Token Spammers, Rug Pulls, and SniperBots: An Analysis of the

Ecosystem of Tokens in Ethereum and the Binance Smart Chain (BNB)

Abstract

In this work, we perform a longitudinal analysis of the BNB Smart Chain and Ethereum blockchain from their inception to March 2022. We study the ecosystem of the tokens and liquidity pools, highlighting analogies and differences between the two blockchains. We estimate the lifetime of the tokens, discovering that about 60% of them are active for less than one day. Moreover, we find that 1% of addresses create an anomalous number of tokens (between 20% and 25%). We present an exit scam fraud and quantify its prevalence on both blockchains. We find that token spammers use short lifetime tokens as disposable tokens to perpetrate these frauds serially. Finally, we present a new kind of trader bot involved in these activities, and we detect their presence and quantify their activity in the exit scam operations.

1 Introduction

The cryptocurrency market is loosely regulated [33, 7]. Even if policymakers are moving towards building a safer environment for cryptocurrency investors [48], it is a complex task, and it needs time. Meanwhile, blockchain-related technologies evolve fast, and with the birth of the DeFi [57] investors begin to move from centralized exchanges (CEX) like Binance or FTX to decentralized exchanges (DEX). DEXes are distributed Applications (dApp) for trading that run on-chain powered by smart contracts. While regulating the standard cryptocurrencies market is not easy, ruling the on-chain trading platform is harder. Indeed, even if the web interface of a DEX can be shut down [5], its smart contracts are still reachable and working on the blockchain.

DEX and DeFi dApp were born in the Ethereum blockchain, but DeFi services rapidly pop up on all the blockchains that support smart contracts. Although Ethereum always plays the role of the main character in the DeFi world, with over 68 billion USD locked in its smart contracts, the BNB smart chain or BSC (former Binance Smart Chain) proposes itself as a faster and cheaper alternative to Ethereum.

Uniswap and PancakeSwap are arguably the two most popular DEXes on Ethereum and BSC. They rely on the Automated Market Maker (AMM) model to handle the trading system. At the basis of the AMM model, there is the concept of liquidity pools, a smart contract that handles two tokens (trading pair) that the user can swap. Unlike CEX, where the platform defines the trading pair, every user can create their pair on DEXes and let the other users use it. However, as we will see in the following, some users abuse this freedom to carry out frauds.

In this work, we perform a longitudinal investigation on tokens and liquidity pools that live in the Ethereum and BSC blockchains. We start by parsing over 3 billion transactions of both blockchains, searching for the largest possible number of tokens and liquidity pools. We identified more than 1.3 million tokens and 1 million liquidity pools. Then we reconstruct their lifetime, discovering that approximately 60% of the tokens have a lifetime shorter than 1 day. Focusing on who creates the token, we observe that a tiny fraction of addresses, just 1%, is responsible for creating more than 20% of the tokens. Given their overproduction of tokens, we will call these addresses token spammers. Surprisingly, we also find that the tokens with a very short life are actively traded on liquidity pools. Albeit this phenomenon is present on both blockchains, we notice that it is more widespread in BSC.

Diving into this subset of tokens, we observe that a large fraction of liquidity pools used to trade the 1-day tokens show the malicious pattern that we call exit scam. We analyze all the liquidity pools looking for exit scam patterns, and we find 266,340 potential frauds in BSC and 21,594 potential frauds in Ethereum. We estimate the cost of the operation and the gains of the scammers. Here, we see that the success rate of this operation is not very high (between 40% and 60%). However, given the simplicity and the very low cost of the operation, scammers can serially arrange the fraud and cover a series of unsuccessful operations with a single successful one.

Our key contributions are:

-

•

Analysis of BNB smart chain: To the best of our knowledge, we are the first to study this young but well-established blockchain, performing a longitudinal analysis from its inception to March 2022. We study the tokens and the liquidity pools ecosystem, highlighting analogies and differences with Ethereum.

-

•

1-day tokens and Token spammers: We estimate the lifetime of the tokens on both blockchains, discovering that about 60% of tokens last less than one day. In particular, a significant fraction of them lasts just 1 block. Analyzing who creates the tokens, we observe that just 1% of addresses create an abnormal number of tokens (about 20-25% of tokens of the blockchain).

-

•

Exit scam operations: We investigate the presence of the exit scam fraud pattern in 1-day tokens. We discover that in BSC, 81.2% of 1-day tokens listed on PancakeSwap have this pattern. Moreover, we notice that 75.1% of the token spammer in BSC carry out at least one operation using “disposable” tokens. We estimate the gains of the scammer, observing that even if the operation is very simple to arrange, given its cheap cost, it is profitable when performed serially.

-

•

Sniper bots: We find the presence of sniper bots, a particular kind of trader bot that observes the mempool of the blockchain to buy newly listed tokens in almost zero time from the moment they are tradable on a liquidity pool. To the best of our knowledge, we are the first to illustrate how this kind of trading bot works, detect their presence, and quantify their activity in the exit scam operations.

2 Ethereum and BNB Smart Chain

2.1 Ethereum

Ethereum [12] is a proof-of-work blockchain. Its native coin is the Ether (ETH), the second most popular cryptocurrency after Bitcoin (BTC) with a market cap of more than 210 billion US dollars. A key feature of Ethereum is smart contracts, pieces of code that can execute in a decentralized way on-chain, making Ethereum a programmable blockchain. Smart contracts enable the creation of decentralized applications (dApp) and the so-called Web3.0 [3]. Through smart contracts, it is possible to create new digital assets like (fungible) tokens and NFTs (not fungible tokens).

The tokens. Tokens, like coins, are cryptocurrencies that can be exchanged or traded. The main difference is that coin is the native asset of the blockchain, whereas tokens are created on top of the blockchain, and their mechanisms are defined using smart contracts. In Ethereum, the ERC-20 [25] standard defines the main properties of tokens. ERC-20 was proposed in late 2015 to establish the standard interface for tokens. An ERC-20 compliant smart contract must implement a set of functions and events specified in the standard. These functions are reported in Table 1. Some of them are optional, in particular the name(), the symbol(), and the decimal() functions. In Ethereum, tokens and digital assets are held into accounts.

Ethereum accounts. There are two kinds of accounts in Ethereum: Externally owned accounts (EOA) and contract accounts. EOAs consist of a pair of public and private keys generated with the Elliptic Curve Digital Signature Algorithm (ECDSA) [30]. An account is represented by its public address, a 42-character hexadecimal string obtained concatenating "0x" to the last 20 bytes of the Keccak-256 [22] hash of the public key. Generally, users interact with an account using applications called wallets. Example of wallets are MetaMask [40], TrustWallet [54] or MyEtherWallet [41]. A contract account, instead, is an account tied to a smart contract, and it is represented with an address of the same format as an EOA. A contract account is generated when a smart contract is deployed to the Ethereum blockchain. Both accounts can hold and send Ether. However, contract accounts can only send transactions in response to receiving a transaction.

Transactions and fee. A transaction is an action that updates the whole Ethereum network. It can be used to move digital assets, deploy a smart contract, or invoke a smart contract. Executing a transaction has a cost, commonly called transaction fee. The fee is variable and depends on two main factors: The state of the network (if the network is heavily loaded, the fee is usually higher), and the complexity of the operation that the transaction triggers. For instance, moving Ether from an EAO to another is the cheapest kind of transaction, while interacting with a smart contract could be very expensive. For the sake of simplicity, we can say that the transaction fee is composed of two parts: the gas limit and the gas price. Gas refers to the unit that measures the computational effort required to execute specific operations. The gas limit represents the maximum amount of gas a user is willing to pay for the operation, and it has to be high enough to pay the computational effort; otherwise, the transaction will fail. Instead, the gas price is the amount of Gwei ( Ether) the user is willing to pay for each gas unit.

Smart contract deployment. As we said, smart contracts are programs that run on the Ethereum blockchain. They are written in a high-level programming language (e.g., Solidity [20]) and compiled into bytecode that runs on the Ethereum Virtual Machine (EVM) [24]. A smart contract can be deployed by sending a contract creation transaction from an EOA to the zero address1110x0000000000000000000000000000000000000000. The transaction contains the bytecode of the smart contract. A smart contract can also create new smart contracts. In this case, the bytecode of the new smart contract has to be embedded in the bytecode of the smart contract that generates the new one. Since a smart contract can not start a transaction by itself but only in response to a transaction that triggers it, an EOA must trigger the generation of a new smart contract.

Events and logs. A smart contract has data associated with it, such as its Ether balance and the value of its variables. Transactions, calling the smart contract methods, can modify those values, hence the state of the smart contract itself. Knowing the internal state of a smart contract can be crucial, especially in cases where it serves as a backend to distributed applications (dApps). Ethereum provides Events and a Logs register to track the internal states of smart contracts. Each time an action changes the internal state of a smart contract, it can fire an Event that will notify the change. All the events are written on an Event log. Thanks to it, users and developers can easily track the state of the smart contracts in the blockchain.

EVM and EVM compliant. Ethereum is a distributed state machine that changes its state at each new block accordingly to a predefined set of rules. The EVM is the entity that computes these changes in states. Specifications of the EVM are described in the Ethereum Yellowpaper [55]. There are several standard implementations of the EVM in different programming languages (e.g., Python, JavaScript, C++). Other than Ethereum, other blockchains rely on the EVM (to name a few: BNB Smart Chain [9], Avalanche [46], Fantom [26], Cronos [18]), and they use one of the standard EVM or a complete custom one. These blockchains are called EVM compliant. They run the same (or with minimal change) smart contract written in Ethereum, use the same convention for the address, and handle states the same way as Ethereum.

2.2 The BNB Smart Chain

The BNB Smart Chain [9] (previously Binance Smart Chain) or BSC is a blockchain that was born in 2020 as a parallel to the Beacon Chain (previously Binance Chain), and together they form the BNB Chain. Its consensus is based on the PoSA [10] (Proof of Stake and Authority). While the Beacon chain handles the staking and the governance of the blockchain, the BSC manages the consensus layer and provides EVM compatibility. The coin of both chains is the BNB (Build and Build, previously Binance Coin)—the third coin by market cap with over 46 billion of capitalization. As Ether on Ethereum, the BNB coin fuels the transactions in the BNB chain. Given the EVM compatibility, creating tokens on the BSC is possible. However, in this case, tokens follow the BEP-20 standard instead of the ERC-20.

3 The Automated Market Maker - AMM

Cryptocurrencies can be traded on centralized exchanges (CEXs)—like Binance, Coinbase, FTX—or on decentralized exchanges (DEXs). The name CEX stems from the fact that users who trade a cryptocurrency for another have to transfer the cryptocurrency from their private wallet to a custodial wallet managed by a centralized entity, that is the exchange. Usually, on CEX, like on the traditional stock exchange, trades are performed following the Order Book Model. In this model, there is a system that matches the users’ trading orders, ensuring that each order is closed accordingly. In simple terms, if trader A wants to buy 1 Bitcoin at $40,000, the system performs the trade only if it finds a trader B willing to sell 1 Bitcoin at the same price.

Unlike CEX, on DEX there is no intermediary. The user interacts with the smart contracts deployed on the blockchain, and the user’s cryptocurrencies leave their private wallet only when traded. Although some DEXs operate the Order Book Model (EtherDelta, Binance Dex, Waves Exchange, DyDx), the most popular follow the Automated Market Maker model. This model relies on a mathematical formula to fix the price of assets and on the concept of liquidity pools and liquidity providers. A liquidity pool is a smart contract that contains two or more cryptocurrencies that the user can swap one for the other. Instead, a liquidity provider is a user who invests in the liquidity pool, providing cryptocurrencies to the smart contract. When a liquidity provider injects liquidity into the liquidity pool, the smart contract mints LP-tokens and gives them to the liquidity provider. The LP-token represents the share of the liquidity pool owned by the investor. Conversely, when the liquidity provider desires to get back her cryptocurrencies, he transfers the LP-tokens to the smart contract. The latter burns the LP-tokens and provides the cryptocurrencies back to the investor. Usually, liquidity pools apply a trading fee to each swap operation and distribute a portion of the fees to the liquidity providers according to their LP-tokens.

3.1 Uniswap and its forks

Uniswap [1] is the first decentralized application (DEX) to use the AMM model successfully. According to DefiLlama [36], a popular DeFi statistics aggregator, Uniswap is the dApp by TVL (Total Value Locked, amount of money locked into smart contracts) with over 6 billion USD, while it is the among the AMMs. Uniswap was launched on Ethereum, but now it is also present on the Ethereum Layer 2 solutions Arbitrum and Optimism and on the Ethereum side chain Polygon Matic. Because of its popularity, its open-source smart contracts, and the copyleft license [51], more than 50 protocols were born on several blockchains by forking Uniswap smart contracts in the last years. Uniswap is on its third version, but all its forks belong to the second version since the third one is under a Business Source License [52]. For this reason, in this work, we focus on Uniswap V2 and its forks. One of the most popular fork of Uniswap is PancakeSwap, which lives in BSC, and it is the dApp by TVL on this blockchain with over 4 billion of USD locked in its smart contracts.

In Uniswap V2, each pool consists of a pair of ERC-20 tokens. We can think of the liquidity pool as divided into two parts, each containing a single token, and both have an equivalent value. Let a pool consist of token A and token B. At each swap, the pool preserves . When a user swaps token A for token B (the user adds token A to the pool and takes token B from the pool), increases by and decreases by , where is computed so that does not change. The rate of the exchange is determined by the ratio of and in the pool. Consequently, the swap operation changes the current exchange rate, the value of token A decreases while the value of token B increases, and the two parts maintain the same value.

Although Uniswap has some pools directly created by itself, anyone can leverage the protocol and create a new pool with a custom trading pair. This freedom allows the creator of the pool to establish the initial price of a new token, balancing the amount of liquidity added to the liquidity pool.

4 The Datasets

For our investigation, we build two different datasets: The Token Dataset contains all the ERC-20 (resp. BEP-20) tokens created, and the Liquidity Pool Dataset, contains data about liquidity pools. Each dataset has two versions, one with data from the Ethereum blockchain and the other from the BNB Smart Chain.

Given the large amount of data and the need to parse the entire blockchains multiple times, for performance reasons and to avoid overloading public nodes (e.g., nodes provided by Binance [8] and Infura [29]) or services (e.g., BSCscan or Etherscan), we host and run an Ethereum and a BNB Smart Chain node. Finally, to query the blockchains and process the data we use the Web3 [42] and the Ethereum-etl [39] Python libraries. Web3 is a library that allows interaction with a local or remote EVM-compliant node using HTTP, IPC, or WebSocket. Ethereum-etl allows extraction of information from EVM-compliant blockchain and exporting them into formats like CSV or JSON.

We consider the whole history of both blockchains from their inception to March 2022. For the Ethereum blockchain, we process all the blocks from block 0 (2015-07-30) to block 14340000 (2022-07-03). For the BSC blockchain from block 0 (2020-04-20) to block 15854000 (2022-03-07).

4.1 The Token Dataset

To build the Token dataset, we perform multiple steps. We first collect all the contract creation transactions on both blockchains, then we expand our dataset by collecting all the contracts that emit a Transfer event. This process is necessary to find tokens generated by internal transactions. Finally, we refine our dataset by selecting only the smart contracts compliant with the ERC-20 (resp. BEP-20) standard.

4.1.1 Gathering Smart Contracts

As a first step to building the Token dataset, we collect all the contract creation transactions issued by EOAs. As mentioned in Section 2, EOAs can deploy a smart contract by sending a contract creation transaction to the zero address. We process all the transactions in the considered time frame in BNB Smart Chain (2.6 billion transactions) and Ethereum (1.4 billion transactions). We collect 2,195,399 and 4,420,389 contract creation transactions respectively.

However, tokens can also be created by a smart contract itself. Indeed, it could be the case that an EOA calls a smart contract method, and its execution generates a new ERC-20 (or BEP-20) compliant smart contract. In this case, the token is created with a so-called internal transaction. Despite the name, internal transactions are not real transactions but instead calls performed by smart contracts. These kinds of transactions are stored off-chain—they are not visible simply by parsing the blockchain.

To track tokens created by internal transactions, we can operate in two ways: The first way is to re-execute all the transactions in the blockchain in the EVM and trace all the calls. This process is extremely expensive [49] from a computational point of view. The alternative is to scan the Event log looking for events that emit a Transfer event. The second way is much faster and we estimate that it loses only 12% of the total number of tokens created by internal transactions. Moreover, the missing tokens are tokens that have never been used, traded, or transferred and are thus of little importance for our study (we discuss in detail the impact of this choice in Section 10). So, we parse all the logs of both blockchains, searching for smart contracts that emit a Transfer event compliant with the ERC-20 (resp. BEP-20) interface. Then, we use EtherScan [31] and BscScan [32] to retrieve the transactions that created these smart contracts and all the needed information.

At the end of these two steps, we have a collection of 3,087,274 and 4,534,599 smart contracts extracted from BSC and Ethereum, respectively. For each of them, we store the following information: The address of the contract, the block number in which the smart contract has been generated, the block in which the smart contract emits the last event, the EOA that deployed the smart contract or in the case of internal transactions the EOA address that triggers the first smart contract, the amount of gas used, the cost of the gas unit (gas price), the bytecode of the smart contract, and if the smart contract has been deployed by an EOA or through an internal transaction.

4.1.2 Token Identification

Smart contracts are not only used to create tokens, and not all smart contracts that emit a Transfer event are tokens (e.g., NFT contracts). Thus, we need to identify which of the retrieved smart contracts are compliant with ERC-20 (resp. BEP-20). Unfortunately, this is not a trivial task, and in the last years several works [21, 53, 15, 14, 27], attempted to face this problem with several approaches that we describe in Section 9. For our analysis, we follow the approach proposed by [53, 15] that leverage the bytecode of smart contracts.

According to the Solidity specification [35], in the bytecode, smart contracts’ methods are identified by signatures that consist of the first 4 bytes of the Kekkack-256 hash of the method name and parameters’ type. Thus, to verify if a bytecode of a retrieved smart contract represents an ERC-20 (resp. BEP-20) compliant token, we verify if it contains at least all the signatures of the ERC-20 (resp. BEP-20) mandatory methods. Tab. 5 in the Appendix shows the signature of the mandatory and optional methods of the ERC-20 and BEP-20 interfaces.

Of the 4,534,599 smart contracts’ bytecode retrieved on the Ethereum blockchain, we find that 389,348 (8.5%) are ERC-20 tokens compliant, and 381,551 (98%) of them also implement the optional functions of the ERC-20 interface. Instead, in the BNB Smart Chain, we find that 1,887,484 out of 3,087,274 (61%) are BEP-20 compliant and, almost all of them also implement the optional methods of the BEP-20 interface. Although we found more smart contracts in Ethereum than in BSC (4,534,599 vs 3,087,274), there are many more compliant tokens in BSC (1,887,484) than in Ethereum (389,348). This discrepancy suggests that BSC may be a more interesting environment to study tokens and, possibly, their misuse.

Lastly, we retrieve all the information about the identified tokens, such as the name, the symbol, the number of decimals, and the total supply. We use the Ethereum-etl library and the Contract Application Binary Interface (ABI) [23]. The ABI is an interface between two program modules. It contains the specification for encoding/decoding methods and structures to interact with the machine code and interpret the results. Through the library, it is possible to instantiate smart contracts in an object-oriented manner and call its methods using an appropriate ABI. We instantiate the token contracts using an ABI that contains the specifications of ERC-20 (resp. BEP-20) methods and call the name(), symbol(), decimals(), totalSupply() methods.

At the end of the process, we have a dataset of ERC-20 (resp. BEP-20) tokens containing all the information about the smart contracts described in Section 4.1.1 and the related tokens. Table 1 shows the number of smart contracts on both blockchains.

| Ethereum | BNB Smart Chain | |||

|---|---|---|---|---|

| Contracts | Total | ERC-20 | Total | BEP-20 |

| External | 4,420,389 | 293,688 | 2,195,399 | 1,021,427 |

| Internal | 114,210 | 95,660 | 891,875 | 866,057 |

| Total | 4,534,599 | 389,348 | 3,087,274 | 1,887,484 |

| Total (w/o LP) | - | 323,863 | - | 1,078,016 |

4.2 Liquidity Pools Dataset

| Ethereum | BNB Smart Chain | |||

|---|---|---|---|---|

| Events | Uniswap | Others | PancakeSwap | Others |

| PairC. | 65,098 | 5,483 | 941,220 | 30,907 |

| Mint | 1,399,599 | 512,319 | 21,944,474 | 5,027,980 |

| Burn | 824,359 | 243,482 | 7,339,286 | 2,481,023 |

| Swap | 54M | 27M | 571M | 179M |

To create the Liquidity Pool dataset, we consider Uniswap, its forks, and other protocols that leverage its smart contracts.

Uniswap has three main smart contracts: Factory, Pair and the Router. The Factory contract is responsible for creating the smart contract that handles the liquidity pool and the LP-tokens. Note that since the same smart contract handles the LP-token and the liquidity pool they have the same contract address. The Pair contract keeps track of the balances of the tokens in the pool and implements the AMM logic explained in Sec. 2. The Router contract offers the entry point to interact with the liquidity pools. Thus, interacting with the Router, it is possible to add or remove cryptocurrencies from a liquidity pool and swap tokens. Each of these contracts implements a set of Events that notify their status changes.

To build our datasets, we parse the Event log of the Ethereum and BSC blockchains. Following there are the events we look for and a brief description:

-

•

PairCreated: This event is fired by the Factory contract each time a new liquidity pool is created. We find 972,127 and 70,581 PairCreated events emitted in BSC and Ethereum, respectively. From the event, we can obtain the transaction hash, the block of the creation of the liquidity pool, the address that created the liquidity pool, the address of the liquidity pool, and the addresses of the two tokens (the pair of the liquidity pool), the gas used and the price paid per gas.

Analyzing the address that fired the event and looking online for notable smart contract addresses, it is possible to have a rough idea of the diffusion of the Uniswap forks in the blockchains. In BSC, we find that PancakeSwap created most liquidity pools, with 941,220 emitted events (96.8%), followed by ApeSwap [4] (3,265 events), BakerySwap [6] (2,418 events) and Mdex [38] (1,602 events). In Ethereum, Uniswap emitted 65,098 events (92.2%), while the SushiSwap [12] Factory contract, a popular alternative to Uniswap on Ethereum, 2,637 (3%).

-

•

Mint & Burn: The Pair contract emits a Mint (or Burn) Event each time a LP-token is minted (or burned). This occurs every time a liquidity provider adds (or removes) tokens into a liquidity pool. Analyzing these events, we can obtain the transaction hash and the block of the Mint (Burn) Event, the address of the liquidity pool, the address that added (removed) the liquidity, the number of LP-tokens minted (burned), the gas used, and price paid for the gas. We find 26,972,454 Mint events and 9,820,309 Burn events in BSC, and 1,911,918 Mint events and 1,067,841 Burn events in Ethereum.

-

•

Swap: This event is fired by the Pair contract each time a user swaps tokens in a liquidity pool. From the event, we obtain all the information related to the swap as: The transaction hash, the block in which the swap occurs, the address of the liquidity pool used, the address that performs the swap, the number of tokens swapped, the gas used and the gas price. We find 750,508,160 events in BSC and 82,447,051 events in Ethereum.

Moreover, we complete our dataset by collecting for each smart contract the block number in which it emits the last event. Tab. 2 describes the final dataset.

LP-tokens are ERC-20 (resp. BEP-20) compliant tokens, and they are already present in our Tokens Dataset. However, our goal is to study standard token and liquidity pools separately. Thus, as the final step, we get rid of the information related to the LP-tokens from the Tokens Dataset. The last line on Tab. 1 reports the number of tokens after getting rid of the LP-tokens.

5 The Lifetime of Tokens

Our data collection revealed a surprisingly high number of tokens and liquidity pools in Ethereum and BSC. Services like CoinGecko [16] or CoinmarketCap [17] list about 13,000 cryptocurrencies on 602 centralized and decentralized exchanges in total. So, it is unclear what is the role of the large majority of tokens in the blockchain ecosystem.

To obtain a first insight into the characteristics of tokens and liquidity pools, we introduce the concept of lifetime. We define the lifetime of a token in the following way: A token begins its lifetime at the block where its smart contract has been deployed, while it ends its lifetime in the last block where it emits any Event. Similarly, a liquidity pool begins its lifetime at the block where the PairCreated event is emitted, and it ends in the last block where the liquidity pool’ smart contract emits any Event.

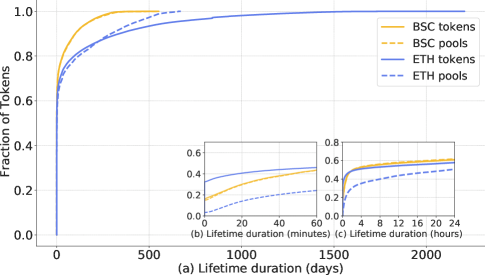

Figure 1 shows the CDF of tokens’ lifetime and liquidity pools’ lifetime in Ethereum (blue lines) and BSC (yellow lines). Tokens and liquidity pools are shown with solid and dashed lines, respectively. The slope of the curves tells that the lifetime of the tokens in BSC are generally shorter than the lifetime of the tokens in Ethereum. Consider that BSC is a young blockchain, with slightly more than two years of activity (released on 2020-04-20), while Ethereum is more than seven years old (released on 2015-07-30). The longevity of Ethereum is also visible by the long tail of its tokens in the CDF. Nonetheless, it is apparent that Ethereum hosts tokens that tend to be more solid and long-lasting. This difference is smaller when we look at liquidity pools. Indeed, PancakeSwap, that handles about 97% of the liquidity pools in BSC, was born only four months after the release of Uniswap V2. The reader can also observe that, in general, the lifetime of the liquidity pools is shorter than the lifetime of the tokens. This is not surprising. Indeed, a liquidity pool needs both tokens involved to be created in advance. Thus, the lifetime of a liquidity pool can be maximum as long as the lifetime of the younger token.

From the CDF, we can also note a few additional interesting facts, particularly when looking at the first 24 hours of the life of tokens and liquidity pools.

A significant fraction of tokens are never active. Looking at the zoomed image in the center of Figure 1 (b), it is possible to see that a significant fraction of tokens have a lifetime of zero, meaning that the token is active only in 1 block when it was created. This phenomenon is more common in Ethereum, with 104,836 out of 323,863 (32.4%) tokens that belong to this category, against 167,318 out of 1,078,016 (15.5%) in BSC. In the following, we refer to the tokens that last only one block as 1-block tokens, while to the other tokens as active tokens. We find 910,698 and 219,027 active tokens in BSC and Ethereum, respectively. Table 3 succinctly reports on these statistics.

A large part of active tokens have an extremely short lifetime. Figure 1 (b) shows that about 60% of the tokens in BSC and Ethereum have a lifetime shorter than one day. We refer to these tokens as 1-day tokens. If we consider only active tokens, we find that 471,385 (51.7%) of all the active BSC tokens and 82,542 (37.7%) of all the Ethereum active are 1-day tokens. Looking at the data at a higher granularity (Figure 1 (b)), we can note that the death ratio of BSC tokens is surprisingly high. BSC has approximately half of the 1-block tokens of Ethereum, about the same proportion of dead tokens after 60 minutes, and a significantly larger proportion of dead tokens after the first 4 hours. As we can see in Figure 1 (c), the first four hours of token life are crucial also in Ethereum.

Almost all the BSC tokens with short lifetime have a liquidity pool. Here, we find one of the main differences between BSC and Ethereum. 414,936 out of 471,385 (88%) active tokens with a lifetime shorter than one day in BSC have a liquidity pool. In Ethereum, only 33% (26,817). It seems that in BSC, the liquidity pool is the main reason to create a token.

| Lifetime | BNB Smart Chain | Ethereum |

|---|---|---|

| 1-day | 638,703 (59.2%) | 187,378 (57.8%) |

| 1-block | 167,318 (15.5%) | 104,836 (32.4%) |

| Total tokens | 1,078,016 | 323,863 |

6 Who Creates Tokens?

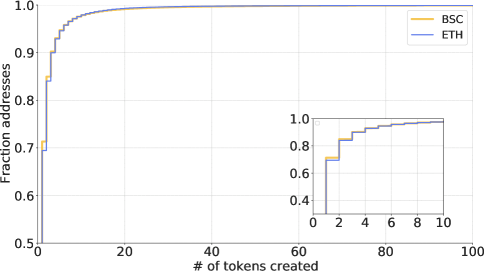

In this section, we change perspective and explore who creates tokens. Retrieving the list of creator addresses from our token dataset, we find 144,795 and 464,095 different addresses that create at least one token, respectively in Ethereum and BSC. Comparing these numbers with the total number of cumulative unique addresses in Ethereum (189,858,744) and BSC (140,522,222)222Data retrieved from Etherscan and BSCscan respectively, we see that they represent only a very small fraction of the addresses, the 0.07% in Ethereum and 0.33% in BSC. Figure 2 shows the distribution of the number of tokens created by addresses in Ethereum and BSC. The first thing to notice is that the two distributions are extremely similar. The large majority of these addresses (70%) create only one token, as we can see in the zoomed image on the bottom right corner of Figure 2. 95% of addresses create 5 tokens or less and just 1% of addresses create more than 18 tokens.

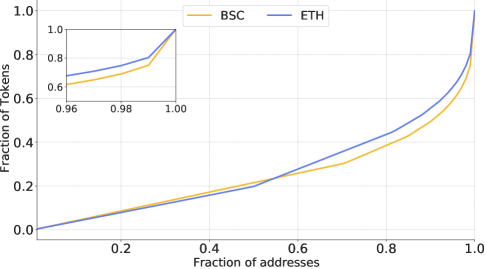

However, we can gather further insights by plotting the same data differently.

A small fraction of addresses creates a disproportionate amount of tokens. Figure 3 shows the CDF of tokens created by fraction of addresses. From the figure, we can see that although 70% of addresses create just 1 token, the total amount of tokens created by these addresses account for only 30% of the tokens on the two blockchains. And, more interestingly, we find that just 1% of the addresses creates 24.3% (262,023) of the tokens in BSC, and similarly, 1% of the addresses in Ethereum create 20.1% (67,838) of the tokens. These addresses create an average of 51 and 61 tokens in Ethereum and BSC, respectively. We will refer to these addresses as token spammers.

6.1 The Token Spammers

In this subsection we put under the lens the token spammers. Here are a few interesting observations.

Token spammers are more prevalent in BSC. Although the distribution of the number of tokens created by addresses in Ethereum and BSC is almost identical (Figure 3), the absolute numbers are different. Indeed, in terms of raw numbers, we find that BSC has almost four times more token spammers than Ethereum (4,231 vs 1,329), and the spammers of BSC create almost four times more tokens in BSC than in Ethereum (262,023 vs. 67,838).

Token spammers create tokens mainly with contract creation transaction. As mentioned in Section 2, tokens can be created in two ways: By sending a contract creation transaction or by sending a transaction to a smart contract that generates the token. We find that 94.8% of the tokens in BSC and 82.3% of the tokens in Ethereum are created directly by sending a contract creation transaction. Focusing on the small fraction created by sending a transaction to a smart contract, we find that token spammers create 13,794 tokens using 3,530 different contracts in BSC and 12,010 tokens using 1,237 different contracts in Ethereum.

Token spammers create short lifetime tokens. As we have seen, a significant fraction of tokens have a lifetime shorter than 1 day. Investigating the relationship between token spammers and 1-day tokens, we discover that most of the tokens created by the spammers have a lifetime shorter than one day. The spammers created 170,768 1-day tokens out of 262,023 (65.1%) and 40,552 1-day tokens out of 67,838 (59.8%) respectively, in BSC and Ethereum.

7 Malicious Activity

The top token spammer creates 17,936 tokens in the timeframe of our analysis. If we look at the name of these tokens, we find that almost all of them have the same name (the tokens have only 76 unique names), with the most used being ’Pornhub’ with 605 occurrences. The median lifetime of these tokens is extremely small: 45 mins. Lastly, almost all of the tokens (99.7%) created by this address have a liquidity pool. We now detail in depth the life of one of the tokens.

The anatomy of an operation. We focus on OnlyFans3330xe8b6f08841d668605343A63144D76ff2dE9A1199, a token created by the top token spammer on block 8090747 (2021-06-07 01:40:34 PM UTC) by issuing a contract creation transaction. This token has a supply of and its symbol is the Unicode U+1F48B, the emoji of a kiss mark, followed by the string "OnlyFans". On block 8090751 (2021-06-07 01:40:46 PM UTC), after 4 blocks from its creation, the token spammer creates a liquidity pool that contains the pair (OnlyFans, WrappedBNB) and adds a liquidity of 20 Wrapped BNB (almost $7,180 at the moment of the operation) and 44 trillions of OnlyFans tokens.

After just 6 seconds, on block 8090753 (2021-06-07 01:40:52 PM UTC), an address swaps 4 billion OnlyFans for 0.002 Wrapped BNB ($0.718). That operation is followed by other 12 addresses—12 different swaps—for a total buy of OnlyFans for 2.67 Wrapped BNB ($958). After 2 hours from the creation of the token, at block 8093101 (2021-06-07 03:38:55 PM UTC), the token spammer removes all the liquidity from the liquidity pools leaving it drained. Since the 12 addresses added Wrapped BNB into the pool by buying OnlyFans, the token spammer collects 22.67 Wrapped BNB and has a profit of 2.67 Wrapped BNB ($958).

These kind of operations are quite frequent and are commonly called rug pulls or exit scams [43, 37].

7.1 The Rug Pull

We develop an approach to systematically find operations following the same pattern we explored in the case study. First of all, we formalize the kind of activity we are interested in:

-

1.

Eve creates a new ERC-20 token .

-

2.

Eve creates a new liquidity pool with pair (, ), where is a valuable token, e.g. Wrapped BNB.

-

3.

Eve adds liquidity to the liquidity pool. The reserves of the pool are now ).

-

4.

At this point, Eve is the only one that owns token . Investors can buy token by swapping their tokens with token in the liquidity pool.

-

5.

Suppose that Bob buys a few swapping it with . The new reserves of the liquidity pool are )

-

6.

Lastly, Eve removes all the liquidity from the liquidity pool. The net gain of the operations is minus the gas fees to execute the transactions.

7.1.1 An Improved Version of the Fraud

The rug pull described above is the simple version of the fraud, in which the scammer never interact with the liquidity pools until he removes the liquidity. To attract more investors, the scammer can manipulate some statistics of the liquidity pool, such as the number of swaps, the trading volume, or the price. The scammer can usewash-trading [13], a well-known market manipulation. In this case, the creator of the pool tries to create the impression that the liquidity pool is active, faking the trading volume by repeatedly buying and selling tokens. The goal is to increase the liquidity pool’s trading volume rather than the scam token’s price.

Another way that scammers have to drum up the attention of investors is to inflate the price by buying the scam token gradually. This action is without risks for the scammer until the liquidity pool has no new investors. Indeed, having the total of the LP-tokens, he can retrieve all the new capital injected when he removes all the liquidity. In the following, we refer to these operations as pump operations.

The scammer can also hedge his gains—eliminating the risk of an unrealized profit while the liquidity pool is still active. The scammer usually does not put the scam token in the pool but maintains a reserve in its wallet. When investors start to buy the scam token, raising the asset’s price, the scammer can gradually sell the owned token, taking profit from the operation. In the following, we refer to these operations as hedge operations. Of course, the scammer can use one or a combination of these practices.

7.2 Looking for Rug Pulls

We leverage our datasets to identify exit scam rug pulls systematically. Since we saw a considerable number of 1-day tokens, and most of them are created serially, we narrow our investigation to the 414,936 in BSC and 26,817 in Ethereum 1-day tokens with a liquidity pool. We analyze all the Events emitted by the liquidity pools, looking for all the liquidity pools that emitted only 1 Mint event and only 1 Burn event in which the address that performs the transaction burns at least 99% of the minted LP-tokens (we don’t use 100% since a small fraction of tokens might be stuck in the wallet due to rounding).

7.2.1 Estimating the Gains of the Fraud

The simple operation, where the scammer does not swap in his liquidity pool, can be carried out by performing just four transactions: A transaction that creates the token, one that creates the liquidity pool, one that adds the liquidity, and finally, the last transaction to remove the liquidity. These transactions can be performed individually, or they can be aggregated by leveraging a smart contract. Of course, we consider both of the cases when computing the fees. If the scammer performs swaps on the liquidity pool, we also consider the transaction fees paid for each swap.

To perform our estimation we use the following formula:

| (1) | |||

| (2) |

The formula can be split into two components. The first part computes the gain in the case of the simple operation, the case that we explored in the Case Study and formalized in Section 7.1. The second formula takes into account the more refined version of the fraud that we described in 7.1.1, where the creator of the liquidity pool manipulates it by performing swaps operations. In this case, we remove from the gain , that is, the amount of tokens that the manipulator artificially adds to the liquidity. We also add to the gain , the quantity of tokens that the manipulator removes from the liquidity pool before the final removal of the liquidity. Finally, we remove from the gains the fees used to perform the swaps operations ().

7.3 Results

After processing our data, we discover that an incredibly high number of liquidity pools are actually rug pulls. In BSC, 266,340 out of 414,936 (65.6%) of the considered liquidity pools have an exit scam pattern, while 21,594 out of 26,817 (81.1%) in Ethereum. This result shows that scammers use most of the 1-day tokens as disposable to carry out rug pulls.

These operations are arranged by 116,516 different addresses in BSC and 16,539 different addresses in Ethereum. As we can expect from the previous analyses, most of the token spammers that operate in BSC are linked to this kind of activity. Indeed, in BSC, 3,179 out of 4,231 (75%) token spammers performed at least one rug pull. Instead, in Ethereum, there are only 101 token spammers (7.6%) that have been involved in this activity. We find 114 addresses that perform more than 100 exit scams in BSC, accounting for 19.1% of the operations, with the most active performing 16,102 operations. Instead, in Ethereum, we find only two addresses performing more than 100 operations. Interestingly, combining the information in the BSC and Ethereum datasets, we find that two token spammers operated on both blockchains with the same address. They perform 78 exit scams in Ethereum and 194 in BSC.

Looking at the liquidity pools, we find that BNB (97.8% of the cases) is the token paired the most with the scam token. It is followed by USDT (0.67%) and BUSD (0.15%), two stable coins pegged to the USD. Instead, ETH is paired with all the scam tokens in all the liquidity pools with an exit scam in Ethereum. As the next step, we want to estimate the number of potential users that fall prey to such activities. To do so, we exclude the addresses that swap into liquidity pools they have created themselves from this analysis. We collect 256,967 different addresses in BSC and 59,043 in Ethereum that interact with at least one liquidity pool with an exit scam pattern. These addresses performed 2,903,021 swaps on the considered liquidity pools in BSC and 317,305 in Ethereum.

We divide the swaps into buy (scam token) and sell operations. As we can expect, given the anatomy of the fraud, we find that most of the operations are buy operations. More in details, in BSC 2,286,056 (78.7%) are buy operations and 616,966 (21.3%) sell operations. In Ethereum, we find a similar pattern, with 254,061 (80.1%) buy operations and 63,196 (19.9%) sell operations.

As final metric, we compute the average value of the swaps performed by the users. The average amount of swaps is almost identical for buy and sell operations on both the blockchains, with 0.01 BNB in BSC and 0.19 ETH in Ethereum. Interestingly, we notice a considerable difference in the average swap amount between the two blockchains. Indeed, the average swap is approximately $3 in BSC and $360 in Ethereum, considering the current price of BNB and ETH44407/06/2022.

7.3.1 The Gains

Before computing the gains of the scammers, we calculate the average price a scammer has to invest in arranging the fraud. If the scammer does not perform any swap into the liquidity pool, the cost of the operation is on average 0.03 BNB in the case of BSC and 0.2 ETH for the Ethereum blockchain. Thus, the investment needed to perform such operations is low, even if it could vary substantially when the blockchains are overloaded. For instance, we found some operations among our set of rug pulls that reached the cost of 1.1 BNB or even 3.3 ETH. The base cost to arrange the fraud is interesting because it represents a bound to the loss that the scammers have to afford for each operation.

We leverage our datasets to compute the gain of the operation using Formula 1. We describe the 266,340 operations on BSC and the 21,594 in Ethereum in terms of successful and unsuccessful operations based on the operation’s net gain. In particular, we define an operation as successful if the net gain is strictly positive.

Successful operations. Among the liquidity pools with an exit scam pattern, there are 104,404 (39.1%) operations in BSC and 13,368 (61.9%) in Ethereum closed with a profit for the scammer. A possible reason for the higher success rate of the rug pull in Ethereum could be that, as we saw, on average, users tend to invest more money. Indeed, on average, attracting only one investor is enough to cover the operation’s cost. To investigate what can affect the gains, we combine information on gains with those of the manipulation. When the creator of the liquidity pool does not perform any manipulation, the net gain is on average 0.11 BNB in BSC and 1.34 ETH in Ethereum. Operations carried out on liquidity pools that suffer wash-trading activity have an average gain of 0.25 BNB in BSC and 12 ETH in Ethereum, which is considerably higher than the previous case. Instead, we notice a negligible increase in gains in the case of pump operations with respect to the gains obtained by the liquidity pools without manipulations. Moreover, we find that both kinds of manipulation have no impact on the success rate. This show that operations that have wash trading are generally more profitable. However, there is a shortcoming. Indeed the scammer have to perform several swaps, increasing its cost and the loss in case of an unsuccessful operation.

Unsuccessful operations. There are 161,936 (60.9%) liquidity pools in BSC and 8,226 (38.1%) in Ethereum, for which the scammer does not cover the transaction fees with the operations. For the 13% (21,122) of these liquidity pools of BSC and the 18.3% (1,506) of Ethereum, we notice that the operations were unsuccessful because nobody swapped into the liquidity pools. Considering the results we obtained, we can conjecture that the aim of the scammers is not to be successful every time but to arrange frauds serially and take profit in the long run. Indeed, the loss of an unsuccessful operation is minimal, and a streak of operations closed in loss can be covered with a single profitable operation.

7.3.2 The Tokens’ Names

| BNB Smart Chain | Ethereum | ||

|---|---|---|---|

| Name | # of tokens | Name | # of tokens |

| Pornhub | 1023 | Hyve.works | 50 |

| Galaxy | 588 | Deriswap | 32 |

| Seedswap | 502 | Shibaswap | 28 |

| Lionswap | 429 | Apple core finance | 17 |

| Eco.finance | 421 | X20.finance | 16 |

| Spacex | 419 | Yield farm rice | 15 |

| Onlyfans | 398 | The sandbox | 14 |

To further deepen our analysis of exit scams, we focus on the names used in the frauds. Analyzing the exit scams, we notice several tokens with the same name in BSC and Ethereum. We find that the tokens involved in exit scams have only 157,864 (57.9%) and 18,801 (86.4%) unique names in BSC and Ethereum. Table 4 shows the most used names and the number of occurrences for each of them. Thus, we attempt to cluster the exit scam tokens into categories and enumerate them.

As a first category, we explore clones—tokens with the same name as an existing (and more popular) cryptocurrency. To systematically search for these cases, we need an authoritative source to discern what tokens are legitimate and what are clones. We leverage CoinGecko APIs [16] to retrieve the name and the addresses of all tokens created and verified with the indexer service on the BSC and Ethereum. At the end of the process, we build a list of 5,325 BSC tokens, and 5,172 Ethereum. We complement this list by adding a list of popular variations for some tokens’ names (e.g., , we also considered ADA as a possible name for the Cardano token). Using our list, we discover 22,002 cloned tokens in BSC and 1,781 in Ethereum. The most cloned tokens in BSC are Berryswap (370 occurrences), ApeSwap (210 occurrences), Shiba Inu (191 occurrences), and SafeMoon (158 occurrences).

The second category we explore is the one of tokens that attempt to impersonate companies or websites. In this case, we retrieve the name of the companies of the Standard and Poor’s 500 (S&P 500) stock market index to obtain a list of possible target companies. Instead, for the websites, we extract the second-level domain from the top-ranked 200 websites according to the Alexa ranking 555Data retrieved Apr. 26, 2022. Using in conjunction these two lists, we find 4,638 tokens of this category in BSC and only 95 in Ethereum. The companies and websites that are present the most are Pornhub (1,023), Spacex(419), Onlyfans (398), Oracle (319), and Amazon (270).

We find several repetitions of names that contain popular meme-related words like "Doge", "Inu" or "Shiba". This is not surprising since meme coins are very popular nowadays after events that involved the "meme stocks" of GameStop (GME) and AMC Entertainment (AMC) in late 2020 [34]. Luckily, CoinMarketCap and CoinGecko offer a categorization of the tokens they list that containing also the "meme" category. We leverage these lists to extract the most frequent words and search for them in tokens involved in exit scams. We find a huge amount of tokens in this category: 54,229 in BSC and 4,835 in Ethereum.

As the last category of our investigation, we look for DeFi services (e.g., Deriswap, Shibaswap, Seedswap, and Eco Finance). In this case, we search for tokens containing the "swap", "defi", and "finance" keywords. With this approach, we find for this category 24,197 tokens in BSC and 3,548 in Ethereum.

With our simple categorization, we covered the names of 39% of the exit scam tokens on BSC and 47% in Ethereum. Even if we were not able to categorize all the tokens, we get some insights into how scammers pick the name to arrange their fraud. In particular, it is possible to note a strong trend in choosing tokens’ names related to the meme category and leveraging the names of popular cryptocurrencies, services, and companies.

8 Sniper Bots 2.0

We find that many exit scams are successful without using fake tokens or wash trading. Since these zero-effort operations are very quick and simple, it is still unclear how they can be profitable. We analyze the operations carried out inside exit scams more in-depth and find out that their success may be the activity of a particular class of trading bots, which we analyze in the following.

8.1 Sniper Bots Description

Sniper bots are automated bots that monitor time-bound activities and perform an action before or after anyone else. An example are “Auction Snipers” which are used to place last-second bidding on auction sites such as eBay [47]. In this case, the goal is to secure the highest bid in the auction. Another example of sniper bots is “Scalping Bot”, bots that monitor the availability of target products from a website and buy them as soon as they are available (e.g., GPU Nvidia GPUs) [11]. Using these bots, it is possible to buy a product as soon as it is available and sell it at a later time at a higher price.

With the birth of and the widespread adoption of AMMs, a new kind of sniper bot has been developed that we define Sniper Bots 2.0. These kinds of sniper bots are programs that buy tokens on liquidity pools as soon as they are listed. Thus, the basic idea is to “snipe” a new coin by buying it before anyone else at its initial price. To do so in the fastest way, sniper bots can leverage the mempool— the list of transactions not yet inserted in blockchain blocks.

We find examples of these bots distributed for free on Github [50, 45, 19] and for a price at several other websites [2, 44]. Analyzing the code, we can infer how they work. As a first step, the bot connects to the blockchain network. Then, it continuously scans the mempool looking for transactions whose byte-code indicates that they are adding liquidity to a brand new liquidity pool. The bot sends a swap transaction to buy the token. If the gas price is adjusted correctly, it is executed in the same block (but immediately after) the transaction that adds the liquidity. Sniper bots typically execute only the buy operation. The user can freely decide when to sell the tokens and make a profit. However, we also found some variants that automatically sell the tokens when the price rise by a certain percentage.

8.2 Identifying Sniper Bots

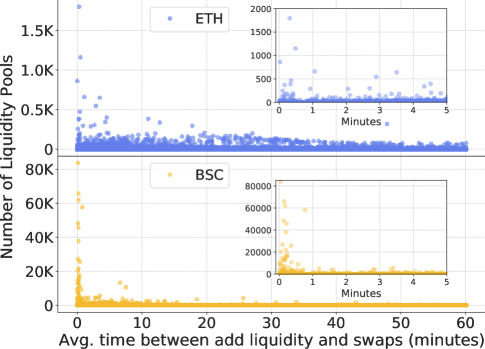

We conjecture that one of the reasons for the profitability of exit scam operations is sniper bots that buy tokens from every liquidity pool indiscriminately. Thus, we can consider the liquidity pools involved in exit-scam as“honey pots” to detect sniper bots. To verify our intuition, we focus on addresses that have swapped inside liquidity pools with an exit scam. Figure 4 shows the phenomenon: every dot is an address, and its position indicates the number of different liquidity pools where the address has swapped and the average delay from the pool creation. The figure shows a few addresses that swap into thousand of liquidity pools almost immediately after creation. Since these addresses perform these operations serially and incredibly fast, we believe that these addresses must be sniper bots. We set up two conservative thresholds to identify evidence of addresses used by sniper bots. We consider all the addresses that swap on average with a delay smaller than 5 blocks (15 seconds, BSC blocks are mined every 3 seconds on average) and that swap in at least 100 different liquidity pools.

We flag 130 addresses as possible sniper bots. These addresses represent only 0.05% of all the addresses that swap inside liquidity pools involved in exit scams. It is impressive that they swap in 235,777 liquidity pools, representing 86.5% of all the liquidity pools with an exit scam. Moreover, these addresses perform also an impressive number of swaps: 646,339. That account for 24% of all the swaps performed in liquidity pools with an exit scam. We find that 31% of these swaps are performed in the same block where the liquidity is added for the first time in the liquidity pool. In these cases, we can confirm that the sniper bots scanned the mempool to swap in the same block where the liquidity is added. However, we also find sniper bots that perform the swap operations a few blocks after the liquidity is created.

From the code of the open-source sniper bots, we find that many implementations do not leverage the mempool but instead wait for the token to be listed on services like BscScan or Etherscan. Indeed, the documentation of sniper bots that use the mempool reports that it is necessary to deploy an Ethereum or BSC node locally. This requires technical knowledge and hardware that is not accessible to most users.

We find sniper bots to be less present in Ethereum. In this case, we pick two thresholds and consider all the addresses that swap on average with a distance lower than 3 blocks (45 seconds, Ethereum blocks are mined on average every 15 seconds) and that swap in at least 10 liquidity pools. We find 64 possible sniper bots that are only the 0.1% of all Ethereum addresses that swap in exit scam liquidity pools. We find that these addresses swap in 30% of all the liquidity pools and perform a much smaller fraction of swaps than BSC sniper bots (3.5% of the total). However, interestingly, a higher percentage of swaps are performed in the same block where the liquidity is added to the liquidity pools (60%).

9 Related Work

Tokens identification. In previous work, there are mainly two approaches for token identification: behavior based approach and interface based approach.

In behavior based approach, there is the assumption that a token contract has a data structure that maps addresses to the quantity of token they own and a function to transfer tokens. Chen et al. [14] observe the EVM execution trace to identify in smart contracts data structure that identify the bookkeeping of a token. They also detect inconsistencies between the actual behavior of the token and the actions indicated by standard interfaces, and the behaviors suggested by standard events.

In interface oriented approach, that is the approach that we take in this work, the aim is to identifiy tokens that are compliant with specific interfaces (e.g ERC20 interface). Thus, the approach consist in locating in the smart contract bytecode the functions and events they implement. Several works use this approach [21, 53, 15]. Frowis et al [27] combine both approaches and compare their performances. They demonstrated that they are able to detect 99% of the tokens in their ground truth dataset using the interface based.

ERC-20 tokens graphs. Some studies on ERC-20 tokens focus on graph analysis. Victor et al. [53] introduce the concept of Token Networks to study ERC-20 tokens from a network perspective. Token Networks are graphs where the nodes are addresses that have owned a specific ERC-20 token and they are connected if there are transfers of such tokens between them. They collect a dataset of 75,514 ERC-20 tokens and build a Token network for 64,393 of them. They analyze the top 1000 Token Networks and find out that they account for 85% of all the token transfers and that some of them barely show any activity after the initial token distribution. Chen et al. [15] expand this work by creating transaction graphs of the whole token ecosystem, considering more than 160,000 tokens. Tokens have been explored also on other blockchains, albeit to the best of our knowledge there are no work that focus on the BSC. Zheng et al. [58] analyzed the EOSIO token ecosystem via graph analysis, focusing on the graph of token creators, token contract creators, and token holders. Similarly to other works on Ethereum, they found out that most of the tokens are “silent” and only 1% of the tokens cover more than 90% of the total token volume. They propose a fake-token detection algorithm to detect anomalous manipulation activities, finding three suspect cases.

Liquidity pools frauds. Xia et al. [56] characterize scam tokens on Ethereum, focusing mainly on the Uniswap DEX. First they leverage CoinMarketCap [17] to obtain a ground truth of official and scam tokens. They use The Graph [28] , a sandbox to obtain blockchain data, to obtain 21,778 tokens and 25,131 liquidity pools from May 2020 to December 2020. Firs they expand the dataset by using a guilt-by-association heuristic and then they use it to train a machine-learning model. Then they run their classifier on the extended dataset and find more than 11,182 scam tokens. Mazorra et al. [37] extend the dataset of Xia et al, adding Uniswap data until 3 September 2021, finding other 18 thousand scam tokens.They provide a classification of three different types of rug pulls, simple, sell, and trap-door rug pulls. Then, they found that more than the 97.7% of the tokens labeled as scam are involved in rug pulls operations.

10 Discussion

What is the impact of not collecting all the internal transactions? Unlike other works [53, 15], we do not collect all smart contracts generated by internal transactions. We collect smart contracts created directly by EOAs, and expand our dataset by adding contracts that emitted at least a Transfer Event. This approach could lead to the loss of a small percentage of tokens. We can perform a rough estimation of the ERC-20 token we miss by comparing the number of tokens we retrieved with the number of tokens retrieved by Chen et al. [15] at the same block height. We find that our approach retrieve 146,928 token instead of 165,955, approximately 12% less. However, it important to note that, by design, our approach misses only tokens that are never used, traded or transferred. So, the missing tokens do not represent interesting cases for our study.

Why does it appear that frauds and token spammers are more frequent in BSC than in Ethereum? From a technical point of view, the frauds work the same way in the two blockchains. Indeed, since BSC is EVM compliant and PancakeSwap is a fork of Uniswap, the same smart contracts can be used on both blockchains. However, the cost of the operation is significantly different. As we saw in Section 7.3.1, performing the fraud in BSC is cheaper (on average $10.5 with peaks of $600) than in Ethereum (on average $400 with peaks of over $2,000). These costs represent a fixed cost for the scammer, and thus going even or gaining money may be more difficult in Ethereum versus BSC.

Can different users coordinate to carry out the same operation, or can a user use multiple addresses? In this work, we considered each address as belonging to a single different user, and we assumed that there is no coordination among addresses. Nonetheless, a user may occasionally switch or, at regular intervals, the address he uses to perform each fraud. It is also possible that a group of users coordinate to carry out the fraud. For example, a user can create a liquidity pool, and the others perform wash trading. A possible approach to detect this malicious behavior is to gather all the transactions among the allegedly involved address and look for malicious patterns or communities (e.g., using graph analysis). In this work, we do not perform this analysis, but we plan to explore more sophisticated frauds as an extension of this work.

Practical relevance of our work. On the Uniswap and PancakeSwap websites, it is possible to select the tokens to swap using the token’s name, the symbol or the address. In our study, we find plenty of fake tokens that attempt to emulate the original ones. An unaware user that selects the pair using the token’s name or symbol can erroneously select a fake pair. Both protocols already provide some kind of protection to the users, displaying a warning message in case a user selects a not official pair—a pair not created by the protocol itself. While many not official pairs are not a fraud and have legitimate reasons to be traded, we have evidence that token spammers are also serial scammers, and it is better not to trust their tokens. In the light of the results of this work, we believe that swap protocols should implement token spammer detection systems and flag the liquidity pools created by these addresses (or new addresses linked to spammers) to increase the users’ awareness. Sniper bots can build blocklists of untrusted addresses and avoid swapping into liquidity pools created by token spammers.

11 Ethical considerations

In this work, we analyzed two blockchains, Ethereum and BNB smart chain, and processed over 3 billion transactions. We looked at the addresses that created tokens on the two blockchains and attempted to understand how the tokens are used. By design, all the data are publicly stored in the blockchain ledger, and the EOAs addresses are pseudo-anonymous. During our study, we never attempt to correlate users’ addresses with external events jeopardizing the privacy of the users. Moreover, we never collected nor attempted to retrieve the IP addresses of the users. Consequently, according to our IRB’s policy, we did not need any explicit authorization to perform our experiments.

12 Conclusion and Future Work

In this work, we thoroughly investigate the tokens and the liquidity pools of the BNB Smart Chain and Ethereum. Although the BSC is five years younger than Ethereum, we find in BSC three times more tokens and liquidity pools than in Ethereum. One of the most surprising differences between the two blockchains is the remarkable difference in the purpose of deployed smart contracts. Indeed, in BSC 61% of smart contracts are token contracts, while in Ethereum, only the 8.5%.

We studied the lifetime of the tokens and who generates them. Here, we discovered two very interesting metrics: 60% of the total tokens of both blockchains do not survive to their first day (1-day token), and a tiny fraction of addresses (1% of addresses), which we called token spammers, created more than 20% of the tokens. We explore the correlation between token spammers and 1-day tokens, and we found that token spammers strongly impact the existence of 1-day tokens. More interestingly, we find that token spammers use 1-day tokens as disposable tokens to arrange frauds exploiting the mechanism of liquidity pools.

We selected from our dataset all the liquidity pools that show evidence of the frauds and used the retrieved data to dissect them, analyzing them from several perspectives. Finally, we introduce the sniper bot, trading bots that aim to buy tokens at their listing price. However, they unwillingly became victims of the scam because of their mechanism.

As future work, we believe it is interesting to further refine our results by verifying and including addresses that cooperate to perpetrate exit scams in the analysis. Moreover, it could be possible to search also for other malicious and more sophisticated patterns. Finally, another promising direction is further exploring sniper bots to provide a more detailed analysis of their typologies and operations.

References

- [1] Hayden Adams, Noah Zinsmeister, and Dan Robinson. Uniswap v2 core. 2020.

- [2] adamsnipes. Pancakeswap bot & uniswap bot. https://adamsnipes.io/home.html, 2022.

- [3] Faten Adel Alabdulwahhab. Web 3.0: the decentralized web blockchain networks and protocol innovation. In 2018 1st International Conference on Computer Applications & Information Security (ICCAIS), pages 1–4. IEEE, 2018.

- [4] ApeSwap. Apeswap. https://apeswap.finance/, 2022.

- [5] Osato Avan-Nomayo. Pancakeswap dex reportedly set to block users from iran. https://www.theblockcrypto.com/linked/133904/pancakeswap-dex-reportedly-set-to-block-users-from-iran, 2022.

- [6] BakerySwap. Bakeryswap. https://www.bakeryswap.org/#/home, 2022.

- [7] Massimo Bartoletti, Salvatore Carta, Tiziana Cimoli, and Roberto Saia. Dissecting ponzi schemes on ethereum: identification, analysis, and impact. Future Generation Computer Systems, 102:259–277, 2020.

- [8] Binance. Binance chain docs - json-rpc endpoint. https://docs.binance.org/smart-chain/developer/rpc.html, 2022.

- [9] Binance. Bnb chain documentation. https://docs.bnbchain.world/docs/learn/intro, 2022.

- [10] Binance. Proof of authority explained. https://academy.binance.com/en/articles/proof-of-authority-explained, 2022.

- [11] Steven Brock. Scalping in ecommerce: Ethics and impacts. Available at SSRN 3793357, 2021.

- [12] Vitalik Buterin et al. A next-generation smart contract and decentralized application platform. white paper, 3(37), 2014.

- [13] Yi Cao, Yuhua Li, Sonya Coleman, Ammar Belatreche, and Thomas Martin McGinnity. Detecting wash trade in financial market using digraphs and dynamic programming. IEEE transactions on neural networks and learning systems, 27(11):2351–2363, 2015.

- [14] Ting Chen, Yufei Zhang, Zihao Li, Xiapu Luo, Ting Wang, Rong Cao, Xiuzhuo Xiao, and Xiaosong Zhang. Tokenscope: Automatically detecting inconsistent behaviors of cryptocurrency tokens in ethereum. In Proceedings of the 2019 ACM SIGSAC conference on computer and communications security, pages 1503–1520, 2019.

- [15] Weili Chen, Tuo Zhang, Zhiguang Chen, Zibin Zheng, and Yutong Lu. Traveling the token world: A graph analysis of ethereum erc20 token ecosystem. In Proceedings of The Web Conference 2020, pages 1411–1421, 2020.

- [16] CoinGecko. Coingecko api. https://www.coingecko.com/en/api, 2022.

- [17] CoinMarketCap. Coinmarketcap. https://coinmarketcap.com/, 2022.

- [18] Crypto.com. Cronos docs. https://cronos.org/docs/getting-started/, 2022.

- [19] damartripamungkas. Botdexdamar. https://github.com/damartripamungkas/botdexdamar, 2022.

- [20] Chris Dannen. Introducing Ethereum and solidity, volume 1. Springer, 2017.

- [21] Monika Di Angelo and Gernot Salzer. Identification of token contracts on ethereum: standard compliance and beyond. International Journal of Data Science and Analytics, pages 1–20, 2021.

- [22] Morris J Dworkin et al. Sha-3 standard: Permutation-based hash and extendable-output functions. 2015.

- [23] Ethereum. Contract abi specification. https://docs.soliditylang.org/en/v0.8.13/abi-spec.html, 2022.

- [24] Ethereum. Ethereum virtual machine (evm). https://ethereum.org/it/developers/docs/evm/, 2022.

- [25] Vitalik Buterin Fabian Vogelsteller. Eip-20: Token standard. https://eips.ethereum.org/EIPS/eip-20, 2015.

- [26] Fantom Foundation. Fantom whitepaper. https://fantom.foundation/research/wp_fantom_v1.6.pdf, 2022.

- [27] Michael Fröwis, Andreas Fuchs, and Rainer Böhme. Detecting token systems on ethereum. In International conference on financial cryptography and data security, pages 93–112. Springer, 2019.

- [28] The Graph. The graph: Apis for a vibrant decentralized future. https://thegraph.com/en/, 2022.

- [29] Infura. Infura. https://infura.io/, 2022.

- [30] Don Johnson, Alfred Menezes, and Scott Vanstone. The elliptic curve digital signature algorithm (ecdsa). International journal of information security, 1(1):36–63, 2001.

- [31] P.C. Kotsias. pcko1/etherscan-python. https://github.com/pcko1/etherscan-python, 2020.

- [32] P.C. Kotsias. pcko1/bscscan-python. https://github.com/pcko1/bscscan-python, 2021.

- [33] Massimo La Morgia, Alessandro Mei, Francesco Sassi, and Julinda Stefa. Pump and dumps in the bitcoin era: Real time detection of cryptocurrency market manipulations. In 2020 29th International Conference on Computer Communications and Networks (ICCCN), pages 1–9. IEEE, 2020.

- [34] Massimo La Morgia, Alessandro Mei, Francesco Sassi, and Julinda Stefa. The doge of wall street: Analysis and detection of pump and dump cryptocurrency manipulations. arXiv preprint arXiv:2105.00733, 2021.

- [35] Solidity Lang. Contract abi specification. https://docs.soliditylang.org/en/v0.5.3/abi-spec.html, 2022.

- [36] Defi Llama. Defi llama. https://defillama.com/, 2022.

- [37] Bruno Mazorra, Victor Adan, and Vanesa Daza. Do not rug on me: Leveraging machine learning techniques for automated scam detection. Mathematics, 10(6):949, 2022.

- [38] Mdex. Mdex. https://mdex.com, 2022.

- [39] Evgeny Medvedev and the D5 team. Ethereum etl. https://github.com/blockchain-etl/ethereum-etl, 2018.

- [40] MetaMask. A crypto wallet & gateway to blockchain apps. https://metamask.io/, 2022.

- [41] MyEtherWallet. Myetherwallet. https://www.myetherwallet.com/, 2022.

- [42] Jason Carve Piper Merriam. Web3.py. https://web3py.readthedocs.io/en/stable/, 2022.

- [43] Valerio Puggioni. Crypto rug pulls: What is a rug pull in crypto and 6 ways to spot it. https://cointelegraph.com/explained/crypto-rug-pulls-what-is-a-rug-pull-in-crypto-and-6-ways-to-spot-it, 2022.

- [44] PumpBot. Sniper bot crypto: Chain sniper- the all in one sniper bot, dex bot, pinksale bot. https://pump-bot.com/crypto-bots/sniper-bot-frontrunner-chainsniper-dexbot, 2022.

- [45] saantiaguilera. Ax-50 liquidity sniper. https://github.com/saantiaguilera/liquidity-sniper, 2022.

- [46] Kevin Sekniqi, Daniel Laine, Stephen Buttolph, and Emin G¨un Sirer. Avalanche Platform, volume 1. online, 2020.

- [47] Srivats Srinivasan. Human or bot. PhD thesis, California State University, Sacramento, 2017.

- [48] Eva Su. Digital Assets and SEC Regulation. Congressional Research Service, 2020.

- [49] Martin Holst Swende and Marius van der Wijden. Eip-3155: Evm trace specification. https://eips.ethereum.org/EIPS/eip-3155, 2022.

- [50] Trading-Tiger. Pancakeswap bsc sniper bot. https://github.com/Trading-Tiger/Pancakeswap_BSC_Sniper_Bot, 2022.

- [51] Uniswap. Uniswap v2 license. https://github.com/Uniswap/v2-core/blob/master/LICENSE, 2022.

- [52] Uniswap. Uniswap v3 license. https://github.com/Uniswap/v3-core/blob/main/LICENSE, 2022.

- [53] Friedhelm Victor and Bianca Katharina Lüders. Measuring ethereum-based erc20 token networks. In International Conference on Financial Cryptography and Data Security, pages 113–129. Springer, 2019.

- [54] Trust Wallet. Trust wallet. https://trustwallet.com/, 2022.

- [55] Gavin Wood. Ethereum yellow paper: A formal specification of ethereum, a programmable blockchain. 2018. URL https://github. com/ethereum/yellowpaper, 2018.

- [56] Pengcheng Xia, Haoyu Wang, Bingyu Gao, Weihang Su, Zhou Yu, Xiapu Luo, Chao Zhang, Xusheng Xiao, and Guoai Xu. Trade or trick? detecting and characterizing scam tokens on uniswap decentralized exchange. Proceedings of the ACM on Measurement and Analysis of Computing Systems, 5(3):1–26, 2021.

- [57] Dirk A Zetzsche, Douglas W Arner, and Ross P Buckley. Decentralized finance. Journal of Financial Regulation, 6(2):172–203, 2020.

- [58] Weilin Zheng, Bo Liu, Hong-Ning Dai, Zigui Jiang, Zibin Zheng, and Muhammad Imran. Unravelling token ecosystem of eosio blockchain. arXiv preprint arXiv:2202.11201, 2022.

Appendix A Appendix

| Function | Signature |

|---|---|

| name() | 06fdde03 |

| symbol() | 95d89b41 |

| decimals() | 313ce567 |

| totalSupply() | 18160ddd |

| balanceOf(address) | 70a08231 |

| transfer(address,uint256) | a9059cbb |

| transferFrom(address,address,uint256) | 23b872dd |

| approve(address,uint256) | 095ea7b3 |

| allowance(address,address) | dd62ed3e |

| Event | Signature |

| Transfer(address,address,uint256) | ddf252ad |

| Approval(address,address,uint256) | 095ea7b3 |