Matching under Imperfectly Transferable Utility††thanks: We are grateful to Antoine Jacquet for useful comments.

Submitted as a draft chapter for the Handbook of the Economics of Matching, edited by Che, Chiappori and Salanié

1 Introduction

1.1 Motivating remarks

In this chapter, we examine matching models with imperfectly transferable utility (ITU)111We use the term “imperfectly transferable utility” throughout this chapter, but others have used terms such as matching with “nontransferabilities” or “not fully transferable” utility, see e.g. [135].. By “imperfectly transferable utility” we mean a situation where two potentially matched partners and bargain over a set of feasible utilities . The (perfectly) “transferable utility” (TU) case corresponds to ; but more generally, in the ITU case, the feasible set of utilities is defined by for some functions and which are increasing and continuous, but not necessarily linear.

In some cases, the distinction between TU and ITU is quite insignificant. In particular, if and bargain in autarky with reservation utilities and , then one can perform a rescaling of the utilities of both partners and , express the reservation utilities in the new scale, and the problem becomes a TU one. In stark contrast, when instead of bargaining in isolation, partners are part of a matching market, things change drastically and this distinction becomes highly relevant. Assume that is in discussion with two potential partners and ; in that case, it will generally be impossible to find a new utility scale under which the bargaining problems with both and are TU. To quote [96] (with our own emphasis), the TU setting “allows to transfer utility between agents at a constant exchange rate so that, for a well-chosen cardinalization of individual preferences (…) irrespective of the economic environment”. In the matching setting studied in this book, the partner’s choice is endogenous, and thus the cardinalization of individual preferences is no longer irrespective of the economic environment.

We argue that ITU is more appropriate than transferable utility for modeling a number of matching markets, for at least two reasons. First, in some settings, there are clear restrictions on the transfer technology that prevent utility from being perfectly transferable. For example, on the labor market, the wage paid by the firm differs from the wage received by the worker due to the (possibly nonlinear) tax schedule in place on that market.

Second, the assumption of perfectly transferable utility is restrictive, despite its advantages. For example, suppose that on the marriage market, married men and women bargain over utility allocations in typical collective fashion. If utility is perfectly transferable, the model yields the same demand for public goods (e.g., expenditures on children) irrespective of the distribution of resources or allocation of bargaining power within the household.

Throughout the chapter, we will explore models outside of the TU realm. We begin by introducing the notations and then discuss a few motivating examples. Our presentation in this chapter is biased towards our own work. Our presentation of aggregate equilibrium in ITU models, as well as a number of related results and applications follows the exposition in [124], hereafter abbreviated GKW; we have also used material from [90] and [91]

1.2 Setting and notations

We consider a general two-sided matching model with one-to-one assignment. To introduce our notation, we use the example of matching men to women222For the purposes of this chapter, we focus on the heterosexual marriage market. The homosexual marriage has been studied in e.g. [105]. on the marriage market. However, our notation can be adapted to other matching contexts, such as matching workers to jobs or children to childcare center positions.

Consider a marriage market where two populations of men and women meet and may form heterosexual pairs. Men are indexed by and women are indexed by . At this individual level, a matching is a variable equal to 1 if man and woman are matched, and 0 otherwise. Note that the matching must satisfy basic feasibility conditions, such as the requirement that each individual can only be matched to at most one partner, i.e. , and .

Later, we will adopt a more “macroscopic” perspective. We will assume that men and women can be gathered in a finite number of types, which are defined as groups sharing similar observable characteristics. We let and denote the types of man and woman , respectively. The number of types of men (resp. women) is (resp. ). We let and denote the total mass of men of type and women of type , respectively. We define the sets and where denotes the option of singlehood. The set of couple types is given by and the set of household types by .

At this macroscopic level, an aggregate matching is a vector measuring the mass of matches between men of type and women of type . We let denote the set of feasible matchings, that is, the set of vectors such that and . The strict interior of , denoted , is the set of matchings such that and . We call the elements of interior matchings. Finally, we let and denote the mass of single men of type and the mass of single women of type , respectively.

1.3 A bestiary of models

We motivate the use of ITU matching models through the following examples. Examples 1 and 2 examine a simple matching model of the labour market in which transfers (wages) are taxed at a single tax rate, or according to some convex tax schedule. Examples 3 and 4 introduce a simple matching model of the marriage market in which partners spend their income on private and public consumption.

Example 1 (Matching with flat taxes).

Consider a matching model in which workers (indexed by ) match with firms (indexed by ). Let be the amenities enjoyed by worker at firm and be the productivity of worker when working in firm . We denote the gross wage paid by the firm to the worker. Suppose wages are taxed at a rate of , then worker and firm receive utilities and , respectively. Let and . It is easy to show that the Pareto frontier, which describes the set of Pareto efficient utility allocations that worker and firm can achieve, is characterized by the following equation:

The frontier is a straight line, but not necessarily of slope as in the TU case. Unless for all pairs, it is not possible to find a cardinalization of the utilities such that frontier is of slope for all and . Later, we will refer to this model as the linearly transferable utility (LTU) model.

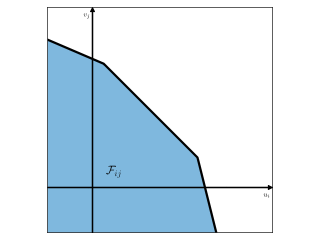

Example 2 (Matching with progressive taxes).

Consider the same setting as in example 1, but this time assume that there are tax thresholds and tax rates. Any income between thresholds and is taxed at rate , income above is taxed at rate , and income below is not taxed. We assume the tax schedule is convex, i.e. that the tax rates are increasing. It can be shown that the Pareto frontier is described by the equation

where and where is a function of the amenities, the tax thresholds and tax rates. The frontier of the bargaining set is piecewise linear, and the bargaining set itself can be thought of as the intersection of many elementary bargaining sets of the type described in example 1.

Example 3 (Matching with private consumption and marital affinity).

Consider a matching model of the marriage market in which men (indexed by ) match with women (indexed by ). Suppose that when a man and a woman form a match, they must decide on how to allocate their income between private consumption for the man () and private consumption for the woman (). For simplicity, we assume that men and women receive utilities and , respectively, where the terms and capture marital affinities, is a preference parameter, and and are such that . In this model, the Pareto frontier is given by

The frontier of the bargaining set is non-linear. Except in trivial cases in which , and do not depend on , it is not possible find a cardinalization of the utilities such that the frontier is a straight line of slope for all and . Later, we will refer to this model as the exponentially transferable utility (ETU) model.

Example 4 (Matching with private consumption, marital affinities and public goods).

Consider the same setting as in example 3, but assume that couples can decide on a discrete amount of public good and allocate the remaining income between private consumption for the man and private consumption for the woman. Let the utilities received by men and women be and , respectively. The equation of the Pareto frontier becomes

The frontier is once again non-linear. The bargaining set is not convex and can be thought of as the union of many elementary bargaining sets of the type described in example 3.

2 Pairwise bargaining sets

We begin by describing the utility allocations that a matched pair can agree on. We assume that when a man and a woman match, they decide on an outcome within a feasible (or bargaining) set of utility allocations. We describe the structure of these bargaining sets, providing an implicit representation and illustrating our approach with several examples.

2.1 The Pareto efficiency approach vs. the Pareto weights approach

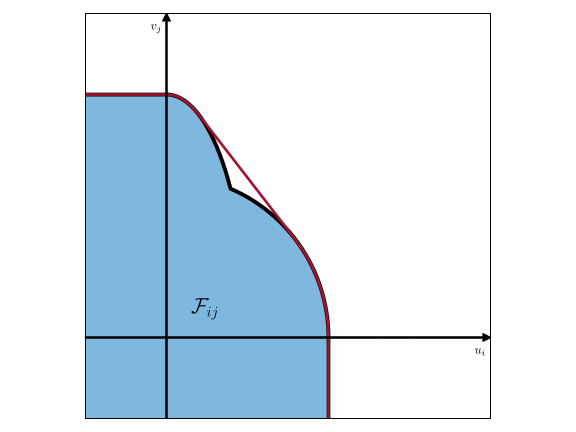

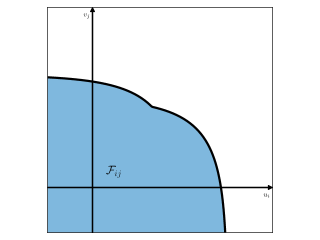

The collective approach to household decision fundamentally relies on the “Pareto efficiency assumption”, which states that couples make decisions that are Pareto efficient. In this chapter’s terminology, if is the set of utilities that are jointly achievable by and , then and will never pick a pair of utilities which is Pareto dominated. On figure 1, that means they lie on the Pareto frontier, which is the solid black line that envelopes the blue set .

While this assumption is arguably plausible, it is often replaced by a stronger “Pareto weights assumption” which states that couples pick pairs of utilities which maximize the weighted sum of the utilities over the set . The weights and are deemed the Pareto weights associated with and respectively. Geometrically, these points are obtained by taking the frontier of the convex hull of the feasible set; they are represented in the solid red line on figure 1. If the feasible set is described by where is concave, the chosen utilities will be such that

which obtains as a increasing function of ’s Pareto weight.

While the two approaches coincide in the case where is convex, they are in general not equivalent, as it is apparent on the figure. There as is not convex, there are points on the Pareto frontier of which are not on the frontier of the convex envelope . These points will never be picked by the Pareto weights approach. But far from being a mathematical subtlety, this can be a serious modeling issue, as we argue in the following example.

Consider the problem of home ownership decision. A couple needs to decide whether to rent or buy their home. Assume that the feasible set of partners’ utilities is if they rent, and if they buy. The unconditional feasible set of utilities is therefore

which is depicted in figure 1. Here, the set is not convex, so its Pareto frontier, which is represented in thick black on figure 1, has some points that are never picked by the Pareto approach; these points are the points that do not coincide with the red envelope. Yet, which point is selected on the Pareto frontier is determined endogenously at equilibrium by the other options that are available to the partners in other potential match. This may perfectly be a point which is not picked up by the Pareto weights method.

One may respond to that critique by assuming that agents have a von Neumann-Morgenstern utility and lotteries over , which means in economic terms that partners are allowed to randomize between buying and renting. In that case, the set of feasible utilities is replaced by its convex envelope , and all points of the frontier of the convexified set can be picked up this time by the Pareto weights approach. But that approach relies on a bold assumption: that partners rely on randomization for big decisions (here, home ownership decision, but the argument would transpose for other public good decisions within the household, such as fertility, residential location, labor market participation, etc.), and that such a randomization actually increases their utility. It is permitted to remain skeptical of the plausibility of this behavioural assumption.

Throughout this chapter, we shall therefore adopt the Pareto efficiency approach, but not the Pareto weights approach. We will assume that the household’s bargaining process leads them to a Pareto efficient solution, but we will not assume that they randomize their decisions, so we will not follow the Pareto weights approach. Instead, which point of the Pareto frontier will be picked will be determined by competitive market equilibrium, and which are the multiple outside options that each partner can considering getting with other potential partners. As we shall see, in the case of large markets, there is a unique such point.

2.2 Properties of feasible sets

In this section we define the precise requirements that we will impose on the feasible set of utilities. We suppose that if man and woman are matched, they bargain over utility allocations . We call the set a feasible utility set, or bargaining set and make the following assumptions on the structure of such sets:

Definition 1 ([124]).

The set is a proper bargaining set if the three following conditions are met:

(i) is closed and nonempty.

(ii) is lower comprehensive: if , , and , then .

(iii) is bounded above: If and bounded below, then for large enough for ; similarly for bounded below and .

Figure 2(d) shows the bargaining sets associated to some of the examples explored in the introduction. Note that the bargaining sets need not be convex in our framework. We only require the sets to be closed (which is necessary for efficient allocations to exist) and non-empty, lower comprehensive (which is equivalent to free disposal), nonempty (which along with lower comprehensiveness implies that if both partners’ demands are low enough, they can always be fulfilled) and bounded above (which is a scarcity requirement, that rules out the possibility of both partners obtaining arbitrarily large utilities).

2.3 Distance-to-frontier function

The distance-to-frontier function implicitly describes bargaining sets. It measures the signed distance of a utility allocation to the frontier of the bargaining set along the diagonal, up to a factor of . The distance is positive if the allocation lies outside the feasible set, negative if it lies inside the feasible set, and equal to 0 if it lies on the frontier. GKW formally define the distance-to-frontier function as follows:

Definition 2 (GKW).

The distance-to-frontier function of a proper bargaining set is defined by

| (1) |

Definition 1 ensures the distance-to-frontier function exists. In addition, it satisfies the following properties:

Lemma 1 (GKW).

Let be a proper bargaining set. Then:

-

(i)

.

-

(ii)

For every , .

-

(iii)

is -isotone, meaning that implies ; and and jointly imply

-

(iv)

is continuous.

-

(v)

.

Representing bargaining sets implicitly with distance-to-frontier functions is particularly useful in practice. One important advantage of that approach is that basic geometric operations on bargaining sets can be expressed as algebraic operations on the corresponding distance-to-frontier functions. Specifically, the distance-to-frontier function for the union of sets is the minimum of the corresponding distance-to-frontier functions, and the distance-to-frontier function for the intersection of sets is the maximum of the distance-to-frontier functions. The following lemma formally states this:

Lemma 2 (GKW).

Assume that are proper bargaining sets, as introduced in definition 1. Then:

-

1.

The sets and are proper bargaining sets,

-

2.

The distance to frontier functions for the sets and are given by

Using this lemma, we can construct complex models from elementary ones. For example, the bargaining set in example 2 is the intersection between elementary bargaining sets of the same type as the ones described in example 1. Similarly, the bargaining set in example 4 is the union between elementary bargaining sets of the same type as the ones described in example 3.

2.4 Examples

In this section, we revisit examples 1, 2, 3 and 4 presented in the introduction. But first, we discuss two cornerstone models in the matching literature, namely matching models with transferable utility and non-transferable utility, and explain how they fit into our framework.

2.4.1 Transferable Utility (TU) models

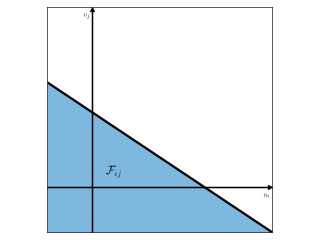

In the classical TU matching model, it is assumed that the partners generate a joint surplus , which they split between themselves. Utility is perfectly transferable: if one partner gives up one unit of utility, then the utility of the other partner increases exactly by one unit. The Pareto efficient utility allocations are such that . The bargaining set is

| (2) |

from which we derive the distance-to-frontier function

| (3) |

2.4.2 Non-Transferable Utility (NTU) models

In non-transferable utility models, utility is not transferable at all. The maximum obtainable utility of each partner is fixed and is independent from what the other partner gets. Assuming that when man and woman are matched they bring surpluses and , respectively, the bargaining set is

| (4) |

from which we derive the distance-to-frontier function

| (5) |

2.4.3 Linearly Transferable Utility models

Consider the setting of example 1, with one modification. We assume that besides having workers pay income taxes (recall that wages are taxed at a rate on the workers’ side), firms pay social contributions so wages are taxed at a rate on their side. We let the tax rates and depend on both and . In this context, if worker and firm match and set a wage , they receive utilities and , respectively. The corresponding bargaining set is given by

where , , and . We obtain the distance-to-frontier function

| (6) |

Note that without loss of generality, we can normalize , and when we recover the standard TU model.

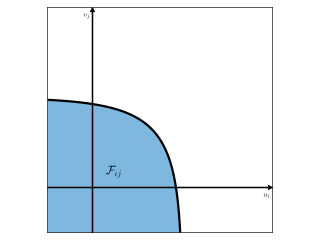

2.4.4 Exponentially Transferable Utility models

Consider the setting of example 3. Recall that when man and woman match, they share income which they allocate to private consumption for the man () and for the woman (), so that . Let the man and the woman utility functions be given by

where the terms and capture marital affinities (non-economic gains to marriage). In this case the bargaining set is

The expression of is:

| (7) |

As pointed out in GKW, an interesting property of this exponentially transferable utility model is that it interpolates between the non-transferable and fully transferable utility models. Indeed, suppose that , then gives the NTU model, while gives the TU model. Here, we can think of the parameter as measuring the degree of transferability.

Note that after a nonlinear rescaling, the ETU model can be expressed as a LTU model. Let , for all pairs , and let and . The utility allocations on the Pareto frontier satisfy the equation . Letting , and , the equation describing the frontier rewrites with associated distance-to-frontier function

which is the LTU model.

2.4.5 Revisiting example 2

We now reexamine example 2 in light of the LTU model and lemma 2. Recall that in that example, wages are taxed only on the workers’ side, according to a convex tax schedule.

Let us introduce the quantity , which we define recursively as follows: we let , and . The utility of a worker receiving gross wage is given by , while the utility of the firm is simply . The bargaining set is

Let . We have , i.e. the bargaining set is the intersection of the elementary LTU sets . Each of these sets has a frontier that is linear (but not necessarily of slope ), so that the frontier of the set is piecewise linear. From lemma 2, we obtain the distance-to-frontier function

| (8) |

2.4.6 Revisiting example 4

We now make use of lemma 2 to reexamine example 4. We consider a similar setting to example 4, but assume that partners must decide on some amount of public good consumption , where is a closed set that may be finite or not. In some applications, this set might be discrete, e.g. in models featuring fertility decisions. Given the chosen amount of public good consumption, we assume that the partners allocate the remaining income to the private consumption of the man and of the woman (), so that . Suppose that the utilities received by the man and the woman are given by

respectively. The bargaining set is

Let . Note that , that is, the bargaining set is the union of elementary ETU sets. From lemma 2, we obtain the distance-to-frontier function

| (9) |

2.4.7 Matching with uncertainty

Consider household bargaining setting similar to that of example 3, to which we add uncertainty. When man and woman match, they share income which we assume to be stochastic. We let and be the contingent private consumptions of the man and the woman, respectively. For a given allocation of private consumption , we let and be the utilities received by the man and the woman, respectively. We assume that the utility function are concave, e.g. and as in the ETU model.

Following a collective approach, we introduce Pareto weights to parametrize the frontier of the bargaining set. We let be the Pareto weight of the man and be the Pareto weight of the woman. For a given and income realization , couple solves

Thus, the bargaining set for that couple is

from which we obtain the distance-to-frontier function

3 Stable matchings without heterogeneity

3.1 Setting

In our matching framework, men and women can form heterosexual pairs or remain unmatched. If a man or a woman remain unmatched, they receive their reservation utility, denoted and , respectively. If man and woman match, they bargain over a proper bargaining set . The indirect payoffs of man and woman are denoted and , respectively, and are determined at equilibrium. Finally, denote the matching which, like the indirect payoffs, is determined at equilibrium.

3.2 From transferable utility to imperfect transferability

In the transferable utility framework, when man and woman match, they generate surplus terms and , respectively. The total surplus generated by the pair is denoted . In addition, if man and woman match, they agree on a transfer from the woman to the man. This transfer, which can be positive or negative, is determined at equilibrium.

After transfer, the man and the woman receive utilities and , respectively. The indirect equilibrium payoffs are given by and . Therefore, for any and , the inequalities and hold jointly and we have . Additionally, and should hold for all and , since partners can always leave an arrangement if it yields less than their reservation utility. Together, these inequalities form the well-known pairwise stability conditions. Finally, if and are matched then . Similarly, if () is unmatched, then (). These equalities are known as the complementary slackness conditions.

In the TU framework, we can thus define an individual equilibrium outcome as a triple that satisfies the following conditions:

-

(i)

, and ;

-

(ii)

for all and , , with equality if ;

-

(iii)

and , with equality if and if , respectively.

Now moving on to the imperfectly transferable utility framework, an individual equilibrium outcome is defined in a similar way to the above, with one key difference: the linear stability condition from the TU framework is replaced with a nonlinear counterpart. Specifically, at equilibrium, should hold for every and . Suppose not: then there would be a pair such that lies strictly within the feasible set . Thus, there would exist payoffs such that and (with at least one strict inequality) and . This would imply that and could both be better off by matching together. Note that if and are matched, we require to be feasible, that is , hence this equation should hold with equality.

This yields the following definition of an individual equilibrium outcome:

Definition 3 (GKW).

The triple is an individual equilibrium outcome if the following three conditions are met:

-

(i)

, and ;

-

(ii)

for all and , , with equality if ;

-

(iii)

and , with equality if and if , respectively.

The vector is an individual equilibrium matching if and only if there exists a pair of vectors such that is an individual equilibrium outcome.

4 Stable matchings with heterogeneity

We now extend our model by assuming that agents can be grouped into a finite number of observable types, and have heterogeneous (unobserved) tastes. This macroscopic analog of the individual equilibrium, called the “aggregate equilibrium”, describes the equilibrium matching patterns and systematic payoffs for each type. We will define this concept in more detail below.

4.1 Unobserved heterogeneity

Within a given type, agents have similar observable characteristics, but heterogeneous tastes. Let denote the observable type of man and denote the observable type of woman (see notations in the introduction to this chapter). We assume that the feasible set of utilities jointly obtainable by and is a random set whose stochasticity has the following structure.

Assumption 1.

There exist families of probability distributions and such that

-

(i)

if and are matched, there exists , where is a proper bargaining set in the sense of definition 1, such that and ,

-

(ii)

if and remain single, then they obtain utilities and , respectively,

where the random vectors and are i.i.d. draws from and , respectively.

Note that in the TU case, assumption 1 boils down to assuming that the joint surplus can be decomposed into , which is the “additive separability” assumption commonly found in the literature.

Next, we impose the following assumption on the distributions of the idiosyncratic terms and , and :

Assumption 2.

and have non-vanishing densities on and .

Assumption 2 requires the distributions and to have full support and be absolutely continuous. Full-support ensures that for any pair of types and , there exist individuals of those types with arbitrarily large valuations for each other. This implies that at equilibrium, there will be matches between individuals of all observable pairs of types. Absolute continuity, on the other hand, ensures that with probability one, both the men and women choice problems have unique solutions.

4.2 Another parameterization of bargaining sets

Before delving into the concept of aggregate equilibrium and its properties, we introduce an explicit parametrization of the bargaining frontier, which will prove instrumental in our analysis.

Let be a proper bargaining set and be the associated distance-to-frontier function. Let be a utility allocation lying on the frontier of the bargaining set, i.e. such that . GKW define the wedge as the difference . They show that there exists two 1-Lipschitz functions and defined on a nonempty open interval such that is nondecreasing and is nonincreasing, and such that the set of utility allocations that are located on the frontier of the bargaining set is given by . Therefore, these functions provide an explicit representation of the bargaining frontier.

In addition, GKW show that and are the unique values of and solving the equations and that they are given by

| (10) |

Building on this explicit wedge parameterization, we introduce the following technical restriction on the bargaining sets :

Assumption 3.

The sets are such that for each man type , either all the , are finite, or all the , coincide with . For each woman type , either all the , are finite, or all the , coincide with .

This assumption, which is needed to ensure existence of an equilibrium, imposes that the maximum utility any man or woman can obtain with any partner is either always finite, or always infinite.

4.3 Aggregate equilibrium

We define an aggregate equilibrium as follows:

Definition 4 (GKW).

The triple is an aggregate equilibrium outcome if the following three conditions are met:

(i) is an interior matching, i.e. ;

(ii) is feasible, i.e.

| (11) |

(iii) , , and are related by the market-clearing condition

| (12) |

where

| (13) |

are the total indirect surplus of men and women, respectively.

The vector is an aggregate equilibrium matching if and only if there exists a pair of vectors such that is an aggregate equilibrium outcome.

Implicitly, the justification for using definition 4 lies in the fact that we are looking for an individual equilibrium with the property that there exist two vectors of systematic utilities and such that if is matched with , then , and . Although it might seem restrictive at first glance, GKW demonstrate that: (i) an individual equilibrium of this form always exists, and (ii) under the additional assumption that the frontier of the feasible set is strictly downward sloping (which rules out the NTU case, for example), any individual equilibrium is of this form. We now examine each of the conditions that make up definition 4.

Condition (i) states that the matching must be feasible and lie in the strict interior of , i.e. that , and .

Condition (ii) relates the systematic utilities and through a feasibility condition. To understand where these systematic utilities come from, let us adapt the definition of an individual equilibrium to our framework with parametrized heterogeneity. The triple is an individual equilibrium outcome when: , and ; for all and , , with equality if ; and and with equality if and , respectively. Note that the nonlinear stability conditions read: for any pair of types and ,

which holds with equality if there is a matching between a man of type and a woman of type . Let us define and ; then the above inequality yields . GKW show that, under weak conditions, this actually holds as an equality, that is

| (14) |

Condition (iii) relates the matching and the systematic utilities through market clearing conditions. It builds on the intuition that the matching problem with heterogeneity in tastes is analogous to a pair of discrete choice problems, each pertaining to one side of the market. The discrete choice formulation allows us to relate the vector of systematic utilities and to the equilibrium matching such that is the mass of men of type and women of type who mutually prefer each other. Note that from the definition of and , we have and , which can be shown to hold with equality. Thus we obtain the discrete choice problems

in which each agent chooses the type of their partner. To obtain the mass of men of type demanding a partner of type and women of type demanding men of type , we refer to the Daly-Zachary-Williams theorem which indicates that these masses are given by and , respectively. At equilibrium, these quantities should coincide for all couple types, that is, in vector notation.

4.4 Existence, uniqueness and computation

GKW propose to reformulate the matching model as a demand system to show existence and uniqueness of an aggregate equilibrium outcome . Recall that the condition in definition 4 is equivalent to the existence of wedges such that and . From now on, these wedges will play the role of market prices while the couple types will be treated as goods that are being produced by men and demanded by women. Interpreting and as the supply and demand of the good, respectively, we introduce the excess demand function:

| (15) |

The next step is to find a price vector such that the excess demand is zero for all goods. GKW show that such a price vector exists and is unique:

Finally, we can obtain the unique aggregate equilibrium outcome , where , , and are related to the solution to system (16) by , , and (Corollary 1, GKW).

As the proofs of existence and uniqueness in theorem 1 are instructive, they are succinctly discussed below.

The proof of existence is constructive, and relies on a Jacobi algorithm. The algorithm’s ability to produce a solution crucially hinges on the excess demand function satisfying the gross substitutability condition (see GKW, Proposition 3). We now explain intuitively what that condition means in our setting, by describing what happens when the price of good increases (keeping all other prices constant). First, excess demand for good decreases as there is less demand from women and more supply from men for that good. Second, for women of type , other types of men become relatively more attractive, hence excess demand for goods (where ) increases. Conversely, for men of type , other types of women become relatively less attractive, hence excess demand for goods (where ) increases. Third, the excess demand for good does not respond to changes in the price of good if and . Fourth, as increases, singlehood becomes weakly less attractive for all men, and strongly less so for men of type , while singlehood becomes more attractive for women. Hence, the excess demand, aggregated over all couple types, decreases.

The algorithm then works as follows. We start by choosing a vector of initial prices, that are high enough so that excess demand is negative for all couple types (i.e. so that ). Then, at each step , we decrease the price of each good such that the excess demand for that good is zero, keeping all other prices fixed (i.e. we set to be such that ). Gross substitutability ensures that, for all pairs , the are decreasing while the excess demand remains negative at every step. GKW show that the sequence remains bounded below; thus, it converges monotonically and its limit is a solution to equation (16). The algorithm is described formally below:

Algorithm 1.

| Step | Start with such that . |

|---|---|

| Step | For each , let solve . |

The algorithm terminates when .

Uniqueness follows directly from the results of [86], which imply that is inverse isotone. By definition, the mapping is inverse isotone if, for any and , implies . The following argument established uniqueness. Suppose there are two vectors and such that . Since , then . And since , then . Hence .

5 The ITU-logit model

In this section and the next, we shall work under the assumption of logit heterogeneities. That is, we assume that and are the distributions of i.i.d. Gumbel (standard type I extreme value) random variables.

While the logit assumption is not required for empirical work, it leads to a very tractable empirical framework. We will first show how our model can be conveniently reformulated as a matching function equilibrium model with partial assignment, and then examine some examples. In the next section, we will show how to estimate these models.

Remark 1 (Beyond the logit case).

While the assumption of logit heterogeneities features prominently throughout the remainder of this chapter, it is possible to use the framework with more general heterogeneities, albeit at the cost of convenience and tractability.

We now provide a concise overview of the steps involved in determining the aggregate equilibrium under general heterogeneities. For a given price vector , we compute the systematic utilities using the functions and . We then draw many values of the idiosyncratic terms and from the desired distributions (provided that assumption 2 is satisfied) and compute and . Recall that in our demand system interpretation, is the supply of the good, and is the demand for that good at price vector . We repeat these steps for possibly many values of until we find the price vector such that excess demand is zero for all goods on the market (see theorem 1 and surrounding discussions).

5.1 Matching functions

With logit heterogeneities, it is well-known that the systematic utilities and can be recovered, in closed form, from the matching . We have, by the classical log-odds-ratio formula, that and , which, together with the feasibility condition yields a relation between , and , namely

| (17) |

which implies by the translation property of distance-to-frontier functions. This gives us

| (18) |

where is the matching function associated to the ITU-logit model:

| (19) |

Although we call that relation a “matching function”, it is important to note that this relationship between the number of “vacancies” and and the number of matches does not exactly play the same role as matching functions that appear in the macroeconomic approaches to the labor markets, specifically in the search-and-matching literature, as surveyed in [144]. There, a matching function specifies a dynamic relationship between matches and vacancies, with the understanding that the numbers of matches that are formed at the end of a period are a function of the number of vacancies at the start of the period. In our setting, we are at equilibrium, and the relation between these quantities is to be understood as a simultaneous equation between these quantities. Of course, it is possible to bring these approaches closer to each other when considering stationary equilibria in a search-and-matching market, as sketched in section 7.7.

5.2 Examples

We revisit some of the examples introduced earlier in the special case of logit heterogeneity. Recall that the matching function is given by expression (19). By construction, the aggregate matching functions in this framework are homogeneous of degree 1 in the masses of singles.

In the TU model, the matching function becomes

| (20) |

The NTU specification with logit heterogeneities yields the matching function

| (21) |

In the elementary LTU model explored in section 2.4, the matching function is

| (22) |

Note that we recover the TU matching function whenever .

Finally, in the case of the elementary ETU model with logit heterogeneity, we obtain the matching function:

| (23) |

As noted earlier, when and , we recover the NTU-logit matching function, while , equation (23) gives the TU-logit matching function.

5.3 Matching function equilibrium

Matching functions relate to the masses of singles and . Combined with the requirement that , this yields a system of nonlinear equations that fully characterize the aggregate matching equilibrium. The concept of matching function equilibrium builds on this idea. Following [91], we define:

Definition 5 (Matching function equilibrium).

The matching patterns form a matching function equilibrium, if these quantities are related together by (18), and if and satisfy the following system

| (24) |

Definition 5 stresses that in the logit case, finding the aggregate equilibrium is equivalent to solving the system of nonlinear equations (24)—a system of equations in the same number of unknowns.

While existence and uniqueness of a solution to this problem follows from theorem 1, it is instructive to give an alternative proof of the existence part, which is constructive and provides an algorithm to compute the equilibrium. The algorithm is described below:

Algorithm 2.

| Step | Fix the initial value of at . |

|---|---|

| Step () | Keep the values fixed. For each , solve for the value of such that the equality holds. |

| Keep the values fixed. For each , solve for the value of such that the equality holds. |

The algorithm terminates when .

Algorithm 2 converges to the unique solution to system (24), a result that we formally state in the following theorem.

Theorem 2.

The proof of this result is straightforward after noticing that the form a decreasing sequence bounded below by . This implies that this sequence converges, which implies in turn that the sequence also converges. Continuity of the matching functions then imply that the limits of these two sets of sequences are solution to system (24).

In the transferable utility case, the two steps in algorithm 2 can be expressed in closed form; this algorithm, initially described by [125], is an extension of the Iterated Proportional Fitting Procedure (IPFP), also known as Sinkhorn’s algorithm, popular in the optimal transport literature.

Algorithm 2 bears an interesting relation with the deferred acceptance algorithm of Gale and Shapley, where, if the ’s form the proposing side, is such that initially, all the ’s are unassigned; like in the Gale and Shapley algorithm, the welfare of the ’s keep decreasing along the algorithm, while the welfare of the ’s keep increasing. Therefore, one may view algorithm 2 as a continuous counterpart of the deferred acceptance algorithm.

6 Estimation

In this section, we follow a parametric approach and assume that belongs to a parametric family where are the parameters of interest. We propose to estimate these parameters by maximum likelihood. We introduce the likelihood and discuss computational challenges.

6.1 The likelihood

Typically, empirical applications will build on a model that specifies the surplus or payoff functions of the agents on the market. We gather in the vector the model’s parameters that are of interest to the econometrician. For a given value of , we can construct the bargaining sets and compute the associated distance-to-frontier functions . This, in turn, allows us to compute the matching function, according to equation (19). In the remainder of this section, we will assume sufficient smoothness on the parametrization, i.e. for each , the map is twice continuously differentiable from to .

We assume that we have a sample of i.i.d. draws of household types , so that we observe the matching as well as the margins . We let denote the distribution vector of men and women’s types.

Given and , let be the (unique) solution to system (24). The predicted equilibrium marriage patterns are obtained from

Letting denote the predicted mass of households on the market, the predicted frequency of a household of type is defined as

| (25) |

Letting , the log-likelihood function is written

Note that the margins can be estimated alongside the other parameters in our framework. However, our focus is on estimating the parameters . Thus the margins are nuisance parameters and we propose to replace these by the consistent estimator , where is the matrix such that .

The next theorem unpacks the likelihood function and provides an expression for the variance-covariance matrix for the parameters .

Theorem 3 (GKW).

(i) The log-likelihood is expressed using

| (26) |

where the quantities and form the unique pair of vectors solution to

| (27) |

(ii) Letting be the maximum likelihood estimator, as the sample size , where the variance-covariance matrix can be consistently estimated by

| (28) |

where is the Hessian333We operate under the assumption that is invertible. The partially identified case when this matrix is no longer invertible requires specialized techniques, which are not the focus here. of with respect to and is the matrix of cross-derivatives of with respect to and .

6.2 Estimation and computational challenges

Following GKW and [91], we present two estimation approaches and discuss some related computational challenges.

In the so-called “nested approach” to estimation, we estimate with the following steps: (i) pick a value of ; (ii) compute the unique pair of vectors solving system (27), (iii) evaluate the log-likelihood and (iv) update the value of (e.g. using the gradient of the log-likelihood). According to this approach, the vectors are endogenous equilibrium quantities solutions to the system of equation (27) that need to be determined for each value of .

The success of the nested approach hinges on our ability to solve system (27) efficiently (specifically, at step (ii) of the procedure described above). Fortunately, it turns out that there is a simple iterative procedure that will achieve that, which we have already formally described in algorithm 2. Importantly, under our main assumptions, algorithm 2 (adapted to the notations of theorem 3) converges toward the unique solution to (27) and always provides the solution, unlike more traditional methods such as the Newton descent. Whenever the distance-to-frontier function is known in closed form, algorithm 2 can also be very fast. [125] show that in the TU-logit case it is even possible to obtain closed form expressions for the solutions and at each step of the algorithm, a result that we recall in remark 2 below. If, on the other hand, the distance-to-frontier function is not known in closed form, then algorithm 2 can be slow and the nested approach to maximum likelihood estimation is not recommended. Finally, note that to ease computations (specifically, at step (iv) of the nested approach to estimation), there is an analytic expression of the gradient of the log-likelihood, see e.g. [91].

An alternative approach is to treat as exogenous parameters to be estimated alongside . This is in line with the Mathematical Program with Equilibrium Constraints (MPEC) approach. In this case, we solve

| (29) |

where the expression of is analogous to equation (26), except that and are parameters. This approach consists in maximizing the likelihood under the equilibrium constraints that the system of equations (27) represents.

Remark 2 (Simplifications in the IPFP algorithm).

Remark 3 (Augmenting the likelihood).

In both the nested and MPEC approaches, we have constructed a likelihood function that only uses the information contained in the matching patterns. However, in many applications, solving for the distance-to-frontier function to obtain the predicted marriage patterns will also return predictions for other decision variables included in the model. If the data contains information about these variables, then the likelihood function can be augmented to account for that information. Consider for example the ETU-logit model. Suppose we parametrize and , and store the parameters in the vectors and , respectively. Let denote the vector of the . The parameters to be estimated are gathered in the vector . For a given value of , let and be the unique solution to (27) and the vector of predicted matching patterns. For couple type , the predicted private consumption of the man is given by while that of the woman is given by . If private consumption is observed (with some measurement error) by the econometrician, then this information can be incorporated into the likelihood function.

7 Remarks and discussions

7.1 Positive assortative mating

Positive assortative mating (PAM) is well studied in the TU case. There, supermodularity of the surplus function ensures positive assortative mating. In the context of imperfectly transferable utility models, assortativeness has been studied in e.g. [135], [101], [88] and [96]. We now explore some of these ideas, following a similar approach to that of [[]chapter 7]chiappori2017. For simplicity, we will assume that men and women differ along a single dimension and , respectively. Let denote the maximum utility a woman can receive when matched with man set to receive utility , and let . A woman chooses her preferred man and receives payoff

which yields the first order condition

where is the assignment rule. Thus , hence . Since the first order condition holds for all , then differentiating a second time with respect to yields , that is

From the second order condition, , thus is of the same sign as , that is, we have PAM whenever

| (30) |

As pointed out in [96], this restriction is a generalization of the famous Spence-Mirrlees condition. In particular, in the TU case where (where denotes the marital surplus), we have and equation (30) boils down to the usual supermodularity condition on the surplus function. In addition, note that having (i.e. women prefer high-type men, even more so when they are high-type themselves), and (i.e. it is easier for high-type women to bid for men as the frontier is flatter) would result in PAM, unsurprisingly.

7.2 Comparative statics

In this section we examine how changes in exogenous parameters affect the matching numbers and the equilibrium utilities and . The framework can be used to obtain comparative statics results that are relevant in many applications, e.g. to study the impact of a change in the distance function or in the parameters of the underlying model (for example, a change in the quantities and in the examples of section 2.4). For the sake of brevity, we will only study the effect of changes in the distributions of characteristics of the populations.

We start by introducing an aggregate matching equation, which is a useful reformulation of the system of equations in definition 4. Building on this reformulation, we derive the comparative statics results.

7.2.1 Aggregate matching equation

The aggregate matching equation formulation consists in rewriting the the system of equations in definition 4 as a simpler system of equations that only depends on the matching . To achieve this, we introduce the Legendre-Fenchel transform (a.k.a. convex conjugate) of and :

| (31) |

Under smoothness assumptions (that hold here given assumption 2), results from convex analysis [[, see]]rockafellar1970 indicate that

Using these results, we can express and as functions of and substitute these out in the system of equations in definition 4. Equilibrium can then be characterized by a set of equations that only depends on . GKW conclude that a matching is an aggregate equilibrium matching if and only if

| (32) |

(see GKW, proposition 1).

7.2.2 Change in populations

Building on this reformulation, we provide comparative statics results, which allows us to predict the vector of change in in the number of matched pairs at equilibrium as a function of the change in the number of men and women of each types, and . From the expression of , we can recover the expression of the systematic utilities at equilibrium and .

In order to do this, we shall use the vectorized elements , and and use the following notations. First, , , and are the doubly-indexed vectors whose -th entry are respectively , , and . Then, we let (resp. ) be the doubly-indexed matrix whose -th entry is (resp. ) if and , otherwise. We denote (resp. ) the doubly-indexed matrix whose -th entry is (resp. ). Finally, we let (resp. ) be the doubly-indexed vector whose -th term is (resp. ).

Using these notations, we now focus on the effect of a change in the population on the equilibrium outcome. As [[]pp. 120–122]becker1993 puts it:

“[…] An increase in the number of men of a particular quality tends to lower the incomes of all men and raise those of all women because of the competition in the marriage market between men and women of different qualities.”

We formalize this Beckerian intuition in the following result.

Theorem 4.

Suppose assumptions 1, 2, and 3 hold and let be the unique equilibrium outcome. Assume that and are changed by some infinitesimal quantities and , respectively. Then:

(i) The change in is given by

| (33) |

(ii) The changes in and are given as a function of , and by

| (34) |

(iii) In particular, under transferable utility, equation (33) becomes

To clarify the structure of our comparative statics, we look at an example with logit unobserved heterogeneity and no observable heterogeneity.

Example 5 (Comparative statics).

Consider an ITU-logit model and assume that there is only one type of man and one type of woman. Let be the number of married couples. In this case, the systematic part of the equilibrium utilities of married men and women are and , and and . Then, equation (33) simplifies to

We have

where we take

Thus, we can compute that

from which we see that if (i.e., if the women’s relative increase in population is larger than the men’s), then the systematic utility of men increases, and the systematic utility of women decreases. (The converse is also true.)

Finally, we consider the effect of the change in population supplies on the average welfare of a man of type and a woman of type , defined as

We obtain the following result:

Corollary 1 (Unexpected Symmetry).

7.3 Equilibrium vs optimality

One of the many appealing properties of TU is the fact that equilibrium and optimality coincide. We shall discuss this statement in greater detail, both in the case with and without heterogeneity, and contrast with the ITU case.

In the case without heterogeneity, it is well known that the TU matching model can be reformulated as an optimal assignment model (or problem), in which a social planner maximizes total surplus under feasibility conditions on the matching. The optimal assignment problem is written as a linear programming problem, in which the complementary slackness conditions for optimality coincide with our equilibrium conditions. This is specific to the TU case, however ; in the ITU case, equilibrium conditions are not, in general, the first-order conditions associated to an optimization problem. That is, equilibrium cannot be interpreted as the solution to some welfare maximization problem.

In the case with unobserved heterogeneity, things are no different. Recall that a matching is an aggregate equilibrium matching if and only if

| (35) |

which, in the TU case, boils down to

| (36) |

It turns out that equation (36) coincides with the first order conditions associated with the following welfare maximization problem

where is an entropy penalization term. This is again a specific feature of the TU model. In general, equation (35) cannot be interpreted as the first-order conditions of an optimization problem because the Jacobian of the function defined by the left hand-side of equation (35) is not symmetric.

7.4 Unregularized case

In the case when there is no heterogeneity, but when individuals are clustered into types for the men and for the women, definition 3 has a straightforward extension which is summarized into table 1 below. An equilibrium outcome is a vector solution to this set of equations.

| Variable | Constraint | Complementarity |

|---|---|---|

| NA | ||

| NA |

As one can see on table 1, the first column contains the variables (“primal” or quantity-like , as well as “dual” or price-like and ), the second contains the corresponding constraints, and the third column represents the complementary slackness condition. In the TU case, these relations are simply the optimality conditions associated with a linear programming problem; in the general ITU case, one loses the reference to optimization.

Several approaches exist to prove that an equilibrium outcome exists. When and for all and , [133]’s approach consists in discretizing the set of into a finite set of possible values and consider a deferred acceptance algorithm where the ’s propose. In an initial round, the ’s are set to their smallest value . Each then makes an offer to the maximizing where is such that . If no received more than one offer, the algorithm stops. If some ’s are made more than one offer, then the values of for these go up by one step, and the proposal phase is repeated. The algorithm runs in that way until each receives at most one offer. [128] provide a reformulation of Kelso and Crawford’s algorithm in lattice-theoretic terms.

[150] using a combinatorial lemma which also provides a computational argument. The idea behind Scarf’s argument is to look for two basis of variables. First, a basis that guarantees primal feasibility, meaning that all the constraint that only involve in table 1 are satisfied; such a problem alone is not difficult. Second, a basis that guarantees dual feasibility, which deals with all the constraints in table 1 involving variables and only; again, this problem alone is not hard. As shown by Scarf, the problem of complementarity consists of ensuring that these two basis coincide. Scarf shows that it is quite straightforward to construct a primal feasible basis and a dual feasible basis that have all but one element in common. He then proceeds to show that a pivoting algorithm in the spirit of [136] algorithm initialized on these overlapping basis necessarily terminates when the two basis coincide.

In [123], it is shown that the proof of existence of a solution to the unregularized problem described in table 1 can be deduced very simply from the existence of a solution to the regularized problem of section 4.3. Indeed, one can show that if we take as function , which recovers (19) when , a matching function equilibrium exists for any value of , and when , the solution to the matching function equilibrium problem tends to a solution to the unregularized equilibrium matching problem.

7.5 Full assignment

In all the models examined so far, agents on the market had the option to remain single. We call these models matching models with partial assignment [91]. In this section, we discuss matching models with full assignment instead, i.e. models in which agents are not allowed to remain unmatched.

For simplicity, we will use the ITU-logit model once again. Full assignment implies that , i.e. there is an equal mass of agents on both sides of the market since all must match. While it is no longer possible to recover the systematic utilities and from the matching patterns, one can show that

where and play the role of fixed effects and are given by and . The feasibility condition from definition 4 yields from which we obtain the matching function which relates the mass of matches of type to the fixed effects and , that is

where . The analog to the matching function equilibrium with partial assignment in the full assignment case is given below:

Definition 6 ([90]).

A matching function equilibrium model with full assignment determines the mass of matches by an aggregate matching function which relates to the fixed effects and , that is

where the fixed effects and satisfy a system of nonlinear accounting equations

| (37) |

Note, however, that there is some dependency in system (37), since by assumption and by construction for any . Therefore, existence and uniqueness of an equilibrium in matching function equilibrium models with full assignment is all but guaranteed. However, it turns out that under some mild conditions on the matching function (namely, continuity, strict isotonicity and appropriate limiting behavior), an equilibrium exists. In addition, under normalization of one of the or , that equilibrium is unique444Uniqueness holds under more general normalizations on , as demonstrated in [90].. Therefore, like the partial assignment models, full assignment models are well suited for empirical work, where the estimation methods introduced in section 6 can be used.

7.6 Non-transferable utility

In this chapter, our definition of non-transferable utility yields the bargaining sets

Unlike traditional NTU models, we allow for utility burning. That is, if and are matched, then and , when at least one of these inequalities holds as an equality, but not necessarily both. In our model, the stable payoffs are not necessarily the (only) efficient allocation . A possible justification for allowing utility burning is that if agents on one side of the market are relatively scarce, then the agents on the other side of the market can engage in wasteful competition, which decreases their utility.

Despite these differences, there is a connection between the NTU stability concept defined in this chapter and NTU stability as it features in the existing literature. In fact, [122] shows that when there is one agent of each type, our notion of NTU equilibrium exactly coincides with traditional NTU stability.

The connection breaks however when there are more than a unit mass of agents per observable type, or when there is unobservable heterogeneity, as in our empirical framework. This explains why the matching function we obtain in the NTU-logit case differs from others in the literature. For example, in [109] and [138], the matching function, which is based on conventional NTU stability, is given by . In contrast, recall that our matching function in the NTU-logit case is . In the first case, the underlying model is that men and women receive utilities and , respectively, where and are i.i.d. type I extreme value distributed shocks. In the second case, the underlying model is that partners receive utilities and where both and are nonnegative and at least one of these terms is equal to and and are i.i.d. type I extreme value distributed shocks. Note that the NTU model in Dagsvik-Menzel features i.i.d. preference shocks over individuals, while our model features preference shocks over types. Therefore, the matching function from Dagsvik-Menzel is not positive homogenous of degree one: as the mass of individuals per type increases, the fraction of married individuals increases, whereas it remains constant in our model.

7.7 Search-and-matching

The distance function approach allows one to generalize the search-theoretic framework of matching with search frictions à-la Shimer and Smith ([153]) from the TU to the ITU case. In that paradigm, at each time pairs meet according to some Poisson process and both agents decide whether to match or not. Both have a reservation utility associated with not matching which is endogenously determined as the option value of waiting for a better match.

More precisely, we consider a continuous-time model where agents discount the future with rate . An unmatched man of type experiences random meetings with women of type as a Poisson process arrival of intensity ; similarly, an unmatched woman of type experiences random meetings with men of type as a Poisson process arrival of intensity . Matches between type and type are exogenously destroyed as a Poisson process of intensity .

Let be the intertemporal value of being type unmatched of type . We assume that if an agent of type is matched with a type , then its intertemporal value is , with . Similarly, we let be the intertemporal value of being type unmatched of type , and we assume that if an agent of type is matched with a type , then its intertemporal value is , with . In a match between and , the partners will respectively get which is on the frontier of at each period until a match is dissolved therefore the Bellman equation of men of type matched with women of type is

and thus and . But as is on the frontier of , , and therefore

Given that is the threat point in this bargaining game, if one assumes Nash bargaining, one has and therefore

Therefore, agents match if , that is if . Letting and , one can write the Bellman equation associated with unmatched agents of type and , respectively

| (38) | |||||

| (39) |

and steady state on the flows of matches yield the matching function

| (40) |

8 Related literature

In the following section, we provide a brief overview of the literature on, or connected to, matching models with imperfectly transferable utility.

Transferable utility. At one end of the spectrum are matching models with (perfectly) transferable utility. [134] is one of the earliest paper to study the assignment problem and its formulation as a linear programming problem. [152] studies assignment games, with a particular emphasis on the core of such games. [84] is one of the early application of the assignment problem to marriage markets. Many of the fundamental results from that early literature can be found in [[]chapter 8]rothsotomayor1990, [[]chapter 3]galichon2016 or [[]chapter 7]browningchiapporiweiss2014.

Non transferable utility. At the other hand of the spectrum are non transferable utility models. The classical NTU model is studied in [120], along with the deferred-acceptance algorithm that produces a stable matching for such matching markets. NTU models are covered in detail in [149]. [122] examine a NTU framework with utility burning, and therefore provides a comprehensive analysis of the connections between this chapter’s treatment of NTU models and the classical NTU model.

Imperfectly transferable utility. Several researchers have explored the theory of ITU matching, including [108], [133], and [128]. These studies have identified conditions and algorithms for finding competitive equilibria outcomes in ITU matching markets and have studied the structure of the sets of equilibria.

Other notable contributions to ITU matching theory include the work of [132], [146], [80], [81], [119], [113], and [117]. The papers provide results on the existence of equilibria and analyzed properties of the core. [145] features a many-to-one ITU matching framework, and characterizes the sharing rules that lead to pairwise alignment of preferences and existence of equilibria.

More recently, [141] examined connections between abstract notions of convexity and matching with ITU, while [127] analyzed the notion of pairwise stability in a ITU framework with a continuum of agents.

Distance-to-frontier functions. The approach of describing bargaining sets via distance-to-frontier functions draws its inspiration from the literature on directional distance functions and efficiency in production, see e.g. [110], [89], and [143].

Existence and uniqueness results. The methods introduced in this chapter to establish existence and uniqueness of an equilibrium are based on the notion of gross substitutability, which features prominently in [133] and in the literature on demand inversion problems, e.g. [86]. Other approaches to establish existence of an equilibrium in the unregularized case include [150], [133], [80], [81] or [128], as discussed in section 7.4.

In our setting, uniqueness also hinges on the full support assumption, for similar reasons that uniqueness arises in continuum matching settings, as in [99] in the TU case or [83] in the NTU case. Other papers have followed a different approach, e.g. [125] rely on convex optimization, albeit in the TU case.

Our reformulation of the matching model as a demand system is in the same spirit as [83] in the NTU case without unobserved heterogeneity. Recently, [90] follow a similar approach (with a supply system) to provide existence and uniqueness results in the full assignment case.

Assortative mating. Our treatment of assortative mating in the ITU case follows [[]chapter 7]chiappori2017. [135] studies assortativeness in ITU models, provides conditions under which PAM arises, and discuss applications to matching under uncertainty with risk aversion. More recently, [101] considered a similar setup with risk sharing, while [88] extended the setting of [135] to the case where agents have different risky endowments.

Empirical frameworks. [104]’s seminal work in the TU case exploits (logit) heterogeneity in tastes for identification purposes, building on the insights of [137]. They were also the first to realize the analytical convenience of the separability assumption, which decomposes the joint surplus into a systematic component and unobserved heterogeneity components. Many papers have followed in the steps of that paper, e.g. [118], [100], [115], [102], [106] and [125], among others. In the NTU case, several papers have used a similar strategy, e.g. [109], [138], [129] or [79]. In the ITU case, the literature is much more sparse. To the best of our knowledge, [124] was the first paper to provide a tractable empirical framework for matching with ITU.

Finally, the ITU-logit model presented in this chapter is reminiscent of the demography literature on matching functions, e.g. [151]. In economics, matching functions have been studied in detail in [154], [139] and [140]. [91] define and study the properties of matching function equilibria, which consists of a behaviorally coherent matching function and accounting constraints, and encompasses many models in this literature.

Estimation and computation. Estimation of the ITU-logit model by maximum likelihood is described in [124]. [90] and [91] discuss the estimation of matching function equibria models (with full assignment and partial assignment, respectively) by maximum likelihood. Algorithm 2 used in those papers is reminiscent of the iterative projective fitting procedure algorithms used in other literatures under different names, see [130] for a review. In the TU-logit case, algorithm 2 simplifies as shown in [125] and reminded in remark 2. The MPEC approach to estimation draws from the works of [114], [155], and [142].

Marriage markets. The collective approach to household decision making, introduced in [93], [82] and [94], assumes that decision makers in household bargain and take Pareto-efficient decisions [[, see]for a discussion on the efficiency assumption]delbocaflinn2012. This approach has spurned a vast theoretical and empirical literature and collective models have quickly become a cornerstone of family economics [[, see]for a review]browningchiapporiweiss2014. However, in these models, both household formation and the allocation of bargaining power are taken as given. Therefore, a growing literature has attempted to embed collective models into matching models of the marriage market in order to endogenize family formation and the allocation of bargaining power. Most of the early papers reconciling the collective and matching approaches have done so in the TU case, e.g. [131], [98], [103], [97] [[, see also]chapters 8 and 9 for a review]browningchiapporiweiss2014. In the ITU case, [95] provides an illustrative example on how to embed a collective model into a matching framework [[, see also]chapter 7]chiappori2017. [124] provide an empirical matching framework with ITU and features several examples inspired by the collective approach. [156] discusses further the connection between collective models and ITU models, and characterizes “proper” collective models that can be embedded in the empirical framework described in this chapter. [147] extends the framework to incorporate a life cycle model and provides an application.

While the framework introduced in this chapter is frictionless, other papers in the search and matching literature have examined the connection between collective models and marriage markets. For example, [126] focuses on the TU case while [107] considers the ITU case and provides an application with NTU.

Finally, other papers in the literature have followed a completely different approach, e.g. [92] derive Afriat-style inequalities from stability conditions on the marriage market to obtain bounds on intra-household sharing rules, which describe how resources are allocated within households.

Labour markets. [116] studies an ITU matching problem with linear taxes and provides comparative statics results, as well as an application to the college-coach football labour market.

References

- [1] Nikhil Agarwal “An Empirical Model of the Medical Match” In American Economic Review 105.7, 2015, pp. 1939–78

- [2] Ahmet Alkan “Existence and computation of matching equilibria” In European Journal of Political Economy 5.2, 1989, pp. 285–296

- [3] Ahmet Alkan and David Gale “The core of the matching game” In Games and Economic Behavior 2.3, 1990, pp. 203–212

- [4] Patricia F. Apps and Ray Rees “Taxation and the household” In Journal of Public Economics 35.3, 1988, pp. 355–369

- [5] Eduardo M. Azevedo and Jacob D. Leshno “A Supply and Demand Framework for Two-Sided Matching Markets” In Journal of Political Economy 124.5, 2016, pp. 1235–1268 eprint: https://doi.org/10.1086/687476

- [6] Gary S. Becker “A Theory of Marriage: Part I” In Journal of Political Economy 81.4, 1973, pp. 813–846

- [7] Gary S. Becker “A Treatise on the Family: Enlarged Edition” Harvard University Press, 1993

- [8] Steven Berry, Amit Gandhi and Philip Haile “Connected Substitutes and Invertibility of Demand” In Econometrica 81.5, 2013, pp. 2087–2111 eprint: https://onlinelibrary.wiley.com/doi/pdf/10.3982/ECTA10135

- [9] Martin Browning, Pierre-André Chiappori and Yoram Weiss “Economics of the Family”, Cambridge Surveys of Economic Literature Cambridge University Press, 2014

- [10] Hector Chade and Jan Eeckhout “Stochastic Sorting” In working paper, 2017

- [11] R.. Chambers, Y. Chung and R. Färe “Profit, Directional Distance Functions, and Nerlovian Efficiency” In Journal of Optimization Theory and Applications 98.2 Springer ScienceBusiness Media LLC, 1998, pp. 351–364

- [12] Liang Chen, Eugene Choo, Alfred Galichon and Simon Weber “Existence of a Competitive Equilibrium with Substitutes, with Applications to Matching and Discrete Choice Models” In working paper, 2023 arXiv:2309.11416 [econ.GN]

- [13] Liang Chen, Eugene Choo, Alfred Galichon and Simon Weber “Matching Function Equilibria with Partial Assignment: Existence, Uniqueness and Estimation” In working paper, 2023 arXiv:2102.02071 [econ.GN]

- [14] Laurens Cherchye, Thomas Demuynck, Bram De Rock and Frederic Vermeulen “Household Consumption When the Marriage Is Stable” In American Economic Review 107.6, 2017, pp. 1507–34

- [15] Pierre-André Chiappori “Rational Household Labor Supply” In Econometrica 56.1 [Wiley, Econometric Society], 1988, pp. 63–90

- [16] Pierre-André Chiappori “Collective Labor Supply and Welfare” In Journal of Political Economy 100.3, 1992, pp. 437–467 eprint: https://doi.org/10.1086/261825

- [17] Pierre-André Chiappori “Modèles d’appariement en économie: Quelques avancées récentes” In Revue économique 63.3 Sciences Po University Press, 2012, pp. 437–452

- [18] Pierre-André Chiappori “Matching with Transfers: The Economics of Love and Marriage” Princeton University Press, 2017

- [19] Pierre-André Chiappori, Monica Costa Dias and Costas Meghir “The Marriage Market, Labor Supply, and Education Choice” In Journal of Political Economy 126.S1, 2018, pp. S26–S72 eprint: https://doi.org/10.1086/698748

- [20] Pierre-André Chiappori, Murat Iyigun and Yoram Weiss “Investment in Schooling and the Marriage Market” In American Economic Review 99.5, 2009, pp. 1689–1713

- [21] Pierre-André Chiappori, Robert J. McCann and Lars P. Nesheim “Hedonic Price Equilibria, Stable Matching, and Optimal Transport: Equivalence, Topology, and Uniqueness” In Economic Theory 42.2 Springer, 2010, pp. 317–354

- [22] Pierre-André Chiappori, Sonia Oreffice and Climent Quintana-Domeque “Fatter Attraction: Anthropometric and Socioeconomic Matching on the Marriage Market” In Journal of Political Economy 120.4, 2012, pp. 659–695 eprint: https://doi.org/10.1086/667941

- [23] Pierre-André Chiappori and Philip J. Reny “Matching to share risk” In Theoretical Economics 11.1, 2016, pp. 227–251 eprint: https://onlinelibrary.wiley.com/doi/pdf/10.3982/TE1914

- [24] Pierre-André Chiappori, Bernard Salanié and Yoram Weiss “Partner Choice, Investment in Children, and the Marital College Premium” In American Economic Review 107.8, 2017, pp. 2109–67

- [25] Eugene Choo and Shannon Seitz “The Collective Marriage Matching Model: Identification, Estimation, and Testing” In Structural Econometric Models 31, Advances in Econometrics Emerald Group Publishing Limited, 2013, pp. 291–336

- [26] Eugene Choo and Aloysius Siow “Who Marries Whom and Why” In Journal of Political Economy 114.1, 2006, pp. 175–201 eprint: https://doi.org/10.1086/498585

- [27] Edoardo Ciscato, Alfred Galichon and Marion Goussé “Like Attract Like? A Structural Comparison of Homogamy across Same-Sex and Different-Sex Households” In Journal of Political Economy 128.2, 2020, pp. 740–781 eprint: https://doi.org/10.1086/704611

- [28] Edoardo Ciscato and Simon Weber “The role of evolving marital preferences in growing income inequality” In Journal of Population Economics 33.1 Springer ScienceBusiness Media LLC, 2019, pp. 307–347

- [29] Melvyn G. Coles and Marco Francesconi “Equilibrium Search with Multiple Attributes and the Impact of Equal Opportunities for Women” In Journal of Political Economy 127.1, 2019, pp. 138–162 eprint: https://doi.org/10.1086/700731

- [30] Vincent P. Crawford and Elsie Marie Knoer “Job Matching with Heterogeneous Firms and Workers” In Econometrica 49.2 [Wiley, Econometric Society], 1981, pp. 437–450

- [31] John K. Dagsvik “Aggregation in Matching Markets” In International Economic Review 41.1, 2000, pp. 27–58 eprint: https://onlinelibrary.wiley.com/doi/pdf/10.1111/1468-2354.00054

- [32] Angus Deaton and John Muellbauer “Economics and Consumer Behavior” Cambridge University Press, 1980

- [33] Colin Decker, Elliott H. Lieb, Robert J. McCann and Benjamin K. Stephens “Unique equilibria and substitution effects in a stochastic model of the marriage market” In Journal of Economic Theory 148.2, 2013, pp. 778–792

- [34] Daniela Del Boca and Christopher Flinn “Endogenous household interaction” Annals Issue on “Identification and Decisions”, in Honor of Chuck Manski’s 60th Birthday In Journal of Econometrics 166.1, 2012, pp. 49–65

- [35] Gabrielle Demange and David Gale “The Strategy Structure of Two-Sided Matching Markets” In Econometrica 53.4 [Wiley, Econometric Society], 1985, pp. 873–888

- [36] Jean-Pierre Dubé, Jeremy T. Fox and Che-Lin Su “Improving the Numerical Performance of Static and Dynamic Aggregate Discrete Choice Random Coefficients Demand Estimation” In Econometrica 80.5, 2012, pp. 2231–2267 eprint: https://onlinelibrary.wiley.com/doi/pdf/10.3982/ECTA8585

- [37] Arnaud Dupuy and Alfred Galichon “Personality Traits and the Marriage Market” In Journal of Political Economy 122.6, 2014, pp. 1271–1319 eprint: https://doi.org/10.1086/677191

- [38] Arnaud Dupuy, Alfred Galichon, Sonia Jaffe and Scott Duke Kominers “Taxation in Matching Markets” In International Economic Review 61.4, 2020, pp. 1591–1634 eprint: https://onlinelibrary.wiley.com/doi/pdf/10.1111/iere.12474

- [39] Tamás Fleiner, Ravi Jagadeesan, Zsuzsanna Jankó and Alexander Teytelboym “Trading Networks With Frictions” In Econometrica 87.5, 2019, pp. 1633–1661

- [40] Jeremy T. Fox “Identification in matching games” In Quantitative Economics 1.2, 2010, pp. 203–254 eprint: https://onlinelibrary.wiley.com/doi/pdf/10.3982/QE3