OAReferences

High Dimensional Generalised Penalised Least Squares

Abstract

In this paper we develop inference in high dimensional linear models with serially correlated errors. We examine the Lasso estimator under the assumption of -mixing in the covariates and error processes. While the Lasso estimator performs poorly under such circumstances, we estimate via GLS Lasso the parameters of interest and extend the asymptotic properties of the Lasso under more general conditions. Our theoretical results indicate that the non-asymptotic bounds for stationary dependent processes are sharper, while the rate of Lasso under general conditions appears slower as . Further, we employ debiasing methods to perform inference uniformly on the parameters of interest. Monte Carlo results support the proposed estimator, as it has significant efficiency gains over traditional methods.

JEL classification: C01, C22, C55

Keywords: Generalised least squares, Lasso, autocorrelation, time series, central limit theorem

1 Introduction

Research in high-dimensional statistics and econometrics has witnessed a surge, because the dimensionality of available datasets, models and associated parameter spaces has grown massively, in relation to the sample size. After the seminal work of Tibshirani (1996), the Lasso has become a focus of this continuously growing literature, since it conducts simultaneously model estimation and selection. More recent work establishes the asymptotic behaviour of the Lasso estimator as well as its model selection consistency, known as the oracle property, see, for example, Meinshausen and Yu (2009), Raskutti et al. (2010), Van De Geer and Bühlmann (2009), Van de Geer (2008) and Zhang and Huang (2008).

Although the majority of the theoretical work is centred around the asymptotic behaviour of the Lasso and relevant estimators in generalised linear models, the main interest still lies in simple designs, such as i.i.d. or fixed covariates, while limited work has been done towards the direction of regularised linear models with time series components. Early work of Wang et al. (2007) suggests a linear model with autoregressive error terms and their resulting Lasso estimator satisfies a Knight and Fu (2000)-type asymptotic property, where the number of covariates cannot be larger than the sample size. Hsu et al. (2008) consider the Lasso estimator under a Vector Autoregressive (VAR) process and derive their asymptotic results following the same setting as the former. Various other papers derive asymptotic results ensuring effective model selection for regularised estimators: Nardi and Rinaldo (2011) consider autoregressive structure on the covariates, Basu and Michailidis (2015) consider stochastic regressions and transition matrix estimation in VAR models, and Kock and Callot (2015) consider models with stationary VAR covariates. These papers are indicative of the work in the high-dimensional literature under more general conditions, but use restrictive assumptions in the error term in order to get the oracle property.

There is significant research in high-dimensional econometrics which allows for more relaxed assumptions: Kock (2016a) shows that the adaptive Lasso is oracle efficient in stationary and non-stationary autoregressions, Masini et al. (2022) consider linear time-series models with non-Gaussian errors, and Wong et al. (2020) consider sparse Gaussian VAR models exploring the efficiency of -mixing assumptions, used to bound the prediction and estimation error of sub-Weibull covariates. Another class of papers focuses entirely on high-dimensional financial econometrics: Babii et al. (2022a) and Babii et al. (2022b) consider prediction and now-casting with panel data and high-dimensional time series respectively, sampled at different frequencies using the sparse-group Lasso.

Although, the Lasso provides an efficient avenue to estimation and variable selection in high-dimensional datasets, one is unable to perform inference on the parameters estimated. Leeb and Pötscher (2005) have proven that ignoring the model selection step in the Lasso, leads to invalid uniform inference. Recent developments hinge on post-selection inference, see, for example, Berk et al. (2013) and Taylor and Tibshirani (2015), among others. The incentive is that post-selection methods provide valid inference on the non-zero coefficients obtained after model selection, which is typically carried out at a first step, using the Lasso. Although post-Lasso inference guarantees valid confidence intervals, it is subject to the model selection made prior to that step, which can be misleading when the conditions for a "well-behaved" model are not met, e.g. i.i.d. errors and/or covariates. The latter facilitates the necessity for post-Lasso inference to allow for more relaxed assumptions, as well as uniformity in the limit theory for general penalised models. A way to relax the i.i.d./Gaussianity assumption has been proposed by Tian and Taylor (2017) and Tibshirani et al. (2018), who consider a bootstrap approach for asymptotically valid testing. However, i.i.d. conditions on the covariates and errors need to be assumed in order examine the large sample properties of the method.

Alternative approaches that allow inference on the true parameters without the limitation of a "well-behaved" model, have been developed. These are based on debiased or desparsified versions of the Lasso, see, for example, Javanmard and Montanari (2014), Van de Geer et al. (2014), Zhang and Zhang (2014) and on certain assumptions on the covariance matrix, such as fixed design, i.i.d-ness or sub-Gaussianity. Further, extensions to a time series framework have been introduced in the literature, see, for example, Chernozhukov et al. (2021) consider the covariates and error terms of a high-dimensional model to be temporally and cross-sectionally dependent and apply bootstrap methods towards estimation and inference of the true parameters. Babii et al. (2020) use debiased sparse-group Lasso for inference in a lower dimensional group of parameters. Kock (2016b) studies high-dimensional correlated random effects panel data models, where they allow for correlation between time invariant covariates and unobserved heterogeneity, as under fixed effects. Finally, Adamek et al. (2022) extend the desparsified Lasso to a time series setting, using near-epoch dependence assumptions, allowing for non-Gaussian, serially correlated and heteroscedastic processes. Notice though that throughout the literature, no link has been made on the use of Generalised Least Squares (GLS) type of inference to account for non-spherical errors, which is the main focus of this paper.

Inference on Ridge regression instead of the Lasso has been considered by Zhang and Politis (2022), where they propose a wild bootstrap algorithm to construct confidence regions and perform hypothesis testing for a linear combination of parameters. A similar approach has been considered by Zhang and Politis (2023), allowing for inference under non-stationary and heteroscedastic errors.

In this paper, we contribute to the ongoing literature of high-dimensional inference under general conditions. We propose a penalised GLS-type estimator which utilizes estimated autocovariances of the residual in a linear regression, where the residual is allowed to follow a general autoregressive process. Lasso works as a preliminary estimator and is shown to be asymptotically consistent under mild assumptions on the covariates and error processes. We perform uniform inference via the debiased GLS Lasso, imposing mild restrictions on the autocorrelation of the error term. In addition, we relax assumptions on the error and most importantly the covariates processes, commonly used in the existing literature, for example fixed design, , sub-Gaussianity, by allowing them to be stationary -mixing processes.

The remainder of this paper is organised as follows. Sections 2 – 4 present the model, proposed methodology and theoretical results. Section 5 describes the regularisation parameter tuning, while Section 6 contains the Simulation Study. Section 7 concludes. Proofs and additional simulation results are relegated to the Supplementary Material.

Setup and notation

For any vector we denote the -, - and - norms, as , , , respectively, and denotes the sign function applied element-wise on . We use "" to denote convergence in probability. For two deterministic sequences and we define asymptotic proportionality, "", by writing if there exist constants such that for all . For any set , denotes its cardinality, while denotes its complement. For a real number , denotes the largest integer no greater than .

2 Theoretical considerations

We consider the following high-dimensional linear regression model,

| (1) |

where is a -dimensional vector-valued stationary time series, is a vector of unknown parameters and is a general second order stationary process. We make the following assumption on the processes and :

Assumption 1.

is a stationary ergodic -mixing sequence, with mixing coefficients , , for some and .

Under Assumption 1, admits an representation, which is a more general setting compared to the standard one, e.g. We propose to estimate the unknown parameters associated with (1) feasibly within the scope of a high-dimensional model. More specifically is a second-order stationary process satisfying

| (2) |

Notice that a stationary process with i.i.d. increments such as (2), in which the marginal distribution of has unbounded support satisfies the -mixing assumption. To further specify the conditions under which is strong mixing, one may refer to theorem 12.4 of Davidson (1994), describing random sequences, which by definition are strong mixing and further on Chapter 14 of Davidson (1994).

Assumption 2.

is an ergodic sequence of r.v.’s such that a.s., a.s., , where is the information set at time .

Remark 1.

In Assumption 2 it is explicitly stated that the innovation process is a continuously distributed, random variable with unbounded support, which is a sufficient and necessary condition for to be -mixing. The latter is necessary in order to avoid cases where the innovations are drawn from more general distributions. For example in the case where and is a Bernouli r.v., where , then by definition is not -mixing, since the mixing coefficient , see e.g. Andrews (1984).

To describe the method in detail, let

where is a preliminary Lasso estimate of . Further, let be the order OLS estimator of the autoregressive parameters for obtained as the the solution to the minimisation of

over . Then, an asymptotically valid feasible and penalised GLS estimate of can be obtained as the solution to the following problem

| (3) |

where , , and is a matrix defined as:

| (11) |

One can use the scalar representation of and vector representation of , to obtain

The loss function in (3) corresponds to the -penalised loss function using the estimates of , where the additional penalty is added to the least squares objective. Note that the asymptotic consistency of can be established even prior to the estimation of . We prove this result in Lemma 1. Further, following the same argument that we used to define in (11), we define , a matrix, with replaced by , denoting the matrix of used to derive the infeasible GLS-Lasso estimates, when the degree of autocorrelation in is known.

Remark 2.

Notice that Yule–Walker or Burg-type estimates (or maximum entropy estimates), see, for example, Burg (1968), Brockwell et al. (2005), can be used instead of the OLS estimates to obtain , used in the construction of , without changing the asymptotic properties of neither the preliminary estimate, nor the GLS-type estimate, .

We highlight now the Assumptions on the covariates and errors, necessary to derive our theoretical results.

Assumption 3.

-

1.

is a -dimensional stationary ergodic -mixing sequence, with mixing coefficients , , for some and , .

-

2.

are mutually independent.

-

3.

have thin-tailed distributions, that satisfy for and uniformly on , using some ,

(12) (13)

Remark 3.

Assumption 3 controls the tail behaviour of the distribution of and via (12) and (13), allowing an exponential decay of correlations that both and can exhibit. Furthermore, the (strong) mixing condition permits heterosedasticity, typically exhibited in empirical data (e.g. financial data), though the latter is not the focus of this paper. Notice that we do not impose the assumption of boundedness on the random variables (covariates), , which is typically assumed when implementing Bernstein type of inequalities. On the contrary, less restrictive assumptions are imposed on and respectively, compared to, for example, Wong et al. (2020), who consider general forms of dynamic misspecification, resulting in serially correlated error terms, which are typically difficult to verify.

Remark 4.

In Assumption 3 one can allow for heavy tails in the distribution of and such that for some , we can write a uniform heavy-tailed distribution property:

| (14) |

The properties presented in (12) can be generalised. Then, we have that there exist such that for all and

| (15) |

One can, then, modify the probability inequalities of from what appears in (15). It is clear that using heavy-tailed distributions for , and the probability inequalities in (15) become polynomial rather than exponential. Allowing then for heavy tails in , and , we implicitly allow for departures from exponential probability tails, implying the requirement that should be relatively small compared to

Our objective is to incorporate a GLS estimator to address the issue of serial-autocorrelation in the error term, , that will enable sharper inference following the paradigm of the debiased Lasso. Such methods have been examined in the past in low dimensional cases, where , see, for example, Amemiya (1973), and Kapetanios and Psaradakis (2016). We extend this framework to allow for , ensuring that is asymptotically consistent using a penalised estimate of , while we limit our research to finite autoregressions. Note that theoretical results can be established even when admits an representation, however certain additional assumptions must be made about , and the theoretical proofs would come at an increased mathematical cost.

The use of penalised models highlights the necessity of imposing sparsity conditions on the parameter set, , which in turn allow for a degree of misspecification in the model. The latter can be approximated by a sparse linear model following certain boundedness conditions on the smallest eigenvalues of the sample variance-covariance matrix, .

For some , we define the following index set

| (16) |

with cardinality . Under an appropriate choice of the regularisation parameter, , contains all that are "sufficiently large", while for , is . We make use of this set in the following assumption, which forms the compatibility condition, as seen in Bickel et al. (2009), Raskutti et al. (2010) and Chapter 6 of Bühlmann and Van De Geer (2011). We make the following assumption under .

Assumption 4.

For denote , , such that has zeroes outside the set , and such that , and . We define the following compatibility constant

| (17) |

Consider , then the following condition holds

| (18) |

The constant might appear arbitrary and can be replaced with a number larger than 1, at the cost of changing the lower bound for .

Remark 5.

Assumption 4 implies the “restricted” positive definiteness of the variance-covariance matrix, which is valid only for the vectors satisfying . Notice that in Assumption 4 we present a modified restricted eigenvalue condition, based on the population variance-covariance matrix, . In Lemma 10.7 of the Supplementary Material, we show that the population covariance can be approximated well by the sample covariance estimate, , such that

| (19) |

Assumption 5.

-

1.

for some .

-

2.

, as .

Assumption 5 introduces the asymptotic rate of the regularisation parameter , based on which the following non-asymptotic bounds are established.

Lemma 1.

For some regularisation parameter , let

| (20) |

be the Lasso regression prior to obtaining . Consider and the following restricted eigenvalue condition,

| (21) |

for some and . Under Assumptions 1 – 3, we show that (22) and (23) hold with probability at least for some positive constants, ,

| (22) | ||||

| (23) |

where is the Lasso estimate obtained from the solution of (20). A detailed proof of Lemma 1 can be found in the Supplementary Material.

Further, in Lemma 1, we show that the oracle inequalities hold prior to estimating . Notice that in (21) we use the population covariance matrix instead of the sample, , for which an argument similar to (19) holds and is formalised in the Supplementary Material, see Lemma 10.7. Notice that (21) is the restricted eigenvalue condition on the population covariance, , while is the compatibility constant. Lemma 1 is of paramount importance and is required in order to establish the following corollary and Theorem 1.

Corollary 1.

Remark 6.

In Corollary 1, the order, , though finite, is not known. To address the latter we adopt a sequential testing technique towards the selection of , similar to Kapetanios and Psaradakis (2016). Allowing more flexibility to our model we also allow for this technique to be dependent on the generation of . To minimize dependence on these conditions, we consider the following bound on , , where , which implies that the case of is not included in our testing procedure.

2.1 A feasible penalised GLS

We start with the main theorem that provides non- asymptotic guarantees for the estimation and prediction errors of the Lasso under a modified compatibility condition, i.e. Assumption 4, which restricts the smallest eigenvalue of the variance-covariance matrix. The results of the next theorem are based on the deviation inequality, which illustrates that as long as the co-ordinates of are uniformly concentrated around zero and the quantity is sharply bounded, using instead of , (25) and (26) hold w.p.a. one.

Theorem 1.

Remark 7.

Notice that the non-asymptotic bounds of the -prediction and -estimation errors of the parameter vector are similar to the bounds of a high-dimensional regression with covariates. This occurs because captures the autocorrelation structure of the errors by considering the transformed samples of and bounding the smallest eigenvalue of , rather than , where and . This ensures fast convergence rates of GLS Lasso under high-dimensional scaling.

3 Point-wise valid inference based on the GLS Lasso

A natural avenue to inference, having obtained the estimates of from (3) is to re-estimate the parameters of the estimated active set, , via OLS. Formally, let be the vector whose element equals the least square re-estimate for all and zero otherwise, while denotes the oracle assisted least squares estimates only including the relevant variables, those indexed by . The following theorem shows that this indeed leads to point-wise valid confidence bands for the non-zero entries of , i.e. those indexed by , since asymptotically.

Theorem 1.

Let the Assumptions of Theorem 1 hold, and assume that is invertible for . Then we have that

| (28) |

Remark 8.

Theorem 1 illustrates that performing least squares after model selection leads to inference that is asymptotically equivalent to inference based on least squares only including the covariates in . However, it is important to note that such inference is of a point-wise nature and it is not uniformly valid. This non-uniformity is visible in the confidence intervals, that could occasionally undercover the true parameter. This remark serves as a warning in applying point-wise inference after -regularisation, similar to the discussion in Leeb and Pötscher (2005).

4 Uniformly valid inference based on the GLS Lasso

We define the following notation: Let

We extend the debiased Lasso estimator, introduced in Javanmard and Montanari (2014), and Van de Geer et al. (2014) to accommodate non-spherical errors while relaxing the Assumptions made for , to perform valid inference in high-dimensional linear models via a penalised GLS-type estimator, introduced in (3). The key idea of the debiased Lasso is to invert the Karush-Kuhn-Tucker (KKT) conditions of the Lasso solution defined in (20). To proceed under correlated errors we invert the KKT conditions of (3). Then,

| (29) |

where is obtained from the subgradient of the -norm at , the last term of (3), such that

| (30) |

The solution of the normal equations, can be further written as:

| (31) |

If , then is not invertible, so we seek a different avenue on approximating its inverse. Let be an approximate inverse of . Then, (31) can be rewritten as

| (32) |

where is the error resulting from the approximation of , which is shown to be asymptotically negligible, in Theorem 1. We use the fact that and define the debiased GLS Lasso estimator

| (33) |

In essence, (33) is the same as in equation (5) of Van de Geer et al. (2014), but using instead of . Notice that, with (32), we obtain the asymptotic pivotal quantity, , since , arriving at the following expression

| (34) |

The error is asymptotically Gaussian and is asymptotically negligible, as shown in Theorem 1.

4.1 Construction of

The most common practice of constructing the approximate inverse of , is given by node-wise regressions on the design matrix . The main idea is similar to Van de Geer et al. (2014), but the asymptotic properties of the method change in the presence of serially correlated errors. Let be a design matrix, and a design sub-matrix, missing the column, for .

We first consider the population nodewise regressions, obtained by the linear projections

| (35) | ||||

| (36) |

where , and . Under Assumption 3 and by consequence of Theorem 14.1 of Davidson (1994), we make the following Assumption for :

Assumption 6.

-

1.

is a -dimensional stationary ergodic -mixing sequence satisfying (12), with mixing coefficients , , for some and , .

-

2.

is an ergodic sequence of r.v.’s such that a.s., a.s., , where is the information set at time , .

-

3.

for all .

-

4.

and have thin-tailed distributions, that satisfy for , using some ,

(37)

Remark 9.

Assumption 6 complements Assumption 3, where the transformed processes, , by consequence of Theorem 14.1 of Davidson (1994) are -mixing series with properties noted in (37). The main argument in Assumption 6 is that the errors of each of the node-wise regressions, defined in (35), is a -dimensional martingale difference sequence (m.d.s.). The proof of this statement is a direct application of Lemma 8.1 of the Supplementary Material.

A feasible way to estimate would be to use instead of in (36). Let be the estimates of the node-wise regressions, obtained as the solution of the following problem:

| (38) |

with components . Using the latter we define the following matrix:

| (39) |

which is the solution to the series of the node-wise regressions, each of them tuned with a different regularisation parameter . We define as:

| (40) |

where

| (41) |

It remains to show that is a suitable approximation of the inverse of , which we explore in Proposition 10.1 of the Supplementary Material. Similarly to Van de Geer et al. (2014) and Kock (2016b), we define the row of as , a vector and analogously . Hence, . The first order (KKT) conditions for the node-wise Lasso regressions in (38), imply that

| (42) |

where is a unit vector. Notice that the bound in (42) is controlled by , which depends explicitly on the solutions of the node-wise lasso regressions, . In Lemma 10.2 of the Supplementary Material, we show that is consistently estimated, and , attains a non-asymptotic bound. We further show that (42) holds a.s., in Proposition 10.1 of the Supplementary Material.

4.1.1 Asymptotic properties of

In order to show that is asymptotically Gaussian, where is defined prior to (11), one needs to explore the limiting behaviour of the approximate inverse . Consider and its approximate inverse. Following a similar partition of as Yuan (2010), we show that is asymptotically equivalent to under certain sparsity assumptions (formalised in Lemma 10.4 of the Supplementary Material). We write

| (43) |

where is the element of the diagonal of , is the element of the diagonal of , is the vector of the design, obtained by removing the column of the row, is the sub-matrix of resulting from the removal of the row and column, is the vector of the design, obtained by removing the row of the same column and is the vector of , obtained by removing the column of the row.

Let (36) be the node-wise regressions. By linear projections, let its first order conditions be

| (44) |

Replacing of (44) into (43), we have that

| (45) |

which illustrates that the row of is sparse, if and only if, is sparse. Furthermore, let the error, , then

| (46) |

Then, using Assumption 6, and the definition of as a penalised quadratic objective function we have that

| (47) |

for some small positive constant . In light of Theorem 1, it is sensible to note that , defined in (38) is close to its population counterpart, . We then can write

| (48) |

Notice that . Therefore, replacing the terms in (40), with their population counterparts, we can write , where matrices are defined similarly to replacing with , which in turn is asymptotically close to the true/population value of as it is shown in Lemma 10.4 of the Supplementary Material. Further, we illustrate in Lemma 10.4 of the Supplementary Material that , such that, a.s. for .

4.1.2 Asymptotic normality

We explore the asymptotic normality of the debiased GLS Lasso, and establish uniformly valid confidence intervals based on the theoretical results considered throughout Section 2.

Theorem 1.

Remark 10.

Theorem 1 holds uniformly, thus both confidence intervals and tests based on these statements are honest, see, for example, the discussion in Li (1989). More importantly, the non-uniformity of the limit theory for regularised estimators as it was described in Leeb and Pötscher (2005), does not exist for . However, we treat that in a more general manner, by using an asymptotic pivotal quantity, which is less restrictive, see Van de Geer et al. (2014).

Following the results of Theorem 1, we introduce asymptotic point-wise confidence intervals for the true parameter, , , given by

| (50) |

, , is the confidence level, and is the standard normal CDF, such that

| (51) |

and is a consistent estimate of the variance of . Thus, one can perform inference on , for some , using the following form

| (52) |

for any . Note that (52) is implied in Theorem 1 for a single-dimensional component, . It can be generalised to hold trivially for a group , of components, which can be allowed to be large, see, for example, Van de Geer et al. (2014).

5 Selection of the optimal regularisation parameter

The selection of the regularisation parameter used to obtain , , and , defined in (3), (20) and (38) respectively, is carried out by a -fold-cross validation scheme, where each fold can be considered as a block. Due to the autocorrelation present in the errors, we do not randomly shuffle the data within the blocks, retaining the structure of dependence intact. Each of the blocks are non-overlapping and consequent to each other.

However, different types of cross validation schemes can be considered. Racine (2000) proposed a cross-validation approach carried out in blocks and highlighting near-independence of the training and validation sub-samples, as an extension to the -block method of Burman et al. (1994), which proved consistent for general stationary processes. The former encompasses our method of cross-validation, the leave-one-out method and the -block method of Burman et al. (1994), and can be an alternative in selecting the optimal regularisation parameter in our framework as well.

6 Simulation study

We use simulations to verify the theoretical properties of the proposed methodology in finite samples. We assess the performance of our method against the debiased Lasso. We generate an array of samples from the following model

| (53) |

where and the sample sizes . The active set has cardinality , where , while . We choose the sparsity level , according to the results of Van de Geer et al. (2014), which are indicative of good performance for the debiased Lasso. Simulation results for are relegated to the Supplementary Material. Each of the sets, assume the form: where is a realisation of random draws of without replacement from . The parameters, are simulated from the distribution at each replication, while the autoregressive parameter used for the simulation of , takes values , where indicates that .

We base our findings on 1000 Monte Carlo replications, and evaluate the following performance measures:

| (54) |

where when , , when , and CIi is a two-sided confidence interval for either or , denoted in (50). Further, we test the null hypothesis , using the following t-statistic

| (55) |

where, for all , , and the student’s- distribution with degrees of freedom, under the null, is defined in (33), is the sample covariance matrix, and is defined in Section 4.1. Note that in the case where , we report the empirical power, while for , we report the empirical size

All tests are carried out at significance level and confidence intervals are at the level. Prior to the estimation of , the estimate of , and a value for the regularisation parameter are required. In Section 2, we describe the method used for the estimation of , along with the testing scheme used for the selection of the optimal lag order, , of the model. Further, we use the -fold cross-validation scheme described in Section 5, where , to select the optimal regularisation parameter, to obtain , and in (3), (20) and (38), respectively. The results are displayed in Table 2.

We also examine the performance of the Lasso, GLS Lasso, debiased Lasso and debiased GLS Lasso estimators in terms of average root mean squared error (RMSE) throughout 1000 replications of model (53). The results are displayed in Table 1.

The first panel of Table 1 reports the ratio of the average RMSE of the Lasso estimator over the RMSE of the GLS Lasso. The second panel of Table 1, reports the ratio of the average RMSE of the debiased Lasso estimator over the RMSE of debiased GLS Lasso. Entries larger than 1 indicate superiority of the competing model (GLS Lasso). Highlighted are the entries corresponding to the RMSE of the GLS Lasso in Panel I and the debiased GLS Lasso in Panel II.

The evidence is compelling, since both the GLS Lasso and debiased GLS Lasso have, in general, the smallest RMSE compared with their counterpart respectively. The most pronounced cases of improvement are when the autocorrelation is strong, i.e. for all possible sample sizes, where the RMSE of the proposed method is almost (and /or more) two times smaller than the one recorded by the benchmark, Lasso. Notice that in the case of GLS Lasso and Lasso perform equally well.

In the first panel of Table 2 we present the average coverage rates (as AvgCov or ) and average length of the confidence intervals, of the debiased GLS Lasso compared to the debiased Lasso. Notice that is the size of the test in (55). In the second panel of Table 2 we facilitate the comparison of the two methods by reporting the size adjusted power of the test. By size-adjusted power, we mean that if the test is found to reject at a rate under the null, then the power of the test is adjusted by finding the empirical quantile of the statistic in (55). We then report the rate that exceeds this quantile. Alternatively, if , then no adjustment is needed.

It is noticeable that when autocorrelation is present in the error term, debiased Lasso underperforms severely in terms of all measures reported. More specifically, as increases the benefits of debiased GLS Lasso are more clear, the coverage rates reported for our method are approaching the desirable rate of , while for the debiased Lasso there are noticeable deviations from the nominal rate. The latter is more severe for higher serial autocorrelation reported, e.g. .

Further, debiased GLS Lasso reports narrower confidence intervals, indicating that the variance of the proposed estimator is significantly smaller compared to the competing method. In addition, our method appears to be more powerful and correctly sized throughout the different cases reported. The best performing case reported is in Table 2, for and , where the size is and for , using the same , the reported size is .

| Panel I | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 100 | 200 | 500 | |||||||||||

| 0 | 0.5 | 0.8 | 0.9 | 0 | 0.5 | 0.8 | 0.9 | 0 | 0.5 | 0.8 | 0.9 | ||

| Lasso/GLS Lasso | 100 | 0.996 | 1.237 | 1.798 | 2.234 | 0.994 | 1.257 | 2.049 | 2.608 | 0.998 | 1.241 | 1.890 | 2.788 |

| GLS Lasso | 0.042 | 0.039 | 0.036 | 0.034 | 0.029 | 0.026 | 0.023 | 0.023 | 0.019 | 0.017 | 0.015 | 0.014 | |

| Lasso/GLS Lasso | 200 | 0.998 | 1.236 | 1.934 | 2.574 | 0.993 | 1.275 | 2.010 | 2.518 | 0.998 | 1.236 | 2.036 | 2.945 |

| GLS Lasso | 0.033 | 0.031 | 0.028 | 0.028 | 0.022 | 0.020 | 0.018 | 0.018 | 0.015 | 0.013 | 0.011 | 0.011 | |

| Lasso/GLS Lasso | 500 | 0.998 | 1.273 | 2.249 | 3.184 | 1.001 | 1.256 | 1.928 | 2.641 | 0.997 | 1.253 | 2.188 | 3.016 |

| GLS Lasso | 0.023 | 0.022 | 0.020 | 0.020 | 0.016 | 0.015 | 0.013 | 0.013 | 0.010 | 0.009 | 0.008 | 0.007 | |

| Panel II | |||||||||||||

| Debiased Lasso/Debiased GLS | 100 | 1.014 | 1.258 | 1.928 | 2.515 | 1.005 | 1.284 | 2.068 | 2.847 | 1.001 | 1.287 | 2.087 | 2.943 |

| Debiased GLS | 0.094 | 0.086 | 0.077 | 0.075 | 0.069 | 0.062 | 0.054 | 0.052 | 0.044 | 0.040 | 0.035 | 0.033 | |

| Debiased Lasso/Debiased GLS | 200 | 1.015 | 1.237 | 1.816 | 2.299 | 1.007 | 1.285 | 2.072 | 2.855 | 1.002 | 1.288 | 2.092 | 2.946 |

| Debiased GLS | 0.090 | 0.083 | 0.078 | 0.079 | 0.067 | 0.060 | 0.053 | 0.051 | 0.044 | 0.039 | 0.034 | 0.033 | |

| Debiased Lasso/Debiased GLS | 500 | 1.017 | 1.128 | 1.228 | 1.257 | 1.005 | 1.291 | 2.073 | 2.734 | 1.003 | 1.293 | 2.088 | 2.986 |

| Debiased GLS | 0.081 | 0.079 | 0.082 | 0.088 | 0.064 | 0.057 | 0.051 | 0.050 | 0.044 | 0.039 | 0.034 | 0.033 | |

| p/T | 100 | 200 | 500 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.5 | 0.8 | 0.9 | 0 | 0.5 | 0.8 | 0.9 | 0 | 0.5 | 0.8 | 0.9 | |||

| Debiased Lasso | AvgCov | 100 | 0.796 | 0.758 | 0.694 | 0.660 | 0.818 | 0.775 | 0.680 | 0.619 | 0.846 | 0.802 | 0.679 | 0.594 |

| AvgCov | 0.864 | 0.831 | 0.753 | 0.709 | 0.868 | 0.830 | 0.730 | 0.654 | 0.879 | 0.836 | 0.713 | 0.613 | ||

| AvgLength | 0.306 | 0.314 | 0.348 | 0.394 | 0.224 | 0.228 | 0.248 | 0.278 | 0.150 | 0.151 | 0.157 | 0.170 | ||

| AvgLengthc | 0.306 | 0.313 | 0.348 | 0.394 | 0.224 | 0.228 | 0.248 | 0.278 | 0.150 | 0.151 | 0.157 | 0.170 | ||

| Debiased GLS | AvgCov | 0.789 | 0.811 | 0.845 | 0.857 | 0.811 | 0.854 | 0.889 | 0.892 | 0.842 | 0.872 | 0.909 | 0.916 | |

| AvgCov | 0.868 | 0.894 | 0.923 | 0.929 | 0.870 | 0.902 | 0.932 | 0.938 | 0.879 | 0.913 | 0.943 | 0.950 | ||

| AvgLength | 0.305 | 0.308 | 0.313 | 0.314 | 0.224 | 0.227 | 0.229 | 0.229 | 0.150 | 0.152 | 0.154 | 0.154 | ||

| AvgLengthc | 0.305 | 0.308 | 0.312 | 0.313 | 0.224 | 0.227 | 0.229 | 0.229 | 0.150 | 0.152 | 0.154 | 0.154 | ||

| Debiased Lasso | AvgCov | 200 | 0.771 | 0.743 | 0.667 | 0.621 | 0.810 | 0.778 | 0.691 | 0.640 | 0.840 | 0.799 | 0.680 | 0.605 |

| AvgCov | 0.870 | 0.847 | 0.782 | 0.742 | 0.875 | 0.840 | 0.745 | 0.678 | 0.878 | 0.835 | 0.721 | 0.633 | ||

| AvgLength | 0.302 | 0.312 | 0.352 | 0.400 | 0.223 | 0.228 | 0.250 | 0.286 | 0.148 | 0.150 | 0.158 | 0.175 | ||

| AvgLengthc | 0.301 | 0.312 | 0.352 | 0.400 | 0.223 | 0.227 | 0.250 | 0.286 | 0.148 | 0.150 | 0.158 | 0.175 | ||

| Debiased GLS | AvgCov | 0.759 | 0.780 | 0.810 | 0.822 | 0.804 | 0.839 | 0.873 | 0.879 | 0.839 | 0.872 | 0.911 | 0.923 | |

| AvgCov | 0.873 | 0.897 | 0.918 | 0.916 | 0.877 | 0.906 | 0.935 | 0.940 | 0.878 | 0.912 | 0.943 | 0.950 | ||

| AvgLength | 0.301 | 0.303 | 0.308 | 0.310 | 0.223 | 0.225 | 0.227 | 0.227 | 0.148 | 0.150 | 0.152 | 0.152 | ||

| AvgLengthc | 0.300 | 0.303 | 0.308 | 0.310 | 0.223 | 0.225 | 0.227 | 0.227 | 0.148 | 0.150 | 0.152 | 0.152 | ||

| Debiased Lasso | AvgCov | 500 | 0.720 | 0.662 | 0.537 | 0.468 | 0.796 | 0.766 | 0.680 | 0.616 | 0.834 | 0.791 | 0.689 | 0.624 |

| AvgCov | 0.887 | 0.868 | 0.863 | 0.870 | 0.887 | 0.853 | 0.761 | 0.707 | 0.876 | 0.837 | 0.737 | 0.651 | ||

| AvgLength | 0.299 | 0.308 | 0.349 | 0.391 | 0.219 | 0.224 | 0.251 | 0.287 | 0.146 | 0.148 | 0.160 | 0.182 | ||

| AvgLengthc | 0.299 | 0.308 | 0.348 | 0.390 | 0.219 | 0.224 | 0.250 | 0.287 | 0.146 | 0.148 | 0.160 | 0.182 | ||

| Debiased GLS | AvgCov | 0.717 | 0.735 | 0.779 | 0.776 | 0.794 | 0.818 | 0.853 | 0.854 | 0.832 | 0.867 | 0.903 | 0.904 | |

| AvgCov | 0.892 | 0.904 | 0.903 | 0.888 | 0.888 | 0.916 | 0.939 | 0.938 | 0.877 | 0.913 | 0.943 | 0.949 | ||

| AvgLength | 0.300 | 0.302 | 0.307 | 0.309 | 0.219 | 0.221 | 0.224 | 0.224 | 0.146 | 0.148 | 0.149 | 0.149 | ||

| AvgLengthc | 0.299 | 0.302 | 0.307 | 0.309 | 0.219 | 0.221 | 0.224 | 0.224 | 0.146 | 0.148 | 0.149 | 0.149 | ||

| Size-adjusted power | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| p/T | 100 | 200 | 500 | ||||||||||

| 0 | 0.5 | 0.8 | 0.9 | 0 | 0.5 | 0.8 | 0.9 | 0 | 0.5 | 0.8 | 0.9 | ||

| Debiased Lasso | 100 | 0.789 | 0.765 | 0.669 | 0.578 | 0.865 | 0.836 | 0.764 | 0.692 | 0.916 | 0.902 | 0.865 | 0.817 |

| Debiased GLS | 0.787 | 0.807 | 0.820 | 0.829 | 0.868 | 0.870 | 0.952 | 0.897 | 0.916 | 0.919 | 0.930 | 0.932 | |

| Debiased Lasso | 200 | 0.780 | 0.748 | 0.649 | 0.556 | 0.852 | 0.838 | 0.780 | 0.706 | 0.913 | 0.901 | 0.857 | 0.802 |

| Debiased GLS | 0.776 | 0.793 | 0.807 | 0.809 | 0.855 | 0.865 | 0.878 | 0.884 | 0.913 | 0.920 | 0.929 | 0.933 | |

| Debiased Lasso | 500 | 0.776 | 0.749 | 0.640 | 0.525 | 0.824 | 0.836 | 0.752 | 0.704 | 0.913 | 0.901 | 0.857 | 0.804 |

| Debiased GLS | 0.775 | 0.782 | 0.792 | 0.789 | 0.850 | 0.868 | 0.881 | 0.884 | 0.913 | 0.920 | 0.929 | 0.933 | |

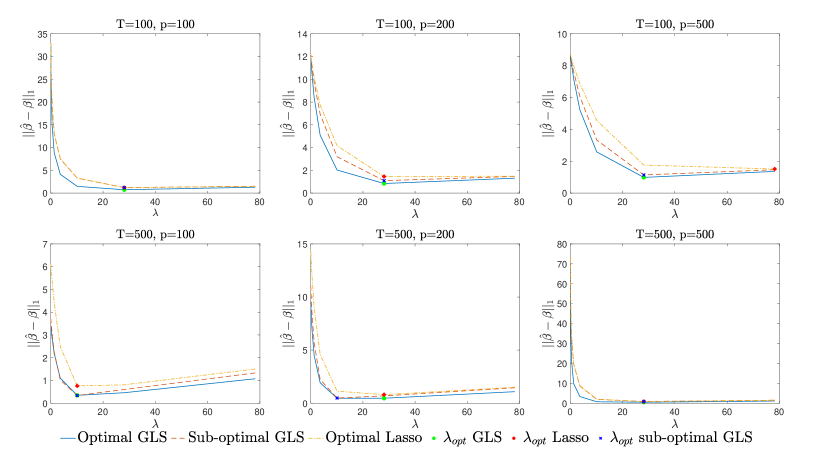

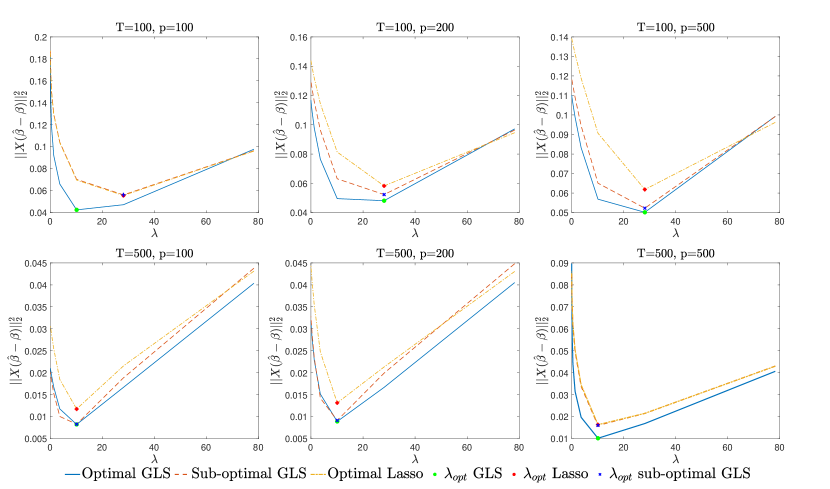

In Figures 1–2 we graph the estimation and prediction error rates of GLS Lasso, defined in (26) and (25) respectively, of Lasso, defined in (22) and (23), and of the sub-optimal GLS Lasso considering a , in the preliminary estimate which maximizes rather than minimising the following test-loss function w.r.t. the regularisation parameter, , for sample sizes and

| (56) |

where is one block (fold) for , excluding block .

Notice that the prediction and estimation error for the GLS Lasso are bounded from below as Theorem 1 indicates, while a lower bound for the Lasso is provided in Lemma 1. In empirical problems, cross-validation does not always yield an optimal selection of , because one has to select between true model recovery (interpretable model) and a parsimonious (highly regularised) model. The latter can potentially be an issue because the selection of controls the lower bound of both the prediction and estimation error, see, for example, (25)–(26). To that end, GLS Lasso provides an asymptotic guarantee that even when the selection of is sub-optimal, it is preferable to using Lasso. Indicative cases of such behaviour are and . Furthermore, in the remaining sets of cases, of a sub-optimal selection of , GLS Lasso still reports smaller errors than Lasso but by a smaller margin.

As a summary of Figure 2, GLS Lasso can be more attractive under relaxed assumptions due to the fact that neither the estimation, nor the prediction error deteriorate severely with different selections of . Further, even when the selection of for the preliminary estimate is sub-optimal, GLS Lasso appears to be, in the majority of the cases, the best method to use as a preliminary vehicle to inference.

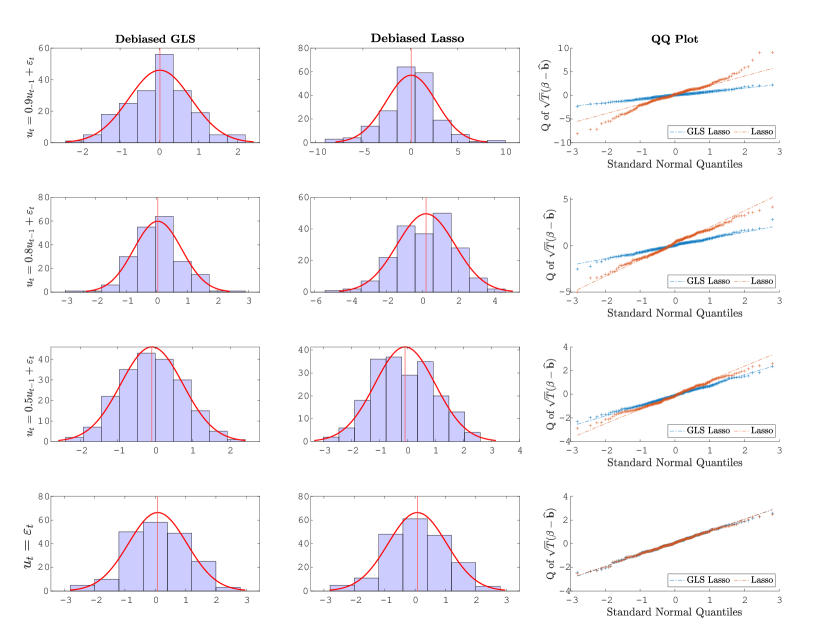

In Figure 3 we graph the density estimates of corresponding to debiased GLS Lasso starting from the left panel, the second panel corresponds to debiased Lasso and the third panel illustrates the quantile-quantile (QQ) plots of the aforementioned. Figure 3 corresponds to the case where the sample size is the largest, i.e. and the number of regressors is for all . A full set of graphs considering all the cases that are reported in the Tables 1–2 are available upon request.

In the first row of graphs in Figure 3 where , it is observed that extreme dependence between and is related to overdispersion of the distribution of , corresponding to the debiased Lasso estimator, while in the same case, departures from the standard normal are observed, with the empirical data showing evidence of heavy tails. On the contrary, the empirical distribution of the debiased GLS Lasso estimator is closer to the Standard Normal, as it is indicative from the QQ-plot of the same row. However, this effect fades as takes values closer to , indicative of the case where In the second row of Figure 3, debiased Lasso appears slightly skewed left with heavy tails to persist indicative of departures from the standard normal distribution, while debiased GLS Lasso appears to approach the standard normal distribution, similar behaviour for both methods is reported in the third row. Finally, in the case where the two methods coincide supporting the evidence in Tables 1–2.

7 Discussion

This paper provides a complete inferential methodology for high dimensional linear regressions with serially correlated error terms. We propose GLS-type of estimators in the high-dimensional framework, derive a debiased GLS Lasso estimator, and establish its asymptotic normality. Theoretical results lead to valid confidence intervals regardless of the dimensionality of the parameters and the degree of autocorrelation, under stationarity of the error and covariate processes. We derive non-asymptotic bounds using Bernstein-type of inequalities derived in Dendramis et al. (2021), allowing for a degree of flexibility in our model compared to what classical assumptions typically allow. Finally, our method explores the underlying structure of the process in the error term, introducing a flexible way of dealing with autocorrelation in high-dimensional models, without a prior knowledge of neither its existence nor its structure. We support this statement both theoretically and with our simulation results, where we show that even when autocorrelation is absent the debiased Lasso and debiased GLS Lasso are asymptotically equivalent.

There are a number of interesting avenues for future work. For example, a natural extension would be to generalise our method using not only -regularised models or (e.g. Zhang and Politis (2023)), but a combination of the two, e.g. the elastic net, covering a wider class of penalised models. Further, since our assumptions allow for a wide class of dependent stochastic processes, one could consider heteroskedastic error processes, see, for example, the framework in Chronopoulos et al. (2022), where

| (57) |

where is a persistent scaling factor, smoothly varying in time, while

Acknowledgements: For discussions and/or comments we thank Jianqing Fan, Dacheng Xiu, Zacharias Psaradakis, Tassos Magdalinos and Yunyi Zhang.

References

- (1)

- Adamek et al. (2022) Adamek, R., S. Smeekes, and I. Wilms (2022): “Lasso inference for high-dimensional time series,” Forthcoming in Journal of Econometrics.

- Amemiya (1973) Amemiya, T. (1973): “Generalized least squares with an estimated autocovariance matrix,” Econometrica, 41, 723–732.

- Andrews (1984) Andrews, D. W. (1984): “Non-strong mixing autoregressive processes,” Journal of Applied Probability, 21(4), 930–934.

- Babii et al. (2022a) Babii, A., R. T. Ball, E. Ghysels, and J. Striaukas (2022a): “Machine learning panel data regressions with heavy-tailed dependent data: Theory and application,” Forthcoming in Journal of Econometrics.

- Babii et al. (2020) Babii, A., E. Ghysels, and J. Striaukas (2020): “Inference for High-Dimensional Regressions With Heteroskedasticity and Auto-correlation,” Available at SSRN 3615718.

- Babii et al. (2022b) (2022b): “Machine learning time series regressions with an application to nowcasting,” Journal of Business & Economic Statistics, 40(3), 1094–1106.

- Basu and Michailidis (2015) Basu, S., and G. Michailidis (2015): “Regularized estimation in sparse high-dimensional time series models,” The Annals of Statistics, 43(4), 1535–1567.

- Berk et al. (2013) Berk, R., L. Brown, A. Buja, K. Zhang, and L. Zhao (2013): “Valid post-selection inference,” The Annals of Statistics, 41(2), 802–837.

- Bickel et al. (2009) Bickel, P. J., Y. Ritov, and A. B. Tsybakov (2009): “Simultaneous analysis of Lasso and Dantzig selector,” The Annals of Statistics, 37(4), 1705–1732.

- Brockwell et al. (2005) Brockwell, P. J., R. Dahlhaus, and A. A. Trindade (2005): “Modified Burg algorithms for multivariate subset autoregression,” Statistica Sinica, 15, 197–213.

- Bühlmann and Van De Geer (2011) Bühlmann, P., and S. Van De Geer (2011): Statistics for high-dimensional data: methods, theory and applications. Springer Science & Business Media.

- Burg (1968) Burg, J. P. (1968): “A new analysis technique for time series data,” Paper presented at NATO Advanced Study Institute on Signal Processing, Enschede, Netherlands, 1968.

- Burman et al. (1994) Burman, P., E. Chow, and D. Nolan (1994): “A cross-validatory method for dependent data,” Biometrika, 81(2), 351–358.

- Chernozhukov et al. (2021) Chernozhukov, V., W. K. Härdle, C. Huang, and W. Wang (2021): “Lasso-driven inference in time and space,” The Annals of Statistics, 49(3), 1702–1735.

- Chronopoulos et al. (2022) Chronopoulos, I., L. Giraitis, and G. Kapetanios (2022): “Choosing between persistent and stationary volatility,” The Annals of Statistics, 50(6), 3466 – 3483.

- Chudik et al. (2018) Chudik, A., G. Kapetanios, and M. H. Pesaran (2018): “A one covariate at a time, multiple testing approach to variable selection in high-dimensional linear regression models,” Econometrica, 86(4), 1479–1512.

- Davidson (1994) Davidson, J. (1994): Stochastic limit theory: An introduction for econometricians. OUP Oxford.

- Dendramis et al. (2021) Dendramis, Y., L. Giraitis, and G. Kapetanios (2021): “Estimation of time-varying covariance matrices for large datasets,” Econometric Theory, 37(6), 1100–1134.

- Hamilton (1994) Hamilton, J. D. (1994): Time series analysis. Princeton university press.

- Hsu et al. (2008) Hsu, N.-J., H.-L. Hung, and Y.-M. Chang (2008): “Subset selection for vector autoregressive processes using lasso,” Computational Statistics & Data Analysis, 52(7), 3645–3657.

- Javanmard and Montanari (2014) Javanmard, A., and A. Montanari (2014): “Confidence intervals and hypothesis testing for high-dimensional regression,” The Journal of Machine Learning Research, 15(1), 2869–2909.

- Kapetanios and Psaradakis (2016) Kapetanios, G., and Z. Psaradakis (2016): “Semiparametric sieve-type generalized least squares inference,” Econometric Reviews, 35(6), 951–985.

- Knight and Fu (2000) Knight, K., and W. Fu (2000): “Asymptotics for lasso-type estimators,” The Annals of Statistics, 28, 1356–1378.

- Kock (2016a) Kock, A. B. (2016a): “Consistent and conservative model selection with the adaptive lasso in stationary and nonstationary autoregressions,” Econometric Theory, 32(1), 243–259.

- Kock (2016b) (2016b): “Oracle inequalities, variable selection and uniform inference in high-dimensional correlated random effects panel data models,” Journal of Econometrics, 195(1), 71–85.

- Kock and Callot (2015) Kock, A. B., and L. Callot (2015): “Oracle inequalities for high dimensional vector autoregressions,” Journal of Econometrics, 186(2), 325–344.

- Leeb and Pötscher (2005) Leeb, H., and B. M. Pötscher (2005): “Model selection and inference: Facts and fiction,” Econometric Theory, 21(1), 21–59.

- Li (1989) Li, K.-C. (1989): “Honest confidence regions for nonparametric regression,” The Annals of Statistics, 17(3), 1001–1008.

- Lutkepohl (1997) Lutkepohl, H. (1997): “Handbook of matrices.,” Computational statistics and Data analysis, 2(25), 243.

- Masini et al. (2022) Masini, R. P., M. C. Medeiros, and E. F. Mendes (2022): “Regularized estimation of high-dimensional vector autoregressions with weakly dependent innovations,” Journal of Time Series Analysis, 43(4), 532–557.

- Meinshausen and Yu (2009) Meinshausen, N., and B. Yu (2009): “Lasso-type recovery of sparse representations for high-dimensional data,” The Annals of Statistics, 37(1), 246–270.

- Nardi and Rinaldo (2011) Nardi, Y., and A. Rinaldo (2011): “Autoregressive process modeling via the lasso procedure,” Journal of Multivariate Analysis, 102(3), 528–549.

- Racine (2000) Racine, J. (2000): “Consistent cross-validatory model-selection for dependent data: hv-block cross-validation,” Journal of Econometrics, 99(1), 39–61.

- Raskutti et al. (2010) Raskutti, G., M. J. Wainwright, and B. Yu (2010): “Restricted eigenvalue properties for correlated Gaussian designs,” The Journal of Machine Learning Research, 11, 2241–2259.

- Taylor and Tibshirani (2015) Taylor, J., and R. J. Tibshirani (2015): “Statistical learning and selective inference,” Proceedings of the National Academy of Sciences, 112(25), 7629–7634.

- Tian and Taylor (2017) Tian, X., and J. Taylor (2017): “Asymptotics of selective inference,” Scandinavian Journal of Statistics, 44(2), 480–499.

- Tibshirani (1996) Tibshirani, R. (1996): “Regression shrinkage and selection via the lasso,” Journal of the Royal Statistical Society: Series B (Statistical Methodology), 58(1), 267–288.

- Tibshirani et al. (2018) Tibshirani, R. J., A. Rinaldo, R. Tibshirani, and L. Wasserman (2018): “Uniform asymptotic inference and the bootstrap after model selection,” The Annals of Statistics, 46(3), 1255–1287.

- Van de Geer et al. (2014) Van de Geer, S., P. Bühlmann, Y. Ritov, and R. Dezeure (2014): “On asymptotically optimal confidence regions and tests for high-dimensional models,” The Annals of Statistics, 42(3), 1166–1202.

- Van de Geer (2008) Van de Geer, S. A. (2008): “High-dimensional generalized linear models and the lasso,” The Annals of Statistics, 36(2), 614–645.

- Van De Geer and Bühlmann (2009) Van De Geer, S. A., and P. Bühlmann (2009): “On the conditions used to prove oracle results for the Lasso,” Electronic Journal of Statistics, 3, 1360–1392.

- Wang et al. (2007) Wang, H., G. Li, and C.-L. Tsai (2007): “Regression coefficient and autoregressive order shrinkage and selection via the lasso,” Journal of the Royal Statistical Society: Series B (Statistical Methodology), 69(1), 63–78.

- Wong et al. (2020) Wong, K. C., Z. Li, and A. Tewari (2020): “Lasso guarantees for -mixing heavy-tailed time series,” The Annals of Statistics, 48(2), 1124 – 1142.

- Yuan (2010) Yuan, M. (2010): “High dimensional inverse covariance matrix estimation via linear programming,” The Journal of Machine Learning Research, 11, 2261–2286.

- Zhang and Huang (2008) Zhang, C.-H., and J. Huang (2008): “The sparsity and bias of the lasso selection in high-dimensional linear regression,” The Annals of Statistics, 36(4), 1567–1594.

- Zhang and Zhang (2014) Zhang, C.-H., and S. S. Zhang (2014): “Confidence intervals for low dimensional parameters in high dimensional linear models,” Journal of the Royal Statistical Society: Series B (Statistical Methodology), 76(1), 217–242.

- Zhang and Politis (2022) Zhang, Y., and D. N. Politis (2022): “Ridge regression revisited: Debiasing, thresholding and bootstrap,” The Annals of Statistics, 50(3), 1401–1422.

- Zhang and Politis (2023) (2023): “Debiased and thresholded ridge regression for linear models with heteroskedastic and correlated errors,” Forthcoming in Journal of the Royal Statistical Society: Series B (Statistical Methodology).

- Zhao and Yu (2006) Zhao, P., and B. Yu (2006): “On model selection consistency of Lasso,” The Journal of Machine Learning Research, 7, 2541–2563.

Supplement to "High Dimensional Generalised Penalised Least Squares"

This Supplement provides proofs of the theoretical results given in the text of the main paper. It is organised as follows: Section 8 provides proofs of Lemma 1, Corollary 1, Theorem 1 and Corollary 2 of the main paper. Section 9 provides the proofs of Theorem 2 and Theorem 3 of the main paper. Section 10 provides proofs of auxiliary technical lemmas. Section 11 contains supplementary simulation material.

Formula numbering in this supplement includes the section number, e.g. , and references to lemmas are signified as “Lemma 8.#", “Lemma 9.#", e.g. Lemma 8.1. Formula numbering in the Notation section is signified with the letter N.#, e.g. (N.1). Theorem references to the main paper are signified, e.g. as Theorem , while equation references are signified as, e.g. (1), (2) (denoted in red).

In the proofs, stand for generic positive constants which may assume different values in different contexts.

Notation: For any vector we denote the -, - and - norms, as , and , respectively. Throughout this supplement, denotes the set of real numbers. We denote the cardinality of a set by , while denotes its complement. For any , denotes the sign function applied to each component of , where if . We use "" to denote convergence in probability. For two deterministic sequences and we define asymptotic proportionality, "", by writing , if there exist constants such that for all . For a real number , denotes the largest integer no greater than . For a symmetric matrix , we denote its minimum and maximum eigenvalues by and respectively. For a general (not necessarily square) matrix , , , are its -, -, -norm respectively. In particular, , , and . We further write that, is the Lasso estimator obtained from the solution of (13) in the main paper, is the GLS Lasso estimator obtained from the solution of (3), given some estimates of the autoregressive parameters and is a parameter vector containing the true parameters.

We define , and its matrix counterpart, , where is a matrix defined as:

| (7.65) |

Further, following the same argument that we used to define , we define , a matrix, with replaced by , denoting the autoregressive parameters, . As a consequence, we define .

We shall frequently refer to the -mixing Assumption 2 and its property of and of Section 2 of the main paper. The r.v.’s have thin-tailed distributions with properties denoted in (5)–(6) of the main paper.

8 Proofs of Lemma 1, Corollary 1, Theorem 1 and Corollary 2 of the main paper

This section contains the proofs of the results of Section 2 of the main paper.

.

Proof of Lemma 1. In Lemma 1 we analyse the asymptotic properties of the Lasso estimator under mixing Assumptions, e.g. Assumption 1 and offer non-asymptotic bounds for the empirical process and prediction errors, as seen in (15) and (16) of the main paper. Re-arranging the basic inequality, as in Lemma 6.1 of Bühlmann and Van De Geer (2011), we obtain

| (8.1) |

The "empirical process" part of the right hand side of (8.1), , can be bounded further in terms of the -norm, such that,

| (8.2) |

The regularisation parameter is chosen such that . Hence, we introduce the event

| (8.3) |

which needs to hold with high probability, where . We proceed to illustrate the former. Using the identity and the union bound we obtain:

Notice that is -mixing as a product of two -mixing sequences, . Then by direct application of Lemma 1 of Dendramis et al. (2021), we obtain

| (8.4) |

for some . It is sufficient to bound , then for a proper selection of , we have that , , and we have that

| (8.5) |

Let Assumptions 1 – 3, 5 and the conditions supporting Lemma 1 hold, then Theorem 6.1 of Bühlmann and Van De Geer (2011) implies

with probability at least , for some positive values of and . ∎

.

Proof of Corollary 1. In Corollary 1 we provide an asymptotic rate of convergence for the error between the estimated autoregressive parameters, utilising and the true autoregressive parameters, . First we define the following

| (8.11) |

where is a vector and is a design matrix. Note that denotes the OLS estimate of the regression coefficients in the following regression:

| (8.12) |

where , follows Assumption 2 and . Similarly to (8.11), we define and , and consider , the OLS estimates of an AR(q) regression, using instead of and instead of .

Then, we can write that

| (8.13) |

and

Notice that . We are interested to show that the following holds

| (8.14) |

To show (8.14), it is sufficient to show that

| (8.15) | ||||

| (8.16) |

Proof of (8.15). To prove the first two statements in (8.15) it is sufficient to show that

| (8.17) | ||||

| (8.18) |

Proof of (8.17). (8.17) is bounded by , where

| (8.19) | ||||

| (8.20) |

Notice that , and by Assumption 3, , are stationary, ergodic and mutually independent, -mixing series. Hence, and the following hold

| (8.21) |

where and Further, by Lemma 1, we have that

| (8.22) |

Then by the Cauchy-Schwartz inequality and substituting (8.21) and (8.22) in (8.17), we obtain

Next,

Similarly, is bounded using the same arguments with , which completes the proof of the first part of (8.15). In view of the results in (8.17) – (8.18) and the analysis in [8.3.17]– [8.3.19] of Hamilton (1994), we can conclude that the second part of (8.15) holds.

Corollary 3.

Under Assumptions 1 – 3, 5 the following holds

| (8.24) |

for some finite large enough constant , where , are defined in (8.13).

Remark 11.

Corollary 3 is an implication of Corollary 1 and is useful to bound different quantities throughout the Supplement.

.

Proof of Corollary 3. Notice that , where and are defined in (8.13), then

| (8.25) |

To show (8.24), it is sufficient to show that the following holds:

| (8.26) |

Consider , and defined in (8.11) – (8.13). In the remainder of our analysis we use the following matrix inequalities from Chapter 8 of Lutkepohl (1997); , since , for an matrix and an matrix , where , exist. We start by showing the first part of (8.26):

| (8.27) | ||||

| (8.28) | ||||

| (8.29) | ||||

| (8.30) | ||||

| (8.31) |

for some , and a large enough positive and finite constant. It is sufficient to show that and are sufficiently small for some large generic positive constant . We start with :

| (8.32) |

where , exists and is positive definite. Step results by using (B.60) in Lemma A11 of Chudik et al. (2018), while results from the inequality where , for two vectors.

It is of interest to show that

| (8.33) |

where . Note that due to positive definiteness of and consequent existence of , it is equivalent to show that

| (8.34) |

since holds. To show , it sufficient to show that

| (8.35) |

which holds, following a similar analysis to Lemma 8.

Further, to show that it is sufficient to show that

| (8.36) |

for a large enough Note that

| (8.37) |

where results by using (B.60) in Lemma A11 of Chudik et al. (2018), for some By the arguments of Lemma 1, (8.36) holds, if and , for some .

We proceed to analyse :

| (8.38) | ||||

| (8.39) | ||||

| (8.40) | ||||

| (8.41) |

To show that it is sufficient to show that and , for some . Considering Lemma A16 of Chudik et al. (2018) and the fact that is positive definite, it is sufficient to bound the following quantity as a lower bound for

To show that , it is sufficient to show that :

| (8.42) |

The inequality holds by using (B.60) in Lemma A11 of Chudik et al. (2018) for some positive constants, By the arguments of Lemma 1, , if and . Therefore .

.

Proof of Theorem 1 In this Theorem, we illustrate that the feasible GLS Lasso estimator, attains similar non-asymptotic bounds to the Lasso, both in terms of prediction and estimation errors. The proof follows closely the steps in Chapter 6 of Bühlmann and Van De Geer (2011). We consider the feasible GLS corrected model:

where is the OLS estimate obtained from an regression on the residuals , where , the solution to the original Lasso problem, using . Recall from Corollary 1 that . Re-arranging the basic inequality, as in Lemma 6.1 of Bühlmann and Van De Geer (2011), we obtain

| (8.45) |

Define as the "empirical process". Notice that the latter can be bounded further in terms of the -norm, such that,

| (8.46) |

The regularisation parameter, is chosen such that . Hence, we introduce the following event

| (8.47) |

which needs to hold with high probability, where . To illustrate the latter, we use the vector representation of the process , and proceed with the following steps:

| (8.48) |

Then, we create the set , under which (8.46) holds.

| (8.49) | ||||

| (8.50) |

Using the identity and the union bound, we get

| (8.51) |

We proceed to analyse each term. Define which is a -dimensional, zero-mean, stationary and ergodic -mixing series, as a product of two -mixing series by Assumption 3 and using Theorem 14.1 of Davidson (1994), with properties similar to (5). For and , we have:

| (8.52) |

where we use Lemma 1 of Dendramis et al. (2021) to obtain (8.52). It is then sufficient to bound :

| (8.53) |

for some large enough constant, , and positive constants, . For , we have,

We proceed to analyse . Define as a m.d.s. by Lemma 2. By direct application of Lemma A3 of Chudik et al. (2018) we obtain

| (8.54) | ||||

| (8.55) |

where and , as .

To analyse , recall that is -mixing as a product of two -mixing series, by Theorem 14.1 of Davidson (1994), then define , . Then:

| (8.56) |

Note that results by direct application of Lemma A.11, equation (B.60) of Chudik et al. (2018). Notice that by Corollary 3 , and follow similar line of arguments with term of (8.51), therefore

for some large enough and positive constants and small , as . Combining the results from (8.52)–(8.56) we have that

| (8.57) |

Since and for some large enough positive constant, , we obtain

| (8.58) |

Note that the "prediction error", is -bounded and is -bounded, then by Corollary 6.2 of Bühlmann and Van De Geer (2011)

| (8.59) | ||||

| (8.60) |

Since under , and by Assumption 4,

| (8.61) | ||||

| (8.62) | ||||

| (8.63) |

where and defined in Assumption 4. Then, substituting (8.61)–(8.63) in (8.60), we obtain the following dual bound

which leads to the result:

| (8.64) | ||||

| (8.65) |

with probability at least , for some and a large enough constant , obtained in (8.57). ∎

9 Proofs of Theorems 2 and 3 of the main paper

This Section provides proofs of Theorems 2, and 3 of the main paper.

.

Proof of Theorem 2 Consider Assumptions 1 – 4 to hold. Then, with a proper selection of , the weak irrepresentable condition proposed by Zhao and Yu (2006), holds, hence , where is defined in (9) of the main paper, and , implying that , where . This can be easily confirmed by directly applying Theorem 4 of Zhao and Yu (2006). For the sake of clarity we provide the proof below:

Let , and . Denote , as the first and last columns of respectively and let . By setting and . can then be expressed in a block-wise form as follows:

We then define two distinct events,

where

Event implies that the signs of the active set, , are correctly estimated, while together imply that the signs of the non-active set, , are estimated consistently.

To show , it is sufficient to show that

| (9.1) |

Using the Identity of we have that

| (9.2) |

where is a vector. Notice that and by Assumption 4, holds , hence

for some positive constant . Denote , , and where is defined in (7.65), then of (9.2) becomes:

Terms are bounded following similar analysis as in Lemma 6, hence . Further, notice that similarly with , , . Therefore by Lemma 2, is a m.d.s, and by Lemma A3 of Chudik et al. (2018),

for some large enough constants . Similar analysis is conducted for , concluding that

| (9.3) |

It remains to show (21): When , , the latter can only differ when , which is asymptotically negligible by (9.3). ∎

.

Proof of Theorem 3. We show that

| (9.4) |

where is defined in (26) and is a vector from defined in (33) of the main paper. By (42) we can write

| (9.5) |

where is defined in (7.65). It is sufficient to show that and . We start by showing that . We denote . To show that , we first need to show that

| (9.6) |

where As a first step we show that the nominator and denominator of is asymptotically equivalent to their corresponding quantities of . Starting with the nominator, by Lemma 6.

| (9.7) |

where , and where is defined in (7.65). Further, for the denominator, by Lemma 7

| (9.8) |

We now show that . We remark that is asymptotically bounded away from zero (positive definite), such that the following statement holds:

| (9.9) |

where the smallest eigenvalue of , and the smallest eigenvalue of , which obey . Then, by consequence of Assumption 3, is a zero-mean stationary process, by consequence , . Taking the expectation of and we obtain

| (9.10) | ||||

| (9.11) |

In view of Theorem 24.6 of Davidson (1994), is asymptotically standard normal, across . It remains to show that . The denominators of are identical, so by (9.9), the denominator of is asymptotically positive definite. It suffices to show that is asymptotically negligible. As an implication of Proposition 1, and by Theorem 1, , therefore

showing that . ∎

10 Proofs of auxiliary results

This section contains auxiliary technical lemmas used in the proofs of Section 9.

Lemma 2.

Let the processes , be series of r.v.’s with properties outlined in Assumption 1, 2 and Assumption 3.2 respectively and . Let and . Further, consider either that (i) or (ii) , where Then the -dimensional series is a martingale difference sequence (m.d.s.).

.

Proof of Lemma 2. Let , notice that under (i) and Assumption 2, and , hence is an m.d.s. ∎

Proposition 1.

Let Assumption 3 hold and let . Then is a good approximation of uniformly for all if

| (10.1) |

where , and as defined in (32).

.

Proof of Proposition 1 We show that is a good approximation of , for the sample variance-covariance matrix. Immediate application of the KKT condition on gives

| (10.2) |

It suffices to show that

| (10.3) | ||||

| (10.4) |

where (10.4), the remainder term on (10.3), and . Notice that

are the KKT conditions of a node-wise regression, , and the corresponding estimates, . Following similar arguments to Theorem 1, , while will have the same properties as . We proceed to show (10.4), using the scalar representations of the processes involved,

Notice that , and ,

| (10.5) |

where the first term obtains its rate of convergence by Lemma 3 and the second term has the same rate of convergence following similar arguments as in Lemma 3. Completing the proof of (10.4). Then we can show that

| (10.6) | ||||

| (10.7) |

where , as the sub-gradient of , as the sub-gradient of , and , leading to by (10.5). Considering the analysis on (10.4) and (10.7), (10.3) becomes

| (10.8) |

by plugging (10.8) into , then,

| (10.9) | ||||

| (10.10) | ||||

| (10.11) |

Recall the definition of in (32) and notice that , is the -th row of , we get that and from claims (31), (33), . Equation (10.11) then becomes

| (10.12) |

where . Then, (10.12) will hold if is a good approximation of , in the sense that the approximation error , which we now evaluate.

For (10.1) to hold, the following expression should hold as well.

| (10.13) | ||||

| (10.14) |

where We wish to show that and attains a bound such that the one in (10.1). We analyse :

| (10.15) |

We have that

| (10.16) |

where results from the norm inequality (8) of Chapter 8.5.2 of Lutkepohl (1997) and results by applying the triangle inequality. For , we analyse :

where , two row vectors of the matrices , respectively, defined in (7.65). The asymptotic rate of results by directly applying Corollary 1. Following a similar analysis to , the term . By Lemma 5, we have that , hence . We analyse

| (10.17) |

The asymptotic rate of is obtained by (10.37). Using and expression (8.21), we get that We then continue the analysis for , to derive the result. We examine the column norm of , where is the column of the identity matrix . By (10.12), , incorporating into ,

| (10.18) |

then (10.18) holds, since . Further, using (10.14) and since , we obtain

| (10.19) |

where . It holds that by direct application of Corollary 4, and given that , the result follows. ∎

Lemma 3.

Let Assumption 3 hold. If further, and for , we have

| (10.20) | ||||

| (10.21) |

.

Proof of Lemma 3 The proof follows the same line of arguments as in Theorem 1. ∎

Corollary 4.

Under Assumptions 3, 4, with row sparsity for bounded by and for a suitable choice of the regularisation parameter we have

| (10.22) |

.

Proof of Corollary 3

We show that the errors of the node-wise regressions uniformly on are small. First we make the following standard statements: The compatibility condition holds uniformly for all node-wise regressions, and the corresponding compatibility constant is bounded away from zero. Further,

and Now, each node-wise regression has bounded prediction and estimation errors as in Lemma 3, and we can then write

where , consequently, can be defined following the same logic. Above we used the fact that , which we now prove.

Notice that results from the following expressions:

By (10.16), . For and , we have that

| (10.23) | ||||

Using the reverse triangle inequality we have,

| (10.24) |

Using similar arguments to prove (10.16), we have that . Following a similar line of arguments and utilising the definitions of and , we conclude that For and using the reverse triangle inequality we have,

| (10.25) |

To show that , we first show that . We start with :

| (10.26) |

where results by following similar arguments as the ones to show (10.16), further the rate of and , is obtained by implication of Lemma 3. Regarding , we can write

| (10.27) |

Lastly follow similar analysis to . Hence, we conclude that , showing that . Showing a similar result as in (10.27) for , we proceed to show (10.22)

where completing the proof. ∎

Lemma 4.

Suppose Assumption 3 holds, then

| (10.28) | ||||

| (10.29) |

.

Proof of Lemma 4.

Before we proceed to the analysis, it is useful to point out that, from the KKT conditions of the node-wise regressions of we have with residuals , further on the same note, the KKT conditions of the node-wise regressions of we have with residuals and , with population residuals, .

We first consider . Then we have that

The first part of the Lemma follows if , we proceed to analyse , where :

Following a similar analysis as in (10.25), (10.16), it can be shown that . We analyse

Further, can be analysed such that

| (10.30) | ||||

| (10.31) | ||||

The first and third term in (10.30)–(10.31) can be analysed following similar analysis as (10.16), the second term is obtained by directly applying Corollary 3 and the last term is an implication of Corollary 3, hence . Following the analysis in (10.26) and by direct application of Corollary 3, we conclude that . Concluding, and follows the same analysis with . Therefore the following holds,

To show (10.29), note that , for all . Recall that , thus

which taken together with Corollary 4, imply

Completing the proof. ∎

Lemma 5.

Suppose Assumptions 2 – 4 hold, and that , then the following statements hold

| (10.32) | ||||

| (10.33) | ||||

| (10.34) | ||||

| (10.35) |

where .

.

Proof of Lemma 5 In this proof, we largely follow Kock (2016b). By definition , similar arguments hold for , then

| (10.36) |

Starting with

| (10.37) |

The first term of (10.37) is a direct result of Lemma 4, the second results from (10.27), and Lemma 4 and the third term results from (10.5), and direct application of Corollary 10.11. Following similar arguments to (10.37), we can show that . By definition of , (similar arguments hold for ), we have

| (10.38) |

The result is based on a direct application of Corollary 4, from which we get that and , from Lemma 3 we get , and by following similar arguments as (10.27), we have .

Using a similar line of arguments with , we have that , completing the proof. ∎

Lemma 6.

Under Assumption 3, we have for ,

| (10.39) |

where is defined in (33) of the main paper, while is its sample counterpart, and is defined in (7.65).

.

Proof of Lemma 6 We use the following decomposition of the left hand side of (10.39):

| (10.40) |

It suffices to show the following :

| (10.41) |

We consider each term, starting with :

By (10.38), , as for term , we have that

| (10.42) |

By Corollary 1 and (8.21) , , and by Lemma 1, , and by (8.21), , hence . We proceed to analyse :

hence . We continue with , by (8.21), . By consequence, , showing the first part of (10.41). For the second part of (10.41), by (10.38) and (10.42) For , by (10.38) and by (10) . For

| (10.43) |

By the arguments of (10.36), and by Lemma 1 , for some . Noting that (8.21) holds, along with the latter, Lastly, for

| (10.44) |

By Lemma 5, , and

| (10.45) |

Note that Concluding that corresponds to the design matrix when , for all , is known, which coincides with the case of , where the design contains the infeasible estimates of . Therefore , and the result follows. ∎

Lemma 7.

Under Assumption 3, we have ,

| (10.46) |

where are defined in Section 4 of the main paper.

.

Proof of Lemma 7. To show the result in (10.46), we use the following decomposition:

It is sufficient to show the following:

| (10.47) |

We consider each term, starting with :

| (10.48) |

Using the definition , we analyse the term as:

Notice that is bounded in probability by the same arguments used in of (8.51) and as a consequence . attains a non-asymptotic bound by direct application of Theorem 1, hence . The term is bounded in probability in Theorem 1, hence , therefore . Then, by direct application of Lemma 5, which completes the analysis for . We continue with :

| (10.49) |

where ,

Set , and its expectation

By Theorem 14.1 of Davidson (1994), and as a product of -mixing series, , is also a -dimensional -mixing series with similar properties as (5)–(6). We then write

| (10.50) | ||||

Note that the term includes an -mixing series and can be bounded following similar arguments as in Lemma A1 of Dendramis et al. (2021), is bounded by Assumption 1, which implies that second moments exist and are bounded. Therefore, , while by direct application of Lemma 5, which completes the analysis for .

We continue with :

where, by Lemma 5 we have that,

Note that and are symmetric positive definite matrices, that satisfy the following properties:

where are the smallest and largest eigenvalues of respectively and are the smallest and largest eigenvalues of respectively. Denote which is a scalar and . Then . Hence we obtain the following statements:

| (10.51) | ||||

| (10.52) |

which completes the proof. ∎

Lemma 8.

Under Assumptions 3, 4, the following holds:

where , and , for some large enough positive and finite constants, and independent from and .

.

Proof of Lemma 8 Notice that, for some

By (10.16), , we analyse :

where and are defined in (7.65). Under Assumption 3, is a thin tailed -mixing sequence with properties defined in (6) of the main paper, with , for some , we have

By Assumption 3, is a -dimensional ergodic -mixing sequences, and consequently by Theorem 14.1 of Davidson (1994), are -mixing series satisfying Assumption 3. Therefore,

Notice that

| and | ||

Then we can write,

| (10.53) |

Since is -mixing with properties similar to (5), (6) and by direct application of Corollary 1. The three terms are bounded using Lemma A1 of the Online Supplement of Dendramis et al. (2021). To show that (10.53) holds, it suffices to show that

| (10.54) | ||||

| (10.55) | ||||

| (10.56) |

for some finite constants independent of , where are large constants. By Lemma A11 , Equation B.61 of Chudik et al. (2018) we have that

| (10.57) | |||

where, analysing we obtain

| (10.58) |

for some . For , let , then for some . For , notice that are non-singular matrices defined in (7.65), then by Corollary 3 we have that

(8.32)–(10.56) can be bounded using similar arguments to (10.57). Finally, by Assumption 3 and following a similar analysis with term , by Corollary 3 term for some . Then, for some large enough finite constant

| (10.59) | ||||

| (10.60) |

Notice that

| (10.61) |

for some positive and finite constants , and . Therefore, the dominant rate corresponds to (10.54), completing the proof. ∎

11 Simulation Study Supplement