Estimation of impulse-response functions with dynamic factor models: a new parametrization

Abstract

We propose a new parametrization for the estimation and identification of the impulse-response functions (IRFs) of dynamic factor models (DFMs). The theoretical contribution of this paper concerns the problem of observational equivalence between different IRFs, which implies non-identification of the IRF parameters without further restrictions. We show how the previously proposed minimal identification conditions are nested in the new framework and can be further augmented with overidentifying restrictions leading to efficiency gains. The current standard practice for the IRF estimation of DFMs is based on principal components, compared to which the new parametrization is less restrictive and allows for modelling richer dynamics. As the empirical contribution of the paper, we develop an estimation method based on the EM algorithm, which incorporates the proposed identification restrictions. In the empirical application, we use a standard high-dimensional macroeconomic dataset to estimate the effects of a monetary policy shock. We estimate a strong reaction of the macroeconomic variables, while the benchmark models appear to give qualitatively counterintuitive results. The estimation methods are implemented in the accompanying R package.

Keywords: Dynamic factor models, parameter identification, impulse-response functions, EM algorithm, monetary policy

JEL classification: C32, C38, C50, E52

1 Introduction

Empirical macroeconomic analysis using structural vector autoregressions (SVARs) assumes implicitly that conditioning on a small information set is enough to isolate unexpected or exogenous variation in the macroeconomic variables of interest. The identification of this variation, i.e. structural shocks, is hampered if a relevant variable is missing since variation in the omitted variable is confounded with that of the structural shock. To guard against this omitted variable bias, empirical macroeconomists have increasingly devoted attention to modelling alternatives that can accommodate large information sets. Building on Forni et al. (2000); Forni and Lippi (2001); Bai and Ng (2002); Stock and Watson (2002a, b), Forni et al. (2009) showed how dynamic factor models (DFMs) can be used in structural analysis similarly to SVARs while using large panels of macroeconomic data, such as those by McCracken and Ng (2016, 2020). The premise of structural DFMs is that large information sets can be incorporated in the estimation process without compromising the flexibility of SVAR identification strategies.

Structural DFMs enable the researcher to track the responses of macroecnomic variables to structural shocks through impulse-response functions (IRFs). However, the IRFs are not identified without further restrictions. Against this backdrop, the main contribution of this paper is to provide a new set of identification conditions for the IRF parameters corresponding to the DFM. Bai and Wang (2015) provide a set of minimal identification conditions of the IRFs, and we generalize these and show how further overidentification restrictions leading to efficiency gains can be obtained in the framework put forth in this paper. Moreover, we treat the topic of parameter identification of DFMs carefully and systematically, which has not received attention in the literature so far. The identification problem entails that two representations of the DFM are observationally equivalent, and cannot be distinguished from each other based on the first and second moments of the data. The identification problem addressed in this paper is distinct from the usual static normalization matter discussed extensively in the DFM literature (see, e.g., Bai and Ng, 2013; Stock and Watson, 2016, Chap. 2.1.3). By solving the more complex problem of observational equivalence between different DFMs, one can identify the IRF parameters parsimoniously based on a simple decomposition into a high-dimensional dynamic factor loading matrix and a small-dimensional VAR lag polynomial.

Building on the observation that the IRFs for a DFM can be identified using existing strategies designed for vector autoregressive moving average (VARMA) models (Hannan and Deistler, 2012, Chap. 2), we make three important contributions to the the structural DFM literature. First, we provide a unified framework for the parameter identification of DFMs. The identifying restrictions proposed in this paper can be defined exhaustively in terms of a small-dimensional vector describing the maximum degrees pertaining to the columns of the lag polynomials of the DFM. These restrictions have not been introduced to the econometrics literature earlier, even though they can be derived straightforwardly by transposing those for the similar VARMA model form. Besides the approach by Bai and Wang (2015), which is a special case of the identification strategy introduced here, there are two dominant strategies for overcoming the identification issue. The first uses frequency domain approaches, i.e. spectral methods involving dynamic principal components. For example, Forni et al. (2000) solve the identification problem by placing restrictions on the eigenvalues of the spectral density matrix. The second strategy is to treat the problem in the time domain, and transform the dynamic model into a static form and impose the necessary restrictions. For example, the popular two-step estimation and identification strategy by Forni et al. (2009) uses static principal components, which satisfies these restrictions by design. Limiting the scope of this paper to the time domain, we note that, compared to the static representation of Forni et al. (2009), the minimal identifying restrictions are fewer, and richer dynamics can be estimated in the dynamic representation considered in this paper (Bai and Wang, 2015).

Second, we provide a modelling alternative which does not involve singular VARs. The singular VARs arise in the static representation of the DFM and have been proposed as a solution to the non-fundamentalness problem, which entails that the estimated residuals do not span the space of structural shocks, because the resulting IRF is “generically zeroless” ensuring that the non-fundamentalness is not a relevant problem (Anderson and Deistler, 2008; Deistler et al., 2010). It involves fitting a VAR to a singular process444Defined as a process, which is driven by a white noise process with a singular covariance matrix. followed by a rank reduction step to obtain a smaller dimensional shock process. However, this approach suffers from two shortcomings. First, fitting a VAR on a singular vector is shown to lead to difficulties in estimation by rendering the associated Yule-Walker system singular when the true VAR order of the process is unknown (Hörmann and Nisol, 2021). Second, the rank reduction step introduces an additional estimation step, which might have a non-trivial effect on the efficiency of the IRF estimator in finite samples. In particular, the simulation study by Han (2018) shows that the estimator of the lower-dimensional shock proposed by Forni et al. (2009) is sub-optimal based on the trace statistic in comparison to the alternative given in the paper. Importantly, the parametrization developed in the current paper does not require an estimation of singular VAR, while the resulting IRF is “zeroless” similarly to that of obtained via singular VAR.

Third, we develop a maximum likelihood (ML) estimation method for DFMs based on the expectation maximization (EM) algorithm, which incorporates the parameter restrictions used to identify the model. In particular, we show how to modify the EM algorithm of Watson and Engle (1983) and Doz et al. (2012) to the present case. Additionally, the estimation strategy adopted here relates closely to those of Bork (2009) and Bańbura and Modugno (2014), who use parameter restricted EM algorithms. The main difference to these approaches is related to the model class as we are interested in estimation of the dynamic representation of DFM. The estimation scheme considered in this paper is, to the best of our knowledge, the first one embedding the minimal identifying restrictions in a frequentist estimation framework. The coding of the identification restrictions and estimation using the EM algorithm are implemented in the accompanying R package.555It can be downloaded from https://github.com/juhokalle/rmfd4dfm or loaded directly to the R environment by entering command devtools::install_github("juhokalle/rmfd4dfm").

In the emprical exercise, we revisit the popular topic concerning the effects of a monetary policy shock. To guard against informational deficiencies, we use a standard high-dimensional monthly macroeconomic data set. The model incorporates 125 variables with a time series dimension of 34 years and 8 months. Using the Forni et al. (2009) estimation method, Forni and Gambetti (2010a) argue that SVARs are informationally deficient and this is why they produce puzzling results, such as contractionary monetary policy raising prices. They argue that the so-called price puzzle is solved by enlarging the information set. We compare our method to that of Forni and Gambetti (2010a) and find that the two methods give somewhat contradicting evidence on the matter. The method put forward in this paper solves some of the puzzling phenomena, while anticipating strong effects of the monetary policy shocks. For example, we estimate that a 50 basis point contractionary monetary policy shock lowers industrial production by percent. Additionally, we see that the conclusions on the puzzles are sensitive to data transformations aimed at reaching stationarity of the time series.

The rest of this article is structured as follows. In Section 2, we describe the model class, related parameter indeterminacy and a new parametrization. Section 3 describes the ML estimation method via the EM algorithm and shows how the parameter restrictions introduced in Section 2 can be incoporated into the estimation procedure. In Section 4, we present the empirical application addressing the effects of monetary policy shocks and propose a model selection strategy. Section 5 concludes. All proofs are deferred to the appendices.

The following notation is used in the article. We use as a complex variable as well as the backward shift operator on a stochastic process, i.e. . The transpose of an dimensional matrix is represented by . For the submatrix of consisting of rows to , , we write and analogously for the submatrix of consisting of columns to , . We use to stack the columns of into a column vector. The -dimensional identity matrix is denoted by . The trace of is denoted by . The adjugate matrix of is written as . The floor function returns the integer part of . The notation refers to the rank of matrix . We use for the expectation of a random variable with respect to a given probability space.

2 Parameter Identification in Dynamic Factor Models

2.1 The Model and Related Parametrization Problem

The starting point of our analysis is the following DFM considered for example in Forni et al. (2009), Bai and Wang (2015), and Stock and Watson (2016)

| (1) | ||||

| (2) |

where the vector is an observable stationary time series with zero mean and finite second moments, the vector is a latent dynamic factor process with , and the vector is a zero mean stationary idiosyncratic component with covariance matrix , . The matrices are called the dynamic factor loadings and are the VAR coefficient matrices pertaining to the dynamic factor process . The -dimensional reduced form shock has a zero mean and a constant covariance matrix and and are uncorrelated at all leads and lags. We consider the structural version of the DFM in (1)–(2) such that

| (3) |

where is an invertible structural impact multiplier matrix, which is used to identify the structural shocks from the reduced form shocks. Finally, the dynamic factor process is driven by a vector with zero mean and identity covariance matrix corresponding to the structural shocks impinging on the economy. The assumption (3) then implies that the covariance matrix of can be decomposed as .

For our purposes it is useful to rewrite equations (1) and (2) as and , where the dynamic factor loadings and VAR coefficient matrices are expressed as and lag polynomials and of order and , respectively. In this paper, we are interested in the case where and 0, setting the DFM (1)–(2) apart from its static counterpart (discussed in more detail in Section 2.3). We assume that the lag polynomial has all roots outside the unit circle, which guarantees the existence of the inverse matrix .666The extension to modeling nonstationary DFMs has been recently explored in Barigozzi et al. (2020) and Barigozzi et al. (2021), while we limit ourselves to the stationary case. Furthermore, using (3), the observable vector can be defined in terms of the structural shocks and idiosyncratic component as

| (4) |

In the DFM literature, the first term on the right hand side of (4) is called the common component and we denote it by , where we assume that and are uncorrelated at all leads and lags. Our interest is in the identification and estimation of the non-stuctural IRF which, upon fixing the rotation , describes the shock propagation from to the common component through the structural IRF . Our main interest is not on the rotation , which uniquely identifies the structural shocks and the identification of which in DFMs is discussed extensively by Han (2018). We only want to highlight that is of dimension and so restrictions are needed for just identification of . Since the number of shocks is usually considerably smaller than that of the model variables , the number of necessary identification restrictions does not increase when considering a structural DFM vis-à-vis structural VAR.777In the empirical application, the cross-sectional and dynamic factor dimensions are and , respectively. Therefore, the same identification strategies that are developed for SVAR analysis are equally applicable in the structural DFM framework (for this discussion, see, e.g., Ramey, 2016).

There are two sources of dynamics in the DFM considered here. First, loads both current and lagged values of in (1). Second, the dynamic factor process is assumed to follow a VAR() as shown in (2). This creates an identification problem such that the lag polynomials and cannot be recovered uniquely from the IRF without further restrictions. To see this, note that two moving average representations of the common component are observationally equivalent:

| (5) |

for any non-singular polynomial matrix , with and for The issue here is that different sets of lag polynomials and of possibly different degrees and can give rise to the same IRF , which implies that the parameters in and are not identified.

This parameter identification issue is similar to the one encountered in relation to VARMA models, which has been treated extensively in Hannan and Deistler (2012, Chap. 2) and Reinsel (1993, Chap. 2.3.). Without delving deeper into the VARMA case, let us only highlight the dual nature of the identification problem in (5) and that of the VARMA model: the IRF in (4) is invariant with respect to postmultiplication of and by , while the same issue concerns premultiplication of AR and MA polynomial matrices by . Exploiting this duality, the main contribution of this paper is to show how to solve the identification problem in (5) using the existing strategies designed for VARMA models.

The parameter indeterminacy in (5) is rarely dealt with in the DFM literature. One notable exception is Bai and Wang (2015), who show in their Proposition 2 that the dynamic factor process and the corresponding loadings are identified using the normalization

| (6) |

i.e. the top block of the zero lag coefficient matrix corresponding to is restricted to an identity matrix while the lower block is left unrestricted, which amounts to restrictions. The authors show how to embed these parameter restrictions into a Bayesian estimation scheme and conduct impulse response analysis with the DFM (1)–(2). It should be noted that the identification issue in (5) does not affect forecasting exercises using DFMs, for which case the identification of the factor space, i.e. their linear combinations rather the factors themselves, is sufficient (Stock and Watson, 2016, Chap. 2.1.3.). However, since our focus is on the impulse-response analysis, the parameter inderterminacy must be treated carefully.

2.2 Parsimonious Parametrization of Dynamic Factor Models

In this section, we show that the identification result (6) is nested in a more general identification strategy and how overidentifying restrictions can be derived which imply more parsimonious parametrizations. We develop a so-called canonical form for the model given in (5), which pins down uniquely the corresponding IRF within the given model class.

For convenience, let us call the representation a right matrix fraction description (RMFD) for the common component.888This name was introduced by Deistler et al. (2010) and Deistler et al. (2015) in the DFM context. The identification problem concerns choosing a unique RMFD from the class of observationally equivalent RMFDs, which are defined as RMFDs giving rise to the same IRF (Hannan and Deistler, 2012, page 36). As shown in (5), the pairs of polynomial matrices generating must be restricted. To this end, we make the right coprimeness assumption stating that the polynomial matrices and are right coprime, i.e.

| (7) |

for all This assumption restricts in (5) to be a unimodular matrix, which is equivalent to saying that the determinant of is non-zero and independent of . Examples of unimodular matrices are

for some constant While the right coprimeness assumption is a necessary condition for identification, it is not, however, sufficient. The goal is to restrict such that the only admissible postmultiplication of and generating is the one by an identity matrix. This ensures that for a given , there is only one set of matrix polynomials and generating this IRF. One model form guaranteeing this is a RMFD in reversed echelon canonical form (RMFD-E, for short), which can be defined similarly to Hannan and Deistler (2012, Theorem 2.5.1) for the present case. The detailed derivation of the RMFD-E is given in Appendix A, and here we only highlight the main properties of this particular RMFD form.999Since the parameter indeterminacy in the RMFD model is completely analogous to that of the VARMA model, an interested reader is referred to e.g. Tiao and Tsay (1989), Reinsel (1993, Chap. 2.3), Lütkepohl (2005, Chap. 12), Hannan and Deistler (2012, Chap. 2), Tsay (2013, Chap. 4) and Scherrer and Deistler (2019) for futher details.

The RMFD-E form implies zero and unity restrictions for certain elements in and , and . Denote the th element of and by and , respectively. The maximum polynomial degree of the th column of is given as . For the number of free parameters in , define further

| (8) |

The RMFD-E satisfies the following restrictions

| (9) | ||||

| (10) | ||||

| (11) |

The column degrees defined before (8) are called the Kronecker indices and play a crucial role in specifying the RMFD-E structure.101010Specifically, the column degrees of a polynomial matrix are called the right Kronecker indices, while the row degrees of a polynomial matrix are left Kronecker indices and are used to identify VARMA models. Since the analysis in this article does not concern VARMA models, no confusion arises by using simply Kronecker indices as reference to the column degrees. In the remainder, we denote the RMFD model subject to the restrictions (8)–(11) by RMFD-E, which highlights the dependence on the Kronecker indices in this model form. Moreover, the impulse response coefficients of an RMFD model are easily seen to follow a recursion

| (12) |

with if and if . Consider the following examples for illustration.

Example 1.

Suppose that the number of variables is the dynamic factor dimension is and the model dynamics are given by a Kronecker index vector . The lag polynomial matrices and corresponding to the RMFD-E are given as

Example 2.

Suppose that and . Then and are given as

Example 3.

Consider now and The polynomial matrices and are

with

Example 1 corresponds to the representation involving the minimal identification restrictions given in (6). For given maximum value of the Kronecker index vector, the structure in Example 1 involves the highest number of free parameters of all models having as the maximum Kronecker index. More parsimonious parametrizations are obtained when some of the Kronecker indices are smaller than . Example 2 illustrates these overidentifying restrictions. The notable feature here is that the column of corresponding to Kronecker index equalling zero has no free parameters. As the dynamic factor loading matrices are these restrictions imply a substantial reduction in the number of estimated parameters when the cross-sectional dimension is high. Example 3 highlights the property that the top block of zero lag coefficient matrices of and are not necessarily identity matrices and thus do not line up with the representations (2) and (6). Notice that if the Kronecker indices are ordered weakly increasing as shown in examples 1 and 2. Finally, we note that in the RMFD-E structure, we have , i.e. the lag polynomials and have the same degree, which might not be supported by a priori infomation on the degrees and . However, the identification by echelon form does not rule out additional parameter restrictions and the lag polynomials can have different degrees by restricting certain parameter matrices to zero. For example, the model considered by Stock and Watson (2005) assumes which is attained by imposing the restriction in Example 3.

2.3 Using Static DFM to Solve the Parameter Indeterminacy

In this section, we first summarize a popular identification and two-step estimation method used extensively to estimate IRFs with DFMs and secondly compare it with the parametrization given in the previous section. The parametrization of this section was first formalized to accommodate structural analysis by Forni et al. (2009) to whom we refer for a more comprehensive treatment.

2.3.1 Static Representation of the DFM

The parameter identification issue in (5) can also be solved by treating the vector of latent factors static. Specifically, first define an vector , which stacks the dynamic factors in a vector and note that the dimension of this vector is . Then one can write equation (1) as

| (13) |

where the factor loading matrix arranges the dynamic factor loadings adjacently , and the common component is given by . The latent factor is called static because it loads on only contemporaneously, while it is customary to assume that itself is a dynamic process. In particular, is modelled as VAR()

| (14) |

where and are parameter matrices, , and . Then the non-structural IRF is given as The existence of a stable VAR() representation of the static factor process is shown in Anderson and Deistler (2008, Proposition 1) and Deistler et al. (2010, Theorem 3) in case one assumes that i.e. Therefore, in (14) is a singular VAR process since the corresponding innovation has a covariance matrix of reduced rank: . A further simplification is attained if , which implies that is a VAR() process. This can be seen by expressing (2) in a companion form:

| (15) |

where if In case , one must include lags of on the right hand side of (15), where the corresponding parameter matrices are restricted to zero apart from the top right block (Bai and Ng, 2007). For example, Forni et al. (2005) and Forni et al. (2009) assume , whereas Stock and Watson (2005) set such that the static factor process admits a VAR() representation in both cases. In the remainder, we will refer to equations (13)–(14) as the static representation of the DFM (S-DFM), while (1)–(2) are called the dynamic representation of the DFM (D-DFM).111111When , also the representation (13) with given in (15) is obtained by increasing the static factor dimension to and restricting such that the block to the right of is zero. This, however, does not constitute a S-DFM since is rank-deficient (see Forni et al., 2009). The structural version of the S-DFM is obtained through (3), similarly to the D-DFM.

The estimation of S-DFM is carried out using the standard principal components strategy and proceeds in two stages. First, one uses the eigenvectors associated with the largest eigenvalues of the sample covariance matrix of as an estimate of , denoted by , and estimates the static factor process by . Second, one fits VAR() on to obtain the estimates of the autoregressive parameters , denoted by . This gives as an estimator for the non-structural IRF. The consistency and a more detailed account of this estimation strategy is shown in Forni et al. (2009).

2.3.2 Discussion

We next draw attention to the differences in the D-DFM and S-DFM in terms of the assumptions on the underlying data generating process (DGP) and estimation. Regarding the former, we highlight two restrictive features in the S-DFM compared to the D-DFM. First, it is well known that and of (13) are both unobserved and not separately identified. This can be seen as for an invertible matrix , which means that now restrictions are needed to identify the parameters in and the static factor process (for different normalization schemes, see, e.g., Bai and Ng, 2013). Therefore, the transformation of (1) to (13) comes at the cost of increasing the necessary restrictions from to as observed by Bai and Wang (2015). Second, the parametrization of the VAR in (14) is heavily constrained regardless of the assumption on the relationship between and . In the D-DFM, the VAR polynomial matrices are unrestricted and the dynamic factors are allowed to interact more freely and allows for a richer correlation structure between the factors.

Turning to the estimation of S-DFM by principal components, we note the following. In a recent contribution, Hörmann and Nisol (2021) show that the Yule-Walker estimator of (14) has poor finite sample properties in case the VAR lag order is misspecified. The authors analyse the DFM model introduced by Forni et al. (2015) and Forni et al. (2017), which involves estimation of singular VARs as an intermediate step. The main finding is that the misspecification of the correct lag order of a singular VAR model renders the Yule-Walker equation system singular as well. This is imporant since while the result by Anderson and Deistler (2008) justifies under a set of weak assumptions that the static factor process be modelled as a finite-order singular VAR process, their result does not give indication as to what is the true VAR order of this process. Forni et al. (2009) assume that follows a VAR() but, as shown in Section 2.3.1, this implies a restriction of generality in terms of the lag structure in (1)–(2). On the other hand, in the D-DFM, the law of motion for the dynamic factor process is the usual non-singular VAR with an unrestricted lag structure in (1)–(2).

As a conclusion to this section, let us summarize the main point in favoring the D-DFM over the S-DFM. If we assume that the small -dimensional structural shock process accounts for the bulk of comovement in the large -dimensional vector of observables, as in the DFM, then the natural way of modelling these shocks is through a factor process of the same dimension rather than a larger -dimensional process with dynamically redundant components that are predetermined given the information at time . The D-DFM does not suffer from this peculiarity, and so the choice of the S-DFM appears to be driven by convenience rather than theoretical considerations.

3 Estimation Using the EM algorithm

In this section, we consider the ML estimation of D-DFM represented as linear Gaussian state space model using the EM algorithm. A novel feature of this estimation scheme is the incorporation of the parameter restrictions implied by the RMFD-E representation for the common component . The model dynamics are completely defined by the Kronecker indices, which can be adjusted to different model structures. For example, different dimensions of the dynamic factor process can be taken into account by changing the dimension of the Kronecker index vector.

The EM algorithm was first introduced by Dempster et al. (1977) in a general setting and by Shumway and Stoffer (1982) for factor models. Watson and Engle (1983) showed how to apply the EM algorithm in the estimation of DFMs and we take their approach as the refrerence point in developing the estimation scheme. More recently, in an important contribution formalizing the ML estimation of DFMs, Doz et al. (2011) prove that the parameter estimates obtained using a two-step method, which is equivalent to one round of E and M-steps in the EM algorithm, converge at rate . Doz et al. (2012) extend the results of Doz et al. (2011) to encompass an estimation scheme where the two steps are repeated until convergence. Barigozzi and Luciani (2019) generalize their asymptotic results to a case where the error term of the factor process has singular covariance matrix, which is relevant to our case. Interestingly, they also show that when the dynamic factor dimension is smaller than the static factor dimension , the EM algorithm performs better than the principal component estimation scheme. Poncela et al. (2021) survey comprehensively the literature on the estimation of DFMs using state space models and the EM algorithm.

3.1 State Space Representation

A necessary preliminary step in the ML estimation of D-DFM via the EM algorithm is to put the model into a state space format:

| (16) | ||||

where is a unobserved state vector, is the maximum Kronecker index, and the equations for and are called the state and observation equation, respectively. Note that the state dimension can be reduced to if the dynamic factor loading matrix is of a smaller degree than the VAR polynomial i.e. , because then . In the remainder, we use to denote the state dimension in (16) and make it explicit if we set and model as -dimensional. It should also be noted that (16) corresponds closely to the S-DFM in state space format (eqs. (13) and (15)). The major difference in terms of the model dynamics is that (16) places no restrictions on polynomial degrees and . In contrast, the assumption is necessary for the VAR process in (14) to be of degree one, as discussed in Section 2.3.1. In other words, if and only if .

Solving the state equation of (16) for and plugging this into the observation equation of (16) gives

| (17) |

from which it is easy to check that the impulse response coefficients from the state space representation match those in equation (12). The error terms are assumed jointly Gaussian

where is with defined in (3) and is . Consequently, the idiosyncratic component is assumed to be serially and cross-sectionally uncorrelated. These assumptions on the idiosyncratic component are rather restrictive and unrealistic for economic applications, where a group of similar variables are included in the panel of data, and amount likely to a model misspecification. However, note that the quasi-ML method assuming a homoskedastic and serially uncorrelated idiosyncratic component estimates the parameters consistently even if either or both of the assumptions are violated for large and , as shown in Doz et al. (2012). In the DFM vocabulary, we are estimating an exact DFM, while the data is more likely generated by an approximate DFM, which allows for a weak cross-correlation in the idiosyncratic component (Poncela et al., 2021, Section 3.1.). Finally, we note that the temporal correlation of the idiosyncratic component can be accommodated by augmenting the state vector with lagged (for a generalization of this sort, see Bańbura and Modugno, 2014). While this extension is straightforward to implement, we leave it for future research and restrict ourselves to estimation of temporally uncorrelated idiosyncratic component.

3.2 The EM Algorithm

The parameter space associated with model (16) is . The parameter space and the number of estimated parameters depend on two assumptions. First, the Kronecker indices determine state dimension through the maximal Kronecker index in (16) and therefore the size of the parameter matrices and . The parameter restrictions imposed on and are defined by the Kronecker index vector . Second, the assumption of a spherical idiosyncratic component implies estimation of only one parameter in . If the latter assumption relaxed, the number of free parameters increases by in case of non-constant diagonal for example.

Let us denote the joint log-likelihood function of and given in (16) by , where and . The EM algorithm consists of successive runs of E and M-steps aimed at maximizing the log likelihood function for given parameter values . These steps decrease the computational burden that the direct maximization of entails, which can be vital as the parameter space increases with . Denote the parameter estimates from the previous iteration by 121212To simplify notation, estimators from the EM algorithm are distinguished from the population parameters by parentheses denoting the iteration round at which the estimator is obtained. where is the iteration counter and then we can summarize the EM algorithm as follows.

-

1.

E-step. Calculate the expected value of the likelihood function:

. -

2.

M-step. Maximize the expected likelihood function with respect to

which gives a new set of parameter estimates.

Specifically, the E-step of the th iteration involves calculating the smoothed estimates of and the corresponding mean square error (MSE) matrices. The smoother calculates these quantities given both all observations , with and the parameter estimates from the th iteration. Following Bork (2009), we use the the smoothing algorithm given in Durbin and Koopman (2012, Section 4.5.3), which is slightly different from the approach suggested in Watson and Engle (1983). The algorithm is summarized in Appendix C. The first iteration of the E-step requires starting values which are obtained using a method described in Appendix B.

The M-step of the th iteration involves GLS regressions, which use the output of the E-step as an input, to obtain parameter estimates of and containing the model parameters of the lag polynomials and . We modify the M-step of Watson and Engle (1983) to impose restrictions of the form , where is an arbitrary constrained parameter matrix of dimension , is a known matrix of rank with zeros and ones as entries, , is an -dimensional vector of free parameters, and is a known -dimensional vector of ones and zeros. For example, consider the case where the model dynamics are described as and no restrictions are placed on the degrees and . This RMFD-E structure corresponds to the minimum identifying restrictions, i.e. equation (6). The matrix is of dimension where the rows corresponding to the restricted elements of are zero. The parameter vector is , and has ones and zeros with ones positioned such that they match those of . Elements of , and are not described as straightforwardly as the parameter matrix has a more constrained structure. Note that the coding of the restrictions implied by the RMFD-E structure for the state space system (16) is implemented in functions contained in the accompanying R package.

We show in Appendix D that the resulting estimators from the M-step of the th iteration are given as

| (18) | ||||

| (19) |

where

The quantities involving the conditional expectation operator are the smoothed conditional moments matrices and and are the covariance estimators obtained from the E-step of the th iteration, details of which are given in Appendix C. Note that the equation (19) can be straightforwardly modified to accommodate a more general covariance structure of the idiosyncratic component by replacing with which is allowed to have non-constant diagonal elements and possibly non-zero off-diagonal elements.

Iterating between E and M steps is continued until convergence to a pre-specifed criterion. We define the convergence criterion as

which is the same used by Doz et al. (2012) and Barigozzi and Luciani (2019). The algorithm stops after the th iteration if or i.e. if the algoritm fails or succeeds to converge, respectively. Finally, the parameter estimates and are used to construct the estimate of the non-identified IRF , which is subject to fixed parameter restrictions determined by the Kronecker index structure.

3.3 Model Selection

In this section, we propose a model selection scheme for the D-DFM in state space form. The problem to be addressed is the specification of the model structure implied by the Kronecker index vector and the possible additional restrictions on the number of lags and in (1)–(2). Let us formulate these two dimensions of the model selection problem in turn. First, the estimation of D-DFM in state space form requires the maximal Kronecker index , which also defines the maximum value between and , meaning that these degrees need to be determined simultaneously. The problem is that the common component is unobserved and defined depending on and , and so attempts at identifying these degrees from are futile. Second, as discussed in Section 2.2, the RMFD-E structure for the common component implies that the values of and are equal. However, we want to allow for mutually different values of and for flexibility and comparability to the literature. Regarding the latter, note that the existing literature on the D-DFM discusses the specification of (1)–(2) only in terms of the lags and . Therefore, for a given , we may still want to set or , either of which amounts to overidentifying restrictions discussed in Section 2.2. This flexibility comes at a cost since the number of model candidates is increased beyond that of implied by the maximal Kronecker index.

To specify , we assume that state space representations of the D-DFM and the S-DFM coincide and use existing information criteria to determine the static factor dimension . Then we can use the relation along with the existing testing procedures used to determine the dynamic factor process dimension, , to pin down . Since in the S-DFM in state space form (see eqs. (13) and (15)) and , we have that . We assume the S-DFM representation in identifying but want to stress that we allow the D-DFM as the DGP in the model estimation. We do not restrict the degrees and , while for the S-DFM to have state space representation it must be that . Then, an estimator for the maximum Kronecker index, in terms of the estimators and is given as

| (20) |

such that the dimension of the vector in (16) is , regardless of the values of and .

Upon fixing the maximal Kronecker index , the lower bound for the number of models left for estimation is from which to choose according to some model selection criterion. Clearly, even for small values of and this approach becomes computationally infeasible. To handle this issue, we impose three additional restrictions to narrow down the set of feasible models. First, we assume that the number of lags in (1) and (2) is non-zero, i.e. , which sets the model under consideration apart from the static factor model. Second, we require that the state space system (16) is minimal in the sense that the state dimension is minimal among all state space systems giving rise to the same IRF (17). To this end, we calculate the observability and controllability matrices

and check that these matrices have rank (Anderson and Moore, 2005, Appendix C). Third, we only consider Kronecker index structures in which the indices are ordered weakly increasing. This ensures that the minimal identifying restrictions given in (6) are satisfied.

For completeness, we summarize the model selection scheme below:

- 1.

- 2.

-

3.

set the maximum Kronecker index according to (20);

-

4.

choose all the specifications satisfying steps 1 to 3 and restrict the set of admissible models to those for which the state space system is minimal and ;

-

5.

restrict attention to those models for which Kronecker indices are ordered weakly increasing to satistfy the identification condition (6) (see sections 2.1 and 2.2 for details);131313The function admissible_mods in the accompanied R package returns the models consistent with steps 3–5 for given and . and

-

6.

estimate all specifications satisfying step 5 using the EM algorithm presented in Section 3.2 and select the best model using standard model selection criteria, such as Akaike, Bayesian and Hannan-Quinn information criterion (AIC, BIC and HQIC, respectively).

4 An Empirical Application

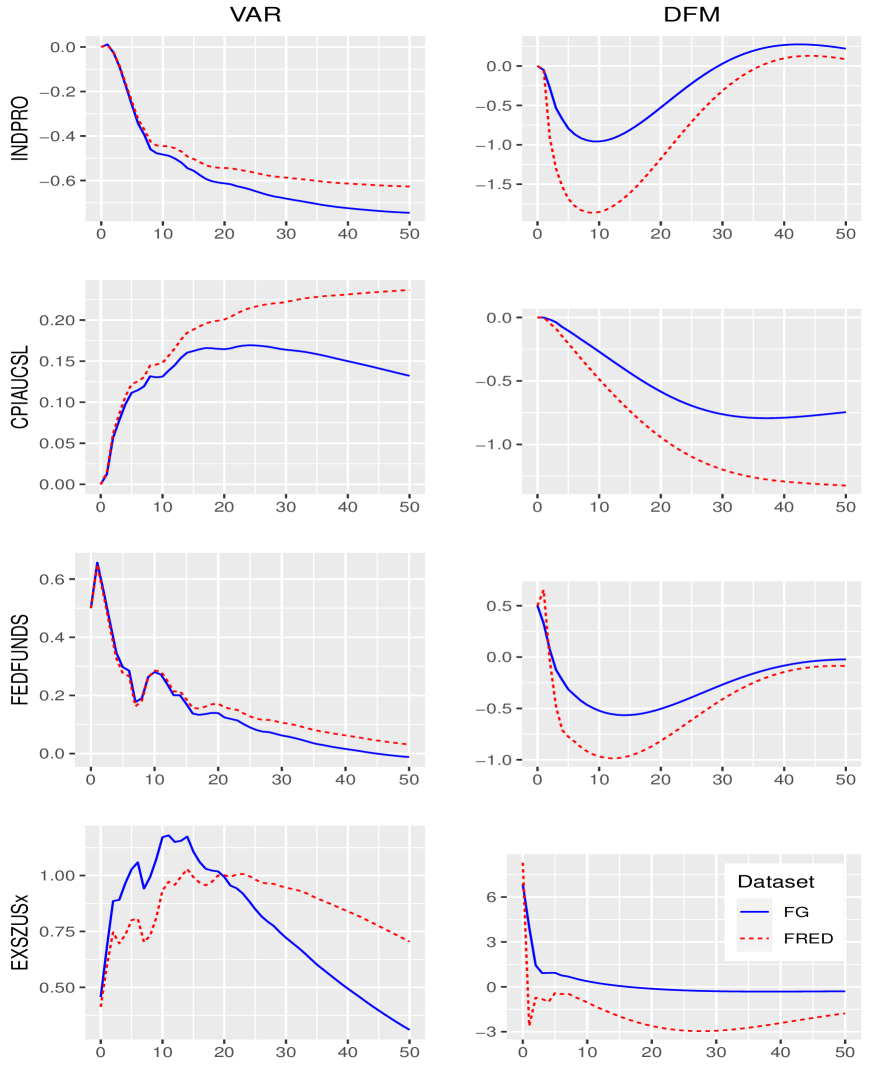

We highlight the usefulness of our D-DFM specification by analysing the effects of a monetary policy shock on main macroeconomic variables. The reference study for us is Forni and Gambetti (2010a, FG from now on), who compare the structural S-DFM introduced in Section 2.3.1 to a monetary VAR in addressing two macroeconomic puzzles contradicting the mainstream macroeconomic theory. First, they take up the prize puzzle, which is encountered in many empirical monetary policy studies and concerns the finding that prices rise in reaction to a monetary contraction (see Ramey, 2016, Section 3.4). Originally discovered by Sims (1992), a potential interpretation of the puzzle is that the central bank conditions the monetary policy decisions on a larger information set than that included in a small-scale VAR and thus the reduced form residuals from the VAR do not span the space of the strucutral shocks. Second, FG discuss the delayed overshooting puzzle, involving a slow reaction of the domestic currency to a monetary contraction with a long delay. The overshooting hypothesis was introduced by Dornbusch (1976) and predicts that the domestic currency appreciates immediately and the depreciates gradually toward the long-run value in response to a domestic monetary contraction. FG argue that, by virtue of including many variables, DFMs are capable of solving the puzzles and attribute these to the omitted variable bias to which low-dimensional VARs are more susceptible.

4.1 Data and Preliminary Transformations

We use a standard high-dimensional dataset from the United States measured at a monthly frequency, the December 2021 vintage of the FRED-MD, which consists of 127 variables covering the time span January 1959 to November 2021.141414This and the earlier vintages are available at https://research.stlouisfed.org/econ/mccracken/fred-databases/. We limit the analysis for a time period between March 1973 and November 2007 such that the selected period corresponds to that in FG and drop two variables due to many missing observations, ACOGNO and UMCSENTx with the mnemonics corresponding to those in McCracken and Ng (2016). The data can be grouped into eight classes 1) output and income, 2) labor market, 3) housing, 4) consumption, orders and inventories, 5) money and credit, 6) interest rates and exchange rates, 7) prices, and 8) stock market, and is described carefully in McCracken and Ng (2016). This is a larger dataset than the one used by FG with some non-overlapping variables. To make sure that the results are comparable between the datasets, we replicated Figure 1 in FG with the FRED-MD data (see Appendix E), and conclude that the IRFs have very similar shapes.151515With FRED-MD being an update of the Stock and Watson (2002b) dataset used by FG, this is as expected. Thus, the differences in the estimation results are not likely due to differences in the datasets. For the estimation of DFMs discussed in this section, the data are standardized prior to estimation, and the resulting IRFs are de-standardized by multiplying the rows of with the corresponding standard deviations.

There is, however, one major difference between the data used in this paper and those in FG, which concerns variable transformations aimed at making them stationary. As observed by Uhlig (2009) in his discussion of Boivin et al. (2008) and recently formalized by Onatski and Wang (2021), estimation of DFMs using non-stationary or highly persistent data may lead to spurious results concerning the factor structure, where a few factors explain a large proportion of the variance in the data. In particular, Onatski and Wang (2021) observed that the first three principal components explain asymptotically over 80 percent of the variation of factorless nonstationary data. Thus, persistent variables create factor structure such that autocorrelations are interpreted as comovements between the variables, while the factor sturcture is non-existent when the variables are transformed stationary. Adopting the terminology by Barigozzi et al. (2014), we employ heavy transformations of the variables, which is in contrast to light transformations used by FG. This entails taking first differences of logarithms of real variables, first differences of nominal variables and and second differences of logarithms of price series. FG keep real variables in levels and take first differences of the price variables. Heavy transformations were also used by Stock and Watson (2005, 2016), Barigozzi et al. (2014) and Forni and Gambetti (2021) in their empirical applications of DFM. Inspection of the distribution of the autocorrelations between the variables from the transformation schemes confirms the finding that the light transformations leave a large number of the variables highly persistent.161616Table containing the distributions of the autocorrelation coefficients is given in Appendix E. This table is adapted from Table 2 of Barigozzi et al. (2014). In conclusion, we stationarize the series as outlined in McCracken and Ng (2016) and, furthermore, impute the missing observations and outliers171717Defined as values deviating more than 10 interquartile ranges from the sample median. using the methdology introduced in Bai and Ng (2021).

4.2 Structural Identification and Model Selection

Following FG and to ensure comparability, we choose the variables of interest as industrial production (INDPRO, the mnemonic in the FRED-MD), consumer price index (CPIAUCSL), federal funds rate (FEDFUNDS) and the Swiss/US exchange rate (EXSZUSx). The model treats federal funds rate as the policy variable and is identified recursively by assuming that the monetary policy shock does not affect industrial production or prices at impact. Without a loss of generality, we order these variables first. Then the estimate of the identification matrix can be obtained from the lower triangular Cholesky decomposition of the covariance matrix corresponding to the reduced form shocks in (2): , where denotes the last iteration of the EM algorithm. The structural impulse responses of the variables of interest to the monetary policy shock are given as , where and are constructed from the M-step of the last EM algorithm iteration (eqs. (18) and (19)), and denotes the third column of . Therefore, we only identify the monetary policy shock and leave the rest unidentified. While the recursive identification strategy has its shortcomings,181818For a general discussion, see Uhlig (2009, 2017), Ramey (2016, Section 3.3) and Kilian and Lütkepohl (2017, Chap. 8.2), and for a monetary policy perspective, see e.g. Castelnuovo (2016a, 2016b). here our aim is to give comparable results to those of FG and we leave the more nuanced identification schemes for future research.191919Within the structural DFM framework, alternative identification strategies are used widely. For an identification strategy based on 1) long-run restrictions in the spirit of Blanchard and Quah (1989), see Giannone et al. (2002) and Forni et al. (2009); 2) sign restrictions, see Forni and Gambetti (2010b, 2021), Barigozzi et al. (2014) and Luciani (2015); 3) recursive short-run restrictions, see FG and Stock and Watson (2016); and 4) external instruments à la Gertler and Karadi (2015), see Alessi and Kerssenfischer (2019).

We give next details of the model selection scheme introduced in Section 3.3. To facilitate comparability with FG, we skip step 1 in the model selection scheme and fix the dynamic factor dimension to . Regarding step 2 on selecting the static factor dimension , we estimate the popular IC1 and IC2 criteria by Bai and Ng (2002) and the corresponding modifications by Alessi et al. (2010), IC and IC. The criterion IC points to , while the other three criteria lend support for which is also the number obtained by McCracken and Ng (2016) when estimating this value using the whole sample.202020Interestingly, FG find evidence for supporting the finding that non-stationary data might lead to overestimation of the number of factors. We use and so the maximum Kronecker index estimate is completing step 3 in the model selection scheme. Step 4 rules out all but the following specifcations: , with for and for such that (20) is satisfied. Regarding step 5, the qualified model structures are

Turning to step 6, Table 1 reports the information criteria of the five estimated models. Let us make a few comments. First, we see that the number of estimated parameters across the models is quite close to each other, which is a result of resticting the degree of the highly parametrized dynamic factor loading matrix to . In case we leave the degree unrestriceted, i.e. , the number of estimated parameters would differ more depending on the Kronecker index structure. Second, the value of the log-likelihood function of the estimated models increases with the complexity, and the highest value is attained for a specification with all the Kronecker indices equalling two. This is as expected since this model nests the more parsimonious ones, and has the most free parameters of the model candidates. Third, two of the information criteria point towards choosing The differences between this and the next complicated model in terms of the sample fit are minor, but adhering to the priciple of parsimony, we choose this specification as the best candidate.

| loglik | AIC | BIC | HQIC | #par | ||

|---|---|---|---|---|---|---|

| (1,1,1,1) | –85.20 | 175.20 | 184.89 | 179.03 | 1000 | 1,1 |

| (1,1,1,2) | –85.19 | 175.19 | 184.89 | 179.03 | 1001 | 2,1 |

| (1,1,2,2) | –85.05 | 174.92 | 184.65 | 178.77 | 1004 | 2,1 |

| (1,2,2,2) | –85.03 | 174.91 | 184.69 | 178.78 | 1009 | 2,1 |

| (2,2,2,2) | –85.03 | 174.95 | 184.79 | 178.84 | 1016 | 2,1 |

-

•

Notes: loglik denotes the value of the log-likelihood function scaled by the number of observations . The column #par gives the number of estimated parameters in and . Column indicates the order of the lag polynomials and . The values in bold denote the optimal model according to the given model selection criterion.

For comparison, we also estimate an S-DFM using the method outlined in Section 2.3.1 and a SVAR model and identify the sturctural shocks recursively using the Cholesky decomposition outlined in the beginning of this section. For the S-DFM, we estimate the static factors as the first principal components of and run a VAR of order on the estimated static factor process, where the parameters and are defined in relation to (14). The SVAR is estimated using nine lags and a constant term, following FG. For all models, we construct the confidence intervals by using a standard non-overlapping block bootstrap where the length of the blocks is chosen to be equal to 52 months as in FG to whom we refer for additional details. The confidence intervals were obtained using 500 bootstrap draws.

4.3 Results

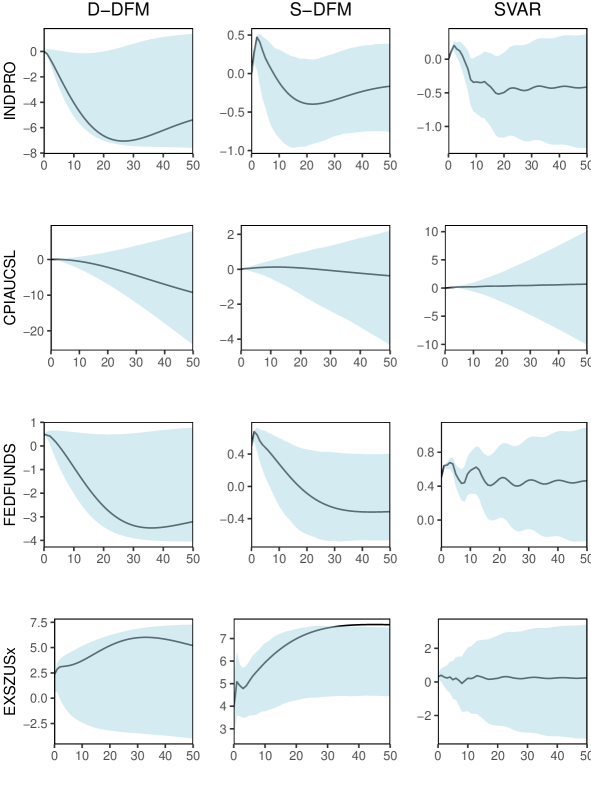

Impulse responses to a contractionary monetary policy shock raising the federal funds rate by 50 basis points (bp) are reported in Figure 1, where the columns and rows show the responses by model and variable, respectively. Starting with the D-DFM method, we see very strong effects on the model variables. Industrial production drops immediately after the shock and the contraction continues for 27 months, with the trough effect estimated at percent. The price level increases slightly after the shock and starts to drop afterwards, exhibiting explosive dynamics, which can be seen by the decreasing slope of the impulse response function. This reflects the heavy transformation of the price variable as the estimated IRF is cumulated twice. The federal funds rate drops also sharply following the impact, turns negative after five months, and reaches its minimum, percent, after 36 months. Finally, the Swiss/US exchange rate reacts positively to the monetary policy shock and peaks 33 months later at percent. Taking stock, the price puzzle disappears in this modeling and identifcation strategy while the delayed overshooting puzzle remains. The monetary policy shock induces a prolonged and deep recession, and the federal funds rate reacts to this according to a counter cyclical feedback rule. Execpt for the delayed overshooting puzzle, these predictions are qualitatively in line with the results from the existing empirical studies in terms of the timing and reaction of the model variables, such as those documented by Coibion (2012). The main difference is the size of the responses. For example, Ramey (2016, Section 3.5, Table 1) collects estimates of the monetary policy shocks on industrial production and prices and reports only percent as the peak effect of a 50bp contractionary monetary policy shock on industrial production.

Turning to the benchmark models, the results obtained with the S-DFM give a different picture of the effects of the monetary policy shock. The S-DFM estimates that industrial production increases sharply, peaks after two months at percent, and turns negative after seven months. The reaction of prices is sluggish, and they turn negative only after 25 months. The fededral funds rate jumps up temporarily and turns negative after 17 months. The exhange rate variable reacts similarly as with the D-DFM. As a conclusion of the results obtained with the S-DFM, using heavy variable transformations appears to give contradicting results to those obtained originally by FG with light transformations. The price and exchange rate variables react such that the puzzles discussed earlier remain in this modeling setup. For the SVAR model, we document muted effects on the price level and exchange rate. The industrial production turns negative after five months, and troughs at 18 months. The SVAR results are largely in line with those documented by Kerssenfischer (2019) who uses the same identification strategy and data but with light transformations.

A few comments are necessary on the differences between the model results. First, albeit not statistically significant, the peak effects estimated with the D-DFM are one order of magnitude larger than those obtained with the S-DFM (excl. the exchange rate variable). These large responses are not unmatched in the literature as Barigozzi et al. (2014) document results of a similar magnitude using the S-DFM and Euro area data with heavy transformations. However, the large differences documented in Figure 1 are still surprising, since one would expect that cumulating the IRFs once or even twice would have similar effects across the estimation methods. Second, the disappearance of the puzzles appears to be dependent on the variable transformations. Keeping in mind that non-stationary data might induce spurious factor structure, it can be disputed whether the conclusions on the effects of enlarging the information set are as robust as argued by FG and Kerssenfischer (2019), for example. Third, we see that the monetary policy shock induces permanent effects on the economy, regardless of the estimation method, which contradicts the view that monetary policy shocks have only transitory effects on the economy. Considering extensions that account for cointegrating relationships between the variables could give satisfactory solution to this issue since the IRFs need not be cumulated (Barigozzi et al., 2020, 2021).

5 Conclusions

In this paper we have proposed a new approach to identify the IRFs in DFMs, which are well known for not being identified without further restrictions. We have solved the problem by proposing an echelon form parametrization, which can be developed analogously to that of the VARMA model. The resulting IRF consists of a simple decomposition into a high-dimensional dynamic factor loading matrix and a small-dimensional VAR polynomial without the need to cast the DFM into a static form. We have shown that the advantages of adopting the new parametrization are related to the flexibility in the model dynamics and estimation. Furthermore, the framework proposed in this paper has made it transparent as to how overidentifying restrictions can be imposed to obtain more parsimonious models. Methods reducing the number of estimated parameters are essential as the DFMs are heavily parametrized. The parameter restrictions are embedded in the ML estimation scheme, and this fills the gap in the literature by incorporating the minimal identifying restrictions in a frequentist estimation framework. To make the methods developed here as accessible as possible, we have proposed a simple model selection strategy and the related estimation methods are made available in the accompanying R package. The empirical application analyzed the effects of a monetary policy shock, and the results are mostly in line with theoretical predictions, while the effects are anticipated to be of a large magnitude.

6 Acknowledgements

We thank, for suggestions and criticism, Pentti Saikkonen, Mika Meitz, Markku Lanne, Henri Nyberg and the participants at Helsinki GSE PhD econometrics seminars, CFE-CMStatistics 2019 conference, 2nd Vienna Workshop on Economic Forecasting 2020, and Finnish Mathematical Days 2022. Financial support by the Research Funds of the University of Helsinki as well as by funds of the Oesterreichische Nationalbank (Austrian Central Bank, Anniversary Fund, project number: 17646) is gratefully acknowledged.

Appendix A

Deriving the Reversed right Kronecker Echelon form

The starting point of our analysis is (rational) second moment information of a high-dimensional, say -dimensional, stationary discrete-time stochastic process . The second moment information is contained in the autocovariance function or equivalently the rational spectral density . We assume that the spectral density is of reduced rank and has no zeros for .

From the spectral factorization theorem, we obtain that there exists an rational spectral factor with no poles inside or on the unit circle and of full rank inside or on the unit circle such that holds where is a -dimensional positive definite matrix and the first linearly independent rows212121Without loss of generality, we will assume henceforth that the first rows of are linearly independent. of are equal to . It follows from having entries which are rational functions of that the associated Hankel matrix

| (21) |

is of finite rank (Hannan and Deistler, 2012, Theorem 2.4.1, page 51), which we shall call McMillan degree (Hannan and Deistler, 2012, page 51).

We construct an echelon form for right MFDs starting from . For identification purposes, we assume that there are no cross-restrictions between the system and noise parameters such that we can assume without loss of generality (except for the fact that the first rows of need to be linearly independent) that .

The Hankel matrix in (21) is in a one-to-one relation with 222222Likewise, is in a one-to-one relation with and jointly.. We denote its columns by , where the index points to the -th column (pertaining to variables and running from to ) in the -th block of columns. Moreover, it can be shown that when choosing a first basis of the column space of , there are no holes in the sense that can be linearly combined by the columns , then the column , pertaining to the same variable but in the following block of columns, can be linearly combined by the columns . In other words, if variable in the -th block is not in the basis, then variable is not in the basis for any blocks to the right of block . Therefore, it makes sense to define the first basis of the column space of with the right-Kronecker indices , describing that the first basis of the column space consists of the columns until .

In order to prepare the definition of a canonical representative among all RMFDs for which holds, let us assume that we have already found such an RMFD , where and . First, we derive a system of equations relating the coefficients in to the Hankel matrix by comparing the negative coefficients in which results in

Second, given any solution from the previous step, we calculate from the non-negative coefficients in and obtain

Since , the degree of is necessarily strictly smaller than the degree of .The decisive task is choosing one canonical representative among the solutions from the first step.

Given a Hankel matrix with right-Kronecker indices , we construct a unique by linearly combining for each “variable ” the first linearly dependent column by columns to its left. In particular, for each “variable ” we set , i.e. the -element of the coefficient in pertaining to . Note that this element pertains to the -th column of the -th block of columns in , i.e. . Thus, for each fixed we end up with the equation

Note that the first part on the left hand side involves the upper limit . This is due to the fact that all variables in the “last block” to the left of may be used to linearly combine , if they cannot be linearly combined by variables to their left themselves.

In this way, we obtain a unique representative of all solutions of the equation where and all elements are zero for , and all when .

Given a unique RMFD for , we will now construct an RMFD for .232323We could obtain from directly as . However, we want to work with polynomials in rather than with polynomials in . Since the column degrees of are equal to242424Remember that the degree of the -th column of is strictly smaller than the degree of the -th column of . , post-multiplication of on results in a matrix polynomial whose coefficient pertaining to power zero is a -dimensional upper-triangular matrix (with ones on its diagonal) stacked upon an -dimensional zero matrix. Thus, we obtain an RMFD for as .

In order to obtain an RMFD of , we merely need to add to such that we obtain the RMFD for

Finally, we obtain the reversed echelon RMFD for . The RMFD model pertaining to right-Kronecker indices, i.e. the encoding of the free parameters, is implemented in the accompanying R package.

Remark 1.

Instead of starting from a singular spectral density, we might be given a-priori information about the degrees and of the polynomials and . For this case, we give some conditions for identifiability similar to the VARMA case (Hannan and Deistler, 2012, Chapter 2), (Kailath, 1980, Section 6.3.1). The pair is called (right-) coprime if it is of full rank for all . For a given spectral factor and a coprime pair such that holds, all other pairs of polynomial matrices for which holds satisfy where is an -dimensional polynomial matrix. It follows that any two coprime pairs and are related by unimodular post-multiplication252525Remember that unimodular matrices can be characterized by the fact that they are polynomial in the same way as their inverses are polynomial.. Moreover, it can be easily seen that any non-constant unimodular transformation increases the degree of a given coprime pair if the end-matrix is of full rank262626Notice that we could, similar to Chapter 2.7 in Hannan and Deistler (2012), require only that the end-matrix for given column-degrees of is of full rank. To reduce the number of integer valued parameter a researcher would have to choose (and the notational burden), we abstain from this more general formulation.. Finally, we obtain that the class of observational equivalence (generating the same spectral factor ) of all coprime pairs with prescribed degrees and , with end-matrix of full rank, and is a singleton.

Remark 2.

We argue that RMFDs are a particularly useful and elegant alternative. The following examples show the connection between the dimension of the static factor process and the dimension of the dynamic factor process . If is constant, then must hold. However, the interesting case for modeling the common component of DFMs is the one where the rank of the autocovariance matrix of the common component at lag zero is larger than the rank of its spectral density. Thus, we have another reason why allowing for non-constant is important.

Example 4 ( non-constant: ).

Consider the MA(1) process where is white noise with variance equal to one and where .

The spectral density is equal to and has rank equal to one, i.e. . However, the zero lag autocovariance is equal to and of full rank, i.e. .

Example 5 ( constant: ).

Consider a right-matrix fraction description (RMFD) of the form where is white noise with variance equal to one, and (at least one needs to be non-trivial) and is a univariate polynomial of degree . The rank of the rational spectral density is again equal to one. Likewise, the left-kernel of the zero lag autocovariance is one-dimensional and equal to and therefore .

Appendix B

Initial values for the EM algorithm

While implementation maximum likelihood estimation of the identified model is in theory straight-forward, it is essential for a successful optimization (i.e. practical convergence of the algorithm) to have “good” initial parameter values available. Therefore, we describe a moment estimator based on subspace estimation of state space models which endows us with consistent initial estimates. The following discussion is based on Larimore (1983) and Bauer et al. (1999)272727In the latter article, the consistency and asymptotic normality of various subspace algorithms is analysed.

The procedure based on Larimore’s CCA subspace algorithm has the following steps and is implemented in the RLDM package:

-

1.

Regress the “future” of the process on the “past” of the process and obtain the regression coefficients of dimension where and are chosen with a heuristic.

-

2.

Approximate a weighted version of by a matrix of reduced rank equal to the desired McMillan degree, and represent it as product (for details, see Bauer et al., 1999)

-

3.

Use the state estimate to perform

-

(a)

the regression of on and obtain estimates and for and in the state space system, respectively;

-

(b)

the regression of on to obtain estimates and for and ;

-

(c)

and obtain estimates and as the sample covariance matrix of and mean of the diagonal elements of the sample covariance matrix of .

-

(a)

Thus, we obtain an estimate for the IRF from the estimates of which satisfies .

Next, we perform an eigenvalue decomposition of the sample covariance matrix of the residuals and right-multiply the first eigenvalues (scaled with the square root of their respective eigenvalues) on the IRF to obtain a new tall IRF of dimension . We may now obtain an initial parameter value for the RMFD using the reversed echelon procedure described above.

Moment-based estimation of initial values fails often if the data are non-stationary. To deal with this issue, we regularize the data by adding a small noise to the data, and calculate the initial values with this regularized data. Specifically, the function boot_init in the accompanied R package executes the following algorithm for the estimation of initial values if the standard CCA subspace algorithm fails.

-

1.

For , draw values from , and organize these into a vector where is set to a large enough number, say, 10.

-

2.

Create an auxiliary variable where is the vector of observed data.

-

3.

Estimate the initial values with the regularized data

-

4.

If step 3 fails, set repeat steps 1–3 until success.

-

5.

Repeat steps 1–4 for times.

-

6.

Cast the models corresponding to initial values into state space format and use Kalman filter to calculate the corresponding values of the log-likelihood function.

-

7.

Pick initial values maximizing the log-likelihood value across the draws.

The steps 4–7 are supplementary and designed to mitigate the effect of data regularization. Choosing a large will obviously slow down the algorithm but gives initial values closer to the maximum value of the log-likelihood function.

Appendix C

Kalman smoother for the E-step of the EM algorithm

Here we summarize the Kalman smoother recursion used in the E-step of the EM algorithm. The algorithm is adapted from Watson and Engle (1983) and Koopman and Shephard (1992, Chap. 4.5.3); Durbin and Koopman (2012, Chap. 4.5.3). The algorithm proceeds by first calculating the linear projection of the state space system (16) using Kalman filter for and given :

| (22) | ||||

| (23) |

where

| (24) | ||||

| (25) | ||||

| (26) | ||||

| (27) |

with and is solved from the following Lyapunov equation .

The smoother algorithm is given for as

| (28) | ||||

| (29) | ||||

| (30) | ||||

| (31) |

where

| (32) | ||||

| (33) |

and for

| (34) |

Appendix D

The GLS regressions for the M-step of the EM algorithm

Consider the observation equation of (16) , which can be equivalently written as

where we have reparametrized as and used the fact that (Lütkepohl, 1996, Section 7.2., rule 4).

If we treat the state vector as observed, we can express this equation such that the observed vectors are given in the left hand side and the unobserved parameter vector is in the right hand side

Then the GLS estimator corresponding to is given as

| (41) |

Focus on the first term inside the inverse of (41), and note that and that (Lütkepohl, 1996, Section 2.4., rules 5 and 7) to write it as

Next, we focus on the first term inside the second square brackets of (41) to write it as

where we have used the same rules regarding the Kronecker product as before. Finally, we can simplify the second term inside the second square brackets as

Consequently, the estimator for , subject to linear constraints , is given as

Analogously to the observation equation, one can write the state equation of (16) as

where the parameter matrix is subject to the linear constraints . Following the same steps that were taken to get , we write the GLS estimator for as

However, the estimators and are not operational as the moment matrices , , and , as well as the covariance matrices and are not observed. To this end, one needs to replace these with the quantities obtained in the E-step of the EM algorithm (see Appendix C), which then gives the estimators (18) and (19).

Appendix E

Supplementary material regarding the empirical exercise

| Percentile | Lag | |||||||

|---|---|---|---|---|---|---|---|---|

| Light | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 5 | 0.07 | 0.04 | 0.01 | 0.01 | 0.03 | 0.02 | 0.02 | 0.02 |

| 25 | 0.26 | 0.16 | 0.16 | 0.11 | 0.09 | 0.09 | 0.07 | 0.07 |

| 50 | 0.60 | 0.49 | 0.47 | 0.45 | 0.39 | 0.37 | 0.32 | 0.32 |

| 75 | 0.93 | 0.89 | 0.86 | 0.83 | 0.79 | 0.75 | 0.72 | 0.67 |

| 95 | 0.99 | 0.97 | 0.96 | 0.94 | 0.93 | 0.92 | 0.9 | 0.89 |

| Heavy | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 5 | 0.07 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| 25 | 0.24 | 0.08 | 0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.04 |

| 50 | 0.34 | 0.17 | 0.12 | 0.09 | 0.09 | 0.08 | 0.08 | 0.08 |

| 75 | 0.59 | 0.47 | 0.40 | 0.33 | 0.31 | 0.26 | 0.24 | 0.20 |

| 95 | 0.93 | 0.89 | 0.86 | 0.83 | 0.79 | 0.76 | 0.72 | 0.69 |

References

- Alessi et al. (2010) Alessi, L., M. Barigozzi, and M. Capasso (2010). Improved penalization for determining the number of factors in approximate factor models. Statistics & Probability Letters 80(23-24), 1806–1813.

- Alessi and Kerssenfischer (2019) Alessi, L. and M. Kerssenfischer (2019). The response of asset prices to monetary policy shocks: stronger than thought. Journal of Applied Econometrics 34(5), 661–672.

- Amengual and Watson (2007) Amengual, D. and M. W. Watson (2007). Consistent estimation of the number of dynamic factors in a large n and t panel. Journal of Business & Economic Statistics 25(1), 91–96.

- Anderson and Moore (2005) Anderson, B. D. and J. B. Moore (2005). Optimal filtering. New York: Dover Publications.

- Anderson and Deistler (2008) Anderson, B. D. O. and M. Deistler (2008). Properties of Zero-free Transfer Function Matrices. SICE Journal of Control, Measurement and System Integration 1(4), 284–292.

- Bai and Ng (2002) Bai, J. and S. Ng (2002). Determining the number of factors in approximate factor models. Econometrica 70(1), 191–221.

- Bai and Ng (2007) Bai, J. and S. Ng (2007). Determining the number of primitive shocks in factor models. J. of Business and Economic Statistics 25, 52–60.

- Bai and Ng (2013) Bai, J. and S. Ng (2013). Principal components estimation and identification of static factors. Journal of Econometrics 176(1), 18–29.

- Bai and Ng (2021) Bai, J. and S. Ng (2021). Matrix completion, counterfactuals, and factor analysis of missing data. Journal of the American Statistical Association, 1–18.

- Bai and Wang (2015) Bai, J. and P. Wang (2015). Identification and bayesian estimation of dynamic factor models. Journal of Business & Economic Statistics 33(2), 221–240.

- Bańbura and Modugno (2014) Bańbura, M. and M. Modugno (2014). Maximum likelihood estimation of factor models on datasets with arbitrary pattern of missing data. Journal of Applied Econometrics 29(1), 133–160.

- Barigozzi et al. (2014) Barigozzi, M., A. M. Conti, and M. Luciani (2014). Do euro area countries respond asymmetrically to the common monetary policy? Oxford bulletin of economics and statistics 76(5), 693–714.

- Barigozzi et al. (2020) Barigozzi, M., M. Lippi, and M. Luciani (2020). Cointegration and error correction mechanisms for singular stochastic vectors. Econometrics 8(1), 3.

- Barigozzi et al. (2021) Barigozzi, M., M. Lippi, and M. Luciani (2021). Large-dimensional dynamic factor models: Estimation of impulse–response functions with i (1) cointegrated factors. Journal of Econometrics 221(2), 455–482.

- Barigozzi and Luciani (2019) Barigozzi, M. and M. Luciani (2019). Quasi maximum likelihood estimation and inference of large approximate dynamic factor models via the em algorithm. arXiv preprint arXiv:1910.03821.

- Bauer et al. (1999) Bauer, D., M. Deistler, and W. Scherrer (1999). Consistency and asymptotic normality of some subspace algorithms for systems without observed inputs. Automatica 35, 1243–1254.

- Blanchard and Quah (1989) Blanchard, O. J. and D. Quah (1989). The dynamic effects of aggregate demand and supply disturba. The American Economic Review 79(4), 655.

- Boivin et al. (2008) Boivin, J., M. P. Giannoni, and B. Mojon (2008). How has the euro changed the monetary transmission mechanism? NBER macroeconomics annual 23(1), 77–126.

- Bork (2009) Bork, L. (2009). Estimating us monetary policy shocks using a factor-augmented vector autoregression: An em algorithm approach. Available at SSRN 1348552.

- Castelnuovo (2016a) Castelnuovo, E. (2016a). Modest macroeconomic effects of monetary policy shocks during the great moderation: An alternative interpretation. Journal of Macroeconomics 47, 300–314.

- Castelnuovo (2016b) Castelnuovo, E. (2016b). Monetary policy shocks and cholesky vars: an assessment for the euro area. Empirical Economics 50(2), 383–414.

- Coibion (2012) Coibion, O. (2012). Are the effects of monetary policy shocks big or small? American Economic Journal: Macroeconomics 4(2), 1–32.

- Deistler et al. (2010) Deistler, M., B. D. O. Anderson, A. Filler, C. Zinner, and W. Chen (2010). Generalized Linear Dynamic Factor Models - An Approach via Singular Autoregressions. European Journal of Control 16(3), 211–224.

- Deistler et al. (2015) Deistler, M., W. Scherrer, and B. D. Anderson (2015). The structure of generalized linear dynamic factor models. In Empirical economic and financial research, pp. 379–400. Springer.

- Dempster et al. (1977) Dempster, A. P., N. M. Laird, and D. B. Rubin (1977). Maximum likelihood from incomplete data via the em algorithm. Journal of the Royal Statistical Society: Series B (Methodological) 39(1), 1–22.

- Dornbusch (1976) Dornbusch, R. (1976). Expectations and exchange rate dynamics. Journal of political Economy 84(6), 1161–1176.

- Doz et al. (2011) Doz, C., D. Giannone, and L. Reichlin (2011). A Two-Step Estimator for Large Approximate Dynamic Factor Models based on Kalman Filtering. Journal of Econometrics 164(1), 188–205.

- Doz et al. (2012) Doz, C., D. Giannone, and L. Reichlin (2012). A quasi–maximum likelihood approach for large, approximate dynamic factor models. Review of economics and statistics 94(4), 1014–1024.

- Durbin and Koopman (2012) Durbin, J. and S. J. Koopman (2012). Time series analysis by state space methods. Oxford university press.

- Forni and Gambetti (2010a) Forni, M. and L. Gambetti (2010a). The dynamic effects of monetary policy: A structural factor model approach. Journal of Monetary Economics 57(2), 203–216.

- Forni and Gambetti (2010b) Forni, M. and L. Gambetti (2010b). Fiscal foresight and the effects of goverment spending.

- Forni and Gambetti (2021) Forni, M. and L. Gambetti (2021). Policy and business cycle shocks: A structural factor model representation of the us economy. Journal of Risk and Financial Management 14(8), 371.

- Forni et al. (2009) Forni, M., D. Giannone, M. Lippi, and L. Reichlin (2009). Opening the black box: Structural factor models with large cross sections. Econometric Theory 25(5), 1319–1347.

- Forni et al. (2000) Forni, M., M. Hallin, M. Lippi, and L. Reichlin (2000). The Generalized Dynamic Factor Model: Identification and Estimation. Review of Economics and Statistics 82(4), 540–554.

- Forni et al. (2005) Forni, M., M. Hallin, M. Lippi, and L. Reichlin (2005). The Generalized Dynamic Factor Model: One-Sided Estimation and Forecasting. Journal of the American Statistical Association 100, 830–840.