A unified theory for ARMA models with

varying coefficients: One solution fits all111The proofs of the statements are included in the appendices of this paper and they are available to the reader upon request.

Abstract

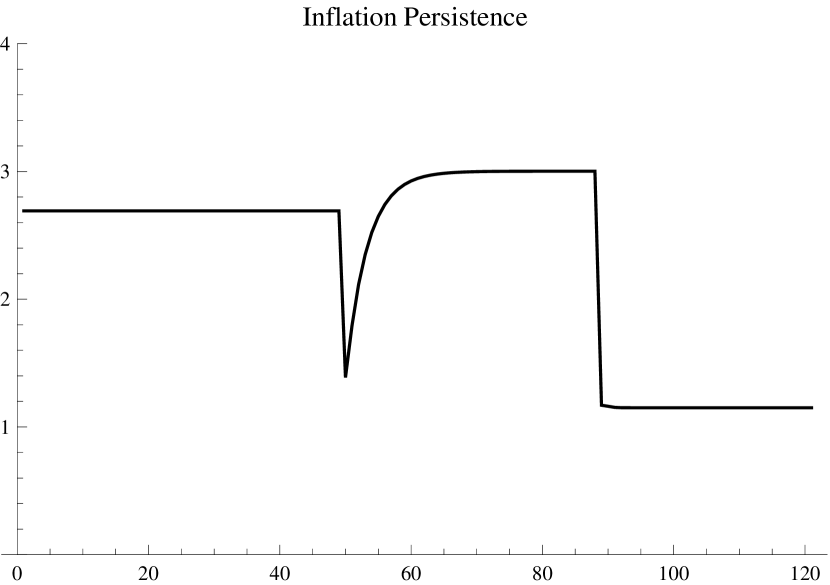

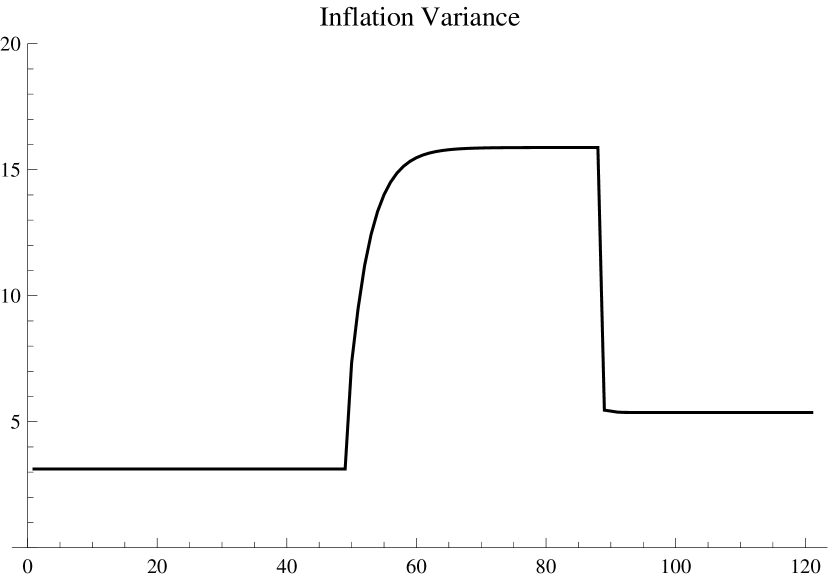

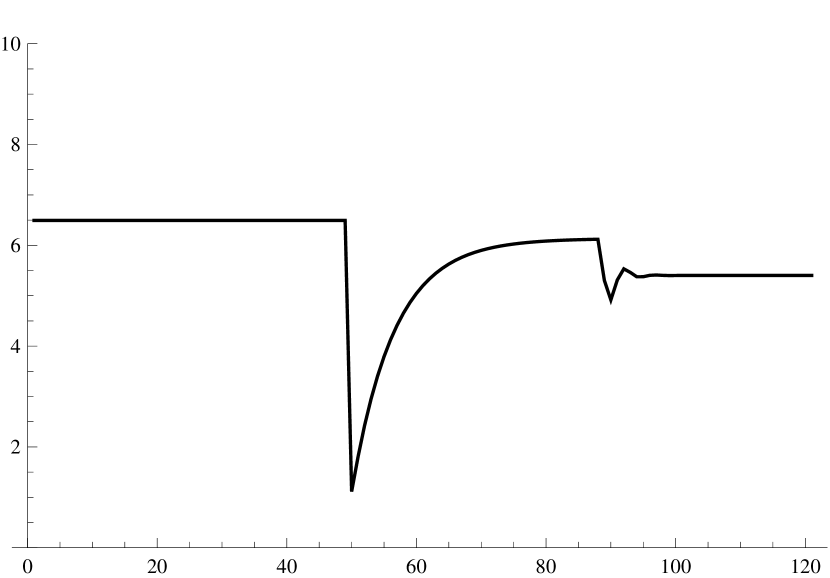

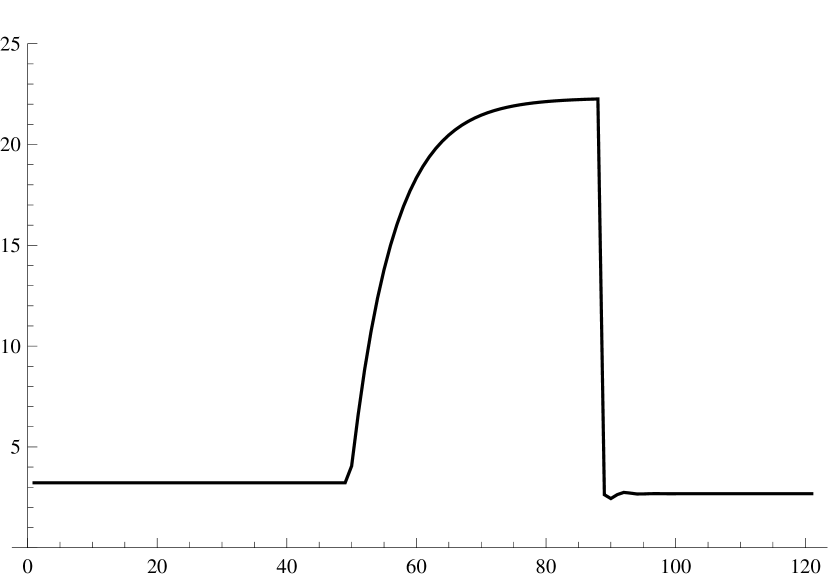

For the large family of ARMA models with variable coefficients (TV-ARMA), either deterministic or stochastic, we provide an explicit and computationally tractable representation based on the general solution of the associated linear difference equation. Analogous representations are established for the fundamental properties of such processes, including the Wold-Cramér decomposition and their covariance structure as well as explicit optimal linear forecasts based on a finite set of past observations. These results are grounded on the principal determinant, that is a banded Hessenbergian representation of a restriction of the Green function involved in the solution of the linear difference equation associated with TV-ARMA models, built up solely of the autoregressive coefficients of the model. The convergence properties of the model are a consequence of the absolute summability of the aforementioned Hessenbergian representation, which is in line with the asymptotic stability and efficiency of such processes. The invertibility of the model is also a consequence of an analogous condition, but now the Green function is built up of the moving average coefficients. The structural asymmetry between constant and deterministically time-varying coefficient models, that is the backward and forward asymptotic efficiency differ in an essential manner, is formally demonstrated. An alternative approach to the Hessenbergian solution representation is described by an equivalent procedure for manipulating time-varying polynomials. The practical significance of the theoretical results in this work is illustrated with an application to U.S. inflation data. The main finding is that inflation persistence increased after 1976, whereas from 1986 onwards the persistence declines and stabilizes to even lower levels than the pre-1976 period.

Keywords: ARMA process, Asymptotic efficiency, Asymptotic stability, Green’s

function, Hessenbergians, Invertibility, Skew multiplication, Structural breaks, time-varying persistence, Variable coefficients, Wold decomposition.

JEL Classification: C13, C22, C32, E17, E31, E58.

▷We would like to thank S. Dafnos, who contributed to the interpretation and synthesis of the work, which led to an earlier version of the paper, and P. Koutroumpis, who provided the empirical Section for this earlier version of the paper.

We gratefully acknowledge the helpful conversations we had with L. Giraitis, and G. Kapetanios in the preparation of the paper. We would also like to thank R. Baillie, M. Brennan, L. Bauwens, A. Demos, W. Distaso, D. van Dijk, C. Francq, P. Fryzlewicz, E. Guerre, C. Gourieroux, M. Guidolin, A. Harvey, C. Hommes, E. Kyriazidou, S. Leybourne, P. Marsh, P. Minford, C. Robotti, W. Semmler, R. Smith, T. Teräsvirta, E. Tzavalis, P. Zaffaroni, and J-M Zakoian for suggestions and comments which greatly improved many aspects of the paper. We are grateful to seminar participants at Aarhus University (Creates), CREST, London School of Economics (Department of Statistics), Erasmus University (Econometric Institute), Imperial College (Tanaka Business School), Queen Mary University of London (School of Economics and Finance), University of Essex (Business School), BI Norwegian Business School, University of Copenhagen (Department of Economics), Birkbeck College, University of London (Department of Economics, Mathematics and Statistics), University of Nottingham (Granger Centre for Time Series Econometrics), University of Manchester (Business School), Cardiff University (Business School), Lancaster University (Management School), University of Reading (ICMA Centre), King’s College London (Business School), University of Turin (Department of Economics and Statistics), Athens University of Economics and Business (Department of Economics) and University of Piraeus (Department of Economics).

We have also benefited from the comments given by participants at the: SNDE 27th, 26th, 25th, 24th, 22nd and 21st Annual Symposiums (Federal Reserve Bank of Dallas, March 2019; Keio University, Tokyo, March 2018; ESSEC Business School, Paris, March 2017; University of Alabama, March 2016; The City University of New York, April 2014; University of Milano-Bicocca, March 2013, respectively), 5th and 4th AMEF Conferences (University of Macedonia, April 2019, 2018, respectively), 2nd DSSR Conference (University of Milano-Bicocca, February 2019), 5th, 3rd, 2nd and 1st IAAE Conferences (University of Montreal, June 2018; University of Milano-Bicocca, June 2016; University of Macedonia, Greece, June 2015; Queen Mary University of London, June 2014, respectively), 12th, 11th, 8th and 7th CFE Conferences (University of Pisa, December 2018, December 2014; Senate House, University of London, December 2013, December 2017), 17th, 13th and 12th CRETE Conferences (Tinos, Crete and Naxos, July 2018, 2014 and 2013, respectively), SEM Conference (MIT, Boston, July 2017), 69th and 67th ESEM European Meetings (University of Geneva, August 2016; Toulouse, France, August 2014, respectively), Final and 1st RastaNews Annual Conferences (Catholic University, Milan, January 2016; Palazzo Clerici, Milan, January 2014, respectively), 35th ISF Conference (Erasmus University, Rotterdam, July 2014), 2nd ISNPS Conference (Cadiz, Spain, June 2014), NSVSM Conference (University of Paderborn, July 2014), 9th and 8th BMRC-QASS conferences on Macro and Financial Economics (Brunel University London, May 2014 and 2013, respectively), and 3rd Humboldt-Copenhagen Conference on Financial Econometrics (Humboldt University, Berlin, March 2013).

1 Introduction

Modelling time series processes with variable coefficients has received considerable attention in recent years in the wake of several financial crises and high volatility due to frequent abrupt changes in the market. Justification for the use of such structures can be found in Timmermann and van Dijk (2013); for example, for the dynamic econometric modelling and forecasting in the presence of instability see the papers in the corresponding Journal of Econometrics special issue, i.e., Pesaran et al. (2013). For some more recent references see, for example, Cavaliere and Taylor (2005, 2008), Cavaliere and Georgiev (2008), Giraitis et al. (2014), Harvey et al. (2018), Chambers and Taylor (2020). Time-varying coefficient models are extensively applied by practitioners, and their importance is widely recognized (see, for example, Granger, 2007 and 2008, Petrova, 2019, Kapetanios et al., 2019, 2020).222A growing empirical literature in macroeconomics is testimony to their importance. See, for example, Evans and Honkapohja (2001, 2009). Crucial advances in both the theory and the empirics for these structures are the works by Whittle (1965), Abdrabbo and Priestley (1967), Rao (1970), Hallin (1979, 1986), Kowalski and Szynal (1990, 1991) and Grillenzoni (1993, 2000).333See also Francq and Gautier (2004a, 2004b). We refer to the introduction of Azrak and Mélard (2006) and Alj et al. (2017) for further references.

This paper provides a general framework for the study of autoregressive moving average models with variable coefficients and heteroscedastic errors (hereafter, TV-ARMA). There are two large classes of stochastic processes: the ones with deterministically and those with stochastically time-varying coefficients. Both types have been widely applied in many fields of research, such as economics, finance and engineering (see for example Barnett et al., 2014, Aastaveit et al., 2017, Mumtaz and Petrova, 2018), but traditionally they have been examined separately. The new framework unifies them by showing that one solution fits all. More specifically, we obtain explicit and computationally feasible solution representations that generate the fundamental properties of these models, whereas the scope of the useful tool which is traditionally used to obtain such representations, that is the characteristic polynomials, is diminished when time parameter variation is present (see, for details, Hallin, 1979, and Grillenzoni, 1990).

Following Miller (1968), in a series of papers, Hallin (1979, 1984, 1986, 1987), Singh and Peiris (1987), and Kowalski and Szynal (1990, 1991) employ the one-sided Green’s function (Green function for short) for the Wold decomposition of TV-ARMA models and their core properties. This is grounded on a particular solution of the associated linear difference equation. However, the Green function involved in this solution, is defined implicitly via a fundamental set of solutions, the elements of which was not, in the general case, explicitly specified. As an alternative, recursive methods were employed to compute it (see, for example, Grillenzoni, 2000, and Azrak and Melard, 2006). An explicit representation of the Green function depends upon the availability of a fundamental set of solutions (marked also by Hallin, 1979) whose elements (known as fundamental or linearly independent solutions) must be explicitly expressed and easily handled, being an ongoing research issue. Having at our disposal such a fundamental solution set, we also have the general homogeneous and in turn the general nonhomogeneous solution of the TV-LDE associated with TV-ARMA models.

In this work we provide such a fundamental solution set yielding a banded Hessenbergian (determinant of a banded Hessenberg matrix) representation of the Green function restriction involved in the solution of the associated TV-LDE (see Paraskevopoulos and Karanasos, 2021), termed here as “principal determinant” and denoted by (see eq. (6)). The entries of are the autoregressive coefficients taken at consecutive time instances. The first fundamental solution is the principal determinant. The remaining fundamental solutions are also expressed in terms of the principal determinant and therefore as banded Hessenbergians, yielding an explicit form for the entries of the companion matrix product. The advantages of the principal determinant representation of the Green function are multiple. Using elementary properties of banded Hessenbergians, we obtain the general homogeneous solution of the linear difference equation associated with a TV-ARMA model as a linear combination of the principal determinant times prescribed initial condition values (see eqs. (9, 11)). The particular solution, mentioned earlier, is also recovered, but in a more explicit form, as a linear combination of the principal determinant times consecutive instances of the forcing term (see eq. (12)). These results lead to an efficient interpretation of the model, described as a decomposition into four structurally different parts (see eq. (16)). In this interpretation the fundamental solutions could be portrayed as autoregressive coefficients of prescribed random variables.

The Hessenbergian representation of TV-ARMA processes gives rise to an explicit condition, that is the absolutely summability of terms involving the principal determinant (see (19)), which leads to easily handled explicit representations of their fundamental properties in spaces. The convergence to zero of the principal determinant along with the boundedness of the autoregressive coefficients ensure the asymptotic stability of all bounded solution processes in . The absolute summability condition along with the boundedness of the drift and the moving average coefficients guarantee the existence and uniqueness of the Wold-Cramér decomposition of asymptotically stable solution processes associated with finite unconditional first two moments and autocovariance function. The invertibility of such solution process is guaranteed by the boundedness of the autoregressive coefficients and the absolutely summability of terms generated by the principal determinant, whereas, in this case, its nonzero entries are the moving average coefficients of the model (see Section 6.1). As a consequence, we derive explicitly the optimal linear predictor for the asymptotically stable solution process of TV-ARMA models along with the forecasting error and its associated mean square error, when an infinite set of data is observed. An alternative approach, employs the aforementioned explicit representation of the model, which yields its optimal linear predictor when a finite set of data is observed. Therefore the problem of obtaining such a predictor is reduced to a matter of dealing with a linear regression. In a causal environment, it turns out that both approaches yield identical forecasting and mean square errors and therefore identical optimal predictors. Moreover, we illustrate mathematically one of the focal points in Hallin’s (1986) analysis concerning the asymptotic efficiency of such models. Namely, that in a time-varying setting two forecasts with identical forecasting horizons, but at different times, yield different mean squared errors. It turns out that the backward asymptotic efficiency is, in the general case, different from the forward one (termed by Hallin Granger-Andersen). In this context, we explicitly provide sufficient conditions for the forward asymptotic boundedness and uniform boundedness of the mean square forecasting error. Equally importantly, we demonstrate how the linear algebra techniques, used to obtain the general solution, are equivalent to a simple procedure for manipulating polynomials with variable coefficients (see Section 8). In order to do so we employ the expression of the principal determinant in conjunction with the so called skew multiplication operator or symbolic operator (see, for example, Hallin, 1986, and Mrad and Farag, 2002).

Various processes with stochastic coefficients are treated within our unified framework in Section 7. We investigate two general models. First, for the random coefficients model, we show that when the principal determinant converges almost surely, then the process converges in distribution. Second, the double stochastic autoregressive model is also employed to formulate explicitly some of its fundamental properties. For example, the convergence in of the principal determinant is a necessary condition for the unconditional variance to exist.

Banded Hessenbergians are computationally tractable due to the linear running time for their calculation (see Paraskevopoulos and Karanasos, 2021). Compact solution representations of banded Hessenbergians, established in Marrero and Tomeo (2012, 2017) and Paraskevopoulos and Karanasos (2021), can be applied to derive analogous explicit representations for the principal determinant. These results modernize and enhance the explicit representations of time-varying models and their fundamental properties, by compact representations.

The definition of the principal determinant arises naturally from Paraskevopoulos (2014), who (by introducing the so called infinite Gauss-Jordan elimination algorithm) provides banded Hessenbergian representations for the fundamental solution set associated with a TV-ARMA() model (see Paraskevopoulos and Karanasos 2021). The results of the present paper are established independently of the infinite elimination algorithm.

To sum up, the unified theory enable us to study linear time series models with either stochastically or deterministically varying coefficients, thus allowing us to make theoretical comparisons between these two large classes of models.

This paper concludes with an empirical application on inflation persistence in the United States (see Section 10), which employs a time-varying model of inflation dynamics grounded on statistical theory. In particular, we estimate an autoregressive process with abrupt structural breaks and we compute an alternative measure of second-order time dependent persistence, which distinguishes between changes in the dynamics of inflation and its volatility and their persistence. Our main conclusion is that persistence increased after 1976, whereas from 1986 onwards it declines and stabilizes to even lower levels than the pre-1976 period. Our results are in line with those in Cogley and Sargent (2002), who find that the persistence of inflation in the United States rose in the 1970s and remained high during this decade, before starting a gradual decline from the 1980s until the early 2000s.

The outline of the paper is as follows. Section 2 introduces the notation used in the paper followed by the principal determinant. The next Section presents the explicit representation for an extensive family of “time-varying” ARMA models, based on the general solution of the associated TV-LDE. In Section 4, we obtain a necessary and sufficient condition which guarantees the asymptotic stability of these processes. Section 5 presents explicit formulas for the fundamental properties of the model, including the Wold-Cramér decomposition, the unconditional moments and the autocovariance function. Section 6 deals with the invertibility and forecasting issues. In Section 7, we examine AR models in which the drift and the autoregressive coefficients are stochastically varying. In Section 8, we introduce a simple procedure for manipulating polynomials with variable coefficients. The next Section gives an illustrative example with abrupt structural breaks and proposes a new measure of time-varying persistence. In Section 10 we present an empirical study for inflation persistence. The final Section of the paper contains some concluding remarks and future work.

The proofs of the statements concerning L of the current paper are demonstrated in (Paraskevopoulos and Karanasos 2021), while the proofs of stochastically oriented statements are included in the Appendix of this paper, which follows the enumeration structure of the main body of the paper. Further details are provided in the Online and the Additional Appendices.

2 Time-varying ARMA

The aim of this Section is to provide a definition of time-varying ARMA models, hereafter termed TV-ARMA, along with the main mathematical tool for their analysis. This is the banded Hessenbergian representation of the Green function associated with such models, which is also referred to here as the principal determinant.

2.1 The Model

This Subsection introduces suitable notation and defines the basic process. Throughout the paper we adopt the following notational conventions: The set of integers (resp. positive and non-negative integers) is denoted by (resp. and ). Similarly, the set of real numbers (resp. positive and non-negative real numbers) is denoted by (resp. and ). Moreover, stands for a probability space and (in short ) stands for the Hilbert space of random variables with finite first two moments defined on .

Let and . A TV-ARMA() model generates a stochastic process (or simply process), which satisfies

| (1) |

with moving average term given by

where the coefficients are either deterministic (real valued functions) or stochastic (random variables), is the time-varying drift generating a deterministic or stochastic process, while is a mean zero random process (that is ) such that for (uncorrelatedness condition), for all (that is is a martingale difference sequence relative to ) and the time-varying variance is non-zero and bounded, that is for all and some . The above conditions guarantee that and ( are orthogonal), whenever .

If the non-constant coefficients and the drift in eq. (1) are deterministic (resp. stochastic) we shall refer to it as DTV-ARMA (resp. STV-ARMA).444Notice that in our setting the time-varying coefficients can depend on the length of the series as well, as in Azrak and Mélard (2006); see the examples in Section 5.3. Further specifications and adjustments for STV-ARMA models are presented in Section 7.

The forcing term is assigned to be the time-varying drift plus the moving average term:

| (2) |

Proceeding with the notation of eq. (2), the associated TV-LDEs() of eq. (1) is defined by:

| (3) |

where stand for the autoregressive coefficients of eq. (1) and , for are considered as realizations of the homonyms random variables.

In this work, both assumptions of stationarity and homoscedasticity have been relaxed (see also, among others, Singh and Peiris, 1987, Kowalski and Szynal, 1990, 1991, and Azrak and Mélard, 2006), which is likely to be violated in practice and we allow to follow, for example, a stochastic volatility or a time-varying GARCH type of process (see, for example, the earlier versions of the current paper: Karanasos et al., 2014c, and Karanasos et al., 2017) or we allow for abrupt structural breaks in the variance of (see the example in Section 9).

The TV-ARMA() model nests both the TV-AR as a special case when and the ARMA specification when the drift, the autoregressive and moving average coefficients, and the variances are all constants, adopting for this purpose the conventional identifications: for all .

The relation between the process under consideration and its innovations is essentially described by the Wold-Cramér decomposition (see Section 5.1), which is the main analytical tool for studying the asymptotic efficiency of the model. In this case, the latest time-point of the observed random variables, denoted here by , moves to the remote past (), while the forecast time-point, denoted here by , is kept fixed. The forward asymptotic efficiency of the model (so-called by Hallin, 1986, Granger-Andersen) is strongly related to the forecasting problem. It directs attention to the asymptotic properties of the mean square forecasting error (MSE for short), as the time moves to the far future, while , is kept fixed (see Section 6.3).

One of the goals of this work is to obtain an explicit inverse of the time-varying autoregressive (AR) polynomial associated with eq. (1) being denoted by , where is the backshift or lag operator (see Section 8). In a time-varying environment, the usual procedure employs the Green function instead of the characteristic polynomials, which are used in the time invariant case. More specifically, we employ the principal determinant, coupled with the so called multiplication skew operator (see the analysis in Section 8.1) to obtain the inverse of .

We should also mention that Kowalski and Szynal (1991) used the product of companion matrices to obtain the associated Green function. Paraskevopoulos and Karanasos (2021) capitalized on the connection between the product of companion matrices and time-varying stochastic difference equations but in the opposite direction. That is, they went the other way around and by finding an explicit and compact representation of the fundamental solutions associated with TV-ARMA models, they obtained an analogous representation for the elements of the associated companion matrix product.

When the coefficients are deterministic time-varying the process is for sure nonstationary. When the coefficients are stochastic time-varying then the process can be stationary.

2.2 The Principal Determinant

In this and next Subsection, we provide some results on linear difference equations of order with variable coefficients (for short TV-LDEs()) and their banded Hessenbergian solution representation.

We start with the main mathematical tool of this paper, the principal determinant, denoted as . It has been shown in (Paraskevopoulos and Karanasos 2021), that is a solution of the homogeneous linear difference equation associated with eq. (3), that is

| (4) |

taking on the initial conditions .

Amongst the various implicit representations of the Green function in terms of undetermined fundamental sets of solutions (see Section 3.1 and (Paraskevopoulos and Karanasos 2021) for further details), the principal determinant provides an explicit and computationally tractable representation of the Green function restriction involved in the solution of the associated TV-LDE (see for details Paraskevopoulos and Karanasos 2021). As a consequence, the main properties of time-varying models acquire analogous representations, as stated in Sections 4, 5 and 6.

To distinguish scalars from vectors we adopt lower and uppercase boldface symbols within square brackets for column vectors and matrices respectively: , . Row vectors are indicated within round brackets and usually appear as transpositions of column vectors: .

For every pair such that the principal matrix associated with the AR part of eq. (1), is defined by

| (5) |

here and in what follows empty spaces in a matrix have to be replaced by zeros. is a lower Hessenberg matrix of order . It is also a banded matrix with total bandwidth (the number of its non-zero diagonals, i.e., the diagonals whose elements are not all identically zero), upper bandwidth (the number of its non-zero super-diagonals), and lower bandwidth (the number of its non-zero sub-diagonals). In particular, the elements of are: occupying the entries of the superdiagonal, the values of the first autoregressive coefficient (from time to time ), occupying the entries of the main diagonal, the values of the -th autoregressive coefficient for (from time to time ), occupying the entries of the -th sub-diagonal, and zero entries elsewhere. It is clear that for , is a full lower Hessenberg matrix.

For every pair with , the principal determinant associated with eq. (5) is given by:

| (6) |

Formally is a lower Hessenbergian (determinant of a lower Hessenberg matrix; for details on Hessenbergians see, for example, the book by Vein and Dale, 1999). We further extend the definition of so as to be defined over by assigning the initial conditions:

| (7) |

Under these initial values, for each fixed the sequence turns out to be a solution sequence of eq. (4) called principal fundamental sequence (see Paraskevopoulos and Karanasos 2021). It is well known that the restriction of the Green function, often designated by for and fixed, solves eq. (4), assuming the prescribed values for and for and (see for example Agarwal, 2000, p.77, Property (iii) or Lakshmikantham and Trigiante, 2002, Theorem 3.4.1 p.87 ). Since the principal determinant solves eq. (4) under the same initial values, just as like with , the uniqueness of the solution for an initial value problem entails that for every arbitrary but fixed the principal determinant coincides with the Green function, that is for all such that and (a proof from first principles is presented in Paraskevopoulos and Karanasos, 2021, Proposition 2). Therefore we will make use of two different, although equivalent terminologies: principal determinant or Green’s function with fixed . An explicit and compact representation of , called Leibnizian representation, is provided in the previously cited reference. An analogous representation of Hessenbergians, as a nested sum, and their inverses are established by Marrero and Tomeo (2017, 2012), respectively.

We conclude this Section with an illustrative example, concerning the ARMA() model with constant coefficients.

Example 1

The AR polynomial associated with eq. (4), whenever (constant autoregressive coefficients), is explicitly expressed in terms of the characteristic values as . The definition in eq. (6) gives the determinant of a banded Hessenbergian Toeplitz matrix (for details on Toeplitz matrices see, for example, the book by Gray, 2006)555For the use of Toeplitz matrices on double-differenced AR(1) models see Han (2007). and satisfies the identity (usually called Widom’s determinant formula; see Widom, 1958)

| (8) |

where is now denoted as , since it depends only on the forecasting horizon ( indicates the order of the matrix too). The second equality in eq. (8) follows (only if ) from standard results in ARMA models (see, for example, Karanasos, 1998, 2001, and in particular, eq. (2.6) in his Corollary ; see also Hamilton, 1994, pp. 12-13).

3 TV-ARMA Representations

In the following Subsections we shall use the principal determinant to describe explicitly the general homogeneous and particular solutions of TV-LDE() in eq. (3). The sum of these solutions yields the general solution of eq. (3),666In linear algebra there have been some isolated attempts to deal with the problem, which have been criticized on a number of grounds. For example, Mallik (1998) provides an explicit solution for the aforementioned equations, but it appears not to be computationally tractable (see also Mallik, 1997 and 2000). Lim and Dai (2011) point out that “although explicit solutions for general linear difference equations are given by Mallik (1998), they appear to be unmotivated and no methods of solution are discussed”. which lead to an explicit and computationally tractable representation of TV-ARMA processes (see Theorem 1). A useful decomposition of the innovation part of the solution is presented in Proposition 1.

3.1 Homogeneous Solution

Let and . Let also and . Taking into account that , the general solution of eq. (4) over is denoted by . The latter can be expressed in terms of the principal determinant, the autoregressive coefficients and the initial conditions for , as follows

| (9) |

(a proof of eq. (9) is provided in (Paraskevopoulos and Karanasos 2021). The two variable solution notation is consistent with the analogous notation used for the principal determinant (or the Green function) and is essential for the TV-ARMA() representation in eq. (16). Moreover, the principal determinant exactly matches the specific restriction of the Green function involved in the general homogeneous solution in eq. (9) and, in turn, of the nonhomogeneous solution of the associated TV-LDE, that is the for all () such that and (a proof is presented in Paraskevopoulos and Karanasos, 2021, Theorem 5 and Corollary 2).

To the extent of our knowledge, the expression of the homogeneous solution in terms of the obtained in eq. (9) is first recorded in earlier versions of this paper (see also Paraskevopoulos and Karanasos, 2021). The effects of eq. (9) on this work are multiple. It makes it possible to construct the general solution of a TV-LDE() entirely in terms of the Green function and any set of prescribed random variables at a time-point of the recent or remote past. Explicit conditions guaranteeing the zero convergence of eq. (9) yield the asymptotic stability and the Wold-Cramér decomposition of the model. Another consequence, is an alternative approach to the forecasting, presented in Section 6.2. As in the case of processes of order (1,1), this is a consequence of the explicit representation of TV-ARMA() models in eq. (16).

In all that follows the following notation is used:

| (10) |

(superscripts within parentheses or brackets [e.g., ] designate the position of the corresponding term [e.g., -th term] in a sequence, so as to distinguish position indices from power exponents). The principal determinant is identified with , that is . Applying eq. (10) with , on account of and for (see eq. (7)), we conclude that: .

It turns out (see Paraskevopoulos and Karanasos 2021) that for every with the sequence is the solution of eq. (4) under the prescribed initial values: and for with . Applying the expression in eq. (10) to the right-hand side of eq. (9), the homogeneous solution takes a more condensed form:

| (11) |

Under the initial values for and for , whenever , the right-hand side of eq. (11) turns into and thus the homogeneous solution in eq. (11) coincides with the principal fundamental sequence . In (Paraskevopoulos and Karanasos 2021), it is shown that the set

is a fundamental (or linearly independent) set of solutions associated with eq. (4). Moreover, it is shown there that the -th fundamental solution can be expressed as a single banded Hessenbergian too. The only difference between any two of these fundamental solutions lies in the first column (see Paraskevopoulos and Karanasos 2021).

3.2 A Particular Solution and its Decomposition

A particular solution to eq. (3) subject to the initial condition values is given by

| (12) |

A proof of the above formula is demonstrated in (Paraskevopoulos and Karanasos 2021). The solution in eq. (12) depends both on and . This has to be compared with the equivalent result presented in Miller (1968, p. 40, eqs. (2.8) and (2.9)).

In Proposition 1 below, we introduce a decomposition of the innovation part in the particular solution in eq. (12), which is used throughout this paper. But first we will introduce the following definition:

Definition 1

First, we define the function on :

| (13) |

Second, for each , we define the function on :

| (14) |

As is equal to plus a sum of terms consisting of the first instances of multiplied by corresponding moving average coefficients, it can also be expressed as a banded Hessenbergian (the proof is deferred to the Online Appendix Subsection F1). The same applies to . Therefore, we shall refer to and as banded Hessenbergian coefficients. In view of eq. (13) , since , whenever and the second term (i.e., the sum), when applied for , vanishes. For the same reason , whenever . To summarize, coincides with the corresponding initial conditions of , whenever (see eq. (7)). In view of eq. (14), if (or ), then the lower summation limit exceeds the upper limit, whence . Finally, for a pure AR() model, that is when , we have: and . The banded Hessenbergian coefficient must be compared with the function defined by Peiris (1986), see his notation “” in eq. (2.2).

Proposition 1

The innovation part of the particular solution in eq. (12) can be decomposed into two parts as follows:

| (15) |

In the first summation of the right-hand side of eq. (15), the length of the time interval between and is the forecasting horizon (). As a consequence, the errors whose index ranges over the integer interval 777If , we adopt the notation: . are unobservable. In the second one the time interval extends from to and therefore the errors whose index ranges over are observable. Notice that for can be equivalently expressed as for . Similarly for can be equivalently expressed as for (see eq. (48)).

Eq. (15) coupled with eq. (16) (in the following Subsection) will be used to obtain TV-ARMA() forecasts in Subsections 6.2 and 7.4. If (or ), the first sum in the right-hand side of eq. (15) reduces to and the second sum reduces to (a formal proof is provided in the Online Appendix Subsection F2). Notice that the above mentioned reduction is in line with Remark 1 below.

3.3 Explicit Model Representation

The results of the previous Section on linear difference equations, are applied herein to obtain in the following Theorem an equivalent explicit representation of the stochastic process in eq. (1) in terms of prescribed random variables: for any with . This is a consequence of the general solution representation of the TV-LDE() in eq. (3) as a sum of the homogeneous and the particular solutions in eqs. (11, 12), respectively, that is for all with . Notice that is independent of , while, in context with time-series, both homogeneous and particular solution functions depend on and . Applying eq. (15) to the particular solution in eq. (12), Theorem 1 follows.

Theorem 1

An equivalent explicit representation of in eq. (1) in terms of prescribed random variables for any and such that is given by:

| (16) |

The algebraic part of the proof, concerning TV-LDEs() is provided in (Paraskevopoulos and Karanasos 2021), the stochastic part is given in the Appendix. The right-hand side of eq. (16) comprises four summation parts. In view of Proposition 1, the sum of its last three parts is the particular solution given by eq. (12). More analytically, the first sum (the homogeneous solution in eq. (11)) is a product of fundamental solutions multiplied by observable random variables. The second sum (the drift part of the particular solution in eq. (12)) is formed by products involving the principal determinant multiplied by the drift . The terms of the third sum (the first part of the “MA decomposition”, see eq. (15)) are the banded Hessenbergian coefficients , multiplied by the unobservable errors. Finally, the terms of the fourth sum (the second part of the “MA decomposition”) are the banded Hessenbergian coefficients , multiplied by observable errors. In the Online Appendix G1, we apply eq. (16) to an AR(1) model, recovering the well known explicit representation of the latter.

Remark 1

Remark 2

Replacing the homogeneous solution part in eq. (16) by eq. (9), and its innovation part with the left-hand side of eq. (15), we can solely express eq. (16) as a linear combination of the Green function. The expression in eq. (16) has to be compared with the corresponding result in (Agarwal, 2000 p.77, eq. (2.11.8)), in which the fundamental solutions, denoted there by “”, are not in general explicitly expressed, but only in specific cases (see the examples in the previously cited reference).

The methodology presented in this Section can be used in the study of infinite order autoregression models as well as in the case of the fourth order moments for time-varying GARCH models. In the interest of brevity the detailed examination of the aforementioned models will be the subject of future papers. We should also mention that another mathematical tool of constant use in difference equations is the generalized continuous fraction approach (see, Van de Cruyssen, 1979). The concept of matrix continued fraction was introduced in Hallin (1984), whereas Hallin (1986) showed the close connection between the convergence of matrix continued fractions and the existence of dominated solutions for multivariate difference equations of order two.

Another advantage of our TV-ARMA representation in eq. (16), is its generality. That is, in deriving it we do not make any assumptions on the time dependent coefficients. Therefore, it does not require a case by case treatment. In other words, we suppose that the law of evolution of the coefficients is unknown, in particular they may be stochastic (either stationary or non stationary) or deterministic. Therefore, no restrictions are imposed on the functional form of the time-varying autoregressive and moving average coefficients. In the non stochastic case the model allows for known abrupt changes, smooth changes and mixtures of them. If the changes are smooth the coefficients can depend on an exogenous variable or or both. In the case of stochastically varying coefficients the model includes the generalized random coefficient (GRC) AR specification (see, for example, Glasserman and Yao, 1995, and Hwang and Basawa, 1998) as a special case or allows for Markov switching behaviour (see, for example, Hamilton, 1989 and 1994, chapter 22). In both aforementioned cases it allows for periodicity. We should also mention that the solution includes the case where the variable coefficients depend on the length of the series (see the example in Section 5.3).

3.4 Gegenbauer Functions as Hessenbergians

We conclude this Section with an example. We show how the Gegengbauer functions can be expressed as Hessenbergians. For a discussion of the Gegenbauer processes and their applications to economics and finance see Baillie (1996) and Dissanayake et al. (2018); see also, Giraitis and Leipus (1995) and Caporale and Gil-Alana (2011).

Example 2

The Gegenbauer (or ultraspherical) functions, denoted by (hereafter, for notational simplicity we use ), are defined to be the coefficients in the power-series expansion of the following equation:

for , , and .

The easiest way to compute (for ) using computers is based on the solution of the following second order homogeneous linear difference equation with coefficients functions of

| (17) |

subject to the initial condition values and (see, for example, Baillie, 1996, Chung, 1996, and the references therein). The solution of eq. (17) is given in the following Proposition. This follows from eq. (11) (or the homogeneous solution part of Theorem 1) applied with , , (e.g. ). Besides is identified with .

Proposition 2

The -th (for ) Gegenbauer coefficient is given by or equivalently (by replacing and ):

| (18) |

where is a -th order banded Hessenbergian (in this case tridiagonal matrix):

Recall that differs from only in the first two elements of the first column (see eq. (LABEL:Def1:_Phi^m_k)), which, in this case, are: (or ) and , respectively. It follows from eq. (10) that . Thus eq. (18) can be rewritten as: . Next, we apply the multi-linearity property of determinants along the first column to express in eq. (18) as a single Hessenbergian:

Corollary 1

The -th Gegenbauer polynomial can be explicitly expressed as a -th order banded Hessenbergian:

4 Asymptotic Stability

In this Section we apply our result in eq. (16) to provide conditions ensuring the asymptotic stability888As pointed out by Grillenzoni (2000) stability is a useful feature of stochastic models because it is a sufficient (although not necessary) condition for optimal properties of parameter estimates and forecasts. Since model (1) can be expressed in Markovian form, the stability condition allows many other stability properties, such as irreducibility, recurrence, regularity, non evanescence and tightness (see Grillenzoni, 2000 for details). of a family of TV-ARMA() processes satisfying eq. (1).

4.1 Stability Conditions

The asymptotic stability problem is to provide sufficient conditions such that a class of stochastic processes solving eq. (1) approaches a solution independently of the prescribed random variables (the effect of the prescribed random variables is gradually dying out) as , that is when the homogeneous solution in eq. (16) tends to zero, under a prescribed type of convergence. The explicit representation of the homogeneous solution in eq. (11) makes it possible to provide such type of conditions in Theorem 2 ensuring the convergence to zero of the homogeneous solution, that is , as , which means that , or equivalently that .

Theorem 2

i)

Let the autoregressive coefficients be deterministic. If for each with , then a sufficient condition for an -bounded stochastic process (that is ) which solves eq. (1) to be asymptotically stable (in sense) is: for each .

ii) Let the autoregressive coefficients be stochastic. If for each with , then a sufficient condition for an -bounded stochastic process , which solves eq. (1), to be asymptotically stable (in sense) is , as for each (see, for

details, Proposition 9 in Section 7.4).999Goldie and Maller (2000) offered sufficient conditions for the asymptotic stability of an AR() model with stochastically varying coefficients, that is the a.s. convergence of the solution, i.e. , a.s. (see also Bougerol and Picard, 1992). Recently, in a multivariate setting, Erhardsson (2014) showed that the only sufficient condition is: as , a result analogous to Theorem 2 (ii) (see also Section 7 below).

In the next Section, the asymptotic stability plays an essential role for the existence and uniqueness of TV-ARMA() solution processes in .

The conditions in Theorem 2(ii) include the “bounded random walk” of Giraitis et al. (2014) also used by Petrova (2019). Properties such as stability characterize the statistical properties ( convergence and asymptotic normality, where is the sample size) of least squares (LS) and quasi-maximum likelihood (QML) estimators of the time-varying coefficients.101010Azrak and Mélard (2006) have considered the asymptotic properties of quasi maximum likelihood estimators for a large class of ARMA models with time dependent coefficients and heteroscedastic innovations. The coefficients and the variance are assumed to be deterministic functions of time, and depend on a finite number of parameters which need to be estimated. Other researchers have also considered the statistical properties of maximum likelihood estimators for very general non stationary models. For example, Dahlhaus (1997) has obtained asymptotic results for a new class of locally stationary processes, which includes TV-ARMA processes (see Azrak and Mélard, 2006, and the references therein).

4.2 Two Illustrative Examples

The first of the following examples concerns the logistic smooth transition AR() model (see, for example, Teräsvirta, 1994). The second example concerns periodic AR models.

Example 3

In the first model the autoregressive coefficient is given by : (we drop the subscript ), where , , , is the first-order logistic function. Clearly, if , then and regime prevails, whereas if , then and regime prevails. Let also be the value of for which if and thus . Similarly, let be the value of for which if and thus (clearly , since is a decreasing function of time). For this model, if and then . Clearly, if and only if , whereas if and only if .

Example 4

In the periodic AR() model, is the number of seasons (i.e., quarters) and , denote the periodically varying autoregressive coefficients. Moreover, stands for the number of periods (i.e., years). Accordingly is time expressed in terms of seasons (i.e., if , and , then quarters). If we want to forecast seasons ahead, that is or , then: . Clearly for all is a sufficient but not necessary condition for (or equivalently ). The necessary and sufficient condition is .111111For a study of the periodic stationarity of a random coefficient periodic autoregression (RCPAR) see, for example, Aknouche and Guerbyenne (2009).

5 Solution Representation in

Having specified a general method for manipulating explicitly the TV-ARMA type of models, we turn our attention to a consideration of their Wold-Cramér decomposition followed by the fundamental second order properties of these models. In this Section we shall restrict ourselves to the treatment of DTV-ARMA processes (those with deterministic coefficients). In Section 7 we present STV-AR processes (those with stochastically varying coefficients), which incorporate the GRC and double stochastic AR models.

5.1 Wold-Cramér Decomposition

In Theorem 3, we provide the existence of the Wold-Cramér decomposition (see Cramér, 1961)121212Since a non-stationary generalization of Wold’s result was given by Cramér, it is referred to as Wold-Cramér decomposition. and, therefore, impulse response functions (IRFs), for the DTV version of the model in eq. (1). In particular, we provide an explicit condition (the absolute summability of the principal determinant):

| (19) |

which, along with the boundedness of the drift and the moving average coefficients, ensure the existence of the Wold-Cramér decomposition (Theorem 3) of DTV-ARMA models with finite first two unconditional moments and autocovariance function (Propositions 3, 4). In Theorem 4 it is shown that every asymptotically stable stochastic process, which solves eq. (1) coincides with the Wold-Cramér decomposition in eq. (20).

As the absolute summability condition in (19) also guarantees the absolute summability of in eq. (13) the following Theorem holds:

Theorem 3 (Existence)

A direct proof of Theorem 3 is given in the Appendix ensuring that in eq. (20) is second order, that is . In particular, show there that (for the definition of see eq. (2)), which extends a result established by Peiris (1986) (see the proof of his Theorem 2.1, provided that ). In addition, we deduce the equivalence between and , provided that converges in (see Proposition G1, in the Online Appendix G2). This extends a result mentioned in the above cited reference, that is is second order if and only if eq. “(2.4)” holds true, provided that . The solution of eq. (1) in eq. (20) is decomposed into two orthogonal parts (see for a proof the Additional Appendix L1), a deterministic part and a mean zero random part, that is, is the non random part (see Proposition 3 below), while (i.e., the limit of forecast errors, see eqs. (31) below) is the mean zero random part of . As eq. (20) is future independent, we shall also referred to it as a causal solution of DTV-ARMA models.

Hallin (1979), Singh and Peiris (1987), Kowalski and Szynal (1991), Grillenzoni (2000), and Azrak and Mélard (2006) evaluate the Wold-Cramér decomposition through recursion. In sharp contrast, eq. (20) in Theorem 3 provides a direct and explicit representation of the Wold-Cramér decomposition expressed in terms of banded Hessenbergians with entries the coefficients of the model in eq. (1). Moreover, in the Appendix we show that the Wold-Cramér decomposition in eq. (20) can be expressed in a compact form:

Let and be an orthonormal sequence in , that is (Kroneker delta). Under these additional assumptions to those considered in Theorem 3, the latter recovers the following uniqueness result: Eq. (20) is the unique solution of eq. (1) (see Hallin and Ingenbleek, 1983, and Peiris, 1986). In the Online Appendix G1 we apply eq. (20) to an AR(1) model, recovering the well known Wold solution representation of the latter.

In the Appendix we show that eq. (20) can be alternatively derived from eq. (16), when the latter is applied with prescribed random variables

for any arbitrary such that . This result arises from the formulas

| (21) |

as follows: Applying eqs. (21) to eq. (16), it follows from eq. (12) that eq. (20) can be equivalently rewritten as: . The first of the formulas in (21) ensures that the Wold-Cramér solution decomposition in eq. (20) is asymptotically stable. Moreover, in the Appendix we show that every asymptotically stable stochastic process in , which solves eq. (1) coincides almost surely with in eq. (20), as demonstrated in the following Theorem:

Theorem 4 (Uniqueness)

Assuming in addition to the conditions of Theorem 4 that for each with and taking into account that the absolute summability condition in (19) implies that , we infer from Theorem 2(i) that every bounded process that solves eq. (1), as being asymptotically stable, also coincides with the Wold-Cramér decomposition in eq. (20). The existence of such a bounded process is guaranteed by the boundedness of the absolute summability, as a function of , that is

| (22) |

We show in the following Corollary that under the condition (22), the Wold-Cramér solution decomposition in eq. (20) is bounded. Moreover, as (22) guarantees the conditions of Theorem 2(i) (see for a proof the Proposition L1 in the Additional Appendix L2), it arises from Theorem 4 that the following uniqueness result holds:

Corollary 2

A proof of these results is included in Appendix. Corollary 2 must be compared with an analogous result established by Neimi (Theorem 2.1, 1983) for ARMA non-stationary processes with constant coefficients coupled with the AR-regularity condition and zero drift (). An extension of this result covering non-stationary TV-ARMA() models coupled with zero drift and extended regularity conditions was obtained by Kowalski and Szynal (1988).

Kowalski and Szynal (1991) and Grillenzoni (2000) derived sufficient conditions ensuring that is second order, that is (Kowalski and Szynal examined the case of deterministic coefficients with zero drift, whereas Grillenzoni allowed the coefficients to be stochastic as well, see also Remark 5 in Section 7.4). These conditions for a TV-AR() model with zero drift are summarized in the following Remark.

Remark 3

The above mentioned sufficient conditions for are as follows: i) The deterministically varying polynomial is regular. That is, are such that there exist the limits and , where , , with (see eq. (8) in Kowalski and Szynal, 1991).131313Kowalski and Szynal (1991) showed that is the spectral

radius of the matrix

(see page 75 in their paper). ii) The deterministically varying polynomial should have roots that entirely lie inside the unit circle, with the exception, at most, of a finite set of points (see Proposition 1 in Grillenzoni, 2000).

The sufficient conditions in Remark 3 are not, however, necessary, since they do not cover the case of periodic coefficients, see Grillenzoni (1990) or Karanasos et al. (2014,a,b). Whereas in the case of TV-AR() models , we infer from the discussion next to Theorem 3 (see also Proposition G.2 in the Online Appendix G) the equivalence between (square summability) and , provided that . As a consequence, the stability condition is necessary for the square summability to hold or equivalently for and therefore it is also necessary for the two conditions in Remark 3, as demonstrated below:

5.2 Unconditional Moments

In this Subsection we present explicit formulae for the first and second unconditional moments of the Wold-Cramér solution decomposition of the DTV-ARMA family of processes coupled with sufficient and necessary conditions for their existence, as demonstrates the following Proposition.

Proposition 3

Let the conditions of Theorem 3 hold. Then the unconditional mean of the process in eq. (20) with deterministic coefficients, exists in and is given by

| (23) |

The absolute summability condition is also sufficient for the existence of the unconditional variance of the above mentioned process , which is given by

| (24) |

Necessary conditions for the process to be second order respectively are:

Moreover, the stability condition, that is , is sufficient for the above two limits to exist, due to the boundedness of and , while it is necessary for the absolute summability to hold.

A proof of Proposition 3 is provided in Appendix, noticing that the unconditional mean is the same for both the AR and the ARMA processes.

The main logical connections between the conditions, described in the above Proposition, are summarized in the following commutative diagrams:

| (25) |

5.3 Autocovariance Function

In the following Proposition, we state an explicit expression for the covariance structure for the Wold-Cramér solution decomposition of the DTV-ARMA() process.

Proposition 4

A proof of Proposition 4 is found in the Appendix. The time-varying variance of in eq. (24), is recovered by applying for , that is . Moreover, the absolute summability condition implies absolute summable autocovariances: for all . Notice again that for a pure AR process, the autocovariance function formula in eq. (26) must be applied for .

From a computational viewpoint, the covariance structure of can be numerically evaluated by computing the banded Hessenbergian coefficients, in eq. (13) and substituting these in eq. (26).

The next remark highlights the importance of the existence of finite second moments.

Remark 4

Azrak and Mélard (2006) considered the asymptotic properties of QML estimators for the DTV-ARMA family of models where the coefficients depend not only on but on as well (see Alj et al., 2017, for the multivariate case). In their Theorem and Lemma the existence of finite second moments was required. They also show that the dependence of the model with respect to has no substantial effect on their conclusions except that a.s. convergence is replaced by convergence in probability, since convergence in norm implies convergence in probability (see Lemma in their paper).

We conclude this Section with two more examples and a discussion of forward asymptotic stability.

Two More Examples:

The following examples, concerning AR() processes with variable autoregressive coefficients, are taken from Azrak and Mélard (2006).

Example 5

In the first example, the autoregressive coefficient is a periodic function of time defined by

where is a martingale difference sequence defined on with constant variance . Moreover, the autoregressive coefficient is given by , where and is the larger integer less or equal to (see also Dahlhaus, 1996). By specializing the results of Theorem 3 and Proposition 3, the Wold-Crámer decomposition (if and only if , where ) is given by

with unconditional variance

where

and, therefore

(see also eq. (4.2) in Azrak and Mélard, 2006).

Example 6

In the second example (see Example 2 in Azrak and Mélard, 2006), the autoregressive coefficient is an exponential function of time given by

where is the sample size. For this case (assuming that )

The condition (necessary and sufficient) entails:

As pointed out by Azrak and Mélard (2006) the use of variable coefficients, which depend on the length of the series, is compatible with the approach of Dahlhaus (1997).

6 Forecasting and Asymptotic Efficiency

In this Section we provide explicitly a sufficient condition for the invertibility of a causal DTV-ARMA process. In conjunction with Theorem 3, the above mentioned condition makes it possible to obtain in Subsection 6.2 an explicit form to the -step-ahead optimal (in sense) linear predictor along with the associated MSE (mean square error). An alternative optimal forecast is based on a finite sequence of observable random variables, employing for that the representation given by eq. (16). Both approaches yield identical forecast and mean square errors. In this context, in Subsection 6.3 we discuss, in a unified scheme, the forward asymptotic efficiency of the model with deterministic coefficients given by eq. (1).

6.1 Invertibility

A DTV-ARMA process is invertible if and only if the current value of the input can be expressed as a (converging) linear combination of the present and past random variables () (see Brockwell and Davis, 2016, p.76). The main result of this Section is presented in Theorem 5 (see below).

Eq. (1) can be rewritten as

| (27) |

The principal matrix associated with the moving average part is defined by

| (28) |

(for ). The matrix has a similar structure to the principal matrix associated with the AR operator, , that is both matrices are banded lower Hessenberg of order . It is clear that for , is a full lower Hessenberg matrix.

For every pair with we define the principal determinant associated with eq. (28):

Formally (and similarly to ), is a banded Hessenbergian. We further extend the definition of by assigning the initial values: and for . Accordingly, is the Green function associated with the MA() operator.

In analogy with the definition of (see eq. (13)), we define:

In the following Theorem we give a sufficient condition for a causal DTV-ARMA() process determined by eq. (20) to be invertible.

Theorem 5

The proof of Theorem 5 essentially repeats the arguments of the proof of Theorem 3; switching the roles of and , and replacing with , with and with . This result is fulfilled by showing in the Online Appendix H, that both terms in the right-hand side of eq. (29) are processes in . Eq. (29) recovers the formula devised by Hallin (1979) in Theorem 3, but this time in a more explicit form.

Following laborious research work, the literature contains a diversity of “time-varying” specifications of linear form whose main time series properties either remain unexplored or have not been fully examined. Making progress in interpreting seemingly different models we have provided in this Section a common platform for the investigation of their time series properties. With the help of a few detailed examples, i.e., smooth transition AR processes, periodic and cyclical formulations, we have demonstrated how to encompass various time series processes within our unified framework. The significance of our methodology is almost self-evident from the large number of problems that it can solve. Our proposed approach allows us to handle “time-varying” models of infinite order, by introducing unbounded order linear difference equation of index . This type of equations also yield Hessenbergian solutions, but involving full lower Hessenberg matrices. The latter enables us to obtain easily handled explicit solutions for the infinite order case along with the fundamental properties of corresponding models. An advantage of our technique is that it can be applied with ease, that is without any major alterations, in a multivariate setting and provides a solution to the problem at hand without adding complexity.

6.2 Optimal Forecasts

Theorems 3 and 4 ensure the existence of a unique asymptotically stable solution of eq. (1) given by eq. (20). Let for be the forecasting horizon. Let also be the smallest closed subspace of based on the sequence of past observations , which also contains all constant functions (see Brockwell and Davis, 1991, p. 62-64). Assuming further the invertibility conditions in Theorem 5, as the terms of the sequence of errors can be expressed in terms of ’s by eq. (29), they also belong to the space . The optimal predictor of in eq. (20), i.e., its conditional expectation on , coincides with its linear projection on the space spanned by , whenever is a martingale difference sequence (see Brockwell and Davis, 2016, p. 334, see also Rosenblatt, 2000, p. 83).

The conditional expectation of given , that is , turns out to be the orthogonal projection of on , an explicit form of which is given in the following Proposition.

Proposition 5

The -step-ahead optimal (in -sense) predictor of , as stated above, is linear and it is given by

| (30) |

where for are given by eq. (29). The forecast error associated with , that is , and the associated mean square error are given by:

| (31) |

Besides, as the expectation of is zero, the forecast is unbiased.

Theorem 5 entails that for . Additionally, as , it follows that . Thus, both terms in the right-hand side of eq. (30) belong to . Using the formulas in eqs. (30 and 31), one can conveniently verify that (a detailed proof is provided in the Additional Appendix N). In other words and are orthogonal (for short ), verifying that the predictor is optimal.

Singh and Peiris (1987), Kowalski and Szynal (1990, 1991), and Grillenzoni (1990, 2000) obtained the evaluation of the optimal forecasts similar to that described in eq. (30), using prediction algorithms and a recursive procedure. We should also mention that Whittle (1965) showed that in general the linear least-square predictor obeys a recursion (see his eq. (12)) and gave a recursive method for obtaining its coefficients. In Section 7 we describe how we can apply this technique in conjunction with our methodology to derive the optimal forecasts when the coefficients are varying stochastically. In particular, we examine the GRC-AR specification and a model with coefficients that follows AR processes.

An alternative and more realistic approach takes advantage of the explicit form of the process , employed in the previous paragraph, but now given by eq. (16). Let be the smallest closed subspace of spanned by the set of past observations , which also contains all constant functions. In a causal environment the past observations of the process in eq. (20), below and including the time point , are realizations of the corresponding random variables, which are given by: for . Applying the conditional expectation operator based on to eq. (16), the next Proposition follows directly:

Proposition 6

The -step-ahead optimal predictor of based on is linear and is given by

The forecast error for the -step-ahead predictor, that is and its associated mean square error (its variance), coincide with those established by eqs. (31), that is:

| (32) |

Besides, as the expectation of is zero, the forecast is unbiased.

In the Additional Appendix N, we show that or equivalently that , which is a prerequisite for the optimal nature of the predictors in . As the forecast errors in Propositions 5 and 6 coincide (in sense), we conclude that: . Moreover, in both cases the unconditional expectations and variances also coincide with that found earlier in Proposition 3, that is:

We remark that in a causal and invertible environment (the conditions of Theorem 5 hold) the past errors for can be expressed in terms of ’s by eq. (29). In practice, eq. (29) can be used to provide error estimates for by replacing in eq. (29) the realizations of the random variables: . Furthermore, we remark that the explicit form of the variance for a Gaussian process is essential for the determination of the confidence intervals of .

Finally, we formulate one of the main arguments made by Hallin (1986), which states that unlike the time invariant case, in a time-varying setting two MSEs with the same forecasting horizon, but at different time points, are no longer equal. With this in mind, consider two pairs of time points, say and , such that . The MSEs associated with these two time points are:

Shifting the time intervals determined by the summation limits, that is ( and ), both to , we get:

In a time-varying environment, a comparison between and , whenever , entails, in the general case, that : . On the other hand, in the time invariant case , which will now be denoted as , becomes (see eqs. (8) and (13)). In this latter case the two MSEs coincide, as being identical to:

6.3 Forward Asymptotic Efficiency

As pointed out by Hallin (1986), if a researcher wants to study the “causal” properties of the observed process, then he/she should examine the Wold-Crámer decomposition (see Theorem 3 in Section 5.1). If forecasting is the main objective, then the forecast obtained by the model should be asymptotically efficient in some sense. Of course the asymptotic forecasting properties of the model rely on its behaviour in the far future, whereas its causal properties involve its remote past only. If the processes is of constant coefficients, these two issues coincide. In the case of time dependent coefficients, however, they apparently differ strongly.

To reiterate one of the main purposes in building models for stochastic processes is to provide convenient forecast procedures. The researcher would like to minimize (asymptotically) the MSE or in other words to achieve asymptotic efficiency. The asymptotic efficiency of a forecasting procedure can be defined in two alternative ways (seemingly, analogous to each other, but indeed basically different). The first one (termed by Hallin efficiency, see Definition 5.1 in his paper) is obtained by considering the asymptotic forecasting performance of a model as tends to (see Proposition 3). The Wold-Cramér representation of a DTV-ARMA model in eq. (20) is efficient if and only if the model is invertible. If it is not an invertible model, then the mean square forecasting error associated with the above mentioned solution representation is not, in the general case, bounded.

A more realistic approach to efficiency consists of considering the asymptotic behaviour of the mean square forecasting error as for being arbitrary but fixed. This forward efficiency concept is also called the Granger-Andersen efficiency (see Definition 5.2 in Hallin, 1986, and the references therein). As the forecast error and the mean square error for the predictors given by eqs. (31 and 32), respectively, coincide, we can examine the forward asymptotic efficiency of DTV-ARMA models within the same forecasting scheme.

In the following Proposition, we give a weak condition, which guarantees the forward asymptotic boundedness of the mean square error.

Proposition 7

Let for . If is bounded, as a function of for each fixed , then the mean square error is also bounded, as a function of . Equivalently, the boundedness of entails that for each either exists in or oscillates with oscillation: .

In the following Corollary, we provide a stronger condition, which guarantees the forward asymptotic uniform boundedness of the mean square error.

Corollary 3

If further the condition (22) holds, that is the function is bounded in , then is uniformly bounded.

The proofs of the above statements are available in the Appendix.

7 Stochastic Coefficients

In Sections 5 and 6, we restricted ourselves to the treatment of DTV models. In this Section we examine processes with stochastically time varying coefficients. For simplicity instead of ARMA processes, we will concentrate on the AR() specification (STV-AR). In particular we will investigate three models: the random coefficients one, its generalization and the double stochastic AR process. But first we will express the STV-AR model in a companion matrix form. The proofs of the present Section are provided in the Appendix.

7.1 Companion Matrix Form

In this Subsection we show how to utilize the principal determinant (Green’s function) and the -th fundamental solution in order to obtain a compact and explicit representation of the companion matrix.

The STV-AR() process, can be expressed as

| (33) |

where is a vector of preceding random variables of , and is a vector of the autoregressive random coefficients. Notice that we denote the STV coefficients, including the drift , by , , instead of , which was the notation used for the deterministic ones.

It is well known that the model (33) can be written in a companion matrix form:

| (34) |

where , , and the companion (square) matrix of order associated to the vector is given by

| (35) |

That is, the STV-AR() process is converted to a -dimensional vector STV-AR() model. For any set of prescribed random variables , iterating eq. (34) yields

| (36) |

where is the product of companion matrices with initial square matrix of order . It follows directly from the above equation and Theorem 1 (see also, for more details, Paraskevopoulos and Karanasos, 2021) that the -dimensional square matrix is given by

In other words the element occupying the -th entry of the matrix () is the -th fundamental solution . We recall that is given in eqs. (5 and 6) (where now, in eq. (5) is replaced by ) and, similarly, is given in eq. (10).

7.2 Random Coefficients AR Model

In this Subsection we examine the random coefficient AR() model (with acronym RC-AR()), which is given by eq. (33), using for this the following notation and specifications: , , is an -dimensional random vector of the coefficients, and the errors, are independent of the random drift and autoregressive coefficients. Let also be a random variable independent of everything else, being the initial state.

Let us call the Euclidean norm on the space . Let be the space of matrices with elements in and denote by the matrix norm induced by (this is known as the spectral norm, defined as the largest singular value of the matrix).

Condition 1

as .

The proof of the next Theorem follows from the fact that as implies that as and, therefore, Theorem 2.1 in Erhardsson (2014) applies.

Theorem 6

Consider the RC-AR() model. Under Condition 1 the following are equivalent:

-

i)

convergences in distribution as ,

-

ii)

a.s.,

-

iii)

converges a.s., as ,

-

iv)

, as ,

-

v)

a.s.

As pointed out by Erhardsson (2014) the implications remain valid even if Condition (1) does not hold.

7.3 The Generalized RC-AR Model

A generalization of the RC-AR process (GRC-AR()) in eq. (33) is discussed in this Subsection. For this model, we show how the expected value of the -th fundamental solution can be expressed as a Hessenbergian, which then can be employed to obtain an explicit representation of the autocovariance function.

The generalized process extends the simple one to cover contemporaneous dependence between the vector of the drift and the autoregressive coefficients, both included in , and the vector of errors .

The GRC-AR() model also integrates the following AR processes (for details, see Hwang and Basawa, 1998):

-

I.

Random coefficient model: , where is a sequence of random variables with , and is independent of for all and . Notice also that if we set , for all and , we get the ordinary AR() process.

-

II.

Markovian bilinear model: .

-

III.

Generalized Markovian bilinear model: , , and has finite moments for all . Note that if we set , for all , we get the Markovian bilinear model coefficients.

-

IV.

Random coefficient exponential model: .

In cases I - IV all the coefficients without time subscript are constants. In the next Proposition and Theorem we will make use of the following notation:

Notation 1

Condition 2

Proposition 8

Under Condition 2 the expected value of the GRC-AR() model is given by

In what follows we adopt the notation , where is the companion matrix (see eq. (35)), is the Kronecker product, and refer to the modulus of the largest eigenvalue of .

Condition 3

.

In the next Theorem we shall also make use of the following notation:

Notation 2

Theorem 7

Let us remark that Condition 2 is equivalent to , which implies that for all , and, therefore, ensures that . As another example we examine the autoregressive process of order 2.

Corollary 4

Consider the GRC-AR() model and let the following condition hold:

Under the above condition its covariance structure is given by

where

and the tridiagonal matrices of order , that is , , are given by

7.4 Double Stochastic AR Models

In this Subsection we examine the more general case where the autoregressive coefficients follow AR processes. We show that for this model the unconditional variance exists in provided that the associated Green function convergences in , a result which is in line with Theorem 2(ii). In other words, we investigate the double stochastic AR model, hereafter termed DS-AR (for double stochastic processes, and in particular ARMA processes with ARMA coefficients see, for example, Grillenzoni, 1993, and the references therein). The DS-AR model is defined by eq. (33) but in this case the autoregressive coefficients, for , follow AR processes:

| (39) |

where and are constant coefficients and for all . are martingale difference sequences defined on , where and , , are independent of each other for all , and . For simplicity, we will assume that the drift in eq. (33) is time invariant, that is, for all .

The results in Sections 5 and 6 can be easily modified to cover DS-AR models by replacing the fundamental solutions with their respective (unconditional and conditional) expectations. More specifically, we present two Theorems followed by two Propositions (their proofs essentially repeat the arguments of the proofs of those in Section 5 and 6).

Sufficient conditions ensuring the Wold-Cramér decomposition of DS-AR() models, and therefore the existence of the first two unconditional moments, are the following two:

| (40) |

Remark 5

Generally, it is very difficult to verify if the two summability conditions are fulfilled. Only some special cases allow to write explicit solutions (see, Andĕl, 1991, and the references therein). A sufficient condition for the absolute summability to hold is that belongs with probability one to the interval , nearly everywhere, that is, with the exception, at most, of a finite number of (see, for example, Grillenzoni, 1993). Similarly, a sufficient condition for the square summability to hold is that with probability one , nearly everywhere, where refers to the modulus of the largest eigenvalue of ; we recall that is the companion matrix (see eq. (35)).

Theorem 8

Theorem 9

In what follows, we present explicit formulae for the first and second unconditional moments for the DS-AR family of processes coupled with sufficient and necessary conditions for their existence.

Proposition 9

Under the two conditions in (40), it follows from Theorem 8 that the unconditional mean of the DS-AR() process, , exists in and is given by

| (42) |

A necessary condition for the absolute summability to hold is

Moreover, the unconditional variance of the process exists in and it is given by

A necessary condition for the second-order summability to hold is

We notice that is equivalent to , which, in turn, is equivalent to . In this latter case, we write , which is in line with Theorem 2(ii).

Proposition 10

Following the notation of Proposition 6, let be the smallest closed subspace of spanned by the finite observed sequence

The -step-ahead optimal (in -sense) linear predictor of the DS-AR() process is:

We remark that is given by eq. (42). In addition, the forecast error for the above -step-ahead predictor, , is given by

The conditional variance of based on , that is is given by

(we recall that have been introduced in eqs. (5) and (6), where now are replaced by ).

We remark that , which is given in Proposition 9.

8 Time-varying Polynomials

In Sections 3, 5 and 6, we employed techniques of linear algebra in order to obtain an explicit representation of the TV-ARMA() model and its first two (conditional and unconditional) moments. The main mathematical tool used was the Hessenbergian determinant. Now that we have expressed the Green’s function as a Hessenbergian, we will see how the summation terms in the various equations in Sections 3 and 5 can be expressed as time-varying polynomials.

Recall that denotes the backshift (or lag operator), defined such that . The time-varying AR and moving average (MA) polynomial (backshift) operators associated with the TV-ARMA() model are denoted as:

| (43) |

Under this notation eq. (1) can be written in a more condensed form

| (44) |

In the time invariant case one can employ the roots of the time invariant polynomial to obtain its general time series properties such as the Wold decomposition and the second moment structure. In a time-varying environment, according to Grillenzoni (1990), the so called here principal fundamental sequence cannot be obtained as in stationarity, that is by expanding in Taylor series the rational polynomial . As an alternative, Hallin (1986) used some results on difference operators involving the symbolic product of operators, which has also been termed by researchers, in the field of engineering, as the skew multiplication operator (see, for example, Mrad and Farag, 2002). Hence, now that we have at our disposal an explicit and computationally tractable representation of the Green function as a banded Hessenbergian, coupled with the use of the time-domain noncommutative multiplication operation -which, as pointed out by Mrad and Farag (2002), is based on the manipulation of polynomial operators with time-varying coefficients using operations restricted to the time domain- we are able to state some important Theorems in relation to the results in Sections 3 and 5.

8.1 The Skew Multiplication Operator

In a time-varying environment, the time-varying polynomial operators in eq. (43) can be manipulated by using the skew multiplication operator “” defined by

| (45) |