[] Overinference from Weak Signals and Underinference from Strong Signals

This version: March 2023)

1 Introduction

People face a constant stream of new information about future events. For example, people might read a new poll about a politician’s favorability, have a brief conversation with their boss at work, or see news about daily stock-market movements. Much of this information is only weakly informative about the relevant future events — whether the politician will be reelected, whether the person will be promoted, or whether they will have enough money for retirement. How do people update their beliefs in response to these types of weakly informative signals? While there is a large literature studying belief updating, it primarily focuses on people’s reactions to information that is relatively strong, with the common finding that people tend to underinfer from such information. We use new experimental and empirical evidence to show that, while people do underinfer from strong pieces of information, they overinfer from weak pieces of information — behavior that is consistent with a simple theory of cognitive imprecision. Consistent overinference from weak signals leads individuals to overvalue low-quality news, and to form beliefs that are overly extreme and excessively volatile.

We start with the observation that weak-signal settings are understudied in the experimental literature. The online appendix of [11]’s (\citeyearB19) survey of the literature, for example, lists over 500 experimental treatment blocks across 21 papers that study inference from symmetric binary signals about a binary state. In none of these papers do subjects see signals that have a diagnosticity — the likelihood of seeing an “high” signal conditional on the “high” state — lower than . Belief updating in these settings often features underreaction to new information relative to the Bayesian benchmark, particularly when signals are very strong, and much of the past literature has settled on underinference as the dominant form of probabilistic reasoning. For example, [11]’s (\citeyearB19) “Stylized Fact 1” states that “Underinference is by far the dominant direction of bias.” Given the limited space of signals studied, however, the experimental literature has had little to say about the reaction to signals with lower diagnosticity.

Identifying updating errors outside of the laboratory is more challenging because both people’s beliefs and the correct Bayesian beliefs are often unobservable. One prominent strand of such work uses asset prices as proxies for beliefs or expectations.111Another line of work uses beliefs as elicited in surveys, often regarding macroeconomic outcomes; see [3] for a survey. Our focus for now is on asset-price data, as financial markets provide useful high-frequency proxies for beliefs over multiple horizons and signal-strength environments. For individual stocks, there is robust evidence of predictable post-earnings announcement drift — in which a firm’s stock price tends to continue drifting in the same direction as the initial change after an earnings announcement — which appears consistent with initial underreaction to the announcement. But this finding seems to conflict with the large literature on excess volatility in overall stock-market valuations, which instead appears consistent with overreaction. While there are many candidate explanations seeking to reconcile these findings, we focus specifically on the role of signal informativeness. Pieces of news like company earnings announcements are relatively informative ([68]), while much of the information that drives daily market price changes (and volatility) is only weakly informative.

Our core goal, then, is to study how reaction to information varies when signals are weak versus strong. To do so, we both create (in the lab) and find (in asset-price data) environments in which signal strengths vary systematically and updating behavior can be measured consistently.

This is relatively straightforward in an experimental setting, where we have full control of the data-generating process (DGP): in the main treatment of our pre-registered experiment, we study a simple updating environment and vary the signal strength more comprehensively than has been done in past work. In particular, in the simplest treatment block, we expose 500 people to 16 different signal strengths in a version of a commonly used “bookbag-and-poker-chips” experimental design (e.g. [60]) in which people receive one binary signal about a binary state.

The main result of our experiment is that, while people underinfer from strong signals, they overinfer from weak signals. In the simple treatment block, subjects have a prior of about a binary state and receive a binary signal with diagnosticity that would move a Bayesian to a posterior of that the more likely state will occur. Consistent with nearly all existing evidence, for strong signals for which , we find robust evidence for underinference: subjects form posteriors that are significantly below . For , we do not find clear evidence for over- or underinference: the difference between and is small.222As discussed in [11], evidence in this range is mixed, though often favoring underinference (e.g., [60] and [26]). However, there is evidence from recent work, such as [2] and others with asymmetric signals, that finds overinference for . However, for , we find clear and robust evidence for overinference: is statistically significantly greater than , and the effect is convex in . For very weak signals, subjects act as if signals are twice as strong as they truly are.

The shape of the belief response function maps closely to the predictions of a theory of cognitive imprecision that we extend, adapting ideas from psychophysics into economic decisionmaking ([29]; [45]).333Fechner’s theory was originally used to explain stimuli such as the weight of an object and brightness of a light; it has been more recently used in economics to explain misperceptions of numbers, probabilities, and risk and ambiguity ([44]; [45]; [27]; [31]). We add to this literature by using psychophysics to study informational signal strengths. In subsequent work, [7] use a related model that includes an added step in which individuals first reduce the complexity of the decision environment. Specifically, we use a meta-Bayesian model in which people are cognitively imprecise about the signal strength (similar to models in [59] and [71]). As a consequence, people’s average perception of signal strength — for — is biased towards “intermediate” strengths.444[63] first popularized the power function for misperceptions of physical stimuli, and [45] use it for misperceptions of values and lotteries. This leads them to perceive weak signals as stronger than they are and strong signals as weaker than they are. In our data, we estimate that and , and that there is a switching point of at which people switch from overinference to underinference. Given this estimate, it is unsurprising that the plethora of experiments which use signals of precision greater than 0.64 find underinference.

While our simple model’s predictions might plausibly arise from a range of potential psychological microfoundations, we do find further evidence in line with our framework when exploring heterogeneity in treatment effects. Consistent with cognitive naivete affecting misinference, subjects with lower scores on a cognitive reflection test (a modified version of the classic test in [30]) both infer more from weak signals and infer less from strong signals. Relatedly, naivete within the experiment is related to more severe biases; using a within-subject test, we find that subjects who have had more experience in the experiment misinfer less in both directions. Finally, consistent with imprecision being an explanatory factor, we find that subjects with higher variance in how they perceive signals misinfer more in both directions. These heterogeneities suggest that cognitive imprecision affects both the overinference and underinference biases in belief updating, expanding upon the work by [71] and [27] in different decision problems.

If people systematically overinfer from weak signals and underinfer from strong signals, they may overvalue low-quality news and undervalue high-quality news, patterns that are borne out in our data. In an additional treatment of the experiment, subjects are asked to purchase up to three signals of varying strengths. Compared to a payoff-maximizing benchmark, subjects purchase too many weak signals and too few strong signals.555These results are qualitatively consistent with those of [2], but with more precise evidence for over-purchasing due to our emphasis on weak signals. These effects can be explained by misinference from both signal strength and signal quantity. To test the latter, we run an additional treatment that varies the number of signals subjects receive, finding consistent evidence that subjects underreact to the quantity of signals (as previously documented by [39]; [13]; and [12]). Combining these factors, people particularly overvalue observing individual weak signals and undervalue observing multiple strong signals.

We use other experimental treatments to explore mechanisms behind these findings. We show that our main results are driven by distorting signal processing, not by distorting probabilities (unlike, for instance, [43]; [66]; and [27]). We are able to distinguish between signal processing distortions and probability distortions by considering how subjects infer from asymmetric signals. A signal that happens to have a likelihood of close to 0.5 does not systematically affect inference, suggesting that it is the signal that is misperceived as opposed to its associated probability.666We also consider other confounds that arise because of the particular design of the experiment (such as a general bias toward high or low numbers), but do not find evidence that these confounds drive results. Additionally, we show that, when faced with signals of an uncertain strength, results suggest that people act as if they misperceive possible realizations of the signal.

While our experiment allows us to cleanly identify over- and underinference, there are reasons to think that the behavior we observe may not carry over to real-world situations. First, rewards for accuracy in an experiment are relatively small, so one might think that people will work to correct their biases in higher-stakes environments (e.g. [50]). Second, the setting of the experiment is abstract and unfamiliar to subjects, so they may rely more on heuristics; in real-world settings with more sophisticated people, perhaps familiarity and experience will drive beliefs towards true probabilities (e.g. [52]).

In light of these concerns, we next turn to evidence from more realistic high-stakes settings by studying the movement of market-implied probability distributions in betting and financial markets.777One cost of this analysis is that we must use equilibrium prices (which reflect the marginal investor’s beliefs and risk preferences) rather than individual beliefs. But we find that the behavior of market-implied beliefs aligns well with our theory, so these results serve as a useful external check on our experimental results. A key challenge with testing any theory of updating in real-world observational data is that we no longer have direct knowledge of the true DGP or signal strength. To overcome this challenge, we develop a new empirical method based on theoretical results from [5] and [4]. The core intuition of these papers is that, when a Bayesian is changing their beliefs over time about some event, they must be learning something and therefore (on average) must reduce their uncertainty correspondingly. This intuition can be formalized by defining movement as the sum of the squared deviations of changes in beliefs over time, and uncertainty reduction as the drop in perceived variance in the outcome.888For example, assume that a Bayesian’s subjective prior that some outcome will take place is . Then it must be the case that (expected movement, where the expectation is taken over possible date-1 signals) is equal to (uncertainty reduction). While movement and uncertainty reduction may differ for a given signal realization, they must be equal in expectation across signal realizations, regardless of the DGP. This insight allows for a DGP-agnostic test of Bayesian updating in observational data. And crucially for our analysis, these statistics are intuitively and theoretically related to over- and underreaction: overreaction will lead to positive excess movement (movement greater than uncertainty reduction) on average, while underreaction will lead to too little movement relative to the reduction in uncertainty.

While this allows for an intuitive test of over- vs. underreaction with an unknown DGP, to test our theory, we also need to distinguish situations in which signals are weak versus strong. Given that the signal strength is also unobservable, we must instead turn to an ex-ante known (and observable) separating variable that is related to signal strength. Our innovation here is to focus on time to resolution as our separating variable. Intuitively, when a person is predicting the value of the S&P 500 in three months, information today should generally not lead to much belief movement; meanwhile, information today is highly informative for the value of the S&P tomorrow, and we should accordingly observe more movement of short-horizon beliefs in response to information.999The relationship between the time horizon and Bayesian belief movement of course depends on the exact DGP. We show that the predicted positive relationship holds very strongly in simulations of game-like DGPs, and more importantly, it clearly holds in our empirical settings.

Our theory then intuitively suggests that there should be overreaction (and too much movement) at long forecast horizons, and underreaction (and too little movement) at short horizons. We first confirm, by simulating simple DGPs matching our empirical setting, that this pattern exists for an agent who misperceives according to our theory, and that this pattern differs from that under Bayesian updating or constant under- or overreaction. We then turn to the data. We first study sports-betting data, making use of over 5 million transactions from a large sports prediction market for five major sports (corresponding to more than 20,000 sporting events). We then study S&P 500 index option markets, using option-implied beliefs regarding the future value of the S&P from over 4 million daily option prices (corresponding to 5,500 trading dates and 955 option expiration dates).101010The option-implied probability distribution is also referred to as the risk-neutral distribution. It coincides with the marginal trader’s subjective distribution only in the case that the trader is risk-neutral; otherwise it incorporates risk aversion. We discuss how we deal with this complication in detail in Section 5.

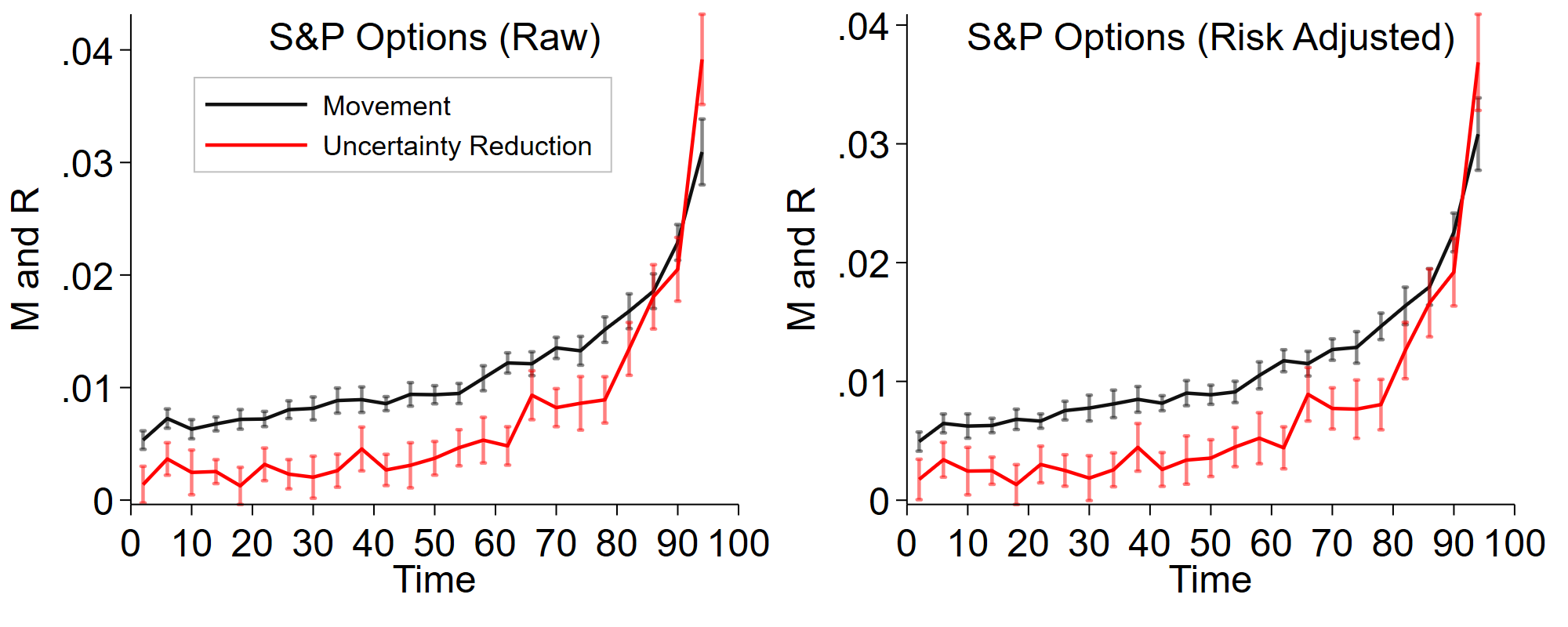

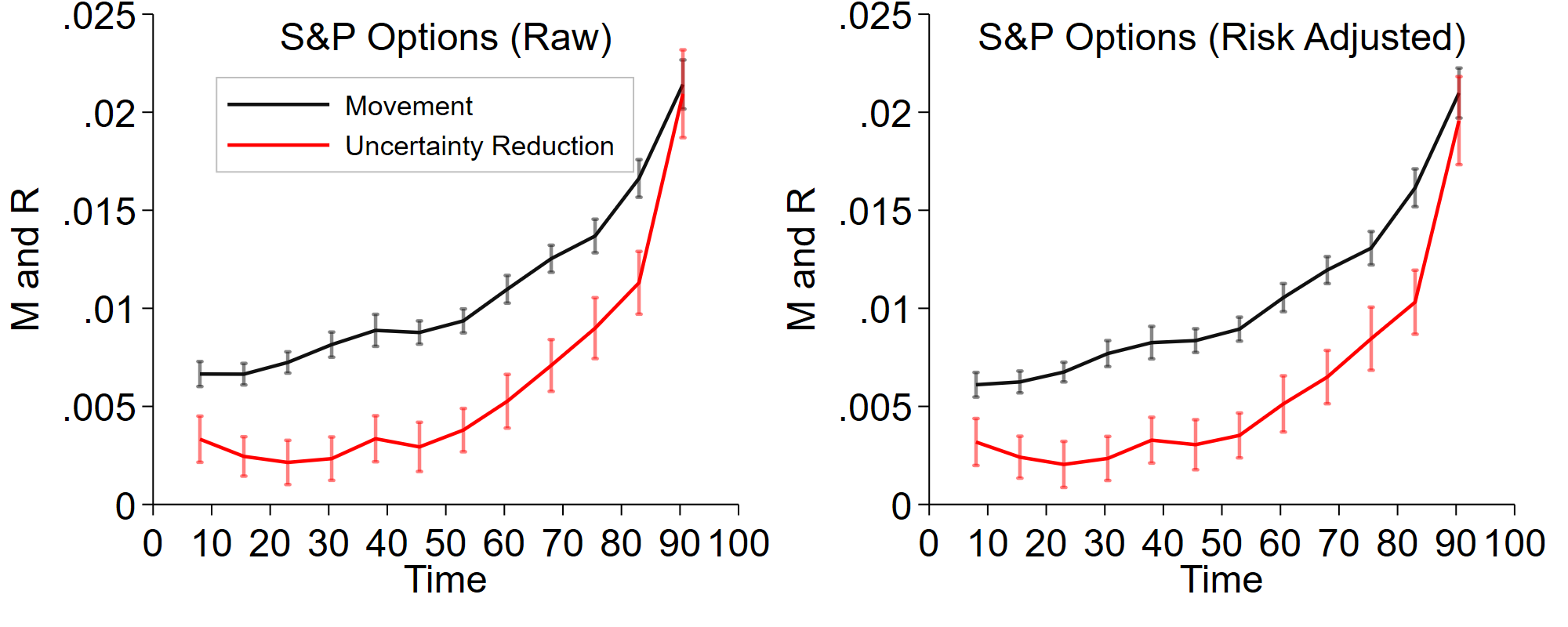

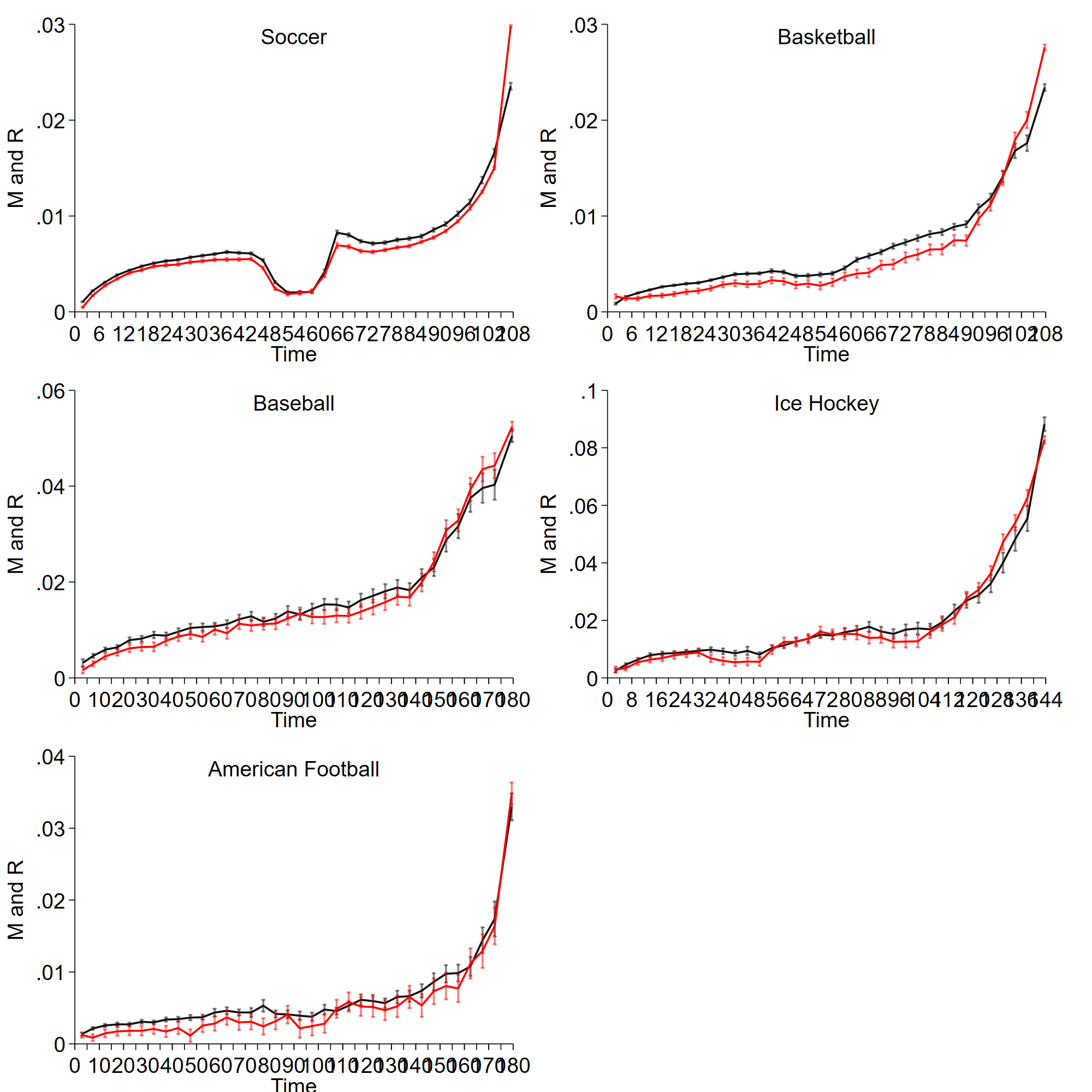

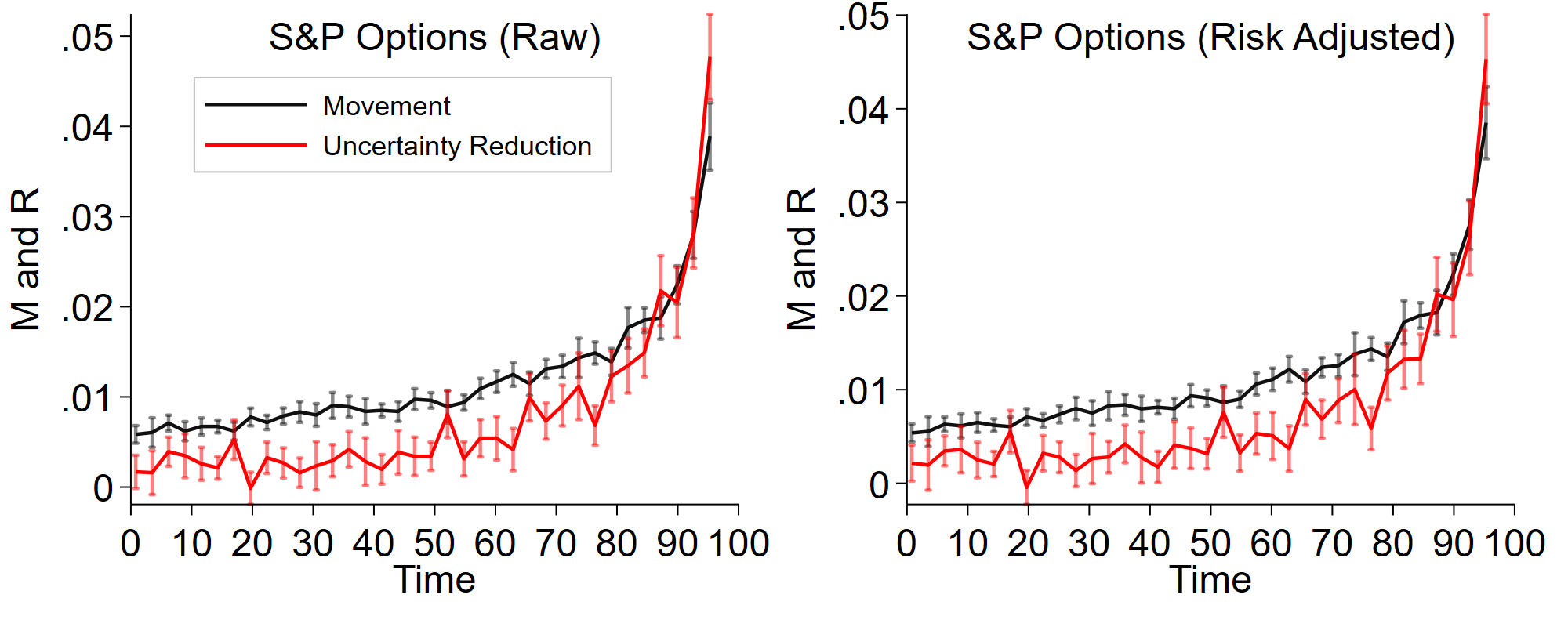

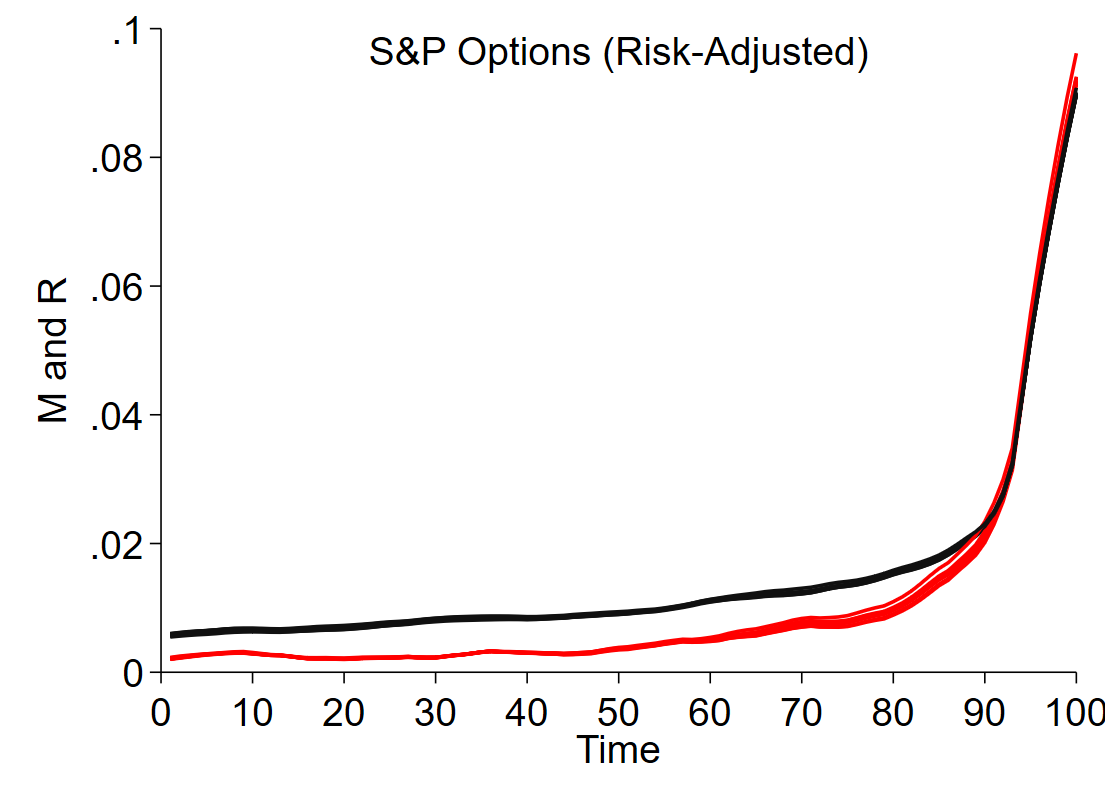

We start by plotting the average movement and uncertainty reduction over time for the sports and financial data. Both uncertainty reduction and movement are generally increasing as the event continues and resolution approaches. However, movement is generally higher than uncertainty reduction at the beginning of the event and lower at the end of the event. For example, in the options data, there is very little daily uncertainty reduction until a few weeks before the contract expires, but beliefs consistently move back and forth, generating positive movement. In other words, news today appears to hold relatively little information about the value of the S&P in multiple months, but the market acts as if has more diagnosticity. However, within two weeks of a contract’s resolution, the relationship reverses: movement is either less than or equal to uncertainty reduction. That is, as signals become stronger, the market begins to underreact. On net, total movement averaged over an entire option contract is too high, matching the finding of excess movement in [4]. But this overall average masks meaningful heterogeneity as one varies the signal strength, with markets misperceiving in the manner predicted by our theory. The same broad pattern holds in the sports-betting data we consider.

To statistically test this relationship, we regress average movement on average uncertainty reduction in a given time window (where time is measured as distance to resolution). While a Bayesian should have a constant of 0 and slope of 1 in such a regression, we show that the constant is significantly positive and the slope is significantly less than one.111111We discuss a variety of econometric issues such as attenuation bias, and show that the richness of the data allows us to tightly bound the effect of such bias. The positive constant indicates that when signals are likely to be weak (uncertainty reduction is low), there is too much belief movement. The less than one-for-one slope indicates that as signals become stronger (uncertainty reduction increases), there is a point at which the relationship flips, and there is too little belief movement.

Given that we cannot observe true signal strength, we must rely on our indirect measure (time to resolution) to test the relationship between signal strength and over- vs. underreaction in real-world high-stakes settings. The strength of our experimental setting, meanwhile, is that these variables are fully observable, but the experiment is lower-stakes and less realistic. The two settings thus provide complementary evidence for our theory, whose predictions align well with both sets of data.

Our main experimental results relate to numerous papers on the topic of belief updating, including several papers that present evidence for other forms of over- and underreaction to information. Classically, [39] show that subjects underreact to the credence of a signal relative to its strength, and [56] show that subjects overreact to what a signal says relative to the environment that produces it. More recently, [35] find underreaction to strong signals but even further underreaction to the retraction of those signals, while [46] find overreaction to disconfirming signals, and [15] find overreaction to the retraction of certain types of information that may be classified as weak. This paper also relates to the use of cognitive imprecision in inference problems, such as in [27] and [65], that finds relationships between underreaction to strong pieces of evidence and cognitive imprecision. There is evidence that other forms of decision problems may induce overreaction, as shown by [28] and [1], so we focus on this particular decision problem.

More recently, [7] run an experiment that confirms many of the patterns that we originally documented in our experiment: they also vary signal diagnosticity and find overreaction to weak signals and underreaction to strong signals. Using theory and other treatments, they extend our findings to argue that individuals reduce the complexity of information structures before misinterpreting these structures in ways consistent with cognitive imprecision. By contrast, they do not analyze non-experimental data, whereas we provide additional empirical evidence from sports-betting and financial markets. We see these papers as highly complementary.

Our results are thus further related to a large literature on asset prices and beliefs, as surveyed recently in [9]. [14] provide an early discussion of the possible link between post-earnings drift and underreaction, while [24] do so for the connection between excess volatility and overreaction.121212More recent work includes [32] and [*]BGLS-WP (\citeyearBGLS-WP), while [22] and [69] consider under- and overreaction along the Treasury yield curve. [48] aim to reconcile these findings through the lens of the extremeness (or fat-tailedness) of the true distribution of outcomes. We focus instead on the informativeness of signals about a given outcome, which is conceptually different from the extremeness of the outcome distribution.

The paper proceeds as follows. Section 2 introduces the theoretical framework; Section 3 details the experimental design; Section 4 presents the experimental results; Section 5 analyzes the market data; and Section 6 discusses our results and concludes. The Appendix contains additional results and empirical details, and screenshots of the pages in the experiment are provided in the Supplementary Appendix.

2 Theory

2.1 Setup and Intuition

We consider individuals who may misinterpret information they receive. In the environment we study, people begin with a prior at time 0, then receive a signal about a binary state , and form a posterior at time 1. An individual has a prior . The signal either sends a low message or a high message ( or ), with . After seeing signal , the individual forms a posterior belief , which we typically shorten to . Defining the logit function , a Bayesian would form a posterior such that (using the setup developed in [37]). We consider a misperceiving person who may over- or underinfer from information and instead forms a posterior of .

Misperception of Signal Strength

The strength of a signal is defined by its log odds ratio: . We study how depends on through . We posit that when people receive a signal of strength , they systematically distort their perception of its strength when using it to form posterior . Following [59], and [71], individuals in our model misperceive via a form of cognitive imprecision. First, as described by the classic Weber-Fechner law, they interpret changes in in relative terms instead of in absolute terms ([29]). Second, they are uncertain as to what the true signal strength is.

Specifically, we follow [71] in assuming that a misperceiving person represents signal strengths with a value , which is drawn from a normal distribution with imprecision parameter : .131313The Weber-Fechner law says that has a mean of , and cognitive imprecision says that individuals face uncertainty about their perception of . They have a “cognitive prior” about how strong signals tend to be, and this belief is distributed log-normally: . They update using Bayes’ rule when observing a signal; given , their perceived posterior expectation of is

where is the prior mean over signal strengths.

Therefore, their perception of the true signal strength is distributed log-normally with mean equal to

| (1) |

where and .

Our main object of interest is the average level of over- and underinference for different values of , so we assume for now that each person perceives to be exactly the expectation given by (1); that is, when they see a signal of strength , they always perceive it to be of strength . This simplification makes the functional form a version of the classical one from [63], and it makes the analysis more tractable without affecting the main results qualitatively.141414This strips away within-person variation in signal representations for a given . But heterogeneity across people is not ruled out, and we explore such heterogeneity in our experimental data below.

The misperception implied by Equation 1 can be described as the individual misweighting signals: by treating signal as having strength , they are effectively weighting a signal with strength by a factor of . There is a switching point for which this weight is below 1 (leading to overreaction) if , and above 1 (leading to underreaction) if .

Updating Given Symmetric Signals

We now focus on symmetric signal structures, which we use in the experiment, in which each signal has the same precision , and therefore the strength of each signal is . When the prior is (as in our experiment), then the Bayesian posterior equals the signal precision . This leads to simplified formulas, which allows for a set of simple two-dimensional graphs that represent the core relationships in the model (we will reproduce these same graphs using experimental data in the next section).

While the Bayesian perceives signals as having the correct strength , the misperceiving person instead treats each signal as having a mean strength of

| (2) |

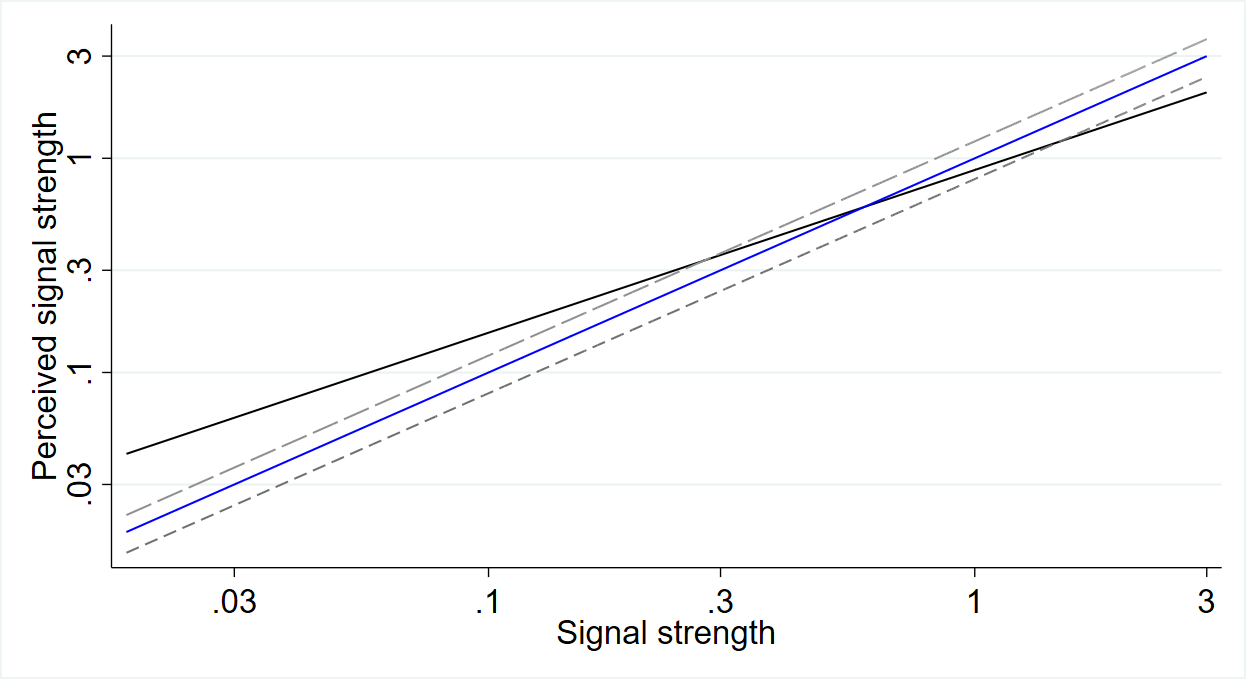

The top panel of Figure 1 plots the relationship between perceived and true strength (given the parameters and we estimate from the experiment). For comparison, we also plot the relationship for a Bayesian (for which they are equal) and a person who exhibits constant conservativism (for which perceived strength is always lower than reality).151515Note that constant conservatism, which corresponds to (and ), is not achievable with this functional form, since implies , but implies . The misperceiving person in our model overreacts to weak signals, but underreacts to strong signals.

When a Bayesian observes a symmetric signal, they will update to either or . Instead, the misperceiving person will update to either or at the mean perceived signal strength, where

| (3) |

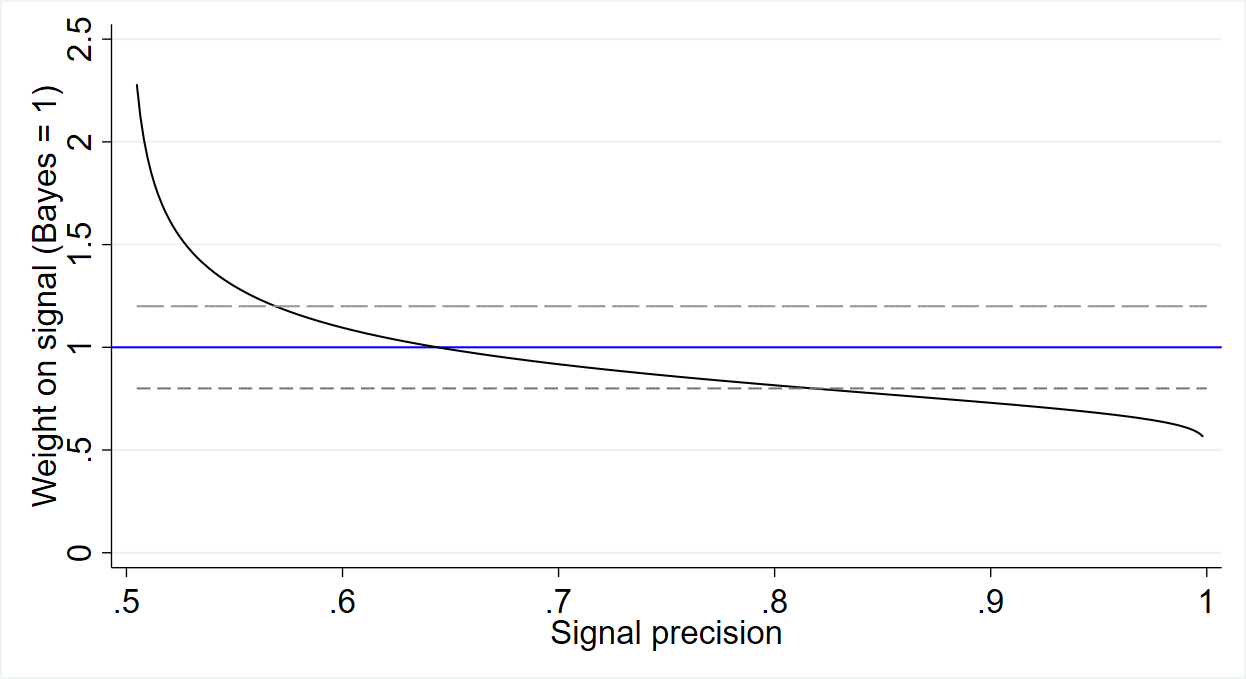

That is, can be seen as the perceived precision of the signal. The middle panel of Figure 1 plots the mapping between the perceived and true precision, which is another way of capturing the core error. The misperceiving person believes that signals with little precision are more precise than reality, and signals with high precision are less precise. Note that, as signals become arbitrarily informative or uninformative, their weighting function becomes arbitrarily small or large, but their posteriors converge to the Bayesian’s.

Following the discussion above, a final interpretation is that the individual is misweighting signals. Defining as the weighting function given precision yields

| (4) |

The bottom panel of Figure 1 plots the weighting function relative to the precision , again given our experimental parameters. The misperceiving person places too much weight on weak signals and too little weight on strong signals. This is the core prediction from our theoretical framework. While mechanisms other than cognitive uncertainty might generate qualitatively similar patterns, the particular power form of our predicted weighting function aligns closely with our experimental data, as discussed further below.

-

•

Notes: These figures provide three representations of the core deviation in our model. Blue lines correspond to Bayesian updating (correct perception of signal strength ), short dashed lines to underinference (with perceived signal strength ), long dashed lines to overinference (perceived signal strength ) and black lines to the misperception in our model (perceived signal strength with and ). The top panel plots signal strength perception as a function of signal strength on a log-log scale. The middle panel plots the perceived precision as a function of the true precision. The bottom panel plots the weight put on signals as a function of the true precision. All figures show that misperceiving individuals overweight weak signals and underweight strong signals.

2.2 General Model Predictions

Figure 1 shows some properties of the weighting function — in particular, how the agent switches from overinference to underinference as signal strength increases — for one particular parameter set. Proposition 1 shows that this is in fact a general property.

Proposition 1 (Misweighting Information).

The weighting function from Equation 4 and the precision from Equation 3 have the following properties:

-

1.

is decreasing in .

-

2.

There exists a switching point such that:

-

•

If the Bayesian perceives the precision to be , and .

-

•

If the Bayesian perceives the precision to be , and .

-

•

The model also makes predictions about which types of individuals and situations will lead to greater overinference from weak signals and underinference from strong signals. Individuals with greater cognitive imprecision, as measured by , act in a way that is further from Bayesian updating for both strong and weak signals. In particular, there is a value

at which iff . That is, cognitively precise people will behave similar to a Bayesian, while cognitively imprecise people will both overweight sufficiently weak signals and underweight sufficiently strong signals.

The misperceiving person’s instrumental value for a signal tracks signal perceptions. Suppose that after receiving the signal, the person is asked to take an action , and they receive utility if and if . In this setup, a person maximizes expected utility by taking the action corresponding to their belief. Given this choice, a person with belief will expect to earn utility . An individual who is aware that they will perceive a signal using Equation 3 will therefore instrumentally value a signal that moves beliefs from 1/2 to at . When individuals start with a prior of 1/2, this means that overinference will lead to excess demand for information and underinference will lead to too little demand, and there will be a switching point at .

3 Experiment Design

This section overviews the design and the sample, then outlines the timing and treatment blocks, and lastly discusses further details of each treatment block. For full details on the experimental design, Supplementary Appendix C contains screenshots of each type of page.

3.1 Overview and Data

Subjects were told that a computer has randomly selected one of two decks of cards — a Green deck or a Purple deck — and both decks are equally likely ex ante. Each deck has Diamond cards and Spade cards: the Green deck has Diamonds and Spades, and the Purple deck has Diamonds and Spades. While subjects see the numbers themselves, we will discuss results in terms of shares: Green has share Diamonds and Spades, and Purple has share Diamonds and Spades.

On most questions, subjects draw one (or multiple) cards from the selected deck, observe their suit, and are asked to predict the percent chance of the Green deck and Purple deck after observing the cards drawn. These probabilities are restricted to be between 0 and 100 percent and the sum of the percent chances is required to equal 100. One signal corresponds to a draw of one card. On other questions, they are asked to purchase cards prior to seeing their realization. This design is adapted from [36].

The experiment used monetary incentives to elicit subjects’ true beliefs, as incentives have been shown to improve decision-making in these settings (e.g. [38]). We implement a version of the binarized scoring rule ([42]) that is easier for subjects to comprehend: paired-uniform scoring ([67]).161616In general, binarized scoring rules are better able to account for risk aversion and hedging ([6]). Subjects’ answers determine the probability that they win a high bonus as opposed to a low bonus.171717Specifically, five subjects were randomly chosen to win bonuses. If they won the high bonus, they received $100; if they won the low bonus, they received $10. All subjects received a $3 show-up fee and the average bonus earnings for the selected subjects was $82.

The experiment was conducted in March 2021. Subjects were recruited on the online platform Prolific (prolific.co). Prolific was designed by social scientists in order to attain more representative samples online; it has been shown to perform well relative to other subject pools ([40]). 552 subjects completed the experiment. Of these, 500 subjects (91 percent) passed the attention check. As preregistered, analyses are restricted to these 500 subjects.

3.2 Timing

Subjects saw the following five treatment blocks: (1) one symmetric signal, (2) one asymmetric signal, (3) three symmetric signals, (4) demand for information, (5) uncertain signals. Details of each are in the subsequent subsections. The ordering of when subjects saw each treatment block was as follows:

| Rounds | Treatment Block | Frequency | Observations |

| 1–12 | One symmetric signal | 67 percent | 4,036 |

| 1–12 | One asymmetric signal | 33 percent | 1,964 |

| 13 | Attention check | 100 percent | 500 |

| 14–18 | Three symmetric signals | 100 percent | 2,500 |

| 19–23 | Demand for information | 100 percent | 2,500 |

| 24–25 | One uncertain signal | 100 percent | 1,000 |

Excluding the attention check, there are 8,000 observations. The 4,036 symmetric signals include 3,964 informative and 72 completely uninformative signals. Except when noted, analyses are restricted to the 7,928 informative-signal observations.

Questions within each treatment block were randomized for each subject. The ordering of treatment blocks (besides “one symmetric” and “one asymmetric”) were fixed for ease of subject comprehension.181818For instance, subjects do not see the “demand for information” treatment until they have played rounds in which they inferred from one signal and from multiple signals. Uncertain signals come after demand because they do not reflect the signals that subjects would purchase. The fixed order makes cross-treatment comparisons more difficult than within-treatment comparisons.

3.3 Treatment Blocks

One Symmetric Signal

This is the case where . The Bayesian posterior is equal to or .

There were 32 possible values of within the range [0.047, 0.495] or [0.505, 0.953]. These values correspond to 16 possible signal strengths () in the range .191919More specifically, we chose whole numbers of cards such that signal strengths would be closest to the following values: . On each question, we randomized whether the Green deck or Purple deck had more Diamonds or Spades, which suit was chosen, and whether the deck consisted of 1665 cards or 337 cards. To further ensure that answers are sensible, some subjects also received an uninformative signal in which they draw a Diamond or Spade when is exactly 1/2.202020Subjects indeed treat this signal as uninformative; 96 percent of subjects give a posterior of exactly 50 percent.

One Asymmetric Signal

This is the case where . The Bayesian posterior is given a Diamond and given a Spade.

One of the probabilities was fixed at or and the other probability was randomly chosen from . We randomized which of or corresponds to the near-0.5 probability, which deck had more Diamonds, which suit was chosen, and whether the deck consisted of 1665 or 337 cards.

Three Symmetric Signals

In this treatment block, subjects saw three simultaneous symmetric signals, each of strength , but possibly in different directions. For a given , subjects randomly saw (3 Diamonds, 0 Spades), (2 Diamonds, 1 Spade), (1 Diamond, 2 Spades), or (0 Diamonds, 3 Spades) with equal probability.

There were 14 possible values of , which corresponded to 14 possible signal strengths. These values were chosen so there would be overlap between the posteriors for five (3,0) signals and five (2,1) signals for a Bayesian, allowing for a sharper comparison. Suit distribution and the card drawn were randomly varied as above; the deck size was fixed for this treatment block at 1665.

Demand for Information

In this treatment block, subjects were given the distribution of cards, but not given a draw of a card. Signals were (known to be) symmetric, so the expected signal strength was regardless of the signal itself. We fix . Unlike before, subjects were asked to choose how many cards they would like to purchase, with costs being a convex function of the number of cards. In particular, they were given the option to:

-

•

Draw 0 cards for a cost of $0;

-

•

Draw 1 card for a cost of $0.50;

-

•

Draw 2 cards for a cost of $1.50; or

-

•

Draw 3 cards for a cost of $3.

These numbers were chosen such that purchasing 0 cards is optimal for all , purchasing 1 card is optimal for , purchasing 2 cards is optimal for , and purchasing 3 cards is optimal for .

We set five possible values of such that optimal level for purchasing ranges from 0 to 3. Suit distribution and the card drawn were randomly varied as above and the deck size was fixed at 1665.

Uncertain Signals

In this treatment block, subjects saw a signal with precision that was equal to either or , with equal probability. Subjects randomly saw one of the following pairs of values: , , , , . Note that a Bayesian would have the same perceived signal strength in each of these cases.

Suit distribution and the card drawn were randomly varied as above, and the deck size was fixed at 1665.

4 Experiment Results

This section discusses the results for each treatment block. The first subsection presents the main results from inference from one symmetric signal and explores heterogeneity. Next, results about inference from multiple signals and demand for information are presented. After exploring potential mechanisms, and how the other treatment blocks help disentangle them, we discuss robustness exercises to probe the strength of the main results.

4.1 Main Results

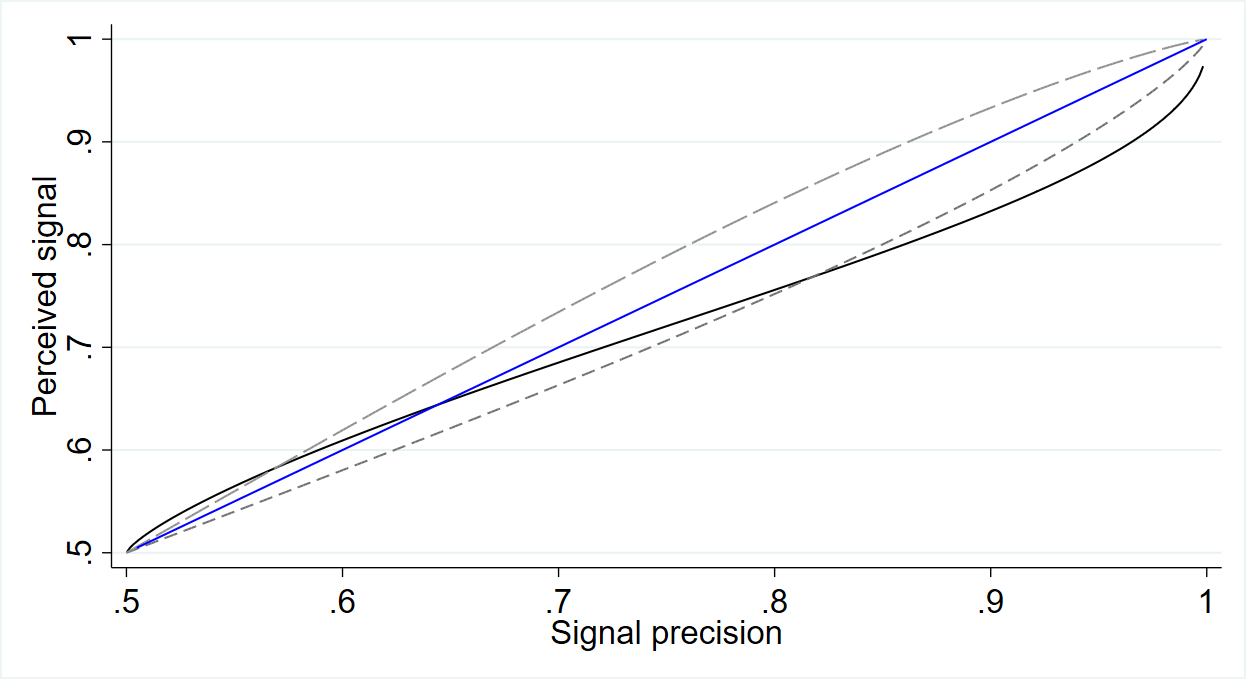

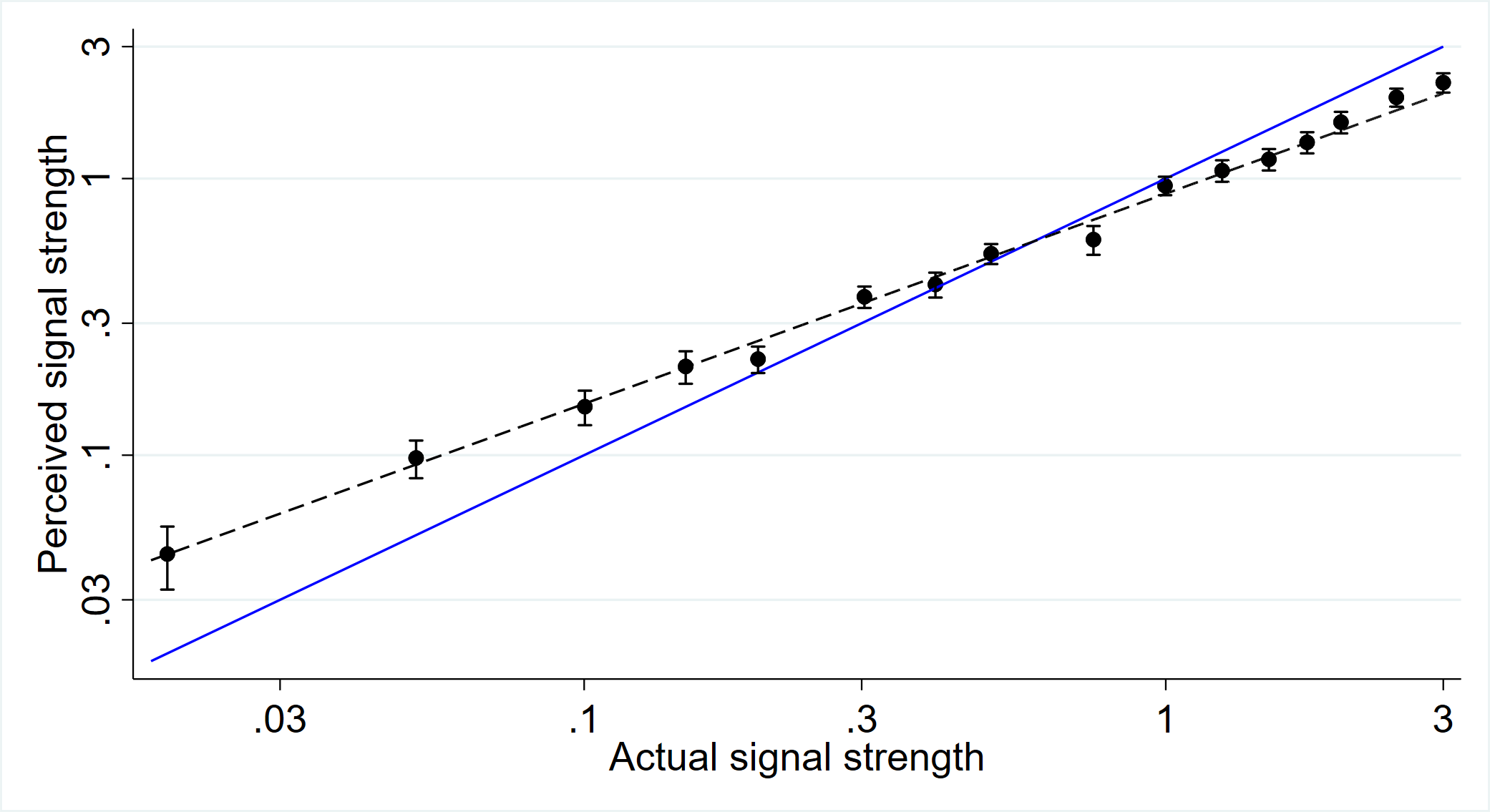

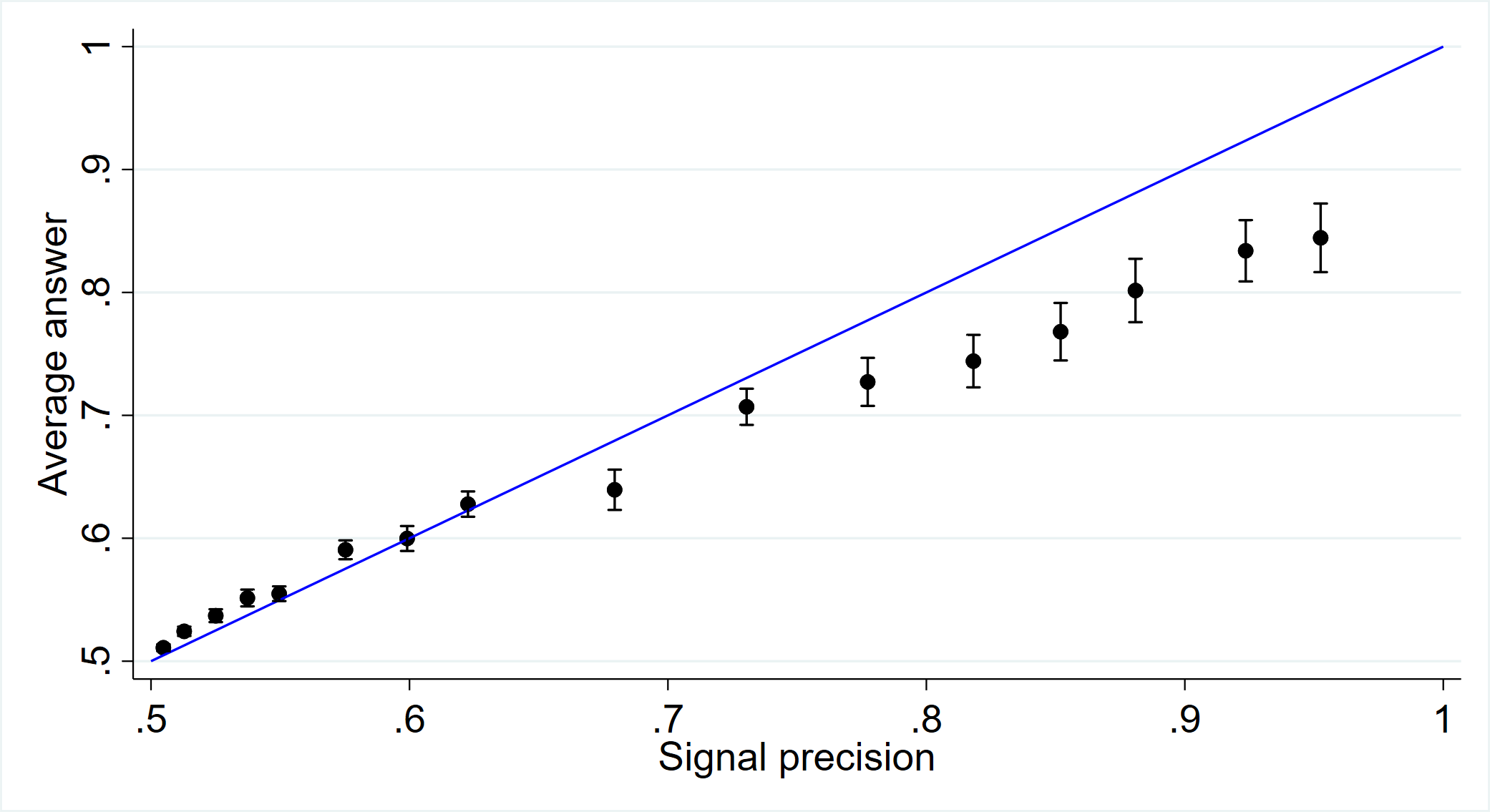

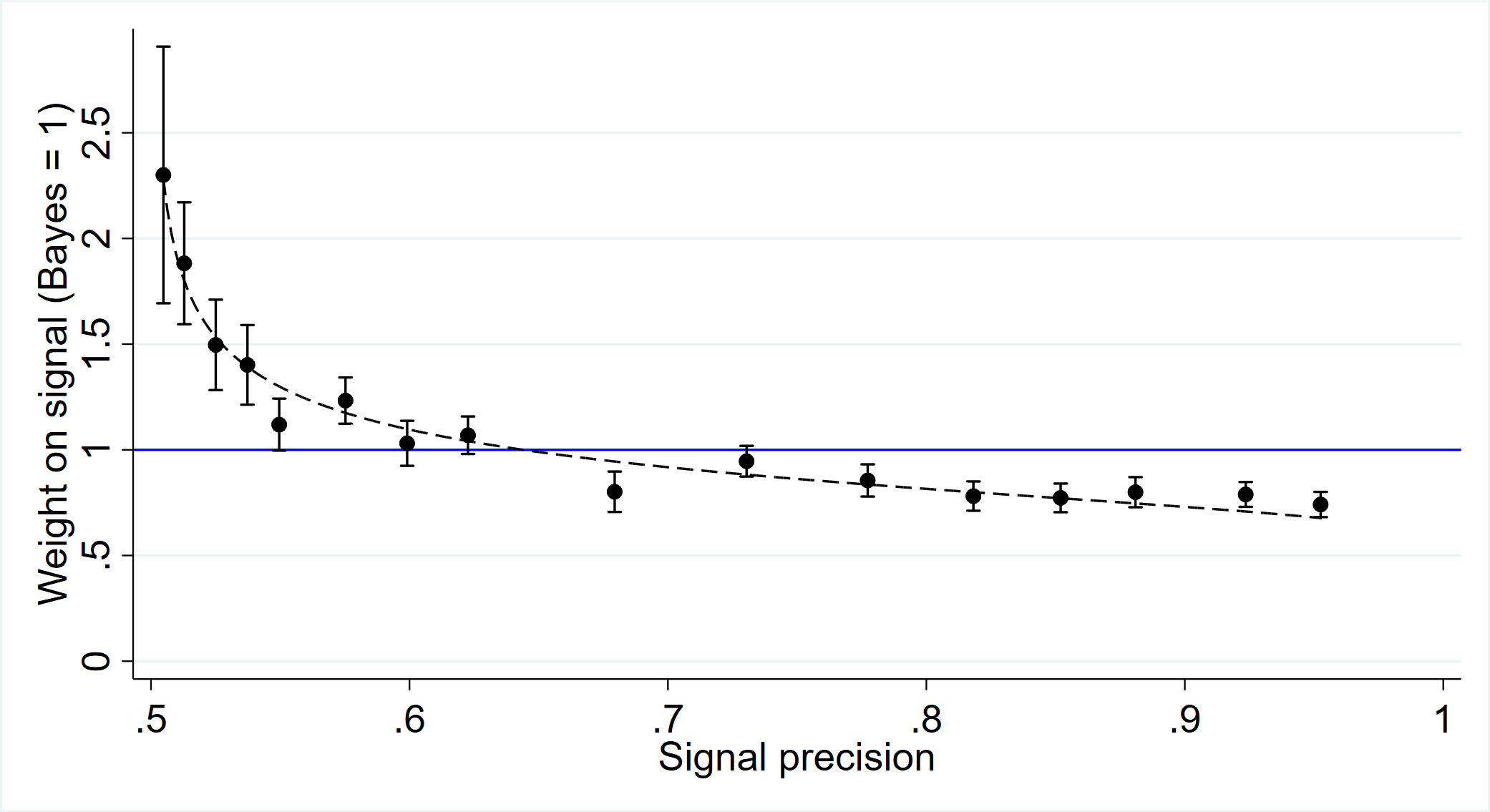

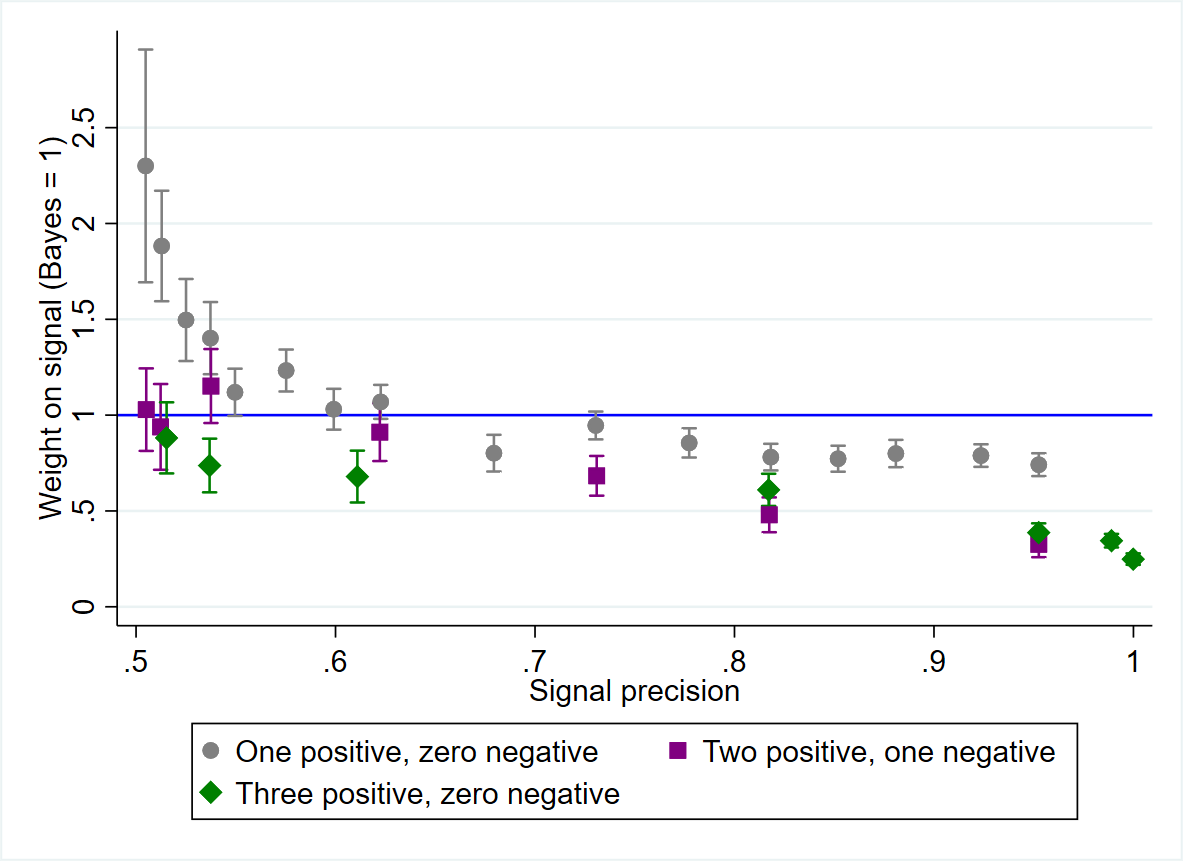

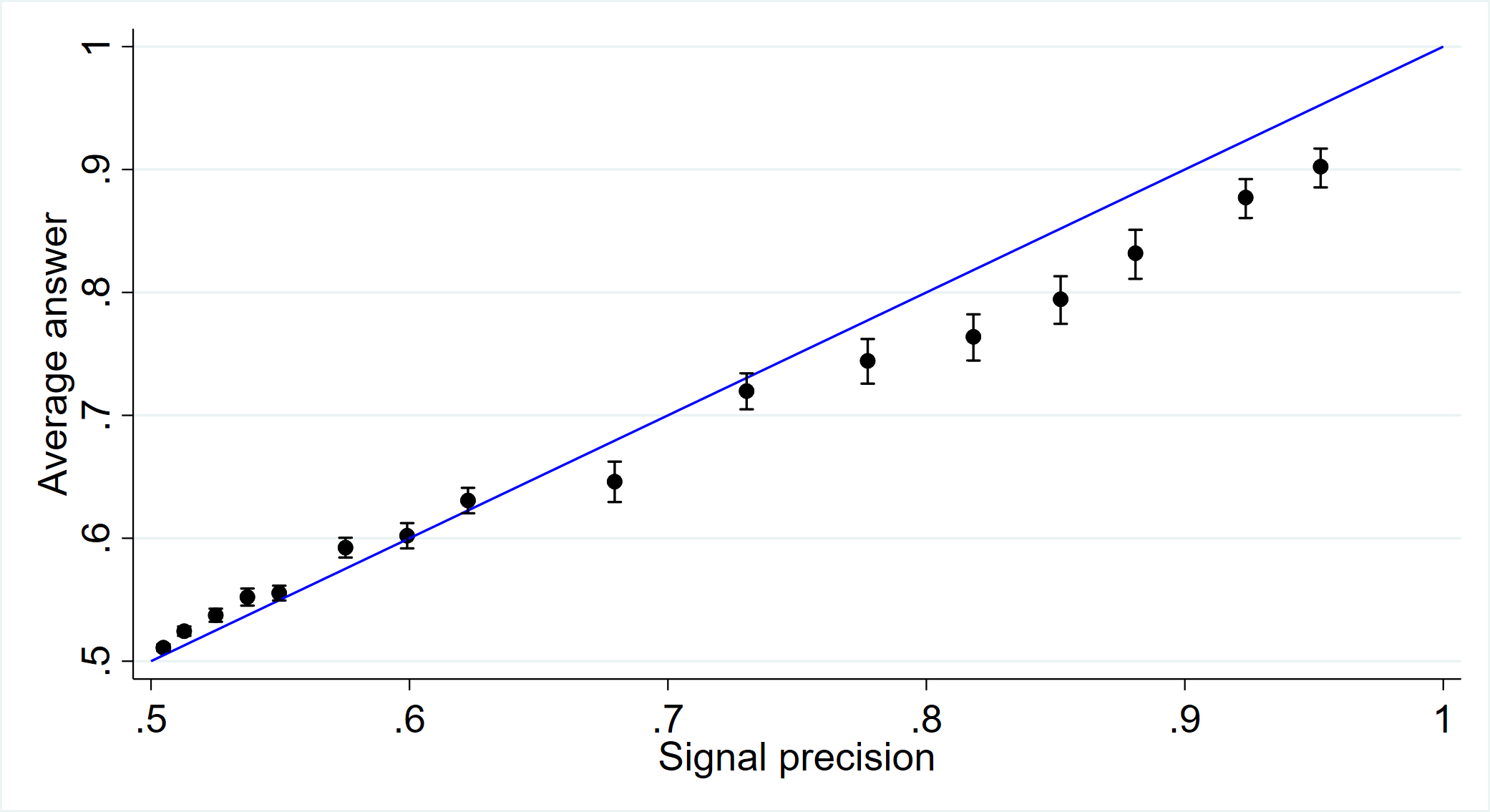

First, we consider how subjects infer from one symmetric signal. Figure 2 presents our main experimental results graphically, comparing our estimates for each condition (black circles) with Bayesian updating (blue lines) and our model’s fitted predictions (dashed lines). Consistent with the theory, subjects systematically overinfer from weak signals and underinfer from strong signals, and the data clearly reject models in which weight is not a function of the Bayesian posterior. The top panel shows that overinference is close to linear in signal strength using a log-log plot, which suggests that the power-law model is a good fit. The middle panel shows that beliefs are increasing but concave in signal precision. The bottom panel provides more evidence that the effect of signal precision on weight is nonlinear. Besides the qualitative explanatory power, the power function from the model in Section 2 predicts the levels of overinference and underinference well.

-

•

Notes: The top panel plots signal strength perception as a function of true signal strength on a log-log scale. The middle panel plots the signal strength average answer subjects give as a function of the Bayesian posterior. The bottom panel plots the average weight subjects put on signals relative to a Bayesian. Blue lines indicate Bayesian behavior. The dashed line fits the data with a power weighting function using nonlinear least squares. All panels show that subjects overweight weak signals and underweight strong signals. Observations are winsorized, for each signal strength, at the 5% level. Error bars indicate 95% confidence intervals, clustered at the subject level.

We estimate and using nonlinear least squares over signal types :

| (5) |

The estimated value for is 0.64 (s.e. 0.01) and for is 0.76 (s.e. 0.03). The value of is statistically significantly less than one (p-value ). These values correspond to an estimate of of 0.88 (s.e. 0.02). All standard errors are clustered at the subject level.

4.2 Heterogeneity

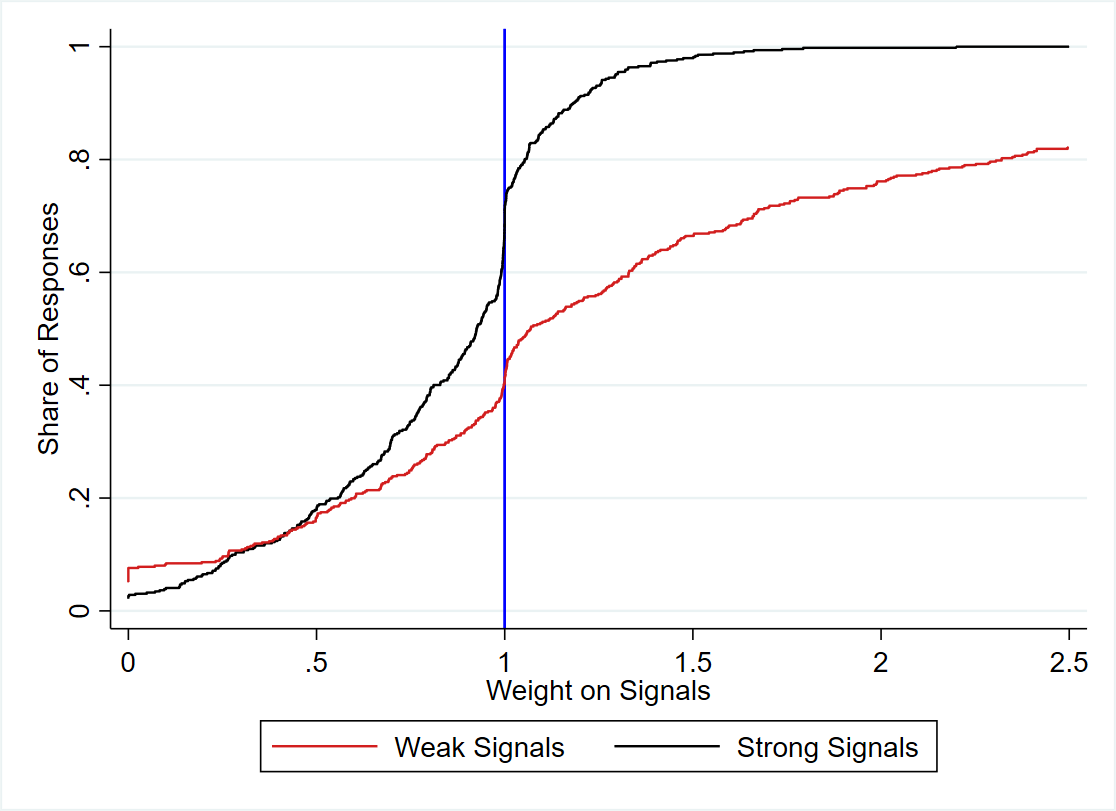

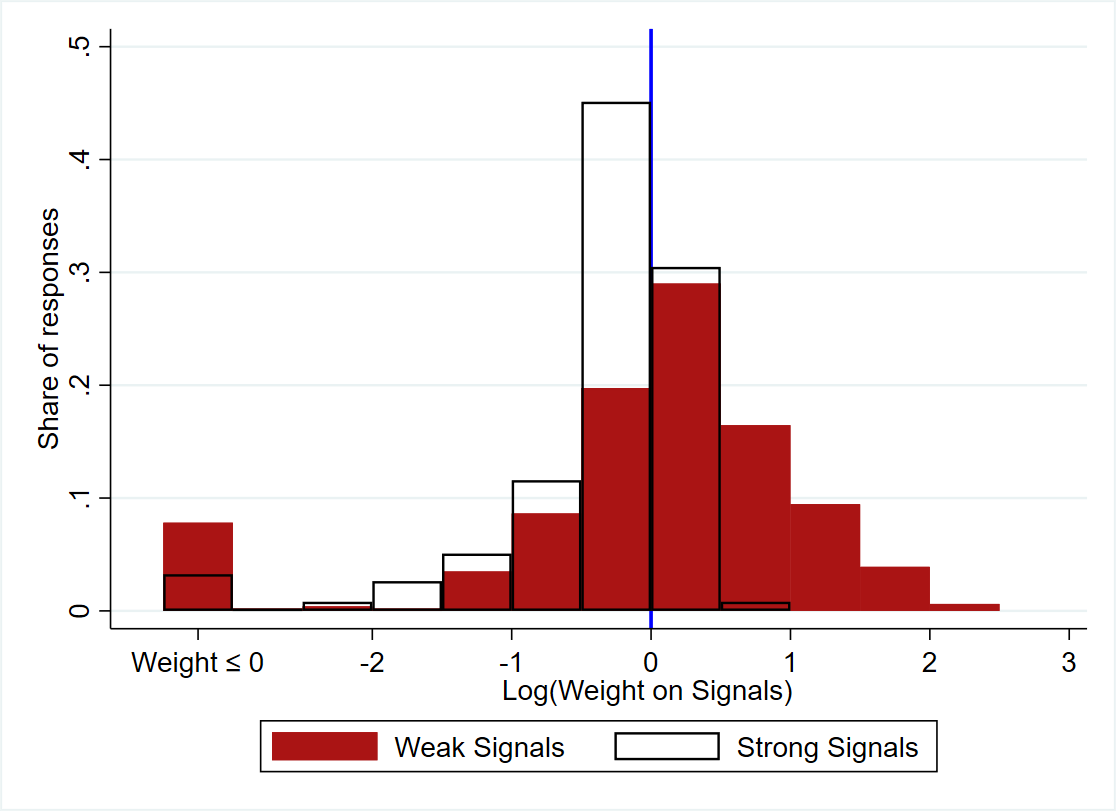

Average effects mask significant heterogeneities across subjects. Appendix Figure A3 plots the raw cumulative distribution and probability density functions at the individual level. This figure shows that while the majority of subjects overweight weak signals and underweight strong signals, some people are much more susceptible to these misperceptions than others.212121This figure also indicates that the choice of winsorization for Figure 2, specified in our pre-analysis plan, is not driving its findings.

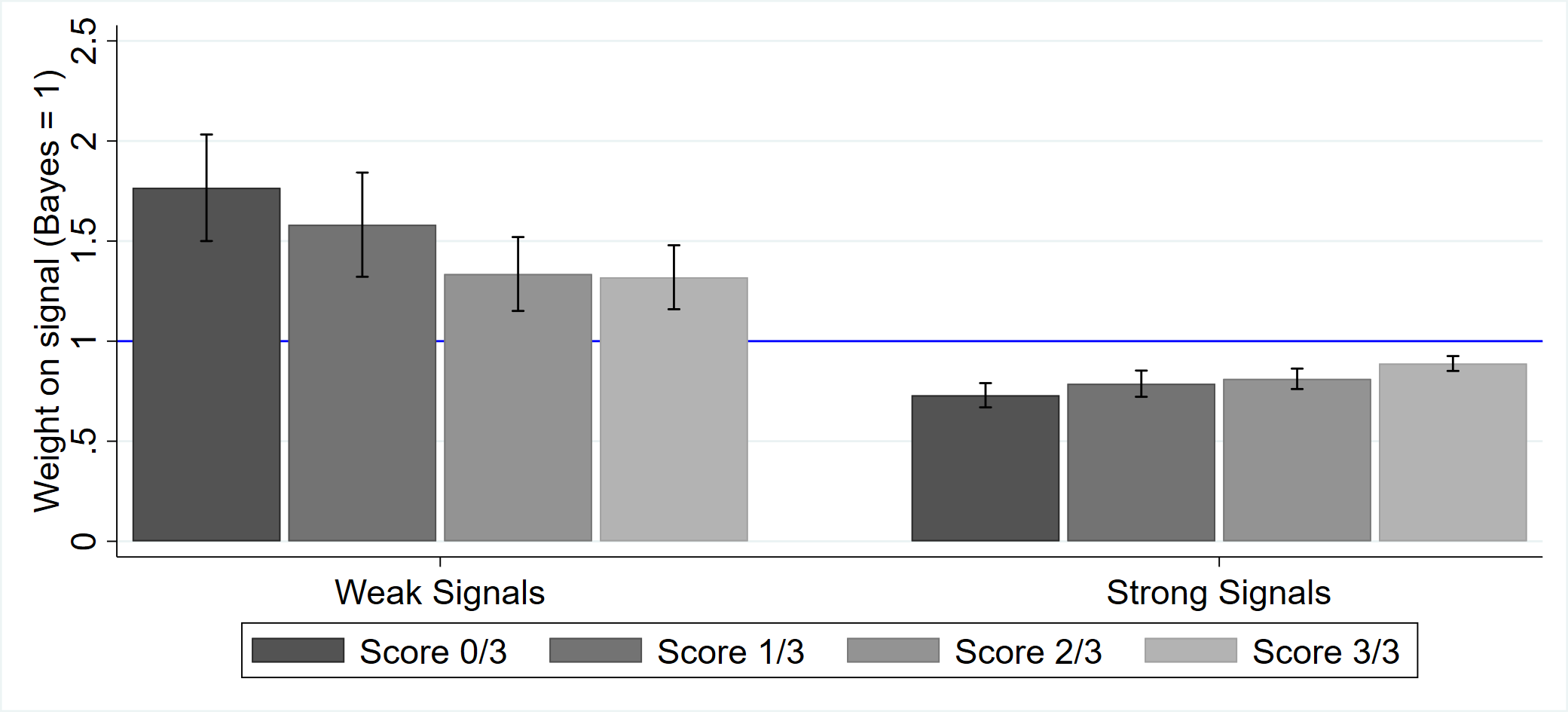

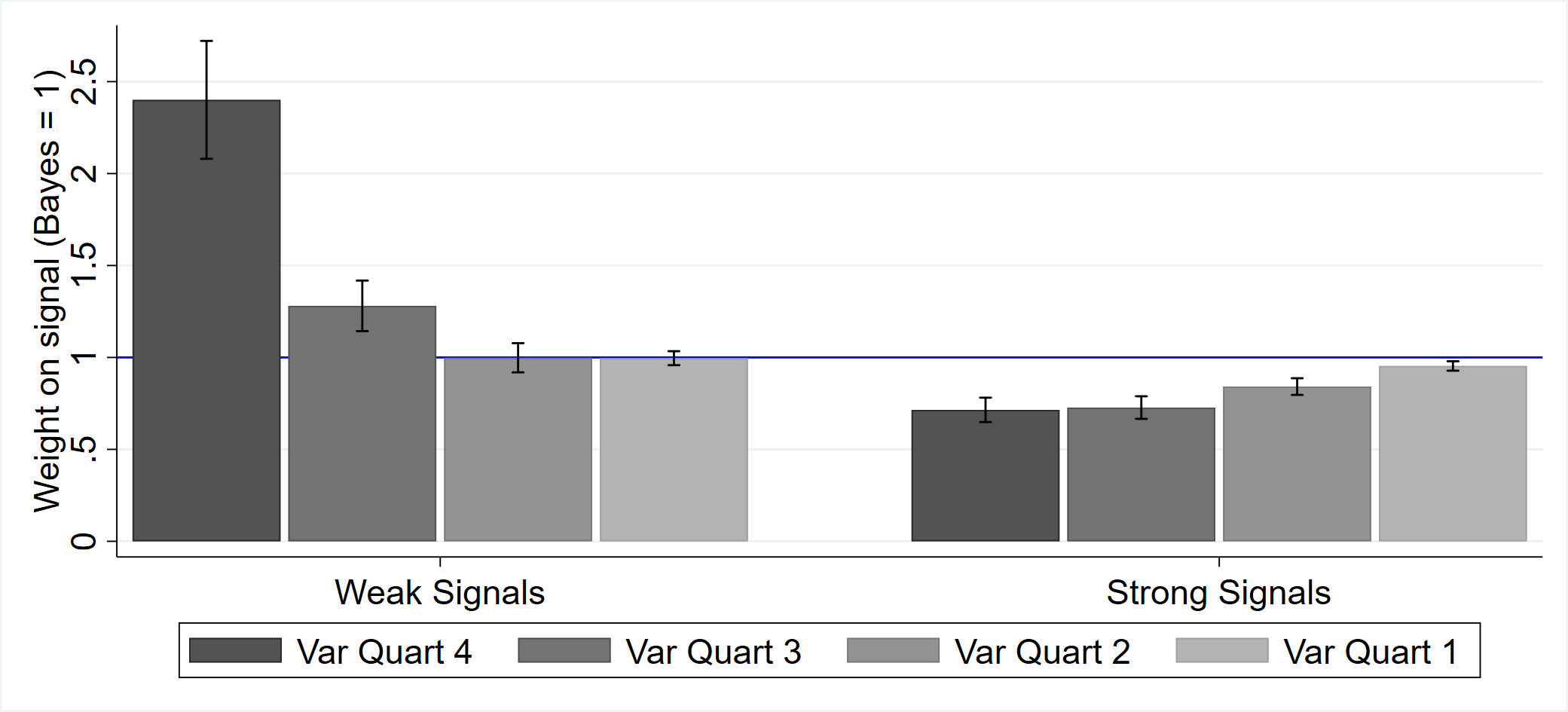

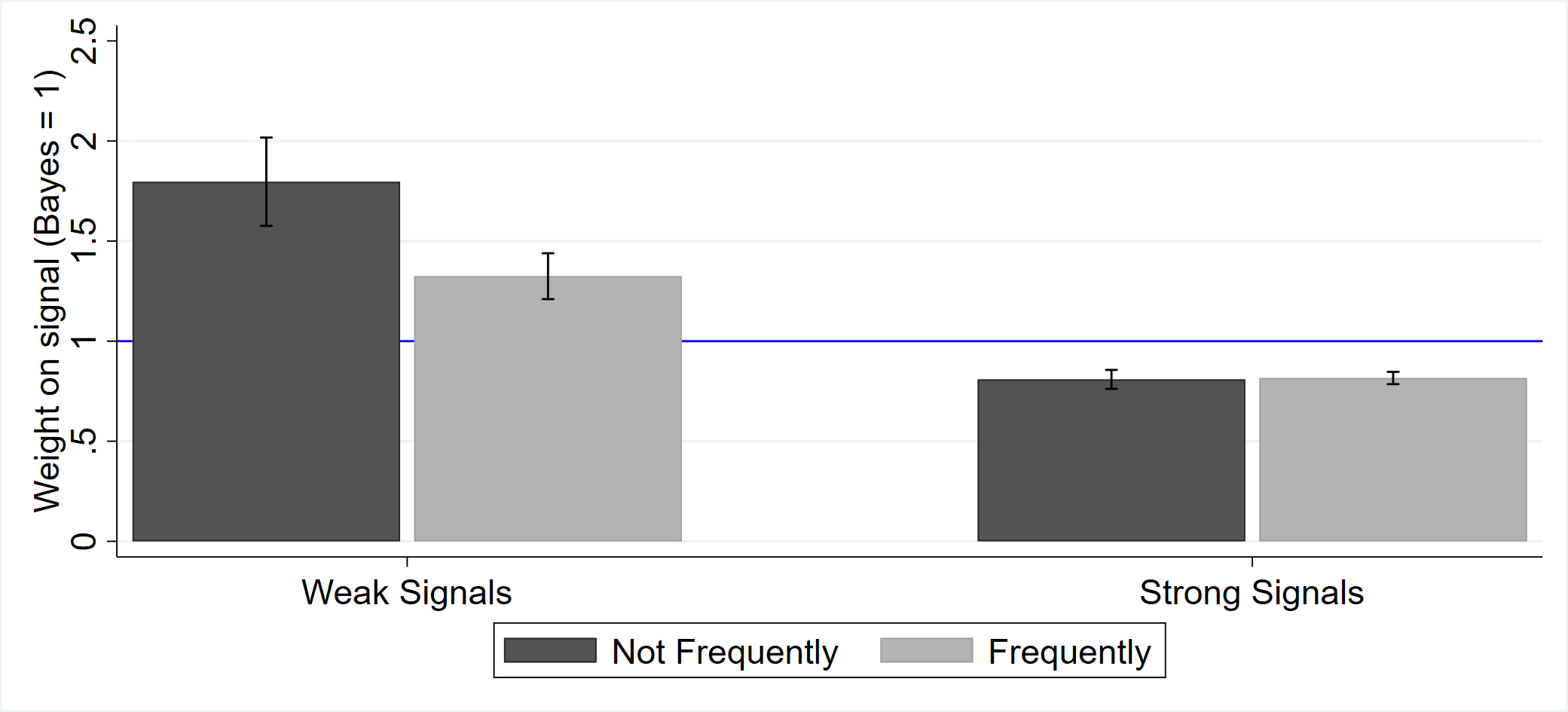

In particular, the types of heterogeneity in treatment effects observed suggest that cognitive sophistication and imprecision are important contributing factors. The three-item cognitive reflection test (CRT) from [30] provides our barometer for cognitive sophistication.222222We modify the text and answers for the items in the test in case subjects have previously seen the classic version of the CRT. See Supplementary Appendix C for the exact questions. The top panel of Figure 3 plots patterns of over- and underinference by CRT score and signal strength. Subjects who score higher on the CRT infer less from weak signals () and more from strong signals (). Moving from a CRT score of 0/3 to 3/3 is associated with a decrease of 0.52 for the weight placed on weak signals (s.e. 0.18, p-value ). Meanwhile, this change is associated with an increase of 0.15 weight on strong signals (s.e. 0.043, p-value ).232323These regressions include controls for exogenous variation in treatments: the experimental round (1–12), signal strength, and deck size.

-

•

Notes: In all three panels, the y-axis is weight subjects put on signals. Weak signals have precision between 0.5 and 0.6; strong signals have precision between 0.7 and 1. The top panel plots weight by CRT score. The middle panel plots weight by round in the experiment. The bottom panel plots weight by how much variance the subject has in their answers. Subjects are ranked by variance in weight and split into quartiles; Quart 1 has the least variance. Blue lines indicate Bayesian updating. This figure shows that higher CRT scores, more experience, and lower variance are associated with less weight on weak signals and more weight on strong signals. Error bars indicate 95% confidence intervals.

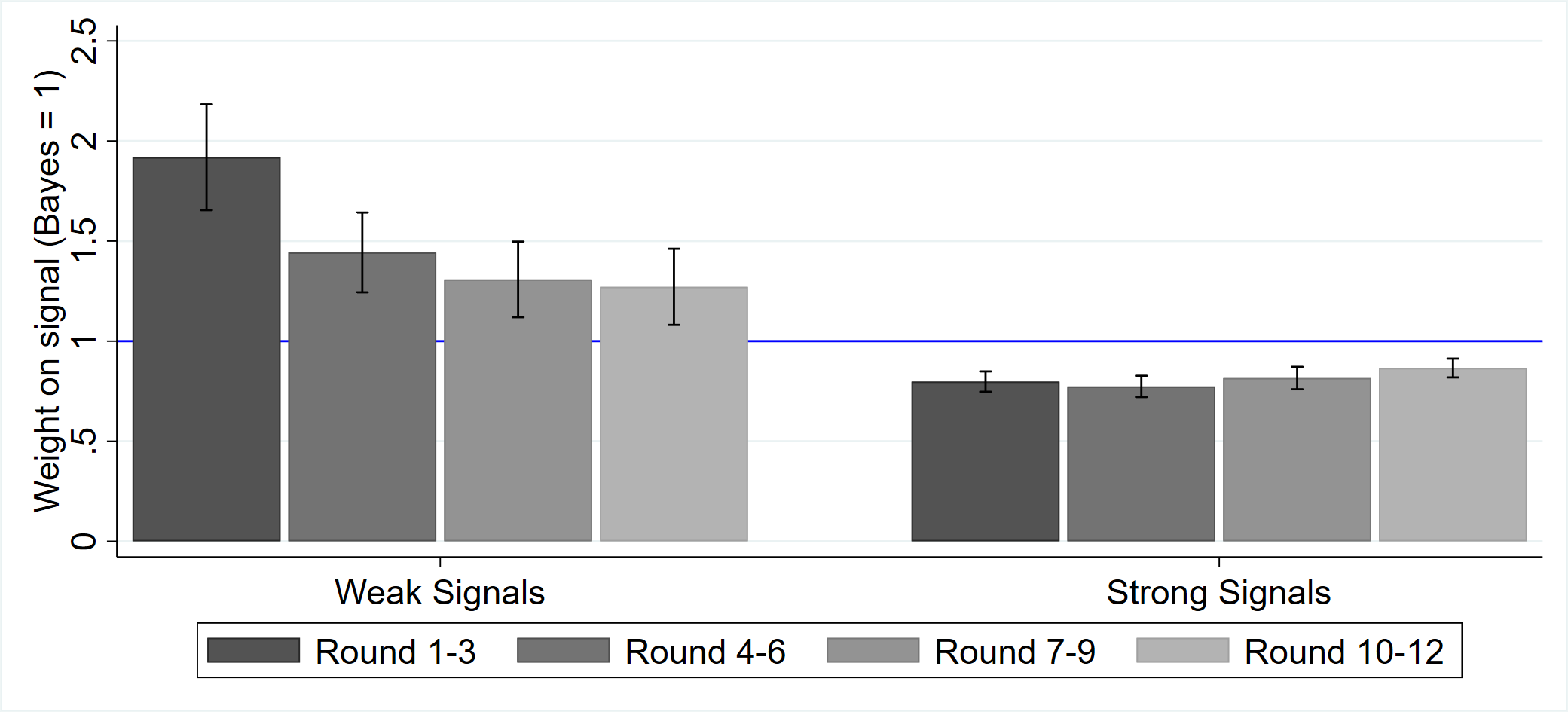

Subjects may become more cognitively precise as they learn how to interpret more signals, so we next consider how subjects behave over the course of this part of the experiment. Results suggest that there is evidence for learning over the course of the experiment, and the middle panel of Figure 3 plots over/underinference over the course of the twelve rounds. An increase in one round of the experiment is associated with a decrease of 0.074 weight on weak signals (s.e. 0.018, p-value ) and an increase of 0.008 weight on strong signals (s.e. 0.004, p-value ).242424This regression includes controls for signal strength and deck size. Appendix Figure A4 shows similar patterns when comparing subjects who have a higher self-reported level of news consumption; the effects are largely driven by differences in overinference of weak signals.

Finally, one direct proxy for cognitive precision is the variance in subjects’ answers; over the course of the experiment, subjects who have weights that have higher variance are likely to be less cognitively precise, leading them to be less sensitive to the true strength of the signals. The bottom panel of Figure 3 ranks subjects by the variance in their weights in the experiment and plots over/underinference by this ranking. Moving from the 75th percentile in variance to the 25th percentile in variance is associated with a decrease of 0.93 weight on weak signals (s.e. 0.11, p-value ) and an increase of 0.17 weight on strong signals (s.e. 0.03, p-value ).252525These regressions include the same controls for exogenous variation in treatments as in footnote 23. Note that variance is endogenous to subjects’ signal weight levels, so some of this effect may be mechanical. Both the CRT and news heterogeneity analyses were preregistered, while the variance and round tests were conducted ex post.

We summarize the main and heterogeneous treatment effects in Table 1. The first column effectively restates the main results in Section 4.1. There is a statistically significant negative relationship between signal strength and overinference weight, and the regression model predicts overinference when , which corresponds to a switching point of . Column (2)-(5) describe the heterogeneity results. The interaction between signal strength and CRT score is positive, indicating that the higher the subject’s CRT score, the more they infer as signal strength increases. Similarly, the interaction between signal strength and round number is positive, between signal strength and standard deviation of guesses is negative, and between signal strength and self-reported news consumption is positive. All effects are statistically significant at the 1-percent level.

While Table 1 uses a linear specification, the model suggests that a nonlinear specification may be more appropriate. As such, we show in Appendix Appendix A that results are similar if we estimate a power-law model using nonlinear least squares. The estimate for sensitivity is again significantly below 1, and the heterogeneity-related interaction effects are similar. While the power-law model provides a better fit for the main effect, the specification chosen does not affect the interpretation of any of the results.

| (1) | (2) | (3) | (4) | (5) | |

| Main Effects | By CRT Score | By Round | By SD | By News | |

| Signal Strength | -0.308 | -0.481 | -0.578 | 0.149 | -0.519 |

| (0.031) | (0.064) | (0.072) | (0.031) | (0.093) | |

| Strength x CRT Score | 0.102 | ||||

| (0.028) | |||||

| Strength x Round Number | 0.042 | ||||

| (0.009) | |||||

| Strength x SD of Guesses | -0.430 | ||||

| (0.038) | |||||

| Strength x News Cons | 0.334 | ||||

| (0.129) | |||||

| Constant | 1.420 | 1.421 | 1.416 | 1.398 | 1.420 |

| (0.030) | (0.030) | (0.030) | (0.021) | (0.030) | |

| Subject FE | Yes | Yes | Yes | Yes | Yes |

| Round FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 3964 | 3964 | 3964 | 3964 | 3964 |

| 0.23 | 0.23 | 0.24 | 0.29 | 0.23 |

-

Notes: OLS, with standard errors (in parentheses) clustered at subject level. Dependent variable is the weight put on the signal compared to a Bayesian (as defined in Equation 2.) Weights greater than 1 correspond to overinference; weights less than 1 correspond to underinference. Column (1) shows that subjects overinfer from weak signals (since the constant is greater than 1) and that overinference declines for stronger signals. Columns (2)-(5) show heterogeneity across CRT score, round number, standard deviation of over/underweighting, and news consumption, respectively. CRT score ranges from 0 to 3. Round number ranges from 1 to 12. News consumption ranges from 0 to 1.

4.3 Multiple Signals

When subjects receive multiple signals, they weight the signals less than if they receive one signal, as is consistent with past literature (as discussed in [11] and [13]). Appendix Figure A1 shows that subjects put less weight on multiple signals than on one signal, holding the Bayesian posterior fixed. This comparison holds both when signals are all in the same direction and when they are mixed.262626It is worth noting that subjects always see the “one signal” treatment block before the “three signals” block. As such, an alternative explanation for these results is that subjects decrease inference over the course of the experiment.

These results extend the findings of [39] by showing that people misperceive both the strength and the quantity of signals. When misperceptions about quantity play a larger role than misperceptions about signal strength, there is a downward shift of the curves when people receive multiple signals.

4.4 Demand for Information

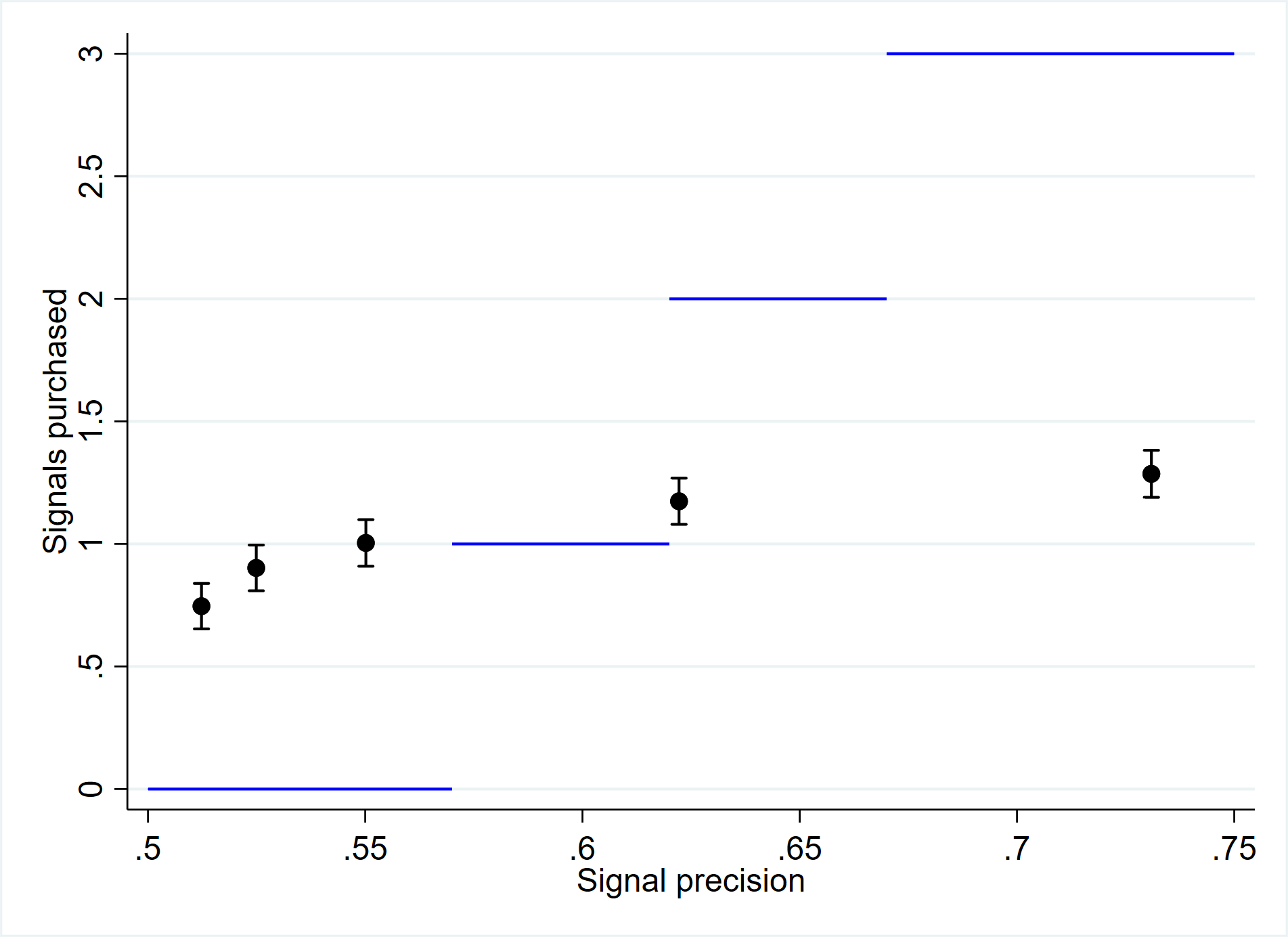

Patterns of overinference and underinference also lead to demand for information that is too high or too low relative to the optimum. Figure 4 plots the average number of signals purchased as a function of each signal strength, comparing subject behavior to the optimal choice if subjects were Bayesian and only valued signals for their instrumental value.

-

•

Notes: This figure plots the number of signals purchased as a function of signal precision. The blue lines correspond to the payoff-maximizing number of signals purchased. This figure shows that subjects over-purchase weak signals and under-purchase strong signals. Error bars indicate 95% confidence intervals.

As can be seen in the figure, subjects systematically over-purchase weak signals and under-purchase strong signals. The cost of a signal that leads a Bayesian to form a posterior of less than 0.57 outweighs its benefit; however, the majority of subjects purchase at least one signal when and . Additionally, 81 percent of subjects purchase fewer than the optimal level of three signals when .

There are other reasons for purchasing signals that are orthogonal to inference. For instance, subjects may be curious to learn the card draw itself, leading them to demand information for its own sake (as in [34]), raising the curve. Subjects’ answers are constrained to be between 0 and 3, so they may prefer to select interior answers, flattening the curve.272727A preference for stating interior answers would cause the average inference to move closer to 0.5 and in particular would not lead to overinference from weak signals. These effects do not fully explain the results but may contribute to the extremeness. For instance, more subjects purchase zero or one signals when than purchase two or three, which cannot be fully explained by curiosity or interior guesses. There is also suggestive evidence that differences in signal purchasing is partly explained by differences in inference at the individual level: subjects who purchase more signals on average have posteriors that move 0.49 pp further (s.e. 0.32 pp, ) on all other questions.

4.5 Mechanisms

Overreaction and underreaction could be driven by misperceptions of signal strength or driven by misperceptions of probabilities that happen to be close to 1/2.282828Results may also be due to misperceiving the difference between priors and posteriors, which would produce similar results to signal misperceptions. For instance, if and , overinference may be due to misperceptions of weak signals or due to the fact that is only slightly greater than . To disentangle these hypotheses, we compare behavior in the treatment asymmetric signals when and to behavior when and , where .

We find that misperceptions of signal strength explains these findings better. Subjects do not systematically infer differently when and . When , the average is 0.54 (s.e. 0.05). When , the average is 0.60 (s.e. 0.05). The difference is not statistically significant (-0.06, s.e. 0.07, p-value ) and the point estimate is in the opposite direction of that of the alternative model.

Next, we consider how people respond to signals of uncertain strength. Misperceiving people may apply their weighting function and signal combination in one of two ways. They might either first combine the signals and then weight the combined signal, or they may first weight the signals separately and then combine the weighted components.

Consider a signal that either leads a Bayesian to a posterior of or , each with probability 1/2. Denoting by the agent’s posterior, the “combined signals” model predicts . The “separate signals” model predicts when and when . These models make noticeably different predictions when is close to 1/2. The combined signals model predicts smooth behavior and a higher , while the separate signals model predicts a kink at and a lower .

In the experiment, subjects receive , or , . The Bayesian model predicts posteriors of 0.656. Using the estimated parameters as before ( and ), the combined signals model predicts near-Bayesian posteriors of 0.653 in each case. Meanwhile, the separate signals model predicts underinference and asymmetry, with a posterior of 0.636 when the signals are both larger than 0.5 and 0.628 when they are in opposite directions.

Empirically, the separate signals model fits the data best. The fit is better for both levels and differences. Subjects’ posteriors are 0.620 (s.e. 0.057) when the signal directions are aligned and 0.609 (s.e. 0.054) when they are misaligned. In fact, subjects underinfer slightly more than the separate signals model predicts (see [51] for one possible explanation). Underinference is suggestively more severe when the directions are misaligned (p-value ) and the point estimate for this difference is similar to that of the theoretical prediction. The difference in behavior from combined and separate signals also indicates that subjects’ behavior is inconsistent with [21]’s (\citeyearC-WP) framework of divisible updating.

4.6 Robustness

This section considers three alternative hypotheses for these results that are unrelated to over- or underinference.

First, it is possible that subjects dislike stating “50 percent” even when signals are very uninformative. There is no systematic evidence for this. Among the 72 subjects who see a completely uninformative signal (where the decks each have 832 Diamonds and 832 Spades), 69 of them (96 percent) give an answer of exactly 50 percent.

Second, it is possible that subjects are systematically more inclined to prefer Green over Purple, or attend more to Diamonds over Spades, or vice versa. If this were the case, then subjects may overinfer in one direction and underinfer in the opposite direction by a different amount, leading to average misinference. However, there is no evidence of color asymmetry; subjects’ average estimate of P(Green) is 0.503 (s.e. 0.002).292929On the screen, subjects always are asked for P(Green) before P(Purple), so this also indicates little question-location asymmetry. There is also no evidence for suit asymmetry; on average, subjects’ signal weight is 1.156 (s.e. 0.031) when they see a Diamond and 1.134 (s.e. 0.035) when they see a Spade.

Third, it is possible that something about the particular number of cards in the deck leads subjects to misperceive signal strength. For instance, they may have a left-digit bias ([64]). Recall that for the one-signal questions, the deck size was randomly either 1,665 or 337. The deck size leads to a statistically significant shift in the estimated switching point but not in the sensitivity : for the larger deck is 0.68 (s.e. 0.02) and is 0.75 (s.e. 0.03); for the smaller deck is 0.61 (s.e. 0.01) and is 0.77 (s.e. 0.04). With each deck size, is statistically significantly less than 1 (-values ).303030One explanation for the shift in is that subjects put some weight on the differences between numbers of cards, and don’t only focus on the ratios. Such a story is possible but beyond the scope of this paper.

It is possible that these factors have modest quantitative effects on the main estimates, but they cannot entirely explain the results.

5 Evidence from Finance and Sports Betting

While the experimental setting is tightly controlled, its abstract features naturally raise questions of external validity. To test the implications of our theory in more realistic high-stakes settings, we therefore now consider evidence from a set of sports betting markets and financial markets. Departing from the experimental environment comes at a cost, as we no longer have direct knowledge of the true DGP or the informativeness of specific signals to which prices are responding. But we choose a set of markets to analyze so as to obtain close proxies for signal informativeness under minimal assumptions: we consider the prices of binary bets (with payouts of either $0 or $1) with known terminal horizon, for which we can construct proxies for signal informativeness under the null of Bayesian updating. By considering price movements across informativeness regimes, we test whether the patterns of overinference vs. underinference documented in the experiment apply in this real-world financial-market setting. We first describe our setting and estimation strategy in more detail, before turning to our empirical results.

5.1 Conceptual Setup

To set the stage for our empirical analysis, we first describe the conceptual framework that we then take to the data. This section builds closely on [5] (AR \citeyearAR21) and [4] (AL \citeyearAL-WP) to generalize Section 2 to handle multiple periods with arbitrary signals. Time is indexed by . As before, there is a binary state . Each period, a person observes a signal drawn from arbitrary distribution where is the history of signal realizations. The person’s belief in state 1 at time given the DGP and history is denoted by (or for short). The belief stream refers to the collection of the person’s beliefs over time.

While we cannot directly test for overinference vs. underinference without knowledge of the DGP, keeping track of the following two objects will allow for well-motivated indirect tests. First, define the movement of a belief stream from period to as the sum of squared changes of beliefs over these periods:

Then, defining the uncertainty of belief at period as , we define uncertainty reduction from period to period as:

For each variable, we define the concomitant random variable in capital letters (e.g., ).

Under the null model of Bayesian updating, beliefs satisfy for all , where is the expectation under the true (physical) measure. We denote

The Equality of Movement and Uncertainty Reduction

As in AR (\citeyearAR21), the martingale property of beliefs under the null implies that, regardless of the DGP, expected Bayesian belief movement from any period to period must equal expected uncertainty reduction:

Proposition 2 (Movement and Uncertainty Reduction).

Assume . For any DGP and for any periods and ,

This result formalizes the “correct” amount of belief volatility (or movement) under rationality, without the need to know the true unobservable DGP. One can then follow AR (\citeyearAR21) to use this result as the basis for a statistical test for Bayesian updating: given a set of belief streams, one can calculate the difference between movement and uncertainty reduction (which they call “excess movement”) and then apply a means test to see if the average difference is statistically different from zero. If so, one can reject — with a certain confidence level — that the beliefs arose from Bayesian updating. This result thus provides a testable link between belief movement, uncertainty reduction, and signal informativeness: when we observe a Bayesian person’s beliefs moving, this must (on average) mean that she is receiving informative signals and reducing her uncertainty accordingly.

We emphasize two crucial features of this test: (1) it is valid regardless of the DGP, and (2) it can be applied to arbitrary belief substreams (from period to ), as Proposition 2 applies ex ante in all cases. Thus, given some ex ante known and observable sorting variable related to signal strength, we can test whether excess movement is related to signal strength. We will use time to resolution () as our separating variable, and we discuss its relation to signal strength — and the relation of excess movement to over- and underinference — below.

Underreaction and Overreaction

There is a natural connection between excess movement and overreaction: people who overreact are intuitively moving around “too much” relative to the informativeness of signals. AR (\citeyearAR21) formalize this connection. In particular, Proposition 6 of that paper demonstrates that in a two-period environment, a person with a correct prior who overinfers from signals will exhibit a positive excess movement statistic, while a person who underinfers will exhibit a negative statistic. Proposition 7 then demonstrates that the same relationship holds over many periods in a simple symmetric binary-signal environment (even though the person no longer necessarily has the correct beliefs in later periods). With other DGPs, however, it is challenging to obtain general analytic results. Consequently, we turn to simulations to confirm the intuition that the same intuitive relationships hold under our updating model in environments that more closely map to our empirical setting.

5.2 Simulated Belief Streams

We use simulations to understand basic patterns in movement and uncertainty reduction for a person who updates using our model in Section 2 when forming beliefs about the outcome of a sporting event or the future level of the stock market. These settings feature similar signals (points scored, daily returns) received in each period, with the aggregate of that information determining the final state. To transparently model such situations, we consider a simple DGP in which there are two “teams” representing the two states, exactly one team scores in each of periods, each team has equal probability of scoring in each period, and the final state is which team has the highest score after the final period. For example, if a team is leading by one score with 2 periods left, they have a 75% chance of being the final winner because they win if they score in one of the final 2 periods.313131There is one complication in this simple setup. In the first period, beliefs always start at 50%. However, regardless of the updating rule, movement and uncertainty reduction are always equal when beliefs start at 50%. Similarly, in the final period, the state has either been determined (in which case both movement and uncertainty reduction are equal) or beliefs are again 50%. Therefore, given that any updating rule will produce zero excess movement for these periods, we drop the first and last period.

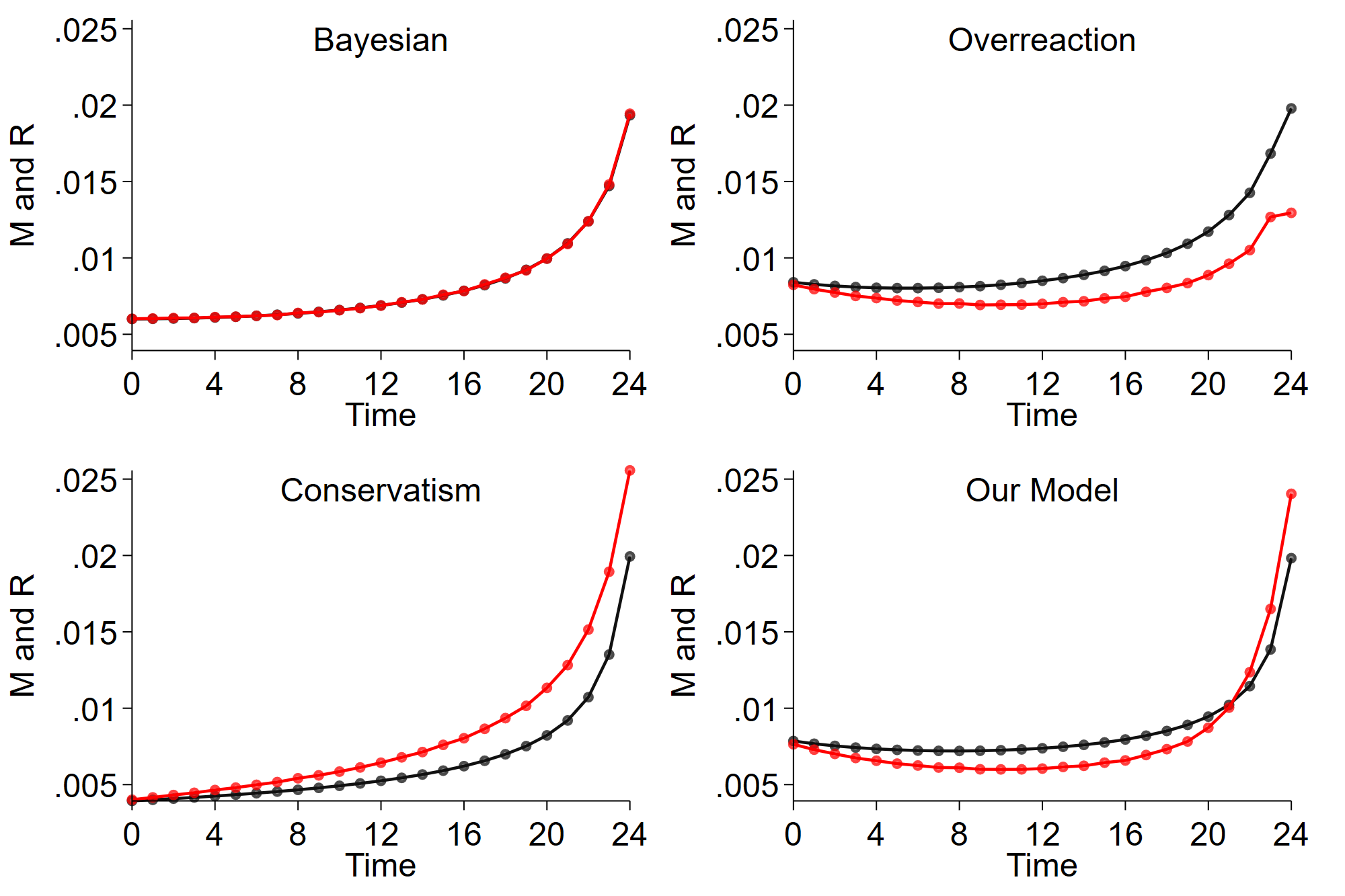

-

•

Notes: This figure shows the average movement (black line) and uncertainty reduction (red line) statistics over time for four different models, averaged over 1 million simulations of the game-like DGP discussed in the text with . The updating models are (1) Bayesian updating (the signal strength is correctly perceived as ), (2) conservatism (the perceived signal strength is ), (3) overreaction (the perceived signal strength is ), and (4) our model (the perceived signal strength is with and ). For Bayesian updating, these statistics are always equal. For conservatism, movement is always less than uncertainty reduction, and the opposite is true for overreaction. For the misperceiving person in our model, movement is greater than uncertainty reduction in early time periods (where signals are generally weak) and lower in later time periods (where signals are generally strong).

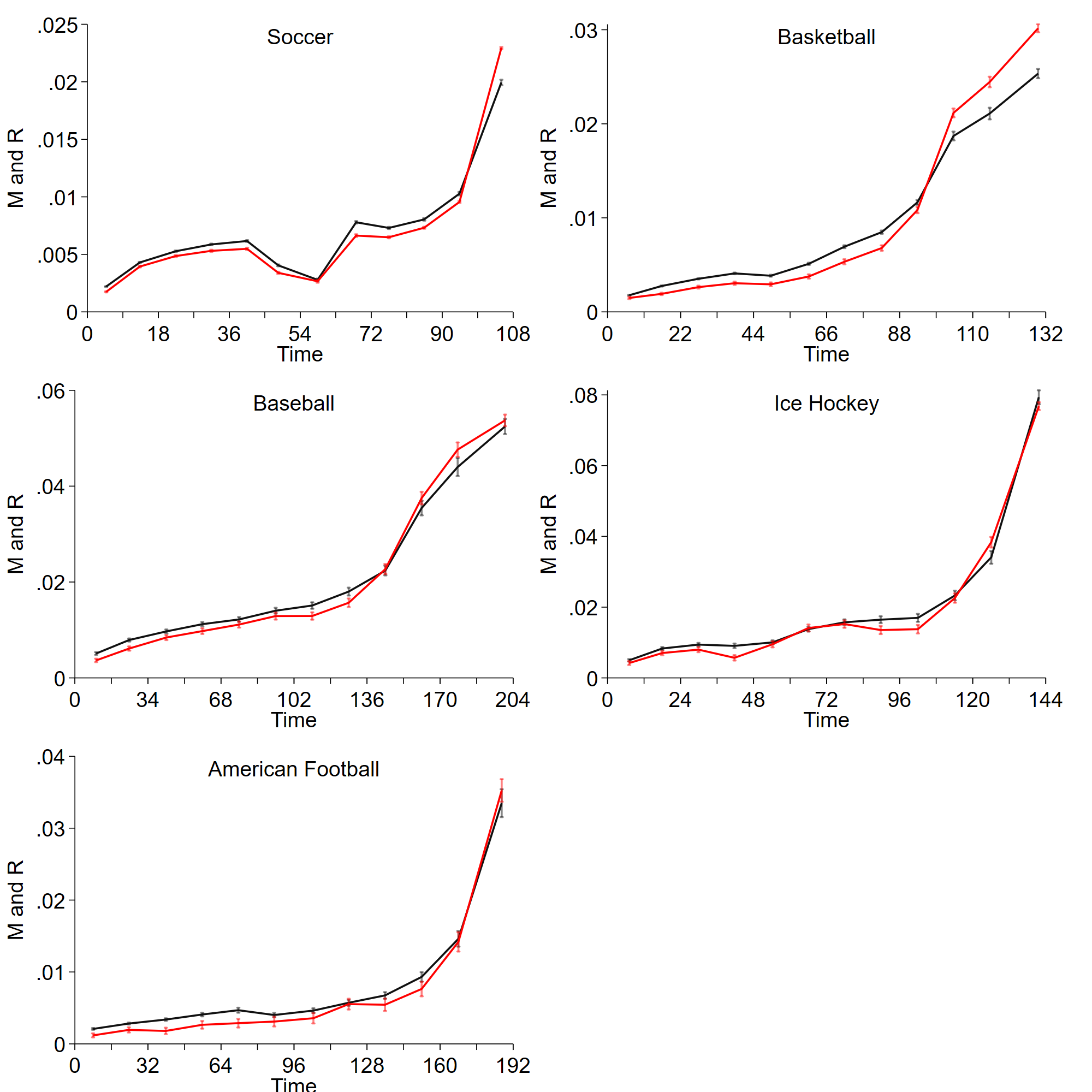

The top-left panel of Figure 5 shows the expected movement and uncertainty reduction statistics over time for a Bayesian (calculated from one million simulations of this DGP). First, as predicted by Proposition 2, the statistics are equal at each period. Next, note that both statistics are rising as the resolution of the game approaches. The initial periods always contain very little information, while the later periods sometimes contain no information (because one team has an insurmountable lead) and sometimes contain a large quantity of information (because the scores are very close). Overall, though, signal strength rises over time, and average movement and uncertainty reduction increase accordingly. As we show shortly, this pattern will also hold in all of our empirical settings.

What do the statistics look like for misperceiving people? Following intuition and the theoretical results from simpler DGPs, overreaction (top-right panel) leads to positive excess movement in every period, while the opposite is true for underreaction (bottom-left panel). The bottom-right panel displays the results for our model, with parameters estimated from our experiment as in Section 4.1 (). In the early periods, average signal strength is low, leading to overreaction, which in turn generates excess movement. In later periods, the amount of information revealed is higher, leading to underreaction. Belief movement increases, but not in line with the increase in uncertainty reduction. There is therefore a switching period at which average movement crosses below uncertainty reduction. This pattern is consistent with our model, but it does not occur under Bayesian updating or when there is universal overreaction or underreaction.

5.3 Sports Betting Data

Data Description

We start with data on sports betting. Our data comes from Betfair, which operates a large prediction market in which individuals are matched on an exchange to make opposing financial bets about the outcome of a sporting event. As in a standard centralized financial exchange, one can observe time-stamped transaction prices — determined by supply and demand — for a contract in which one party pays another a set amount given a particular realized outcome of the game. These are the same data as used in AR (\citeyearAR21), and we use the same sample (2006–2014) and data filters (discussed further below) as in that paper.323232See AR (\citeyearAR21) or [20] for a more detailed introduction to the Betfair sports data.

Given our focus in this section on equilibrium bet-price data, we follow the literature that interprets these prices as “market beliefs.”333333The interpretation of betting-market prices as averages of heterogeneous individual beliefs has been studied in a range of work. [33] and [70] show the validity of such an interpretation when traders have log utility and do not trade for speculative purposes (cf. [54]). [57] consider beliefs’ and prices’ reaction to information; in their setting, prices in fact generally underreact to information (in contrast to the bulk of our evidence) due to the logic of market clearing. [55] show the obverse in a setting with speculative trading. In standard Bayesian settings with complete markets, meanwhile, such an interpretation is straightforward (see AL \citeyearAL-WP). An excess movement test based on Proposition 2, therefore, can be viewed in this setting as a test of the joint null that market prices may be interpreted as beliefs and that these beliefs are Bayesian. But while this might affect the interpretation of full-sample excess movement tests, it poses less of a problem for our purposes. We are fixing the environment (i.e., the particular betting market in question) and comparing excess movement as one varies the signal strength (proxied by time to maturity) within this environment. If we assume that the mapping from individual to market beliefs does not change systematically within a stream as one moves closer to maturity, our findings are at minimum directionally informative about both individual and market-level reactions to information across signal-strength regimes.

We focus on markets for five major sports (soccer, American football, baseball, basketball, and hockey), and we restrict attention to contracts over the final winner of the game (and omit more exotic contracts, such as which team will be winning at the midpoint and the number of goals scored).343434If there are multiple contracts — e.g., one paying off if team A wins, another if team B wins — we use the contract for which the starting beliefs are closest to 0.5. We use observations only when the game is being played. To remove extremely high-frequency noise, we follow AR (\citeyearAR21) and keep at most one observation per minute, and also drop observations with less than 1% of average volume. Finally, we attempt to have similar timing in events by dropping (less common) events in a category for which the timing of the game is different (such as WNBA games, in which the game time is shorter than the NBA).

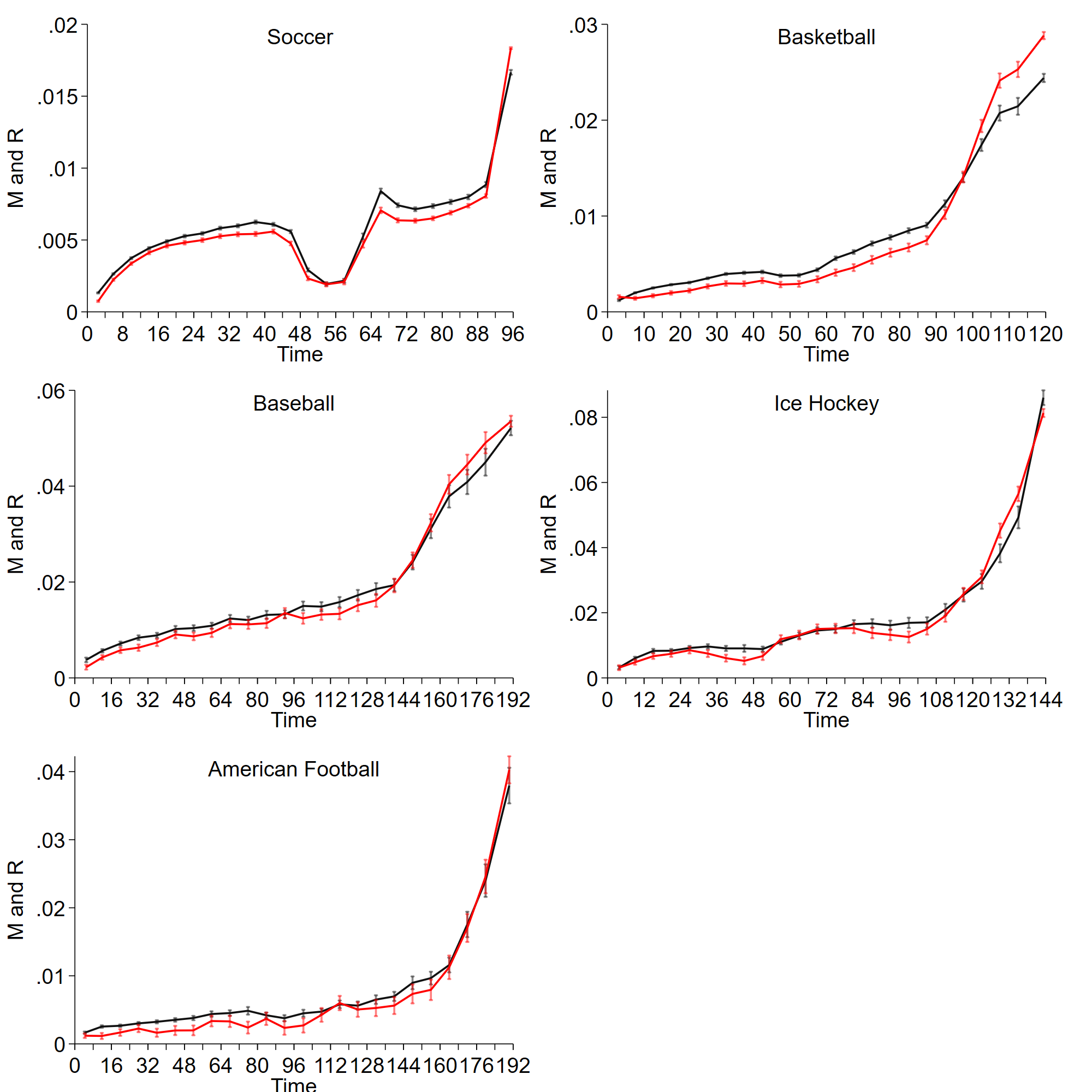

Graphs of Movement and Uncertainty Reduction

Figure 6 shows average movement and uncertainty reduction (as well as confidence intervals) across time for each sport. Observations occur in continuous time and therefore must be aggregated in some way. Our data contain clock-time (“1:31pm”) rather than game-time (“4:50 through the third quarter”) observations; we therefore consider average movement and uncertainty reduction for observations within 24 time chunks, each of which corresponds to the length of an average game.353535For example, as the average basketball game lasts around 132 minutes, basketball games are broken into 24 chunks of 5.5 minutes. The final chunk then includes all observations that occur after 132 minutes. Results are similar if we use different numbers of chunks. Separately, in constructing confidence intervals, we assume observations are uncorrelated across contracts. As in the simulations, average movement and uncertainty reduction are generally increasing over time (with the exception of mid-period breaks). Early in games for each sport, movement is greater than uncertainty reduction, and for each sport there is a time at which movement drops below uncertainty reduction. For four of the five sports, movement then continues to be lower than uncertainty reduction after this time (for hockey, movement stays lower than uncertainty until the final period). The market accordingly appears to overreact to the less-informative signals at the beginning of a game, and underreact to the more-informative signals at the end of a game.

-

•

Notes: This figure shows the average movement (black line) and uncertainty reduction (red line) statistics over time for five different sports (as well as 95% confidence intervals). In each case, movement is greater than uncertainty reduction in early time periods and then drops below in later time periods.

Statistical Tests

Are the patterns in the figures statistically meaningful? To answer this question, we require a test to determine if there is overreaction (captured by expected movement being greater than uncertainty reduction) when signals are weak (captured by low uncertainty reduction), and underreaction when signals are strong. We therefore regress average movement in each period on average uncertainty reduction in each period. Under the null hypothesis of Bayesian updating, the constant will be equal to 0 and the slope coefficient equal to 1, as average movement should be equal to average uncertainty reduction in every period. However, for a misperceiving person who updates according to our model, average movement will be higher than average uncertainty reduction when reduction is low, but lower than uncertainty reduction when reduction is high, such that the constant will be positive and the slope coefficient will be less than one.

The results for these regressions are shown in the first five columns of Table 2. Given that the regressions use calculated averages, we bootstrap standard errors by resampling events with replacement and recalculating averages 10,000 times (OLS standard errors are very similar). For each sport, the slope and constant coefficients are highly statistically significantly different from the Bayesian benchmark in the direction predicted by the theory: we consistently observe evidence for overinference from weak signals (when average uncertainty reduction is low) and underinference from strong signals (when reduction is high).

To understand the magnitude of the estimates, note that beliefs moving 3 percentage points up and then 3 points down would produce movement of 0.0018 (close to the average constant coefficient) and no uncertainty reduction. Given this average constant, the average slope coefficient then implies that movement will cross uncertainty reduction when both are around 0.014, which corresponds to one belief movement of around 12 percentage points.

| Dep Var: | Sports | Finance | |||||

|---|---|---|---|---|---|---|---|

| Movement | Soccer | Basketball | Baseball | Hockey | Football | Raw | Risk-Adj. |

| Uncert. Red. | 0.918 | 0.806 | 0.889 | 0.945 | 0.912 | 0.680 | 0.733 |

| (0.005) | (0.008) | (0.013) | (0.013) | (0.027) | (0.040) | (0.041) | |

| Constant | 0.0009 | 0.0018 | 0.0026 | 0.0018 | 0.0015 | 0.0065 | 0.0060 |

| (0.0001) | (0.0001) | (0.0002) | (0.0002) | (0.0002) | (0.0003) | (0.0003) | |

| 0.977 | 0.985 | 0.995 | 0.976 | 0.995 | 0.944 | 0.941 | |

| Time Chunks | 24 | 24 | 24 | 24 | 24 | 24 | 24 |

| Events | 6,584 | 5,176 | 3,927 | 4,123 | 1,390 | 955 | 955 |

| Observations | 4,589,289 | 867,567 | 166,346 | 109,751 | 86,193 | 58,864 | 58,864 |

| -val.: | <0.001 | <0.001 | <0.001 | <0.001 | 0.007 | <0.001 | <0.001 |

| -val.: | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 | <0.001 |

-

•

Notes: This table presents the results from OLS regressions (with bootstrapped standard errors in parentheses) of average movement in a time period on average uncertainty reduction for five sports and the options data.

Note that we are regressing the average movement in a time chunk on the average uncertainty reduction. We do this because, for a Bayesian, the expected movement at any time must equal the expected uncertainty reduction . However, any individual belief change does not yield movement and reduction equal to these expectations, but rather equal to these expectations plus a mean-zero error term. Therefore, if we simply regressed all the (unaveraged) movement statistics on the (unaveraged) uncertainty reduction statistics, there would be significant attenuation bias due to error in the independent variable. By taking the average over thousands of belief changes at a given time horizon, we are able to estimate the expectation at that time plus a tiny error term, effectively eliminating this bias. In our case, the estimated variance of the error term at each period is more than 100,000 times smaller than the estimated variance of the independent variable, such that the attenuation bias is negligible.363636By averaging the movement and uncertainty reduction statistics over time chunks, we face the subjective question of how many chunks to use. The main results do not change significantly when using a different number of chunks. For example, the estimated slope coefficients for the five sports change to (0.839, 0.797, 0.903, 0.987, 0.912) when using 12 chunks (see Appendix Table A1) and to (0.847, 0.849, 0.883, 0.925, 0.920) when using 36 chunks (see Appendix Table A2). The -values for all sports remain very highly significant, except for hockey with 12 chunks (p-value ) and football with 36 chunks (p-value ). Note that the values in all cases are very close to 1: variation in movement can be explained almost entirely by variation in uncertainty reduction, but only when the coefficient is less than one.

5.4 Index Options Data

Data Description

The sports betting data provide a useful lab for studying beliefs in an incentivized setting, but they come naturally with some limitations: trading budgets are capped,373737As of late 2022, for example, Betfair imposes payout limits ranging from £50,000 to £250,000 for single-game bets on American sports. and payoffs are unrelated to macroeconomically relevant outcomes. So we now consider market-implied beliefs data from a large-scale financial market of first-order importance: options on the S&P 500 index, which are effectively bets on the value of the market index as of some fixed future expiration date.383838Denoting the market index price by , a call option with strike price and expiration date has a date- payoff of . (Conversely, a put option has payoff .) As in AL (\citeyearAL-WP), we obtain data from OptionMetrics on S&P index option prices with all available strike prices and expiration dates traded on the Chicago Board Options Exchange (CBOE). The sample of trading dates is 1996–2018. We use daily (end-of-day) data, and we implement the same data filters as described in AL (\citeyearAL-WP); see Section B.1 for further details.

Converting Option Prices to Market-Implied Beliefs

On any given trading date , there are prices for a wide range of S&P options with the same expiration date . The options differ only in their strike prices (for a call option, the minimum S&P index value at which the option will obtain a positive payoff at expiration). The set of option prices for a given pair can thus be translated, using standard methods following [19], into a market-implied (or risk-neutral) probability distribution over the future S&P price on the option expiration date.393939This mapping requires only the minimal assumption that there are no arbitrage opportunities in option markets. Intuitively, as options allow for bets over the future index price, their prices allow us to back out a probability distribution over this future price.

Unlike in the case of sports betting data, index options have payoffs that are tied (by construction) to the value of aggregate wealth. Option prices therefore reflect risk aversion in addition to subjective probability assessments about the future index value. This is the main complication in using option-implied probability distributions: they do not, in general, correspond to any notion of aggregate subjective beliefs. (They are equivalent to subjective beliefs only in the case of risk neutrality over the index value, which motivates referring to them as risk-neutral beliefs.) For example, suppose that there are two possible date- macroeconomic states that are perceived by investors as equally likely. If investors value a marginal dollar in the “bad” state (when the market is low) more than in the “good” state (when the market is high), they will be willing to pay more for the option that pays off in that state. If these risk preferences are not taken into account, one will (falsely) conclude that investors believe that the bad state is more likely.

Addressing this issue is the main theoretical task taken up in AL (\citeyearAL-WP). That paper shows that under certain assumptions, one can place a bound on excess movement in risk-neutral (RN) beliefs under the null that underlying subjective beliefs are rational. The bound is tight in the space of possible DGPs — that is, one can construct a DGP under which it holds exactly — but it is not necessarily tight under the true real-world DGP.404040While the bound is sufficient for the full-stream tests considered in that paper, it might not be here: we wish to understand how “true” excess movement evolves with signal informativeness within a stream. We therefore provide two sets of results in the current analysis, (1) using the raw RN beliefs, and alternatively (2) translating these beliefs to a set of physical (subjective) beliefs under an assumption on risk aversion. For (2), we consider multiple possible assumptions in translating from risk-neutral to physical beliefs, detailed in Appendix B.2. While the hundreds of possible assumptions and parameterizations matter in determining the physical belief estimated for a given risk-neutral belief, their effect on our movement and uncertainty-reduction statistics is so small as to be nearly indetectable.414141This is intuitive, as risk aversion is unlikely to be changing meaningfully from day to day. In addition, the main point of interest for this analysis is that the basic patterns found in the experimental data and in the sports betting data are also observed in the finance data, regardless of the RN beliefs correction used. We therefore report results here under our main translation, which assumes a representative investor with power utility over the terminal index value. For robustness, we present estimates under a wide range of alternative parameterizations in Appendix Figure A9, finding that these choices have little effect on our results.