Stock Market Speculation:

Spontaneous Symmetry Breaking of Economic Valuation

Abstract

Firm foundation theory estimates a security’s firm fundamental value based on four determinants: expected growth rate, expected dividend payout, the market interest rate and the degree of risk. In contrast, other views of decision-making in the stock market, using alternatives such as human psychology and behavior, bounded rationality, agent-based modeling and evolutionary game theory, expound that speculative and crowd behavior of investors may play a major role in shaping market prices. Here, we propose that the two views refer to two classes of companies connected through a “phase transition”. Our theory is based on 1) the identification of the fundamental parity symmetry of prices (), which results from the relative direction of payment flux compared to commodity flux and 2) the observation that a company’s risk-adjusted growth rate discounted by the market interest rate behaves as a control parameter for the observable price. We find a critical value of this control parameter at which a spontaneous symmetry-breaking of prices occurs, leading to a spontaneous valuation in absence of earnings, similarly to the emergence of a spontaneous magnetization in Ising models in absence of a magnetic field. The low growth rate phase is described by the firm foundation theory while the large growth rate phase is the regime of speculation and crowd behavior. In practice, while large “finite-time horizon” effects round off the predicted singularities, our symmetry-breaking speculation theory accounts for the apparent over-pricing and the high volatility of fast growing companies on the stock markets.

1 Introduction

There is a growing interest in understanding the divergence in the stock market between“New Economy” and “Old Economy” stocks, between technology and almost everything else. Over the past two years, stocks in the Standard & Poor’s technology sector have risen nearly fourfold, while the S&P 500 index has gained just 50%. And without technology, the benchmark would be flat. In January 2000 alone, 30% of net inflows into mutual funds went to science and technology funds, versus just 8.7% into S&P 500 index funds. As a consequence, the average price-over-earning ratio P/E for Nasdaq companies is above 200 (corresponding to a ridiculous earning yield of ), a stellar value above anything that serious economic valuation theory would consider reasonable. It is worth mentioning that the very same concept and wording of a “New Economy” was hot in the minds and mouths of investors in the 1920’s. The new technologies of the time were General Electric, ATT and other electric and communication companies, and they also exhibited impressive price appreciations of the order of hundreds of percent in a 18 month time intervals before the 1929 crash.

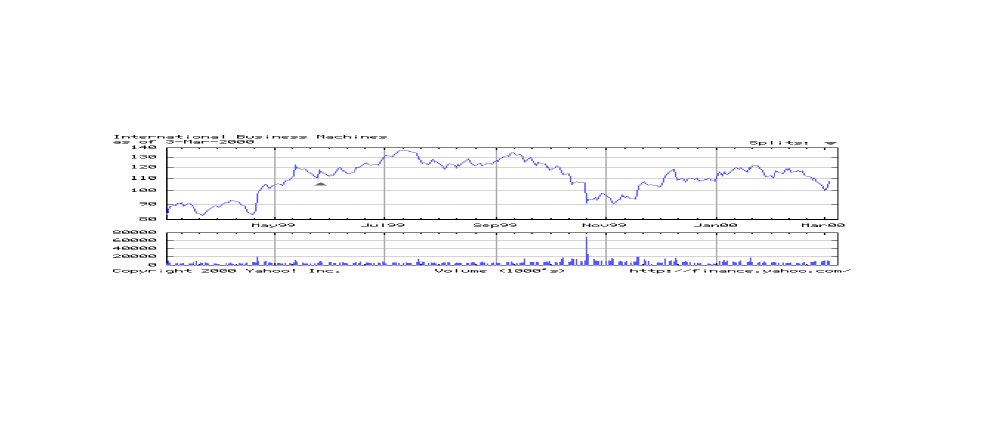

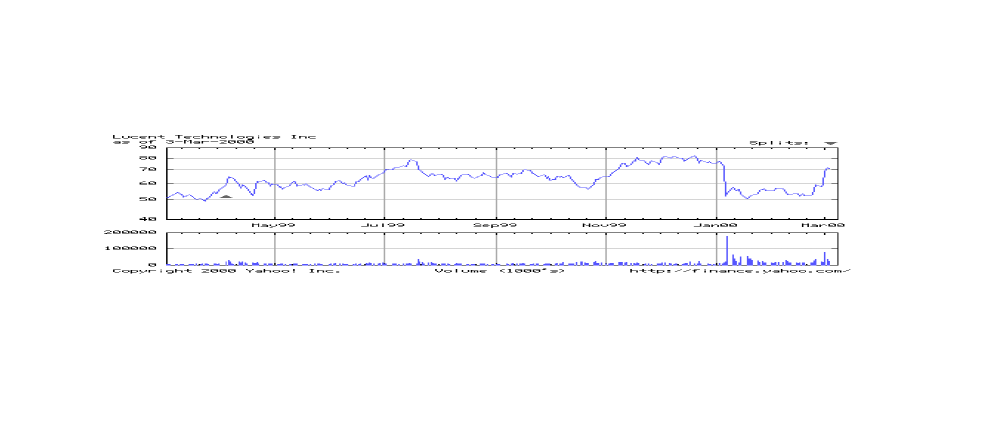

Another noteworthy phenomenon is the anomalous occurrence of large sudden losses (not necessarily always associated with the ‘new economy’ stocks). For instance, three of the ten largest companies in terms of their capitalization on the US market have recently seen their stock price crash. IBM (P/E ) dropped 33% from a top of 133.31 on 14-Sep-99 to a low of 90.25 on 5-Nov-99 and during that period dropped 15% from 107 on 20-Oct-1999 to 91 on 21-Oct-1999 in one day (see figure 1), due to announcement by IBM executives of lower than expected earnings, that surprised Wall Street. This 33% drop corresponds to a market capitalization loss of about $73 billion. Lucent Technologies (P/E , P/d ), the telephone equipment giant, dropped 28% from a close of 72.375 on 5-Jan-2000 to a close of 52 on 6-Jan-2000 (see figure 2) after the telephone equipment maker warned that its first-quarter earnings will fall short of expectations, surprising investors. This 28% drop corresponds to a market capitalization loss of about $56 billion. Procter & Gamble (P/E ), the Cincinnati-based maker of Tide laundry detergent and Crest toothpaste, dropped 30% from 87.44 on 6-Mar-2000 to 61 on 7-Mar-2000 leaving the stock at its lowest since April 1997 (see figure 3) after it caught analysts and investors off guard with a profit warning that sent its stock and those of other consumer products makers in the United States and overseas plummeting. This 30% drop corresponds to a market capitalization loss of about $22 billion.

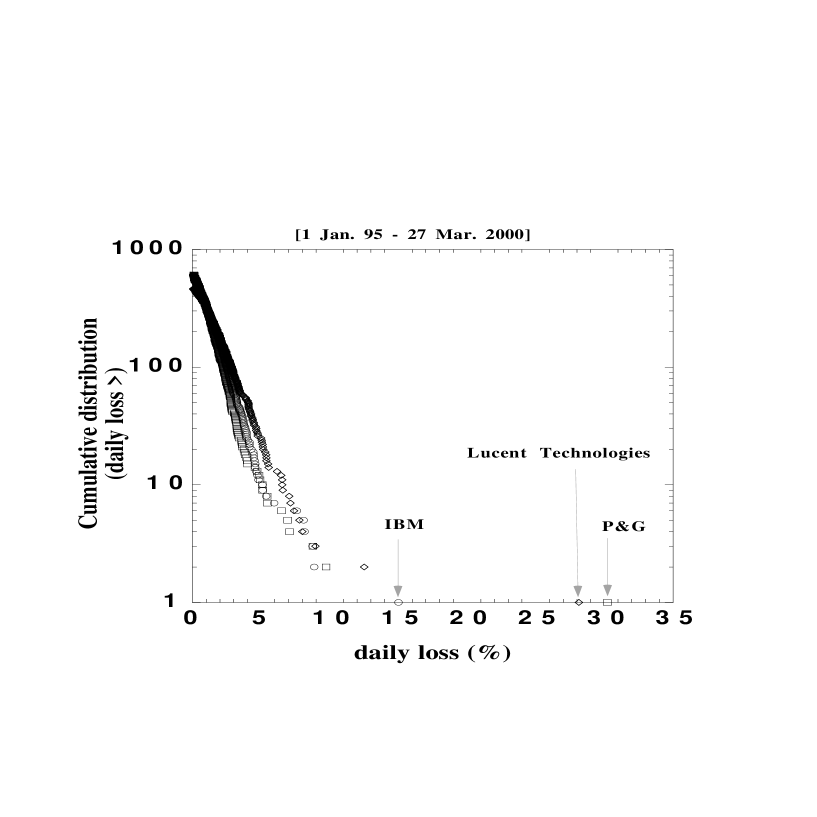

These enormous events are outliers in the following sense. As seen on figure 4, which shows the (complementary) cumulative distribution of negative daily returns expressed in percent, for the three compagnies IBM, Lucent technology and Procter & Gamble for the period from 1st January 1995 to 27 March 2000, most of the negative returns can be consistently described by an exponential distribution, qualified as a straight line in this semi-logarithmic representation [1], with a typical negative return approximately equal to . However, the three recent dramatic daily losses on these three companies stand out very clearly off the tail of the exponential distributions. Extrapolating the exponentials, this leads to an average repeat time of about a century for the IBM 15% drop, and of the order of thousands of centuries for the two other events. This confirms the picture found for the Dow Jones index [2] that there exists special times where extraordinary events occur, suggestive of some amplification of an instability.

These observations and many others, including so-called speculative bubbles and crashes [3, 4], have led to question the idea, cherished by a long tradition of academic researchers, that markets are efficient and rational, with alternatives such as human psychology and behavior in financial decision making, bounded rationality, agent-based modeling and evolutionary game theory being actively investigated. Here, we advance the novel idea that there is a deep connection between firm-foundation pricing and speculative phases: they can be seen as two phases of the same dynamics separated by a bifurcation or “phase transition”. If the risk-adjusted expected growth rate is large enough, we find that a novel speculative-like regime can spontaneously appear which can sustain large price values. This regime is characterized by a large sensitivity with respect to expectations, which may explain the observed large reactions of the market.

An important consequence of our proposed theory is that “speculation” is not a distinct “animal” but rather the “mutation” of normal (approximately) rational behavior. We do not imply that all speculative behaviors can be fully quantitatively understood from our approach; rather, we envision the speculative phase emerging from the spontaneous price symmetry breaking as the nucleus for speculation blossoming with imitation and behaviorial processes.

In section 2, we summarize the firm-foundation theory and discuss its consequences. In section 3, we present the concept of price parity symmetry and show how, together with the firm-foundation theory, it leads to the concept of a critical bifurcation to a spontaneous symmetry breaking regime and suggest the existence of a “speculative phase” linked to the fundamental valuation phase. Section 4 proposes a simple dynamical extension of the firm-foundation theory that captures both regimes and leads to observable predictions. Section 5 analyses finite time-horizon effects and the effect of future prices on expectation of growth. Section 6 concludes.

2 Equilibrium economic valuation: effect of expected dividend growth

The “firm-foundation” theory asserts that a stock has an intrinsic value determined by careful analysis of present conditions and future prospects. Developed by S. Eliot Guild [5] and John B. Williams [6], it is based on the concept of discounting future dividend incomes. In the words of Burton G. Malkiel [7], discounting refers to the following concept: “rather than seeing how much money you will have next year (say $1.05 if your put $1 in a saving bank at 5% interest), you look at money expected in the future and see how much less it is currently worth (thus next year’s 1$ is worth today only about 95c, which would be invested at 5% to produce $1 at that time).” In practice, the intrinsic value approach is a quite reasonable idea which is however confronted with slippery estimations: the investor has to estimate future dividends, their long-term growth rates as well as the time-horizon over which the growth rate will be maintained. Notwithstanding these problems, this approach has been promoted by Irving Fisher [8] and Graham and Dodd [9] so that generations of Wall Street security analysists have been using some kind of “firm-foundation” valuation to pick their stocks.

Consider a company paying a dividend per share at regular time intervals , , … Let be the fixed risk-free interest rate (the “price of money”) paid by investing one unit of wealth over a time . The time discount factor per unit time is thus : one unit of weath at time is worth at present .

In the firm-foundation equilibrium economic theory [10], the equilibrium price of a share is the present expected discounted value of all future payoffs:

| (1) |

This standard result expresses a no-arbitrage condition as the instantaneous return obtained by owning the stock is essentially equal to the risk-free rate. The price-over-dividend ratio is

| (2) |

The price-over-earning ratio uses the company’s earning (total revenues minus expenses after tax). The price-over-dividend ratio is function of the company’s strategy of how much of the earnings should be distributed to the share holders in the form of dividends rather than reinvested in the company or used to pay debts. Earnings and dividends are empirically correlated and exhibit parallel evolutions but they have different explanatory and predictive powers of price returns. Lamont [11] has shown recently that the price-over-dividend ratio forecasts excess returns of stocks: high dividends forecast high returns. In contrast, high earnings forecast low returns. One interpretation is that dividends measure the permanent component of stock prices, due to managerial behavior in setting dividends because they help measure the future dividends. The level of earnings is a good measure of current business conditions: a more favorable economy implies larger earnings, for which investors require lower future returns as risk premia, hence larger earnings predict smaller returns.

Let us now consider the possibility for the dividend to grow as a function of time at the fixed rate , as a result of increased productivity and other factors. has to be understood as the expected growth rate of future dividends. Usually, growth forecasts are performed on the company’s growth, in terms of its earnings. We shall assume for simplicity that both dividends and earnings have statistically the same growth rate. Equation (1) is then changed into

| (3) |

The price-over-dividend ratio is then changed into

| (4) |

This is the celebrated valuation formula of Gordon and Shapiro [12].

Expression (4) accounts for the impact on the stock price of the expected dividend payout , the growth rate and the market interest rate . The last important ingredient is the degree of risk. There is no unique measure of risk. For our purpose, risk embodies several components, such as market price and earning volatilities as well as growth rate uncertainty and variability. To quantify the impact of these risks on the value of a stock, we shall adopt the pragmatic procedure in which the growth rate is adjusted for risk by replacing it by , where is an aggregate risk level. In the spirit of a quality ratio , such as the Sharpe ratio, renormalizes . Errors in estimating will increase the uncertainties on already present due to the large uncertainties in the growth rate . Expression (4) is thus replaced by

| (5) |

In accordance with intuition, the price-over-dividend increases with dividend and with the rise of expected dividend due to a positive growth rate, i.e. with the expectation that future gains will grow. This expression (5) reveals interesting perhaps less intuitive phenomena. When the risk-adjusted dividend growth rate is not small compared to the risk-free interest rate , (5) shows that the price can be many times larger than the valuation formula (1) would lead us to believe. Take for instance, , and . Expressions (2) and (5) give respectively and . In this framework, large price-over-dividend ratios express the large expected growth rate of future earnings. This valuation formula (5) may actually form the basis for a partial rationalization of some large observed price-over-dividends and probably also price-over-earning ratios. This is particularly true for the “new economy” based on high-growth information- and internet-based companies that are expected to develop large future earnings. What (5) teaches us is that their pricing may actually be not as much irrational as often believed but rather reflects the high future growth of the expected earnings. The new emphasis is not so much on the present dividend but on its future risk-adjusted growth rate . This view has been expounded by many workers (see intuitive presentations in [7] and [14]).

What happens when the risk-ajusted growth rate becomes larger than , so that the valuation formula (5) gives a meaningless negative price? In the economic literature, this regime is known as the growth stock paradox [15]. This is the question addressed in the sequel.

Note that the valuation problem has been posed in 1938 by Von Neumann [13] who demonstrated that, in an economy with balanced growth, the growth rate is always identical to the interest rate and thus equal to the discounted rate. Zajdenweber [14] then points out that the value of a share is, as a consequence, always infinite as seen from (3). The intuition is that when becomes equal to (and this is all the more true when it is larger than) , the price of money is not enough to stabilize the economy: it becomes favorable to borrow money to buy shares and earn an effective rate of return, which is positive for all values of the dividend. This is exactly what happened on the US market in the rally preceeding the Oct. 1929 crash [16]. Note that a negative is similar to a negative interest rate in absence of growth and risks: it leads to an arbitrage opportunity since you can borrow $1 now, keep it under your mattress, and give back at a later time, pocketing cents in the process. Another well-known situation of negative is when the inflation rate is larger than the interest rate. Tax laws which tax the nominal income and ignore inflation reduce the effective even more. Here again, you lose money by keeping it.

The valuation formula (3) can be easily generalized to account for arbitrary time-varying dividends and rates

| (6) |

where is the global “discount” factor at year in the future, taking into account a possible variation of the risk-free interest rate and of the risk-adjusted dividend growth rate (which can be negative). The sum of products given in the r.h.s. of (6) has been studied in a variety of contexts (see [17] for a review) including a mechanism for Pareto distributions of cities [18] and in relation with ARCH(1) processes [19]. The asymptotic behavior of expression (6) is well-understood:

-

•

for , where the brackets denote the expectation with respect to the distribution of , is finite and is distributed with a power law tail with exponent depending sensitively on the distribution of the ’s [17, 20]. This is reminiscent of the fat tail character of price returns (see [21] for the relation between prices and price returns in this context) and of the sensitivity of prices to external news that may be seen to impact the estimation of the risk-adjusted growth rate .

-

•

For , the sum grows on average exponentially fast with the number of terms (time horizon) with an average growth rate equal to , while exhibiting large fluctuations. This regime is qualitatively the same as that seen in (5) for , i.e. .

-

•

The critical transition point is in general also characterized by a growth as the number of terms included increases, but this growth is sub-exponential and depends on details of the distribution and on correlations [22].

3 Spontaneous price valuation

3.1 Negative prices and price parity symmetry

Expressions (3) and (5) have no meaning for , as the price become negative which makes no apparent sense. This argument that prices should always remain positive was actually at the basis of the rejection of Bachelier’s seminal random walk model of prices [23] in favor of Samuelson’s random walk model of the logarithm of prices [24], which has become the paradigm in economic and finance modeling.

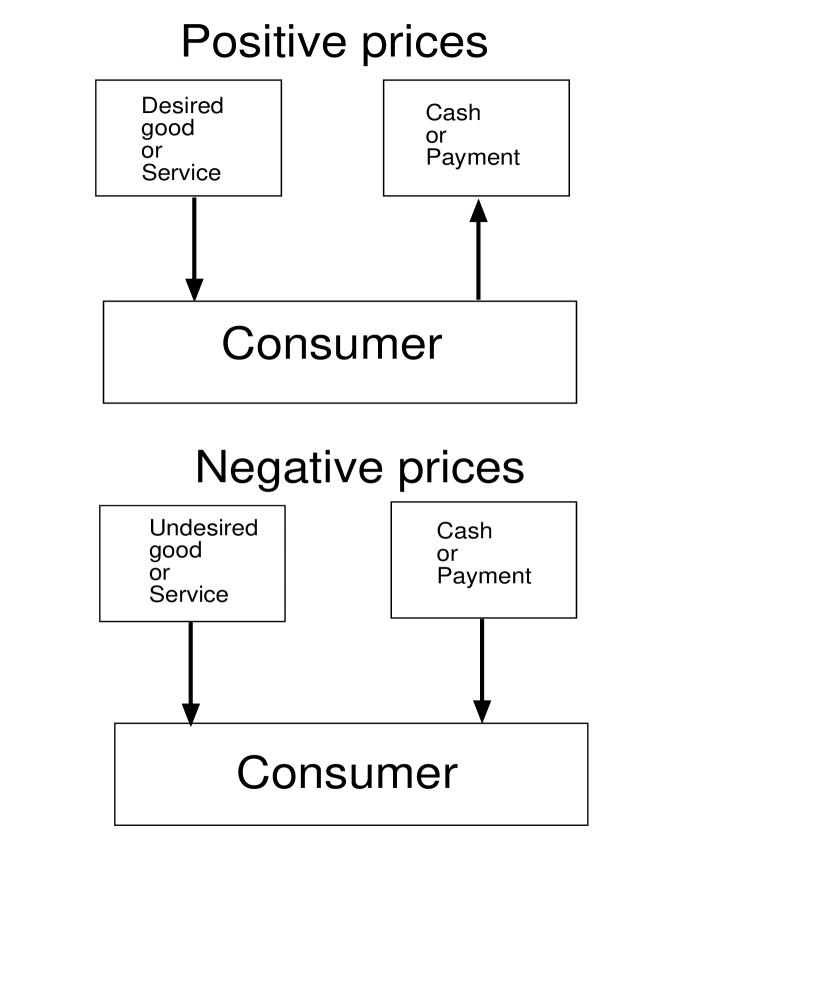

Actually, it makes perfect sense to think of negative prices. We are ready to pay a (positive) price for a commodity that we need or like. However, we will not pay a positive price to get something we dislike or which disturb us, such as garbage, waste, broken and useless car, chemical and industrial hazards, etc. Consider a chunk of waste. We will be ready to buy it for a negative price, in order words, we are ready to take the unwanted commodity if it comes with cash. This exchange of waste for income is the basis for the industry of waste management. Nuclear waste from some countries such as Japan for instance are shipped to La Hague reprocessing complex in France, which is ready to store the unwanted wastes for income. The Japanese are thus paying a price to get rid of their waste, that is to say, La Hague is paying a negative price to get the nuclear waste commodity! As a matter of fact, this exchange of wastes is at the basis of a huge business for the present and future management of industrial and nuclear waste that counts in hundreds of billions of dollars. A less obvious example is the case of electricity companies which sell surplus electricity in exceptional cases for negative prices; it is expensive for them to shut down a power plant and to restart it again (R. Weron, private communication). Stauffer humoristically points out (private communication) that the page charges some authors pay to the journals to get rid of their manuscripts are a nice example of negative prices. Actually, this is not correct but this example illustrates the intricacy of the concept: authors pay to get published, not get rid of their paper but to buy fame, i.e. cash leaves the authors but fame comes to them (hopefully), hence the positivity of the price.

In sum, we pay a positive price for something we like and a negative price for something we would rather be spared of (i.e. we pay a (positive) price to get rid of it or we need a remuneration to accept this unwanted commodity). This concept is illustrated in figure 5.

In the economy, what makes a share of a company desirable? Answer: its earnings, that provide dividends, and its potential appreciation that give rise to capital gains. As a consequence, in absence of dividends and of speculation, the price of share must be nil. There is thus a natural

| (7) |

where both positive and negative prices quantify our liking or disliking of the commodity. The earnings leading to dividends thus act as a symmetry-breaking “field”, since a positive makes the share desirable and thus develop a positive price. It is clear that a negative dividend, a premium that must be paid regularly to own the share, leads to a negative price, i.e. to the desire to get rid of that stock if it does not provide other benefits. Andersen et al. [25] have also used the price, rather than its logarithm, to develop a fundamental framework of price patterns.

For a share of a company that is neither providing utility nor a waste, there is no intrinsic value for it if it does not give you more buying power for something you desire. Hence, its price is for . We can allow for both positive and negative price fluctuations, but there is a priori nothing that breaks the symmetry (7).

We stress that the price symmetry (7) is distinct from the gain/loss symmetry of stock holders, before the advent of limited liability companies in the middle of last century. With the present limited liability of stock holders, owning a stock is akin to hold an option: gain is accrued from dividend and capital gains; on the downside, losses are limited at the buying price of the stock. This asymmetry, which is a relatively recent phenomenon and led to the full development of capitalism, is conceptually distinct from the symmetry (7) of prices.

These considerations can be summarized by the following analogy between valuation and physical phase transitions (liquid-gas or paramagnetic-ferromagnetic) as, for instance, examplified by the canonical Ising model [26]:

In this analogy, the price equation (3) becomes

| (8) |

Notice again that the positive value of the price is associated with the positivity of the dividend. Expression (8) takes the standard form for the dependence of the order parameter as a function of the external field within linear response theory [27]. The coefficient of proportionality is seen to diverge as the control parameter approaches

| (9) |

3.2 Speculation and spontaneous price symmetry breaking

This analogy suggests a very natural interpretation of the regime where the risk-ajusted dividend growth rate becomes larger than the risk-free rate : for negative reduced control parameter, the price can become non-zero even in absence of dividend by a mechanism known as “spontaneous symmetry breaking” (SSB).

SSB is one of the most important concept in modern science that underpins our present understanding of the universe and of its interactions. Its basic principle can be illustrated by a very simple dynamical system

| (10) |

This equation possesses the parity symmetry (7), since both and are solution of the same equation. A solution respecting this symmetry obeys the symmetry condition whose unique solution is called the symmetry-conserving solution. For , is attracted to zero and the asymptotic solution is zero, which as we said is the only solution respecting the parity symmetry. However, a solution of (10) may not always respect the parity symmetry of its equation. This occurs for for which the asymptotic solution is

| (11) |

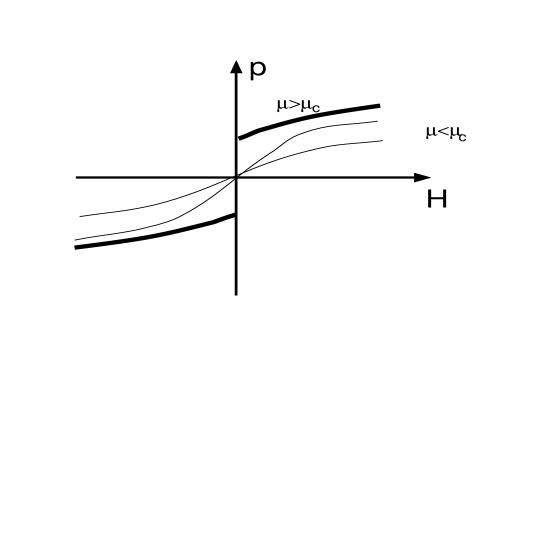

where gives the characteristic scale of the amplitude of p. Notice that there are now two distinct solutions, each of them being related to the other by the action of the parity transformation : the set of solutions respects the parity symmetry as an ensemble but each solution separately does not respect this symmetry. This phenomenon is called “spontaneous symmetry breaking” (SSB). More generally, the concept of SSB describes the situation in which a solution has a lower symmetry than its equation. Expression (10) shows that the parameter controls the symmetry breaking. The so-called “super-critical bifurcation” diagram near the threshold synthetizing the transition from a symmetric solution to a SSB solution is shown in figure 6.

The SSB concept takes its full meaning in presence of a very small external “field” such that (10) is transformed into

| (12) |

For , the stationary solution of (12) is given by (8). In constrast, in the SSB regime , jumps from to when goes from positive to negative as illustrated in figure 7: any infinitesimal field is enough to flip abruptly the order parameter from one of its two symmetry-broken solutions to the other. We refer to [28] for general references and pedagogical introductions and examples. It will never be sufficiently stressed how important is this concept of SSB: for instance, it is invoked to unifying fundamental interactions: weak, strong and electromagnetic interactions are now understood as the result of a more fundamental spontaneous symmetry broken interaction [29]. In another sweeping application, particles and matter in this universe seem to be the spontaneous symmetry-broken phases of a fundamental vacuum state [29], similarly to the non-vanishing price emerging in the SSB phase out of the symmetry-conserved “vacuum” solution . Critical phase transitions are also understood as SSB phenomena [27].

To come back to the valuation problem, we thus propose that, for , assets acquire a spontaneous valuation as a result of this spontaneous symmetry breaking mechanism. When become negative, money is not a desirable commodity. You lose money by keeping it. Other commodities become valuable in comparison with money, hence, the spontaneous price valuation in absence of dividend. We thus propose that, for , the price becomes spontaneously positive (or possibly negative depending on initial conditions or external constraints) and this spontaneous valuation is nothing but the appearance of a speculation regime: investors do not look at or care for dividends; the increase of price is self-fulfilling. And the interpretation of speculation (defined as price higher than fundamental here) is a spontaneous symmetry-breaking around the value .

According to our theory, the regime is a self-sustained growth regime where prices become unrelated to earnings and dividends: prices can go up independently of the dividends due to the “spontaneous symmetry breaking” where a company’s share acquires spontaneously value without any earning. This situation is similar to the spontaneous magnetization of iron at sufficiently low temperature which acquires a spontaneous magnetization under zero magnetic field. This regime could be relevant to understand regimes of bubbles as well as regimes as can be seen in the present “new economy” where prices increase resulting in high price-over-dividend without apparent economic rationalization.

4 A simple extension of pricing theory to the critical and spontaneous valuation regime

The question we now address is how to determine the price at and below the “critical point” for which the standard equilibrium economic approach fails.

In order to make further progress in the quantification of these different phases, we propose first to cure the nonsensical valuation expression (3) by extending the description into a dynamical framework. Building on the price symmetry (7), it is natural to consider a Taylor expansion around the neutral value to obtain the simplest possible dynamical equation for price evolution that embodies these previous elements. The following Langevin equation has the same structure as (11)

| (13) |

where is a numerical coefficient with “dimension” of price. Expression (13) embodies four contributions. The first term in the r.h.s. is simply stating that price is driven up by earning. A comparison with (12) shows that indeed plays the role of the external field breaking the symmetry . The second term is limiting this appreciation by the discounting process such that the price would converge at long times to the equilibrium value (3). Note that it correspond to a growth of the price only if is positive, i.e. the growth rate is larger than the discount rate. The third term is such that it is negligible as long as the price is not too large: quantifies what is meant by “large.” When the price become very large as for instance when , its growth becomes limited by nonlinear feedback effects. We choose a cubic term as the first relevant non-linear term, as it is the first one keeping the symmetry . In the spirit of a Taylor expansion in powers of , expression (13) thus contains a constant term (which, as already said, breaks the symmetry), a linear and a cubic term. Higher order terms can easily be incorporated but are less important. The fourth term in the r.h.s. of (13) is a noise with covariance , which accounts for the stochastic structure of pricing on stock market. The constant in the l.h.s. is a time scale characterizing the reaction time of the price with respect to a change of any of the terms in the r.h.s. It is typically of the order of seconds in liquid markets. In the physical literature, equation (13) is well-known and has been studied in different contexts, for instance as a noisy mean-field time-dependent Landau theory for critical phenomena or as the noisy normal form of supercritical bifurcations in dynamical system theory.

Equation (13) has not been derived on the basis of direct economic reasoning but uses instead 1) symmetry arguments and 2) the constraint that it recovers the firm-foundation valuation formula for . Direct derivations from standard valuation settings give different equations where the constant term is usually given a negative sign to account for the fact that, at equilibrium, the value of the stock is not changed by the dividend payment , where is the time of dividend payment and the superscripts refer to the time just before and after the dividend payment. It is important to realize that expression (13) accounts for both economic valuation due to growth and for the impact of dividend and growth rate on the psychological appreciation of the value of the stock by investors. In other words, the symmetry-based equation (13) somehow automatically embodies a mixture of economic and psychological ingredients. This is indeed necessary for this equation to describe both the standard firm-foundation and the speculative regimes. Deriving (13) from first principles will require to include a blend of economic and psychological factors. We hope to report on this in a future communication. Similarly to phase transitions in the physical sciences, we realize here again the power of symmetry-derived effective equations, in contrast to microscopically-derived equations which are much more prone to miss important contributions. For instance, we have seen that a purely economically-based valuation equation leads to the growth stock paradox [15], which cannot be solved without enlarging the theory as we do with (13).

The consequences of equation (13) are the following. At , the apparent divergence of the price given by (3) is replaced by a non-analytic dependence of the equilibrium price as a function of dividend (neglecting the noise term):

| (14) |

This one-third power law dependence of the price thus predicts a much faster increase of the price as a function of earnings than the usual linear dependence (3) for small ’s as illustrated in figure 8. Indeed, expression (14) has an infinite slope for . Expression (14) is a characteristic signature of the critical point . Close to the critical point, changes in expected dividends thus lead to large price movements. This has recently been seen on IBM, Lucents and Procter & Gamble, discussed in the introduction.

We can retrieve (14) by assuming a co-integration of and parameterized by

| (15) |

valid for small and . This expression implies that, as , the price can remain well-behaved if also goes to zero with the appropriate relationship. This is seen by plugging the expression (15) into (3) which yields

| (16) |

This retrieves the conceptual content of (14) and quantitatively gets the same exponent with the choice .

For such that the expected risk-adjusted growth of earnings is faster that the riskless interest rate, the prices tend to grow spontaneously even without visible earning (). This is the regime of “spontaneous valuation”, similar to the “spontaneous symmetry breaking” discussed in the previous section. This may explain the present frenzy on “growth companies” which have apparently ridiculously high price-over-dividend ratios. In this case, we see that the equilibrium price is set by

| (17) |

independently of earnings for small ’s as seen in figure 7. The rational for paying a high price without earning is that any possible future non-zero earnings will grow sufficiently fast so that it will become valuable. This is the regime of speculation.

The general stationary solution of (13) that combines the two regimes (14) and (17) takes the form [27]

| (18) |

where the function for small and for large . The first condition ensures that (18) retrieves (17) for small or vanishing dividends. The second condition allows to retrieve (14) at or very close to the critical point. The specific functional form of the cross-over of at intermediate values of depends on higher order terms that have been dropped out of this description.

The noise term in (13) ensures that the price is stochastic. The correlation of price returns can be explicitely calculated and takes the form

| (19) |

where the correlation time is

| (20) |

In agreement with empirical observations, returns are correlated only over a very short time scale proportional to (since we have neglected the effect of transaction costs, is of the order of the typical time for a trade, i.e. seconds), except when approaches for which the correlation time can be longer. The mathematical divergence of the correlation time (20) is very difficult to observe in practice because the amplification factor really kicks off when is quite close to . If seconds, say, and , (20) gives minutes. needs to be of the order of or smaller for the correlation time to be of the order of minutes or larger. This suggests the following interpretation: when investors estimate the risk-ajusted growth rate in the range of the risk-free interest rate, pockets of predictability can be created. Inversely, it is sometimes argued by operators and managers of funds that the market exhibits “pockets of predictability”. Such non-stationary structures could be attributed to a particular risk and growth estimation by investors collectively at some particular times.

5 Market instabilities and finite time horizons

5.1 Amplification of price variations by correlations between dividend and its growth rate

The previous framework allows us to cast some light on apparent anomalies and on surprising market behavior. According to (1), the announcement of an expected drop of dividend should lead to a proportional drop in price. Amplification of the drop occurs if the drop in dividend is also seen as an expected drop in future growth of dividends. Then, equation (3) applies and leads to a large amplification if moves away from . Consider for instance the Procter & Gamble crash on 7-Mar-2000. P&G said it expected fiscal third-quarter earnings per share to be down 10 to 11 percent from the year-ago quarter, compared with its prior forecast for a rise of 7 to 9 percent. Thus, the expected earnings dropped by . According to (1), the price should have dropped by a maximum of . The extra can be rationalized by an amplification coming from a downward revision of the expected earning growth rate . Taking and a change of only in the expected is enough to account for the additional . This illustrates quantitatively the large susceptibility expressed by (8,9).

5.2 Finite time horizon

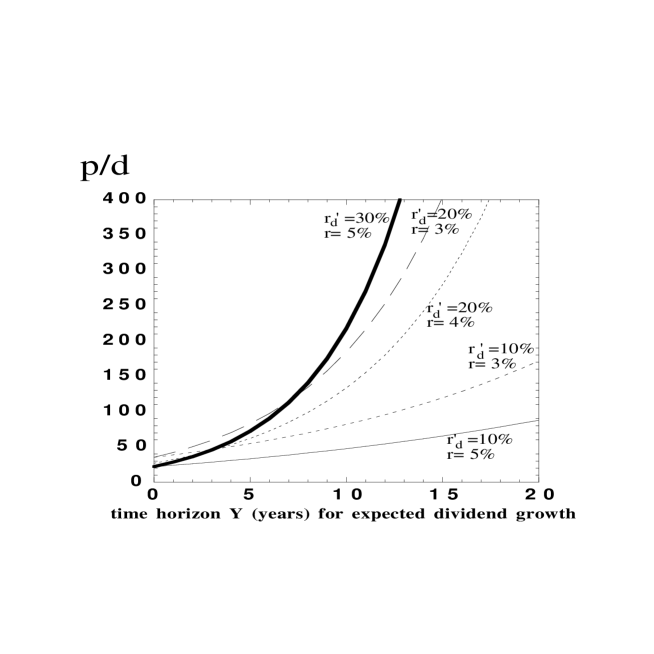

The formulas (1,3,18) assume that investors have an infinite time horizon. In practice, humans are mortal and have a time horizon to estimate the value of a company of the order of years to ten years or more. It is thus interesting to quantify the effect of this finite-time effect, as it also allows us to get finite prices even in the phase , using the firm-foundation valuation theory. The simplest model is to assume that the earnings grow from year to year at the fixed growth rate and then stay constant at the value attained at year . The valuation formula (3) is then changed into

| (21) | |||||

where

| (22) |

Figure 9 shows that a of 200 can be reach for instance with a growth rate with and a time horizon years or with and a time horizon years. For much more moderate growth rate , a similar requires a small discount rate and a longer time horizon years. This set of curves also show the large sensitivity of the price-over-dividend ratio with respect to changes in as well as time horizon , especially for the larger growth rates. For , we see the impact of an increase of discount rate from to : a major crash of more than in the stock price.

5.3 Delayed expectations

Our theory also rationalize the real estate speculative bubbles for which rents () had not increased significantly, but investors and buyers thought that the price would grow without end. This spontaneous over-valuation can be make more precise by the following future expectation equation:

| (23) |

Expression (23) expresses that the price increment has the usual proportionality dependence on price in the growth regime, however not on present but on the future price at a time in the future. If is fixed, it is easy to solve this equation and find that grows exponentially but with a growth rate larger than given by the solution of the equation

| (24) |

obtained by looking at exponentially growing solutions in (23). Since the exponential is always larger than for positive arguments , this shows that is always larger than for positive as shown in figure 10: the expectation of future growth projected a time in the future enhanced the price growth rate. It is easy to solve iteratively this equation. There is a bifurcation point: for , develops an imaginary part, i.e. the growth becomes oscillatory. If the optimism of investors increases, we can capture this increase by a larger horizon time and get a further accelerating growth rate of the price. In this model, more confidence in the long term growth and thus in the long term horizon directly translates into an accelerating growth rate as since in figure 10. Many variations of this model (23) can be developed that we leave for a future report.

6 Concluding remarks

We have proposed a simple theoretical framework to account for paradoxical behavior of the “new economy”, based on the valuation of dividend growth rate. The basic concept is as follows. If the dividend is small, the price is large only when we take into account all the discounted future earnings with a large growth rate . The corresponding divergence of the price occurs only if investors have an infinite horizon. For a finite time horizon, say ten years, the price will be finite but will exhibit a sensitive dependence on the estimation of the risk-adjusted earning growth rate and of the horizon up to which this growth rate will be sustained, as seen in the previous section. A move of the Federal Reserve to increase its basic rate will have a strong effect in certain region of the parameter space as it will bring back the price to lower ratio.

The simple valuation equation (3) and its generalizations (14,17) and (18) accounts for a number of stylized facts observed during speculative bubbles:

-

•

the sentiment that the “run” will last indefinitely;

-

•

the large increase in the price-over-dividend ratio;

-

•

each speculative move has had its “growth companies”; in 1857, the railways; in 1929, the utilities (electricity production); in the 1960’s, the office equipment companies (e.g. IBM) and the rubber companies (car makers); today, we have the internet, software, banks and investment companies. These companies have a fast growth rate (usually larger than 30% per year) and investors thus expect a large growth rate of their earnings.

-

•

Speculative phases are often stopped by successive increase of the discount rate; this occurred in 1929 (increase fom 3.25% up to 6%), in 1969, and in 1990 in Japan (increase from 2.5% to 6%).

-

•

The high sensitivity of valuation close to the critical point and the spontaneous speculative valuation below it suggest that crashes and rallies can also be interpreted as reassessments of expected risk-ajusted returns and their growth rates.

This leads to the following avenue for future research: new technologies, such as internet, wireless communication, wind power, etc. should be compared to old technologies, such as cars, shipping, mining, etc. We expect that stocks in the new technology class have high prices and low earnings and thus high price-over-dividend and price-over-earning ratios, while stocks in the old technology class have lower prices and higher earning and then lower price-over-dividend and price-over-earning ratios. If one goes back in time, present “old technology” was new technology and a similar pattern of high price-over-dividend and price-over-earning ratios should be seen. This is an interesting empirical investigation that we intend to report on in future work.

I acknowledge stimulating discussions with and suggestions from D. Darcet, A. Johansen, W.I. Newman, B. Roehner and D. Zajdenweber. I thank A. Johansen for bringing my attention to the three company crashes discussed here.

References

- [1] J. Laherrère and D. Sornette, Stretched exponential distributions in Nature and Economy: “Fat tails” with characteristic scales, European Physical Journal B 2, 525-539 (1998)

- [2] A. Johansen and D. Sornette, Stock market crashes are outliers, European Physical Journal B 1, 141-143 (1998)

- [3] White, E.N., ed., Stock market crashes and speculative manias, The international library of macroeconomic and financial history, vol. 13 (An Elgar Reference Collection, Cheltenham, UK; Brookfield, US, 1996)

- [4] Johansen, A., D. Sornette and O. Ledoit, Predicting Financial Crashes using discrete scale invariance, Journal of Risk 1 (4), 5-32 (1999); A. Johansen and D. Sornette, Critical Crashes, Risk, Vol 12, No. 1, p.91-94 (1999).

- [5] Guild S.E., Stock growth and discount tables (Financial publishers, 1931).

- [6] Williams J.B., The theory of investment value (Harvard University Press, 1938).

- [7] Malkiel B.G., A random walk down Wall Street (W.W. Norton & Company, New York, 1999)

- [8] Fisher I., The theory of interest (Kelley, 1961).

- [9] Graham B. and D.L. Dodd, Security analysis, 1st edition (McGraw-Hill, 1934).

- [10] Debreu, G., Theory of value : an axiomatic analysis of economic equilibrium (New Haven : Yale University Press, 1987, 1959).

- [11] O. Lamont, Earnings and expected returns, The Journal of Finance LIII, 1563-1587 (1988)

- [12] Gordon, M.J. and E. Shapiro, Capital investment analysis: the required rate of profit, Management Sci. 3, 102-110 (1956).

- [13] Von Neumann, J., ”Uber ein ökonomisches Gleichungssystem und eine Verallgemeinerung des Brouwerschen Fixpunktsatzes (1938) english translation: A model of general economic equilibrium, “Readings in mathematical economics”, Peter Newman editor, John Hopkins Press, Baltimore, 1968, p.221-229.

- [14] Zajdenweber, D., Economie des extrêmes, collection Nouvelle Bibliothèque Scientifique (Flammarion Editor, Paris, Feb. 2000).

- [15] Blanchard, O. and S. Fischer, Lectures on macroeconomics (Cambridge, Mass. : MIT Press, 1989).

- [16] J.K. Galbraith, The great crash, 1929 (Boston: Houghton Mifflin Co., 1997).

- [17] Sornette, D., Linear stochastic dynamics with nonlinear fractal properties, Physica A 250, 295-314 (1998).

- [18] D.G. Champenowne, Economic Journal 63, 318-51 (1953).

- [19] de Haan, L., Resnick, S.I., Rootzén, H. & de Vries, C.G. Stochastic Processes and Applics. 32, 213-224 (1989)

- [20] Sornette, D. and R. Cont, Convergent multiplicative processes repelled from zero: power laws and truncated power laws, (cond-mat/9609074), J. Phys. I France 7, 431-444 (1997)

- [21] Lux, T. and D. Sornette, On Rational Bubbles and Fat Tails, submitted to the Journal of Money, Credit and Banking (preprint at http://xxx.lanl.gov/abs/cond-mat/9910141)

- [22] de Calan, C., Luck, J.-M., Nieuwenhuizen, T.M. and Petritis, D. (1985) On the distribution of a random variable occurring in 1D disordered systems, J. Phys. A 18, 501-523.

- [23] Bachelier, M.L., Théorie de la Spéculation (Gauthier-Villars, Paris, 1900).

- [24] Samuelson, P.A., Collected Scientific Papers (M.I.T. Press, Cambridge, MA, 1972).

- [25] Andersen, J. V., S. Gluzman and D. Sornette, Fundamental Framework for Technical Analysis, European Physical Journal B 14, 579-601 (2000).

- [26] Moss de Oliveira, S., P.M.C de Oliveira and D. Stauffer, Evolution, Money, War and Computers, Teubner, Stuttgart-Leipzig, 1999.

- [27] Goldenfeld, N. (1992) Lectures on Phase Transitions and the Renormalization Group (Addison-Wesley, Advanced Book Program, Reading, Mass.).

- [28] J. Sivardiere, Spontaneous symmetry breaking in a Cavendish experiment, American Journal of Physics 65, 567-568 (1997); P.K. Aravind, A simple geometrical model of spontaneous symmetry breaking, American Journal of Physics 55, 437-439 (1987); J.R. Drugowich de Felicio and O. Hipolito, Spontaneous symmetry breaking in a simple mechanical model, American Journal of Physics 53, 690-693 (1985) J. Sivardiere, A simple mechanical model exhibiting a spontaneous symmetry breaking, American Journal of Physics 51, 1016-1018 (1983); M. Consoli and P.M. Stevenson, Physical mechanisms generating spontaneous symmetry breaking and a hierarchy of scales, Int. J. Mod. Phys. A 15, 133-157 (2000).

- [29] S. Weinberg, The quantum theory of fields (Cambridge; New York: Cambridge University Press, 1995-1996).