Jump detection in high-frequency order prices

Abstract

We propose methods to infer jumps of a semi-martingale, which describes long-term price dynamics based on discrete, noisy, high-frequency observations. Different to the classical model of additive, centered market microstructure noise, we consider one-sided microstructure noise for order prices in a limit order book.

We develop methods to estimate, locate and test for jumps using local order statistics. We provide a local test and show that we can consistently estimate price jumps. The main contribution is a global test for jumps. We establish the asymptotic properties and optimality of this test. We derive the asymptotic distribution of a maximum statistic under the null hypothesis of no jumps based on extreme value theory. We prove consistency under the alternative hypothesis. The rate of convergence for local alternatives is determined and shown to be much faster than optimal rates for the standard market microstructure noise model. This allows the identification of smaller jumps. In the process, we establish uniform consistency for spot volatility estimation under one-sided microstructure noise.

A simulation study sheds light on the finite-sample implementation and properties of our new statistics and draws a comparison to a popular method for market microstructure noise. We showcase how our new approach helps to improve jump detection in an empirical analysis of intra-daily limit order book data.

keywords:

Boundary model, high-frequency data , limit order book , market microstructure, price jumpsJEL classification: C12, C58

1 Introduction

For price data recorded at high frequencies it is well-known that market microstructure noise dilutes the underlying semi-martingale dynamics due to structural market effects, such as the bid-ask bounce and transaction costs. The standard observation model to account for these effects is

where is a latent, continuous-time semi-martingale, which models the efficient log-price process, and are observation errors due to market microstructure. The classical model of market microstructure noise (MMN) introduces an additive noise process with expectation zero, see, for instance, Aït-Sahalia et al., (2005), Hansen and Lunde, (2006), Barndorff-Nielsen et al., (2008), Aït-Sahalia and Jacod, (2014) and Li and Linton, (2022). It is motivated and typically used for transaction prices. Besides volatility estimation, testing for jumps of , based on discrete observations with or without MMN, is one of the most important topics in statistics for high-frequency data, see Barndorff-Nielsen and Shephard, (2006), Aït-Sahalia and Jacod, (2009), Aït-Sahalia et al., (2012), Lee and Mykland, (2008) and Lee and Mykland, (2012), among others.

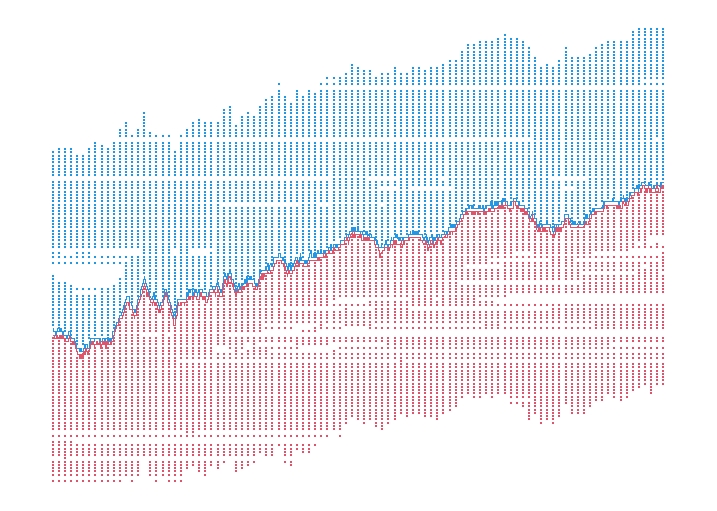

Limit order book data comprises more information than only trade prices. At each time point, it provides different quote levels including the best bid and best ask. Figure 1 shows a snapshot of quote dynamics for the AAPL asset traded at Nasdaq†††We use limit order book data provided by LOBSTER, lobsterdata.com. within a short time interval of 10 minutes. In the upper part, prices of ask limit orders are plotted with the line of best ask prices as a lower hull. In the lower part, we show bid limit order prices, where the upper hull depicts the path of best bid prices. At each time, all ask prices are above all bid prices with a bid-ask spread between the two lines. Since trades occur mainly when market orders are executed against existing limit orders, trade prices bounce between the best bid and the best ask. A natural question is how to efficiently use information from this data for inference on the efficient log-price and how to model and smooth out market microstructure for such data. One approach in recent works is to design structural noise models incorporating observed order book quantities, see Li et al., (2016), Chaker, (2017), Clinet and Potiron, (2019) and Andersen et al., (2022). Assuming more structure than fully uninformative noise, these works establish improved volatility estimation and inference on the efficient log-price compared to MMN. We take a different point of view on the market microstructure and do not impose a functional form of the noise. Instead, we argue that the noise of limit order prices should not have unbounded support . Noise distributions with restricted support facilitate improved inference on the efficient log-price without imposing further structural conditions. This intriguing effect was used by Bibinger et al., (2016) to estimate the integrated volatility of a continuous semi-martingale with improved optimal rate , while the slower rate is optimal for MMN. A generalization to spot volatility estimation and progress in the theory to establish asymptotic confidence intervals for volatility were recently contributed in Bibinger, (2024). Whenever data from a limit order book is available, we suggest to consider the time series of best ask price levels. Best bid prices can be used equivalently and both be combined in practice. While in such a situation the MMN-model has been calibrated to mid quotes, it is not clear why it should be suitable for best ask prices or best bid prices. In fact, considering best ask price dynamics, we do not have any bid-ask bounce effect. Instead, efficient prices should (usually) lie below the ask prices and above bid prices within the spread. Therefore, different to the MMN-model, we consider an additive noise model with limit order microstructure noise (LOMN). For ask orders this is modeled by lower-bounded, one-sided microstructure noise, i.e., . Since our statistics use only differences between adjacent block-wise local minima, our methods are robust to model generalizations where , for any continuous boundary function of finite variation. For instance, a positive gap between boundary and the efficient log-price could exist to compensate market processing costs. This gap may be time-varying, but it seems plausible that it should be rather persistent within the class of continuous functions of finite variation.

In this work we show that in the LOMN-model inference on jumps of the efficient log-price can be considerably improved compared to MMN. We construct methods to estimate, locate and test for jumps of the efficient log-price process. Our test for jumps based on extreme value theory is in the spirit of the jump tests by Lee and Mykland, (2008), for non-noisy high-frequency prices, and Lee and Mykland, (2012) and Bibinger et al., 2019b for the MMN-model. The very different structure of the noise in the LOMN-model, however, leads us to consider statistics based on local minima instead of local averages. The non-linearity of these statistics requires fundamentally different proofs in the asymptotic theory as . We prove a Gumbel convergence of a maximum statistic on which our test is based on and consistency under local alternatives with an optimal rate of convergence. While the Gumbel convergences in Lee and Mykland, (2008) and Lee and Mykland, (2012) can be traced back to the weak convergence of the maximum of i.i.d. standard normally distributed random variables, this is not the case for our maximum statistic. Based on extreme value theory and bounds for the tails of convolutions, we explicitly derive this convergence in distribution. An important advantage compared to related procedures for MMN is that we establish uniformly consistent spot volatility estimation and the asymptotic theory for jump tests without any assumptions on the moments of the noise. The rate of convergence for local alternatives improves from under MMN to the faster rate . This means that under LOMN we are able to detect smaller jumps than under MMN. For fixed jump size and number of observations, the power of our test outperforms the power of tests under MMN. Beyond improved asymptotic properties, our methods do not cause the finite-sample problems known for MMN. In particular, we show that the effect of pulverization of jumps by pre-averages reported in Mykland and Zhang, (2016) under MMN, which can result in spurious jump detection or gradual jumps, is avoided when using local order statistics.

We develop consistent estimators for jump sizes as well as a local and a global test for jumps. The global test allows to test for jumps over some time period, usually one trading day. This is the standard problem of testing for jumps and can be used in practice to analyze whether or not jumps have to be taken into account. Detecting specific jumps with a local test and estimates of jump times and jump sizes are important to separate jumps and continuous price adjustments. This can be used, for instance, to perform high-frequency regression or factor analysis, separately for jumps and continuous components. Due to different mechanisms behind co-jumps and continuous co-movement of prices, it is crucial to split the two price components in such an analysis, see Li et al., 2017a , Li et al., 2017b , Alexeev et al., (2017), Caporin et al., (2017), Aït-Sahalia et al., (2020) and Pelger, (2019), among others. Using jumps to model price shocks in response to news and announcements, their estimation is moreover one main ingredient of several macroeconomic studies based on intra-daily high-frequency data, for instance in the research field on monetary policy, see, among others, Evans, (2011) and Ayadi et al., (2020).

The remainder of this paper is structured as follows. The theoretical contribution is developed in Section 2. Section 2.1 discusses the LOMN-model. In Section 2.2 we construct and discuss statistical methods for which asymptotic results are presented in Section 2.3 on uniformly consistent spot volatility estimation and in Section 2.4 on jump detection. All proofs are provided in Section 6. Although jump tests under MMN and under LOMN are designed for two different models, we emphasize the possibility to apply it to time series coming from the same limit order book data in our numerical analysis. Based on simulations, in Section 3 we study on the one hand the finite-sample implementation and properties of our new methods and, on the other hand, provide a comparison to the test by Lee and Mykland, (2012). For this comparison, we simulate the same efficient log-prices alternatively with both LOMN and MMN to apply our methods and as well the classical method by Lee and Mykland. We follow this paradigm in an empirical analysis of limit order book data in Section 4 comparing results for LOMN-based methods applied to best ask and best bid prices and the classical MMN-approach considering mid quotes. This empirical part reveals advantages of the LOMN-approach and emphasizes stylized facts of limit order book data which are generally relevant for studies of price jumps. Section 5 concludes.

2 Theory

2.1 Model with lower-bounded, one-sided microstructure noise

On a filtered probability space, , the latent, efficient log-price process in continuous time is described by an Itô semi-martingale

| (1) | |||||

with a one-dimensional standard Brownian motion , the drift process , the volatility process , and with defined on . The Poisson random measure is compensated by , with a -finite measure . We write

| (2) |

with the continuous component , and the càdlàg jump component .

In the model with lower-bounded, one-sided microstructure noise,

| (LOMN) |

the discretization , with high-frequency observations of on the fix time interval , is perturbed by exogenous i.i.d. noise , with a cumulative distribution function (cdf) which satisfies

| (3) |

The model with condition (3) is nonparametric. Close to the boundary, condition (3) means that the extreme value index is for the minimum domain of attraction. We do not make any assumption about the tails of the noise and its maximum domain of attraction. For instance, a uniform distribution on some interval , , an exponential distribution and a heavy-tailed (shifted) Pareto distribution all satisfy (3). In particular, the developed asymptotic theory for the LOMN-model does not require conditions on the right tail of the noise distribution or on the existence of moments of the noise. Considering block-wise minima instead of block-wise averages as typically in the MMN-model, this is an important advantage of the statistical methods designed for LOMN. The standard assumption (3) on one-sided noise has been imposed in the same way by Jirak et al., (2014) and Bibinger et al., (2016).

Assumption 1.

The drift is a locally bounded process. The volatility is strictly positive, , -almost surely. For all , , , with some constants , and , it holds that

| (4) |

Condition (4) imposes a certain regularity of the volatility process, measured by the parameter , but does not rule out volatility jumps. Working under Assumption 1 with general , our asymptotic theory is developed in a framework which covers different volatility models recently discussed in the literature. For rough volatility, see Chong et al., (2022) and references therein, is given by the Hurst exponent while holds under the common assumption that is another Itô semi-martingale. We impose the following standard condition on the jumps.

Assumption 2.

Assume for the predictable function in (1) that is locally bounded with a non-negative, deterministic function that satisfies

| (5) |

The notation , and , is used throughout this manuscript. The generalized Blumenthal-Getoor or jump activity index , in (5) determines the jump activity. The most restrictive case is , when jumps are of finite activity. The larger , the more general jump components are included.

2.2 Statistical methods

We first discuss inference for a possible jump,

at some given (stopping) time . For this purpose, consider

| (6) |

These statistics are local minima of noisy observations over blocks, where we choose the block length such that is integer-valued. The two disjoint blocks contain observations in a vicinity shortly after and before time , respectively. We can estimate the jump based on

| (7) |

Asymptotically, , and , as . Therefore, , for sufficiently large and any , such that we omit a discussion of adjustments for boundary cases when . In order to construct a global test for jumps and to perform volatility estimation, we partition the whole observation interval in equispaced blocks, , and take local minima on each block. Consider, for , the local block-wise minima

| (8) |

Here, is an integer, while in general not. In particular, can be different for the local and for the global statistics. This is necessarily the case when is such that a choice and is not possible. However, since the asymptotic orders of optimal block lengths will be identical, we use for simplicity the same notation for the block lengths in the construction of local and global statistics.

Under the global null hypothesis of no price jumps, a consistent estimator for the spot squared volatility is given by

| (9) |

for suitable sequences and . This estimator is available on-line at time during a trading day because it relies only on past observations before time . Working with ex-post data over the whole interval, one may use as well

| (10) |

for some odd integer . A difference of estimators

| (11) |

over a window after time and (9) over a window before time allows to infer a possible jump in the volatility process at time . Minima and maxima in the lower and upper summation limit are only relevant when is close to the boundaries in small intervals with lengths that tend to zero. In these boundary cases, the factor can also be adjusted to get an average over available . Since the boundary effects are not relevant for the asymptotic theory, we do, however, not incorporate such adjustments in (9), (10) and (11).

A spot volatility estimator which is robust with respect to jumps in , is obtained with thresholding. We truncate differences of local minima whose absolute values exceed a threshold , with a constant , which leads to

| (12) |

The estimators , and , are constructed analogously.

Our global test for price jumps is based on the maximum statistic

| (13) |

with , for , and , else.

A benefit of jump tests based on maximum statistics is that they readily facilitate localization of jumps. If the test rejects, when statistic (13) exceeds a critical value, the time at which the maximum is taken consistently estimates the position of the largest absolute jump. A sequential application, when we discard the time block with the maximum after the test in each step, allows consistent estimation of finitely many jump times.

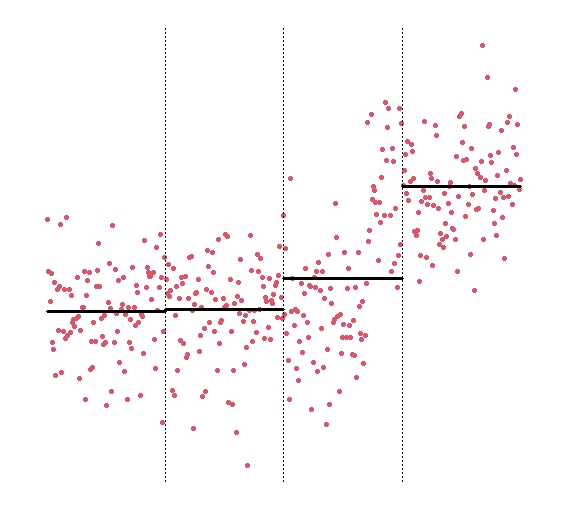

Similar methods as developed here for observations with LOMN have been discussed in the literature for observations under MMN. While our mathematical analysis requires some new proof techniques, we illustrate next that inference on jumps is statistically less involved when using order statistics for LOMN instead of local averages for MMN. Figure 2 shows four blocks with observations of a signal which is constant up to one upward jump and observations with additive noise. On the left-hand side we show i.i.d. centered normally distributed MMN, while on the right-hand side we depict i.i.d. exponentially distributed LOMN. For MMN, the estimation of jumps is based on pre-averages which are drawn as lines in the left plot of Figure 2. Instead of identifying one jump, the differences between pre-averages suggest two adjacent jumps of smaller sizes. This effect, caused by averaging over a jump time, has been highlighted by Mykland and Zhang, (2016) as the “pulverisation of jumps by pre-averages”. It is a difficult problem when estimating jumps at a priori unknown times and can only be solved with sophisticated statistical methods, see, Vetter, (2014) and Bibinger et al., 2019b . In contrast, the differences of local minima right-hand side suggest one jump and correctly identify its size. Having an upward jump on the third block, the minimum on this block is taken before the jump. In case of a downward jump, the minimum would be taken after the jump. In any case, this results in only one large difference between block-wise local minima of the correct size. So, there is no pulverization effect here.

2.3 Uniformly consistent spot volatility estimation

We establish asymptotic results for equidistant observations, . We begin with the asymptotic theory on spot volatility estimation. The expectation of the volatility estimator hinges on the function

| (14) | ||||

where and denote two independent standard Brownian motions. In Bibinger et al., (2016) it was proved that is monotone and invertible. For , we have

| (15) |

such that we do not require knowledge of for the construction of a consistent estimator.

If is continuous, i.e., in (2), under Assumptions 1 and (3), Bibinger, (2024) prove that the spot volatility estimator (9) is consistent with

| (16) |

when is chosen such that , and with

| (17) |

By (15), holds true. However, this estimation error does in general not decay as fast as the one in (16). Analogous results apply in case of the modified versions (10) and (11), respectively. Under the same setup with jumps satisfying Assumption 2 with

| (18) |

the truncated spot volatility estimator (12) with

| (19) |

satisfies

| (20) |

Moreover, feasible central limit theorems and asymptotic confidence intervals for the estimators are established in Bibinger, (2024). The convergence rate gets arbitrarily close to , which is optimal in the LOMN-model. In the important special case when , for a semi-martingale volatility, the rate is arbitrarily close to . This is much faster than the known optimal rate of convergence in the MMN-model, which is , see Bibinger et al., 2019a . In (18) we impose mild restrictions on the jump activity. For the standard model with a semi-martingale volatility, i.e., , we require that . For , we have the strongest condition implying .

In this work, we do not require central limit theorems for spot volatility estimation. Instead, the asymptotic theory for the global jump test relies on uniformly consistent spot volatility estimation. Uniform consistency in functional estimation is typically much more difficult to prove than pointwise results. We prove a quite strong result under surprisingly mild assumptions.

Proposition 2.1.

It is clear that consistency uniformly over the interval requires the assumption of a continuous volatility, see e.g., the discussion in Section 2.2 of Jacod et al., (2021). A generalization of this result to jumps in using the threshold estimator is possible. However, for the construction of our test we will exactly need Proposition 2.1. Under MMN a uniformly consistent volatility estimation requires the existence of all moments of the noise, see Madensoy, (2020). It is clear that Rosenthal-type inequalities or related results to prove the uniformity require existence of higher moments. From this point of view, it might be surprising that we do not have to impose such assumptions for Proposition 2.1. Although our proof relies as well on maximal and moment inequalities, this is not the case here, since we only need moments of the local minima for which (3) is sufficient. This is a crucial advantage of inference based on local order statistics compared to local averages, in particular for uniform consistency.

By (15), uniform consistency also holds without accounting for the function in Proposition 2.1. However, for the given rate of convergence, we require a better asymptotic approximation of than the first-order identity. In fact, this is feasible. In Bibinger, (2024), Section 5.1, it is shown how the function and its inverse can be approximated numerically.

2.4 Asymptotic results on the identification of jumps

We start with an asymptotic result on the inference for jumps at some pre-specified time .

Theorem 1.

For , under Assumptions 1, 2 and (3), from (7) satisfies the stable weak convergence

| (21) |

with two random variables

| (22) |

which are conditionally on independent. HMN refers to the half mixed normal distribution, that is, , for standard normal. If ,

| (23) |

with two independent random variables

| (24) |

HN refers to the standard half-normal distribution.

The standardization in (23), where and are the square roots of the estimators (12) and the truncated version of (11), takes into account possible simultaneous price and volatility jumps, see Tauchen and Todorov, (2011) and Bibinger et al., 2019b for empirical evidence of such simultaneous jumps. Figure 5 moreover illustrates two examples. Stable convergence is stronger than weak convergence and is important here, since the limit random variables hinge on the stochastic volatility. More precisely, we prove stability with respect to in the sense of Jacod and Protter, (2012), Section 2.2.1. Since the asymptotic distribution does not hinge on the noise level , in contrast to methods for MMN, we do not require any pre-estimation of noise parameters. Moreover, our methods and results remain valid for time-varying noise levels in (3), under the mild assumption that , for all .

Theorem 1 shows that we can consistently estimate price jumps. The convergence rate is , up to a logarithmic factor. Moreover, asymptotic confidence is feasible and (24) yields the following local jump test.

Corollary 2.2.

The test for the null hypothesis that there is no jump at time , , which rejects when

| (25) |

with being the quantile of the distribution of and the half-normal random variables from (24), has asymptotic level and asymptotic power 1. That is, under , and , it holds for any that

| (26) |

Standardizing the local minima with estimates of the volatility before and after time , the method is robust with respect to a volatility jump, . It is intuitive that this requires the mild assumption that .

Remark 1.

In the MMN-model jumps can be estimated with an optimal rate of convergence based on equidistant high-frequency observations, see, for instance, the LAN result in Proposition 5.2 of Koike, (2017). Hence, the rate of convergence for LOMN is faster. The optimal rate in the LOMN-model is , and we attain this rate up to a logarithmic factor.

Using extreme value theory, we present a result for a global test for price jumps in the spirit of the Gumbel test by Lee and Mykland for high-frequency prices without noise in Lee and Mykland, (2008) and with MMN in Lee and Mykland, (2012), respectively.

Theorem 2.

On the null hypothesis of no jumps,

| (27) |

under Assumptions 1, 2 and (3) with Hölder continuous with regularity , with and as in (17), the statistic (13) satisfies the Gumbel convergence

| (28) |

where refers to the standard Gumbel distribution, that is, it holds with , for all that

| (29) |

The test that rejects whenever

| (30) |

for being the quantile of the Gumbel distribution, has asymptotic level . Moreover, under the alternative hypothesis that

| (31) |

under Assumptions 1, 2 and (3), the test rejects asymptotically with probability 1:

| (32) |

The condition of a continuous volatility is required to use Proposition 2.1 in the proof of the Gumbel convergence on the null hypothesis. Since volatility jumps are typically associated with events that simultaneously trigger price jumps, it is not too restrictive to work under a null hypothesis that there are no price and no volatility jumps. For the results under the alternative hypothesis, we only require pointwise consistency of the spot volatility estimator and allow for volatility jumps.

In contrast to the Gumbel convergences in Lee and Mykland, (2008), Lee and Mykland, (2012) and Bibinger et al., 2019b , we cannot trace back our result (28) to the Gumbel convergence for the maximum of i.i.d. standard normally distributed random variables. Instead, we prove that the statistic can be approximated by the maximum of absolute differences of 1-dependent half-normally distributed random variables. We then establish the extreme value theory for these random variables. Since we expect this and related results to be of interest in their own right for extreme value theory and its applications to various high-frequency jump tests, the result embedded into a more general theory is provided as a preliminary note Bibinger, (2021). Nunes and Ruas, (2024) adds a recent discussion of the convergence rates obtained in Lee and Mykland, (2008), Lee and Mykland, (2012) and Bibinger, (2021) and shows that they are coherent.

The result (32) implies consistency of the test, i.e., it rejects asymptotically almost surely if there is a jump, . The stronger result (32) addresses moreover local alternatives. The sequence of tests can detect jumps with decreasing sizes in , as long as the jump sizes decrease slower than . This result provides information about what jump sizes can be detected for a given sample size . While in the MMN-model, is the optimal rate for local alternatives, our rate , for any , is much faster. This shows that for the same sample size, we can detect much smaller jumps.

3 Simulations and finite sample behavior

The aim of this simulation study is twofold. Firstly, we evaluate the finite sample performance of the main theoretical results and, secondly, we provide a comparison of jump tests for the LOMN-model and the MMN-model. For both cases, we simulate observations, corresponding to one observation per second over a (NASDAQ) trading day of 6.5 hours. The efficient log-price process under the null hypothesis is sampled from

| (33a) | ||||

| (33b) | ||||

| (33c) | ||||

The factor generates a typical U-shaped intraday volatility pattern and is a two-dimensional Brownian motion with leverage . This setup captures a variety of realistic features of financial high-frequency data. Variants thereof are frequently employed in the literature, see, e.g., Lee and Mykland, (2012) and Bibinger et al., 2019b as well as the references therein. Under the alternative, (33a) is augmented by a jump occurring at a random time point, however neither close to the beginning nor to the end of the sampled trajectory. We consider both positive and negative jumps. The sizes of the jumps under the alternative are given in Tables 1 – 3 in absolute value. They are chosen to illustrate the transition from non-detectable to detectable sizes depending on the noise level as well as the block length as discussed below. R code and replication files for all simulations are publicly available.‡‡‡github.com/bibinger/LOMN

| 0.05 | 0.16 | 0.59 | 0.91 | 0.99 | 1.00 | 1.00 | |

| 0.05 | 0.15 | 0.56 | 0.90 | 0.99 | 1.00 | 1.00 | |

| 0.05 | 0.14 | 0.54 | 0.89 | 0.98 | 1.00 | 1.00 | |

| 0.05 | 0.13 | 0.52 | 0.87 | 0.98 | 1.00 | 1.00 | |

| 0.05 | 0.13 | 0.50 | 0.85 | 0.97 | 1.00 | 1.00 | |

3.1 Size and power of the global test under Theorem 2

Based on the setup for , (33a) - (33c), the noisy observations are generated by

| (34) |

where the noise level is shown in Table 1. To perform the jump test following Theorem 2, the block length and the spot volatility estimates have to be determined. The spot volatility is estimated by (10). As in the simulations of Bibinger, (2024), the spot volatility estimator is tuned rather conservatively by averaging over many relatively short intervals of local minima . Our asymptotic results are worked out under the condition that , we choose here. Even though this finite-sample tuning can be sub-optimal for the larger noise levels, it estimates the volatility path quite robustly. As demonstrated in Section 5.1 of Bibinger, (2024), the function in (16) needs to be taken into account as the first-order approximation (15) generates a non-negligible finite-sample bias for this tuning. To account for this bias, the spot volatility estimator is multiplied with the correction factor as suggested in Section 5.1 of Bibinger, (2024).

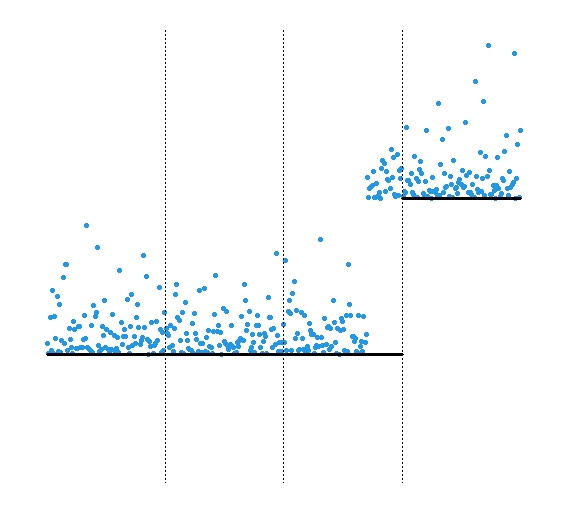

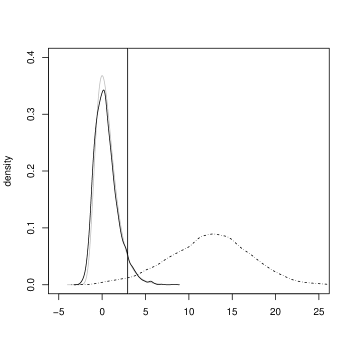

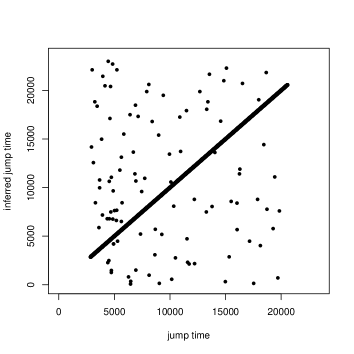

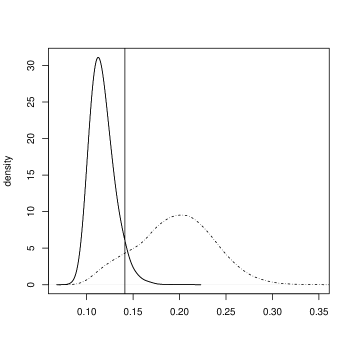

Table 1 documents the size () and power ( ) of the global test for different noise levels . We observe that the test keeps its level. The power of the test decreases slightly for rising noise level and a given jump size. Here, jumps of small size are more likely to be detected in case of low noise while jumps of larger size can be detected for all noise levels considered. For and , the performance of the test is illustrated in Figure 3 which shows kernel density estimates of the standardized version of the test statistic under the null and under the alternative. For comparison, in Figure 3, we also show the density function of the standard Gumbel distribution. Even though there are minor deviations in the center of the distribution of the standardized test statistics compared to the standard Gumbel distribution, the right tail of the distribution of the test statistics under the null is quite accurately approximated. In the right panel of Figure 3 we plot the true jump times against the inferred jump times associated with the interval maximizing the test statistic for . As most of the points are on the main diagonal, we conclude that the test indeed correctly detects the intervals containing the jumps in most cases. As more points are off the diagonal in the morning than around lunch time, we further conclude that the test performs slightly worse in intraday periods, where the volatility tends to be higher.

3.2 A comparison with Lee and Mykland, (2012)

In order to compare the LOMN-model with the MMN-model, we generate observations of both models by

| (35) | ||||

| (36) |

where are the observations of the LOMN-model and are the observations of the MMN-model, . Note that , such that the noise variances are identical. It can be easily verified that half-normally distributed noise satisfies (3). In both models, we have the same underlying efficient log-prices .

For the MMN-model, the global test for price jumps uses the maximum statistic

| (37) |

based on differences between local averages, where we assume that is an integer with , and is a constant that is documented for different noise levels in Lee and Mykland, (2012). The statistic builds on differences of local averages (while uses local minima) and the asymptotic standard deviation of these differences of local averages (the denominator) depends on the variance of the noise . Lee and Mykland, (2012) show that converges after appropriate standardization to a standard Gumbel distribution that permits testing hypotheses analogously to Theorem 2.

| test | 0.000% | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 0.01% | 3 | BHR | 0.00 | 0.96 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| LM | 0.00 | 0.74 | 0.97 | 1.00 | 1.00 | 1.00 | 1.00 | ||

| 4 | BHR | 0.01 | 0.96 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

| LM | 0.00 | 0.75 | 0.94 | 0.99 | 1.00 | 1.00 | 1.00 | ||

| 0.05% | 11 | BHR | 0.05 | 0.31 | 0.63 | 0.85 | 0.94 | 0.98 | 1.00 |

| LM | 0.04 | 0.14 | 0.29 | 0.50 | 0.69 | 0.83 | 1.00 | ||

| 15 | BHR | 0.05 | 0.29 | 0.59 | 0.83 | 0.94 | 0.98 | 1.00 | |

| LM | 0.05 | 0.16 | 0.33 | 0.54 | 0.72 | 0.85 | 1.00 | ||

| 0.10% | 20 | BHR | 0.05 | 0.14 | 0.32 | 0.57 | 0.77 | 0.89 | 1.00 |

| LM | 0.05 | 0.07 | 0.10 | 0.19 | 0.32 | 0.47 | 1.00 | ||

| 34 | BHR | 0.05 | 0.12 | 0.23 | 0.43 | 0.64 | 0.80 | 1.00 | |

| LM | 0.05 | 0.08 | 0.14 | 0.24 | 0.37 | 0.52 | 1.00 | ||

It should be noted that the improved power under LOMN is due to the (asymptotically) smaller blocks of order close to , instead of under MMN. When choosing a small constant factor to determine the block lengths for the MMN-model and a much larger proportionality constant under LOMN, the test can – in finite samples – perform better in terms of power than the test for the LOMN-model. This finite sample phenomenon is in contrast to the asymptotic considerations but can arise in situations when the specific tuning of results in shorter intervals in the MMN-model than in the LOMN-model. We compare results for the tests with the same blocks for different block lengths including values which optimize the power of the methods based on a grid search.

To produce comparable results, we employ a simple bootstrap. Following Proposition 2 of Lee and Mykland, (2012) and a simple generalization to LOMN, consistent estimators and of the noise level are given by

| (38) |

Based on these estimates, we generate bootstrap samples

| (39) | ||||

| (40) |

for , and determine critical values under the null hypothesis based on the empirical quantiles of and . Similar Monte Carlo or wild bootstrap procedures are used and known to perform well for high-frequency statistics, in particular for extreme value statistics, see, for instance, Li et al., 2017c , Dovonon et al., (2019) and Algorithm 1 in Chen and Feng, (2023). In practice, this bootstrap relies on an estimate of the stochastic volatility process , , in order to generate based on an Euler-Maruyama scheme where we set the drift to zero and with the Gaussian increments of a Brownian motion. For this comparison, however, we use the simulated true volatility. Otherwise we would require different spot volatility estimators for the two different models, which would complicate the comparison of the combined methods. Using the true volatility for both methods sheds light on their different capabilities to detect jumps based on maximal differences of local minima under LOMN, and local averages under MMN, respectively.

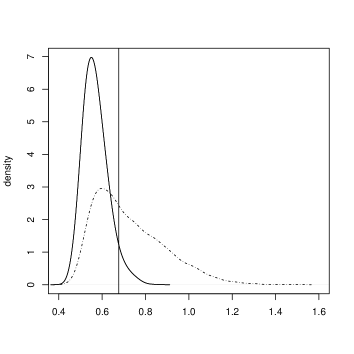

Table 2 reports the results of the simulations based on 5,000 replications for both methods with noise levels , and , and different numbers of observations per interval. We choose such that the power of the corresponding test is maximized over a large grid of values for (the results of the respective other test are presented for comparison). Except for , we observe that both tests keep the size and reject the null hypothesis (provided that the null is true) with approximate probability . For , the size is underestimated because of the short interval lengths. It can be shown that the size is kept for longer intervals such as , what has been found to be appropriate for the test statistic in Lee and Mykland, (2012). The power of both tests crucially depends on the noise level and the . Generally, the power of both tests increases with the and decreases in the noise level. In comparison, the power of the test in the LOMN-model always outperforms the test in the MMN-model even with same block lengths, although the magnitude depends admittedly on the specific setting. Figure 4 illustrates the difference in the power of the tests for the special case of and . Even though both plots use a different scaling, i.e., the non-standardized test statistics are not directly comparable, the better performance of the test in the LOMN-framework is evident.

In summary, our findings suggest that jumps are more likely to be detected under LOMN than under MMN, and that jumps of smaller size can be detected in the LOMN-framework. Compared to the results of Section 3.1, we observe that the number of observations per block, , can be chosen smaller in the test setting relying on the bootstrap. These smaller blocks translate into a more precise localization of jumps and the possibility to detect smaller jumps. In the test setting relying on the asymptotic Gumbel distribution of the standardized version of the maximum statistic , the length of the time blocks was chosen larger than to be in line with the assumptions of the asymptotic theory. When comparing the power of the test for the bootstrap-based setting with the setting relying on the asymptotic distribution for specific choices of and jump sizes (given the same ), we did not find noteworthy differences. In this sense, in our experiments, the distribution of the noise has no impact on the power of the test.

| test | 0.000% | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 0.01% | bef- | BHR | 0.05 | 0.87 | 0.99 | 1.00 | 1.00 | 1.00 | 1.00 |

| LM | 0.04 | 0.49 | 0.71 | 0.82 | 0.90 | 0.95 | 0.99 | ||

| at | BHR | 0.05 | 0.97 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

| LM | 0.04 | 0.97 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | ||

| aft+ | BHR | 0.05 | 0.87 | 0.99 | 1.00 | 1.00 | 1.00 | 1.00 | |

| LM | 0.05 | 0.51 | 0.72 | 0.83 | 0.90 | 0.95 | 0.99 | ||

| 0.05% | bef- | BHR | 0.05 | 0.42 | 0.71 | 0.88 | 0.95 | 0.98 | 0.99 |

| LM | 0.05 | 0.18 | 0.34 | 0.47 | 0.58 | 0.66 | 0.75 | ||

| at | BHR | 0.05 | 0.58 | 0.91 | 0.99 | 1.00 | 1.00 | 1.00 | |

| LM | 0.04 | 0.45 | 0.79 | 0.96 | 1.00 | 1.00 | 1.00 | ||

| aft+ | BHR | 0.05 | 0.41 | 0.71 | 0.88 | 0.94 | 0.97 | 0.99 | |

| LM | 0.05 | 0.19 | 0.32 | 0.47 | 0.58 | 0.65 | 0.75 | ||

| 0.1% | bef- | BHR | 0.06 | 0.26 | 0.49 | 0.70 | 0.84 | 0.91 | 0.96 |

| LM | 0.05 | 0.12 | 0.20 | 0.31 | 0.42 | 0.51 | 0.64 | ||

| at | BHR | 0.05 | 0.34 | 0.67 | 0.89 | 0.97 | 0.99 | 1.00 | |

| LM | 0.05 | 0.27 | 0.51 | 0.75 | 0.90 | 0.98 | 1.00 | ||

| aft+ | BHR | 0.06 | 0.26 | 0.49 | 0.70 | 0.84 | 0.91 | 0.96 | |

| LM | 0.05 | 0.12 | 0.20 | 0.32 | 0.42 | 0.51 | 0.64 | ||

The origin of the outperformance in terms of power is due to the fast convergence rate of the test statistic in the LOMN-framework, but also due to the pulverization of jumps by pre-averages in the MMN-framework. To quantify the effect of this pulverization on the power of the local test statistics, we generate again Monte Carlo samples of (35) and (36). Under the alternative, these samples are augmented by analogue jumps as used above. In contrast to the global test, the local test is performed at a pre-specified time, for which we use the following three scenarios: Firstly, the test is performed at the exact time of the jump. Secondly, the test is performed at a random time before the jump but the distance between the jump time and the test time is at most the time between the jump and the th observation before the jump. Thirdly, the test is performed at a random time after the jump but the distance between the jump time and the test time is at most the time between the jump and the th observation after the jump. Similarly to the global test, we use a bootstrap based inference for the local test statistics to obtain comparable results. In particular, for the number of observations within an interval is , for the number of observations is , and for the number of observations is .

Table 3 provides the corresponding results. The local test under MMN based on the method by Lee and Mykland, (2012) is detailed in Section 3.1.1 of Bibinger et al., 2019b . In analogy to the results of the global test above, both tests keep the size and the power of both tests decreases in the noise level . In the situation when the jump time and the test time coincide (i.e., there is no pulverization of jumps by pre-averages), the power of both tests is of the same order of magnitude for . For , the power of the test based on the LOMN-model is slightly better, while for it is significantly better. In the more realistic scenarios when the jump time and the test time do not exactly coincide, a severe drop in the power can be observed for the test in the MMN-framework compared to the situation when jump time and test time coincide. In the LOMN-framework though, there is only a moderate drop in the power. Note that this comparable better performance materializes only if the local test is performed before the jump and the jump direction is negative or the local test is performed after the jump and the jump direction is positive. However, this connection between the direction of the jump and the test time is not important for the global test in the LOMN-model.

4 Empirical example for JPM stock quotes

We apply the procedures discussed above to data from actual quotes of JPMorgan Chase & Co. (with symbol JPM). The sample period is from July 2007 to September 2009 covering the most turbulent time of the subprime mortgage crisis, where we expect many large changes in equity prices and corresponding quotes. Thus, the data set is appropriate for a comparative empirical study of jump tests under MMN and LOMN, respectively.

4.1 Data

We use first-level limit order book data of ask and bid quotes at the highest possible frequency from the LOBSTER database§§§https://lobsterdata.com/, which provides access to reconstructed limit order book data for NASDAQ traded stocks. First-level means that bid and ask price refer to the best bid and best ask in the sequel. LOBSTER data has been used in several recent research papers, e.g., Andersen et al., (2022). The data has at least millisecond precision, which generally permits an analysis at the highest time resolution possible. In a non-negligible proportion of cases, there is no change between subsequent quoted bid or ask prices (and corresponding mid quotes). This is in conflict with both, the LOMN-model and the MMN-model. We therefore select only those observations where the bid or ask price changes. Moreover, all quotes before 9:30am or after 4:00pm are discarded. We also exclude the data during 9:30am and 9:35am for each trading day in order to avoid peculiarities during the opening period and in view of the reduced reliability of jump detection close to boundaries. No further data cleaning procedures are performed before we apply the statistics.

| trading hour | 09:35-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | 15-16 | |

|---|---|---|---|---|---|---|---|---|

| 3081 | 4032 | 2554 | 2027 | 2107 | 2646 | 3412 | ||

| ask | 0.0224 | 0.0197 | 0.0195 | 0.0194 | 0.0199 | 0.0197 | 0.0205 | |

| 0.0252 | 0.0287 | 0.0162 | 0.0132 | 0.0138 | 0.0191 | 0.0282 | ||

| 3083 | 4060 | 2561 | 2015 | 2112 | 2649 | 3375 | ||

| bid | 0.0222 | 0.0199 | 0.0196 | 0.0195 | 0.0201 | 0.0196 | 0.0204 | |

| 0.0253 | 0.0286 | 0.0164 | 0.0131 | 0.0139 | 0.0188 | 0.0276 | ||

| 6162 | 8092 | 5115 | 4042 | 4218 | 5295 | 6787 | ||

| mid | 0.0112 | 0.0099 | 0.0098 | 0.0097 | 0.0100 | 0.0098 | 0.0102 | |

| 0.0244 | 0.0290 | 0.0167 | 0.0130 | 0.0141 | 0.0193 | 0.0257 | ||

As in Lee and Mykland, (2012) each considered trading day is split into seven time intervals. Table 4 reports the averages of the corresponding sample size per interval, the estimated noise level and the estimated variance , which is assumed to be constant within each out of the 3,974 intervals considered in total. All quantities (, and ) exhibit the expected U-shaped intra-daily seasonal pattern across ask, bid and mid quotes. In line with current research we calibrate the MMN-model to mid quotes having available data from a limit order book. A comparison with the MMN-model calibrated to trade prices reconstructed from the limit order book could yield different results due to smaller sample sizes of trades. The noise levels are estimated using (38). For the LOMN-model, we employ the same volatility estimator (with same tuning) as in our simulations, while we use the spectral approach from Bibinger et al., (2014) and Bibinger et al., 2019a for volatility estimation in the MMN-model. The estimated volatilities are rather similar across ask, bid and mid quotes, which is coherent with the idea of the same underlying efficient log-prices in both models, and should hence not affect the comparison between the jump tests considerably. While differences in the sample sizes between ask and bid quotes are not worth mentioning, there are major differences in the sample sizes between ask and mid quotes as well as bid and mid quotes, respectively. Since by construction, changes in ask or bid quotes imply changes of mid quotes, the sample size of the mid quotes is (approximately) the sum of the sample sizes of ask and bid quotes. Combining bid and ask prices would hence result in equal sample sizes for the LOMN- and MMN-model. A further difference between ask and mid quotes as well as bid and mid quotes is the estimated noise level , which is just half size for mid quotes compared to ask and bid quotes. This is due to the rather mechanical effect that the tick size for mid quotes is just half the tick size of ask or bid quotes. In other words, if the best ask or bid changes by one tick (e.g., 0.01$), the mid quote changes by just half a tick (e.g., 0.005$). As smaller noise levels improve the power of the tests in our simulations, the lower noise level should favor an analysis based on mid quotes.

4.2 Summary of empirical results

We perform the global test once for each time interval such that the total number of intervals is equivalent to the number of performed tests. This is similar to Lee and Mykland, (2012). In contrast to the asymptotic theory, the finite-sample time blocks are chosen on average a bit smaller for the computation of local averages of mid quotes than for taking local minima or maxima of ask and bid quotes, respectively. In light of the data characteristics shown in Table 4 and in line with the small proportionality constant for the MMN-model suggested in Lee and Mykland, (2012), i.e., for , this is not that surprising, however. Thus, we fix block lengths in the same way as in our simulations. In most of the 3,974 cases, there are three observations within one time block for mid quotes and four observations for ask and bid quotes.

| trading hour | 09:35-10 | 10-11 | 11-12 | 12-13 | 13-14 | 14-15 | 15-16 | total |

|---|---|---|---|---|---|---|---|---|

| ask | 13.33 | 4.74 | 5.79 | 6.49 | 6.01 | 7.09 | 10.11 | 7.65 |

| bid | 13.68 | 5.44 | 4.56 | 7.02 | 8.30 | 9.04 | 9.04 | 8.15 |

| mid | 18.07 | 5.79 | 2.81 | 2.46 | 2.12 | 4.96 | 11.70 | 6.84 |

Table 5 presents the testing outcomes in terms of relative rejection frequencies of the null hypothesis of the global test (no jump) on a significance level of 5%. We observe that more jumps are detected after opening and before closing. Since more jumps are detected based on ask or bid quotes than based on mid quotes in total, one expects that particularly small-sized jumps are not (easily) detected based on mid quotes. However, estimated sizes of detected jumps are on average slightly smaller for mid quotes compared to ask and bid quotes. While this seems to be surprising (in view of the asymptotic theory), this results from the finite-sample comparison due to the finer approximation of the non-observable based on mid quotes for which time blocks are smaller. Note that also the effect of pulverization of jumps by pre-averages as illustrated in Section 2.1 can contribute to this effect. This can for example be the case, if a large-size jump is mistakenly identified as two adjacent jumps of smaller sizes instead.

There are, moreover, interesting differences in the results stemming from both methods. During 09:35am-10am and 15am-16am, more jumps are detected by the global test for the MMN-model, while the tests for the LOMN-models reject the null hypothesis more frequently during the day. These differences might put in question our paradigm assuming the same underlying efficient price with the same jumps for the three different time series. Results being fully coherent with this idea should rather yield the same detected jumps of larger absolute sizes and some smaller jumps based on either LOMN- or MMN-data. In many of the incoherent cases though, the detected jumps are large absolute log-returns, which do not fully reflect the stylized picture of large directional jumps. Thus, categorizing these cases into small-sized jumps or false alarms is challenging, which is also true for differences between jumps inferred from bid and ask quotes. We shed light on these examples in the next subsection.

Overall, the null hypothesis is more frequently rejected by the tests based on LOMN-data compared to MMN-data. One possible way of combining ask and bid quotes is to reject the null hypothesis of the global test (no jump) when at least one of the tests based on local minima of ask quotes, or local maxima of bid quotes, rejects. This results in a rejection frequency which is considerably larger than the rejection frequency based on mid quotes. Considering rejections based on bid quotes only yields 8.15%, and on ask quotes only 7.65%, such that these values are already larger compared to mid quotes (6.84%). The results thus support our theoretical finding that more jumps can be detected in the LOMN-model. In this finite-sample data example, this is not only due to different convergence rates, but also due to the improved robustness of local order statistics compared to local averages, including the pulverization of jumps by pre-averages.

Still, the presented results are not fully coherent in the sense that the tests for the LOMN-model do not always reject the null hypothesis when the test for the MMN-model does. In fact, in 2.29% of the time intervals we detect jumps only based on mid quotes. Many of these events that systematically induce some incoherence, however, are due to specific bounce-back movements of prices which we discuss in the following subsection.

4.3 A closer look at examples

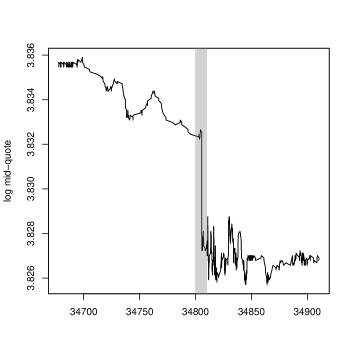

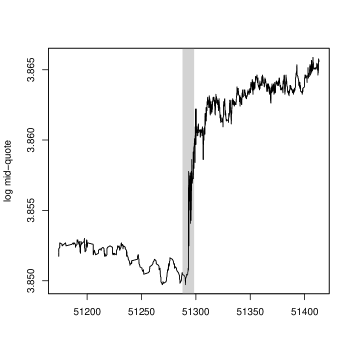

There are several situations when all of the three tests detect a jump in the same time interval, with the corresponding statistics identifying almost the same time point. Two typical examples illustrating how stylized large-sized jumps can look like are presented in Figure 5, where the left panel shows a negative jump and the right panel shows a positive jump in the log mid quote. The gray areas in Figure 5 provide a rough orientation of the time of the jump. Interestingly, both jumps are followed by an immediate increase in volatility suggesting that the efficient log-price process and the volatility process jump simultaneously. Such examples of instantaneous, large price adjustments, which are clearly in line with the notion of a jump of , are coherently found by all considered methods.

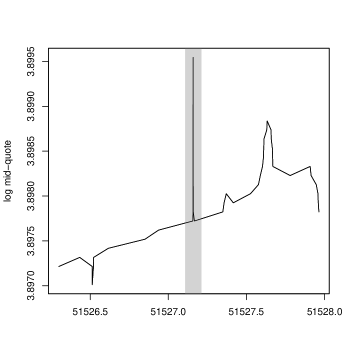

We analyze cases with incoherent test decisions next. These are cases where the LOMN-methods indicate no rejection of the null hypothesis, i.e., they do not detect jumps, while the test based on the MMN-model points in the opposite direction. This could be seen as incoherent with the idea of the same underlying efficient price. However, we find that this discrepancy is frequently explained by rapid bounce-back movements of the observable price of a few tick sizes magnitude. One extreme example is illustrated in Figure 6 (left panel), where the bounce-back movement of the price occurs within only the hundredth of a second. This mid quote movement originated from the almost simultaneous cancellation of 24 ask orders comprising 5900 shares in total leading to a spontaneous increase of the best ask price from 49.39$ to 49.48$, followed by an immediate bounce back to 49.35$. It is intuitive that local averages of mid quotes detect a jump. Conversely, local minima of ask quotes are more robust to isolated outliers than local averages and thus do not notify a jump in this example. At the same time, however, similar events occasionally further result in differences between tests based on local maxima of bid prices and local minima of ask prices. Moreover, for this example, the null hypothesis is also rejected on a smaller significance level of 1% for the considered small number of mid quotes per block , while no jump is identified as soon as the length of time blocks is increased. In our data, there are several patterns similar to this example which might have been discarded by applying a data cleaning procedure. However, there is no doubt that the cancellations of the ask orders are real and thus, they should not be treated as recording errors that have to be removed from the data. Since the long-term price movement is not affected by this bounce-back effect within a very short time period, we think that this microstructural effect should not be regarded as a jump of . Identifying a jump in such an event could be prevented by combining bid and ask quotes in a way that we only reject the null if both tests reject. However, the question whether such price dynamics should be modeled as jumps, or should be categorized in an alternative way, might depend on the application and concrete research question. This should be thought of with the statistical model and inference in the context of one another.

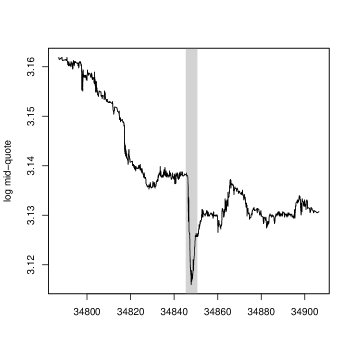

Finally, the right panel of Figure 6 highlights an interesting incoherent test decision. This example addresses the sensitivity of the considered global jump tests with respect to the lengths of time blocks. Here, both tests based on the LOMN-model detect a jump, which, however, the MMN-model cannot identify. This is true for the automatically chosen number of observations per time block for ask quotes, for bid quotes and for mid quotes. However, in case of different choices of the number of mid quotes per time block, i.e., , the picture reverses and the MMN test also identifies a jump. Hence, in this example, the LOMN-based tests prove to be more robust with respect to changes of time blocks.

4.4 Insights from the empirical analysis

Overall, we find that the empirical results mostly support our idea to model mid quotes by the sum of an efficient log-price and MMN, while single ask and bid quotes are modeled by the sum of the same efficient log-price and one-sided LOMN. We find, however, that some subtle microstructural effects present in the data can result in minor inconsistencies with this idea. The coherence of results can surely be increased by reducing the significance level or by increasing the lengths of the blocks, but the question how to handle these examples should be relevant for all jump tests based on ultra high-frequency data.

The empirical analysis shows that despite a much faster convergence rate for the detection of jumps under LOMN, the performance based on mid quotes and the MMN-model is competitive in finite samples due to the large number of available mid quotes and the tuning with very small time blocks. Nevertheless, we point out several advantages of using our new statistical methods with local minima of ask and local maxima of bid quotes. Our new jump test turns out be more sensitive in practice than the classical one based on mid quotes. Moreover, local order statistics avoid the pulverization effect that manipulates jump detection based on local averages of mid quotes. They are shown to be more robust to bounce-back effects and varying block sizes. In any case, using LOMN-based inference additionally to mid quotes and classical jump tests provides more information and a more complete picture of intra-day price jumps.

5 Conclusion

The main insight of this work is that under one-sided noise (LOMN) we can detect smaller jumps in the efficient price compared to regular market microstructure noise (MMN). We develop methods to infer jumps of absolute size larger than order , when we have observed best ask prices. For a fixed jump size, we attain higher power than tests based on observations with regular market microstructure noise. Moreover, the intricate effect of pulverization of jumps by pre-averages vanishes using block-wise local minima. Even for uniformly consistent spot volatility estimation, we do not require conditions on the right tail or moments of the noise distribution.

Extending the theory to more general noise distributions in future research is certainly of interest. Instead of (3) we could allow for a general extreme value index at the minimum and develop methods to estimate it for different assets. In particular, we conjecture that this extreme value index influences convergence rates and the minimum jump sizes which can be detected. It might be interesting to investigate if the estimated index is different over different assets, how large its deviation from the standard value -1 is, and if it is constant over different time periods. Furthermore, relaxing the independence assumption on the noise to some weak dependence appears relevant. Working with order statistics, however, such an extension is completely different than for local averages in case of regular noise and requires extensive work and new concepts.

Our finite-sample analysis demonstrates that both models (MMN and LOMN) and corresponding inference methods can be applied to different time series from the same limit order book data. As expected we find overall more jumps based on our LOMN-methods and limit order quotes. We highlight some sound finite-sample properties of local order statistics of bid and ask prices compared to local averages of mid quotes. While it nevertheless appears difficult to conclude that one approach outperforms the other, we conclude that a combination of both provides most information. Incoherent test decisions of the different methods are often due to stylized facts as in the extreme example illustrated left-hand side in Figure 6, while the methods coherently detect large directional jumps.

6 Proofs

6.1 Crucial lemmas on the asymptotic distribution of local minima

In the sequel, we write

For sufficiently large , it holds for all that . The standard localization procedure in high-frequency statistics allows us to assume that there exists a (global) constant , such that

for all . We refer to Jacod and Protter, (2012), Section 4.4.1, for a proof.

Lemma 1.

For any , , we have that

where , .

Proof.

It holds for all that

In particular, we conclude that

Changing the roles of and , we obtain by the two analogous bounds and the triangle inequality that

We are left to prove that

| (41a) | |||

| (41b) | |||

We begin with the first term and decompose

By Itô’s isometry and Fubini’s theorem we obtain under Assumption 1 that

Applying Doob’s martingale maximal inequality and using that , yields that

such that (41a) holds, since . Next, consider the jump term. Under Assumption 2 with , we obtain for all , with some constant , the bound

We used Jensen’s inequality. Markov’s inequality yields that

which is bounded from above by , if . This shows that

and thus (41b), since . ∎

Denote by the positive part and by the negative part of some real-valued function . We use the following lemma from Bibinger, (2024), Lemma 6.1, on an expansion of the cdf of the integrated negative part of a Brownian motion close to zero.

Lemma 2.

For a standard Brownian motion , it holds that

Lemma 3.

Proof.

We prove pointwise convergence of the survival functions which implies the claimed convergence in distribution. We begin with similar transformations as in the proof of Proposition 3.2 of Bibinger et al., (2016). Conditional on means that we can treat as a constant here. For , we have that

where we have used the tower rule for conditional expectations, and that . We use the illustration

and a Riemann sum approximation with a standard Brownian motion . We obtain with (3), a first-order Taylor expansion of , and dominated convergence that

Instead of setting as in Bibinger et al., (2016), and trying to deal with the very involved distribution in this case, observe that

| (42) |

when . The leading term becomes simpler in this case when the minimum of the Brownian motion over the interval dominates the noise compared to a choice of . However, since we do not have a lower bound for , we need a careful estimate to show that the remainder term indeed tends to zero. Using that the first entry time of in , conditional on , has a bounded, continuous conditional density , we use Lemma 2 and properties of the Brownian motion what yields for any that

We use that

holds true with any sequence , . We apply Lemma 2 in the last step. Choosing minimal yields that

almost surely. From the unconditional Lévy distribution of , is explicit, but its precise form does not influence the asymptotic order. We have verified (42).

It is well known that by the reflection principle it holds that

for , and since , we conclude the result. ∎

6.2 Uniformly consistent spot volatility estimation

In the sequel, we write for two real sequences, if there exists some and a constant , such that , for all . With the estimate from Lemma 1 and using (41a) under the stronger condition that is Hölder continuous with regularity , we obtain with the process

that

Subtracting from and in differences , we obtain with this error bound that

with

Denote by expectations with respect to conditional probability measures given . The remainder of the proof relies on a maximum and a moment inequality, for which we use that the conditional moments of satisfy

with the moments of the standard half-normal distribution. We have used Lemma 3. We conclude the existence of all moments of , and analogously for . We use a generalization of Rosenthal’s inequality which states for i.i.d. random variables , with zero mean and , , that

with some constant depending on , such that for , it holds that

By Burkholder, (1973) the inequality extends to martingale increments. Note that while and are correlated for the same , is a sequence of uncorrelated random variables and we conclude that

and analogous bounds when replacing by , or . By the tower rule for conditional expectations, the considered random variables in the sum have mean zero. With the Markov inequality we hence obtain for all that

Choosing sufficiently large, the term converges to zero as . For being Hölder continuous with regularity , we have that

By the differentiability of , based on Eq. (A.35) from Bibinger et al., (2016), a local approximation of the volatility in the argument of is asymptotically negligible as well. This finishes the proof of Proposition 2.1.

6.3 Asymptotic distribution of jump estimates

By Lemmas 1 and 3, we obtain for any , , conditional on , that

| (43a) | |||

| With , a completely analogous proof as for Lemmas 1 and 3, using that is as well a Brownian motion, shows that for any , , conditional on , it holds true that | |||

| (43b) | |||

Moreover, by the strong Markov property of and since the are i.i.d., covariances of the statistics in (43a) and (43b) for vanish, such that we deduce joint weak convergence. For any , holds true for sufficiently large . Continuous mapping readily yields (21).

We show that, when not conditioning on , the convergences in (43a) and (43b) are stable in law with respect to the -field . The proof is analogous for both sequences, and we restrict to the first one. The stable convergence is equivalent to the joint weak convergence of with any -measurable, bounded random variable . That is,

| (44) |

as , for any continuous bounded function , and

| (45) |

with being independent of . By Lemma 1 it suffices to prove this for , and measurable w.r.t. . Define the sequence of intervals , and consider the sequences of decompositions

of . If denotes the -field generated by and , then is an isotonic sequence with . Since in , it suffices to show that

| (46) |

for being -measurable for some . Since, for all , conditional on , has a law independent of , we obtain with the tower rule of conditional expectations:

for being -measurable where we can use Lemma 3 in the last step. The stability allows to conclude (23) from (20) and the analogous consistency of the truncated version of (10) with (43a) and (43b). This completes the proof of Theorem 1.

6.4 Asymptotic distribution under the null hypothesis of the global test

To prove the asymptotic result for the global test, we establish the extreme value convergence for the maximum of i.i.d. random variables distributed as the absolute difference of two independent, standard half-normally distributed random variables in the next proposition. This is based on classical extreme value theory and an expansion of convolution tails.

Proposition 6.1.

Let be a -dimensional vector of i.i.d. standard normally distributed random variables. It holds true that

| (47) |

where denotes the standard Gumbel distribution, with the sequences

| (48) |

Proof.

Denote with the density of on the positive real line and and the associated cdf and survival function, respectively. For , , we compute

with the cdf of the standard normal distribution and

For asymptotic equivalence of two positive functions and , we write , which means that

Based on l’Hôpital’s rule we obtain that

and conclude that

Based on l’Hôpital’s rule, we obtain that the associated survival function satisfies

By Equation (1.2.4) of de Haan and Ferreira, (2006),

| (49) |

is satisfied with some sequences and , if there exists a function , such that for all , the survival function satisfies

| (50) |

is the right end-point of the distribution which is here. In this case, (50) is satisfied with , since

We show that (49) applies with

| (51) |

We can determine and based on

| (52) |

or use , with the general notation for the left-continuous generalized inverse of , see Remark 1.1.9 in de Haan and Ferreira, (2006). Setting , with a null sequence , yields that

and we find that the identity holds true for

Computing , starting with , gives for the sequence that

We exploit the symmetry of the distribution to conclude (47) readily from (49), see Lemma 1 in Bibinger, (2021) for a more detailed argument. ∎

Let us point out that the sequences and are different compared to the Gumbel convergence in the standard normal case, see Bibinger, (2021) for a comparison and discussion. These differences are of course crucial.

The triangle inequality yields for all , that

By an analogous bound starting with , and elementary transformations, we obtain that

using that is Hölder continuous with exponent . For the difference between statistics with estimated and true volatilities we use the estimate

The uniform consistency of the spot volatility estimator yields that

Based on these two preliminary approximation steps, we obtain that

For any fix , by the independence between statistics on different blocks and Lemma 3, the vector converges in distribution to a vector , with two sequences of independent normally distributed random variables and , with and correlated only for the same index .

Using continuous mapping and the Skorokhod representation we derive that

where and are i.i.d. sequences of standard normally distributed random variables, with and independent for . The Gumbel convergence shown in Proposition 6.1 generalizes from an i.i.d. to a 1-dependent non-i.i.d. sequence as shown in Watson, (1954). As , we can thus apply Proposition 6.1 replacing by the number of differences between blocks, . This proves (28).

6.5 Proofs of consistency of the tests

We are left to prove the consistency of the tests, (32) and (26). Under the alternative hypothesis, there is some with , such that admits a jump at time : . By standard bounds for the jump component, we have that

where the remainder is due to possible additional jumps on . We obtain the elementary lower bound

and the upper bound

since we know that the difference between the two minima in the maximum is . In case that , we obtain that

while for , we obtain that

Under the alternative hypothesis in Theorem 2, we thus have that

with , for which , for some . The consistency of the global test, (32), now follows from

since and . This completes the proof of Theorem 2.

References

- Aït-Sahalia and Jacod, (2009) Aït-Sahalia, Y. and Jacod, J. (2009). Testing for jumps in a discretely observed process. The Annals of Statistics, pages 184–222.

- Aït-Sahalia and Jacod, (2014) Aït-Sahalia, Y. and Jacod, J. (2014). High-frequency financial econometrics. Princeton, NJ: Princeton University Press.

- Aït-Sahalia et al., (2012) Aït-Sahalia, Y., Jacod, J., and Li, J. (2012). Testing for jumps in noisy high frequency data. Journal of Econometrics, 168:207–222.

- Aït-Sahalia et al., (2020) Aït-Sahalia, Y., Kalnina, I., and Xiu, D. (2020). High-frequency factor models and regressions. Journal of Econometrics, 216(1):86–105.

- Aït-Sahalia et al., (2005) Aït-Sahalia, Y., Zhang, L., and Mykland, P. A. (2005). How often to sample a continuous-time process in the presence of market microstructure noise. Review of Financial Studies, 18:351–416.

- Alexeev et al., (2017) Alexeev, V., Dungey, M., and Yao, W. (2017). Time-varying continuous and jump betas: The role of firm characteristics and periods of stress. Journal of Empirical Finance, 40:1–19.

- Andersen et al., (2022) Andersen, T. G., Archakov, I., Cebiroglu, G., and Hautsch, N. (2022). Local mispricing and microstructural noise: A parametric perspective. Journal of Econometrics, 230(2):510–534.

- Ayadi et al., (2020) Ayadi, M. A., Ben Omrane, W., Wang, J., and Welch, R. (2020). Macroeconomic news, public communications, and foreign exchange jumps around u.s. and european financial crises. International Journal of Finance & Economics, 25(2):197–227.

- Barndorff-Nielsen et al., (2008) Barndorff-Nielsen, O. E., Hansen, P. R., Lunde, A., and Shephard, N. (2008). Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise. Econometrica, 76(6):1481–1536.

- Barndorff-Nielsen and Shephard, (2006) Barndorff-Nielsen, O. E. and Shephard, N. (2006). Econometrics of testing for jumps in financial economics using bipower variation. Journal of Financial Econometrics, 4(1):1–30.

- Bibinger, (2021) Bibinger, M. (2021). Gumbel convergence of the maximum of convoluted half-normally distributed random variables. online supplement, arxiv: 2103.14525.

- Bibinger, (2024) Bibinger, M. (2024). Inference on the intraday spot volatility from high-frequency order prices with irregular microstructure noise. Journal of Applied Probability, 61(3):forthcoming, https://doi.org/10.1017/jpr.2023.96.

- Bibinger et al., (2014) Bibinger, M., Hautsch, N., Malec, P., and Reiß, M. (2014). Estimating the quadratic covariation matrix from noisy observations: Local method of moments and efficiency. The Annals of Statistics, 42(4):80–114.

- (14) Bibinger, M., Hautsch, N., Malec, P., and Reiss, M. (2019a). Estimating the spot covariation of asset prices—statistical theory and empirical evidence. Journal of Business & Economic Statistics, 37(3):419–435.

- Bibinger et al., (2016) Bibinger, M., Jirak, M., and Reiß, M. (2016). Volatility estimation under one-sided errors with applications to limit order books. The Annals of Applied Probability, 26(5):2754–2790.

- (16) Bibinger, M., Neely, C., and Winkelmann, L. (2019b). Estimation of the discontinuous leverage effect: Evidence from the nasdaq order book. Journal of Econometrics, 209(2):158 – 184.

- Burkholder, (1973) Burkholder, D. L. (1973). Distribution Function Inequalities for Martingales. The Annals of Probability, 1(1):19 – 42.

- Caporin et al., (2017) Caporin, M., Kolokolov, A., and Renò, R. (2017). Systemic co-jumps. Journal of Financial Economics, 126(3):563–591.

- Chaker, (2017) Chaker, S. (2017). On high frequency estimation of the frictionless price: The use of observed liquidity variables. Journal of Econometrics, 201(1):127–143.

- Chen and Feng, (2023) Chen, D. and Feng, L. (2023). Change point detection in beta process with high frequency data. Available at SSRN, http://dx.doi.org/10.2139/ssrn.4398513.

- Chong et al., (2022) Chong, C., Hoffmann, M., Liu, Y., Rosenbaum, M., and Szymanski, G. (2022). Statistical inference for rough volatility: Minimax theory. Available at SSRN, https://ssrn.com/abstract=4236905, arXiv:2210.01214,.

- Clinet and Potiron, (2019) Clinet, S. and Potiron, Y. (2019). Testing if the market microstructure noise is fully explained by the informational content of some variables from the limit order book. Journal of Econometrics, 209(2):289–337.

- de Haan and Ferreira, (2006) de Haan, L. and Ferreira, A. (2006). Extreme value theory. An introduction. New York, NY: Springer.

- Dovonon et al., (2019) Dovonon, P., Gonçalves, S., Hounyo, U., and Meddahi, N. (2019). Bootstrapping high-frequency jump tests. Journal of the American Statistical Association, 114(526):793–803.

- Evans, (2011) Evans, K. P. (2011). Intraday jumps and us macroeconomic news announcements. Journal of Banking & Finance, 35(10):2511–2527.

- Hansen and Lunde, (2006) Hansen, P. and Lunde, A. (2006). Realized variance and market microstructure noise. Journal of Business and Economic Statistics, 24:127–218.

- Jacod et al., (2021) Jacod, J., Li, J., and Liao, Z. (2021). Volatility coupling. The Annals of Statistics, 49(4):1982 – 1998.

- Jacod and Protter, (2012) Jacod, J. and Protter, P. (2012). Discretization of processes. Springer.

- Jirak et al., (2014) Jirak, M., Meister, A., and Reiss, M. (2014). Adaptive function estimation in nonparametric regression with one-sided errors. The Annals of Statistics, 42(5):1970–2002.

- Koike, (2017) Koike, Y. (2017). Time endogeneity and an optimal weight function in pre-averaging covariance estimation. Statistical Inference for Stochastic Processes, 20(1):15–56.

- Lee and Mykland, (2012) Lee, S. and Mykland, P. (2012). Jumps in equilibrium prices and market microstructure noise. Journal of Econometrics, 168(2):396–406.

- Lee and Mykland, (2008) Lee, S. and Mykland, P. A. (2008). Jumps in financial markets: A new nonparametric test and jump dynamics. Review of Financial Studies, 21:2535–2563.

- (33) Li, J., Todorov, V., and Tauchen, G. (2017a). Adaptive estimation of continuous-time regression models using high-frequency data. Journal of Econometrics, 200(1):36–47.

- (34) Li, J., Todorov, V., and Tauchen, G. (2017b). Jump regressions. Econometrica, 85(1):173–195.

- (35) Li, J., Todorov, V., Tauchen, G., and Chen, R. (2017c). Mixed-scale jump regressions with bootstrap inference. Journal of Econometrics, 201(2):417–432.

- Li et al., (2016) Li, Y., Xie, S., and Zheng, X. (2016). Efficient estimation of integrated volatility incorporating trading information. Journal of Econometrics, 195(1):33–50.

- Li and Linton, (2022) Li, Z. M. and Linton, O. (2022). A remedi for microstructure noise. Econometrica, 90(1):367–389.

- Madensoy, (2020) Madensoy, M. (2020). Change points and uniform confidence for spot volatility. PhD thesis, University of Mannheim. https://madoc.bib.uni-mannheim.de/54196.

- Mykland and Zhang, (2016) Mykland, P. A. and Zhang, L. (2016). Between data cleaning and inference: Pre-averaging and robust estimators of the efficient price. Journal of Econometrics, 194(2):242–262.

- Nunes and Ruas, (2024) Nunes, J. P. V. and Ruas, J. P. (2024). A note on the Gumbel convergence for the Lee and Mykland jump tests. Finance Research Letters, 59:104814.

- Pelger, (2019) Pelger, M. (2019). Large-dimensional factor modeling based on high-frequency observations. Journal of Econometrics, 208(1):23–42. Special Issue on Financial Engineering and Risk Management.

- Tauchen and Todorov, (2011) Tauchen, G. and Todorov, V. (2011). Volatility jumps. Journal of Business and Economic Statistics, 29:356–371.

- Vetter, (2014) Vetter, M. (2014). Inference on the Lévy measure in case of noisy observations. Statistics & Probability Letters, 87:125–133.

- Watson, (1954) Watson, G. S. (1954). Extreme values in samples from -dependent stationary stochastic processes. Ann. Math. Statist., 25(4):798–800.