Second Order Multiscale Stochastic Volatility Asymptotics: Stochastic Terminal Layer Analysis & Calibration

Abstract

Multiscale stochastic volatility models have been developed as an efficient way to capture the principle effects on derivative pricing and portfolio optimization of randomly varying volatility. The recent book Fouque, Papanicolaou, Sircar and Sølna (2011, CUP) analyzes models in which the volatility of the underlying is driven by two diffusions – one fast mean-reverting and one slow-varying, and provides a first order approximation for European option prices and for the implied volatility surface, which is calibrated to market data. Here, we present the full second order asymptotics, which are considerably more complicated due to a terminal layer near the option expiration time. We find that, to second order, the implied volatility approximation depends quadratically on log-moneyness, capturing the convexity of the implied volatility curve seen in data. We introduce a new probabilistic approach to the terminal layer analysis needed for the derivation of the second order singular perturbation term, and calibrate to S&P 500 options data.

1 Introduction

Stochastic volatility models relax the constant volatility assumption of the Black-Scholes model for option pricing by allowing volatility to fluctuate randomly. In this context the market is incomplete in the sense that volatility is not traded and volatility risk cannot be fully hedged. There are many risk-neutral measures and we take the usual point of view that the market is choosing one of them by pricing call and put options for instance without introducing an arbitrage. As a result, stochastic volatility models are able to capture some of the well-known features of the implied volatility surface, such as the volatility smile and skew. While some single-factor diffusion stochastic volatility models such as Heston’s [15], enjoy wide success due to the existence of semi-analytic pricing formula for European options, it is known that such models are not adequate to match implied volatility levels across all strikes and maturities; see, for instance, [12]. Numerous empirical studies have identified at least a fast time scale in stock price volatility on the order of days, as well as a slow scale on the order of months, for example [2, 5, 16, 18]. This has motivated the development of multiscale stochastic volatility models, in which instantaneous volatility levels are controlled by multiple driving factors running on different time scales.

A class of multiscale stochastic volatility models is analyzed in [7], where an approximation for European options and their induced implied volatilities is derived, which can capture the overall level of implied volatility, its skew across strike prices and its term-structure over a wide range of maturities. However, the analysis there is limited to a first order approximation, which cannot pick up the slight convexity of the observed equity implied volatility surface. In this paper we extend the results of [7] to second order. This extension is non-trivial, as it requires a careful terminal layer analysis, which we approach probabilistically. For some related multiscale perturbation techniques in European option pricing, we refer for instance to [3] and [4] (spectral methods), [17] (matched asymptotic expansions), [1], [14] and [11] (Malliavian calculus), [10] (Edgeworth expansion), and [24] (inner-outer expansions). For a recent related analysis within a different asymptotic regime, see [21].

Our second order results allow us to capture the slight convexity of the implied volatility skew. Additionally, we are able to maintain analytic tractability which is important for calibration to data, as we demonstrate. Of course, numerous asymptotic regimes have been analyzed in recent years for the option pricing problem in incomplete markets: see [8], [13] and [20] for some references. Here our focus is not just on deriving and proving convergence of the approximation in the appropriate limits, but in disentangling the calibration procedure that results from it. Compared to the first order theory, this is much more involved as there are many more group parameters and basis functions that have to be accommodated to implied volatility data. Despite the increase in complexity, we show this can be implemented successfully.

The rest of this paper proceeds as follows. In Section 2, we describe the class of multiscale stochastic volatility models that we will work with. Using a formal singular and regular perturbation analysis, we derive a pricing approximation which is valid for any European-style option. We establish the accuracy of our pricing approximation in Theorem 2.4, where we use a regularization to handle the non-smoothness of payoffs such as call and put option payoffs. In Section 3, we present an explicit formula for the implied volatility surface induced by our option pricing approximation. Additionally, we show how a parameter reduction, crucial for calibration purpose, can be achieved with no loss of accuracy. In Section 3.2, we outline a procedure for calibrating the class of multiscale stochastic volatility models to the empirically observed implied volatility surface of liquid calls and puts. We carry out this calibration procedure on S&P500 index call and put options data. Section 4 concludes.

2 Second Order Option Pricing Asymptotics

We consider the class of multiscale stochastic volatility models studied in [8]. Let denote the price of a non-dividend-paying asset whose dynamics under the historical probability measure is defined by the following system of stochastic differential equations (SDEs):

| (2.1) |

Here, (, , ) are -Brownian motions with correlation structure

where (, , ) satisfy and , which guarantees that the correlation matrix of the Brownian motions is positive-semidefinite. The asset has geometric growth rate and stochastic volatility which is driven by two factors, and . Under the physical measure, the infinitesimal generators of and are scaled by factors of and respectively. Thus, and represent the intrinsic time-scales of these processes. We will work in the regime where and so that and represent fast- and slow-varying factors of volatility respectively. Most importantly, we assume the fast factor is mean-reverting. Specifically, is an ergodic process, assumed reversible, and with a unique invariant distribution under , which is independent of .

Under the risk-neutral pricing measure (chosen by the market) the dynamics are described by

| (2.2) |

where (, , ) are -Brownian motions with the same correlation structure as between their -counterparts, and is the risk-free rate of interest. The functions and represent market prices of volatility risk, which we have assumed such as to preserve the Markov structure of , the pair , and by itself.

2.1 Assumptions

Throughout this manuscript, we shall make the following assumptions which are stated here along with some of their immediate consequences essential to the paper:

- 1.

-

2.

The volatility function of the two variables is measurable, bounded and bounded away from zero: there exist constants and such that for all .

-

3.

The market prices of volatility risk are bounded: and . In particular, combined with the previous assumption, and are equivalent and is an Equivalent Martingale Measure.

-

4.

Let be a diffusion process whose infinitesimal generator is (so that, in distribution, under ). We assume that is a Feller process (that is, a Markov process with a Feller semigroup), that it is ergodic and its unique invariant distribution has a strictly positive density denoted by . Furthermore, we assume the following specific exponential ergodicity condition: for every integer , there exist constants and such that

These conditions will enable us to use in Appendix A.3 the exponential ergodic rates provided by Theorem 6.1 of [22]. We note that two of the processes that are most commonly used as stochastic volatility drivers — the Ornstein-Uhlenbeck (OU) and Cox-Ingersoll-Ross (CIR) processes — satisfy these conditions (in the case of CIR, the state space is with the classical condition on the coefficients ensuring that the process never hits zero).

-

5.

Let be a diffusion process whose infinitesimal generator is (so that, in distribution, under ). We assume that is a Feller process, that it is ergodic and its unique invariant distribution has a strictly positive density denoted by . Furthermore, we assume the specific exponential ergodicity condition: for every integer , there exist constants and independent of such that

Note that, for OU and CIR processes, this condition holds as a consequence of Assumptions 3 and 4.

-

6.

The process admits moments of any order uniformly bounded in :

(2.3) Note that this assumption on moments is satisfied by OU and CIR processes (see [8, Sections 3.3.3 and 3.3.4] for more details on these processes).

-

7.

Let be a diffusion process whose infinitesimal generator is (so that, in distribution, under ). We assume that admits moments of any order uniformly bounded in , for fixed :

(2.4) -

8.

In addition to Assumption 2 ( is bounded), we assume that for all with bounded derivatives. Note that consequently, the averaged square-volatility defined by

(2.5) is finite and differentiable. Furthermore, consider Poisson equations of the form

where (2.6) and where is at most polynomially growing in and . We assume solutions of such equations are at most polynomially growing in and . In particular, this applies to the solutions and to the Poisson equations (2.40), (2.53) and (2.74). In the cases that is an OU or a CIR process, this follows from assumption 2 above and [8, Lemmas 3.1 and 3.2].

-

9.

We denote by the payoff function of a European option. The payoff is measurable, locally bounded (i.e. bounded on intervals for any ), and is at most polynomially growing at and (where, with a slight abuse of terminology, polynomially refers to inverse power law growth at ). In other words, there exist a finite constant and an integer such that

(2.7) Note that -style payoffs (which are used to price variance swaps) are in this class of payoffs, and of course it contains vanilla put and call payoffs (essential for calibration to implied volatilities), binary call and put payoffs, as well as other traded payoffs such as butterflies and straddles.

Remark 1.

We will refer to as smooth in the case that , and and all its derivatives are at most polynomially growing at and . The proof of accuracy for our second order pricing approximation (Theorem 2.4) will be separated into two parts. First, in Appendix A, we establish the accuracy of the approximation for options with smooth payoffs. Results from the smooth case proof will be used in Appendix B, where we establish the accuracy of the approximation for options with payoffs which may have a finite number discontinuities in or its derivatives. The proof that is given in Appendix B involves a regularization argument, which was used in [6] to establish the accuracy of the first order approximation with only a fast factor of volatility.

-

10.

In what follows, we also assume that (2.9), the linear pricing partial differential equation (PDE) given below, admits a unique classical solution.

2.2 Pricing PDE

Consider a European option with expiration date and payoff . The no-arbitrage pricing function of this option at time is given by the expectation of the discounted option payoff:

| (2.8) |

Here, denotes an expectation taken under the pricing measure , and we have used the Markov property of . The pricing function is the classical solution of the following PDE and terminal condition:

| (2.9) |

where, introducing the notation

| (2.10) |

the operator is given by

| (2.11) |

with

| (2.12) | ||||

| (2.13) | ||||

| (2.14) | ||||

| (2.15) | ||||

| (2.16) | ||||

| (2.17) |

For general coefficients , we do not have an explicit solution to (2.9), and we seek an asymptotic approximation for the option price to make the calibration problem computationally tractable. The fast factor asymptotic analysis is a singular perturbation problem, while the slow factor expansion is a regular perturbation. Thus, the small- and small- regime gives rise to a combined singular-regular perturbation about the operator . We expand in powers of and as follows

| (2.18) |

This is a formal series expansion, for which we find for explicitly, and prove an accuracy result for the truncated series in Section 2.5. As the combined regular-singular perturbation expansion is quite lengthy, we give a summary of the key results in Section 2.4. We also point out that we are working within an infinite-dimensional family of models since the functions are unspecified: the group parameters that are found in Section 2.6 and calibrated in Section 3.2 contain specific moments of these functions identified by the asymptotic analysis.

2.3 Formal Asymptotics

We first construct a regular perturbation expansion in powers of by writing

| (2.19) |

where, from (2.11),

| (2.20) |

Inserting (2.19) into (2.9) and collecting terms of like-powers of , we find that the lowest order equations of the regular perturbation expansion are

| (2.21) | |||||

| (2.22) | |||||

| (2.23) |

Within each of these three equations, we now perform a singular perturbation analysis with respect to .

2.3.1 First Order Fast Factor Term

From a fast factor expansion of equation (2.21), we will now find the zeroth order term in our approximation (2.18), and the first term coming from the fast factor, .

We insert expansions (2.20) into (2.21) and collect terms of like-powers of . The resulting and equations are:

| (2.24) | |||||

| (2.25) |

We see from (2.12) and (2.13) that all terms in and take derivatives with respect to . Thus, if we choose and to be independent of , the above equations will automatically be satisfied. Hence, we seek solutions of the form

| (2.26) |

i.e., no -dependence. Continuing the asymptotic analysis, the , and equations are:

| (2.27) | |||||

| (2.28) | |||||

| (2.29) |

where we have used the fact that .

Equations (2.27), (2.28) and (2.29) are Poisson equations of the form

| (2.30) |

By the Fredholm alternative, equation (2.30), which is a linear ODE in , admits a solution in only if the following solvability, or centering, condition holds:

| (2.31) |

where we introduced the invariant distribution in assumption 4 of Section 2.1. Note that two such solutions will differ by a constant (in ). We refer to [8, Section 3.2] for further details.

Applying the centering condition to equations (2.27), (2.28) and (2.29), and using the fact that and do not depend on , we find

| (2.32) | |||||

| (2.33) | |||||

| (2.34) |

where, from (2.14), the operator is given by

| (2.35) |

with

| (2.36) |

We observe that is the Black-Scholes pricing operator with effective averaged volatility , in which the level of the slow factor appears as a parameter, and we will express as a Black-Scholes option price in Proposition 2.1.

Expanding the terminal condition in (2.9) leads to the terminal conditions

| (2.37) | |||||

| (2.38) |

To find from equation (2.33), we next compute . Using (2.32), we re-write (2.27) as follows

| (2.39) |

Introducing a solution to the Poisson equation

| (2.40) |

we deduce the following expression for :

| (2.41) |

for some that is independent of , and which is yet to be determined. Inserting (2.41) into (2.33) yields the following PDE for

| (2.42) |

where the -dependent operator is given by

| (2.43) |

and we introduce the notation

| (2.44) |

The solution of the PDE (2.42) with terminal condition (2.38) will be given in Proposition 2.1.

2.3.2 Second Order Fast Factor Term and Terminal Layer

The form of (2.41) shows that the natural terminal condition is not enforceable because the singular perturbation with respect to the fast factor creates a terminal layer near . However, as we will demonstrate in Section 2.5, the ergodic theorem enables us to impose the averaged terminal condition

| (2.45) |

and to obtain the desired accuracy of our pricing approximation. In fact, we will see that this is the only appropriate choice for proof of convergence. Moreover, the solution of the Poisson equation (2.40) is defined in up to a constant in . We choose this constant by imposing the condition

| (2.46) |

and we will show in Section 2.5 that this choice is needed in the proof of accuracy of our pricing approximation.

To determine , given by (2.41), we need a PDE and terminal condition for the unknown function . These will be found from the centering conditions equation (2.34) and the terminal condition (2.45). Starting from the expression (2.41) for , applying the operator and averaging, we obtain:

Since and commute when acting on functions independent of , we have

and therefore

| (2.47) |

where is given in (2.58) below.

To find we first compute . From (2.28), (2.33), (2.40), (2.41), and the definitions of and , we have

| (2.48) | ||||

| (2.49) | ||||

| (2.50) | ||||

| (2.51) |

Therefore, we can write

| (2.52) |

for some which is independent of , and where and satisfy the Poisson equations

| (2.53) |

Now, we can compute :

| (2.54) | ||||

| (2.55) |

where , and are given in equation (2.58) below.

Inserting (2.47) and (2.55) into (2.34) yields the PDE for given in (2.57) below. The terminal condition is found by averaging (2.41), and using (2.45) and (2.46):

| (2.56) |

where we have used our choice on in equation (2.46).

In summary, we have that the function satisfies the following PDE and terminal condition

| (2.57) |

where the -dependent operator is given by

| (2.58) |

The solution of the PDE with terminal condition (2.57) will be given in Proposition 2.1. This is as far as we will take the asymptotic analysis of the equation (2.21).

2.3.3 First Order Slow and Fast-Slow Terms and

Proceeding as in Section 2.3.1, we insert expansions (2.20) into (2.22) and collect terms of like-powers of . The resulting and equations are:

| (2.59) | |||||

| (2.60) |

where we have used since , given in (2.15), contains , and is independent of . Recalling that all terms in and also contain , we seek solutions and of the form

| (2.61) |

Continuing the asymptotic analysis, the and equations are:

| (2.62) | |||||

| (2.63) |

Equations (2.62) and (2.63) are Poisson equations of the form (2.30). Applying the centering condition (2.31) to (2.62) and (2.63) yields

| (2.64) | |||||

| (2.65) |

We also have the following terminal conditions

| (2.66) | |||||

| (2.67) |

The PDE (2.64) and terminal condition (2.66) can be used to find an expression for , which will be given in Proposition 2.1.

The operator appearing in (2.64) can be written as

| (2.68) |

where (recall that we have assumed that in (2.5) is differentiable) and we introduce the notation

| (2.69) |

In order to make use of equation (2.65) to find , we need expressions for and . To get to , we first compute . Using (2.62) and (2.64), we have

| (2.70) | ||||

| (2.71) | ||||

| (2.72) |

Thus, is given by

| (2.73) |

for some which does not depend on , and where and satisfy the Poisson equations

| (2.74) |

Consequently,

| (2.75) | ||||

| (2.76) | ||||

| (2.77) | ||||

| (2.78) |

which leads to

| (2.79) |

where are defined in (2.82) below.

Next, using expression (2.41) for we find

| (2.80) |

which gives

| (2.81) |

where

| (2.82) | ||||

| (2.83) | ||||

| (2.84) | ||||

| (2.85) |

2.3.4 Second Order Slow Term

We now move on to the equation (2.23). Proceeding as in Sections 2.3.1 and 2.3.3, we insert expansions (2.20) into (2.23) and collect term of like-powers of . The resulting and equations are:

| (2.88) | |||||

| (2.89) |

where we have used since contains and is independent of . Recalling that all terms in and also contain , we seek solutions and of the form

| (2.90) |

Continuing the asymptotic analysis, the equation is:

| (2.91) |

Equation (2.91) is a Poisson equation of the form (2.30) whose centering condition (2.31) is

| (2.92) |

We also have the following terminal condition

| (2.93) |

The solution of the PDE (2.92) with terminal condition (2.93) will be given in Proposition 2.1. This is as far as we will take the combined singular-regular perturbation analysis.

2.4 Review of Asymptotic Analysis and Pricing Formulas

In the previous sections we showed (formally) that the price of a European option can be approximated by

| (2.94) |

where

| (2.95) |

and the -dependent operators in (2.95) are given by

| (2.96) |

We introduce the Black-Scholes price of the option with volatility , time to maturity , and payoff function :

| (2.97) |

Then we denote the solution to (2.32) with terminal condition (2.37) by

| (2.98) |

the Black-Scholes price with volatility . In the following, we provide explicit expressions for the functions () in terms of the contract’s Black-Scholes price and its derivatives (or “Greeks”).

Proposition 2.1.

Let be the unique classical solutions of the linear PDEs with terminal conditions given in (2.95). Then we have the following expressions for the in terms of the Black-Scholes price defined in (2.97):

| (2.99) | |||

| (2.100) | |||

| (2.101) | |||

| (2.102) |

Here is the time-to-maturity, and we have introduced the -dependent operators

| (2.103) |

and -dependent parameters

| (2.104) |

We re-iterate that all the terms are functions of , except , which also depends on the current level of the fast volatility factor. This is what creates the need for the terminal layer analysis in this paper.

In (2.98), we have already found that . In order to derive expressions for the higher order terms , we need the following two lemmas.

Lemma 2.2 (Vega-Gamma Relation).

Proof.

We have that

where

| (2.106) |

A direct computation shows that . Thus, we compute

| (2.107) | ||||

| (2.108) |

where passing the derivative operators through the integrals is justified by the polynomial growth assumption (at and ) on the option payoff . ∎

Remark 2.

Another way to derive the Vega-Gamma relationship (2.105) is to write a linear PDE with source for the Vega by differentiating the Black-Scholes PDE for and checking that the unique classical solution is given in terms of the Gamma by .

Using Lemma 2.2 and the fact that the logarithmic derivative operators in (2.10) commute (), which implies that and any commute (), one can show:

Lemma 2.3.

Proof.

2.5 Accuracy of the Approximation

The accuracy of our pricing approximation defined in (2.94) is as follows.

Theorem 2.4.

Proof.

Remark 3 (Terminal Layer Analysis).

The main difficulty in Theorem 2.4 in extending the accuracy of our pricing approximation from first order to second order is the treatment of the terminal condition for the second order term arising from the singular expansion due to the fast factor . In [17], the solution is derived by a formal matched asymptotic expansion with a terminal layer of size . Here, in Appendix A, we provide a probabilistic proof for options with smooth payoffs , which is based on the ergodic property of the fast factor , and justifies the choice of terminal condition made in (2.45). The proof of accuracy for options with payoffs satisfying Assumption 9, is given in Appendix B. The proof makes use of the results derived in Appendix A and additionally relies on a payoff-regularization argument.

2.6 Group Parameters

We now summarize the parameters needed in the pricing approximation formulas derived in the previous section. We begin by separating the -dependent part in given by (2.94), by writing

| (2.113) |

where

| (2.114) |

Using (2.94), (2.95) and the linearity of the operator , we find that satisfies the following PDE and terminal condition

| (2.115) |

where the source term is given by

| (2.116) | ||||

| (2.117) | ||||

| (2.118) | ||||

| (2.119) |

To extract which group parameters are needed for the price expansion, we absorb a half-integer power of and/or into the corresponding group parameters and define:

| (2.120) |

where the were defined in (2.69) and (2.44), and the , and in (2.58), (2.104) and (2.82) respectively. Similarly, we absorb the appropriate or pre-multiplier into the terms of the expansion (2.114) by defining and through

Substituting from (2.96) the expressions for and , and changing the derivatives in and acting on into derivatives acting on , we finally have

| (2.121) | ||||

| (2.122) | ||||

| (2.123) | ||||

| (2.124) | ||||

| (2.125) |

Here our notation is , and similarly . Since is linear in and and is linear in and , neither , , nor contain any of the ’s (that is, they are order one quantities).

As such, the group parameters that appear in the source term and therefore, in the price approximation (2.94) are

| (2.126) |

These 18 parameters, which move with the slow volatility factor , as well as needed in (2.94), can be obtained by calibrating the class of multiscale stochastic volatility models to the implied volatility surface of (liquid) European options, as described the Section 3.2. Note from (2.120) that the are order , the order and that they appeared in the first order asymptotic theory in [7]. The new parameters come from the order , order and order terms in the the second order expansion respectively.

2.6.1 Parameter Reduction

The group parameters in (2.126) depend on the current level of the slow volatility factor and, in the case of , on the fast factor too. In order to calibrate completely from the implied volatility surface and not use historical returns data to estimate , we replace it by a quantity which absorbs the term . In so doing, there is now one less parameter (listed explicitly for calibration purposes in (3.43)), and we show in Appendix C that the accuracy of the second order approximation is unchanged.

We define

| (2.127) |

and as the solutions to

| (2.128) |

where

| (2.129) |

These correspond to the PDEs and terminal conditions in (2.95) of the asymptotic approximation to second order with replaced by , and the terms containing removed. Their solutions are exactly as in Proposition 2.1 with in place of and both and set to zero.

Proposition 2.5 (Parameter Reduction).

Proof.

The proof is given in Appendix C. ∎

3 Asymptotics for Implied Volatilities and Calibration

It is common practice to quote option prices in units of implied volatility, by inverting the Black-Scholes formula for European call options with respect to the volatility parameter. This does not imply that the Black-Scholes assumptions of constant volatility are adopted, it is merely a convenient change of unit through which to view the departure of market data from the Black-Scholes theory, and to assess improvements due to multiscale stochastic volatility as we use here. In what follows, we translate the second order expansion of options prices found in the previous section, to a corresponding expansion in implied volatility units.

3.1 Implied Volatility Expansion

We seek an implied volatility expansion of the form

| such that | (3.1) |

Performing a Taylor expansion of about and rearranging terms yields

| (3.2) | ||||

| (3.3) | ||||

| (3.4) | ||||

| (3.5) | ||||

| (3.6) | ||||

| (3.7) |

Equating terms in (3.7) of like powers in the parameters and , and using , we find

| (3.8) |

For a European call or put option with strike price and time to maturity it is convenient to express the ’s as functions of forward log-moneyness

| (forward log-moneyness). | (3.9) |

Setting the payoff function for a call option and using the expressions given for in Theorem 2.1, the ’s in (3.8) become

| (3.10) | |||||

| (3.11) | |||||

| (3.12) | |||||

| (3.13) | |||||

| (3.14) | |||||

| (3.15) | |||||

| (3.16) | |||||

| (3.17) | |||||

| (3.18) | |||||

| (3.19) | |||||

| (3.20) | |||||

| (3.21) | |||||

| (3.22) | |||||

| (3.23) | |||||

| (3.24) | |||||

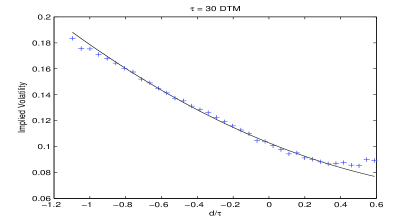

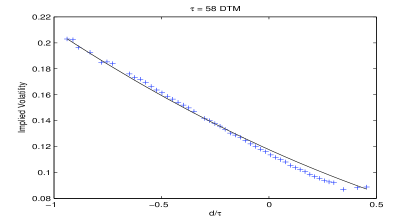

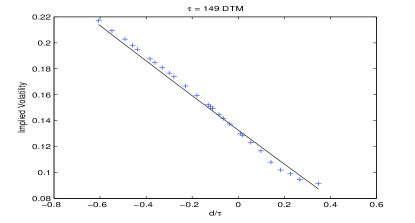

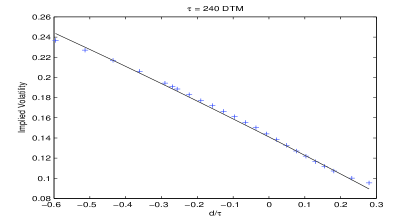

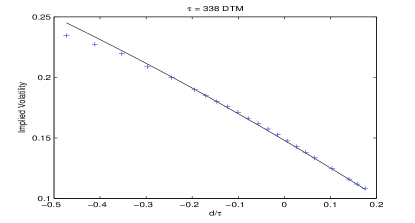

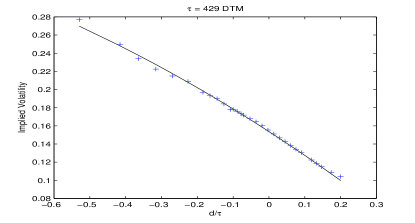

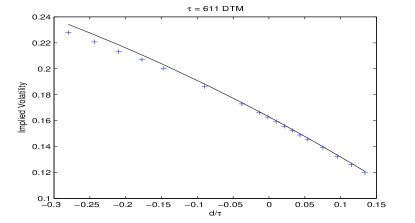

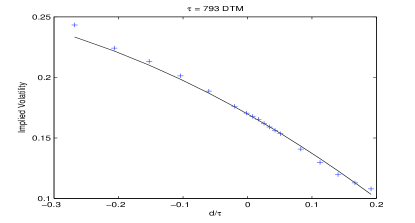

Observe that this second order expansion produces an implied volatility curve which is quadratic in log-moneyness and therefore accounts for the slight turn in the skew that is most prominent in shorter maturity options data, as we will see in Figure 1. The first order approximation derived in [7] is linear in and therefore only accounted for the skew effect. Note also that the parameter reduction outlined in Section 2.6.1 can be applied to this implied volatility expansion as well ( replaced by and -terms removed), and this will be used in the calibration in the next section. We also remark that the formal second order expansion for the case of a single slow volatility factor had previously been considered in [9], [19] and [23], for instance.

3.2 Calibration

In this section we discuss how the parameters (2.126), can be obtained by calibrating the multiscale class of models to liquid European options data. We define

| (3.25) |

Using (3.10) and the parameter reduction described in Proposition 2.5, we have

| (3.26) |

where

| (3.27) | |||||

| (3.28) | |||||

| (3.29) | |||||

| (3.30) | |||||

| (3.31) | |||||

| (3.32) | |||||

| (3.33) | |||||

| (3.34) | |||||

| (3.35) | |||||

| (3.36) | |||||

| (3.37) | |||||

| (3.38) | |||||

| (3.39) | |||||

| (3.40) | |||||

In total, we have ten “basis functions” with which to fit the empirically observed implied volatility surface:

| (3.41) |

It will be helpful to define

| (3.42) | ||||

| (3.43) |

We let be the implied volatility of a European call option with time to maturity and forward log-moneyness as observed from option prices on the market. We let be the implied volatility of a European call as calculated using (3.26). The calibration procedure consists of the following steps:

-

1.

Find such that

(3.44) where the double sum runs over all maturities and strikes (corresponding to forward log-moneyness ) for which a call or put is liquidly traded. This is the least-squares fit of formula (3.26) resulting in estimated .

-

2.

Next the ten constraints of equation (3.27) are used to find the minimal set of parameters . That is, we find such that

(3.45)

We emphasize that our calibration procedure encompasses all maturities, that is we do not fit maturity-by-maturity. Note that the implied volatility approximation , defined in (3.25), retains the same order of accuracy as the price approximation in the case of a non-smooth payoff. This follows directly from smoothness of the Black-Scholes formula as a function of the volatility.

3.3 Data

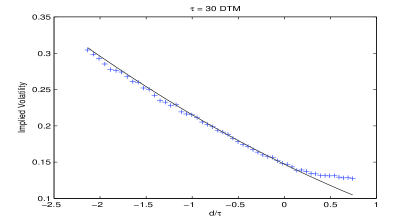

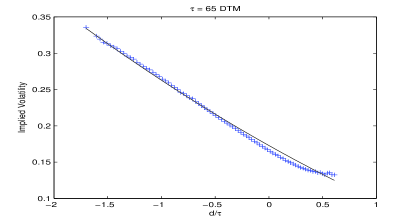

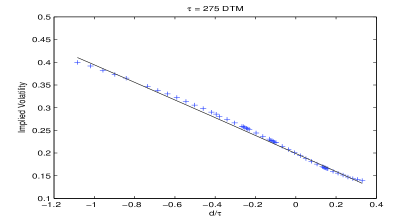

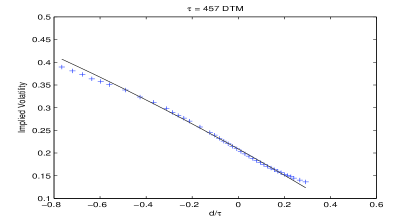

We perform the described calibration procedure on European call and put options on the S&P500 index on two separate dates, one pre-crisis on October 19, 2006, and one post-crisis on March 18, 2010. In Figure 1 we plot the implied volatility fit from October 19, 2006. The parameters obtained from the above calibration procedure are

| (3.46) | ||||||||||||||

| (3.47) | ||||||||||||||

| (3.48) |

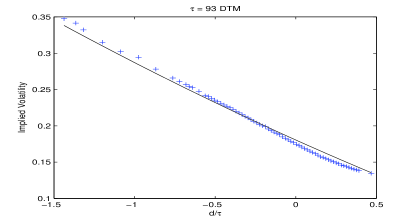

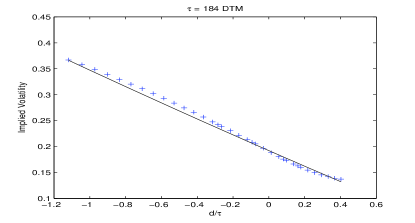

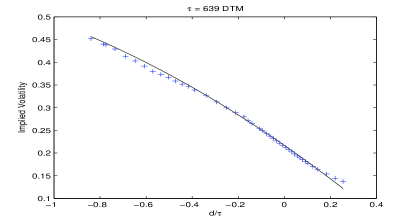

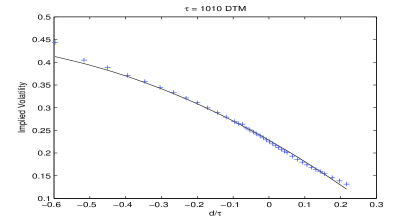

In Figure 2 we plot the implied volatility fit from March 18, 2010. The parameters obtained from the above calibration procedure are

| (3.49) | ||||||||||||||

| (3.50) | ||||||||||||||

| (3.51) |

Notice that, in both cases, the obtained parameters other than are small, as expected in the regime of validity of our expansion (i.e., small and small ).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Concluding Remarks

We have derived a second order asymptotic approximation for European options under multiscale stochastic volatility models with fast and slow factors. Proof of convergence requires a terminal layer analysis that is developed probabilistically, in contrast to the techniques of matched asymptotic expansions that are more common in fluid mechanics. The price approximation is translated to an implied volatility surface approximation which is quadratic in log-moneyness and highly nontrivial in the term structure direction. We have shown that the second order approximation fits the data well across strikes and maturities (Figures 1 and 2). Moreover, the extracted parameters are small when they should be small in the regime of the asymptotic analysis (Section 3.3).

Appendix A Proof of Accuracy for Smooth Payoffs

In this appendix, we derive the accuracy result for options with smooth payoffs as described in Remark 1 following Assumption 9. This is needed in order to give a meaning to the terminal value studied in Section 2.3.2 and justify the regularization argument for general payoffs given in Appendix B.

In what follows, we will make use of the following Lemma several times.

Lemma A.1.

Let be a smooth payoff function, that is is , and it and all its derivatives grow at most polynomially at and . Then its Black-Scholes price is also in , and () are also at most polynomially growing at and in the current stock price , and is bounded uniformly in for fixed .

Proof.

From the formula (2.97), we see that is in , and grows at most polynomially in at and as inherited from the behavior of . Then, we compute

| (A.1) |

where is the -the derivative of , which is at most polynomially growing by assumption, and therefore is also at most polynomially growing at and in , and uniformly bounded in for fixed . ∎

We note that this Lemma does not hold for the nonsmooth case of puts and calls where the derivatives of the payoff are singular at the strike price.

Remark 4.

Since we have , it follows that is at most polynomially growing in and bounded uniformly in for fixed .

We will also use the fact that and have moments of all orders uniformly bounded in and (thanks to Assumptions 6 and 7 made on and in Section 2.1):

Lemma A.2.

If is at most polynomially growing, then for every there exists a positive constant such that

| (A.2) |

The proof of this lemma can be found following Lemma 4.9 in [8].

The following property will also be used in what follows:

Lemma A.3.

For each , there exists a constant depending on and such that

| (A.3) |

Proof.

A.1 Intermediate Lemmas

Lemma A.4.

Let and be functions that are at most polynomially growing, with for all . Assume further that is smooth in with derivatives at most polynomially growing and is smooth in with derivatives at most polynomially growing as well. Then we have that

| (A.4) |

In order to establish Lemma A.4, we will need the following.

Lemma A.5.

Let be a function that is at most polynomially growing, with for all . Then, for and fixed, there exists and a polynomial such that

The proof of Lemma A.5 is given at the end of this section.

Proof of Lemma A.4.

First, we replace with . This replacement results in an error:

| (A.5) |

To see this, we observe from (2.2) that

| (A.6) |

The error (A.5) is then deduced by Taylor expanding with respect to and using the linear growth of coefficients in Assumption 1 in Section 2.1, the polynomial growth of functions , and their derivatives, and the uniform finiteness of moments of all orders in Lemma A.2.

A.2 Proof of Theorem 2.4

Now, we recall our price approximation from (2.94):

| (A.11) |

where are given in Proposition 2.1. The singular perturbation proof involves terms with higher order in , and so we introduce

| (A.12) |

Remark 5.

The additional terms are solutions of the Poisson equations (2.28), (2.29), (2.62) and (2.63) whose centering conditions have been used to obtain lower order terms in the price expansion. Since these four additional terms are not part of our approximation, but instead are used only for the proof of accuracy, we simply need them to be any solution of these four Poisson equations, which are all of the form

where the sum is finite, the are at most polynomially growing in and , and bounded uniformly in , and the are at most polynomially growing in , and bounded uniformly in for fixed by Remark 4. Therefore, by Assumption 8, the solutions are at most polynomially growing in , and are bounded uniformly in .

Next, we define the residual

| (A.13) |

The proof of Theorem 2.4 consists of showing that for . By the choices made in Sections 2.3.1, 2.3.3 and 2.3.4, when applying the operator to the function , all of the terms of order cancel, as does the term . Hence, we deduce that the residual satisfies the following PDE:

| (A.14) |

pointwise in , where the source term in (A.14) is quite lengthy to write explicitly. However, it is straightforward to check that it is a finite sum of the form

| (A.15) |

where the coefficients are bounded uniformly in and at most polynomially growing in and . We know the terms , are at most polynomially growing in and bounded uniformly in for fixed by Lemma A.1 and the observation in Remark 4. Consequently the source term in (A.14) is at most polynomially growing in and , uniformly bounded in and . Thus we have .

Using the terminal conditions for , we deduce the terminal condition for the residual:

| (A.16) |

pointwise in , where, again, the terms in come from the Poisson equations discussed in Remark 5. It is straightforward to check that is of the form

| (A.17) |

where again the sum is finite and the coefficients are at most polynomially growing in and . The terms , are at most polynomially growing in by the assumption in Theorem 2.4. Consequently the term in (A.16) is at most polynomially growing in and , uniformly in . Thus we have . The same polynomial growth condition holds for

| (A.18) |

It is important to note that the non-vanishing terminal value plays a particular role since it appears at the order. The probabilistic representation of , solution to the Cauchy problem (A.14)-(A.16), is therefore

| (A.19) |

where denotes expectation under the -dependent dynamics (2.2) starting at time from . The term denoted by comes from in (A.14) and in (A.16) and it retains the same order because of the uniform control of the moments of , and recalled in Lemmas A.2 and A.3 at the beginning of this section. We next examine the above expectation in (A.19) detail.

A.3 Proof of Lemma A.5

Let us first consider the case . For fixed, being at most polynomially growing in , there exists and an integer such that . By Assumption 4 in Section 2.1, we are in position to apply Theorem 6.1 of [22] (note that by assuming Feller property and a strict positive density for the invariant distribution, the condition that every petite set is compact for some skeleton chain is satisfied). Therefore, there exists and such that

By stationarity one deduces that for ,

and consequently

Lemma A.5 follows by using for . Note that this last inequality is what we need for the second order accuracy studied in this paper but can be improved (in fact, to any power of up to a multiplicative constant or for small enough).

However, under the pricing measure , due to the presence of the possibly nonzero market price of volatility risk , we need to deal with the perturbed infinitesimal generator and its associated diffusion process denoted by which satisfies

| (A.20) |

The process in (A.20) admits the invariant distribution with density

| (A.21) |

where is a normalization factor. Using Assumption 5 and following the argument given above in the case , we obtain that there exists and independent of such that

Now, expanding (including ), we derive for any

| (A.22) |

Hence, using the fact that and the triangle inequality, Lemma A.5 follows. Note that the term in in A.22 would generate a contribution of order from which would contribute a term of order if one would seek an expansion of the price at that order.

Appendix B Proof of Theorem 2.4

In this appendix, we consider payoffs satisfying Assumption 9. We regularize such a payoff by replacing it with its Black-Scholes price with time to maturity and volatility which appears as a constant volatility, being a parameter. Accordingly, we define

| (B.1) |

where is the Black-Scholes price of an option with payoff as a function of the time to maturity , the stock price , and the volatility . We note that, for , the regularized payoff , as a function of , is , at most polynomially growing at and as well as its derivatives. As such, is smooth, as considered in Appendix A.

The price of the option with the regularized payoff satisfies

| (B.2) |

where the operator is given in (2.11). Corresponding to the price approximation given in (2.94), we introduce the second order approximation of the regularized option price denoted by :

| (B.3) |

where, from Proposition 2.1, is the Black-Scholes price of the option maturing at with payoff , evaluated at volatility . Since we have regularized the payoff in (B.1) by using the Black-Scholes price with volatility , it follows that is given by

| (B.4) |

Similarly, the other terms in (B.3) are solutions of the PDE problems in (2.95) with replaced by , and they are given explicitly in Proposition 2.1. Note that the term in (B.3) plays a particular role. From (A.18), it is given by

| (B.5) |

where is centered, and at maturity, this term becomes .

The proof of Theorem 2.4 will rely on the following three Lemmas, which we prove below.

Lemma B.1.

For a fixed point with , there exist constants , and such that

| (B.6) |

for all and .

Lemma B.1 controls the error between the model price and the model price with the regularized payoff.

Lemma B.2.

For a fixed point with , there exist constants , and such that

| (B.7) |

for all and .

Lemma B.2 controls the error between the approximated price and the approximated price with the regularized payoff.

Lemma B.3.

For a fixed point with , there exist constants , and such that

| (B.8) |

for all , any , and uniformly in .

Lemma B.3 controls the error between the model price and the approximated price, both with the regularized payoff.

B.1 Proof of Theorem 2.4

B.2 Proofs of Lemmas B.1 and B.2

Proof of Lemma B.1.

The proof is a straightforward extension of [6, Lemma 4.1]. It requires a multi-factor “correlated Hull-White formula” with general payoffs which is in [8, Section 2.5.4]. We give some details here since it introduces notations that will also be used in the proof of Lemma B.4 below. Conditioning on the volatility path (or their driving brownian motions ), we obtain the representations

| (B.12) | |||

| (B.13) |

where is the Black-Scholes price with payoff and maturity , and for :

| (B.14) | |||

| (B.15) | |||

Therefore,

| (B.16) |

where denote the Gaussian density of and the Gaussian density of . Observe that the variance is bounded and bounded below by where from Assumption 2 in Section 2.1. Lemma B.1 follows by using polynomial growth of at and , and exponential moments of . ∎

Proof of Lemma B.2.

From Proposition 2.1, we can express each () as an operator acting on , and since derivatives with respect to can be converted to derivatives with respect to by the Vega-Gamma relation (2.105), we can write the price approximation in (2.94) as , where the operator is a polynomial in with bounded coefficients for given. Similarly we can express as , and therefore

| (B.17) |

Using the differentiability of and with respect to at , Lemma B.2 follows easily. ∎

B.3 Estimates on Greeks

The key to proving Lemma B.3 is the following Lemma providing uniform estimates.

Lemma B.4.

As in Lemma B.3, in what follows, is fixed such that . Let be a function which is at most polynomially growing in , and that is smooth in with partial derivatives with respect to that are at most polynomially growing in . Denote by the log-process and by the corresponding log-variable. Then, for any integer , there exists a finite constant , which may depend on , such that uniformly in , , and :

| (B.18) |

and, for a given ,

| (B.20) |

Additionally, if is centered, for all , then, for any and any integer , there exists a finite constant , which may depend on such that for any satisfying and any satisfying , uniformly in we have

| (B.21) |

and, for a given ,

| (B.22) |

Proof of Lemma B.4.

This is an improved version of Lemma 5.2 in [6] where the proof consisted in an explicit computation of in the case of a call payoff. Here, we aim at estimates which are uniform in . Conditioning on the volatility path and using the notations introduced in the proof of Lemma B.1 in Section B.2, we get:

| (B.23) |

where is the Gaussian density of

| (B.24) |

and, and are defined for in (B.14) and (B.15) respectively. Note that for , and the Gaussian distribution is simply The uniform bound (B.18) follows from the uniform lower bound of the variance of , polynomial growth of , uniform moments of and (Lemma A.2), and exponential moments of . The bound (B.20) is a direct consequence of (B.18).

If, in addition is centered, we define

and we write for ,

| (B.25) |

The second term in (B.25) is treated as in the proof of Lemma A.4. Replacing with results in an error. Lemma A.5 (using the centering condition) and the argument given above to prove (B.18) give

| (B.26) |

Regarding the first term in (B.25), we write as in (B.23)

where is the Gaussian density of (B.24) and is the Gaussian density of

| (B.27) |

where . Using differentiability with respect to the mean and variance of a normal density (with variance bounded away from zero), and, as in the proof of (B.18), polynomial growth of , uniform moments of and (Lemma A.2), and exponential moments of , we deduce that

| (B.28) |

B.4 Proof of Lemma B.3

The proof essentially follows the proof of Theorem 2.4 in Appendix A.2. We define the residual for the regularized payoff via the following equation

| (B.29) |

where the approximation is given by (B.3), and, as in the proof in the smooth case in Section A.2, we have introduced the additional terms . As we discussed in Remark 5 in that section, they are solutions of the Poisson equations (2.28), (2.29), (2.62) and (2.63) (augmented with the superscript), whose centering conditions have been used to obtain lower order terms in the price expansion.

More precisely, applying the operator to , we find the analog of (A.14):

| (B.30) |

where the source terms and are given by

| (B.31) | ||||

| (B.32) | ||||

| (B.33) | ||||

| (B.34) | ||||

| (B.35) | ||||

| (B.36) |

We have separated the terms involving singular perturbation only, that is , and the terms involving regular perturbation as well, that is . With the same decomposition in mind, at the maturity date , we have

| (B.37) |

where the functions and are given by

| (B.38) | ||||

| (B.39) |

and the particular term is given in (B.5). The residual has the following stochastic representation

| (B.40) | ||||

| (B.41) |

At this point, in order to apply the bounds in Lemma B.4, it is useful to change variables to . We note that, for a function that is at least -times differentiable, we have

| (B.42) |

where the are integers. Denoting , a direct computation shows that is of the form

| (B.43) | ||||

| (B.44) |

Likewise, one finds that is of the form

| (B.45) |

where . Then, by expressions (B.44) and (B.45), and Lemma B.4 (bounds (B.21) and (B.22) for the terms in , and bounds (B.18) and (B.20) for the other terms), there exists a constant such that uniformly in :

| (B.46) | ||||

| (B.47) |

Next, analyzing the terms and given by (B.36) and (B.39) respectively, we find there exists a constant such that uniformly in :

| (B.48) | ||||

| (B.49) |

Here, we omit the lengthy details which consist in writing decomposition formulas for and similar to the ones obtained for and in (B.44) and (B.45). and correspond to performing first a regular perturbation bringing a factor and then performing a first order singular perturbation which does not involve boundary layer terms.

Appendix C Proof of Accuracy after Parameter Reduction in Section 2.6.1

Throughout this Section we use the notation to indicate terms that are of order for any . Recall from (2.127) that where, we do not show the -dependence for simplicity of notation.

We show that replacing in Theorem 2.4 by defined in (2.130) does not alter the order of accuracy of the approximation. Note that we are in fact performing a regular perturbation on the volatility. We provide here a PDE based proof assuming smooth payoffs as in Appendix A and we omit the details of the regularization argument which is a simple application of Lemma B.2 and its extension to the regularization of the approximation .

First, we note that since

| (C.1) |

Next, we define by

| (C.2) |

the difference in the first order approximations. Note that and

| (C.3) |

Thus, we conclude that .

Similarly incorporating the order term, we define by

| (C.4) |

From equation (A.22) and by using one can show that . We then compute

| (C.5) |

Incorporating the order term, we define by

| (C.6) |

Note that and

| (C.7) |

Now define by

| (C.8) |

Note that and

| (C.9) |

Finally,

| (C.10) | ||||

| (C.11) |

Hence, we conclude

| (C.12) |

References

- [1] E. Alòs. A generalization of Hull and White formula and applications to option pricing approximation. Finance & Stochastics, 10(3):353–365, 2006.

- [2] M. Chernov, R. Gallant, E. Ghysels, and G. Tauchen. Alternative models for stock price dynamics. Journal of Econometrics, 116(1-2):225–257, 2003.

- [3] J. Conlon and M. Sullivan. Convergence to Black-Scholes for ergodic volatility models. European Journal of Applied Mathematics, 16(3):385–409, 2005.

- [4] J.-P. Fouque, S. Jaimungal, and M. Lorig. Spectral decomposition of option prices in fast mean-reverting stochastic volatility models. SIAM Journal on Financial Mathematics, 2:665–691, 2011.

- [5] J.-P. Fouque, G. Papanicolaou, R. Sircar, and K. Sølna. Short Time-Scale in S&P 500 Volatility. Journal of Computational Finance, 6(4):1–23, 2003.

- [6] J.-P. Fouque, G. Papanicolaou, R. Sircar, and K. Sølna. Singular perturbations in option pricing. SIAM J. Applied Mathematics, 63(5):1648–1665, 2003.

- [7] J.-P. Fouque, G. Papanicolaou, R. Sircar, and K. Sølna. Multiscale stochastic volatility asymptotics. SIAM J. Multiscale Modeling and Simulation, 2:22–42, 2004.

- [8] J.-P. Fouque, G. Papanicolaou, R. Sircar, and K. Sølna. Multiscale Stochastic Volatility for Equity, Interest-Rate and Credit Derivatives. Cambridge University Press, 2011.

- [9] E. Fournié, J. Lebuchoux, and N. Touzi. Small noise expansion and importance sampling. Asymptotic Analysis, 14(4):361–376, 1997.

- [10] M. Fukasawa. Asymptotic analysis for stochastic volatility: Edgeworth expansion. Electronic J. Probab., 16:764–791, 2011.

- [11] M. Fukasawa. Asymptotic analysis for stochastic volatility: martingale expansion. Finance & Stochastics, 15(4):635–654, 2011.

- [12] J. Gatheral. Modeling the implied volatility surface. In Global Derivatives and Risk Management, Barcelona, May 2003.

- [13] J. Gatheral. The Volatility Surface: a Practitioner’s Guide. John Wiley and Sons, Inc., 2006.

- [14] E. Gobet and M. Miri. Time dependent Heston model. SIAM Journal on Financial Mathematics, 1:289–325, 2010.

- [15] S. Heston. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud., 6(2):327–343, 1993.

- [16] E. Hillebrand. Neglecting parameter changes in GARCH models. Journal of Econometrics, 129(1-2):121–138, 2005.

- [17] S. Howison. Matched asymptotic expansions in financial engineering. J. Eng. Math., 53:385–406, 2005.

- [18] B. LeBaron. Stochastic volatility as a simple generator of apparent financial power laws and long memory. Quantitative Finance, 1(6):621–631, 2001.

- [19] R. Lee. Local volatilities under stochastic volatility. International Journal of Theoretical and Applied Finance, 4(1):45–89, 1999.

- [20] Alan Lewis. Option Valuation under Stochastic Volatility. Finance Press, 2000.

- [21] M. Lorig, S. Pagliarani, and A. Pascucci. Explicit implied volatilities for multifactor local-stochastic volatility models. ArXiv preprint arXiv:1306.5447, 2014.

- [22] P. Meyn and Tweedie R. L. Stability of markovian processes iii: Foster-lyapunov criteria for continuous-time processes. Advances in Applied Probability, 25(3):518–548, 1993.

- [23] R. Sircar and G. Papanicolaou. Stochastic volatility, smile and asymptotics. Applied Mathematical Finance, 6(2):107–145, June 1999.

- [24] M. Souza and J. Zubelli. On the asymptotics of fast mean-reversion stochastic volatility models. Int. J. Theor. Appl, Finance, 10(5):817–835, 2007.