QBIC of SEM for diffusion processes from discrete observations

Abstract.

We deal with a model selection problem for structural equation modeling (SEM) with latent variables for diffusion processes. Based on the asymptotic expansion of the marginal quasi-log likelihood, we propose two types of quasi-Bayesian information criteria of the SEM. It is shown that the information criteria have model selection consistency. Furthermore, we examine the finite-sample performance of the proposed information criteria by numerical experiments.

Key words and phrases:

Structural equation modeling with latent variables; Quasi-Bayesian information criterion; Diffusion process; High-frequency data.1. Introduction

We consider a model selection problem for structural equation modeling (SEM) with latent variables for diffusion processes. First, we set the true model of the SEM. The stochastic process is defined as the following factor model:

| (1.1) |

where is a -dimensional observable vector process, is a -dimensional latent common factor vector process, is a -dimensional latent unique factor vector process, and is a constant loading matrix. is not zero, , and and are fixed. Assume that and satisfy the following stochastic differential equations:

| (1.2) | ||||

| (1.3) |

where , , , , , , and and are and -dimensional standard Wiener processes, respectively. The stochastic process is defined by the factor model as follows:

| (1.4) |

where is a -dimensional observable vector process, is a -dimensional latent common factor vector process, is a -dimensional latent unique factor vector process, and is a constant loading matrix. is not zero, , and and are fixed. Suppose that satisfies the following stochastic differential equation:

| (1.5) |

where , , , and is an -dimensional standard Wiener process. Set . Moreover, the relationship between and is expressed as follows:

| (1.6) |

where is a constant loading matrix, whose diagonal elements are zero, and is a constant loading matrix. is a -dimensional latent unique factor vector process defined by the following stochastic differential equation:

| (1.7) |

where , , , and is an -dimensional standard Wiener process. , , and are independent standard Wiener processes on a stochastic basis with usual conditions . Let , where denotes the transpose. Below, we simply write as . are discrete observations, where , , is fixed, and , , and are independent of . We consider a model selection problem among the following parametric models based on discrete observations. Let be the parameter of Model , where is a convex and compact subset of with a locally Lipschitz boundary; see, e.g., Adams and Fournier [1]. The stochastic process is defined by the factor model as follows:

| (1.8) |

where is a -dimensional observable vector process, is a -dimensional latent common factor vector process, is a -dimensional latent unique factor vector process, and is a constant loading matrix. Suppose that and satisfy the following stochastic differential equations:

| (1.9) | ||||

| (1.10) |

where and . The stochastic process is defined as the following factor model:

| (1.11) |

where is a -dimensional observable vector process, is a -dimensional latent common factor vector process, is a -dimensional latent unique factor vector process, and is a constant loading matrix. Assume that satisfies the following stochastic differential equation:

| (1.12) |

where . Furthermore, we express the relationship between and as follows:

| (1.13) |

where is a constant loading matrix, whose diagonal elements are zero, and is a constant loading matrix. is a -dimensional latent unique factor vector process defined as the following stochastic differential equation:

| (1.14) |

where . Let and , where denotes the identity matrix of size . Set , , , , , , and . It is assumed that and are full column rank matrices, and are non-singular, and , , and are positive definite matrices. Let . The variances of and are defined as

respectively, where

and

Furthermore, we suppose that Model is a correctly specified model. In other words, it is assumed that there exists such that .

SEM with latent variables is a method for examining the relationships among latent variables that cannot be observed. In SEM, statisticians often consider some candidate models. In this case, it is necessary to select the optimal model among these models. In SEM, the Akaike information criterion (AIC) and Bayesian information criterion (BIC) are often used for model selection; see e.g., Huang [10]. These criteria are devised for different purposes. AIC selects the model to minimize Kullback-Leibler divergence in terms of prediction. On the other hand, BIC selects the model to maximize posterior probability given the data. As is well known, BIC has the model selection consistency while AIC does not.

The statistical inference for continuous-time stochastic processes based on discrete observations has been investigated for many years, see Yoshida [20], Genon-Catalot and Jacod [8], Bibby and Sørensen [3], Kessler [12], Yoshida [21], Uchida and Yoshida [18] [19], Kamatani and Uchida [11] and references therein. In the field of financial econometrics, many researchers have extensively considered the factor model based on high-frequency data. For example, Aït-Sahalia and Xiu [2] studied a continuous-time latent factor model for a high-dimensional model using principal component analysis, and Kusano and Uchida [14] extended the classical factor analysis to diffusion processes. Using these methods, we can investigate the relationships between observed variables and latent variables based on high-frequency data. However, the factor model does not provide the relationships between latent variables. Thus, Kusano and Uchida [15] proposed SEM with latent variables for diffusion processes, and studied the asymptotic properties. The method enables us to study the relationships between latent variables based on high-frequency data. See also Kusano and Uchida [16] for details of the SEM.

Recently, the model selection problem for continuous-time stochastic processes based on high-frequency data have studied; see, e.g., Uchida [17], Fuji and Uchida [7], Eguchi and Uehara [6], Eguchi and Masuda [4] and references therein. Eguchi and Masuda [4] proposed the quasi-BIC (QBIC) by using the stochastic expansion of the maginal quasi-likelihood, and applied it to ergodic diffusion processes and continuous semimartingales. Eguchi and Masuda [4] also showed that the QBIC has the model selection consistency. Furthermore, Eguchi and Masuda [5] studied the Gaussian QBIC for the ergodic Lvy driven processes.

Kusano and Uchida [16] studied the quasi-AIC (QAIC) for the SEM with latent variables for diffusion processes, and examined the asymptotic properties. On the other hand, what we propose in this paper is the QBIC for the SEM . It is shown that the QBIC for the SEM has the model selection consistency unlike the QAIC for the SEM.

This paper is organized as follows. In Section , the notation and assumptions are presented. In Section , based on the asymptotic expansion of the marginal quasi-log likelihood, we propose two types of quasi-Bayesian information criteria of the SEM, and investigate their asymptotic properties. In Section , we provide examples and simulation studies to show the finite-sample performance of the proposed information criteria. Section is devoted to the proofs of the theorems given in Section .

2. Notation and assumptions

First, we prepare the notations and definitions as follows. For any vector , , is the -th element of , and is the diagonal matrix, whose -th diagonal element is . For any matrix , , , is the -th element of , and represents the Moore-Penrose inverse of . If is a positive definite matrix, we write . For any symmetric matrix , , and stand for the vectorization of , the half-vectorization of and the duplication matrix respectively, where ; see, e.g., Harville [9]. For matrices and of the same size, we define . Let and . Set as the space of all functions satisfying the following conditions:

-

(i)

is continuously differentiable with respect to up to order .

-

(ii)

and all its derivatives are of polynomial growth in , i.e., is of polynomial growth in if .

is the set of all real-valued positive definite matrices. denotes the expectation under . and denote the convergence in probability and the convergence in distribution, respectively. Define

Set the prior density of as . Let

Next, we make the following assumptions.

-

[A]

-

(a)

-

(i)

There exists a constant such that

for any .

-

(ii)

For all , .

-

(iii)

.

-

(i)

-

(b)

-

(i)

There exists a constant such that

for any .

-

(ii)

For all , .

-

(iii)

.

-

(i)

-

(c)

-

(i)

There exists a constant such that

for any .

-

(ii)

For all , .

-

(iii)

.

-

(i)

-

(d)

-

(i)

There exists a constant such that

for any .

-

(ii)

For all , .

-

(iii)

.

-

(i)

-

(a)

-

[B]

-

(a)

For ,

-

(b)

For ,

as for each .

-

(a)

3. Main results

Based on the discrete observations , we define the quasi-likelihood as

where . Set the quasi-maximum likelihood estimator as

Furthermore, the marginal quasi-likelihood is defined as

where

Set the relative likeliness of Model occurrence as , where . The posterior model selection probability of Model is given as

| (3.1) |

for . Our purpose is to know the model which maximizes the posterior model selection probability (3.1). As , the model which maximizes (3.1) is equivalent to the model which maximizes . Consequently, it is sufficient to estimate . However, is very intractable. Thus, we consider the asymptotic expansion of . Let

and

Furthermore, we make the assumptions as follows.

-

[C1]

-

(a)

There exists a constant such that

for all .

-

(b)

.

-

(a)

Remark 2

Set

Note that as under and since it holds from the proof of Lemma 6 that converges in probability to a positive definite matrix. We have the asymptotic expansion of the marginal quasi-log likelihood on as follows.

Theorem 1

Suppose that

| (3.2) |

Under , and , as ,

on .

Note that it follows from Theorem 1 that

on as . Since it holds from [B] (a) that

as , we see from (3.2) that

Hence, is set as

where

Moreover, it follows from Lemma 6 that

as . Therefore, is defined as

Note that on .

Next, we consider the situation where the set of competing models includes some (not all) misspecified parametric models. Set

and . Note that is the set of correctly specified models. The optimal model is defined as follows:

Note that we assume that the optimal model is unique. The optimal parameter is set as

where

For , we note that . The following assumption is made.

-

[C2]

-

(a)

.

-

(b)

.

-

(a)

Furthermore, we define that Model is nested in Model when and there exist a matrix with and a constant such that for all . By the following theorem, we obtain the model selection consistency of and .

Theorem 2

Under [A], [B] and [C1], as Model is nested in Model ,

as .

Moreover, we have the following asymptotic result.

Theorem 3

Under [A], [B] and [C2], as ,

for .

Theorem 3 shows that the probability of choosing the misspecified models converges to zero as .

4. Numerical experiments

4.1. True model

The stochastic process is defined as follows:

where is a four-dimensional observable vector process, is a one-dimensional latent common factor vector process, and is a four-dimensional latent unique factor vector process. Assume that and are the one and four-dimensional OU processes as follows:

where and are one and four-dimensional standard Wiener processes, and

The stochastic process is defined by the following factor model:

where is a six-dimensional observable vector process, is a two-dimensional latent common factor vector process, and is a six-dimensional latent unique factor vector process, respectively. Suppose that satisfies the following stochastic differential equation:

where is a six-dimensional standard Wiener process, and

Furthermore, the relationship between and is expressed as follows:

where is a two-dimensional latent unique factor vector process defined by the following two-dimensional OU process:

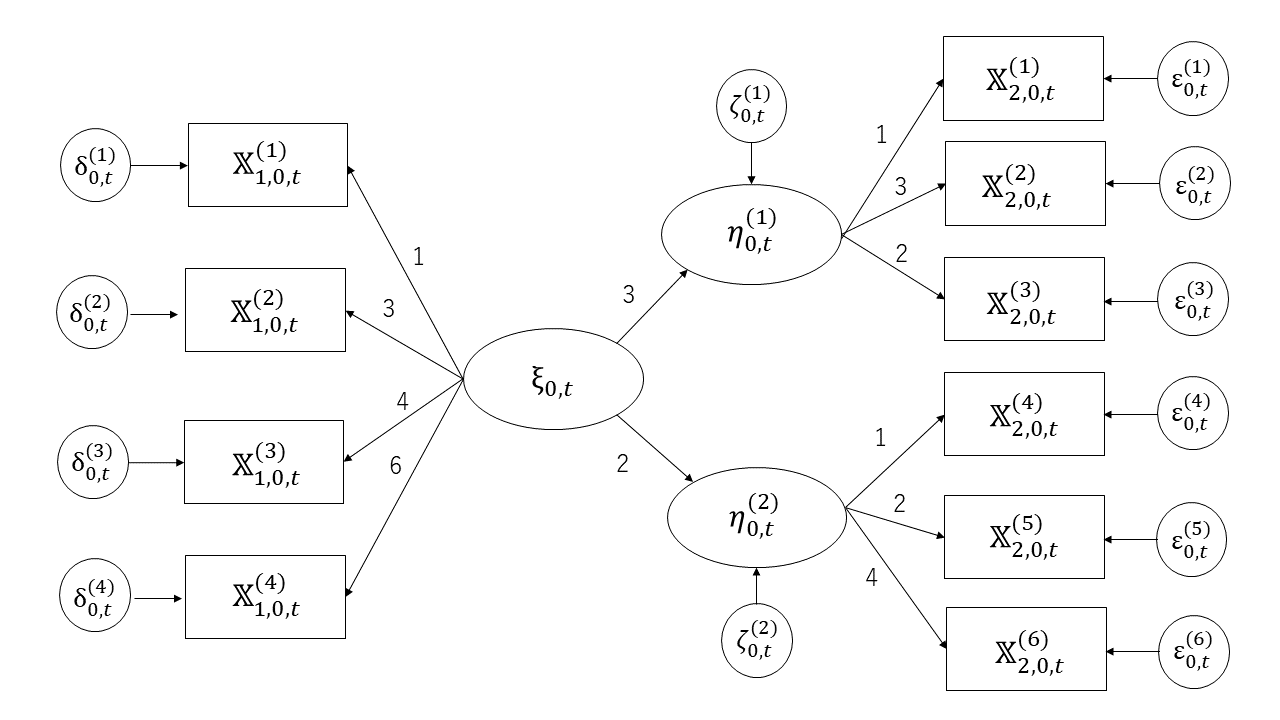

where is a two-dimensional standard Wiener process. Figure 1 shows the path diagram of the true model at time .

4.2. Parametric models

4.2.1. Model 1

Let , , , and . Suppose

and

where for are not zero. It is assumed that and satisfy

and

Furthermore, we suppose that and satisfy

and

Let

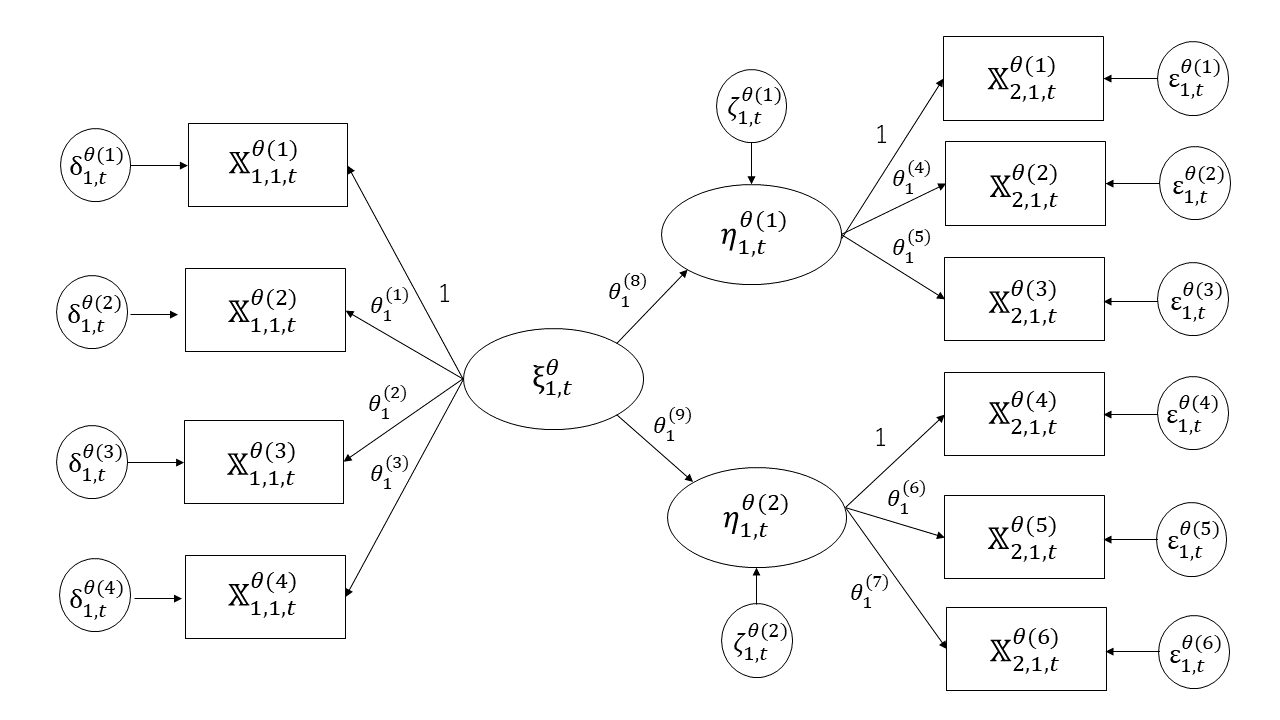

Since , Model is a correctly specified model. Note that Model satisfies the identifiability condition [C1] (a). For the check of the identifiability condition, see Appendix 6.2. Figure 2 shows the path diagram of Model at time .

4.2.2. Model 2

Set , , , and . Assume

and

where for and are not zero. and are supposed to satisfy

and

Moreover, we assume that and satisfy

and

Let

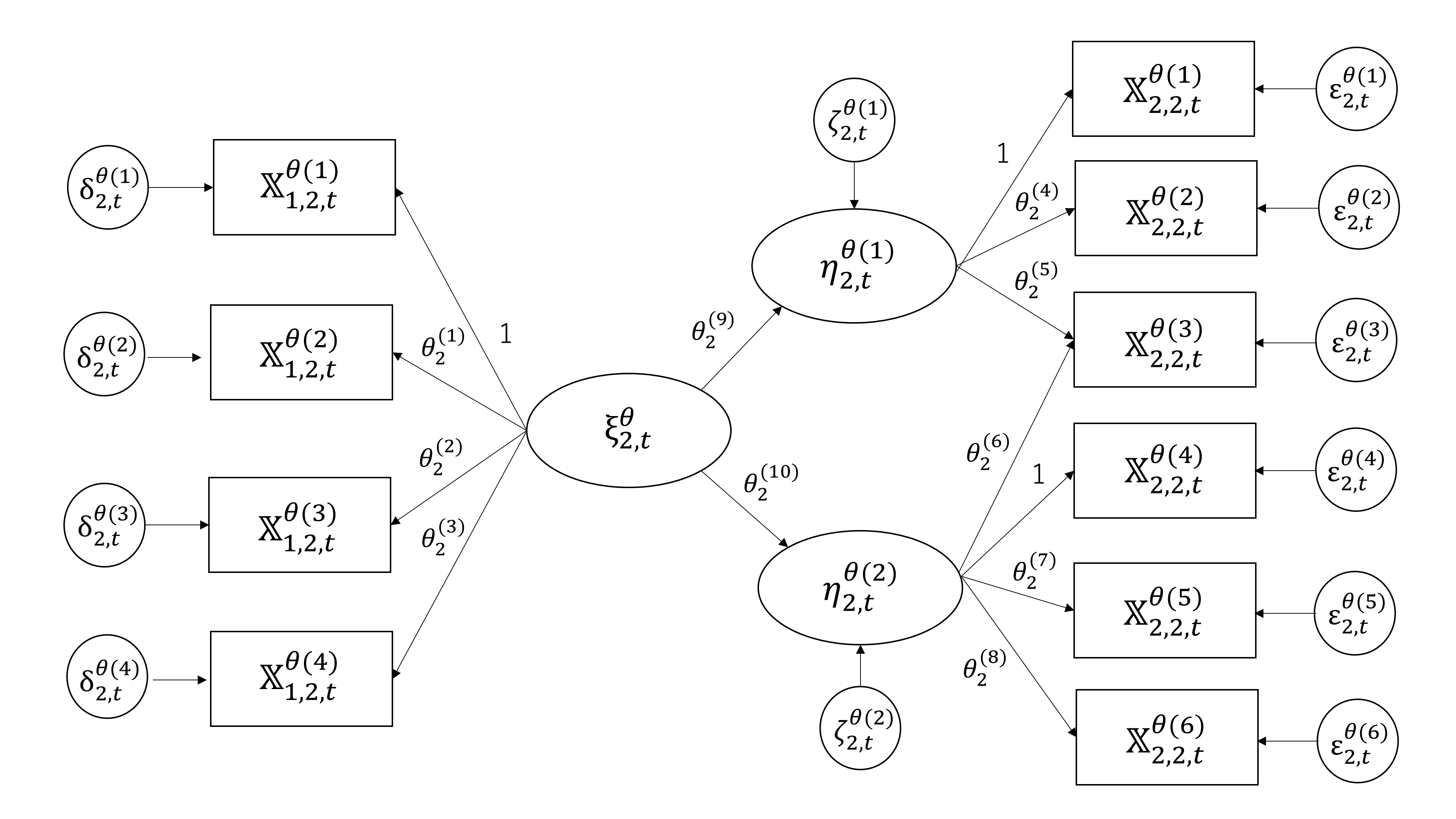

It holds that , so that Model is a correctly specified model. In a similar way to Model , we can check the identifiability condition of Model . Figure 3 shows the path diagram of Model at time .

4.2.3. Model 3

Let , , , and . Suppose

and

where for are not zero. It is assumed that and satisfy

and

Furthermore, we suppose that and satisfy

and

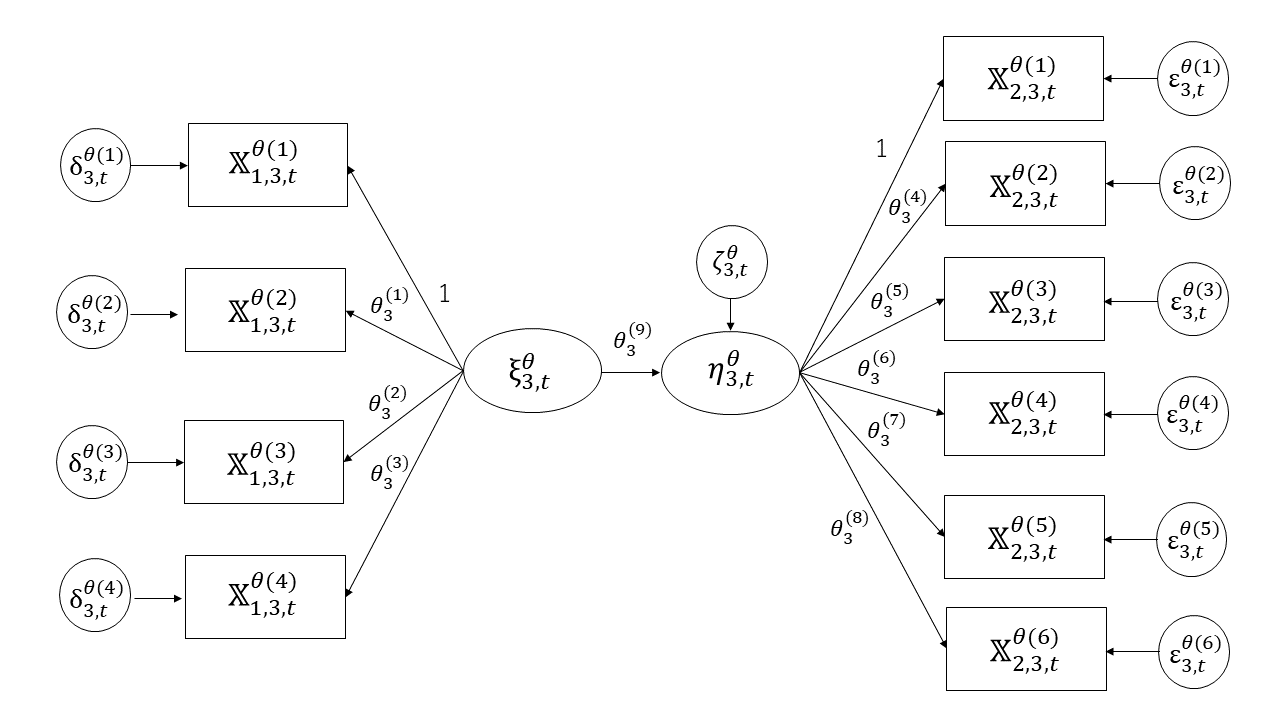

Since we have for any , Model is a misspecified model. Figure 4 shows the path diagram of Model at time .

4.3. Simulation results

In the simulation, we use optim() with the BFGS method in R language. The true value was used as the initial value for optimisation. independent sample paths are generated from the true model. Let and we consider the case where . To see the differences in model selection, we use

See Kusano and Uchida [16] for the details of QAIC for SEM with latent variables for diffusion processes.

Table 1 shows the number of models selected by , and QAIC. For any cases, and choose the optimal model (Model ), which implies that Theorem 2 seems to be correct in this example. In all cases, is more likely to select the optimal model than especially as sample size is small. On the other hand, selects the over-fitted model (Model ) with significant probability even for a large sample size. This implies that does not have the model selection consistency. Furthermore, in all cases, the misspecified model (Model ) is not selected by , and . It seems that Theorem in Kusano and Uchida [16] and Theorem 3 hold true for this example.

| Model 1∗ | Model 2 | Model 3 | |

|---|---|---|---|

| 9469 | 531 | 0 | |

| 9644 | 356 | 0 | |

| QAIC | 8327 | 1673 | 0 |

| Model 1∗ | Model 2 | Model 3 | |

|---|---|---|---|

| 9854 | 146 | 0 | |

| 9911 | 89 | 0 | |

| QAIC | 8465 | 1535 | 0 |

| Model 1∗ | Model 2 | Model 3 | |

|---|---|---|---|

| 9956 | 44 | 0 | |

| 9972 | 28 | 0 | |

| QAIC | 8443 | 1557 | 0 |

| Model 1∗ | Model 2 | Model 3 | |

|---|---|---|---|

| 9991 | 9 | 0 | |

| 9995 | 5 | 0 | |

| QAIC | 8400 | 1600 | 0 |

5. Proof

In this section, the model index ”” may be omitted. Let , where

Set the random field as

for and for . Furthermore, we define

for .

Lemma 1

Under [A], as ,

| (5.1) |

and

| (5.2) |

for .

Proof.

Lemma 2

Under [A] and [C1] (a),

as .

Proof.

See Lemma in Kusano and Uchida [16]. ∎

Lemma 3

Under [A] and [C1], for all , there exists such that

for all .

Proof.

See Lemma 8 in Kusano and Uchida [16]. ∎

Eguchi and Masuda [4] stated only that the following Lemma 4 can be proven using the proof of Theorem 6 in Yoshida [21]. However, we provide the detailed proof of the following Lemma 4 since we consider the proof to be non-trivial.

Lemma 4

Under [A] and [C1], for all , there exists such that

Proof.

Note that

| (5.3) |

since for . Let us consider the following decomposition:

| (5.4) | ||||

for all . First, we consider the first term on the right-hand side of (5.4). For all , it holds from Lemma 3 that there exists such that

for all and , so that one gets

Furthermore, we see

which yields

| (5.5) | ||||

Next, we consider the second term on the right-hand side of (5.4). Note that

for all . It is shown that

| (5.6) | ||||

by using the polar coordinates transformation:

where , for and . Moreover, we see

for all and , so that it holds from (5.6) that

| (5.7) | ||||

It follows from d’Alembert’s ratio test that

since one gets

as for and . Furthermore, we have

so that it holds from (5.7) that

for all , which yields

| (5.8) | ||||

Hence, we see from (5.3)-(5.5) and (5.8) that

| (5.9) | ||||

for all . Since as for any , one gets

as . Therefore, there exists such that

so that it follows from (5.9) that

∎

Proof of Theorem 1.

It is enough to check the regularity conditions of Theorem 3.7 in Eguchi and Masuda [4] as and . Note that is a positive definite matrix under [C1] (b); see Lemma 35 in Kusano and Uchida [13] for the proof. Lemmas 1 and 4 satisfy Assumptions 3.1 and 3.3 in Eguchi and Masuda [4] respectively. [B] yields Assumption 3.2 in Eguchi and Masuda [4]. Furthermore, it holds from Lemma 2 that , which completes the proof. ∎

Lemma 5

Under [A], as ,

for .

Proof.

Lemma 6

Under [A] and [C1],

| (5.10) |

and

| (5.11) |

for .

Proof.

First, we will prove (5.10). In a similar way to Lemma 5, it is shown that

| (5.12) |

for . Since is continuous in , the continuous mapping theorem and Lemma 2 show

| (5.13) |

for . Let

It holds from (5.12) and (5.13) that

for , so that one gets

Note that as for since is a positive definite matrix. For all , we have

as for , which yields

| (5.14) |

Thus, it follows from the continuous mapping theorem and (5.14) that

for . For the proof of (5.11), see Lemma in Kusano and Uchida [16]. ∎

Proof of Theorem 2.

In an analogous manner to the proof of Theorem 1, Assumptions 3.1-3.3 in Eguchi and Masuda [4] are satisfied. The proof of Theorem 5.1 (i) in Eguchi and Masuda [4] is valid when is a positive definite matrix. On the other hand, Eguchi and Masuda [4] implies that and have the model selection consistency if for . Indeed, from Lemma 6, we can obtain the result in the same way as the proof of Theorem 5.1 (i) in Eguchi and Masuda [4]. See also Appendix 6.1. ∎

Proof of Theorem 3.

Set

for . Note that has the unique maximum point at . Since we have

for , it is shown that

| (5.15) |

which yields for . For , it holds from Lemma 5 that . Furthermore, [C2] (a) yields the uniqueness of . Therefore, in a similar way to the proof of Theorem 5.1 (ii) in Eguchi and Masuda [4], from Lemma 6, we can prove the result. See also Appendix 6.1. ∎

References

- [1] Adams, R. A. and Fournier, J. J. (2003). Sobolev spaces. Elsevier.

- [2] Aït-Sahalia, Y. and Xiu, D. (2017). Using principal component analysis to estimate a high dimensional factor model with high-frequency data. Journal of Econometrics, 201(2), 384-399.

- [3] Bibby, B. M. and Sørensen, M. (1995). Martingale estimation functions for discretely observed diffusion processes. Bernoulli, 1, 17-39.

- [4] Eguchi, S. and Masuda, H. (2018). Schwarz type model comparison for LAQ models. Bernoulli, 24(3), 2278-2327.

- [5] Eguchi, S. and Masuda, H. (2024). Gaussian quasi-information criteria for ergodic Lévy driven SDE. Annals of the Institute of Statistical Mathematics, 76(1), 111-157.

- [6] Eguchi, S. and Uehara, Y. (2021). Schwartz‐type model selection for ergodic stochastic differential equation models. Scandinavian Journal of Statistics, 48(3), 950-968.

- [7] Fujii, T. and Uchida, M. (2014). AIC type statistics for discretely observed ergodic diffusion processes. Statistical Inference for Stochastic Processes, 17, 267-282.

- [8] Genon-Catalot, V. and Jacod, J. (1993). On the estimation of the diffusion coefficient for multidimensional diffusion processes. Annales de l’Institut Henri Poincaré (B) Probabilités et Statistiques, 29, 119-151.

- [9] Harville, D. A. (1998). Matrix algebra from a statistician’s perspective. Taylor & Francis.

- [10] Huang, P. H. (2017). Asymptotics of AIC, BIC, and RMSEA for model selection in structural equation modeling. Psychometrika, 82(2), 407-426.

- [11] Kamatani, K. and Uchida, M. (2015). Hybrid multi-step estimators for stochastic differential equations based on sampled data. Statistical Inference for Stochastic Processes, 18, 177-204.

- [12] Kessler, M. (1997). Estimation of an ergodic diffusion from discrete observations. Scandinavian Journal of Statistics, 24(2), 211-229.

- [13] Kusano, S. and Uchida, M. (2023). Structural equation modeling with latent variables for diffusion processes and its application to sparse estimation. arXiv preprint arXiv:2305.02655v2.

- [14] Kusano, S. and Uchida, M. (2024a). Statistical inference in factor analysis for diffusion processes from discrete observations. Journal of Statistical Planning and Inference, 229 106095.

- [15] Kusano, S. and Uchida, M. (2024b). Sparse inference of structural equation modeling with latent variables for diffusion processes. Japanese Journal of Statistics and Data Science, 7, 101-150.

- [16] Kusano, S. and Uchida, M. (2024c). Quasi-Akaike information criterion of structural equation modeling with latent variables for diffusion processes. arXiv preprint arXiv:2402.08959.

- [17] Uchida, M. (2010). Contrast-based information criterion for ergodic diffusion processes from discrete observations. Annals of the Institute of Statistical Mathematics, 62, 161-187.

- [18] Uchida, M. and Yoshida, N. (2012). Adaptive estimation of an ergodic diffusion process based on sampled data. Stochastic Processes and their Applications, 122(8), 2885-2924.

- [19] Uchida, M. and Yoshida, N. (2014). Adaptive Bayes type estimators of ergodic diffusion processes from discrete observations. Statistical Inference for Stochastic Processes, 17, 181-219.

- [20] Yoshida, N. (1992). Estimation for diffusion processes from discrete observation. Journal of Multivariate Analysis, 41, 220–242.

- [21] Yoshida, N. (2011). Polynomial type large deviation inequalities and quasi-likelihood analysis for stochastic differential equations. Annals of the Institute of Statistical Mathematics, 63(3), 431-479.

6. Appendix

6.1. The proofs of Theorem 2 and Theorem 3

Proof of Theorem 2.

Let

Since Model is nested in Model , there exist a matrix with and a constant such that

for all , where . Using the Taylor expansion, we have

on for , where

and

Note that

for . Lemma 6 yields

| (6.1) | ||||

for . Furthermore, using the Taylor expansion, it is shown that

for and , where

Consequently, we obtain

for and . Lemma 1 and Lemma 6 show

| (6.2) | ||||

for and . In a similar way, it holds from Lemma 1, Lemma 6 and (6.1) that

| (6.3) | ||||

for and . Thus, it follows from Lemma 1, (6.2) and (6.3) that

| (6.4) |

Furthermore, we see from Lemma 6, (6.1) and (6.4) that

| (6.5) | ||||

on , and

| (6.6) | ||||

Therefore, it follows from (6.5), (6.6) and Slutsuky’s Theorem that

as for . In a similar way, we can obtain

as for . ∎

Lemma 7

Under [A] and [C2] (a), as ,

for .

Proof.

The result can be shown in a similar way to Lemma 36 in Kusano and Uchida [13]. ∎

Proof of Theorem 3.

Note that is continuous in . It holds from Lemma 7 and the continuous mapping theorem that

| (6.7) |

for . Thus, it follows from Lemma 5 and (6.7) that

for , which yields

| (6.8) |

In an analogous manner to Lemma 6, it is shown that

| (6.9) |

for . For , we see from (6.8) and (6.9) that

| (6.10) | ||||

Furthermore, (5.15) shows

| (6.11) |

for . Therefore, it holds from (6.10) and (6.11) that

as for . In a similar way, we can prove

as for . ∎

6.2. The check of identifiability

In a similar way to Appendix 6.2 in Kusano and Uchida [16], to check [C1] (a), it is sufficient to show

and . Since , we see from Lemma 35 in Kusano and Uchida [13] that . Assume

| (6.12) |

Note that , and are not zero. The (1,2)-th, (1,3)-th, and (2,3)-th elements of (6.12) show

| (6.13) | ||||

Thus, it holds from (6.13) and the (1,2)-th, (1,3)-th, and (1,4)-th elements of (6.12) that

and is not zero, which yields

| (6.14) |

It follows from the (1,1)-th, (2,2)-th, (3,3)-th, and (4,4)-th elements of (6.12) that

so that (6.13) and (6.14) show

| (6.15) |

Moreover, we see from (6.13) and the (1,5)-th, and (1,8)-th elements of (6.12) that

and is not zero, which implies

| (6.16) |

Since it follows from (6.13), (6.16), and the (1.6)-th, (1.7)-th, (1.9)-th, and (1.10)-th elements of (6.12) that

and , and are not zero, one gets

| (6.17) |

Note that the (5.6)-th, and (8.9)-th elements of (6.12) are

and and are not zero. (6.13), (6.16) and (6.17) implies

which yields

| (6.18) |

As the (5.5)-th, (6.6)-th, (7.7)-th, (8.8)-th, (9.9)-th and (10.10)-th elements of (6.12) are

we see from (6.13), (6.16), (6.17) and (6.18) that

| (6.19) |

Therefore, it follows from (6.13)-(6.19) that , which completes the proof.