=0

Recovery Rates in investment-grade pools of credit assets:

A large deviations analysis

Abstract.

We consider the effect of recovery rates on a pool of credit assets. We allow the recovery rate to depend on the defaults in a general way. Using the theory of large deviations, we study the structure of losses in a pool consisting of a continuum of types. We derive the corresponding rate function and show that it has a natural interpretation as the favored way to rearrange recoveries and losses among the different types. Numerical examples are also provided.

Keywords Recovery rates, Default rates, Credit assets, Large deviations

Mathematics Subject Classification 60F0560F1091G40

JEL Classification G21G33

1. Introduction

Understanding the behavior of large pools of credit assets is currently a problem of central importance. Banks often hold such large pools and their risk-reward characteristics need to be carefully managed. In many cases, the losses in the pool are (hopefully) rare as a consequence of diversification. In [Sowa], we have used the theory of large deviations to gain some insight into several aspects of rare losses in pools of credit assets. Our interest here is the effect of recovery. While a creditor either defaults or doesn’t (a Bernoulli random variable), the amount recovered may in fact take a continuum of values. Although many models assume that recovery rate is constant—i.e., a fixed deterministic percentage of the par value, in reality the statistics of the amount recovered should be a bit more complicated. The statistics of the recovered amount should depend on the number of defaults; a large number of defaults corresponds to a bear market, in which case it is more difficult to liquidate the assets of the creditors. Our goal is to understand how to include this effect in the study of rare events in large pools. We would like to look at these rare events via some ideas from statistical mechanics, or more accurately the theory of large deviations. Large deviations formalizes the idea that nature prefers “minimum energy” configurations when rare events occur. We would like to see how these ideas can be used in studying the interplay between default rate and recovery rate.

Our work is motivated by the general challenge of understanding the effects of nonlinear interactions between various parts of complicated financial systems. One of the strengths of the theory of large deviations is exactly that it allows one to focus on propagation of rare events in networks. Our interest here is to see how this can be implemented in a model for recovery rates which depend on the default rate.

This work is part of a growing body of literature which applies the theory of large deviations to problems of rare losses in credit assets and tries to approximate the tail distribution of total losses in a portfolio consisting of many positions. For a survey on some existing large deviations methods applied to finance and credit risk see [Pha07]. In [GKS07, GL05] rare event asymptotics for the loss distribution in the Gaussian copula model of portfolio credit risk and related importance sampling questions are studied. In [G02] the author considers saddle point approximations to the tails of the loss distribution. Measures such as Value-at-Risk (VaR) and expected shortfall have been developed in order to characterize the risk of a portfolio as a whole, see for example [DS03, G03, MFE05, FM02, FM03]. Issues of recovery have also been considered in the works [ABRS05, SH09] and in the references therein. Our work is most closely related to [DDD04, LMS09], where the dynamics of a configuration of defaults was studied. In [DDD04] it is assumed that a ”macro-environmental” variable , to which all the obligors react, can be chosen so that conditional on , the recovery and default rates in a pool of finite number of ”types” are independent. In [LMS09] the recovery rate is assumed to be independent of the defaults in a pool of one type with a brief treatment of a pool with finite types. Our work here is explicitly interested in the dependence of the recovery rate on the fraction of the number of defaults and the framework of our efforts is a continuum of types. The case of a continuum of types requires slightly more topological sophistication. The dependence assumption and the continuum of types unavoidably complicate the proof since several auxiliary technical results need to be proven.

The novelty of our result stems from the following two things. The first novelty is that the distribution of the recoveries for the defaulted assets depends upon the number of defaults in a fairly general way. This allows for consideration of the case when recovery rates are affected by the number of defaults. Note however that the individual defaults are assumed independent. The second novelty is more technical in nature. In particular, we prove the large deviations principle for the joint family of random variables where is the average loss and is the empirical measure on type-space determined by the names which default. In addition to the large deviations principle, we derive various equivalent representations for the rate function which give some more insight to the favored way to rearrange recoveries and losses among the different types and also ease its numerical computation.

The paper is organized as follows. In Section 2 we introduce our model and establish some notation. In Section 3 we study the “typical” behavior of the loss of our pool; we need to understand this before we can identify what behavior is “atypical”. In Section 4, we present some formal sample calculations and our main results, Theorems 4.6 and 4.8. These calculations are indicative of the range of possibilities and they illustrate the main results. In Section 5 we present some numerical examples which illustrate some of the main aspects of our analysis and conclude with a discussion and remarks on future work. The proof of Theorem 4.6 is in Sections 6, 7 and 8. Section 9 contains an alternative expression of the rate function, which is a variational formula which optimizes over all possible configuration of recoveries and defaults, and which leads to a Lagrange multiplier approach which can be numerically implemented. Lastly, Section 10 contains the proofs of several necessary technical results.

The model at the heart of our analysis is in fact very stylized. Since our primary interest is the interaction between default rates and recovery rates, our model focuses on this effect, but simplifies a number of other effects. In particular, we assume that the defaults themselves are independent. Our work complements the existing literature and hopefully contributes to our understanding of the interplay and interaction of recovery and default rates. It seems plausible that more realistic models (e.g., which include a systemic source of risk) can be analyzed by techniques which are extensions of those developed here.

2. The Model

In this section we introduce our model and explain our goals. Let’s start by considering a single bond (or “name”). For reference, let’s assume that all bonds have par value of . If the bond defaults, the assets underlying the bond are auctioned off and the bondholder recovers dollars, where . We will record the default/survival coordinate as an element of , where corresponds to a default and to survival.

The pool suffers a loss when a bond defaults, and the amount of the loss is , where is the recovery amount (in dollars). Define

and let be the non-zero loss that occurs in the event of default of the name, i.e., when . Equivalently, is the non-zero exposure of the name that occurs when . Clearly if is the recovery of the name then .

The default and loss rates in the pool are then

| (2.1) |

We denote by the risk-neutral probability of default of the name in a pool of names. Moreover, let be the distribution of the recovery of the name in a pool of names. Notice that we allow to depend on the default rate .

Let us make now the aforementioned discussion rigorous by introducing the probability space that we consider. The minimal state space for a single bond is the set . Since we want to consider a pool of bonds, the state space in our model will be , where . , as a closed subset of is also Polish, and thus is also Polish. We endow with the natural -algebra .

The only remaining thing to specify is a probability measure on . For each , fix . These are the risk-neutral default probabilities of the names when the pool has names. We next fix 111We shall write as a map from into such that for each , is an element of and such that is weakly continuous.; i.e., a collection of probability measures on , the range of the recovery, indexed by the default rate . Namely, for each and , is a probability measure that depends on the default rate . Some concrete examples are in Subsection 5.1.

For each and , define the coordinate random variable . For each , we then fix our risk-neutral probability measure (with associated expectation operator ) by requiring that

for all . In particular, the aforementioned construction implies that for each , is an independent collection of random variables with under .

With this probabilistic structure in place, we will clearly want to be able to condition on the default rate so that we can then focus on the recovery rates. To this end we define the -algebra

We are interested in the typical behavior and rare events in this system. We seek to understand the structure of these rare events in our model. We are interested in the following questions:

-

•

What is the typical behavior of the system? In other words we want to characterize .

-

•

What can we say about rare events in this general setting? In particular we compute the asymptotics of as , particularly for . Then is an “atypical” event.

Understanding the structure of rare events may give guidance in how to optimally control how rare events propagate in large financial networks.

Remark 2.1.

Our formulation allows for a fairly general dependence of the recovery distribution on the default rate. This is also partially exploited in Subsection 5.1 where we study several concrete examples. On the other hand, the general treatment of this paper unavoidably complicates the proof of the law of large numbers and especially of the large deviations principle.

3. Typical Events: A Law of Large Numbers

Let’s start our analysis by identifying the “typical” behavior of as defined by equation (2.1). In order to motivate the calculations, we first investigate how and behave as in a homogeneous pool, Example 3.1, and in a heterogeneous pool of two types, Example 3.2.

Example 3.1 (Homogeneous Example).

Fix and and let and for all and .

Let’s see what and look like in this setting. By the law of large numbers . Thus in distribution

where the ’s are i.i.d. with distribution . We should consequently have that

Example 3.2 (Heterogeneous Example).

Fix and in and fix and in . Every third bond will be of type and have default probability and recovery distribution governed by , and the remaining bonds will have default probability and recovery distribution governed by . In other words, the rate of default among the bonds is and the rate of default among the bonds is .

For future reference, let’s separate the defaults and into the two types. If we define

we have

Thus and , so

Thus we should roughly have

where the ’s have law , the ’s have distribution and the ’s and ’s are all independent. Consequently, it seems natural that

the first term being the limit of the losses from the type A names, and the second term being the limit of the losses from the type B names.

In view of our examples, it seems reasonable that we should be able to describe the average loss in the pool in terms of a frequency count of

We note that takes values in the set . Since is Polish, so is , and thus is Polish. We will henceforth refer to elements of as types. For each , we now define as

Assumption 3.3 below is our main standing assumption. It is a natural assumption since it makes the family relatively compact. It will be assumed throughout the paper, even though this may not be always stated explicitly.

Assumption 3.3.

We assume that exists (in ).

Remark 3.4.

We can now identify the limiting behavior of . Define

| (3.1) |

To see that these quantities are well-defined, note that

| (3.2) |

are continuous mappings from, respectively, and , to . The continuity of the first map of (3.2) implies that is well-defined. Combining the continuity of both maps of (3.2), we get that the map

is a continuous map from to ; thus is also well-defined.

Proof.

For and , let’s first define

Again we can use (3.2) and show, by the same arguments used to show that and of (3.1) are well-defined, that is well-defined, and furthermore that it is continuous on . For each , define

note that is a random variable but and are deterministic. Note also that by weak convergence,

The claim will follow if we can prove that

| (3.3) |

To see the first part of (3.3), we calculate that

Conditioning on , we have that

This implies the first part of (3.3).

To see the second part of (3.3), we write that where

We first calculate that

Thus . Similarly,

Therefore

To bound , fix . Due to Assumption 3.3, Prohorov’s theorem implies that is tight, so there is a such that

Defining

for all , compactness of and and continuity of imply that . Thus

Take , then let . Finally let . We conclude that indeed . Hence, the second part of (3.3) also holds which concludes the proof of the lemma.∎

4. Problem Formulation and Main Results

Let’s now set up our framework for considering atypical behavior of the ’s; i.e., large deviations. We motivate the main result, Theorem 4.6 through a formal discussion related to the setting of Examples 3.1 and 3.2. The proof of Theorem 4.6 is in Sections 6, 7 and 8. In Section 6 we prove compactness of the level sets of the rate function. In Sections 7 and 8 we prove the large deviations lower and upper limit respectively. An equivalent insightful representation of the rate function is given in Theorem 4.8 and its proof is in Section 9. This representation is a variational formula which optimizes over all possible configuration of recoveries and defaults, and which leads to a Lagrange multiplier approach which can be numerically implemented.

For the convenience of the reader we here recall the concept of the large deviations principle and the associated rate function.

Definition 4.1.

If is a Polish space and is a probability measure on , we say that a collection of -valued random variables has a large deviations principle with rate function if

-

(1)

For each , the set is a compact subset of .

-

(2)

For every open ,

-

(3)

For every closed ,

One thing which is clear from Example 3.2 is that we need to keep track of the type associated with each default (but not the types associated with names which do not default). To organize this, let be the collection of measures on such that (i.e., the collection of subprobability measures).

As it is discussed in Section 6, is a Polish space. For each , define a random element of as

| (4.1) |

Thus, is the empirical measure on type-space determined by the names which default.

Next, define a sequence of -valued random variables as

Since and are both Polish, is also Polish. We seek a large deviations principle for the ’s. Since projection maps are continuous, the contraction principle will then imply a large deviations principle for the ’s. Note furthermore that

the map is continuous in the topology on , so the recovery statistics depend continuously on .

Before proceeding with the analysis, we need to define some more quantities.

Definition 4.2.

For , define

For , define

To understand the behavior of , we need to construct its moment generating function. For this purpose, we have the following definition.

Definition 4.3.

For , define

is the Legendre-Fenchel transform of .

Let’s now see if we can formally identify a large deviations principle for the ’s in the setting of Examples 3.1 and 3.2. In both examples we want to find a map such that, at least formally,

for each fixed . Assume that . This is done without loss of generality, since, as we shall also see in the sequel, the rate function if .

Conditioning on the event that , we have

| (4.2) |

We want to derive asymptotic expressions for the first and second term in the right hand side of (4.2).

Example 4.4.

[Homogeneous Example 3.1 continued]. First, we understand the second term in (4.2), i.e., . Recall that

This is now essentially the focus of Sanov’s theorem–i.i.d. Bernoulli random variables. Namely, recalling the definition of and by Definition 4.2 we have

| (4.3) |

Second, we understand the first term in (4.2), i.e. . As in Example 3.2, we should have in law

| (4.4) |

where the ’s are i.i.d. with common law . In the homogeneous pool of this example, the log moment generating function defined in Definition 4.3 takes the form

for all . The logarithmic moment generating function of of (4.4) is approximately . Thus we should have that

We should then get the large deviations principle for by combining this, (4.3), and (4.2), i.e.,

Example 4.5.

[Heterogeneous Example 3.2 continued]. We proceed similarly to Example 4.4. First, we understand the second term in (4.2), i.e., . Observe, that we explicitly have

Similarly

Thus

Again, this is essentially the focus of Sanov’s theorem–i.i.d. Bernoulli random variables. Namely, recalling the definition of and by Definition 4.2 we have

| (4.5) | ||||

Second, we understand the first term in (4.2), i.e. . If , then there are about defaults of type A, and defaults of type B. Thus, as in Example 3.2, we should have in law

| (4.6) |

where the ’s are i.i.d. with common law and the ’s are i.i.d. with common law . In the heterogeneous pool of this example, the log moment generating function defined in Definition 4.3 takes the form

for all . The logarithmic moment generating function of of (4.6) is approximately . Thus we should have that

We should then get the large deviations principle for by combining this, (4.5), and (4.2), i.e.,

Theorem 4.6 (Main).

Proof.

Next we mention a useful representation formula for that is defined in Definition 4.2. Its proof will be given in Section 10. Define

for all and . Then and are convex duals; i.e.,

| (4.8) | ||||

and we have:

Lemma 4.7.

One way to interpret Theorem 4.6 is that the rate functions and give the correct way to find the “minimum-energy” configurations for atypically large losses to occur. In general, variational problems involving measures can be computationally difficult, so Section 9 addresses some computational issues. In particular, we find an alternate expression which takes advantage of the specific structure of our problem. Define

| (4.10) | ||||

for all . Observe that we can write

| (4.11) |

for all and . Define next .

Theorem 4.8.

Let Assumption 3.3 hold. For and , set

| (4.12) | ||||

We have that for all . An alternate representation of is

| (4.13) | ||||

The proof of this is given in Section 9. The point of the second representation (4.13) is that the innermost minimization problem (the one with and fixed) involves linear constraints. Namely, that takes values in and that two integrals of take specific values. This will be useful in some of our numerical studies in the next section.

5. Examples and Discussion

In Subsection 5.1 we present some numerical examples. These examples showcase some of the possibilities and some of the implications of the dependence of the recovery distribution on the defaults. We conclude this section with Subsection 5.2, where we summarize our conclusions.

5.1. Numerical Examples

Let’s see what our calculations look like in some specific cases. To focus on the effects of recovery, let’s assume a common (relatively high) probability of default of ; i.e., for all and .

In the first group of examples (Cases 1-4), we will consider four specific cases, one with fixed recovery rate, two homogeneous pools with stochastic recoveries and one heterogeneous pool with stochastic recovery. For comparison purposes, the law of large numbers average loss in the pool will be the same in all cases and equal to . We would like to remark the following. In a more realistic scenario one would expect to have pools with combinations of high-rated and low-rated counter-parties that have different default probabilities. Our formulation allows for such a scenario, but since we want to focus on the effects of recovery we assume a common probability of default in all of our examples. Moreover, recall that we have assumed as a reference point that all bonds have par value of . We will see that the tails (the large deviations principle rate functions) are significantly different. Although our theory has primarily focused on the rate function in the large deviations principle for , the solution of the variational problem (4.7) (or equivalently (4.12) or (4.13)) gives useful information.

In the second group of examples (Cases 5-6), we consider two heterogeneous pools, one with recovery whose distribution depends on the default rate (Case 5) and one with recovery whose distribution does not depend on the default rate (Case 6). As expected, the dependence on the default rate affects the tails.

In Cases 2-5 we consider stochastic recovery rates. We want to consider the case that the recovery is in an appropriate sense negatively correlated with the defaults; i.e., that more defaults imply less recovery. In an economy that experiences recession, recovery rates tend to decrease just as defaults tend to increase. This property is also a documented empirical observation, e.g., see [SH09], [ABRS05] and the references therein.

In Case 1, let’s assume that the recovery rate is fixed at ; i.e., for all and . The LDP here is essentially a straightforward application of Cramer’s Theorem. Let’s see how our general formulation of Theorem 4.6 covers this as a special case. In this case and . Also we have

and

Collecting things together, we have that and are governed, respectively, by the rate functions

We note that is finite only if .

In Case 2 we consider a homogeneous pool with the recovery rate following a beta distribution. Essentially, this is a special case of Examples 3.1 and 4.4. For , define

this is the law of the beta distribution with parameters and . As increases, the amount of mass near decreases. We also have that

for all (as increases, the mean of decreases). This will allow a number of explicit formulae for the expected recovery (given the default rate).

We here assume that the recovery rate has a beta distribution whose parameters depend linearly and monotonically on the empirical default rate. Namely, if the default rate is , then the recoveries will all have common beta distribution with parameters and

note that . Define

Then .

This choice of results in a conditional expected recovery which is affine in ; i.e.,

Observe that the expected recovery of a single name in the homogeneous pool is decreasing in and always in . According to (3.1), the law of large numbers average loss is

The rate functions in this case are somewhat similar to those in Case 1. Again we have that

For each , define

Then if where we have from Definition 4.3,

Here and are governed, respectively, by the rate functions.

| (5.1) | ||||

In Case 3, we replace of Case 2 with one that results in a conditional expected recovery which is quadratic in ; this allows us some insight into the effects of convexity in the conditional expected recovery. We set

Again we have that , and we set , , and have that Here we have that

Observe that the expected recovery of a single name in the homogeneous pool is decreasing in and always in .

We again get that . The corresponding rate function is .

Case 4 involves the beta distribution again. Here, however, we now consider a heterogeneous pool of two types (Examples 3.2 and 4.5). We concentrate on the effect of the heterogeneity in the recovery distribution, so as in the previous cases all bonds will have default probability of . For all , every third bond will have recovery distribution governed by and the remaining bonds will have recovery distribution governed by . We thus have that . It is easy to see that again the law of large numbers average loss is:

For notational convenience and in order to illustrate the usage of Theorem 4.8 we use the alternative representation (4.13). If for some , then for all , we have that for all and for all . Since the support of is exactly , we can consider and in of the form

Thus (4.13) becomes

| (5.2) | ||||

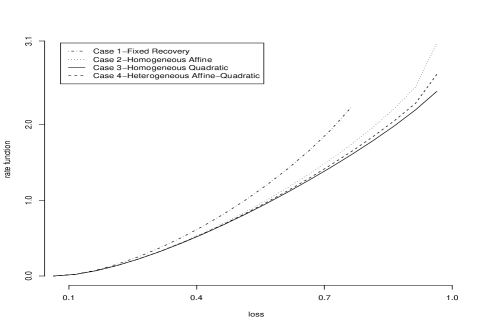

In Figure 1, we plot the rate functions , , and . We use a Monte Carlo procedure to compute and . As expected, all action functions are nonnegative and zero at the (common) law of large numbers average loss of .

We observe that . In particular, the heterogeneous case, which is a mixture of an affine conditional expected recovery and a quadratic conditional expected recovery, is in between the two homogeneous cases (cases 2 and 3). Of course, we should not be surprised that the rate function in Case 1 is larger than that in Cases 2 through 4, there are in general many more configurations which lead to a given overall loss rate. An interesting observation that seems to be suggested by the examples considered here is that more convexity results in smaller values for the rate function.

The discussion from now on will be formal. However, we believe that it offers some useful insights in the effect of default rates on the average recovery of large pools.

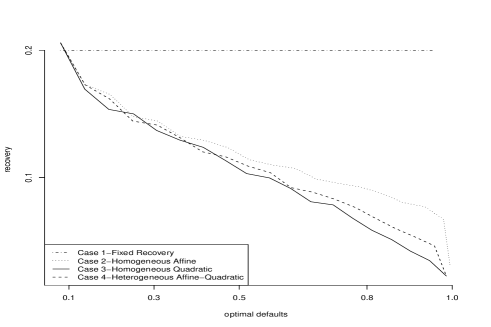

Another useful insight which we can numerically extract is the “preferred” way which losses stem from defaults versus recovery. For each , let be the minimizer222Case 1 is of course degenerate this sense; for a given loss rate , the default rate must be very close to . in the expression (5.1) for , or alternately the expression (5.2) for . can be interpreted as the “most likely“ default rate in the pool given that . We make the following assumption.

Assumption 5.1.

Assume that for each the aforementioned minimizer exists and is unique.

Numerically finding in the examples considered here, verifies that Assumption 5.1 holds in these cases. For and , the Gibbs conditioning principle [DZ98, Section 7.3] implies that we should have that

| (5.3) |

In other words, conditional on the pool suffering losses exceeding rate , the default rate should converge to . Using this information, we can then say something about how the average recovery of the pool is related to the optimal default rate . Motivated by (3.1) we write that

to find an effective recovery rate in terms of the loss rate and the default rate. This formulation quantifies the fact that losses are due to both default and recovery. For atypically large losses in a large pool of credit assets, we should combine this with the Gibbs conditioning calculation of (5.3). Namely, let’s define

We can also formalize the dependence of recovery on default by letting be such that

| (5.4) |

We refer to as the effective average recovery of the pool.

Figure 5.2 is a plot of for the cases which we are studying. As it was expected, we observe that, for Cases and , the optimal average recovery of the pool and the optimal defaults are negatively correlated. Of course, this is consistent with the corresponding negative correlation of the individual recovery and default rate that is embedded in the choices of the individual recovery distribution. Notice however that is a ”global” quantity in that it represents the effective average recovery in the pool. Another interesting observation is that the graph of the heterogeneous case which is a mixture of an affine and a quadratic conditional expected recovery is between the graph of the homogeneous cases 2 and 3 which treat the affine and quadratic case respectively.

We conclude this subsection with a comparison of a heterogeneous portfolio whose distribution of recovery depends on the default rate with one that does not.

Case 5. Consider the setup of Case 4 with the only difference being the definitions of and . In particular, we consider

The corresponding rate function is .

Case 6. Again, consider the setup of Case 4 with the only difference being the definitions of and . In particular, we consider

Notice that in this case the distribution of the recovery is independent of the default rate . The corresponding rate function is .

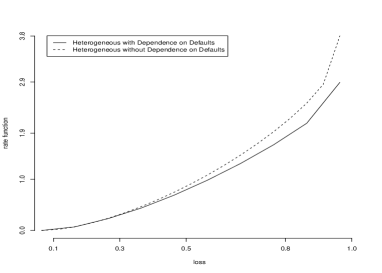

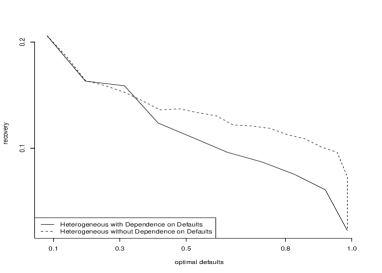

In both cases the law of large numbers average loss is the same as before. In Figure 5.3, we plot (a): on the left, the rate functions and and (b): on the right, for cases 5 and 6.

As it is indicated by the left figure, one of the effects of the dependence of the distribution of the recovery on the defaults is to decrease the values of the rate function, i.e., . The effective average recovery, , is in both cases negatively correlated with the optimal default rate . Notice however that for large overall default rates the effective average recovery of the heterogeneous pool with dependence on defaults (Case 5) is less than the effective average recovery of the heterogeneous pool without dependence on defaults (Case 6). This is consistent with our intuition, namely that dependence of the recoveries on defaults should affect the recovery of the pool and in particular that more defaults should decrease recovery.

5.2. Conclusions and Discussion

In this subsection we summarize our findings and pose some question that would be interesting to study.

-

•

Assuming that the recoveries for the defaulted assets depend upon the number of defaults in a fairly general way we have characterized the typical (Lemma 3.5) and atypical (Theorems 4.6 and 4.8) behavior of the loss rates in the pool. This allows for consideration of the case when recovery rates are affected by the number of defaults. We prove in Theorem 4.6 the large deviations principle for the joint family of random variables where is the average loss and is the empirical measure on type-space determined by the names which default. Then, the large deviations principle for follows by the contraction principle. Furthermore, we derive in Theorem 4.8 various equivalent representations for the rate function which give some more insight to the favored way to rearrange recoveries and losses among the different types and also ease its numerical computation.

-

•

Moreover, as we have demonstrated in Subsection 5.1, the rate functions can be calculated numerically for both homogeneous and heterogeneous cases. The rate function determines the main term in the logarithmic asymptotics of the probability that the average loss in the pool is, let’s say, bigger than a specific level. In particular, it determines the main term of the tail distribution of total losses on a portfolio consisting of many positions. See also [DDD04, G02] for a related discussion. Also note that in the examples considered here, more convexity resulted in smaller rate functions.

-

•

Our formulation allows to extract some information regarding the optimal default rate in the pool for a given level of average loss in the pool. Moreover, a useful insight into the fact that losses are due to both default and recovery is perhaps given by the effective average recovery as defined by relation (5.4).

-

•

As it is indicated by the comparison of Cases 5 and 6, the effect of the dependence of the distribution of the recovery on the default rate is (a): to reduce the rate function and (b): to reduce the effective average recovery of the pool especially when the optimal default rate gets larger.

Some interesting questions that naturally arise are below. These questions will be pursued elsewhere.

-

•

In this paper we deal with logarithmic asymptotics. It would be interesting to study the exact asymtpotics and characterize the prefactor that appears in the asymptotic expansion of the loss distribution as the pool gets larger. Similar questions have also been studied in [DDD04, LMS09] under various assumptions.

-

•

A question that is in particular relevant for financial applications is to study measures such as Value-at-Risk (VaR) and expected shortfall (ES). VaR at level is the a-quantile of the loss distribution and expected shortfall at level a is defined as . It would be interesting to study the asymptotic behavior of and , characterize their limits as the pool gets larger and study the corresponding implications of the dependence of the recoveries on defaults. Under certain conditions similar questions have also been investigated in [G03, FM02, FM03].

6. Compactness of Level Sets

The first part of the large deviations claim is that the level sets of are compact. The proof follows along fairly standard lines.

First, however, we need to topologize . This is done in the usual way. In particular, fix a point that is not in and define . Give the standard topology; open sets are those which are open subsets of (with its original topology) or complements in of closed subsets of (again, in the original topology of ). Define a bijection from to by setting

for all . The point is introduced because is a subprobability measure. The topology of is the pullback of the topology of and the metric on is that given by requiring to be an isometry.

Since is Polish, so is , and thus is Polish, and thus is a Polish space.

Proposition 6.1.

For each , the set

is a compact subset of .

Proof.

We first claim that is contained in a compact subset of . Since is already compact, it suffices to show that is a compact subset of . If , then and, since for , we have that

so for any , . Since itself is tight (it is a probability measure on a Polish space), is tight; for every , there is a such that for all . We claim that thus is also tight. Indeed, fix . Letting be the inclusion map, we have that is continuous, and thus is compact. Since singletons are also compact, is a compact subset of . For every , , so indeed is tight. Thus and hence

the last claim following since is a homeomorphism. Gathering things together, we have that is indeed contained in a compact subset of .

We now want to show that is closed, or equivalently, that is open. Using Lemma 4.7, we have that

For each and , then map is continuous, so we have written as a union of open sets. ∎

7. Large Deviations Lower Bound

We next prove the large deviations lower bound. As with most large deviations lower bounds, the idea is to find a measure transformation under which the set of interest becomes “typical”. In this case, this measure transformation will come from a combination of Cramer’s theorem and Sanov’s theorem.

First, we mention an auxiliary approximation result which will be useful in the proof. Its proof is in Section 10.

Lemma 7.1.

Fix such that . Then there is a sequence such that

(and thus for all ) and such that

are both well-defined and in for all .

We start with a simplified lower bound where the measure transformation in Cramer’s theorem is fairly explicit. For each , we make the usual definition [DZ98][Appendix A] that

this will of course be an interval; will be the relative interior of .

Proposition 7.2.

Fix an open subset of and such that and . Then

| (7.1) |

Proof.

The proof will require a number of tools. For presentation purposes we split the proof in three steps. In Step 1, we prove several auxiliary results and are then used to define and analyze the measure change that is used to prove the initial lower bound. In Step 2, we prove that under the measure defined by (7.7) in Step 1, the recovery rates for the names that have defaulted are independent and that the default probabilities are independent as well. In Step 3, we put things together in order to prove the initial lower bound (7.1).

Step 1. Since , there is a such that

| (7.2) |

(see [DZ98][Appendix A]). Let’s now fix a relaxation parameter . Then there is an and an open neighborhood of such that . Using the first equality of (7.2), we have that . Since the maps and are continuous, there is an and an open subset of such that

| (7.3) | ||||

We next want to use Lemma 7.1 to choose a particularly nice element of . Namely, Lemma 7.1 ensures that there is a such that and such that both and

| (7.4) |

are in and such that . Let be an open subset of which contains and such that

for all .

We can now proceed with our measure change. For each , define

| (7.5) |

Standard calculations show that

| (7.6) |

Define a new probability measure as

| (7.7) |

This will be the desired measure change.

Define

| (7.8) |

On ,

so in fact . Thus

Let’s also assume that is large enough that

Thus by (7.2),(7.3),(7.5) and (7.8) we have that

Next we prove that

| (7.9) |

for -almost all . This follows from standard convex analysis and the form (7.4) of when . Since , (10.2) implies that, except on a -negligible set,

if is such that . In other words, (7.9) holds except on a -negligible set.

Thus

| (7.11) |

Step 2. Let’s understand the law of under defined by (7.7). In particular we prove that under the measure defined by (7.7) the recovery rates for the names that have defaulted are independent and that the default probabilities are independent as well.

For any , we have that

Thus

where

for all and . In other words, the recovery rates for the names which have defaulted are independent with laws given by the ’s. In particular,

Moreover,

| (7.12) |

In a similar way, we next need to understand the statistics of the defaults under . For ,

Thus

| (7.13) |

where

for all and . In other words, under the defaults are independent with probabilities given by the ’s.

Step 3. Let us go back to (7.11). We want to show that , which will in turn follow if . To organize our thoughts, we write that

| (7.14) |

Let us show that

| (7.15) |

We can now prove the full lower bound

Proposition 7.3.

Let be an open subset of . Then

Proof.

Fix . If and , then we get (7.1) from Proposition 7.2. If , we of course again get (7.1). Finally, assume that . We use the fact that and convexity of . Fix a relaxation parameter . Then there is an such that and (see [DZ98][Appendix A]). Using Proposition 7.2, we get that

Letting , we again get (7.1). Letting vary over , we get the claim. ∎

8. Large Deviations Upper Bound

The heart of the upper bound is an exponential Chebychev inequality. We will mimic, as much as possible, the proof of the upper bound of Cramér’s theorem. The main result of this section is

Proposition 8.1.

Fix any closed subset of . Then

Not surprisingly, we will first prove the bound for compact; we will then show enough exponential tightness to get to the full claim.

Proposition 8.2.

Fix any compact subset of . Then

Proof.

To begin, fix . Fix also a relaxation parameter . For each , define the set

(these open sets were used in the proof of Proposition 6.1).

Fix now a . By definition of and Lemma 4.7, we see that there is a such that . Since is continuous, there is an open neighborhood of such that and such that

for all . Thus

the compactness of implies that we can extract a finite subset of such that

and thus

Fix now . We have that

We have used here the fact that

(compare with (7.6)) and that

Letting , we get that

This gives the claim. ∎

Let’s next show that is in a compact set.

Proposition 8.3 (Exponential Tightness).

For each there is a compact subset of such that

Proof.

First note that Assumption 3.3 implies that is tight. Thus for each , there is a compact subset of such that

We will define

Then is compact, and we have that

We now compute that

We have used here the calculation that for ,

Combining things together, we get that

∎

We can now get the full upper bound.

9. Alternative Expression for the Rate Function

In this section, we discuss the alternative expression for the rate function of Theorem 4.6 given by Theorem 4.8. In particular, this alternative representation shows that has a natural interpretation as the favored way to rearrange recoveries and losses among the different types. In addition to providing intuitive insight, this alternative expression suggests numerical schemes for computing the rate function. We will rigorously verify that the alternative expression is correct, but will be heuristic in our discussion of the numerical schemes.

We defer the proof of Theorem 4.8 to the end of this section and we first study the variational problem (4.12) using a Lagrange multiplier approach. Even though an explicit expression is usually not available, one can use numerical optimization techniques to calculate the quantities involved. In order to do that, we firstly recall that we can rewrite of (4.12) as a two-stage minimization problem, see expression (4.13).

This naturally suggests an analysis via a Lagrangian. Define

Let’s assume that and are the minimizers. Let’s also assume that is differentiable for all in the support of . We should then have that for every and in ,

Ignoring any complications which would arise on the set where , we should then have that

for all . This is a triangular system; the first equation depends on both and , but the second depends only on . Recalling now (4.2) and the structure of Legendre-Fenchel transforms, we should have that

for all . We can then invert this. This leads us to the following. Define

where is such that

We conclude this section with the rigorous proof of the alternate representation.

Proof of Theorem 4.8.

First, we prove that . Consider any and such that

| (9.1) |

For any ,

Define as

then

Varying , we get that

and then varying and in (such that (9.1) holds), we get that .

To show that , fix such that . We want to show that

| (9.2) |

For all , define

Dominated convergence implies that

From (4.11) and the monotonicity of moment generating functions, we can see that is nondecreasing; thus . This leads to three possible cases.

Case 1: Assume that , and let be such that ; i.e.,

| (9.3) |

Then

Define now and . By (10.3) and (4.10) respectively we have that . Then (9.3) is exactly that . Thus

This is exactly (9.2).

Case 2: Assume next that . For every , define

for all ; thus

for all . For all and , the mapping is decreasing and maps into . Monotone convergence implies that

If , then we can use the fact that for all to see that

If , then by the monotonicity of the ’s,

| (9.4) |

for all , and

Defining and , we have that

Collecting things together, we see that if , we again get (9.2).

Case : We finally assume that . The calculations are very similar to those of Case 2. For every , define

for all , so that

for all . For all and , the mapping is increasing and maps into . Monotone convergence implies that

If , then we can use the fact that for all to see that

If , then by the monotonicity of the ’s,

for all , and

Defining and , we have that

again implying (9.2).

10. Detailed structure of

Recall the quantities defined in Definition 4.2. Note that

| (10.1) |

Thus if , we can restrict the region of integration to get that

so in fact

| (10.2) | ||||

Fix such that . The main technical challenges in both proofs is to stay away from the singularities in and . Note that

and keeping (10.1) in mind, we thus need to be careful near , and for .

To start, let’s note some implications of the assumption that . Clearly . Secondly,

| (10.3) |

Let’s now do the following. Fix . Define

| (10.4) |

Clearly , so we can define as

In light of (10.3) and (10.2), -a.s., so it follows that . We next compute that

Using again (10.3) and (10.2), we have that for -almost-all . If , then is increasing on and decreasing on . Thus for -almost-all . Dominated convergence thus implies that .

Proof of Lemma 7.1.

Fix ; we want to approximate by “nice” elements of . Note that

Since is regular (recall that is Polish), we can approximate by elements of . From (10.4), we have that if is such that , so we can truncate these approximations at and without any loss. Namely, there is a sequence in such that

| (10.5) |

For each , let be such that if and if . For each , define

for all . Then for all . We also have that

Dominated convergence and (10.5) then ensure that

| (10.6) |

Clearly , so we can define as

Thanks to (10.6), we have that . Note next that for such that ,

If is such that , then

| (10.7) |

so if ,

where

Thus if ,

for all . Thanks to (10.6), we thus have that .

We finally note that is continuous on ((10.7) ensures that takes values in in this case). On , we have that . This finishes the proof. ∎

Proof of Lemma 4.7.

Assume first that is not absolutely continuous with respect to . We will show that then the right-hand side of (4.9) is infinite. Then there is an such that and . Since is Polish, is regular; i.e.,

Thus there is a closed subset of such that . Fix also now . For each , define

where is the distance (in ) from to . Then for all , and . Recall the definition of from (4.8). Since is nondecreasing and continuous for each , we also have that for all . Thus

Let to see that the right-hand side of (4.9) is infinite.

Assume next that . We use the fact that and are convex duals of each other. For any ,

To show the reverse inequality, let’s write that

where

| (10.8) |

for all and . We can explicitly solve this minimization problem; for and , define

(where is the standard signum function). Then

for all and . Clearly and are measurable, and . From (10.8), we also see that is nondecreasing in . Thus by (10.8) and monotone convergence

Since is Polish, and are regular; and thus we can approximate elements of by elements of , completing the proof. ∎

References

- [ABRS05] Edward I. Altman, Brooks Brady, Andrea Resti, and Andrea Sironi. The Link between Default and Recovery Rates: Theory, Empirical Evidence, and Implications. The Journal of Business, vol. 78, no. 6, 2203–2227, 2005.

- [ADEH99] Philippe Artzner, Freddy Delbaen, Jean-Marc Eber and Heath, David. Coherent measures of risk. Mathematical Finance, 9(3), 203–228, 1999.

- [DDD04] Amir Dembo, Jean-Dominique Deuschel, and Darrell Duffie. Large portfolio losses. Finance Stoch., 8(1):3–16, 2004.

- [DZ98] Amir Dembo and Ofer Zeitouni. Large deviations techniques and applications. Springer-Verlag, New York, 1998.

- [DS03] Darell Duffie and Kenneth J. Singleton, Credit risk: Pricing, measurement, and management. Princeton University Press, 2003.

- [G02] Michael B. Gordy. Saddle point approximation of CreditRisk. Journal of Business & Finance., 26: 1335–1353, 2002.

- [G03] Michael B. Gordy. A risk-factor model foundation for ratings-based bank capital rules. Journal of Financial Intermediation., 12(3):199–232, 2003.

- [GL05] Paul Glasserman and Jinyi Li. Importance sampling for portfolio credit risk. Management Science 51, 1643–1656, 2005.

- [GKS07] Paul Glasserman, Wanmo Kang and Perwez Shahabuddin. Large deviations in multifactor portfolio credit risk. Mathematical Finance 17 (3), 345–379, 2007.

- [LMS09] Vincent Leijdekker, Michel Mandjes, and Peter Spreij. Sample-path large deviations in credit risk, arXiv:0909.5610v1 [math.PR], 2009.

- [MFE05] Alexander J. McNeil, Rudiger Frey, and Paul Embrechts. Quantitative risk management: Concepts, techniques and tools. Princeton University Press, 2005.

- [FM02] Rudiger Frey and Alexander J. McNeil. VaR and expected shortfall in portfolios of dependent credit risks: Conceptual and practical insights. Journal of Banking and Finance 26, 1317–1334, 2002.

- [FM03] Rudiger Frey and Alexander J. McNeil. Dependent defaults in models of portfolio credit risk. Journal of Risk 6(1), 311-329, 2003.

- [Pha07] Huyên Pham. Some applications and methods of large deviations in finance and insurance. In Paris-Princeton Lectures on Mathematical Finance 2004, volume 1919 of Lecture Notes in Math., pages 191–244. Springer, Berlin, 2007.

- [SH09] Das Sanjiv and Paul Hanouna. Implied recovery. Journal of Economic Dynamics and Control, 33(11):1837–1857, 2009.

- [Sowa] Richard B. Sowers. Exact pricing asymptotics of investment-grade tranches of synthetic cdo’s part i: A large homogeneous pool. International Journal of Theoretical and Applied Finance, 13(3): 367-401, 2010.

- [Str93] Daniel W. Stroock. Probability theory, an analytic view. Cambridge University Press, Cambridge, 1993.