Part

#2. #2 \DeclareSourcemap \maps[datatype=bibtex] \map \step[typesource=techreport, typetarget=report] \stackMath

Profit-shifting Frictions and the Geography of Multinational Activity111We wish to thank James Albertus, Pierre Boyer, Michael Devereux, Rafael Dix-Carneiro, Peter Egger, Clemens Fuest, Philipp Kircher, Marko Köthenbürger, Niels Johannesen, Julien Martin, Philippe Martin, Nora Paulus, Nadine Riedel, Florian Scheuer, Juan Carlos Suarez-Serrato, Gabriel Zucman and seminar participants at Banque de France, City University of London, CESifo, CREST, ECARES, ETH Zurich, European University Institute, Geneva, Kiel, Moscow Higher School of Economics, Nottingham, OECD, Paris 1, Paris School of Economics and at the ERWIT conference, the Villars CEPR Workshop on International Trade, the Mannheim Taxation Conference, the NTA Congress, the CESIfo Area Conference on Public Economics, the 31st FIW Workshop, the Mainz “Shaping Globalization” Workshop, the ECARES Workshop on International Corporate Taxation, and the NBER Business Taxation in a Federal System Conference for useful comments and discussions. We thank the Booster program of the ENS Paris-Saclay for financial support. We thank Baptiste Souillard for his contributions to the earlier stages of this project. Felix Samy Soliman provided excellent research assistance. This paper is accompanied by online supplemental material available on our webpages.

Abstract

International tax rules are commonly viewed as obsolete as multinational corporations exploit loopholes to move their profits to tax havens. This paper uncovers how international tax reforms can curb profit shifting and impact real income and welfare across nations. We introduce profit shifting and corporate taxation in a quantitative model of multinational production. The model delivers "triangle identities" through which we recover bilateral profit-shifting flows. Our estimates of both tax-base and profit-shifting elasticities, together with profit-shifting frictions, govern how taxes shape the geography of production and profits. Our model accommodates a rich set of corporate taxation scenarios. A global minimum tax would be beneficial for welfare since it would increase the public good provision and encourage countries to raise their statutory corporate tax rates. Instead, a border-adjustment tax that eliminates profit shifting could result in welfare losses.

Keywords: Profit Shifting; Tax Avoidance; Tax Havens, International Tax Reforms; Minimum taxation; DBCFT; Multinational firms.

JEL codes: F23, H25, H26, H32, H73.

1 Introduction

The current tax system has inherited the broad principles the League of Nations set out in 1928. Based on separate accounting, it treats multinational corporations (MNCs) as a loose collection of legal entities across different host countries. Mounting empirical evidence shows that MNCs exploit outdated international tax rules to shift profits to low or no-tax jurisdictions and avoid taxes.666A large literature has documented the use of low-tax jurisdictions and, in particular, tax havens by multinational firms. See for instance [112], [28], [48], [10] or [115]. Many papers have also discussed how these tax havens are used for tax avoidance. See for instance [43] for a general perspective, [82] for a meta-study, [34], [107], [88], [104], [14], [62] on U.S. multinational firms. In response, international taxation is undergoing an important reform supported by the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting ([68]). While this reform is meant to reduce the erosion of government tax revenues, its impact is hard to evaluate without considering the responses of multinational corporations regarding the location of their real activities and profit shifting.

In this paper, we build a general equilibrium model of multinational production (MP) to study the consequences of changes in corporate tax rates and taxing rights allocation for the location and amounts of real resources and reported incomes of multinational corporations. In addition to endogenous country characteristics (market potential, production costs) and determinants of trade and investment, our model features profit-shifting frictions (i.e., the cost of moving profits from a production country to a low-tax jurisdiction) that impact the location choices of MNCs.777These determinants include, for instance, bilateral trade and investment frictions ([4], [52]) or corporate taxes ([45], [46], [1], [66]). We discipline the model through a new theory-consistent methodology to calibrate bilateral profit-shifting frictions. Our framework is tractable and readily applies to a broad range of tax policy scenarios using widely available data. Importantly, it allows us to evaluate the effect of international and domestic tax reforms on real activity and welfare, accounting for the relocation of firms in general equilibrium.

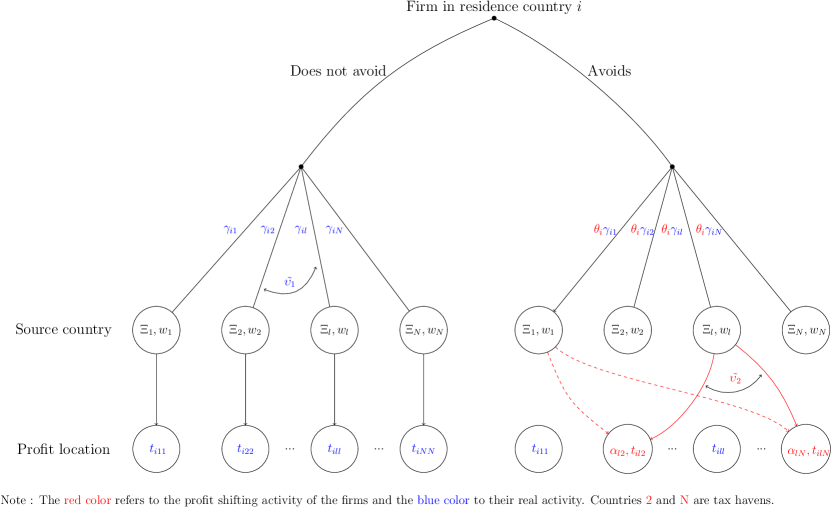

In the model, the location of multinationals’ real activity depends on the ability of firms to shift their profits to tax havens. We allow firms to choose production, investment, and profit shifting jointly. Firms choose their production location based on real economic forces (productivity of the production country, proximity to demand, wages) and profit-shifting forces (e.g., proximity to tax havens). We let profit-shifting frictions be bilateral to reflect different profit-shifting technologies, bilateral communication costs, and compatibility between tax and legal systems of the source and tax haven countries. Our model delivers standard gravity equations for trade flows and multinational production, but it also features a gravity equation for bilateral profit-shifting flows. These equations are then used to calibrate the model’s key tax elasticities. These elasticities and profit-shifting frictions govern how international tax reforms affect firms’ profitability in a given location and reshape the geography of global production and profit shifting.

The calibration of our framework requires estimates of bilateral profit-shifting flows. We proceed in two steps. First, we estimate a gravity model for direct investment income flows across countries, including the existence of tax havens as a predictor. We then use the estimated model to compute the counterfactual direct investment income flows without tax havens. The difference between the model and counterfactual predictions corresponds to the profits shifted to tax havens for each residence country. In the second step, we use a set of model-consistent relationships - which we refer to as “triangle identities” - between residence, source, and haven countries to recover the distribution of bilateral profit-shifting flows. Our methodology highlights the role of geography in determining bilateral profit-shifting flows.

Our framework allows us to quantify two important objects of interest. First, we estimate profit-shifting frictions and find them to be substantial: on average, shifting profits from a residence country to a tax haven through a source country generates an increase in the production cost of 23%, all else equal.888Anecdotal evidence confirms that these costs can be substantial. For example, according to the investigations of the U.S. Permanent Subcommittee on Investigations, Caterpillar paid more than $10 million annually to the consulting firm PwC to set up its Swiss tax planning strategy ([114], p.42). Note that these consulting fees constitute a set-up cost and not the entirety of the expenses for tax planning in this case. By comparison, the frictions associated with multinational production are found to raise costs by 40%. These costs can be decomposed into a bilateral component that depends on the source country-tax haven pair and on the unilateral ability of residence countries to reduce their firms’ profit-shifting costs.999We show that the U.S. and some European countries have better abilities to reduce their firms’ profit-shifting costs than other residence countries. This finding echoes the recent literature that shows that U.S., European, or Chinese firms are more ”aggressive” than firms from other countries ([42], [115]). Our estimated bilateral frictions explain 27% of the variation in profit-shifting costs.

Second, our structural gravity framework allows the estimation of two distinct tax elasticities: one for the (reported) tax base and one for profit shifting. We find an elasticity of profit shifting approximately thrice as large as that of the tax base.101010We also extend our model and allow for a variable elasticity of profit shifting. Profit shifting becomes more elastic when the tax rate differential between a non-haven and a tax haven decreases. This approach speaks to the recent results of [11]. We validate our calibration of the profit-shifting elasticity using estimations based on alternative datasets on i) profit shifting from [115] (TWZ hereafter); ii) country-by-country reporting from the OECD; iii) a new sample of bilateral reported pre-tax income and bilateral effective tax rates constructed using firm-level data.

Next, we use the model as a laboratory for counterfactual policy experiments. We start by showing that the closure of a tax haven has a negative impact on the real income of non-haven countries. We attribute this effect to profit-shifting frictions that shape the reallocation of profits across tax havens and, consequently, affect the location of multinational production through their interaction with MP frictions.

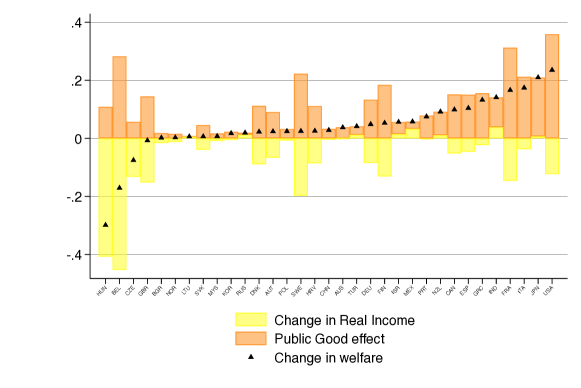

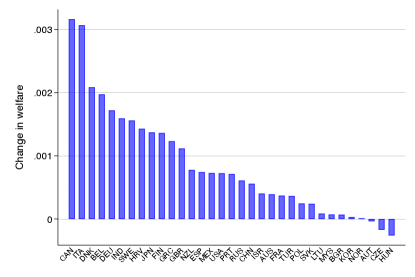

We then use our model to evaluate the impact of a global minimum tax, in line with the second pillar of the OECD agreement signed in October 2021. Implementing a minimum tax increases the tax revenues from multinational firms’ profits. For the U.S., it corresponds to an increase in corporate tax revenues by about 4%. While a response from tax havens reduces these gains by half, they do not fully eliminate them because the reform lowers the return on engaging in profit shifting: firms’ endogenous response to the minimum rate leads to an increase in the corporate tax base of non-haven countries.111111The expected response of tax havens to match the minimum rate has started to materialize, see, e.g., the announcement of the Irish government [56]. The reform’s overall impact is best analyzed by disentangling its effect on private consumption from that on the provision of public goods. The latter unambiguously increases through a larger collection of tax revenues. The former, however, is more complex. While the reform would reduce the dispersion in tax rates across jurisdictions, allowing location decisions to reflect countries’ fundamentals better, the overall effective tax rate increase may also encourage headquarters to exit non-havens and/or relocate to tax havens. Our results suggest that anti-abuse laws targeting corporate inversions can help mitigate the reform’s adverse effects.

Combining private consumption and public-good provision in a welfare function informed by the data, we typically find a gain from a global minimum tax. We also examine whether non-haven countries would have an incentive to deviate from a global residence-based minimum tax, holding their preferences for public-good provision constant. We find that a global minimum tax rate reduces the cost of increasing the statutory rate because such a reform would limit the erosion of the tax base through profit shifting. Consequently, countries are incentivized to increase their tax rates unilaterally.

Importantly, we find that a global minimum tax set at 15% does not eliminate profit shifting. Our estimates suggest that it would reduce profit shifting from the U.S. by at most 30-40%. This raises the question of whether more ambitious designs, such as the Destination-Based Cash Flow Tax (DBCFT hereafter), would be preferable. This proposal replaces the corporate income tax with a border-adjustment tax. Since firms’ tax burden becomes entirely determined by the location of their sales, most standard profit-shifting strategies become inoperative. Our quantitative analysis of DBCFT brings back a trade-off between private and public consumption. Compared to a global minimum tax, however, the most favorable parameters of such a policy increase real income at the expense of the provision of the public good, leading to a negative impact on welfare. We also find that the design of DBCFT is not immune to significant distortions, with low DBCFT rates generally preferable for private consumption.

Related Literature.

Our paper is related to the literature estimating profit shifting. To the best of our knowledge, [115] is the only paper that provides estimates of bilateral profit-shifting flows.121212A large literature focuses on profit shifting of U.S. multinational firms ([112], [74], [107, 108], [104], [14], [49]), or provide estimates at a global scale ([113], [42], [75]). Their methodology infers profit shifting by comparing the profitability of domestic and multinational firms in tax havens. This profit premium is then allocated to country pairs using mainly bilateral excess trade in services between non-haven countries and tax havens. To compute bilateral profit shifting, we rely instead on bilateral excess FDI income and a model-consistent bilateral allocation of profits shaped by the tax base and profit-shifting elasticities. Our methodology allows us to remain agnostic on the channel through which profit shifting occurs.

Empirical studies have found significant real effects of international taxation, i.e., an impact of corporate tax reforms beyond changes in tax revenues ([47], [35], [70], [25, 26], [13]). We introduce profit-shifting frictions into a quantitative model to examine changes in corporate taxation and taxing rights on income and welfare distributions.

A burgeoning literature evaluates international tax reforms ([50]). The reforms of international taxation and their potential impacts are discussed in [39], [55] and [29]. Most of the literature evaluates the so-called Pillar II i.e. the introduction of minimum taxation. [67] and [6] propose estimations of the expected tax revenue gains from implementing Pillar II. None of these contributions allows for real and profit-shifting responses from multinational firms, nor general equilibrium effects. Moreover, they focus on tax revenues only. A notable exception is the contemporaneous and independent work of [33], whose model is based on the location of intangibles from high-tax to low-tax regions and calibrated using TWZ’s data on profit shifting. Relative to this literature, our methodology allows us to recover profit-shifting flows while remaining agnostic about its channels. Our model also allows us to quantify the impact of these reforms on welfare and the incentive for countries to adjust their tax rate post-reform. Our quantitative exercise is made possible by estimating a new elasticity for paper profits. To our knowledge, our paper is also the first effort to benchmark the current reform against the DBCFT proposal within a single framework.

On the theoretical side, the papers of [53], [57], and [60] have used tax competition models to investigate the impact of minimum taxation. [60] shows that global minimum taxation leads to positive welfare gains for non-havens when the minimum tax rate is sufficiently high to eliminate profit-shifting. [53] show conditions under which the reform might also benefit low-tax countries. Both models do not consider the real responses of multinationals, which might influence welfare results. [57] incorporate these responses in a three-country model and show that the impact of minimum taxation depends on the use of other incentivizing instruments by governments, such as subsidies. We find that welfare changes are mostly driven by how foreign-owned firms react to a change in taxation. Studying the incentive of governments to change taxes after the implementation of minimum taxation, we find that the majority of them would gain by increasing their taxes, in line with the results in these tax competition models.

Last, our quantitative analysis builds on recent advances from the quantitative trade and economic geography literature. We build our model from a multi-country Krugman-type model à la [51] augmented with multinational firms and profit shifting. The patterns of trade and multinational production have received a lot of attention ([4], [52]) with applications to corporate taxation ([71], [37], [76]). None of these papers, however, recover bilateral shifted profits, nor do they estimate the elasticity of profit shifting. Relatedly, they do not consider bilateral profit-shifting frictions, which we found to be sizeable. We also introduce a border-tax reform in the spirit of DBCFT which we benchmark against a global minimum tax. We show that the deviations from Lerner symmetry that arise are quantitatively important. Our results point to important distortions that low tax rates can mitigate at the expense of public good provision.

We proceed as follows: in Section 2, we present the model used for the counterfactual analysis. In Section 3, we show how the model guides the estimation of bilateral profit shifting and our elasticities. In Section 4, we estimate the two corporate tax elasticities that govern the location of real activities and profit shifting as well as profit-shifting frictions. In Section 5, we present the counterfactual results. We conclude in Section 6.

2 Model

This section describes the model we use for our counterfactual analysis. The model introduces tax havens and the ability of firms to shift profits. It guides the empirical estimation of both key elasticities that determine the responses of multinational corporations to corporate tax reforms.

2.1 Set-up

Structure of the Model.

The world economy comprises countries, among which are labeled “tax havens”. Each country is endowed with labor, the unique factor of production. The workers are immobile across countries. They inelastically offer one unit of labor paid . An endogenous number of corporations operate under monopolistic competition. Each corporation designs and produces a single variety that can be sold in any country. The set of varieties supplied in country is .

Demand.

The demand for any variety in at price is given by . The price-elasticity of demand is ; denotes total expenditures; is the price index given by Real expenditure is given by .

Pricing-rule.

A firm with productivity sets its headquarter in a residence country , sources its production in one source country , and serves all destination markets through local sales or exports. Under CES preferences and monopolistic competition, the profit-maximizing markup equals and is independent of the destination market. Labor costs in and a set of frictions described below determine the firm’s production costs and profitability.

Frictions and taxation.

When the source country and the residence country differ, the cost to produce abroad involves a friction , which reflects a technology transfer from the headquarter. Serving foreign destination markets comes with trade frictions for iceberg transport costs. Neither producing nor serving the destination market requires the payment of a fixed cost. Therefore, firms serve all markets and . The geography of a source country , its economic size, and that of its trade partners adjusted by trade frictions are summarized by the endogenous market potential of country , [51]. In the absence of profit shifting, taxes are levied where production takes place, country , at the rate , and the reported tax base reflects the location of the actual economic activities.

In our model, MNCs producing in non-haven country can book their profits in tax haven . We allow tax haven to host and tax profits of foreign firms at the rate without requiring their physical presence, i.e., a production site. When shifting their profits, we assume that firms incur a bilateral cost . There are various reasons to expect these costs to be heterogeneous across production countries or tax havens. For example, these costs can subsume heterogeneity across production countries , e.g., different sector composition and sectoral differences in profit-shifting abilities, which we do not model. Similarly, they can capture differences across tax havens . Havens differ in characteristics that facilitate profit shifting, like communications infrastructures or the legal technologies they offer to foreign firms (e.g., reduced incorporation time and costs, opacity and secrecy, accounting rules, and treaty network). Our reduced-form friction goes further by allowing these determinants to be bilateral, so the cost of shifting profits to a tax haven differs whether they stem from production that is sourced in the U.S. or, for instance, in France.131313This is consistent with recent evidence about the sectoral and geographical specialization of tax havens discussed, for instance, in [91], [12] or [62].

Profits.

We denote global post-tax profits of a corporation from with productivity producing in booking profits in and selling its goods in all countries as

| (1) |

The term denotes the global revenues of a firm in the triplet . These revenues turn into pre-tax profits with the standard relationship that the sales-to-profit ratio is governed by the elasticity of demand . This parameter simultaneously governs profitability and the curvature of demand, meaning that all firms in the world have the same sales-to-profit ratio. As this is counterfactual, anticipating the calibration of the model, we separate these two by introducing a production-country-specific wedge between sales and profits. Firms producing in have a sales-to-profit ratio equal to . We return to the calibration of and in Section 3.

Finally, we allow the tax rate to be trilateral. For instance, taxing rights at the origin matter when discussing ongoing reforms, e.g., the global minimum tax reform, which gives taxing rights over the tax deficits in tax havens to residence countries .

Importantly, we assume that each firm books all its profits in a single tax domicile. This assumption implies that at the micro level tax avoiders’ profits in bunch at zero, consistent with [10]. Aggregate bilateral profit-shifting flows then result from the aggregation of heterogeneous profit-shifting patterns across firms.

2.2 From micro to macro

Firm heterogeneity.

We parametrize the distribution of and tax avoidance abilities to relate our model to bilateral macroeconomic flows, e.g., trade shares, multinational production shares, and profit shifting. We write the model with the understanding that further micro heterogeneity at the firm level would be subsumed in sufficient statistics as in [3]. For instance, despite its simplicity, our model retains gravity patterns for both trade and multinational production flows. We leverage this minimal structure to incorporate profit-shifting flows to tax havens.

We introduce firm heterogeneity as follows: in each residence country, firms decide whether to enter or not, i.e., to set up a headquarter in upon the payment of a sunk cost .141414Sunk entry costs can be country-specific. Note that already absorbs such variations. Entrants find out how productive they would be when locating their production facility in any country and recording their profits in any country (where is equal to means that the firm does not shift profits abroad). We assume that firm productivity has two components. The first component, , is deterministic and inherited from the residence country . The second component is idiosyncratic, specific to both the source country and the location of profits . A firm resident in , sourcing production in and booking profits in , makes post-tax profits .

Parametrization.

Building on [64], we consider a multivariate -Fréchet distribution of productivities with scale parameters and a homogeneous correlation function so that the draws by country are distributed according to the following c.d.f.:

where

with and denotes a matrix with generic entry .

The function determines the substitutability across pairs and, therefore, the mobility of the tax base and paper profits. We make a technical assumption on the exact form of to obtain two properties. First, the above expression assumes : it allows for a higher elasticity for paper profits vis-à-vis the elasticity of the tax base. As will become clear below, this assumption comes down to assuming that profits from tax-avoiding firms are more elastic to corporate taxes. The underlying idea is that it is harder to move production plants than P.O. boxes for profit booking. Second, we let the correlation functions be specific and governed by . This allows for different residence countries to have different profit-shifting intensities. A lower increases the likelihood of a firm with residence-country engaging in profit shifting. It can thus be interpreted as an inverse measure of a residence country’s “aggressiveness” in profit shifting.151515Our theoretical definition of aggressiveness echoes the empirical strategy of [110] who test whether “MNCs differ in the aggressiveness of their tax planning depending on the country of their headquarters” (p.8). The tax “aggressiveness” parameter, , reflects the headquarters’ different abilities to reduce the costs of shifting profits.

Sourcing and profit-shifting decisions.

After observing the draws, firms from select a unique pair that maximizes their profits. A firm from chooses its profit-maximizing production site tax haven pair :

| (2) |

Formally, this choice depends on i) each firm’s idiosyncratic profitability , which reflects firms’ production and tax-dodging technologies when operating through a source-haven pair , ii) bilateral frictions between the residence, source, destination, and tax havens such as , and iii) country-specific variables such as the profitability wedge , labor costs , market potentials , and iv) the trilateral tax rates .

2.3 Equilibrium

The probability for a firm from country to locate its production in and book its profits in is:

| (3) |

where encompasses corporate income tax rates and other determinants of firms’ location choices are contained in .

We denote by the partial derivative of with respect to the term and, with a slight abuse of notation, we denote by the correlation function evaluated at .

Expression (3) results directly from [65]’s discrete choice framework using Generalized Extreme Value distributions (GEV).161616To obtain the above formula, note that using (1), profits from a residence country follow a multivariate -Fréchet distribution with scale parameters and the same correlation function . Using the properties of the GEV again, the expected post-tax profits of a firm headquartered in , taken across all possible pairs , are given by

| (4) |

Given profits, we can build a government’s tax revenue flow. Denote the number of firms incorporated in country , then aggregate post-tax profits of firms from are . To compute pre-tax profits, we note that a firm headquartered in , producing in and booking profits in is subject to the tax rate . As a consequence, post-tax profits correspond to pre-tax profits . Firms from choose the triplet with probability , so the total pre-tax profits are given by . Under a territorial tax regime and in the absence of profit shifting, the subscript can be removed, and the relevant tax rate for country ’s tax revenues is if and zero otherwise. Hence, tax revenues of country are given by . In other words, if taxation is levied where production occurs (country ), then the tax revenues obtained by country are the total pre-tax profits of firms from each country of incorporation that are producing in , multiplied by the tax rate .

The exact shape of tax revenues depends on the taxation regime in the economy. For example, consider instead a minimum tax regime that allows country to tax worldwide profits i) generated by firms from , ii) shifted to tax havens, and iii) taxed at a rate smaller than . Under this taxation regime, country would raise tax revenues from firms producing in and from firms headquartered in paying taxes in a tax haven with a tax rate lower than . Formally, tax revenues are given by , where the first term describes the tax revenues generated by firms producing in and the second term by firms headquartered in booking profits in a tax haven for which the minimum tax rate binds. To encompass all these cases, we write compactly that tax revenues are described by

| (5) |

where is the tax rate relevant for country’s tax authorities .

Production in country aggregates multinational production from all origin countries. Under CES preferences, production is proportional to profits with a factor , hence, we get:

| (6) |

Setting up a headquarter in country involves a fixed entry cost paid in labor. Wages clear the labor market in each country:

| (7) |

The first term corresponds to wages paid to labor used for firm entry, while the second reflects wages paid to workers in the production process. Last, the price index in country can be simplified as follows:

| (8) |

For example, the price index can be low thanks to large and close trade partners. Finally, aggregate expenditures in country result from labor income and corporate income tax revenues:

| (9) |

where are the profits net of entry costs, and the residual imbalances are captured by .171717Whether imbalances are considered to remain constant in absolute terms instead of relative terms does not make a difference for our quantification exercises. The system of equations (5)-(9) determines , , , with a numeraire condition such that . The long-run monopolistically competitive equilibrium determines through a free-entry condition imposing that

| (10) |

2.4 Tax-base and profit-shifting elasticities

The max-stable property of the Fréchet distribution implies that corresponds to the share of profits realized by firms from in .Denote the total sales of firms from selecting the pair . The probability that firms from select the pair is:

| (11) |

Denoting by the worldwide sales of firms from , (11) implies:

| (12) |

Combining our specific function and equations (3), and (12), we obtain the following proposition.

Proposition 1 (Gravity Structure of Multinational Production and Profit Shifting).

The fraction of profits that remain taxable in each source country is given by:

| (13) |

Moreover, the fraction of shifted income generated by firms from that is produced in and reported in tax haven is given by:

| (14) |

As a consequence, from (13), the partial elasticity of the tax base in to is . Moreover, from (14), the partial elasticity of profits shifted from to w.r.t. is equal to .

The proof is relegated to Appendix A.2. The model captures tax competition for paper profits across tax havens. Formally, the multilateral resistance terms in the denominator of (14) show that beyond the characteristics of tax haven , those of the other tax havens also matter for bilateral profit shifting. A decrease in a tax haven’s tax rate triggers two main effects. First, it increases the total share of profits shifted from toward tax havens (see Equation 3). Second, it reshuffles these profits among tax havens (see Equation 14). Some non-avoiding firms in start shifting their profits to and some firms producing in move their production site to and engage in profit shifting. Moreover, some firms that were previously shifting their profits to now switch to tax haven .

This gravity-based profit-shifting enriches the reduced-form set-up à la [112], standard in the corporate tax avoidance literature, in which bilateral profit-shifting abstracts from other tax havens’ attributes and reallocation mechanisms across tax havens.181818In these models, bilateral profit shifting between and is proportional to the difference in tax rates between and . This implies that the elasticity of profit shifting is not constant. In section 4.2, we augment our model to allow for a varying profit-shifting elasticity. We provide a schematic representation of the model in Appendix A (Figure A1).

2.5 Real Income and Welfare

In our model, given the absence of a public good, households derive utility from consuming their real income alone, which, at the country level, measures the efficiency of production of the consumption bundle. This, in turn, depends on the number of varieties available for consumption and the allocation of consumption across goods with respect to their relative costs of production (see [30] for a general treatment of efficiency under monopolistic competition with firm heterogeneity).

Corporate tax policy impacts real income through both these channels: a tax rate hike in one jurisdiction may lower the number of active firms by decreasing post-tax profits but it also distorts the spatial allocation of production across countries. In addition, tax-induced income effects will feed back into market potentials, distorting location probabilities further.

Disentangling quantitatively which channels impact real income is challenging in general equilibrium. For this reason, we start by stressing a simple neutrality result of taxation that will guide our interpretation in Section 5.

Proposition 2 (Residence-based top-up neutrality).

Consider an equilibrium holding fixed the number of firms where hold. A top-up residence-based unilateral tax in an otherwise territorial tax system is neutral on the market equilibrium and, thus, on real income.

To build the intuition for this neutrality result, consider a short-run equilibrium response to a change in tax policy where the number and spatial allocation of headquarters across countries is fixed. Practically, remains constant for all and there is no level effect on the number of available varieties. Firms headquartered in country can change their production location and where they book their profits. Consider a top-up residence-based corporate tax, defined as a residence-based tax , which is levied on profits repatriated to the residence country once corporate taxes have been paid on a territorial basis, i.e., in the source or haven-country at rate . Thus, a firm from , sourcing in and booking its profits in will have pre-tax profits given by . Since the top-up is applied to all firms headquartered in , it does not directly change the relative profitability of different production and profit-booking locations. Formally, , as defined in (3), does not depend directly on . It could, however, change the incentives to locate in a country if it were to distort market access or the equilibrium labor costs . For instance, market access depends on total expenditures and, thus, tax revenues. Plugging (5) into (9) shows that the budget constraint does not depend on . Using (4), we note that pre-tax profits do not depend on either. Moreover, since the top-up is unilateral, it does not change the income of countries . We conclude that the solution of is invariant to the top-up.

Two corollaries may be noted. First, it is immediate to see from this benchmark result that the effect of a unilateral residence-based top-up must be negative in the long run on real income when firms can re-optimize their headquarter entry decision. Such a reform will lead to a decrease in the number of headquarters in country , thereby generating a negative real income effect in the long run.191919 The intuition can be traced back from [31] and [30] in a closed economy: since real income is maximized without any taxes, starting from an equilibrium with taxes features an inefficiently low number of firms. A decrease in the number of firms shifts the equilibrium further away from the first-best. Second, this result helps interpret a unilateral change in a source-based tax regime. Such change is identical to a unilateral residence-based tax change applied to domestic firms and a change in the tax rate applied to foreign producers. Proposition 2 implies that the first-order effect of a source-based change in the tax rate is only driven by foreign firms.

Public Goods Provision and Welfare.

We conclude the model description by introducing a distinction between real income and welfare. The reason behind this extension is that the direction of real income and efficiency changes induced by any reform depends on the status quo level of taxes and, in particular, whether they are too high or too low to begin with. So far, tax rates are not optimized on, namely, the tax rates observed in the data are not an equilibrium of the “tax game”, rather, the allocation defines an equilibrium given the observed tax rates. In principle, we could have a model in which taxes are too low and the reforms, by increasing the tax burden, would move the economy towards preferable outcomes. To discipline our comparison, we extend our model to rationalize the observed data as a Nash equilibrium. This allows us to pin down country-specific motives to obtain tax revenues. We think of this as a stand-in for heterogeneous preferences over public goods or political economy considerations. We remain agnostic on the deep rationales behind these preferences and include real tax revenues as a direct source of utility in our model, which does not distort the decisions of firms and consumers. We then ask what parametrization would reconcile the data as a Nash equilibrium.

Formally, we define the welfare of country as , where, as before, is real income. From the data we back out the vector of such that at the initial equilibrium, under territorial taxation, countries would not have an incentive to change their statutory rate. Namely, must be maximized around the initial tax rates with . Note that, by definition, this pins down a Nash equilibrium. Under this specification of welfare, the vector of implies that non-haven countries have no incentive to change their statutory rate unilaterally. Then, log changes in welfare are , namely a combination of private and public goods consumption.

3 Estimating Profit Shifting

Taking our model to the data requires estimating several parameters. An essential step in our procedure is estimating profit-shifting flows, from which we can back out through a set of structural relations in the model.202020As typical in the literature, we assume that no profit is shifted out of tax havens (, when ). Therefore, we back out the profit-shifting shares for the residence and non-haven country .

Our identification strategy rests on two pillars. The first is a decomposition implied by our model, which we formalize in Proposition 3. We start by noting that equation (3) describes the probability for a firm from to select the pair to locate its production and book its post-tax profits. The firm can either report its profit in the source country () or shift profits from the source country to a tax haven (). We denote by the total post-tax profits declared in by firms from producing in and by post-tax profits shifted to by firms producing in . Total profits - shifted or not - by firms from are denoted , while (resp. ) represents total shifted profits by firms from (resp. from to ). We use the separability of across country pairs to derive accounting equations determining bilateral profit shifting.

Proposition 3 (Decomposition of ).

The following decomposition holds

| (15) |

where is the probability that firms headquartered in shift profits, is the probability that a tax-avoiding firm headquartered in locates production in and is the probability that a tax-avoiding firm producing in books its profits in .

The proof is provided in Appendix B.1. This proposition states that to infer , it is enough to observe three simpler objects: and .

Our strategy’s second pillar helps us identify these objects. First, we show that can be recovered as a function of multinational production flows, of aggregated profit shifting in residence countries and in source countries , and of and . Intuitively, for profits to be shifted from , production must occur in . However, because production and paper profits have different elasticities, the patterns of shifted profits are a distorted representation of real activity: our model implies that this distortion is shaped by (see in Appendix B.2). Second, to pin down , we use the following “triangle identities”: the profits from firms with residence in that are booked in a tax haven must match the profits that they shift from any source country where they operate to a given tax haven . Since our data allows us to compute , we can thus recover the share of profits shifted from to any , i.e., . We formalize this relationship in Proposition 4:

Proposition 4 (Triangle of Profit Shifting).

The following holds

| (16) |

The system shown in (16) gives a set of equations, with the number of non-haven countries and the number of tax havens. Equipped with our estimates of and , we can solve for the set of . Last, it should be noted that our estimates of pin down and thus . Summarizing our methodology, as formalized in Propositions 3 and 4, is readily obtained from , and .

3.1 Data

Our baseline sample consists of 40 countries from 2010-2014, which accounts for 84% of the world GDP in 2014. The sample includes seven major tax havens (Hong Kong, Ireland, Luxembourg, Netherlands, Singapore, Switzerland, and Offshore Financial Centers, an aggregate of smaller tax havens). Our methodology to estimate profit shifting, elasticities, and frictions uses information on bilateral FDI income and multinational production as building blocks. We also use other data sources in the analysis (tax rates, tax havens’ policies, trade, profits, and other national accounts data). Details on the construction of the datasets and auxiliary sources of information are provided in the data Appendix C.

The bilateral FDI income dataset is the first source of information from which we compute profit shifting.212121See also [74, 113, 75] for studies that use the FDI rate of returns in tax havens. The profits shifted to tax haven affiliates are either returned to the high-tax country as dividends or counted as reinvested earnings. To construct our FDI income series, we add up the flows of reinvested earnings in tax havens and dividends from tax havens.

The second important dataset is the multinational production (MP) dataset. This data allows us to construct , the sales resulting from the production in the country by firms headquartered in the country . We use data on country-level production to compute production by domestic firms (). We construct the MP data following [98].

In the following, we sketch our methodologies to calibrate profit shifting and the key elasticities. This procedure requires the calibration of and . We use administrative French firm-level data from the FARE dataset and follow the methodology provided by [85] to estimate firm-level markups. The results give a median markup equal to 17%, which corresponds to .222222This is in line with estimates found in the literature, e.g., [72]. Similarly, [23] find a median markup of around 20 percent using Compustat data. With the estimation of , is then calibrated using the wedge between gross output and profits (corrected for profit shifting). Overall, absorbs any non-labor cost that impacts profits but not sales.

3.2 Estimation of

We now evaluate profit shifting from each headquarter country to each tax haven , . It corresponds to the difference between the predicted FDI income and the counterfactual FDI income that would have been generated if there were no tax haven in our sample. These counterfactual incomes are computed from an equation that regresses FDI income on factors related to gravitational forces, a tax haven indicator, and the effective average tax rate differential between pairs of countries. The complete estimation results and details on the methodology are given in Appendix D.1.

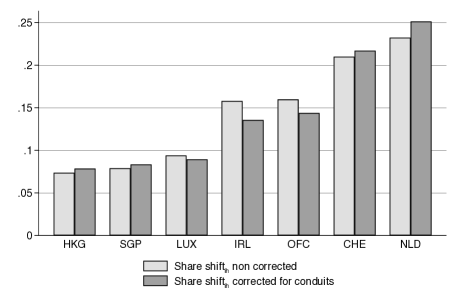

Table 1 presents the tax haven coefficients across different specifications. We aggregate the amount of bilateral profit shifted that we report along with the share of aggregate profit shifting in the sample’s total profit. We use column (2) estimates to compute . In particular, this specification includes Region Tax Haven fixed effects to capture the geographical specialization of tax havens ([61]). The amount of profit shifting could be overstated because some tax havens, like The Netherlands, are used as intermediate locations from where profit might be transferred. We follow [84] to correct the profit-shifting series from conduit-tax havens (see appendix D.2).

| Dependent variable: | |||||

| (1) | (2) | (3) | (4) | (5) | |

| 1.565*** | 2.336*** | 2.767*** | 2.104*** | 1.677** | |

| (0.227) | (0.238) | (0.337) | (0.747) | (0.669) | |

| Gravity Controls | Yes | Yes | Yes | Yes | Yes |

| HQ FE | Yes | Yes | Yes | Yes | Yes |

| HQ FE Haven | No | No | No | Yes | Yes |

| Destination Region FE | Yes | Yes | Yes | Yes | Yes |

| Destination Region FE Haven | No | Yes | Yes | Yes | Yes |

| Observations | 1,444 | 1,444 | 1,444 | 1,444 | 1,212 |

| Pseudo R2 | 0.819 | 0.836 | 0.861 | 0.884 | 0.898 |

| Destination countries | 52 | 52 | 52 | 52 | 52 |

| Implied Aggregate Profit Shifting | 393551 | 397358 | 411327 | 408764 | 380954 |

| Share sample’s profits | 39% | 40% | 41% | 41% | 40% |

Once equipped with , we can compute , the total amount of profit shifting. We estimate it to $397bn, which corresponds to 39% of all profits in the sample. This is in line with TWZ, that report a share of profit shifting that amounts to 36% of global multinational profits. In Appendix D.3, we provide alternative quantifications based on the OECD’s Country-by-Country reporting (CbCR) data. With this alternative source, we also evaluate this share to be about 40%.

3.3 Real activity and profit-shifting elasticities

Armed with the estimated profit-shifting flows, we can use a first set of model relations to estimate the tax elasticities. They will determine how changes in the global tax environment affect entry, production, and profit-shifting decisions. A novelty of our approach is to allow for, and calibrate, two tax elasticities: one for the tax base (governed by ) and one for profit shifting (governed by ). This allows corporate tax changes to induce different responses from real activities and profit shifting. In addition, the model restrictions impose , meaning that profit shifting is more elastic to taxes than real production (which is governed by both and ). This approach is motivated by the recent empirical corporate taxation literature, which emphasizes the non-linear responses of profits to corporate tax rates (e.g., [88], [15], [38], [110]). These papers, however, do not distinguish between profits generated by production activities and shifted incomes. Instead, the elasticity is estimated using data that pool together tax havens (where a large share of profits are shifted) and high-tax countries. Conditional on real activity, their results suggest a larger impact of corporate tax rates on profits for countries with low tax rates than for countries with higher tax rates. This finding is consistent with our setting, where the elasticity of profit shifting to taxes is larger than that of real activity.

To estimate the elasticities, we start by using Proposition 1, rewriting equations (13) and (14) in terms of observables and fixed effects.

Elasticity of the tax base.

The elasticity of the tax base in country , , is obtained by rearranging and estimating the logarithm of equation (13) as:

| (17) |

where is our coefficient of interest. includes bilateral frictions between residence and source countries and the production market’s wage level and size. The regression analysis includes total and per capita GDP (in logs) and gravity-related control variables such as distance, contiguity, and indicators for colonial relationships. The headquarter country fixed effect is . We, therefore, use the variation across source countries to identify our coefficients.

Profit-shifting elasticity.

Taking the logarithm of (14), we obtain:

| (18) |

where is our coefficient of interest. is the tax rate applicable in tax haven to tax-avoiding firms producing in country . This tax rate is not observed as tax havens generally offer legal dispositions that allow effective tax rates to differ from the observed statutory tax rate. We use the OECD’s Country-by-Country reporting (CbCR) data to compute it. This data aggregates (mandatory) firm-level reports informing on the country-by-country breakdown of firms’ accounting information, including taxes paid, turnover and profits. It is gathered by the OECD as part of the Action 13 of the BEPS project and targets large MNEs (revenues larger than 750 million euros).232323This data has been used in other studies on tax avoidance by multinationals ([42] at the macro level, [38] or [15] at the micro-level). The CbCR dataset is publicly available for a limited sample of 25 reporting countries. We use this data to proxy the effective tax rate () by the median effective tax rate observed in each tax haven, . In further exercises reported in section 4.2, we show the robustness of the results using bilateral effective tax rates and alternative data sources.

In Equation (18), comprises information about technology ; bilateral frictions between residence and source countries ; between source countries and the tax havens, ; the source country’s wage and market potential . The last term on the RHS of (18) is a headquarter fixed effect. We add a set of headquarter production country fixed effects, and we parametrize the frictions between the source country and the tax haven with gravity covariates. We also add an index of the tax haven aggressiveness, taken from the TJN’s Corporate Tax Haven Index ([96]), to proxy for the tax avoidance “technology” of tax havens.

As noted earlier, is needed to estimate profit shifting (see Section 3) while it is also estimated using profit-shifting data. To determine its value, we follow an iterative procedure.242424We guess a value of , compute and and use (16) to back out and (15) to compute . We then use the implied profit-shifting flows to update the guess on through (18) and iterate until convergence.

We summarize the methodology covered in this section before diving into the analysis of our empirical results. Given profit shifting and multinational production flows, we can i) estimate the elasticities and , ii) compute the probability that a firm from shifts profits , iii) use data on multinational production and the elasticity to compute the probability that a tax-avoiding firm from locates production in , , iv) use our “triangle identities” to back out the probability that a firm, producing in , shifts profits to , ; and v) use our decomposition in to compute .

4 Profit-Shifting Flows, Elasticities and Frictions

In this section, we discuss our empirical results. We start by describing the estimated profit-shifting flows and their implied elasticities. Finally, we illustrate our estimates of the profit-shifting frictions.

4.1 Profit-Shifting Flows

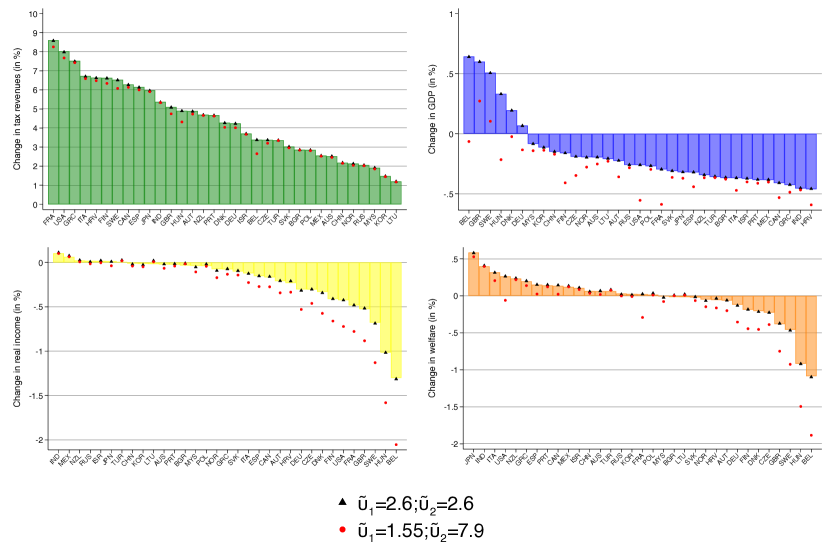

The diagram in Figure 1 displays the estimated profit that has been shifted to tax havens (in the center) according to the residence country (on the left) and the source country (on the right). For visualization, we display the top 10 countries and aggregate the bilateral shares for others.

and from source-country to ().

The figure shows the predominance of residence countries such as the U.S. and, to a lesser extent, Germany, the UK, and France in shifting profits to tax havens. It also shows the importance of European tax havens and, in particular, the Netherlands as a major destination for profit shifting. Furthermore, Figure 1 suggests larger shares of profit shifted from the U.S. as a residence country than as a source. This is also the case for France, Germany, and the United Kingdom but not Japan and China. The pattern displayed in Figure 1 confirms that gravitational frictions shape profit shifting. European tax havens prominently host profits from non-haven countries in the E.U. and the U.S., while China and Japan shift most of their profits to Hong Kong and Singapore.

Comparisons.

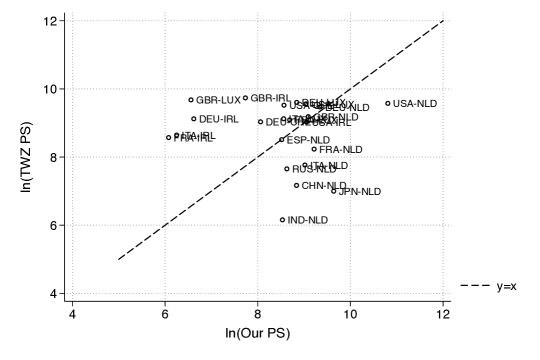

Several papers provide estimates of profit shifting at the production country or tax haven level ([117], [107, 108], [113], [110] and [115]). [115] is the first paper to propose a methodology to compute bilateral profit shifting across pairs of source and tax haven countries. They use the global amounts of shifted profits and an allocation key based on trade in high-risk services to determine profit-shifting between source countries and tax havens.252525In Supplemental Material section A, we briefly discuss the approach followed so far by the literature and especially TWZ. We argue that profit shifting in goods, tax-havens deflated imports and non “high-risk” services are three additional sources that come on top of the excess of “high-risk” services exports and intra-firm interest payments considered in TWZ. We also discuss the robustness of our calibration using inputs from TWZ in Supplemental Material section C.

While the relative rank of source countries using different methodologies proves to be similar, we find the relative position of country pairs regarding profit shifting to be less correlated.

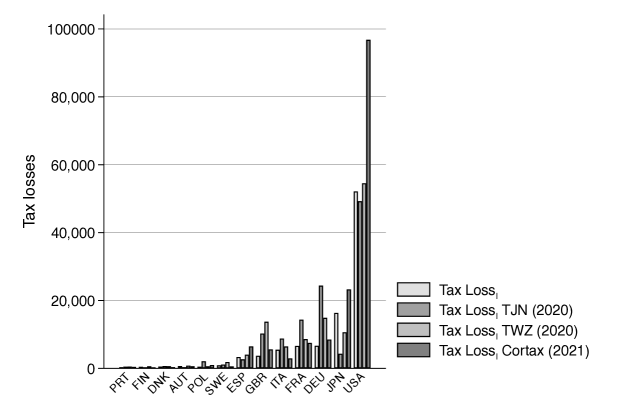

We benchmark our shifted profit flows with these previous estimates. Table 2 reports Spearman’s rank correlations of our vector of estimated profit shifting with different estimates from the literature. In Panel A, we aggregate our bilateral measure of profit shifting for each production country and display the correlations of this vector with unilateral profit-shifting measures constructed by TWZ, the Tax Justice Network ([109]), and the European Commission using the CORTAX model ([105]). We find large positive rank correlations at the unilateral level suggesting a stable relative position of each source country in profit shifting irrespective of the methodology used.

| Source | Correlation | Obs. |

| A. Unilateral profit shifting: | ||

| [115] | 0.90 | 33 |

| [109] | 0.92 | 33 |

| [105] | 0.95 | 21 |

| B. Bilateral profit shifting: | ||

| [115] | 0.61 | 111 |

In Panel B, we compare our estimations with the bilateral estimates of [115]. We restrict our comparison to bilateral estimates for European tax havens as TWZ reports an aggregate for non-European tax havens. We find a strong rank correlation between our bilateral measure and the one of TWZ, slightly above 60%. TWZ’s bilateral allocation of profit shifting mainly relies on exports of services by tax havens. In contrast, we are agnostic about the channels of profit shifting (see section A of our Supplemental Material for a discussion). In our Supplemental Material section B, we provide additional material that compares our profit-shifting estimates with other sources found in the literature.

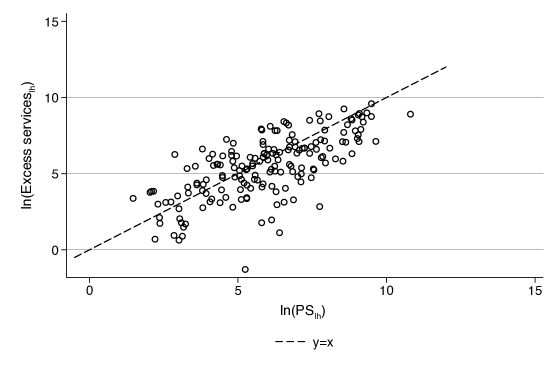

Finally, we propose different robustness exercises in our Supplemental Material section C. We assess the correlation between our profit-shifting allocation and an allocation based on excess trade in services with tax havens only. We find a positive and significant correlation between excessive high-risk services and our theoretically consistent measure of bilateral profit shifting. The Spearman rank correlation coefficient of 0.6 indicates a relatively high correlation between both series but the estimated in this paper is generally larger than the excess of services trade. This result suggests that services trade is an important driver of profit shifting between source countries and tax havens but shall not be considered as its unique determinant.262626 In Supplemental Material Figure C2, we explore the role of the parameters and on the allocation of profit shifting and find that the estimated profit shifting is robust to different calibrations of these elasticities.

4.2 Tax Base and Profit-Shifting Elasticities

Table 3 reports the estimated coefficients and the corresponding parameter elasticities and . In columns (1) and (2), we use the statutory tax rates as the corporate tax variable, while we use the median effective tax rate in columns (3) and (4). We report the result using OLS in columns (1) and (3), and PPML in columns (2) and (4).

| Estimation | Estimation | |||

| Dep. Var. | ||||

| (1) | (2) | (3) | (4) | |

| 2.639*** | 3.047* | |||

| (0.688) | (1.674) | |||

| (Med.) | 7.869*** | 8.625*** | ||

| (0.191) | (1.295) | |||

| Observations | 1,256 | 1,600 | 6,561 | 7,091 |

| Estimator | OLS | PPML | OLS | PPML |

| Gravity controls | Yes | Yes | Yes | Yes |

| country FE | Yes | Yes | No | No |

| i-l pair FE | – | – | Yes | Yes |

| Technology controls | Yes | Yes | – | – |

We find a profit-shifting elasticity, , three times the tax base elasticity, . Our estimate suggests that multinational production - which is governed by both elasticities - is relatively mobile across countries.272727The elasticity of production to MP-frictions would have been assuming . It is somewhat larger than the elasticity found in the literature. For comparison, [52] and [76] estimate an elasticity of 7.7. This implies that the impact of multinational firms’ production and profit-shifting frictions will be downplayed in our quantitative exercises compared to these estimates. For comparability purposes, in table D1 of our Supplemental Material, we also compute the semi-elasticity of the tax base to taxes and of profit shifting to taxes using the same specification as in table 3. We find a semi-elasticity of the tax base of 3.6 and of profit shifting of 8.3. In their meta-study, [82] find that the average semi-elasticity of profits to taxes estimated in studies that use aggregate data is between 2.5 (Table 2, column 3) and 2.9 (Table 2, column 2). Our semi-elasticity of the tax base to taxes, despite being slightly higher than this average, lies in the same range. In their estimation of a non-linear elasticity of profit to taxes using micro-level country-by-country reporting data, [38] find a semi-elasticity of profits to taxes between -10 and -13 when the effective tax rate is close to zero, a situation which typically corresponds to tax haven affiliates. This result confirms large elasticities for profits (essentially paper profits) located in tax havens. Finally, we assess the sensitivity of our counterfactual experiments to alternative calibrations of and in section E of the Supplemental Material.

Profit-shifting elasticity: Robustness.

Overall, there is no direct comparison between our estimate of the profit-shifting elasticities and the literature. [82] show in their meta-analysis that, all else equal, a 1-point decrease in the tax rate corresponds to an increase in reported profits by 1%. In addition, a few studies have estimated the elasticity of reported profits to corporate taxes using country-level data. [44] find a moderate elasticity of the corporate tax base with respect to current effective tax rates (equivalent to 0.2). Using administrative data on U.S. tax filings, a recent study by [19] decomposes the corporate tax elasticity of taxable income into a tax base and a paper profit elasticity. In line with our findings, their results suggest larger profit-shifting reactions to corporate tax than tax-base responses.

So far, our estimation relies on the profit-shifting flows we estimated following the methodology of section 3. To assess the sensitivity of our implied elasticities, we use alternative data sources of income and profit shifting, effective tax rates, and different methodologies. First, we reproduce the results shown in column (4) of Table 3 by using direct information on profit shifting from source to haven countries from [116]. Second, we reproduce the results of Table 3 by using the information on bilateral effective tax rates for the 25 countries reporting in the OECD CbCR dataset. Third, we construct a new sample of bilateral reported pre-tax income and bilateral effective tax rates using micro-level data from the Refinitiv Thomson Reuters Eikon database – hereafter, the Eikon dataset. The dataset allows us to use high dimensional fixed effects and control for unobserved bilateral frictions determining excess profits. It has, however, the drawback of covering only a few countries, particularly tax havens. Details on sample construction are provided in Appendix D.3.

Using data from [115] allows a direct estimation of while the other two sources require us to estimate shifted profits. Therefore, we proceed in two steps using the CbCR and Eikon datasets. In the first step, we estimate the amounts of profit shifted to tax havens. The empirical specification includes bilateral ETRs, gravity controls, and a set of origin year and destination year fixed effects, removing country-specific and time-varying unobserved heterogeneity. Under this fixed effect specification, we cannot identify excess profits based on the tax haven dummy. We follow the methodology proposed by [110], who compute profit shifting to havens based on the hypothetical case that tax havens would have had an effective tax rate (ETR) of 25%. Profit shifting is computed as the difference between the predicted profits and those predicted with the counterfactual tax rates of 25%. In the second step, we regress profit shifting on the , gravity controls, and a set of origin year and destination year fixed effects following the specification of equation (14). When time variation allows, we include pair-fixed effects in both steps.

Table 4 reports a summary of our results. The complete estimation table is reported in Appendix D.3.

| (1) | (2) | (3) | (4) | |

| Data Source | WZ | CBCR | Eikon | Eikon |

| Implied | 10.5 | 8.2 | 8.4 | 5.4 |

| Controls and FE in first and second steps | ||||

| Gravity Controls | Yes | Yes | Yes | No |

| Origin Year FE | Yes | Yes | Yes | |

| Destination Year FE | Yes | Yes | Yes | |

| Pair FE | No | No | Yes |

Note: This table displays alternative estimations of profit shifting and corresponding estimation of . In column (1), we directly use profit-shifting data from [116] (WZ). In column (2), we estimate profit shifting using data from Country-by-country reports (CbCR), and in columns (3) and (4), we use the Eikon dataset. Details on the estimation procedure, additional results, and full tables are provided in Appendix D.3.

In column (1), we use the TWZ estimate of profit shifting to compute following the specification of table 3. In column (2), we use the bilateral ETR computed from the CbCR dataset and assume a constant profit elasticity to the effective tax rate.282828In Appendix D.3, we follow [112], [88] [110] and allow for non-linearities. The results are qualitatively the same. We report the results using the Eikon dataset in columns (3) and (4). Compared to column (3), column (4) reports results using pair fixed effects in addition to origin year and destination year fixed effects. Using alternative samples and calibration, we find that varies between 5.4 and 10.5 compared to in the baseline estimation.

In additional results shown in Appendix D.3, we find that the ratio of profit shifting to total incomes in most samples matches our previous estimates at around 40% of total incomes. We find lower estimates using the aggregated micro-level dataset because it is composed of fewer tax havens. Moreover, only a few firms report profits in tax-haven countries.

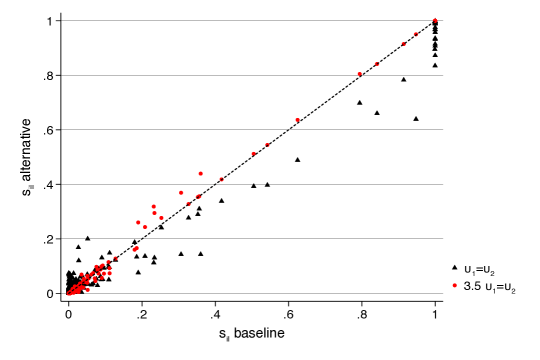

Extension: varying profit-shifting elasticity.

Our calibration of rests on the assumption that the share of profits shifted to tax havens is a constant elasticity function of the corporate tax rate. While this assumption is reasonable for small changes in corporate tax rates, policies like a minimum taxation reform could generate large variations in effective tax rates and tax rate differentials. We refine our parametrization of the profit-shifting elasticity and allow for an additional variable profit-shifting elasticity. We augment our profit-shifting friction with where is a shape parameter. The partial elasticity of profit shifting then becomes . The shape parameter is recovered from the data (see results in Table E1). The estimated is such that the elasticity is below for tax rate differentials above 20 percentage points. This property will have implications for the implementation of the minimum tax rate.292929A higher rate would reduce profit shifting more than proportionally. We observe large elasticities for tax differentials that are smaller than 10%. This result suggests larger responses of profit shifting when the tax differential is small. We implement this varying profit-shifting elasticity to simulate minimum taxation policy scenarios.

4.3 Profit-shifting frictions

In this subsection, we back out the profit-shifting frictions consistent with the observed flows of shifted profits by firms in residence to tax haven from source country . We first detail the procedure and then explore the magnitude and determinants of these frictions.

Identifying Profit-shifting frictions.

We start by noting that, at the calibrated equilibrium, we know profit-shifting probabilities ; taxes and ; frictions ; wages ; market potential ; and our estimated elasticities (see Appendix F for details). We group these in a set of observables denoted . We formalize an important result for the identification of profit-shifting frictions in the next Proposition.

Proposition 5 (Identifying Profit-Shifting Frictions).

At the calibrated equilibrium the following holds

| (19) |

where is a known function of observables and is a normalizing constant such that . We specify both and in Appendix F.

This important result allows us to recover the set of profit-shifting frictions up to a normalization constant . We define as such that when and absent profit-shifting frictions, firms would have an equal probability of engaging in tax avoidance and booking their profits domestically ceteris paribus.

We note that and can be mapped into a marginal cost equivalent . This is the marginal cost increment associated with profit shifting from any to any by firms from if all profit-shifting frictions were such that . In contrast with trade or multinational production frictions, the interaction of the tax base and profit-shifting elasticities implies that bilateral profit-shifting flows do not verify the irrelevance of independent alternatives. The cost of shifting profits from to depends on the profit-shifting frictions between other pairs.

Average profit-shifting costs.

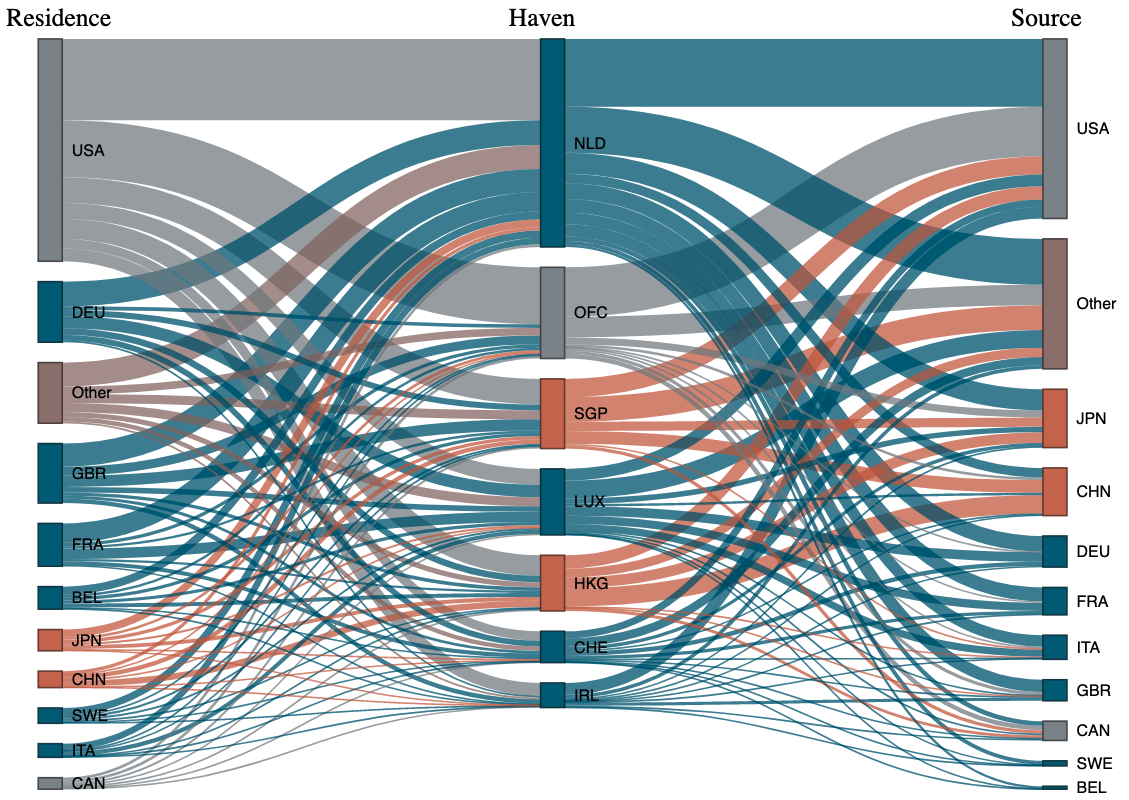

We start by describing the distribution of average between and in Figure 2. We plot the distribution of the profit-shifting cost averaged over (non-haven) countries: .

Conditional on observing profit shifting, the median value of profit-shifting costs calculated in our sample is 1.23. A profit-shifting cost of 1.23 means that shifting from a residence country to a tax haven through a production affiliate generates an increase in the cost of production of 23%, all other things being equal. The friction can be compared to the variable friction , which represents the costs of separating the location of production from headquarters. We find a median value of of 1.40, similar to the multinational production costs of 1.31 provided by [52] for the car industry.

Components of profit-shifting costs: and .

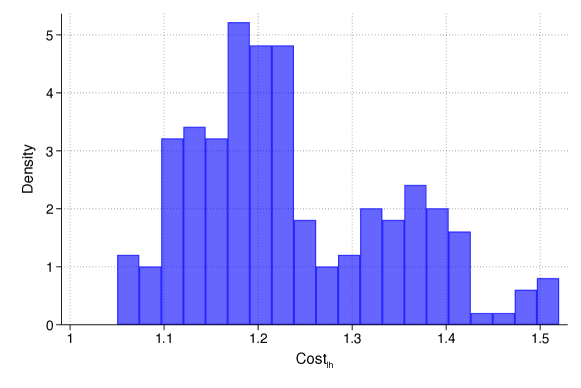

The profit-shifting cost has two components: the tax aggressiveness of the residence country and the bilateral friction . Our model suggests that the costs are separable via a fixed effect for and one for pairs: . The residence country fixed effects correspond to the log of . The source and tax haven dyadic fixed effects capture the bilateral profit-shifting frictions . About 27% of the variation in profit-shifting costs is explained by the (log) bilateral frictions, . 303030Note that the different abilities of each residence country to reduce the costs of shifting profits should be interpreted as deviations from the tax aggressiveness of one reference country that we choose to be the U.S.

In Figure 3, we show the cross-country distribution of . Compared to U.S. MNCs, Turkish firms experience a profit-shifting cost penalty of 35%. Belgian MNCs benefit from a 13% reduction in profit-shifting costs. The differences in tax aggressiveness across residence countries in Figure 3 show the key role of headquarters in firms’ profit-shifting practices.

We conclude with the examination of bilateral profit-shifting frictions. We regress the log of on gravitational variables, tax rates, and the TJN’s Corporate Tax Haven index (CTHI). We show in the Appendix Table F1, that distance between the source and tax haven countries, and other gravitational forces determine . Moreover, profit-shifting frictions are negatively correlated with the TJN’s Corporate Tax Haven indexes and with the corporate tax rate difference between the source and the havens. We also find a negative correlation between the difference in tax rates of the source and haven countries and the profit-shifting friction, controlling for source and haven fixed effects. This points to the importance of introducing a varying profit-shifting elasticity as done in Section 4.2.

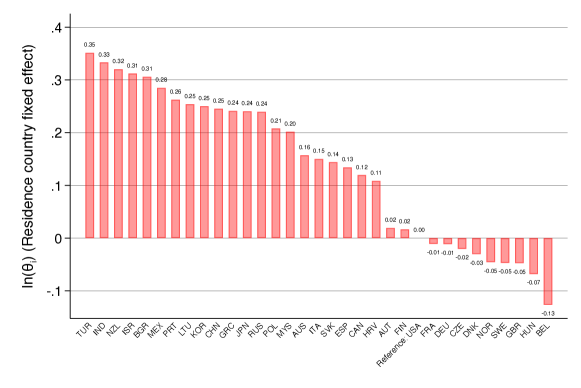

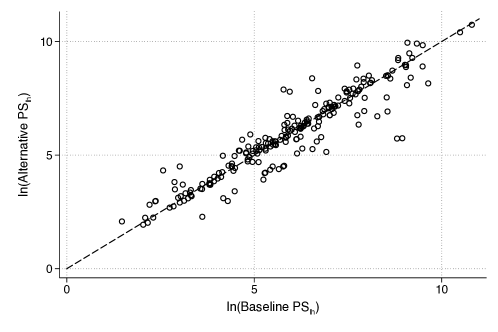

5 Policy Simulations

This section discusses policy simulations regarding tax policy changes in various countries, including their effects on tax revenues, GDP levels, profit shifting, real income, and welfare. It starts by demonstrating the effects of simple tax policy changes to illustrate the model’s key mechanisms. Then, it quantifies different scenarios of minimum taxation and discusses these policies’ short- and long-term effects. Finally, it evaluates the introduction of a border-adjustment tax in the spirit of the DBCFT proposal. The findings are derived using calibrated parameters summarized in Table H1. We assess the external validity of the calibration in Figure H1, and we analyze the sensitivity of the results to different elasticities in the Supplemental Material (section E).

To simulate counterfactual tax reforms, we follow the exact hat algebra methodology popularized by [86] and [20], which consists in writing the new equilibrium in proportional changes w.r.t. the baseline one (see Appendix G for details). We mainly focus on the U.S. as an example throughout the discussion.

5.1 Preliminaries: Model mechanism

Unilateral tax reforms.

What are the effects of a 5% unilateral reduction of U.S. statutory tax rate (from 40% to 38%)? We illustrate our findings in Table H2. The reduction in the U.S. tax rate has a modest positive impact on GDP (+0.33%). All else equal, the U.S. becomes a more attractive production location after the reform. The policy decreases profit-shifting activities (-9.95%) because some U.S.-based firms book their profits in the U.S. after the reform. The cross-country reallocation of production and profit-shifting activities dampens the negative effect on tax revenues. We find a reduction of tax revenue by 3.9%, which also reduces consumers’ income because of lower lump-sum transfers. In this scenario, U.S. production, and labor demand increase, raising workers’ wages. We find a positive effect of the policy on real income (+0.33%) and a slight negative impact on welfare (-0.02%), driven by the loss of tax revenues. This former effect can be decomposed between the effect of a significant positive response of wages (increasing welfare by +0.39%) that is not offset by the negative response of tax revenues (decreasing welfare by 0.08%). The net effect on welfare is driven by the lower provision of public goods as tax revenues decline.

Benchmarking: Closing a tax haven.

What are the tax revenues and real effects of closing a tax haven? We choose Singapore and illustrate the effects on the U.S. We implement this by setting .

The results are presented in the second line of Table H2. Profit shifting reduces by 3.3%. This result comes from the increased costs for some firms to shift their profits to other tax havens. As they face considerable bilateral profit-shifting frictions , they stop shifting profits to tax havens. Tax revenues increase by 0.27%. Consistent with [70], we find additional effects beyond tax revenue. The U.S. GDP loss (-0.01%) is due to the relative increase in the effective tax rate for tax-avoiding U.S. firms. In this scenario, some firms would leave the U.S. leading to a net loss in real income (-0.02%).

In Figure H2, we illustrate the importance of bilateral profit-shifting frictions and gravitational forces in explaining profit shifting to tax havens. In panel (a), we find that closing Singapore induces a larger reallocation of profits to Hong Kong than to Luxembourg or Ireland. In panel (b), we observe that fewer firms engage in profit-shifting activities, which broadens the tax base of countries geographically close to Singapore, such as India, New Zealand, Australia, or Japan. On the other hand, European countries, which are more distant, benefit less from this reallocation.313131In Appendix H.2, we also discuss the scenario in which countries implement effective anti-abuse policies, de facto eliminating profit shifting.

5.2 Minimum taxation

We now study the effects of minimum taxation. The general principle of minimum taxation implies that no foreign affiliate can escape a minimum rate of taxation by declaring its operations in a low-tax jurisdiction. However, implementing minimum taxation poses several challenges, including the allocation of taxing rights. Determining which jurisdictions should have the right to enforce the minimum tax is delicate since it requires taking a stance on whether the value is created in the location of headquarters, the location of research and development, or the place of production of physical output (see [29]). Therefore, the taxing rights could be either allocated to the source or to the residence countries.323232The recent reform of international taxation allocates the residual taxing right on foreign profits to residence countries (see [68]). Allocating taxing rights to residence countries rather than source countries is still debated (see [36]). Moreover, minimum taxation can be implemented unilaterally or multilaterally.

We implement a 15% minimum tax reform where real activities are fully deductible from the minimum tax. In this version, the minimum tax applies to shifted profits only, . This captures the OECD/G20 Inclusive Framework agenda, which aims to tackle the erosion of the tax base through profit shifting and not through tax competition for real resources.

A common objection to introducing a minimum effective tax rate is the possibility of corporations moving their headquarters to a country that does not apply an effective minimum tax rate. Our model allows dissecting the effect of minimum taxation in the short run (assuming a fixed number and location of headquarters) and in the long run (once the number and location of headquarters adjust endogenously). By assumption, the short-run scenario does not allow for corporate inversions. However, multinational firms may relocate their production across countries in both scenarios. Table 5 reports the results of the short-run (Panel A) and long-run (Panel B) scenarios.

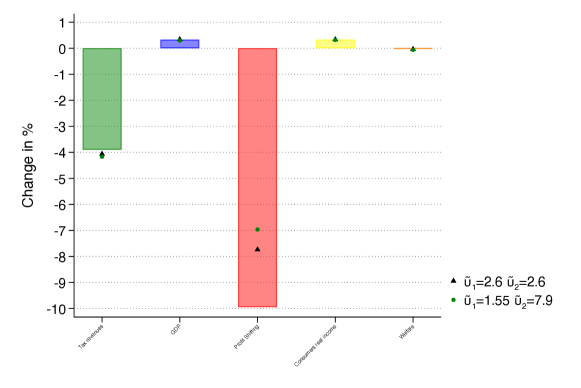

| % change in … | ||||||

| Minimum Taxation | Tax | Profit | Real | Consumer | Welfare | |

| revenues | Shifting | Production | Real Income | |||

| A. Short Run | ||||||

| Unilateral | ||||||

| – Residence | 4.20 | -28.38 | 0.06 | 0.08 | 0.45 | |

| – Source | 4.40 | -38.68 | -0.06 | -0.001 | 0.38 | |

| Multilateral | ||||||

| – Residence | 4.33 | -29.37 | 0.11 | 0.11 | 0.49 | |

| – Source | 3.99 | -29.37 | 0.11 | 0.11 | 0.46 | |

| B. Long Run | ||||||

| Unilateral | ||||||

| – Residence | 4.00 | -27.77 | -0.04 | -0.14 | 0.21 | |

| – Source | 4.33 | -38.58 | -0.12 | -0.09 | 0.29 | |

| Multilateral | ||||||

| – Residence | 4.09 | -28.94 | -0.06 | -0.12 | 0.24 | |

| – Source | 3.79 | -28.95 | -0.06 | -0.13 | 0.20 | |

| – Tax havens’ adjustment | 2.33 | -28.95 | -0.06 | -0.16 | 0.05 | |

Unilateral minimum taxation.

Under a residence-based minimum tax rate , the U.S. taxes U.S. MNCs that continue to shift profits to tax havens at a rate that is equal to the difference between the minimum rate and their effective tax rate (), regardless of the source countries where they operate. Additionally, the reform also directly increases the U.S. tax base as some U.S. firms operating in the U.S. no longer find it profitable to engage in profit shifting. As a result, corporate tax revenues in the U.S. increase (+4.20% in the short run) because of both the reduction in profit shifting (-28.38%) and the implementation of the minimum tax. Ex-ante, the impact of residence-based minimum taxation on production is ambiguous. In comparison to a top-up residence-based tax that applies to all repatriated profits, a minimum tax raises the ETR only for those firms engaging in tax avoidance. In contrast to the neutral impact of a top-up residence-based tax, discussed in Proposition 2, we show that a residence-based minimum tax distorts firms’ production and profit-booking location decisions. Specifically, under the minimum tax regime, U.S. firms give more weight to U.S. fundamentals () and less weight to the effective tax rate when deciding where to book profits and allocate production. Our simulations reveal that the minimum tax positively affects production (+0.06%), increases workers’ wages, and positively impacts real income (+0.08%). Additionally, the effect on welfare is positive and sizeable (+0.45%), which is primarily driven by increased tax revenues.

Our findings suggest that the effects of implementing a unilateral source-based minimum tax would differ from those described above. Under this scenario, the effective tax rate of all profit-shifting firms operating in the U.S. increases, resulting in a decrease in production by 0.06%. Although tax revenues increase, the overall real income effect is negative but minimal, with a decrease of 0.001%. The impact on welfare is smaller than in the residence-based scenario, with an increase of 0.38%.

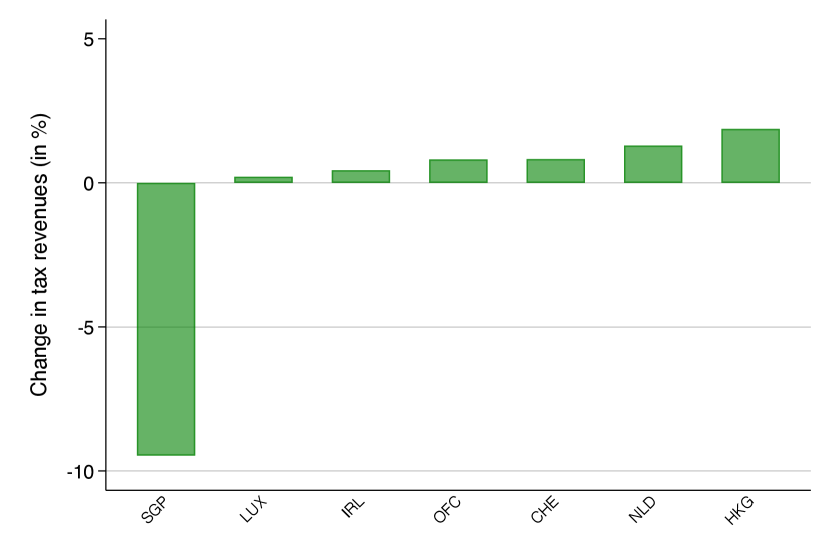

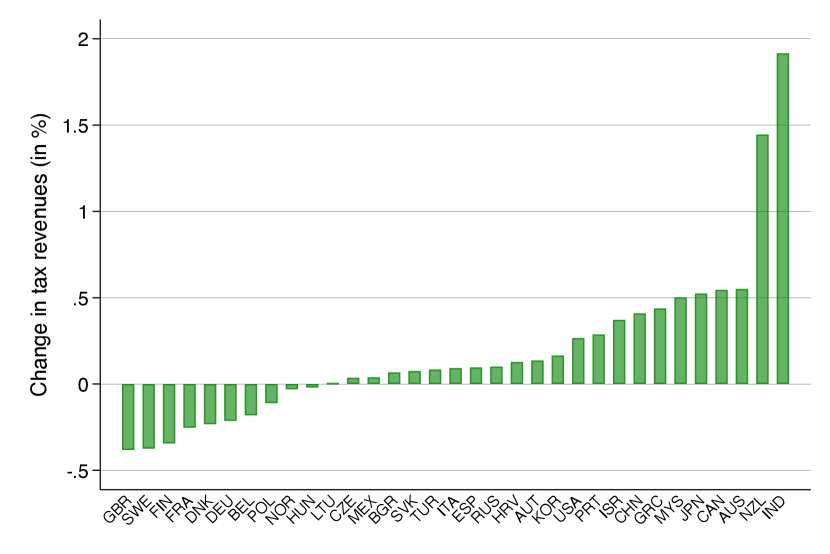

The exit of headquarters can diminish the positive impact on welfare in the long run by reducing private consumption. This negative effect on real income is particularly pronounced when a residence-based minimum tax targets all U.S.-headquartered firms, as opposed to a source-based minimum tax that applies to firms operating in the U.S.. In fact, a unilateral source-based minimum tax is found to be more beneficial for welfare in the long run, resulting in a 0.29% increase.