This paper proposes a novel method for sparse latent factor modeling using a new sparse asymptotic Principal Component Analysis (APCA). This approach analyzes the co-movements of large-dimensional panel data systems over time horizons within a general approximate factor model framework. Unlike existing sparse factor modeling approaches based on sparse PCA, which assume sparse loading matrices, our sparse APCA assumes that factor processes are sparse over the time horizon, while the corresponding loading matrices are not necessarily sparse. This development is motivated by the observation that the assumption of sparse loadings may not be appropriate for financial returns, where exposure to market factors is generally universal and non-sparse. We propose a truncated power method to estimate the first sparse factor process and a sequential deflation method for multi-factor cases. Additionally, we develop a data-driven approach to identify the sparsity of risk factors over the time horizon using a novel cross-sectional cross-validation method. Theoretically, we establish that our estimators are consistent under mild conditions. Monte Carlo simulations demonstrate that the proposed method performs well in finite samples. Empirically, we analyze daily stock returns for a balanced panel of S&P 500 stocks from January 2004 to December 2016. Through textual analysis, we examine specific events associated with the identified sparse factors that systematically influence the stock market. Our approach offers a new pathway for economists to study and understand the systematic risks of economic and financial systems over time.

Keywords: Factor Analysis, Asymptotic Principal Components, Sparsity, Large-Dimension, Panel Data

JEL classification: C33, C38, C55

1 Introduction

In the realm of big-data analysis, the study of large-dimensional panel data has gained significant prominence in recent years. Large-dimensional panel data refers to datasets where observations are recorded for multiple individuals or entities over time, resulting in a wealth of information over the spatial and time horizons. Analyzing such datasets is essential for understanding complex economic, financial, and social phenomena. However, as the dimensionality of the data increases, traditional statistical techniques encounter numerous challenges, including multicollinearity, computational complexity, and difficulties in extracting meaningful insights. To address these challenges, latent factor modeling, also referred to as statistical factor modeling in Campbell, Lo, and MacKinlay (1997), has emerged as a powerful and versatile approach in the field of panel data analysis. Latent factor models offer a structured framework for dimension reduction and capturing common sources of variation in high-dimensional data. For example, asset returns in finance are often modeled as functions of a small number of factors; see Ross (1976) and Connor and Korajczyk (1986, 1988). Macroeconomic variables of multiple countries are found to have common components; see Stock and Watson (1989), Gregory and Head (1999), and Forni, Hallin, Lippi, Reichlin, et al. (2000). In demand systems, the Engle curves can be expressed in terms of a finite number of factors; see Lewbel (1991). As the dimensions of the panel data systems increase, various factor models have been developed to reduce the dimensionalities under different scenarios. See, for example, the approximate factor models in Chamberlain and Rothschild (1983), Stock and Watson (2002b, a), Bai and Ng (2002), Bai (2003), Fan, Liao, and Mincheva (2013), Lettau and Pelger (2020), Pelger (2020), and Gao and Tsay (2023, 2024), and the dynamic factor models in Forni, Hallin, Lippi, and Reichlin (2000), among others. These models are particularly well-suited for large-dimensional panel datasets where the number of variables (or features) can be moderately large.

One of the most profound challenges in factor modeling is to handle high-dimensional time series data efficiently and effectively. Sparse factor modeling represents a groundbreaking approach to this challenge, offering a powerful technique to extract meaningful insights from complex datasets characterized by a multitude of variables. Sparse factor modeling seeks to identify and capture the underlying structure of data while simultaneously promoting simplicity by selecting only a subset of relevant variables (or features) from the original set. The central idea behind sparse factor modeling is to uncover latent factors that drive the observed data’s variation while enforcing a degree of sparsity, meaning that only a few variables are deemed essential to explain the data’s structure. This approach is particularly valuable in scenarios where the number of variables far exceeds the number of observations, as it not only reduces computational demands but also enhances the interpretability of the results. Examples of articles concerning this approach include the sparse PCA in Jolliffe, Trendafilov, and Uddin (2003), Zou, Hastie, and Tibshirani (2006), Shen and Huang (2008), and Witten, Tibshirani, and Hastie (2009), and the sparse factor analysis with sparse loadings in Kristensen (2017), among others, where all of the aforementioned works are in line with factor analysis with sparse loadings, implying that each factor process is a linear combination of a small subset of the original panel series only.

It is widely known that the key idea in a large-dimensional factor model is that the dimensions of both the timeline and the cross-section of the data are large, and most of the co-movements can be explained by a few factors. These factors and loadings are usually estimated by the conventional principal component analysis (PCA) method due to its ability to parsimoniously capture much of the information in a large number of variables. However, the resulting latent PCs or factors are typically linear combinations of of all cross-sectional units/variables, which are usually hard to interpret. The sparse PCA restricts the cardinality of the weight vectors for the PCs, or equivalently, the loadings for the factor processes, so the the PCs are sparse linear combinations of the underlying variables. Consequently, the PCs or factors are only linear combinations of a small subset of the cross-sectional units, which facilitates the interpretations of the resulting PCs or factors. Nevertheless, there is little literature concerning the justificaton of the sparsity assumption in the loadings. For example, the assumption may not be appropriate for financial returns, where the exposure of the returns to a market factor is universal and non-sparse, as pointed out in Pelger and Xiong (2022), see also the empirical evidence in Gao and Tsay (2021).

In view of the above discussion, this paper marks a further development in the sparse factor modeling of large-dimensional panel data from a different perspective. Motivated by the empirical success of a general approximate factor model, see Pelger (2020) and the references therein, we also adopt such a similar framework. Unlike the sparse factor modeling approach with sparse loadings in existing literature, we assume the latent factor processes are sparse over time, while the loadings can be nonzero in general settings. Specifically, for a given time period of economic or financial series, we postulate that cross-sectional units may exhibit varying strengths of co-movement over time. During certain periods, the co-movement may not be significant enough, allowing idiosyncratic terms to dominate the co-movement, potentially resulting in the absence of a systematic risk factor. See the empirical evidence of the dominance of idiosyncratic risk in Campbell, Lettau, Malkiel, and Xu (2001) and Goyal and Santa-Clara (2003), among others. Consequently, the loading vector of each panel series can be treated as a linear combination of the corresponding series over the entire timeline. When a factor process is sparse, the corresponding loading associated with each series is a linear combination of the series over a small subset of the entire time horizon. This implies that only specific data points contribute to the strength of the loading for each series. The interpretation of this approach is quite straightforward. For example, asset returns in finance may not always exhibit systematic co-movements over the entire timeline, even though the market beta associated with the market factor can be significantly different from zero since it is calculated based on the entire timeline. However, clear and significant co-movement patterns do emerge during certain periods, such as when the Federal Reserve raises interest rates to combat inflation or during financial crises triggered by currency issues, debt, banking problems, or subprime mortgage defaults. Therefore, our proposed approach can facilitate researchers in economics and finance in discovering the connections between specific policies or events and the co-movements of economic or financial systems.

In this paper, we first introduce approximate factor models and their estimation procedures using the conventional PCA or the asymptotic PCA (APCA) method introduced by Connor and Korajczyk (1986, 1988). We then present a sparse APCA technique by formulating a sparse factor modeling framework with sparse factors over time horizons. Under the -constraint imposed on the factors, we propose a truncated power method to estimate the sparse factors in the one-factor case, corresponding to the hard-thresholding technique in the machine learning literature. Additionally, we develop a sequential deflation estimation procedure for multi-factor cases, utilizing the truncated power method along with certain projection techniques. The theoretical properties of the proposed estimators are established under some mild conditions when both the dimension and the sample size go to infinity. Simulated and real data examples are used to illustrate the proposed method. To the best of our knowledge, this is the first study in the literature to consider sparse factors over the timeline, and we establish theoretical guarantees for the estimation procedure. The proposed approach provides an effective way to bridge time and significant risk factors, which play a crucial role in studying the dynamics of large-dimensional panel systems.

In an empirical application, we apply the proposed method to study the dynamics of daily stock returns for a balanced panel of S&P 500 stocks from January 2004 to December 2016. Through textual analysis, we examine specific events associated with the identified sparse factors that systematically influence the stock market. Our findings reveal nine significant time factors that may systematically affect the financial market: Economic Indicators, Government Policies, Global Events, Market Sentiment, Company-specific Factors, Credit Risk, Oil Price, China, and Europe. The findings contribute to a deeper understanding of market dynamics and the critical events that drive stock market movements, providing a valuable resource for both investors and policymakers in navigating the complexities of financial markets. The empirical study suggests that our proposed method not only provides interpretable results but also establishes connections between co-movements and specific events over time, effectively bridging time and risk. Our approach offers a new pathway for economists to study and understand the systematic risks of economic and financial systems over time.

Note that the proposed framework not only marks a clear distinction from existing sparse PCA or sparse factor modeling in the literature in terms of formulation and interpretation, but the technique used in this paper also differs from those employed in previous works. For example, in the sparse PCA literature, such as Zou, Hastie, and Tibshirani (2006), Shen and Huang (2008), and Witten, Tibshirani, and Hastie (2009), the true sparse eigenvectors are assumed to be constant vectors, and regularized estimation algorithms are proposed to estimate these sparse eigenvectors. In the realm of sparse factor modeling, such as in Kristensen (2017) and Uematsu and Yamagata (2022), the loadings are assumed to be sparse and non-random, with -regularized methods used to estimate the sparse loadings. Conversely, in the sparse proximate factor modeling approach of Pelger and Xiong (2022), only the factor weights are assumed to be sparse, while the resulting loading and factor processes are non-sparse. In contrast with the aforementioned frameworks, the proposed sparse APCA method assumes that the random factor processes exhibit a sparse structure, meaning each factor data point can be either a random variable or zero over the timeline. A zero factor point indicates that the return series may not have co-movement at that specific time point. Our estimation procedure is developed under -constraints on the factors. Therefore, our theoretical analysis differs from all the previously mentioned approaches, as the dependence structure along the timeline differs from that across the cross sections. Consequently, our method offers a way to link specific time points with the relevant risk factors that systematically influence the panel of interest.

This paper is also related to the literature on high-dimensional factor models with weak factors. In this context, there are two classes of weak factors: the first type affects only a subset of cross-sectional units, while the second type has relatively weak effects on the entire cross-section. The former type is often estimated using a group structure or some prior knowledge about factor strength, as discussed in Bailey, Kapetanios, and Pesaran (2021) and Anatolyev and Mikusheva (2022). In addition, Huang, Jiang, Li, Tong, and Zhou (2022) proposed a scaled PCA method to scale down weak factors through a supervised learning approach. This method was later extended to a supervised dynamic PCA method by Gao and Tsay (2024) for dynamic forecasting with weak factors. Importantly, Bai and Ng (2023) showed that PCA estimators exhibit a slower convergence rate under a weak factor model. Our paper fits into the second category, where factors over the time horizon are assumed to be either zero or nonzero, denoting weak and strong factors, respectively. Zero factors indicate that idiosyncratic components are relatively more dominant compared to weak systematic risk factors. For long time series sequences, our method also offers a dimension-reduction approach (in time horizon) to studying the dynamics of the economic and financial series over time horizons.

The contributions of this paper are multi-fold. First, to the best of our knowledge, this is the first study to consider sparse factors over the time horizon, providing economists with a novel approach to bridging the gap between time and risk in economic and financial systems. Second, unlike the -penalized methods in sparse PCA, we propose using a truncated power method based on an -constraint for the one-factor case and a sequential optimization procedure for estimating multiple factors. This extends the asymptotic PCA technique developed by Connor and Korajczyk (1986, 1988) for factor analysis to high dimensions. Third, rather than using the traditional cross-validation method to identify sparsity structure, we introduce a new cross-validation approach by partitioning the spatial dimensions, enabling the estimation of sparsity parameters through this method. Theoretically, we establish the consistency of the proposed estimators as the dimension and sample size approach infinity. Importantly, we provide theoretical guarantees for the proposed cross-sectional cross-validation method, demonstrating its ability to consistently estimate the sparsity structure over the time horizon of factor models. This offers a rigorous approach to linking time and significant systematic risks across the time horizon.

The rest of the paper is organized as follows. Section 2 introduces the sparse factor modeling framework and its estimation procedure. Section 3 presents asymptotic properties of the estimators obtained in Section 2. Section 4 studies the finite-sample performance of the proposed approach via simulation, and 5 illustrates the proposed procedure with an empirical application. Section 6 concludes. All the proofs and derivations for the asymptotic results are relegated to an online Appendix.

Notation: We use the following notation. For a vector , is the -norm and is the -norm. denotes the identity matrix. For a matrix , its Frobenius norm is and its operator norm is , where denotes the largest eigenvalue of a matrix, and is the square root of the minimum non-zero eigenvalue of . denotes the absolute value of elementwisely. The superscript ′ denotes the transpose of a vector or matrix. We also use the notation to denote and or and have the same order of stochastic bound when they are random variables.

2 Model and Methodology

2.1 Model Setup

Let be the -th unit of the cross-sectional panel at time , for example, can be the stock return of the -th asset at time , we consider the following approximate factor model:

| (1) |

where is the only observed datum for the -th cross-section at time (; ), is an -dimensional vector of common or systematic risk factors, is an -dimensional vector of factor loadings, and is the idiosyncratic component of that cannot be explained by the common risk factors. We may combine all the cross-sectional units together and write the above equation as

| (2) |

where and . Assume a panel data set of time-series observations and cross-sectional observations, denoted as , has a factor structure with common factors. Let and , then Models (1) and (2) can be written in the following matrix form

| (3) |

For ease of notation, we also denote , , and when referring to their columns. In the econometrics/statistical and finance literature, Model (3) is usually estimated using the Principal Components or Asymptotic Principal Components estimation method (see Connor and Korajczyk (1986, 1988), Bai and Ng (2002), Bai (2003), and Fan, Liao, and Mincheva (2013), among others). As a result, all the elements in the estimators and are usually nonzero, making it difficult to interpret the dynamic and cross-sectional relationships of the data. Moreover, the role of the idiosyncratic terms is rarely considered or even ignored in characterizing the individual dynamics of the series.

In the next subsection, we briefly introduce the identification issues in Model (3) and the estimators obtained by the method of PCA.

2.2 Identification and PCA Estimation

As the panel of data is the only observable component in Model (3), and and are latent and unobserved ones, the pair itself is not identifiable since they can be replaced by for any non-singular matrix , without altering the equation in (3). Therefore, it is conventional to impose some constraints on the factors and their associated loadings. There are two equivalent sets of identification conditions in the PCA framework. The first one assumes

| (4) |

and the second one postulates that

| (5) |

See, for example, Bai and Ng (2002) and Fan, Liao, and Mincheva (2013). Note that and are still not identifiable when the diagonals in (4) or (5) have multiplicity or there exists a diagonal matrix with the diagonals being or such that is still a pair of solutions. In this paper, we do not consider the special case of multiplicities, and the change of signs does not affect our analysis because it gives us an advantage to choose an with any particular signs to facilitate the interpretations of the estimates. On the other hand, according to the discussion in Bai and Ng (2013), the estimates can be uniquely defined asymptotically under conditions (4) or (5) if the top eigenvalues of the covariance of the panel are distinct. They showed that the rotation matrix is asymptotically equal to an identity with certain convergence rates. As a matter of fact, the conditions in (4) and (5) are reasonable if we adopt the PCA method to estimate the factors and their associated loadings, because the estimated PCA factors and loading either satisfy the condition in (4) or (5) depending on whether we apply PCA to or as discussed below.

Suppose is a demeaned vector, under condition (4), the estimation of is obtained by conducting a PCA on or a scaled version , and each estimated loading vector is a linear combination of the th series using the weight matrix . Specifically, under condition (4), the estimated factor matrix, denoted by , is times the normalized eigenvectors corresponding to the largest eigenvalues of the matrix . For a given , the estimated factor loading matrix is , which can be obtained by ordinary least-squares (OLS) estimation. This approach is also known as Asymptotic Principal Component Analysis (APCA) in the finance literature; see Connor and Korajczyk (1986, 1988) for details. Consequently, the estimated loading vector for the -th series is a linear combination of the -th series using the weight matrix over the timeline.

Similarly, under condition (5), the estimation of is obtained by performing a PCA on (or ). By abuse of notation, we still denote the estimated loading and factor matrices as and , respectively. The estimated loading matrix is constructed as times the normalized eigenvectors corresponding to the largest eigenvalues of the matrix . Then, the estimated factor matrix is . Therefore, each factor is a linear combination of using the weights in over the cross section.

We highlight that the conditions in (4) and (5) are only imposed in order to estimate the factors and loading matrix by the PCA method, and the true underlying factors and loading matrix do not necessarily satisfy either (4) or (5) so long as some regularity conditions as those in Assumptions A-B of Bai and Ng (2002) are met. For example, if the estimated factors satisfy that , then there exists an invertible rotation matrix such that the consistency of to can be established; See Bai (2003) and Fan, Liao, and Mincheva (2013) for details. Moreover, if we further assume the true factors satisfy , or more rigorously, as that in (4), then the rotation matrix is an orthogonal one (asymptotically) as shown in Fan, Liao, and Mincheva (2013). If we additionally assume the loading matrix satisfy the condition in (4), then is an identity asymptotically, as shown in Bai and Ng (2013).

Note that the two estimation procedures are equivalent in the sense that the estimated common component stays the same, which is due to the nature of the PCA method. In either case, the PCA factors and loadings are difficult to interpret. This poses a challenge for modeling and understanding the dynamic structure and the co-movement in the data, especially for those in finance and economics where understanding the hidden economic mechanism in the data is a main objective to study.

In this article, we adopt the conditions in (4) and pick a specific choice of the rotation matrix based on the APCA approach, ensuring the unique identification of and . For example, suppose the true underlying factor and loading matrices are and , respectively, such that , we can show that there exists a rotation matrix such that the estimated APCA factors with is consistent to (up to a scale). Hence, by redefining and , the model transforms into , enabling us to uniquely estimate and through the APCA approach. With this redefined framework, our sparsity assumption will be directly imposed on in subsequent analysis, as there are no identification issues as discussed above. Our work aims to extend the APCA of Connor and Korajczyk (1986, 1988) to high dimensions using advanced machine learning techniques.

2.3 Sparse Factor Processes

In view of the discussion in Section 2.2, the traditional APCA estimators are difficult to interpret, especially when the dimension is large. In the past decades, various sparse PCA or sparse factor modeling techniques have been proposed in the statistical and econometrics literature. See, for example, Zou, Hastie, and Tibshirani (2006), Witten, Tibshirani, and Hastie (2009), and Kristensen (2017), among other. Sparse PCA restricts the cardinality of the weight vectors for the PCs so that the PCs are sparse linear combinations of the underlying cross-sectional variables. By setting the factor weights to zero, sparse PCA facilitates the interpretation of the PCs, which improves interpretability without sacrificing the explanatory ability of the PCs or factors. To the best of our knowledge, all the aforementioned approaches assume that the loadings are sparse in the population model, and formulate the estimation of sparse loadings as a regularized optimization problem to estimate principle components with a penalty term, which allows for developing asymptotic inferential theory. Nevertheless, the assumption of sparse population loadings may not be satisfied in many datasets. For example, in finance, the exposure of asset returns to a market factor is universal and non-sparse. In addition, according to Camacho, Smilde, Saccenti, and Westerhuis (2020), the sparse PCA method presents disparate and limited performance when modeling sparse data, even in the optimistic case of noise-free data.

In this paper, unlike the existing approach in sparse factor modeling where the loadings are sparse, we assume the systematic risk factor process is sparse along the time horizon as it characterizes the co-movement of the panel dynamically. When all components of are zero at some certain time point, it implies that the panel is driven dominantly by individual factors or the corresponding idiosyncratic terms rather than a systematic one. On the other hand, for the economic and financial panel series, the nonzero factor at certain data points can be treated as a systematic response of the panel to some important and influential economic or financial events or outcomes.

To illustrate the interpretations of the proposed approach, we take the panel of asset returns in finance as an example. First of all, the factor process measures the overall co-movement of all stock returns over the time horizon considered in the data set. When there is no co-movement over some certain period, the factors would be zero at such time points. Under such circumstances, the stock returns would be driven by their idiosyncratic terms because there are not enough government policies, influential news, or other major events that can drive all the cross-sectional movement, and consequently, the systematic response might be not significant. Second, each loading vector is a linear combination of the corresponding series over the time horizon, which measures the average dependence on the factors for the given time period of the data. When the factors are zero at a specific time point, the contribution of the series at such time point to the loading would be negligible.

2.4 Examples of Sparse Factors in Time Horizons

Factor analysis is an important statistical tool for reducing the dimensions of large panels of economic and financial data. When the factors are latent and unobservable, the conventional PCA estimation procedure, though easy to implement and possessing good theoretical properties (Bai and Ng (2002) and Bai (2003)), often results in loadings and factors that provide unclear economic insights and are difficult to interpret in practice. Under the proposed framework, sparse factors will improve the interpretability of the factors and offer a useful tool for understanding systematic risk over the timeline in economic and financial panel systems.

-

(i)

Asset Pricing Models. In the Arbitrage Pricing Theory (APT) proposed by Ross (1976), a fundamental assumption is that a small number of factors can explain a large number of asset returns. In contrast to cases where the factors are observable, as in Fama and French (1993), the latent factors ’s extracted from the panel ’s are difficult to interpret. Financial economists widely recognize that time and risk are two critical factors that make finance challenging (see, for example, Treynor (1961)). The finance subject would be incomplete without these two elements. The proposed framework provides an approach to bridge the systematic risk factor and time for financial returns. When the systematic/common factors are nonzero at certain time points, we may relate events such as macroeconomic conditions, news, government policies, and banking conditions to the nonzero systematic risk factors detected over that time period. Conversely, when the systematic factors are zero, we may conclude that the market was mainly driven by company-specific shocks during those corresponding time periods.

-

(ii)

Disaggregate Business Cycle Analysis. Gregory and Head (1999) found that cross-country variations have common components, referred to as global shocks. In addition, each country also experiences country-specific shocks. It is clear that the global and country-specific shocks are reflected by the common factors ’s and the idiosyncratic terms ’s in Model (2), respectively. Under the proposed framework, sparse factors over a certain time period correspond to situations where global shocks do not play a dominant role in driving the cyclical variations in a country’s economy. Conversely, nonzero factors will inspire researchers to discover the possible reasons for significant global shocks during the corresponding time period.

-

(iii)

Consumption and Demand System. Let be the budget share of good for agent , where we have goods and agents in total. Consumer theory assumes that in a single price regime, where is an -dimensional unknown functional factors of with being agent ’s total expenditure. See Section 4 of Lewbel (1991) for details. For certain agents, their budget shares for good can be zero, implying that ’s are zero for belonging to such agents. Therefore, the proposed sparse factor models may provide economists with one way to understand certain groups of households’ preferences for specific goods. See a similar argument in Gabaix (2014).

-

(iv)

Monitoring and Forecasting. Stock and Watson (1998) and Forni, Hallin, Lippi, Reichlin, et al. (2000) have demonstrated that factor models provide an effective way to monitor economic activities, as large-dimensional economic panel data can be described by a small number of factors. In other words, business cycles can be modeled by the co-movements of economic variables, which correspond to the common factors ’s in Model (2). When the factors are sparse, we can monitor economic activities according to the systematic risks detected by our approach. Additionally, Stock and Watson (1998) also considered forecasting inflation with the common factors (diffusion indices) extracted from a large panel of macroeconomic variables and found that these factors can improve forecasting accuracy.

2.5 Sparse APCA: Formulation and Estimation

We first introduce some further notation used in the estimation procedure. For an vector , is the Euclidean norm and is the cardinality or number of non-zero elements in . Let be the set of orthogonal matrices and be the set consisting of the orthogonal complements of the ones in . For a matrix and a vector , implies that for .

In the following subsection, we first formulate the estimation procedure in the one-factor case, i.e. the number of factors in Model (3), and the multi-factor case can be carried out based on the one-factor estimation procedure.

2.5.1 One-Factor Case

We consider the case when and the first factor process over the timeline is . Let , it follows that can be approximated by the first normalized eigenvector of the positive semi-definite matrix according to Model (3). We assume , it suffices to solve the following optimization problem:

| (6) |

and consequently, the estimator for is denoted as such that which satisfies the first condition in (4). Note that the solutions in (6) are the same as those obtained by PCA in Bai and Ng (2002) and Gao and Tsay (2023), among others, if the constraint is removed. Furthermore, the problem in (6) is also equivalent to finding the largest eigenvalue associated with an -sparse eigenvector of the matrix :

| (7) |

which is a non-convex problem in general. In fact, it is NP-hard because it can be reduced to the subset selection problem for ordinary least-squares problem; see Moghaddam, Weiss, and Avidan (2006).

In fact, the optimization in (6) is still a sparse PCA problem symbolically, and numerous methods have been developed to obtain sparse eigenvectors during the past decades. See the regularization method with elastic net in Zou, Hastie, and Tibshirani (2006) and the penalized matrix decomposition (PMD) algorithm using -penalty in Witten, Tibshirani, and Hastie (2009), among others.

In this paper, we extend the APCA method of Connor and Korajczyk (1986, 1988) to high dimensions by adopting an -constraint on the sparse factors. We propose to use the truncated power method introduced in Yuan and Zhang (2013) to solve the first normalized sparse eigenvector in problem (6). The method is similar to the classical power method but includes an additional truncation operation to ensure sparsity. The rationale for this is as follows. First, the conventional APCA is conducted based on the following matrix perturbation formulation:

| (8) |

where is the matrix obtained by the noisy observation , is a symmetric matrix whose eigenvectors are the true ones, and is a random perturbation. The decomposition of (8) is formulated in (IA.1) of the online Appendix. If the true largest eigenvector of is sparse, then it is natural to recover from the noisy matrix . This recovery is guaranteed when the error is of a smaller order using the well-known theorem in Davis and Kahan (1970) under the approximate factor model. Second, for any given vector , the power method estimates the first eigenvector by

| (9) |

and a normalized converges to the first eigenvector of . To see this, note that there exist ,…, such that

where are the eigenvectors associated with the eigenvalues of . Then,

Under the assumption that for , it follows that the direction of converges to that of .

Motivated by the above discussion, we modify the power method by adding a truncation in each iteration, and the procedure is given in Algorithm 1 below.

Algorithm 1 (Estimation procedure of the first sparse risk factor process).

The procedure, presented in Algorithm 1, generates a sequence of intermediate -sparse eigenvectors from an initial sparse approximation . At each time stamp , the intermediate vector is multiplied by , and then the entries are truncated to zeros except for the largest entries. The resulting vector is then normalized to unit length. Finally, the estimated first factor process is , where is the output one in Algorithm 1. Note that the sparsity parameter is unknown in practice, and we will propose a cross-validation procedure below to choose such a parameter.

In practice, the convergence criterion in Algorithm 1 needs to be given first. A common criterion for the convergence of Algorithm 1 is that the two eigenvector iterates and for satisfy

| (10) |

for a small . Simulation results suggest that the convergence is not sensitive to a sufficiently small , and the numerical results in Section 4 indicate that the algorithm works well when we take in (10).

2.5.2 Multi-Factor Case

In this section, we consider the general case when there are multiple factor processes in Model (3), i.e. . In the presence of more than one common factor process, we need to apply Algorithm 1 multiple times and extract all the common factors in a sequential way. Specifically, when is given via Algorithm 1, we subtract the projection on first factor component of the panel and the residual would be . The resulting scaled covariance . Then the second eigenvector can be obtained by solving the following optimization problem (11) below:

| (11) |

and the second eigenvector is . Consequently, the second estimated factor process is . We use the normalization condition to maximize the additional variance of the original matrix , which is the same as the deflation framework in Mackey (2008). In other words, we need to eliminate the effect of the previous eigenvector directions by a projection method. Consequently, we formulate the procedure in Algorithm 2 below.

Algorithm 2 (A sequential estimation procedure of the sparse risk factors).

From the optimization problem in (11) and the procedure in Algorithm 2, we cannot enforce the orthogonality and sparsity at the same time, which is similar to the case in the sparse PCA framework. When there is no -constraint in (6) and (11), we can easily obtain that and are the two normalized and orthogonal eigenvectors associated with the top two eigenvalues of and, the approach reduces to the traditional APCA method. One of the differences between the one-factor case in (6) and the multi-factor case in (11) is that the estimated factors and loadings in the one-factor case satisfy the conditions in (4), whereas those obtained in the multi-factor case may not. It is important to note that this discrepancy is only a finite sample outcome. Asymptotically, we can demonstrate that the multi-factor case still satisfies the identification conditions in (4). Similar outcomes are also observed in the sparse PCA literature, including Zou, Hastie, and Tibshirani (2006) and Witten, Tibshirani, and Hastie (2009), as well as in the sparse factor modeling frameworks discussed in Kristensen (2017).

For each sparse vector obtained in Algorithm 2, the estimated factor process is obtained as . It is not hard to see that the number of iterations is , and the th iteration outputs a sparse estimator (multiplied by ) of the th column of . For the optimization problem in Step 4 of Algorithm 2, by the argument in Lemma A.1 of the Appendix, the matrix in each step is a symmetric one. Therefore, we modify the truncated power method in Algorithm 1 and propose the following algorithm to obtain a sparse eigenvector for Step 4 of Algorithm 2.

Algorithm 3 (Estimation of the -th eigenvector in Algorithm 2).

Note that the symmetric matrix in Algorithm 3 is not strictly positive definite, the half-inverse should be taken as a generalized one in line with the Moore-Penrose generalized inverse matrix.

2.6 Determination of the Number of Factors

The estimation method in Section 2.5 depends on a known number of factors . In practice, is unknown and we need to develop a data-driven method to estimate it. There are several useful methods developed in the past decades to estimate the number of factors including the information criterion in Bai and Ng (2002), the random matrix theory method in Onatski (2010), the ratio-based method in Lam and Yao (2012) and Ahn and Horenstein (2013), and the white noise testing approach in Gao and Tsay (2022), among others.

In this section, we only introduce two commonly used ways, one is based on the well-known information criterion (IC) method in Bai and Ng (2002), which estimates the number of factors by

| (12) |

where is a prescribed upper bound, and are the estimated factors and loading matrix based on factors. The other method is based on the eigenvalue ratios introduced by Lam and Yao (2012) and Ahn and Horenstein (2013). Specifically, let be the sample eigenvalues of , we adopt the ratio-based method to estimate by

| (13) |

where is a prescribed upper bound as in (12) to control the stability of the ratios. In practice, we may choose under the assumption that the number of factors is usually not large.

2.7 Choice of the Tuning Parameters

For a given number of factors , which can be estimated by the methods in Section 2.6 above, if the cardinality of each column in is known, we can obtain the estimated factors by solving the optimization problem using the proposed algorithms in Section 2.5. The resulting estimated loading matrix is , which can be obtained by the Ordinary Least-Squares (OLS) method. When the true factors are sparse and orthogonal, the theoretical results in Section 3 below suggest that , implying that each column loading vector is a sparse linear combination of the panel data over the timeline.

In practice, the cardinality of each column in is unknown, and we may choose them by the cross-validation method which is commonly used in machine learning literature. In fact, even though the sparsity parameters of factor processes may not be the same, it is still a convenient way to assume that which can simplify the cross-validation procedure significantly. According to the theoretical results in Section 3 and the proofs in the Appendix, when the sparsity parameters are distinct, the convergence of the estimator for can be achieved, where . Therefore, we assume that the sparsity parameters of each column are the same in this section. The cross-validation procedure is as follows.

For each fixed where is a chosen candidate set for the sparsity parameter , we first randomly divide the panel into two segments consisting of one training sample with components and the other a testing one with components, where and . Equivalently, we partition the data matrix into and , where and . Let be the estimated factors based on the training sample and be the estimated loading matrix. Define the testing error as

| (14) |

When we range the parameter over the candidate set , the optimal number of nonzero factors, denoted by , is the one that produces the smallest errors in (14). On the other hand, we do not expect to be a large one to avoid the overfitting issue. Therefore, we define as a penalty function, and let

Then, is the one that minimizes the above criterion, that is,

| (15) |

implying that we choose the optimal which results in minimal testing errors in the cross-validations. There are many choices for the penalty function as shown in Theorem 4 in Section 3 below. We will discuss the required properties of such that we can establish the consistency of in theory.

In practice, we may replace the candidate set by where is a prescribed bounded integer. Note that the cross-validation method is different from the classical one in the machine learning literature where the samples are partitioned along the time horizon, whereas we partition the samples over the cross-section in this paper. In fact, we can even perform more cross-validation experiments in order to obtain an optimal parameter . For example, we can choose a sufficiently large integer , and we can obtain testing errors as that in (14) for each fixed by partitioning the samples for times. We may denote the testing error by for the -th random partition and the average testing error for is defined as

| (16) |

where is the estimated factors based on the training sample in the -th cross-validation. Then, the optimal number of nonzero factors is the one that produces the smallest error of the information criterion in (15) by replacing the therein by in Equation (16) for .

3 Theoretical Properties

In this section, we present the asymptotic consistency and stochastic bounds of the estimators from Section 2 under under the framework where . Assuming the number of factors is fixed, and can be either fixed or slowly increasing, we first derive the asymptotic results under known and . We also demonstrate the consistency of the estimators for and thereafter. The mathematical proofs are provided in the Appendix.

To derive the asymptotic properties of the proposed method and estimators from Section 2, we need the following high-level assumptions. These assumptions can be readily verified by some standard and more primitive assumptions, which will be discussed in detail later. Most of the assumptions below are commonly used in the PCA or approximate-factor modeling literature, and some of which are stronger than those in Bai and Ng (2002) in order to show that the estimated sparse factor is close to . We will use or to denote a generic positive constant the value of which may change at different places.

Assumption 1.

The process is -mixing with the mixing coefficients satisfying the condition , where is defined as

| (17) |

where is the -field generated by .

Assumption 2.

Assume and the covariance satisfies .

Assumption 3.

There exists a vector such that , where is defined as that in (3).

Assumption 4.

The eigenvalues of are distinct and bounded away from and as .

Assumption 5.

for some , where is independent and identically distributed over and .

Assumption 6.

, , and are mutually independent groups.

Assumption 7.

and are sub-Gaussian variables for and in the sense that

for any .

Assumption 1 is standard to characterize the dynamic dependence of the factor processes. See, for example, the Lemma 1 in the appendix of Gao, Ma, Wang, and Yao (2019). Assumptions 2-3 impose an identification condition and a sparsity structure on the true factor process . Assumption 4 specifies that the top eigenvalues of the covariance of the panel data are distinct in order to avoid multiplicity of eigenvalues. Assumptions 2 and 4 provide identifiability for the Model (3) so that the factors and the loading matrix can be uniquely determined asymptotically. See Bai and Ng (2013) for a detailed argument. Assumption 5 is only made to simplify the theoretical derivations. It can be relaxed to a weaker assumption such as Conditions (c.i)–(c.iii) in Bai and Ng (2013). Similar assumptions are also made in Huang, Jiang, Li, Tong, and Zhou (2022) to simplify the theoretical derivation. Assumption 7 is used to derive the Bernstein-type concentration inequality in establishing the convergence rates of the estimated factors, and it can be relaxed to much weaker ones as those in Merlevède, Peligrad, and Rio (2011).

The following theorem establishes the consistency of the first estimated factor process.

Theorem 1.

From Theorem 1, we see that the angle between the estimated direction and the true one is asymptotically equal to zero or if . In fact, we can rewrite as where is the angle between and . Some remarks for Theorem 1 are as follows

Remark 1.

(i) It follows immediately from Theorem 1 that

If , we have that asymptotically, implying that or . Therefore, and coincide on the same line.

(ii) When the two vectors and point to the same direction in the sense that the angle is acute, then and . Theorem 1 implies that

and therefore,

implying that we can uniquely determine the factors asymptotically if as .

Next, we present the theorem concerning the consistency of all the estimated factors along the time horizon. For the distance between two matrices and , there are several measures that can be used in the literature. For example, We adopt the discrepancy measure used by Pan and Yao (2008): for two semi-orthogonal matrices and satisfying the condition , the difference between the two linear spaces and is measured by

| (18) |

Note that It is equal to if and only if , and to if and only if . By Lemma A1(i) in Pan and Yao (2008), is a well-defined distance measure on some quotient space of matrices. Alternatively, we may also adopt the measure

| (19) |

which is the Frobenius norm of the difference between the projection matrices of two spaces and is also a well-defined distance between linear subspaces. In addition, if we denote the singular values of by , in descending order, then the principal angles between and , , are defined as ; see, for example, Theorem I.5.5 of Stewart and Sun (1990). The squared Frobenius norm of the so-called distance, defined as

| (20) |

can also be used to measure the distance between two linear spaces. In fact, if is finite, the distances in (18)–(20) are equivalent, because

| (21) |

Therefore, we shall only use the distance in (19) to present our theoretical results in the main article.

Theorem 2.

Remark 2.

(i) From Theorem 2, we may plug the estimated factor and obtain

implying that all the principal angles will be asymptotically zero or if . On the other hand, if all directions of the estimated eigenvectors are in the same direction of the corresponding true ones.

(ii) Suppose the singular values of are where , then . If all the directions of the estimated eigenvectors and the true ones coincide on the same line, by an elementary argument, we can show that

where we used the inequality . Therefore, by (3), we have that

Consequently, we obtain the result for as

which is similar to the one in Remark 1(ii) for each single factor process.

(iii) When there is no sparsity, i.e., , we have that

which is in line with the conventional result in factor modeling if we ignore the term. See Gao and Tsay (2024) for details.

Next, we establish the theoretical results for the estimated loading matrix in the following theorem.

Theorem 3.

Remark 3.

By Assumptions 2 and the results in Theorem 1, it is not hard to show that , but we can use the sample version in empirical applications. If Assumption 5 holds, then the variance term in (23) reduces to , where can be estimated from the residuals. Under the general setting that the noise are not , we can use the well-known heteroskedasticity and autocorrelation consistent (HAC) estimator such as that in Andrews (1991) to approximate the long-run covariance term .

Furthermore, we discuss the consistency of the estimated number of factors. Given the convergence results in Theorems 1 and 2, it is not hard to see that the estimated number of factors are consistent no matter whether we apply the information criterion of Bai and Ng (2002) or the eigenvalue ratio based method in Lam and Yao (2012) and Ahn and Horenstein (2013). The detailed proofs are the same as the techniques used therein, and we omit them to save space here.

Finally, we provide the consistency of the cross-validation method in estimating the sparsity parameters . We consider the case where the sparsity parameters of each column of are the same, i.e., , as discussed in Section 2.7. Otherwise, the following theorem states the consistency for estimating the largest sparsity parameter among the columns.

Theorem 4.

Remark 4.

(i) When the columns of have distinct sparsity parameters, it is an important step to estimate the largest one among first, and in Theorem 4 is an estimator for . In other words, we can show that

| (24) |

On the other hand, estimating the largest sparsity parameter is often adequate since all the important factors over the timeline can be recovered. Furthermore, we can subsequently estimate the sparsity of each factor sequence using a coordinate descent approach.

(ii) In practice, there are many choices for in (15). For example, we may take

and

| (25) |

can consistently estimate , where can be replaced by obtained in (13).

(iv) When is diverging with the sample size in the sense that , then should be replaced by . For example, if , then the information criterion in (25) will be

| (26) |

which works well as shown in the simulation studies.

4 Simulation Evidence

In this section, we illustrate the finite-sample properties of the proposed methodology under different choices of and . To ensure our simulation results are reproducible, we set the seed to 1234 in R programming.

4.1 One-factor Case

First, we consider the one-factor case in Model (2), i.e., is used in this section. The factor process is generated by

where we set . We consider the dimensions and , with sample sizes , and for each . Each loading value is generated independently from the uniform distribution , and the -dimensional loading vector is then re-normalized to have an -norm strength of . For each configuration of , we choose the sparsity , which is the nearest integer greater than or equal to , and we randomly generate integers from and keep those elements in to be nonzero, re-normalizing the sparse vector to have unit variance. We consider two scenarios for the idiosyncratic terms ’s in each experiment:

where is a diagonal matrix with the diagonal elements generated from . A total of 500 replications are used throughout the experiments.

We first study the accuracy of the estimated factors by defining the estimation error in each replication as

| (27) |

Table 1 reports the average of the errors through 500 replications for two scenarios of the idiosyncratic terms. From Table 1, we see that for each scenario of the idiosyncratic terms, the estimation error decreases as the sample size increases for each fixed dimension N. Additionally, the estimation error also decreases as the dimension increases for each fixed sample size . This finding is in line with our asymptotic theory in Theorem 1.

| 200 | 500 | 800 | 1000 | 1200 | 200 | 500 | 800 | 1000 | 1200 | ||

| 50 | 0.050 | 0.040 | 0.036 | 0.034 | 0.032 | 0.087 | 0.069 | 0.054 | 0.051 | 0.055 | |

| 100 | 0.033 | 0.027 | 0.024 | 0.022 | 0.021 | 0.055 | 0.041 | 0.040 | 0.036 | 0.035 | |

| 150 | 0.026 | 0.021 | 0.018 | 0.017 | 0.016 | 0.044 | 0.035 | 0.031 | 0.030 | 0.028 | |

| 300 | 0.018 | 0.014 | 0.013 | 0.012 | 0.011 | 0.029 | 0.023 | 0.020 | 0.019 | 0.018 | |

| 500 | 0.014 | 0.011 | 0.009 | 0.009 | 0.008 | 0.022 | 0.017 | 0.015 | 0.014 | 0.013 | |

Next, we study the accuracy of the empirical recovery (ER) of the sparse factors. Let be the set of true indexes of the nonzero elements in , and the set of indices of the nonzero elements in . For each replication, define the empirical recovery rate of the non-sparse indices as

| (28) |

where is the cardinality of the intersection between the estimated indices and the true ones. Table 2 presents the empirical recovery rate of the sparsity in the factor process using the measure defined in (28). From Table 2 we see that the empirical accuracy increases as the the sample size increases for each fixed dimension , and it also increases as the dimension increases for each fixed sample size . This is also in agreement with our asymptotic results in Section 3.

| 200 | 500 | 800 | 1000 | 1200 | 200 | 500 | 800 | 1000 | 1200 | ||

| 50 | 0.918 | 0.933 | 0.936 | 0.938 | 0.940 | 0.884 | 0.900 | 0.914 | 0.916 | 0.910 | |

| 100 | 0.940 | 0.950 | 0.954 | 0.956 | 0.957 | 0.916 | 0.930 | 0.930 | 0.935 | 0.937 | |

| 150 | 0.952 | 0.959 | 0.962 | 0.963 | 0.965 | 0.931 | 0.939 | 0.943 | 0.945 | 0.947 | |

| 300 | 0.969 | 0.971 | 0.971 | 0.974 | 0.973 | 0.951 | 0.956 | 0.958 | 0.962 | 0.961 | |

| 500 | 0.971 | 0.978 | 0.979 | 0.980 | 0.980 | 0.957 | 0.965 | 0.969 | 0.970 | 0.971 | |

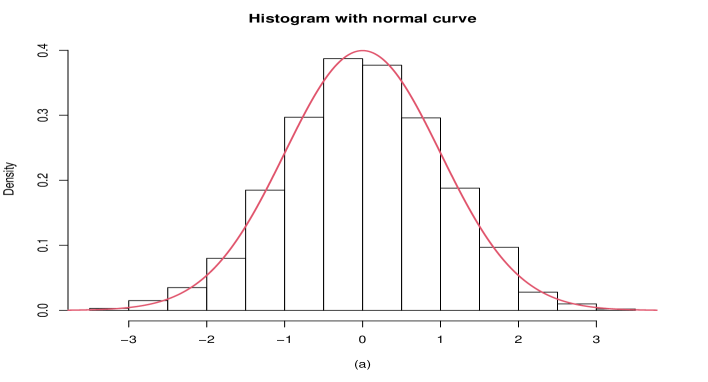

Finally, we evaluate the distribution of the estimated loadings as described in Theorem 3. For simplicity, we consider the case when the noises are and plot the empirical histogram of the estimated loading associated with the first series in Figure 1. The variance of the normal curve is based on the average of the estimated variance across 2000 replications. From Figure 1, we see that the estimators behave closely to normal, which is in agreement with our asymptotic theory.

4.2 Multi-factor Case

In this section, we further verify the efficacy of the proposed algorithms when there are multiple factors. The number of factors is set to be , and the factors are generated by

where is a diagonal matrix. We consider the dimensions , and , with the sample size , and for each in this experiment. For each configuration of , we set the sparsity parameters to . We first randomly generate indexes from to form an index set , such that we only keep the corresponding time points of and the remaining ones are set to zero. The index set is formed by generating indexes , keeping only those locations of . the sparse is obtained by repeating the above procedure. Then each is normalized to have unit variance. For the generation of the loading matrix , we first generate an matrix with elements independently generated from , we then perform a singular-value decomposition on , and the left singular matrix is . The loading is taken as multiplied by on its right. We also consider the two scenarios for the idiosyncratic terms as in Section 4.1. A total of 500 replications are used throughout the experiments.

Now, we first study the estimation accuracy of the factor processes. We define the measure of the errors of the estimated factors as

| (29) |

The average estimation errors of the factors over 500 replications are reported in Table 3. From Table 3, we observe a similar pattern to that in Section 4.1. For each fixed dimension , the estimation error generally decreases as the sample size increases. Additionally, the error decreases as the dimension increases for each fixed , which is in agreement with our asymptotic theory in Theorem 4, regardless of whether the idiosyncratic terms are i.i.d. or dynamically dependent.

| 100 | 200 | 300 | 500 | 800 | 100 | 200 | 300 | 500 | 800 | ||

| 50 | 0.090 | 0.080 | 0.073 | 0.065 | 0.058 | 0.136 | 0.127 | 0.116 | 0.114 | 0.100 | |

| 100 | 0.059 | 0.054 | 0.049 | 0.043 | 0.039 | 0.099 | 0.090 | 0.075 | 0.068 | 0.063 | |

| 150 | 0.047 | 0.043 | 0.039 | 0.033 | 0.031 | 0.078 | 0.071 | 0.063 | 0.056 | 0.050 | |

| 200 | 0.041 | 0.036 | 0.032 | 0.029 | 0.026 | 0.068 | 0.061 | 0.055 | 0.049 | 0.043 | |

| 300 | 0.032 | 0.029 | 0.026 | 0.023 | 0.020 | 0.052 | 0.045 | 0.043 | 0.037 | 0.032 | |

Furthermore, we study the empirical recovery (ER) of the sparsity in the factor processes. Similar to the measure in (28), we define

| (30) |

where and is the the estimated nonzero locations in for , and . Table 4 reports the empirical accuracy of the sparsity locations in the factor processes when . From Table 4, we see that the pattern is also similar to the case when in Section 4.1. The empirical results are in line with our asymptotic ones in the sense that the estimation accuracy will increase as the dimension or the sample size increases.

| 100 | 200 | 300 | 500 | 800 | 100 | 200 | 300 | 500 | 800 | ||

| 50 | 0.949 | 0.950 | 0.953 | 0.957 | 0.960 | 0.931 | 0.931 | 0.932 | 0.934 | 0.940 | |

| 100 | 0.966 | 0.965 | 0.965 | 0.969 | 0.971 | 0.947 | 0.948 | 0.952 | 0.955 | 0.958 | |

| 150 | 0.971 | 0.971 | 0.973 | 0.977 | 0.976 | 0.956 | 0.957 | 0.960 | 0.964 | 0.965 | |

| 200 | 0.973 | 0.974 | 0.977 | 0.977 | 0.980 | 0.959 | 0.959 | 0.964 | 0.966 | 0.970 | |

| 300 | 0.980 | 0.979 | 0.981 | 0.983 | 0.983 | 0.968 | 0.971 | 0.971 | 0.973 | 0.975 | |

Although the ratio-based method of (13) for determining the number of factors has been shown to be valid in many previous studies, we conduct an auxiliary experiment to verify its efficacy under our setting. Table 5 reports the empirical probabilities of in 500 replications under the aforementioned setting. From Table 5, we see that the ratio-based method performs well, with most of the empirical probabilities being close to one. This is understandable since all the factors are strong ones. Similar results can be found in Gao and Tsay (2023).

| 100 | 200 | 300 | 500 | 800 | 100 | 200 | 300 | 500 | 800 | ||

| 50 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 100 | 1 | 1 | 1 | 1 | 1 | 0.998 | 1 | 1 | 1 | 1 | |

| 150 | 1 | 1 | 1 | 1 | 1 | 0.998 | 1 | 1 | 1 | 1 | |

| 200 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 300 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

4.3 Determining the Sparsity with Cross-Validation

In this section, we study the estimation accuracy of the information criterion discussed in Section 2.7 and Remark 4 in estimating the sparsity of the factors. For simplicity, we only consider the case when , but similar results can be obtained for . The generation of the factors and the data is similar to those in Section 4.1, but we only keep the largest elements of the factor process in absolute value for each sample size . We consider the dimension , and , and the sample size , and for each in this section. For each configuration of , we set the number of partitions for simplicity and set in the partition. Since is diverging with the sample size , we will use the information criterion defined in (26) to estimate the sparsity. 500 replications are used throughout the experiment. Table 6 reports the Empirical probabilities (EP) of determining the sparsity parameter using the information criterion in (26) when the number of factors . The empirical probabilities are calculated based on the 500 experiments. From Table 6, we see that the proposed information criterion works sufficiently well in estimating the sparsity parameters. When the idiosyncratic terms possess some dynamic dependence structure, the proposed method does not provide a probability close to one to estimate the sparsity, but the performance of the proposed method still improves as the sample size and/or the dimension increases, which is in agreement with our asymptotic theory in Theorem 4.

| 100 | 200 | 300 | 500 | 800 | 100 | 200 | 300 | 500 | 800 | ||

| 50 | 1 | 1 | 1 | 1 | 1 | 0.882 | 0.980 | 1 | 1 | 1 | |

| 100 | 1 | 1 | 1 | 1 | 1 | 0.998 | 1 | 1 | 1 | 1 | |

| 150 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 200 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 300 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

5 An Empirical Application to Stock Returns

5.1 Data

In this section, we estimate the sparse latent risk factors across the time horizons in daily returns of individual stocks. The nonzero factors over certain time period can provide us one way to bridge time and certain type of risks in the financial market. The daily returns are downloaded from the CRSP daily security database and adjusted for dividend and stock splits. The data set used is the same as that in Pelger (2020) and consists of the daily stock returns for the balanced panel of S&P 500 stocks from January 1st 2004 to December 31st 2016. The daily interest rates from Prof. Kenneth French’s website (https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html) are used to adjust the daily returns of individual stocks. The full data set is also available at https://mpelger.people.stanford.edu/data-and-code, where only the stocks with returns available for the full-time horizon are included, leaving us with a panel of and .

Similar to Pelger (2020), we group these 332 stocks into 14 categories by industry sector, as shown in Table 7. The data encompasses a wide range of industry sectors within the stock market, including Oil, Finance, Electricity, Technology, Food, Manufacturing, Pharma&Chemicals, Primary Manufacturing, Machinery, Health, Transportation, Trade, Services, and Mining.

| Category | Stock Ticker |

|---|---|

| Oil | APA, APC, CHK, CNX, COP, CVX, HAL, HP, MRO, MUR, NBR, NE, NFG, NFX, OXY, PXD, RDC, RIG, SLB, SRE, TSO, VLO, XOM |

| Finance | ACAS, AET, AFL, AIG, AIV, AJG, ALL, AMG, AMT, AXP, BAC, BEN, BK, BXP, C, CI, CINF, CME, COF, FII, FITB, GS, HBAN, HCN, HCP, HIG, HRB, JNS, JPM, KEY, LNC, MBI, MET, MMC, MTG, NTRS, PFG, PLD, PNC, PRU, RF, RJF, SLM, SNV, SPG, SPY, STI, STT, TMK, TROW, UDR, UNM, USB, WFC, XL, ZION |

| Electricity | AEP, AES, CMS, CNP, FE, LNT, NI, PCG, PEG, PNW, PPL, SO, XEL |

| Technology | AAPL, ADBE, ADI, ADP, ADSK, AKAM, AMD, AMZN, APH, CA, CERN, CSC, CSCO, CTSH, CTXS, CVG, FFIV, FISV, HAR, HPQ, IBM, INTC, INTU, JBL, JNPR, KLAC, LLL, LLTC, LMT, MCHP, MSFT, MU, NCR, NTAP, NVDA, ORCL, QCOM, SNPS, STX, SWKS, SYMC, TXN, UIS, VRSN, WDC, XLNX, XRX, YHOO |

| Food | CAG, CCE, CPB, GIS, HSY, K, KO, MKC, MO, PEP |

| Manufacturing | CTAS, GCI, IP, JCI, KMB, LEG, LPX, MAS, NYT, RL, WY |

| Pharma & Chemicals | ABT, AMGN, APD, AVP, BMY, CL, CLX, ENDP, GILD, IFF, JNJ, LLY, MON, MRK, MYL, OLN, PFE, PG, PPG, PRGO, PX |

| Primary manufacturing | AA, AKS, ATI, COH, CTB, GLW, GT, NKE, NWL, OI, SNA, SWK, TUP, USG, UTX, WOR |

| Machinery | A, AMAT, AME, BA, BC, BGG, BHI, CAT, CMI, COL, FLIR, FOSL, FTI, GD, GE, GRMN, HAS, HON, HRS, IR, ITT, LRCX, MAT, NOC, PBI, PCAR, PKI, ROK, RTN, TEN, TER, TKR, TMO, TXT, WHR |

| Health | BAX, BCR, BDX, MDT, MMM, SYK, VAR, XRAY |

| Transportation | ALK, CCI, CCL, CMCSA, CSX, CTL, DISH, EXPD, JBHT, KSU, LUV, LVLT, NSC, TDW, UNP, UPS, VIAB, VZ |

| Trade | ABC, ANF, AZO, BBBY, BBY, CAH, COST, CVS, DLTR, FAST, FL, GPC, GPS, GWW, HD, HSIC, JCP, JWN, KMX, KR, KSS, LOW, MCD, MCK, ORLY, PDCO, RAD, ROST, SBUX, SHW, SPLS, SVU, SYY, TGT, TIF, TSCO, URBN, WEN, WMT, YUM |

| Services | ACN, ADS, APOL, EBAY, ESRX, FLR, IGT, INCY, IPG, IT, KBH, LEN, LH, MAR, MCO, NFLX, OMC, PAYX, PCLN, PHM, PWR, R, RCL, RHI, SEE, SRCL, THC, TWX, UHS, URI, WYNN |

| Mining | NEM, VMC |

5.2 Sparse Factor Estimation

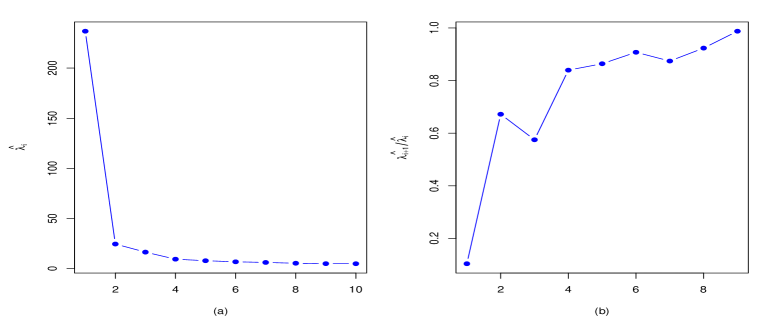

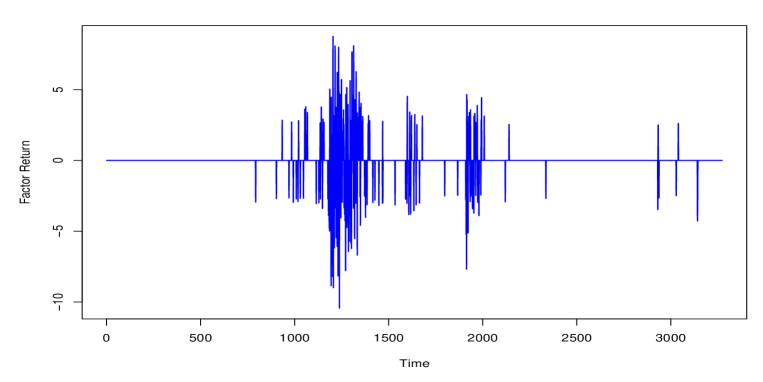

We first determine the number of factors for the centered data using the eigenvalue-ratio method in (13). Figure 2 plots the ratios of eigenvalues of and shows that the largest gap between the eigenvalues occurs between and , implying that the number of factors is . Next, we apply Algorithm 1 and the cross-validation method in Section 2.7 with the number of random partitions , where the seed number is set to be 1234 in R. For the sparsity of the factors over the time horizon, we conduct a grid search over the time interval , where denotes the smallest integer that exceeds . The estimated sparsity parameter is , indicating that there are 184 days during which the stocks were driven by significant systematic risks. We can see that the method achieves a substantial dimension-reduction compared to the full time length .

We then plot the estimated sparse factor returns in Figure 4. The plot reveals roughly three clusters of time periods associated with significant risks that systematically affect the stock market. The first cluster is centered around 2008, driven by the 2007–2008 financial crisis. The second and third clusters are closely related, both associated with the European sovereign debt crisis. The most prominent cluster is centered around 2008, driven by the 2007–2008 financial crisis. This period saw severe disruptions in the financial markets, with significant declines in stock returns across the board. For the two closely related clusters associated with the European sovereign debt crisis, the first cluster corresponds to the initial phase of the crisis in 2010, while the second cluster relates to the intensification of the crisis in 2011 and 2012.

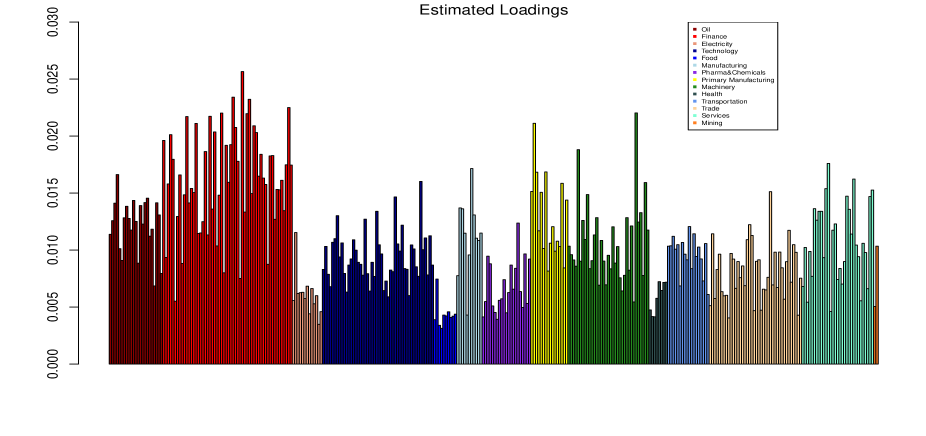

Next, we estimate the loadings of the 332 stock returns given the sparse common factors. We present the estimated loadings, indicating the level of dependence of 14 different industry sectors on the common risk factor in Figure 3. The loadings quantify the extent to which each sector is influenced by these common factors. Here are the detailed observations based on the average dependence values: Oil Sector: Exhibits moderate dependence on common risk factors, with an average loading of 0.0122. Finance Sector: Shows significant dependence, with an average loading of 0.0163. Electricity Sector: Demonstrates relatively low dependence, with an average loading of 0.0061. Technology Sector: Reflects moderate dependence, with an average loading of 0.0094. Food Sector: Indicates low dependence on common factors, with an average loading of 0.0044. Manufacturing Sector: Displays moderate dependence, with an average loading of 0.0113. Pharma & Chemicals Sector: Shows relatively low dependence compared to other sectors, with an average loading of 0.0068. Primary Manufacturing Sector: Exhibits moderate dependence, with an average loading of 0.0130. Machinery Sector: Demonstrates moderate dependence, with an average loading of 0.0106. Health Sector: Indicates relatively low dependence, with an average loading of 0.0059. Transportation Sector: Shows moderate dependence, with an average loading of 0.0096. Trade Sector: Reflects moderate dependence, with an average loading of 0.0081. Services Sector: Exhibits moderate dependence, with an average loading of 0.0108. Mining Sector: Indicates relatively low dependence on common risk factors, with an average loading of 0.0077.

Overall, the Finance sector shows the highest average dependence on common risk factors, while sectors like Food, Health, and Electricity exhibit lower average dependence. These variations highlight the differing levels of sensitivity across industry sectors to common economic and market risk factors.

5.3 Bridging Time and Risk Factors

To further identify the systematic factors over time, referred to as time factors, Table LABEL:Table-ft in the Appendix provides a comprehensive list of dates with significant systematic risk factors, the reasons for these factors, and their associated time factors. Each entry explains the specific event and its impact on stock returns, summarized according to the descriptions of the time factors in Table 8. These reasons are extracted from the daily reports on CNN Money (www.money.cnn.com) after the market closes on each trading day.

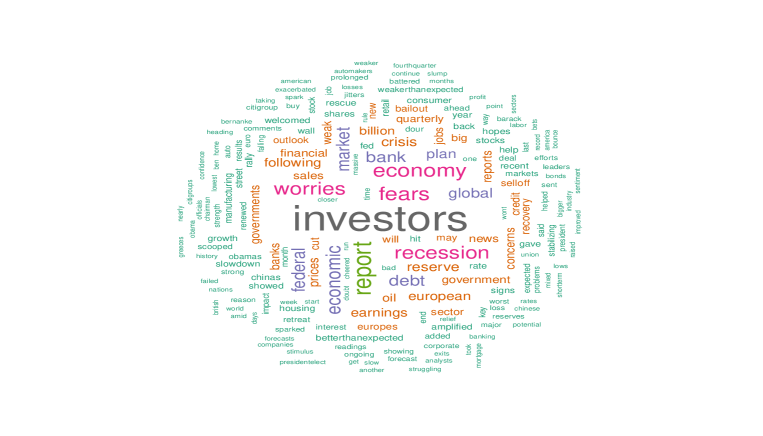

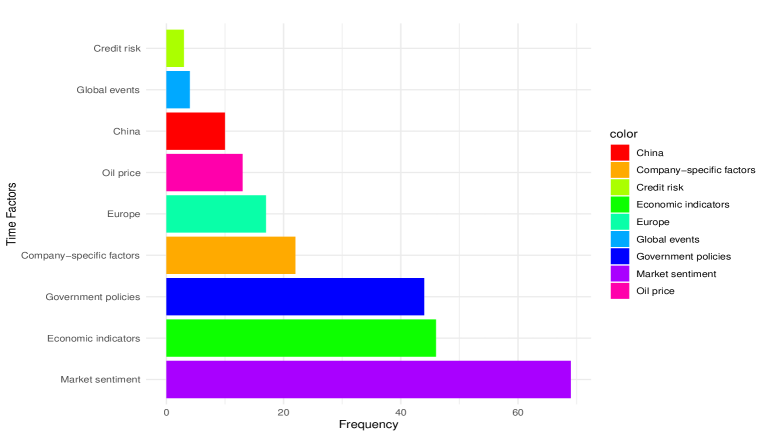

From Table LABEL:Table-ft, we see that specific events impact the stock market on each date with identified systematic factors. We further analyze the words generated from the columns of "Reason" in Table LABEL:Table-ft through textual analysis. The word cloud shown in Figure 5 provides a visual representation of the most frequent terms and phrases mentioned as influencing factors. These words are associated with nine significant factors outlined in Table 8 that affect stock returns. We treat Credit risk, Oil price, China, and Europe as individual factors since they significantly influence stock returns during the period from January 1, 2004, to December 31, 2016. The nine factors are summarized in Table 8.

| Time Factor | Description |

|---|---|

| Economic Indicators | Economic activities such as GDP growth, inflation, interest rates, and consumer confidence, sector reports, and job reports, etc. |

| Government Policies | Government policies, such as interest rate policies, tax policies, trade policies, and monetary policies, etc. |

| Global Events | Global events such as political instability, terrorist attacks, natural disasters, and pandemics, etc. |

| Market Sentiment | Market sentiment, which refers to the overall mood of investors. |

| Company-specific Factors | Company-specific factors, such as financial performance, management quality, and competitive position, can also impact financial markets. |

| Credit Risk | Credit risk refers to the possibility of borrowers defaulting on their obligations, affecting lenders and investors. |

| Oil Price | A reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus, and Western Canadian Select (WCS). |

| China | All significant economic activities associated with China such as a big decline in its financial market or a slowdown in its economic growth. |

| Europe | All significant economic activities associated with Europe and major European countries such as a debt crisis and the Brexit. |

We also plot the frequency charts of the nine factors over the time horizon in Figure 6. The most frequently mentioned factor is market sentiment, highlighting its dominant role in driving stock price fluctuations. Economic indicators and government policies follow closely, indicating the significant impact of macroeconomic data and policy decisions on market behavior. Company-specific factors also play an important role, affecting individual stock performance and, by extension, broader market trends. Factors related to Europe, such as economic conditions and crises, have a moderate influence, reflecting the interconnectedness of global markets. Oil price fluctuations, China’s economic activities, and global events are also notable contributors, underscoring the importance of global economic dynamics. Credit risk, while mentioned less frequently, remains a critical factor during periods of financial instability.

5.4 Implications

From Tables LABEL:Table-ft and 8, we can see that these factors are all important to the stability of the financial market. In general, they affect the financial market in the following ways:

-

(1)

Economic Indicators: This includes employment reports, GDP growth, inflation rates, interest rates, and consumer confidence indices. For example, the weaker-than-expected December jobs report on January 4, 2008, exacerbated worries about a potential recession, leading to significant negative returns.

-

(2)

Government Policies: These involve fiscal and monetary policy decisions such as interest rate cuts, bailouts, and tax policies. For instance, the Federal Reserve’s emergency interest rate cut on January 23, 2008, initially had a mixed impact but ultimately contributed to a market bounce back.

-

(3)

Market Sentiment: Refers to the overall mood and confidence of investors. Market sentiment was notably affected on October 28, 2008, when investors dove back into stocks despite the ongoing financial turmoil, reflecting a temporary boost in confidence.

-

(4)

Company-specific Factors: Events specific to individual companies, such as financial performance, management changes, and competitive positioning, can significantly impact their stock prices and, by extension, the broader market.

-

(5)

Credit Risk: This pertains to the risk of defaults and financial instability within the banking sector. Renewed credit market fears on November 7, 2007, following concerns about Bear Stearns, led to a significant drop in stock returns.

-

(6)

Oil Price: Fluctuations in crude oil prices directly impact stock returns. For example, a spike in oil prices on June 6, 2008, contributed to significant negative returns, highlighting the sensitivity of the market to energy costs.

-

(7)

Global Events: Includes political instability, terrorist attacks, natural disasters, and pandemics. The news of explosions at the Boston Marathon on April 15, 2013, resulted in a sharp market decline.

-

(8)

China: Economic activities and market movements within China. The big decline in Chinese stocks on February 27, 2007 had a notable impact on global markets.

-

(9)

Europe: Economic activities and crises within Europe, including the debt crisis and Brexit. The downgrade of Greece’s debt rating to junk status on April 27, 2010, sparked fears about the European debt crisis, leading to significant negative returns.

From Tables LABEL:Table-ft and 8, we have the following findings and implications:

-

(1)

Understanding Systematic Risks: Identifying the key factors that drive systematic risks provides valuable insights for investors and policymakers. By recognizing these factors, they can make more informed decisions to mitigate risks and capitalize on potential opportunities.

-

(2)

Temporal Patterns and Market Sensitivity: The clustering around the 2008 financial crisis and the European debt crisis underscores how prolonged economic uncertainties impact market stability. The varying reactions to government policies and economic indicators suggest the critical role of investor confidence during crises. For example, the mixed market reaction to the Federal Reserve’s interest rate cut on January 23, 2008, illustrates the complexity of market sentiment during turbulent periods.

-

(3)

Policy Implications: Our findings emphasize the importance of timely and effective government interventions, such as interest rate cuts and bailouts, in stabilizing the markets. Clear communication from policymakers can significantly influence investor sentiment and market outcomes. The market’s positive response to the Federal Reserve’s emergency interest rate cut on January 23, 2008, and the subsequent bounce back in stock prices highlight the effectiveness of such interventions.

-

(4)

Sector-Specific Insights: The financial sector’s vulnerability to systemic risks, particularly credit market fears and bank-specific news, is evident. Additionally, fluctuations in oil prices impact not only the energy sector but also broader market sentiments. The significant impact of renewed credit market fears on November 7, 2007, following concerns about Bear Stearns, underscores the interconnectedness of the financial sector and overall market stability.

-

(5)

Global Interconnectedness: The influence of events in China and Europe on US stock returns highlights the interconnected nature of global markets. This interconnectedness suggests that investors may benefit from diversifying their portfolios to mitigate risks associated with specific regions or events. The market’s reaction to the downgrade of Greece’s debt rating on April 27, 2010, and the subsequent fears about the European debt crisis illustrate the global ripple effects of regional economic events.

Our empirical analysis using sparse factor modeling provides valuable insights into the significant risk factors influencing stock returns over time. The identified clusters of risk periods and the associated factors offer a deeper understanding of market dynamics and the impact of various economic and political events. The findings underscore the importance of timely government interventions, clear communication from policymakers, and the need for diversification in investment portfolios to manage global risks effectively.

6 Conclusion

Sparse factor modeling focuses on extracting meaningful insights by identifying a subset of relevant variables, thereby enhancing interpretability and reducing computational demands. This study proposes a novel perspective by assuming that factor processes are sparse over the timeline, rather than enforcing sparsity on loadings. This approach is particularly relevant for scenarios where systematic co-movements are significant only during certain periods, such as financial crises or policy changes.

The paper introduces approximate factor models and their estimation using conventional PCA, followed by the proposed sparse asymptotic PCA framework. It details the estimation procedures and theoretical properties. Simulation and empirical studies demonstrate the method’s effectiveness in providing interpretable results and linking co-movements to specific events. This study not only advances the methodology of sparse factor modeling but also bridges the gap between time-specific events and risk factors in economic and financial systems. The proposed approach offers a robust framework for future research, including the expansion of time horizons, sector-specific analyses, and the integration of advanced modeling techniques.