Prediction oriented variant of financial log-periodicity and speculating about the stock market development until 2010

Summary. A phenomenon of the financial log-periodicity is discussed

and the characteristics that amplify its predictive potential

are elaborated. The principal one is self-similarity that obeys

across all the time scales. Furthermore the same preferred scaling factor

appears to provide the most consistent description of the market

dynamics on all these scales both in the bull as well as in the

bear market phases and is common to all the major markets. These ingredients

set very desirable and useful constraints for understanding the past

market behavior as well as in designing forecasting scenarios.

One novel speculative example of a more detailed SP500 development

until 2010 is presented.

Key words. Financial physics, critical phenomena, log-periodicity

The concept of financial log-periodicity is based on the appealing assumption that the financial dynamics is governed by phenomena analogous to criticality in the statistical physics sense (Sornette et al. 1996, Feigenbaum and Freund 1996). Criticality implies a scale invariance which, for a properly defined function characterizing the system, means that

| (1) |

A constant describes how the properties of the system change when it is rescaled by the factor . The general solution to this equation reads:

| (2) |

where the first term represents a standard power-law that is characteristic of continuous scale-invariance with the critical exponent and denotes a periodic function of period one. This general solution can be interpreted in terms of discrete scale invariance. It is due to the second term that the conventional dominating scaling acquires a correction that is periodic in and may account for the zig-zag character of financial dynamics. It demands however that if , where denotes the ordinary time labeling the original price time series, represents a distance to the critical point , the resulting spacing between the corresponding consecutive repeatable structures at seen in the linear scale follow a geometric contraction according to the relation . The critical points correspond to the accumulation of such oscillations and, in the context of the financial dynamics, it is this effect that potentially can be used for prediction.

An extremely important related element, for a proper interpretation and handling of the financial patterns as well as for consistency of the theory, is that such log-periodic oscillations manifest their action self-similarly through various time scales (Drożdż et al. 1999). This applies both to the log-periodically accelerating bubble market phase as well as to the log-periodically decelerating anti-bubble phase. Furthermore, more and more evidence is collected that the preferred scaling factor and is common to all the scales and markets (Drożdż et al. 2003). These two elements, self-similarity and universality of the , set very valuable and in fact crucial constraints on possible forms of the analytic representations of the market trends and oscillation patterns, including the future ones as well.

A specific form of the periodic function in Eq. 2 is as yet not provided by any first principles which opens room for certain, seemingly mathematically unrigorous assignments of patterns. This, on the other hand, allows to correct for frequent market ’imprecisions’ when relating its real behavior versus the theory. Very helpful in this respect is the requirement of self-similarity which greatly clarifies the significance of a given pattern and allows to determine on what time scale it operates. Since in the corresponding methodology the oscillation structure carries the most relevant information about the market dynamics, for transparency of this presentation, we use the first term of its Fourier expansion,

| (3) |

This implies that . Already such a simple parametrization allows to properly reflect the contraction of oscillations, especially on the larger time scales. On the smaller time scales just replacing the cosine by its modulus often, even quantitatively in addition, describes departures of the market amplitude from its average trend.

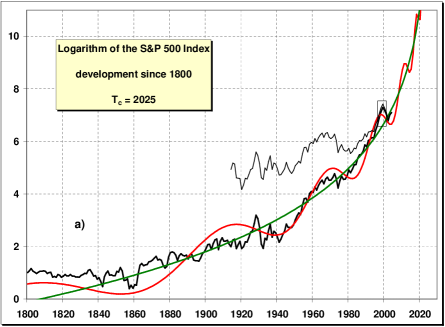

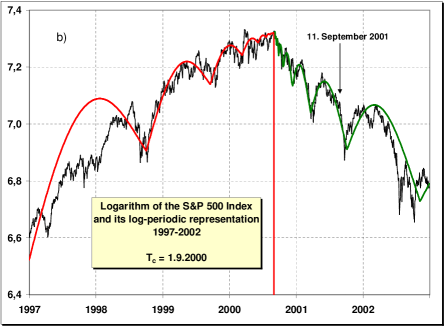

One particularly relevant and special, for several reasons, example is shown in Fig. 1. The upper panel (a) illustrates a nearly optimal log-periodic representation of the SP500 data over the most extended time-period of the recorded stock market activity as dated since 1800. As already pointed out (Drożdż et al. 2003) this development signals in around 2025 a transition of the SP500 to a globally declining phase as measured in the contemporary terms. The magnification of the small rectangle covering the period 1997-2002 is displayed in the lower panel (b) of the same Fig. 1. It thus illustrates the nature of the stock market evolution on a much smaller time scale of resolution. An impressive log-periodicity with the same on both sides of the transition date (September 1, 2000) can be seen.

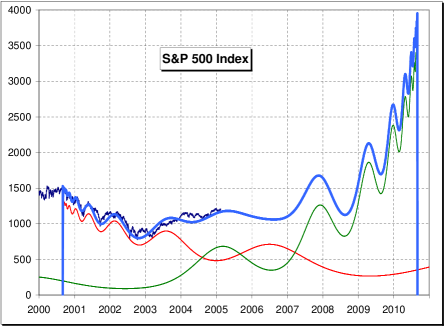

The next stock market top from the perspective of the largest time scale (Fig. 1a) can be estimated to occur in around the years 2010-2011. In the spirit of the log-periodicity its neighborhood is to be accompanied by the smaller time scale oscillations - similar in character to those in Fig. 1b. Of course, when going far away from those large scale transition points such pure log-periodic structures - representative to the one level lower time scale - must get dissolved. A particularly interesting related question then is what characteristics are to govern the stock market dynamics in the transition period when going from 2000 to 2010. The most natural and straightforward way is to view this process as schematically is indicated in Fig. 2. This whole period is thus covered by the two main components represented by the thin lines and the market dynamics is driven by the superposition of of these two components whose phases, slopes and weights are adjusted such that the overall global market trend up to now is reproduced.

In this scenario, close to the two large-scale transition points (September 2000 and, as provisionally estimated here based on Fig. 1a, September 2010) the market is driven, as needed, essentially by the single log-periodic components, decelerating and accelerating one, correspondingly. More complicated is the situation in the middle of this time interval where the two components contribute comparably. Most interestingly, it indicates that the period of the stock market stagnation may extend even into the year 2008, before it seriously starts rising. It also demonstrates a possible mechanism that generates modulation structures responsible for the apparent higher order corrections (Johansen and Sornette 1999) to Eq. (3). The changes in the frequency relations observed in the transition period between the bear and the bull market phases originate here from the interference between the two components, both of the simple form as prescribed by Eq. (3) and with the same . Of course, similar effects of interference may occur on the whole hierarchy of different time scales.

There is one more element that from time to time takes place in the financial dynamics and whose identification appears relevant for a proper interpretation of the financial patterns with the same universal value of the preferred scaling factor . This is the phenomenon of a ”super-bubble” (Drożdż et al. 2003) which is a local bubble, itself evolving log-periodically, superimposed on top of a long-term bubble. Two such spectacular examples are provided by the Nasdaq in the first quarter of 2000 and by the gold price in the beginning of 1981 (Drożdż et al. 2003).

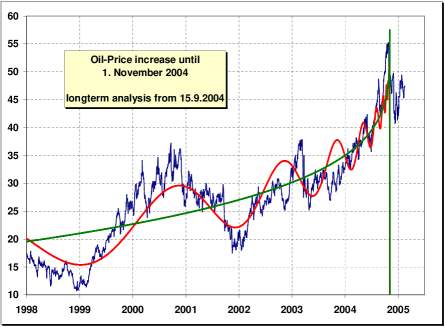

In connection with this second case it is important to remember that the same value of as for the stock market turns out appropriate. That such its value may be characteristic to the whole commodities market as well, is shown in Fig. 3 which displays the New York traded oil futures versus the best log-periodic representation. In fact, this scenario has been drawn by the authors on September 15, 2004, insisting on using , even though one local minimum (in the beginning of 2004) in the corresponding sequence did not look very convincing. Designed this way it was indicating a continuation of the increase until the end of October and then a more serious reverse of the trend. Subsequent development of the oil futures provides further arguments in favor of this way of handling the financial log-periodicity.

References

-

Drożdż S, Ruf F, Speth J, Wójcik M (1999) Imprints of log-periodic self-similarity in the stock market. Eur. Phys. J. B 10:589-593

-

Drożdż S, Grümmer F, Ruf F, Speth J (2003) Log-periodic self-similarity: an emerging financial law? Physica A 324:174-182

-

Feigenbaum JA, Freund PGO (1996) Discrete scale invariance in stock markets before crashes. Int. J. Mod. Phys. B 10:3737-3745

-

Johansen A, Sornette D (1999) Financial ”anti-bubbles”: Log-periodicity in gold and Nikkei collapses. Int. J. Mod. Phys. C 10:563-575

-

Sornette D, Johansen A, Bouchaud J.-P (1996) Stock market crashes, precursors and replicas. J. Physique (France) 6:167-175