A multidimensional objective prior distribution from a scoring rule.

Abstract

The construction of objective priors is, at best, challenging for multidimensional parameter spaces. A common practice is to assume independence and set up the joint prior as the product of marginal distributions obtained via “standard” objective methods, such as Jeffreys or reference priors. However, the assumption of independence a priori is not always reasonable, and whether it can be viewed as strictly objective is still open to discussion. In this paper, by extending a previously proposed objective approach based on scoring rules for the one dimensional case, we propose a novel objective prior for multidimensional parameter spaces which yields a dependence structure. The proposed prior has the appealing property of being proper and does not depend on the chosen model; only on the parameter space considered.

1 Introduction

The derivation of objective priors is known to be challenging when it comes to multidimensional parameter spaces. A possible solution is to assume prior independence and set up the joint prior as the product of the marginals. If one wishes to assign an objective prior to a parameter vector , the independent prior idea would be to have

where , for , would be obtained using any “standard” objective methods, such as Jeffreys prior (Jeffreys, 1961) or the reference prior (Bernardo, 1979). However, as models become ever larger, the idea of placing independent priors on all parameters, which are derived from the model, or using Jeffreys or the reference priors, is too problematic; see Consonni et al. (2018). While the above implementation of objective priors for multidimensional parameter spaces may be advisable in some circumstances, it is important to take into consideration that the assumption of independence a priori is not always a satisfactory default choice. It can be hardly credible to assign a strategy to be objective due to the lack of a better choice such as a specific justification.

In this paper we concentrate on proposing a prior for multidimensional parameter spaces based on objective considerations which extend the work of Walker and Villa (2021).

The review of the available objective approaches to deal with multidimensional parameter spaces is quite straightforward. Jeffreys himself (Jeffreys, 1961) acknowledged the limitation of obtaining a prior distribution for multidimensional parameter spaces employing his approach (i.e. Jeffreys rule prior) and proposed to use the a priori independence (i.e. independent Jeffreys prior). See also the discussion in Kass and Wasserman (1999). As for the class of reference priors, while a formal definition for the unidimensional case is available, (Berger et al., 2009), the extension to any parameter space has not yet been provided. There are ad hoc solutions for some particular cases, such as how to deal with nuisance parameters, see (Liseo, 1993), but these do not provide any clear indication on how to proceed when the parameters cannot be considered nuisance. Furthermore, quite often the resulting prior distribution may be different depending on the “order of importance” assigned to the parameters of interest.

Besides the aforementioned obvious limitation, one aspect that has to be taken into consideration when dealing with objective priors, is that they are typically improper. While it is well known that this does not constitute an issue per se as long as the corresponding posterior is proper, there is still the problem that posterior properness would need to be verified. For multidimensional parameter spaces, the tediousness and difficulty of this task is evident. We refer the reader to Kass and Wasserman (1999) for a discussion.

The idea of this paper is to propose a novel objective prior for multidimensional parameter spaces that has the appealing property of being proper. Naturally, this prior will not require the verification of posterior properness and, more importantly, it can be employed in all the scenarios where an improper prior distribution is not suitable, for example when dealing with Bayes Factors. The idea builds on the procedure presented in Walker and Villa (2021), where the connection between information, divergence and scoring rules is exploited to obtain an objective prior distribution. In fact, it assumes that the score function is constant, meaning that we do not favour any particular parameter value with respect to others. It also has the property of minimizing a measure of information. A key aspect of the prior is that it does not depend on the chosen model, but only on the parameter space.

The paper is organised as follows. In Section 2, we present the derivation of the prior distribution for the case and show how to derive the general multidimensional case. In Section 3 we illustrate the implementation of the proposed prior distribution for both simulated and real data; the examples we discuss include single sample results as well as frequentist analysis on repeated samples. Finally, Section 4 concludes with a brief discussion and some remarks.

2 Prior derivation

We start by reviewing the idea from Walker and Villa (2021). This is useful, as the extension to the multidimensional case requires more complex calculations but the principles remain largely the same. Consider the general relationship between divergence, information and score; that is, for densities and

| (1) |

where denotes a divergence between the two density functions, is the corresponding information, and is the score function. For a one dimensional parameter, Walker and Villa (2021) proceeded by taking a Bregman divergence (Bregman, 1967), , where

for some convex function . For a local score function and to achieve the form (1) it is necessary to set

which is guaranteed through the choice , for some convex function . Then, setting the score function to be 0, results in the objective prior being the solution to

When the convex function is taken to be “simple” and of the form . The result is

for some and (details in Appendix A). This is a member of the Lomax family of density functions, which we denote . We will not reduce this further at this point by specifying and , save to say that and are well motivated choices with respect to invariance and minimizing information, respectively. To elaborate on these points, if we now undertake the transform , then

which only matches when . Further, after setting , which is done without loss of generality for what follows, consider the negative entropy

The integral is , so , which is minimized at .

2.1 Dimension

To simplify the notation, we use and to represent the two arguments of the prior . Before going through the scoring rule idea, we introduce the solution and some appealing properties of the multivariate Lomax distribution.

If independence between and is not assumed a priori, the conditional prior distribution should also take the form of a Lomax distribution, as it is one dimensional and should adhere to the ideas discussed in the previous section; hence, will be a Lomax with parameters and . If we have that, marginally, the prior for is , and we take and , then

| (2) |

which is a bivariate Lomax density function. Moreover, both the marginals are .

We now consider the bivariate version of the Bregman divergence

where the integral is intended over the space and, without loss of generality, we assume for now . Define

and similarly for , where for the bivariate function , we denote , and similarly for . In detail, we have

| (3) |

Rearranging, and using integration by parts with assumptions on the densities vanishing at end points, the integral of (3) becomes

To obtain the decomposition of equation (1), we need

| (4) |

yielding the score function

Following the reasoning outlined in Walker and Villa (2021), we propose

| (5) |

for some convex function . In the absence of information, it is reasonable to assume that and carry the same importance for both the definition of the Bergman divergence and of the scoring rule. This is guaranteed by the symmetry condition . We can also motivate the additive version of the multidimensional case based on the notion of adding dimensions, hence we take

Now, setting (which we recall being our “objective” argument) results in the solution given in (2).

2.2 General multidimensional case

The extension to the -dimensional case, with , is relatively straightforward, using the following convex function:

If we apply the same strategy as outlined above, the solution results in

which is the density of a multivariate Lomax, denoted . All the marginal and the conditional density functions also belong to the Lomax family.

In particular, the marginal density of , for , is which is based on the integral

for . The conditional distribution of given , for , is .

3 Illustrations

In this Section we look at some implementations of the multivariate Lomax as an objective prior. In particular, we perform some single sample analysis as well as the analysis of the frequentist performance of the prior on repeated samples. For the latter, we evaluate the behaviour of the prior density with respect to the mean squared error (MSE), possibly in its more informative version as the relative square root MSE, and the coverage of the 95% posterior credible intervals.

We first implement the proposed prior to estimate the parameters of a Weibull distribution, as an illustration with a parameter of dimension two. We then present a key example to illustrate the actual implementation of the objective multivariate prior on a parameter space of dimension larger than two, by focusing on the three parameters of the Dagum distribution (Dagum, 1975). Finally, we use the multivariate Lomax prior to estimate the parameters of a linear regression model, with normal error terms and two covariates. The prior is jointly assigned on the intercept, the two coefficients and the regression variance and, as far as we are aware, this is the sole objective prior distribution allowing this in a straightforward manner.

3.1 Weibull distribution

Bayesian estimation of the parameters of a Weibull distribution using objective priors has been the object of some attention in the literature, with particular focus on Jeffreys prior and the reference prior. A discussion, with comparisons on the possible objective priors, can be found in Sun (1997). The author shows the superiority of the reference prior, although the choice of which (if any) parameter is nuisance is fundamental and gives rise to different priors.

We consider the Weibull distribution with the following parametrisation

where is the scale parameter and the shape parameter. The objective prior against which we compare our proposal is the reference prior under the scenario where both parameters are of interest, that is . Following the guidelines of the simulation study in Sun (1997), we have drawn 250 independent samples of sizes and , respectively, from a Weibull distribution with and . This is due to the fact that changes in the scale parameter do not affect the behaviour of the prior.

| MSE: | MSE: | ||||||

|---|---|---|---|---|---|---|---|

| Reference | 3.92 | 3.90 | 3.91 | 3.13 | 3.13 | 3.12 | |

| Lomax | 3.33 | 3.27 | 3.21 | 2.59 | 2.61 | 2.69 | |

| COV: | COV: | ||||||

| Reference | 0.90 | 0.91 | 0.91 | 0.91 | 0.92 | 0.91 | |

| Lomax | 0.91 | 0.91 | 0.90 | 0.95 | 0.96 | 0.96 |

The results of the simulation study are summarised in Table 1, for , and in Table 2, for . Concerning the relative square root mean squared error (MSE), given by , where is the posterior mean, we note that in every scenario the Lomax prior outperforms the reference prior. Furthermore, as one would expect, for both priors the MSEs are smaller when the sample size is larger. In terms of coverage of the 95% posterior credible intervals, we do not observe any particular deviation from what one would sensibly expect, as the values are within the normal range of tolerance.

| MSE: | MSE: | ||||||

|---|---|---|---|---|---|---|---|

| Reference | 1.85 | 1.86 | 1.94 | 1.36 | 1.37 | 1.37 | |

| Lomax | 1.77 | 1.75 | 1.76 | 1.29 | 1.29 | 1.30 | |

| COV: | COV: | ||||||

| Reference | 0.94 | 0.95 | 0.94 | 0.94 | 0.93 | 0.94 | |

| Lomax | 0.93 | 0.93 | 0.92 | 0.95 | 0.94 | 0.94 |

To conclude this study, analyze some real data, taken from Ellah (2012), and consisting of 19 times to breakdown (in minutes) of an insulating fluid between electrodes at a voltage of 34 KV (Table 3).

| 0.96 | 4.15 | 0.19 | 0.78 | 8.01 | 31.75 | 7.35 | 6.50 | 8.27 | 33.91 |

| 32.52 | 3.16 | 4.85 | 2.78 | 4.67 | 1.31 | 12.06 | 36.71 | 72.89 |

The maximum likelihood estimates of the parameters are and . Looking at the posterior statistics of the posteriors under the reference prior and the Lomax prior (Table 4), we see that the intervals obtained with both priors include MLE estimates of the corresponding parameters. For , the performance of the two priors is quite similar. For the shape parameter , however, we see that the Lomax prior outperforms the reference prior, which is obvious by comparing both the posterior variances and 95% credible intervals.

| Reference | Lomax | |||||

|---|---|---|---|---|---|---|

| Mean | Variance | 95% C.I. | Mean | Variance | 95% C.I. | |

| 0.8 | 0.02 | (0.55,1.10) | 0.73 | 0.02 | (0.48,1.02) | |

| 16.84 | 44.93 | (8.51,31.89) | 11.11 | 15.08 | (5.07,20.36) | |

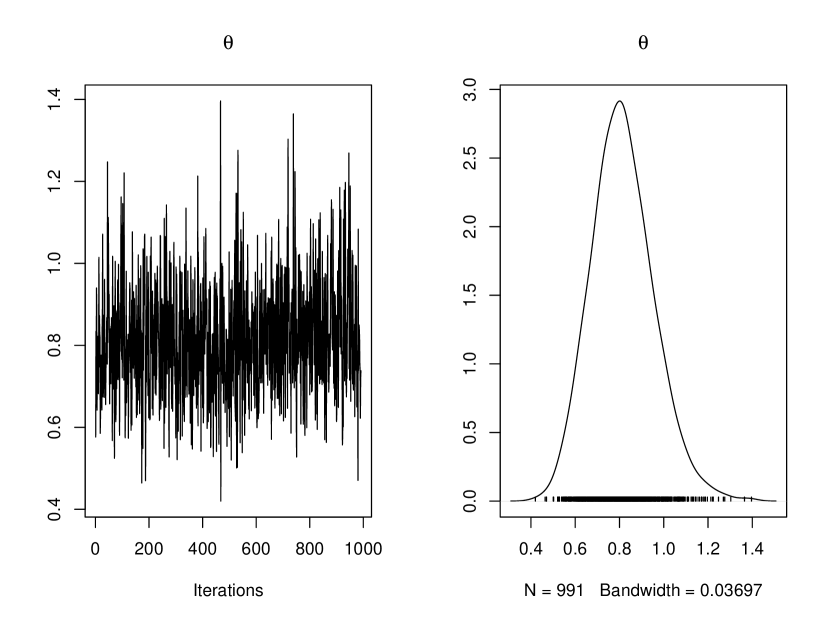

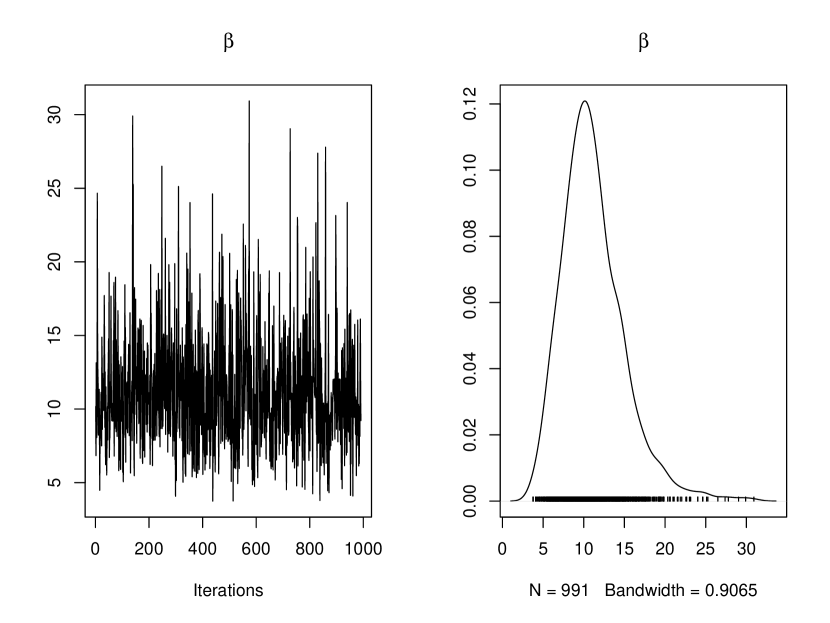

To complete this illustration, we show the posterior chains and estimated densities in Fig. 1.

3.2 Dagum distribution

The Dagum distribution was introduced for the first time in Dagum (1975), and is widely used in economics, for example, to model income and wealth data. We say that a random variable follows a Dagum distribution if it has the following probability density function:

where and are shape parameters, and is a scale parameter.

The Bayesian literature on adopting objective priors to estimate the parameters of a Dagum distribution is scarce, with the exception of Nawash et al. (2017), where the authors propose an extension of Jeffreys prior; however, the proposed prior is not, strictly speaking, an objective prior as it depends on a hyper-parameter that has to be set and which impacts the performance of the prior itself. As such, in order to have a suitable comparison of the multivariate Lomax with an alternative solution, we will consider a joint prior on the three parameters, to be the product of three independent vague gamma densities. That is, , with , , , , and relatively small (e.g. equal to 0.1 or 0.01).

To compare the multivariate Lomax prior to the above vague prior, we analyse two scenarios. First, we consider a Dagum distribution with parameters , and then a Dagum with parameters . We have chosen so that both the mean and the variance of the distribution exist. We replicate 250 independent samples for each scenario with sizes and . The posterior distributions for the parameters are not available in closed form, so we implemented a Metropolis within Gibbs to sample from them.

In Tables 5 and 6, we repor the relative (square root) mean squared error and coverage of the 95% posterior credible intervals for the above scenarios, under the two priors.

| MSE | Vague | Lomax | Vague | Lomax |

|---|---|---|---|---|

| Parameter | n = 30 | n = 100 | ||

| 13.28 | 6.59 | 7.87 | 4.89 | |

| 2.80 | 2.05 | 1.45 | 1.24 | |

| 4.26 | 3.18 | 2.92 | 2.44 | |

| COV | Vague | Lomax | Vague | Lomax |

| Parameter | n = 30 | n = 100 | ||

| 0.97 | 1.00 | 0.95 | 0.97 | |

| 0.96 | 0.99 | 0.96 | 0.96 | |

| 0.98 | 1.00 | 0.94 | 0.96 | |

We notice that, in both cases, the multivariate Lomax outperforms the joint vague Gamma density in terms of the MSE. This appears to be more prominent for the estimates of the parameter , suggesting a better accuracy of the Lomax prior. Regarding coverage, the priors tend to behave similarly, with relatively larger intervals for the smaller sample sizes, as one would expect.

| MSE | Vague | Lomax | Vague | Lomax |

|---|---|---|---|---|

| Parameter | n = 30 | n = 100 | ||

| 8.05 | 3.55 | 9.21 | 4.52 | |

| 2.38 | 2.03 | 1.24 | 1.11 | |

| 3.96 | 2.80 | 3.09 | 2.38 | |

| COV | Vague | Lomax | Vague | Lomax |

| Parameter | n = 30 | n = 100 | ||

| 0.99 | 0.99 | 0.97 | 0.98 | |

| 0.96 | 0.98 | 0.97 | 0.98 | |

| 1.00 | 1.00 | 0.95 | 0.98 | |

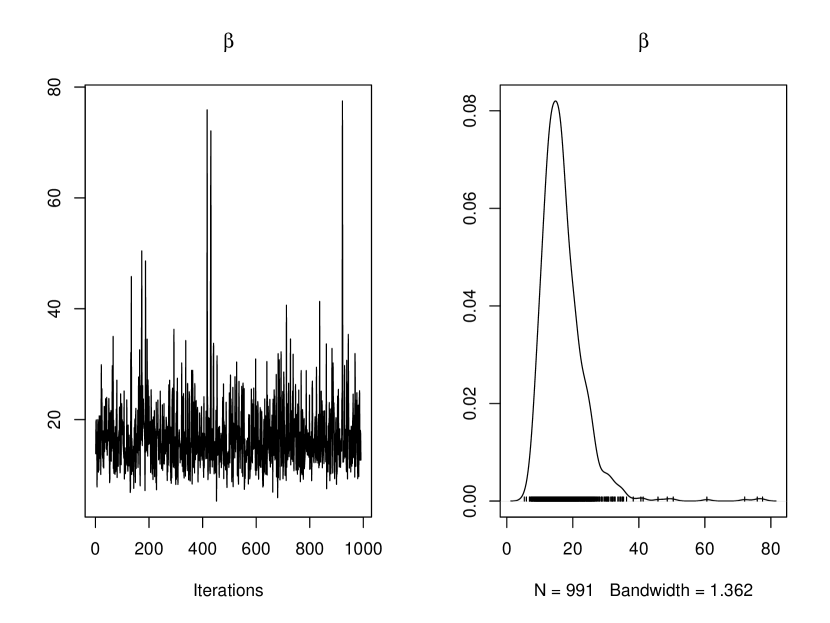

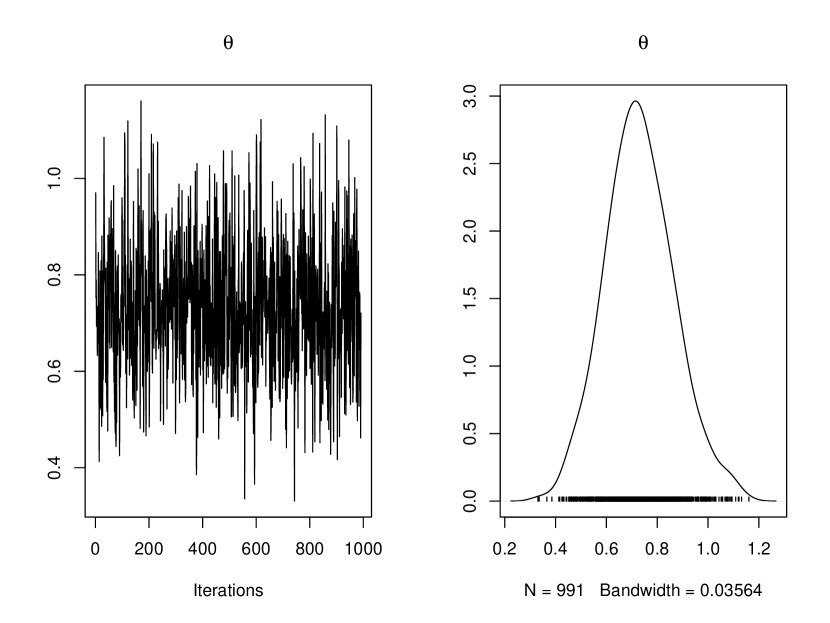

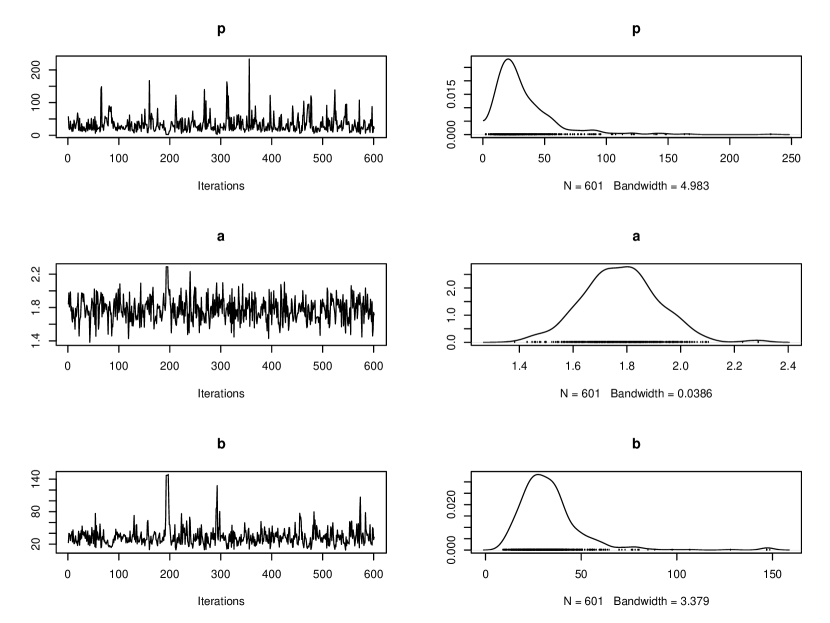

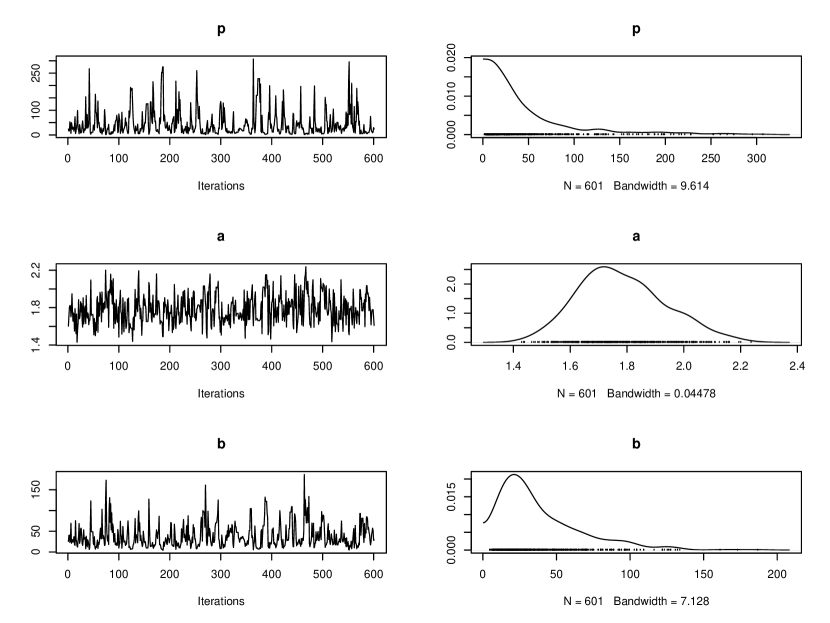

To conclude the illustration of the Dagum density, we analyse the UK Quarterly Gas Consumption in the period 1960–1986 (Durbin and Koopman, 2001), a publicly available data set. We compare the thre-dimensional multivariate Lomax with the product of three vague Gamma densities. In Figure 2, we have the posterior traces and estimated densities that have been obtained when the multivariate Lomax has been used as joint prior on the three parameters of the Dagum distribution, assumed as statistical model for the data. In Figure 3, we have the same plots when a product of three independent vague Gamma densities has been used as joint prior. It is clear that, while the three marginal posterior densities appear to be centred around the same values under both priors, the variability, and so the uncertainty, expressed by the posteriors under the Lomax prior seems to be smaller than the competing vague Gamma density. This is confirmed by the posterior statistics reported in Table 7.

| Parameter | Lomax | Gamma | ||

|---|---|---|---|---|

| p | 25.5 | (6.61, 104.19) | 27.2 | (3.40, 209.14) |

| a | 1.77 | (1.50, 2.04) | 1.76 | (1.52, 2.10) |

| b | 30.66 | (12.86, 76.68) | 29.1 | (7.31, 109.23) |

3.3 Linear regression

An interesting application of the proposed prior is to estimate the parameters of a linear regression model. Typically, objective prior distributions for this type of model separate the coefficients from the intercept and the regression variance. In other words, for the model

with , the objective prior would be of the type

Usually, in an objective Bayesian set up, one would set , while the prior on the coefficients can take different forms, such as in Zellner and Siow (1980), Fernández et al. (2001), Liang et al. (2008) and Bayarri et al. (2012). Here, we discuss the implementation of the proposed prior via a single sample example and a frequentist analysis performed on a repeated sampling scheme.

3.3.1 Linear regression: Single sample

Let us consider a sample of size drawn from a linear regression model with two covariates, and (both defined on ), intercept , coefficients , and variance . The (4-dimensional) Lomax prior has the following form,

| (6) |

with , for , and . To study the posterior distribution, we implemented a Markov Chain Monte Carlo (MCMC) algorithm with 100,000 iterations, taking a burn–in of 10,000 samples and a thinning gap of 50 samples.

.

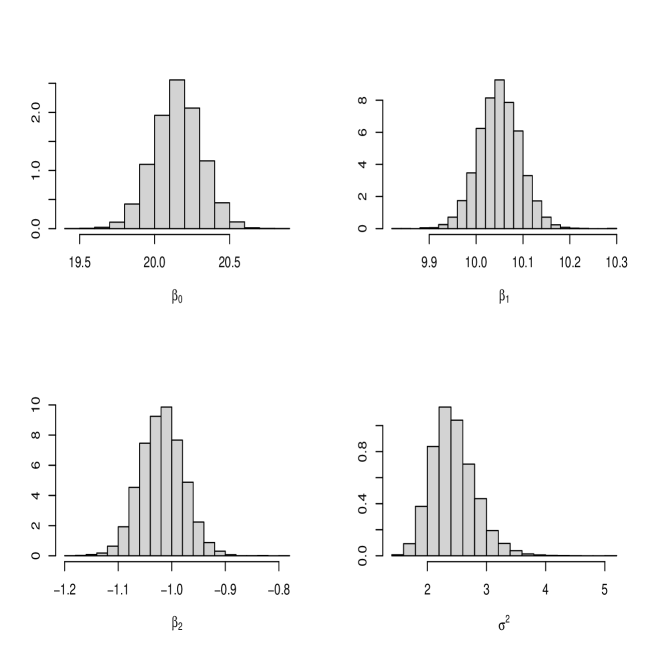

In Fig. 4 we present the histograms of the four marginal posterior samples, while in Table 8 we report the corresponding posterior summary statistics.

| Parameter | Median | 95% C.I. |

|---|---|---|

| 20.15 | (19.84, 20.47) | |

| 10.05 | (9.96, 10.14) | |

| -1.02 | (-1.10, -0.94) | |

| 2.41 | (1.83, 3.26) |

We see that the true parameter values are well contained in the posterior 95% credible intervals, showing a correct inferential performance of the proposed prior.

3.3.2 Linear regression: Frequentist analysis

To show the performance of the proposed prior, and to compare it to other methods, we have drawn 250 samples of size from a linear regression model with intercept , coefficients and , and variance . The proposed prior is given in (6), and it has been compared with an independent vague prior, that is

where is a diagonal matrix of dimension 3, and has been chosen to be sufficiently large to represent vague prior information. Additionally, to compare the proposed prior to a prior that is considered objective, we have used the following version of Zellner’s prior (Zellner, 1986)

where has been calibrated to be 500, and is the design matrix. In Table 9 we have reported the (square root) relative squared error from the maximum a posteriori (MAP) under each of the three prior distributions. It is easy to see that the values are virtually the same.

| Parameter | Lomax | Vague | Zellner’s |

|---|---|---|---|

| 0.998 | 0.998 | 0.998 | |

| 1.000 | 1.000 | 1.000 | |

| 1.001 | 1.002 | 1.001 | |

| 1.098 | 1.095 | 1.094 |

In Table 10 we report the coverage of the 95% posterior credible intervals under each prior. Again, the performances of the prior distributions are almost identical.

| Parameter | Lomax | Vague | Zellner’s |

|---|---|---|---|

| 0.95 | 0.94 | 0.95 | |

| 0.97 | 0.96 | 0.97 | |

| 0.97 | 0.98 | 0.98 | |

| 0.93 | 0.92 | 0.92 |

4 Discussion

In this paper, we have presented a general approach to the specification of a multidimensional objective prior distribution. The prior is proper, as it is a multivariate Lomax distribution, and has some appealing coherency properties consisting on the fact that all joint, marginal and conditional distributions are also Lomax.

Through the analysis of both simulated and real data, we have showed how the proposed prior behaves in different scenarios, including when the data is assumed to be distributed as a Weibull or a Dagum, as well as when a linear regression model is considered. In all cases, the multivariate prior performs as well as the competing solutions and, for the Weibull and the Dagum cases, it actually outperforms the alternative priors.

An interesting final remark related to linear regression models, is that the multivariate Lomax on the coefficients produces a result that can be compared with the LASSO regression. In fact, it can be noted that the multivariate Lomax is a mixture of independent Laplace densities with respect to the exponential distribution. That is,

| (7) |

where is a Laplace density with location zero and scale parameter . If we apply the above (7) to a lineal regression model, we would then need to minimise the following function

which can be compared to the LASSO minimising function, for which the last term would be , instead of . The idea is that having the penalty term in the log scale, would result in more robust estimates. More on this can be found in Appendix B.

References

- Bayarri et al. (2012) M. J. Bayarri, J. O. Berger, A. Forte, and G. García-Donato. Criteria for bayesian model choice with application to variable selection. The Annals of Statistics, 40(3):1550–1577, 2012. ISSN 00905364, 21688966.

- Berger et al. (2009) J. O. Berger, J. M. Bernardo, and D. Sun. The formal definition of reference priors. The Annals of Statistics, 37:905–938, 2009.

- Bernardo (1979) J. M. Bernardo. Reference posterior distributions for bayesian inference. Journal of the Royal Statistical Society. Series B (Methodological), 41(2):113–147, 1979.

- Bregman (1967) L. Bregman. The relaxation method of finding the common point of convex sets and its application to the solution of problems in convex programming. USSR Computational Mathematics and Mathematical Physics, 7:200–217, 1967.

- Consonni et al. (2018) G. Consonni, D. Fouskakis, B. Liseo, and I. Ntzoufras. Prior distributions for objective bayesian analysis. Bayesian Analysis, pages 627–679, 2018.

- Dagum (1975) C. Dagum. A model of income distribution and the conditions of existence of moments of finite order. Bulletin of the International Statistical Institute, 46:199–205, 1975.

- Durbin and Koopman (2001) J. Durbin and S. Koopman. Time Series Analysis by State Space Methods. Oxford University Press, Oxford, England, 2001.

- Ellah (2012) A. H. Ellah. Bayesian and Non-Bayesian Estimation of the Inverse Weibull Model Based on Generalized Order Statistics. Intelligent Information Management, 4:23–31, 2012.

- Fernández et al. (2001) C. Fernández, E. Ley, and M. F. Steel. Benchmark priors for bayesian model averaging. Journal of Econometrics, 100(2):381–427, 2001.

- Hutchinson (1979) T. P. Hutchinson. Four applications of a bivariate pareto distribution. Biometrical Journal, 21(6):553–563, 1979. doi: https://doi.org/10.1002/bimj.4710210605.

- Jeffreys (1961) H. Jeffreys. Theory of Probability. Oxford University Press, Oxford, England, 1961.

- Kass and Wasserman (1999) R. E. Kass and L. Wasserman. The selection of prior distributions by formal rules. The Journal of the American Statistical Association, 91:1343–1370, 1999.

- Liang et al. (2008) F. Liang, R. Paulo, G. Molina, M. A. Clyde, and J. O. Berger. Mixtures of g priors for bayesian variable selection. Journal of the American Statistical Association, 103(481):410–423, 2008.

- Lindley and Singpurwalla (1986) D. V. Lindley and N. D. Singpurwalla. Multivariate distributions for the life lengths of components of a system sharing a common environment. Journal of Applied Probability, 23(2):418–431, 1986. doi: 10.2307/3214184.

- Liseo (1993) B. Liseo. Elimination of nuisance parameters with reference priors. Biometrika, 80:295–304, 1993.

- Nawash et al. (2017) S. Nawash, S. Ahmad, and A. Ahmed. Bayesian analysis of dagum distribution. Journal of Reliability and Statistical Studies, 10:123–136, 2017.

- Nayak (1987) T. K. Nayak. Multivariate lomax distribution: Properties and usefulness in reliability theory. Journal of Applied Probability, 24(1):170–177, 1987. ISSN 00219002.

- Ovcharov (2018) E. Ovcharov. Proper scoring rules and bregman divergence. Bernoulli, 24:53–79, 2018.

- Sun (1997) D. Sun. A note on noninformative priors for Weibull distributions. Journal of Statistical Planning and Inference, 61:319–338, 1997.

- Walker and Villa (2021) S. G. Walker and C. Villa. An objective prior from a scoring rule. Entropy, 23(7), 2021.

- Zellner (1986) A. Zellner. On Assessing Prior Distributions and Bayesian Regression Analysis with g Prior Distributions. In Goel, P.; Zellner, A. (eds.). Bayesian Inference and Decision Techniques: Essays in Honor of Bruno de Finetti. Studies in Bayesian Econometrics and Statistics. Vol. 6., pages 233–243, 1986.

- Zellner and Siow (1980) A. Zellner and A. Siow. Posterior odds ratios for selected regression hypotheses. Trabajos de Estadística y de Investigación Operativa, 31:585–603, 1980.

Appendix A Mathematical details

Define and where, for

and likewise for . We consider the divergence between probability measures and to be the Bregman divergence (see Bregman (1967) and Ovcharov (2018)):

| (8) |

where and are the densities associated with and , respectively, and

| (9) |

for some continuously differentiable convex function on .

Lemma 1

The corresponding Bregman score function is given by

under the assumption that the extremum values for

disappear for each and satisfies

| (10) |

Proof. The condition in the statement of the Lemma allows for an integration by parts of for each . Hence, we can rewrite (8) as

which identifies the score function as given, with satisfying the constraint provided in the statement of the Lemma

To meet the constraint for we define to be

and for any density on . Note that the first and second partial derivatives are

so the Hessian matrix has determinant

and therefore is convex for whenever is odd.

Let

| (11) |

Proof. We present the proof in the case of , for higher dimensions the math follows likewise. In the following and . Now

and

and

showing that condition (10) is satisfied.

Appendix B More on the Alternative to LASSO

Here we discuss the idea of regularization using the penalty term for variable selection, so the aim is to minimize

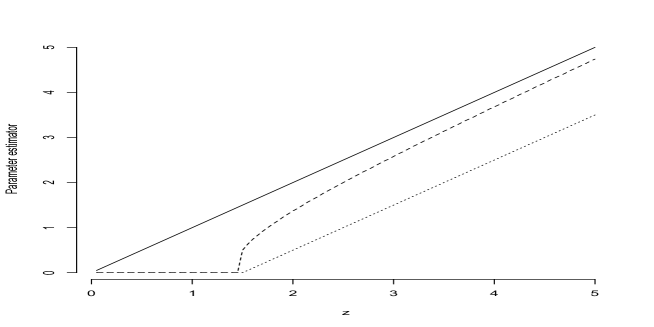

for some . It is easier to see the consequences of using , rather than the more usual which characterizes the LASSO, if we move to one dimension, for which the problem reduces to minimizing

Strictly, this is assuming that and .

The solution to this is easy to find:

if and

if .

In many aspects this solution is similar to the LASSO problem, i.e. to minimize

for which the solution is for , and is for and for . Hence, as , for example, the LASSO estimator never returns to the standard unbiased estimator . However, for the penalty it does. We see that as , so

It is important to note that both the LASSO and the log penalty achieve for . Hence, it is when that we should focus on, and the simple fact here is that for the log penalty estimator is close to which itself is closer to the true parameter.

To conduct such an experiment, we took and sampled

where the are independent standard Normal random variables. Computing , we obtain the estimators based on the LASSO, , and the log penalty, , and over a repeat of such an experiment 1000 times we get a mean square error for each estimator; i.e. and . Every scenario results in a smaller compared with . For example, with and , we obtain and . Keeping and now setting we get and . These improvements are based on the fact that for we have and for it is that . See Fig. 5.

With we get indicating in every case. If we keep and now take we get and . This latter result is easy to explain due to the closer the LASSO estimator is to 0 when . However, when the log penalty estimator provides a smaller mean square error.