Explicit approximations for nonlinear switching diffusion systems in finite and infinite horizons††thanks: This work was supported by National Natural Science Foundation of China (11171056, 11471071, 11671072), the Natural Science Foundation of Jilin Province (No.20170101044JC), the Education Department of Jilin Province (No.JJKH20170904KJ).

Abstract

Focusing on hybrid diffusion dynamics involving continuous dynamics as well as discrete events, this article investigates the explicit approximations for nonlinear switching diffusion systems modulated by a Markov chain. Different kinds of easily implementable explicit schemes have been proposed to approximate the dynamical behaviors of switching diffusion systems with local Lipschitz continuous drift and diffusion coefficients in both finite and infinite intervals. Without additional restriction conditions except those which guarantee the exact solutions posses their dynamical properties, the numerical solutions converge strongly to the exact solutions in finite horizon, moreover, realize the approximation of long-time dynamical properties including the moment boundedness, stability and ergodicity. Some simulations and examples are provided to support the theoretical results and demonstrate the validity of the approach.

Keywords: Explicit scheme; Switching diffusion systems; Local Lipschitz condition; Strong convergence; Stability; Invariant measure

1 Introduction

The switching diffusion systems (SDSs) modulated by Markov chains involving continuous dynamics and discrete events, have drawn more and more attention to many researches. Much of the study originated from applications arising from biological systems, financial engineering, manufacturing systems, wireless communications (see, e.g., [1, 2, 3, 4, 5] and the references therein). Compared with those of the subsystems the dynamics of SDSs are seemingly much different. For instance, considering a predator-prey ecosystem switching between two environments randomly, Takeuchi et al. in [4] revealed that both subsystems develop periodically but switching between them makes them neither permanent nor dissipative. Pinsky and his coauthors in [6, 7] provided several interesting examples to show that the switching system is recurrent (resp. transient) even if its subsystems are transient (resp. recurrent). Due to the coexistence of continuous dynamics and discrete events, the dynamics of SDSs are full of uncertainty and challenge.

Since solving SDSs is almost unavailable, numerical scheme or approximation techniques become viable alternatives. The explicit Euler-Maruyama (EM) scheme is popular for approximating diffusion systems and SDSs with global Lipschitz coefficients [2, 8, 5]. However, the coefficients of many important diffusion systems and SDSs are only locally Lipschitz and superlinear (see, e.g., [9, 10, 5, 3] and the references therein). Hutzenthaler et al. [10, Theorem 2.1] showed that the absolute moments of the EM approximation for a large class of diffusion systems with superlinear growth coefficients diverge to infinity at a finite time point . The implicit EM scheme is better than the explicit EM scheme in that its numerical solutions converge strongly to the exact solutions of diffusion and switching diffusion systems with the one-sided Lipschitz drift coefficient and global Lipschitz diffusion coefficient (see Higham et al. [11], Mao and Yuan [2, p.134-153]). Nevertheless, additional computational efforts are required for its implementation since the solution of an algebraic equation has to be found before each iteration. Due to the advantages of explicit schemes (e.g., simple structure and cheap computational cost), a few modified EM methods have been developed for diffusion systems with nonlinear coefficients including the tamed EM method [12, 9, 13, 14], the tamed Milstein method [15], the stopped EM method [16] and the truncated EM method [17]. These modified EM methods have shown their abilities to approximate the solutions of nonlinear diffusion systems. However, to the best of our knowledge these methods are not developed, even unavailable for a large class of nonlinear SDSs. For instance, Hamilton [18] remarked that the economy may either be in a fast growth or slow growth phase with the regime switching governed by the outcome of a Markov chain. Consider a two-dimensional nonlinear stochastic volatility model switching randomly between a fast growth phase

| (1.3) |

and a slow growth phase

| (1.6) |

modulated by a Markov chain . This SDS is one of popular volatility models used for pricing option in Finance (see, e.g., [18, 1, 19, 3] and the references therein), especially, for pricing VIX options. Based on its importance and no closed-form, one of our aims is to construct the explicit scheme available for this kind of SDSs and to study its convergence in the th moment as well as the rate of convergence.

On the other hand, long-time behaviors of SDSs are also the major concerns in stochastic processes, systems theory, control and optimization (see, e.g., the monographs [2, 5] and the references therein). So far, the dynamical properties of SDSs are investigated deeply including stochastic stability (see, e.g., [2, 5, 20, 21]), invariant densities (see, e.g., [22, 23]), recurrence and transience (see, e.g., [5, 24]) and so on. Although the finite-time convergence is one of the fundamental concerns, how to approximate long-time behaviors of SDSs is significant and challenging. Recently, Higham et al. [25] by using the EM scheme, Mao and Yuan [2, pp.229-249] by using the backward EM (BEM) scheme showed respectively that the numerical solutions preserve the mean-square exponential stability of SDSs with globally Lipschitz continuous coefficients. Mao et al. [26] gave a counter-example that the EM numerical solutions don’t share the underlying almost surely exponential stability of SDSs with the nonlinear growth drift term, but the BEM numerical solutions do. Mao et al. [27], Yuan and Mao [28] and Bao et al. [29] made use of the EM method with a constant stepsize to approximate the underlying invariant measure of SDSs with linear growth coefficients while Yin and Zhu [5, p.159-179] did that by using the EM scheme with the decreasing step sizes. In the above mentioned works, the diffusion coefficients of SDSs are always required to be globally Lipschitz continuous. For the further development of numerical schemes for SDSs, we refer readers to [30], for example, and the references therein. Accommodating many applications although these systems are more realistically addressing the demands, the nontraditional setup makes the discrete approximations of the long-time behaviors for nonlinear SDSs more difficult. Thus, in order to close the gap, the other aim is to construct an appropriate explicit scheme for a large class of nonlinear SDSs such that the numerical solutions realize the underlying infinite-time dynamical properties, such as the th moment () boundedness, stability as well as approximate the underlying invariant measure.

Motivated by the truncation idea in [17], together with the novel approximation technique, we have constructed a new explicit scheme and get the convergence with order rate in finite time interval. Then we go further to improve the scheme according to the structure of the SDSs such that it is easily implementable for approximating the underlying invariant measure (resp. stability). The schemes proposed in this paper are obviously different from those of [2, 13, 17, 31]. More precisely, the numerical solutions at the grid points are modified before each iteration according to the growth rate of the drift and diffusion coefficients such that the numerical solutions keep the underlying excellent properties of the exact solutions of SDSs. Our contributions are as follows.

-

We construct an easily implementable scheme for the SDSs with only local Lipschitz drift and diffusion coefficients and establish finite-time moment convergence results. The rate of convergence is also estimated under slightly stronger conditions.

-

Using novel techniques (i.e., combining the Lemma 4.1 with the Perron-Frobenius theorem (see [32, p.6]) to construct appropriate Lyapunov functions depending on the states and analyzing their asymptotic properties), we obtain the criterion on the existence and uniqueness of invariant measures of the SDSs as well as the th moment () and the almost surely exponential stability; see Theorem 4.6 and Corollary 4.5.

-

We reconstruct the explicit scheme which numerical solutions admit a unique invariant measure converging to the underlying one in the Wasserstein distance. The restrictions on the coefficients by using the EM scheme (c.f. [28, 29, 33]) are relaxed. Thus this scheme is more suitable for the measure approximation of nonlinear SDSs.

-

Without extra restrictions the numerical solutions of the appropriate explicit scheme stay in step of dynamical properties with the exact solutions.

The rest of the paper is arranged as follows. Section 2 begins with notations and preliminaries on the properties of the exact solutions. Section 3 constructs an explicit scheme, and yields the convergence in th moment and the rate. Two examples are given to illustrate the availability of this scheme. Section 4 focuses on the analysis of invariant measures. The other explicit scheme is constructed preserving the stability in distribution, which numerical invariant measure approximates the underlying one in the Wasserstein distance. Several numerical experiments are presented to illustrate the results. Section 5 gives some concluding remarks to conclude the paper.

2 Notations and preliminaries

Throughout this paper, we use the following notations. Let , and denote finite positive integers, denote the Euclidean norm in and the trace norm in . If is a vector or matrix, its transpose is denoted by and its trace norm is denoted by . For vectors or matrixes and with compatible dimensions, denotes the usual matrix multiplication. If is a symmetric matrix, denote by and its largest and smallest eigenvalue, respectively. For any define ) and . For any , , and . If is a set, its indicator function is denoted by , namely if and otherwise. Let and denote two generic positive real constants respectively, whose value may change in different appearances, where is dependent on and is independent of .

Let , be a complete probability space, and denotes the expectation corresponding to . Let be a -dimensional Brownian motion defined on this probability space. Suppose that is a right-continuous Markov chain with finite state space and independent of the Brownian motion . Suppose is a filtration defined on this probability space satisfying the usual conditions (i.e., it is right continuous and contains all -null sets) such that and are adapted. The generator of is denoted by , so that for a sufficiently small ,

where satifies . Here is the transition rate from to if while It is well known that almost every sample path of is right-continuous step functions with a finite number of simple jumps in any finite interval of (c.f. [26]).

In this paper, we consider the -dimensional SDS described by a hybrid stochastic differential equation (HSDE)

| (2.1) |

with an initial value , where the drift and diffusion terms

are locally Lipschitz continuous, that is, for any there exists a positive constant such that, for any with and any ,

Let denote the family of all nonnegative functions on which are continuously twice differentiable in . For each , define an operator from to by

| (2.2) |

where

In order for the existence of exact regular solutions we impose the following assumption.

Assumption 1

For some and each , there exists a symmetric positive-definite matrix and a constant such that

| (2.3) |

where

Now we give the regularity of exact solutions as well as the estimation on their th moment.

Theorem 2.1

Proof. For any and , Assumption 1 together with the continuity of and implies that there exists a positive constant such that

| (2.5) |

for any . For any fixed , define Direct calculation, together with (2.5), leads to

| (2.6) |

For any and any , using the Young inequality, we obtain

| (2.7) |

Therefore it follows from (2) and (2.7) that

| (2.8) |

where The next proof is standard (see e.g., Mao and Yuan [2, Theorem 3.19, p.95]) and hence is omitted.

3 Moment estimate and strong convergence

In this section, we aim to construct an easily implementable explicit scheme and show the strong convergence under Assumption 1. Given a stepsize and let , for , and one-step transition probability matrix The discrete Markov chain can be simulated by the technique in [2, p.112]. To define appropriate numerical solutions, we firstly choose several strictly increasing continuous functions such that as and

| (3.1) |

We note that is well defined since and are locally Lipschitz continuous. Denote by the inverse function of , obviously is a strictly increasing continuous function. We also choose a strictly decreasing such that

| (3.2) |

where is a positive constant independent of the iteration order and the stepsize . For any given , each , define a truncation mapping by

where we use the convention when . Obviously, for any

| (3.3) |

Remark 3.1

If there exists a state such that we choose for any , and let for any . Then , and (3.3) hold always.

Next we propose an explicit scheme to approximate the exact solution of SDS (2.1). To avoid the arbitrarily large excursions from Brownian pathes, we truncate the grid point value according to the growth rate of the drift and diffusion functions. Define

| (3.7) |

for any integer , where . We call this iteration the truncated EM scheme. This method prevents the diffusion term from producing extra-ordinary large value. Additionally, the drift term and diffusion term have the linear property

| (3.8) |

To obtain the continuous-time approximations, define , and by

For convenience, denote by the -algebra generated by . Obviously, . The following lemma will play an important role in the proof of the moment boundedness of the numerical solutions.

Lemma 3.2

For any measurable functions , and , we have

| (3.9) | ||||

| (3.10) |

and

| (3.11) |

Proof. First of all, note that and are -measurable. Then, by the Markov property, we derive that

Thus, the required assertion (3.9) follows. Note also that , and are -measurable. Using the properties

| (3.12) |

where denotes the identity matrix. Thus, we obtain that

which implies that (3.10) holds. Moreover,

| (3.13) |

Making use of (3.9) we arrive at (3.2). The proof is complete.

In order to estimate the th moment of the numerical solution , we prepare an elementary inequality.

Lemma 3.3

For any given ( is a nonnegative integer) the following inequality

holds for any , where represents a th-order polynomial of which coefficients depend only on .

Proof. Applying the Taylor formula, for , namely, , we have

| (3.14) |

Then using the above inequality, for , namely, , we have

for any Generally, for and any , we have

Therefore the desired result follows.

3.1 Moment estimate

Let us begin to establish the criterion on the th moment boundedness of the numerical solutions of Scheme (3.7).

Theorem 3.4

Proof. For any integer , we have

| (3.16) |

where

and we can see that . By the virtue of Lemma 3.3, without loss the generality we prove (3.15) only for . It follows from (3.14) and (3.1) that

| (3.17) |

It follows from Lemma 3.2 and (3.8) that

and

Thus both of the above inequalities implies

| (3.18) |

Using Lemma 3.2 and (3.8) again yields

| (3.19) |

Using the properties

| (3.20) |

for any as well as Lemma 3.2, we deduce that

By virtue of Lemma 3.2, for any integer ,

Making use of the above inequality and (3.8) yields

| (3.21) |

Similarly, we can also prove that for any integer , Combining (3.1)-(3.1) and (3.1), using (2.5) and (2.7), we obtain that

for any integer . The truncation property of Scheme (3.7)

implies that

Repeating this procedure we obtain

Taking expectations on both sides, for any integer satisfying , then we have

Therefore the desired result follows.

In order to establish the strong convergence theory of Scheme (3.7), we give the following lemma.

Lemma 3.5

Under Assumption 1, define

| (3.22) |

then for any ,

| (3.23) |

for all , where is a constant independent of and .

Proof. Define then Obviously, and are , stopping time, respectively. For , we have and

On the other hand, for , we have and hence

Therefore, we derive from (3.7) that for any integer ,

Then

| (3.24) |

where

By the virtue of Lemma 3.3, without loss the generality we prove the required result only for . It follows from (3.14) and (3.24) that

| (3.25) |

By Lemma 3.2 one oberserves that

| (3.26) |

Note that Since is a continuous local martingale, by the virtue of the Doob martingale stopping time theorem, we know that and Hence

The above equality together with Lemma 3.2 implies

Thus the above inequality and (3.1) imply

| (3.27) |

Using the techniques in the proof of Theorem 3.4, we show that

| (3.28) |

and

| (3.29) |

Similarly, we can also show that for any integer ,

Combining (3.1) and (3.1)-(3.1), using (2.5) and (2.7), for any integer ,

Repeating this procedure we obtain

for any integer satisfying . Therefore the required assertion follows from that

where represents the integer part of . The proof is complete.

3.2 Strong convergence

In this subsection, we give the convergence result of Scheme (3.7).

Theorem 3.6

If Assumption 1 holds with , then for any ,

| (3.30) |

Proof. Let and be defined as before. Define

For any , using the Young inequality we obtain that

| (3.31) |

It follows from Theorem 2.1 and Theorem 3.4 that

Now let be arbitrary. Choose small sufficiently such that , then we have

| (3.32) |

Then choose large sufficiently such that Choose small sufficiently such that Then for any , it follows from Lemma 3.5 that This together with (2.9) implies

| (3.33) |

Combining (3.2), (3.32) and (3.33), we know that for the chosen and all ,

If we can show that

| (3.34) |

the required assertion follows. For this purpose we define the truncated functions

for any . Consider the truncated SDS

| (3.35) |

with the initial value and . For the chosen , Assumption 1 implies that and are globally Lipschitz continuous with the Lipschitz constant . Therefore, SDS (3.35) has a unique regular solution satisfying

| (3.36) |

On the other hand, for each , we apply the EM method to (3.35) and denote by the piecewise constant EM solution (see [2]) which has the property

| (3.37) |

Due to , we have a.s. This together with (3.36) implies

Thus the desired assertion (3.34) follows from (3.37). The proof is complete.

3.3 Convergence Rate

In this subsection our aim is to establish the rate of convergence. The rate is optimal similar to the standard results of the explicit EM scheme for SDSs with globally Lipschitz coefficients, see [2, p.115]. To estimate the rate, we need somewhat stronger conditions compared with the convergence alone, which are stated as follows.

Assumption 2

For some , there exist positive constants and such that

| (3.38) | |||

| (3.39) |

Remark 3.7

One observes that if Assumption 2 holds, then

| (3.40) |

One also knows that

| (3.41) |

and by Young’s inequality,

| (3.42) |

Remark 3.8

Making use of Scheme (3.7), we define an auxiliary approximation process by

| (3.43) |

Note that , that is and coincide with the discrete solution at the grid points.

Lemma 3.9

Proof. For any , there is a nonnegative integer such that . Then,

Due to (3.41), (3.42) and Theorem 3.4,

The required assertion follows.

Lemma 3.10

Lemma 3.11

Let Assumption 1 hold. Define

| (3.46) |

Then for any ,

| (3.47) |

for all , where is a positive constant independent of .

Lemma 3.12

Proof. Define , , for any , where , and are defined by (2.9), (3.22) and (3.46), respectively. Using the Young inequality, we have

| (3.48) |

It follows from the results of Theorem 2.1 and Lemma 3.10 that

| (3.49) |

It follows from (2.9), (3.23) and (3.47) that

| (3.50) |

On the other hand, note that for any ,

Using the generalised Itô formula (see, e.g., [2, Lemma 1.9, p.49]) yields that

where is a local martingale (see, e.g. [2]). Choose a small constant such that , then the application of Young’s inequality implies

| (3.51) |

It follows from Assumption 2 and the elementary inequality that

| (3.52) |

Due to (3.39) and (3.40), by Jensen’s inequality and Lemma 3.9, one observes

| (3.53) |

Let , by (3.41), (3.42), using Young’s inequality yields

It follows from Theorem 3.4 and the property of Markov chain that

| (3.54) |

Substituting (3.3) and (3.54) into (3.3), applying the Gronwall inequality, we yield that

| (3.55) |

Inserting (3.49), (3.3) and (3.55) into (3.3) yields the desired assertion.

Theorem 3.13

Remark 3.14

If we can find a uniform function such that (3.1) holds for each , then we can find the unform truncation function . The second equation in (3.7) degenerates to independent of . Note that the results of Theorem 3.6 and Theorem 3.13 still hold for this special case. One observes that sometimes it is hard to find a uniformly continuous function for . However, for the given and , it is easy to find , the minimum of all . Let Clearly, the property (3.8) still holds for Scheme (3.7) with , which implies Theorem 3.6 and Theorem 3.13 still hold. On the other hand, in view of computation, the cost of using the uniform scheme is the same as that of using the non-unform one because the value of is fixed before each iteration. More precisely, we illustrate it in Example 3.15.

3.4 Numerical examples

In order to illustrate the efficiency of Scheme (3.7) we recall the introductory example and present some simulations.

Example 3.15

Consider the stochastic volatility model with random switching between (1.3) and (1.6) modulated by a Markov chain with generator

where initial value , and is a two-dimensional Brownian motion. Obviously, its coefficients

are locally Lipschitz continuous for any and , .

In order to represent the simulations by Scheme (3.7), we divide it into five steps.

Step 1. Examine the hypothesis. Since that

and

Assumption 1 holds for any . By Theorem 2.1, the unique regular solution exists.

Step 2. Choose and . For any , compute

Then choose , . Obviously, , . We set and then it satisfies (3.2) for any . We can therefore conclude by Theorem 3.6 that the numerical solution of Scheme (3.7) satisfies for any , .

Step 3. MATLAB code. Next we specify the MATLAB code for simulating :

Step 4. Approximating the error . Due to no closed-form of the solution, using Scheme (3.7), we regard the better approximation with as the exact solution and compare it with the numerical solution with . To compute the approximation error, we run independent trajectories where and represent the th trajectories of the exact solution and the numerical solution respectively. Thus

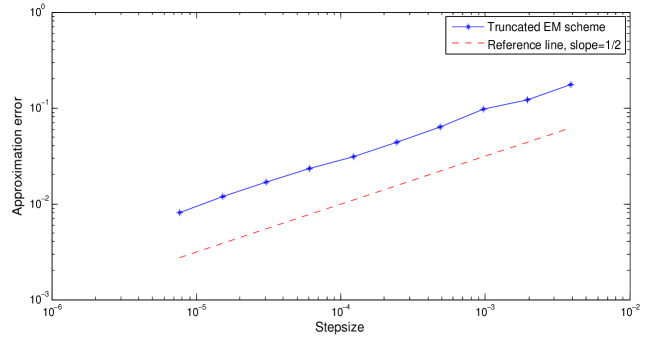

Step 5. The log-log error plot with . The simulation procedure is carried out by steps 3 and 4. The blue solid line depicts log-log error while the red dashed is a reference line of slope in Figure 1. Figure 1 depicts the approximation error of the exact solution and the numerical solution of Scheme (3.7) as the function of stepsize . One observes that the schemes proposed in [17, 13, 12] are quite sensitive to the high nonlinearity of the diffusion coefficient, which don’t work for the above equation. However, the performance of Scheme (3.7) is very nice for this case.

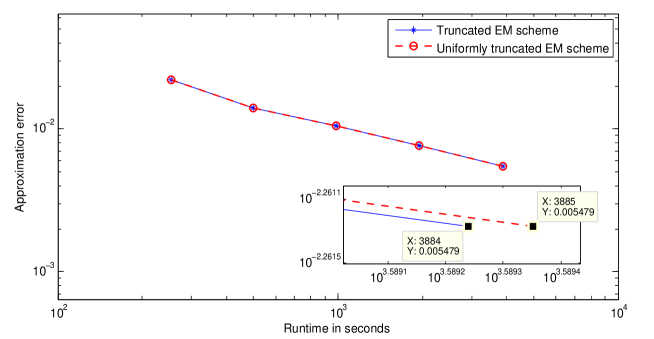

On the other hand, as the claim in Remark 3.14, we can also use the uniform truncation mapping Now let us compare the simulation time of Scheme (3.7) with the truncation mapping dependent on the states and with the uniform one . Figure 2 depicts the approximation error of the exact solution, and the numerical solutions by the truncated scheme and by the uniformly truncated scheme, respectively, as functions of the runtime with and . When , the runtime of the truncated scheme achieving the accuracy 0.005479 on the computer with Intel Core 2 duo CPU 2.20GHz, is about 3884 seconds while the runtime of the uniformly truncated scheme achieving the accuracy 0.005479 is about 3885 seconds on the same computer (see the enlargement in Figure 2). Thus, the computational cost of the non-uniform scheme is the same as that of the uniform one.

Let us discuss another example to compare our scheme with the implicit EM scheme.

Example 3.16

Consider the scalar hybrid cubic SDE (i.e. the stochastic Ginzburg-Laudau equation (4.52) in [8, p.125])

| (3.56) |

where is the Markov chain taking values in with generator matrix

and for any Obviously, for any , , are locally Lipschitz continuous. Assumption 1 holds for any . Note that there exists a unique regular solution to SDS (3.56) for any initial data , . In the same way as in [8], we get its closed-form

| (3.57) |

Clearly, for any , for any , where . Thus, we define and Compute for any . Note that Assumption 3 holds with any and . By the virtue of Theorem 3.13 the numerical solution of Scheme (3.7) converges to the exact solution in the root mean square with error estimate .

We compare the simulations by the implicit EM scheme and by Scheme (3.7) for SDS (3.56) with , , , ; , , ; , . We specify the truncated EM scheme

| (3.61) |

and the implicit EM scheme

| (3.64) |

for any , where . Thanks to Cardano’s method, roots of one-dimensional polynomials of degree three are known explicitly. Thus the implicit scheme (3.64) becomes

| (3.69) |

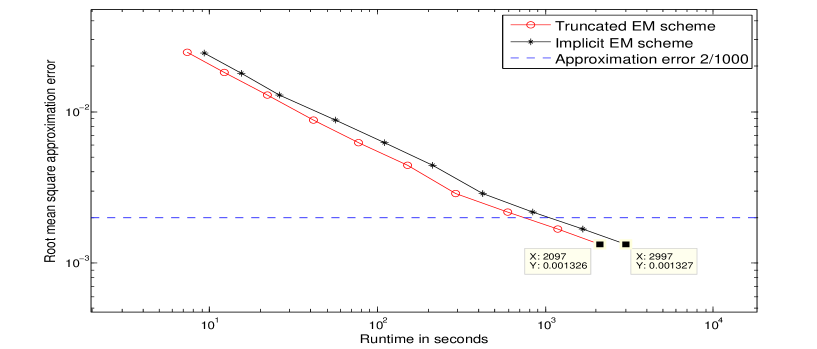

Figure 3 depicts the root mean square approximation error with sample points by different schemes as the functions of runtime, which reveals that the runtime of the implicit EM scheme (3.64) achieving the accuracy is time than that of the truncated EM scheme (3.61) with the same stepsize.

4 Approximation of invariant measure

In this section, we are concerned with the existence and uniqueness of invariant measures of the exact and numerical solutions for SDS (2.1). We reconstruct an explicit scheme and show the existence and uniqueness of the numerical invariant measure converging to the underlying exact one in the Wasserstein metric. Our results cover a large kind of nonlinear SDSs with only locally Lipschitz continuous coefficients. For the convenience of invariant measure study we introduce some notations as well as an assumption. We write in lieu of to highlight the initial data . For each , let . Let denote the family of all Borel sets in and denote the family of all probability measures on . For any , define a metric on as follows

and the corresponding Wasserstein distance between by

| (4.1) |

where denotes the collection of all probability measures on with marginal measures and . The Wasserstein distance admits a duality representation (see, e.g, [34]), i.e.

where is a continuous function on and

From this section we always assume is irreducible, namely, the following linear equation

| (4.2) |

has a unique solution satisfying for each . This solution is termed a stationary distribution. For any vector , any constant , define

| (4.3) |

where and denote the spectrum of (i.e. the multiset of its eigenvalues) and the real part of , respectively. In order to examine the properties of the exact solution of SDS (2.1), we prepare the following lemma.

Lemma 4.1

Assume that Then for any , , and there is a vector such that

where

| (4.6) |

Proof. Fix any . Recalling (4.3) and utilizing [35, Proposition 4.2] yields . Let . Then, the spectral radius of (i.e. ) equals to . Since all coefficients of are positive, by the Perron-Frobenius theorem (see, e.g., [32, p.6]), is a simple eigenvalue of and there exists an eigenvector corresponding to , where is a zero vector, and () means each component () for any . Note that eigenvector of corresponding to is also an eigenvector of corresponding to . Thus, we obtain that Therefore the desired result follows.

4.1 Boundedness

Since it is related closely to the tightness as well as the ergodicity we go further to investigate the moment boundedness of solutions in infinite time interval. Firstly, we establish the criterion on the moment boundedness of the exact solutions of SDS (2.1). Then we show that the numerical solutions of Scheme (3.7) keep this property very well.

Theorem 4.2

Proof. For the given and any , are defined as (4.3) and (4.6). For any , Lemma 4.1 implies that and there exists such that

| (4.8) |

holds. Choose . Using the generalised Itô formula (see, e.g., [2, Lemma 1.9, p.49]) together with (4.8), (2.5)-(2.7), yields

where

One observes that Therefore the desired assertion follows from that

The proof is complete.

In order to show that the numerical solutions of Scheme (3.7) preserve this asymptotic boundedness perfectly, we further require the function satisfying

| (4.9) |

for some . Then the asymptotic boundedness of the numerical solution is obtained as follows.

Theorem 4.3

Proof. For any , by the virtue of (3.7), we have

| (4.11) |

for any integer , where

One observes . By Lemma 3.3, without loss the generality, we prove (4.10) only for . It follows from (3.14) and (4.11) that

| (4.12) |

where the vector is given in the proof of Theorem 4.2. It follows from Lemma 3.2 that Then, making use of the techniques in the proof of Theorem 3.4 as well as (4.9) yields

| (4.13) |

One further observes that

| (4.14) |

From (3.8), (3.20) and (4.9), one obtains

| (4.15) |

Similarly, we can also prove that for any integer , For any integer , substituting (4.1)-(4.1) into (4.1), we derive from (4.8), (2.5) and (2.7) that

Choose sufficiently small such that , Taking expectations on both sides, for any , yields

for any integer . Repeating this procedure arrives at

Therefore, The desired assertion follows.

4.2 Invariant measure

In this subsection, we discuss the criterion on the existence and uniqueness of the invariant measure for SDS (2.1). It follows from SDS (2.1) that

| (4.16) |

for any two initial values , , where is a compact set in . For convenience we impose the following hypothesis.

Assumption 3

There exists a positive constant such that

where and each is a constant.

In order for the unique invariant measure we provide the asymptotic attractivity of SDS (2.1).

Lemma 4.4

Proof. For the given and any , are defined as (4.3) and (4.6). Fix . Lemma 4.1 implies that and there exists such that

| (4.18) |

holds. By generalised Itô’s formula (see e.g., [2, Theorem 1.45, p.48]), we obtain

| (4.19) |

where

and

where is a martingale measure, the definition of can be found in [2, p.48], and is a real-valued local continuous martingale (see [2]) with . Thus, taking expectations on both sides, using (4.18) and Assumption 3 implies

| (4.20) |

for any two initial values , . Define a stopping time Due to the irreduciblility of , there exists a constant such that

| (4.21) |

For any , choose such that . Using Hölder’s inequality, (4.20) and (4.21) yields

| (4.22) |

For any , it follows from Theorem 4.2 that and

Thus the desired assertion (4.17) follows from (4.2). The proof is complete.

As well as we know the stability of the trivial solution is one of the major concerns in many applications. As a corollary, the result on the stability follows from the proof of Lemma 4.4 directly. For clarity we impose the following assumption.

Assumption 4

If

| (4.23) |

holds, and for some , there exists a symmetric positive-definite matrix such that

| (4.24) |

holds, where and is a constant.

Due to the above assumption, one observes that is the trivial solution of SDS (2.1) with initial values , any .

Corollary 4.5

Proof. In the same way as the proof of Lemma 4.4, for any initial data , the solution satisfies inequality (4.20) with . Then (4.25) follows directly. On the other hand, due to Assumption 4 and (4.2) with , by the nonnegative semimartingale convergence theorem (see, e.g., [2, p.18, Theorem 1.10]), we obtain Therefore the other required assertion follows. The proof is complete.

Next we give the existence and uniqueness of the invariant measure for the solution of SDS (2.1). Let be the transition probability kernel of the pair , a time homogeneous Markov process (see, e.g, [2, Theorem 3.27, pp.104-105]). Recall that is called an invariant measure of if

holds.

Theorem 4.6

Under the conditions of Lemma 4.4, the solution admits a unique invariant measure .

Proof. For arbitrary , define a probability measure

Then, for any , by Theorem 4.2 and Chebyshev’s inequality, there exists a positive integer sufficiently large such that

for any . Hence is tight since is a compact subset of . Moreover, one observes that enjoys the Feller property (see, e.g., [5, Theorem 2.18, p.48]). Thus, the solution of SDS (2.1) has an invariant measure (see, e.g., [36, Theorem 4.14, p.128]). We have established the existence of the invariant measure, and next we go a further step to show its uniqueness. For any , (4.17) and the irreducibility of result in

| (4.27) |

where stands for the Dirac’s measure at the point . Assume both and are invariant measures, then we have

One then observes that, due to (4.27), as The desired assertion follows.

4.3 The invariant measure of numerical solution

In order to approximate the invariant measure of SDS (2.1) we need to construct the appropriate scheme such that the numerical solutions are attractive in th moment and admit a unique numerical invariant measure. However, the proposed mapping is not suitable for the avoidance of extra wide divergence in distance between two different numerical solutions. Thus we construct a new truncation mapping according to the local Lipschitz continuity of the drift and diffusion coefficients. Then making use of the appropriate truncation mapping we give an explicit scheme. Finally we show that, it produces a unique numerical invariant measure which tends to the invariant measure of SDS (2.1) as in the Wasserstein metric.

For each choose a strictly increasing continuous functions such that as and

| (4.28) |

Due to the local Lipschitz continuity of and the function can be well defined as well as its inverse function . We choose a strictly decreasing such that

| (4.29) |

for some holds, where is a positive constant independent of and . For a given stepsize , let us define the truncated mapping by

| (4.30) |

where we let when . Obviously, for any and ,

| (4.31) |

and

| (4.32) |

Remark 4.7

For any given stepsize , define a new truncated EM method scheme by

| (4.37) |

for any integer . To obtain the continuous-time approximation, define for any . We write in lieu of to highlight the initial data . Then we have

| (4.40) |

and linear property

| (4.41) |

Thus, the above properties support that the conclusion of Theorem 3.6 holds for Scheme (4.37). In order for the uniqueness of the numerical invariant measure we prepare the attractive property of the numerical solutions.

Lemma 4.8

Proof. Recall the definitions of and in (4.2), we know that

| (4.43) |

Without loss the generality, we prove (4.42) only for . For any , any , we derive from (3.14) and (4.43) that

| (4.44) |

where satisfying (4.18) is given in the proof of Lemma 4.4, and

Using the techniques in the proof of Theorem 4.3, by (4.40), we deduce that

| (4.45) | |||

| (4.46) |

and

| (4.47) |

Similarly, we can also prove that for any integer , For any integer , substituting (4.45)-(4.47) into (4.3), we deduce from (4.18) that

For any given , choose sufficiently small such that Taking expectations on both sides and letting , then using the theorem on monotone convergence and Assumption 3, for any , yields

for any and any . Notice that which implies that

for any integer . Repeating this procedure yields

| (4.48) |

Define For any , choose such that . Thus, using Hölder’s inequality, (4.21) and (4.48) yields

| (4.49) |

Due to (4.41), one observes that the conclusion of Theorem 4.3 holds for the new scheme (4.37). Then One further observes that

which implies

Inserting this into (4.3) yields the desired assertion (4.42).

Furthermore we can also use Scheme (4.37) to approximate the stability as follows.

Corollary 4.9

Proof. Clearly, (4.50) follows from (4.48) directly. Moreover, an application of the Borel-Cantelli lemma (see, e.g., [2]) results in (4.51), please refer to [37, p.600].

In order for the ergodicity, we show the Markov property of .

Lemma 4.10

is a time homogeneous Markov chain.

Proof. One observes

Since and are identical in probability law, comparing the two fomulas above, we know that and are identical in probability law under , and , respectively. Thus

for any , which is the desired homogenous property. For any , , , , define

By (4.37) we know that and . Note that and are bounded measurable random functions independent of . Hence, for any , using [2, Lemma 3.2, p.104] with yields

which is the desired Markov property.

Let be the transition probability kernel of the pair , a time homogeneous Markov chain. If satisfies

for any , then is called an invariant measure of . Moreover, such an invariant measure is also called a numerical invariant measure. Next we give the existence and uniqueness of the numerical invariant measure for SDS (2.1) using Scheme (4.37).

Theorem 4.11

Proof. For arbitrary integer , define a measure sequence that

for any and . For any and , by Theorem 4.3 and Chebyshev’s inequality, we derive that is tight, then one can extract a subsequence which converges weakly to an invariant measure. Thus, the numerical solution has an invariant measure . For any , we have established the existence of the numerical invariant measure, and now we further show its uniqueness. For any , it follows from (4.21) and (4.42) that

| (4.52) |

Assume both and are invariant measures, then we have

Due to (4.52), holds as The desired assertion follows.

The following theorem reveals that numerical invariant measure converges in the Wassertein distance to the underlying one .

Theorem 4.12

Under the conditions of Theorem 4.6,

Proof. By the virtues of Theorems 4.6 and 4.11, we have

and

for any . Hence

Thus for any , there exists a positive integer sufficiently large such that

| (4.53) |

Moreover, by Theorem 3.6, there is a such that for any . Therefore, for any ,

The proof is complete.

Remark 4.13

For the given stepsize and , it is easy to find , the minimum of all . Define the uniform truncation mapping Clearly, the properties (4.40) and (4.41) still hold for Scheme (4.37) with each . This implies that all results on numerical solutions in this section still hold for this uniformly truncated scheme.

4.4 Numerical examples

Before closing this section we carry out some simulations to illustrate the efficiency of the scheme (4.37) in the approximation of invariant measures.

Recall Example 3.15. Assumption 1 holds with and , . Due to more computations Assumption 3 holds with and , . Solving the linear equation (4.2) results in Clearly,

It follows from Theorem 4.6 that exact solutions of stochastic volatility model with random switching between (1.3) and (1.6) admit a unique invariant measure . By the virtues of Theorems 4.11 and 4.12 Scheme (4.37) produces a unique numerical invariant measure converging to in the Wasserstein metric. To the best of our knowledge almost all numerical methods in the literatures such as [28, 29, 33] cannot treat this case.

Secondly we carry out some numerical experiments. Basing on the model structure, we begin to specify the explicit truncated EM scheme (4.37).

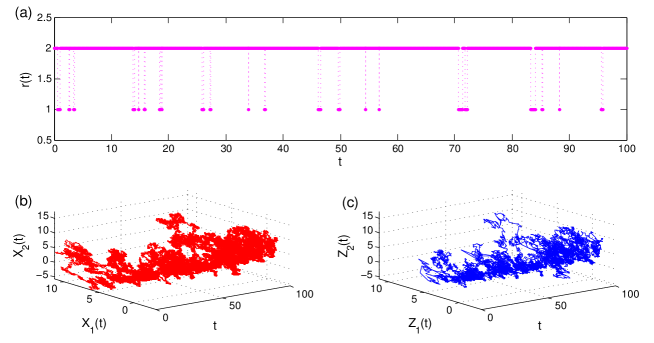

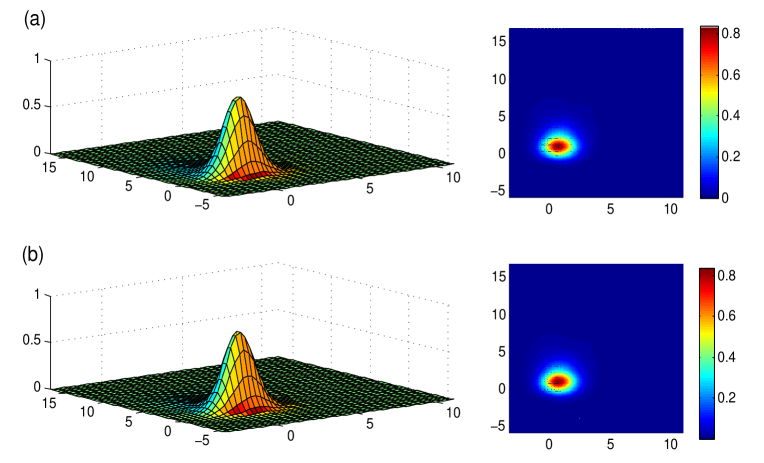

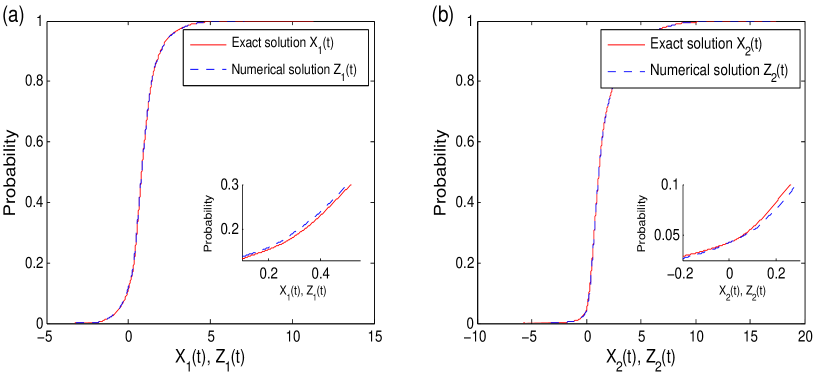

Step 2. MATLAB code. Next we specify the MATLAB code for calculating the truncated EM approximation :

Step 3. MATLAB simulations. Without the closed-form, the more precise numerical solution with is a good substitute of the exact solution. We compare it with the other numerical solution with stepsize . Figure 4 depicts the paths of the Markov chain (Figure 4(a)), (Figure 4(b)) and (Figure 4(c)) for . With 51201 iterations, Figure 5(a) depicts the empirical density of in 2D and 3D settings while Figure 5(b) depicts the empirical density of in 2D and 3D settings. It is evident to see that these two density pictures are very similar. To support the theoretical results deeply, we further plot the empirical cumulative distribution function (ECDF) of with the blue dashed line and the ECDF of with the red solid line. To measure the similarity quantitatively, we use the Kolmogorov-Smirnov test [38] to test the alternative hypothesis that the exact and numerical invariant measures are from different distributions against the null hypothesis that they are from the same distribution for each component. With 2% significance level, the Kolmogorov-Smirnov test indicates that we cannot reject the null hypothesis. So the numerical invariant measure approximates the underlying exact invariant measure very well.

To further illustrate the validity, we reanalyze the existence of the invariant measure and its approximation of SDS (3.56) .

Example 4.14

Let be a Markov chain with the state space and the generator

for some . Its unique stationary distribution is given by Consider the scalar hybrid cubic SDS (3.56) with the initial value , and coefficients

Thus, Assumption 1 holds with any negative constant and for any . Moreover, one observes Assumption 3 holds with , for any . Let , then we know holds with . It follows from Theorem 4.6 that the exact solutions of SDS (3.56) admit a unique invariant measure . Moreover, by Theorems 4.11 and 4.12, the unique numerical invariant measure of the truncated EM scheme exists and converges to in the Wasserstein metric.

Next we begin to construct the explicit scheme to approximate the underlying invariant measure of SDS (3.56). For any , compute

Thus, for any , we choose which implies Let Clearly, (4.28) and (4.29) hold for any . Then, we give the truncated EM scheme

| (4.57) |

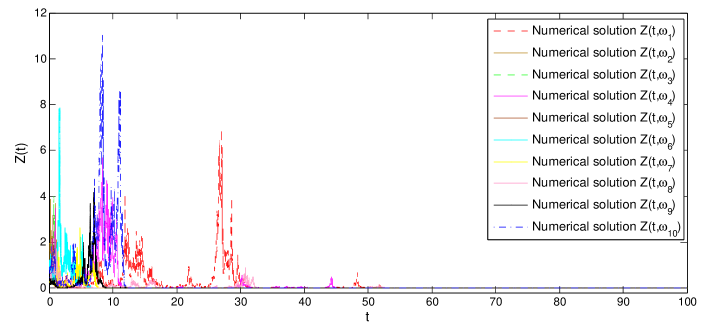

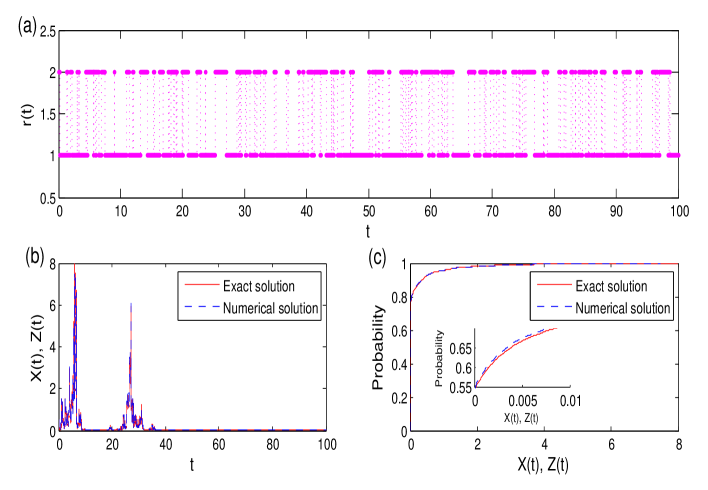

for any Let , and stepsize . We implement Scheme (4.57) in the numerical experiments. We simulate paths by using MATLAB. On the computer running at Intel Core i3-4170 CPU 3.70 GHz, the runtime of the truncated EM scheme (4.57) is about 22.137421 seconds while the the runtime of the backward EM scheme (3.64) is about 38.229964 seconds on the same computer. Thus we know that the speed of the truncated EM scheme (4.57) is 1.727 times faster than that of the backward EM scheme. Figure 7 depicts 10 paths of the numerical solution of Scheme (4.57). Figure 8(a) depicts the path of the Markov chain, Figure 8(b) further compares the path of the exact solution with that of the numerical solution while Figure 8(c) compares the ECDF of the exact solution with that of the numerical solution. The similarity between the paths as well as the distributions is significant. Thus the numerical invariant measure approximates the underlying one very well.

5 Concluding Remarks

This paper investigates the approximation methods for the SDSs without globally Lipschitz continuous coefficients. A novelty is to construct two explicit schemes approximating the dynamical properties of SDSs. In finite horizon, by one scheme, we show the boundedness of the numerical solutions, obtain the convergence in the th moment and estimate the rate of convergence. On the other hand, in infinite horizon we use the other scheme to approximate the underlying invariant measure of exact solutions in the Wasserstein distance. Moreover, this scheme is also suitable to realize the stability of SDSs. Our exploiting schemes perform the dynamical behaviors of exact solutions very well but don’t require more restrictions except the structure conditions which guarantee the exact solutions posses some propery such as stability, moment boundedness and ergodicity. Some simulation examples are provided to support the theoretical results and demonstrate the validity of approaches.

Acknowledgements

The authors thank the editors and referee for the helpful comments and suggestions.

References

- [1] Y. Shen, T. K. Siu, Pricing variance swaps under a stochastic interest rate and volatility model with regime-switching, Oper. Res. Lett. 41 (2) (2013) 180–187.

- [2] X. Mao, C. Yuan, Stochastic Differential Equations with Markovian Switching, Imperial College Press, 2006.

- [3] M. K. P. So, K. Lam, W. K. Li, A stochastic volatility model with markov switching, J. Bus. Econom. Statist. 16 (2) (1998) 244–253.

- [4] Y. Takeuchi, N. H. Du, N. T. Hieu, K. Sato, Evolution of predator-prey systems described by a lotka-volterra equation under random environment, J. Math. Anal. Appl. 323 (2) (2006) 938–957.

- [5] G. Yin, C. Zhu, Hybrid Switching Diffusions: Properties and Applications, New York: Springer-Verlag, 2010.

- [6] M. Pinsky, R. G. Pinsky, Transience/recurrence and central limit theorem behavior for diffusions in random temporal environments, Ann. Probab. 21 (1) (1993) 433–452.

- [7] M. Pinsky, M. Scheutzow, Some remarks and examples concerning the transience and recurrence of random diffusions, Ann. Inst. H. Poincar Probab. Statist. 28 (4) (1992) 519–536.

- [8] P. E. Kloeden, E. Platen, Numerical Solution of Stochastic Differential Equations, Springer-Verlag, Berlin, 1992.

- [9] M. Hutzenthaler, A. Jentzen, Numerical approximations of stochastic differential equations with non-globally lipschitz continuous coefficients, Mem. Amer. Math. Soc. 236 (1112) (2015) 99 pp.

- [10] M. Hutzenthaler, A. Jentzen, P. E. Kloeden, Strong and weak divergence in finite time of euler’s method for stochastic differential equations with non-globally lipschitz continuous coefficients, Proc. R. Soc. Lond. Ser. A Math. Phys. Eng. Sci. 467 (2011) 1563–1576.

- [11] D. J. Higham, X. Mao, A. M. Stuart, Strong convergence of euler-type methods for nonlinear stochastic differential equations, SIAM J. Numer. Anal. 40 (3) (2002) 1041–1063.

- [12] M. Hutzenthaler, A. Jentzen, P. E. Kloeden, Strong convergence of an explicit numerical method for sdes with nonglobally lipschitz continuous coefficients, Ann. Appl. Probab. 22 (4) (2012) 1611–1641.

- [13] S. Sabanis, A note on tamed euler approximations, Electron. Commun. Probab. 18 (13) (2013) 1–10.

- [14] S. Sabanis, Euler approximations with varying coefficients: the case of superlinearly growing diffusion coefficients, Ann. Appl. Probab. 26 (4) (2016) 2083–2105.

- [15] X. Wang, S. Gan, The tamed milstein method for commutative stochastic differential equations with non-globally lipschitz continuous coefficients, J. Difference Equ. Appl. 19 (3) (2013) 466–490.

- [16] W. Liu, X. Mao, Strong convergence of the stopped euler-maruyama method for nonlinear stochastic differential equations, Appl. Math. Comput. 223 (4) (2013) 389–400.

- [17] X. Mao, The truncated euler-maruyama method for stochastic differential equations, J. Comput. Appl. Math. 290 (2015) 370–384.

- [18] J. D. Hamilton, A new approach to the economic analysis of nonstationary time series and the business cycle, Econometrica 57 (2) (1989) 357–384.

- [19] J. Goard, M. Mazur, Stochastic volatility models and the pricing of vix options, Math. Finance 23 (3) (2013) 439–458.

- [20] R. Z. Khasminskii, C. Zhu, G. Yin, Stability of regime-switching diffusions, Stochastic Process. Appl. 117 (8) (2007) 1037–1051.

- [21] J. Shao, F. Xi, Stability and recurrence of regime-switching diffusion processes, SIAM J. Control Optim. 52 (6) (2014) 3496–3516.

- [22] Y. Bakhtin, T. Hurth, Invariant densities for dynamical systems with random switching, Nonlinearity 25 (10) (2012) 2937–2952.

- [23] Y. Bakhtin, T. Hurth, J. C. Mattingly, Regularity of invariant densities for 1d systems with random switching, Nonlinearity 28 (11) (2015) 3755–3787.

- [24] J. Shao, Criteria for transience and recurrence of regime-switching diffusion processes, Electron. J. Probab. 20 (63) (2015) 15 pp.

- [25] D. J. Higham, X. Mao, C. Yuan, Preserving exponential mean-square stability in the simulation of hybrid stochastic differential equations, Numer. Math. 108 (2) (2007) 295–325.

- [26] X. Mao, Y. Shen, A. Gray, Almost sure exponential stability of backward euler-maruyama discretizations for hybrid stochastic differential equations, J. Comput. Appl. Math. 235 (5) (2011) 1213–1226.

- [27] X. Mao, C. Yuan, G. Yin, Numerical method for stationary distribution of stochastic differential equations with markovian switching, J. Comput. Appl. Math. 174 (2005) 1–27.

- [28] C. Yuan, X. Mao, Stationary distributions of euler-maruyama-type stochastic difference equations with markovian switching and their convergence, J. Difference Equ. Appl. 11 (1) (2005) 29–48.

- [29] J. Bao, J. Shao, C. Yuan, Approximation of invariant measures for regime-switching diffusions, Potential Anal. 44 (4) (2016) 707–727.

- [30] S. L. Nguyen, T. A. Hoang, D. T. Nguyen, G. Yin, Milstein-type procedures for numerical solutions of stochastic differential equations with markovian switching, SIAM J. Numer. Anal. 55 (2) (2017) 953–979.

- [31] S. Zhou, Strong convergence and stability of backward euler-maruyama scheme for highly nonlinear hybrid stochastic differential delay equation, Calcolo 52 (4) (2015) 445–473.

- [32] M. Chen, Y. Mao, An Introduction of Stochastic Processes, Higher Education Press, 2007.

- [33] W. Liu, X. Mao, Numerical stationary distribution and its convergence for nonlinear stochastic differential equations, J. Comput. Appl. Math. 276 (2015) 16–29.

- [34] J. Shao, Ergodicity of regime-switching diffusions in wasserstein distances, Stoch. Proc. Appl. 125 (2) (2015) 739–758.

- [35] J. B. Bardet, H. Guérin, F. Malrieu, Long time behavior of diffusion with markov switching, ALEA Lat. Am. J. Probab. Math. Stat. (7) (2010) 151–170.

- [36] M. Chen, From Markov Chains to Non-equillibrium Particle Systems, World Scientific Publishing Co. Pte. Ltd., Singapore, 2004.

- [37] D. J. Higham, X. Mao, C. Yuan, Almost sure and moment exponential stability in the numerical simulation of stochastic differential equations, SIAM J. Numer. Anal. 45 (2) (2007) 592–609.

- [38] F. J. Massey, The kolmogorov-smirnov test for goodness of fit, J. Amer. Statist. Assoc. 46 (253) (1951) 68–78.