Optimal post-retirement investment under longevity risk in collective funds

Abstract

We study the optimal investment problem for a homogeneous collective of individuals investing in a Black-Scholes model subject to longevity risk with Epstein–Zin preferences. We compute analytic formulae for the optimal investment strategy, consumption is in discrete-time and there is no systematic longevity risk. We develop a stylised model of systematic longevity risk in continuous time which allows us to also obtain an analytic solution to the optimal investment problem in this case. We numerically solve the same problem using a continuous-time version of the Cairns–Blake–Dowd model. We apply our results to estimate the potential benefits of pooling longevity risk over purchasing an insurance product such as an annuity, and to estimate the benefits of optimal longevity risk pooling in a small heterogeneous fund.

Keywords: Collective pension funds, idiosyncratic and systematic longevity risk; Epstein–Zin preferences

1 Introduction

In this paper we calculate the optimal consumption and investment strategies for a pension investor in a Black–Scholes market subject to longevity risk, but who has access to longevity insurance through a tontine structure or a similar scheme of longevity credits. We only consider the drawdown stage of retirement. Our focus is on situations where we can obtain analytic results. For this reason, we will throughout model the preferences of the investor using either a power utility, or more generally, Epstein–Zin preferences.

We begin by considering the discrete-time case where there is no systematic longevity risk. This scenario is the simplest and enables us to build the necessary intuition to understand Epstein-Zin utility and its impact on pension problems, before moving onto more complex scenarios in continuous time. We assume that all investors are identical. We assume a tontine structure where all investors have agreed that each year the funds remaining from any dying investor will be shared evenly among the survivors as longevity credits. Under these circumstances, we will see that it is possible to solve the optimal investment problem to obtain difference equations determining the optimal strategy. We obtain the solution for both finite and infinite funds.

As an application of these results, we can prove rigorously that our infinite fund represents a limit of the finite fund case. We also use our result to show that an effective strategy for managing a heterogeneous fund where investors have different preferences and mortality distributions, is for each investor to trade and consume as though they were in a homogeneous fund. When combined with a longevity credit mechanism that accounts for the different market risks taken by different individuals, we find numerically that this results in strategies that perform close to optimally. This demonstrates that results obtained on the assumption of homogeneous funds are in fact useful in practice.

We next introduce systematic longevity risk. In order to obtain tractable problems, in this section we work in continuous time. In the first instance, we are interested primarily in analytic tractability, so we introduce a new stochastic model for longevity risk which is designed to be such. The cost of this tractability is that the model cannot be calibrated to realistic data, but can be used to obtain qualitative results on behaviour by explicitly solving the Hamilton-Jacobi-Bellman (HJB) equation.

Finally, we consider a realistically calibrated 1-factor model for systematic longevity risk based on the Cairns–Blake–Dowd (CBD) model Cairns et al. (2006). We must solve the resulting HJB equation using PDE methods, but the use of homogeneous preferences at least allows us to reduce the dimensionality of the problem. This model enables us to study the consumption-investment problem with more realistic mortality risk. These results confirm are earlier qualitative results.

Our results demonstrate that, as expected, large benefits are available through longevity-credit mechanisms and from incorporating investment in risky assets post retirement. These benefits can be obtained entirely through a mechanism of mutual insurance and do not require any inter-generational transfers of wealth, as seen in Collective Defined Contribution Schemes.

We also show that when individuals face systematic longevity risk, it is sometimes possible to obtain better pension outcomes. This is because in a model for systematic longevity risk, one gains increasing information about one’s mortality with time and one can potentially use this information to make better investment and consumption decisions. This provides an additional means by which longevity pooling in a collective fund can out perform an annuity than those identified in Boon. et al. (2019) for instance.

Our results contribute to the extensive literature on optimal investment that was initiated by Merton in Merton (1969). The results in our first section provide an improvement on the similar results of Stamos (2008) by considering finite funds of arbitrary size and incorporating Epstein–Zin utility. Epstein–Zin utility allows one to have preferences for consumption over time where one can separately consider risk-aversion and the diminishing returns from increasing consumption at one moment in time. It has been shown that this allows one to resolve a number of asset pricing puzzles (Bansal and Yaron, 2004; Bansal, 2007; Benzoni et al., 2011; Bhamra et al., 2009). It therefore seems likely that any realistic model of an individual’s preferences for pension investments will also separate these factors. The tractability of optimal investment problems with Epstein–Zin utility is studied extensively in Campbell and Viceira (1999). Fully rigorous treatments of continuous-time Epstein–Zin investment problems without mortality, can be found in Kraft et al. (2017) and Xing (2017).

Our paper also contributes to the growing literature on tontines. An extensive review of the history of tontines, their potential benefits and of the more recent literature can be found in Milevsky (2015). Other authors have also identified optimal investment strategies for homogeneous pools of investors subject to various constraints on the design of the pension product. Milevsky and Salisbury (2015) considers the optimal investment problem for a tontine invested in a bond. Chen and Rach (2019) considers a tontine structure with a minimum guaranteed payout. Chen et al. (2019) considers structures combining annutities and tontines. Boado-Penas et al. (2020) consider a product where an individual and shared fund are maintained according to a specific set of rules that ensure the funds are kept within certain ”corridors”.

Our results are intended to be simple, tractable and used as a benchmark for studying risk-pooling mechanisms in collective pensions. Our ultimate conclusions suggest that tractable homogeneous preferences such as power utility and Epstein–Zin preferences, provide a reasonable model for individuals who have insufficient funds to achieve a fully adequate pension in retirement, but do not yield plausible strategies for individuals with large pension pots. As a result, we believe that inhomogeneous preference models are required for realistic modelling.

2 Pooling idiosyncratic longevity risk

For our market model, we take the Black–Scholes model with a risk-free asset with interest rate and a single risky asset , satisfying the SDE

| (2.1) |

for a constant drift and volatility , and a -dimensional Brownian motion . We assume that consumption occurs in discrete-time at evenly-spaced time points .

In this section, we will be interested only in idiosyncratic longevity risk, so we will assume individuals have independent mortality, with the unconditional probability of dying in the interval being . Hence, the survival probability between times and , is given by:

| (2.2) |

When an individual dies, their remaining wealth is shared evenly among the survivors.

An individual’s consumption of their pension is given by a stochastic process . Let be a -valued random variable denoting the last time at which the individual was able to consume. Note that is not a stopping time, but is.

We will assume that each individual seeks to maximize a value function given by a homogeneous Epstein–Zin utility which we now define.

Definition 2.1.

Discrete-time homogeneous Epstein–Zin utility with mortality depends on parameters , , and . It is the -valued stochastic process defined recursively by

| (2.3) |

To interpret this formula we use the convention for .

We call these preferences homogeneous because they satisfy the equation for any constant . Our choice of value for the utility when , is determined by the requirement that positive homogeneity still holds.

The parameter can be interpreted as controlling satiation, as the term will result in diminishing returns to consumption at any instant in time. This will lead optimal investors, to spread their consumption over time, and so the choice of can also be viewed as determining intertemporal substitution. The parameter is a risk-aversion parameter. The parameter is a discount rate indicating the level of preference for earlier consumption. When , maximizing these Epstein–Zin preferences is equivalent to maxmizing the von Neumann–Morgenstern utility:

We will primarily be interested in the case when . This is because we have included mortality in our model which already provides a motivation for preferring earlier consumption and additional discounting does not seem appropriate when considering a pension income.

If we allow continuous-time trading between consumption, then to find the optimal investment strategy we must solve a sequence of one-period investment problems for each discrete-time step. The value function in the resulting HJB equation will depend upon the variables where is the total wealth of the individual at time . Because Epstein–Zin preferences are positively homogeneous, each one-period investment problem will be equivalent to a classical Merton problem with a power utility, and so can be solved analytically. This allows us to obtain difference equations for the optimal investment strategy. We state the result and give the detailed calculations in Appendix A.

Theorem 2.2.

Let denote the optimal Epstein–Zin utility, (A.2), for a collective of individuals investing an amount at time . Suppose the discounting parameter in the preferences is equal to . The collective is allowed to invest in the Black–Scholes–Merton market (2.1) in continuous time, but consumption occurs at discrete times .

The optimal Epstein–Zin utility is determined by the equations:

| (2.4) |

| (2.5) |

| (2.6) |

| (2.7) |

| (2.8) |

To compute , note that the last two equations determine from , and we know the terminal utility .

The term defined in (2.5) is the optimal proportion invested in the risky asset. It is independent of both and the distribution of mortality.

The optimal proportion of wealth consumed by each survivor at a given time point is

| (2.9) |

The term , defined in (2.4), is the transition probability from surviving individuals to surviving individuals over the interval .

Our analytic formulae make it relatively simple to quantify the convergence of the value function as the number of individuals tends to infinity.

Theorem 2.3.

Let denote the maximum Epstein–Zin utility at time for the infinitely collectivized case, then

See Appendix A.3 for the proof.

Because we are, in effect, solving a sequence of Merton problems it is possible to compute the probability distribution for the consumption analytically. We state the result in the most interesting cases when and . To distinguish these cases we define a constant by

| (2.10) |

Theorem 2.4.

Under the same conditions as 2.2, and with or , the optimal fund value per survivor at time , , follows a log normal distribution. Write and for the mean and standard deviation of so that

| (2.11) |

The standard deviation is given by

| (2.12) |

where is given by (2.5). The mean satisfies the difference equation

| (2.13) |

where is given by (A.13) and we define by the same formula used to define , but with set to zero, i.e.

| (2.14) |

The optimal consumption per survivor, , at time , is also log normally distributed with

| (2.15) |

The mean of the log consumption per survivor satisfies the equation

| (2.16) |

where is given by equation (A.9).

The proof is given in Appendix A.

To understand the role of Epstein-Zin preferences in Theorem 2.4, we specialize to the case of a market where and to preferences with . This represents the problem of consuming a fixed lump sum over time when there is no inflation but also no investment opportunities. While not financially reasonable, this problem highlights how longevity risk affects consumption, when considered in isolation from market risk. In this case, is a deterministic function. We find from equations (2.16) and (A.9) that

| (2.17) |

We note that is a non-zero probability, so . We may use equation (2.17) to compute whether consumption increases or decreasing over time. We summarize the results in Table 1.

| Collectivised | Individual | |

|---|---|---|

| Increasing | Decreasing | |

| Increasing | Increasing | |

| Decreasing | Decreasing | |

| Constant | Decreasing | |

| Constant | Decreasing |

Perhaps surprisingly, we find that sometimes consumption increases over time rather than decreases. When , living longer always increases the total lifetime utility. In this case the risk an individual faces is the risk of dying young with leftover funds, which is addressed by consuming early. When , living longer decreases the total lifetime utility, and the lower the income the more sharply it decreases. In this case the risk an individual faces is the risk of living longer and running out of funds, so the individual chooses to save (and postpone consumption) to compensate themselves for this risk.

Some may believe that increased longevity should always increase utility, in which case only Epstein–Zin utilities with should be considered. Others may believe that it is possible that if one were too poor in old age, living longer might indeed be detrimental. Epstein–Zin utilities with could then be used to model individuals with an adequate pension and , to model poor individuals who are unable to achieve an adequate income in retirement. We believe that a more realistic model should include an adequacy level such that consumption above the adequacy level results in improved utility with longer lifetimes and consumption below the adequacy results in decreasing utility. However, doing so will inevitably break the positive homogeneity of the preferences, leading to an analytically intractable result. Thus, while Epstein–Zin preferences provide an instructive model due to their tractability, non-homogenous preferences will ultimately be required in a realistic preference model. We will consider preference models which allow for more refined modelling of adequacy in future research.

In the individual case (), the concern that one will die young is much more serious. This is why for the individual problem, the fear of an inadequate pension only dominates when both and .

The case corresponds to standard von-Neumann Morgernstern preferences, in which case constant consumption is optimal. More significantly, our result also shows the converse. Constant consumption from one period to the next is only optimal if and only if either (i) the survival probability is one, or (ii) so one is satisfaction risk-neutral. Hence, even ignoring market effects, constant consumption will be sub-optimal for any realistic parameter choices.

We have not shown the case in Table 1 as we found the resulting behaviour to be difficult to interpret as rational, cautious (as understood intuitively) strategies. In our view, this is because when , Epstein–Zin preferences do not correctly operationalise the intuitive notion of risk-aversion. To see why, it is helpful to rewrite the Epstein–Zin utility function. We define the signed power function by

and define the Epstein–Zin satisfaction, , by

We may then write the defining equations of homogeneous Epstein–Zin preferences as follows

| (2.18) |

For deterministic cashflows, these preferences simplify to

Since affects ones preferences even over deterministic cashflows, we interpret this equation as showing that is a parameter measuring satiation, that is the diminishing returns from increased consumption over one time period, rather than risk-aversion.

Equation (2.18) shows that if , the preferences are risk-seeking in the satisfaction, risk-neutral if and risk-averse if . Constant consumption is optimal in a market with only if , that is only if one is satisfaction-risk-neutral. For Epstein–Zin preferences, a risk-averse investor will prefer early consumption to a steady income in retirement. This may be one of the reasons many retirees see annuities as unattractive.

It is also interesting to calculate how consumption changes according to the available investment opportunities. If interest rates increase, one may choose to defer consumption to a later date to benefit from the increased rate. To quantify this behaviour, one wishes to calculate the elasticity of intertemporal substitution (EIS) which is defined as follows.

Definition 2.5.

The elasticity of intertemporal substitution at time is defined to be

When is deterministic, this definition corresponds with the standard definition of Hall (1988).

Theorem 2.4 allows us to calculate this elasticity.

Corollary 2.6.

For the optimal investment strategy of Theorem (2.2) we have

If this simplifies to

In the case of von Neumann-Morgernstern utility we have

Proof.

This result explains why we call a satiation parameter rather than following the convention in the economics literature of saying that it is a parameter for EIS. The concept of satiation is a feature inherent to the preferences alone, whereas EIS depends upon other features of the model.

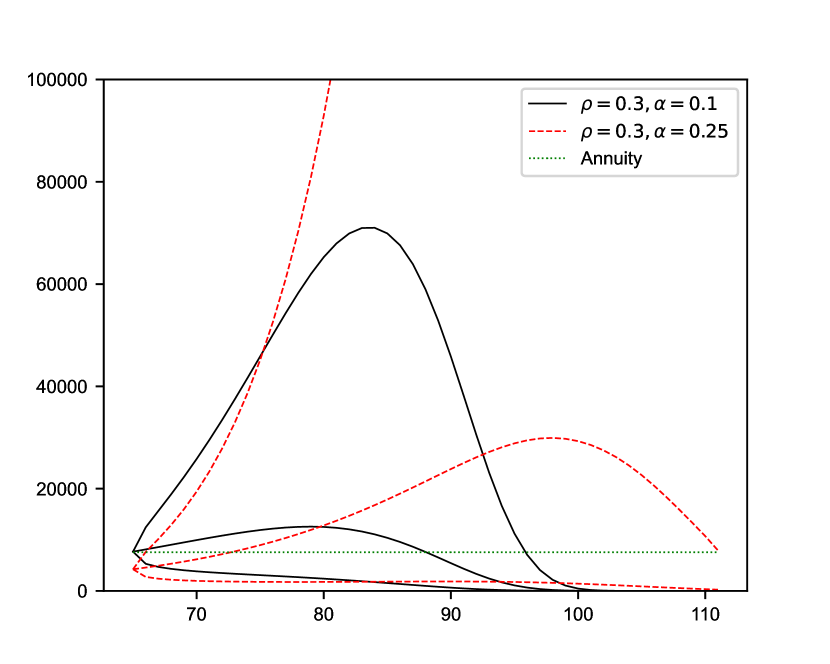

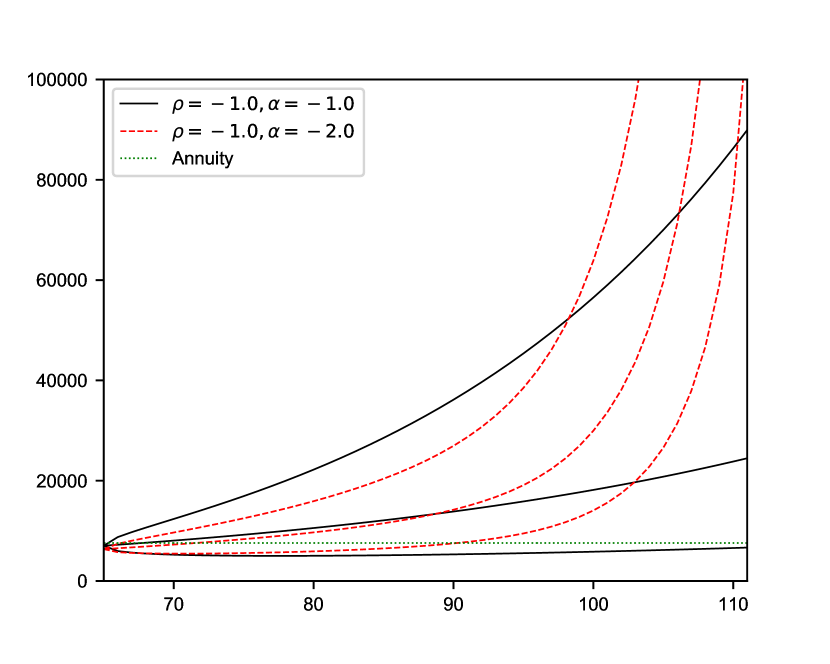

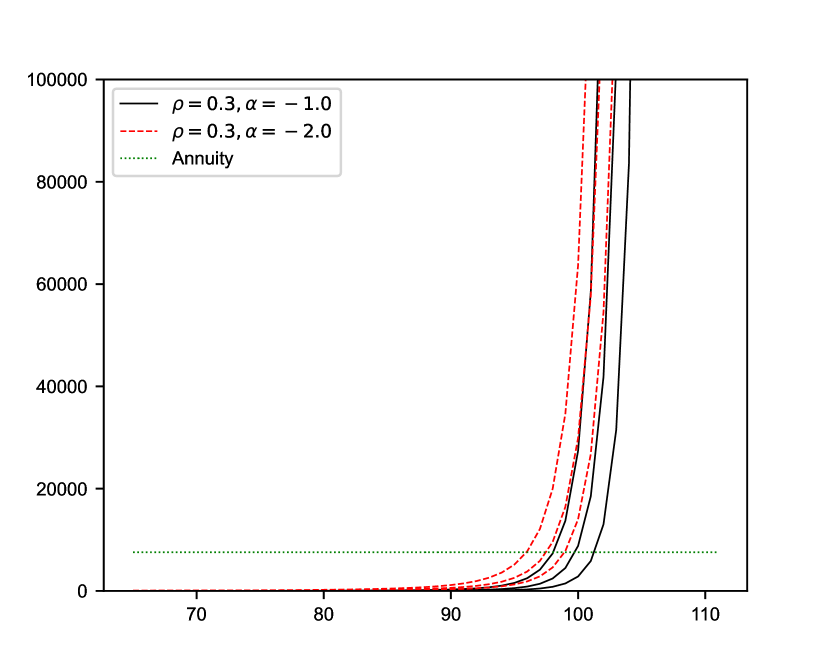

We now simulate some example pension outcomes using Theorem 2.2. In Figure 1, we plot the optimal consumption calculated using homogeneous Epstein–Zin preferences with mortality distribution given by the Mortality Projections Committee (2019) model CMI_2018_F [1.5%], with market parameters , , and an initial fund of value . The parameters are chosen to represent a median-earning female retiring in the UK in 2019.

Regarding values of and , empirically relevant values are those such that Xing (2017), at least for incomplete markets. Although, values of and are considered in Xing (2017). The case will yield relevant results. Havranek et al. (2015) finds a mean value of 0.5 in a meta-analysis of empirical studies on the elasticity of inter-temporal substitution. Using the relation we found in Corollary 2.6, seems a reasonable choice. If anything, this should underestimate the benefits of our scheme when compared to the case . While the case is not typically studied in the literature, our analysis shows it is a qualitatively distinct and interesting case corresponding to individuals with adequate pensions.

Figure 1 shows consumption strategies in the presence of market risk. For (Figure 1 (a)), living longer still increases total utility, but consumption increases then decreases, since it is initially postponed to take advantage of investment opportunities. For (Figure 1 (b) and (c)), living longer still decreases utility, so consumption continues to be postponed to avoid running out of funds. Additionally, Figure 1 visually illustrates how our homogeneous preferences effectively set an adequacy level of zero when and infinity when . Because the adequacy level is zero when , the investor is willing to accept some years where the pension is unrealistically low (even zero) and this is what leads to the unrealistic consumption strategies seen in Figure 1 (a). In Figure 1 (c), the investor aggressively targets achieving an adequacy of infinity at the expense of almost no consumption until they are close to death. This is also an unrealistic strategy. Figure 1 (b) represents a more plausible strategy, with the median scenarios outperforming an annuity at all ages.

We believe investors with sufficiently large pension pots will be concerned more by the risk of dying young, than they will be of running out of money and so will not be adequately modelled by preferences with . To model such investors, it seems necessary to go beyond homogeneous preferences and include an explicit adequacy level within the model. It also seems likely that utility decreasing with increasing lifetime is a necessary feature of any optimization model that will yield reasonable consumption strategies.

(a)

(b)

(c)

2.1 Heterogeneous Funds

As an application of our computation for the optimal investment strategy for a finite number of individuals, we propose an algorithm for managing heterogeneous funds of individuals with different preferences and mortality distributions.

Algorithm 2.7 (Heterogeneous fund algorithm).

Choose a positive integer . Let denote the number of survivors at time . Define by

Compute the consumption and investment strategy as follows:

-

1.

Keep accounts of the current funds associated with each individual.

-

2.

At time , for each surviving individual in the fund, invest and consume according to the optimal strategy for a homogeneous fund of investors identical to that individual with budget given by their current funds. Even if, after consumption, the individual dies at time , one should pursue the same investment strategy as one would have done if they had survived.

Compute the resulting wealth of each individual who was alive at time .

-

3.

For an investor who survives to time , we define their “contribution” to the collective at time , , by

where is the survival property of individual from time to .

-

4.

When an individual dies, divide their funds among the survivors in proportion to each survivor’s contribution .

The purpose of the cut-off in this algorithm is simply that it is computationally expensive to compute the optimal strategy for a collective of investors, if is large.

The logic behind this algorithm is that we assume we can divide our population into large groups of similar individuals. Let one such group of individuals be close to one particular individual which we label . Since the individuals are similar we assume that the optimal strategies for each member of the group will be similar. If the number of individuals in the group is large, the optimal strategy for individuals of a given type will be similar to the optimal strategy for individuals of a given type. The number of survivors will also be close to the expected value. Thus, (2) and (3) together will ensure that the utility achieved by individuals of type close to , will be close to the utility that can be obtained by an infinite collective of individuals all of type exactly .

This argument is essentially a compactness and continuity argument. One could therefore write out a formal topological proof of its convergence as the number of individuals tends to infinity, under suitable assumptions, and with small changes to the algorithm similar to those used to prove Theorem 2.3. However, we do not believe doing so would be particularly illuminating.

We note that our method of redistributing the funds of deceased members could be improved as it is not strictly “fair”. Let denote the pricing measure for the market and the measure for individual lifetimes. One might wish to choose the specifics of the redistribution mechanism so that the investment of each individual matches the discounted expectation of their funds at the start of the next period. Our algorithm only achieves this approximately. See (Piggott et al., 2005; Sabin, 2010) to see how this can be fixed, if desired.

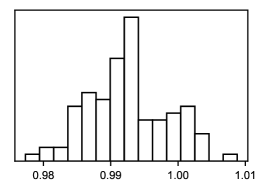

We now test the effectiveness of Algorithm 2.7 for a small heterogeneous fund. We generate a random fund of individuals. Each individual has inter-temporally additive von Neumann–Morgenstern preferences given by a power utility, with the power uniformly generated in the range . The initial wealth of each individual is taken to be uniformly distributed in the range . The retirement age of each individual is taken to be a uniformly distributed random integer in the range –. The sex of the individual is chosen as male with probability . All of these random choices are made independently. The mortality distribution for each individual is then computed using the CMI model with longterm rate and retirement year of . The market parameters are chosen as on page 2.6.

Using this population, we run simulations of the above algorithm with set to . This allows us to compute a sample average utility, , for each individual . We use von Neumann–Morgenstern preferences for our simulations, as it is much simpler to compute expected utilities from a Monte Carlo simulation in this case, than the case of Epstein–Zin preferences. We define , to be the expected utility that would be achieved by individual , if they were to invest in a homogeneous collective of individuals. We define the optimality ratio for individual by

If this ratio is close to , then the utility experienced by individual is close to the optimum value they can expect from a heterogeneous fund.

In Figure, 2 we plot a histogram of the optimality ratio, , for each of our fund members. In our example, the optimality ratio is almost always above . This demonstrates that, even with as few as investors, our investment strategy is close to the optimal value for a heterogeneous fund.

3 Systematic longevity risk

Having studied the effects of idiosyncratic longevity risk, we now move on to systematic longevity risk. To obtain a fully tractable model for systematic longevity risk, we need to allow consumption in continuous time and therefore consider the continuous time version of Epstein–Zin preferences with mortality.

Let be the force of mortality. We define the Epstein–Zin aggregator with mortality by

| (3.1) |

Here, the constant represents a rate of discounting corresponding to the parameter in the definition of discrete-time Epstein–Zin preferences with mortality. We define the gain function for Epstein–Zin oreferences with mortality to be the solution of the Backwards Stochastic Differential Equation

| (3.2) |

with terminal condition . We justify this definition heuristically in Appendix B.1, arguing that defined in this way is the continuous-time analogue of the discrete-time quantity . The argument is essentially identical to the standard justification for the definition of continuous-time Epstein–Zin preferences without mortality, in terms of a BSDE Kraft et al. (2017).

We will consider the optimal investment problem for an insured drawdown fund in the Black-Scholes model, where the force of mortality satisfies a diffusion equation of the form

| (3.3) |

where is a Brownian motion independent of . We assume that it is possible to fully insure idiosyncratic longevity risk. Survivors receive longevity credits so that their wealth process satisfies

| (3.4) |

where is the quantity invested in the risky asset at time . controls whether the longevity credit system is implemented or not.

Our problem has two symmetries. Firstly, at any time , the Black-Scholes market with initial stock price , is equivalent to the same market with any other possible initial stock price. As a result, one expects that the optimal investment strategy will be independent of the stock price . Secondly, we recall that the discrete-time Epstein-Zin utility , is positively homogeneous and that is derived as being the discrete-time limit of . Hence, is positively homogeneous of order , that is . Since we are in the Black-Scholes market, one expects that the value function will also be positively homogeneous of order in the wealth. This motivates an ansatz for the HJB equation.

Proposition 3.1.

If one substitutes the ansatz

| (3.5) |

into the HJB equation for the problem of optimizing Epstein–Zin preferences with mortality in an insured drawdown fund, with dynamics given by equations (3.4) and (3.3), one obtains the partial differential equation:

| (3.6) |

The optimal consumption rate and quantity invested in the stock are given by:

| (3.7) | |||

| (3.8) |

Note that the equation for the optimal investment is identical to the optimal investment strategy in the classical Merton problem.

3.1 A stylised mortality model

We now consider a concrete mortality model that is chosen to ensure the problem has analytic solutions. To do this, we assume that the mortality satisfies the SDE

| (3.9) |

for some constants and .

This model is not intended to be a realistic model of human mortality, indeed, it significantly exaggerates systematic longevity risk. However, this model does have similar qualitative properties to human mortality: will always be positive, it will explode to in a finite time, ensuring that all members of the funds die in finite time and, ignoring short-term fluctuations, mortality rates increase with age.

The key motivation for using this mortality model is that it is designed to lead to an analytically solvable model. This is because the equation is time-scale invariant: if one changes the units of time, then equation (3.9) is unchanged. If we also assume that in our market model and that in our preferences, this eliminates all time-scale dependence in our equations. Thus, with these assumptions, the HJB equation will have a scaling symmetry in time. In addition, since all our coefficients are constant, the HJB equation has a translation symmetry in time. This suggests we use the ansatz

| (3.10) |

for equation (3.6). It is now a simple calculation to check that

Theorem 3.2.

The HJB equation for insured drawdown investment () with mortality model (3.9) and with , has the trivial solution zero together with an additional analytic solution

| (3.11) |

so long as the term in brackets is positive.

Rigorously proving that our analytic solution is the unique solution to the optimization problem would be somewhat challenging, but we believe the papers Kraft et al. (2017), Herdegen et al. (2023) provide a basic roadmap for how one might do this. We believe the key step in such a proof will be to replace the time variable , with a new variable , satisfying the equation:

In this new coordinate system, the problem becomes an infinite-horizon Epstein–Zin utility control problem with now following a geometric Brownian motion, rather than exploding in finite time.

When the optimization problem is ill-posed, the supremum of the value function may be , or . This explains why we sometimes obtain complex solutions to the HJB equation. By evaluating the value-function for other strategies that fit the ansatz, but which do give real values, one can analyze the supremum of the value function in those cases where the supremum is not attained. See Appendix B.3 for an illustrative example.

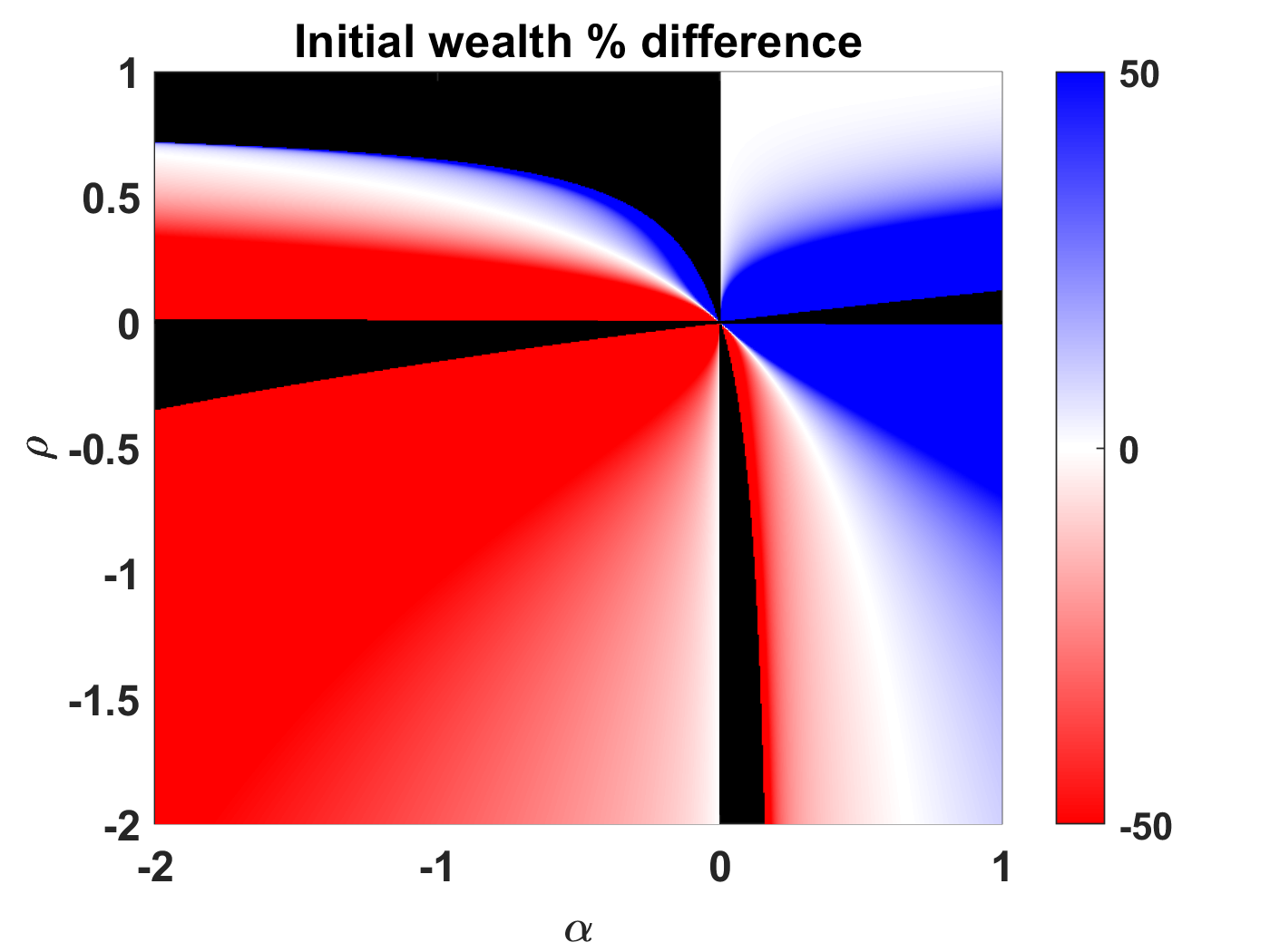

Given an optimal drawdown problem, we can set the value of to zero to obtain an associated drawdown problem without any systematic longevity risk. In order for the original drawdown problem to have the same value function as the drawdown problem without systematic longevity risk, we will need to change the initial wealth by a certain percentage relative to the associated problem without systematic risk. We will call this percentage “the cost of systematic mortality risk” for the problem. We plot the cost of systematic mortality risk for different values of and in Figure 3, in the case , and . The plot is complex, but as a brief summary one can see that the cost of systematic mortality risk varies within each quadrant in either a clockwise or anti-clockwise direction, jumping as one moves from quadrant to quadrant. Note that only the qualitative features of this figure are important as we have made no attempt to calibrate the model to data.

The most interesting point is that the cost of systematic mortality risk may be either positive or negative depending on the values of and . This may seem surprising at first, but it can be explained by the tension between the change in risk that occurs as changes with the increase in information that also occurs (this tension is balanced along the curve ). This highlights an important difference between an annuity and insured drawdown. An annuity provider sets a price at retirement, but in insured drawdown it is possible to react to new information as it comes in and adjust one’s consumption strategy. The supremum of the value function for the insured drawdown problem with systematic longevity risk will always be greater than the value function for the insured drawdown problem without systematic longevity risk, if the mortality distributions conditioned on the information at time zero are the same. This is because receiving information increases the size of the set of admissible strategies, and so can only increase the value. By contrast the cost of an annuity will be expected to go up in this situation, making the strategy of purchasing an annuity at retirement less attractive.

To give a more precise statement, we specialise to the case of von Neumann-Morgenstern utility, where . The value function then simplifies to

| (3.12) |

Hence, when we find that the value is decreasing in and increasing in . Given our remarks earlier on the relationship between the sign of and pension adequacy, we see that this corresponds to an investor with an adequate pension who will be glad if is small as they will have more time to enjoy their pension, and will also benefit from knowing if their mortality has increased so they can increase spending. When , the value is increasing in and decreasing in . In this case, the investor has an inadequate pension and so they are concerned if is too low that they will not have enough to live on. It also appears more difficult for such an investor to benefit from increased information about mortality, and the benefit of information is outweighed by the increased risk.

3.2 A realistic mortality model: Cairns-Blake-Dowd

We now consider a realistic mortality model to provide meaningful numbers on the differences in performance between a insured drawdown fund with and without systematic longevity risk. We consider a 1-factor continuous time analogue of the two-factor Cairns-Blake-Dowd model, which leads to the following mortality rate equation:

| (3.13) |

The constant coefficients can be found in Table 2. Details of the derivation of this equation can be found in Section B.4.

| Coefficient | Value |

|---|---|

| 0.00118 | |

| 0.00306 | |

| 0.00140 | |

| 1.05 | |

| 0.137 | |

| 0.0799 | |

| 0.00134 |

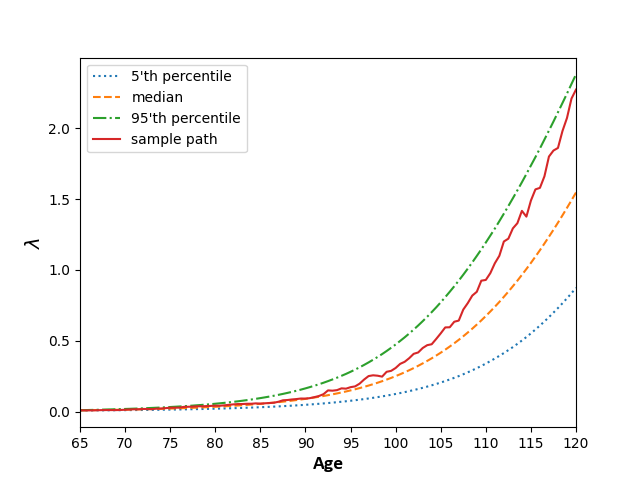

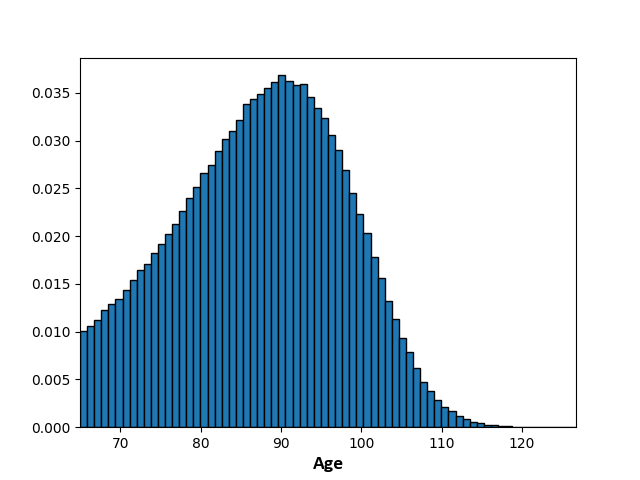

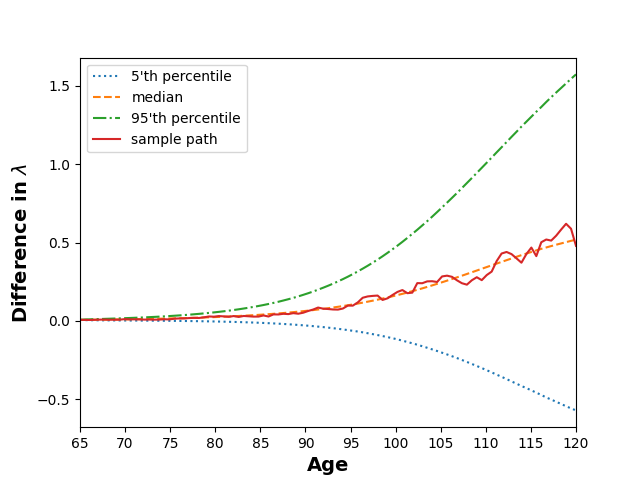

A fan diagram of simulated mortality rates and the probability density function of the time of death, is shown in Figure 4.

(a)

(b)

For this mortality model, our HJB equation is (3.6) with and replaced by the drift and volatility in (3.13). Full details of our numerical approach for solving this equation can be found in Section B.5. Our choice of market parameters are as in Section 2. Regarding choices of and , recall from Section B.3, that when are of opposite sign in our stylised model, a maximum either does not exist, or the value function is zero. For the CBD model, numerical results suggest we obtain a value function of zero in these cases. Hence, we focus on cases when and are of the same sign and meaningfully solutions should exist.

In Table 3, we provide a summary of the cost of systematic longevity risk for different values of and . The table follows the same qualitative trends predicted by our stylised mortality model. That is, for the cost is negative and for the cost is positive (when and are of opposite sign, we find the value function to be zero when systematic longevity risk is and is not present, at least for the parameter values we have checked). Focusing on the case , where systematic longevity risk has a detrimental impact on the fund, we see provided is not too small (i.e., ), systematic longevity risk has around a 6% (or less) impact on the starting wealth a fund requires. As a result, systematic longevity may not be considered a significant risk factor for most collective funds that are not highly risk averse. However, for more extreme choices of , e.g. , the cost of systematic longevity risk can be as much as 22.4%. In this situations there is likely to be considerable benefit from purchasing insurance contracts on systematic longevity risk, a question we will address in future work.

| Initial wealth difference | 22.4% | 6.45% | 3.06% | 6.02% | -7.34% | -22.8% |

With the impact of systematic longevity quantified, we now analyse how a collective fund in the presence of systematic longevity risk performs in comparison to an annuity. As in Section 2, we use an initial fund value of £126,636 for our collective scheme, which under our CBD mortality model purchases an annuity of approximately £5,100 a year. In the remainder of this section, we consider von Neumann-Morgenstern preferences with for ease of computation.

Fan diagrams of the consumption streams with and without investment in a risky asset when , are presented in Figure 5. With investment in a risky asset, the median scenario for the collective fund outperforms an annuity with a total consumption of £900,000 (which is unrealistically high). The median scenario delivers a highly inconsistent consumption stream with little consumption in the early years of retirement and negligible consumption from age 115 onwards, but with extremely high levels of consumption in between this range. When there is no risky asset, the median consumption is above the annuity level until the age of 90 and falls to zero by age 110. The behaviour here is analogous to that in Figure 1 (a) and for the same reasons we do not believe these plots represent a realistic consumption strategy.

We repeat the same exercise for in Figure 6. With investment in a risky asset the collective fund outperforms an annuity, the median scenario is always above the annuity, while the 5’th percentile of scenarios dips slightly below the annuity in some years. When no risky asset is present, the median scenario outperforms the annuity up to age 90 and from age 110 onwards. These consumption strategies seem to be more realistic than the those seen in the previous figure and mirror those in Figure 1 (b). Both Figure 5 and Figure 6 highlight the value of longevity pooling and investing in risky assets post retirement.

4 Conclusions

In this paper, we study optimal consumption-investment problems for collective pension funds characterised by a tontine/longevity credit system within the Black-Scholes market. In the interest of analytic tractability, in both discrete and continuous time, we model investors preferences over pension outcomes through Epstein-Zin preferences. This framework allows us to provide informative analytic formulae which illuminate the impact of investors preferences and longevity risks on pension outcomes.

In discrete time, we consider the case where investors are exposed to idiosyncratic longevity risk only. For a homogeneous collective, we solve the problem via difference equations that determine the optimal strategy for both finite and infinite funds. This allows us to elucidate the effects of risk aversion, , and satiation, , on consumption with and without market risk. Furthermore, applying the optimal strategy for an infinite homogeneous collective to each investor in a heterogeneous collective, we see the resulting outcomes are still effectively optimal. Thus, the solution to the homogeneous case provides a useful tool for the management of complex heterogeneous funds.

In continuous time, we additionally incorporate systematic longevity risk. Using a stylised mortality model, we analytically solve the associated HJB equation and explicitly obtain the optimal strategies. This reveals the surprising fact that systematic longevity risk can improve pension outcomes provided . This occurs because the benefits of gaining additional information about one’s mortality over time outweigh the detrimental effect of changing mortality risk. These effects are balanced when , while risk outweighs information for , leading to worse outcomes. These trends remain true for the case of a more realistic 1-factor continuous time CBD mortality model, at least for and . Here, we solve the HJB equation numerically and provide estimates on the cost of systemic longevity risk. Provided individuals are not too strongly risk averse ( is not too small), systematic longevity risk requires approximately 6% (or less) additional wealth to be put into the fund initially to achieve equivalent outcomes.

Our results demonstrate that, as would be expected, there is considerable benefit to be gained by investing in a collective fund with longevity-risk pooling over a fixed-rate annuity. This is because of the ability to include some investment in the risky asset, the ability to benefit from inter-temporal substitution and the ability to adaptively vary one’s strategy. In the face of systematic longevity risk, these advantages become more striking: hedging systematic longevity risk is extremely challenging for an annuity provider, whereas a collective fund can gradually vary consumption levels in response to new information about mortality.

An additional conclusion from our work is the need for better preference models. While Epstein-Zin preferences lead to tractable models, and they have been successful in solving asset pricing puzzles, the consumption strategies they produce are not always reasonable. The key issue is that for , investors are willing to accept little or no income in some years, while for individuals try to target an infinite income as they approach death. This is a result of the positive homogeneity of Epstein-Zin preferences. Hence, inhomogeneous optimization models that impose minimum consumption or adequacy levels (which every individual will need in retirement), are required.

Acknowledgments

JA and JD gratefully acknowledge funding from the Nuffield Foundation (grant FR-000024058).

References

- Bansal [2007] R. Bansal. Long-run risks and financial markets. Technical report, National Bureau of Economic Research Cambridge, Mass., USA, 2007.

- Bansal and Yaron [2004] R. Bansal and A. Yaron. Risks for the long run: A potential resolution of asset pricing puzzles. The Journal of Finance, 59(4):1481–1509, 2004.

- Benzoni et al. [2011] L. Benzoni, P. Collin-Dufresne, and R. S. Goldstein. Explaining asset pricing puzzles associated with the 1987 market crash. Journal of Financial Economics, 101(3):552–573, 2011.

- Bhamra et al. [2009] H. S. Bhamra, L.-A. Kuehn, and I. A. Strebulaev. The levered equity risk premium and credit spreads: A unified framework. The Review of Financial Studies, 23(2):645–703, 2009.

- Bhattacharya [1971] R. N. Bhattacharya. Rates of weak convergence and asymptotic expansions for classical central limit theorems. The Annals of Mathematical Statistics, pages 241–259, 1971.

- Boado-Penas et al. [2020] M. C. Boado-Penas, J. Eisenberg, A. Helmert, and P. Krühner. A new approach for satisfactory pensions with no guarantees. European Actuarial Journal, 10(1):3–21, 2020.

- Boon. et al. [2019] L.-N. Boon., M. Brière’., and B. Werker. Systematic longevity risk: to bear or to insure? Journal of Pension Economics and Finance, 27(1):127–158, 2019.

- Cairns et al. [2006] A. J. G. Cairns, D. Blake, and K. Dowd. A two-factor model for stochastic mortality with parameter uncertainty: Theory and calibration. The Journal of Risk and Insurane, 74(4):687–718, 2006.

- Campbell and Viceira [1999] J. Y. Campbell and L. M. Viceira. Consumption and portfolio decisions when expected returns are time varying. The Quarterly Journal of Economics, 114(2):433–495, 1999.

- Chen and Rach [2019] A. Chen and M. Rach. Options on tontines: An innovative way of combining tontines and annuities. Insurance: Mathematics and Economics, 89:182–192, 2019.

- Chen et al. [2019] A. Chen, M. Rach, and T. Sehner. On the optimal combination of annuities and tontines. Available at SSRN 3430546, 2019.

- Hall [1988] R. E. Hall. Intertemporal substitution in consumption. Journal of Political Economy, 96(2):339–357, 1988.

- Havranek et al. [2015] T. Havranek, R. Horvath, Z. Irsova, and M. Rusnak. Cross-country heterogeneity in intertemporal substitution. Journal of International Economics, 96(1):100–118, 2015.

- Herdegen et al. [2023] M. Herdegen, D. Hobson, and j. Jerome. The infinite-horizon investment–consumption problem for epstein–zin stochastic differential utility. i: Foundations. Finance and Stochastics, 27(1):127–158, 2023.

- Kraft et al. [2017] H. Kraft, T. Seiferling, and F. T. Seifried. Optimal consumption and investment with epstein–zin recursive utility. Finance and stochastics, 21(1):187–226, 2017.

- Lord. et al. [2014] G. J. Lord., C. E. Powell., and T. Shardlow. An Introduction to Computational Stochastic PDEs. Cambridge University Press, 2014.

- Merton [1969] R. C. Merton. Lifetime portfolio selection under uncertainty: The continuous-time case. The Review of Economics and Statistics, pages 247–257, 1969.

- Milevsky [2015] M. A. Milevsky. King William’s Tontine: why the retirement annuity of the future should resemble its past. Cambridge University Press, 2015.

- Milevsky and Salisbury [2015] M. A. Milevsky and T. S. Salisbury. Optimal retirement income tontines. Insurance: Mathematics and economics, 64:91–105, 2015.

- Mortality Projections Committee [2019] Mortality Projections Committee. Working paper 119. CMI mortality projections model: Cmi_2018. Technical report, Continuous Mortality Investigation, Institute and Faculty of Actuaries, 2019.

- Pham [2009] H. Pham. Continuous-time stochastic control and optimization with financial applications, volume 61. Springer Science & Business Media, 2009.

- Piggott et al. [2005] J. Piggott, E. A. Valdez, and B. Detzel. The simple analytics of a pooled annuity fund. Journal of Risk and Insurance, 72(3):497–520, 2005.

- Sabin [2010] M. J. Sabin. Fair tontine annuity. Available at SSRN 1579932, 2010.

- Stamos [2008] M. Z. Stamos. Optimal consumption and portfolio choice for pooled annuity funds. Insurance: Mathematics and Economics, 43(1):56–68, 2008.

- Stein and Shakarchi [2010] E. M. Stein and R. Shakarchi. Complex analysis, volume 2. Princeton University Press, 2010.

- Xing [2017] H. Xing. Consumption–investment optimization with Epstein–Zin utility in incomplete markets. Finance and Stochastics, 21(1):227–262, 2017.

Appendix A Proofs and technical appendices

A.1 The optimal control problem with no systematic longevity risk

From our assumption of non systematic longevity risk, we have independent identically distributed random variables representing the last time of consumption of individual . Write for the number of survivors at time , that is the number of individuals whose where . We will write down optimal control problems for both finite and infinite collectives.

Write for proportion of the fund invested in stock at time . Write for the value of the fund per survivor at time before consumption. Define if . Similarly, let denote the value of the fund per survivor after consumption. Note that at time points . At intermediate times, , obeys the SDE

with initial condition given by the budget equation

| (A.1) |

unless in which case we define to be zero on . Observe that this formula is based on our convention that an individual who dies at a time still consumes at that time and the corresponding convention for which ensures is measurable.

Let denote the space of admissible controls : that is -predictable processes such that and with . We define the value function of our problem starting at time to be

| (A.2) |

where is an Epstein–Zin utility function.

A.1.1 The cases and

To avoid notational complexity we consider separately the simple cases when and , leaving the case of general until Section A.1.2. We define to distinguish these cases as in equation (2.10).

We write so that the positive-homogeneity of implies that

| (A.3) |

We note that we have not yet shown whether is finite, but equation (A.3) can still be interpreted for infinite values of .

Let denote the consumption rate at time , so for an individual who is still alive at time . The budget equation (A.1) can then be written as

| (A.4) |

We now let be the set of random variables , representing the value of our investments at time , that can be obtained by a continuous time trading strategy with an initial budget given by (A.4) with . Thus is the set of admissible investment returns given the budget and the consumption.

The Markovianity of Epstein–Zin preferences and the definition of to compute allow us to apply the dynamic programming principle to compute

| (A.5) |

The second line follows from the first by the positive homogeneity of Epstein–Zin utility (A.3).

If , we may compute the value of

by solving the Merton problem for optimal investment over time period , with initial budget , no consumption, and terminal utility function .

We find

| (A.6) |

where

| (A.7) |

For details see Merton’s paper Merton [1969] or Pham [2009] equations (3.47) and (3.48). We find that is as given in equation (2.6) and moreover the proportion invested in stock is given by which is a constant determined entirely by and the market. In the case where we must instead compute

However, apart from the change of a to an everything is algebraically identical, so the same formulae emerge.

Putting the value (A.6) into our expression (A.5) for the value function we obtain

| (A.8) |

where the last line follows from the budget equation (A.4). We define

| (A.9) |

so that (A.8) may be written as

| (A.10) |

Differentiating the expression in square brackets on the right-hand side, we see that the supremum is achieved in equation (A.8) when , where satisfies

or, if this yields a negative value for , we should take . Simplifying we must have

| (A.11) |

So

| (A.12) |

This expression for is non-negative, so it always gives the argument for the supremum in (A.8). We obtain

We conclude that

| (A.13) |

where is given by equation (A.9). We observe also that equation (A.12) for the optimal consumption rate per survivor simplifies to (2.9).

This completes the proof of Theorem 2.2 in the cases and .

A.1.2 Finite funds

Let be the value function (A.2) for the optimal investment problem for individuals with homogeneous Epstein–Zin preferences. By positive homogeneity we may define , so that .

Let denote the event that both

-

(i)

there are survivors at time , i.e. .

-

(ii)

the individual whose utility we wish to calculate is one of those survivors, so .

Recall that denotes the value of the fund per survivor at time before consumption and mortality.

Hence

We now let be the set of random variables representing the value of the fund per survivor at time before consumption that can be obtained by a continuous time trading strategy given initial capital per survivor when . Using the dynamic programming principle we find

We used positive homogeneity to obtain the last line. The argument of Section A.1.1 tells us how to optimize over . Hence we find

where is as defined in equation (2.6). The optimal investment policy is also described in equation (2.5), and as before it depends only on the market and the monetary-risk-aversion parameter .

A.2 Distribution of consumption over time

Proof of Theorem 2.4.

We suppose as induction hypothesis that the distribution of is as described at time .

The budget equation (A.4) then tells us that the wealth per survivor after consumption, , satisfies

Hence

Our investment strategy from to is a continuous time trading strategy where we hold a fixed proportion of our wealth in stocks at all time. So, in the interval , satisfies the SDE

By Itô’s lemma we find

| (A.16) |

We deduce that conditioned on the value of will follow a normal distribution with mean and standard deviation . Moreover the random variable is independent of .

The sum of independent normally distributed random increments yields a new normally distributed random variable, and one can compute the mean and variance by adding the mean and variance of the increments. Hence

where

| (A.17) |

and

| (A.18) |

Solving the recursion (A.18) yields equation (2.12). The result for now follows by induction.

A.3 Proof of Theorem 2.3

Proving Theorem 2.3 requires some preliminary material. Our proof strategy will be to approximate an expectation involving the binomial distribution with a Gaussian integral which we can then estimate using Laplace’s method. To get a precise convergence result, we need some estimates on the rate of convergence in the Central Limit Theorem. The estimates given in Bhattacharya [1971] suit our purposes well. For the reader’s convenience we will summarize the result we will need.

We begin with some definitions. A random variable is said to satisfy Cramér’s condition if its characteristic function satisfies

| (A.19) |

for all positive . Let be the standard normal distribution. Given a set , and a function , is defined to equal

The set is the ball of radius around .

Let be the appropriately normalized -th partial sum of a sequence of independent identically distributed random variables for which Cramér’s condition holds and which have finite moments have all orders. Appropriately normalized means normalized such that the central limit theorem implies converges to in distribution. Then there exists a constant such that for any bounded measurable function

| (A.20) |

The full result given in Bhattacharya [1971] is more general and more precise than we need. Let us explain how the statements are related. We have simplified our statement to the one-dimensional case, we have assumed the are identically distributed and we have assumed all moments of exist. The statement in Bhattacharya [1971] is therefore more complex, and in particular involves additional terms called defined in the one-dimensional case by

where

Our assumptions on guarantee that is independent of and so we have been able to absorb these terms into the constant . In addition, our statement uses Theorem 1 of Bhattacharya [1971], together with remarks at the end of the second paragraph on page 242 about Cramér’s condition.

We are now ready to prove the desired convergence result.

Proof of Theorem 2.3.

We proceed by a backward induction on . The result is trivial for the case . We now assume the induction hypothesis

We wish to compute , but only the sum in the expression (2.7) is difficult to compute. We will call this sum , so

| (A.21) |

Heuristically, one can approximate with a Gaussian integral using the Central Limit Theorem and then apply Laplace’s method to compute the limit as . This motivates the idea of decomposing the sum above into a “left tail” for small values of , a central term for values of near the mean of the Binomial distribution , and a “right tail” for larger values of . We will in fact bound the tails separately (Steps 1 and 2, below), and then we will be able to rigorously apply a Central Limit Theorem argument to the central term (Step 3).

We compute

| (A.22) |

We note that

So we define an integer by

and then equation (A.22) will ensure that we have exponential decay of as decreases

| (A.23) |

Step 1. We can now estimate the left tail of (A.21). There exists a constants , such that

| (A.24) |

To estimate this term, we observe that

Hence by equations (A.22) and (A.24) we find

which decays exponentially as . Our induction hypothesis ensures that the are bounded, so we may safely conclude that

| (A.25) |

Step 2. We apply the same strategy to the right tail. This time we compute

we define

to ensure that

Repeating the same argument as for the left tail tells us that

| (A.26) |

We note that is monotonic in and that and tend to finite, non-zero limits as . We deduce that there exists a constant such that

| (A.27) |

This implies that

Using this together with our induction hypothesis, we may obtain from (A.26) that

| (A.28) |

Step 3. In order to apply the bound (A.20), we define a Bernoulli random variable which takes the value if the -th individual survives at time and otherwise. Thus is the probability that . We define scaled random variables of mean and standard deviation by

and so the appropriately scaled partial sum is given by

We now wish to rewrite (A.28) as an integral.

We make the substitution to find

| (A.29) |

We may rewrite this as

| (A.30) |

where

From our expressions for and one readily sees that tends to at a rate proportional to as . Likewise tends to at a rate as . We will assume that is large enough to ensure that .

Let us define by

| (A.31) |

By (A.27), is bounded by a constant independent of . Hence is bounded independent of . We can bound the derivative of inside the interval , independent of . Hence for any and for sufficiently large , for some constant independent of . It follows that

| (A.32) |

Since tends to at a rate proportional to , since is bounded, and since the normal distribution has super-exponential decay in the tails, we have

| (A.33) |

and similarly

| (A.34) |

Estimates (A.32), (A.33), (A.34) together with the bound on allow us to apply the Central Limit Theorem estimate (A.20) to (A.30). We note that Cramér’s condition holds. The result is

We now apply Laplace’s method to estimate this Gaussian integral (see Proposition 2.1, page 323 in Stein and Shakarchi [2010] ) and obtain

From the definition of in equation (2.7) and our definition of in (A.21) we obtain

We may now compare this with the definition of given in (A.9) for the infinitely collectivised case . We see that in this case

It now follows from the recursion relations for and (given in (A.13) and (2.8) respectively) together with our induction hypothesis that

This completes the induction step and the proof. ∎

Appendix B Systematic Longevity Risk

B.1 Justification for continuous-time aggregator

If an individual’s time of death is independent of the systematic factors, their discrete-time Epstein-Zin utility with mortality satisfies

where we have introduced a discounting rate so that . Rearranging we find

We define by requiring . The coefficient is there to ensure that the transform is monotone so that is a gain function that defines identical preferences to . So

Proceeding formally, we use l’Hôpital’s rule to find:

| (B.1) |

This then motivates the definition for the Epstein–Zin aggregator with mortality as a solution to the BSDE (3.2) will satisfy equation (B.1).

B.2 Computation of the HJB equation

We assume the value function is smooth and apply Itô’s lemma to obtain:

The dynamic programming principle tells us is a martingale for the optimal strategy and a supermartingale otherwise. Hence, we require the drift of to equal zero for the optimal strategy and be less than zero otherwise. Thus, our HJB equation is

B.3 The supremum of the value function for ill-posed problems

We now explain why our non-trivial analytical solution is complex for certain values of and , and what the value function must be in these cases, at least for . First, we return to our most general HJB equation (B.2). Here, we now take (which implies the quantity of the risky asset purchased is ), and let the consumption rate be proportional to wealth (as we should still have a symmetry of the HJB equation with respect to wealth), but otherwise unspecified, so that the supremum is not necessarily obtained. As for our ansatz, we let

| (B.5) |

The resulting HJB equation is the following algebraic expression

| (B.6) |

which has the trivial solution and

| (B.7) |

When and the longevity credit system is removed, this solution is always real. We now focus on the case with longevity credits, which can produce complex solutions. In order to get a real non-trivial value function, we must require

| (B.8) |

Checking this condition for all four sign combinations of and , we learn the following:

-

1.

In the top right quadrant, when , , so our consumption is unbounded. As , we see and hence (at least for finite wealth). As we see and hence (at least for finite wealth). A maximum can therefore be obtained and our analytic solution is meaningful.

-

2.

In the top left quadrant, when , , so our consumption is bounded from below. As , we see and hence (at least for finite wealth). As we see and hence (at least for finite wealth). The best we can do is obtain a value function of , which is possible since is a solution to (B.6) in this case.

-

3.

In the bottom left quadrant, when , , so our consumption is bounded from above. As , we see and hence (at least for finite wealth). As we see and hence (at least for finite wealth). A maximum can therefore be obtained and our analytic solution is meaningful.

- 4.

When and are non-zero, this picture is similar, but somewhat perturbed. For the specific case , we find non-trivial regions in the -plane where our analytical solution is complex (see Figure 3)

B.4 Continuous time CBD mortality model details

We consider a continuous time version of the two-factor Cairns-Blake-Dowd model, for which the underlying mortality effects are described by:

| (B.9) |

where

The parameter values used come from Cairns et al. [2006] equation (4). C is the upper triangular matrix from the Cholesky decomposition of V i.e.,

| (B.10) |

The process captures general improvements in mortality over time at all ages (and therefore trends downwards with time), while captures the fact mortality improvements have been greater at lower ages (and therefore trends upwards with time) Cairns et al. [2006].

We next define to be the survival probability at time , for a cohort of age at time , and

to be the probability of death at time . We assume , with essentially being a time dependent rate parameter for an exponential distribution. We therefore interpret as our mortality rate and have

| (B.11) |

We would next like to derive the SDE for , which is done by an application of Itô’s Lemma. In its current form, we obtain an SDE with a stochastic drift due to the term. This increases the dimension of the HJB equation from 2 to 3. For simplicity, we make the following modification. Note that the SDE for , is given by

| (B.12) |

where denotes the ’th component of (B.10) and is a new independent Brownian motion. To obtain a tractable problem, we define a new variable in (B.11), which satisfies the SDE

| (B.13) |

i.e., (B.12) with replaced by the solution of the ODE . This then yields a HJB equation dependent on and only. Looking at Figure 1 in Cairns et al. [2006], we choose .

The impact of this simplification (i.e. the difference between simulating (B.12) and (B.13)) is a lower mortality rate at older ages. Looking at Figure 7, there is little difference in the mortality rates up to age 80. The difference only becomes notable from age 90 onwards, by which point the prediction of either model becomes less meaningful.

B.5 Numerical approach for solving the CBD problem

We solve the HJB equation for the CBD model using the Crank-Nicolson scheme, along with an improved Euler step to generate the first estimate of the solution at each time step. We set to be the starting age of our simulations. corresponds to a survival probability of 0.99 at retirement age, while yields a survival probability of , so that all individuals are almost surely dead at this point. We are therefore interested in the solution for .

The value of the solution at the boundaries is not obvious a priori. As such, we enforce Neumann boundary conditions at the ends of our domain and extend our computational domain to to minimise the impact of the boundary conditions on the solution for , the points of interest. We expect as and as . Because of this expected behaviour, we take advantage of two transformations: (i) we use the change of variables and (ii) solve the HJB equation for . We first solve the riskless equation as it only requires one boundary condition plus the payoff. Using the stylised model as a guide, we expect to be a rough approximation to the solution. Taking into account our transformations, we therefore enforce

With the risk-less solution obtained, we solve the full HJB equation with

and

where the derivatives are approximated using backward and forward difference approximations respectively.

Again, informed by (3.11) from the stylised model, we take our payoff at the final time , to be

which should be a rough approximation to the correct payoff. Since this is an approximation, we would like to minimise its impact on the solution. We therefore run our numerical scheme back from time (which corresponds to age 215). Our computational domain for extends to , and in a deterministic setting (i.e., the volatility is zero in (3.13)) the simulated value of is approximately 20 at age 215, hence the choice. This time is far longer than is required for all individuals to die (our simulations suggest everyone will be dead by age 120 (see Figure 4) (b)) and therefore achieves our aim of minimising the payoff’s impact

We would also like to generate typical wealth and consumption streams for a fund that behaves optimally. This can be done as follows. Having obtained the numerical solution to (3.6), it is not difficult to find constants such that . This can then be used to approximate in (B.3). Along with given by (B.4), this can be feed into (3.4). We can then simulate this approximation to (3.4) using the Euler-Maruyama method Lord. et al. [2014].