High-dimensional inference via hybrid orthogonalization ††thanks: Yang Li is Postdoctoral Fellow, International Institute of Finance, The School of Management, University of Science and Technology of China, Hefei, Anhui, 230026, China (E-mail:tjly@mail.ustc.edu.cn). Zemin Zheng is Professor, International Institute of Finance, The School of Management, University of Science and Technology of China, Hefei, Anhui, 230026, China (E-mail:zhengzm@ustc.edu.cn). Jia Zhou is Ph.D. candidate, International Institute of Finance, The School of Management, University of Science and Technology of China, Hefei, Anhui, 230026, China (E-mail:tszhjia@mail.ustc.edu.cn). Ziwei Zhu is Assistant Professor, Department of Statistics, University of Michigan, Ann Arbor, MI 48109 (E-mail:ziweiz@umich.edu).

Abstract

The past decade has witnessed a surge of endeavors in statistical inference for high-dimensional sparse regression, particularly via de-biasing or relaxed orthogonalization. Nevertheless, these techniques typically require a more stringent sparsity condition than needed for estimation consistency, which seriously limits their practical applicability. To alleviate such constraint, we propose to exploit the identifiable features to residualize the design matrix before performing debiasing-based inference over the parameters of interest. This leads to a hybrid orthogonalization (HOT) technique that performs strict orthogonalization against the identifiable features but relaxed orthogonalization against the others. Under an approximately sparse model with a mixture of identifiable and unidentifiable signals, we establish the asymptotic normality of the HOT test statistic while accommodating as many identifiable signals as consistent estimation allows. The efficacy of the proposed test is also demonstrated through simulation and analysis of a stock market dataset.

Keywords— Large-scale inference, Relaxed orthogonalization, Identifiable predictors, Hybrid orthogonalization, Feature screening, Partially penalized regression

1 Introduction

Feature selection is crucial to a myriad of modern machine learning problems under high dimensions, including bi-clustering analysis with high-throughput genomic data, collaborative filtering in sophisticated recommendation systems, compression of deep neural networks, among others. However, characterizing the uncertainty of feature selection is challenging: the curse of high dimensionality of covariates can undermine the validity of classical inference procedures [11, 38], which only holds under low-dimensional setups.

When the dependence structure of the response variable on the explanatory variables takes some special form such as a linear one, a series of statistical inference methods have been proposed to mitigate the curse of dimensionality and derive valid p-values for these explanatory variables. Among them, a line of research performs statistical inference after model selection with significance statements conditional on the selected model [28, 7, 24, 41, 39]. Another complementary class of methods, which are more closely related with this work, propose to de-bias the penalized estimators by inverting the Karush-Kuhn-Tucker condition of the corresponding optimization problem or equivalently through low-dimensional projections [20, 42, 48], to establish unconditional significance statements. The major advantage of such inference procedures is that they do not require the true signals to be uniformly strong, thereby accommodating general magnitude of true regression coefficients. This de-biasing technique has been extended to inference of graphical structures [18, 35, 5, 19, 34], goodness-of-fit tests [17] and empirical likelihood tests [4]. It has also been generalized to remove the impact of high-dimensional nuisance parameters [6] and tackle distributed high-dimensional statistical inference [23, 1, 26, 49].

There is no free lunch though: the asymptotic normality of the de-biased estimators comes at the price of a strict sparsity constraint: , where is the sample size, is the dimension of the parameter of interest, and denotes the number of nonzero coefficients. This is more restrictive than , which suffices for consistent estimation in -loss. When the true regression coefficients are strictly sparse (-sparse) and the row-wise maximum sparsity of the population precision matrix of the features satisfies , [21] developed a novel leave-one-out proof technique to show that the constraint on can be relaxed to a nearly optimal one: . For approximately sparse (capped -sparse, see (2)) structures, it remains unknown if the sparsity constraint can be relaxed similarly.

Our work is mainly motivated by a key observation that despite of embracing signals of various strength, the existing de-biasing inference methods [48, 20, 42] treat all the covariates equally, regardless of their signal strength. Then the estimation errors on all the signal coordinates can accumulate and jeopardize the asymptotic validity of the resulting tests. Note that when the magnitude of a regression coefficient is of order , it can be identified by feature screening techniques [10, 25, 44] or variable selection methods [43, 47, 48] with high probability. Then a natural question arises: if those strong signals can be identified in the first place, is the number of them still limited to for valid inference? If not, what will be the new requirement for the number of identifiable signals, particularly in the presence of many weak signals? Another interesting question is whether the test efficiency can be improved by exploiting these identifiable signals. If so, then how?

In this paper, we intend to address these questions by developing and analyzing a new inference methodology that takes full advantage of the identifiable signals. We propose to first identify the strong signals and eliminate their impact on the subsequent test. Specifically, we propose a new residualization technique called Hybrid OrThogonalization (HOT) that residualizes the features of our interest such that they are strictly orthogonal to the identifiable features and approximately orthogonal to the remaining unidentifiable ones. The resulting HOT test thus avoids the bias of estimating identifiable coefficients in the original de-biasing step and substantially relaxes the requirement on the sparsity . To the best of our knowledge, such a hybrid inference procedure is new.

1.1 Contributions and organization

We summarize our main contributions of this work as follows:

-

1.

We construct the HOT test statistic via exact orthogonalization against strong signals followed by relaxed orthogonalization against the remaining signals. Denote by the maximum row-wise sparsity level of the precision matrix of the predictors. We establish the asymptotic normality of the HOT test statistic, which allows the number of identifiable coefficients to be of order . One crucial ingredient of our analysis is verifying that the sign-restricted cone invertibility factor of the residualized design matrix that is yielded by the exact orthogonalization step is well above zero.

-

2.

We propose another equivalent formulation of the HOT test statistic through a partially penalized least squares problem (see Proposition 1). Analyzing this form also leads to the asymptotic normality of the HOT test statistic, but with a different requirement on : . This matches the sparsity requirement for consistent estimation in terms of the Euclidean norm. Combining this sparsity constraint with the first one gives a further relaxed constraint: .

-

3.

We show that the HOT test allows the number of weak signals (non-identifiable) to be of order , which is the same order as the sparsity constraint under existing de-biasing works.

-

4.

Last but not least, we show that the asymptotic efficiency of the HOT test is the same as the existing de-biasing methods, indicating no efficiency loss due to the hybrid orthogonalization.

The rest of this paper is organized as follows. Section 2 presents the motivation and the new methodology of the HOT-based inference. We establish comprehensive theoretical properties to ensure the validity of the HOT tests in Section 3. Simulated data analyses are provided in Section 4. We also demonstrate the usefulness of the HOT test by analyzing the data set of stock short interest and aggregate return in Section 5. Section 6 concludes with discussion and future research directions. The proofs and additional technical details are relegated to the supplementary materials to this paper.

1.2 Notation

For any vector , denote by the -norm for . Given two sets and , we use to denote . For any matrix X, denote by the submatrix of X with columns in , and the submatrix of X with rows in and columns in . We write as the submatrix of X with columns constrained on the set . For two series and , we write if there exists a universal constant such that when is sufficiently large. We write if there exists a universal constant such that when is sufficiently large. We say if and .

2 Efficient inference via hybrid orthogonalization

2.1 Setup and motivation

Consider the following high-dimensional linear regression model:

| (1) |

where is an -dimensional vector of responses, is an design matrix with covariates, is a -dimensional unknown regression coefficient vector, and is an -dimensional random error vector that is independent of X. Under a typical high-dimensional sparse setup, the number of features is allowed to grow exponentially fast with the sample size , while the true regression coefficient vector maintains to be parsimonious. Given that the strict sparsity and uniform signal strength assumptions are often violated in practice, we impose rather the weaker capped sparsity condition that was suggested in [48]:

| (2) |

where is in accordance with the level of the maximum spurious correlation . Specifically, a signal gets fully counted towards the sparsity allowance only when its order of magnitude exceeds , which allows it to stand out from spurious predictors and be identified through feature screening or selection [10, 43, 47]. The weaker signals instead have discounted contribution to , whose magnitude depends on their strength. Therefore, depending on whether the signal strength exceeds , the sparsity parameter can naturally be decomposed into two parts and that correspond to the identifiable and weak signals respectively. As we shall see in the sequel, the major bottleneck of our HOT test lies in only , while the constraint on by standard de-biasing methods can be substantially relaxed through the proposed hybrid orthogonalization.

To motivate our approach, we first introduce the low-dimensional projection estimator (LDPE) proposed in [48]. Consider an initial estimator obtained through the scaled lasso regression [36] with tuning parameter :

| (3) |

Then for , define the LDPE as

where is a relaxed orthogonalization of against and can be generated as the residual of the corresponding lasso regression [40]. To see the asymptotic distribution of LDPE, note that

| (4) |

The first term on the right hand side (RHS) dictates the asymptotic distribution of the LDPE and is of order . The second term on the RHS is responsible for the bias of the LDPE. Define the bias factor

and the noise factor

Then the bias term of the LDPE is bounded as

| (5) |

When the design is sub-Gaussian, and under typical realizations of X. Therefore, in order to achieve asymptotic normality of , we require the bias term in (5) to be , which entails that

Under mild regularity conditions, [48] showed that . Combining this with the aforementioned order of suggests that one requires

| (6) |

to achieve the asymptotic normality of . Similar sparsity constraint is necessitated by other de-biasing methods such as [20] and [42], implying that valid inference via the de-biased estimators typically requires the true model to be more sparse than that with estimation consistency, which requires merely that .

The advantage of this inference procedure is that it applies to general magnitudes of the true regression coefficients under sparse or approximately sparse structures as long as the aforementioned accuracy of the initial estimate holds. The downside, however, is that it requires the stringent sparsity assumption (6). Looking back at (4) and the definition of , we find that the construction of in LDPE does not discriminate between identifiable and weak signals. Then even with an initial estimate to offset the impacts of identifiable signals in the bias term, the estimation errors of the identifiable nonzero coefficients can aggregate to be of order , which gives rise to a harsh constraint on the number of identifiable predictors.

To address this issue, we propose to construct the vector by a hybrid orthogonalization technique after identifying large coefficients by feature screening or selection procedures. A partial list of such procedures include SIS [10], distance correlation learning [25], HOLP [44], lasso [40], SCAD [9], the adaptive lasso [51], the Dantzig selector [3], MCP [47], the scaled lasso [36], the combined and concave regularization [14], the thresholded regression [50], the constrained Dantzig selector [22], among many others [31]. Intuitively, an ideal hybrid orthogonalization vector should be orthogonal to the identifiable features so that their impact can be completely removed in the bias term even without resorting to any initial estimate. At the same time, it should be a relaxed orthogonalization against the remaining covariate vectors in case that some weak signals are above the magnitude of and break down the asymptotic normality.

2.2 Unveiling the mystery of the hybrid orthogonalization

The first step of hybrid orthogonalization is residualizing the target covariate and the unidentifiable ones using the identifiable covariates through exact orthogonalization. After obtaining those residualized covariate vectors, we then construct the relaxed orthogonalization vector via penalized regression. Specifically, given a pre-screened set of identifiable signals and any target index , the HOT vector can be constructed in two steps:

Step 1. Exact orthogonalization. For , we take as the exact orthogonalization of against . That is,

| (7) |

where is the projection matrix of the column space of . Therefore, for any , the projected vector is orthogonal to . The submatrix of the identifiable covariates will then be discarded in the construction of after this step. It is worth noticing that when , for any , , which is the residual vector of projecting onto the space spanned by all covariate vectors in . However, varies across , since the corresponding projection space only includes the other covariate vectors in .

Step 2. Relaxed orthogonalization. The hybrid orthogonalization vector is constructed as the residual of the following lasso regression based on :

| (8) | |||

where is the matrix consisting of columns for , , denotes the th component of and the regularization parameter. It is clear that is also orthogonal to the matrix of identifiable covariates since it is a linear combination of the projected vectors , . Moreover, together with (7), we have for any that

| (9) |

Therefore, the resulting bias factor is the same as in [48], given that

In the sequel, we drop the superscript H in to simplify notation. Through this two-step hybrid orthogonalization, is a strict orthogonalization against the identifiable predictors but a relaxed orthogonalization against the others.

With , the HOT estimator is defined coordinate-wise as

| (10) |

Plugging model (1) to the definition above, we obtain that

| (11) |

where the last equality is due to the exact orthogonalization of to . Furthermore, since the coefficients of order are typically guaranteed to be found and included in by the aforementioned feature screening or selection procedures under suitable conditions, the signals corresponding to the set are weak with an aggregated magnitude no larger than the order of . Thus, by taking the relaxed projection in Step 2, the proposed method inherits the advantage of LDPE in dealing with the weak signals. We will show that the main sparsity constraint for HOT here is that

while is allowed to be at least of order .

| Input: , , a pre-screened set and a significance level |

| for |

| for |

| # is the scaled lasso estimate of |

| output for -confidence intervals of |

The HOT inference procedure is described in Algorithm 1. It is interesting to notice that no initial estimate of is involved in HOT. As we shall see, HOT has two main advantages over standard de-biasing techniques. First of all, HOT completely removes the impact of identifiable signals in equation (11), thereby eliminating the bias induced by the estimation errors on identifiable coefficients and yielding more accurate confidence intervals under finite samples. Second, HOT accommodates at least identifiable signals; in contrast, existing works require .

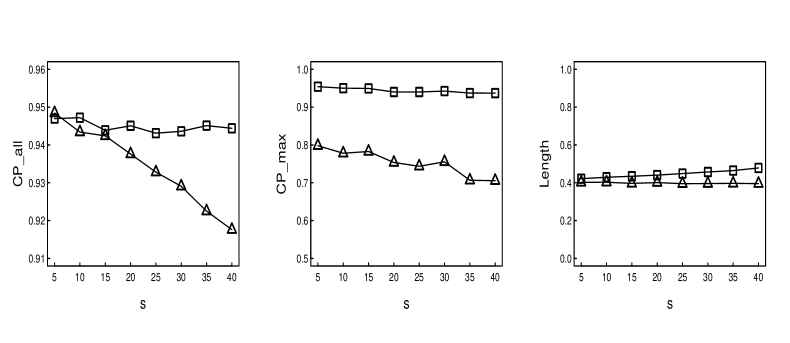

The enhanced efficiency of inference via HOT can be seen from a simple simulation example summarized in Figure 1 with a pre-screened set selected by SIS, where the data are generated similarly as in Section 4.1 so that the number of nonzero coefficients varies from 5 to 40, the sample size , the dimensionality , and the covariate correlation parameter . It is clear that when the number of nonzero coefficients increases, the averaged coverage probability of confidence intervals by LDPE deteriorates, while the confidence intervals constructed through HOT keep the averaged coverage probability around .

2.3 An equivalent form of the hybrid orthogonalization

It turns out that the aforementioned two-step hybrid orthogonalization can be formulated as a partially penalized regression procedure. The following proposition elucidates this alternative formulation.

Proposition 1.

Proposition 1 shows that in Algorithm 1 can be viewed as the residual vector from a partially penalized regression problem. Under the context of the goodness-of-fit test for high-dimensional logistic regression, [17] exploited a similar partial penalty to better control the type I error of the test in its empirical study. [17] argued that this technique helps with controlling the reminder term of the asymptotic expansion of the test statistic under a “beta-min condition” that all the non-zero coefficients are at least of order in absolute value. The major difference between our work and [17] lies in the setups and goals: our motivation of imposing partial penalty is to accommodate larger sparsity of the true model in inference. Besides, an important methodological difference is that we do not residualize our predictors against the target predictor in the exact orthogonalization step if is among the identifiable predictors.

3 Theoretical Properties

This section presents the theoretical guarantees of the proposed HOT test. Suppose that is the smallest positive constant satisfying , which implies that the dimensionality can grow exponentially fast with respect to . Then the maximum spurious correlation level is of order . It follows that any coefficient of order is identifiable if . Therefore, we define as follows to collect all the identifiable coefficients:

where can be sufficiently close to but smaller than , and where is some constant. To distinguish weak signals from those in , we assume that ’s are uniformly bounded by for .

3.1 Theoretical results for fixed design

We establish the asymptotic properties of the proposed estimator under fixed design X.

Theorem 1.

Given a fixed set , the HOT estimator satisfies

Suppose that the components of are independent and identically distributed with mean 0 and variance . If there is some such that the inequality

| (12) |

holds, we further have

where , and where is the distribution function of the standard normal distribution.

Theorem 1 presents a preliminary theoretical result of the proposed method. The first part of this theorem shows that the error of the HOT estimator can be decomposed into a noise term and a bias term , which is consistent with the results in [42, 48]. However, one interesting difference from the standard de-biasing methods here is that is non-random, because we do not need the random initial estimator as shown in (10) and (11). The proposed HOT estimator can be regarded as a modified least squares estimator for high-dimensional settings, which is generally not shared by these de-biasing methods and is actually the essential reason for the above difference.

The second part of this theorem establishes the asymptotic normality of the noise term based on the classical Lyapunov’s condition (12), which relaxes the Gaussian assumption in [42, 48]. Recall that the Gaussian assumption in [42, Theorem 2.1] was imposed to guarantee the accuracy of , which suggests that the initial estimator can induce extra error.

Moreover, the assumption of independent and identically distributed noise can be further weakened to that of independent but possibly non-identically distributed noise, as detailed in the following corollary:

Corollary 1.

Suppose that the errors are independent across and that has mean 0 and variance . If there is some such that

| (13) |

holds with , we further have

The Lyapunov condition (13) here is slightly different from the version in (12) because of the heteroskedasticity of noise. To develop intuition for this condition, we consider a simple case where . Then (13) can be rewritten as

| (14) |

which is a pretty weak assumption about the random error . For example, when are independent across and distributed with the uniform distribution , the above equality (14) holds with .

3.2 Theoretical results for random design

We provide here the theoretical results for random design X. Before introducing the main results, we list a few technical conditions that underpin the asymptotic properties of the HOT test.

Condition 1.

, where the eigenvalues of are bounded within the interval for some constant .

Condition 2.

, where with .

Condition 3.

, and .

Condition 1 assumes that the rows of the design matrix are independent and normally distributed. The eigenvalues of the precision matrix are well bounded from below and above. Similarly to [48], the Gaussian assumption is imposed to facilitate the theoretical analysis when justifying some model identifiability condition such as the bounded sign-restricted cone invertibility factor assumption [45]. Our technical arguments also apply to non-Gaussian settings such as the sub-Gaussian distribution. Condition 2 is a typical assumption in high dimensions and the sparsity of the population precision matrix is needed to guarantee consistent estimation of the penalized regression (relaxed projection) among the predictors. We will utilize this standard assumption, which was also imposed in other de-biasing works such as [42] and [48], to analyze the variance of the hybrid orthogonalization estimator.

The most appealing properties of the HOT inference are reflected in Condition 3, especially its first part. To the best of our knowledge, it is weaker than the sparsity constraints in existing high-dimensional works on statistical inference or even the estimation since it holds when either or . Specifically, it allows the number of identifiable nonzero coefficients , where is a fundamental constraint on the sparsity level to guarantee consistent estimation in high dimensions. Therefore, the bound is much weaker than imposed in the aforementioned de-biasing methods or in [21]. Remarkably, the proposed inference method even allows for , which can be substantially larger than when . The second part of Condition 3 implies that the sparsity level of the weak signals can be bounded as

where we recall . It is worth mentioning that when , the identifiable coefficients may not be found by feature selection methods due to the lack of estimation consistency. Feature screening procedures such as SIS, distance correlation learning, and HOLP will be preferred.

We first analyze the statistical properties of the relaxed projection in (8), which is essentially a lasso regression on the residualized features . We start with investigating the sign-restricted cone invertibility factor [45] of , an important quantity that determines the error of the lasso estimator. Let and . For some constant , the sign-restricted cone invertibility factor of the design matrix is defined as

where the sign-restricted cone

Compared with the compatibility factor or the restricted eigenvalue [2], the sign-restricted cone invertibility factor can be more accommodating. In fact, all three of them are satisfied with high probability when the population covariance of the random design has bounded spectrum. The following proposition shows that the sign-restricted cone invertibility factor of the design matrix is well above zero with high probability. It ensures the identifiability of the support of the true regression coefficients by avoiding collinearity among the design vectors when constrained on the sign-restricted cone.

Proposition 2.

Note that the conclusion of Proposition 2 is typically assumed directly in high dimensions for design matrices with independent and identically distributed (i.i.d.) rows. However, the design matrix here consists of projected vectors, so that the rows of are neither independent nor identically distributed. We overcome this difficulties by a new technical argument that is tailored for the -constrained structure of the cone. The upper bound is required to show the asymptotically vanishing difference between and its population projected counterpart.

Proposition 2 lays down the foundation for the following theorem on the statistical error of the relaxed projection.

Theorem 2.

Theorem 2 establishes estimation and prediction error bounds for the relaxed projection in (8). One striking feature here is that the statistical rates no longer depend on the size of the penalization-free set : the identifiable predictors have been eliminated in the exact orthogonalization step and are not involved in the relaxed projection. Next, we analyze the partially penalized regression, which is crucial to derive the asymptotic normality of the subsequent HOT test.

Theorem 3.

Theorem 3 establishes estimation and prediction error bounds for the solution of the partially penalized regression problem. It guarantees estimation and prediction consistency of when the size of the penalization-free set is of order . Such an can typically be obtained through regularization methods, e.g, [2, 14, 22]. The estimation and prediction consistency of the solution of the partially penalized regression is important for ensuring valid inference via HOT in that it guarantees the convergence of the hybrid orthogonalization vector to its population counterpart . Based on Proposition 1 and a joint analysis of penalized and penalization-free covariates, Theorem 3 also explicitly characterizes the dependence of the estimation error on the size of .

It is worth pointing out that the partially penalized procedure here is essentially different from those weighted penalization methods such as the adaptive lasso, whose weights target at improving the estimation accuracy of the regression coefficients. In contrast, the partial penalization in our setup can downgrade the estimation quality. Note that the pre-screened set of identifiable predictors may have little overlap with the support of , which is the set of significant covariates associated with the predictor . Therefore, lifting regularization on incurs more exposure of to noise and increases statistical error: the sparsity factor in the error bounds in Theorem 3 is instead of just . Despite of the sacrifice on the estimation accuracy, the resulting is strictly orthogonal to , which is the key to accommodating more identifiable signals in the HOT test than in the standard debiasing-based test.

In fact, both Theorems 2 and 3 lead to the same guarantee for :

see the proof of Theorem 4 for details. Perhaps more importantly, the two theorems complement each other in terms of the requirement on the magnitude of , so that we allow . Therefore, if , we follow Theorem 2 to analyze ; otherwise we follow Theorem 3.

Before presenting the main theorem on the HOT test, the following definition characterizes the properties that a pre-screened set should satisfy.

Definition 1 (Acceptable set).

Set is called an acceptable pre-screened set if it satisfies: (1) is independent of the data ; (2) with probability at least for some asymptotically vanishing , and .

The first property in Definition 1 is imposed so that the randomness of does not interfere with the subsequent inference procedure. The same property was suggested in [12, 13] to facilitate the theoretical analysis. In practice, it can be ensured through data splitting and our numerical studies show that it can be more of a technical assumption than a practical requisite. The second property is the sure screening property for the identifiable predictors, which can be satisfied by the aforementioned screening or variable selection procedures under suitable conditions. For example, under the assumptions of bounded and significant marginal correlations, SIS [10, Theorem 3] can yield a sure screening set with failure probability of order . The tail probability also vanishes asymptotically for variable selection methods [47] when the design matrix satisfies the irrepresentable condition [46]. In addition, the second part of Definition 1 also assumes the size of the pre-screened set to be of the same order as , the number of the true identifiable predictors. For feature screening procedures such as SIS, the selected model can be reduced to a desirable size through multiple iterations. For variable selection methods such as the lasso, the number of selected features is generally around with probability tending to one [2] if the largest eigenvalue of the Gram matrix is bounded from above. Other nonconvex regularization methods tend to select even sparser models [14, 22]. In fact, even if this assumption is violated, our theoretical results still hold as long as in view of the technical arguments.

Now we are ready to present our main theorem that establishes the asymptotic normality of the HOT test statistic.

Theorem 4.

Let for some constants and , . Assume that Conditions 1-3 hold and that satisfies Definition 1. Then for any and sufficiently large , the HOT estimator satisfies

where and . Moreover, it holds with probability at least that

Suppose that the components of are independent and identically distributed with mean 0 and variance . For any given X, if there is some such that the inequality

holds, we further have

where is the distribution function of the standard normal distribution.

Compared with existing inference results on de-biasing, Theorem 4 guarantees the asymptotic normality of the HOT estimator under a much relaxed constraint on the number of strong signals. When so that , either feature screening or selection methods can be used to select . When and thus , feature screening procedures will be preferred to identify . The constraint in the latter case reveals an interesting trade-off between the sparsity in the regression coefficient and that in the precision matrix of the predictors. A recent related work [21] used a novel leave-one-out argument to show that when , the standard de-biasing test allows , which is still more stringent than in our result. Finally, while coping with much more strong signals, the HOT test also accommodates weak signals as the standard de-biasing tests do.

Moreover, converges to the same constant as that of LDPE in [48]. Given that the noise factor determines the asymptotic variance of the test, Theorem 4 implies no efficiency loss incurred by HOT. Similarly to [20] and [42], when the noise standard deviation is unknown in practice, we can replace it with some consistent estimate given by the scaled lasso for general Gaussian settings, say. When the data are heteroscedastic, we can use the kernel method as suggested in [30] to estimate .

4 Simulation Studies

In this section, we use simulated data to investigate the finite sample performance of HOT, in comparison with that of LDPE. Both SIS and HOLP are utilized to pre-screen the set of identifiable coefficients and we denote the two versions of HOT by HOT-SIS and HOT-HOLP, respectively. To control the number of selected identifiable coefficients in , we take the least squares estimates after constraining the covariates on and then apply BIC to choose the optimal one. While these two methods use the same data set for pre-screening and the subsequent inference procedure, as a comparison, an independent data set of the same size as the original sample is also generated for the pre-screening step. The corresponding versions are denoted by HOT-SIS(I) and HOT-HOLP(I), respectively.

The hybrid orthogonalization vectors are calculated by the lasso as defined in (8) with the regularization parameter tuned by GIC [15]. Two simulation examples are conducted for both sparse and non-sparse settings. Throughout the simulation studies, we aim at establishing the confidence intervals for all coefficients, corresponding to the significance level . The estimated error standard deviation is obtained through the scaled lasso with the universal regularization parameter set according to [37].

4.1 Simulation Example 1

Here we adopt the same setting as that in [42]. To be specific, 100 data sets were simulated from model (1) with so that . For each data set, the rows of X were sampled as independent and identically distributed copies from , where with . The true coefficient vector , where and the nonzero were independently sampled from the uniform distribution . Three performance measures are used to evaluate the inference results, including the averaged coverage probability for all coefficients (CP_all), the averaged coverage probability for nonzero coefficients (CP_max) in this example or that for the maximum coefficients in the second example, and the averaged length of confidence intervals for all coefficients (Length). The averaged estimated error standard deviation obtained by the scaled lasso is and we also display the performance measures when equals to the population value for comparison.

| HOT-SIS | HOT-SIS(I) | HOT-HOLP | HOT-HOLP(I) | LDPE | ||

|---|---|---|---|---|---|---|

| CP_all | 0.942 | 0.943 | 0.941 | 0.939 | 0.943 | |

| CP_max | 0.942 | 0.945 | 0.935 | 0.941 | 0.702 | |

| Length | 0.673 | 0.677 | 0.670 | 0.671 | 0.659 | |

| CP_all | 0.951 | 0.953 | 0.950 | 0.951 | 0.953 | |

| CP_max | 0.950 | 0.951 | 0.947 | 0.951 | 0.729 | |

| Length | 0.700 | 0.701 | 0.701 | 0.700 | 0.697 |

The results are summarized in Table 1. It is clear that while the averaged coverage probabilities for all coefficients (CP_all) by different methods are all around , the averaged coverage probabilities for nonzero coefficients (CP_max) of different versions of HOT are significantly closer to the target than that of LDPE under this finite sample set. Moreover, the averaged lengths of confidence intervals by different methods are around the same level. By comparing the results of HOT using the same or an independent data set for the pre-screening step, we find that the independence assumption on the pre-screening set can be more of a technical assumption than a practical necessity.

4.2 Simulation Example 2

In this second example, we consider the approximately sparse setting in [48], where all coefficients are nonzero but decay fast as the indices increase except for some significant ones. Specifically, the true regression coefficients with for , and for all the other . The other setups are similar to those in the first example with . We adopt the same performance measures and summarize the results in Table 2. Under such non-sparse setting, the scaled lasso estimate tended to overestimate a bit with its mean value equaling . Therefore, with the estimated , the averaged coverage probabilities of different versions of HOT are above the target a bit, while that of LDPE for maximum coefficients is still slightly below . If we utilize the population value so that to construct the confidence intervals, the averaged coverage probabilities of different versions of HOT are around the target. It shows that the proposed method can still be valid under some approximately sparse settings.

| HOT-SIS | HOT-SIS(I) | HOT-HOLP | HOT-HOLP(I) | LDPE | ||

|---|---|---|---|---|---|---|

| CP_all | 0.971 | 0.970 | 0.970 | 0.967 | 0.949 | |

| CP_max | 0.967 | 0.967 | 0.970 | 0.965 | 0.935 | |

| Length | 0.341 | 0.342 | 0.340 | 0.338 | 0.341 | |

| CP_all | 0.949 | 0.950 | 0.949 | 0.947 | 0.922 | |

| CP_max | 0.943 | 0.945 | 0.945 | 0.943 | 0.896 | |

| Length | 0.305 | 0.305 | 0.305 | 0.305 | 0.306 |

5 Application to Stock Short Interest and Aggregate Return Data

In this section, we will demonstrate the usefulness of the proposed methods by analyzing the stock short interest and aggregate return data set originally studied in [32], available at Compustat (www.compustat.com). The raw data set includes 3274 firms’ monthly short interests, reported as the numbers of shares that were held short in different firms, as well as the 500 monthly log excess returns from January 1994 to December 2013. As shown in [32], the short interest index, that is, the average of short interests of the firms, is arguably the strongest predictor of aggregate stock returns. Then with the proposed large-scale inference technique, we can further identify which firms among the thousands of candidates that had significant impacts on the 500 log excess returns.

We approach this problem by the following predictive regression model

| (15) |

where is the 500 log excess return of the th month and with each component indicating the short interest of the th firm in the th month. Due to the high correlations between short interests of firms, we use one representative for those firms with correlation coefficients larger than 0.9, resulting in representative firms. Moreover, the aforementioned period yields a sample size of and both predictor and response vectors are standardized to have mean zero and -norm . We applied HOT and LDPE similarly as in Section 4 at a significance level of . SIS was utilized in HOT for screening the identifiable predictors to bypass the high correlations.

| HOT | LDPE | |

|---|---|---|

| Num | 6 | 11 |

| Length | 0.489 | 0.507 |

Table 3 summarizes numbers of important firms and averaged lengths of confidence intervals by different methods. While the averaged lengths of confidence intervals are very close, LDPE selects more firms than HOT. To verify the significance of the selected firms, we refit model (15) via ordinary least squares (OLS) constrained on the selected firms by HOT and LDPE, respectively. The corresponding significance test shows that only five firms out of the eleven selected by LDPE are significant at the 0.05 level, while four our of the six firms identified by HOT are significant around the 0.05 level. We display the refitted OLS estimates and the p-values for the six firms by HOT in Table 4.

| Firm | -value | Firm | -value | ||

|---|---|---|---|---|---|

| GAPTQ | -0.167 | 0.025 | PKD | -0.098 | 0.183 |

| WHR | 0.088 | 0.361 | HAR | 0.171 | 0.034 |

| GCO | -0.310 | 0.000 | OMS | -0.126 | 0.052 |

-

1

GAPTQ: Great Atlantic Pacific Tea Company; WHR: Whirlpool Corporation; GCO: Genesco Inc; PKD: Parking Drilling Company; HAR: Harman International Industries Inc; OMS: Oppenheimer Multi-Sector

In view of Table 4, the p-values of four firms, GAPTQ, GCO, HAR, and OMS, are around or below 0.05. These firms are also influential in their respective fields. Among them, GAPTQ (Great Atlantic Pacific Tea Company) is a supermarket with estimated sales of billion in 2012, ranking 28th among the “top 75 food retailers and wholesalers”. The most significant firm GCO (Genesco Inc) is a retailer of branded footwear and clothing with thousands of retail outlets across the world. Furthermore, OMS (Oppenheimer Multi-Sector) has grown into one of the largest and the most popular investment managers in the world since going public in 1959. The negative coefficients of them imply that the increases in the short interests of these firms tend to significantly decrease the future 500 return. With these identified influential firms, it can be helpful to develop some augmented short interest index to further enhance the prediction performance for excess returns.

6 Discussions

In this paper, we have demonstrated that the maximum number of identifiable coefficients is allowed to be substantially larger than existing ones in presence of many possibly nonzero but weak signals for valid high-dimensional statistical inference. We also propose the hybrid orthogonalization estimator that takes full advantage of the identifiable coefficients, so that the bias induced by the estimation errors of the identifiable coefficients can be removed to enhance the inference efficiency.

Alternatively, based on the hybrid orthogonalization vectors () constructed in Section 2.2, we can also utilize the self-bias correction idea with the aid of an initial estimate such as the scaled lasso estimate in equation (3). Then an alternative hybrid orthogonalization estimator can be defined through each coordinate as

The validity of it can be seen from the following decomposition

where the items with indices in the set are zero due to the exact orthogonalization of to similarly as in (11). Moreover, the bias term on the right hand side of the above equality is bounded by

where the bias factor and the noise factor are of the same definitions as those in (5) except that the orthogonalization vectors are now the hybrid ones.

Since and can be shown to take the same orders of magnitudes as those in [48], the main advantage of the alternative hybrid orthogonalization estimator is to reduce the item in the bias term of (5) to , which denotes the -estimation error of constrained on the index set . When the possibly nonzero but weak signals are not identified by the initial estimate , the bias term here would be as small as that for the proposed hybrid orthogonalization estimator , so that their sample size requirements for valid inference are basically the same.

Note that except for the linear regression models that utilize the squared error loss, the second order derivative of the loss function would typically rely on the regression coefficient vector. Therefore, the main advantage of the alternative hybrid orthogonalization estimator is that it can be readily extended to other convex loss functions such as generalized linear models. The key point is to construct hybrid orthogonalization vectors based on the second order derivatives of the loss function for the corresponding models after identifying the significant coefficients by powerful feature screening techniques [25, 29, 27] targeted at non-linear models. It would be interesting to explore the theoretical properties of hybrid orthogonalization estimators in these extensions for future research.

Acknowledgements

This work was supported by National Natural Science Foundation of China (Grants 72071187, 11671374, 71731010, 12101584 and 71921001), Fundamental Research Funds for the Central Universities (Grants WK3470000017 and WK2040000027), and China Postdoctoral Science Foundation (Grants 2021TQ0326 and 2021M703100). Yang Li and Zemin Zheng are co-first authors.

References

- [1] Battey, H., Fan, J., Liu, H., Lu, J. and Zhu, Z. (2018). Distributed testing and estimation under sparse high dimensional models. Ann. Statist. 46, 1352–1382.

- [2] Bickel, P. J., Ritov, Y. and Tsybakov, A. B. (2009). Simultaneous analysis of Lasso and Dantzig selector. Ann. Statist. 37, 1705–1732.

- [3] Candès, E. and Tao, T. (2007). The Dantzig selector: Statistical estimation when is much larger than . Ann. Statist. 35, 2313–2404.

- [4] Chang, J., Chen, S., Tang, C. and Wu, T. (2020). High-dimensional empirical likelihood inference. Biometrika, to appear.

- [5] Chen, M., Ren, Z., Zhao, H. and Zhou, H. (2016). Asymptotically normal and efficient estimation of covariate-adjusted Gaussian graphical model. J. Amer. Statist. Assoc. 111, 394–406.

- [6] Chernozhukov, V., Chetverikov, D., Demirer, M., Duflo, E., Hansen, C., Newey, W. and Robins, J. (2018). Double/debiased machine learning for treatment and structural parameters. Econom. J. 21, C1–C68.

- [7] Chernozhukov, V., Hansen, C. and Spindler, M. (2015). Valid post-selection and post-regularization inference: An elementary, general approach. Annual Review of Economics 7, 649–688.

- [8] Eldar, Y. C. and Kutyniok, G. (2012). Compressed Sensing: Theory and Applications. Cambridge University Press, Cambridge.

- [9] Fan, J. and Li, R. (2001). Variable selection via nonconcave penalized likelihood and its oracle properties. J. Amer. Statist. Assoc. 96, 1348–1360.

- [10] Fan, J. and Lv, J. (2008). Sure independence screening for ultrahigh dimensional feature space. J. R. Stat. Soc. Ser. B. Stat. Methodol. 70, 849–911.

- [11] Fan, Y., Demirkaya, E. and Lv, J. (2019). Nonuniformity of p-values can occur early in diverging dimensions. J. Mach. Learn. Res. 20, 1–33.

- [12] Fan, Y., Jin, J. and Yao, Z. (2013). Optimal classification in sparse Gaussian graphic model. Ann. Statist. 41, 2537–2571.

- [13] Fan, Y., Kong, Y., Li, D. and Zheng, Z. (2015). Innovated interaction screening for high-dimensional nonlinear classification. Ann. Statist. 43, 1243–1272.

- [14] Fan, Y. and Lv, J. (2014). Asymptotic properties for combined and concave regularization. Biometrika 101, 57–70.

- [15] Fan, Y. and Tang, C. (2013). Tuning parameter selection in high dimensional penalized likelihood. J. R. Stat. Soc. Ser. B. Stat. Methodol. 75, 531–552.

- [16] Hwang, S.-G. (2004). Cauchy’s interlace theorem for eigenvalues of Hermitian matrices. Amer. Math. Monthly 111, 157–159.

- [17] Janková, J., Shah, R. D., Bühlmann, P. and Samworth, R. J. (2020). Goodness-of-fit testing in high dimensional generalized linear models. J. R. Stat. Soc. Ser. B. Stat. Methodol. 82, 773–795.

- [18] Janková, J. and van de Geer, S. (2015). Confidence intervals for high-dimensional inverse covariance estimation. Electron. J. Stat. 9, 1205–1229.

- [19] Janková, J. and van de Geer, S. (2017). Honest confidence regions and optimality in high-dimensional precision matrix estimation. Test 26, 143–162.

- [20] Javanmard, A. and Montanari, A. (2014). Confidence intervals and hypothesis testing for high-dimensional regression. J. Mach. Learn. Res. 15, 2869–2909.

- [21] Javanmard, A. and Montanari, A. (2018). Debiasing the Lasso: Optimal sample size for Gaussian designs. Ann. Statist. 46, 2593–2622.

- [22] Kong, Y., Zheng, Z. and Lv, J. (2016). The constrained Dantzig selector with enhanced consistency. J. Mach. Learn. Res. 17, 1–22.

- [23] Lee, J., Liu, Q., Sun, Y. and Taylor, J. (2017). Communication-efficient distributed sparse regression. J. Mach. Learn. Res. 18, 1–30.

- [24] Lee, J., Sun, D., Sun, Y. and Taylor, J. (2016). Exact post-selection inference with the Lasso. Ann. Statist. 44, 907–927.

- [25] Li, R., Zhong, W. and Zhu, L. (2012). Feature screening via distance correlation learning. J. Amer. Statist. Assoc. 107, 1129–1139.

- [26] Lian, H. and Fan, Z. (2018). Divide-and-conquer for debiased -norm support vector machine in ultra-high dimensions. J. Mach. Learn. Res. 18, 1–26.

- [27] Liu, W., Ke, Y., Liu, J. and Li, R. (2020). Model-free feature screening and FDR control with knockoff features. J. Amer. Statist. Assoc. to appear.

- [28] Lockhart, R., Taylor, J., Tibshirani, R. and Tibshirani, R. (2014). A significance test for the Lasso. Ann. Statist. 42, 413–468.

- [29] Ma, S., Li, R. and Tsai, C.-L. (2017). Variable screening via partial quantile correlation. J. Amer. Statist. Assoc. 112, 650–663.

- [30] Müller, H.-G. and Stadtmüller, U. (1987). Estimation of heteroscedasticity in regression analysis. Ann. Statist. 15, 610–625.

- [31] Radchenko, P. and James, G. (2008). Variable inclusion and shrinkage algorithms. J. Amer. Statist. Assoc. 103, 1304–1315.

- [32] Rapach, D. E., Ringgenberg, M. C. and Zhou, G. (2016). Short interest and aggregate stock returns. J. Financ. Econ. 121, 46–65.

- [33] Raskutti, G., Wainwrigh, M. J. and Yu, B. (2010). Restricted eigenvalue properties for correlated Gaussian designs. J. Mach. Learn. Res. 11, 2241–2259.

- [34] Ren, Z., Kang, Y., Fan, Y. and Lv, J. (2019). Tuning-free heterogeneous inference in massive networks. J. Amer. Statist. Assoc. 114, 1908–1925.

- [35] Ren, Z., Sun, T., Zhang, C.-H. and Zhou, H. (2015). Asymptotic normality and optimalities in estimation of large Gaussian graphical model. Ann. Statist. 43, 991–1026.

- [36] Sun, T. and Zhang, C.-H. (2012). Scaled sparse linear regression. Biometrika 99, 879–898.

- [37] Sun, T. and Zhang, C.-H. (2013). Sparse matrix inversion with scaled Lasso. J. Mach. Learn. Res. 14, 3385–3418.

- [38] Sur, P., Chen, Y. and Candès, E. (2020). The likelihood ratio test in high-dimensional logistic regression is asymptotically a rescaled chi-square. Probability Theory and Related Fields 175, 487–558.

- [39] Tian, X. and Taylor, J. (2018). Selective inference with a randomized response. Ann. Statist. 46, 679–710.

- [40] Tibshirani, R. (1996). Regression shrinkage and selection via the Lasso. J. R. Stat. Soc. Ser. B. Stat. Methodol. 58, 267–288.

- [41] Tibshirani, R. J., Taylor, J., Lockhart, R. and Tibshirani, R. (2016). Exact post-selection inference for sequential regression procedures. J. Amer. Statist. Assoc. 111, 600–620.

- [42] van de Geer, S., Bühlmann, P., Ritov, Y. and Dezeure, R. (2014). On asymptotically optimal confidence regions and tests for high-dimensional models. Ann. Statist. 42, 1166–1202.

- [43] Wainwright, M. J. (2009). Information-theoretic limitations on sparsity recovery in the high-dimensional and noisy setting. IEEE Trans. Inform. Theor. 55, 5728–5741.

- [44] Wang, X. and Leng, C. (2016). High dimensional ordinary least squares projection for screening variables. J. R. Stat. Soc. Ser. B. Stat. Methodol. 78, 589–611.

- [45] Ye, F. and Zhang, C.-H. (2010). Rate minimaxity of the Lasso and Dantzig selector for the loss in balls. J. Mach. Learn. Res. 11, 3519–3540.

- Zhao and Yu [2006] Zhao, P. and Yu, B. (2006). On model selection consistency of Lasso. J. Mach. Learn. Res. 7, 2541–2567.

- [47] Zhang, C.-H. (2010). Nearly unbiased variable selection under minimax concave penalty. Ann. Statist. 38, 894–942.

- [48] Zhang, C.-H. and Zhang, S. (2014). Confidence intervals for low dimensional parameters in high dimensional linear models. J. R. Stat. Soc. Ser. B. Stat. Methodol. 76, 217–242.

- [49] Zheng, Z., Zhang, J., Li, Y. and Wu, Y. (2020). Partitioned approach for high-dimensional confidence intervals with large split sizes. Statistica Sinica, to appear.

- [50] Zheng, Z., Fan, Y. and Lv, J. (2014). High-dimensional thresholded regression and shrinkage effect. J. R. Stat. Soc. Ser. B. Stat. Methodol. 76, 627–649.

- [51] Zou, H. (2006). The adaptive lasso and its oracle properties. J. Amer. Statist. Assoc. 101, 1418–1429.

E-companion to “High-dimensional inference via hybrid orthogonalization”

Yang Li, Zemin Zheng, Jia Zhou and Ziwei Zhu

This supplementary material consists of two parts. Section 1 lists the key lemmas and presents the proofs for main results. Additional technical proofs for the lemmas are provided in Section 2.

1 Proofs of main results

1.1 Lemmas

The following lemmas will be used in the proofs of the main results.

Lemma 1.

Suppose that and the eigenvalues of are bounded within the interval for some constant . For a given set and any , we have the following conditional distribution

where the residual vector and is the corresponding regression coefficient vector. Then the residual matrix consisting of the residual vectors for satisfies

Lemma 2.

Suppose that the eigenvalues of a symmetric matrix are bounded within the interval for some constant . Then we have

-

1.

the eigenvalues of are also bounded within the interval ;

-

2.

the diagonal components of and are bounded within the interval ;

-

3.

the eigenvalues of any principal submatrix of and are bounded within the interval ;

-

4.

the -norms of the rows of and are bounded within the interval ;

-

5.

for any .

Lemma 3.

Consider the following linear regression model

where the design matrix X is independent of . Suppose that and the eigenvalues of are bounded within the interval [1/L, L] for some constant . When , for any satisfying and any constant , we have with probability at least , the ordinary least squares estimator exists and satisfies

Lemma 4.

Suppose that the random matrix , where the eigenvalues of are bounded within the interval for some constant . For a positive constant and a set , the cone invertibility factor and the sign-restricted cone invertibility factor are defined as

respectively, where , the cone , and the sign-restricted cone . Then for , there exist positive constants , , such that with probability at least ,

1.2 Proof of Proposition 1

We first prove the equivalence of the optimization problems. For any , , by definition we have

| (A.1) |

Since the coefficients in the set are not penalized, the Karush-Kuhn-Tucker (KKT) condition for gives

which entails

| (A.2) |

When , we have

| (A.3) |

Thus, it follows from (A.2) and (A.3) that the optimization problem (A.1) is equivalent to

Therefore, and in (8) are the optimal solutions of the same optimization problem. It yields that and are equivalent. Moreover, in view of (A.2), we also have

which entails that is equivalent to the hybrid orthogonalization vector defined in (8) due to the equivalence of and .

Second, although the penalized regression problem of is not strictly convex and may not have a unique minimizer, we continue to show that different minimizers would give the same value of . It implies that the value of the hybrid orthogonalization vector is unique. In what follows, we will prove this by contradiction.

Suppose that there are two solutions and such that . Denote by the minimum value of the optimization problem obtained by either or . Then for any , the optimization problem attains a value of at as follows,

where and denote the th elements of and , respectively.

On one hand, due to the strict convexity of the function , we get

On the other hand, it follows from the convexity of the function that

Thus, combining these two inequalities gives

which means that attains a smaller value than . This contradicts the definition of , which completes the proof.

1.3 Proof of Theorem 1

We first prove the first part of this theorem. With some simple algebra, we have

In addition, by the KKT condition and the equality (9), for any , we can get

which along with yields

We proceed to prove the second part of this theorem. With the aid of the Lyapunov’s condition (12), applying the Lyapunov’s Central Limit Theorem gives

where is any real number. In view of , the above equality can be rewritten as

which completes the proof of this theorem.

1.4 Proof of Corollary 1

The proof of this corollary is the same as that of Theorem 1, and, therefore, has been omitted.

1.5 Proof of Proposition 2

Since the design matrix X here is random instead of a fixed one as that in [48], the statistics related to X are also random variables. We will first analyze the properties of some key statistics before proving Proposition 2.

Part 1: Deviation bounds of . Under Condition 1, since for any with denoting the th entry of , applying the following tail probability bound with for the chi-squared distribution with degrees of freedom [35, inequality (93)]:

| (A.4) |

gives that

holds with probability at least . By Condition 1 that the eigenvalues of are within the interval , with the aid of Lemma 2, we have for any . In view of by Condition 2, it follows that for sufficiently large , with probability at least ,

| (A.5) |

where are two positive constants.

Therefore, we have

as well as

Combining the above two inequalities further yields

| (A.6) |

Part 2: Deviation bounds of for . Assume that the index is the th index in the set . On one hand, in view of , we can rewrite as

| (A.7) |

where is the least squares estimate of the coefficient vector of regressing on .

On the other hand, since the rows of are independent and normally distributed with for , the conditional distribution of given follows the Gaussian distribution

with . Here the -dimensional coefficient vector is the th row of with the th component removed. Based on this conditional distribution, we know that the random error vector

| (A.8) |

is independent of and follows the distribution . It is worth mentioning that can be easily deduced from Condition 1 and Lemma 2.

Now we provide the deviation of from its population counterpart . In view of Lemma 3, combining inequalities (A.7) and (A.8) above yields

Moreover, in view of (A.7) and (A.8), we also have

which together with the above inequality gives

| (A.9) | |||||

Since , the above inequality entails

| (A.10) |

In order to proceed, we will then construct the deviation bounds of . Note that . By applying (A.4) with for the chi-squared distribution with degrees of freedom, we have

holds with probability at least . This inequality together with (A.10) entails that with probability at least ,

Since and , which entails , it follows that for sufficiently large , with probability at least ,

| (A.11) |

where are two positive constants. Thus, we have

and

respectively. Combining the above two inequalities further yields

| (A.12) |

We proceed to prove Proposition 2. Since the following argument applies to any , , we drop the superscript in and for notational simplicity. Recall that the sign-restricted cone invertibility factor here is defined as

with the sign-restricted cone

In what follows, we mainly present the proof when and the same argument applies to .

First of all, by the inequality (A.9), we have

Since , it follows that for sufficiently large , with probability at least ,

where is some positive constant. Thus, we further have

| (A.13) |

We then prove the conclusions of this proposition. For any , we will first give the deviation of from its population counterpart . For any matrix and any vector , it is clear that

Based on this inequality, we have

Therefore, for any with , in view of (A.13), , and , with probability at least ,

| (A.14) |

Now we turn our attention to . By Lemma 1, we have

with . Since the eigenvalues of are bounded within the interval for some constant , we can deduce that the eigenvalues of are also bounded within the interval by Lemma 2. Thus, for any , applying the same argument as that of (A.69) in Lemma 4 yields that

holds with probability at least , where and are some positive constants.

Together with (A.14), it follows that for any ,

| (A.15) |

holds with probability at least . Moreover, since , it entails that

which implies that .

Therefore, based on this fact, together with the assumptions of and , it follows from (A.15) that

| (A.16) |

holds with probability at least , where is some constant and is defined as

Note that the cone .

1.6 Proof of Theorem 2

Under the conditions of Theorem 2, it is clear that the results in Part 1 and Part 2 of the proof of Proposition 2 are still valid. In what follows, we mainly present the proof when and the same argument applies to for a given set . Throughout the proof, , where the constant with two positive constants , and is defined in Condition 1. In addition, is some positive constant which can vary from expression to expression.

Part 1: Deviation bounds of . Let and , respectively. Recall that we have the conditional distribution

where is independent of and follows the distribution . Thus, it follows that

which can be simplified as

| (A.17) |

according to the definition of . Here and .

Denote by , , and . In what follows, we first use similar arguments as those in the proof of Theorem 3 to construct bounds for and the main difficulty here is that the predictor matrix is much more complex than a usual design matrix with i.i.d. rows. First of all, by the same argument as that in (A.30) gives

for all vectors satisfying . Based on the above inequality, if , it follows from that

which entails that

| (A.18) |

for .

In addition, if , using the same argument as that in (A.33) gives

| (A.19) |

for any , where is the th component of . In view of (A.18) and (A.19), if , we can get

| (A.20) |

for . Here the sign-restricted cone is defined as

In order to proceed, our analysis will then be conditional on the event for some constant . Note that holds on this event, which together with (A.20) implies that

for some constant . Similarly, we first clarify that the magnitude of is around a constant level. By the same argument as that in (A.35) gives

Moreover, since , it follows that

Thus, in view of , combining the above results gives

| (A.21) |

where the sign-restricted cone invertibility factor is defined as

We then derive the probability of the event . Since is independent of and , it entails that is independent of . In addition, it follows from the definition of that

Thus, together with for any on the event and follows the distribution , when , using the same argument as that in (A.38) gives

| (A.22) |

We now show the magnitude of . By Proposition 2, under the assumption that , there is some positive constant such that

holds with probability at least . Moreover, with the aid of (A.12) and (A.22), we get

Thus, combining these results with (A.21) gives

| (A.23) |

Part 2: Deviation bounds of and for . We first construct bounds for . Some simple algebra shows that

| (A.24) |

Conditional on the event , it follows that

which further yields

| (A.25) |

1.7 Proof of Theorem 3

Under the conditions of Theorem 3, it is clear that the results in Part 1 and Part 2 of the proof of Proposition 2 are still valid. In what follows, we mainly present the proof when and the same argument applies to for a given set . Throughout the proof, the regularization parameters with , which are the same as those in the proof of Theorem 2. In addition, is some positive constant which can vary from expression to expression.

Part 1: Deviation bounds of . In this part, our analysis will be conditioning on the event , where and , respectively. For clarity, we start with some additional analyses. Consider the conditional distribution

| (A.28) |

where is independent of and follows the distribution , and the regression coefficient vector . Let , , and .

Here the th component of satisfies

where and denotes the th component of . Without loss of generality, we assume that . Thus, based on the above KKT condition, it follows that

| (A.29) |

where .

In what follows, we proceed to use similar arguments as those in [45] to construct bounds for and the main difference here is that the partially penalized regression problem can be more complex. To this end, we first analyze the properties of . Denote by . Thus, it follows from (A.29) and that

for all vectors . If v satisfies , with the aid of for any , it follows that

which together with and for any further gives

Combining these results gives

| (A.30) |

for all vectors satisfying . Based on the above inequality, if , it follows from that

which entails that

| (A.31) |

for .

Moreover, in view of (A.29), with , it follows from that

| (A.32) |

for any , where the inequality can be derived by applying an argument similar to that in (A.30). With the aid of (A.32), if , it follows that

| (A.33) |

for any . In view of (A.31) and (A.33), if , we finally get

| (A.34) |

for , where the sign-restricted cone introduced in [45] is defined as

In order to proceed, our analysis will be conditioning on the event for some constant . Note that holds on this event, which together with (A.34) implies that

for . We then clarify that the magnitude of is around a constant level such that can be a constant.

In view of , it follows that

which entails that

which is a constant larger than one in view of . Combining this inequality with further gives

| (A.35) |

Moreover, since , it follows from (A.29) that

Thus, in view of , combining the above results gives

| (A.36) |

where the sign-restricted cone invertibility factor introduced in [45] is defined as

Then we will derive the probability bound of the event , which can be obtained by making use of the inequality that

| (A.37) |

for . Since is independent of and follows the distribution , it yields that

for any , which together with (A.37) gives

Note that the right hand side of the above inequality is independent of . Thus, we can obtain

Based on this inequality and taking the probability of the event into consideration, with , it follows that

| (A.38) |

We still need to know the magnitude of . Since the eigenvalues of are bounded within the interval for some constant , we can deduce that the eigenvalues of are also bounded within the interval by Lemma 2. Since can be derived by Condition 2 and , in view of Lemma 4, there are positive constants , , such that

with probability at least . Since , it follows that

which entails .

Moreover, with the aid of (A.6), (A.12), and (A.38), we know that

Thus, combining these results with (A.36) gives

| (A.39) |

Part 2: Deviation bounds of and with . We first construct bounds for . Some simple algebra shows that

| (A.40) |

In the event , it follows that

which further yields

| (A.41) |

1.8 Proof of Theorem 4

Under the conditions of Theorem 4, it is clear that the results in Part 1 and Part 2 of the proof of Proposition 2 are still valid. Denote by the event in Definition 1. By Definition 1, is independent of the data , so we treat as given. Conditional on the event , we will first analyze the properties of some key statistics before deriving the confidence intervals of . In what follows, we mainly present the proof when and the same argument applies to . Throughout the proof, is some positive constant which can vary from expression to expression.

Part 1: Deviation bounds of . We derive the deviation bounds of in two different cases that correspond to the asymptotic results in Theorems 2 and 3, respectively. In each case, the assumption on is different but we get asymptotically equivalent deviation bounds of . In both cases, the regularization parameters with , which are the same as those in the proof of Theorem 3.

Case 1: . Since and , the convergence rates established in Theorem 2 are asymptotically vanishing. Then in this case, we mainly utilize the results in Theorem 2. Since is independent of , it follows from defined in (A.17) that

In view of , applying the same argument as that in (A.5) gives

where are some positive constants. Since the right hand side of the above inequality is independent of , we further have

| (A.44) |

In addition, it follows from and that

which together with inequality (A.27) gives

| (A.45) |

In view of , the above inequality together with the inequality (A.44) yields that

| (A.46) |

Therefore, in both cases, we have with significant probability at least .

Case 2: . In view of by Definition 1, it follows from that , so that the convergence rates in Theorem 3 are asymptotically vanishing. Then in this case, we mainly utilize the asymptotic results in Theorem 3. For defined in (A.28), applying the same argument as that in (A.5) gives

| (A.47) |

where are some positive constants. By Proposition 1, we have . It yields that

which together with the inequality (A.43) gives

| (A.48) |

In view of and , the above inequality together with inequality (A.47) shows

| (A.49) |

Part 2: Deviation bounds of . First of all, it follows from the equality (9) that

| (A.50) |

where the third equality above follows from the Karush-Kuhn-Tucker (KKT) condition of the Lasso estimator, which gives

| (A.51) |

with being the th component of , for any . By (A.50), we immediately have

| (A.52) |

It remains to find the lower bound of . With the aid of (A.12), it follows that with probability at least ,

| (A.53) |

Base on (A.52) and (A.53), it follows that

| (A.54) |

We then derive the bounds of . Note that by the triangle inequality,

According to the equality (A.17), . Thus, we have , where . Since the eigenvalues of are bounded within the interval for some constant , it follows from Lemma 2 that

Based on these facts, it holds that

which further gives

Since , combining these results with (A.26) gives

Utilizing again, we get based on the bound of in the above inequality. This along with (A.46) and (A.54) gives that

Moreover, it is not difficult to see that with probability at least ,

where the last equality is due to the previously established inequalities (A.50) and (A.53) such that

We will then derive the limit of when by showing that

Since the above limit already holds in view of (A.48) in Case 1 of Part 1, we mainly prove it for Case 2 of Part 1, where we have

according to (A.45). We first derive the deviation of from . Note that is defined in (A.17). Since is independent of , it follows that

Thus, applying the same argument as that in (A.5) gives

where are two positive constants. Since the right hand side of the above inequality is independent of , we get

This together with further gives

Combining this result with (A.45) yields that

holds with probability at least .

Since and , we finally have

where the last equality holds due to the facts that and has the distribution . It follows that

holds with probability at least .

Part 3: Deviation bounds of the inference bias . Note that the inference bias here is defined as

Then we have

Similar to (A.50) and (A.51), by the KKT condition and the equality (9), for any , we can get

Recall that the inequality (A.11) gives

Thus, with the aid of (A.49) and (A.50), we have

Since on the event , the above inequality together with in Condition 3 entails that

Part 4: Confidence intervals of the coefficients .

The proof of this part is the same as that of Theorem 1, and, therefore, has been omitted.

2 Additional technical details

This part presents the proofs of the lemmas that are used in the proofs of the main theoretical results.

2.1 Proof of Lemma 1

We first consider the conditional distribution

where and . Without loss of generality, we write as

By some simple algebra, we can get

| (A.59) |

where .

On the other hand, based on the conditional distribution of given , it yields that

Then it follows from (A.59) that

2.2 Proof of Lemma 2

We will prove the conclusions of Lemma 2 successively.

1. In view of the fact that the eigenvalues of and are the inverses of each other, the first conclusion is clear.

2. Suppose that the eigenvalues of are . Then there is some orthonormal matrix such that

| (A.63) |

Thus, for any , we have

which completes the proof of this conclusion.

3. By the Cauchy’s interlace theorem for eigenvalues in [16, Theorem 1], this conclusion is also clear.

4. Based on (A.63), we have

| (A.67) |

Denote by the -norm of the th row of . Since is symmetric, is equal to the th diagonal component of for any .

In view of (A.67), we know that the eigenvalues of the symmetric matrix are bounded within the interval . Thus, the second conclusion of this lemma gives that is bounded within the interval , which yields that is bounded within the interval . It completes the proof of this conclusion.

2.3 Proof of Lemma 3

We first prove that with significant probability, is invertible so that the ordinary least squares estimator exists. Clearly, . Applying [8, Theorem 5.39], we can conclude that for some positive constants and , with probability at least , it holds that

where and are the smallest and the largest singular values of , respectively. Since , it follows that for sufficiently large , with probability at least , will have full column rank.

Moreover, since is positive definite, we can deduce that with probability at least , X is of full column rank, so that is positive definite and thus invertible. For any satisfying and any constant , we have

which entails . Thus, we can claim that is positive definite and invertible with probability at least .

We then show the prediction error bound of . Since X is independent of , by the properties of the ordinary least squares estimator, we have

Applying the tail probability bound of the chi-squared distribution in (A.4) with gives

Since the right hand side of the above inequality is independent of X, it follows that

which completes the proof of Lemma 3.

2.4 Proof of Lemma 4

Since , it is immediate that . To show the constant lower bound, we first establish a connection between and the restricted eigenvalues (RE), which are defined as

for a positive integer and the cone of the same definition as that in Lemma 4. By [45, Proposition 5], we have

Since , it follows that

We then prove a constant lower bound for with significant probability. First, it follows from [33, Theorem 1] that for any , there exist positive constants and so that

holds with probability at least , where . On the other hand, for , it follows from the definition of that

In addition, we have , where is the smallest eigenvalue of . Thus, it follows that

| (A.69) |

holds with probability at least . Since the eigenvalues of are bounded within the interval , both and are bounded from above and below by some positive constants according to Lemma 2.

Therefore, when , it follows from the definition of that there exists some positive constant such that for sufficiently large ,

holds with probability at least . It completes the proof of Lemma 4.