Absolute ruin in the Ornstein-Uhlenbeck type risk model

Abstract.

We start by showing that the finite-time absolute ruin probability in the classical risk model with constant interest force can be expressed in terms of the transition probability of a positive Ornstein-Uhlenbeck type process, say . Our methodology applies to the case when the dynamics of the aggregate claims process is a subordinator. From this expression, we easily deduce necessary and sufficient conditions for the infinite-time absolute ruin to occur. We proceed by showing that, under some technical conditions, the transition density of admits a spectral type representation involving merely the limiting distribution of the process. As a by product, we obtain a series expansions for the finite-time absolute ruin probability. On the way, we also derive, for the aforementioned risk process, the Laplace transform of the first-exit time from an interval from above. Finally, we illustrate our results by detailing some examples.

Key words: Risk theory, absolute ruin, Ornstein-Uhlenbeck type processes, first-passage time, spectral representation.

2000 Mathematics Subject Classification: 60G18, 60G51, 60B52

1. Introduction

Let be a driftless subordinator defined on a filtered probability space , that is is a valued process with stationary and independent increments. It is well known that the law of is characterized by its Laplace exponent which admits the following Lévy-Khintchine representation

| (1.1) |

where the Lévy measure satisfies the integrability condition and we refer to the monograph of Kyprianou [20] for background on subordinators. By we denote the law of the dual of , i.e. the law of under . For , we denote by the law of the process defined, for any , by

| (1.2) |

where . Similarly, stands for the law of the process as defined in (1.2) with . We simply write (resp. ) for (resp. ). Note that equivalently, is the unique strong solution to the stochastic differential equation

| (1.3) |

The process under with has been used in the literature to model the reserves of an insurance company, the parameter standing for the premium rate, the jumps of standing for the claims and standing for the initial value of the reserves. In particular, when , under is the classical risk process where the claims arrive according to a Poisson process with intensity parameter and the claim distribution is given by . When , the process under has been suggested as a risk process where the cost of lending/borrowing money are taken into account. In this model the insurer earns (credit) interest when the surplus is positive and when the surplus becomes negative, the insurer can cover the deficit by a loan for which he has to pay a (debit) interest. Although in practice the debit interest is much higher than the credit interest, we restrict ourselves to the case where both rates are equal since this choice is particularly tractable and allows us to use techniques which can no longer be used in the general case. Processes of the form (1.1) with a general Lévy process are known in the literature as processes of Ornstein-Uhlenbeck type (for short OU-type) and therefore in this paper we call the process under with , the OU-type risk process.

From (1.3), it is clear that when the OU-type risk process reaches the interval , the premium rate can no longer compensate the interest payments and so the surplus will decrease to minus infinity. Following Gerber [15], we say that in this case absolute ruin occurs. This model and in particular the event of absolute ruin, has been the focus of many research in insurance mathematics, its first appearance can be traced back to Segerdahl [35]. For more recent investigations and substantial refinements, we mention Gerber [15], Dassios and Embrechts [10], Embrechts and Schmidli [12], Schmidli [33], Sundt and Teugels [37], Albrecher et al. [2], Gerber and Yang [17] and Cai [9]. We refer to the survey papers of Paulsen [28] and [27] for an overview of ruin models with interest. For general background in ruin theory, we refer to Gerber [16] and Albrecher and Asmussen [1].

We also point out that the process under with , is well known in the literature and has appeared in various settings. For instance, in mathematical finance, this process has been used by Barndorff-Nielsen and Shephard for the modeling of the stochastic volatility of stock prices, see [3]. It also belongs to the class of one factor affine term structure models, see e.g. Filipovic [13]. Moreover, when the Lévy measure is finite, it is a specific example of a Poisson shot noise process, see e.g. Perry et al. [29] and Iksanov and Jurek [19].

2. Main results

We start by providing a representation of the law of the absolute ruin time. To this end, we introduce some notation. First, let, for any ,

be the first-passage time below the level for . Henceforth, we shall assume that . We are interested in the distribution of under . We call this random variable the absolute ruin time. As mentioned in the introduction, the reason for the adjective ‘absolute’ is that once the OU-type risk process goes below the level , it will never go back above this critical level, i.e.

| (2.1) |

We first note that from (1.2) we immediately see that the process under has the same law as the process under . In particular

Based on this observation, we state all the results in the paper for the case only; the analogue for is then obvious. The first theorem gives the link between the distribution of under and the distribution of under , which leads to an explicit expression for the Laplace transform in space of the finite-time absolute ruin probability. This is in contrast with the the finite-time ruin probability in the case, where only an explicit expression for the double Laplace transform in space and time exists (cf. Theorem 8.1(ii) of Kyprianou [20]).

Theorem 2.1.

For any and , we have

Consequently, for any , we have

where stands for the exponential distribution of parameter (where we used the notation ).

Theorem 2.1 in combination with Theorem 17.5 of Sato [30] leads to the following result about the infinite time absolute ruin probability. We refer to Sato [30] for background on self-decomposable random variables.

Corollary 2.2.

-

(i)

If , then, under , converges in distribution, as , to a positive self-decomposable random variable and

Moreover, for any , we have

-

(ii)

If , then, for any ,

It is interesting to note that for the risk process without interest (), ruin is certain when the safety loading is negative that is whenever , whereas for the premium rate does not have any influence on whether ruin is certain or not.

Before stating the next two theorems we need to introduce a little further notation. Let and define the measure on via its Laplace transform as follows

| (2.2) |

Noting, by an integration by parts, that

it follows readily that

where is the law of a positive, self-decomposable random variable with infinite Lévy measure (cf. [30, Corollary 15.11]). It follows that the function is well-defined, increasing and by [30, Theorem 27.4] that is continuous. Note that if , then is simply the distribution function of the random variable from Corollary 2.2. We extend to the whole real line by setting on . Further, for all , the -th derivative of , denoted by , exists and is continuous on (cf. [30, Theorem 28.4]).

The next theorem concerns a discrete spectral type representation of the transition distribution of the process under . We stress that the spectral theory for self-adjoint operators in an Hilbert space structure is well established. In particular, McKean [24] discusses in details the nature of the spectrum of the semigroup of linear diffusions. However, this general theory does not apply here since we are dealing with non self-adjoint operators. In this context, there are little examples in the literature where such a spectral decomposition has been given. One notable exception is the paper of Ogura [26]. Therein, the author provides conditions under which the semigroup of continuous state branching processes with immigration (for short CBI) admits a discrete or continuous spectral representation. Furthermore, in a very elegant fashion, he manages to characterize through Laplace transform, the eigenmeasure and eigenfunctions associated to the semigroup. To be more precise, in [26, Theorem 3.1], Ogura shows, under some conditions, that for some the semigroup of a CBI process satisfies the discrete spectral representation

| (2.3) |

where , resp. , are eigenfunctions, resp. eigenmeasures, of corresponding to the eigenvalue with . Although the process under does belong to the class of CBI processes, they were excluded in [26]. Moreover, the methodology of [26] does not extend to our case; in particular the suggestion made in footnote 3) on p.309 of [26] does not lead to the right direction. In Theorem 2.3 below we are able to give, under some technical conditions on the Lévy measure, a spectral representation similar to (2.3) for the semigroup of this process when . We refer to Chapter 2.7 of Bingham et al. [5] for the definition of a quasi-monotone function and remark that the theorem remains valid if quasi-monotone is replaced by ultimately monotone. Recall that a function is ultimately monotone at infinity if there exists such that is monotone on and that is slowly varying at infinity if for all .

Theorem 2.3.

Assume that the Lévy measure satisfies

-

i)

for all ,

-

ii)

with and a quasi-monotone slowly varying function at infinity.

Then for any and , the transition distribution of the process under is given by

where

Consequently, for any ,

| (2.4) |

Moreover, for any , is an eigenmeasure of corresponding to the eigenvalue in the sense that

Our final theorem concerns the two-sided exit problem for the OU type process. More specifically, we compute the Laplace transform of the stopping time

on the event that exits the interval at . When is a spectrally negative Lévy process, this quantity is given by with being the parameter of the Laplace transform and where (resp. ) is the so-called -scale function (resp. scale function) of the spectrally negative Lévy process, cf. [20, Theorem 8.1]. In Theorem 2.4, we derive a similar expression for the case where is the OU-type risk process and show that the ‘corresponding -scale function’ is given in terms of the fractional integral of the function , which we denote by . Hence if one has an explicit expression for , one automatically gets for in closed-form; this is in contrast to the case of spectrally negative Lévy processes, see the discussion on p.1674 of Kyprianou and Rivero [22].

Theorem 2.4.

For , define the function by on and on by the Riemann-Liouville fractional integral of order of i.e.

| (2.5) |

Then, for any , and , we have

We point out that Theorem 2.4 simultaneously gives the first-passage time above of the OU-type risk process. For a process defined by (1.2) with a general Lévy process with no negative jumps and with , Hadjiev [18] (under an extra assumption) and Novikov [25] provided an explicit expression for the Laplace transform of the first-passage time of above a fixed level. Although not considered in these papers, it can be checked that their methodology and expression extend to the case where and a Lévy process with no downward jumps and paths of unbounded variation. However, when and is a subordinator (that is, the OU-type risk process), the situation is completely different due to the possibility of absolute ruin. We remark here that we cannot expect to find a more explicit expression like the one given in [18] and [25] for the case, since this would lead to an explicit expression for the distribution function of any positive self-decomposable random variable.

3. Examples

Before studying some examples let us recall the definition of a transformation recently introduced by Kyprianou and Patie [21], which will be helpful in our context. For any Laplace exponent of a subordinator, that is of the form (1.1), we write for any

Then, in [21], it is proved that is the Laplace exponent of the driftless subordinator with Lévy measure . In particular, . Obviously, . We assume throughout this section that and therefore the quantity defined by

is well-defined for . It is easily seen, after a change of variable, that

In other words, the action of the mapping on the backward Laplace exponent is equivalent to the action of the Esscher transform on the Laplace exponent of the limiting distribution. In particular, if stands for the limiting distribution function associated to the backward Laplace exponent , then we have the following simple relationship

| (3.1) |

(Note that by [30, Theorem 28.4], is always differentiable on .)

Next we detail some examples where the function and/or the distribution of the absolute ruin time can be given in closed form. For more examples of cases where is explicit, we refer to Iksanov and Jurek [19]. We end this section by giving an example that illustrates Theorem 2.3.

3.1. The compound Poisson case with exponential jumps

Let us start with the case where for ,

Hence the subordinator is a compound Poisson process with exponentially distributed jumps. We have

and so the Laplace transform of under is easily computed via (4.2). By inverting this Laplace transform, Perry et al. [29] shows that the transition function of under admits the following form

where stands for the dirac point mass at and is the confluent hypergeometric function, see e.g. Lebedev [23, Section 9.9]. Hence, from Theorem 2.1, we deduce that

From Corollary 2.2, it follows that (or equivalently ) equals the gamma distribution with shape parameter and scale parameter ; this fact was first established by Gerber [15].

3.2. The compound Poisson process with Linnik distribution

We consider an example found in Iksanov and Jurek [19]. Assume that the Lévy measure of is given by

where and

is the Mittag-Leffler function and is the gamma function. Hence the subordinator is a compound Poisson process with arrival rate and with jumps distributed according to a positive Linnik distribution. We have and thus

We point out that in the case , the Linnik distribution boils down to the exponential distribution and hence this example can be seen as a generalization of the previous. Next, we deduce, from the identity (4.2) below, that

Denote for by the increasing function on characterized through its Laplace transform which is given by

Note that . By means of the binomial formula, we get, for any ,

and hence we obtain by a term-by-term inversion

where is a Wright hypergeometric function, see e.g. Braaksma [7, Chap. 12]. Note that for ,

recovering the exponential jumps case studied above. Next, observing that for big enough by the binomial theorem,

we get, by means of Laplace transform inversion and Theorem 2.1,

| (3.3) |

Note that, for any , the power series

is analytic in the disc of radius . Since for any , and, clearly for any and , we deduce that the series on the right-hand side of (3.3) is uniformly convergent on . Note also that the identity (3.3) simplifies when is an integer. In particular, when , the finite-time ruin probability is simply a weighted sum of and the infinite-time ruin probability, i.e.

Moreover, when , we have

where the last equality follows from the identity , see, after correcting the obvious typo, formula 9.11.2 in [23]. This is consistent with the previous example. We finally note that when , we can use (3.1) to get a new example where the infinite-time ruin probability is explicit.

3.3. The stable subordinator

We assume that under is a stable subordinator of index . Its Laplace exponent takes the form , . It is easy to verify that in this case , . One can check by taking Laplace transforms and using the scaling property of that,

Hence, by writing for the distribution of a positive stable random variable of index , we deduce in combination with Theorem 2.1 that

and by taking the limit as , we get from Corollary 2.2,

We mention that a series representation of stable densities can be found in Sato [31]. Additional interesting representations has also been derived by Schneider [34]. In particular, in the case , we recall that the stable distribution admits the well known simple expression

| (3.4) |

We consider now the image of by the mapping which gives

This Laplace exponent is a specific instance of the family of characteristic exponents of truncated Lévy processes constructed by Boyarchenko and Levendorskii [6], also called tempered stable processes. From the identity (3.1), we deduce that

3.4. Example from Theorem 2.3

We now give an example where we use the representation (2.4) for the finite-time absolute survival probability in Theorem 2.3. Assume with and

Then is a Lévy measure that satisfies all the conditions of Theorem 2.3. Note that this Lévy measure corresponds to a subordinator with stable-like jumps near the origin and no jumps larger than . This model with claims bounded in size, might for instance be used in the case where the insurance company has excess-of-loss reinsurance. A straightforward computation involving integration by parts, shows that

where is the incomplete gamma function. We want to check how well the spectral representation (2.4) performs. Since we do not know an explicit expression for , we proceed by numerical inversion. Let . For we compute by inverting the right-hand side of (4.9) below using the (inverse) fast Fourier transform. We then numerically integrate to get and consequently we get an approximation for the right-hand side of (2.4) where the upper boundary is replaced by . We remark here that as increases, it gets more difficult to obtain accurate approximations for since these functions oscillate more and more as increases. In particular, for , has distinct zeros, cf. [32, Theorem 5.1]. In order to get an approximation for the left-hand side of (2.4), note that from (4.2), it follows that the Fourier transform of the transition density of under is given by

| (3.5) |

and by numerical Fourier inversion and integration, one gets (cf. Theorem 2.1) an approximation of the finite-time absolute survival probability at a fixed time . Hence we obtain numerical approximations of the truncation error corresponding to (2.4) which we define by

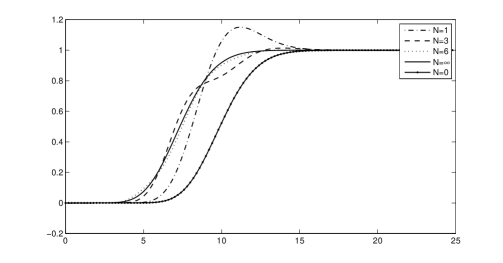

For our example we take , , , and . All the calculations are done in Matlab. In Table 1, numerical approximations of the truncation error are displayed for different values of and . One sees that convergence takes place for as grows and that for a fixed , the error becomes smaller as grows. We point out that the numbers in the table, besides the truncation error, also consists of integration error due to the Fourier inversion. In particular, the integration error will dominate the truncation error for high values of (and low values of ) due to the highly oscillating nature of for large values of ; this might explain the large value in the table for and . The spectral representation performs badly for , but note that and hence this case is not covered by Theorem 2.3. The convergence of to for is graphically displayed in Figure 1.

We remark that the benefit of computing finite-time absolute survival/ruin probabilities via (2.4) is that one can quickly calculate these probabilities for a whole range of time points , whereas if ones uses the method via (3.5), one has to perform a separate Fourier inversion for each . Moreover, by using the spectral representation, one can take advantage of (3.1) to quickly obtain the distribution of the absolute ruin time in the case where the tail of the Lévy measure equals with .

| 3 | 5 | 7 | 10 | 15 | |

|---|---|---|---|---|---|

| 0 | 0.905 | 0.718 | 0.526 | 0.312 | 0.130 |

| 1 | 0.768 | 0.461 | 0.244 | 0.091 | 0.027 |

| 2 | 1.283 | 0.453 | 0.139 | 0.025 | 0.020 |

| 3 | 1.587 | 0.385 | 0.090 | 0.024 | 0.021 |

| 4 | 2.424 | 0.426 | 0.088 | 0.025 | 0.021 |

| 6 | 4.080 | 0.349 | 0.039 | 0.022 | 0.021 |

| 9 | 9.320 | 0.237 | 0.033 | 0.022 | 0.021 |

| 12 | 22.508 | 0.167 | 0.031 | 0.022 | 0.021 |

| 16 | 582.088 | 0.887 | 0.030 | 0.022 | 0.021 |

4. Proofs

Proof of Theorem 2.1.

First, by means of a change of variables and the duality lemma for Lévy processes, see e.g. [4, p. 45], we obtain

| (4.1) | |||||

Let . Now using that the ruin time is absolute, (1.2) and (4.1),

which gives the first assertion. The second follows directly from the well-known expression for the Laplace transform of under which reads,

| (4.2) |

see e.g. Sato [30]. ∎

Denote by (resp. ) the semigroup of the process under (resp. ), i.e. for any positive measurable function on ,

For the proof of Theorem 2.4 we need the following lemma; note that part (ii) is a (weak) duality result between the two semigroups.

Lemma 4.1.

-

(i)

For any and ,

(4.3) where stands for the identity in distribution.

-

(ii)

For any two positive measurable functions and ,

(4.4) where .

-

(iii)

For all , .

Proof.

Item (i) follows directly from (1.2). Next, using successively Tonelli, (4.3), a change of variables, (4.1) and (4.3) again, we get

yielding (ii). Finally, choosing and with in (4.4) leads to and now by applying standard argument from measure theory (cf. Exercise 3.1.12 of [36]) and Fatou’s lemma, we get

Hence for all and the proof is completed. ∎

Proof of Theorem 2.4.

The first equality follows directly from Lemma 4.1(iii) and (2.1). In order to prove the second equality, we first show that for all ,

| (4.5) |

Let , and recall that . From the identity (2.2) and observing the convolution in (2.5), we get

| (4.6) |

On the other hand, using successively (4.4), (4.2) and (4.6), we obtain, denoting , , that the Laplace transform of the left-hand side of (4.5) is given by

Hence by uniqueness of the Laplace transform and the continuity of , (4.5) follows.

Proof of Theorem 2.3.

Denote , . By assumption (i), and consequently are entire functions (see e.g. [30, Section 25]) and hence we can write

| (4.8) |

By assumption (ii), and thus from Sato and Yamazato [32, Equation (2.20)], we get

| (4.9) |

From the above identity, we deduce that

| (4.10) |

and now we want to use Fubini to switch the sum and the integral. We have for by (4.8),

| (4.11) |

Using Fubini, we have

Because of condition (ii), it follows by [5, Equation (4.3.8)] that

and hence by Karamata’s Theorem [5, Theorem 1.5.11],

Here as stands for . Similarly for by Fubini,

and thus by Karamata’s theorem and Karamata’s Tauberian theorem [5, Theorem 1.7.1],

In particular is regularly varying at infinity with parameter and thus

It follows that as if . Assume now that and let . Then is regularly varying at infinity with parameter and it follows by e.g. [5, Theorem 1.5.6(iii)] that there exists some and such that for all , . Since and are even and continuous functions, we can now conclude that the right-hand side of (4.11) is finite.

This allows us to use Fubini in (4.10) for to get with the aid of (4.8),

The right-hand side of the previous identity is the inverse Fourier transform of the Fourier transform of with . From earlier considerations, we see that this Fourier transform is integrable when . This implies in particular that for , has a continuous density , see e.g. the first line of Section 28 in Sato [30]. Since is trivially integrable as well, we can now use the Fourier inversion theorem (see e.g. [14, Theorem 8.26]) to conclude

The first identity follows then from the identity (4.3).

To prove the second identity, noting that the right-hand side of (4.11) does not depend on , we see that for any measurable and integrable (i.e. ), we can use Fubini to deduce

Choosing and applying Theorem 2.1 shows (2.4). The last part follows by taking Laplace transforms on both sides, hereby making use of Fubini, (4.2) and (2.2). Note that by p.190/191 of [30], goes to zero as goes to and hence is bounded on which allows one to use Fubini. ∎

References

- [1] H. Albrecher and S. Asmussen. Ruin Probabilities. World Scientific, New Jersey, second edition, in press, 2010. ISBN: 978-981-4282-52-9.

- [2] H. Albrecher, J. L. Teugels, and R. F. Tichy. On a gamma series expansion for the time-dependent probability of collective ruin. Insurance Math. Econom., 29(3):345–355, 2001. 4th IME Conference (Barcelona, 2000).

- [3] O.E. Barndorff-Nielsen and N. Shephard. Non-Gaussian Ornstein-Uhlenbeck-based models and some of their uses in financial economics. Journal of the Royal Statistical Society, 63(2):167–241, 2001.

- [4] J. Bertoin. Lévy Processes. Cambridge University Press, Cambridge, 1996.

- [5] N. H. Bingham, C. M. Goldie, and J. L. Teugels. Regular variation, volume 27 of Encyclopedia of Mathematics and its Applications. Cambridge University Press, Cambridge, 1989.

- [6] S. Boyarchenko and S. Levendorskii. Option pricing for truncated Lévy processes. Inter. J. Theor. Appl. Fin., 3:549–552, 2000.

- [7] B.L.J. Braaksma. Asymptotic expansions and analytic continuations for a class of Barnes-integrals. Compositio Math., 15:239–341, 1964.

- [8] H. Bühlmann. Mathematical methods in risk theory. Die Grundlehren der mathematischen Wissenschaften, Band 172. Springer-Verlag, New York, 1970.

- [9] Ph. Carmona, F. Petit, and M. Yor. Exponential functionals of Lévy processes. Lévy processes Theory and Applications, pages 41–55, 2001.

- [10] A. Dassios and P. Embrechts. Martingales and insurance risk. Comm. Statist. Stochastic Models, 5(2):181–217, 1989.

- [11] E. B. Dynkin. Markov processes. Vols. I, II, volume 122 of Translated with the authorization and assistance of the author by J. Fabius, V. Greenberg, A. Maitra, G. Majone. Die Grundlehren der Mathematischen Wi ssenschaften, Bände 121. Academic Press Inc., Publishers, New York, 1965.

- [12] P. Embrechts and H. Schmidli. Ruin estimation for a general insurance risk model. Adv. in Appl. Probab., 26(2):404–422, 1994.

- [13] D. Filipović. A general characterization of one factor affine term structure models. Finance Stoch., 5(3):389–412, 2001.

- [14] G. B. Folland. Real analysis. Pure and Applied Mathematics (New York). John Wiley & Sons Inc., New York, second edition, 1999. Modern techniques and their applications, A Wiley-Interscience Publication.

- [15] H. U. Gerber. Der einfluss von zins auf die ruinwahrscheinlichkeit. Bulletin of the Swiss Association of Actuaries, 71:63–70, 1971.

- [16] H. U. Gerber. An introduction to mathematical risk theory, volume 8 of S.S. Heubner Foundation Monograph Series. University of Pennsylvania Wharton School S.S. Huebner Foundation for Insurance Education, Philadelphia, Pa., 1979. With a foreword by James C. Hickman.

- [17] H. U. Gerber and H. Yang. Absolute ruin probabilities in a jump diffusion risk model with investment. N. Am. Actuar. J., 11(3):159–169, 2007.

- [18] D.I. Hadjiev. The first passage problem for generalized Ornstein-Uhlenbeck processes with nonpositive jumps. In Séminaire de Probabilités XIX,1983/84, volume 1123 of Lecture Notes in Math., pages 80–90. Springer, Berlin, 1985.

- [19] A. M. Iksanov and Z. J. Jurek. Shot noise distributions and selfdecomposability. Stochastic Anal. Appl., 21(3):593–609, 2003.

- [20] A. E. Kyprianou. Introductory lectures on fluctuations of Lévy processes with applications. Universitext. Springer-Verlag, Berlin, 2006.

- [21] A. E. Kyprianou and P. Patie. Transformations of characteristic exponents of convolution semigroups. Working Paper, 2008.

- [22] A. E. Kyprianou and V. Rivero. Special, conjugate and complete scale functions for spectrally negative Lévy processes. Electron. J. Probab., 13:1672–1701, 2008.

- [23] N.N. Lebedev. Special Functions and their Applications. Dover Publications, New York, 1972.

- [24] H. P. McKean. Elementary solutions for certain parabolic partial differential equations. Trans. Amer. Math. Soc., 82:519–548, 1956.

- [25] A.A. Novikov. Martingales and first passage times for Ornstein-Uhlenbeck processes with a jump component. Teor. Veroyatnost. i Primenen, 48(2):340–358, 2003.

- [26] Y. Ogura. Spectral representation for branching processes with immigration on the real half line. Publ. Res. Inst. Math. Sci., 6:307–321, 1970.

- [27] J. Paulsen. Ruin models with investment income. Probab. Surveys, 5:416–434 (electronic), 2008.

- [28] J. Paulsen. Ruin theory with compounding assets—a survey. Insurance Math. Econom., 22(1):3–16, 1998. The interplay between insurance, finance and control (Aarhus, 1997).

- [29] D. Perry, W. Stadje, and S. Zacks. First-exit times for Poisson shot noise. Stoch. Models, 17(1):25–37, 2001.

- [30] K. Sato. Lévy Processes and Infinitely Divisible Distributions. Cambridge University Press, Cambridge, 1999.

- [31] K. Sato. Density transformation in Lévy processes. Technical Report Lecture Notes 7, MaPhySto, Aarhus, Denmark, 2000.

- [32] K. Sato and M. Yamazato. On distribution functions of class . Z. Wahrsch. Verw. Gebiete, 43(4):273–308, 1978.

- [33] H. Schmidli. Risk theory in an economic environment and Markov processes. Schweiz. Verein. Versicherungsmath. Mitt., (1):51–70, 1994.

- [34] W. R. Schneider. Stable distributions: Fox functions representation and generalization. In Stochastic processes in classical and quantum systems (Ascona, 1985), volume 262 of Lecture Notes in Phys., pages 497–511. Springer, Berlin, 1986.

- [35] C.-O. Segerdahl. Über einige risikotheoretische Fragestellungen. Skand. Aktuarietidskr., 25:43–83, 1942.

- [36] D. W. Stroock. A concise introduction to the theory of integration. Birkhäuser Boston Inc., Boston, MA, third edition, 1999.

- [37] V.N. Suprun. The ruin problem and the resolvent of a killed independent increment process. Ukrain. Mat. Ž., 28(1):53–61, 1976.