Sub-Gaussian High-Dimensional Covariance Matrix Estimation under Elliptical Factor Model with th Moment

Abstract

We study the estimation of high-dimensional covariance matrices under elliptical factor models with th moment. For such heavy-tailed data, robust estimators like the Huber-type estimator in fan2018large can not achieve sub-Gaussian convergence rate. In this paper, we develop an idiosyncratic-projected self-normalization (IPSN) method to remove the effect of heavy-tailed scalar parameter, and propose a robust pilot estimator for the scatter matrix that achieves the sub-Gaussian rate. We further develop an estimator of the covariance matrix and show that it achieves a faster convergence rate than the generic POET estimator in fan2018large.

Keywords: High-dimension, elliptical model, factor model, covariance matrix, robust estimation

1 Introduction

1.1 Covariance Matrix Estimation for Heavy-tailed Distributions

There is an extensive interest in robust estimation of the covariance matrices for heavy-tailed data, which are commonly seen in various fields such as finance, economics and biology. Huber-type robust estimators (minsker2018sub; minsker2020robust), and truncation or shrinkage methods (fan2021shrinkage) are popular approaches in this area. Notably, these studies typically assume that data have finite 4th moment.

avella2018robust study the high-dimensional covariance matrix estimation for cases where data have finite 4th or th moment with . Under sparsity assumptions on the covariance matrix or its inverse matrix, their approach involves applying thresholding techniques (cai2011adaptive; cai2016estimating) on a robust pilot matrix. The pilot matrix combines a Huber-type M-estimator of variances and a rank-based robust correlation matrix estimator such as the marginal Kendall’s tau (liu2012high; xue2012regularized). Under the high-dimensional setting where the dimension and the sample size both go to infinity, if the data have 4th moment, avella2018robust show that their estimator achieves the convergence rate of , which is the same convergence rate as in the sub-Gaussian case. However, for the case when only th moment exists, the convergence rate reduces to ; see Proposition 6 therein.

1.2 Elliptical Factor Models

Due to their flexibility in modeling heavy-tailedness and capturing tail-dependences, elliptical models are widely used to model financial returns (ZL11; han2014scale), gene microarrays (avella2018robust) and brain images (han2018eca). An elliptical model is typically defined as follows:

| (1.1) |

where is the expectation, is a random scalar variable, is a nonnegative matrix, and is a length- vector uniformly distributed on the unit sphere and independent of . The covariance matrix of is . Usually, is referred to as the scatter matrix (fan2018large). For identification purposes, can be normalized to have a trace of . Popular estimators of the scatter matrix include the minimum covariance determinant (MCD) and minimum volume ellipsoid (MVE) estimators (rousseeuw1984least; rousseeuw1985multivariate), Maronna’s M-estimator (maronna1976robust) and Tyler’s M-estimator (tyler1987distribution). However, these estimators can not handle the case when ; see, for example, the discussions in van2009minimum, zhang2016robust; zhang2016marvcenko and hubert2018minimum.

High-dimensional data such as financial returns usually exhibit a factor structure. FFL08; FLM11; fan2013large utilize factor models coupled with idiosyncratic sparsity to estimate the high-dimensional covariance matrix under such settings. These studies focus on the case where data are sub-Gaussian or sub-Exponential.

fan2018large consider elliptical factor models under which only th moment exists and propose a generic Principal Orthogonal ComplEment Thresholding (POET) procedure to estimate the high-dimensional covariance matrix. Their approach relies on three components, , and , which are robust pilot estimators of the covariance matrix , its leading eigenvalues and eigenvectors , respectively. The theoretical properties of the generic POET procedure crucially depend on the consistency of the pilot components, which have sub-Gaussian convergence rate under the th moment condition:

| (1.2) | |||

| (1.3) | |||

| (1.4) |

When only th moment exists, the convergence rates in equations (1.2) and (1.3) reduce to .

1.3 Our Contributions

Infinite kurtosis and cross-sectional tail dependence are commonly seen in financial data. Stock returns contain large and dependent jumps (e.g., ding2023stock), which have slowly decaying tails that suggest infinite 4th moment (bollerslev2013jump). For data with only th moment, the aforementioned covariance matrix estimation methods can not achieve the sub-Gaussian rate.

An important and challenging question is:

Is there a covariance matrix estimator that can achieve a higher rate than or even the sub-Gaussian rate of when only th moment exists?

We address this question in this paper. We study the robust estimation of high-dimensional covariance matrices under elliptical factor models with only th moment.

It is worth mentioning that in the elliptical model (1.1), the scatter matrix determines the cross-sectional dependence and plays a central role in various applications. For example, the eigenstructure of governs the principal component analysis (PCA) of . In financial applications, the inverse of the scatter matrix, , is used in constructing the minimum variance portfolio. The scalar component, , on the other hand, is not relevant in the above applications.

These observations motivate us to estimate the two components, and , separately.

In this paper, we propose an estimator of the scatter matrix that achieves the sub-Gaussian convergence rate under the condition that has only th moment. We summarize the construction of our estimator below.

First, we estimate and remove the effect of in . ZL11 develop a self-normalization approach to remove in elliptical models. Specifically, when is large, can be consistently estimated by , where is a properly demeaned . The consistency of in estimating requires that the data do not admit a strong factor structure. Under the elliptical factor model, such a consistency no longer holds. In this paper, we develop an idiosyncratic projected self-normalization (IPSN) approach that allows the existence of factors.

Next, we use the idiosyncratic-projected self-normalized data to construct the pilot components for the generic POET estimation of . We use the sample covariance matrix of the idiosyncratic-projected self-normalized data and standardize it to have trace . The resulting estimator is the pilot covariance matrix estimator, . The pilot leading eigenvalues and leading eigenvector estimators, and , are simply the leading eigenvalues and eigenvectors of . We show that our pilot estimators achieve the sub-Gaussian rate under only 2+th moment condition. We then apply the generic POET procedure on the proposed IPSN pilot estimators to obtain the scatter matrix estimator, denoted by GPOET-IPSN. We show that the GPOET-IPSN estimator achieves the sub-Gaussian convergence rate under a conditional sparsity assumption.

Finally, to estimate the covariance matrix , we construct a consistent estimator of based on . We show that the estimator achieves the same converge rate as the oracle estimator based on the unobserved process. Combining our proposed GPOET-IPSN estimator of with the estimator of yields our estimator of , which we show achieves a faster convergence rate than the generic POET estimator in fan2018large.

The favorable properties of our proposed estimator are clearly demonstrated in the numerical studies. Simulation studies show that the GPOET-IPSN estimator performs robustly well under various heavy-tailedness settings and achieves a higher estimation accuracy than the robust generic POET estimator in fan2018large and the POET estimator in fan2013large. Empirically, we apply our proposed estimator to construct minimum variance portfolios using S&P 500 Index constituent stocks. We find that our portfolio has a statistically significantly lower out-of-sample risk than benchmark portfolios.

The rest of this paper is organized as follows. We present our theoretical results in Section 2. Simulations and empirical studies are presented in Sections 3 and 4, respectively. We conclude in Section 5. The proofs of the theorems and propositions are presented in Section A. The proofs of the lemmas are collected in the Supplementary Material (DZ24_supp).

We use the following notation throughout the paper. For any matrix , its spectral norm is defined as , where for any vector ; the Frobenius norm is defined as ; and the relative Frobenius norm is defined as , where is a positive-definite matrix.

2 Main Results

2.1 Settings and Assumptions

Suppose that follows the elliptical model (1.1). We make the following assumptions.

Assumption 1

are i.i.d. and independent with . Moreover, there exist constants such that for some and .

Assumption 2

There exist constants such that .

Write the eigen decomposition of as , where , are the eigenvalues of , and is the corresponding matrix of eigenvectors. We assume that factors exist so that the following eigen-gap condition holds.

Assumption 3

There exist a and such that , and for .

Widely used approaches for estimating the number of factors such as those developed in bai2002determining, onatski2010determining and ahn2013eigenvalue require the existence of 4th moment. Under the elliptical factor model with th moment, the number of factors can be consistently estimated using the robust estimator in yu2019robust, which utilizes eigenvalue ratios of spatial Kendall’s tau matrices. In the following analysis, we assume that the number of factors is known.

2.2 Idiosyncratic-Projected Self-Normalized Estimator of Covariance Matrix

Observe that under the model (1.1), we can write as follows:

| (2.1) |

where , and and are independent. The heavy-tailedness of is solely determined by . Motivated by this observation, we separately estimate and . To do so, we develop an idiosyncratic-projected self-normalization (IPSN) approach.

We explain the construction of our proposed estimator below.

Step I. Estimate

Given that is heavy-tailed, in Step I, we estimate using a Huber estimator. Specifically, the estimator solves

| (2.2) |

where is the Huber function:

| (2.3) |

with a tuning parameter, which goes to infinity with and satisfies . Numerically, the tuning parameter can be chosen with cross-validation (sun2020adaptive).

Step II. Construct idiosyncratic-projected self-normalized variables

In Step II, we normalize observations to remove the effect of . We use the norm of estimated idiosyncratic variables to conduct normalization. Specifically, we first compute the spatial Kendall’s tau matrix:

get its leading eigenvectors, denoted by , and use them as a robust estimator of . Then, we define a projection matrix as follows:

that is, is the matrix that spans the null space of and satisfies and .

The goal of the idiosyncratic projection is to remove the strong cross-sectional dependence in the data, thereby enabling consistent estimation of the scalar component . This step is crucial. As can be seen in Section 3.3 below, when there is strong cross-sectional dependence, the self-normalization approach in ZL11 no longer works in estimating the time-varying scalar component .

Next, we define the idiosyncratic projected self-normalized variables :

| (2.4) |

The normalization terms are approximately proportional to , hence are approximately proportional to .

Step III. Construct pilot estimators of

In Step III, we estimate with the following estimator:

| (2.5) |

where

| (2.6) |

By doing so, we essentially normalize with

| (2.7) |

By the definition of in equation (2.6), we ensure that .

Write the eigen-decomposition of as , where is the matrix of eigenvalues with , and is the matrix of eigenvectors. We then use the leading eigenvectors and leading eigenvalues of as the corresponding pilot estimators:

The estimators , and will be used in the generic POET procedure for estimating .

In the generic POET procedure proposed in fan2018large, the leading eigenvectors are estimated using the spatial Kendall’s tau, and pilot components of the covariance matrix and its leading eigenvalues are from a Huber estimator of the covariance matrix.

As these estimators are from different sources, the resulting pilot idiosyncratic covariance matrix estimator is not guaranteed to be semi-positive definite. Our approach, on the other hand, does not have such an issue because our pilot estimators of the leading eigenvalues and leading eigenvectors are from the eigen decomposition of a same covariance matrix estimator.

Step IV. Estimate

In order to estimate , we also need to estimate . We propose the following robust estimator that solves

| (2.8) |

where . Again, the tuning parameter can be chosen using cross-validation.

Step V. Generic POET estimators of and

Finally, we estimate the scatter matrix and the covariance matrix . To estimate , we apply the generic POET procedure on our proposed idiosyncratic-projected self-normalized pilot estimators, , and from Step III. Specifically, the estimator of is

| (2.9) |

where is obtained by applying the adaptive thresholding method (cai2011adaptive) to .

To estimate , we combine from Step IV with in equation (2.9):

| (2.10) |

The corresponding idiosyncratic covariance matrix estimator is .

It can be seen that is equivalent to the generic POET estimator using the following pilot estimators: , , and .

We summarize our IPSN approach in the following algorithm.

Algorithm:

Idiosyncratic-Projected Self-Normalization (IPSN) for Covariance Matrix Estimation

Input:

, .

Output:

, .

Step I.

Compute via (2.2).

Step II.

Compute via (2.2).

Step III.

Compute and via (2.6) and (2.7), respectively. Compute via (2.5), its first eigenvalues , and the corresponding eigenvectors .

Step IV.

Compute via (2.8).

Step V.

Compute via (2.9), and via (2.10).

2.3 Theoretical Properties

In this subsection, we present the asymptotic properties of our proposed estimators.

2.3.1 Convergence Rates of Idiosyncratic-Projected Self-Normalized Pilot Estimators

We start with the properties of the idiosyncratic-projected self-normalization. The key to the success of our approach lies in approximating with defined in equation (2.7). Intuitively, if is close to , then is close to , which is absent of the heavy-tailed scalar process . The next proposition gives the properties of .

Proposition 1

Equation (2.11) guarantees that, with probability approaching one, is bounded away from zero, hence the normalization based on is well-behaved. Furthermore, equation (2.12) guarantees the consistency of in estimating . We need both to estimate consistently, and can be much larger than .

The next theorem gives the convergence rate of the IPSN pilot estimators, , , and .

Theorem 1 states that the pilot estimators of the scatter matrix achieve the sub-Gaussian convergence rates under th moment assumption. By contrast, when only th moment exists, the pilot estimator in fan2018large has a convergence rate of only .

2.3.2 Convergence Rates of Generic POET Estimators based on IPSN

Under the factor model specified in Assumption 3, we can write , where is a matrix, and is the idiosyncratic component of the scatter matrix .

We consider factor models with conditional sparsity. Specifically, we assume that belongs to the following class of sparse matrices: for some , , and ,

| (2.14) | ||||

Assumption 4

for some .

Denote . The next theorem gives the convergence rate of our proposed generic POET estimator of the scatter matrix.

Theorem 2 asserts that in estimating of the scatter matrix, its idiosyncratic components and their inverse matrices, under only th moment condition, our generic POET estimator achieves the same convergence rate as the sub-Gaussian case; see Theorems 3.1 and 3.2 in fan2013large.

Finally, about the estimation of the covariance matrix, recall that we combine the estimators and to estimate , and combine and to estimate . The next proposition gives the convergence rate of defined in equation (2.8) in estimating .

The error term is from robust Huber estimation based on the infeasible series , and the error term comes from the estimation error of . When , the convergence rate of is the same as the robust Huber estimator applied to the unobserved series .

The next theorem gives the convergence rates of and in estimating the covariance matrix and the idiosyncratic covariance matrix, respectively.

One can show that when only th moment exists, the generic POET estimator proposed in fan2018large has a lower convergence rate. Specifically, it has a convergence rate with the term replaced by and the term replaced by for .

3 Simulation Studies

3.1 Simulation Setting

We generate data from the following model. We first simulate , where , , , , and . We then set .

We generate the scalar process from a Pareto distribution with for , where is chosen such that . We set with or . When , has finite moments with order below 4, and when , does not have a finite third moment.

We then generate from , , where . Note that the estimators of the scatter matrices and covariance matrices are location invariant, hence without lost of generality, we set . The dimension and the sample size and are set to be and , respectively.

3.2 Covariance Matrix Estimators and Evaluation Metrics

We evaluate the performance of the following covariance matrix estimators: the generic POET estimators based on our idiosyncratic-projected self-normalization approach, denoted by GPOET-IPSN, the robust generic POET estimators in fan2018large, denoted by GPOET-FLW, and the original POET estimator based on the sample covariance matrix (fan2013large), denoted by POET-S.

We use the same evaluation metrics as in fan2018large. Specifically, errors in estimating and are measured by the difference in the relative Frobenius norm:

Errors in estimating the matrices , , , and are measured by the difference in spectral norm.

3.3 Simulation Results

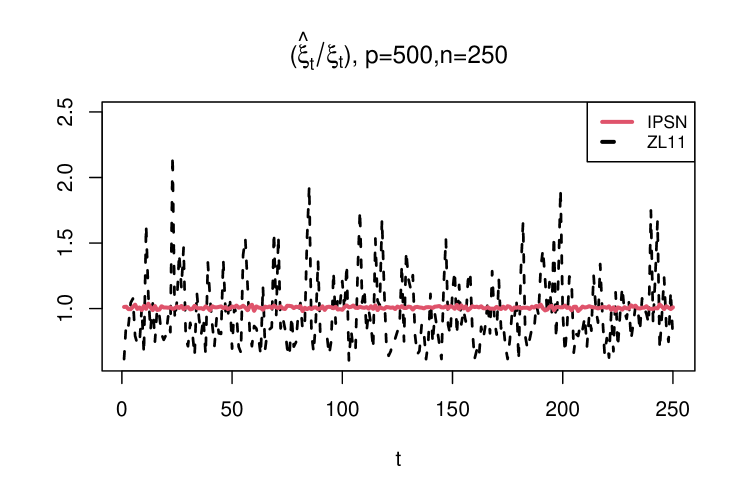

First, to illustrate how well our approach works in estimating the scalar process , we compute the estimator from our IPSN approach in equation (2.7) and obtain the ratio from one realization. We compare the results with the estimator in ZL11 (denoted by ZL11). The results are shown in Figure 1.

We see from Figure 1 that the ratios between our estimated and the true ’s are remarkably close to one for all . In contrast, due to the factor structure in the data, the estimator in ZL11 is not consistent, reflected in that the ratios between the estimated process and the true ones can be far away from one.

Next, we summarize the performance of the pilot estimators. We include our IPSN pilot estimators and the following benchmark methods for comparison: the robust estimators of fan2018large (FLW), as well as the sample covariance matrix with its leading eigenvectors and eigenvalues (SAMPLE). For the benchmark methods, we get the pilot estimators for and by normalizing and with . For the pilot estimators of and , we compute the error in the maximum norm. For the estimators of , we evaluate the maximum error scaled by , For the estimators of and , we report the errors in ratios: In Table 1, we report the performance of the pilot estimators from 100 replications.

| IPSN | 0.482 | 0.676 | 0.100 | 0.165 | 0.592 |

|---|---|---|---|---|---|

| (0.108) | (0.273) | (0.048) | (0.099) | (0.177) | |

| FLW | 0.706 | 0.921 | 0.111 | 0.181 | 0.620 |

| (0.392) | (0.760) | (0.053) | (0.122) | (0.178) | |

| SAMPLE | 0.728 | 0.923 | 0.135 | 0.204 | 0.872 |

| (0.394) | (0.768) | (0.076) | (0.147) | (0.488) | |

| IPSN | 0.485 | 2.105 | 0.100 | 0.623 | 0.598 |

| (0.109) | (2.706) | (0.048) | (0.886) | (0.182) | |

| FLW | 1.820 | 3.371 | 0.141 | 0.656 | 0.641 |

| (1.289) | (9.982) | (0.062) | (0.891) | (0.185) | |

| SAMPLE | 1.913 | 3.406 | 0.326 | 0.882 | 2.135 |

| (1.313) | (9.987) | (0.248) | (2.350) | (1.147) |

We see from Table 1 that our IPSN estimators outperform the other estimators in all measures. The advantage of IPSN over FLW and SAMPLE is more salient in the estimation of the scatter matrices and with increasing heavy-tailedness in the data. In particular, for the pilot estimators of the scatter matrix and its leading eigenvectors and leading eigenvalues, when changes from 2 to 0.2, that is, when data get more heavy-tailed, the estimation errors for IPSN remain almost the same. By contrast, the errors in the FLW and SAMPLE estimators increase substantially. For pilot estimators of the covariance matrix, the error of our IPSN estimator grows with the heavy-tailedness of the model, but it still significantly outperforms the other methods.

Finally, we summarize the performance of the generic POET estimators in Table 2.

| GPOET-IPSN | 0.241 | 0.091 | 0.107 | 0.122 | 1.023 | 2.894 | 1.029 | 1.161 |

|---|---|---|---|---|---|---|---|---|

| (0.008) | (0.020) | (0.012) | (0.034) | (0.209) | (0.396) | (0.210) | (0.301) | |

| GPOET-FLW | 0.328 | 0.127 | 0.545 | 0.632 | 1.533 | 2.995 | 1.542 | 1.621 |

| (0.103) | (0.085) | (0.768) | (1.360) | (0.354) | (0.290) | (0.357) | (0.318) | |

| POET-S | 0.479 | 0.186 | 0.206 | 0.224 | 1.423 | 3.235 | 1.430 | 1.494 |

| (0.483) | (0.278) | (0.239) | (0.318) | (0.437) | (0.284) | (0.439) | (0.289) | |

| GPOET-IPSN | 0.242 | 0.219 | 0.107 | 0.266 | 1.023 | 7.155 | 1.028 | 5.448 |

| (0.009) | (0.289) | (0.013) | (0.371) | (0.210) | (2.567) | (0.211) | (2.417) | |

| GPOET-FLW | 0.707 | 0.375 | 2.245 | 3.098 | 4.822 | 11.321 | 6.839 | 12.611 |

| (0.394) | (1.218) | (2.428) | (15.229) | (10.292) | (10.969) | (20.067) | (27.690) | |

| POET-S | 3.331 | 1.381 | 0.549 | 0.412 | 4.925 | 11.616 | 4.972 | 9.888 |

| (4.122) | (5.096) | (0.567) | (0.434) | (11.121) | (2.812) | (11.203) | (2.996) |

We see from Table 2 that our GPOET-IPSN estimators deliver the lowest estimation error in all measures. Compared to GPOET-FLW or POET-S, the advantage of GPOET-IPSN is especially evident for the estimation of , , their inverse matrices, and for the more heavy-tailed setting when . When estimating the scatter matrix, its idiosyncratic component and their inverses, the performance of GPOET-IPSN is robust for different heavy-tailedness conditions. When decreases from 2 to 0.2, the data become more heavy-tailed, but the estimation errors of GPOET-IPSN remain largely the same. By contrast, the errors of the GPOET-FLW and POET-S estimators increase sharply in the more heavy-tailed setting. In the estimation of and , GPOET-IPSN also has lower estimation errors than the benchmark methods.

In summary, the simulation results validate the theoretical properties of our approach and demonstrate its substantial advantage in estimating the scatter matrix and its inverse matrix. Such advantages are particularly valuable in applications where only the scatter matrix matters while the scalar component does not, as we will show in the empirical studies below.

4 Empirical Studies

4.1 Global Minimum Variance Portfolio Optimization

The estimation of the minimum variance portfolio (MVP) in the high-dimensional setting has drawn considerable attention in recent years. It is widely used to measure the empirical performance of covariance matrix estimators (fan2012vast; ledoit2017nonlinear; DLZ19). In this subsection, we conduct empirical analysis to evaluate the performance of our proposed estimator in the MVP optimization.

The MVP is the portfolio that achieves the minimum variance among all portfolios with the constraint that the summation of weights equals one. Specifically, for asset returns with a covariance matrix of , the MVP solves

where is a length vector of portfolio weights, and is a length vector of ones. The solution of the MVP is

It is straightforward to see that under elliptical models,

In other words, using and are equivalent in constructing the MVP. Using an estimator of the inverse of the scatter matrix or the covariance matrix, or , we estimate the MVP by

| (4.1) |

4.2 Data and Compared Methods

We use the daily returns of S&P 500 Index constituent stocks between January 1995 and December 2023 to construct MVPs. At the beginning of each month, we use the historical returns of the stocks that stayed in the S&P 500 Index for the past five years to estimate the portfolio weights. We evaluate the risk of the portfolios based on their out-of-sample daily returns from January 2000 to December 2023.

We estimate the MVP using equation (4.1) with the following estimators: our GPOET estimator of the scatter matrix based on idiosyncratic-projected self-normalization, GPOET-IPSN, the GPOET-FLW estimator, and the original POET estimator based on the sample covariance matrix, POET-S. When performing the generic POET procedure, the tuning parameter is chosen by cross-validation with the criterion of minimizing the out-of-sample MVP risk. The number of factors is estimated by the method in yu2019robust. We also include the equal-weight portfolio as a benchmark portfolio, denoted by EW.

4.3 Out-of-Sample Performance

We use the standard deviation of out-of-sample returns to evaluate the out-of-sample risk of portfolios. In addition, we perform the following test to evaluate the statistical significance of the differences in risks between our GPOET-IPSN method and benchmark portfolios:

| (4.2) |

where denotes the standard deviation of the GPOET-IPSN portfolio and denotes the standard deviation of a benchmark portfolio. We adopt the test in LW11 and use the heteroskedasticity-autocorrelation-consistent (HAC) standard deviation estimator of the test statistic therein.

Table 3 reports the risks of various portfolios.

| Out-of-sample portfolio risk | |||||

|---|---|---|---|---|---|

| Period | 2000–2023 | 2000 | 2001 | 2002 | 2003 |

| GPOET-IPSN | 0.121 | 0.154 | 0.116 | 0.140 | 0.090 |

| GPOET-FLW | 0.150 *** | 0.168 ** | 0.167 *** | 0.173 *** | 0.121 *** |

| POET-S | 0.150 *** | 0.152 | 0.121 | 0.140 | 0.095 ** |

| EW | 0.217 *** | 0.192 *** | 0.208 *** | 0.269 *** | 0.179 *** |

| Period | 2004 | 2005 | 2006 | 2007 | 2008 |

| GPOET-IPSN | 0.081 | 0.084 | 0.068 | 0.081 | 0.208 |

| GPOET-FLW | 0.095 *** | 0.100 *** | 0.089 *** | 0.100 *** | 0.224 |

| POET-S | 0.091 *** | 0.091 *** | 0.074** | 0.087 *** | 0.188 |

| EW | 0.128 *** | 0.115 *** | 0.113 *** | 0.166 *** | 0.460 *** |

| Period | 2009 | 2010 | 2011 | 2012 | 2013 |

| GPOET-IPSN | 0.133 | 0.083 | 0.103 | 0.082 | 0.084 |

| GPOET-FLW * | 0.228 *** | 0.094 ** | 0.108 | 0.073 | 0.081 |

| POET-S | 0.189 *** | 0.089 * | 0.114 ** | 0.084 | 0.089 |

| EW | 0.357 *** | 0.210 *** | 0.271 *** | 0.148*** | 0.123 *** |

| Period | 2014 | 2015 | 2016 | 2017 | 2018 |

| GPOET-IPSN | 0.076 | 0.096 | 0.099 | 0.072 | 0.105 |

| GPOET-FLW | 0.081 | 0.114 *** | 0.128 *** | 0.076 | 0.116 * |

| POET-S | 0.089 | 0.120 *** | 0.116 ** | 0.073 | 0.119 *** |

| EW | 0.119 *** | 0.158 *** | 0.157 *** | 0.077 | 0.161 *** |

| Period | 2019 | 2020 | 2021 | 2022 | 2023 |

| GPOET-IPSN | 0.097 | 0.269 | 0.106 | 0.141 | 0.125 |

| GPOET-FLW | 0.131 *** | 0.317 ** | 0.184 *** | 0.179 ** | 0.176 *** |

| POET-S | 0.101 | 0.413 *** | 0.194 *** | 0.226 *** | 0.168 *** |

| EW | 0.137 *** | 0.404 *** | 0.144 *** | 0.239 *** | 0.152 *** |

We see from Table 3 that our GPOET-IPSN portfolio achieves a substantially lower risk than benchmark portfolios for the period between 2000 and 2023. The statistical test results suggest that the differences in the risk between our portfolio and benchmark portfolios are all statistically significantly negative. In addition, when checking the risk performance in different years, we see that the GPOET-IPSN portfolio performs robustly well. It outperforms the benchmark portfolios by achieving the lowest risk in the majority of the years (20 out of 24 years). The statistical test results show that the difference between the risks of our GPOET-IPSN portfolio and other portfolios is statistically significantly negative for most of the years.

5 Conclusion

We propose an idiosyncratic-projected self-normalization (IPSN) approach to estimate the scatter matrix under high-dimensional elliptical factor models. We show that our estimator achieves the sub-Gaussian convergence rate under only th moment condition, a property that can not be achieved by existing approaches. Moreover, we develop POET estimators of the scatter matrix and the covariance matrix under a conditional sparsity assumption, and show that they have higher convergence rates than the generic POET estimator in fan2018large. Numerical studies demonstrate the clear advantages of our proposed estimators over various benchmark methods.

6 Proofs

In this section we prove Theorems 1–3 and Propositions 1–2. We first give the following lemmas. The proofs of Lemmas 4–8 are given in the Supplementary Material (DZ24_supp).

6.1 Lemmas

Lemma 1

[Corollary 1 of avella2018robust] Suppose that , , , and , …, are i.i.d. random variables with mean and bounded th moment, i.e. . Take . Let satisfies that with being the Huber function defined in equation (2.3). Then with probability at least ,

Lemma 2

[Lemma 9 of ZL11] Suppose that , where ’s are i.i.d. random variables such that , and for some . Then there exists , depending only on , and such that for any nonrandom matrix ,

Lemma 3

[Lemma 3 of chatterjee2013assumptionless] Suppose that , . The ’s need not be independent. Let . Then

Lemma 5

Suppose that . For any positive semi-definite matrix , we have

| (6.1) |

and

| (6.2) |

Define

Let with be the leading eigenvalues and the corresponding eigenvectors of .

Recall that stands for the th largest eigenvalue of . Define

| (6.6) |

Under Assumption 3, we have that .

6.2 Proof of Proposition 1

The desired results follow from Lemma 7.

6.3 Proof of Theorem 1

6.4 Proof of Proposition 2

Using the definition of and the inequality that for any ,

| (6.13) |

we have

where for defined as follows:

We will show that

| (6.14) |

and

| (6.15) |

We start with (6.14). By (2.1), we have

| (6.16) | ||||

The definition of implies that for any ,

Hence, for any , ,

| (6.17) |

| (6.18) | ||||

By Lemma 5, and the assumptions that and is independent with , we have

| (6.19) |

By (6.19) and equation (S31) in avella2018robust, for ,

| (6.20) |

By Lemma 4,

| (6.21) |

By the Cauchy-Schwarz inequality,

| (6.22) | ||||

By the assumption that , (6.1) and Markov’s inequality,

| (6.23) |

Combining (6.21), (6.22) and (6.23) yields that

| (6.24) |

The desired bound (6.14) follows from (6.18), (6.20), (6.21) and (6.24).

Finally, about (6.15), if , we have that for all large enough,

where in the first inequality we use so that for all large . Similarly, if ,

It follows that

| (6.25) |

We have

where terms , and are defined in equation (6.16). By (6.19), , and Markov’ inequality, we have

By Lemma 1, the assumptions that and , we have

By the Cauchy-Schwarz inequality, . We then get that

Combining the results above yields that

| (6.26) |

Using (6.13), we have

| (6.27) | ||||

By (6.26), we have

and

Therefore,

| (6.28) |

Combining (6.14), (6.27) and (6.28) yields that

Similarly, one can show that

Using the definition of and the continuity of the function , we then get that

| (6.29) |

Combining (6.25), (6.26) and (6.29) yields that

By Markov’s inequality and that , we get the desired result (6.15).

6.5 Proof of Theorems 2 and 3

Supplementary Materials

Supplement to “Sub-Gaussian High-dimensional covariance matrix estimation under elliptical factor model with th moment.”

References

- Ahn and Horenstein, (2013) Ahn, S. C. and Horenstein, A. R. (2013). Eigenvalue ratio test for the number of factors. Econometrica, 81(3):1203–1227.

- Avella-Medina et al., (2018) Avella-Medina, M., Battey, H. S., Fan, J., and Li, Q. (2018). Robust estimation of high-dimensional covariance and precision matrices. Biometrika, 105(2):271–284.

- Bai and Ng, (2002) Bai, J. and Ng, S. (2002). Determining the number of factors in approximate factor models. Econometrica, 70(1):191–221.

- Bollerslev et al., (2013) Bollerslev, T., Todorov, V., and Li, S. Z. (2013). Jump tails, extreme dependencies, and the distribution of stock returns. Journal of Econometrics, 172(2):307–324.

- Cai and Liu, (2011) Cai, T. and Liu, W. (2011). Adaptive thresholding for sparse covariance matrix estimation. Journal of the American Statistical Association, 106(494):672–684.

- Cai et al., (2016) Cai, T. T., Liu, W., and Zhou, H. H. (2016). Estimating sparse precision matrix: Optimal rates of convergence and adaptive estimation. The Annals of Statistics, 44(2):455–488.

- Chatterjee, (2013) Chatterjee, S. (2013). Assumptionless consistency of the lasso. arXiv preprint arXiv:1303.5817.

- Ding et al., (2023) Ding, Y., Li, Y., Liu, G., and Zheng, X. (2023). Stock co-jump networks. Journal of Econometrics.

- Ding et al., (2021) Ding, Y., Li, Y., and Zheng, X. (2021). High dimensional minimum variance portfolio estimation under statistical factor models. Journal of Econometrics, 222(1):502–515.

- (10) Ding, Y. and Zheng, X. (2024a). Sub-gaussian high-dimensional covariance matrix estimation under elliptical factor models with 2+th moment.

- (11) Ding, Y. and Zheng, X. (2024b). Supplement to “sub-gaussian high-dimensional covariance matrix estimation under elliptical factor models with 2+th moment”.

- Fan et al., (2008) Fan, J., Fan, Y., and Lv, J. (2008). High dimensional covariance matrix estimation using a factor model. Journal of Econometrics, 147(1):186–197.

- Fan et al., (2012) Fan, J., Li, Y., and Yu, K. (2012). Vast volatility matrix estimation using high-frequency data for portfolio selection. Journal of the American Statistical Association, 107(497):412–428.

- Fan et al., (2011) Fan, J., Liao, Y., and Mincheva, M. (2011). High-dimensional covariance matrix estimation in approximate factor models. The Annals of Statistics, 39(6):3320–3356.

- Fan et al., (2013) Fan, J., Liao, Y., and Mincheva, M. (2013). Large covariance estimation by thresholding principal orthogonal complements. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 75(4):603–680.

- Fan et al., (2018) Fan, J., Liu, H., and Wang, W. (2018). Large covariance estimation through elliptical factor models. The Annals of Statistics, 46(4):1383.

- Fan et al., (2021) Fan, J., Wang, W., and Zhu, Z. (2021). A shrinkage principle for heavy-tailed data: High-dimensional robust low-rank matrix recovery. The Annals of Statistics, 49(3):1239.

- Han and Liu, (2014) Han, F. and Liu, H. (2014). Scale-invariant sparse pca on high-dimensional meta-elliptical data. Journal of the American Statistical Association, 109(505):275–287.

- Han and Liu, (2018) Han, F. and Liu, H. (2018). Eca: High-dimensional elliptical component analysis in non-gaussian distributions. Journal of the American Statistical Association, 113(521):252–268.

- Hubert et al., (2018) Hubert, M., Debruyne, M., and Rousseeuw, P. J. (2018). Minimum covariance determinant and extensions. Wiley Interdisciplinary Reviews: Computational Statistics, 10(3):e1421.

- Ledoit and Wolf, (2011) Ledoit, O. and Wolf, M. (2011). Robust performances hypothesis testing with the variance. Wilmott, 2011(55):86–89.

- Ledoit and Wolf, (2017) Ledoit, O. and Wolf, M. (2017). Nonlinear shrinkage of the covariance matrix for portfolio selection: Markowitz meets goldilocks. The Review of Financial Studies, 30(12):4349–4388.

- Liu et al., (2012) Liu, H., Han, F., Yuan, M., Lafferty, J., and Wasserman, L. (2012). High-dimensional semiparametric gaussian copula graphical models. The Annals of Statistics, 40(4):2293–2326.

- Maronna, (1976) Maronna, R. A. (1976). Robust m-estimators of multivariate location and scatter. The Annals of Statistics, pages 51–67.

- Minsker, (2018) Minsker, S. (2018). Sub-gaussian estimators of the mean of a random matrix with heavy-tailed entries. The Annals of Statistics, 46(6A):2871–2903.

- Minsker and Wei, (2020) Minsker, S. and Wei, X. (2020). Robust modifications of u-statistics and applications to covariance estimation problems. Bernoulli, 26(1):694–727.

- Onatski, (2010) Onatski, A. (2010). Determining the number of factors from empirical distribution of eigenvalues. The Review of Economics and Statistics, 92(4):1004–1016.

- Rousseeuw, (1984) Rousseeuw, P. J. (1984). Least median of squares regression. Journal of the American Statistical Association, 79(388):871–880.

- Rousseeuw, (1985) Rousseeuw, P. J. (1985). Multivariate estimation with high breakdown point. Mathematical Statistics and Applications, 8(283-297):37.

- Sun et al., (2020) Sun, Q., Zhou, W.-X., and Fan, J. (2020). Adaptive huber regression. Journal of the American Statistical Association, 115(529):254–265.

- Tyler, (1987) Tyler, D. E. (1987). A distribution-free m-estimator of multivariate scatter. The Annals of Statistics, pages 234–251.

- Van Aelst and Rousseeuw, (2009) Van Aelst, S. and Rousseeuw, P. (2009). Minimum volume ellipsoid. Wiley Interdisciplinary Reviews: Computational Statistics, 1(1):71–82.

- Xue and Zou, (2012) Xue, L. and Zou, H. (2012). Regularized rank-based estimation of high-dimensional nonparanormal graphical models. The Annals of Statistics, 40(5):2541–2571.

- Yu et al., (2019) Yu, L., He, Y., and Zhang, X. (2019). Robust factor number specification for large-dimensional elliptical factor model. Journal of Multivariate Analysis, 174:104543.

- Zhang, (2016) Zhang, T. (2016). Robust subspace recovery by tyler’s m-estimator. Information and Inference: A Journal of the IMA, 5(1):1–21.

- Zhang et al., (2016) Zhang, T., Cheng, X., and Singer, A. (2016). Marčenko–pastur law for tyler’s m-estimator. Journal of Multivariate Analysis, 149:114–123.

- Zheng and Li, (2011) Zheng, X. and Li, Y. (2011). On the estimation of integrated covariance matrices of high dimensional diffusion processes. The Annals of Statistics, 39(6):3121–3151.

Supplement to “Sub-Gaussian High-Dimensional Covariance Matrix Estimation under Elliptical Factor Model with th Moment”

Yi Ding and Xinghua Zheng

Appendix A Proofs

The theorem/proposition/lemma/equation numbers below refer to the main article (DZ24). In the following proofs, and denote generic constants which do not depend on and and can vary from place to place.

Proof of Lemma 4

Proof of Lemma 5

Write the eigen decomposition of as with . Denote . Because , and , we have that , and

| (A.1) |

By symmetry,

Equation (6.1) follows.

Proof of Lemma 6

The desired bounds are immediate results of Lemmas A.2, A.3 and A.5 of DLZ19.

For any vector , let be its th entry of , and for any matrix , let be its th entry.

Proof of Lemma 7

We start with (6.7). Using (2.1), we have

| (A.2) | ||||

By Lemma 4 and the assumption that ,

Define . About term , we have

| (A.3) |

We have , and by Lemma 2,

| (A.4) |

Under the assumption that , there exists such that for all large enough. We then set sufficient large such that and get

| (A.5) | ||||

By Lemma 2 again,

| (A.6) | ||||

By Assumption 2 and Lemma 3, we have . Hence by the assumptions that and for some , we have

In addition, by Theorem 4.1 of fan2018large111Note that the Spatial Kendall’s tau is independent of the scalar process , see P.1402 in fan2018large., we get that . It follows that

| (A.7) |

Therefore,

| (A.8) | ||||

where the last equality holds by the assumption that . By (A.5) and (A.8), we get

| (A.9) | ||||

Combining (A.3), (A.5), (A.6), (A.8) and (A.9) yields

About term , we have

The desired result (6.7) follows.

Next, we show (6.8). We have

| (A.10) | ||||

About term , we have

where the last inequality holds because

By Jensen’s inequality and (A.4), for all ,

Hence,

Similarly,

| (A.11) |

It follows that

| (A.12) |

About term , by (A.2) and (A.3), and the inequality that , we have

| (A.13) | ||||

By Lemma 2, we have that

Hence,

| (A.14) |

Because , we also have

| (A.15) |

Combining Lemma 4, (A.6), (A.7), (A.13), (A.14) and (A.15) yields that

| (A.16) |

The desired bound (6.8) follows from (6.7), (A.10), (A.12) and (A.16).

About term , by Lemma 4, (6.7) and the assumption that , we have

About terms and , we have

It follows from (6.3), (6.7) and (A.6) that

About term , we have

where . By the Cauchy-Schwarz inequality, we have

By Bernstein’s inequality, we have . By (6.8), (A.6) and (A.11), we then get

Combining the results above yields

| (A.17) |

In addition, by (6.3),

The desired result (6.9) follows.

Proof of Lemma 8

The desired bound (6.10) follows from (6.9) and (A.17). The bound (6.11) then follows from (6.10), Assumption 3, Lemma 6 and Weyl’s Theorem.

Finally, about (6.12), by Assumption 3, (6.10), (6.11) and the sin Theorem,

| (A.18) |

By the definitions of and , we have and . Hence, for all ,

| (A.19) | ||||

Note that

and

By Assumption 3, Lemma 6, (6.10) and (6.11), we have , , and there exists such that with probability approaching one, for all large ,

| (A.20) |

Because , it follows that

| (A.21) |

The desired bound (6.12) follows from (6.10), (6.11) and (A.18)–(A.21).