (21) James, J., Webber, N.: Interest Rate Modelling. Wiley-Blackwell Publishing Ltd (2000)

- (22) Janson, S.: Gaussian Hilbert Spaces. Cambridge University Press (1997)

- (23) Jin, Y., Glasserman, P.: Equilibrium positive interest rates: a unified view. The Review of Financial Studies. 14(1), 187-214 (2001)

- (24) Malliavin, P.: Stochastic Analysis. Springer-Verlag (1997)

- (25) Meyer, P.A.: Probability and Potentials. Blaisdell Pub. Co. (Waltham, Mass) (1966)

- (26) Nualart, D.: The Malliavin Calculus and Related Topics. Springer-Verlag (1995)

- (27) Rogers, L.C.G.: The potential approach to the term structure of interest rates and foreign exchange rates. Mathematical Finance. 7, 157-176 (1997)

- (28) Rogers, L.C.G.: One for all: The potential approach to pricing and hedging. In Mathematics in Industry, 8, Progress in Industrial Mathematics at ECMI 2004, A. Di Bucchianico, R. M. M. Mattheij, M. A. Peletier (eds), Heidelberg: Springer-Verlag (2006).

- (29) Rutkowski, M.L.: A note on the Flesaker-Hughston model of the term structure of interest rates. Applied Mathematical Finance. 4(3), 151-163 (1997)

- (30) Shoutens, W.: Stochastic Processes and Orthogonal Polynomials. Lecture Notes in Statistics. Springer. 146 (2000)

- (31) Wiener, N.: The homogeneous chaos. American Journal of Mathematics. 60, 897-936 (1938)