Polyspectral Mean Estimation of General Nonlinear Processes

Abstract

Higher-order spectra (or polyspectra), defined as the Fourier Transform of a stationary process’ autocumulants, are useful in the analysis of nonlinear and non-Gaussian processes. Polyspectral means are weighted averages over Fourier frequencies of the polyspectra, and estimators can be constructed from analogous weighted averages of the higher-order periodogram (a statistic computed from the data sample’s discrete Fourier Transform). We derive the asymptotic distribution of a class of polyspectral mean estimators, obtaining an exact expression for the limit distribution that depends on both the given weighting function as well as on higher-order spectra. Secondly, we use bispectral means to define a new test of the linear process hypothesis. Simulations document the finite sample properties of the asymptotic results. Two applications illustrate our results’ utility: we test the linear process hypothesis for a Sunspot time series, and for the Gross Domestic Product we conduct a clustering exercise based on bispectral means with different weight functions.

keywords:

, , and

1 Introduction

Spectral Analysis is an important tool in time series analysis. The spectral density provides important insights into the underlying periodicities of a time series; see Brockwell, Davis [2016] and McElroy, Politis [2020]. However, when the stochastic process is nonlinear, higher-order autocumulants (cf. Brillinger [2001]) can furnish valuable insights that are not discernible from the spectral density, as argued in Brillinger, Rosenblatt [1967]. In particular, three- and four-way interactions of a nonlinear process can be measured through the third and fourth order polyspectra; see Brillinger [1965], Brillinger, Rosenblatt [1967], Brockett et al. [1988], Gabr [1988], Maravall [1983], Mendel [1991], and Berg, Politis [2009]. Linear functionals of higher-order spectra (here referred to as polyspectral means) are often encountered in the analysis of nonlinear time series, and are therefore a serious object of inference. Whereas there is an existent literature on estimation of polyspectra (Brillinger, Rosenblatt [1967], Van Ness [1966], Raghuveer, Nikias [1986], Spooner, Gardner [1991]), inference for polyspectral means remains a gap. This paper aims to fill this gap by developing asymptotic distributional results on polyspectral means, and by developing statistical inference methodology for nonlinear time series analysis.

Let be a order stationary time series, that is,

and

for all integers ,

and for all ,

for given . The most commonly occurring case is , corresponding to the

class of second order stationary (SOS) processes. Thus, for a SOS process

, is a constant and its cross-covariances depend only on the time-difference

for all

, where

denotes the set of all integers. When the autocovariance

function is absolutely summable,

has a spectral density given by , ,

where .

Important features of a stochastic process can be extracted with a spectral mean, which is defined as , where is a weight function. Spectral means can provide important insights into the time series afforded by different g functions. For example, a spectral mean with corresponds to the lag autocovariance, whereas gives the spectral content in the interval , where denotes the indicator function. Analogous definitions can be made for higher order spectra. The order autocumulant is defined as for all , where denotes the cumulant of jointly distributed random variables (cf. Brillinger [2001]) and where are integer lags. If the corresponding autocumulant function is absolutely summable, then we define the polyspectra of order as the Fourier transform of the order autocumulants:

where , and denotes the transpose of a matrix . A polyspectral mean with weight function is defined as

| (1.1) |

Thus, spectral means correspond to the case , in which case we drop the subscript (and write ). Polyspectral means give us important information about a time series that can not be obtained from the spectral distribution, e.g., when the time series is nonlinear or the innovation process is non-Gaussian. Additionally, we can extract several features from a time series through the polyspectral mean corresponding to different weight functions. These features can play an important role in identifying (dis-)similarities among different time series (cf. Chua et al. [2010], Picinbono [1999], Dubnov [1996], Vrabie et al. [2003]).

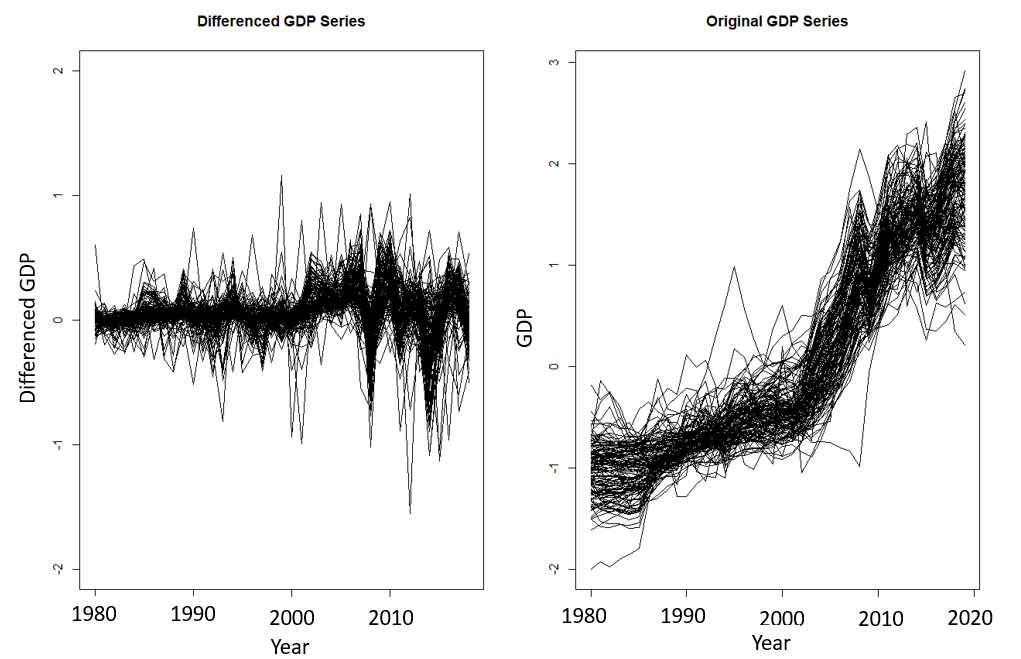

For an illustrative example, we consider the annual Gross Domestic Product (GDP) data from 136 countries over 40 years. Our goal is to obtain clustering of the countries based on patterns of their GDP growth rates. The right panel of Figure 1 gives the raw time series and the left panel gives the differenced and scaled versions of the GDP of different countries. As a part of exploratory data analysis, we tested for Gaussianity and linearity; a substantial proportion of the time series are non-Gaussian, and some of them are nonlinear. Hence, using spectral means alone to capture relevant time series features may be inadequate. Here we use (estimated) higher order polyspectral means with different weight functions to elicit salient features of the GDP data, in order to capture possible nonlinear dynamics of the economies. See Section 6 for more details.

Estimation of spectral and polyspectral means can be carried out using the periodogram and its higher order versions, which are defined in terms of the discrete Fourier transform of a length sample (described in Section 2). However, distributional properties of the polyspectral mean estimators are not very well-studied. Dahlhaus [1985] proved the asymptotic normality of spectral means, i.e., the case ; however, in the general case (), there does not seem to be any work on the asymptotic distribution of polyspectral mean estimators. One of the major contributions of this paper is to establish asymptotic normality results for the polyspectral means of a general order. We develop some nontrivial combinatorial arguments involving higher-order autocumulants to show that, under mild conditions, the estimators of the order polyspectral mean parameter in (1.1) are asymptotically normal. We also obtain an explicit expression for the asymptotic variance, which is shown to depend on certain polyspectral means of order . This result agrees with the known results on spectral means when specialized to the case , where the limiting variance is known to involve the trispectrum . In particular, the results of this paper provide a unified way to construct studentized versions of spectral mean estimators and higher order polyspectral mean estimators, which can be used to carry out large sample statistical inference on polyspectral mean parameters of any arbitrary order .

The second major contribution of the paper is the development of a new test procedure to assess the linearity assumption on a time series. Earlier work on the problem is typically based on the squared modulus of the estimated bispectrum (Rao, Gabr [1980], Chan, Tong [1986], Berg et al. [2010], Barnett, Wolff [2004]). In contrast, here we make a key observation that under the linearity hypothesis (i.e., the null hypothesis) the ratio of the bispectrum to a suitable power transformation of the spectral density must be a constant at all frequency pairs in . This observation allows us to construct a set of higher order polyspectral means that must be zero when the process is linear. On the other hand, for a nonlinear process, not all of these spectral means can be equal to zero. Here we exploit this fact and develop a new test statistic that can be used to test the significance of these polyspectral means. We also derive the asymptotic distribution of the test statistic under the null hypothesis, and provide the critical values needed for calibrating the proposed test.

The rest of the paper is organized as follows. Section 2 covers some background material, and provides some examples of polyspectra and polyspectral means. Section 3 gives the regularity conditions and the asymptotic properties of the polyspectral means of a general order. The linearity test is described in Section 4. Simulations are presented in Section 5, and two data applications, one involving the Sunspot data and the other involving the GDP growth rate (with a discussion of clustering time series via bispectral means), are presented in Section 6. The proofs of the theoretical results are given in Section 7.

2 Background and examples

First, we will define estimators of the polyspectral mean defined in (1.1), corresponding to a given weight function . Following Brillinger, Rosenblatt [1967], we define an estimator of by replacing by the order periodogram. Specifically, given a sample from the mean zero time series , let denote the Discrete Fourier Transform (DFT) of the sample, where and . Such a frequency may be a Fourier frequency, taking the form for some integer , in which case we write . Here and in the following, denotes the integer part of a real number . A -vector of frequencies is denoted by ; if these are all Fourier frequencies, then we write . Then the order periodogram is defined as

where is a shorthand for . Next, let denote a shorthand for a summation over vector that consist of Fourier frequencies. Then we define the estimator of the polyspectral mean as

| (2.1) |

where is an indicator function that is zero if and only if lies in any proper linear sub-manifold of the -torus . That is, is one if and only if for all subset of (), . We further assume that the weighting function is continuous in (except possibly on a set of Lebesgue measure zero; cf. Section 2.4, Athreya, Lahiri [2006] ), and satisfies the symmetry condition

| (2.2) |

for all . This condition holds for all polyspectra, and holds more broadly for any function that has a multi-variable Fourier expansion with real coefficients, thereby encompassing most functions of interest in applications. Moreover, this assumption ensures that the corresponding polyspectral mean is real-valued, since

using (2.2) and a change of variable . We will also assume that , which screens out perverse cases of that are of little practical interest.

Note that the value of the polyspectral mean (1.1) is the same whether or not we restrict integration to sub-manifolds of the torus, since such sets have Lebesgue measure zero. We need to introduce the indicator function, since Brillinger, Rosenblatt [1967] established that the order periodogram diverges if the Fourier frequencies lie in such sub-manifolds. This is a significant issue. Indeed, the estimator of the polyspectral density in Brillinger [1965] is also given by a kernel-weighted average of the order periodogram, where the average is taken by avoiding the sub-manifolds. The polyspectral density estimator involves a bandwidth term, which in general makes the convergence rate much slower. Since we are working with polyspectral means, it is not necessary to smooth the order periodogram, and hence we can ignore the bandwidth problem and focus directly on regions that avoid the sub-manifolds.

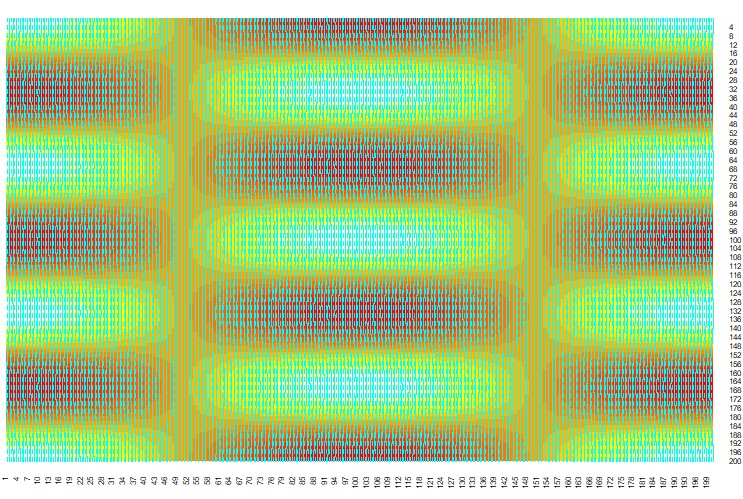

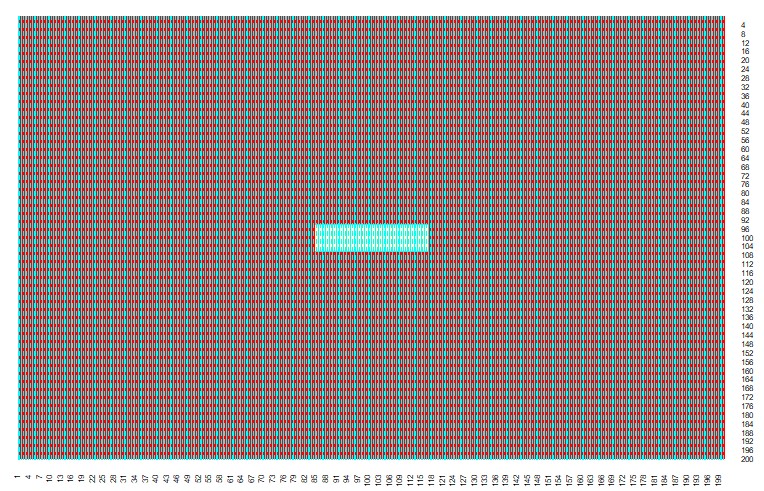

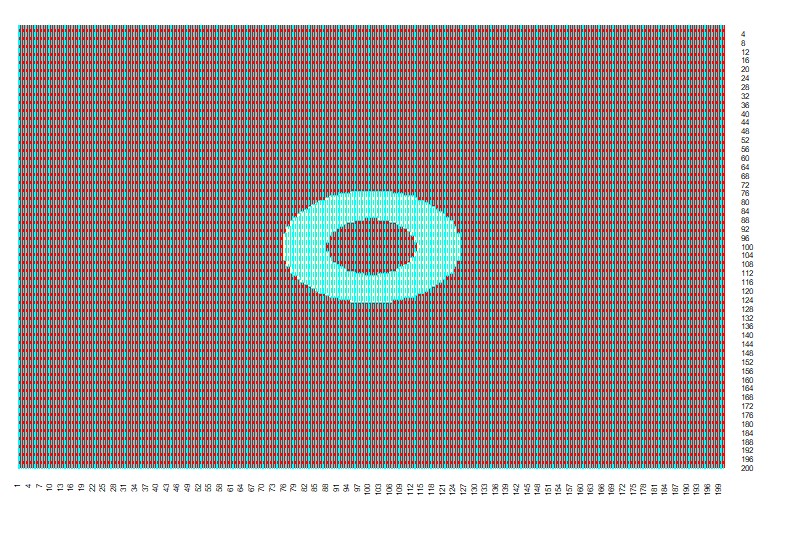

Some illustrations of weighting functions are given in Figure 2. We also provide some specific examples of polyspectral means below, demonstrating how diverse features of a nonlinear process can be extracted with different weighting functions. (Recall that we assumed that the process has mean zero, which assumption is used throughout.)

Example 2.1 (Example 1:).

Our first example, which was mentioned in the introduction, is already familiar: let , so that , where is the second order autocumulant function, i.e., the autocovariance function. Its classical estimator is the sample autocovariance , where the summation is over all such that (the sampling times). This agrees with our proposed polyspectral mean estimator, viz. , using the fact that

| (2.3) |

Note that in our expression for there are no sub-manifolds of the 1-torus.

Example 1 can be extended to third-order autocumulants via the weight function . Then it follows that

| (2.4) |

where is the third order autocumulant function. The classical estimator of this autocumulant function is given by where the summation is over all such that . We next show that this is asymptotically equivalent (i.e., the same up to terms tending to zero in probability) to . First, note that the sub-manifolds of the 2-torus that we must exclude are simply the sets where either or equals zero; hence

Note that the last term is simply the cube of the sample mean , which tends to zero in probability. For the other terms, we can apply (2.3) to obtain , which is asymptotically equivalent to .

Example 2.2 (Example 2:).

For a zero mean process, the autocumulants and automoments of order 2 and 3 coincide, and therefore Example 1 shows that the spectral mean estimator is a consistent estimator of these autocumulants/automoments. A similar (but more involved) calculation is required to show that a similar result holds for higher order autocumulants. As an example, we now consider the fourth order autocumulant function (which is different from the fourth order automoment function). To that end, we consider the trispectral mean with the weight function . Then, letting denote the order 3 auto-moment, and using the identity , we get

Setting , we obtain

If for some , then we will obtain a term, which will be asymptotically zero under the zero mean assumption. Consider the case for : . Hence, the estimate takes the form

Each of the terms above is a consistent estimator and therefore, is consistent for .

Example 2.3 (Example 3:).

The weighted center of Bispectrum (WCOB) [Zhang et al., 2000] is a widely used feature in nonlinear time series analysis (cf. Chua et al. [2010], Acharya et al. [2012], Yuvaraj et al. [2018], Martis et al. [2013]) which is defined using ratios of polyspectral means. Specifically, we can define the WCOB as (in the -torus), where

A discrete analog of WCOB was proposed in [Zhang et al., 2000] which was defined as follows:

The quantities and are ratios of polyspectral means, where the numerators have weight functions and , respectively for the cases of and ; each denominator has a constant weight function. The estimate of the bispectral mean in the numerator of is

Estimators of the other polyspectral means in can be defined similarly.

Example 2.4 (Example 4:).

Another type of polyspectral mean is obtained by examining the total spectral content in a band. In the case, this has been used to examine the contribution to process’ variance due to a range of stochastic dynamics, such as business cycle frequencies. Analogously for , we define for ; the corresponding measures the bispectral content in the rectangular region . Our estimator of this polyspectral mean is

The above example can be extended to the bispectral content on any general region , which will provide us the bispectral content in that region. We can also consider non-rectangular regions; for example, one can use an annular region like . Several variations of such polyspectral means can be found in the literature; see Boashash, Ristic [1993], Saidi et al. [2015], Martis et al. [2013].

Example 2.5 (Example 5:).

Consider the Bartlett-type function , for which the estimate of the polyspectral mean is

Letting for and , it can be shown that is asymptotically equivalent to This bispectral mean can be interpreted as the spectral content in a pyramidal region around the center and tapered away from .

3 Asymptotic Results for Polyspectral Means

3.1 Asymptotic mean and variance

In this section, we derive asympttic expressions for the mean and the variance of the the polyspectral mean estimate proposed in Section 2. We will need the following assumption on order autocumulants, as stated in Brillinger [1965].

| (3.1) |

Assumption A[k] is directly related to the smoothness of the order polyspectra.

Proposition 3.6.

Suppose that for some , is a order stationary time series and suppose that Assumption A[r] holds for all . Let be a weight function satisfying the symmetry condition (2.2) that has finite absolute integral over the k-torus. Then the polyspectral mean estimator computed from a sample of length satisfies (as )

| (3.2) |

The -remainder term is , provided

| (3.3) |

where , is the discretized version of .

Condition (3.3) is a mild smoothness condition on , allowing Lipschitz functions (e.g., Examples 1 and 2) as well as many discontinuous functions (e.g., Example 4). Proposition 3.6 shows that the estimator’s expectation tends to the polyspectral mean, and hence it is asymptotically unbiased.

Next, we seek to compute the variance (or second cumulant) of the polyspectral mean. Following Brillinger [2001], a complex normal random variable has variance if . Since we are ultimately interested in demonstrating asymptotic normality of the spectral means, we shall first investigate the variance, , with . To that end, we first introduce some convenient abbreviations. As before, let and , but we can concatenate the two, which will be denoted by , i.e., . Next, the -vector of DFTs corresponding to is abbreviated by ; similarly, is the -vector given by with appended to the end. Finally, let denote the product of all the components of any vector . Then from (3.2) it follows that

| (3.4) |

The main challenge here is to derive an asymptotic expression for the cross-product moment term in (3.4), which requires some nontrivial combinatorial arguments. To highlight the key points we outline the main steps below, providing details of the arguments in Section 7.2.

Using our product notation, the cross-product moment can be written

Considering only the part inside the expectation in the above equation, one can show that for any and ,

| (3.5) |

where is a partition of and is the set of all partitions of . Each is a cumulant of DFTs whose frequencies have subscript belonging to the set (which is an element of ). From Lemma 1 of Brillinger, Rosenblatt [1967], under Assumption A[2k+1] (or (3.1)), each such term is non-zero if and only if the sum of the frequencies within the set is . The presence of and ensures that the frequencies in the sum are concentrated on a subset of the -dimensional torus with the property that and for all . In other words, the Fourier frequencies do not lie in any sub-manifold, i.e., no subset of or has their sum equal to . Hence, the terms will be non-zero in two possible ways depending on partitions of the set :

-

•

The partition consists of the sets and ,

-

•

The partition consists of sets, each of which has at least one element of both and .

The first case yields an expression that equals the second term of (3.4), resulting in its cancellation out of the cumulant; so the only remaining terms will be those arising from the second case above. Now suppose we have such mixture partitions of and . We shall designate the sets of a partition through binary matrices, where each row corresponds to a set of the partition, and each column has a one or zero depending on whether the corresponding entry of belongs to that set of the partition. More specifically, let equal the set of -dimensional matrices with binary entries; then for , (for and ) equals if the component of is in set of the partition (and is zero otherwise). Likewise encodes whether the component of is in the same set of the partition. Because all the sets of a partition must be disjoint, each column of such a matrix (or ) has exactly one ; likewise, because we are considering partitions that have at least one element of both and , it follows that each row of (and of ) must have at least one . Let us denote this subset of as :

Now the frequencies of a set in a partition have the property that they sum to zero, and this is the defining property of such partitions; this essentially refines our class of potential matrices . This constraint is simply expressed by . So it follows that the collection of partitions corresponding to given and is encoded by

| (3.6) |

As an illustration, for bispectra and the set of possible choices of matrices and in (3.6) is

For example, with the choices

we see that (3.6) indicates two constraints, the first of which (corresponding to the upper row of the matrices) is ; the second constraint from the lower row is identical to the first due to the fact that the vectors and add up to . As a result, the corresponding partition consists of the sets and , with a nonzero value of provided that .

In general we always have constraints given by the fact that the sum of all the elements of and are zero, since we have and as the final components of and . The rows of the binary matrices in (3.6) can be characterized as follows: let denote the number of possible ways to partition into positive integers, and define to be the collection of all possible sets of positive integers that sums up to . That is, , where each (for ) is a vector of positive integers whose components sum to . (For instance, with and , .) Then for every , let

so that . Let us define to be the polyspectra of order (where is a vector of length ), and let and denote the sum of the row of and respectively. Further, set , which denotes the sum of the row of and subtracted by 1. Also let denote the subset of that contains the elements corresponding to the non-zero positions of the row of . Similarly, define . Using the matrices from (3.6), and some combinatorial arguments, it can be shown that the asymptotic variance of the polyspectral mean estimate is given by

| (3.7) |

where is the order polyspectra. It is to be noted that the case when all the and lie in the same partition is covered in the case , and is simply the polyspectral mean of order with weight function , as mentioned in the introduction. These derivations are summarized in the following proposition, whose formal proof is provided in Section 7.2.

Proposition 3.7.

Suppose that, for some , is a order stationary time series with finite order moment, and suppose that Assumption A[r] holds for all . Let be a weight function satisfying conditions (2.2) and (3.3), and let have a finite absolute integral over the k-torus. Then the variance of the polyspectral mean estimator based on a sample of length is of the form , where is given by (3.7).

A simple extension of the proof of Proposition 2 shows that the covariance between polyspectral means of different orders goes to at rate . The proof is given in Section 7.3.

Corollary 1.

Suppose that, for some , is a order stationary time series with finite order moment, and suppose that A[r] holds for all . Let and be weight functions that each satisfy the symmetry condition (2.2), and have finite absolute integral over the k- and (k+1)-toruses respectively. Then tends to

where , where each (for ) is a vector of positive integers with norm=, and is the number of possible ways to partition into positive integers.

3.2 Asymptotic normality

We shall give two results on asymptotic normality of the polyspectral mean estimators under two different sets of conditions. The first approach is based on the convergence of the sequence of cumulants (which is also known as the method of moments). Now that we have derived the asymptotic mean and variance of the polyspectral mean estimator, we may prove its asymptotic normality by showing that the higher order autocumulants (of order 3 and more) go to at a rate faster than . To do that we make use of Theorem 2.3.3 of Brillinger [2001], which states that

| (3.8) |

where the summation is over all indecomposible partition of a 2-D array with rows, with the th row having elements. Using this result, it can be shown that cumulants of order tend to at rate (see Section 7.4 for a detailed proof), and we have the following result:

Theorem 3.8.

Thus, the polyspectral mean estimators are asymptotically normal with asymptotic variance that involves the th order polyspectral density. However, one potential drawback of this approach is that it requires all moments of to be finite, which is too strong for many applications. It is possible to relax the moment condition by using a mixing condition and/or using the approach of Wu [2005] based on the physical dependence measure. For the second result on asymptotic normality, here we follow neither of these approaches. We develop a new approach based on a suitable structural condition on (similar to Wu [2005], but with a different line of proof) that is valid under a weaker moment condition. In fact, the moment condition is minimal, as it requires existence of th order moments only, which appears in the asymptotic variance of (cf. Proposition 2) and must necessarily be finite. The structural conditions on the sequence allow us to approximate the polyspectral mean estimators by its analog based on a suitably constructed approximating process that is simpler, and that has all finite moments with quickly decaying cumulants of all orders. To describe the set up, let be a collection of independent and identically distributed random variables, with , and let

| (3.9) |

for some Borel measurable function . The class of stochastic processes given by (3.9) includes common linear time series models such as ARMA (), as well as many nonlinear processes, such as the threshold AR process and the ARCH process, among others. See Hsing, Wu [2004] for a long list of processes that can be represented as (3.9).

The next corollary gives the joint distribution of multiple polyspectral mean estimators of the same order but with different weight functions. The proof is discussed in the first part of Section 7.5. Corollary 2 will be useful in deriving the time series linearity test proposed in the next section.

Corollary 2.

Suppose the assumptions of either Theorem 3.8 or Theorem LABEL:theo1p hold, and consider the polyspectral means of order for different weight functions . Then, the -dimensional vector

converges to a -variate normal distribution with mean 0 and covariance matrix with entry given by where

| (3.10) |

4 Testing of Linear Process Hypothesis Using Bispectrum

As discussed earlier, it is often of interest to determine whether a process is linear. McElroy et al. [2023] showed that it is possible to use quadratic prediction instead of the widely used linear predictor to get significant improvement in prediction error. In this section we will provide a novel test of linearity using the bispectrum. Consider the null hypothesis

| (4.1) |

where is the backshift operator. Here, the moving average filter is assumed to be known under . Thus, when the null hypothesis is true, the bispectrum will be of the form for some . Setting , we study the quantity:

noting that will be constant under (4.1). Setting , it follows that for any and the expression

| (4.2) |

equals whenever either or (or both) are non-zero. We will examine the case where (4.2) is zero for a range of between and (an upper threshold chosen by the practitioner) such that not both are zero; this set is described via . Substituting for in (4.2), we can construct a test statistic of the form . This test statistic, after scaling by , i.e., the asymptotic variance corresponding to the weight function ), becomes

| (4.3) |

Note that under , is known and given by (3.7), and hence is computable. As discussed in Corollary 2, the asymptotic distribution of a vector of polyspectral means with different choices of function is a multivariate normal with covariance term given by (3.10). In fact, under the null hypothesis the vector of scaled polyspectral means converges in distribution to a multivariate normal variable with known covariance matrix defined by (4.4) below.

There are many applications where researchers have used linear processes to model time series data, and our proposed test can be used to identify deviations from the linear model. For example in Section 6 we consider Sunspot data to which Abdel-Rahman, Marzouk [2018] fitted an AR(1) model; our proposed test can be used to check whether the fitted model is appropriate for the dataset, or whether there are departures from the bispectrum implied by such a model. Our test considers to be known, and as such the limiting distribution under is completely known. Then we have the following:

Theorem 4.9.

Let be a time series satisfying

the null hypothesis for i.i.d. random variables with and and for some known satisfying . Then, the test statistic defined in (4.3) is asymptotically distributed as , where are i.i.d. random variables, and are the eigenvalues of the covariance matrix , with th entry

| (4.4) |

5 Simulation

The simulation processes, weighting functions for polyspectral means, and simulation results are described below.

5.1 AR(2) Process

Our first simulation process is an AR(2) process that is similar to Example 4.7 of Shumway, Stoffer [2005], and is defined via , where . In this case, and , where . It follows that the spectral density is

Similarly, the bispectra and trispectra are given by and , respectively. We also consider this process with , which changes the scale of the polyspectra.

5.2 ARMA(2,1) Process

Next, we consider an ARMA(2,1) process , defined via , where , i.e. and , where . Hence, . The spectra, bispectra, and trispectra are:

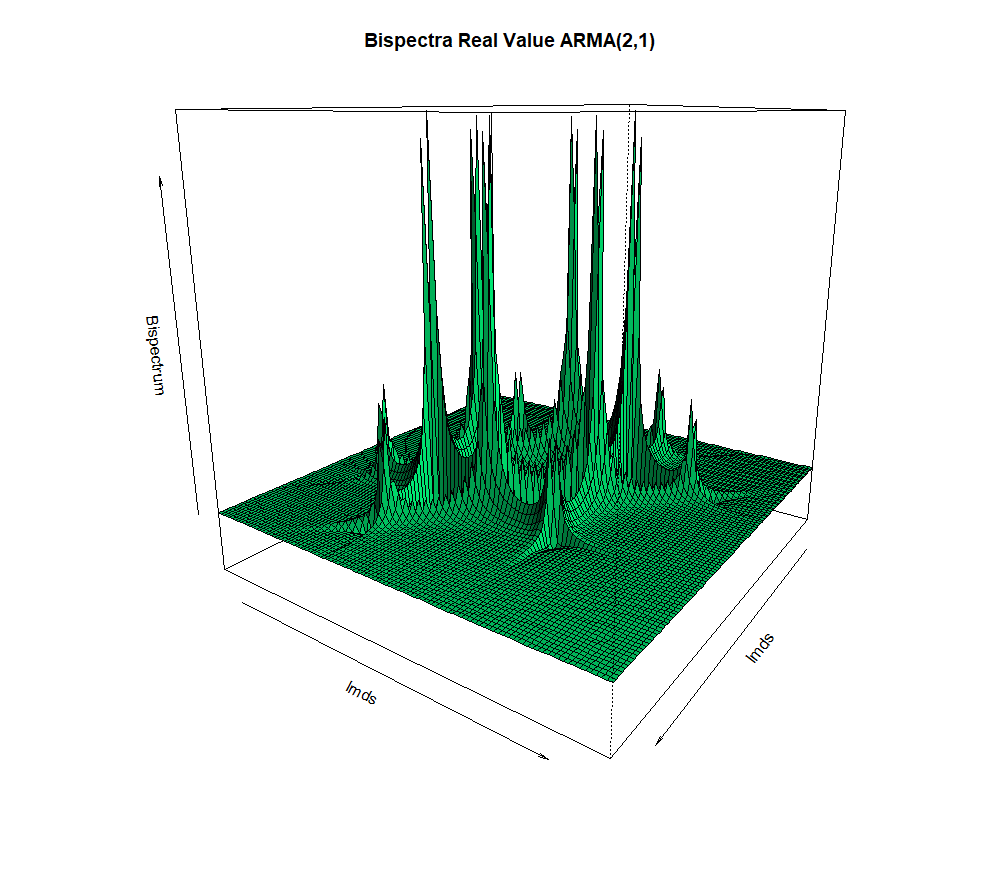

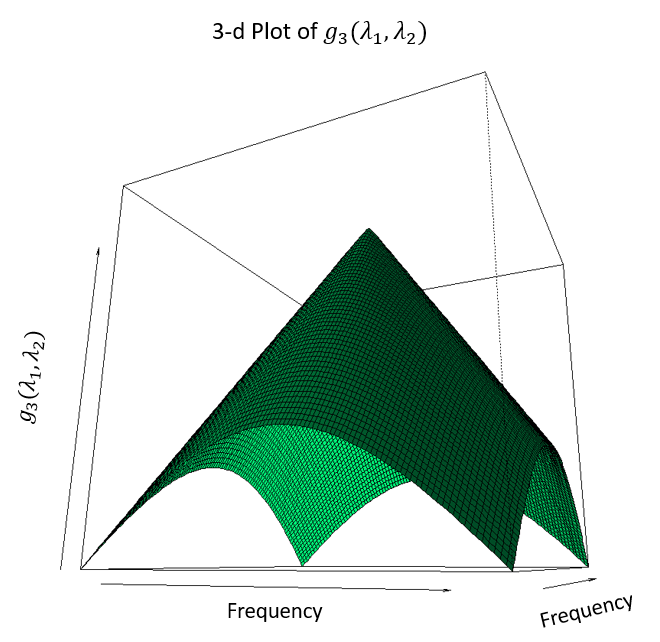

The bispectra of the ARMA(2,1) process is depicted in Figure 3. We also consider this process with , which changes the scale of the polyspectra.

5.3 Squared Hermite

The final example is a squared Hermite process defined by , where , , and is a MA(1) process such that with . The autocumulants are

The expression for is very long, and is given in the Supplement Ghosh et al. [2024].

5.4 Simulation Results

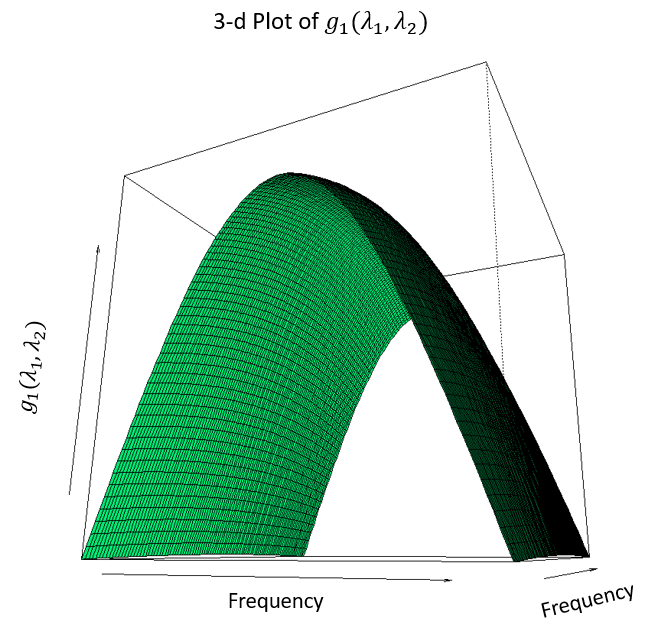

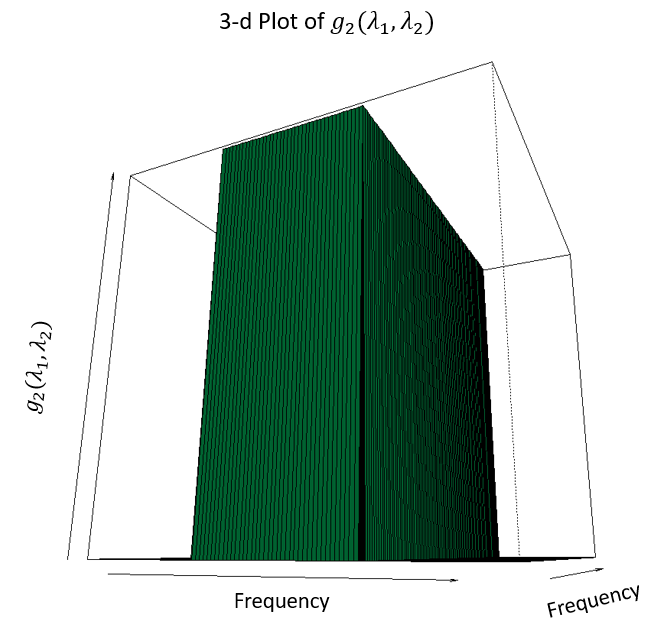

For each of these three processes, we construct bispectral means from the following weight functions:

-

•

(as discussed in Example 1)

-

•

(as discussed in Example 4)

-

•

The 3-d plots of the weight functions are given in Figure 4. Each choice of determines the parameter , and we also compute the true asymptotic variance as given in (3.7). Next, we compute from simulations of length , with replications. The sample variance of these values of provides an estimate of ; repeating the entire procedure another times yields variance estimates for . The Mean Squared Error (MSE) and scaled MSE is then computed using the formulas and , respectively. The results of the simulation are given in Table 1: for all cases, all models, and all weight functions, the computed asymptotic variance is close in terms of MSE to the simulated quantities.

| Model | g() | MSE | Scaled MSE |

|---|---|---|---|

| Model 1: AR(2) with errors | 0.003 | 0.12 | |

| 0.023 | 0.19 | ||

| 0.017 | 0.26 | ||

| Model 2: AR(2) with errors | 0.005 | 0.07 | |

| 0.011 | 0.15 | ||

| 0.073 | 0.82 | ||

| Model 3: ARMA(2,1) with errors | 0.023 | 0.39 | |

| 0.010 | 0.40 | ||

| 0.027 | 0.14 | ||

| Model 4: ARMA(2,1) with errors | 0.034 | 0.15 | |

| 0.005 | 0.28 | ||

| 0.009 | 1.07 | ||

| Model 5: Squared Hermite process | 0.081 | 0.27 | |

| 0.037 | 0.14 | ||

| 0.002 | 0.91 |

5.5 Power Curve for Linearity Test

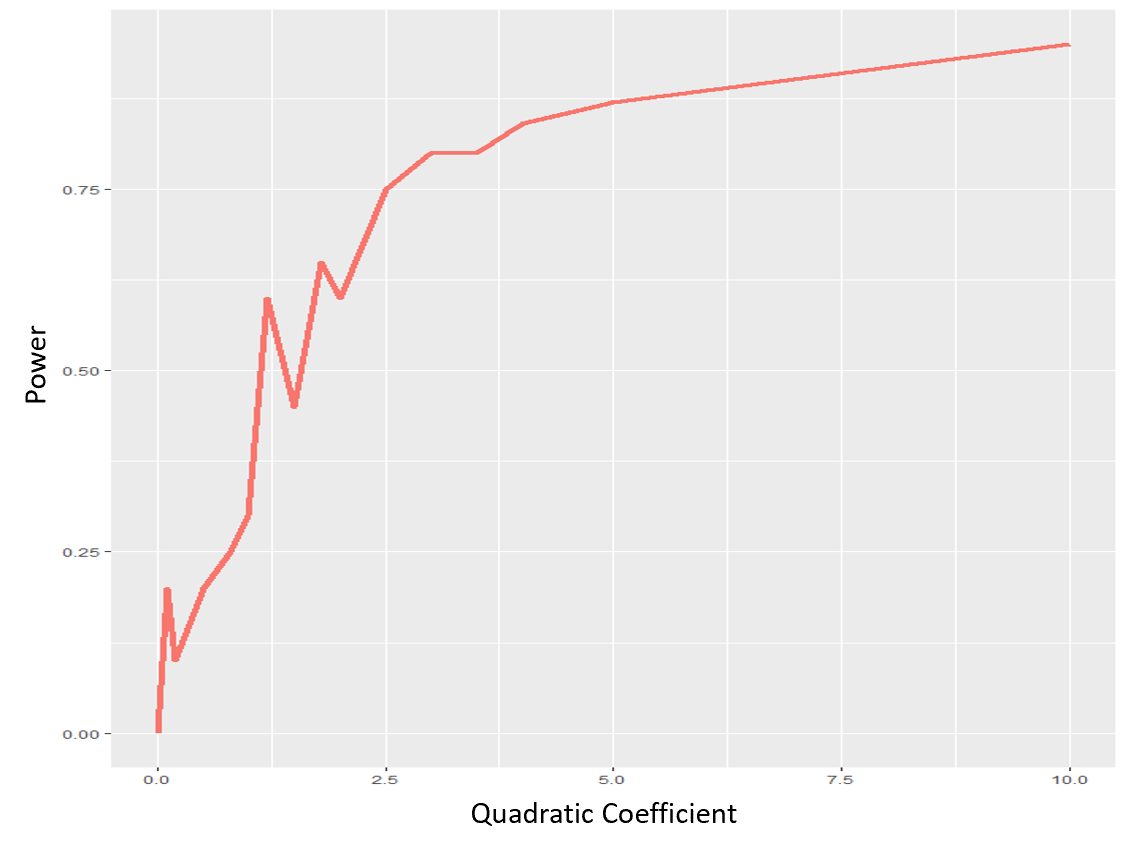

We studied through simulations the power of our proposed linearity test (4.3) with , generating the process from

| (5.5) |

Note that when this process is linear, and hence corresponds to the null hypothesis (4.1) of our linearity test statistic. Non-zero values of generate nonlinear effects, corresponding to the alternative hypothesis, and so we can determine power as a function of . We generated simulations of sample size of the process (5.5), letting range from to . The power curve (Figure 5) increases with , as anticipated; there are a few jags that are attributed to Monte Carlo error.

6 Real Data Analysis

6.1 Sunspot Data Linearity Test

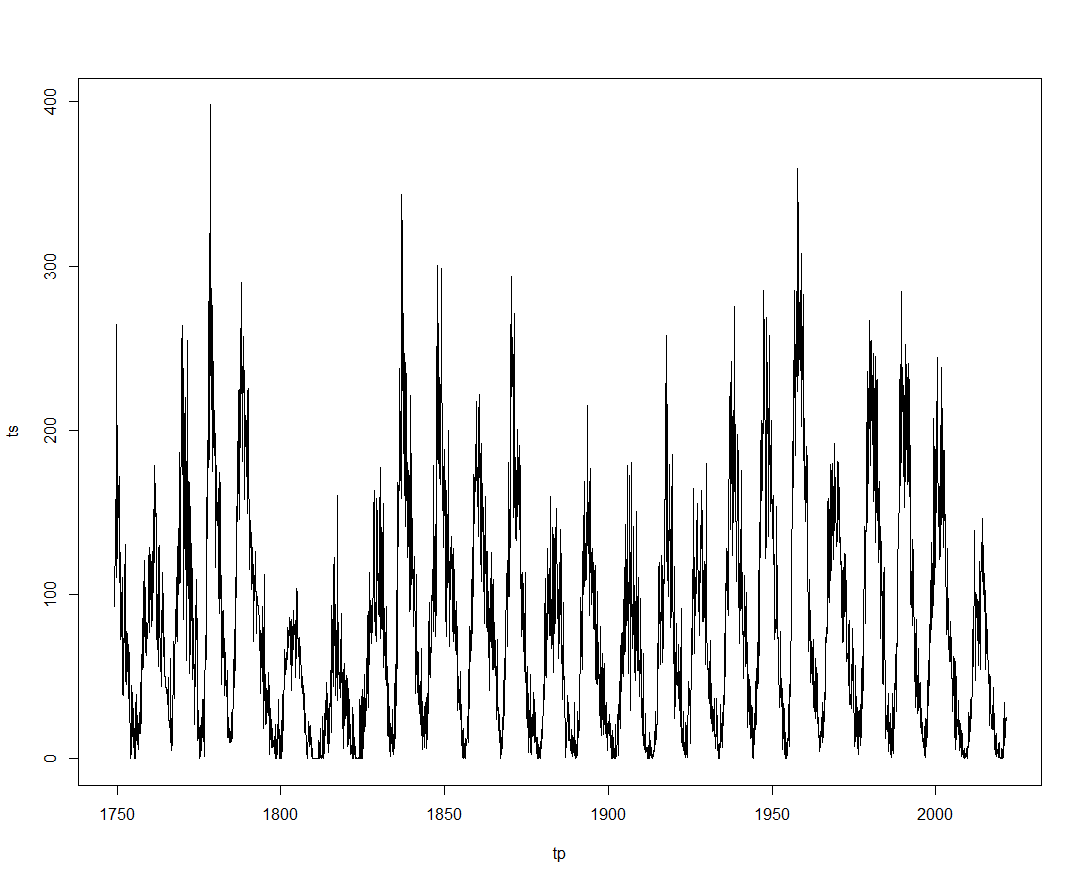

Sunspots are temporary phenomena on the Sun’s photosphere that appear as spots relatively darker than surrounding areas. Those spots are regions of reduced surface temperature arising due to concentrations of magnetic field flux that inhibit convection. It is already known that the solar activity follows a periodic pattern repeating every 11 years Schwabe [1844]. Figure 6 shows the time series of the sunspot data in a monthly interval SILSO World Data Center [1749-2021].

McElroy et al. [2023] demonstrated that it is possible to gain significant improvement in prediction in sunspot data by using quadratic prediction instead of linear prediction. This means that there must be nonlinearity present in the sunspot data. Here we will use the test statistic proposed in Section 4 to examine whether the sunspot data follows the particular linear process studied in Abdel-Rahman, Marzouk [2018], namely the order one autoregressive process given by . In the context of Section 4, this means that and . Choosing , the test statistic (4.3) is , which has a p-value (Choosing , the test statistic was (p-value: ) and choosing , we get (p-value: )). Hence, our proposed test rejects the null hypothesis of linearity of the sunspot data, as assumed by Abdel-Rahman, Marzouk [2018].

6.2 GDP Trend Clustering

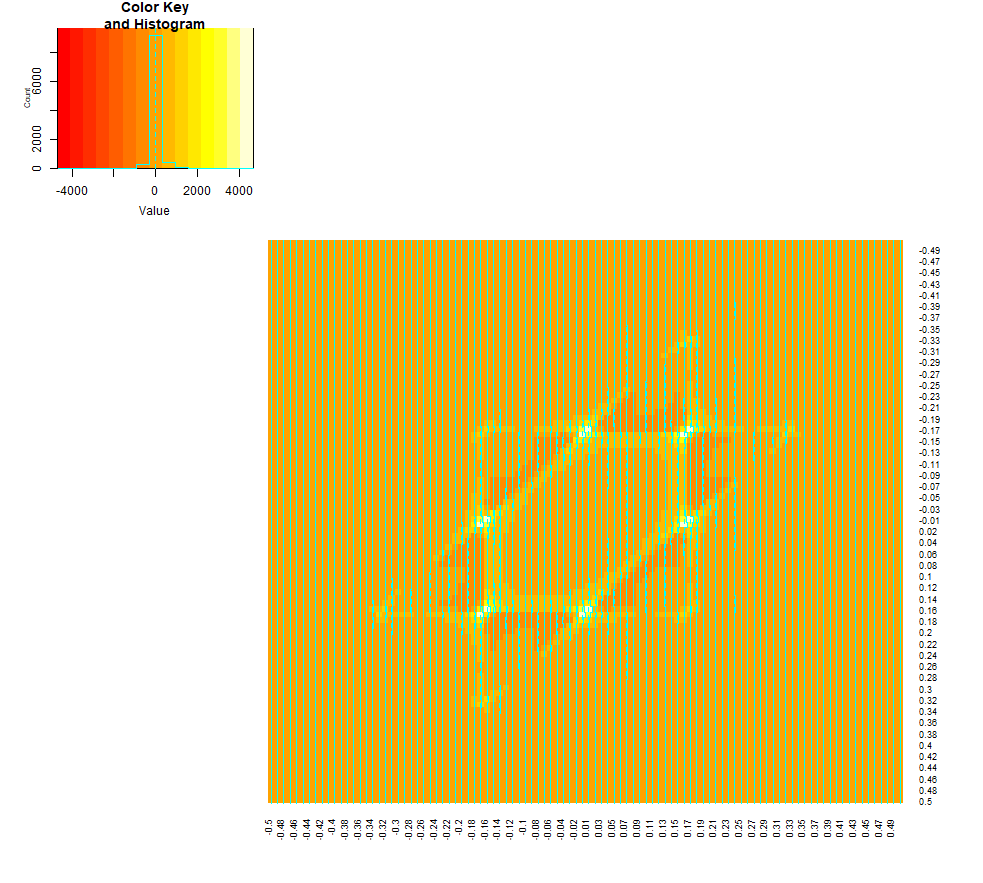

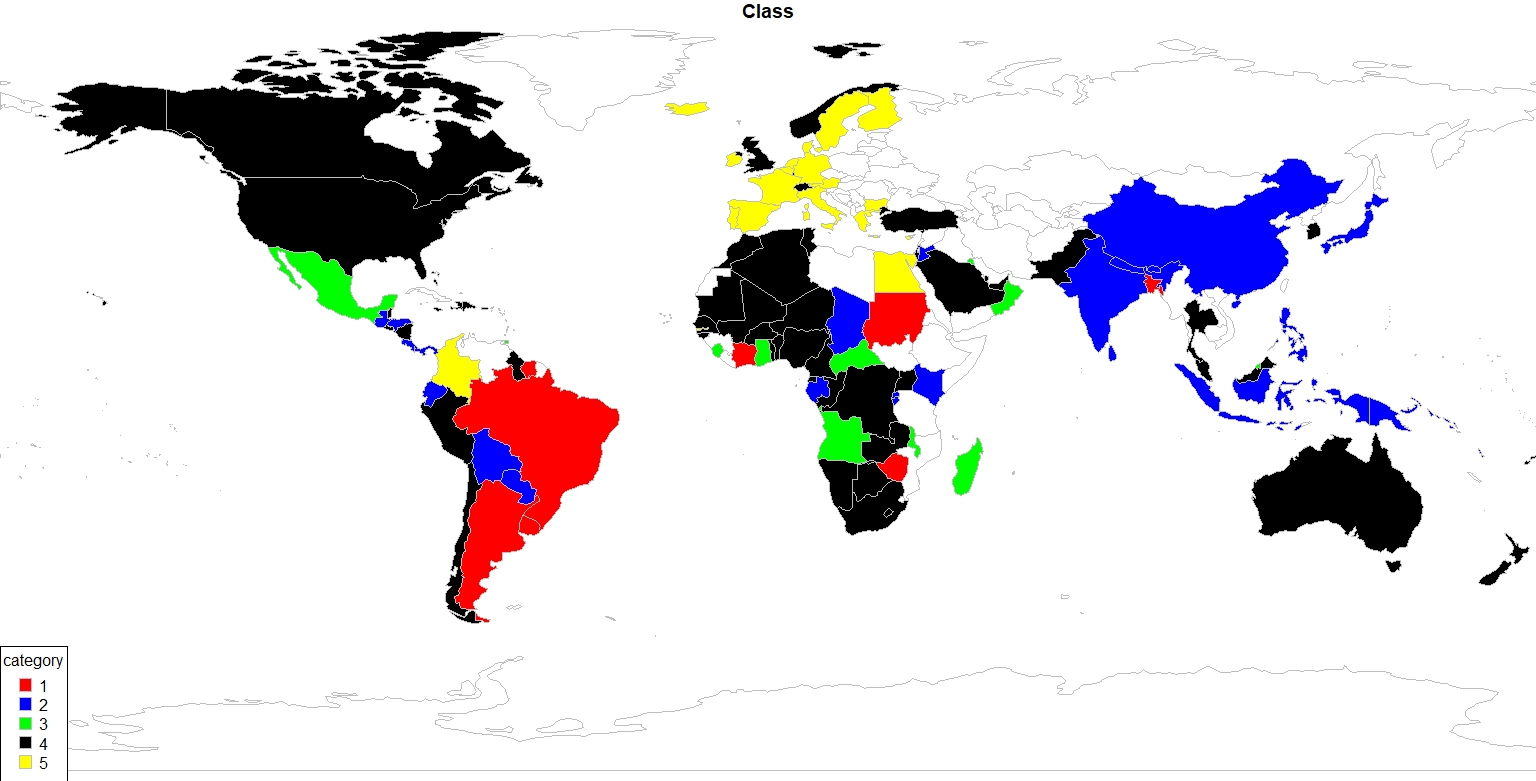

Time series clustering is a possible application of polyspectral means; by choosing various weighting functions, we can extract different types of information from a time series. In this section, we have analyzed the Gross Domestic Product (GDP) of 136 countries (measured over the past 40 years), and have attempted to classify the growth trend of the GDP of different countries based on the bispectral means taken with different weight functions. The right panel of Figure 1 shows that there are different trend patterns for the various countries, and these diverse patterns are reflected in the differenced time series (left panel of Figure 1); the differencing ensures that the resulting growth rates are stationary. We investigate clustering of these time series through examining bispectral means of their growth rates. The weight functions considered are:

-

•

, where a and b are taken such that the interval is split into 10 segments. Hence, we have 10 such bispectral means for each annulus (as discussed in Example 4).

-

•

(as discussed in Example 5).

-

•

(as discussed in Example 1).

The 12 computed bispectral means are then used to classify the 136 countries into 5 classes, as shown in Figure 7, using k-means clustering. The features considered are all the bispectral means obtained using the given weight functions. The developed EU countries all fall into the same category. The South Asian and South-East countries form another category, while all types of categories are found in Africa and South America. Some developed countries, like the USA and Canada, are members of the same category as undeveloped countries such as Benin, and this is likely due to similar patterns of GDP growth. In other words, the classification algorithm classifies countries based on the growth trend of the GDP rather than the actual GDP, and the fact that USA and Benin are in the same group might be due to the fact that both countries have recently shown similar growth trend in GDP, the reasons behind which might be of practical interest, and can be explored in further studies.

7 Proofs

7.1 Proof of Proposition 3.6

Proof 7.10.

By direct calculation, the expected value of is

Now, using results from Brillinger, Rosenblatt [1967] we obtain

The term will be non-zero only when the sum of the Fourier frequencies inside the partition is , which can only occur when the partition contains all the ’s, since the Fourier Frequencies are assumed not to lie in any sub-manifold. Therefore, where the last equality is a direct outcome of Lemma 1 of Brillinger, Rosenblatt [1967], and the error term is uniform for all . Hence, using the convergence of a Riemann sum to an integral form (which is valid given the properties of the weight function), we obtain . Note that by (3.1), the th order polyspectrum is bounded. Hence, it is easy to show that the -term is indeed when (3.3) holds.

7.2 Proof of Proposition 2

Proof 7.11.

Recall that (3.4) has been established, and hence from (3.4) and (3.5) we only need to examine . From Lemma 1 of Brillinger, Rosenblatt [1967], under the assumption that , this term is non-zero if and only if the sum of the frequencies is 0. Recall that is a shorthand for . Then it follows that the terms will be non-zero in two possible partitioning of the vector , as given in Section 3. As we described in the referred section, there are two possible partitions, one with two sets containing elements only from and , and others with a mixture of each vector, such that every set contains at least one element from each vector.

In the first case, we have only one partition with two sets, namely, . Let us denote this partition by . Since the sum of elements of both partitions is zero, both of them will contribute non-zero values to the product, rendering the product to be non-zero. Hence can be written as

Hence, substituting the value of in the sum of (3.5), we obtain the following:

Thus, the final expression is , which in view of (3.4) leaves a term. The terms and are uniform in , as given in Brillinger, Rosenblatt [1967].

The second case can have multiple possible partitions, where every set of every partition must contain a mixture of and . Let us first consider the special case where we have only one set in the partition, i.e. the partition consists only of . Let us call this partition as . Then,

Hence, again substituting the value of in the sum (3.5) we obtain

Hence, the final expression will be a polyspectral mean of order , with a weight function depending on the original weight function.

The third case includes the situation where if the blocks of a partition are , and the block contains elements , then the sums of all those elements must be for each of the blocks . This is because if any of the blocks has elements which do not add up to , the corresponding will be zero, and hence will become zero for that partition. Now, we have ensured that no subset of the Fourier frequencies lies in a sub-manifold, i.e., for no subset of can the sum be . Hence, for one partition to have a non-zero value, all of its blocks must contain at least one element from each of and . The only other case is covered in the first case, where the partition contains all elements of and . Now that we know that every block of the partition contains a mixture of and , let us call each mixture a constraint since each mixture should have a sum 0, and hence would produce a constraint and thereby reducing the degrees of freedom by 1. Suppose we have such constraints, i.e., linear combinations of and are . This also means we have blocks. Then we will have a factor from the integrand since every block would contribute a from the cumulant, and a from the residual. The sum will hence run for only the above cases, i.e., only when the linear combinations of the elements of partitions are equal to 0. In other words, only when there exists such that , where . Recall that the rows and columns of (and ) have the properties delineated in the definition of , arising from the properties of the partition.

Let , , , , , and be as defined in Section 3. Then each term inside of the sum of (3.5) is given by (recall the notation introduced previously)

Now, for each of these quantities, we have constraints ( of which arise from each row of the matrices in , lessened by one because of a redundant constraint that the entire sum is ). Then, for each term we have

This goes to 0 at rate . Recall the definitions of , and from Section 3. Then we will have the summation in (3.5) running over all possible choices of matrices and within the sets for all choices of , such that . Then each of the summands will be of the form

and the powers of can be expressed as . It follows that the second cumulant is of the form

from which the stated formula for (3.7) is obtained. The case is the second case mentioned earlier, which would give a polyspectral mean of order . This completes the proof.

7.3 Proof of Corollary 1

Proof 7.12.

The proof follows from the fact that

In this case, the proof would be similar to previous calculations, except the matrix will be of dimension and the matrix will be of dimension . The proof can be easily extended to the covariance between polyspectral means of any two orders.

7.4 Proof of Theorem 3.8

Proof 7.13.

Propositions 1 and 2 give the mean and variance of the limiting distribution. The only thing remaining to prove asymptotic normality is to show that the higher-order cumulants of the scaled transformation go to zero as n goes to . Recalling that , we can write (letting denote the order joint cumulant)

Applying Theorem 2.3.3 of Brillinger [2001], we find that

where the summation is over all indecomposible partitions of the following table:

From the expression of cumulants, we know that each of those cumulants is non-zero only when the sum of the corresponding Fourier frequencies inside is equal to zero, and can contribute terms of order at most for each of the partitions, i.e., the highest order from each of these elements is . Hence, to obtain the leading term we would need to take the maximum number of such partitions such that the sum of ’s in the partitions is zero. By our definition of , no subset of the ’s fall in a sub-manifold. Hence, each of these partitions must contain either all distinct , or a mixture of ’s. However, if they were all distinct then the partition would not be indecomposable. Hence, we are left with only mixture of ’s. Also, an indecomposable partition would mean that we don’t have any single , i.e. all the partitions must be a mixture of all the ’s. This is encoded by the matrix notation described earlier. Here we just have matrices such that . Hence, partitions would give constraints, thereby giving an order of , and with these come constraints. Therefore, the sum would need to be weighted by in order to be non-negligible asymptotically, and the remainder term would be . Thus, the cumulants of order higher than will go to at a rate faster than , thereby proving the asymptotic normality of the scaled transformation.

7.5 Proof of Theorem 4.9

Proof 7.14.

Recall that is defined by (4.3), and . First we need to show that is ; since under the null hypothesis is a constant multiple of the denominator of , and , the integral is zero. Hence, the asymptotic distribution of under is , using Theorem LABEL:theo1p (with ).

Let us next consider the joint distribution of . Suppose we want to find the limiting distribution of for any scalars and . We can write:

where . Since we have already established the asymptotic normality of polyspectral mean for any function, it follows that any linear combination is asymptotically normal. Therefore, the joint distribution is asymptotically normal.

Hence, we now need to find the asymptotic covariance between and . As we saw earlier, one term that would arise corresponds to the partition consisting of the sets and . We only need to show that there are no other partitions in this case. The covariance will be similar to the form of established in Theorem 3.8, as given in (3.10) of Corollary 2. We have finally established the joint distribution of as a multivariate normal with covariance matrix given by

for any arbitrary , where the matrix entries are defined via (3.10), i.e., is the covariance between the bispectral means with weight functions and .

Next, consider the joint distribution of the vector such that . Then with defined by (4.4), the asymptotic distribution of under the null hypothesis can be expressed as , where . The covariance matrix has an eigenvalue decomposition of the form , where is a diagonal matrix of the eigenvalues of . Let , so that , where is the -dimensional identity matrix. Then, . Hence, the asymptotic distribution under the null hypothesis is expressed as a weighted sum of random variables, where the weights are given by the eigenvalues of the covariance matrix .

Acknowledgements

This report is released to inform interested parties of research and to encourage discussion. The views expressed on statistical issues are those of the authors and not those of the U.S. Census Bureau. This work partially supported by NSF grants DMS 1811998, DMS 2131233, DMS 2235457.

References

- Abdel-Rahman, Marzouk [2018] Abdel-Rahman HI, Marzouk BA. Statistical method to predict the sunspots number // NRIAG Journal of Astronomy and Geophysics. 2018. 7, 2. 175–179.

- Acharya et al. [2012] Acharya U Rajendra, Sree S Vinitha, Ang Peng Chuan Alvin, Yanti Ratna, Suri Jasjit S. Application of non-linear and wavelet based features for the automated identification of epileptic EEG signals // International journal of neural systems. 2012. 22, 02. 1250002.

- Athreya, Lahiri [2006] Athreya Krishna B, Lahiri Soumendra N. Measure theory and probability theory. 19. 2006.

- Barnett, Wolff [2004] Barnett Adrian G, Wolff Rodney C. A time-domain test for some types of nonlinearity // IEEE Transactions on Signal Processing. 2004. 53, 1. 26–33.

- Berg et al. [2010] Berg Arthur, Paparoditis Efstathios, Politis Dimitris N. A bootstrap test for time series linearity // Journal of Statistical Planning and Inference. 2010. 140, 12. 3841–3857.

- Berg, Politis [2009] Berg Arthur, Politis Dimitris N. Higher-order accurate polyspectral estimation with flat-top lag-windows // Annals of the Institute of Statistical Mathematics. 2009. 61, 2. 477–498.

- Boashash, Ristic [1993] Boashash Boualem, Ristic Branko. Application of cumulant TVHOS to the analysis of composite FM signals in multiplicative and additive noise // Advanced Signal Processing Algorithms, Architectures, and Implementations IV. 2027. 1993. 245–255.

- Brillinger [1965] Brillinger David R. An introduction to polyspectra // The Annals of mathematical statistics. 1965. 1351–1374.

- Brillinger [2001] Brillinger David R. Time series: data analysis and theory. 2001.

- Brillinger, Rosenblatt [1967] Brillinger David R, Rosenblatt Murray. Asymptotic theory of estimates of kth-order spectra // Proceedings of the National Academy of Sciences of the United States of America. 1967. 57, 2. 206.

- Brockett et al. [1988] Brockett Patrick L., Hinich Melvin J., Patterson Douglas. Bispectral-based tests for the detection of Gaussianity and linearity in time series // Journal of the American Statistical Association. 1988. 83, 403. 657–664.

- Brockwell, Davis [2016] Brockwell Peter J, Davis Richard A. Introduction to time series and forecasting. 2016.

- Chan, Tong [1986] Chan WS, Tong Howell. On tests for non-linearity in time series analysis // Journal of forecasting. 1986. 5, 4. 217–228.

- Chua et al. [2010] Chua Kuang Chua, Chandran Vinod, Acharya U Rajendra, Lim Choo Min. Application of higher order statistics/spectra in biomedical signals—A review // Medical engineering & physics. 2010. 32, 7. 679–689.

- Dahlhaus [1985] Dahlhaus Rainer. Asymptotic normality of spectral estimates // Journal of Multivariate Analysis. 1985. 16, 3. 412–431.

- Dubnov [1996] Dubnov Shlomo. Polyspectral analysis of musical timbre. 1996.

- Gabr [1988] Gabr M.M. On the third-order moment structure and bispectral analysis of some bilinear time series // Journal of Time Series Analysis. 1988. 9, 1. 11–20.

- Ghosh et al. [2024] Ghosh D., McElroy T., Lahiri S.N. Supplement to ”Polyspectral Mean Estimation of General Nonlinear Processes” // Preprint. 2024.

- Hsing, Wu [2004] Hsing Tailen, Wu Wei Biao. On weighted U-statistics for stationary processes // Annals of Probability. 2004. 32, 2. 1600–1631.

- Maravall [1983] Maravall Agustin. An application of nonlinear time series forecasting // Journal of Business & Economic Statistics. 1983. 1, 1. 66–74.

- Martis et al. [2013] Martis Roshan Joy, Acharya U Rajendra, Lim Choo Min, Mandana KM, Ray Ajoy K, Chakraborty Chandan. Application of higher order cumulant features for cardiac health diagnosis using ECG signals // International journal of neural systems. 2013. 23, 04. 1350014.

- McElroy et al. [2023] McElroy Tucker S, Ghosh D., Lahiri S. Quadratic prediction of time series via autocumulants // Sankhya. 2023.

- McElroy, Politis [2020] McElroy Tucker S, Politis Dimitris N. Time Series: A First Course with Bootstrap Starter. 2020.

- Mendel [1991] Mendel Jerry M. Tutorial on higher-order statistics (spectra) in signal processing and system theory: Theoretical results and some applications // Proceedings of the IEEE. 1991. 79, 3. 278–305.

- Picinbono [1999] Picinbono Bernard. Polyspectra of ordered signals // IEEE Transactions on Information Theory. 1999. 45, 7. 2239–2252.

- Raghuveer, Nikias [1986] Raghuveer Mysore R, Nikias Chrysostomos L. Bispectrum estimation via AR modeling // Signal Processing. 1986. 10, 1. 35–48.

- Rao, Gabr [1980] Rao T Subba, Gabr MM. A test for linearity of stationary time series // Journal of time series analysis. 1980. 1, 2. 145–158.

- SILSO World Data Center [1749-2021] SILSO World Data Center . The International Sunspot Number // International Sunspot Number Monthly Bulletin and online catalogue. 1 1749-2021.

- Saidi et al. [2015] Saidi Lotfi, Ali Jaouher Ben, Fnaiech Farhat. Application of higher order spectral features and support vector machines for bearing faults classification // ISA transactions. 2015. 54. 193–206.

- Schwabe [1844] Schwabe Heinrich. Sonnenbeobachtungen im jahre 1843. von herrn hofrath schwabe in dessau // Astronomische Nachrichten. 1844. 21. 233.

- Shumway, Stoffer [2005] Shumway Robert H, Stoffer David S. Time series analysis and its applications (Springer texts in statistics). 2005.

- Spooner, Gardner [1991] Spooner CM, Gardner WA. Estimation of cyclic polyspectra // [1991] Conference Record of the Twenty-Fifth Asilomar Conference on Signals, Systems & Computers. 1991. 370–376.

- Van Ness [1966] Van Ness John W. Asymptotic normality of bispectral estimates // The Annals of Mathematical Statistics. 1966. 1257–1272.

- Vrabie et al. [2003] Vrabie Valeriu, Granjon Pierre, Serviere Christine. Spectral kurtosis: from definition to application // 6th IEEE international workshop on Nonlinear Signal and Image Processing (NSIP 2003). 2003. xx.

- Wu [2005] Wu Wei Biao. Nonlinear system theory: Another look at dependence // Proceedings of the National Academy of Sciences. 2005. 102, 40. 14150–14154.

- Yuvaraj et al. [2018] Yuvaraj Rajamanickam, Rajendra Acharya U, Hagiwara Yuki. A novel Parkinson’s Disease Diagnosis Index using higher-order spectra features in EEG signals // Neural Computing and Applications. 2018. 30. 1225–1235.

- Zhang et al. [2000] Zhang Ji-Wu, Zheng Chong-Xun, Xie An. Bispectrum analysis of focal ischemic cerebral EEG signal using third-order recursion method // IEEE transactions on biomedical engineering. 2000. 47, 3. 352–359.