Scaling symmetry, renormalization, and time series modeling

Abstract

We present and discuss a stochastic model of financial assets dynamics based on the idea of an inverse renormalization group strategy. With this strategy we construct the multivariate distributions of elementary returns based on the scaling with time of the probability density of their aggregates. In its simplest version the model is the product of an endogenous auto-regressive component and a random rescaling factor designed to embody also exogenous influences. Mathematical properties like increments’ stationarity and ergodicity can be proven. Thanks to the relatively low number of parameters, model calibration can be conveniently based on a method of moments, as exemplified in the case of historical data of the S&P500 index. The calibrated model accounts very well for many stylized facts, like volatility clustering, power law decay of the volatility autocorrelation function, and multiscaling with time of the aggregated return distribution. In agreement with empirical evidence in finance, the dynamics is not invariant under time reversal and, with suitable generalizations, skewness of the return distribution and leverage effects can be included. The analytical tractability of the model opens interesting perspectives for applications, for instance in terms of obtaining closed formulas for derivative pricing. Further important features are: The possibility of making contact, in certain limits, with auto-regressive models widely used in finance; The possibility of partially resolving the long-memory and short-memory components of the volatility, with consistent results when applied to historical series.

I Introduction

Time series analysis plays a central role in many disciplines, like physics kantz , seismology shcherbakov , biology wilkinson , physiology ivanov , linguistics petersen , or economy preis , whenever datasets amount to sequences of measurements or observations. A main goal of such analysis is that of capturing essential regularities of apparently unpredictable signals within a synthetic model, which can be used to get forecasts and a deeper understanding of the mechanisms governing the processes under study. A satisfactory time series modeling for complex systems may become a challenging task, due to the need to account for statistical features of the data connected with the presence of strong correlations. In the last decades, features of this kind have been extensively studied in the context of financial time series, where they strongly stimulated the search for adequate stochastic modeling bouchaud_1 ; tsay_1 ; musiela_1 . The non-Gaussianity of the probability density function (PDF) of aggregated returns of an asset over time intervals in substantial ranges of scales, its anomalous scaling and multiscaling with the interval duration, the long-range dependence of absolute return fluctuations (volatility), the violation of time-reversal symmetry, among other robust statistical features called stylized facts in finance cont_1 ; cont_3 , still remain elusive of synthetic and analytically tractable modeling. Besides the standard model of finance based on geometric Brownian motion bouchaud_1 ; voigt , proposed descriptions include stochastic volatility models (See, e.g., musiela_1 and references therein), multifractal models inspired by turbulence ghashghaie_1 ; mandelbrot_1 ; vassilicos_1 ; bacry_1 ; eisler_1 ; borland_1 , multi-timescale models zumbach_1 ; borland_2 , various types of self-similar processes mantegna_1 ; mantegna_2 ; baldovin_2 ; stella_1 ; peirano_1 ; andreoli_1 , multi-agent models lux_1 ; lebaron_1 ; alfi_1 , and those in the Auto-Regressive Conditional Heteroskedastic (ARCH) and Generalized-ARCH (GARCH) family engle_1 ; bollerslev_2 ; bollerslev_1 ; tsay_1 .

To be effective, a stochastic model should not only correctly reproduce the statistical features observed in the empirical analysis, but also be easy to calibrate and analytically tractable in order to be useful in applications like derivative pricing and risk evaluation bouchaud_1 ; hull_1 . In this respect, research in stochastic modeling of financial assets is still a challenging topic borland_1 . Recently, some of us proposed an approach to market dynamics modeling baldovin_2 ; baldovin_1 inspired by the renormalization group theory of critical phenomena kadanoff_1 ; lasinio_1 ; goldenfeld_1 . The background ideas exposed in Refs. baldovin_2 ; baldovin_1 already stimulated some contributions along various lines baldovin_2 ; stella_1 ; baldovin_3 ; baldovin_4 ; baldovin_5 ; peirano_1 ; andreoli_1 . In particular, in peirano_1 a model with nonstationary increments and lacking a volatility feedback mechanism has been discussed in detail, pointing out its potential interest and missing features. In the present Paper, we make a step forward along the lines proposed in baldovin_2 , by introducing a novel discrete-time stochastic process characterized by both an auto-regressive endogenous component and a short-memory one. The firt provides a volatility feedback thanks to its long dynamical memory; the latter represents, besides immediate endogenous mechanisms, also the impact of external influences. Many features of the model are under analytical control and a number of basic properties, like increments’ stationarity, time-reversal asymmetry, strong mixing and ergodicity as a consequence, can be proved. In addition, an explicit procedure for calibrating its few parameters makes the model a candidate for applications, e.g., to derivative pricing bouchaud_1 ; hull_1 , for which useful closed expressions can be derived baldovin_6 . An interesting feature of our approach is the possibility of resolving the long-memory and short-memory components of the volatility. This could be exploited in order to partially separate exogenous and endogenous mechanisms within the market dynamics. The version of the model we discuss within the present Paper does not include skewness in the return PDF and the leverage effect bouchaud_1 ; bouchaud_lev . However, here we outline simple ways of improving it in order to consistently recover also these effects.

While some analytical derivations and detailed proofs are reported in the Supplementary Material supplementary , in the main text we illustrate the general ideas inspiring the model, we discuss its properties, and show that they allow to implement a successful calibration protocol. Specifically, we use the model to reproduce the daily historical time series of the S&P500 index in the years 1950-2010. The Paper is organized as follows. The next Section contains a description of the background ideas inspiring the model construction, whose precise definition is reported in Section III. This Section also describes a simple parametrization in which contact with a Markov-switching ARCH process (SWARCH) is realized. Section IV is then devoted to a brief review of the properties of the model. Section V proposes a simple calibration scheme, whereas a comparison with historical series is discussed in Section VI. Section VII deals with the interesting question about identifying the long-memory and short-memory components in empirical time series. In Section VIII we discuss the possibility of describing skewness and the leverage effect and mention other perspective developments. Finally, in Section IX we draw our conclusions.

II Scaling as a guiding symmetry

Since the pioneering work of Mandelbrot and van Ness on fractional Brownian motion mandelbrot_4 , interest in scaling features has characterized many models of financial and other time series, especially in contributions by members of the physics community. Proposals include the representation of financial processes as truncated Levy flights mantegna_1 ; mantegna_2 , or the more sophisticated descriptions through multifractal cascades inspired by turbulence ghashghaie_1 ; mandelbrot_1 ; vassilicos_1 ; bacry_1 ; eisler_1 ; borland_1 . In the financial literature, a similar focus on scaling properties is harder to find. Indeed, although leptokurtic distributions of aggregated returns are typically obtained in ARCH and similar models by making the conditioned variance of successive elementary increments dependent on the past history engle_1 ; bollerslev_2 ; bollerslev_1 ; tsay_1 , even for more specialized versions of this type of approach, like FIGARCH baillie_1 , a proper description of the correct scaling and multiscaling properties of aggregated increments is still an open issue.

A cornerstone achievement in statistical physics has been the formulation of the renormalization group approach to scaling kadanoff_1 ; lasinio_1 ; goldenfeld_1 . In this approach one tries to deduce the scaling properties of a system at criticality by analyzing how coarse-graining operations, which rescale the minimal length at which the system is resolved, change its statistical description in terms of effective interactions or similar parameters. The scaling invariance at criticality then emerges when such changes do not occur (fixed point). In a recent publication baldovin_2 , some of the present authors made the proposal that the problem of modeling the stochastic financial process on time scales for which a well defined scaling symmetry holds at least approximately, may be faced by inverting the logic of the standard renormalization group procedure. Given as an input the scaling properties of the aggregated increment PDF over a certain time scale, the idea is to find by fine-graining basic probabilistic rules that apply to elementary increments in order for them to be consistent with the input scaling properties stella_1 ; baldovin_1 . These rules should describe the system on time scales shorter than that of the aggregation interval, and their knowledge is regarded to be equivalent to that of the effective fixed point interactions in the standard renormalization group approach. Of course, even if properties like the martingale character of the financial process pose strong constraints, there is a degree of arbitrariness in the fine graining operation, and an important task is to show that the proposed fine-graining is plausible at the light of the relevant stylized facts.

This fine-graining, reverse renormalization group strategy for the description of market dynamics has been already exemplified in previous contributions baldovin_2 ; peirano_1 ; andreoli_1 , especially dealing with high frequency processes baldovin_3 ; baldovin_4 ; baldovin_5 . Unlike in cases for which a single time series is available, in Refs. baldovin_3 ; baldovin_4 ; baldovin_5 we focused on a particular, fixed window of the daily evolution of an asset, and extracted from the available records an ensemble of histories which have been assumed to be independent realizations of the same stochastic process. The manifest time inhomogeneous character of this process and its limited duration in time significantly simplify a modeling approach based on the above fine-graining strategy. Things become more difficult when only one realization of the process one wishes to model is available in the form of a single, long time series. This is the situation we discuss in the present work.

While a precise mathematical definition of our model is postponed to the next Section, in the present one we summarize the basic ideas behind its construction. In particular, we emphasize the inspiration by the renormalization group approach and the basic complementary role played by both endogenous and exogenous mechanisms. Another key aspect concerns the introduction of an auto-regressive dynamical scheme. In our context this endows the endogenous mechanism with sufficiently long memory, guaranteeing at the same time strong mixing, and hence also the ergodicity of the process mathpaper .

Let be a sequence of random variables representing the increments (logarithmic returns in finance) of a discrete-time stochastic process. This process possesses a simple-scaling symmetry if has the same probability law as for any , being the scaling (Hurst) exponent. If this is the case, the property

| (1) |

holds for the PDF of the aggregated increments , where is the scaling function (which also coincides with the PDF of ). One immediate consequence of Eq. (1) is a scaling property for the existing moments of the process:

| (2) |

A normal scaling symmetry is obtained with Gaussian and . Anomalous scaling refers to the fact of not being Gaussian and/or . Another kind of anomalous behavior for which Eq. (2) holds with an exponent explicitly depending on the moment order is called multiscaling and in this case is also named generalized Hurst exponent frisch_1 ; di_matteo_1 .

The simple-scaling symmetry can also be expressed in terms of characteristic functions (CF) as

| (3) |

or, equivalently, as

| (4) |

where is the joint CF of , i.e. the Fourier transform of the joint PDF .

Aiming at constructing a model for the increments consistent with Eq. (1) for a given scaling exponent and general scaling function , we notice that the knowledge of combined with Eq. (4) allows us to only fix the CF along the diagonal:

| (5) |

The basic inspiration of our approach is thus a quest for the existence of conditions implied by the presence of anomalous scaling which allow us to determine this joint CF also off-diagonal. Namely: “Are there ways of fixing such that with non-Gaussian and/or assumed to be given?” As a rule, when applying the renormalization group approach, one would be faced with the inverse problem: given a parametric form for , or for , one tries to fix its parameters in such a way that Eq. (4), and thus Eq. (1) with and to be determined, is satisfied. This amounts to the identification of the fixed point and is generally accomplished by operating a suitable coarse-graining operation on the description of the process. The fixed point is just an instance of the process which is left invariant under such operation. To satisfy our quest, we need to implement a plausible inversion of the coarse-graining operation in which the fixed point scaling is assumed to be known and needs to be constructed. This inverse procedure is not unique in general and its plausibility needs to be tested a posteriori. We are thus somehow “reverting” the ordinary flux in a renormalization-group approach, as we are trying to realize a fine-graining procedure compatible with the existence of an anomalous fixed point scaling.

Given and as an input, our proposal is to set

| (6) |

where

| (7) |

for any , and to find conditions on which guarantee that such a is a proper CF. If this is the case, is the Fourier transform of a PDF and manifestly solves Eq. (4). We thus meet with the problem of characterizing the class of scaling functions which make the inverse Fourier transform of our trial CF a non-negative joint PDF. Fortunately, this problem is addressed by Schoenberg’s theorem schoenberg_1 ; aldous_1 , which guarantees that Eq. (6) provides a proper CF for all if and only if is of the form

| (8) |

being a PDF on the positive real axis. The class of scaling functions suitable for our fine-graining procedure is thus constituted by the Gaussian mixtures

| (9) |

where, here and in the following, denotes a Gaussian PDF with mean zero and variance . Such a class, whose elements are identified by , is rich enough to allow us to account for very general anomalous scaling symmetries. The joint PDF of the variables ’s provided by our inverse strategy and corresponding to , i.e. to , is then obtained by applying an inverse Fourier transform to Eq. (6) and reads

| (10) |

with the ’s as in Eq. (7).

There are various ways in which Eq. (10) can inspire the construction of a stochastic process suitable for finance. Some possibilities have been tested in Refs. stella_1 ; peirano_1 ; andreoli_1 ; baldovin_3 ; baldovin_4 . In general, the joint PDF of Eq. (10) itself cannot describe a stationary ergodic sequence , but for the problem we address here, i.e. to describe long historical time series, such features are relevant. To recover stationarity and ergodicity keeping contact with Eq. (10), we here conceive the process of the returns as separated into two components. As shown below, the manifest scaling property of the Gaussian

| (11) |

which holds for any , prompts such a separation. In the financial time series context, one is then naturally led to interpret these components as accounting for long-memory endogenous dynamical mechanisms and for the occurrence of short-memory endogenous and exogenous events, respectively.

As far as the former component is concerned, a correlated process with memory order is considered. Up to equal to , this process is characterized by the joint PDF of Eq. (10) with for all ’s. This is a sequence of non-Gaussian, dependent random variables and at times up to their sum satisfies a form of anomalous scaling with and given by Eq. (9). The introduction of a finite of course limits the range of time for which this form of scaling is valid. This is not a problem, because empirically we know that anomalous scaling approximately holds within a finite time window. The entire process is then obtained through an auto-regressive scheme of order . This auto-regressive scheme is such to prevent the dynamics from stabilizing the conditional variance of ’s, given the past history, to a constant value after an initial transient, thus restoring full ergodicity stella_1 ; mathpaper . At the same time, the conditioning effect of the previous values of the process on the future dynamical evolution is of primary importance in applications like, e.g., those related to derivative pricing baldovin_6 or volatility forecasts.

The latter component introduces a multiscaling behavior by multiplying each element of the above sequence by the corresponding factor given in Eq. (7): . In principle, these rescaling factors convey a time inhomogeneity to the increments ’s, a property which has been exploited in the modeling of ensembles of histories baldovin_3 ; baldovin_4 ; baldovin_5 . However, a proper randomization of the time argument of the ’s restores the stationarity of the ’s, making them suitable for describing single time series whose statistical properties are thought to be independent of time cont_1 . This randomization, which is obtained by the introduction of a short-memory process, is regarded as mimicking the effects on market evolution of both short-memory endogenous random factors and external inputs of information or changing conditions, thus conferring also an exogenous character to this second component. The first component, which is responsible for the volatility clustering phenomenon thanks to its possible long dynamical memory , is then interpreted as the long-memory endogenous part. In order to have a simple intuition of the returns’ compound process, we may sketch a comparison with electronics and telecommunications regarding the long-memory component as a carrier signal, which is modulated by the short-memory one, playing thus the role of a modulating signal.

As we shall review in the Paper, and show in the Supplementary Material supplementary , relevant properties of the model, like its multiscaling and the power-law decay of non-linear autocorrelations over finite time horizons, are determined by the short-memory component. We stress that when combining the long-memory and short-memory processes, together with simple scaling features also the direct link between the Hurst exponent and the exponent entering in Eq. (7) is lost. For this reason, in the following we will denote by , instead of , the parameter involved in the definition of the model [See Eq. (19) below].

III Model definition

On the basis of the background material elaborated in the previous Section, here we precisely define our stochastic process of the increments. Such a process is obtained as the product of an endogenous auto-regressive component and a rescaling, or modulating, factor , where is a discrete Markovian random time independent of , and is a positive sequence:

| (12) |

The stochastic process is a Markov process taking real values with memory . It is defined, through its PDF’s, by the following scheme:

| (13) |

if , and

| (14) | |||||

if . Here, the PDF’s are given by

| (15) |

The process is a Markov chain of order 1 valued in . The memory order 1 of this sequence, to be compared with the memory order of the above one, justifies our convention of referring the two components as “short-memory” and “long-memory”, respectively. The chain is defined by the initial condition

| (16) |

and by the transition probabilities

| (17) |

In words, we are stating that at time there is a “time-reset” or “restart” () with probability , whereas with probability time flows normally (). For notational simplicity we set and we collect the transition probabilities into a stochastic matrix with entries . We point out that our choice of corresponds to the invariant distribution of , with the consequence that turns out to be a stationary process:

| (18) |

It should be stressed that here we assume that and are independent in favor of an initial simplicity. As a consequence, the present model results in a Markov-switching model where, by definition, the switching mechanism between different regimes is controlled by an unobservable state variable that follows a first-order Markov chain. In Section VIII we shall then hint at the possibility of making the random time dependent on .

Finally, is a positive sequence where, without loss of generality, we can set . In analogy with the previous Section, we assume a factor of the form

| (19) |

with . The relation between the Hurst exponent and the model parameter will be addressed in what follows. For the moment, let us point out that the sequence is identically equal to 1 if while monotonically decays to zero or diverges if or , respectively. For financial applications, the instance appears to be the interesting one and, since , the decay of the rescaling factor is of power-law type. However, in principle other choices for the functional form of are possible and could be introduced for further extensions and applications of the model.

The endogenous process recalls the ARCH construction of order engle_1 because the conditional PDF of the current , given the past history, depends on the previous outcomes only through the sum of the squares of the latest ones, as one can easily recognize. As a matter of fact, becomes a genuine ARCH process if the function is properly chosen, as we shall show in a moment. In general, the basic difference with respect to an ARCH process is that here the whole conditional PDF of , and not only its variance, changes with time. In spite of this, the process is identified by a small number of parameters independently of the order . Indeed, besides , the parameters associated to are only those related to . As we discuss below, satisfactory parametrizations of for financial time series require just two parameters. This must be contrasted with the fact that in realistic ARCH models the number of parameters can proliferate with the memory, easily becoming of the order of several tens tsay_1 . Such a synthetic result, which we believe to be a most interesting innovative feature of , is made possible by the exploitation of the scaling symmetry embodied in Eqs. (13–15).

A most practical choice for is one which allows us to explicitly perform the integration over in Eq. (15). Indeed, we notice that weighing according to an inverse-gamma distribution is the way to reach this goal. Furthermore, in the context of financial modeling, this prescription is in line with the rather common belief that the distribution of the square of the empirical returns can be modeled as an inverse-gamma distribution gerig_1 ; micciche_1 ; peirano_1 . This is identified by two parameters, and governing its form and the scale of fluctuations, respectively, and reads

| (20) |

where denotes the Euler’s gamma function. Interestingly, making this choice within the model, the endogenous component becomes a true ARCH process of order with Student’s t-distributed return residuals, as anticipated above. Indeed, in the Supplementary Material supplementary we prove that if is given by Eq. (20), then we can reformulate our model as with

| (21) |

and the return residual process amounting to a sequence of independent Student’s t-distributed variables:

| (22) |

with . It is also worth noticing that the Markov-switching character of the volatility, introduced by the process , reconciles this particular instance of our model with the SWARCH category proposed by Hamilton and Susmel hamilton_1 . The only difference, apart from dealing with an infinite number of regimes corresponding to the infinite possible values taken by , is that these regimes never persist for more than one time step. We stress however that besides only two parameters, and , are here needed to completely specify . This typically applies also to other possible parametrizations of , not related to the inverse-gamma distribution.

The component entails our model with two further parameters, i.e. establishing the frequency of occurrence of the “time restarts”, and the exponent defining the modulating factor . In summary, the model is thus typically identified by 5 parameters, three related to the long-memory and two to the short-memory components. The general fact that both and are hidden processes, not separately detectable, complicates the effectiveness of a parameter calibration protocol. However, as discussed below, analytical features of the model allow us to identify moment optimization procedures that guarantee, for sufficiently long time-series, proper determination of the input parameters.

In the next Section we clarify in details up to what extent the scaling symmetry is preserved by the process . For the moment we point out that the contact with the ARCH and Markov-switching models’ literature is particularly interesting. Indeed, thanks to our general results below it sheds some light on how to obtain anomalous scaling properties in auto-regressive models on limited temporal horizons mantegna_2 .

IV Model properties

A number of properties of our model are independent of the choice of the function and can be analytically investigated. Here we briefly review these properties referring to the Supplementary Material supplementary for detailed derivations.

IV.1 Joint PDF and stationarity

For any the joint PDF of is given by the formula

| (23) | |||||

Since is defined via mixtures of centered Gaussian variables, Eq. (15), we realize immediately that the conditional expectation of , given the past history, vanishes. The process is thus a martingale difference sequence, reflecting the efficient market hypothesis fama_1 ; fama_2 . Moreover, the structure of shows that the observed process cannot retain the Markov property characterizing both and , with the consequence that its future evolution always depends on all past events. This feature reflects the impossibility of directly detecting from the examination of the random time . More importantly, the latter fact makes a maximum-likelihood estimation of the model parameters very difficult because of the too onerous computational work needed. Thus, one is forced to refer to some moment optimization procedure for settling this issue. For this reason, in the next Section we shall propose a simple implementation of a generalized method of moments. A procedure to identify the most probable time restarts by means of the calibrated model, valuable for some applications like, e.g., in option pricing, will be also discussed in Section VII.

A remarkable feature of the joint PDF is that it does not explicitly depend on the memory range at short time scales. Indeed, when from Eqs. (4) and (13) we have [notice that Eq. (14) gives ]

| (24) | |||||

This fact implies that models with different memory orders and , and the same other parameters, cannot be distinguished by looking at their features at times shorter than or equal to . Observe also that the Gaussian mixture structure provided by our fine-graining strategy and the random nature of the factor redefining the typical magnitude of the fluctuations is particularly clear in Eq. (24).

Our process is strictly stationary, meaning that is distributed as for any and . This property directly follows from the fact that and are both stationary processes and, in particular, tells us that Eqs. (4) and (24) give the PDF of any string of consecutive variables extracted from . We stress that stationarity is a basic assumption in time series analysis, when one is forced to reconstruct the underlying stochastic process on the basis of a single, possibly long, time series.

We also point out that the long-memory endogenous component is not only a stationary sequence, but even a reversible one: the law of is the same as the law of for any . In contrast, the observed process is not reversible, being such time-reversal symmetry broken by the short-memory component. In Section VI we shall better analyze this feature of the model, attempting to quantify the time-reversal asymmetry of .

The single-variable PDF, which is the same for any thanks to stationarity, is obtained by setting in Eq. (24) and explicitly reads

| (25) |

The mixture of Gaussian densities with different width can endow this PDF with power law tails, as observed for financial assets cont_1 . Specifically, when decays as the power-law for large , becomes a fat-tailed distribution with the same tail index . Thus, for example choosing as in Eq. (20) we have with

| (26) |

and the above form parameter controls the tails of the PDF of the ’s as long as is finite. It is worth noticing that, even if the above condition on is necessary for having fat tails in a strict asymptotic sense, there is the possibility of approximately realizing such a feature for returns in empirically accessible ranges by only considering rare enough time restarts. As explained in the Supplementary Material supplementary , indeed, assuming given by Eq. (19) with , and properly rescaling in order to avoid to concentrate around zero in the small- limit, in general the single-variable PDF displays fat tails with index when the restart probability approaches zero. Of course, with behaving as for large and , the tail index is determined by even in the rare-restart limit. In practice, when dealing with small values of the empirically-accessible power law exponent of depends on all , , and . This fact, and the uncertainty affecting the empirical estimate of such exponent cont_1 , lead us to a calibration protocol (See below) which is not based on matching the effective power law tails of .

Since we have here stated the stationarity of our model, we also mention that strong mixing properties can be proved under mild assumptions on the function mathpaper . These mixing properties entail ergodicity, which justifies the comparison between empirical long time averages and theoretical ensemble expectations. They also imply the validity of the central limit theorem, to which we appeal for discussing scaling features of aggregated returns on the long time horizon under, basically, the only hypothesis that the second order moment of the elementary increments is finite. Stating precisely these results and discussing their proof however requires a more rigorous setting mathpaper which is beyond the scope of the present Paper. The ergodicity has also been numerically verified on the basis of model-based simulations.

IV.2 Scaling features

Scaling features of are at the heart of our approach and two different scaling regimes, corresponding to the empirical evidence found for financial assets iori_1 ; di_matteo_1 ; di_matteo_2 , can be identified within the present model: one is an effective multiscaling regime, which is most easily discussed in analytical terms for , and the other is an asymptotic Gaussian simple-scaling scenario, which prevails for as a consequence of the central limit theorem mentioned above mathpaper . We focus here on the former, which is directly relevant for applications in finance.

The moment time-dependence of the aggregated return is only ruled by the short-memory component if , since Eq. (24) enables one to demonstrate supplementary that in such a case

| (27) | |||||

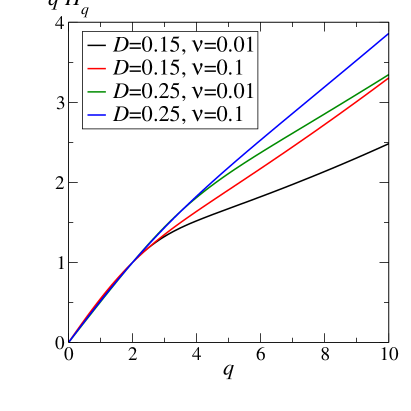

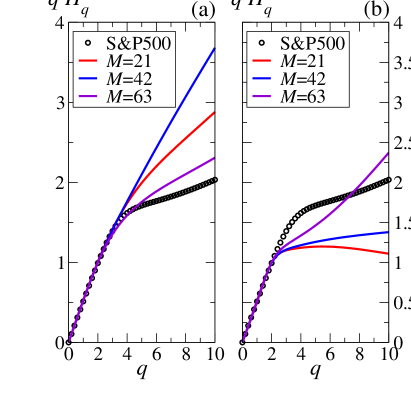

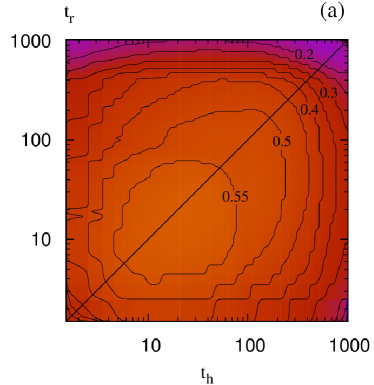

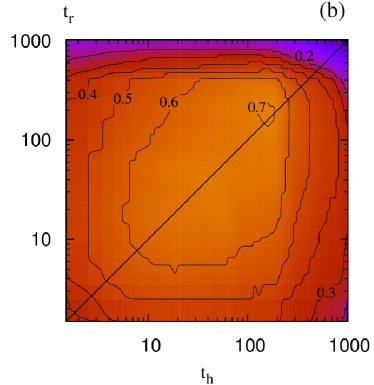

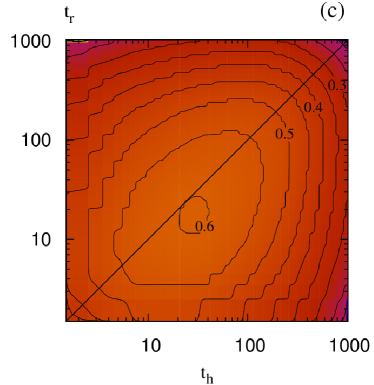

Notice that the r.h.s. of Eq. (27) is well defined for any . If the ’s PDF’s are endowed with fat tails, this is not true for the l.h.s. of the same equation. When and not too small, effective scaling properties of the model follow from the fact that , although apparently a rather complex function of the time, is well approximated by the power for supplementary . The generalized Hurst-like exponent can be computed using a least squares method over time. Referring for instance to a temporal window extending up to and adopting a memory order , Fig. 1 displays for different pairs of and values. The exponent stays close to for low orders up to about , denoting an initial simple-scaling regime. It recovers a dependence on for larger moment orders, manifesting a multiscaling behavior. A sharp result is found in the limit of small , where for supplementary .

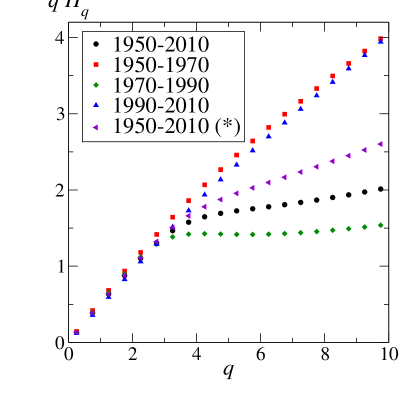

In the perspective of a comparison of our model with data, a remark on the scaling features of empirical financial data is in order (See also peirano_1 ). While the simple-scaling behavior at low is a stable and robust empirical evidence, multiscaling features occurring at larger are sensibly dependent on the time series sample, for series of a length comparable with that at our disposal for the S&P500 index. We report this observation in Fig. 2 with respect to the S&P500 daily time series. The empirical exponent is here obtained from the time-average estimation of , as computed in the next Section. In turn, from the modeling point of view, the multiscaling region in the moment order axis mostly overlaps the non-existing moment region when fat-tailed distributions are involved.

IV.3 Volatility autocorrelation

In view of financial applications, the volatility autocorrelation of order can be introduced as the autocorrelation function of the process :

| (28) |

Again, this autocorrelation is easily investigated for , where the Markov-switching component alone determines its decay. Indeed, thanks to the independence of the processes and , can be rewritten as supplementary for , while . Here, is the autocorrelation of , and , are two time-independent coefficients whose explicit expression is provided in the Supplementary Material supplementary . We thus see that the time dependence of comes from at short time scales . Interestingly, for small enough, the smaller the restart probability , the more correlations get persistent: when approaches zero, we find for any if . Notice that this last threshold for the moment order is now half of that previously discussed for the simple-scaling behavior.

While the initial decay of the volatility autocorrelation is strongly dependent on the parameter setting, in particular through the ratio , on time scales much larger than , decays exponentially fast, due to the strong mixing properties of our model mathpaper . In the Supplementary Material supplementary we show that this is indeed the case focusing on the function given by Eq. (20) and the instance , for which the correlation decay rate can be explicitly computed.

We conclude the Section with a remark concerning our convention of referring to “long-memory” and “short-memory” processes, which contrasts with some common use in the econometric literature. Indeed, within this literature a process is said to possess long memory if the autocorrelation is not summable in time Baillie . The asymptotic exponential decay of provided by our model supplementary entails that the above sum is finite also for the process . However, our convention stresses the different structure of the two components.

V Model calibration

An important issue for the application of a model to time series analysis is the implementation of efficient calibration protocols, capable of identifying the model parameters which most effectively reproduce a specific empirical evidence. As anticipated, the inclusion of both a long-memory and a short-memory part in our model complicates the calibration procedure, because the two components cannot be easily resolved along an empirical time series. In order to overcome this difficulty, we devise here a method based on the comparison between empirical and theoretical moments, drawing on the generalized method of moments alastair_1 and taking advantage of the analytical structure of our model.

With the relatively limited amount of daily historical data available for financial assets, the identification of the model parameters is affected by large uncertainties. Since our memory parameter establishes the time horizon over which the long-memory endogenous dynamical dependence operates, we can choose to fix it on the basis of the time scale associated with the specific application of interest. Given , we thus optimally exploit the simple analytical structure within the time window for the calibration of the remaining parameters. In order to present the procedure and to test our model on real data, we refer here and in the following to the advantageous function introduced in Section III by Eq. (20). Once is fixed, the further parameters to be estimated are four: the exponent , the restart probability , and the parameters and identifying . For simplicity, we collect the first three of them into the vector and we denote by its feasible range. The parameter plays a minor role in the model since we only need it to fix the scale of ’s fluctuations.

Given a time series with empirical mean zero, our calibration protocol is based on the idea of better reproducing, within the model, its scaling and autocorrelation features on times up to . Thus, in a least square framework, we choose those parameters which minimize the distance between the theoretical and , defined by Eqs. (27) and (28) respectively, and the corresponding empirical estimations and in the window . Such empirical estimations are obtained via time averages over the available series. To illustrate the computation, for instance we get as with

| (29) |

We recall that the comparison between empirical time averages and theoretical ensemble expectations is justified by the ergodicity of our process mathpaper .

Being properly normalized, and do not depend on the scale parameter . Denoting by the set of the moment orders we consider for the calibration purposes, our parameter estimation results thus to be

| (30) | |||||

where the dependence of and on is explicitly indicated. We have directly checked that this calibration procedure precisely recovers the input parameters when applied to sufficiently long time series simulated through the model.

We close the calibration protocol providing a way of estimating the parameter . Once , , and have been obtained, we can evaluate by optimizing with respect to , where , , and are set equal to , , and respectively. Making explicit the dependence of on , the relationship is rather evident. If denotes the empirical counterpart of , we then get our estimation of through the formula

| (31) |

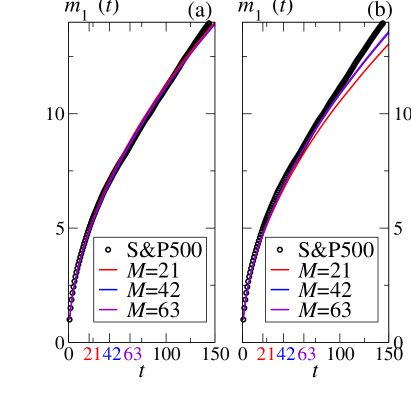

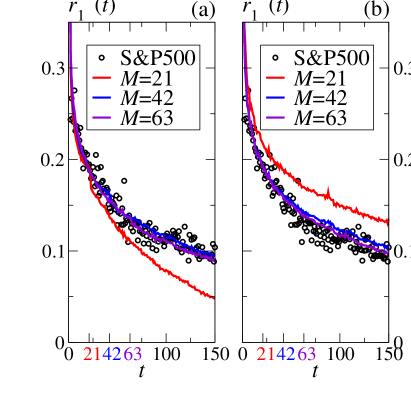

Aiming at reducing the computational load of the parameter estimations, in the present Paper we work out calibration with the moment order only: . Fig. 3a and 4a report the result of this protocol applied to the logarithmic increments of the daily closures of S&P500 from January 1st 1950 to December 31st 2010. We set for , being and the considered S&P500 time series. The value of the drift is such that . In compliance with an application we are developing to derivative pricing baldovin_4 , we have chosen (the operating market days in one month) yielding , (two months) giving , and (three months) for which . Notice how the calibrated model fits the S&P500 scaling features and the volatility autocorrelation well beyond in the case of two and three months, whereas one month does not seem to be enough to get the correct decay as soon as is larger than .

VI Comparison with S&P500 index and null hypothesis

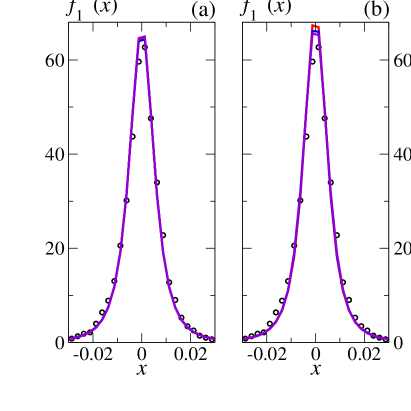

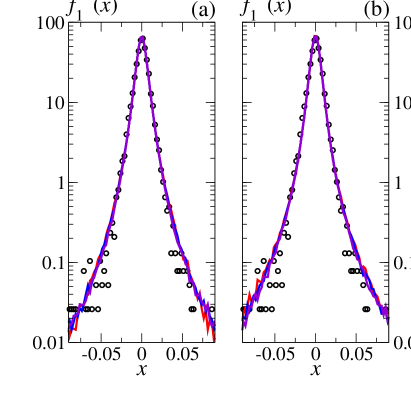

In order to put into context the performance of our model and to probe the role of the memory , here we consider, as the null hypothesis, a limit version in which is kept fixed to a constant value [], which turns out to be the scale parameter. From Eq. (15) we get that this prescription replaces the auto-regressive component with a sequence of independent normal variables, preventing the parameter from playing any role note_andreoli . Even if the null model has no endogenous memory, for the sake of comparison we estimate its parameters (first and , and later ) by means of the procedure outlined in the previous Section and with the same values of and used for the model characterized by the function of Eq. (20), which we name here “the complete model”. Figs. 3b and 4b show the outcome of the calibration protocol, which gives the following results: for , for , and when . The figures indicate that calibration is slightly less successful for the null model than for the complete one.

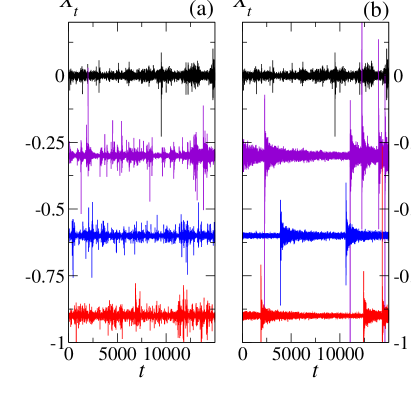

The unconditional return PDF of the S&P500 is very well reproduced by both the complete and the null calibrated models, both in the central part and in the tails. We realize this fact by an inspection of the linear and log plots of in Figs. 5 and 6 respectively. While the function defined by Eq. (20) endows the complete model with fat tails, setting prevents the null model from recovering such a feature from a strict mathematical standpoint. However, in Section IV.1 we mentioned that with a small enough value of the restart probability one recovers an effective fat tails scenario when . This circumstance explains why the null model reproduces the empirical fat tails thanks to an estimated value of which is one or two orders of magnitude smaller than the corresponding value for the complete model. The drawback is that a very small restart probability entails very rare but high and strongly time-asymmetric volatility bursts in the typical trajectories of the model, which are not observed in the historical series. Indeed, Fig. 7b, showing the comparison of typical simulated realizations of the benchmark model with the S&P500 time series, reports the discrepancy between the S&P500 and the null model paths, where one can immediately identify the time restarts. In contrast, once the auto-regressive component retains the memory of the previous returns, the combined effect of more frequent restarts and of the volatility clustering phenomenon produces typical trajectories which are pretty similar to the historical S&P500, as shown in Fig. 7a where the above comparison is proposed for the complete model. Notice that restart events become here much harder to identify.

In order to recover the role of the exponent , in Figs. 8a and 8b we also compare the aggregated return scaling features of the calibrated models with those of the S&P500 series. While, as anticipated in Fig. 2, the empirical multiscaling regime is very erratic and dependent on single extreme events, the simple-scaling behavior () up to seems a stable feature of the S&P500. On the other hand, in Section IV.2 we noticed that our model predicts that the latter extends up to at low values of when , irrespective of the function . The complete model provides for the calibration with , for , and if , therefore showing a qualitative agreement with the empirical evidence. The same cannot be said for the null model, which gives close to 2 for all the three calibrations.

Financial time series are reported to break time-reversal invariance, not only in terms of return-volatility correlation properties (e.g., the leverage effect bouchaud_1 ; bouchaud_lev ), but also in terms of volatility-volatility correlations zumbach_2 . Although in the form discussed so far our model cannot explain the former (which is an odd-even correlation), it can account for the latter since, as we have already mentioned in Section IV.1, the Markov-switching component breaks the temporal symmetry through the mechanism of time restarts. We thus conclude this Section considering an even-even correlation, specifically the historical versus realized volatility correlation zumbach_2 ; borland_1 ; borland_2 ; zumbach_1 ; peirano_1 , and assessing an asymmetry between the past and the future for the calibrated complete model. In Section VIII we shall discuss how to improve the present model in order to also take into account the leverage effect.

Consider two consecutive time windows, named “historical” and “realized”, of width and , respectively. The associated “historical volatility” and “realized volatility” are defined as the random variables

| (32) |

and

| (33) |

For a reversible process, the correlation between past and future volatilities lynch_1 , namely

| (34) |

is a symmetric function of the time horizons and , as one can easily verify starting from the definition of reversibility given in Section IV.1. In contrast, the structure of its empirical estimation for the S&P500 time series shows some degrees of asymmetry. This is highlighted by the level curves plot in Fig. 9, also named “volatility mug shots” borland_1 ; zumbach_1 . Such an asymmetry is however rather mild and sample dependent, as illustrated by Figs. 9a and 9b where the whole S&P500 sample and the second half only are exploited, respectively. As far as our model is concerned, at variance with what pointed out in Ref. peirano_1 for a different implementation of our ideas, we remark that such a mild time asymmetry is consistently reproduced. For instance, Fig. 9c displays the level curves of corresponding to the complete model calibrated with .

In the various comparisons outlined in this Section we have used the average values defined by our calibrated model. In model-generated time series with a length of the order of that of the available S&P500 dataset, we have also inspected the fluctuations around these average values. In general, we have observed fluctuations that are consistent with those associated to the sample-dependence of the S&P500 time series.

VII Long-memory and Short-memory volatility

An interesting feature for a model of asset evolution is the possibility of distinguishing between long-memory and short-memory contributions to the volatility. Since part of the short-memory random effects may be attributed to the impact of external information on the asset’s time evolution, such a distinction is also related to attempts in separating the endogenous and exogenous contributions to the volatility Cutler ; Sornette_1 ; Sornette_2 ; Joulin ; Filimonov_1 ; Hardiman ; Filimonov_2 . Indeed, although this should not be regarded as a clear cut distinction, one may reasonably expect that long-memory contributions could be ascribed to cooperative influences among the agents, whereas random volatility switches may also come from news reaching the market. In our model, albeit intimately combined together, the long-memory and short-memory components play their own distinct role in reproducing realistic financial features. The question then naturally arises about the possibility of identifying these two different contributions. For this reason, we propose here a procedure to localize the time restarts in a given finite realization of a process which is assumed to be well represented by our model. Once the restarts are supposed to be known, we can identify the auto-regressive trajectory , thus succeeding in distinguishing between the two contributions.

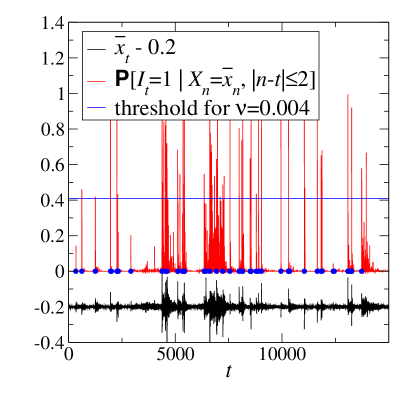

To the purpose of locating restarts, we consider the probability of having a restart at a certain time conditioned to the information available in a narrow time window centered in with half-width . Namely,

| (35) |

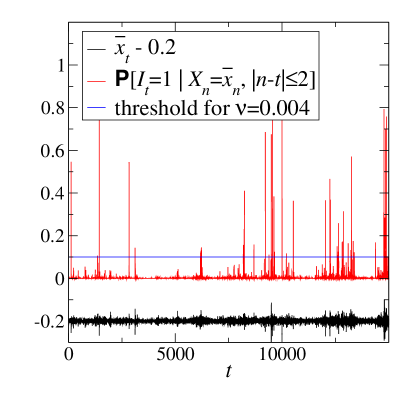

The time restarts can thus be tentatively associated to the peaks of this probability. Since a priori we expect about time restarts, being the length of the considered time series, we associated them to the highest peaks. In Fig. 10 is used with respect to a model-generated time series. Conditioning the time restarts identification to more time series values by taking a larger value of would in principle provide better results. In practice however computational limitations force us to focus on small values of . Despite this restriction, in Fig. 10 we have been able to identify exactly of the true restarts and about with an uncertainty of two days. Fig. 11 displays the result of the same “time restarts analysis” applied to the S&P500 dataset.

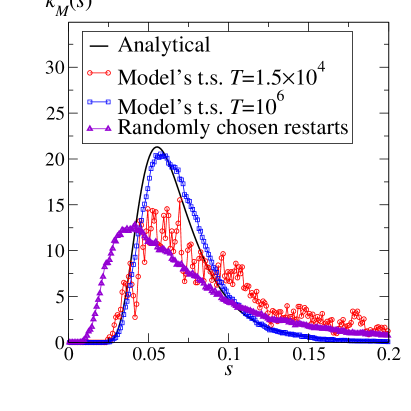

Once the time restarts have been unveiled and the auto-regressive trajectory thus identified, we can analyze the long-memory part of the volatility. Within our model, a convenient way of defining the long-memory volatility on the time horizon is through the random variable

| (36) |

The PDF of this variable is easily obtained when , due to the fact that reduces to a mixture of factorized Gaussian densities with the same variance. It turns out to be

| (37) |

In particular, if the function is chosen according to Eq. (20), then is explicitly found as

| (38) |

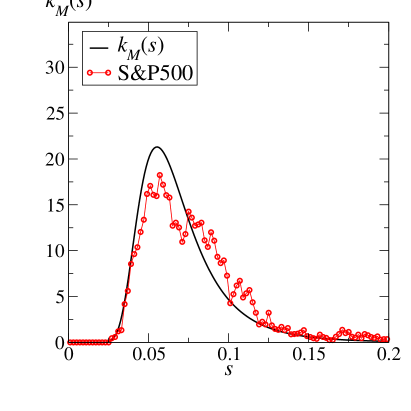

where is the Euler’s Beta function. On the empirical side, the distribution can be sampled from the estimated auto-regressive path . Fig. 12 shows a comparison between theoretical and empirically detected long-memory component of the volatility distributions for model-generated time series with . Notice that as the model’s time series length increases, the outcome of the present procedure becomes very close to the theoretical prediction in Eq. (38). This is particularly evident if, in place of using the restarts obtained through Eq. (35), we randomly choose them along the time series. Finally, the consistency of the S&P500 histogram with the theoretical predicition for (Fig. 13) points out that our procedure for identifying the long-memory component of the volatility could be successfully applied to the real market evolution, having sufficiently long historical time series at disposal.

A distinction between long-memory and short-memory components of the volatility is not a standard practice in finance. However, we think that its consideration could open interesting perspectives in fields like risk evaluation and market regulation.

VIII Improvements and further developments

Even if the present version of our model represents a significant advancement in terms of stylized-facts-reproduction-to-analytical-control ratio, some important empirical features like the leverage effect and the skewness of the return distribution are missing. Here we briefly discuss how both these effects can be reproduced by suitable improvements of the model.

The leverage effect refers to the presence in historical time series of a negative odd-even correlation of the kind . The model we have presented gives for any and, also, a symmetric returns distribution. So far, in favor of an initial simplicity we have kept the long-memory and short-memory components independent. The introduction of a dependence between these two processes, such as that arising when the latter is assumed somehow affected by the past values of the former (similarly, e.g., to the ideas outlined in Ref. bouchaud_lev ) could produce non-zero sign-volatility correlations like the leverage effect. An appealing and potentially interesting way of doing this within our mathematical construction may simply consist in making time restarts dependent on the sign of the auto-regressive endogenous component. We sketch some arguments about this perspective.

Introducing the process of the signs of , defined as if and if , in the Supplementary Material supplementary we show that and the sequence of the magnitude of ’s are mutually independent for the model considered so far. Moreover results in a sequence of i.i.d. binary variables with , telling us that we have been tossing a fair coin to decide the sign of returns. These considerations allow one to recast our model as with , , and independent from each other.

In order to improve the model, we could then think in general at different alternatives. We could assume that the ’s take vale different from and as, e.g., in Ref. eisler_1 . Also, we could draw independently of the past events, but making the restart occurrence dependent on the value of . In such a case, the process would result in a bivariate Markov chain, still independent of . We already know that a simple setting of this kind guarantees the martingale character, the stationarity, and the mixing properties of the returns’ process defined as . At the same time, a skewness in the return distribution is recovered by properly choosing the values assumed by the ’s. The leverage effect occurs then making negative returns more likely followed by a time restart than positive ones. Work is in progress along these lines.

Coming back to the model discussed in the present Paper, an interesting applicative perspective is the fact that its analytical handiness permits the derivation of closed-formulas for derivative pricing and the associated hedging strategy. As pointed out in peirano_1 , in the presence of a Gaussian mixture process for the underlying asset an obvious way of obtaining an arbitrage-free option price is by taking the average Black-Scholes price black_1 ; bouchaud_1 ; hull_1 according to the variance measure of the mixture. In the present approach, such a basic idea must be shaped in order to take into account two basic facts. In first place, the auto-regressive endogenous component implies that an effective variance measure of the Gaussian mixture is conditioned by the previous endogenous values of the process. On the other side, the Markov-switching process strongly influences the volatility. Thus, an effective way of identifying time restarts according to the scheme discussed in Section VII must be developed. In a related work in progress baldovin_6 we have been able to successfully tackle these two aspects and to produce an equivalent martingale measure which allows one to derive European option prices hull_1 in a closed form and to associate a natural hedging strategy with the underlying asset dynamics.

IX Conclusions

Scaling and long range dependence have played a major role in the recent development of stochastic models of financial assets dynamics. This development proceeded parallel to the progressive realization that indeed scaling and multiscaling properties are themselves relevant stylized facts. A key achievement has been the multifractal model of asset returns (MMAR) proposed by Mandelbrot and coworkers mandelbrot_1 . This model introduced important features, like the possibility of multiscaling return distributions with finite variance and the long range dependence in the volatility, with uncorrelated returns. This long range dependence had been previously a peculiarity of ARCH or GARCH type models engle_1 ; bollerslev_2 ; bollerslev_1 ; tsay_1 , widely used in empirical finance. The difficulties mainly arising from the strict time reversal invariance of the MMAR has been overcome by subsequent proposals of multi-time-scale models zumbach_1 ; borland_2 which are somehow intermediate between GARCH processes and descriptions based on multiplicative cascades. However, a limitation of all the approaches mentioned above is due to the scarce analytical tractability and the difficulty in efficiently expressing the conditioning effect of past histories when applying them to VaR estimates or option pricing.

The model we presented here addresses the problem first posed by Bachelier over a century ago bachelier_1 and opens some interesting perspectives. From a methodological point of view, due to the roots in renormalization theory, it offers an example where scaling becomes a guiding criterion for the construction of a meaningful dynamics. This direction appears quite natural if we look at the development of complex systems theory in statistical physics. Scaling is normally regarded as a tool for unconditioned forecasting. Thanks to our renormalization group philosophy, here we have shown that scaling can also be exploited in order to obtain conditioned forecasting, which is of major importance in finance. This conditioned forecasting potential is based on the multivariate price return distributions like Eqs. (4) and (24), which one can construct on the basis of scaling properties.

The coexistence of exogenous and endogenous effects driving the dynamics of the markets has been recognized since long. Indeed, the variations of the assets’ price and volatility cannot be explained only on the basis of arrival of new information on the market. A remarkable feature of our model is the fact that it embodies a natural and sound distinction between the long-memory endogenous influences and the short memory, partially exogenous ones on the volatility. Even if the distinction is model-based, the comparison with the S&P500 dataset has shown consistency with historical data.

In the relatively simple form discussed in this Paper, our model has important requisites for opening the way to useful applications. One of these applications, namely a closed-form formulation for pricing derivative assets, is presently under development baldovin_6 . Indeed, in view of the capability to account for a considerable number of stylized facts, our model maintains a high degree of mathematical tractability. This tractability allows to rigorously derive important mathematical properties of the process and to set up successful calibration procedures.

A deep connection of our approach with ARCH models engle_1 ; bollerslev_2 ; bollerslev_1 ; tsay_1 is the fact that we identify an auto-regressive scheme as a natural one on which to base the ergodic and stationary dynamics of our endogenous process. Remarkably, we are naturally led to this choice following our criteria based on scaling and on the quest for ergodicity and stationarity.

Our modeling is not based on a “microscopic”, agent based description lux_1 ; lebaron_1 ; alfi_1 , which should be regarded as a most fundamental and advanced stage at which to test the potential of statistical physics methods in finance. However, we believe that our results open in the field novel perspectives thanks to the application of one of the most powerful methods available so far for the study of complexity in physics, the renormalization group approach. This approach provides an original, valuable insight into the statistical texture of return fluctuations, which is a key requisite for successful stochastic modeling.

Acknowledgments

We would like to thank J.-P. Bouchaud and M. Caporin for useful discussions. This work is supported by “Fondazione Cassa di Risparmio di Padova e Rovigo” within the 2008-2009 “Progetti di Eccellenza” program.

References

- (1) H. Kantz, and T. Schreiber, Nonlinear Time Series Analysis, 2nd edn. (Cambridge University Press 2004).

- (2) R. Shcherbakov, G. Yakovlev, D.L. Turcotte, and J.B. Rundle, A model for the distribution of aftershock waiting times, Phys. Rev. Lett. 95, 218501 (2005).

- (3) D.J. Wilkinson, Stochastic modelling for quantitative description of heterogeneous biological systems, Nature Reviews Genetics 10, 122 (2009).

- (4) P.Ch. Ivanov L.A. Nunes Amaral, A.L. Goldberger, S. Havlin, M.G. Rosenblum, Z.R. Struzik, and H.E. Stanley, Multifractality in human heartbeat dynamics Nature 399, 461 (1999).

- (5) A.M. Petersen, J. Tenenbaum, S. Havlin, and H.E. Stanley, Statistical Laws Governing Fluctuations in Word Use from Word Birth to Word Death, Scientific Reports 2, 313 (2012).

- (6) T. Preis, D.Y. Kenett, H.E. Stanley, D. Helbing, and E. Ben-Jacob, Quantifying the Behavior of Stock Correlations Under Market Stress, Scientific Reports 2, 752 (2012).

- (7) J.-P. Bouchaud, and M. Potters, Theory of Financial Risk and Derivative Pricing: from Statistical Physics to Risk Management, 2nd edn. (Cambridge University Press, 2003).

- (8) R.S. Tsay, Analysis of Financial Time Series (John Wiley & Sons, 2002).

- (9) M. Musiela, and M. Rutkowski, Martingale Methods in Financial Modelling, 2nd edn. (Springer Verlag, 2005).

- (10) R. Cont, Empirical properties of asset returns: stylized facts and statistical issues, Quant. Fin. 1, 223 (2001).

- (11) R. Cont, Long range dependence in financial time series, in E. Lutton, J. Levy Véhel eds. Fractals in Engineering (Springer-Verlag, New York, 2005).

- (12) J. Voigt, The Statistical Mechanics of Financial Markets (Springer, Berlin, 2001).

- (13) S. Ghashghaie, W. Breymann, J. Peinke, P. Talkner, Y. Dodge, Turbulent cascades in foreign exchange markets, Nature 381, 767 (1996)

- (14) B. Mandelbrot, A. Fisher, and L. Calvet, A Multifractal Model of Asset Returns (Cowles Foundation Discussion Papers 1164, Cowles Foundation, Yale University, 1997)

- (15) J.C. Vassilicos, A. Demos, and F. Tata, No evidence of chaos but some evidence of multifractals in the foreign exchange and the stock market in A.J. Crilly, R.A. Earnshaw, H. Jones, eds. Applications of Fractals and Chaos (Springer, Berlin, 1993).

- (16) E. Bacry, J. Delour, and J.F. Muzy, Modelling financial time series using multifractal random walks, Physica A 299, 84 (2001).

- (17) Z. Eisler, and J. Kertész, Multifractal model of asset returns with leverage effect, Physica A 343, 603 (2004).

- (18) L. Borland, J.-P. Bouchaud, J.F. Muzy, and G.O. Zumbach, The Dynamics of Financial Markets – Mandelbrot’s Multifractal Cascades, and beyond, Science & Finance (CFM) working paper archive 500061, Science & Finance, Capital Fund Management, (2005).

- (19) G.O. Zumbach, M.M. Dacorogna, J.L. Olsen, and R.B. Olsen, Measuring shock in financial markets, Int. J. Theor. Appl. Finance 3, 347 (2000).

- (20) L. Borland, and J.-P. Bouchaud, On a Multi-Timescale Statistical Feedback Model for Volatility Fluctuations, Science & Finance (CFM) working paper archive 500059, Science & Finance, Capital Fund Management (2005).

- (21) R.N. Mantegna, and H.E. Stanley, Scaling behaviour in the dynamics of an economic index, Nature 376, 46 (1995); Nature 383, 587 (1996).

- (22) R.N. Mantegna, H.E. Stanley, H. E., An Introduction to Econophysics (Cambridge University Press, Cambridge, UK, 2000).

- (23) F. Baldovin, and A.L. Stella, Scaling and efficiency determine the irreversible evolution of a market, Proc. Natl. Natl. Acad. Sci. USA 104, 19741 (2007).

- (24) A.L. Stella, and F. Baldovin, Anomalous scaling due to correlations: limit theorems and self-similar processes, J. Stat. Mech. P02018 (2010).

- (25) P.P. Peirano, and D. Challet, Baldovin-Stella stochastic volatility process and Wiener process mixtures, Eur. Phys. J. B 85, 276 (2012).

- (26) A. Andreoli, F. Caravenna, P. Dai Pra, and G. Posta, Scaling and multiscaling in financial series: a simple model, Adv. in Appl. Probab. 44, 1018 (2012).

- (27) T. Lux, and M Marchesi, Scaling and criticality in a stochastic multi-agent model of a financial market, Nature 397, 498 (1999).

- (28) B. LeBaron, Short-memory traders and their impact on group learning in financial markets, Proc. Natl. Acad. Sci. USA 99, 7201 (2002).

- (29) N. Alfi, M. Cristelli, L. Pietronero, and A. Zaccaria, Minimal agent based model for financial markets I and II, Europ. Phys. J. B 67, 385 (2009).

- (30) R. Engle, Estimates of the variances of U.S. inflation based upon the ARCH model, Journal of Money, Credit and Banking 15, 286 (1983).

- (31) T. Bollerslev, Generalized autoregressive conditional heteroskedasticity, Journal of Econometrics 31, 307 (1986).

- (32) T. Bollerslev, R.F. Engle, and D.B. Nelson, ARCH Models, in Handbook of Econometrics, edited by R.F. Engle, D.L. McFadden (Elsevier, 1994), pp. 2959–3038.

- (33) J.C. Hull, Options, Futures and Other Derivatives (Prentice-Hall, 2000).

- (34) F. Baldovin, and A.L. Stella, Central limit theorem for anomalous scaling due to correlations, Phys. Rev. E 75, 020101(R) (2007).

- (35) F. Baldovin, D. Bovina, F. Camana, and A.L. Stella, Modeling the Non-Markovian, Non-stationary Scaling Dynamics of Financial Markets, in F. Abergel, B. K. Chakrabarti, A. Chakraborti, and M. Mitra (eds.) Econophysics of order-driven markets (1st edn), (New Economic Windows, Springer 2011) pp. 239–252.

- (36) F.Baldovin, F.Camana, M. Caporin, and A. L. Stella, Ensemble properties of high frequency data and intraday trading rules, to be published (2013) [arXiv:1202.2447].

- (37) F.Baldovin, F. Camana, M. Caraglio, A.L. Stella, and M. Zamparo Aftershock prediction for high-frequency financial markets’ dynamics in F. Abergel, B.K. Chakrabarti, A. Chakraborti, A. Ghosh, eds., Econophysics of Systemic Risk and Network Dynamics (New Economic Windows, Springer 2013), pp 49-58.

- (38) F. Baldovin, M. Caporin, M. Caraglio, A.L. Stella, and M. Zamparo, Option pricing with anomalous scaling and switching volatility, to be published (2013) [arXiv:1307.6322].

- (39) J.-P. Bouchaud, A. Matacz, and M. Potters, Leverage Effect in Financial Markets: The Retarded Volatility Model Phys. Rev. Lett. 87, 228701 (2001).

- (40) M. Zamparo, F. Baldovin, M. Caraglio, and A.L. Stella, Scaling symmetry, renormalization, and time series modeling – Supplementary Material, (2013).

- (41) B.B. Mandelbrot, and J.W. Van Ness, Fractional Brownian motions, fractional noises and applications, SIAM Review 10, 422 (1968).

- (42) R.T. Baillie, T. Bollerslev, and H.O. Mikkelsen, Fractionally integrated generalized autoregressive conditional heteroskedasticity, Journal of Econometrics 74, 3 (1996).

- (43) L.P. Kadanoff, Statistical Physics, Statics, Dynamics and Renormalization, (World Scientific, Singapore 2005).

- (44) G. Jona-Lasinio, Renormalization group and probability theory, Phys. Rep. 352, 439 (2001).

- (45) N. Goldenfeld, Lectures on phase transitions and the renormalization group, (Addison-Wesley, 1993).

- (46) U. Frisch, Turbulence: The Legacy of A.N. Kolmogorov (Cambridge University Press, Cambridge, 1995).

- (47) T. Di Matteo, Multi-scaling in finance, Quant. Fin. 7, 21 (2007).

- (48) M. Zamparo, F. Baldovin, M. Caraglio, and A.L. Stella, in preparation (2013).

- (49) I.J. Schoenberg, Metric Spaces and Completely Monotone Functions, Ann. Math. 39, 811 (1938).

- (50) D.J. Aldous, Exchangeability and related topics, Lecture Notes in Mathematics 1117, 1 (1985).

- (51) G.Iori Scaling and Multiscaling in Financial Markets, in Disordered and Complex Systems, ed. P.Sollich et al., AIP Conference Proceedings 553, 297 (2001).

- (52) T. Di Matteo, T. Aste, and M.M. Dacorogna, Long-term memories of developed and emerging markets: Using the scaling analysis to characterize their stage of development, J. Bank. & Fin. 29, 827 (2005).

- (53) A. Gerig, J. Vicente, and M.A. Fuentes, Model for non-Gaussian intraday stock returns Phys. Rev. E 80, 065102R (2009).

- (54) S. Miccichè, G. Bonanno, F. Lillo, and R.N. Mantegna, Volatility in financial markets: stochastic models and empirical results, Physica A 314, 756 (2002).

- (55) J.D. Hamilton and R. Susmel, Autoregressive Conditional Heteroskedasticity and Changes in Regime, Journal of Econometrics 64, 307 (1994).

- (56) E.F. Fama, Efficient capital markets: review of theory and empirical work, Journal of Finance 25, 383-417 (1970).

- (57) E.F. Fama, Efficient capital markets: II, J. Finance 46, 1575 (1991).

- (58) R.T. Baillie, Long memory processes and fractional integration in econometrics, Journal of Econometrics 73, 5-59 (1996).

- (59) A.R. Hall, Generalized Method of Moments (Advanced Texts in Econometrics) (Oxford University Press, 2005).

- (60) G. Zumbach, Time reversal invariance in finance Quant. Fin. 9, 505 (2009).

- (61) P.E. Lynch, and G.O. Zumbach, Market heterogeneities and the causal structure of volatility Quant. Fin. 3, 320 (2003).

- (62) F. Black, and M. Scholes, The Pricing of Options and Corporate Liabilities, J. Polit. Econ. 81, 637 (1973).

- (63) L. Bachelier, Theorie de la speculation, Ann. Sci. Ecole Norm. Sup. 17, 21 (1900).

- (64) S.J. Hardiman, N. Bercot, and J.-P. Bouchaud, Critical reflexivity in financial markets: a Hawkes process analysis, [arXiv:1302.1405v2].

- (65) A. Joulin, A. Lefevre, D. Grunberg, and J.-P. Bouchaud Stock price jumps: news and volume play a minor role, Wilmott Magazine (September-October, 2008) 1.

- (66) D.M. Cutler, J.M. Poterba, D. Grunberg, and L.H. Summers, What moves stock prices, Journal of Portfolio Management 15 no. 3, 555 (1989).

- (67) V. Filimonov, and D. Sornette, Quantifying reflexivity in financial markets: towards a prediction of flash crashes, Phys. Rev. E 85, 056108 (2012).

- (68) V. Filimonov, S. Wheatley, and D. Sornette, Effective Measure of Endogeneity for the Autoregressive Conditional Duration Point Processes via Mapping to the Self-Excited Hawkes Process, [arXiv:1306.2245].

- (69) D. Sornette, Endogenous versus Exogenous Origins of Crises, Extreme events in nature and society, Springer (2006).

- (70) D. Sornette, F. Deschâtres, T. Gilbert, and Y. Ageon, Endogenous versus exogenous shocks in complex networks: An empirical test using book sale rankings, Phys. Rev. Lett. 93, 228701 (2004).

- (71) This version of the model results to be the discrete-time counterpart of the one considered in Ref. andreoli_1 after one keeps a constant average volatility.

Scaling symmetry, renormalization, and time series modeling

Supplementary Material

Marco Zamparo

Dipartimento di Fisica, Sezione INFN, CNISM, and Università di Padova, Via Marzolo 8, I-35131 Padova, Italy and

HuGeF, Via Nizza 52, 10126 Torino, Italy

Fulvio Baldovin, Michele Caraglio, and Attilio L. Stella

Dipartimento di Fisica, Sezione INFN, CNISM, and Università di Padova, Via Marzolo 8, I-35131 Padova, Italy

I Introduction

This Supplementary Material provides proofs of the model properties announced in the Main Text. In Section II the joint PDF’s of the process are derived from the definition of the long-memory and short-memory components and , respectively. Section III is devoted to prove the stationarity of , while in Section IV we show that is a reversible sequence and that the series of its sign is independent of . In Sections V and VI we reconsider the issue of the tail of the single-variable PDF and the scaling features of our model supplying a more complete study. In Section VI we prove some properties of what we called the “null” and the “complete” models in the Main Text, in particular showing that the endogenous component of the complete model [with the choice in Eq. (20) of the Main Text for the function ] is an ARCH process. Lastly, Section VIII contains a detailed analysis of the autocorrelation .

II PDF’s associated with the model

Here we derive the joint PDF’s of the increments , reported in Eq. (23) in the Main Text. The derivation exploits the features of the hidden processes and . To this and further purposes, we shall work with the expectation values of test functions. Unless explicitly stated, we will implicitly assume that such expectation values exist.

Given and a test function on , we have

| (1) | |||||

where as usual denotes Kronecker’s symbol. On the other hand, recalling that and are mutually independent, the following factorization holds:

| (2) | |||||

Thus, plugging this in Eq. (1), we obtain the chain of identities

| (3) | |||||

The last equality is the consequence of a simple change of variables in the integrals. This result, combined with the arbitrariness of , clearly shows that the joint probability density distribution of is

| (4) | |||||

As far as the density is concerned, let us recall that for where

| (5) |

Moreover, solving Eq. (14) of the Main Text, we explicitly get also when as

| (6) |

III Stationarity

This Section is devoted to prove the strict stationarity of the process , for which we must verify that is distributed as for any and . As a matter of fact, inherits this property from the hidden processes and and so proving the strict stationary of and is the main issue. Let us assume for a moment that we know that and are distributed as and , respectively, for any and . Then, given , , and a test function on and exploiting again the independence between and , we obtain

| (7) | |||||

where the third equality is due to the hypothesis of stationarity of both and . The arbitrariness of then tells us that is distributed as .

The stationarity of was already discussed in the Main Text and is the consequence of the fact that is the invariant distribution of . Thus, now we only have to analyze the process . In order to prove the strict stationarity of this process, let us observe that for any , isolating the first terms in the products of Eq. (6), we get the identity

| (8) |

Then, the fact that

| (9) |

leads us to the result

| (10) |

which is also valid for , where , and hence for any . This relation allows us to prove that

| (11) |

for any and any function on . Indeed

| (12) | |||||

where we have made use of Eq. (10) to obtain the second equality and we have just re–labeled the variables to get the third. The iteration of Eq. (11) then provides

| (13) |

which states the stationarity of the process .

IV Reversibility and sign-magnitude independence of the endogenous component

In the Main Text we pointed out that the process is reversible, namely that is distributed as for any . Here we provide the proof verifying that

| (14) |

for any and . This identity descends from the invariance of with respect to permutations of its arguments and is evident if . At the same time, when , replacing with in Eq. (6) and rearranging the indexes, we obtain

| (15) | |||||

The exchangeability of the arguments of and , again, gives Eq. (14).

In Section VIII of the Main Text, in order to propose possible extensions of the model, we also mentioned that the sign and the magnitude of constitute two independent processes, the former being a sequence of i.i.d. binary variables taking values in with equal probabilities. This fact follows from the symmetry of with respect to any of its arguments. Setting with if and if , to prove the above two statements we have to check that for any and any test functions on and on the identity

| (16) |

and the relation

| (17) |

hold.

V Tail behavior of

In the Main Text we considered the issue about the tail of very briefly. Here we provide a more extended discussion on this point studying the expectation for . In addition, we need to consider similar expectations also below in this Supplementary Material.

The independence between and allows us to write . Since Eq. (19) of the Main Text for the sequence makes always finite, we realize that is finite if and only if is finite. On the other hand, is finite if and only if is so. Indeed, from the definitions of and [Eqs. (13) and (15) of the Main Text, respectively] we get

| (20) | |||||

where is the Euler’s Gamma function. Thus we discover that and , and the tails of as a consequence, are only ruled by the last factor on the r.h.s. of Eq. (20), i.e. by . In particular, if the function decays according to a power law as for large , then inherits the same feature and displays fat tails with the same tail index .

In the Main Text we also noticed that an effective fat tail scenario can be obtained also by considering suitable small values of the restart probability if . In order to shed light on this issue, we need to consider the limit of when goes to zero. Nevertheless, such a limit is meaningless if we do not rescale the function properly with since, if is kept fixed in the limit procedure, then concentrates around zero. The reason is that, when restarts get very rare, the random time tends to never go back to , reaching very large values in equilibrium conditions. As a consequence, when the rescaling factor tends to vanish and thus the mixture giving becomes dominated by component distributions having a vanishing variance. If we want then to keep the variance of the random variable independent of , we must fix a function which does not depend on and define according to

| (21) |

Indeed, Eq. (20) now provides

| (22) |

which in particular entails

| (23) |

In this framework the fluctuations of do not shrink in the limit and we obtain

| (24) |

if and otherwise. We thus get the proof that fat tails with index appear in this limit situation. It is clear that a function which endows the model with tails characterized by a tail index hides this effect.

We conclude sketching the computation of this limit. To this purpose, it is convenient to introduce the notation of asymptotic equivalence: given two generic functions and of , we shall write to say that . Then, if is a sequence for which there exists and such that , we have that as goes to zero

| (25) |

The last series is convergent. The instance is a consequence of the Karamata’s theorem Feller , whereas the case is due to the Abel’s theorem Feller . The limit value of Eq. (22) follows then by noticing that implies .

VI Scaling features

We reconsider here the scaling features of our model at short time scales, providing a deeper insight into the properties outlined in Section IV B of the Main Text.

To begin with, we derive the distribution of the aggregated return when . To this aim, let us observe that from Eqs. (4) and (5), thanks to the stability of Gaussian distributions with respect to linear combinations of independent Gaussian variables, we attain

| (26) |

for any test function on . This identity clearly shows that, if , the PDF of is given as a function of by the expression

| (27) |

We notice that this PDF cannot be obtained by simply rescaling , except if or for any in which case the normal scaling behavior with exponent is recovered. Thus, in general the model accounts for a richer scenario than a perfect time-scale-invariance framework, as we know.

Choosing in Eq. (26) , with such that , we get

| (28) |

This result allows us to prove Eq. (27) of the Main Text:

| (29) |

Notice in passing that the r.h.s. of Eq. (29) is well defined for any real , even if diverges.