A nonparametric test for rough volatility††thanks: We would like to thank Torben G. Andersen, Federico M. Bandi, Markus Bibinger, Tim Bollerslev, Dachuan Chen, Rama Cont, Yi Ding, Masaaki Fukasawa, Jean Jacod, Z. Merrick Li, Nour Meddahi, Per Mykland, Yingying Li, Mark Podolskij, Eric Renault, Roberto Renò (discussant), Mathieu Rosenbaum, Neil Shephard, Shuping Shi, George Tauchen, Jun Yu, Xinghua Zheng and participants at various conferences and seminars for their helpful comments and suggestions. An earlier version of the manuscript was circulated under the title “The Fine Structure of Volatility Dynamics.”

Abstract

We develop a nonparametric test for deciding whether volatility of an asset follows a standard semimartingale process, with paths of finite quadratic variation, or a rough process with paths of infinite quadratic variation. The test utilizes the fact that volatility is rough if and only if volatility increments are negatively autocorrelated at high frequencies. It is based on the sample autocovariance of increments of spot volatility estimates computed from high-frequency asset return data. By showing a feasible CLT for this statistic under the null hypothesis of semimartingale volatility paths, we construct a test with fixed asymptotic size and an asymptotic power equal to one. The test is derived under very general conditions for the data-generating process. In particular, it is robust to jumps with arbitrary activity and to the presence of market microstructure noise. In an application of the test to SPY high-frequency data, we find evidence for rough volatility.

AMS Classification: Primary: 62G10, 62G20, 62G35; secondary: 62M99, 91B84

Keywords: fractional Brownian motion; high-frequency data; Itô semimartingale; characteristic function; nonparametric test; rough volatility.

1 Introduction

Most economic and financial time series exhibit time-varying volatility. The standard way of modeling volatility in continuous time is via stochastic integrals driven by Brownian motions and/or Lévy jumps, see e.g., the review articles of Ghysels et al. (1996) and Shephard and Andersen (2009). This way of modeling volatility implies that, while volatility paths can exhibit discontinuities, they nevertheless remain smooth in squared mean and have finite quadratic variations in particular. An alternative way of modeling volatility, which has gained significant popularity recently, is via stochastic integrals driven by a fractional Brownian motion, see Comte and Renault (1996, 1998) and the more recent work of Gatheral et al. (2018). In this case, volatility paths can be very rough, with a lot of oscillations at short time scales leading to an explosive quadratic variation.

Naturally, the degree of roughness of volatility (controlled by the Hurst parameter of the driving fractional Brownian motion) determines the optimal rate of convergence of nonparametric spot estimators of volatility, with the latter dropping to zero as the degree of roughness increases. In fact, many of the tools developed for the analysis of high-frequency data, see e.g., Jacod and Protter (2012), depend critically on volatility being a semimartingale process. The goal of this paper, therefore, is to develop a general nonparametric test to decide whether volatility is a standard semimartingale with a finite quadratic variation or is a rough process with infinite quadratic variation.

If volatility were directly observable, it would be relatively easy to design such a test based on variance ratios. For example, if one were to observe volatility at high frequency, then one way of testing for roughness of volatility would be by assessing the scaling of the quadratic variation of the discretized volatility process computed at different frequencies, see e.g., Barndorff-Nielsen et al. (2011). Volatility is of course not directly observable, and testing for rough volatility is significantly more challenging when using high-frequency observations of the underlying process only. This is mainly for three reasons.

First, spot volatility estimates contain nontrivial estimation errors. As noted by Cont and Das (2024), this error can make the volatility estimates appear rough even if the true volatility process is not. Therefore, rough volatility, that is, the roughness of unobserved spot volatility, has to be distinguished from the roughness of volatility estimates such as realized variance (as studied by e.g., Wang et al. (2023)). Second, rough volatility will result in larger increments of spot volatility estimates, but bigger in size increments can be also due to jumps in volatility, which are well documented in practice; see e.g., Jacod and Todorov (2010), Todorov and Tauchen (2011) and Bandi and Renò (2016). Third, infinite activity jumps in the price process, see e.g., Aït-Sahalia and Jacod (2011), and microstructure noise in the price observations, see e.g., Hansen and Lunde (2006), further make it difficult to estimate volatility in the first place. In fact, as shown in Jacod and Reiß (2014), the optimal nonparametric rate for estimating volatility from high-frequency data in the presence of jumps depends on the degree of jump activity, with the rate becoming significantly worse (and approaching zero) for higher degree of jump activity. At the same time, the presence of market microstructure noise in observed prices further slows down the rate at which volatility can be estimated, making it difficult to evaluate its behavior over small time scales. For example, the optimal rate of convergence for estimating integrated volatility from noisy observations is compared to in the noise-free setting (Reiß (2011)). While several recent works have proposed solutions to the latency of volatility when estimating volatility roughness (see e.g., Bennedsen et al. (2022), Fukasawa et al. (2022), Bolko et al. (2023), Chong et al. (2024a, b) and Szymanski (2024)), a robust statistical theory for rough volatility that takes into account price jumps, volatility jumps and microstructure noise on top of estimation errors has been notably absent.

In this paper we show that, in spite of the poor rate of estimating volatility in the presence of jumps with high jump activity and market microstructure noise, one can nevertheless test for volatility roughness, with the properties of the test unaffected by the degree of jump activity and the presence of microstructure noise. We achieve this by relying on a second—equivalent—characterization of rough volatility in terms of the autocorrelation of its increments. Mainly, volatility is rough if and only if changes in volatility are negatively correlated at high frequency (Theorem 3.1). By contrast, high-frequency volatility increments in semimartingale volatility models are asymptotically uncorrelated, as they are locally dominated by the martingale component of volatility. Note that rough volatility concerns the negative correlation of volatility moves on short time scales only and has no implication for the long range behavior of volatility. Therefore, rough volatility models are compatible with the well-documented long memory of volatility (Andersen et al. (2003)), see Remark 2.

More specifically, we propose a test based on the sample autocovariance of increments of spot volatility estimates. The spot volatility estimates are constructed from the empirical characteristic function of price increments in local blocks of high-frequency data. By choosing values of the characteristic exponent away from zero, we mitigate the impact of finite variation jumps on the spot volatility estimators. While the latter still contain non-negligible biases due to the infinite variation jumps and microstructure noise, these biases have increments that are asymptotically uncorrelated across different blocks.

Therefore, even in the presence of jumps, noise and estimation errors, the first-order autocovariance of increments of spot volatility estimates—computed over non-overlapping blocks—should be zero asymptotically if volatility follows a standard semimartingale process. On the other hand, after appropriately scaling down the sample autocovariance, it converges to a strictly negative number when volatility is rough. The resulting test statistic is a self-normalized quantity which converges to a standard normal random variable under the null hypothesis of semimartingale volatility and diverges to negative infinity under the rough volatility alternative hypothesis (Theorems 3.2 and 3.3).

The rest of the paper is organized as follows. We start with introducing our setup in Section 2. The theoretical development of the test is given in Section 3 and its finite sample properties are evaluated in Section 4. Section 5 contains our empirical application. Section 6 concludes. The proofs are given in Appendix A with technical details deferred to Appendix B in the supplement (Chong and Todorov (2024)).

2 Model Setup

We denote the logarithmic asset price by . We assume that is defined on a filtered probability space , with the following Itô semimartingale dynamics:

| (2.1) |

where is an -measurable random variable, is a standard -Brownian motion, is an -Poisson random measure on with intensity measure , and is a -finite measure on an auxiliary space . The drift is a locally bounded predictable process, while and are predictable functions such that the integrals in (2.1) are well defined. We think of and as modeling infinite variation and finite variation jumps, respectively, rather than modeling small and big jumps. This distinction is important because our assumptions on the two below will differ. In particular, if has only finite variation jumps, we can and should take .

The goal of this paper is to develop a statistical test for the fine structure of the spot (diffusive) variance, . More precisely, our goal is to develop a nonparametric test to decide whether the realized path is the path of a semimartingale process or whether it is rough in the following sense:

Definition 1.

We say that a function is rough if

| (2.2) |

for some . We say that a sequence converges subsequentially to a limit , denoted by , if for every subsequence there is another subsequence such that as . Moreover, in (2.2), we use the convention and define for and for .

To paraphrase, a function is rough if the realized variance of computed with twice the original step size, , is only a fraction of the realized variance of computed with the original step size, . This notion of roughness is model-free, with a smaller value of indicating less regular sample paths of . The reason we use a subsequential criterion in (2.2), instead ordinary convergence to , is to make this definition more suitable for examining the roughness of a path of a stochastic process . Indeed, in this case, proving convergence in probability in (2.2) is sufficient to deduce the almost sure roughness of the sample paths of . With ordinary convergence in (2.2), one would have to show almost sure convergence of the realized variance of , which is usually quite involved or even unknown (e.g., if is a general continuous martingale).

It is easy to see that the limit in (2.2), if it exists, must satisfy in all cases, and that we have if is continuously differentiable. If has a finite and non-zero quadratic variation (e.g., if is the path of a semimartingale with a non-zero local martingale part), we have . If is the path of a pure-jump process, then if there is no jump on (in which case, is a constant); otherwise, there is at least one jump on and we have . Therefore, the paths of a pure-jump process are almost surely not rough according to our definition. If is the path of a fractional Brownian motion with Hurst parameter , then we have and is rough precisely when .

With this definition, we can now introduce the null and alternative hypotheses we wish to test:

| (2.3) |

where is some fixed number.

Remark 1.

There are other notions of roughness in the literature; see e.g., Cont and Das (2024) and Han and Schied (2024). These definitions are based on -variations for different values of and produce the same ranking as Definition 1 when used to compare the roughness of continuous processes (for discontinuous processes, there are some differences). The main reason we use Definition 1 in this paper is because, as we show in Theorems 3.1–3.3 below, Definition 1 admits a statistical implementation that is robust to estimation errors, jumps and microstructure noise.

Remark 2.

Roughness in the sense of Definition 1 is a local property and is independent of the behavior of the underlying process as . In particular, if is a stationary process, roughness is unrelated to the short- or long-memory properties of , which are usually defined in terms of the decay of its autocorrelation function as . As we show in Theorem 3.1 below, roughness in fact is related to the autocorrelation of the increments of as the sampling frequency increases but with the length of the time interval kept fixed. Of course, in parametric models, it can happen that roughness and long/short memory properties are parametrized by a single parameter. This is, for instance, the case with models based on fractional Brownian motion, where depending on whether the Hurst parameter is smaller or bigger than , one has either roughness and short memory or no roughness and long memory. The need to separate roughness on the one hand and short versus long memory on the other hand has been recognized in previous work already; see Bennedsen et al. (2022) and Liu et al. (2020).

For our theoretical analysis, we need to impose some mild structural assumptions on (and other coefficients in (2.1)) under both and , as detailed in the following two subsections. We note that and do not exhaust the whole model space; e.g., could have a finite (possibly zero) quadratic variation without being a semimartingale process. For such a model for , we have in (2.2) and in that sense such a specification implies smoother volatility paths than our null hypothesis. As we explain in Remark 5 below, such very smooth volatility models are not going to be rejected by our test.

Also, to keep the exposition simple, in our detailed formulation of the null and alternative hypotheses, we assume that is either a semimartingale process (with paths that are almost surely not rough) or a rough process (with paths that are rough almost surely). These hypotheses, and the subsequent results, can be easily extended to the case where is a semimartingale path on one subset of and rough on another.

2.1 The Null Hypothesis

Under , we further assume that is an Itô semimartingale process given by

| (2.4) |

where is a standard -Brownian motion that is independent of , is -measurable and the requirements for the coefficients of will be given later. All continuous-time stochastic volatility models that are solutions to stochastic differential equations are of this form, and (2.4) is a frequent assumption in the financial econometrics literature, see e.g., Assumption (K-) in Aït-Sahalia and Jacod (2014) and Jacod and Protter (2012). In particular, can have jumps and is nowhere differentiable in the presence of a diffusive component. Nevertheless, volatility is smooth in squared mean in the following sense: There exists a sequence of stopping times increasing to infinity such that for all ,

| (2.5) |

In addition, we need similar structural assumptions on the infinite variation jumps of . More precisely, we assume that , for every , is a complex-valued Itô semimartingale of the form

| (2.6) |

where and are independent standard -Brownian motions (jointly Gaussian with and possibly dependent on and ) and the coefficients of may be complex-valued.

If is a deterministic function, is simply the spot log-characteristic function of the infinite variation jump part of . Condition (2.6) is a rather mild condition and is satisfied, for example, if has the same infinite variation jumps as , where is an Itô semimartingale and is a time-changed Lévy process with the time change being also an Itô semimartingale, see Example 1 below. This situation covers the vast majority of parametric jump models considered in the literature. A condition like (2.6) is needed in order to safeguard our test against the worst-case scenario (which is possible in theory but perhaps less relevant in practice) where price jumps are of infinite variation and their intensity is much rougher than diffusive volatility. The null hypothesis does cover situations where has infinite variation jumps with non-rough intensity and/or finite variation jumps with arbitrary degree of roughness.

Our assumption for the process under the null hypothesis is given by:

Assumption H0.

We assume the following conditions under the null hypothesis:

- (i)

-

(ii)

There exist a sequence of stopping times increasing to infinity almost surely and nonnegative measurable functions satisfying for all such that whenever , we have

(2.7) -

(iii)

For any compact subset , the process

(2.8) is locally bounded, while the processes

(2.9) (2.10) converge uniformly on compacts in probability to as . Finally, for any , there are constants such that as and

(2.11) for all and .

The conditions on the coefficients of , and are only slightly stronger than requiring them to be Itô semimartingales. In particular, all three processes are allowed to have jumps of arbitrary activity. The following example shows that the assumptions on are mild indeed.

2.2 The Alternative Hypothesis

Under the alternative hypothesis, the stochastic volatility process ceases to be a semimartingale and is given by a rough process with a low degree of regularity. More precisely, we assume under the alternative hypothesis that

| (2.13) |

is -measurable and is a -function. The kernel has the semiparametric form

| (2.14) |

where , if and otherwise, and with . The normalization constant is chosen such that in the case , and , we have as for any . The specification in (2.13) contains the rough volatility models considered in Gatheral et al. (2018), Bennedsen et al. (2022) and Wang et al. (2023) as special cases.

Since and has the same behavior as the fractional kernel at , the process has the same small time scale behavior, and thus the same degree of roughness, as a fractional Brownian motion with Hurst parameter . However, due to the presence of , there are no restrictions on the asymptotic behavior of and hence of as . In particular, can have short-memory behavior or long-memory behavior. As explained in Remark 2, the separation of roughness and memory properties of has been found important in practice; see Bennedsen et al. (2022) and Liu et al. (2020). In addition to a fractional component, may also have a regular part , which can include a (possibly discontinuous) semimartingale component.

We can compare the smoothness of under the alternative hypothesis with that under the null hypothesis. We have the following result for in (2.13): There exists a sequence of stopping times increasing to infinity such that for all ,

| (2.15) |

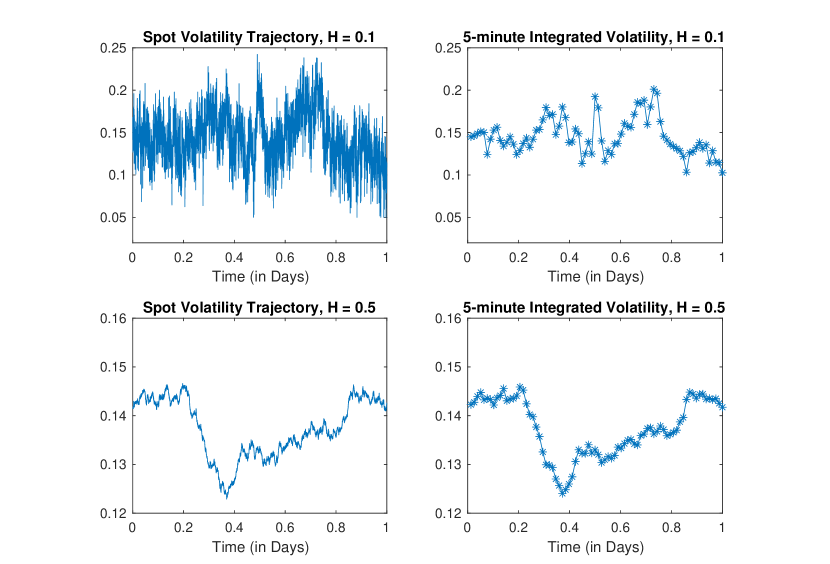

In particular, (2.15) is not differentiable at . This leads to paths of of infinite quadratic variation. The parameter governs the roughness of the volatility path, with lower values corresponding to rougher volatility dynamics. The limiting case corresponds to the standard semimartingale volatility model under the null hypothesis. Figure 1 below visualizes the difference between a rough volatility path and a semimartingale volatility path.

Our assumption for the process under the alternative hypothesis is given by:

Assumption H1.

We have the following setup under the alternative hypothesis:

- (i)

-

(ii)

There exist stopping times increasing to infinity almost surely and nonnegative measurable functions satisfying for all such that whenever , we have

(2.16) -

(iii)

For any compact subset of , the process

(2.17) is locally bounded. Moreover, for any , there is such that

(2.18) (2.19) (2.20) for all and some satisfying as .

Due to Condition (2.18), can be any predictable process that is marginally smoother than . In particular, can be another fractional process with or an Itô semimartingale (possibly with jumps) or a combination thereof.

Example 2.

Consider the same setting as in Example 1, except that and can be any predictable locally bounded process satisfying

| (2.21) |

for all and where and are as in Assumption H1. Then, we still have (2.12) and both (2.17) and (2.19) are satisfied. This is shown in Lemma A.6. In particular, this example covers the case where for some -function .

3 Testing for Rough Volatility

If volatility were directly observable, testing for rough volatility would be a straightforward matter based on the variance ratio in (2.2); see Barndorff-Nielsen et al. (2011). Due to the latency of volatility, however, examining the realized variance of spot volatility estimates at different frequencies is problematic as a testing strategy, as estimation errors can produce spurious roughness and jumps in price and volatility as well as microstructure noise in the data can lead to significant biases. To avoid such complications, we base our test on an equivalent—but more robust—characterization of rough functions.

To this end, we expand the square in the numerator of (2.2) and obtain

in the case where . Recognizing the last term as the first-order sample autocorrelation of the increments of , we conclude that is rough precisely when its increments are negatively correlated at high frequency.

Theorem 3.1.

With this insight, we construct a rough volatility test based on the sample autocovariance of increments of spot volatility estimates. Such a covariance-based test has one important advantage over tests relying on variances or -variations with different values of . Mainly, while statistical errors in estimating spot volatility and biases from jumps and microstructure noise can heavily distort variance or -variation estimates, they remain largely uncorrelated across non-overlapping blocks of data and, as a result, have a much smaller impact on autocovariances. For example, our test achieves robustness to jumps and microstructure noise without any procedure to remove them.

3.1 Formulation of the Test

We assume that we have high-frequency observations of the log-asset price process at time points up to time , where as and , the number of trading days, is fixed. We split the data into blocks of increments, where is a positive integer increasing to infinity. Our test statistic is based on estimating spot log-variance (i.e., ) on each of the blocks and then computing the first-order autocovariance of the increments of these volatility estimates. More specifically, following Jacod and Todorov (2014) and Liu et al. (2018), we estimate the spot variance using the local empirical characteristic function of the price increments within each block. These local volatility estimators are given by

| (3.2) |

for , some and some . For a generic process , we write . If , we have time gaps between the blocks used in computing successive . This is done to minimize the impact from potential dependent market microstructure noise in the observed price on the statistic, see Section 3.3 below.

Denoting , we next form increments between blocks, that is, . We further difference between consecutive days and denote this difference by

| (3.3) |

To simplify notation, we assume that and are both even integers. In this case, is the number of blocks within one trading day, which is asymptotically increasing. The differencing across days is done to mitigate the effect on the statistic from the presence of a potentially erratic periodic intraday volatility pattern, which can be quite pronounced as previous studies have found (see e.g., Wood et al. (1985); Harris (1986); Andersen et al. (2024)). Indeed, if volatility is a product of a deterministic function of time of the trading day and a regular stochastic semimartingale, then the intraday periodic component of volatility gets canceled out in the asymptotic limit of . Importantly, the daily differencing in (3.3) has no impact on the power of the test.

Our test statistic is then based on the sample autocovariance of . More specifically, it is given by

| (3.4) |

where . This choice of avoids including the covariance between the last volatility increment of a trading day and the first one on the next trading day. This way, the summands in the numerator of are asymptotically uncorrelated under the null hypothesis and this makes the construction of a feasible estimator of the asymptotic variance straightforward.

We note that one can easily derive the asymptotic distribution for higher-order sample autocovariances and include them in the formulation of the test as they should be all asymptotically zero under the null hypothesis and all asymptotically negative under the alternative hypothesis. We do not do this here because one can show that the first-order autocovariance is typically much higher in magnitude than the higher-order ones under the alternative hypothesis.

The arguments of the empirical characteristic functions used in are chosen in a data-driven way using information from preceding blocks. Their specification is given in the following assumption:

Assumption U.

We have

| (3.5) |

where and is an -measurable random variable with the following properties: There is an adapted and stochastically continuous process such that almost surely for all and, for every ,

| (3.6) |

as , where is the sequence of stopping times from Assumption H0 or H1. Moreover, for every , there is are constants such that

| (3.7) |

3.2 Asymptotic Behavior of the Test

Let and use to denote -stable convergence in law, see page 512 of Jacod and Shiryaev (2003) for the definition. The following theorem characterizes the asymptotic behavior of under the null and alternative hypotheses.

Theorem 3.2.

Suppose that

| (3.10) |

and consider the test statistic as defined in (3.4), where satisfies Assumption U.

-

(i)

Under the null hypothesis set forth in Assumption H0, we have

(3.11) -

(ii)

Under the alternative hypothesis set forth in Assumption H1, we have

(3.12)

In particular, a test with critical region

| (3.13) |

where is the cumulative distribution function of the standard normal distribution, has asymptotic size under Assumption H0 and is consistent under Assumption H1.

The requirements for the number of elements in a block, , in (3.10) is a standard condition that essentially balances asymptotic bias and variance in the spot volatility estimation. The limit behavior of the statistic under the null hypothesis is driven by the diffusive component of . While infinite variation jumps are of higher asymptotic order, they can nevertheless have nontrivial effect in finite samples. The estimates of the asymptotic standard error of the autocovariance used in should automatically account for such higher order terms. Therefore, we expect good finite sample behavior of the test statistic even in situations with high jump activity. We confirm this in the Monte Carlo study in Section 4. This is not the case for nonparametric estimates of diffusive volatility, which are known to have poor properties in the presence of infinite variation jumps. Finally, the rate of divergence of the statistic under the alternative hypothesis is determined by the length of the interval over which local volatility estimates are formed.

3.3 Robustness to Microstructure Noise

Volatility estimators such as realized variance can be severely impacted by microstructure noise in observed asset prices. By contrast, we show in this section that the test statistic from (3.4) is naturally robust to many forms of microstructure noise considered in the literature, without the need to employ classical noise-reduction techniques such as two-scale estimation (Zhang et al. (2005)), realized kernels (Barndorff-Nielsen et al. (2008)) or pre-averaging (Jacod et al. (2009)). The reason for this is similar to that for the robustness towards infinite variation jumps. Mainly, the contribution of the noise to the empirical characteristic function gets canceled out in the differencing of the consecutive volatility estimates in .

Assumption H.

The observed log-prices are given by

| (3.14) |

where the latent efficient price follows (2.1) and satisfies Assumption H0, while the noise variables are of the form

| (3.15) |

Here, determines the size of the noise, is an adapted locally bounded process and is a strictly stationary -dependent sequence of random variables (for some ), independent of and with mean , variance and finite moments of all orders.

-

(i)

If , we further assume that is an Itô semimartingale of the form

(3.16) where is a standard -Brownian motion that is independent of (and jointly Gaussian and potentially correlated with , and ), is an -measurable random variable, , and are locally bounded adapted processes and and are predictable functions. Moreover, as , the process converges uniformly on compacts in probability to and we have whenever (where is the localizing sequence from Assumption H0).

- (ii)

Assumption H.

We have (3.14), where satisfies Assumption H1 and the noise variables satisfy (3.15), where , and have the properties listed in the sentence immediately after (3.15).

-

(i)

If , we further assume that

(3.18) where is a -function, is -measurable and for some and with . Moreover, is a standard -Brownian motion that is independent of and and jointly Gaussian (and possibly correlated) with , and . The processes , , and are adapted and locally bounded, and for any (and with as in H0 and and as in H1), we have

(3.19) (3.20) -

(ii)

If or if in Assumption U′ below, we have as for some .

-

(iii)

If and , then almost surely for all . If and , then almost surely for all , where

and .

We consider the case when the noise is asymptotically shrinking () and when this is not the case (). Naturally, the requirements for the process are somewhat stronger for lower values of (which correspond to asymptotically bigger noise). A typical example where the conditions on are met, irrespective of the size of the noise, is when is a function of volatility, in which case we have and . Given prior evidence for a strong relationship between noise intensity and volatility, this is also the empirically relevant case.

To test H against H, we use the same test statistic from (3.4) as before, except that now

| (3.21) |

which uses the observed prices instead of the latent efficient price . We do not change the notation of , , and to reflect the fact that (3.2) is a special case of (3.21), namely when microstructure noise is absent. More importantly, in practice, one does not have to know or decide whether noise is present or not. We do have to adjust Assumption U in the presence of noise:

Assumption U′.

Theorem 3.3.

Suppose that Assumption U′ is satisfied. If

| (3.22) |

then the behavior of the test statistic remains the same as described in (3.11) or (3.12) depending on whether we have, respectively, Assumption H or H. A test based on the critical region (3.13) has asymptotic size under Assumption H and is consistent under H.

The rate conditions in (3.22) are slightly stronger than those in (3.10) corresponding to the case of no market microstructure noise. In particular, the last condition in (3.22) is necessary to avoid the noise having an asymptotic effect on the statistic. Since one does not typically know a priori the degree of dependence in the noise, it is better to pick slightly above one.

In the noisy case, we need if . The consequence of that is that we only need to assess the characteristic function of the noise for values of the exponent around zero. Setting in Theorem 3.3, we can verify that Theorem 3.2 remains true even if we choose (subject to (3.22) and the strengthened conditions for ). Similarly, as shown in Lemma A.7, Example 3 can be extended to the noisy case with , where . Importantly from an applied point of view, in order to implement the test, we do not need to decide whether microstructure noise is present or not (or know the value of ).

Finally, the rate of convergence of the statistic is determined either by the noise or by the diffusive component of the price. This depends on the value of , i.e., on how big in asymptotic sense the noise is. The user does not need to know this in implementing the test.

Remark 3.

Remark 4.

As Li et al. (2022) and Shi and Yu (2023) show, there is a weak identification issue in estimating discrete-time rough volatility models. For example, within the class of ARFIMA models, it is asymptotically impossible to distinguish a near-stationary long-memory model from a rough model with near unit root dynamics. As our theoretical analysis shows, this weak identification issue is a feature of discrete-time volatility models only. In fact, roughness of a function is intrinsically a continuous-time concept and one can achieve identification of the roughness of the volatility path by considering an infill asymptotic setting. Therefore, our test can identify rough volatility irrespective of whether volatility has short or long memory behavior.

Remark 5.

As we mentioned above, the hypotheses and in (2.3) encompass most continuous-time volatility models considered in prior work. That said, there are specifications for that do not belong to either or . The most notable such specification is one in which is a non-semimartingale process with finite quadratic variation. This is for instance the case if is a fractional process of the form (2.13) but with in (2.14) (and if there is noise). In this case, the volatility paths will have zero quadratic variation and the high-frequency increments of volatility will have positive autocorrelations. In fact, denoting , one can show that if , then . This is because the positive autocovariance of volatility (or noise intensity) increments dominates in this case. If , then estimation errors dominate and we have . In summary, the asymptotic rejection rate of a one-sided test based on the critical region in (3.13) will not exceed the nominal significance level under such very smooth specification for . As we do not observe any significant positive values of the test statistic in the empirical application, we omit a formal proof of the aforementioned fact.

4 Monte Carlo Study

In this section, we evaluate the performance of the test on simulated data.

4.1 Setup

We use the following model for :

| (4.1) |

where is a standard Brownian motion, is an integer-valued random measure counting the jumps in with compensator measure and is given by

| (4.2) |

The volatility under the null hypothesis (corresponding to ) follows the standard Heston model:

| (4.3) |

where is a Brownian motion with . The volatility under the alternative hypothesis follows the rough Heston model of Jaisson and Rosenbaum (2016):

| (4.4) |

where again is a Brownian motion with .

In the above specification of , we allow both for stochastic volatility, which can exhibit rough dynamics, and jumps. The jumps are modeled as a time-changed tempered stable process, with the time change determined by the diffusive volatility as in Duffie et al. (2000). This is consistent with earlier empirical evidence for jump clustering. The parameters and control the behavior of the big and small jumps, respectively. In particular, coincides with the Blumenthal–Getoor index of controlling the degree of jump activity. We fix the value of throughout and consider different values of . For given and , we set the value of the scale parameter to

| (4.5) |

With this choice of , we have , which is roughly consistent with earlier nonparametric evidence regarding the contribution of jumps to asset price variance.

Turning next to the specification of the volatility dynamics, we set the mean of the diffusive variance to (unit of time corresponds to one year) and the mean reversion parameter to , which corresponds approximately to half-life of a shock to volatility of one month. The volatility of volatility parameter in the Heston model is set to (recall that the Feller condition puts an upper bound on of ). We then set the value of for the different rough specifications (i.e., for the different values of ) so that the unconditional second moment of is the same across all models.

Finally, we assume that the observed log-price is contaminated with noise, i.e., instead of observing , we observe

| (4.6) |

where is an i.i.d. sequence of standard normal random variables defined on a product extension of the sample probability space and independent from . We set . The value corresponds to the median of the ratio of daily realized volatility from five-second returns over the daily realized volatility from five-minute returns in the data set used in the empirical application. The numbers and correspond, respectively, to the number of five-second and five-minute returns for our daily estimation window, see the discussion below for our sampling scheme. The above calibration of the noise parameter is based on the fact that in our model, the ratio of daily realized variances at five seconds versus five minutes is approximately equal to , with a business time convention of trading days per year (which we use as our unit of time here).

The parameter values for all specifications used in the Monte Carlo are given in Table 1. We consider two different values of the Blumenthal–Getoor index: one corresponds to finite variation jumps () and one to infinite variation jumps (). For the volatility specification, we consider three values of the roughness parameter: (this is the standard Heston model), and , with the first value corresponding to the null hypothesis and the last two to the alternative hypothesis. Recall that lower values of imply rougher volatility paths and the rough volatility literature argues for value of around (Gatheral et al. (2018)).

| Case | Variance Parameters | Jump Parameters | Noise Parameter | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| V1-J1 | |||||||||||

| V1-J2 | |||||||||||

| V2-J1 | |||||||||||

| V2-J2 | |||||||||||

| V3-J2 | |||||||||||

| V3-J2 | |||||||||||

We simulate all models using a standard Euler scheme. Since the rough volatility models are non-Markovian and because the asymptotic distribution of the test statistic is determined by the Brownian motion driving the price , we independently generate blocks of seven days of daily high-frequency data in order to save computational time. The first five days are used for determining the value of the characteristic exponent on the last two days as will become clear below. For each independent block of data we then keep the products of the differenced volatility increments over the last day.

The starting value of volatility is set to its unconditional mean. The sampling frequency is five seconds. As a result, on each day, we have five-second price increments in a hour trading day. This matches exactly the number of high-frequency daily observations in our empirical application. To further match what we do in the application, we drop the first minutes on each day in the Monte Carlo. This leads to a total of five-second return observations per day that we use in the construction of the test.

In the top left panel of Figure 1, we plot a simulated path from the rough volatility specification V1-J1 with over one day. One can clearly notice the sizable short-term oscillations of the spot volatility which is due to the roughness of the volatility path. In the top right panel of Figure 1, we display the integrated volatility over intervals of five minutes. Our local volatility estimators can be thought of as estimators of such integrated volatilities over short windows. The oscillations in the five-minute integrated volatility series are much smaller than in the spot volatility one. This is not surprising and illustrates the difficulty of the testing problem at hand. Nevertheless, even when volatility is integrated to five-minute intervals, one can notice frequent short-term volatility reversals. These reversals lead to negative autocorrelation in the first difference of the five-minute integrated volatility and will effectively provide the power of our test.

In the bottom panels of Figure 1, we plot the spot and five-minute integrated volatilities for a simulation from the specification V3-J1, which corresponds to the null hypothesis with . The oscillations in spot volatility are now orders of magnitude smaller. Furthermore, the five-minute integrated volatility from specification V3-J1 does not exhibit any distinguishable short-term reversals.

The contrast between the spot volatility and the integrated volatility in the two top panels of Figure 1 further illustrate the difficulty of estimating spot volatility in a rough setting. For example, the relative absolute bias of five-minute integrated volatility as a proxy for the spot volatility at the beginning of the interval is around 20% in scenario V1-J1 (corresponding to ) and only 1% in scenario V3-J1 (corresponding to ).

We finish this section with explaining our choice of tuning parameters. For computing the statistic, we use a block size of , which leads to blocks per day. On each local block, we use the first four minutes to estimate volatility, i.e., we set . This implies a one-minute gap between blocks of increments used in computing the empirical characteristic functions. Finally, for each day, the characteristic exponent parameter is set to

| (4.7) |

and the data dependent scale parameter is set to

| (4.8) |

where correspond to the indices of the blocks of increments over the past five trading days covering the same time of day as the -th and -th blocks. (Extending Example 3 to the case where gaps are permitted, one can easily show that this specification of satisfies Assumptions U and U′.) With this choice of tuning parameters, has a norm of approximately . We experiment with three different values of of , and . These correspond to , and , respectively.

4.2 Results

The Monte Carlo results are reported in Table 2. We can draw several conclusions from them. First, the test appears correctly sized with only minor deviations from the nominal size level across the different configurations. Second, the test has very good power against volatility specification with very rough paths, i.e., against the specification V1 corresponding to . Earlier work arguing for presence of rough volatility has found the rough parameter to be close to zero and below . As seen from the reported simulation results, our test can easily separate such an alternative hypothesis from the null hypothesis of smooth Itô semimartingale volatility dynamics. Indeed, the empirical rejection rates of the test in scenarios V1-J1 and V1-J2 is 100%. Third, the power of the test is significantly lower against rough volatility with . This is not surprising because this case corresponds to significantly less roughness in the volatility paths and illustrates the difficulty of the testing problem. Fourth, the power of the test decreases slightly with the decrease in , with the performance for and being very similar. Naturally, the power of the test increases when including more data, i.e., when going from one to four years of data. Finally, we note that neither the size nor the power properties of the test are affected by the level of jump activity, which is consistent with our theoretical derivations.

| Case | ||||||

|---|---|---|---|---|---|---|

| V1-J1 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| V1-J2 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| V2-J1 | 0.1640 | 0.1640 | 0.1240 | 0.3280 | 0.3160 | 0.2760 |

| V2-J2 | 0.1360 | 0.1120 | 0.0800 | 0.3480 | 0.3360 | 0.2800 |

| V3-J1 | 0.0570 | 0.0600 | 0.0490 | 0.0510 | 0.0440 | 0.0430 |

| V3-J2 | 0.0580 | 0.0550 | 0.0540 | 0.0480 | 0.0580 | 0.0680 |

Note: Reported results are empirical rejection rates of the test with nominal size of based on Monte Carlo replications for the scenarios corresponding to the null hypothesis and on Monte Carlo replications for the scenarios corresponding to the alternative hypothesis.

5 Empirical Application

We apply the test for volatility roughness to high-frequency data for the SPY exchange traded fund tracking the S&P 500 market index over the period 2012–2022. On each trading day, we sample the SPY price at five-second frequency from 9:35 AM ET until 4:00 PM ET. We drop days with more than zero five-minute returns over the entire trading period of 6.5 hours. This removes from the analysis mostly half-trading days around holidays when liquidity tends to be lower. We further exclude days with FOMC announcements. The choice of and as well as of the characteristic exponents is done exactly as in the Monte Carlo.

The test results are reported in Table 3. They provide evidence for existence of rough volatility. Indeed, when conducting the test over the different calendar years in our sample, we reject the null hypothesis in 5 to 7 (depending on the level of ) out of a total of 11 years at a significance level of . If we conduct the test over periods equal to or exceeding 3 years, then we always reject the null hypothesis at the same significance level of . Comparing the performance of the test on the data and in the simulations, we see that the rejection rates on the data are lower than for the case in the simulations but higher than those for the case .

| Year | Test Statistic | Year | Test Statistic | ||||

|---|---|---|---|---|---|---|---|

| 2012 | 0.26 | 0.05 | -0.12 | 2012–2015 | -2.34 | -1.81 | -1.45 |

| 2013 | -2.88 | -1.93 | -1.63 | ||||

| 2014 | -1.62 | -1.24 | -0.82 | ||||

| 2015 | -0.17 | -0.59 | -0.95 | ||||

| 2016 | -1.04 | -1.66 | -1.75 | 2016–2019 | -3.67 | -3.18 | -2.59 |

| 2017 | -2.02 | -2.08 | -2.61 | ||||

| 2018 | -1.61 | -1.40 | -1.87 | ||||

| 2019 | -3.10 | -2.31 | -0.79 | ||||

| 2020 | -1.92 | -2.07 | -2.03 | 2020–2022 | -2.17 | -3.01 | -4.06 |

| 2021 | -1.74 | -2.47 | -3.44 | ||||

| 2022 | -1.17 | -1.74 | -1.84 | ||||

| 2012–2022 | -5.27 | -5.04 | -4.57 | ||||

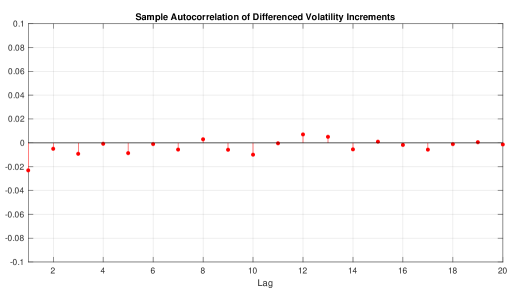

In Figure 2, we plot the autocorrelation of the differenced volatility increments over the entire sample period 2012–2022. Under the null hypothesis of no rough volatility, the autocorrelations should be all zero asymptotically. Under the alternative of rough volatility, these autocorrelations should be negative asymptotically, with the highest in magnitude being the first one. The reported autocorrelations up to lag 7 are all negative, with the highest in magnitude being the first one. This is consistent with existence of rough volatility. We note that the reported autocorrelations are small in absolute value. This is at least in part due to the nontrivial measurement error in the volatility estimates.

6 Concluding Remarks

We develop a nonparametric test for rough volatility based on high-frequency observations of the underlying asset price process over an interval of fixed length. The test is based on the sample autocovariance of increments of local volatility estimates formed from blocks of high-frequency observations with asymptotically shrinking time span. The autocovariance, after suitable normalization, converges to a standard normal random variable under the null hypothesis if volatility is not rough and to negative infinity in the case of rough volatility. The proposed test is robust to the presence of price and volatility jumps with arbitrary degree of jump activity and to observation errors in the underlying process.

Implementing the test on SPY transaction data, we find evidence in support of rough volatility throughout the past eleven years. As a consequence of this finding, nonparametric estimation of spot volatility is much more difficult in reality than what is implied by standard models with Itô semimartingale volatility dynamics used in economics and finance. Indeed, the rate of convergence for estimating spot variance at a fixed time point becomes arbitrarily slow as volatility roughness increases. In spite of this observation, classical spot variance estimators based on sums of squared increments retain their usual rates of convergence in a rough volatility setting when viewed as estimators of local averages of spot variance, where is the length of the estimation window. Therefore, regardless of how rough volatility is, practically feasible inference is possible for local averages of spot variance rather than spot variance itself.

That said, many estimators in high-frequency financial econometrics, other than the standard realized variance, rely on volatility being a semimartingale process, see e.g., the book of Jacod and Protter (2012). We leave a detailed investigation of the implications of rough volatility on the properties of such estimators for future work.

Appendix A Proof of Main Results

A.1 Proof of Theorems 3.2 and 3.3

Since the noise-free case is obtained from the noisy one by choosing , and (which we formally allow in the proof below), Theorem 3.2 is just a special case of Theorem 3.3. We sketch the main steps in the proof of the latter, with technical details deferred to Appendix B in the supplement (Chong and Todorov (2024)). By a classical localization procedure (see e.g., Jacod and Protter (2012, Chapter 4.4.1)), it suffices to prove Theorem 3.3 under the following Assumptions SH, SH and SU′, which are strengthened versions of Assumptions H, H and U′, respectively. If in Assumption U′, we write to denote for some (that can vary from one place to another); if , shall mean the same as .

Assumption SH.

For any compact subset of and with the notation , the following holds in addition to Assumption H (the assumptions on , , , and only apply if ):

-

(i)

We have and the processes , , , , , , , , , and

(A.1) are uniformly bounded by a constant . Moreover, and, if , we have for all almost surely.

-

(ii)

There is a nonnegative measurable function satisfying as well as such that for all ,

(A.2) -

(iii)

As , the following sequences all converge to :

(A.3) (A.4) (A.5) (A.6) - (iv)

Assumption SH.

The following holds in addition to Assumption H (the assumptions on , , , , and only apply if ):

-

(i)

We have . The functions and are bounded and twice differentiable with uniformly continuous and bounded derivatives and the processes , , , , , , , , and and are uniformly bounded by a constant .

- (ii)

-

(iii)

For any compact subset of , we have

(A.8) With the same as in Assumption H and for all and , we have

(A.9) (A.10) (A.11)

We can assume because is just a drift that can be absorbed into . A similar argument shows that only contributes a drift that can be absorbed into , if .

Assumption SU′.

In addition to Assumption U′, the following conditions are satisfied:

-

(i)

There is such that for all .

-

(ii)

We have

(A.12) -

(iii)

We have

(A.13) -

(iv)

There are constants such that

(A.14)

We first consider the behavior of the test statistic under the null hypothesis and suppose that Assumptions SH and SU′ are satisfied. Using the notations

we can write the test statistic as

| (A.15) |

where

| (A.16) | ||||

| (A.17) |

Since , where is the principal branch of the complex logarithm, a first-order expansion gives

| (A.18) |

where and for . As is a local estimator of the conditional characteristic function of , we can decompose

| (A.19) |

where

and with

and . The next lemma is a key technical step in the proofs and shows that in the limit as , only the variance term in and the signal term in have to be retained in (A.18) for the asymptotic analysis of . In particular, the signal part of has no asymptotic contribution to . To understand the intuition behind, consider the noise-free case where the signal part of is essentially given by an increment of . Since this is an Itô semimartingale in under the null hypothesis, it has asymptotically uncorrelated increments with variances dominated by because of (3.22).

The asymptotic distribution of can now be established by an application of the martingale central limit theorem. Recall that by assumption, if , while for , both and are allowed.

Lemma A.2.

Correspondingly, the denominator in (A.15) is a consistent estimator of .

For the proof of Theorem 3.2 under the alternative hypothesis, we can suppose that Assumptions SH and SU′ hold true. A key difference between a semimartingale and a rough volatility process is that the latter has asymptotically correlated increments. So, instead of and , the correctly normalized quantities are now

| (A.24) |

and

| (A.25) |

where and by convention if we have .

Lemma A.4.

Recall from (3.22) that is the asymptotic ratio of . Furthermore, let . (By our choice of in (3.22), we either have , or . The last case happens precisely when and .) Under Assumptions SH and SU′, there are finite constants and that only depend on and such that

| (A.26) |

where

and

and . Moreover, for all and .

A.2 Proofs for Examples 1, 2 and 3

Proof.

We only prove (2.10); the other two properties can be shown similarly. We can assume that and are driven by and and by symmetry, it suffices to analyze . Using Itô’s formula, we have that

where and are the coefficients of and with respect to . Therefore

| (A.27) |

As , the integrand in the last line converges to pointwise in for all . Moreover, it is bounded by

which does not depend on and is integrable with respect to almost surely. Therefore, the dominated convergence theorem shows that (A.27) tends to as . ∎

Proof.

Property (2.17) follows immediately from (2.12) and dominated convergence. For (2.19), we can assume by localization and that . Then, because

we have

Clearly, the integrand tends to pointwise in as . Since , and , we can further bound it by

which is -integrable. The claim now follows by dominated convergence. ∎

Lemma A.7.

Proof.

It suffices to show that Assumption U′ is satisfied, as Assumption U follows by considering the special case and . To simplify notation, we further restrict ourselves to the case (i.e., ). The general case is similar but more cumbersome to write. With this choice, is clearly -measurable. In order to show (3.6) and (3.7), we can work under the strengthened conditions of Assumption SH and SH by localization. In particular, we can assume for all . Introducing the notation , where , we have

Therefore,

| (A.28) |

As by Lemma B.3, we obtain , which goes to uniformly in . With jumps and drift removed, it is now easy to show that we can replace by and by () in , incurring only an - or -error (depending on whether we have H or H) that is uniform in . Using a martingale argument and writing , one can prove that the resulting expression approaches, at a rate of , the term , which approximates with a uniform - or -error. This shows (3.6) and its extension mentioned in Assumption U′.

Next, we consider (3.7) and observe that , where

In , the th term is -measurable and has a zero expectation conditionally on . So if we split the sum over into two, one taking only even and one only taken odd values of , both will be martingale sums. Taking th moments for and using the BDG inequality and (B.1) or (B.2), we obtain

Markov’s inequality with implies that for any sequence ,

| (A.29) |

By (3.22), the last line tends to if slowly enough. In this case, it follows that

This implies (3.7) (with instead of ) provided that is bounded from above and below, uniformly in and . Thanks to (B.1) or (B.2), we have , which readily gives the upper bound. For the lower bound, observe that for a general random variable , we have by the Cauchy–Schwarz inequality, which implies

| (A.30) |

We want to apply this to in . The denominator satisfies the bound . For the numerator, we distinguish whether or . In the first case, Jensen’s inequality applied to the function for the conditional expectation yields . Recalling (B.5), we further have by the reverse triangle inequality. Moreover, combining Doob’s martingale inequality with the BDG inequality, we get

Therefore, if is sufficiently large, and consequently, by (A.30), , where does not depend on or . If , we instead bound . So in both cases, it follows that where is independent of and , which concludes the proof of (3.7). ∎

Appendix B Proof of Auxiliary Results

Throughout this section, denotes a deterministic constant in , whose value does not depend on any important parameters and may change from line to line. Given random variables and and a deterministic sequence , we write if , where neither depends on nor . If and further depend on indices such as or , then does not depend on or , either. The notations and are used analogously. We also use the abbreviations and .

B.1 Preliminary Estimates

Lemma B.1.

Let and be a compact set.

Proof.

Writing

| (B.5) |

we have . Since and , we have . Similarly, because and , Itô’s isometry gives , showing the bound on in both (B.1) and (B.2). And because , we have , which is the last inequality in both (B.1) and (B.2). Under Assumption SH, the processes and (if ) are Itô semimartingales with bounded coefficients, so the bounds on and in (B.1) follow by applying the bound for to . A similar argument, combined with (A.1) and (A.4)–(A.6), yields the bound on . Under Assumption SH, the derivative is bounded by some constant , so the mean-value theorem implies that , where . By (A.9), we have . Since and are uniformly bounded by and , Itô’s isometry shows that

| (B.6) |

The last integral is finite (in fact, equal to by Theorem 1.3.1 of Mishura (2008)), which yields the bound on in (B.2). The bound on in (B.2) follows analogously.

For the third part of the lemma, dominated convergence shows because

and the integrand tends to pointwise in and is bounded by , which is integrable with respect to and independent of . If , we can use the estimate and (A.7) to upgrade the previous bound to . A similar argument shows .

For the last part of the lemma, we deduce the first inequality from the bound and the assumption that . To get the second inequality, we bound

Since and is centered, we obtain the desired inequality. ∎

Next, we recall (A.19) and introduce the notations , and . The next lemma gathers estimates for the increments , and .

Lemma B.2.

Grant Assumption SH and let be a compact set. There are constants and, for any , such that the following holds for any , , and -measurable random variable with values in :

-

(i)

Let . Then

(B.7) -

(ii)

For some function satisfying , we have

(B.8) -

(iii)

Let and

Then

(B.9) and

(B.10)

Proof.

The identity (B.9) is a simple consequence of the Lévy–Khintchine formula and the independence of from . For all other statements, there is no loss of generality to assume that for some . Let , , and

| (B.11) |

By (B.9), we can decompose

| (B.12) | ||||

Since takes the form (3.16) if , the mean-value theorem combined with (B.1) yields

| (B.13) |

By assumption, is continuous (if , -Hölder continuous) in , so by (B.3) and (B.4),

| (B.14) |

Because and are bounded by , we obtain (B.10).

For (B.7), note that is -measurable and because is -dependent and independent of , we have . This shows that . Upon writing

we realize that is a martingale sum for each , relative to the discrete-time filtration . Also, sums over at most nonzero terms and . Therefore, combining the Minkowski and the Burkholder–Davis–Gundy (BDG) inequalities, we obtain the first inequality in (B.7) from the estimates

| (B.15) |

where sums over all such that The second inequality in (B.7) follows by the triangle inequality.

Next, we decompose

| (B.16) | ||||

By Lemma B.1 and the Cauchy–Schwarz inequality, the last term is and can therefore be neglected in the proof of (B.8). Similarly,

Since is independent of , we obtain (using the notation )

| (B.17) |

where the -term is independent of . If , the mean-value theorem implies the bound for some intermediate value and an analogous bound for the imaginary part. Since and we have another factor in front of in (B.17), it follows that (B.17) is if . If , the last line in (B.17) is because of (B.1). Therefore, any additional modification that yields an extra -term can be absorbed into the -bin in (B.17). There are two cases: If , then the -factor in front of renders (B.17) an -term. If , we note that and , so by Lemma B.3, almost surely, for some that satisfies . In addition, because is independent of and , we have

where the last step follows from the fact that when and . Since the last line above is except when , we have shown that

| (B.18) |

We pause here and move to the second term on the right-hand side of (B.16), that is,

Writing and using Itô’s formula (see Jacod and Shiryaev (2003, Theorem I.4.57)), one can verify that for any fixed and , the process satisfies the stochastic differential equation with . In particular, since is a martingale, so is . Combining this with the Lévy–Khintchine formula and using the notation , we obtain

| (B.19) | ||||

As a consequence of our assumptions on , , and and the elementary inequalities , and , we have

Denote the last term by . Then and , so

| (B.20) |

Defining

| (B.21) |

and recalling from (B.3), we have

| (B.22) |

The first term on the right-hand side is bounded by , where . For the second term, note that by (B.3). The third term is bounded by

| (B.23) |

due to (A.1) and (A.4)–(A.6). Thanks to the bound and Lemma B.3, the last two terms in (B.22) are bounded by and , respectively. Altogether, we have shown that the right-hand side of (B.22) is . In a similar fashion, one can further show that the right-hand side of (B.20) is , which implies

almost surely. The last step holds because is a martingale driven by and (without any component driven by ), so and are uncorrelated conditionally on . Since satisfies (A.3), we further have

Recalling (B.16) and (B.18), we arrive at

| (B.24) |

where the -term does not depend on or . This yields the first estimate in (B.8).

To prove the second estimate, denote the right-hand side of (B.24) (without the -term) by and note that by what we have shown so far. If , (B.4) implies . Because , and, if , and are continuous (if , at least -Hölder continuous) in and both and are differentiable (as has moments of all orders), it follows that , proving the second estimate in (B.8). ∎

Lemma B.3.

Let , where is a predictable function and satisfies for all , and some measurable nonnegative function with . Then, for any ,

where does not depend on or and satisfies .

Proof.

Let if and if . There is no loss of generality to assume that . By the BDG inequality,

For the last step, we applied Jensen’s inequality to the first expectation and the bound to the second. Concerning the first term, note that if . Moreover, since is integrable, satisfies as . Concerning the second term, we use Hölder’s inequality to bound

Since is integrable and , the dominated convergence theorem implies that satisfies as . The lemma is proved by choosing . ∎

The moment estimates derived in the Lemma B.2 translate into pathwise bounds for the variance and bias terms and that hold with high probability.

Lemma B.4.

Proof.

Note that by (A.14). On , we have , where . Therefore, by Lemma B.2 (note that is -measurable) and Markov’s inequality, we have , which implies by (3.22). This yields the first statement of the lemma. For the first set of bounds in (B.25), observe from (B.3) that

for large . Hence, and satisfy

if is large. Moreover, on , which implies . By (B.9), this gives , which in turn shows on . The bounds for and can be derived in the same way. For the second set of inequalities in (B.25), note that

by (B.11). As , we can use (B.4) to obtain , which completes the proof of (B.25). ∎

B.2 Proof of Technical Results from Appendix A

Proof of Lemma A.1.

Expanding the product, we can decompose into the sum of four differences, all of which can be treated similarly. Therefore, we only detail the proof that , where

| (B.26) |

To this end, we further introduce

| (B.27) |

where and

| (B.28) |

Recalling the set from Lemma B.4, we decompose , where

and . By Lemma B.4, we have in probability. For the other two terms, we may assume that we are on the set . In fact, we will tacitly do so for the remainder of this section and write for . Also, we will often use the fact that by (3.22). On , we have and for all and . So if is large, we have . Upon realizing that is a second-order expansion of around , we can use Lemma B.2 to derive

| (B.29) |

Similarly, for large enough and because by (3.22), we have

Analogously, . Hence, by the Cauchy–Schwarz inequality, we have , which converges to by (3.22).

Next, we want to replace by a simpler expression ( for “simplified”), to be determined in several steps in the following, and accordingly replace by

| (B.30) |

Clearly,

where is and will be chosen as -measurable. Since and by (3.22), we only have to make sure is chosen such that on the one hand and on the other hand. Then the last display will converge to in .

To get the first version of , we expand the increment using (B.28) and omit all terms that are . Simplifying terms, we arrive at , where

We start by investigating the contribution of . Our goal is to show that is negligible. To this end, it suffices to show that

vanishes asymptotically. Indeed, since is -measurable, the th term that appears in the difference will be -measurable with a zero -conditional expectation. Therefore, is a martingale sum and consequently, we have by (3.22). Next, consider the term . Recalling (B.11), we can use (B.3) and (B.4) to show that

| (B.31) |

Moreover, is -Hölder continuous in squared mean, so we have . Therefore, instead of , it is enough to consider

Note that from (B.11) is an Itô semimartingale with bounded coefficients (uniformly in sufficiently small such that ). Thus, by (B.12), (B.14) and a first-order expansion,

where signifies a term whose -conditional -norm is , uniformly in . This shows that is negligible.

We proceed to and consider

| (B.32) |

Revisiting the proof of (B.10), one can actually show .111This is because we can improve the right-hand side of (B.13) to if . Since , its contribution to (B.32) is a term whose -norm is , which is negligible by (3.22). Since can be omitted as we have shown, we can replace in (B.32) by . As above, because is an Itô semimartingale with bounded coefficients (for sufficiently small) and , we have for and . As a consequence, instead of (B.32), it is sufficient to further analyze

| (B.33) |

Since , a martingale argument (along the lines of the analysis of ) reduces (B.33) to

| (B.34) |

Now, recall the notation and observe that for ,

| (B.35) |

where the second sum is taken over all . The covariance term in (B.35) is zero whenever . We want to replace everywhere in (B.35) by , and similarly for the terms indexed by . As

| (B.36) |

with some that is uniform in and ,222If , the second bound follows from the assumption that is an Itô semimartingale with bounded coefficients. If , we use the fact that by (3.22). we have

| (B.37) |

Since , we have

| (B.38) |

Recall that is a martingale. By taking conditional expectation with respect to and using the fact that , one can show that the third term is zero, while the first one on the right-hand side of (B.38) is equal to times

| (B.39) |

where the -term is uniform in and . Note that the last line (apart from the -term) is independent of (and hence, of ), and so is the second term on the right-hand side of (B.38) since is a stationary sequence. A similar argument shows that the same is true for the nondiagonal terms in (B.35), which means that

| (B.40) |

A similar argument proves that

| (B.41) |

Therefore, the -norm of (B.34) is , which shows that has no asymptotic contribution. In other words, we have where is given by (B.30) and .

Our next goal is to show that and can also be omitted, that is,

is asymptotically negligible. By Lemma B.2, one can readily see that do not contribute in the limit as . Furthermore, similarly to how we obtained (B.33), we can replace (for and ) by . A martingale argument further allows us to take inside the sum over , which also eliminates . Hence, only

has to be studied further. Here, we only need to keep the dominating part of (all higher-order terms only have negligible contributions). Thus, we need to analyze

| (B.42) |

We decompose , where

Since contains the contributions of drift, finite variation jumps and noise (if ), we have by (B.4). By (B.1), we further have the bound . Therefore, in (B.42), it suffices to keep instead of . Writing , we have that —up to an error whose -norm is —is equal to

or

where the second step follows from Itô’s formula and by ignoring all drift terms of order . At the same time, because by (3.22) for all and , and (if ) are Itô semimartingales with bounded coefficients, we have , where . Hence,

By conditioning on , it is easy to see that the second part does not contribute to . By definition, we have , where

so a straightforward computation shows that

| (B.43) |

where are integers satisfying and stands for the integrand of the -integral in the expansion of above. After a moment of thought, one realizes that , where does not depend on , , or . Since (as we have shown right below (B.19)), it follows by dominated convergence that the -integral in the display above is . Since the -integral in (B.43) is of order , we only need to further consider the case where . Then the -integral is of size , which implies that we are free to make any additional modification of order . Because of the -continuity properties of and , and of and if , and because , it suffices, instead of (B.42), to consider

| (B.44) |

where

In fact, we can also replace in (B.44) first by

and then, in a second step, by

Thanks to (A.12) and (A.13), we can also substitute for in the last expression and in the definition of . After all these modifications, the th term in (B.44) will have a zero -conditional expectation, so a martingale argument shows that (B.44) is asymptotically negligible. Hence, in (B.30), we can choose .

The next reduction is to remove (), for which we have to show that

is asymptotically negligible. As before, we can replace by (, ). By a martingale argument, we can further take conditional expectation with respect to , which eliminates the first part of the sum above, while it renders the second part negligible by (B.40) and (B.41). This shows that we can choose .

Lastly, we want to show that we can replace as defined in (B.30) (with ) by from (B.26), which will conclude the proof. We proceed in three steps by decomposing , where (recall the definition of from the statement of the lemma)

and was defined before (B.11). Because is a martingale sum and we have by (B.3) and (B.31), we readily obtain . The same argument shows that . Regarding , we use the expansion to bound

by . Since we have and , where , the previous bound implies that instead of , it suffices to study

and

Since the th term in has a zero -conditional expectation, we can argue as in the analysis of to show that converges to in . For , by the same argument, we can take conditional expectation with respect to for the th term, which can be computed similarly to (B.42). The final result after a tedious computation is that vanishes asymptotically. ∎

Proof of Lemma A.2.

Let . Then we can decompose , where

In each of the five sums, the th term is -measurable with a zero -conditional expectation. Therefore, is a four-dimensional martingale array and we can use Theorem 2.2.15 in Jacod and Protter (2012) to prove its convergence, from which (A.21) can be easily deduced. Verifying the assumptions of Theorem 2.2.15 in Jacod and Protter (2012) is straightforward, so we only derive the asymptotic covariance and leave the remaining conditions to the reader. A moment’s thought reveals that the limits of are -conditionally independent, so all we are left to show is that their -conditional variances are given, respectively, by , and, for both and , by . As the proof is almost identical, we only determine the -conditional variance of , which we denote by and is given by the limit as of

| (B.45) |

By a martingale argument,333The difference between (B.45) and (B.46) can be split into two martingale sums, one summing over even and one summing over odd values of . this is asymptotically equivalent to

| (B.46) |

To determine the limit of (B.46), we start with the following a priori estimate, which follows from the bounds in (B.15):444Note that one can replace in by without changing anything, where in our case. Then the claim follows from the bound .

| (B.47) |

where does not depend on or . Moreover, and are uncorrelated and is -measurable, so

For , we have the identity

| (B.48) |

Since and , one can argue as in (B.15) to derive the bounds

| (B.49) |

For , there are such that

| (B.50) |

where the first set of bounds follows as in Lemma B.4 and the last bound holds because and . In conjunction with (B.47), these bounds show that the second term on the right-hand side of (B.48) is negligible for computing the limit of . Regarding the last term in (B.48), note that (B.49) and the Cauchy–Schwarz inequality imply . Therefore, of the last term in (B.48) is bounded by and does not contribute to . Thus, is asymptotically equivalent to

In fact, by (B.49) and (B.50), the previous display is , so we are allowed to make any further -modification. For example, we can ignore the imaginary part of () and replace by . This shows that is asymptotically equivalent to

| (B.51) |

Regarding the denominator, we have

| (B.52) |

Moreover, since is -dependent and ,

| (B.53) |

for , where the sum ranges over all such that . Using (B.36) for the second step, (B.3) for the fourth one and (A.12) and (A.13) for the last one, we have

Similarly, with the notations and , we can deduce

Now, if , then the contributions of and are and only the terms where remain, which via (B.53) shows that for ,

If , the contributions of and dominate asymptotically. Moreover, we have by assumption, so expanding , we get

and

which inserted in (B.53) and after simplifications yields

If , we also have , so combining the previous results, we obtain

and

Thus, if , we have

Inserting the obtained expansions in (B.51) and noting that by (A.13) and , one can use classical Riemann approximation results to show (by distinguishing the cases , and , and in the first case, further whether or not). ∎

Proof of Lemma A.3.

We decompose , where

As seen in the proof of Lemma A.1, we have . Therefore, invoking a martingale argument, we can apply to the th term defining , after which the only expression left to be analyzed is. Similarly to how we eliminated in the paragraph following (B.32), one can verify that this term converges in probability to .

Therefore, only contributes asymptotically. By our analysis of in the proof of Lemma A.1, we have

| (B.54) |

Analogously to the decomposition of at the beginning of the proof of Lemma A.2, we can split the last line (without the -term) into four terms, say, , each of which is asymptotically equivalent to the -conditional variance of the corresponding -term. To see this, consider for example, which is given by . As usual, by a martingale argument, we can take -conditional expectation, which turns the previous line exactly into (B.46). This shows that converges in probability to . Repeating this argument for , and completes the proof of the lemma. ∎

Proof of Lemma A.4.

Throughout this proof, we use to signify a term whose -norm is bounded by , where is a constant independent of , and . The notations and are used similarly. Also, recall that by convention if .

Our analysis of , , in the proof of Lemma B.2 was independent of whether we are under SH or SH. In particular, we still have (B.7). Regarding , we argue as in (B.16) and use (B.2) and (A.10) to obtain

Because (cf. (B.17)) and, we conclude that with .

By the Lévy–Khintchine formula, the mean-value theorem and (B.3) and (A.10), we further have that

Since the last display is by (B.4), by (3.22), and by (B.25), we conclude that

where the second step follows from (recall the definition after (A.20)). Then , where

and .

Next, with the notation , a first-order expansion shows that is given by555The second term is set to zero if .

plus an -error. Note that we have and . Besides, given an increasing integer sequence such that , we have

for all , since is integrable. The same type of estimate applies to the integral involving . Together with (B.52) (which continues to hold under the alternative hypothesis), it follows that , where and