Effects of regulation on a self–organized market

Abstract

Adapting a simple biological model, we study the effects of

control on the market. Companies are depicted as sites

on a lattice and labelled by a

fitness parameter (some ‘company–size’ indicator). The

chance of survival of

a company on the market at any given time is related

to its fitness, its position

on the lattice and on some particular external

influence, which may be considered to

represent regulation from governments

or central

banks. The latter is rendered as a penalty for companies which show a very

fast betterment in fitness space. As a result, we find that the

introduction of regulation on the market contributes to

lower the average fitness of companies.

PACS:

05.65 self organized criticality -

87.23.Ge Biological physics: ecology and evolution: Dynamics of social systems -

89.90.+n Other areas of general interest to physicists

Keywords:

Critical dynamics,

Self–organization,

Economic regulation,

Evolutionary models.

Complex extended systems showing critical behavior, a lack of scale in their features, appear to be widespread in nature, being as diverse as earthquakes [1], river networks [2], and biological evolution [3]. The common characteristic of these systems is that they do not need any fine tuning of a parameter to be in a critical state. In an attempt to explain this behavior, Bak, Tang and Wiesenfeld introduced the concept of self–organized criticality (SOC) [4]. In the critical state, there are long range interactions, by which each part of the system feels the influence of all the others. More precisely, this means that many of the relevant observables in the system follow a power–law or Pareto–Lévy distribution with a non-trivial exponent.

Human society is, by far, one of the more complex extended systems. Its self–organisation is evident: Every single characteristic (historical, cultural, etc.) of a member of a society influences all the other members around him, and through them all the others, in a non–trivial way. However, despite this complexity, it is universally accepted that cultural details play an interesting but somewhat “marginal” role in the human history. Economic development has always been considered the driving (or relevant) force in determining the relationships inside a society (for new perspectives on this old topic, the reader is kindly referred to [5]).

Moreover, it has been confirmed, first in the context of paleontology, that evolution and extinction follow a pattern of punctuated equilibrium [6]. In a nutshell, punctuated equilibrium means that long periods of stasis, during which no significant changes take place, are interrupted by sudden bursts of activity, that may last for a very short time, after which the qualitative structure of the system might be completely changed. Models for biological evolution have shown how punctuated equilibrium–like behavior arises naturally if the system is in a self–organized critical state [3].

Something similar could be said about human history. Indeed, the fact that it follows a “punctuated” pattern is a widely acknowledged observation: Wars, famines, revolutions and counter–revolutions are the most evident (and extreme) illustrations of these bursts of historical activity. There is enough data in the last ten years (not to speak of the last ten centuries), to illustrate this fact. It is then natural, if nothing else by the force of mere analogy, to look for evidences of critical behavior in social systems. In this paper we will concentrate on one particular aspect of social systems, namely economic processes. Since economy is the one of the most relevant factors in determining the structure of a society, a great deal of effort has been devoted in recent years to the analysis of economic data. From stock–exchange fluctuations [7], models of production [8], to size distribution of companies [9], it has finally been shown that market economy exhibits properties characteristic of a critical system [10]. Although we are still far from being able to predict large–scale phenomena, such as recessions, crashes, etc., these results lend credence to the theory that economy is indeed a self–organized critical system. Bearing these considerations in mind, we present here a simple model that shows SOC on a macroeconomic level together with some of its implications.

In particular, we consider a modified version of the model proposed by Bak and Sneppen (BS) to describe the co–evolution of natural species [3]. In our model, an economical system (a market) will be described by a one–dimensional lattice, every site of which represents a company or a production sector. Companies with stronger mutual interactions (because they offer the same product or one furnishes goods to the other) are arranged on neighboring sites (this is similar to the food–chain in the biological case). Each company is characterized by a number (its fitness) describing, for example, the size of the company, its average earnings or any suitable combination of both. In more general terms, the fitness represents the chance a company has to survive in the market. As we shall see in the context of our model, this represents only the microscopic point of view. Indeed, from a macroscopic point of view, any company with a fitness beyond a certain threshold survives with the same probability. Thus, the company with the lowest fitness is the one that feels the strongest pressure to change. One can then say that, formulated in these terms, the fitness carries global information about, and over to, all the market chain. As an example, the company with the lowest fitness may be one working in a rapidly expanding sector or in a sector that, for some reason, cannot develop any further. However, on a macroeconomic level we do not need to explain which sector or which company might be involved or why. Indeed, at any given time, there are production or distribution sectors which are developing or shrinking and companies that are in a key position in those sectors. Moreover, on a long time basis, it is rather hard to predict which sector will be the most active and what will be the consequences of that on a microeconomic level. Correspondingly, in the simplified situation we are considering, we neglect the distinction among different specialisations: This is justified by the observation that, on a macroeconomic level, all different branches are necessary and in mutual interaction [11].

The fate of the worst fit company is either to evolve or go bankrupt with its place taken by some new company in the same economical niche. The nearest neighbour companies will find a different environment, and their fitnesses will be changed too. As a result the system exhibits sequences of causally connected evolutionary events called avalanches [3]. An avalanche has a duration distributed as follows

| (1) |

where is the duration of the avalanche and [12] is the avalanche critical exponent. This kind of behavior, which is the essence of self–organized criticality, is also the one responsible for the above–mentioned punctuated equilibrium.

In the original (biological) BS model, the mutation of the least fit species is realized by giving to it a new fitness taken at random [3] from a uniform distribution. More precisely, each lattice site is assigned a random number between and . At each time step the smallest is found. Then, and the two nearest neighbors are updated according to the rule

| (2) |

that assigns a new fitness to the chosen lattice site. The function is just a random function with a uniform distribution between 0 and 1. After a transient time, the system reaches a stationary critical state in which the distribution of fitnesses is zero below a certain threshold [12] and uniform above it. It has also been shown that the updating rule (2) need not be a random function. Indeed, deterministic updating has also been considered [13, 14] and, provided the updating rule has no long–time correlations, SOC is preserved together with the universality class.

There is, however, a very important difference between an ecosystem and an economic market. In a competitive market, a company does not change at random. Quite on the contrary, it will always try to increase its fitness, i.e. to move “upwards” towards higher efficiency in order to improve its chances to stay in business. Thus, when modelling the change the company makes to survive in the market, one has to include a deterministic component, while still keeping the “random character” of the market [15]. The introduction of chaotic (deterministic) instead of random updatings take into account both the rather unpredictable variation of the market and the voluntary moves of the head of the company. Indeed, according to [14], chaotic (deterministic) updatings do not change the statistical properties of the system.

One very important difference between markets and ecosystems still requires consideration: For a given company, too rapid a growth might be a source of problems in the very near future. Indeed, a very rapidly growing company may face a series of new duties (from new tax rates to new delivery and/or new advertising systems or new very expensive technology) that its structures are not able to support. In other words, the market rules may be different according to the size of the company. Adaptation to new rules/tasks might require time, and when time is not enough this may lead to bankruptcy. From this point of view, we are looking for a version of the BS model which still shows self–organized criticality but which nevertheless includes some instability for those companies that have experienced too big an increase in their fitness.

For instance, let us suppose that the parameter represents the size (suitably normalized to 1). Let us consider the simplified situation in which there are two taxation rates: Companies whose size is bigger than have to pay a bigger rate than those whose size is smaller. From this point of view, if a company changes its class from small to big size, it may face a higher taxation rate that prevents it from consolidating its new position. We then implement a dynamic rule in the following way: After having assigned to each site a random value we proceeds in four basic steps:

-

1.

Find the site of the absolute minimum on the lattice (this site will be called the active site) and those of the two nearest neighbors.

-

2.

Change at the same time their values by giving them new numbers according to the given map .

-

3.

If after applying 2, some of the three moves from the lower to the upper sector, we apply again the map on it.

-

4.

Go to step 1.

Step 3 is tantamount to saying that when a company changes from the category of “small business” to the category of “big business”, the rules are different and it has to re–adapt to its different environment. Clearly, this step can be accommodated to consider any possible interpretation of the microscopic parameter at any given time–step. Thus, the dynamic rule we have introduced can be considered as being a general, if anything a little abstract, way of saying that too fast a betterment may turn into its contrary.

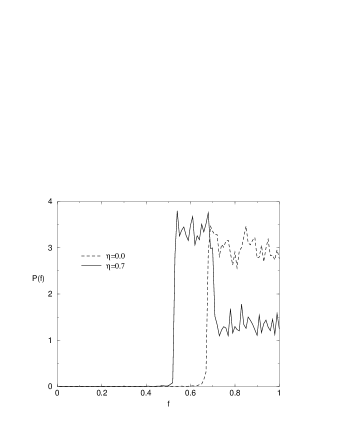

With the rules explained above, the universality class is preserved and the stationary distribution of the ’s follows also a pattern similar to that of the random updating (see Fig. 1).

The difference between applying or not step 3 can be observed in Fig. 1. The “control” applied on the market, namely the re–adaptation to different (size dependent) rules, helps companies of lesser fitness to survive. In a sense, this means that controlling the market helps more companies to stay in business at the expense of reducing the “average” fitness. In fact the average fitness goes like and since the threshold decreases, the average fitness decreases also.

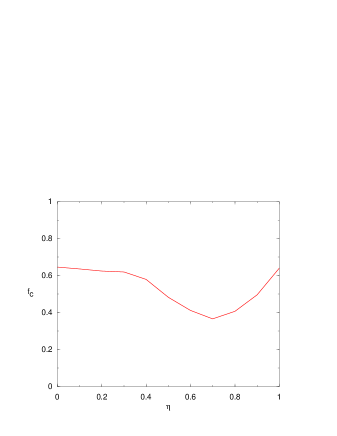

Fig. 2 shows the resulting dependence of the critical fitness on the value , (according to rules 1–4). Notice that in the curve, there is a particular value of where a minimum occurs. This means that slight variations of the parameter do not influence the average and critical value of the fitness. On the other hand, when is sensibly away from its minimum, but still far from its extreme values, any tiny variation of the taxation levels has amplified effects on the average fitness. In particular it should be noticed that, although the boundary cases and lead to the same critical fitness, in a neighbourhood of them the derivative of the curve is different. Tiny variations around have smaller effects on the average fitness than those of tiny variations around .

The results presented here indicate that, on a global scale, the behavior of the market is not affected by the exact details of the control rules. On the other hand, time correlations in the chaotic map used for the updating can push the threshold towards bigger values [14]. These time–correlations take into account how strongly is correlated to in Eq. (2), i.e. they are related to the decrease in the average randomness in the movements of the variables . In other words, an on–average stronger control (less “erratic” decisions, due for instance to better management) on the part of the management of the companies would have a global consequence, namely an increase of the value of the threshold . In a world where management skills increase with time (as our world is likely to be), the threshold will also increase with time and consequently it will be always more difficult to stay in business.

Summarizing, the model introduced in this paper shows which kind of changes appear when some control is applied on an SOC system. The exact nature of the control is, in this simplified model, irrelevant. In particular, we show that a control, like the one introduced here, produces always a decrease in the average fitness of the companies operating in the market. This could in principle explain why, when deregulated, a market shows initially a big percentage of companies going out of business. This percentage represents those “protected” by the control that are left unprotected once the control is removed.

Caution should be exercised, however, in order to avoid misleading interpretations or too simplistic analogies with Darwinian evolution. On the one hand , if we look at the fitness parameter, as it is often intended in the biological context, one could infere that regulation subsidizes the less economically adapted companies. On the other hand, as we mentioned above, the word fitness could refer to economical indicators –or to functions of them– related to the size of a company (income, number of employees, sale size, economic value added…). In this sense, a smaller average fitness means a richer variety in the economic system.

References

- [1] J. M. Carlson and J. S. Langer, “Properties of Earthquakes Generated by Fault Dynamics” Physical Review Letters 62, 2632–2635 (1989).

- [2] A. Maritan, F. Colaiori, A. Flammini, M. Cieplak, and J. R. Banavar, “Universality classes of optimal channel networks” Science 272, 984–986 (1996).

- [3] P. Bak and K. Sneppen, “Punctuated Equilibrium and Criticality in a Simple Model of Evolution” Physical Review Letters 71, 4083–4086 (1993).

- [4] P. Bak, C. Tang, and K. Wiesenfeld, “Self–Organized Criticality: An Explanation of Noise” Physical Review Letters 59, 381–384 (1987); “Self–Organized Criticality” Physical Review A 38, 364–374 (1988).

- [5] R. Lucas, Models of Business Cycles, Basil Blackwell, Oxford (1987).

- [6] M. D. Raup, “Biological Extinction in Earth History” Science 231, 1528-1533 (1986); N. Eldredge and S. J. Gould, Punctuated equilibria: an alternative to phyletic gradualism in Models in Paleobiology, Freeman, Cooper & Co., San Francisco (1972); N. Eldredge and S. J. Gould, “Punctuated Equilibrium Prevails” Nature 332, 211–212 (1988).

- [7] T. Lux and M. Marchesi, “Scaling and criticality in a stochastic multi-agent model of a financial market” Nature 397, 498–500 (1999); R. N. Mantegna and H. E. Stanley, “Scaling behavior of an economic index” Nature 376, 46–49 (1995); R. N. Mantegna, “Lévy walks and enhanced diffusion in Milan stock exchange” Physica A 179, 232–242 (1991).

- [8] P. Bak, K. Chen, J. A. Scheinkman, and M. Woodford, “Aggregate fluctuations from independent sectoral shocks: self–organized criticality in a model of production and inventory dynamics” Ricerche Economiche 47, 3–30 (1993).

- [9] M. H. R. Stanley, L. A. N. Amaral, S. V. Buldyrev, S. Havlin, H. Leschhorn, P. Maass, M. A. Salinger, and H. E. Stanley, “Scaling behaviour in the growth of companies” Nature 379, 804–806 (1996).

- [10] B. B. Mandelbrot, Fractal and Scaling in Finance, Springer, New York (1997); R. N. Mantegna and H. E. Stanley, J. Stat. Phys. 89, 469 (1997); R. N. Mantegna and H. E. Stanley, An Introduction to Econophysics, Cambridge Univ. Press, Cambridge, UK (in press).

- [11] R. C. Bryant, Empirical Macroeconomics for Interdependent Economies, The Brookings Institution, Washington D.C. (1988).

- [12] S. Maslov, M. Paczuski, and P. Bak, “Avalanches and noise in evolution and growth models” Physical Review Letters 73, 2162–2165 (1994); M. Paczuski, S. Maslov, and P. Bak, “Avalanche dynamics in evolution, growth, and depinning models” Physical Review E 53, 414–443 (1996).

- [13] P. De Los Rios, A. Valleriani, and J. L. Vega, “Self–Organized criticality driven by deterministic rules” Physical Review E 56, 4876–4879 (1997).

- [14] P. De Los Rios, A. Valleriani, and J. L. Vega, “Self–Organized criticality in deterministic systems with disorder” Physical Review E 57, 6451-6459 (1998).

- [15] P. H. Cootner, The Random Character of Stock Market Prices, The MIT Press, Cambridge, Massachusetts (1964).