Calibrating distribution models from PELVE

Abstract

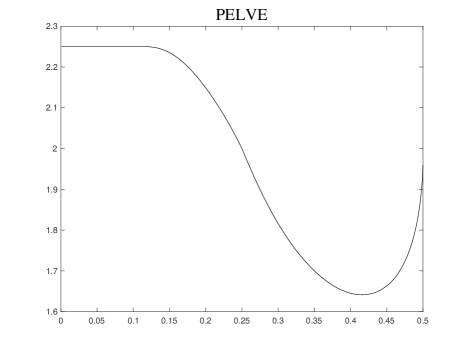

The Value-at-Risk (VaR) and the Expected Shortfall (ES) are the two most popular risk measures in banking and insurance regulation. To bridge between the two regulatory risk measures, the Probability Equivalent Level of VaR-ES (PELVE) was recently proposed to convert a level of VaR to that of ES. It is straightforward to compute the value of PELVE for a given distribution model. In this paper, we study the converse problem of PELVE calibration, that is, to find a distribution model that yields a given PELVE, which may either be obtained from data or from expert opinion. We discuss separately the cases when one-point, two-point, -point and curve constraints are given. In the most complicated case of a curve constraint, we convert the calibration problem to that of an advanced differential equation. We apply the model calibration techniques to estimation and simulation for datasets used in insurance. We further study some technical properties of PELVE by offering a few new results on monotonicity and convergence.

Keywords: Value-at-Risk, Expected Shortfall, risk measures, heavy tails, advanced differential equation.

1 Introduction

Value-at-Risk (VaR) and Expected Shortfall (ES, also known as TVaR and CVaR) are the most widely used risk measures for regulation in finance and insurance. The former has gained its popularity due to its simplistic approach toward risk as the risk quantile, and the second one is perceived to be useful as a modification of VaR with more appealing properties, such as tail-sensitivity and subadditivity, as studied in the seminal work of Artzner et al. (1999).

In the Fundamental Review of the Trading Book (FRTB), the Basel Committee on Banking Supervision (BCBS (2019)) proposed to replace VaR at 1% confidence with ES with a 2.5% confidence interval for the internal model-based approach.111In this paper, we use the “small ” convention for and . Hence, “VaR at 1% confidence” and “ES at 2.5% confidence” correspond to and in BCBS (2019), respectively. The main reason, as mentioned in the FRTB, was that can better capture tail risk; see Embrechts et al. (2018) for a concrete risk sharing model where tail risk is captured by ES and ignored by VaR. On the other hand, VaR also has advantages that ES does not have, such as elicitability (e.g., Gneiting (2011) and Kou and Peng (2016)) or backtesting tractability (e.g., Acerbi and Székely (2014)), and the two risk measures admit different axiomatic foundations (see Chambers (2009) and Wang and Zitikis (2021)). We refer to the reviews of Embrechts et al. (2014) and Emmer et al. (2015) for general discussions on VaR and ES, and McNeil et al. (2015) for a standard treatment on risk management including the use of VaR and ES. The technical contrasts of the two risk measures and their co-existence in regulatory practice give rise to great interest from both researchers and practitioners to explore the relationship between them.

To understand the balancing point of VaR and ES during the transition in the FRTB, Li and Wang (2022) proposed the Probability Equivalent Level of VaR-ES (PELVE). The value of PELVE is the multiplier to the tail probability when replacing VaR with ES such that the capital calculation stays unchanged. More precisely, the PELVE of at level is the multiplier such that ; such uniquely exists under mild conditions. For instance, if for a future portfolio loss , then PELVE of at probability level 0.01 is the multiplier . In this case, replacing with in FRTB does not have much effect on the capital requirement for the bank bearing the loss . Instead, if , then the bank has a larger capital requirement under the new regulatory risk measure; this is often the case for financial assets and portfolios as shown by the empirical studies in Li and Wang (2022). The PELVE enjoys many convenient properties, and it has been extended in a few ways. In particular, Fiori and Rosazza Gianin (2023) defined generalized PELVE by replacing and with another pair of monotone risk measures , and Barczy et al. (2022) extended PELVE by replacing ES with a higher-order ES.

For a given distribution model or a data set, its PELVE can be computed or estimated in a straightforward manner. As argued by Li and Wang (2022), the PELVE for a small may be seen as a summarizing index measuring tail heaviness in a non-limit sense. As such, one may like to generate models for a given PELVE, in a way similar to constructing models for other given statistical information; see e.g., Embrechts et al. (2002, 2016) for constructing multivariate models with a given correlation or tail-dependence matrix. Such statistical information may be obtained either from data or from expert opinion, but there is no a priori guarantee that a corresponding model exists. Since PELVE involves a parameter , its information is represented by a curve. The calibration problem, that is, to find a distribution model for given PELVE values or a given PELVE curve, turns out to be highly non-trivial, and it is the main objective of the current paper.

From now on, suppose that we receive some information on the PELVE of a certain random loss from an expert opinion, and we aim to build a distribution model consistent with the supplied information. Since PELVE is location-scale invariant, such a distribution, if it exists, is not unique.

The calibration problem is trivial if we are supplied with only one point on the PELVE curve. As the PELVE curve of the generalized Pareto distribution is a constant when the PELVE is well defined, we can use the generalized Pareto distribution to match the given PELVE value, which has a tail index implied from the expert opinion. The calibration problem becomes more involved if we are supplied with two points on the PELVE curve, because the value of the PELVE at two different probability levels interact with each other. The situation becomes more complicated as the number of points increases, and we further turn to the problem of calibration from a fully specified PELVE curve. Calibrating distribution from the PELVE curve can be reformulated as solving for a function via the integral equation , where the curve is computed from the PELVE curve. This integral equation can be further converted to an advanced differential equation (see Bellman and Cooke (1963)). For the case that is a constant curve, we can explicitly obtain all solutions for . We find other distributions that also have constant PELVE curves other than the simple ones with a Pareto or exponential distribution. As a consequence, a PELVE curve does not characterize a unique location-scale family of distributions; this provides a negative answer to a question posed by Li and Wang (2022, Section 7, Question (iv)). For general function , we develop a numerical method to compute .

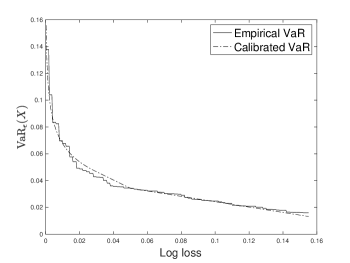

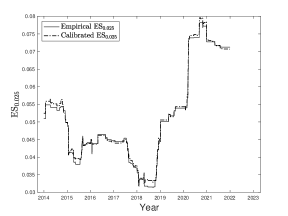

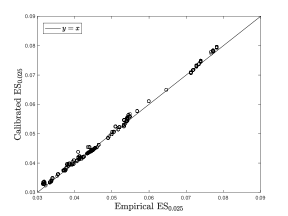

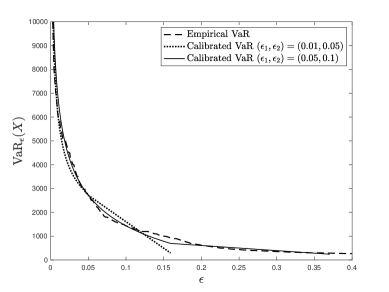

The calibrated distribution can be used to estimate the value of other risk measures such as VaR and ES at different levels. We illustrate by an empirical example that two points of PELVE give a quite good summary of the tail distribution of risk. Daily log-losses (negative log-returns) of Apple (AAPL) from Yahoo Finance are collected for the period from January 3, 2012 to December 31, 2021 within total of 2518 observations. We calculate the empirical PELVE at levels 0.01 and 0.05 using the empirical PELVE estimator provided by Li and Wang (2022, Section 5) with a moving window of 500 trading days. For each pair of two points of PELVE at levels 0.01 and 0.05, we produce a quantile curve from the two empirical PELVE points by our calibration model in Section 3.2, which is scaled such that and are equal to their empirical values.222Recall that PELVE is location-scale free, and hence we need to pick two free parameters to specify a distribution calibrated from PELVE. Figure 1 presents the empirical and calibrated quantile curves on December 31, 2021 using 500 trading days prior to that date. The two quantile curves are close to each other, with our calibrated curve being more smooth. We also report the values of of the calibrated distribution, which we call the calibrated , and compare it with empirical . The left panel of Figure 2 shows the curves of empirical and calibrated . In the right panel of Figure 2, we create a scatter plot using empirical and calibrated . Both figures show that the empirical and calibrated curves are quite close.

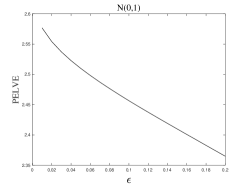

To further enrich the theory of PELVE, we study a few technical properties of PELVE, such as monotonicity and convergence as the probability level goes to 0. A decreasing PELVE indicates a relatively larger impact of in risk assessment than moving towards the tail. As we will see, while for the most known parametric distributions the PELVE is decreasing, there exist some examples at some risk levels it is not decreasing. This means that for those examples becomes a stricter risk measure when moving towards the tail. To obtain conditions for monotonicity, we define the dual PELVE by moving the multiplier from the side to the side. PELVE can be seen as a functional measure of tail heaviness in the sense that a heavier-tailed distribution has a higher PELVE curve (Li and Wang (2022, Theorem 1)). The hazard rate, on the other hand, is another functional measure of tail heaviness. We show that the PELVE is decreasing (increasing) if the inverse of the hazard rate is convex (concave). Monotonicity also leads to conditions for the PELVE to have a limit at the tail, which from the risk management perspective, identifies the ultimate relative positions of and in the tail region. From a mathematical perspective, the limit of PELVE at allows us to extend the domain of PELVE to include as a measure of tail heaviness.

The rest of this paper is organized as follows. Section 2 introduces the background and examples of the PELVE. In Section 3 we calibrate a distribution from finitely many points in the PELVE curve. Section 4 calibrates the distribution from given PELVE curves, where we give a class of explicit solutions for constant PELVE functions and numerical solutions for general PELVE functions. In Section 5, we study the monotonicity and convergence of the PELVE. Section 6 presents two examples of the model calibration techniques applied to datasets used in insurance. A conclusion is given in Section 7. Some technical proofs of results in Sections 3, 4 and 5 are provided in the Appendices.

2 Definitions and background

Let us consider an atomless probability space , where is the set of the measurable sets and is the probability measure. Let be the set of integrable random variables, i.e., , where is the expectation with respect to .

We first define and in , the two most popular risk measures. The at probability level is defined as

| (1) |

where is the distribution of . The at probability level is defined as

Note that we use the “small ” convention for and , which is different from Liu and Wang (2021). Let and . We have that is the mean of . We will also call the quantile function of , keeping in mind that in our convention this function is decreasing.333Throughout the paper, all terms like “increasing” and “decreasing” are in the non-strict sense.

For , the PELVE at level , proposed by Li and Wang (2022), is defined as

where . Li and Wang (2022) used for our , and our choice of notation is due to the fact that the curve is the main quantity of interest in this paper.

The PELVE of is finite if and only if . The value of the PELVE is the multiplier such that If is not a constant for , then the PELVE is the unique solution for the multiplier. By Theorem 1 in Li and Wang (2022), the PELVE is location-scale invariant. The distribution with a heavy tail will have a higher PELVE value.

If is a normal distributed random variable and , we have . It means that . That is, the replacement suggested by BCBS is fair for normally distributed risks. In other words, a higher PELVE will result in a higher capital requirement after the replacement.

In this paper, we are generally interested in the question of which distributions have a specified or partially specified PELVE curve. We first look at a few simple examples.

Example 1 (Constant PELVE).

We first list some distributions that have constant PELVE curves. From the definition of the PELVE, we know that the PELVE should be larger than 1. As we can see from Table 1, the PELVE for the generalized Pareto distribution takes values on . For , we have when , when and when . Furthermore, if follows the point-mass distribution or the Bernoulli distribution, we have .

| Distribution | Distribution or probability function of | |

|---|---|---|

| for | ||

| and | for | |

| for | for | |

| for | ||

| 1 | for |

-

1

The distribution is called the standard generalized Pareto distribution. As when , the PELVE exists only when . The support of is when and when . When , the is exactly exponential distribution with . There is a three-parameter , which is a location-scale transform of standard GPD. Therefore, has the same PELVE as .

Example 2.

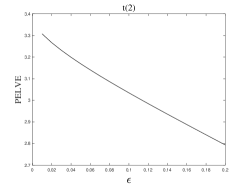

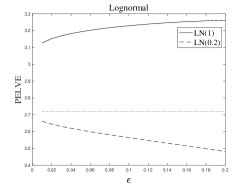

Here we present some non-constant PELVE examples. We write for the t-distribution with parameter , and for the log-normal distribution with parameter .

As we can see, for normal distribution and t-distribution, the PELVE curve is decreasing as increasing. The monotonicity of the PELVE of the lognormal distribution depends on the value of . The monotonicity of the PELVE will be further discussed in Section 5. For more PELVE examples, see Li and Wang (2022).

3 Calibration from finite-point constraints

In this section, we discuss the calibration problem when some points of the PELVE are given. We will focus on the case where one point or two points on the PELVE curve are specified, for which we can explicitly construct a corresponding quantile function.

We first note that the calibrated distribution is not unique. For example, if we are given , we can assume the distribution of is the Normal distribution or the generalized Pareto distribution with tail parameter satisfying from Table 1. Therefore, the distributions obtained in our results are only some possible choices, which we choose to have a generalized Pareto tail, as Pareto tails are standard in risk management applications.

3.1 Calibration from a one-point constraint

Based on Table 1, we can calibrate the distribution for from one given PELVE point such that . A simple idea is to take the generalized Pareto distribution when and when . We summarize the idea in the following Proposition.

Proposition 1.

Let and such that . If , let such that . Then, has . If , then for some constant has .

The proof can be directly derived from Table 1 and it is omitted. By Proposition 1, if we have the value of PELVE at point , we can find a distribution of which has the same PELVE value at . If we also have the value of at , we can determine the scale parameter () for the GPD distribution or the value of to match the value of . For Table 1, we can see that the calibrated generalized Pareto distribution can also serve as a solution for a more prudent condition when .

3.2 Calibration from a two-point constraint

The calibration problem would be much more difficult when we are given two points of the PELVE curve. Given two points and such that , we want to find a distribution for such that and . Nevertheless, the choices of and are not arbitrary. First, we need and by the definition of the PELVE. Then, we will show that the value of will be restricted if and are given.

Lemma 1.

For any , let be such that and . Then, we have .

By Lemma 1, for given and , the value of is bounded below by both 1 and . We also note that if , then is constant on , which implies . In Appendix A, Proposition 6 shows that the above lower bound is achieved if and only if .

From the definition of the PELVE and Lemma 1, for , the possible choices of and should satisfy , and . We denote by the admissible set for , that is,

We illustrate the possible region of with given and in Figure 4. We divide the region into 5 cases and calibrate the distribution for each case.

The calibration process is to construct a continuous and decreasing quantile function that can satisfy two equivalent conditions between and , which are

| (2) |

As we can see, only the values of for matters for the equivalent condition (2). Therefore, we focus on constructing for . In addition, we want a continuous calibrated quantile function.

The case or is special, which means that is a constant on the tail part. If , we can set the tail distribution as the generalized Pareto distribution from Table 1 such that .

For , we will construct a class of functions, denoted by , in five different cases according to Figure 4. The function will be our desired quantile function. If , let be any two constants satisfying . If , let be such that ,

and . We first claim that the function can be any arbitrary continuous and decreasing function on since the values of for do not affect its PELVE at and . The value of on is given by

-

(i)

Case 1, (which implies ):

-

(ii)

Case 2, and :

-

(iii)

Case 3, and :

-

(iv)

Case 4, and :

-

(v)

Case 5, and :

An illustration of the functions on in Case 2 to Case 5 is presented in Figure 5, and we omit Case 1 in which is a constant function on .

Theorem 1.

For , the random variable with a continuous quantile function given by satisfies and .

Remark 1.

As we can see from Figure 5, some parts of the calibrated quantile function may be flat, corresponding to the existence of atoms in the distribution. This may be considered as undesirable from a modeling perspective, and indeed it is forced by the boundary cases of in Figure 4. The flat parts in Cases 1 to 3 are necessary due to Propositions 6. On the other hand, the flat part in Case 5 can be replaced by a strictly decreasing function. For instance, we can replace the flat part with a strictly decreasing linear segment as long as satisfies the bounds shown in Propositions 7 in Appendix A. Another way is to set as for if , and this choice is applied in the numerical examples in the Introduction and Section 6. The interested reader can see Propositions 6 and 7 in Appendix A, where we show that a strictly decreasing quantile function cannot attain the boundary cases , and hence the flat parts are necessary to include and unify these cases.

We can easily get the distribution of from . As the PELVE is scale-location invariant, we can scale or move the distribution we get to match more information. For example, if and are given, we can choose two constants and such that matches the specified VaR values. In a similar spirit, the calibration problem can be extended to calibrate the distributions from some given and values. The two points calibration problem can be regarded as given two and values. Calibrating from only or would be easy. However, the choices of values will also be limited by values if we consider them at the same time, which is the same as the choice of as we discussed in this section.

3.3 Calibration from an n-point constraint

As we see above, the PELVE calibration problem is quite technical even when only two points on the PELVE curve are given. By extending the constraint to more than two points, the problem will in general become much more complicated. We briefly discuss this problem in this section.

For the -point constraint problem, we first need to figure out the admissible set for . By Lemma 1, the admissible set for the -point calibration problem is a subset of

However, it is not clear whether each point in the above set is admissible. There are other constraints for the admissible points such as Proposition 7. Once the admissible set is determined, we need to divide the admissible set according to the position of and , . Furthermore, the case and for need special attention as Cases 1, 2 and 3 in the two-point constraint problem. For instance, in the three-point constraint problem, we need to discuss over 10 separate cases.

Below, we only discuss some special cases of . First, if , then the problem becomes trivial, as the calibrated quantile functions satisfy for some in .

For the case for , we can set the calibrated quantile function in recursively. This is because such a configuration of allows for separation of the constraints, in the sense that we can adjust the values of for to match PELVE at without disturbing for . Let be the calibrated quantile function from the -point constraint problem for where follows Theorem 1. The calibrated quantile function for the -point constraint problem is

In particular, for , and assuming , the calibrated function is given by, with ,

In Figure 6, we show the calibrated quantile function for the case and . Note that the condition is needed here.

Although we cannot solve the -point constraint problem in general, we can instead discuss calibration from a given PELVE curve, which is the problem addressed in the next section.

4 Calibration from a curve constraint

By the location-scale invariance properties of the PELVE, we know that the solution cannot be unique. Conversely, it would be interesting to ask whether all solutions can be linearly transformed from a particular solution; that is, for a given function , whether the set is a location-scale class. This question, as well as identifying satisfying , is the main objective of this section.

4.1 PELVE and dual PELVE

First, we note that calibrated distributions from an entire PELVE curve on would be unnatural, because the existence of the PELVE requires which may not hold for not very small. Thus, the PELVE curve does not behave well on some parts of . To address this issue, we introduce a new notion called the dual PELVE and an integral equation which can help us to calibrate the distribution by differential equations. The dual PELVE is defined by moving the multiplier in PELVE from the side to the side.

Definition 1.

For , the dual PELVE function of at level is defined as

The existence and uniqueness of can be shown in the same way as the existence and uniqueness of the PELVE. There are advantages and disadvantages of working with both notions; see Li and Wang (2022, Remark 2). In our context, the main advantage of using the dual PELVE is that is finite for all , while is finite only when .

Note that for with a discontinuous quantile function, there may not exist such that . In order to guarantee the above equivalence, we make the following assumption for the quantile function, represented by general function .

Assumption 1.

The function is strictly decreasing and continuous, and .

Let be the set of with quantile function satisfying Assumption 1. The requirement that the quantile function of is continuous and strictly decreasing is equivalent to that the distribution function is continuous and strictly increasing in ; see Embrechts and Hofert (2013). We limit our discussion to random variables , which include the most common models in risk management.

Proposition 2.

For with quantile function satisfying Assumption 1 and , we have and if . Furthermore, is the unique solution to the equation

4.2 An integral equation associated with dual PELVE

In order to calibrate distributions from the dual PELVE, we can equivalently focus on quantile functions. Let us consider and . Then, solving is the same as solving in following equation:

| (3) |

for . The solution is . As , satisfies Assumption 1. Denote by the set of all satisfying Assumption 1. For any , the existence of the solution is guaranteed by the mean-value theorem and its uniqueness is obvious. For , let be the solution to (3) associated with . Clearly, and is strictly increasing. This is similar to Lemma 1 for the two-point case. Obviously, is also location-scale invariant under linear transformation on . That is, for and . Furthermore, is continuous as is continuous and strictly decreasing. The next proposition is a simple connection between and .

Proposition 3.

Proof.

For any satisfying Assumption 1, let . Hence, is a continuous and strictly increasing distribution function and for . Let and . Then and . As , we have . Take . We have and .

For , let . Then, we have for . Furthermore, we have . Therefore, there exists such that . Let . Then, we have and . ∎

Proposition 3 allows us to study instead of for the calibration problem. The integral equation (3) can be very helpful in characterizing the distribution from the dual PELVE.

Some examples of and are listed in Table 2, which is corresponding to the PELVE presented in Table 1.

For a given dual PELVE curve , we find the solution to the integral equation by the following steps.

-

1.

Let for all .

-

2.

Find that satisfies for all .

-

3.

By Proposition 3, for some will have the given dual PELVE .

Therefore, we will focus on characterizing from a given below. Generally, it is hard to characterize explicitly. We first formulate the problem as an advanced differential equation, which helps us to find solutions.

4.3 Advanced differential equations

In this section, we show that the main objective (3) can be represented by a differential equation. The use of differential equations in computing risk measures has not been actively developed. The only paper we know is Balbás et al. (2017) which addresses a different problem.

Let us recall the integral equation (3) from Section 4.2. For a function , we solve the function from (3). We represent (3) by an advanced differential equation using the following steps.

-

1.

Let . It is easy to see that . Hence, is strictly increasing and continuous on and .

-

2.

Let be the inverse function of . We have that is a continuous and strictly increasing function and .

-

3.

Replacing with in (3), we have

-

4.

Assume is continuously differentiable. It is clear that is continuously differentiable on . Hence, we can represent (3) by the following advanced differential equation

For a given function , let such that for . Then, we solve the function by the following differential equation

| (4) |

If for some , then is a strictly increasing and continuous function such that . Furthermore, if is continuously differentiable, then we can characterize all with by (4). As and , (4) is a linear advanced differential equation which is well studied in the literature. In Berezansky and Braverman (2011), it is shown that there exists a non-oscillatory solution for (4).

4.4 The constant PELVE curve

We first solve the case that for all and some constant . As we can see from Table 2, the power function and logarithm function have constant . If for , we can see that . In this section, we can characterize all the other solutions which can not be expressed as a linear transformation of the power function. That is, we will see that the set

is not a location-scale class. Hence, we can answer the question at the beginning of the section; that is, in the case the PELVE is a constant, the set is not a location-scale class.

Theorem 2.

The proof of Theorem 2 is provided in Appendix B. As we can see, Theorem 2 characterizes all such that . If , is negative. As , we can see that is regularly varying of index . Hence, one can then consider the Pareto distribution with survival function as a representative solution for the tail behavior. An open question is that, in the general case that the PELVE is not necessarily constant, whether all the solutions behave similarly regarding their tail behavior.

Another interesting implication of the theorem and its proof is that one can give a non-trivial solution for is a constant.

Example 3.

For , let be a solution of

Then, the function , given by

| (5) |

satisfies and Assumption 1, where solves , , , is a constant such that and .

If we take , we get the simplest power function for . If , the solution (5) is not a linear transformation of the power function solution.

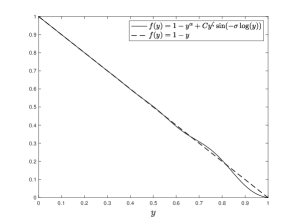

Let us look at the example where for all , which means for . As we have seen in Table 2, can be a solution that leads to . Furthermore, according to Example 3, we can have another solution

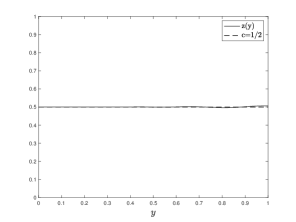

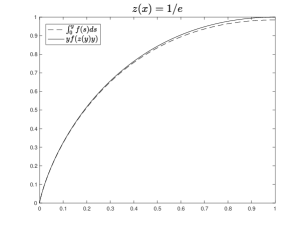

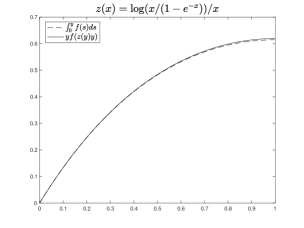

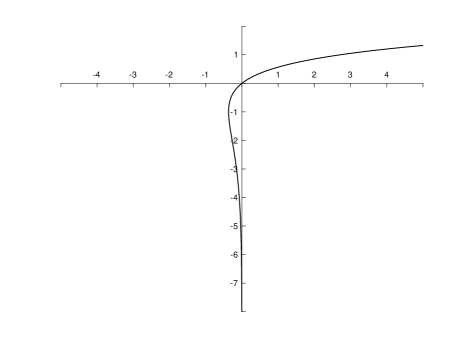

where , , and . In the left of Figure 7, we have depicted the two solutions for . We can see they are quite different when goes to 1. In the right of Figure 7, we numerically calculate for . We can see its numerical value is almost 1/2 and the discrepancy is due to limited computational accuracy.

By letting , we get for all and such does not follow the uniform distribution.

4.5 A numerical method

In general, it is hard to get an explicit solution to (4). Here we present a numerical method to solve (4). Let us introduce the following process.

-

1.

Let , , …,.

-

2.

For , let be the solution to . Let

(6) on .

-

3.

We can solve the following ODE on :

-

4.

Now we can repeat step 3 by induction on for by solving

-

5.

In general, the solution for differential equation is

So, we get the following solution for :

-

6.

Finally, let on .

Note that since we start with a strictly decreasing function, then from equation (4) we have

so remains strictly decreasing.

The solution produced by the numerical method heavily relies on . The equation (4) does not have a unique solution, but the solution from the above process is unique. We set as (6) by assuming can be extended from to and set for all . We use this assumption for simplification as we can know that (6) satisfies (4) for a constant from Section 4.4. This choice of is the same as the choice of in the two-point calibration problem, and this reflects our subjective view of the importance of the Pareto distribution in risk management. Especially, when for some constant , we have . Therefore, (5) gives

If we set as (6), we can have also in the form of (6). Then, it is obvious that is also in the form of (6). Therefore, the numerical method gives the simplest power function or logarithm function when is a constant on as Table 2, which leads to the generalized Pareto distribution for .

4.6 Numerical calibrated quantile function

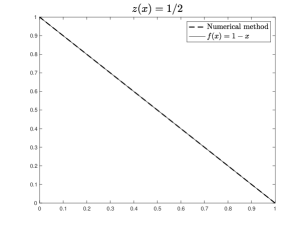

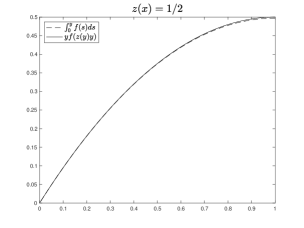

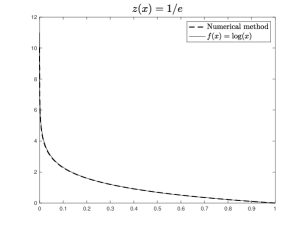

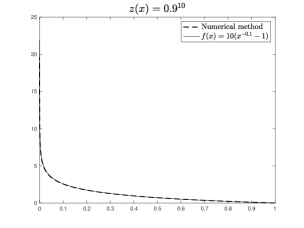

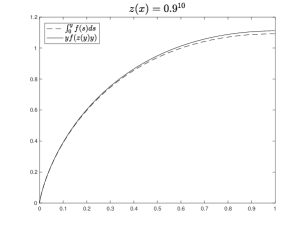

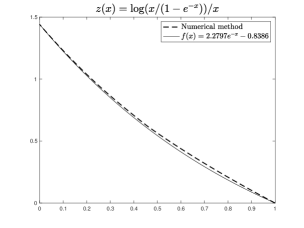

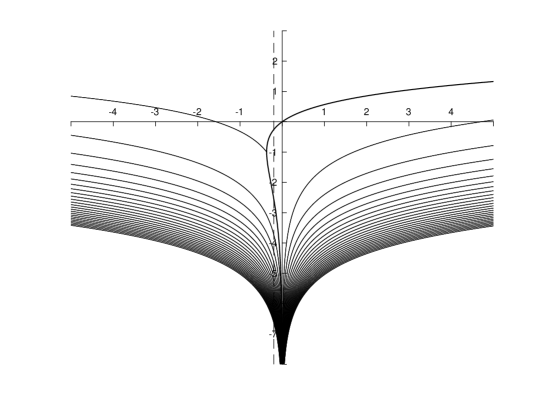

Now let us explore the method in Section 4.5 with simulation. Here we present the results for a few cases. In Figures 8 to 11, we compare the solution from the numerical method with the standard formula in Table 2 in the left panel, and compare with to validate the equation (3) in the right panel.

We first try some examples where is constant as shown in Table 2, i.e. (Figure 8), (Figure 9) and (Figure 10). For Figure 8 to 10, we can see that the numerical method provides exactly the same function as Table 2.

In Figure 11, we check the case . The function satisfies (3). We can see that the solution from the numerical method is close to a function of the form , which is known to satisfy the integral equation.

5 Technical properties of the PELVE

We now take a turn to study several additional properties of PELVE. In particular, we will obtain results on the monotonicity and convergence of the dual PELVE as well as the PELVE.

5.1 Basic properties of dual PELVE

The following proposition that shows the PELVE and dual PELVE share some basic properties such as monotonicity (i), location-scale invariance (ii) and shape relevance (iii)-(iv) below.

Proposition 4.

Suppose the quantile function of satisfies Assumption 1 and .

-

(i)

is increasing (decreasing) in if and only if so is .

-

(ii)

For all and , .

-

(iii)

for all strictly increasing concave functions: with .

-

(iv)

for all strictly increasing convex functions: with .

The statements (ii)-(iv) are parallel to the corresponding statements in Theorem 1 of Li and Wang (2022) on PELVE. The proof of Proposition 4 is put in Appendix C. Proposition 4 allows us to study the monotonicity and convergence of the PELVE by analyzing the corresponding properties of the dual PELVE, which is more convenient in many cases. In the following sections, we focus on finding the conditions which make the dual PELVE monotone and convergent at 0. By Proposition 4, those conditions can also apply to the PELVE.

5.2 Non-monotone and non-convergent examples

In this section, we study the monotonicity and convergence of dual PELVE. For monotonicity, we have shown some well-known distributions such as normal distribution, t-distribution and lognormal distribution have monotone PELVE curves in Example 3. However, the PELVE is not monotone for all . Below we provide an example.

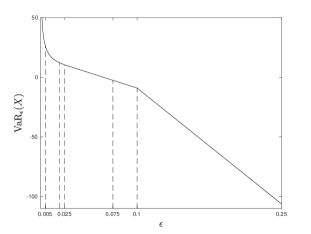

Example 4 (Non-monotone PELVE).

Let us consider the following density function on ,

For with density function , Figure 12 presents the value of for . As one can see, the PELVE is not necessarily decreasing, and so is the dual PELVE.

For the convergence, it is clear that is continuous in for . Therefore, exists for all . However, both and are not well defined at . If exists, we can define as the limit, and similarly. However, the following example shows that the limit does not exist for some .

Example 5 (No limit at 0).

We can construct a random variable such that does not exist from the integral equation (3) in Section 4.2. Equivalently, we will find a continuous and strictly decreasing function such that does not exist. Let be the Cantor ternary function on . Note that is continuous and increasing on and . Let . It is clear that and . For each , we have

Since is strictly decreasing, for . It means that is a constant on if exists. Now, let us look at two particular points of . We can show that . Let . Then, we have . For , we have and . Therefore, we get . For , we have

As is strictly decreasing, we have which implies . As a result, does not exist. Therefore, we have a continuous and strictly decreasing such that does not exist.

5.3 Sufficient condition for monotonicity and convergence

In risk management applications, for a random variable modeling a random loss, the behavior of its tail is the most important. Let be the upper -tail distribution of (see e.g., Liu and Wang (2021)), namely

We will see that the dual PELVE of is a part of the dual PELVE of .

Lemma 2.

Let be the distribution function of with quantile function satisfying Assumption 1. For and , it holds

Proof.

It is clear that and . Therefore,

Thus, we have the desired result. ∎

The tail distribution can provide a condition to check whether the dual PELVE is decreasing.

Proposition 5.

Let be the distribution function of with quantile function satisfying Assumption 1. If is convex (concave) for all , then and are decreasing (increasing).

Proof.

We assume that is a convex function on first. Let be a strictly increasing convex function such that for Then, we have . By Proposition 4, we get . As , we have for all . Thus, is decreasing. By Proposition 4, we have is also decreasing.

On the other hand, if is concave, we have for all and is increasing. So is . ∎

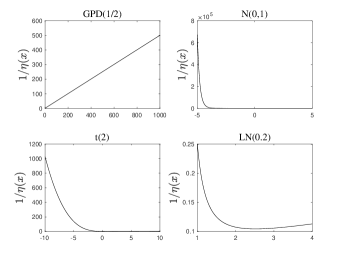

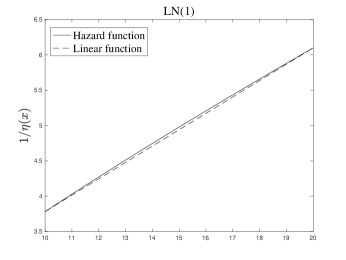

The condition is convex (concave) for all is generally hard to check. Intuitively, this condition means that has a less heavy tail compared to . We can further simplify this condition by using the hazard rate function. For with distribution function and density function , let be the survival function and be the hazard rate function. As is continuous and strictly increasing, is continuous and strictly decreasing.

Theorem 3.

For with quantile function satisfying Assumption 1, let be the hazard rate function of . If is second-order differentiable and convex (concave), then and are decreasing (increasing).

Example 6.

For the normal distribution, we can give a short proof of the convexity of . Let be the survival function of the standard normal distribution and its density. Let . One can easily see that

| (7) |

which gives . This with (7) implies that

| (8) |

First, consider the negative line i.e., . In this case (7) and (8) imply and The implication of the two relations is that is a convex and decreasing function on negative line. Now we consider the case . In this case, let . From what we have proved it is clear that is an increasing function on . On the other hand, we have . This combined with (7) gives us

This means is an increasing function on as it is a summation of two other increasing functions, so is convex on the positive line as well.

Figure 13 presents the curve for the generalized Pareto distribution, the Normal distribution, the t-distribution and the Lognormal distribution. For distributions , and , we can see that the curves are convex, and this coincides with decreasing PELVE shown in Example 2. For the Lognormal distribution, the shape of depends on . As shown in Example 2, the PELVE for is visibly decreasing for and increasing for . Corresponding to the above observations, we see that is convex for and concave for .

Corollary 1.

If the hazard rate of a random variable is second-order differentiable and concave, then and are decreasing.

Proof.

Just note that if is concave, then is non-positive. It follows that

Thus, is convex, and the desired statement follows from Theorem 3. ∎

The corollary above is a result of the fact that the concavity of implies convexity of . Therefore, concave always leads to decreasing PELVE. For example, the Gamma distribution with density has concave hazard rate function when . Furthermore, by Theorem 3, we can easily find more well-known distributions that have decreasing .

As the tail distribution determines around , we can focus on the tail distribution to discuss the convergence of at . Note that if the survival distribution function is regularly varying, then its tail parameter one-to-one corresponds to the limit of at as shown by Theorem 3 of Li and Wang (2022). Hence, the limit of , if it exists, can be useful as a measure of tail heaviness, and it is well defined even for distributions that do not have a heavy tail. By the monotone convergence theorem, we have exists if is monotone. The limit may be finite or infinite.

Corollary 2.

For with quantile function satisfying Assumption 1, let be the hazard rate of . If is second-order differentiable and convex (concave) in for some , then exists. In particular, this is true if is second-order differentiable and concave on .

Proof.

Let . Then, the survival function for is for . The density function is for . Therefore, the hazard rate function is for .

As is convex (concave) when , we have is convex (concave). By Theorem 3, we have is decreasing (increasing) on . As a result, we have is decreasing (increasing) on and exists.

By Corollary 1, if is concave on , is convex on and also exists. ∎

Example 7.

If is a constant, we have as . We give the numerical values of at very small probability levels for normal, t, and log-normal distributions. These distributions do not have a constant PELVE curve, and using Corollary 2 we can check that their PELVE have limits. As we can see from Table 3, PELVE can still distinguish the heaviness of the tail even when is very small. The heavier tailed distributions report a higher PELVE value. For the normal distribution and the log-normal distribution with , the value of PELVE is close to as . From the numerical values, it is unclear whether for all log-normal distributions, but there is no practical relevance to compute for in applications.

| Distribution | N | LN() | LN() | LN() | t() | t() |

|---|---|---|---|---|---|---|

| 2.6884 | 2.9167 | 2.7944 | 2.7290 | 4.0000 | 3.3750 | |

| 2.6909 | 2.9077 | 2.7920 | 2.7287 | 4.0000 | 3.3750 |

6 Applications to datasets used in insurance

In this section, we apply the PEVLE calibration techniques to datasets used in insurance to show how to use the calibrated distribution in estimating risk measure values and simulation.

6.1 Dental expenditure data

In this example, we apply the calibration model to the 6494 complete household component’s total dental expenditure data from Medical Expenditure Panel Survey for 2020. An earlier version of the same dataset is used by Behan et al. (2010) to study the relationship between worker absenteeism and overweight or obesity. The main purpose of this experiment is to construct tractable models, with continuous and simple quantile functions, which have similar risk measure values as the original dataset, and the same PELVE at certain levels. We present in Figure 14 two quantile functions calibrated from and , with and , respectively. The two calibrated quantile functions are scaled up according to the empirical and . By Theorem 1, we can calibrate the quantile functions from Case 4 when , and from Case 5 when . As mentioned before, for , we set the calibrated quantile function in as the Pareto quantile function. Hence, there is no flat part in the two calibrated quantile functions shown in Figure 14. As we can see, both the two calibrated quantile functions fit the empirical quantile functions well. The calibrated quantile function can be regarded as a special parameterized model for tail distribution, which can fit the value of and at specified levels. With the parameterized calibrated model, we can estimate the value of tail risk measures (see Liu and Wang (2021)) such as ES, VaR, and Range-VaR (RVaR), amongst others. In Tables 4 and 5, we compute the values of ES and RVaR for the calibrated model and compare them with empirical ES and RVaR values, respectively, where the risk measure RVaR is defined as

for ; see Cont et al. (2010) and Embrechts et al. (2018). As we scale the calibrated quantile function to empirical and , the calibrated ES and empirical ES are identical at levels and by the definition of PELVE. For other probability levels, the calibrated ES and RVaR in Tables 4 and 5 are close to their empirical counterparts. When , it may only be useful to compute calibrated for because the calibrated quantile function is arbitrary beyond the level . If we need to estimate ES or RVaR for a larger probability level, we can choose a higher as long as is satisfied. For this dataset, the highest we can use is 0.1983.

Using the methods in Section 3, for quantile levels between , the distribution calibrated from one point is the same as the one calibrated from two points and . Hence, the results for of the one-point calibrated function are also shown in Tables 4 and 5 in the cells .

| 0.01 | 0.05 | 0.1 | 0.2 | 0.3 | |

|---|---|---|---|---|---|

| Empirical | 10073.1 | 5361.7 | 3624.8 | 2317.9 | 1696.7 |

| Calibrated from | 11703.9 | 5357.7 | 3759.1 | - | - |

| Calibrated from | 10878.1 | 5439.6 | 3711.3 | 2293.7 | 1696.4 |

| Empirical | 5748.5 | 3662.4 | 1887.9 | |

| Calibrated from | 5003.7 | 3360.2 | 2160.6 | |

| Calibrated from | 5634.6 | 3561.8 | 1983.1 |

6.2 Hospital costs data

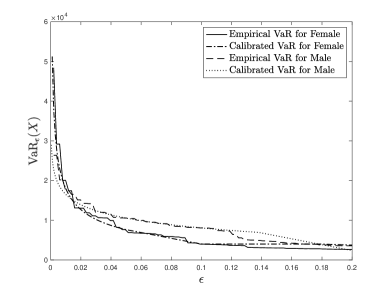

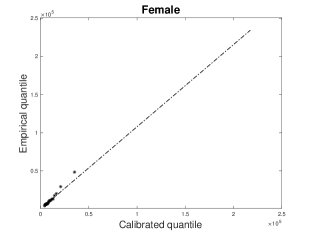

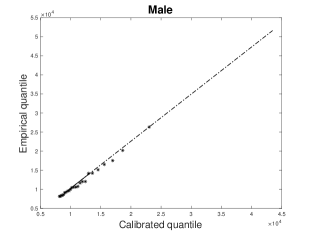

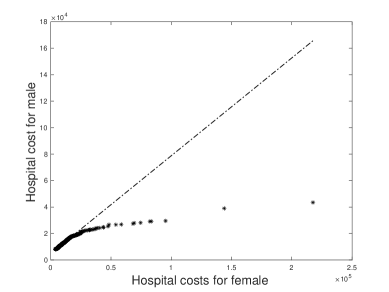

In this example, we apply the calibration process to the Hospital Costs data of Frees (2009) which were originally from the Nationwide Inpatient Sample of the Healthcare Cost and Utilization Project (NIS-HCUP). The data contains 500 hospital costs observations with 244 males and 256 females which can be regarded as the losses of the health insurance policies. Using the calibration model of the two-point constraint problem, we calibrate quantile functions for females and males from PELVE at probability levels and , which are shown in Figure 15. Except for estimating the risk measure, the calibrated distribution is useful in simulation. Assume the insurance company wants to know the top 10% hospital costs; that is where is the hospital costs. There are only 24 available data for males and 25 available data for females, which would be not enough for making statistically solid decisions. To generate more pseudo-data points, we can simulate data from the calibrated distribution; that is, we simulate data from where is the calibrated distribution in Figure 15. Taking , we have with from Figure 15. We simulate 1000 data from the calibrated distributions based on PELVE at and . In Figure 16, we present two QQ plots of simulated data against empirical data for females and males respectively. As we can see, the simulated data has a similar distribution as the empirical data. Those simulated pseudo-data points can be used for estimating risk measures or making other decisions. For example, the simulated hospital cost can be used to design health insurance contrasts or set the premium in complex systems, where sometimes methods based on simulated data are more convenient to work with than methods relying on distribution functions. This may be seen as an alternative, smoothed, version of bootstrap; recall that the classic bootstrap sample can only take the values represented in the dataset. Furthermore, we compare the simulated data of hospital costs for females and males in Figure 17, which shows that the distribution of the hospital costs for females has a heavier tail than that for males.

7 Conclusion

In this paper, we offer several contributions to the calibration problem and properties of the PELVE. The calibration problem concerns, with some given values from a PELVE curve, how one can build a distribution that has this PELVE. We solve a few settings of calibration based on a one-point constraint, a two-point constraint, or the entire curve constraint. In particular, the calibration for a given PELVE curve involves solving an integral equation for a given function , and this requires some advanced analysis and a numerical method in differential equations. For the case that is a constant curve, we can identify all solutions, which are surprisingly complicated. In addition, we see that if is a constant larger than , which is observed from typical values in financial return data (Li and Wang (2022)), share the same tail behavior with the corresponding Pareto solution. We also applied our calibration techniques to two datasets used in insurance.

On the technical side, we study whether the PELVE is monotone and whether it converges at 0. We show that the monotonicity of the PELVE is associated with the shape of the hazard rate. If the inverse of the hazard rate is convex (concave), the PELVE is decreasing (increasing). The monotonicity at the tail part of the PELVE leads to conditions to check the convergence of the PELVE at . If the inverse of the hazard rate is convex (concave) at the tail of the distribution, the limit of the PELVE at exists.

There are several open questions related to PELVE that we still do not fully understand. One particular such question is whether the tail behavior, e.g., tail index, of a distribution is completely determined by its PELVE. We have seen that this holds true in the case of a constant PELVE (see Theorem 2), but we do not have a general conclusion. In the case of regularly varying survival functions, Li and Wang (2022, Theorem 3) showed that the limit of PELVE determines its tail parameter, but it is unclear whether this can be generalized to other distributions. Another challenging task is, for a specified curve on , to determine whether there exists a model with . The case of -point constraints for large may require a new design of verification algorithms. This question concerns the compatibility of given information with statistical models, which has been studied, in other applications of risk management, by Embrechts et al. (2002, 2016) and Krause et al. (2018).

Acknowledgements

The authors thank Xiyue Han for many helpful comments. Ruodu Wang is supported by the Natural Sciences and Engineering Research Council of Canada (RGPIN-2018-03823, RGPAS-2018-522590).

References

- Acerbi and Székely (2014) Acerbi, C. and Székely, B. (2014). Backtesting expected shortfall. Risk, 27(11), 76-81.

- Artzner et al. (1999) Artzner, P., Delbaen, F., Eber, J.-M. and Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9(3), 203–228.

- Balbás et al. (2017) Balbás, A., Balbás, B. and Balbás, R. (2017). Differential equations connecting VaR and CVaR. Journal of Computational and Applied Mathematics, 326, 247–267.

- Barczy et al. (2022) Barczy, M., Nedényi, F. K. and Sütő, L. (2022). Probability equivalent level of Value at Risk and higher-order Expected Shortfalls. Insurance: Mathematics and Economics, 108, 107–128.

- BCBS (2019) BCBS (2019). Minimum Capital Requirements for Market Risk. February 2019. Basel Committee on Banking Supervision. Basel: Bank for International Settlements. BIS online publication No. bcbs457.

- Behan et al. (2010) Behan, D. F., Cox, S. H., Lin, Y., Pai, J., Pedersen, H. W. and Yi, M. (2010). Obesity and its relation to mortality and morbidity costs. Society of Actuaries, 59.

- Bellman and Cooke (1963) Bellman, R. and Cooke, K. L. (1963). Differential-difference Equations. Academic Press, New York.

- Berezansky and Braverman (2011) Berezansky, L. and Braverman, E. (2011). On nonoscillation of advanced differential equations with several terms. Abstract and Applied Analysis, 2011, 637142.

- Chambers (2009) Chambers, C. P. (2009). An axiomatization of quantiles on the domain of distribution functions. Mathematical Finance, 19(2), 335–342.

- Cont et al. (2010) Cont, R., Deguest, R. and Scandolo, G. (2010). Robustness and sensitivity analysis of risk measurement procedures. Quantitative Finance, 10(6), 593–606.

- Embrechts and Hofert (2013) Embrechts, P. and Hofert, M. (2013). A note on generalized inverses. Mathematical Methods of Operations Research, 77(3), 423–432.

- Embrechts et al. (2016) Embrechts, P., Hofert, M. and Wang, R. (2016). Bernoulli and tail-dependence compatibility. Annals of Applied Probability, 26(3), 1636–1658.

- Embrechts et al. (2018) Embrechts, P., Liu, H. and Wang, R. (2018). Quantile-based risk sharing. Operations Research, 66(4), 936–949.

- Embrechts et al. (2002) Embrechts, P., McNeil, A. and Straumann, D. (2002). Correlation and dependence in risk management: properties and pitfalls. Risk Management: Value at Risk and Beyond, 1, 176–223.

- Embrechts et al. (2014) Embrechts, P., Puccetti, G., Ruschendorf, L., Wang, R. and Beleraj, A. (2014). An academic response to Basel 3.5. Risks, 2(1), 25–48.

- Emmer et al. (2015) Emmer, S., Kratz, M. and Tasche, D. (2015). What is the best risk measure in practice? A comparison of standard measures. Journal of Risk, 18(2), 31–60.

- Fiori and Rosazza Gianin (2023) Fiori, A. M. and Rosazza Gianin, E. (2023). Generalized PELVE and applications to risk measures. European Actuarial Journal, 13(1), 307-339.

- Frees (2009) Frees, E. W. (2009). Regression Modeling with Actuarial and Financial Applications. Cambridge University Press. Cambridge.

- Gneiting (2011) Gneiting, T. (2011). Making and evaluating point forecasts. Journal of the American Statistical Association, 106(494), 746–762.

- Krause et al. (2018) Krause, D., Scherer, M., Schwinn, J. and Werner, R. (2018). Membership testing for Bernoulli and tail-dependence matrices. Journal of Multivariate Analysis, 168, 240–260.

- Kou and Peng (2016) Kou, S. and Peng, X. (2016). On the measurement of economic tail risk. Operations Research, 64(5), 1056–1072.

- Li and Wang (2022) Li, H. and Wang, R. (2022). PELVE: Probability equivalent level of VaR and ES. Journal of Econometrics, 234(1), 353–370.

- Liu and Wang (2021) Liu, F. and Wang, R. (2021). A theory for measures of tail risk. Mathematics of Operations Research, 46(3), 1109–1128.

- McNeil et al. (2015) McNeil, A. J., Frey, R. and Embrechts, P. (2015). Quantitative Risk Management: Concepts, Techniques and Tools. Revised Edition. Princeton, NJ: Princeton University Press.

- Rudin (1987) Rudin, W. (1987). Real and Complex Analysis. International Series in Pure and Applied Mathematics (3rd Ed.). McGraw–Hill. New York.

- Siewert and Burniston (1973) Siewert, C. E. and Burniston, E. E. (1973). Exact analytical solutions of . Journal of Mathematical Analysis and Applications, 43(3), 626–632.

- Wang and Zitikis (2021) Wang, R. and Zitikis, R. (2021). An axiomatic foundation for the Expected Shortfall. Management Science, 67, 1413–1429.

Appendix A Omitted proofs in Section 3

Proof of Lemma 1.

As and , . By Proposition 1 in Li and Wang (2022), and .

For any satisfying ,

Let . For any , we have and . Hence, and this gives . Therefore, . ∎

Proof of Theorem 1.

We will check the equivalent condition (2) between and . Note that if is a constant on , then . If is not a constant on , then is the unique solution that satisfies .

-

(i)

Case 1, . It is clear that is a constant for and (2) is satisfied. Hence, Moreover, is also a constant for , which implies .

-

(ii)

Case 2, and . For , is a constant for . Hence, . Next, we check whether . The value of is

The value of is . Thus, (2) is satisfied. As is not a constant for , we have .

-

(iii)

Case 3, and . In this case, we have

and as . Thus, we only need to check whether . The value of is

The value of is also . Hence, (2) is satisfied and , because is not a constant on .

- (iv)

-

(v)

Case 5, and . The equality between and can be checked by

The equality between and can be checked by

Hence, (2) is satisfied, and and .

Therefore, it is checked that satisfies and for all five cases. ∎

The following propositions address the issue discussed in Remark 1 by showing that the boundary cases of cannot be achieved by strictly decreasing quantile functions, and hence our construction of quantiles with a flat region in Figure 5 are needed.

Proposition 6.

For any , let be such that and . Then, if and only if .

Proof.

Using the same logic as in Lemma 1, we have that and are finite.

We first show the “if” statement. Assume . As is decreasing, we know that is a constant on .

If for , then is a constant on . Therefore, we can get . Note that . Thus, we obtain .

If there exists such that , then is strictly decreasing on . By the equivalent condition between VaR and ES, implies . Thus, . Furthermore, we have

Thus, and we get .

Next, we show the “only if” statement. Assume .

If , then . This implies that is a constant on , which gives .

If , then . Hence, we have

Thus, we complete the proof. ∎

Proposition 7.

For any , let be such that and . Let and . If , then

where

Moreover, .

Proof.

As , we have and . By definition, . From Lemma 6, we get . Thus, the value of should be in .

Note that satisfy the equivalent condition (2). We can rewrite (2) as

Therefore, we have

Furthermore, by the monotonicity of , we have

The two inequality will provide an upper bound and a lower bound for .

An upper bound on . Using we have

| (9) |

If , the left side of (9) is less or equal to 0 and the right side of (9) is larger or equal to 0 because . Therefore, (9) is satisfies for any . The upper bound for is unchanged.

On the other hand, if , we have

Thus, an upper bound for is .

A lower bound on . It holds that

Subtracting from both sides, we get

| (10) |

For , let

As we can see, , and if . The is increasing in the interval , decreasing in . Hence, by (10), the lower bound for is

As , we have . ∎

Appendix B Omitted proofs in Section 4.4

Proof of Theorem 2.

By Proposition 3, for any , we can find satisfying (3) such that and . As is a continuously differentiable function, we know that all such is characterized by the advanced differential equation (4). First, we show for any strictly decreasing solution to (4) can be represented as

Let us start with (4). If , we need to solve from

Even though in the first place is considered on , given that , and this final equation, one can expand it to the whole positive line:

Next, let for and . This is equivalent to say that . This changing variable simply gives the following delayed differential equation:

Since we have assumed that is strictly decreasing, i.e., , we have an extra restriction on . Note that

Thus, we have . Therefore, we are looking for a solution to the following delay differential equation (DDE):

| . | (11) |

A standard approach of finding the solutions is to assume that they are in the form of a characteristic function . Putting this solution inside the equation, we get

This means any solution is given by where solves the characteristic equation

| (12) |

where . Let . As , we have . This equation has one obvious real solution at . To find , we need to know about the inverse of . The inverse of the function is known as the Lambert function and plays an essential role in solving delayed and advanced differential equations.

From the Lambert function, we know that has two real solutions when and one real solution when . As illustrated by Figure 18, if , the two real solutions are and ; thus, . If , the two real solutions are and ; thus, . If , there is only one real solution ; thus .

It is important to note that in general an equation like has infinite complex roots. Let , and . In that regard, we have

This implies that , and , leading to

We plot the curves and to find out the relation between and the real part of the solution in Figure 19. The -axis is and the -axis is . The blue curve is associated with , which is essentially the principle branch of the Lambert function. For any , one can find the real values of the roots by fixing . For instance, the green dashed line is associated with . As one can see, the curves intersect this line in infinite negative values. For , we can see that the real roots are greater than the real part of the complex roots. For more explanation of this, see Siewert and Burniston (1973).

Now assume that all the complex solutions for are for , where and . Based on the above discussions, we have

and

Let

be the set of all complex numbers. Then,

is a complex solution that solves (11). It is clear that (11) still holds for the linear transform of . Therefore, for any two vector and ,

is also a solution to (11).

In Bellman and Cooke (1963), it is shown that all complex solutions to (11) can be represented as follows:

Putting it in the real-valued context, we have that all real-valued solutions are in the following form:

Now let us check . This means that , and for all must satisfy

As for , we have . Therefore, we need if or if . That is . Then the solution can be written as

By a change of variable, we get

where and . As and , we have and . Also note that since solves , by replacing and , we get . ∎

Appendix C Omitted proofs in Section 5

Proof of Proposition 4.

Before proving the statements in the proposition, we introduce the following linking function, for ,

As it is easy to check that satisfies Assumption 1 for any . The domain of is and its range is .

As , we have

Hence we have the simple relationship Therefore, and . The function yields an association between a point on the PELVE on and a point on the dual PELVE curve on with the same value. Furthermore, we have is continuous on as and is continuous.

Next, we show the statements (i)-(iv). The equivalence (i) of monotonicity of and that of follows from , and that is increasing.

For (ii), (iii) and (iv), we first show that is location-scale invariant and shape relevant (in the sense of (13)). Assume that is a strictly increasing concave function such that . By Jensen’s inequality and the dual representation of , we have

for all . This statement can be found in Appendices A.2 in Li and Wang (2022). Therefore,

| (13) |

Then, we have for all strictly increasing concave functions: with .

For any strictly increasing convex function with , we can take , which is a strictly increasing concave function. Therefore, we have for all strictly increasing convex functions .

For and , we have that is both convex and concave. Therefore, for all . In conclusion, we have the following results for .

-

(1)

For all and , .

-

(2)

for all strictly increasing concave functions: with .

-

(3)

for all strictly increasing convex functions: with .

Then, we have (ii), (iii) and (iv) from . ∎

Proof of Theorem 3.

The idea is to prove that if is convex (concave), then is convex (concave) for all . Then, we can get the desired result by Proposition 5. We will use the following steps to show this statement.

Step 1. Let for . Then, is a continuous and strictly decreasing function and . Let be the inverse function of . Now, we have

and

Therefore,

Let . It follows that the statement that is convex (concave) for all is equivalent to the statement that is convex (concave) for all .

Step 2. Let . Then, is strictly increasing. We will show that if is convex (concave), is convex (concave).

As we have

Let . We have

| (14) |

Then, taking the derivative on both sides of (14), we get

Taking a derivative in both sides again, we get

Then, is a convex (concave) function means (), which gives that is convex (concave).

Step 3. For , let . We are going to show

| (15) |

for all .

We take first. As is strictly decreasing, is also strictly decreasing. Then, is a continuous and strictly increasing function. As , we also have . Take arbitrary and such that , and . Let . Then, we have . Define

By the definition of , we have , and . As a result, we have

By the mean-value theorem, there exists , , and such that

Furthermore, and satisfy and . If is small enough, then and will also be small enough as is continuous. Therefore, we have and when is small enough.

In Step 2, we have that is convex when is convex. Therefore, we get

for all and , which means

As , we have

As is strictly decreasing, it means that

for and . Therefore, we have as and . That is,

On the other hand, and . Therefore,

when is small enough. If , we can also get (15) by an analogous argument.

Hence, the second-order derivative of is increasing for each , which means that is convex for all if is convex.

An analogous argument yields that is concave for all when is concave. ∎