Multifractality in the stock market:

price increments versus

waiting times

Abstract

By applying the multifractal detrended fluctuation analysis to the high-frequency tick-by-tick data from Deutsche Börse both in the price and in the time domains, we investigate multifractal properties of the time series of logarithmic price increments and inter-trade intervals of time. We show that both quantities reveal multiscaling and that this result holds across different stocks. The origin of the multifractal character of the corresponding dynamics is, among others, the long-range correlations in price increments and in inter-trade time intervals as well as the non-Gaussian distributions of the fluctuations. Since the transaction-to-transaction price increments do not strongly depend on or are almost independent of the inter-trade waiting times, both can be sources of the observed multifractal behaviour of the fixed-delay returns and volatility. The results presented also allow one to evaluate the applicability of the Multifractal Model of Asset Returns in the case of tick-by-tick data.

keywords:

Multifractality , Financial marketsPACS:

89.20.-a , 89.65.Gh , 89.75.-k1 Introduction

From the perspective of the classical financial market models, behaviour of the consecutive price and index fluctuations does not present any significant time autocorrelations except for short time scales up to several minutes. As regards the dynamical character of these fluctuations, they are considered as being to a good approximation the fractional Gaussian noise [1], with very small and negligible probability of the occurrence of non-Gaussian large jumps in the index or the share price. As a natural consequence, the stock market data is expected to present only monofractal properties. However, these widely-used models do not describe the processes underlying the evolution of financial data with satisfactory precision. The so-called financial stylized facts comprising, among others, the non-negligible fat tails of log-return distributions, volatility clustering and its long-time correlations, anomalous diffusion etc. [2, 3, 4, 5] counter the above-mentioned fundamental assumptions of market dynamics challenging their applicability in practice. That the financial dynamics is more complex than it is commonly assumed can also be inferred from a number of recently-published papers discovering and exploring the multifractal characteristics of data from the stock markets [6, 7, 8, 9, 10], the forex markets [7, 10, 11, 12, 13] and the commodity ones [14]. The concept of multifractality was developed in order to describe the scaling properties of singular measures and functions which exhibit the presence of various distinct scaling exponents in their different parts [19, 20]. Soon the related formalism was successfully applied to characterize empirical data in many distant fields like turbulence [21, 22], earth science [23], genetics [24, 25, 26], physiology [27, 28, 29] and, as already mentioned, in finance. The problem of detecting multifractality in real data is delicate, however. There are models based on fractal processes which are able to mimic the real multifractal evolution of markets being either multifractal or monofractal [15, 18, 30, 31, 32]. Moreover, as it has been pointed out ([18, 33]), the power of commonly-used tests of multifractality is limited, because they cannot effectively distinguish between the two types of fractal behaviour of the financial (but perhaps also other) data. One important source of this difficulty is the presence of non-Gaussian tails in the distributions of data (e.g. truncated Lévy [33]), the fact which is ubiquitous in finance. Thus, all conclusions drawn from multifractal analysis have to be interpreted with care.

In the present paper we analyze data from the German stock market focusing on their fractal properties. We apply the multifractal detrended fluctuation analysis which is a well-established method of detecting scaling behaviour of signals. By exploiting the character of the high-frequency transaction-by-transaction recordings for the most liquid stocks belonging to DAX, we are able to inspect not only the properties of share price fluctuations, but also the properties of time intervals between consecutive trades (waiting times). The majority of analyses carried out so far was devoted to time series of the returns calculated with some fixed time delay . According to the Multifractal Model of Asset Returns introduced by Mandelbrot and others [15, 16, 17, 18, 31], the source of multifractality in the returns is a deformation of time , which takes place due to the fact that at the microscale the so-called business time is “paced” by transactions rather than any constant time units. In this model the increments of so-deformed time can be directly related [4, 31] to the fixed- volatility which depends both on the trading activity (i.e. , where stands for the number of transactions in ) and on the variance of the price change in the individual transactions over . Looking deeper into the microstructure of the market, as these quantities are equal to, respectively, the reciprocal of the average waiting time in and to the average squared price increment in , one may ask whether, at the microscopic level, the multifractal properties of originate from the price behaviour, from the waiting times fluctuations or from both of them. This is our motivation for performing the present analysis. We find the German stocks particularly suitable for such a study due to the fact that the moments of transactions are recorded with high precision (0.01 s), which almost completely eliminates falsely simultaneous transactions. Such an analysis for the liquid stocks from NYSE, although desired, cannot be so successfully carried out as the time resolution of the recordings is poor (1 s) and too many transactions are forced to be simultaneous, distorting the underlying real dynamics.

2 Methods and data

There are two possible procedures of analyzing multifractal properties of a time series. The first one uses the continuous wavelet transform and extracts scaling exponents from the wavelet transform amplitudes over all scales [34]. This method is more computationally demanding and, as our preliminary tests showed, the stability of results for our data is not satisfying. Therefore, for the present study we prefer to employ the multifractal version of the detrended fluctuation analysis method (MF-DFA) [24, 35].

Given the time series of price values of a stock recorded at the discrete transaction moments , one may consider two independent random processes defined by price and time or, alternatively, logarithmic price increments111 Throughout this paper we intend to use the expression “price increments” instead of “returns” to underline the fact that we study the price differences between consecutive trades which occur irregularly in time, while in literature the “returns” are usually associated with a constant time step. and time increments (waiting times) .

For the time series of the log-price increments (and analogously for the waiting-times series ), one needs to estimate the signal profile

| (1) |

where denotes the mean of . is divided into disjoint segments of length starting from the beginning of . For each segment , the local trend is to be calculated by least-squares fitting the polynomial of order to the data, and then the variance

| (2) |

In order to avoid neglecting data points at the end of which do not fall into any of the segments, the same as above is repeated for segments starting from the end of (i.e. finally one has segments total and the same number of ’s). The polynomial order can be equal to 1 (DFA1), 2 (DFA2), etc. The variances (2) have to be averaged over all the segments and finally one gets the th order fluctuation function

| (3) |

In order to determine the dependence of on , the function has to be calculated for many different segments of lengths .

If the analyzed signal develops fractal properties, the fluctuation function reveals power-law scaling

| (4) |

for large . The family of the scaling exponents can be then obtained by observing the slope of log-log plots of vs. . can be considered as a generalization of the Hurst exponent with the equivalence . Now the distinction between monofractal and multifractal signals can be performed: if for all , then the signal under study is monofractal; it is multifractal otherwise. By the procedure, describe the scaling properties of small fluctuations in the time series, while the large ones correspond to . It also holds that is a decreasing function of .

By knowing the spectrum of the generalized Hurst exponents, one can calculate the singularity strength and the singularity spectrum using the following relations (e.g. [35]):

| (5) |

where stands for the derivative of with respect to .

Our analysis was performed on the time series of tick-by-tick recordings for the 30 DAX stocks comprising the over-two-years-long interval between Nov 28, 1997 and Dec 31, 1999. The time series were approx. 250,000 points long on average (almost 500 transactions daily) with the minimal length of 63,000 (Karstadt Quelle, KAR) and the maximal one of 588,000 (Daimler-Chrysler, DCX). Firstly, we removed all the overnight price increments, because they correspond to extremely long inter-trade intervals and larger-than-usual price jumps (such effects were identified to introduce distortion of the financial scaling [36]); we do not remove zero increments from and zero waiting times from because the corresponding zero-intervals are so short that they do not alter the results. The so-preprocessed data was subject to the MF-DFA analysis with the polynomials (MF-DFA(3)), owing to the fact that for the present data they optimally extract the fluctuations whose scaling is to be analyzed (Eq. 4).

3 Results

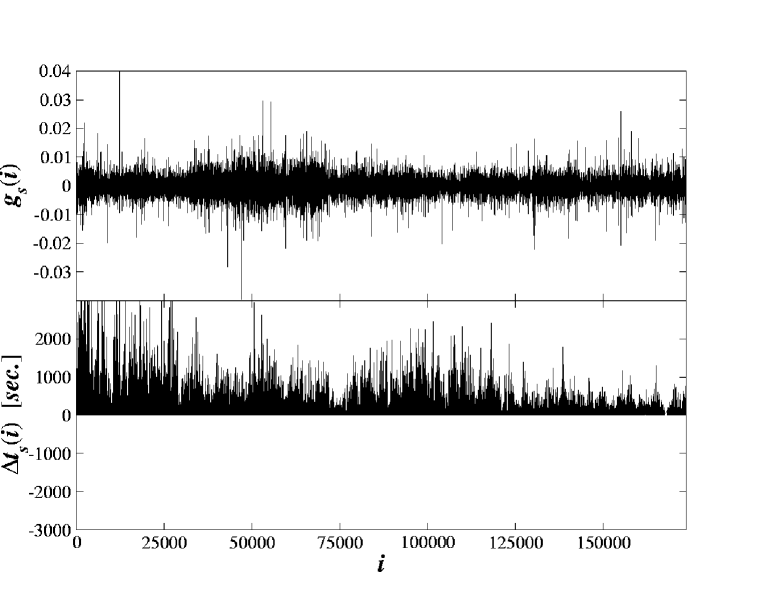

Figure 1 shows the time course of (upper panel) and (lower panel) for the complete interval under study. There is a clear difference between the series, because while the distribution of the former is symmetric around zero, the latter cannot assume negative values and, hence, its distribution is skewed.

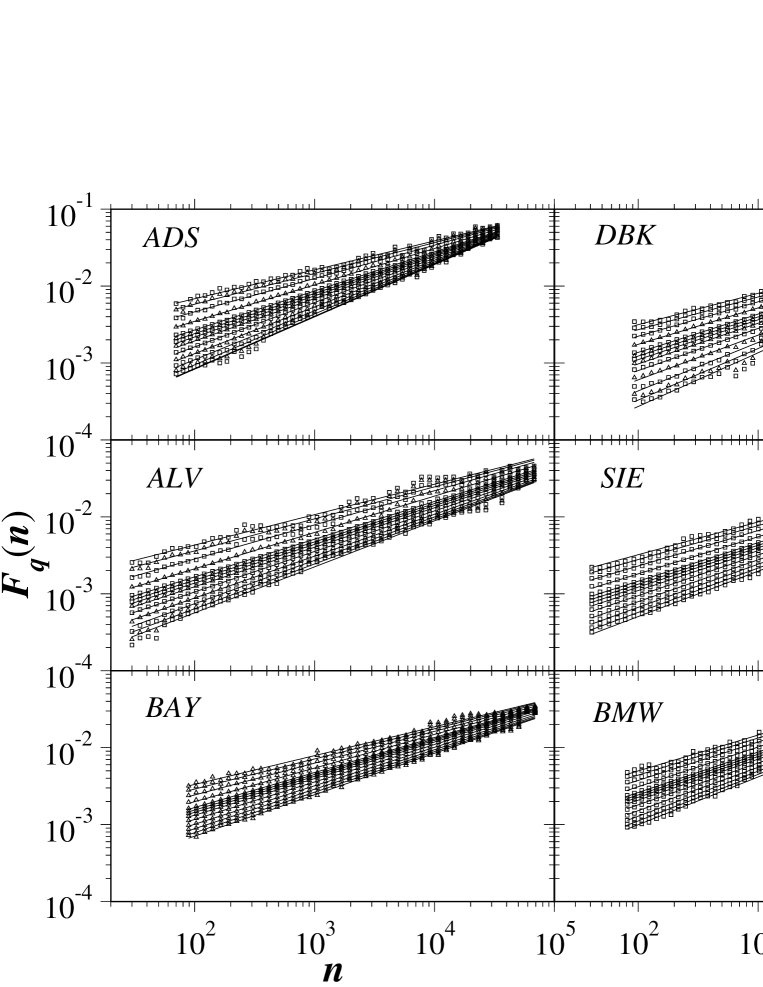

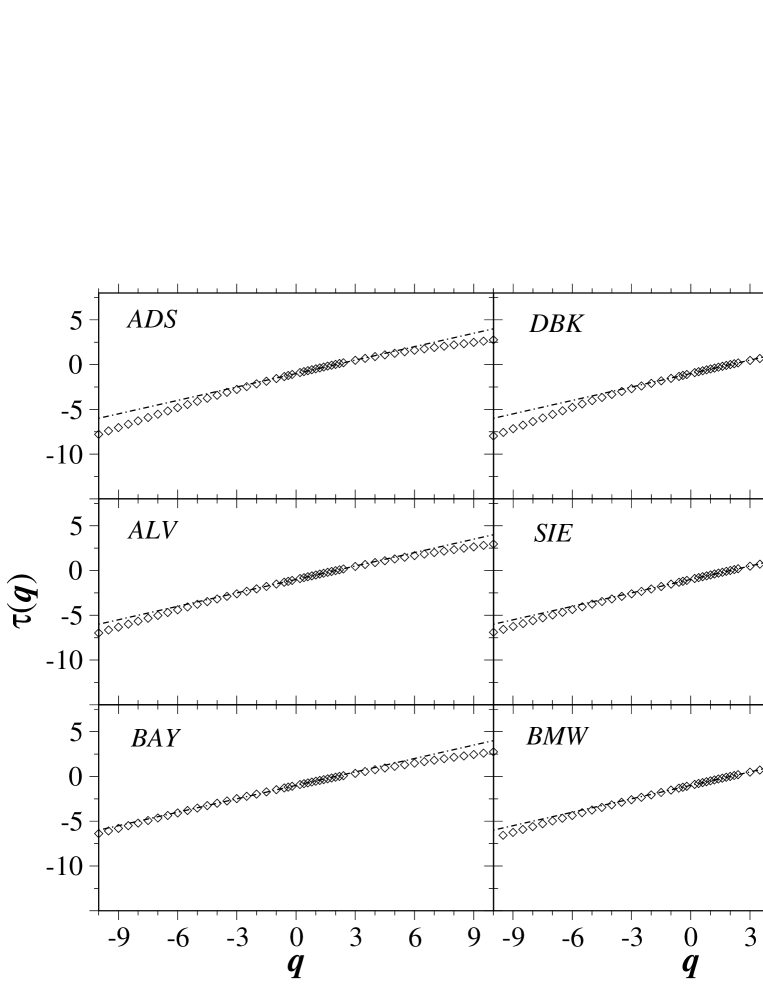

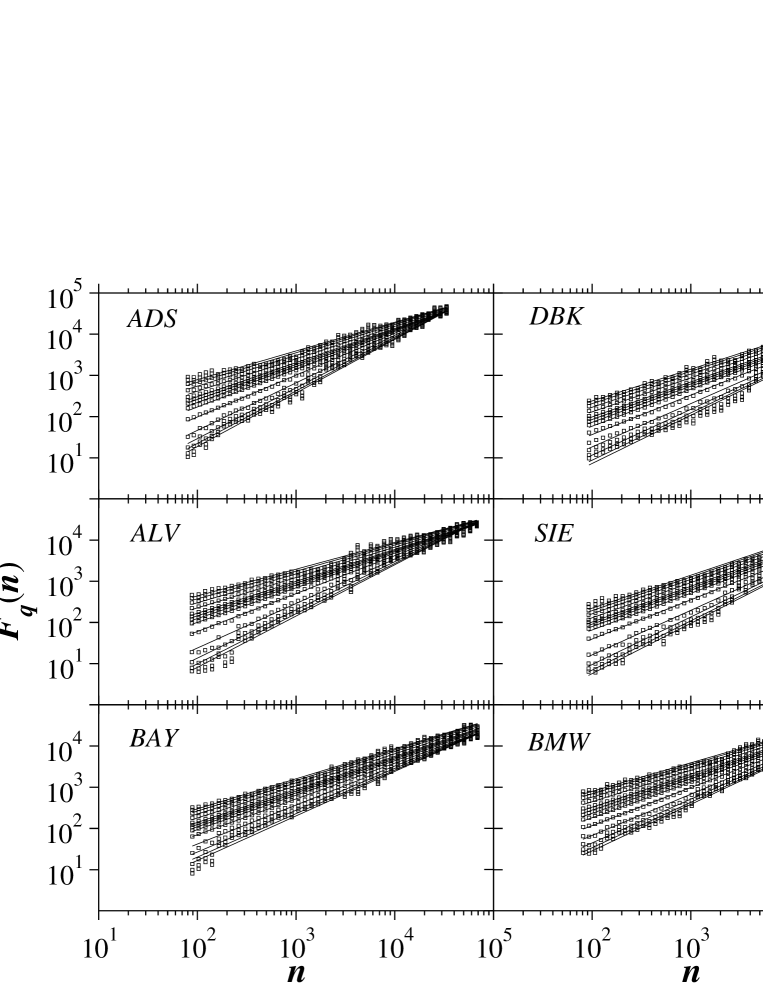

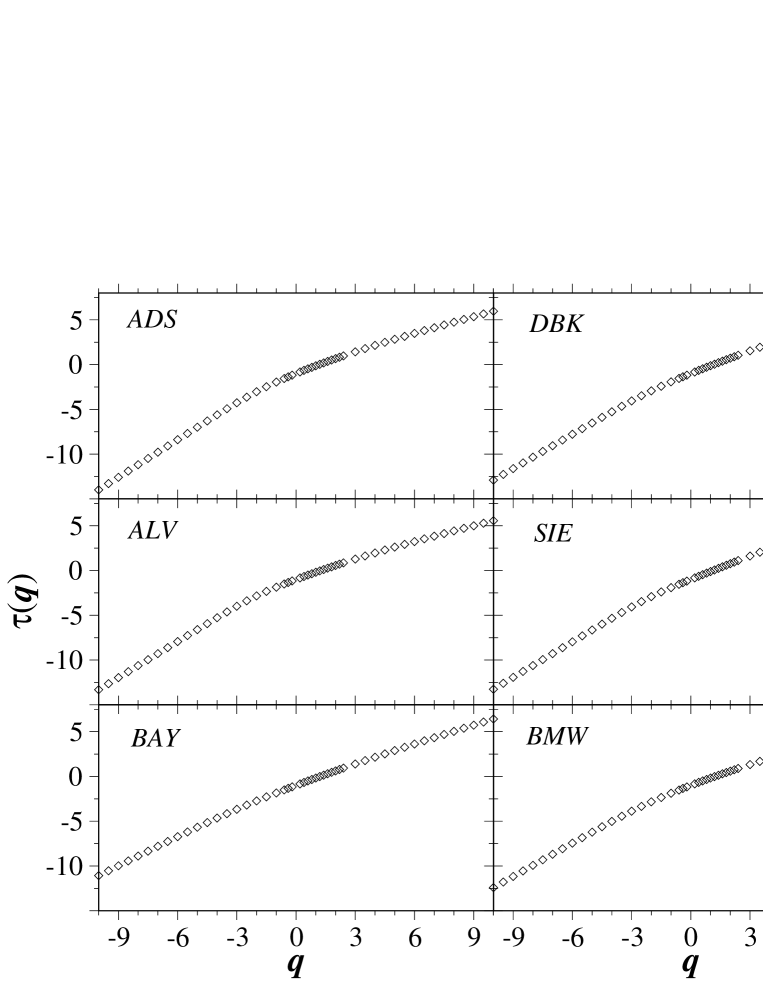

First we shall present results of our study of the price increments data. Following Eq. (4), for each stock we created double-logarithmic plots of for the various segment lengths in the range data points and for various choices of . It is widely assumed that the amplitude of the price fluctuations scale according to the inverse cubic power law, which in principle implies infinite moments for . In real data the large-order moments are therefore inevitably affected by the finite-size effects. However, we decided to include the values of as high as 10 purely to improve readability of the plots of the multifractal and singularity spectra and to make any comparison of the spectra’s widths easier; this step does not reduce the significance of our results. The plots of for six representative stocks from different market sectors are collected in Fig. 2 and ordered according to the decreasing slope spread between and 10 (with the step of 0.2 for small ’s and of 0.5 for larger ones). In order to indicate the range of ’s used for fitting the exponents , we present the scaling regions only and cut off the regions characterized by the lack of scaling (this happens for small ’s, probably due to the existence of long periods of constant price of a stock). The largest difference between the slopes is observed for Adidas Solomon (ADS, top left panel) and the smallest one for BMW (bottom right panel). The plots for different companies show noticeable differences in the range of with the scaling behaviour; the widest range of over three decades is observed for moderate values of for ALV (Allianz) and SIE (Siemens). In each case, for extremely small and extremely large ’s the scaling breaks down as expected from statistical considerations [35]. In order to better visualize the scaling character of the data, in Fig. 3, we show the corresponding multifractal spectra. Instead of , we display its function , defined by the relation . Monofractal signals (const) are associated with a linear plot , while multifractal ones possess the spectra nonlinear in . Keeping in mind the already-mentioned limitations of the method ([17]), our calculations indicate that the time series of price increments for all companies can be of the multifractal nature. Consistently with the log-log plots on the left, the highest nonlinearity of the spectrum and the strongest multifractality are attributes of ADS and DBK (Deutsche Bank), and the smallest nonlinearity and the weakest multifractal character correspond to BMW and BAY (Bayer). The nonlinearity of is confined to the central range of ’s around and for larger values of the behaviour of is almost linear (due to the finite size of the sample).

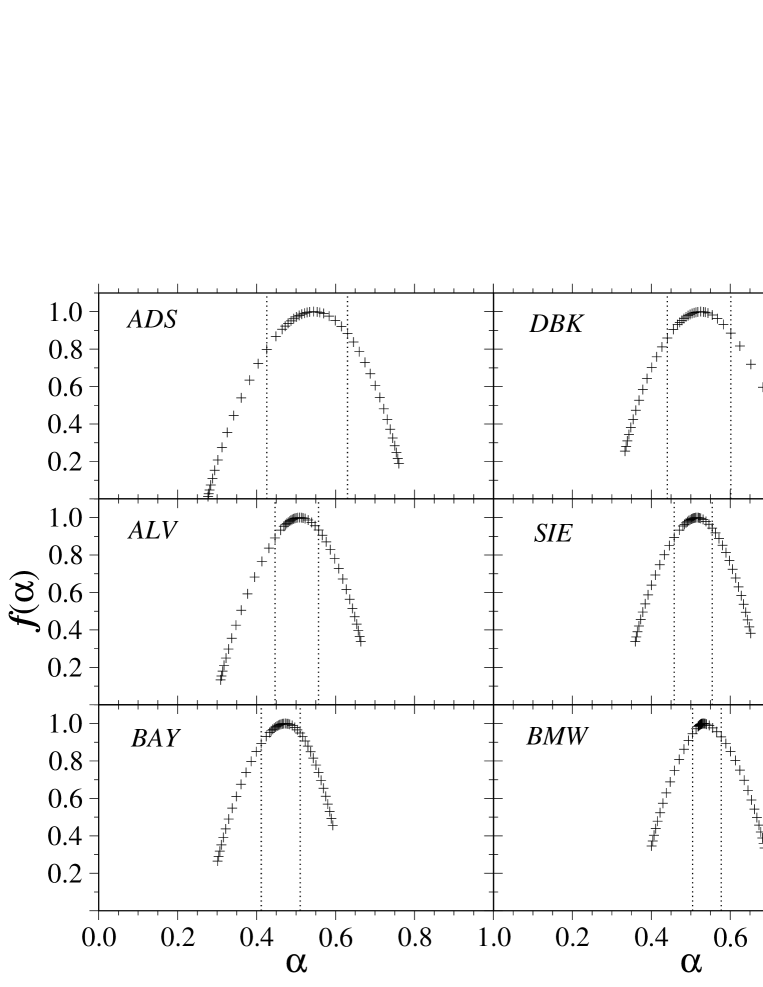

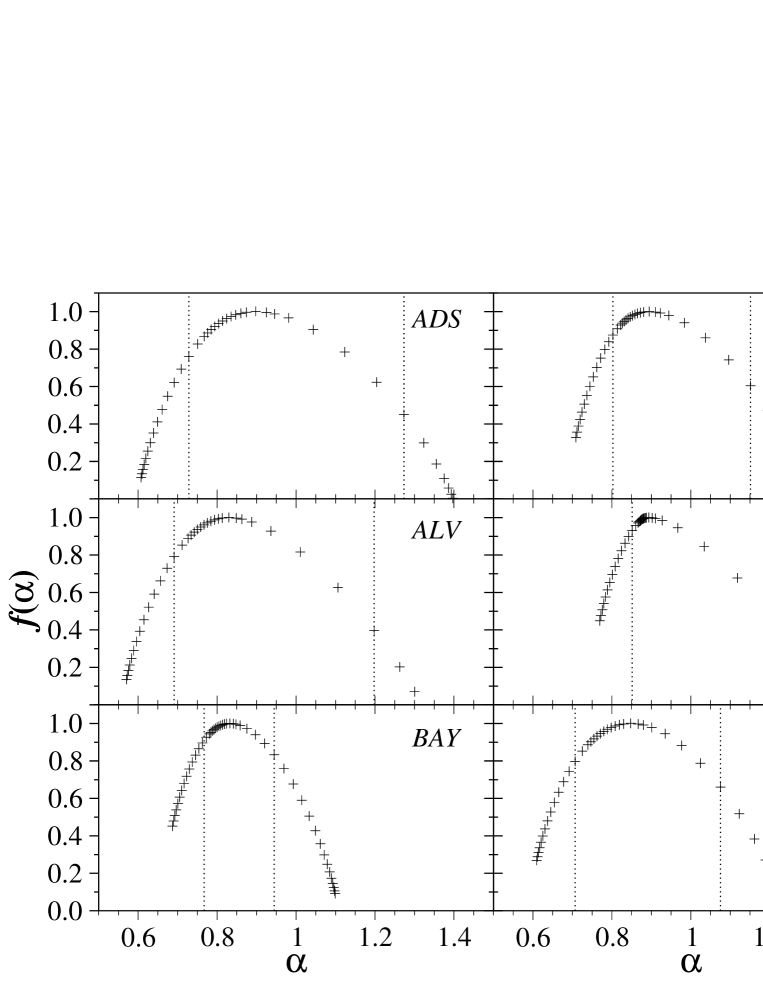

The multifractal nature of the data can also be expressed in a different manner, i.e. by plotting the singularity spectra (Eq. 5). It is a more plausible method because here one can easily assess the variety of scaling behaviour in the data. Figure 4 displays such spectra for the same stocks as in Figs. 2 and 3, with their presentation order being preserved. As before, the richest multifractality (the widest curve) is visible for ADS () and DBK (), the poorest one for BAY and BMW (). The maxima of are typically placed in a close vicinity of indicating no significant autocorrelations exist. It is worth mentioning, that the singularity spectra for the price changes between two consecutive transactions closely resemble their counterparts for the fixed- log-returns. We do not show the corresponding results graphically, but the widths of the spectra are similar in both cases.

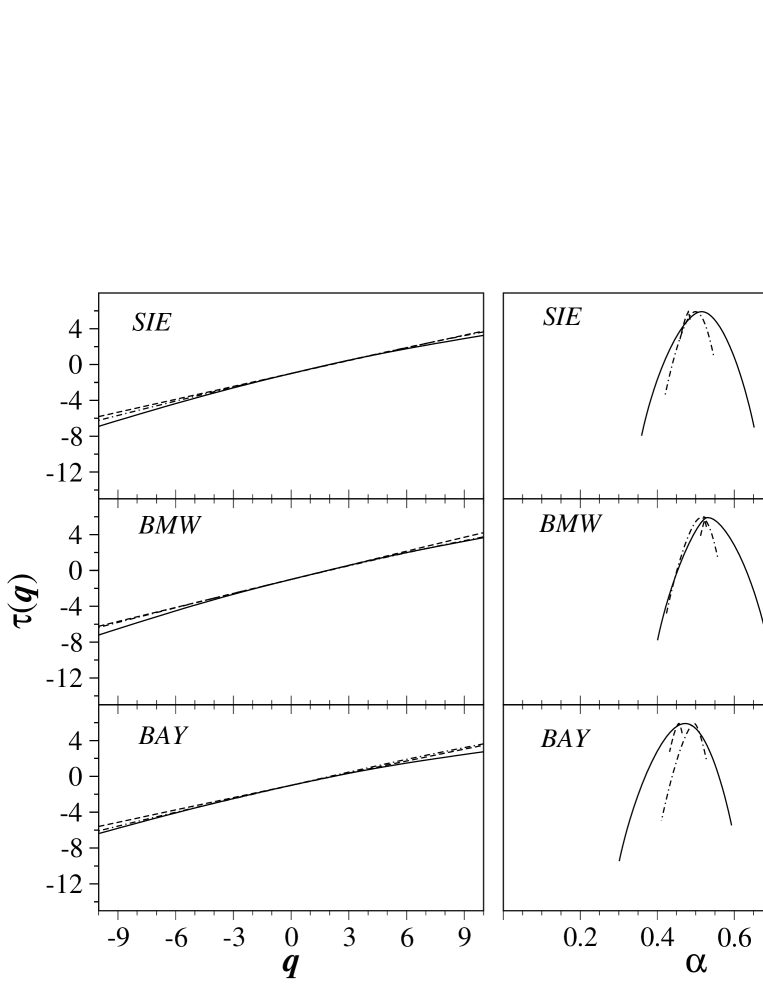

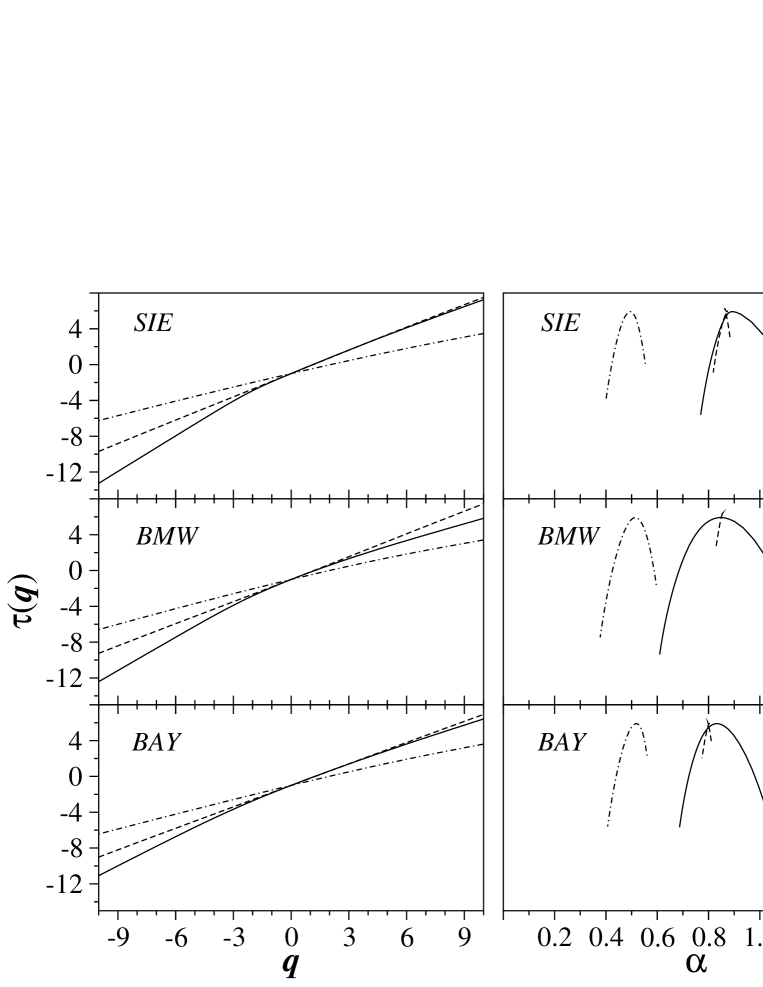

The multifractal character of price fluctuations can originate from the existence of the long-range correlations in the price increments (via volatility) as well as from their non-Gaussian distributions [33]. The possible influence of each of these factors can be detected by a proper modification of the data. The long-range autocorrelations can be completely erased by randomly reshuffling the original time series and the non-Gaussianity of the distributions can be weakened by creating the phase-randomized surrogates [37]. In the latter case we exploit the fact that the price increments distributions are unstable in the sense of Lévy, which leads to their convergence to a Gaussian under the discrete Fourier transforms. Figure 5 shows three examples of (left column) and (right column) spectra for the original (solid), reshuffled (dot-dashed) and phase-randomized (dashed) data. Both the widths of the spectra in each case are much smaller and the nonlinearity of ’s is much weaker for the modified signals than for the original ones. This behaviour of the reshuffled signals confirms that the persistent autocorrelations play an important role in multiscaling of the price increments. However, the spectra for the surrogates are typically much narrower than for the reshuffled data which can be interpreted as an evidence of the influence of extremely large non-Gaussian events on the fractal properties of the signals. Keeping in mind the difficulties in precisely calculating the scaling exponents for finite time series, one may interpret the narrow curves for the modified signals in Fig. 5 as the manifestation of their relatively, but not precisely, monofractal character.

To this end, we concentrated on multifractal properties of the time series of logarithmic price increments. Our results go in parallel with earlier analyses of other groups, which managed to show multifractality in the stock market data [8, 12, 14]. Once again, we stress that what distinguishes our approach is that we did not sample the data with fixed time interval, but rather look into the tick-by-tick data and constructed the time series of price increments for variable inter-trade time intervals (thus unfolding time). Now we shall go back to the original time axis, and study properties of the inter-trade time intervals forming the series .

Figures 6, 7, and 8 are fully analogous to Figs. 2, 3, and 4, respectively, but for the waiting times instead of the price increments. As before, we observe significant difference between the slopes for the most negative and the most positive ’s with this strength being different among the stocks. The scaling in Fig. 6 is good for small and moderate values of , but is poorer for large ’s for the majority of companies (the effect of finite size and noise). The spectra in Fig. 7 show strong nonlinearity, and although it is confined to middle range of ’s, this nonlinearity is stronger than for the price increments. By comparing Figs. 2-4 and 6-8 we see that there is no systematic evidence of the relations between the properties of and for the given companies. Fig. 8 is a counterpart of Fig. 4 and presents the singularity spectra for the time series of the waiting times. All the spectra can be interpreted as multifractal. The main differences are the larger widths of ’s, their asymmetry and the positions of maxima at approx. instead of 0.5 for price fluctuations. The widest spectra correspond to ADS and ALV, the significantly narrower ones to BAY, in different order than for . The shift of the maxima can be related to long-range correlations between consecutive waiting times, leading to a strong persistence (see also Fig. 9). However, despite the fact that both the spectra for and for are multifractal, they cannot be directly compared to each other. The crucial factor here is that they represent processes of different character: signed and unsigned, respectively. There exists a method of rescaling the spectra of the unsigned (or signed) process (as it was proved in [16]), but it requires that the underlying processes are strongly interrelated through the fractional Brownian motion with some Hurst exponent (then simply ). However, in the context of our data, this assumption seems to be violated: and can in principle be independent or, at least, might not be mutually related in so simple way. But, nevertheless, the fact that the singularity spectra for are wider than their counterparts for and shifted towards larger ’s is still in the spirit of the above-mentioned relation between the signed and unsigned processes.

Our results suggest that as regards the original time series of price increments without any unfolding of the time axis, in that case we can well deal with a fully two-dimensional multifractal process, multiscaling both in the argument and in the value . This may suggest that both the price increments and the waiting times contribute to the multifractal properties of the time deformation and of the fixed- log-returns.

Finally, Figure 9 shows a comparison of the spectra for the original (solid), the reshuffled (dot-dashed) and the surrogate time series (dashed). Contrary to Fig. 5, here the randomized data displays completely different behaviour, being not only narrowed but also systematically shifted towards . This is not surprising, however: reshuffling removes the strong autocorrelation of the inter-trade time intervals completely. It can also be noted that the spectra for the surrogate signals preserve the positions of the maxima at 0.8; this is a natural consequence of the strong linear correlations still present in the surrogates.

4 Conclusions

We study the multifractal properties of the most liquid stocks from the German stock market. Our original data consisting of the recordings of time and price at which all the transactions took place, allowed us to separate the complete process of the stock trading into its pure price and pure time components. Since both components can contribute to the fixed- volatility and returns, studying the properties of these components can help to identify the microscopic sources of the observed multifractality of the fixed-delay returns. We show that both the signals for the transaction-to-transaction price increments and for the inter-trade waiting times exhibit the characteristics that can be interpreted in terms of multifractality. Its degree expressed by e.g. the widths of the singularity spectra varies across different stocks but these properties are entirely company-specific and are not related to industry sectors, company size, average transaction frequency or any other characteristics of this type. The multifractal properties of and are of different nature; though on a qualitative level the corresponding spectra can be related. The relevant relation [16] between the spectra for the returns and for the multifractal time does not however apply fully quantitatively. This is because the c.d.f. of the microscopic price increments and the c.d.f. of the inter-trade time intervals are not related through the Brownian motion as required in [16]. If the price and the time components of the trading are independent or they at most weakly depend on each other, the compelling next step in this kind of analysis is to perform a fully 2-D multifractal approach in order to link the fractal nature of the price and the time increments into one unified frame.

References

- [1] B.B. Mandelbrot and J.W. van Ness, SIAM Review 10 (1968) 422-437

- [2] V. Plerou, P. Gopikrishnan, L.A.N. Amaral, M. Meyer and H.E. Stanley, Phys. Rev. E 60 (1999) 6519-6529

- [3] P. Gopikrishnan, V. Plerou, L.A.N. Amaral, M. Meyer and H.E. Stanley, Phys. Rev. E 60 (1999) 5305-5316

- [4] V. Plerou, P. Gopikrishnan, L.A.N. Amaral, X. Gabaix and H.E. Stanley, Phys. Rev. E 62 (2000) R3023-R3026

- [5] S. Drożdż, J. Kwapień, F. Gruemmer, F. Ruf and J. Speth, Acta Phys. Pol. B 34 (2003) 4293-4305

- [6] M. Pasquini and M. Serva, Economics Letters 65 (1999) 275-279

- [7] K. Ivanova and M. Ausloos, Physica A 265 (1999) 279-291

- [8] M. Ausloos and K. Ivanova, cond-mat/0108394 (2002)

- [9] A. Bershadskii, Physica A 317 (2003) 591-596

- [10] T. Di Matteo, T. Aste and M.M. Dacorogna, cond-mat/0403681 (2004)

- [11] A. Fisher, L. Calvet and B. Mandelbrot, Multifractality of Deutschemark / US Dollar Exchange Rates, Cowles Foundation Discussion Paper 1166 (1997)

- [12] N. Vandewalle and M. Ausloos, Eur. Phys. J. B 4 (1998) 257-261

- [13] A. Bershadskii, Eur. Phys. J. B 11 (1999) 361-364

- [14] K. Matia, Y. Ashkenazy and H.E. Stanley, Europhys. Lett. 61 (2003) 422-428

- [15] B.B. Mandelbrot, Fractal and Scaling in Finance: Discontinuity, Concentration, Risk, Springer Verlag (New York, 1997)

- [16] L. Calvet, A. Fisher, B.B. Mandelbrot, Large Deviations and the Distribution of Price Changes, Cowles Foundation Discussion Paper 1165 (1997)

- [17] T. Lux, The Multi-Fractal Model of Asset Returns: Its Estimation via GMM and Its Use for Volatility Forecasting, Univ. of Kiel, Working Paper (2003)

- [18] T. Lux, Detecting multi-fractal properties in asset returns: The failure of the ‘scaling estimator’, Univ. of Kiel, Working Paper (2003)

- [19] T.C. Halsey, M.H. Jensen, L.P. Kadanoff, I. Procaccia and B.I. Shraiman, Phys. Rev. A 33 (1986) 1141-1151

- [20] A.-L. Barabási and T. Vicsek, Phys. Rev. A 44 (1991) 2730-2733

- [21] J.F. Muzy, E. Bacry and A. Arneodo, Phys. Rev. Lett. 67 (1991) 3515-3518

- [22] S. Ghasghaie, W. Breymann, J. Peinke, P. Talkner and Y. Dodge, Nature 381 (1996) 767-770

- [23] Y. Ashkenazy, D.R. Baker, H. Gildor and S. Havlin, Geophys. Res. Lett. 30 (2003) 2146

- [24] C.-K. Peng, S.V. Buldyrev, S. Havlin, M. Simons, H.E. Stanley, A.L. Goldberger, Phys. Rev. E 49 (1994) 1685-1689

- [25] S.V. Buldyrev, A.L. Goldberger, S. Havlin, R.N. Mantegna, M.E. Matsa, C.-K. Peng, M. Simons and H.E. Stanley, Phys. Rev. A 51 (1995) 5084-5091

- [26] A. Arneodo, B. Audit, E. Bacry, S. Manneville, J.F. Muzy and S.G. Roux, Physica A 254 (1998) 24-45

- [27] P.Ch. Ivanov, L.A.N. Amaral, A.L. Goldberger, Sh. Havlin, M.G. Rosenblum, Z.R. Struzik and H.E. Stanley, Nature 399 (1999) 461-46

- [28] S. Blesic, S. Milosevic, D. Stratimirovic and M. Ljubisavljevic, Physica A 268 (1999) 275-282

- [29] J.M. Hausdorff, Y. Ashkenazy, C.-K. Peng, P.Ch. Ivanov, H.E. Stanley and A.L. Goldberger, Physica A 302 (2001) 138-147

- [30] J.-F. Muzy, D. Sornette, J. Delour and A. Arneodo, Quant. Finance 1 (2001) 131-148

- [31] Z. Eisler and J. Kertész, cond-mat/0403767 (2004)

- [32] J.-P. Bouchaud, M. Potters and M. Meyer, Eur. Phys. J. B 13 (2000) 595-599

- [33] H. Nakao, Phys. Lett. A 266 (2000) 282-289

- [34] A. Arneodo, E. Bacry and J.F. Muzy, Physica A 213 (1995) 232-275

- [35] J.W. Kantelhardt, S.A. Zschiegner, E. Koscielny-Bunde, A. Bunde, Sh. Havlin and H.E. Stanley, Physica A 316 (2002) 87-114

- [36] A.Z. Górski, S. Drożdż and J. Speth, Physica A 316 (2002) 496-510

- [37] J. Theiler, S. Eubank, A. Longtin, B. Galdrikian, J.D. Farmer, Physica D 58 (1992) 77-94