*mps*

A Hamiltonian Approach to Barrier Option Pricing Under Vasicek Model

Abstract

Hamiltonian approach in quantum theory provides a new thinking for option pricing with stochastic interest rates. For barrier options, the option price changing process is similar to the infinite high barrier scattering problem in quantum mechanics; for double barrier options, the option price changing process is analogous to a particle moving in a infinite square potential well. Using Hamiltonian approach, the expressions of pricing kernels and option prices under Vasicek stochastic interest rate model could be derived. Numerical results of options price as functions of underlying prices are also shown.

I Introduction

In 1973, Black and Scholes derived a closed-form solution for European options Black . Since then the field of derivative pricing has grown greatly Amin ; Rubinstein . In resent years, path-dependent options have become increasingly popular in financial markets, and barrier options are considered to be the simplest types of path dependent options. Owing to the constraint of the barrier, barrier options give investors more flexibilities to transactions. Snyder was the first to discuss down-and-out barrier options Snyder . Merton derived a closed-form solution for the down-and-out barrier call option Merton:1973 . Chiara et al priced barrier options by a Mellin transform method Chiara . Karatzas and Wang gave closed-form expressions for the prices of American up-and-out put options Karatzas . Baaquie et al discussed barrier options and double barrier options by path integral approach, and derived the corresponding analytical expressions Baaquie . Kunitomo and Ikeda studied the barrier options with floating barriers Kunitomo . Chen et al gave the integral expressions for floating barrier option prices by path integral methods Chen . All the papers mentioned above assumed that the model parameters such as interest rate and volatility are constants. However, as we know, interest rate and volatility change with time in the real market, and the Black-Scholes model should be revised to be close to the reality. Lo et al give a closed-form expression for the price of barrier options with time dependent parameters Lo . Lemmens et al discussed Stochastic interest rate and volatility by means of path integral approach Lemmens . More about the discussions on option with time dependent parameters could be studied in Hull ; Wiggins ; Roberts ; Bernard .

In this paper, we assume that the interest rate obeys the Vasicek model Vasicek . Using -arbitrage strategy, the partial differential equation (PDE) of option price could be derived, which could be rewirtten into a Schrödinger-type equation. The Hamiltonian of the option system determines the expression of the pricing kernel which could be derived by a quantum mechanics approach Baaquie ; Chen . The pricing kernel represents all the information for option price evolution, which is in correspondence to the propagator in quantum theory. Options with floating barriers give investors more flexibilities. With the barriers moving, the opportunities for an option to touch the barriers would change, and the option price increases or decreases correspondingly. We would take up-and-out call options for instance to illustrate the effect of floating barriers and give the closed-form formula for the option price.

Our work is organized as follows. In Section 2, we will review the derivation of the option price PDE under Vasicek model and rewrite the PDE into a Schrödinger-type equation. In Section 3, we will derive the integral expressions for the barrier option price by a Hamiltonian approach. In Section 4, we will derive the integral expressions for the double barrier option price. In Section 5, We will generalize the results in Section 3 and Section 4 into the case of an option with floating barriers. Numerical results will be discussed in Section 6. We summarize our main results in Section 7.

II Option Pricing Under the Vasicek Model

Assuming that the model of stock price obeys Brownian movement,

| (1) |

where is the volatility of , and is the stochastic interest rate which obeys Vasicek model Vasicek

| (2) |

where is the volatility of , and indicate regression rate and long-term mean, respectively. and are standard Brownian movements, with the covariance

| (3) |

Using -arbitrage strategy, the option price satisfies the follow partial differential equation (PDE)

| (4) |

for a call option, the final condition at is

| (5) |

where is the maturity, and is the exercise price. By means of variable substitutions

| (6) |

the PDE (4) could be simplified into

| (7) |

where

| (8) |

and is the zero-coupon bond price. For the Vasicek model, obeys the following PDE and the final condition

| (9) |

(LABEL:VasicekPDE) has the following explicit solution

| (10) |

III Path Integral Approach for Barrier Option Pricing

The barrier option Hamiltonian is

| (15) |

where

| (16) |

and the potential is

| (17) |

The Schrödinger equation for is

| (18) |

where is the scattering state wave function of the option, which describes the option price at time , and is corresponding to the “option energy”. The solution of (18) is

| (19) |

which is the option wave function represented in coordinate space with the barrier level , and

| (20) |

for , the wave function .

Owing to changes with time, we discretize so that there are steps to maturity, with each time step . tends to be a constant during each small enough time step. The pricing kernel could be denoted as

| (21) |

where the completeness condition

| (22) |

has been used. The matrix element is

| (23) |

Using Gaussian integral formula, the integral in (23) could be calculated as

| (24) |

Similarly,

| (25) |

now we calculate the four integrals in (25)

| (26) |

| (27) |

| (28) |

| (29) |

where

| (30) |

is the error function. Owning to the error function is an odd function, (25) could be simplified into

| (31) |

Repeating the above calculation, the pricing kernel is

| (32) |

where

| (33) |

could be viewed as the effective volatility, and the option price could be denoted as

| (34) |

IV Path Integral Approach for Double Barrier Option Pricing

The double barrier option Hamiltonian is

| (35) |

the potential is

| (36) |

where and are the lower and higher barrier levels, respectively. The Schrödinger equation for is

| (37) |

with the eigenstate

| (38) |

where

| (39) |

Owing to changes with time, we also discretize to steps, with each step . The matrix element is

| (40) |

where is the momentum operator, and

| (41) |

similarly,

| (42) |

where the orthonormalization condition

| (43) |

has been used. Repeating the above calculation, the pricing kernel for double barrier option is

| (44) |

and the option price is

| (45) |

V Option Pricing with Floating Barriers

Consider an option with the following exponential boundaries Kunitomo:1992

| (46) |

where is the initial barrier level, and is the floating rate, which denotes the change rate of the barrier. Using substitution (12), the barrier could be rewritten as

| (47) |

and the th matrix element is

| (48) |

after a series of calculations, the price kernel could be denoted as

| (49) |

and the option price is

| (50) |

For a double floating barrier option, the lower bound and the upper bound could be denoted as

| (51) |

respectively, which indicates that the two barriers either get far away from each other (), or get close to each other (). Similar to (44), the pricing kernel for a double barrier option with floating barriers could be calculated step by step as

| (52) |

where

| (53) |

and

| (54) |

where

| (55) |

is the function, and

| (56) |

is the function,

| (57) |

is the Lerch zeta function.

The option price could be denoted as

| (58) |

VI Numerical Results

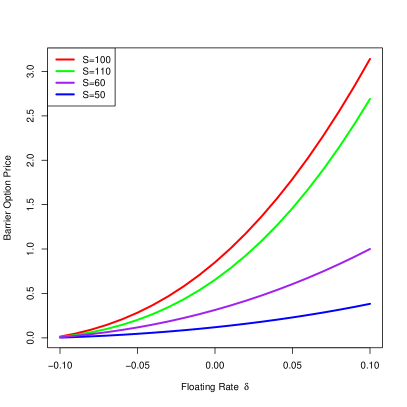

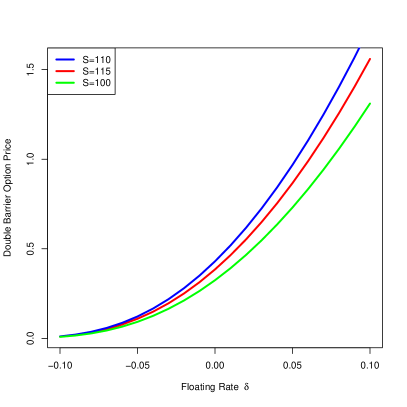

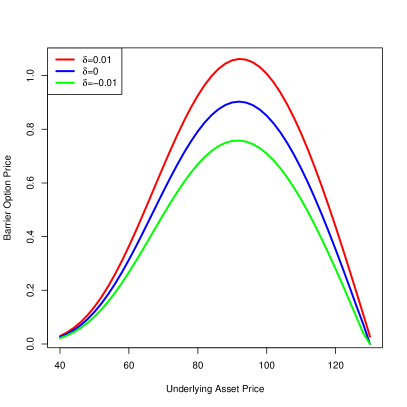

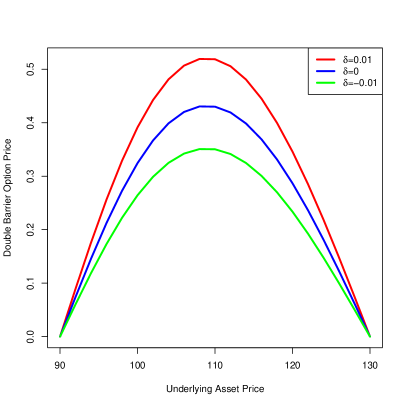

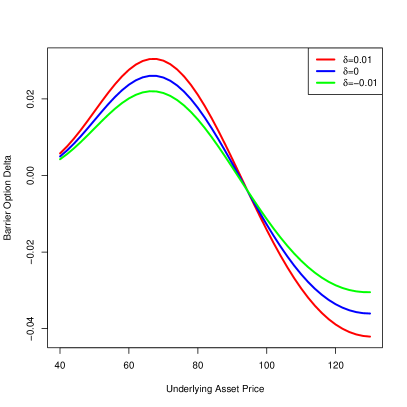

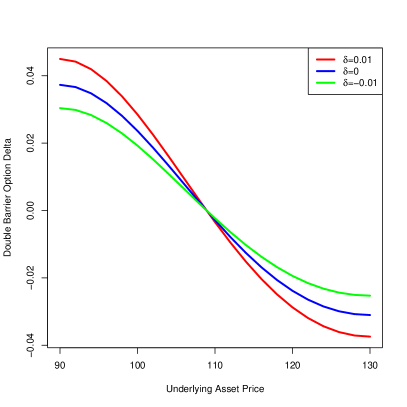

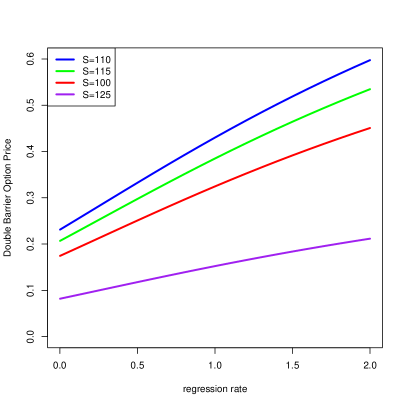

Table. 1 shows the dependence of a up-and-out barrier call price and a up-and-out double barrier call price on the underlying price for different barrier floating rates . is the initial interest rate. Without loss of generality, we set . The underlying asset price and the barrier level () are joint to determine the option price. When is far smaller than the exercises price , dominates the option price and there tends to be less probability to exercise the option. Hence the option price is very low. When is near the barrier, the option has more probabilities to touch the barrier, and the option price is low as well. In Fig. 1, we show the dependence of the option price on the floating rate for different underlying prices. With the increase of , the option price increases. In Fig. 2, it is obviously shown that the price of the option with a positive (the red line) is higher than that of a standard barrier option with the same exercise price , since the option has more space to survive. For the same reason, the option with a negative (the green line) is cheaper than the standard barrier option with the same . The dependence of option Delta on the underlying asset price is shown in Fig. 3.

| Underlying Price | Single Barrier Option Price | Double Barrier Option Price | ||||

| 40 | 0.0218088 | 0.0255593 | 0.0226368 | - | - | - |

| 60 | 0.267311 | 0.31392 | 0.364335 | - | - | - |

| 80 | 0.669909 | 0.792455 | 0.925853 | - | - | - |

| 90 | 0.756554 | 0.89997 | 1.0571 | 0 | 0 | 0 |

| 100 | 0.70949 | 0.850758 | 1.00701 | 0.26442 | 0.324539 | 0.391472 |

| 120 | 0.275938 | 0.352539 | 0.437257 | 0.233614 | 0.286748 | 0.345922 |

| 128 | 0.041192 | 0.0748869 | 0.111453 | 0.0504391 | 0.061912 | 0.0746894 |

| 130 | 0 | 0 | 0 | 0 | 0 | 0 |

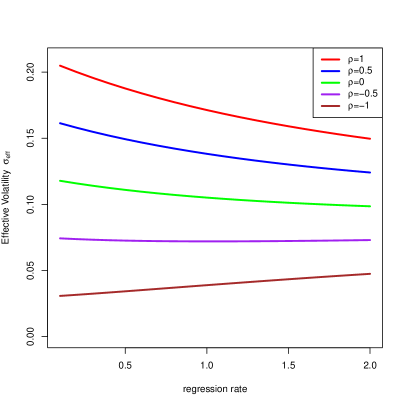

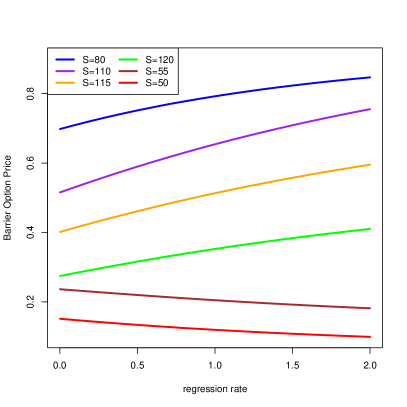

In Fig. 5, we show the dependence of the option price on the regression rate for different underlying asset prices at . For a single barrier option, it is shown that in Fig. 4, the effective volatility decreases with the increase of for , hence the option price decreases with the increasing at a low underlying price. When is near the barrier level, the decrease of would make the option has less opportunities to touch the barrier, and the option price increases with the increasing . For a double barrier option, the decrease of makes the option has less opportunities to touch both sides of the barriers, and the option price increases with the increase of .

VII Conclusion

Barrier option price changing with time could be analogous to a particle moving under some special potential. For stochastic interest rates, the maturity should be split into steps, and each matrix element during a tiny step is calculated by Gaussian integral. After times integral calculation, the pricing kernel could be written in the form of a series, which could be represented as some special function. Hamiltonian is an effective approach linking option price changing to a particle moving under some potential in the space. The pricing of other barrier options such as step options could be studied by defining appropriate potentials.

Acknowledgments

Chao Guo and Hongtao Wang are supported by the Natural Science Foundation of Hebei Province under Grant No. A2022408002.

Declaration of interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Data availability statement

The authors confirm that the data supporting the findings of this study are available within the article.

References

- (1) F. Black and M. Scholes, The Pricing of Options and Corporate Liabilities, Journal of political economy 81, 637 (1973).

- (2) K. Amin and A. J. Morton, Implied Volatility Functions in Arbitrage-Free Term Structure Models, Journal of Financial Economics 35, 141 (1994).

- (3) M. Rubinstein, Displaced Diffusion Option Pricing, Journal of Finance 38, 213 (1983).

- (4) G. L .Snyder, Alternative Forms of Options, Financial Analysts Journal 25, 93-99 (1969).

- (5) R. C. Merton, Theory of Rational Option Pricing, The Rand Journal of Economics 4, 141-183 (1973).

- (6) G. Chiara, M. R. Rodrigo and S. Simona A Mellin Transform Approach to Barrier Option Pricing, Ima Journal of Management Mathematics 1 (2018).

- (7) I. Karatzas and H. Wang A Barrier Option of American Type, Applied Mathematics and Optimization 42: 259-279 (2000).

- (8) B. E. Baaquie, C. Coriano and M. Srikant, Hamiltonian and Potentials in Derivative Pricing Models: Exact Results and Lattice Simulations, Physica A 334, 531-57 (2004).

- (9) N. Kunitomo and M. Ikeda, Pricing Options With Curved Boundaries, Mathematical Finance 2(4) (1992).

- (10) Q. Chen, H. T. Wang and C. Guo, A Hamiltonian Approach to Floating Barrier Option Pricing, [arXiv:2209.12542].

- (11) C. F. Lo, H. C. Lee and C. H. Hui A Simple Approach for Pricing Barrier Options with Time-Dependent Parameters, Quantitative Finance 3(2), (2003), 98-107.

- (12) D. Lemmens, M. Wouters, J. Tempere and S. Foulon A Path Integral Approach to Closed-Form Option Pricing Formulas with Applications to Stochasitic Volatility and Interest Rate Models, Phys. Rev. E 78(1), (2008), 016101.

- (13) J. C. Hull and W. Alan, The Pricing of Options on Assets with Stochastic Volatilities , Journal of Finance 42, (1987),281-300.

- (14) J. Wiggins, Option Values under Stochastic Volatility: Theory and Empirical Estimates, Journal of Financial Economics 19, (1987),351-372.

- (15) G. O. Roberts and C. F. Shortland Pricing Barrier Options with Time-Dependent Coefficients, Mathematical Finance 7(1), (1997), 83-93.

- (16) C. Bernard, O. Le Courtois, F. Quittard-Pinon Pricing derivatives with barriers in a stochastic interest rate environment, Journal of Economic Dynamics and Control 32(9), (2008), 2903-2938.

- (17) O. A. Vasicek An Equilibrium Characterization of the Term Structure, Journal of Financial Economics 5: 177-88 (2004).

- (18) N. Kunitomo and M. Ikeda, Pricing Options With Curved Boundaries, Mathematical Finance 2(4)(1992).