Callable convertible bonds under liquidity constraints

Abstract

This paper provides a complete solution to the callable convertible bond studied in [Liang and Sun, Dynkin games with Poisson random intervention times, SIAM Journal on Control and Optimization, 57(4): 2962–2991, 2019], and corrects an error in Proposition 6.2 of that paper. The callable convertible bond is an example of a Dynkin game, but falls outside the standard paradigm since the payoffs do not depend in an ordered way upon which agent stops the game. We show how to deal with this non-ordered situation by introducing a new technique which may of interest in its own right, and then apply it to the bond problem.

keywords:

Constrained Dynkin game, callable convertible bond, order condition, saddle point.AMS:

60G40, 91A05, 91G80, 93E20.1 Introduction

The holder of a perpetual bond receives a coupon from the firm indefinitely. If the bond is convertible, the bondholder has the additional opportunity to exchange the bond for a fixed number of units of the firm’s stock at a moment of the bondholder’s choosing. If the convertible bond is callable then the firm has the option to call the bond on payment of a fixed surrender price to the bondholder. The problem of pricing the callable convertible bond involves finding the value of the bond and the optimal stopping rules for conversion (by the bondholder) and call (by the firm).

The callable convertible bond is an example of a Dynkin game. A Dynkin game [3] is a game played by two agents, each of whom chooses a stopping time. The game involves a payment from the second player to the first. If the first player is first to stop (at ) then the payment is ; if the second player is first to stop (at ) then the payment is ; under a tie () then the payment is . Here, , and are adapted stochastic processes. For stopping rules and , the expected value of the payment is . The objective of Player 1 is to maximise whilst the objective of Player 2 is to minimise and this leads to two problem values and (respectively the upper and lower value) depending on whether we take the perspective of the first or second player. Trivially : of great importance is whether in which case the Dynkin game is said to have a value . See [6] and [10] for general treatments using the backward stochastic differential equation approach and the Markovian setup, respectively, and [13] for an extensive survey with applications to financial game options. One of the main ideas is to find a saddle point, i.e. a pair of stopping times such that (i) for all and (ii) for all ; then it is straightforward to show that the game has a value and are optimal for Player 2 and Player 1 respectively.

Historically, the relative order of the payoff processes , and in a Dynkin game has been important in proving that the game has a value. When , [3] proved that a Dynkin game has a value under the Mokobodzki condition which states that there exist two supermartingales whose difference lies between and . Such a condition was later relaxed in [16], see Kifer [13, Theorem 1] for a statement of the result under the order condition and an integrability condition. Subsequently, the order condition was further relaxed in [14, 19, 23] by extending the class of stopping strategies to randomized stopping times. [14] shows the game has a value under fairly general conditions on the various payoffs, provided that agents are allowed to use randomised strategies. In particular the players can use these strategies to ‘hide’ their stopping time from the opposing player. One important result is that the game is always terminated (i.e. at least one player chooses to stop) at or before the first moment that .

In general, the information structure is a crucial element in Dynkin games. See, for example, [7, 8] for the treatment of asymmetric/incomplete information and [1] for a robust version of a Dynkin game in which the players are ambiguous about their probability model. Moving beyond the classical set-up in a different direction, Liang and Sun [18] introduced a constrained Dynkin game in which the players’ stopping strategies are constrained to be event times of an independent Poisson process. The constrained Dynkin game is an extension of the Dynkin game in the same way that the constrained optimal stopping problem of [9] is an extension of a classical optimal stopping problem. When the problem involves a time-homogeneous payoff, a time-homogeneous diffusion process and an infinite time-horizon, the use of a Poisson process to determine the set of possible stopping times maximises the tractability of the constrained problem. Then under the order condition on the payoffs [18] prove existence of a constrained game value.

The Dynkin game formulation of the perpetual callable convertible bond was first introduced in [20] (see also [21] for the finite horizon counterpart). They reduced the problem from a Dynkin game to an optimal stopping problem, and discussed when call precedes conversion and vice versa. A key element of the problem specification in [20] is that the firm’s stock price is calculated endogenously. Extensions of this convertible bond model include, for example, [2] which considered the problem of the decomposition of a convertible bond into a bond component and an option component, [5] which studied the convertible bond with call protection, and [4] which added the tax benefit and bankruptcy cost to the convertible bond.

In contrast to the abovementioned works on convertible bonds, [18] introduced a constraint on the players’ stopping strategies by assuming that both bondholder and firm may only stop at times which are event times of an independent Poisson process. The idea is that the existence of liquidity constraints may restrict the players’ abilities to stop at arbitrary stopping times. [18] assumes that the firm’s share price is exogeneous, and then the analysis is an extension of [9], [11], [12], [15] and [17] which study optimal stopping problems under a liquidity constraint and their applications. In the same way that the classical callable convertible problem is related to a Dynkin game, the problem with liquidity constraints can be related to a Dynkin game under a condition that the stopping times lie in a restricted set.

The callable convertible bond was studied in [18] but, unfortunately, one of the calculations in Proposition 6.2 of [18] is incorrect. [18] first reduced the original problem from the state space to with to be endogenously determined, and argued that the order condition would hold in the domain , whereas the game would stop at the earliest Poisson arrival time after the firm’s stock price exceeds . However, the threshold in Proposition 6.2 of [18] was incorrectly calculated, making the remaining analysis for the optimal stopping strategies of the convertible bond in [18] void. It turns out cannot be endogenously determined because the game will not automatically stop after exceeds . One way to correct this error is to enforce this stopping condition by assuming is exogenously given (e.g. ) and introducing a forced conversion condition: conversion is assumed to automatically occur at the earliest Poisson arrival time after the stock price process first exceeds . See [22, Chapter 2.5] for further details. However, one significant drawback of the above modification is that there is a possibility that the stock price drops below any small number at the moment when the forced conversion is taking place, that is . This is obviously against the interest of both the firm and the bondholder as neither of them would have incentive to stop in such a situation. Moreover, the new convertible bond (with forced conversion) is different from the original convertible bond that we are interested in.

One of the difficulties in the callable convertible bond problem is that, although it can be recast in the standard form of a Dynkin game, the upper payoff process does not necessarily dominate the lower payoff process . As a result the general existence results for Dynkin games (see [16] or [13]) and especially the existence theorem in the Poisson (constrained) case ([18, Theorem 2.3]) do not apply. One possibility is to try to remove the order condition in the Poisson case as in [14, 19, 23], but at best that would give us an existence result, and we would like an explicit solution. Instead therefore, we take a different approach. The idea is to replace the original problem with a modified problem for which the order condition is satisfied (in both the standard case with unconstrained stopping times, and the illiquid case where stopping times are constrained to be event times of a Poisson process) and to which the theory applies. We then use a saddle-point argument to find the (explicit) solution to this modified problem, and a further (general) argument to show that this saddle-point is also a saddle-point for the original (constrained) perpetual callable convertible bond problem.

2 The extended saddle point result

Recall the classical formulation of a Dynkin game: for , , and

| (1) |

define the upper and lower values

where is a set of stopping times. If then we say the game has a value where .

The Dynkin game was analysed in [3] and [16] (amongst others, see [13] for a comprehensive survey). Often this analysis is under a condition that the payoffs are ordered: , and when this condition fails there are simple examples which show that the game may not have a value.

Example 1.

Suppose that and . Then, . It is clear that , as, given , Player 1 who maximizes can choose a stopping strategy (or more generally any stopping time for which on and on .) On the other hand, , as Player 2 who minimizes can choose a stopping strategy with on and on .

Notwithstanding the above example, in any given problem the pragmatic approach to finding a solution is to find a saddle point, i.e. to find a pair such that for all . Then,

Since trivially , we conclude that and the game has a value.

Note that the existence of a saddle-point gives a direct proof of the existence of a game value, but leaves us no nearer to finding the game value unless we can identify the optimisers and . Nonetheless our first key result is an extension of this argument.

Proposition 2.

Suppose , , and let be a set of stopping times.

Suppose that there exists a pair of stopping times such that

(i) ;

(ii) for any ;

(iii) for any .

Then, and the game for payoff triple and stopping time set has a value. Moreover is a saddle point for the game with payoffs .

Proof.

Since remains constant throughout, to economise on notation we omit the label . It follows from monotonicity of the payoffs and (i)-(iii) that

and

Hence, is indeed a saddle-point for the game with payoffs . ∎

Remark 3.

Under the hypotheses of Proposition 2, is also a saddle-point for the games with payoffs and and these games also have value . Indeed, We have

which, when combined with (ii) of Proposition 2 gives the desired result for the game with payoff triple .

Conversely, , and the corresponding results follow for .

For general triples , and we cannot expect to find stopping times satisfying the conditions of the proposition. But, the following special case will prove to be exactly what we need for the callable convertible bond. The key point is that it translates a problem where the ordering condition is violated to a problem where it is satisfied, and then the general theory of [18] can be applied. In particular, the existence theorem for constrained games ([18, Theorem 2.3]) is valid for problems where the ordering constraint is satisfied.

Recall is the process given by .

Corollary 4.

Suppose that there exists a pair of stopping times such that

(i) ;

(ii) for any ;

(iii) for any .

Then and the game for payoff triple and (constrained) stopping time set has a value .

Proof.

Take , , in Proposition 2. ∎

Example 5.

Suppose that and . (Note the different treatment of when compared with Example 1.) Then, . Although is not satisfied, it is still possible to find a saddlepoint in the sense of Corollary 4. Indeed, is a saddle point. To see this, for , . It is clear that

so the extended saddle point conditions in Corollary 4 are satisfied. Hence the game has a value, and that value is 1.

3 The callable convertible bond: problem specification

From the bondholder’s viewpoint, the discounted payoff of a perpetual callable convertible bond issued by a firm has the form

| (2) |

Here represents the stock price process starting from . The firm issues convertible bonds as perpetuities with a constant coupon rate . The investor then purchases a share of this convertible bond at initial time . By holding the convertible bond, the investor will continuously receive the coupon rate from the firm until the contract is terminated: (i) if first, (i.e. ) the firm calls the bond at some stopping time , the bondholder will receive a pre-specified surrender price at time ; (ii) if first (i.e. ) the investor chooses to convert their bond at some stopping time , the bondholder will obtain at time from converting their bond to shares of firm’s stock with a pre-specified conversion rate . If bondholder and firm choose to stop the contract simultaneously (i.e. ) then the bondholders act takes priority and the bondholder will obtain .

Note that can be rewritten using integration by parts as

This is exactly of the form in (1) with and . Note that we do not have ; in particular if then . Then is given by

| (3) |

We work under the following assumption on the stock price process :

Standing Assumption 6.

The price process of the firm’s stock follows

where the constants (with ) represent the risk-free interest rate, the dividend rate and the stock’s volatility, and is a Brownian motion.

Following [18] (and also [9] and others) the liquidity constraint is modelled as follows. Instead of allowing and to be any stopping times we assume that , where

Herein, is the filtration generated by the underlying Brownian motion (with its natural filtration ) and an exogenous Poisson process (with its natural filtration and jump times ), i.e. . Then, in summary, we work on a filtered probability space which supports a Brownian motion driving the price process and a Poisson process, and is the set of -valued stopping times.

It turns out that it is useful to consider the (upper and lower) value of the callable convertible bond as functions of the initial value of the stock price. Then, with the superscript denoting the rate of the Poisson process we define the upper and lower value of the convertible bond with liquidity constraint via

| (4) | |||||

| (5) |

where is as given in (3). In the case where there are no liquidity constraints on the stopping times, the superscript is omitted. Our goal is first to show that as functions of and hence that the game value is well defined, and second to give an explicit form for .

A key element of the financial specification of the callable convertible bond is that if the firm calls at the same time as the bondholder then the bondholder’s actions take priority. In particular, . A second key element is that if the firm calls then the bondholder is given a final opportunity to preempt the call, and to convert. Effectively then, the payoff when the firm calls is given by (and not ). This suggests that we should consider the problem with modified payoffs given by , for which the ordering condition holds. We aim to find a saddle-point for this modified problem, and then to use Corollary 4 to deduce that it provides a solution to the original problem.

For future reference, let and be the two characteristic roots of the differential operator

| (6) |

That is, are the roots of with . For simplicity, we also write , , and .

Lemma 7.

For and we have . Then, if , and (and ). Conversely, if then and .

Further, we have and hence .

Proof.

We have . If then this is immediately positive; if then it is positive since . The final result follows similarly. ∎

4 Two auxiliary optimal stopping problems

In this section, we solve the optimal stopping problems of the bondholder and the firm separately. They will serve as the building blocks for the construction of the optimal stopping strategies for the convertible bond in the next section.

4.1 Optimal stopping of the bondholder

Consider the following optimal stopping problem

| (7) |

This is the problem facing the bondholder in the absence of any callable feature for the firm. We aim to find to maximize the above expected discounted payoff of the bondholder. For later use, we also introduce an equivalent formulation, under which the bondholder finds an optimal number of Poisson jumps, i.e.

| (8) |

where

Define by

| (9) |

It will turn out that is a critical threshold both in the problem under consideration, and for the callable convertible bond. The subscripts and are intended to convey that the quantity arises in the convertible bond problem under a liquidity constraint based on the Poisson process with rate .

Lemma 8.

Assume that and . Let be given as in (9). Then and .

Proof.

Moreover, is equivalent to . If this is immediate. Otherwise, it follows from Lemma 7.

Finally, after some algebra it can be shown that is equivalent to

Given the signs of and , it is sufficient to argue that . But if this is immediate, and if then since , we have . ∎

Lemma 9.

Suppose that and . Then, the value function has the explicit expression

| (10) |

The optimal stopping time for (7) is given by with defined as

| (11) |

Proof.

Following along similar arguments in Theorem 1 of [9], it can be shown that the value function satisfies the recursive equation

| (12) | |||||

which, in turn, implies that is a solution of the HJB equation

(Moreover, is the solution which is bounded at zero, and of linear growth at infinity).

From the structure of the stopping problem, we expect that there is a continuation region with and a stopping region with . On , solves and on , it solves , together with boundary conditions that and is of linear growth. In addition we expect value matching and smooth fit at (and that ).

We find that with replaced by the optimal threshold , on ,

| (13) |

and on

| (14) |

Furthermore, first order smooth fit gives that

This can be solved to give

Given the lower bounds on of Lemma 8, it is clear from (13), (14) and the smooth fit at that is increasing and convex in . Then, since , and it follows that crosses the line exactly once on . In particular, on and on . Hence, .

Finally, consider given by

Using arguments similar to those in Theorem 1 of [9] it can be shown that is a -supermartingale, and a -martingale when is replaced by . In turn, for any ,

Substituting the above inequality into the recursive equation (12) yields that

The above inequality will become an equality with . This proves the optimality of . ∎

Lemma 9 implies that the whole region can be divided into the continuation region and the stopping region . Furthermore, we have the following properties of the value function and the optimal stopping time .

Corollary 10.

Suppose that and and that the surrender price satisfies . Then, the value function satisfies for .

Proof.

Since is increasing in , we have for . On the other hand, by the value matching at , we have . The conclusion then follows from the assumption . ∎

Proposition 11.

The value function satisfies the dynamic programming equation

| (15) |

for any with .

Proof.

First, integration by parts yields

Next, for any stopping time with , by conditioning on , we have

Then, the dynamic programming equation (15) follows since . ∎

4.2 Optimal stopping of the firm

For , consider the following optimal stopping problem

| (16) |

where is as defined in (11). Taking the perspective of the firm we aim to find to minimize the modified expected discounted payoff of the bondholder, where the bondholder is not allowed to make any stopping decisions, except that at the bondholder may choose to preempt and to receive shares in preference to a cash payment. In line with (8), the optimal stopping problem (16) also has an equivalent formulation

| (17) |

where we used the stopping condition that the bond is forced to stop at , and that if .

Lemma 12.

Suppose that , and . Then, the value function has the explicit expression

| (18) |

where the unknowns , , and the optimal threshold are given by

| (19) | |||||

| (20) | |||||

| (21) | |||||

| (22) |

The optimal threshold for this problem will turn out to be an optimal threshold for the callable convertible bond with liquidity constraint (for moderate values of surrender value ) which justifies the subscripts and .

Proof.

Similar to Lemma 9, it can be shown that the value function satisfies the recursive equation

| (23) | |||||

which in turn implies that is a solution of the HJB equation

Moreover, is bounded at zero and of linear growth.

To solve the above equation, we first consider . For small , we expect that the firm will continue, so and solves subject to . For moderate , we expect that the firm will choose to call, so and solves . Next, we consider . The firm will be forced to stop in this situation, so solves subject to being of linear growth.

The boundary between small and moderate occurs at where . The boundary between moderate and large occurs at where . We expect value matching and first order smooth fit at both boundaries, which lead to the expression (18) and (writing ), the four algebraic equations

| (24) | |||||

| (25) | |||||

| (26) | |||||

| (27) |

We next solve (24)-(27). Multiplying (25) by eliminates , and then (24) and the modified (25) can be solved to give expressions for and in (19) and (20), respectively. Note that since we have and by Lemma 7. (26) and (27) can then be solved for and . Indeed, we have

We can use the last equality to find given in (21), and then this gives in (22).

We are left to show , on and on . The first statement will be proved in Proposition 13 below. The second and third statements follow from the increasing property of in and the value matching condition . (In particular, it is easily checked that on , where for the second statement we use that and . Finally, on we have that, irrespective of the sign , is monotonic in , since the values of the derivative are positive at both ends of the interval, it must be positive throughout.) The three statements then imply that

Finally, note that

is a -submartingale, and a -martingale with replaced by . The proof is similar to the one in Lemma 9 (see also Theorem 1 in [9]), and is therefore omitted. In turn, for any such that , since , by the submartingale property we have

Substituting the above inequality into the recursive equation (23) yields that

The above inequality turns out to be an equality with , which shows the optimality of . ∎

Lemma 12 implies that the whole region can be divided into the continuation region and the stopping region . The next proposition provides a relationship between the optimal thresholds in Lemma 9 and in Lemma 12, which also completes the proof of Lemma 12.

Proposition 13.

Suppose that , and . Then, if and only if .

Proof.

Proposition 14.

Suppose that , and . Then, the value function satisfies for .

Proof.

Note that is increasing in , and , so it is sufficient to show that does not cross on . In turn, this will follow if at any crossing point — then may cross down below but cannot cross back above.

Let be such that . Then and

The last inequality in the above follows from Lemma 8 since we have . This proves the claim.∎

To conclude this section, we provide the dynamic programming equation for the optimal stopping problem (16). The proof follows along similar arguments in Proposition 11 and is thus omitted.

Proposition 15.

The value function satisfies the dynamic programming equation

| (28) |

for any with .

5 Pricing the callable convertible bond

We divide our analysis into three cases according to the value of the surrender price . Observe that is the value of the corresponding perpetuity if the bond is never converted nor called. Define and by

| (29) |

and

| (30) |

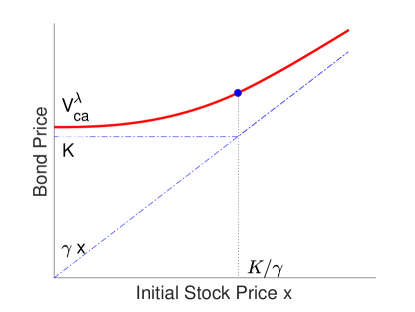

5.1 Case

In this case, since the surrender price is smaller than the corresponding perpetuity value , the firm will choose to call at the first opportunity. On the other hand, the bondholder will preempt the firm’s stopping action by converting the bond if .

Theorem 16.

Proof.

The signs of and follow from Lemma 7. For the main result it is sufficient to verify the conditions (i)-(iii) in Corollary 4 to show is a saddle point for in (4)-(5) where and are as in (29) and (30) respectively.

First, we apply integration by parts to to obtain

where to save space we write . By the definitions of , on the event . Hence,

which verifies (i). To show (ii), for any , we have

Then, (ii) follows by observing that

| (32) |

For (iii), we have, for any ,

Since and , we further obtain

which verifies (iii).

To calculate the game value in (32), we may use the exponential distribution of to rewrite (32) as

which, in turn, implies that is the solution of the following HJB equation

such that is bounded at zero, and of linear growth at infinity. It is immediate that, on

and on

where and are constants to be determined. Value matching and first order smooth fit at give that and solve

which yield the expressions of and in the theorem, and we conclude. ∎

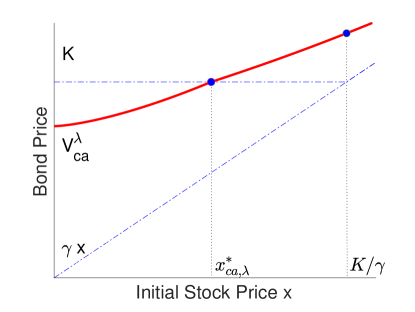

5.2 Case

In this case, since the surrender price is larger than the value of the perpetuity, the firm will not seek to call the bond when the stock price is low; nor will the bondholder seek to convert in this case. Conversely, when the stock price is large both the firm will seek to call, and the bondholder will seek to convert, with the bondholder’s action taking precedence. Finally, when the stock price is moderate the firm will seek to call. The bondholder would prefer that the bond is not called and would not choose to convert of their own volition, but, given that the bond is being called, may elect to convert.

In particular, there are no circumstances where the bondholder wants to convert and the firm does not want to call. Hence the game option reduces to an optimal stopping problem for the firm (subject only to the fact that the bondholder may choose to pre-empt the call to receive rather than .) The resulting optimal stopping problem is precisely the problem we studied in Section 4.2. Then is the candidate optimal stopping time of the firm. Moreover, Proposition 14 implies that in the continuation region (for the firm), the value function dominates the conversion payoff . This confirms that indeed, there is no incentive for the bondholder to convert even if they were given such an opportunity. Instead, if we define another stopping time , then since we have that

| (33) |

The idea is to show in that is a saddle point for in (4)-(5).

Theorem 17.

Proof.

Recall the definitions of and from (29) and (30). We want to show that (i)-(iii) of Corollary 4 are satisfied.

By Proposition 13, we know that . This means . In turn, the definition of implies that

Moreover, integration by parts yields

| (34) | |||||

where we used Lemma 12 in the last equality. This shows condition (i) and that is the game value.

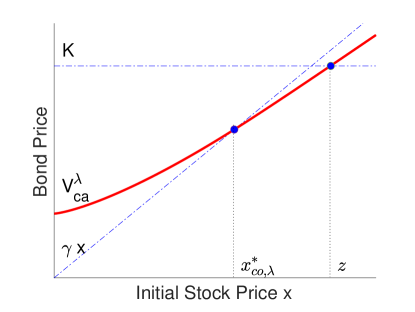

5.3 Case

In this case, since the surrender price is very high, the firm will postpone their call time to avoid paying unless the stock price is very high. On the other hand, in the region where the firm does want to call, the bondholder already wants to convert, and therefore, the callable feature has no impact. This means that the game problem for a callable convertible bond reduces to an optimal stopping problem without the callable feature, i.e. the first auxiliary problem we studied in Section 4.

Recall that in Section 4.1 we defined the (optimal) stopping time . Now define another stopping time where the level is such that . Since , is in the stopping region, meaning that . In turn, , and

| (35) |

Theorem 18.

Proof.

By (35), we know that . In turn, Lemma 9 implies that

| (36) | |||||

This shows condition (i) and that is the game value.

6 Comparison with convertible bonds with forced conversion/no liquidity constraints

In this section, we compare our results with two situations. The first one is with a forced conversion condition, and the second one is without liquidity constraints.

6.1 Comparison with convertible bonds with forced conversion

In [22], a forced conversion condition is introduced, i.e. the firm will force a conversion of the convertible bond to shares of stock at the earliest Poisson arrival time after the stock price exceeds a predetermined threshold . By introducing the triggering and conversion times and , the expected discounted payoff of the convertible bond at can be calculated as

By introducing such a forced conversion condition, it is sufficient to solve the problem for , so the state space reduces from to for which the upper payoff always dominates the lower payoff (so the existence theorem of constrained Dynkin games in [18] applies). See Chapter 2.5 in [22] for further details.

Although the forced conversion guarantees the order condition , its drawback is significant: there is a possibility that the stock price drops below any small number when the forced conversion is taking place, i.e. . Neither the firm nor the bondholder have incentive to stop in such a situation. In particular, the problem with forced conversion studied in [18] and [22] is not the true callable convertible bond problem as studied in this paper.

In the following table, we make a comparison between our results and the convertible bond with forced conversion in [22]. Note that ‘small’, ‘moderate’ and ‘large’ values of refer to different reference points in the two situations. They are and without forced conversion, and and with forced conversion.

| Without forced conversion | With forced conversion | |

| State space | ||

| Small | ||

| Call precedes conversion | Call precedes conversion | |

| Moderate | ||

| Call precedes conversion | Call precedes conversion | |

| Large | ||

| Conversion precedes call | Conversion precedes call |

6.2 Comparison with convertible bonds without liquidity constraints

Finally, we investigate the asymptotic behavior of the optimal stopping strategies and the convertible bond values when . Intuitively, they will converge to their counterparts without liquidity constraints. Let us first recall a result from [24] (see also Proposition 7.1 in [18]) about the convertible bond without liquidity constrains.

Recall that is the positive root of with and .

Proposition 19.

Suppose that , and that the admissible stopping times (of the firm) and (of the bondholder) are chosen as -stopping times. Let

| (37) |

Then,

(i) Case : and the convertible bond value is given as .

(ii) Case : and the convertible bond value is given as

(iii) Case : and the convertible bond value is given as

We conclude the paper with an asymptotic analysis for the case where the Poisson intensity increases to .

Proposition 20.

When , , , and . Hence, the convertible bond with liquidity constraints will converge to its counterpart without liquidity constraints when .

Proof.

We prove the claims using Theorems 16-18 and Proportion 19. From the definitions of and as roots of quadratics we have that as , , , and . Moreover, from the expression for in (9) and (37) we have , and from Lemma 8, .

For Case , from the properties of and above we have . Hence, for and for , which means

References

- [1] E. Bayraktar and S. Yao. On the robust Dynkin game. The Annals of Applied Probability, 27(3): 1702–1755, 2017.

- [2] T. R. Bielecki, S. Crépey, M. Jeanblanc, and M. Rutkowski. Arbitrage pricing of defaultable game options with applications to convertible bonds. Quantitative Finance, 8(8):795–810, 2008.

- [3] J. Bismut. Sur un probleme de Dynkin. Probability Theory and Related Fields, 39(1):31–53, 1977.

- [4] N. Chen, M. Dai, and X. Wan. A nonzero-sum game approach to convertible bonds: Tax benefit, bankruptcy cost, and early/late calls. Mathematical Finance, 23(1):57–93, 2013.

- [5] S. Crépey and A. Rahal. Pricing convertible bonds with call protection. The Journal of Computational Finance, 15(2):37, 2011.

- [6] J. Cvitanić and I. Karatzas. Backward stochastic differential equations with reflection and Dynkin games. The Annals of Probability, 24(4):2024–2056, 1996.

- [7] T. De Angelis, E. Ekström, and K. Glover. Dynkin games with incomplete and asymmetric information. Mathematics of Operations Research, to appear.

- [8] T. De Angelis, N. Merkulov, and J. Palczewski. On the value of non-Markovian Dynkin games with partial and asymmetric information. The Annals of Applied Probability, to appear.

- [9] P. Dupuis and H. Wang. Optimal stopping with random intervention times. Advances in Applied probability, 34(1):141–157, 2002.

- [10] E. Esktröm and G. Peskir. Optimal stopping games for Markov processes. SIAM Journal on Control and Optimization, 47, 684–702, 2008.

- [11] D. Hobson. The shape of the value function under Poisson optimal stopping. Stochastic Processes and their Applications, 133: 229–246, 2021.

- [12] D. Hobson and M. Zeng. Constrained optimal stopping, liquidity and effort. Stochastic Processes and their Applications, https://doi.org/10.1016/j.spa.2019.10.010, 2019.

- [13] Y. Kifer. Dynkin’s Games and Israeli Options. International Scholarly Research Notices, 2013: 1–17, 2013.

- [14] R. Laraki and E. Solan. The value of zero-sum stopping games in continuous time. SIAM Journal on Control and Optimization, 43(5):1913–1922, 2005.

- [15] J. Lempa. Optimal stopping with information constraint. Applied Mathematics & Optimization, 66(2):147–173, 2012.

- [16] J. P. Lepeltier and E. Maingueneau. Le jeu de Dynkin en théorie générale sans l’hypothèse de Mokobodski. Stochastics: An International Journal of Probability and Stochastic Processes, 13(1-2):25–44, 1984.

- [17] G. Liang. Stochastic control representations for penalized backward stochastic differential equations. SIAM Journal on Control and Optimization, 53(3):1440–1463, 2015.

- [18] G. Liang and H. Sun. Dynkin games with Poisson random intervention times. SIAM Journal on Control and Optimization, 57(4): 2962–2991, 2019.

- [19] D. Rosenberg, E. Solan, and N. Vieille. Stopping games with randomized strategies. Probability Theory and Related Fields, 119(3):433–451, 2001.

- [20] M. Sîrbu, I. Pikovsky, and S. E. Shreve. Perpetual convertible bonds. SIAM Journal on Control and Optimization, 43(1):58–85, 2004.

- [21] M. Sîrbu and S. E. Shreve. A two-person game for pricing convertible bonds. SIAM Journal on Control and Optimization, 45(4), 1508–1539, 2006.

- [22] H. Sun, Constrained optimal stopping games. PhD thesis, University of Warwick, 2021.

- [23] N. Touzi and N. Vieille. Continuous-time dynkin games with mixed strategies. SIAM Journal on Control and Optimization, 41(4):1073–1088, 2002.

- [24] H. Yan, F. Yi, Z. Yang, and G. Liang. Dynkin game of convertible bonds and their optimal strategy. Journal of Mathematical Analysis and Applications, 426(1):64–88, 2015.