Identification in Bayesian Estimation of the Skewness Matrix in a Multivariate Skew-Elliptical Distribution††thanks: This research is supported by the Keio University Doctorate Student Grant-in-Aid Program from Ushioda Memorial Fund; and JSPS KAKENHI under Grant [number MKK337J].

Abstract

Harvey et al. (2010) extended the Bayesian estimation method by Sahu et al. (2003) to a multivariate skew-elliptical distribution with a general skewness matrix, and applied it to Bayesian portfolio optimization with higher moments. Although their method is epochal in the sense that it can handle the skewness dependency among asset returns and incorporate higher moments into portfolio optimization, it cannot identify all elements in the skewness matrix due to label switching in the Gibbs sampler. To deal with this identification issue, we propose to modify their sampling algorithm by imposing a positive lower-triangular constraint on the skewness matrix of the multivariate skew-elliptical distribution and improved interpretability. Furthermore, we propose a Bayesian sparse estimation of the skewness matrix with the horseshoe prior to further improve the accuracy. In the simulation study, we demonstrate that the proposed method with the identification constraint can successfully estimate the true structure of the skewness dependency while the existing method suffers from the identification issue.

Keywords: Bayesian Estimation, Identification, Label Switching, Skew-Elliptical Distribution, Skewness Matrix.

1 Introduction

The mean-variance approach proposed by Markowitz (1952) still plays the central role in portfolio management even today. One of the key assumptions of this approach is that asset returns jointly follow a multivariate normal distribution, though it is well-known that they tend to follow a fat-tailed, possibly skewed distribution as Kon (1984), Mills (1995), Markowitz and Usmen (1996), Peiró (1999) among others have pointed out. Therefore, researches have proposed numerous distributions that can express these characteristics of asset returns well. In particular, a so-called skew-t distribution is often assumed for asset returns since Hansen (1994) first used it for modeling financial data. There are various types of skew-t distribution known in the literature, but arguably the most famous one is based on the generalized hyperbolic (GH) distribution.

The GH distribution, which was originally introduced by Barndorff-Nielsen (1977), can flexibly describe many distributions including the normal distribution, hyperbolic distribution, normal inverse Gaussian (NIG) distribution, Student’s t distribution, and skew-t distribution. The skew-t distribution as a special case of the GH distribution is called the GH skew-t distribution. Hansen (1994), Fernández and Steel (1998) and Aas and Haff (2006) assumed the GH skew-t distribution for asset returns. Especially, application of the GH distribution has been recently advanced in the field of asset price volatility models. For example, Nakajima and Omori (2012) assumed the GH skew-t distribution for the error distribution of the stochastic volatility (SV) model and proposed a Bayesian Markov chain Monte Carlo (MCMC) method while Nakajima (2017) constructed a sparse estimation method for the skewness parameter of the GH skew-t distribution in the SV model and demonstrated that it could improve prediction accuracy.

Although the GH distribution is flexible enough to model a single asset on many occasions, it has difficulty in capturing the skewness dependency among multiple assets. Fund managers would find the skewness dependency useful in particular when the financial market crashes and almost all assets suddenly go south since such sharp price co-movement may not be captured by the second moment (i.e., correlation) only.

To circumvent this shortcoming of the GH distribution, we propose to use the skew-elliptical distribution, which was proposed by Branco and Dey (2001) as a generalization of the multivariate skew-normal distribution by Azzalini and Valle (1996) and later improved by Sahu et al. (2003)222Although we take up the skew-elliptical distribution based on Sahu et al. (2003) with application to portfolio management in mind, there are alternative skew-elliptical-type distributions known in the literature. Research on skew-elliptical-type distributions to financial data is very active (e.g., Barbi and Romagnoli (2018), Carmichael and Coën (2013), Alodat and Al-Rawwash (2014)). Adcock and Azzalini (2020) reviews the recent development in this field and explains relationship among various types of skew-elliptical distribution in detail.. The skew-elliptical distribution includes the normal distribution, Student’s t distribution and their skewed counterparts: skew-normal and skew-t distribution. Unlike the GH distribution, it is straightforward to extend the skew-elliptical distribution to the multivariate case. The multivariate skew-normal distribution has another advantage: Its Bayesian estimation can be conducted via pure Gibbs sampling. For example, Sahu et al. (2003) proposed a Gibbs sampler for a linear regression model in which the error term follows a skew-elliptical distribution without skewness dependency. Moreover, Harvey et al. (2010) improved Sahu et al. (2003)’s method, and applied it to Bayesian estimation of the multivariate skew-normal distribution as well as portfolio optimization that considers up to the third moment in the presence of skewness dependency.

In our assessment, however, the Bayesian estimation method of the multivariate skew-elliptical distribution by Harvey et al. (2010) has an identification issue about the skewness parameters due to so-called label switching. To elaborate on our point, let us look into the definition of a multivariate skew-elliptical distribution. For simplicity, we only consider the multivariate skew-normal distribution333In essence, any skew-elliptical distributions have the same identification issue. So we start with the skew-normal distribution as a representative example. It is straightforward to extend our argument to any skew-elliptical distributions including the skew-t distribution which we will deal with in Section 3.. Suppose a random vector of asset returns follows a multivariate skew-normal distribution such that

| (1) | ||||

where each element in is supposed to independently follow a positive half normal distribution with the scale parameter equal to 1. and are the skewness matrix444Here we call the skewness matrix though it does not match the skewness of the distribution in this model. For more information, see Section 2.2 and Appendix A of Harvey et al. (2010). and the precision matrix555Harvey et al. (2010) used the covariance matrix in their specification of the skew-normal distribution and assumed the inverse-Wishart prior for it, which is equivalent to assuming the Wishart prior for the precision matrix in our specification. We use the precision matrix because we later examine the extended model that incorporates sparsity into the graphical structure among asset returns. respectively. Harvey et al. (2010) did not impose any restriction and assumed is full matrix :

By defining

(1) can be rewritten as

| (2) |

Note that in (2) is

| (3) | ||||

Since the summation in each element of (3) is invariant in terms of permutation, the likelihood of in the model (2) takes the same value for any permutations of the columns in . As a result, it is likely that the columns of are randomly misaligned during the Gibbs sampler and their interpretability is lost. This problem is well-known in the field of latent factor models, which have a structure similar to the model (2).

As far as we know, no research666Panagiotelis and Smith (2010) pointed out that, in the model by Sahu et al. (2003) or Azzalini and Capitanio (2003), it becomes difficult to identify the parameter when the skewness parameter approaches to 0, and proposed the improved model with sparsity. The identification issue we point out in this paper still occurs regardless of the magnitude of the skewness parameter when the co-skewness is taken into consideration as in Harvey et al. (2010). Note that this is a separate issue from Panagiotelis and Smith (2010). In this paper as well, we will study an extended model with sparsity of co-skewness in Section 4. has examined the identification issue of Harvey et al. (2010)’s model due to the label switching problem yet. Therefore we aim to construct a modified model in which the identification issue of is resolved and the interpretability is assured. Moreover, we also propose an extended model assuming a shrinkage prior to further to improve the estimation accuracy.

This paper is organized as follows. In Section 2, we briefly review the estimation method by Harvey et al. (2010) and propose the modified method that solves the identification issue. Then we extend our proposed method by applying the shrinkage prior to the co-skewness. In Section 3, we perform simulation studies in multiple settings of the structure of and verify whether proposed methods can properly estimate the true structure. The conclusion is given in Section 4.

2 Proposed Method

First we review the Bayesian MCMC method proposed by Harvey et al. (2010). Based on (1) and (2), two equivalent expressions of the joint conditional density of given is obtained as:

| (4) | ||||

| (5) |

Harvey et al. (2010) assumed the following normal-Wishart prior for , and 777While Harvey et al. (2010) sampled and together by jointly assuming the multivariate normal prior for them, we describe and separately because we will later extend our proposed method to the model with a shrinkage prior for .:

| (6) |

We refer to the skew elliptical distribution with the normal- Wishart prior (6) as Full-NOWI. With Bayes’ theorem, the posterior distribution of is obtained as

| (7) |

Since the multiple integral in (7) is intractable, we employ Monte Carlo integration to compute the summary statistics of parameters in the posterior distribution (7). For this purpose, we apply a Markov chain sampling method to draw the latent variables along with the parameters from the posterior distribution (7).

The full conditional posterior distribution of , , , and are derived as follows.

| (8) | ||||

| (9) | ||||

| (10) | ||||

| (11) |

where and .

Since it is difficult to jointly draw from (11), the element-wise Gibbs sampler can be applied to (11). Without loss of generality, we partition , and as

where , and are scalars, , and are vectors, and is an matrix. Then the full conditional posterior distribution of is

| (12) |

The full conditional posterior distribution of the second to the last element of can be derived in the same manner as (12). Then we can construct the element-wise Gibbs sampler for by drawing each element of sequentially from its full conditional posterior distribution.

Since columns in are not identified without imposing any constraints as we confirmed in the introduction, we use a positive lower-triangular constraint (PLT, Geweke and Zhou (1996), West (2003) and Lopes and West (2004))888Although, Frühwirth-Schnatter and Lopes (2018) recently proposed a generalized lower triangular condition that generalizes the positive lower-triangular (GLT) condition, but in the case of the multivariate skew-elliptical distribution, the GLT condition matches the PLT condition since is square matrix. Therefore, we used the PLT condition in this research. on which is often used in econometric field. Assume upper-triangular above the main diagonal of equals to zero as:

| (13) |

By defining

we can rewrite (2) as

| (14) |

where

Using W and , (6) can be rewritten as:

| (15) |

We refer to the multivariate skew-elliptical distribution with the lower-triangle constraint (13) and the normal-Wishart prior (15) as LT-NOWI.

With (14) and (15), the full conditional posterior distribution of is derived as:

| (16) |

where and . The posterior distribution of , , are the same as in (10), (8) and (11).

It is known that, when the normal-Wishart prior is used, the posterior distribution may not have a sharp peak around zero even if the true value is exactly equal to zero. In order to make the posterior distribution shrink toward zero and improve the estimation accuracy, we propose an extended model with a shrinkage prior for and .

To non-zero elements in , we apply the horseshoe prior (Carvalho et al. (2010)):

| (17) |

where is the -th element in and stands for the half Cauchy distribution. Note that the half Cauchy distribution in (17) is expressed as a mixture of inverse gamma distributions as in Makalic and Schmidt (2016):

| (18) |

For computation, we first randomly generate , from the inverse Gaussian distribution. Then, we also randomly generate , and set them as initial values. The derivation of the full conditional posterior distribution of is straightforward. Given , the prior distribution of is

Thus, the full conditional posterior distribution of is identical to (16) except

The full conditional posterior distributions of and in (17) are

| (19) | ||||

| (20) |

while those of the auxiliary variables are

| (21) | ||||

| (22) |

We also apply the graphical horseshoe prior to the off-diagonal elements in as in Li et al. (2019). Although it is tempting to use a horseshoe prior such as

| (23) | ||||

| (24) |

where is the element in , (23) is not appropriate for our purpose because the support of in (23) includes points where is not positive definite. Thus we need to put the positive definiteness constraint upon (23). In this paper, we refer to the multivariate skew-elliptical distribution with the lower-triangle constraint (13), the horseshoe prior for the skewness matrix (17) and the positive-definiteness-assured graphical horseshoe prior for the precision matrix (23)–(24) as LT-HSGHS.

To assure the positive definiteness of in the course of sampling, we apply a block Gibbs sampler by Oya and Nakatsuma (2021). To illustrate the block Gibbs sampler, we introduce the following partition of and :

| (25) |

where and are scalars, and are vectors, and and are matrices. In each step of the block Gibbs sampler, we draw a diagonal element and off-diagonal elements from their full conditional posterior distributions. Without loss of generality, rows and columns of can be rearranged so that the upper-left corner of , , should be the diagonal element to be drawn from its full conditional posterior distribution. By using and in (25), we have

and

Then (5) is rewritten as

| (26) |

Furthermore, following Wang (2012), we reparameterize to where

Finally we have

| (27) |

where we ignore the parts that do not depend on nor .

We need to be careful in choosing the prior distribution of . Given that from the previous iteration of the block Gibbs sampler is positive definite, newly generated and must satisfy

| (28) |

to ensure that the updated is also positive definite. This condition (28) requires

Hence, we can use a gamma distribution:

| (29) |

as the prior distribution of . Moreover, we suppose the prior distribution of off-diagonal elements is a truncated multivariate normal distribution:

| (30) |

where

in order to assure that the condition (28) holds in the course of sampling. Applying Bayes’ theorem to (29) and (27), we have

| (31) |

With (30), (24) and (27), the full conditional posterior distribution of is derived as

| (32) |

In order to draw from (32), we apply the Hit-and-Run algorithm (Bélisle et al. (1993)) as in Oya and Nakatsuma (2021).

- Step 1:

-

Pick a point on the unit sphere randomly as , .

- Step 2:

-

Draw a random scalar from where

- Step 3:

-

Update the old with .

Finally it is straightforward to derive the full conditional posterior distributions of hyper-parameters and auxiliary variables:

| (33) | ||||

| (34) | ||||

| (35) | ||||

| (36) |

3 Performance Comparisons with Simulation

In this section, we report results of Monte Carlo experiments to compare three models (Full-NOWI, LT-NOWI and LT-HSGHS), which are summarized in Table 1, in terms of accuracy in the parameter estimation.

| Constraint for | Prior for | Prior for | |

|---|---|---|---|

| Full-NOWI | Nothing | Normal | Wishart |

| LT-NOWI | Positive Lower-Triangular | Normal | Wishart |

| LT-HSGHS | Positive Lower-Triangular | Horseshoe | Graphical Horseshoe |

We assume the following three designs of in this simulation:

-

1.

-Diag: , , otherwise 0.0.

-

2.

-Sparse: , , , otherwise .

-

3.

-Dense: , , , otherwise the elements in lower-triangular equals to 1.0.

Since our main purpose is to compare estimation of , we set a simple assumption for the other parameter; is the identity matrix, is fixed to zero. We generate artificial data of t = 1,500 and n = 15 from the multivariate skew-elliptical distribution with each specification and evaluate the posterior statistics of each parameter via MCMC. The hyper-parameters in the prior distributions are set up as follows.

In all cases, the number of burn-in iterations were 50,000, and the Monte Carlo sample from the following 100,000 iterations was used in the Bayesian inference. Also, we repeated simulations 30 times for each setup and obtained a set of point estimates of and . All computations are implemented with Python 3.7.0 on a desktop PC with 128GB RAM, 8GB GPU and eight-core 3.8GHz i7-10700K Intel processor.

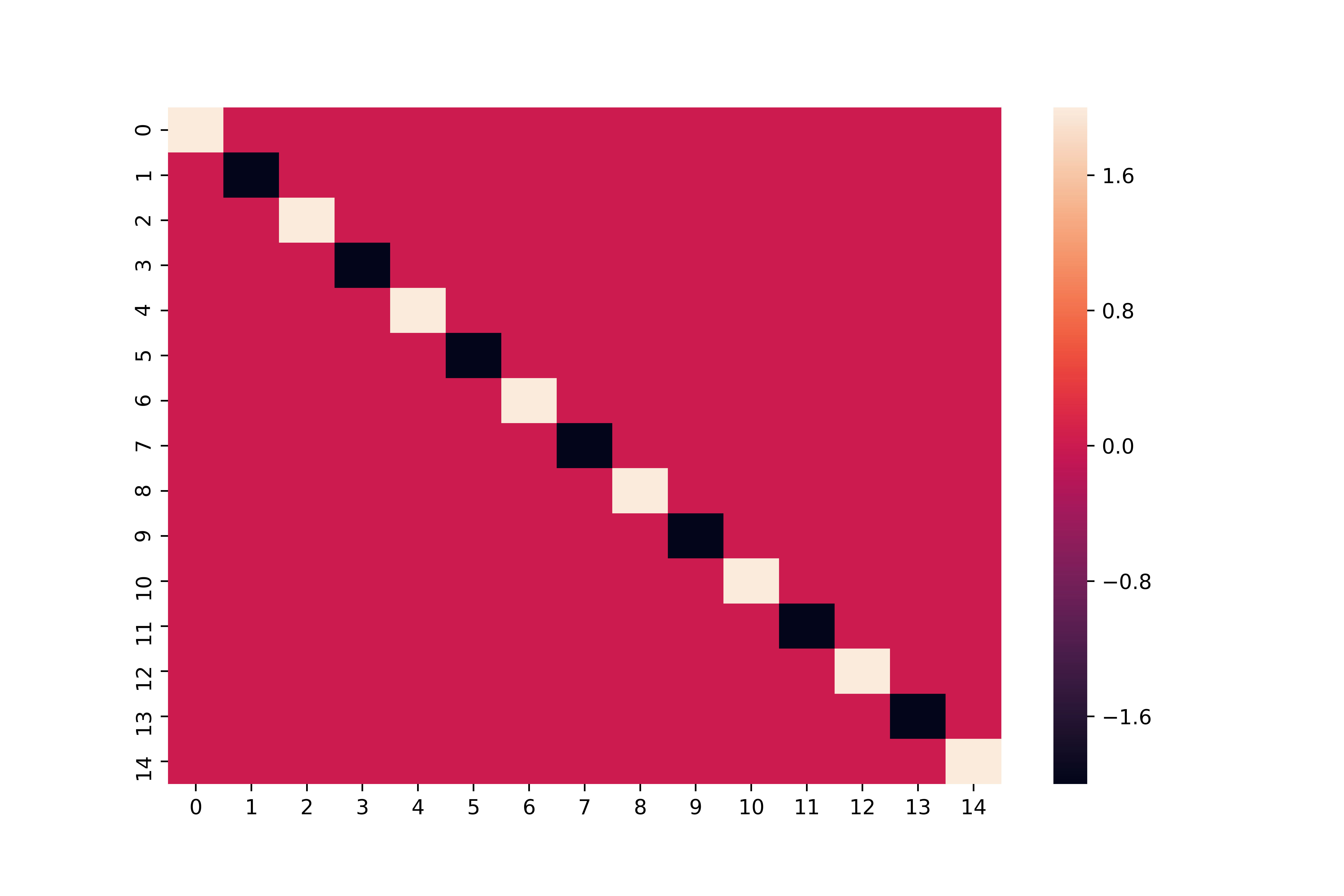

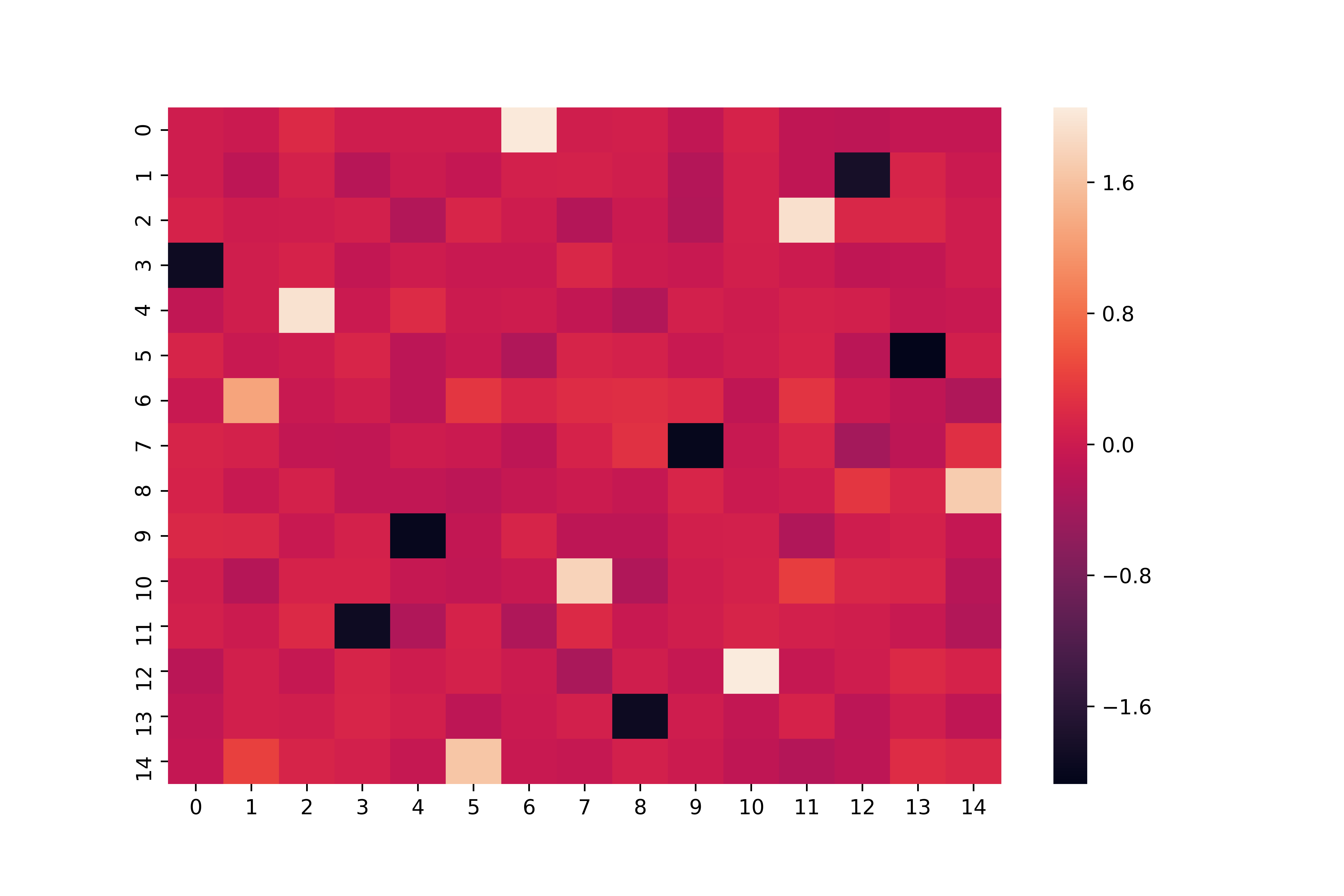

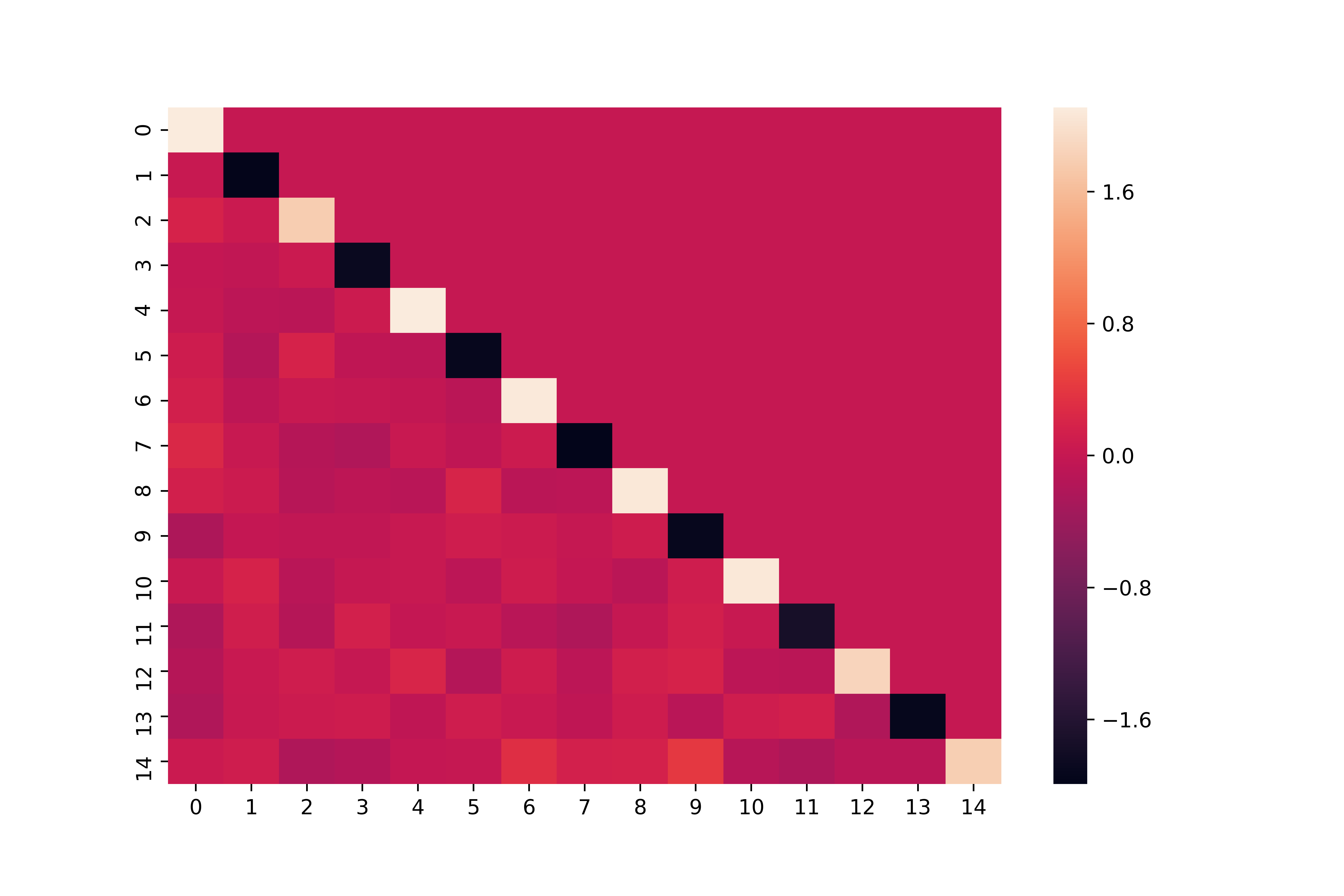

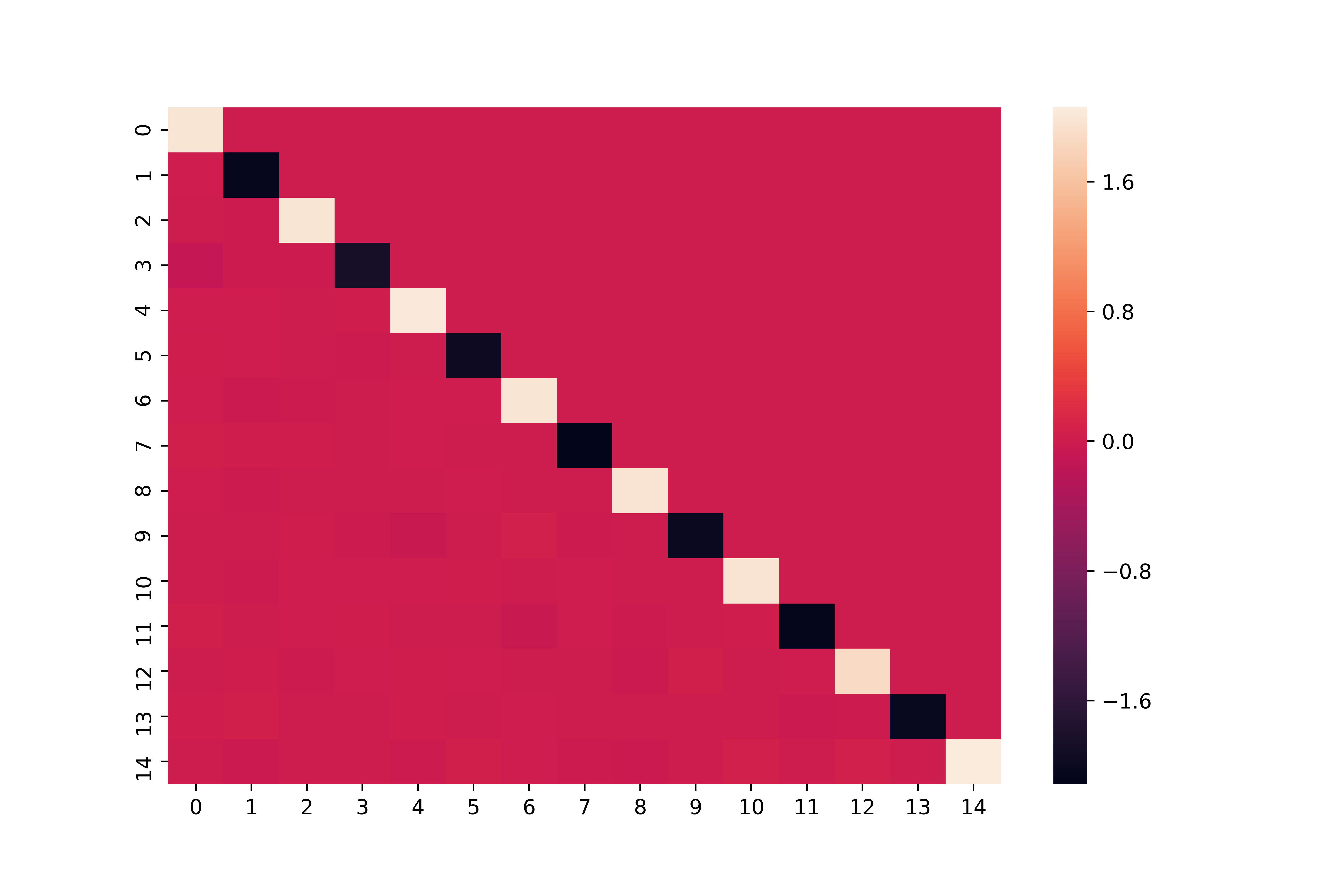

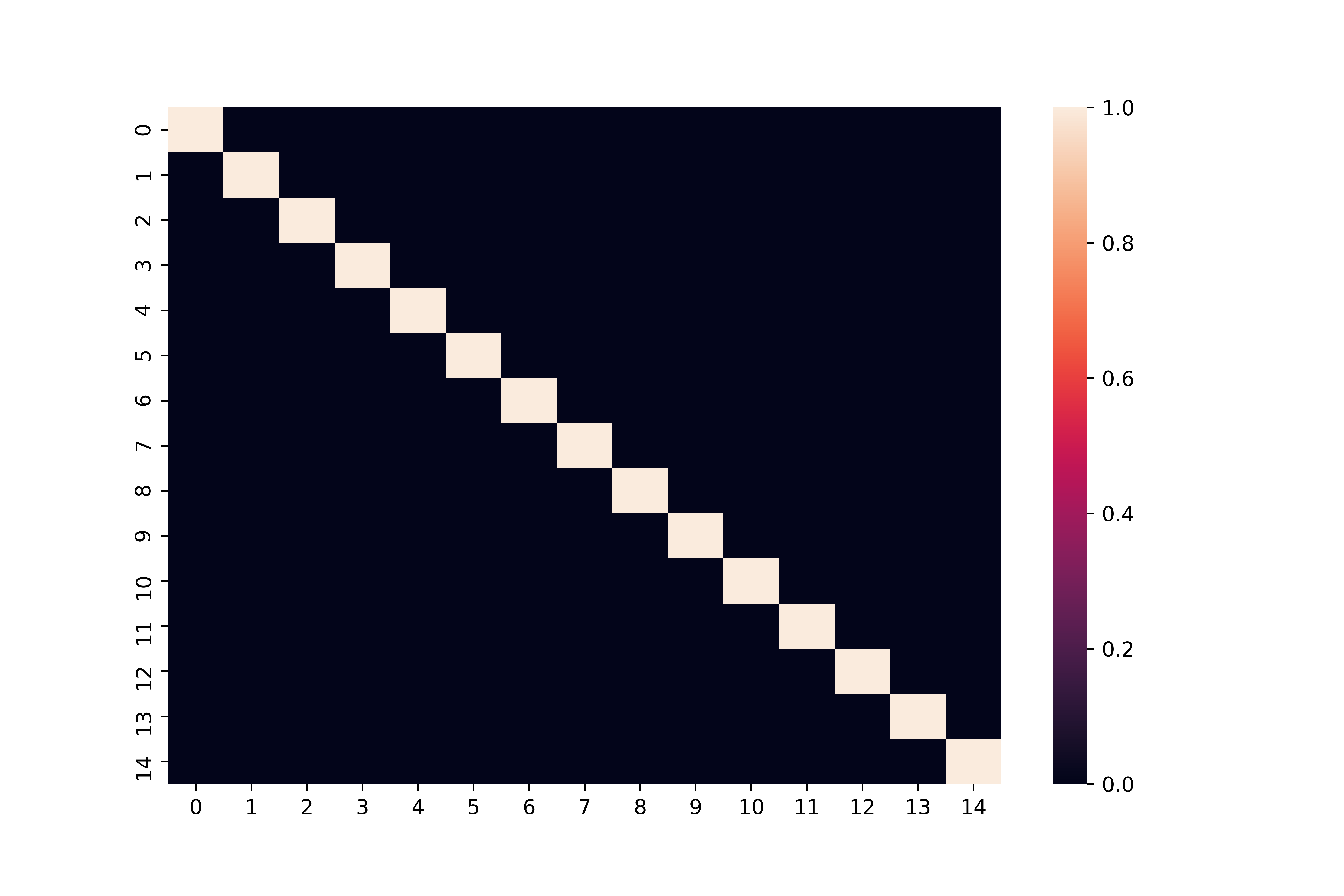

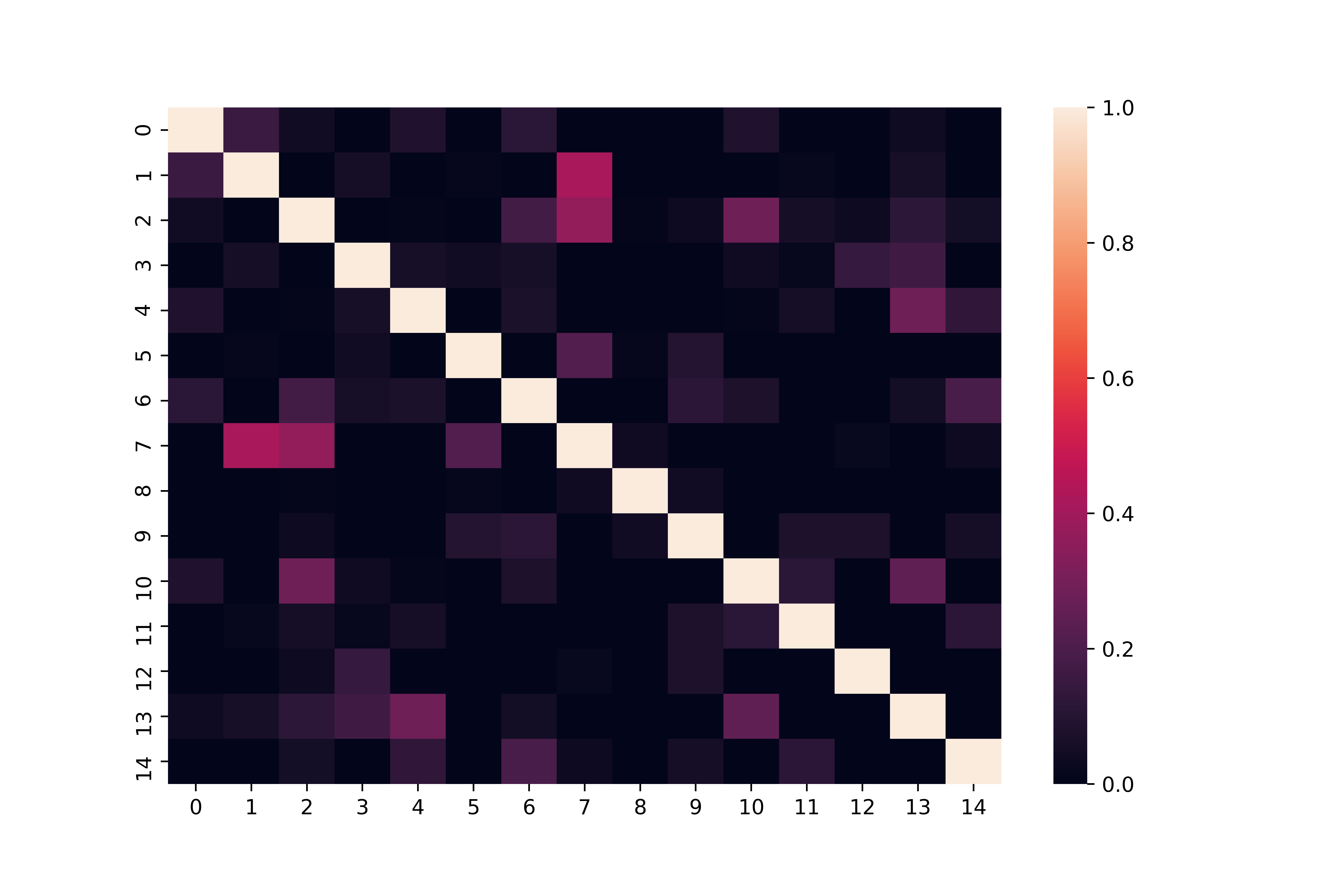

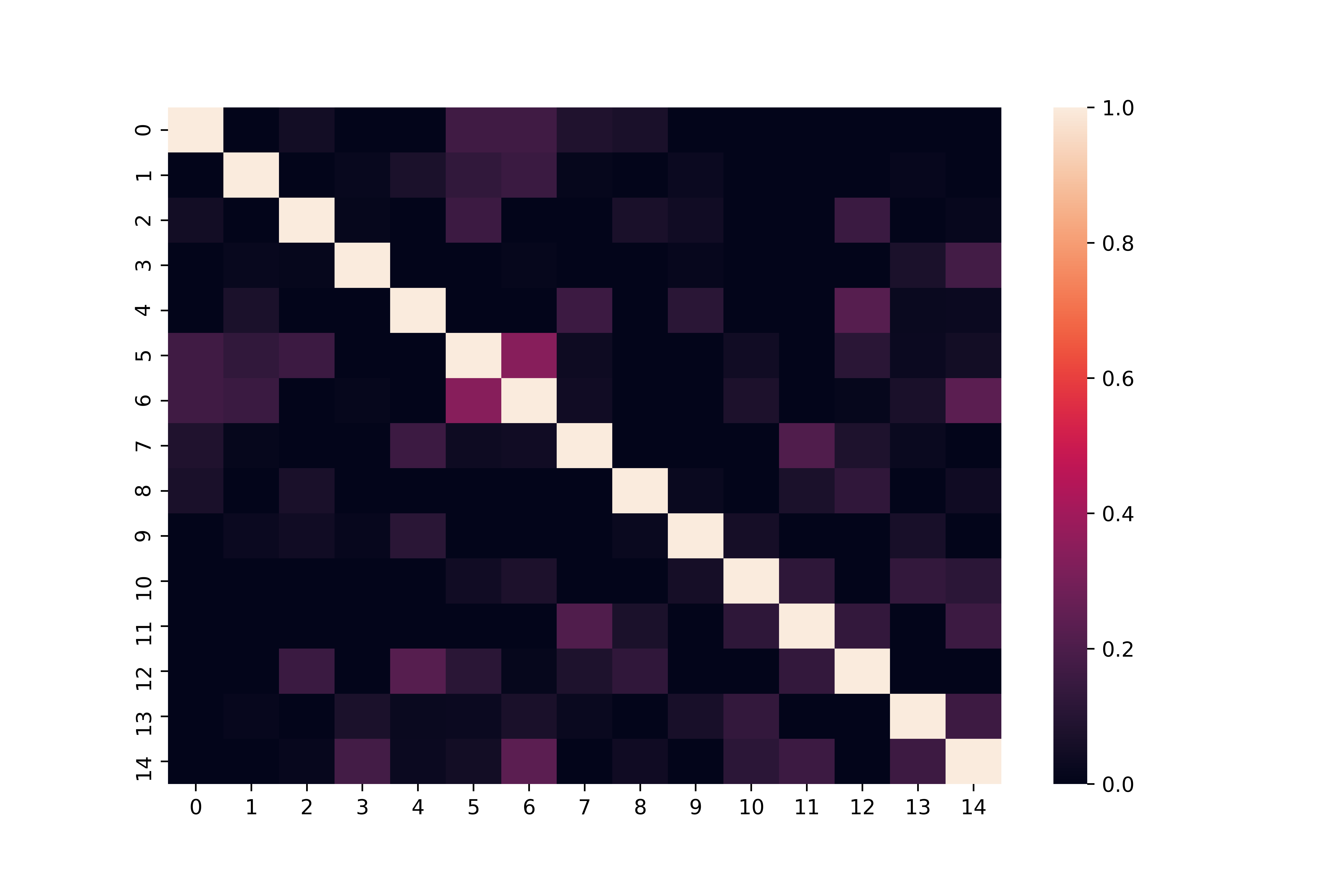

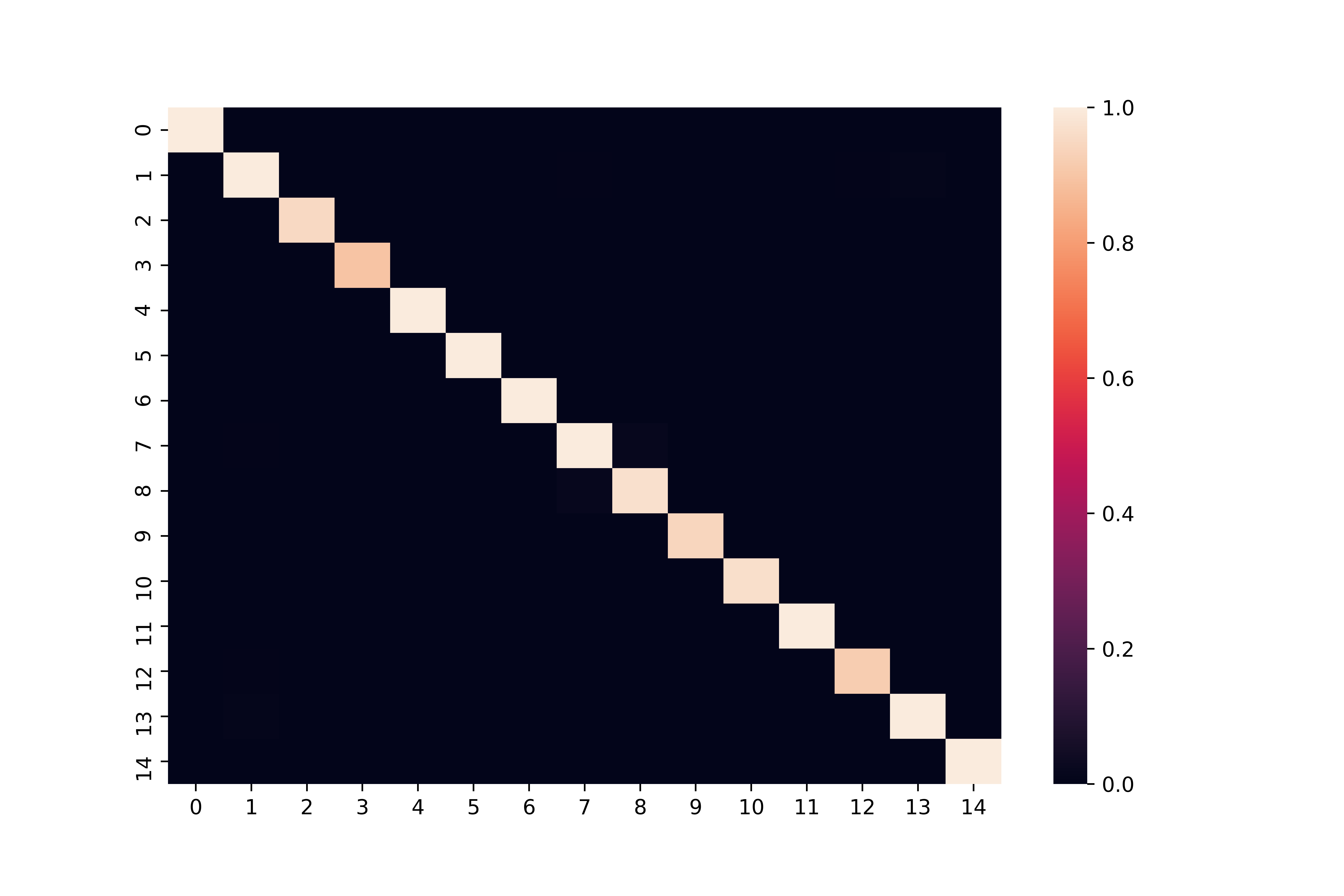

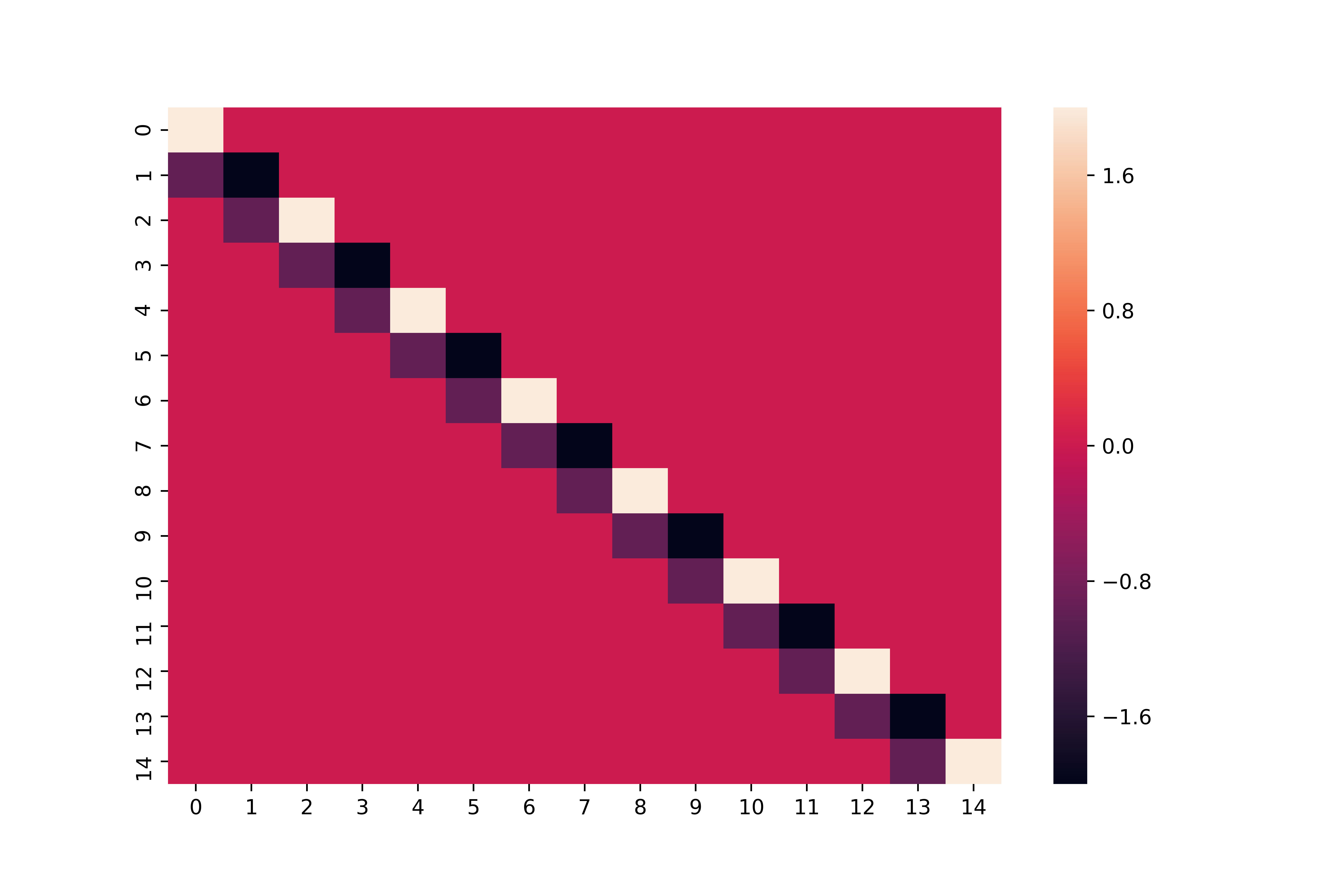

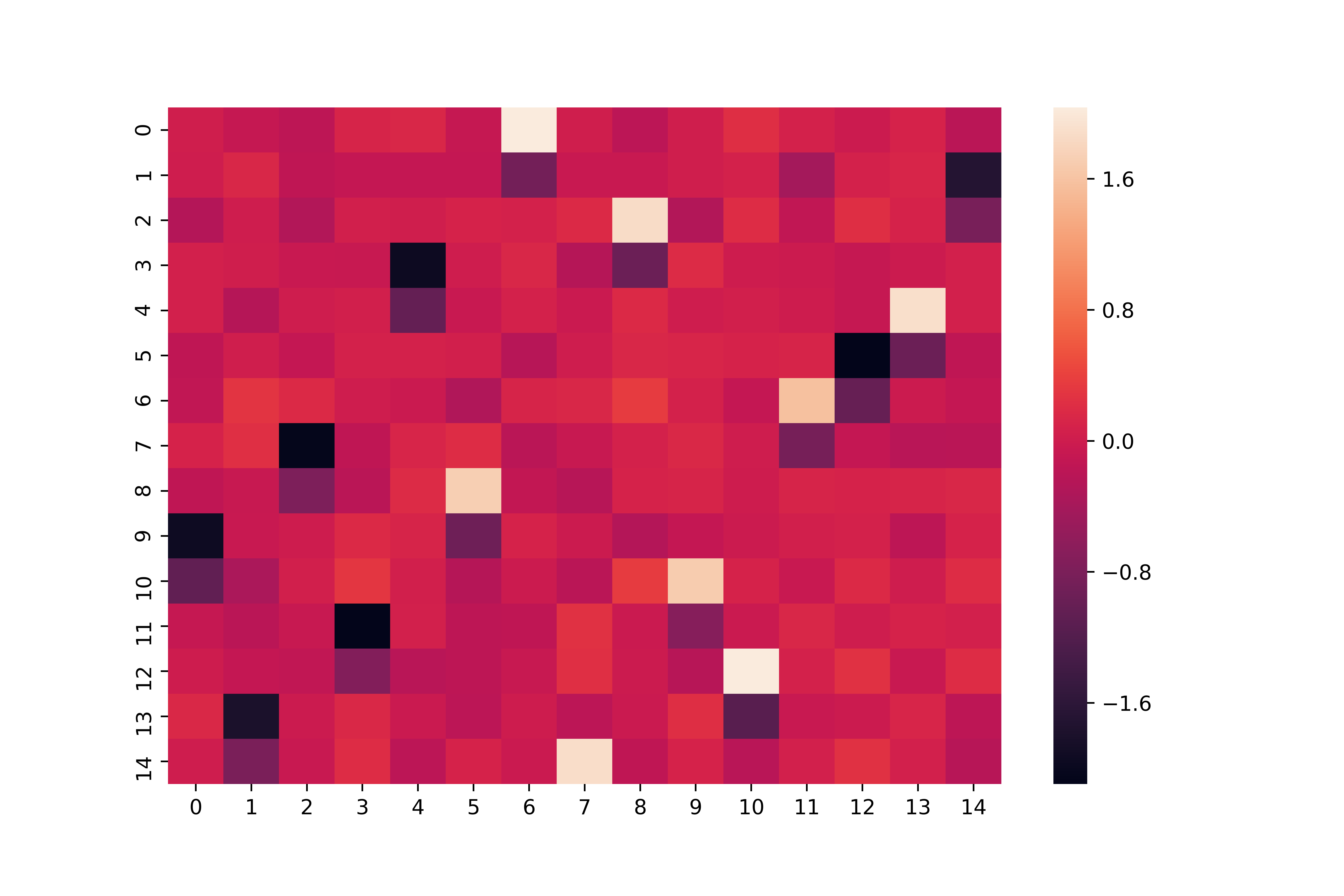

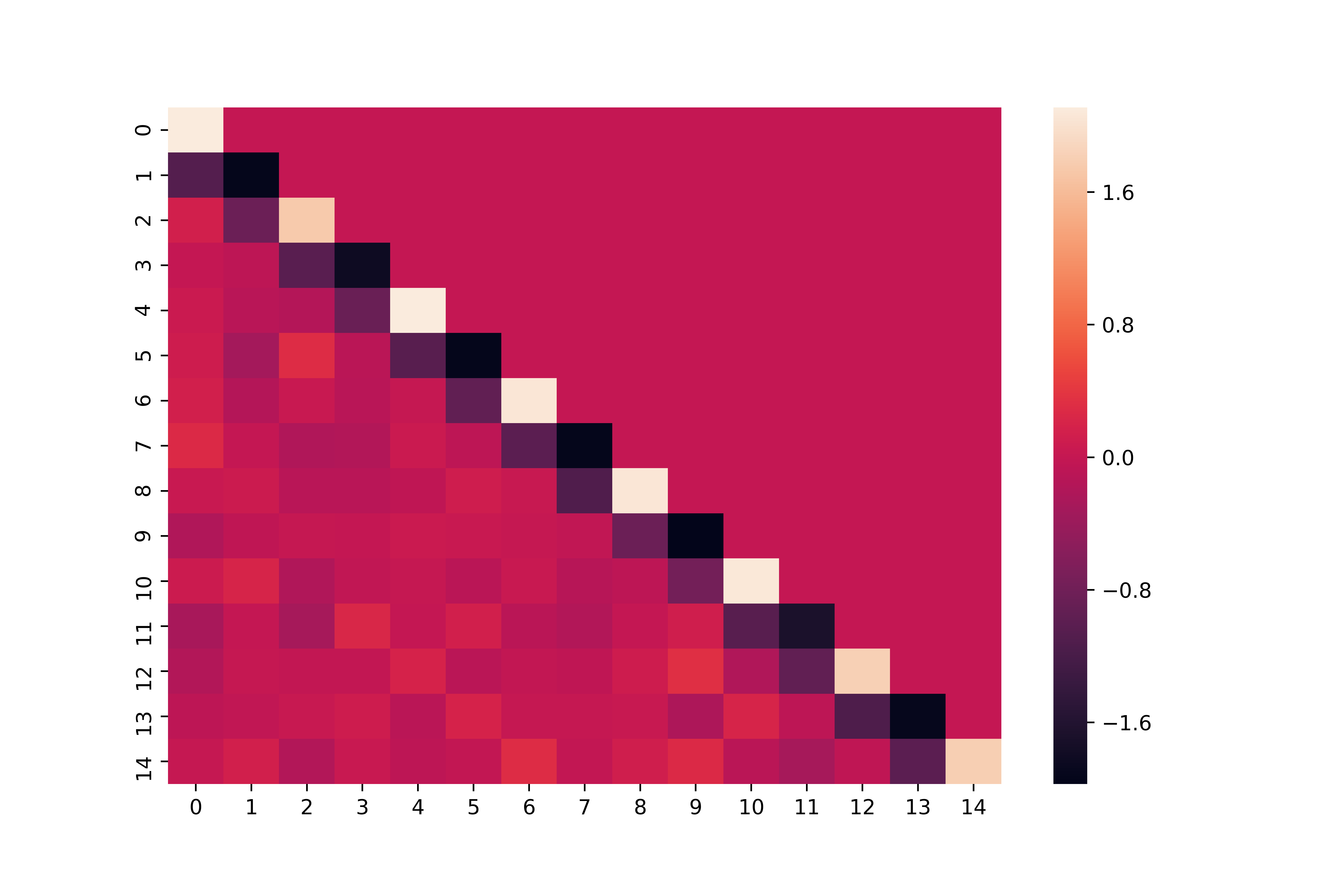

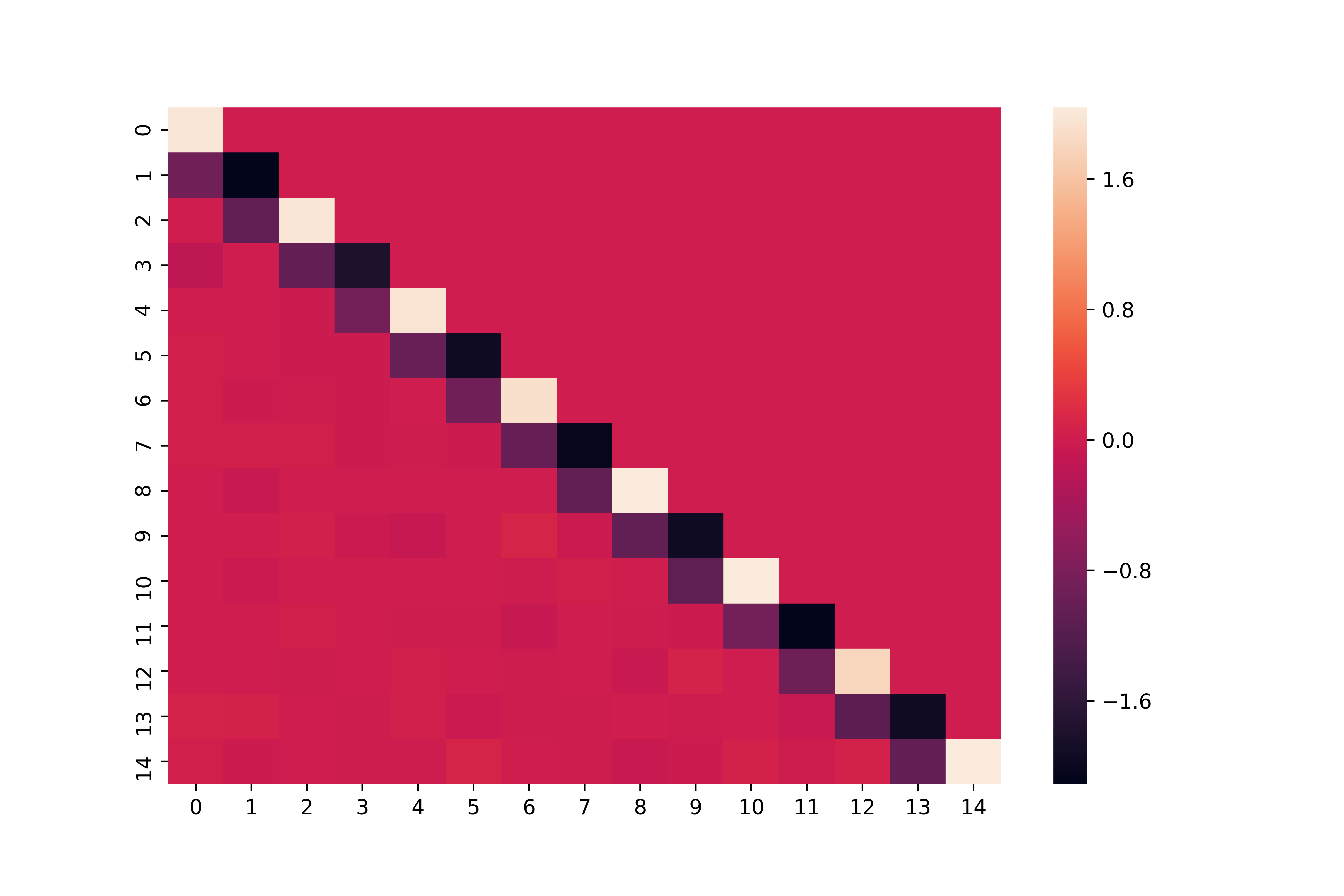

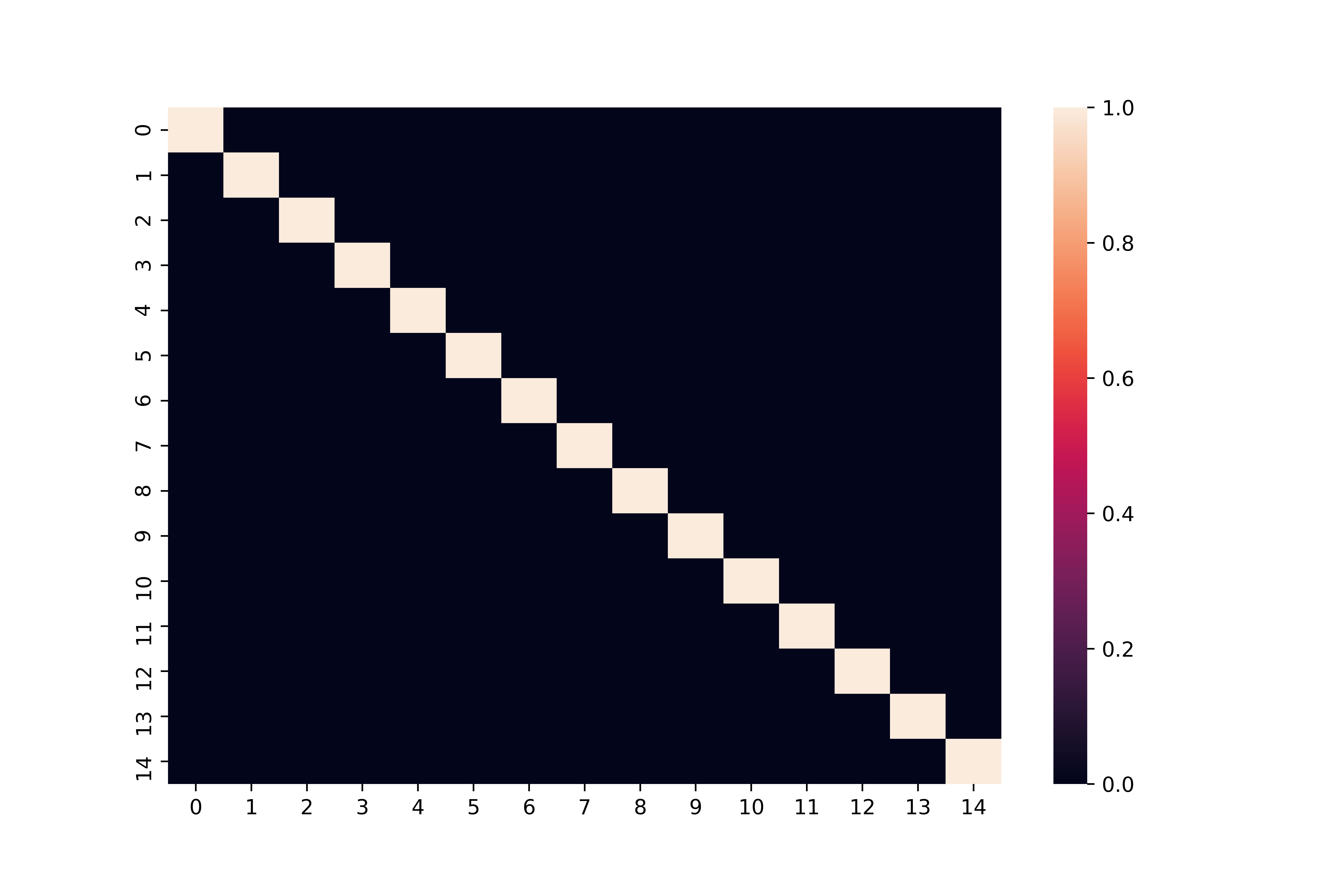

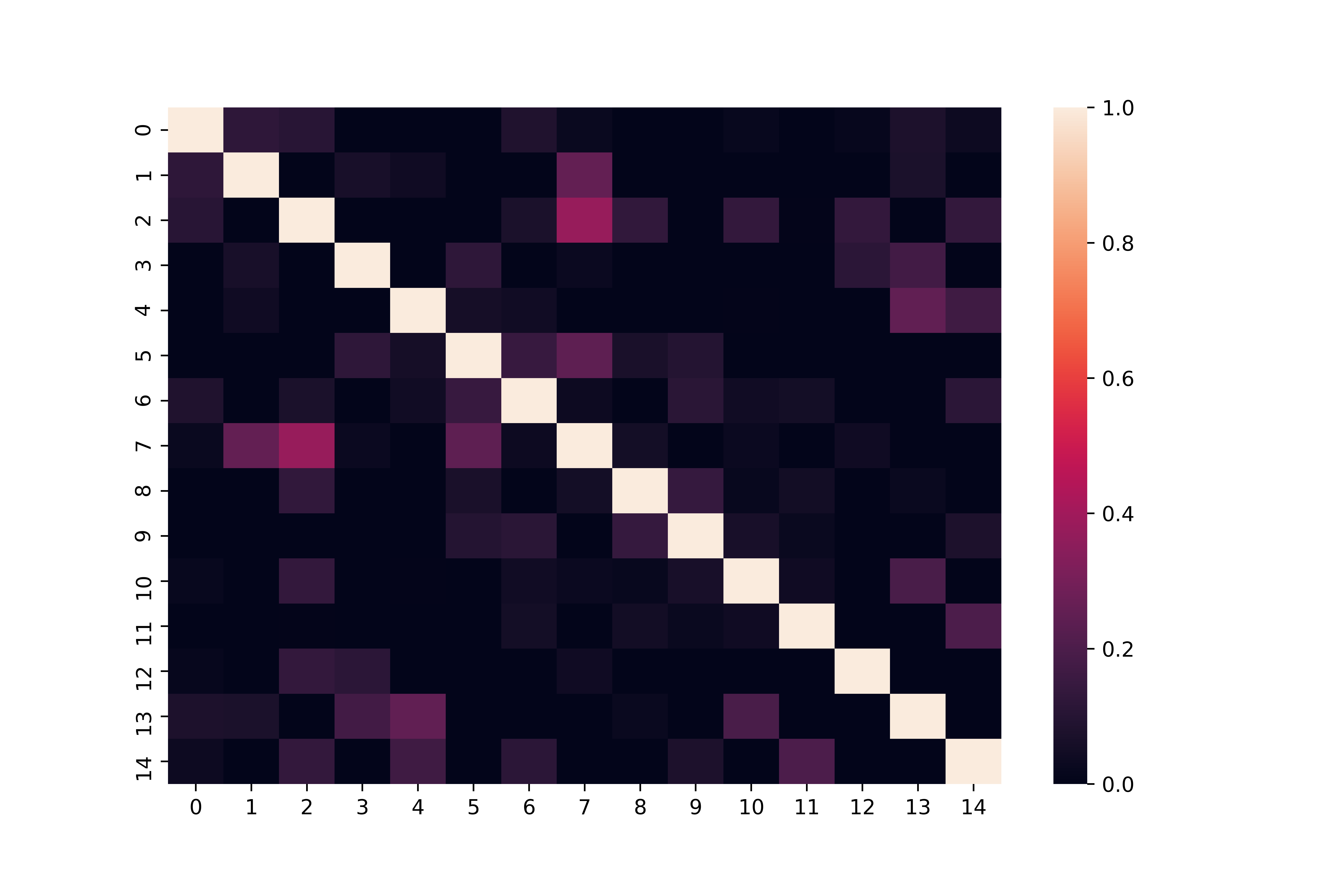

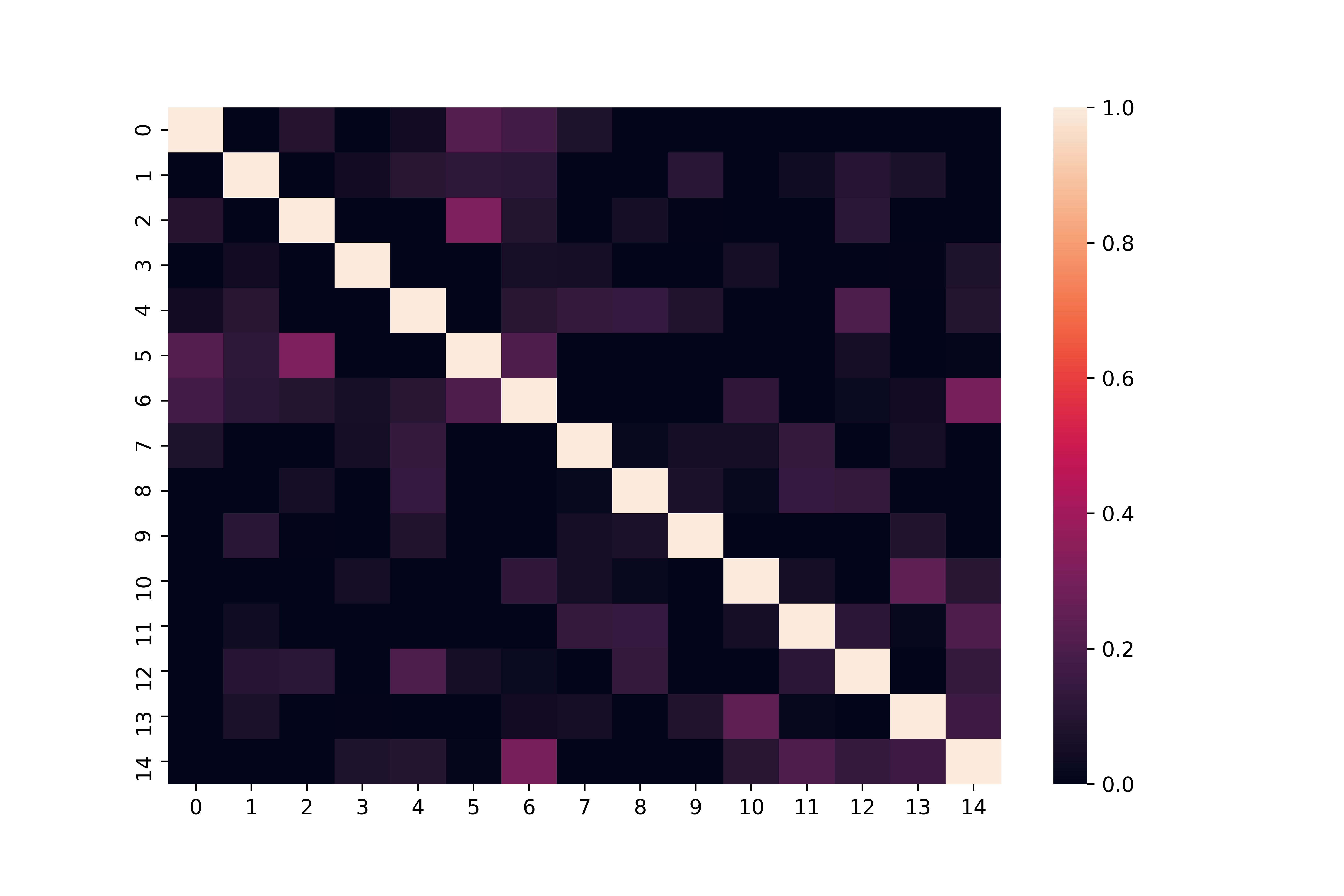

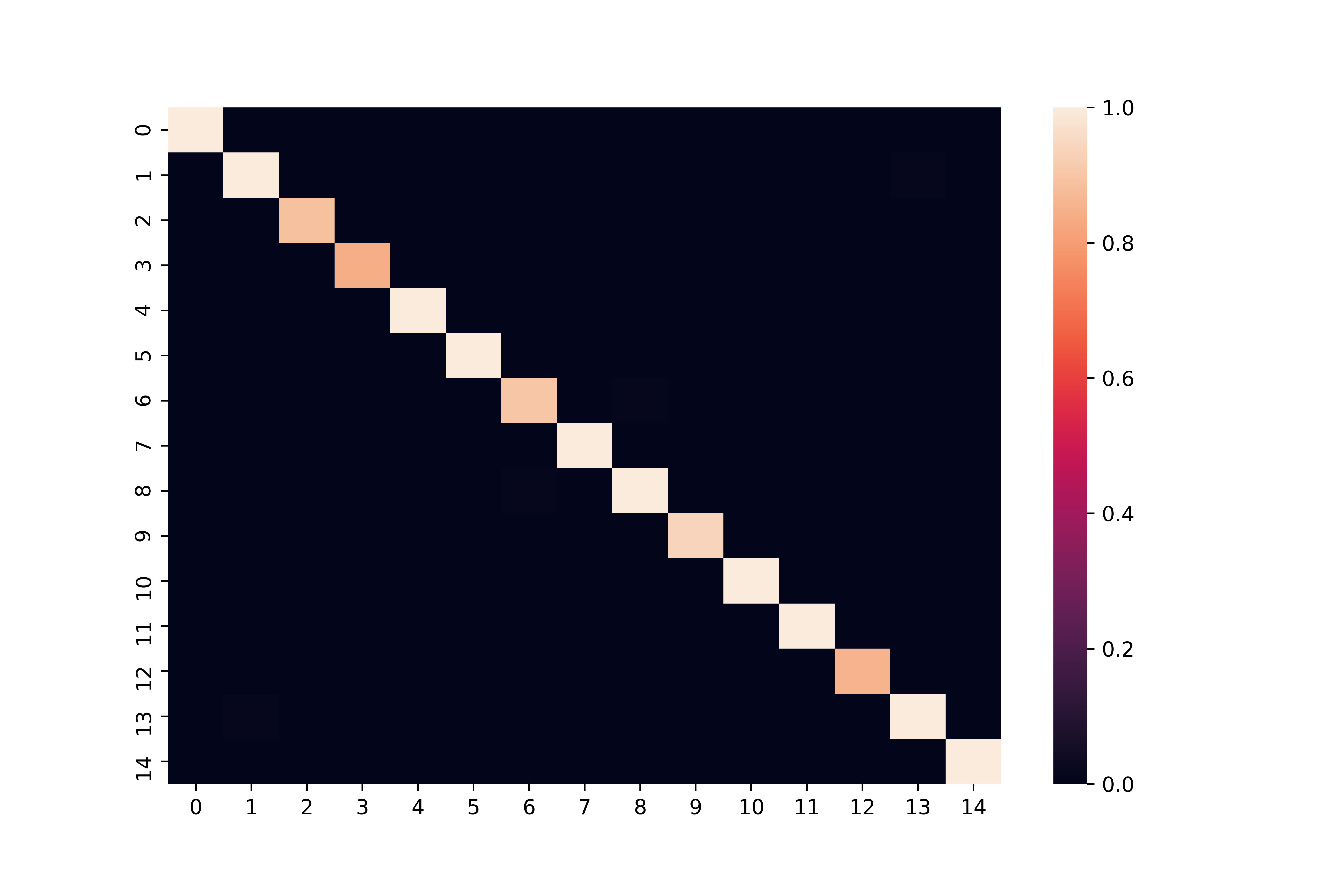

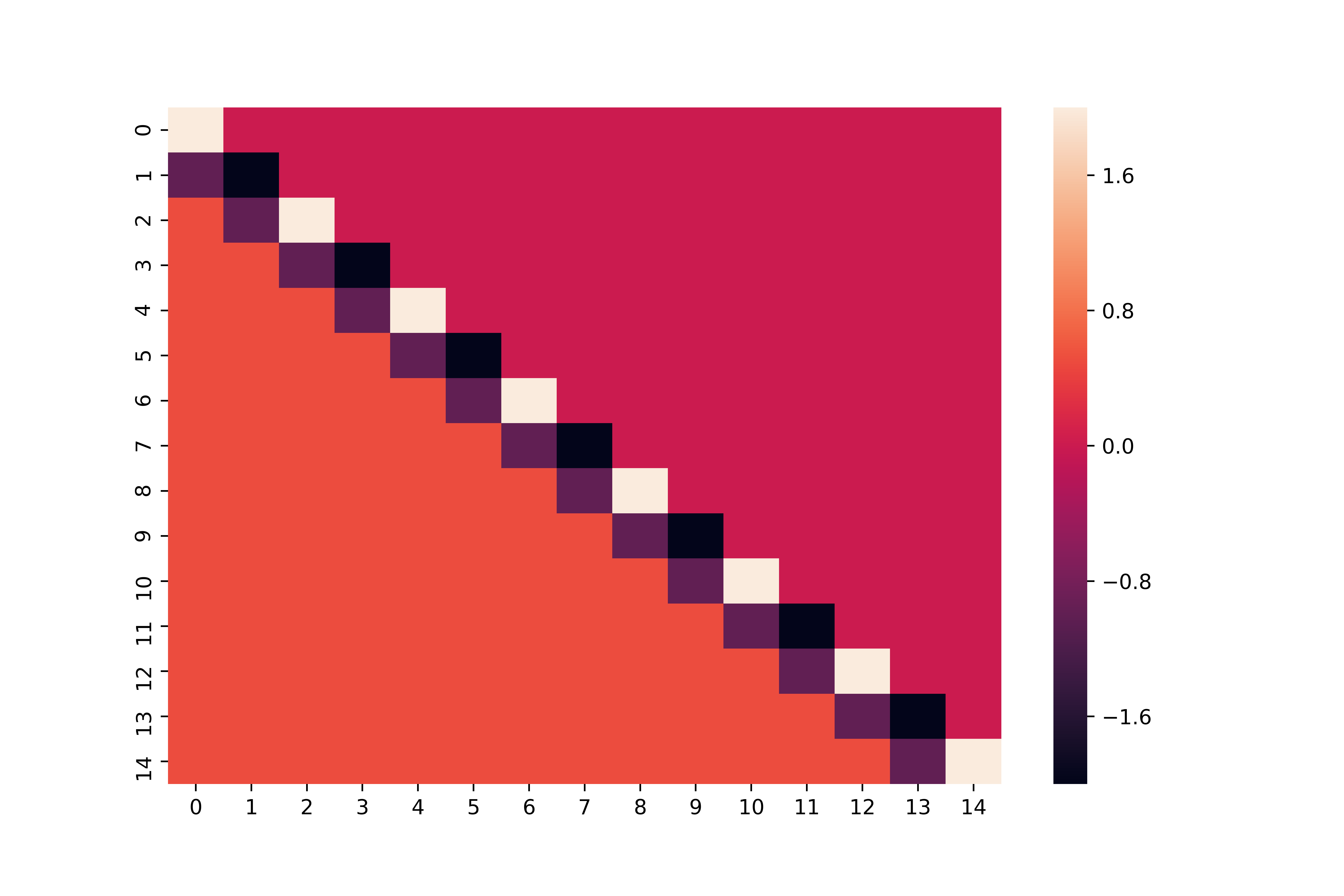

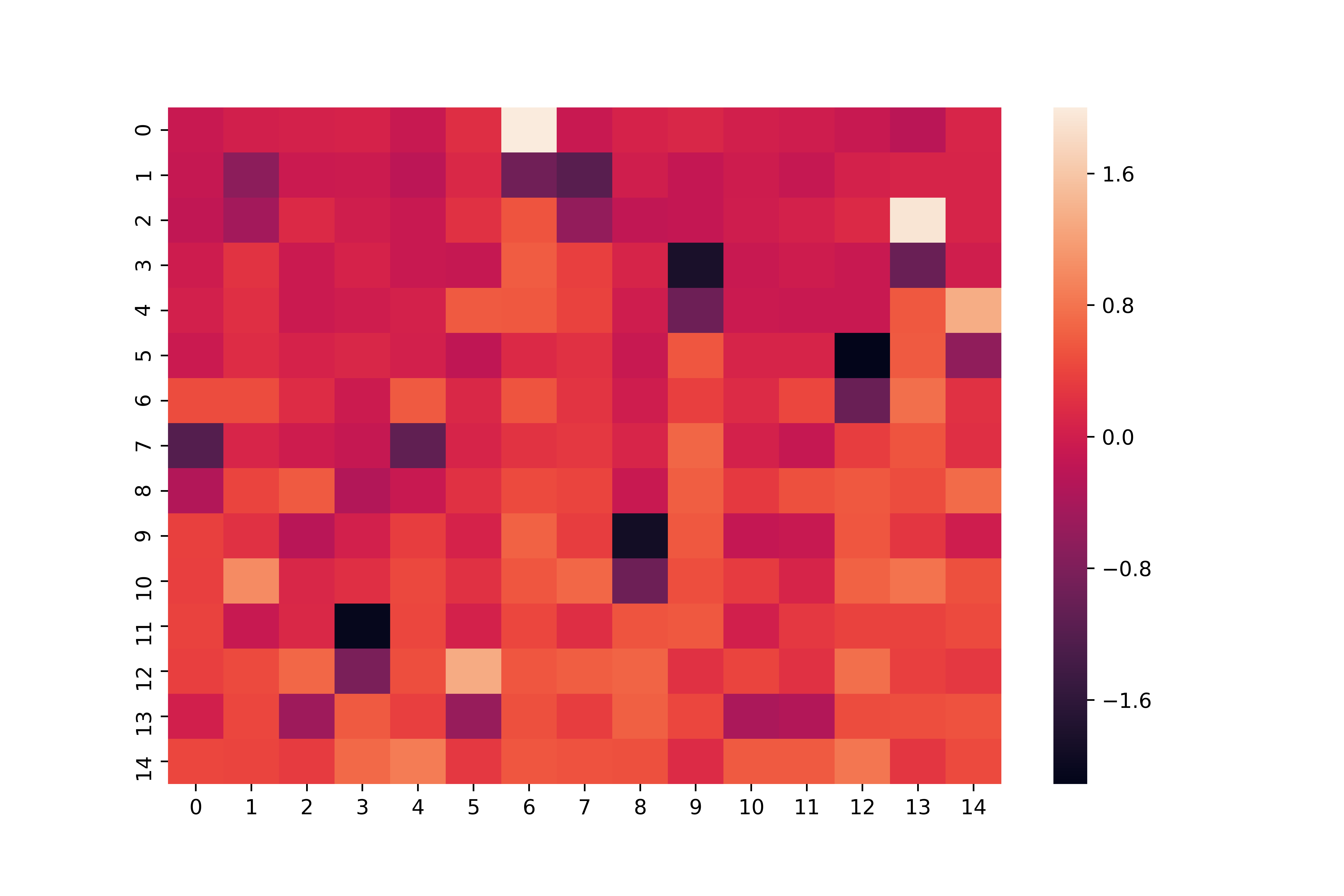

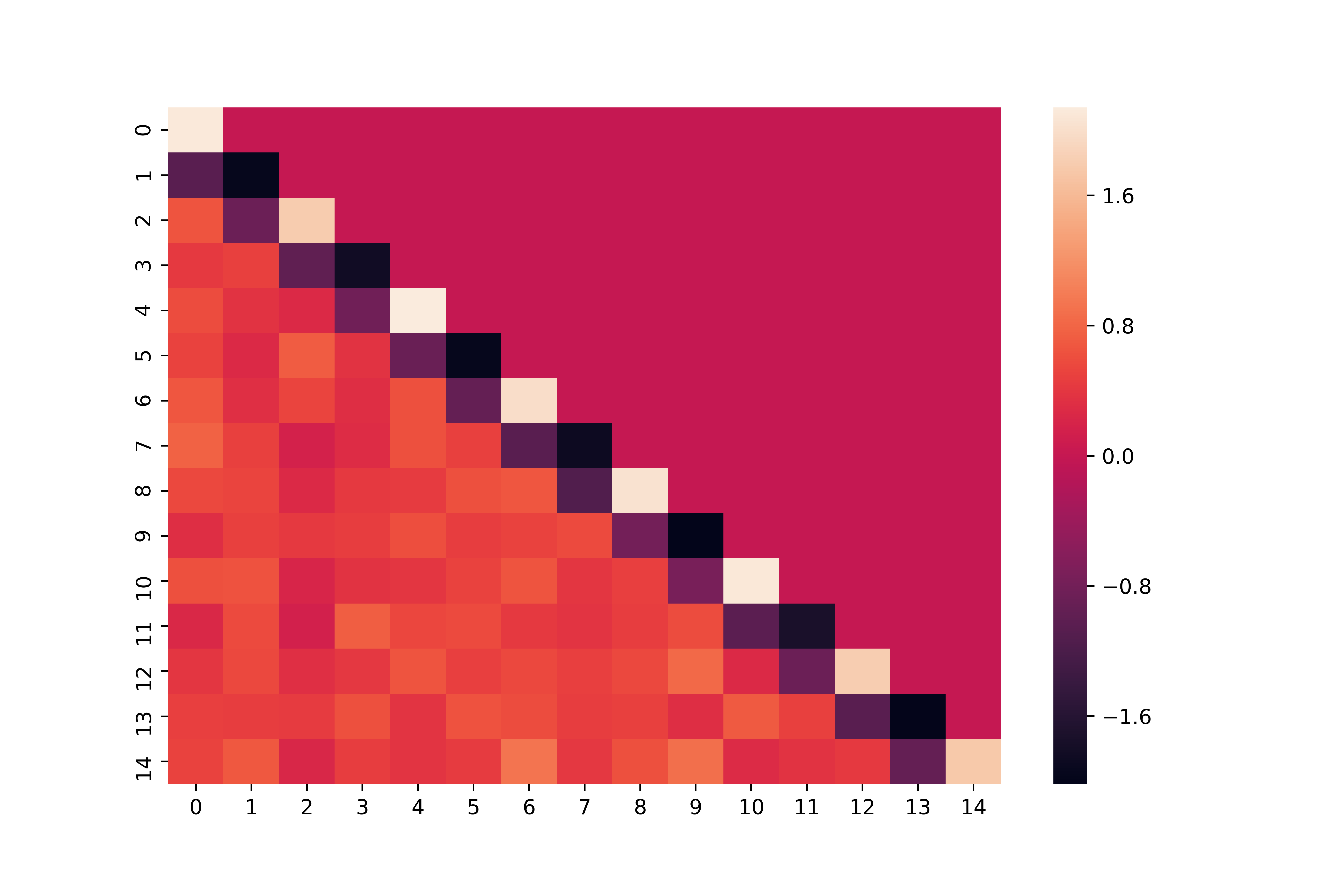

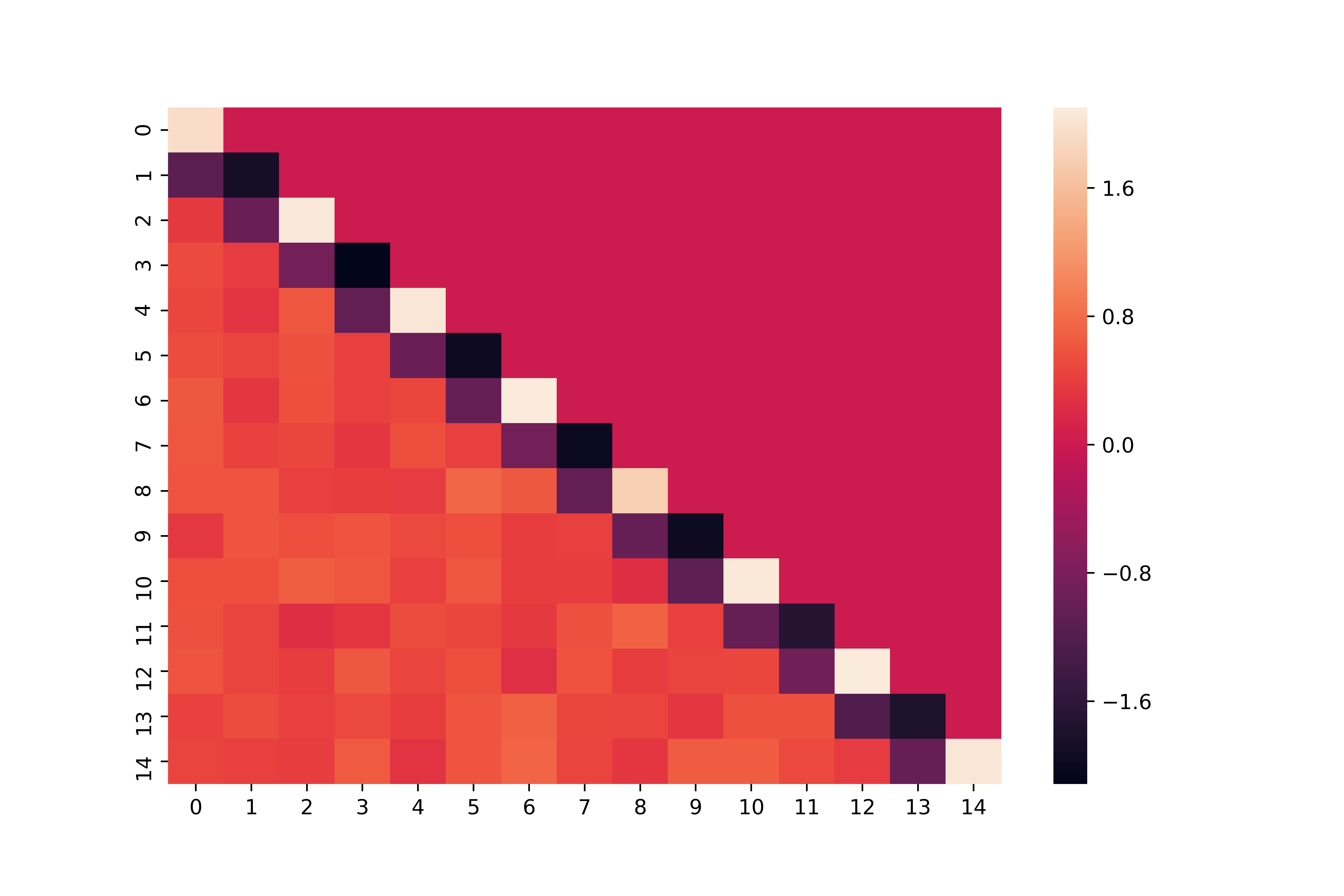

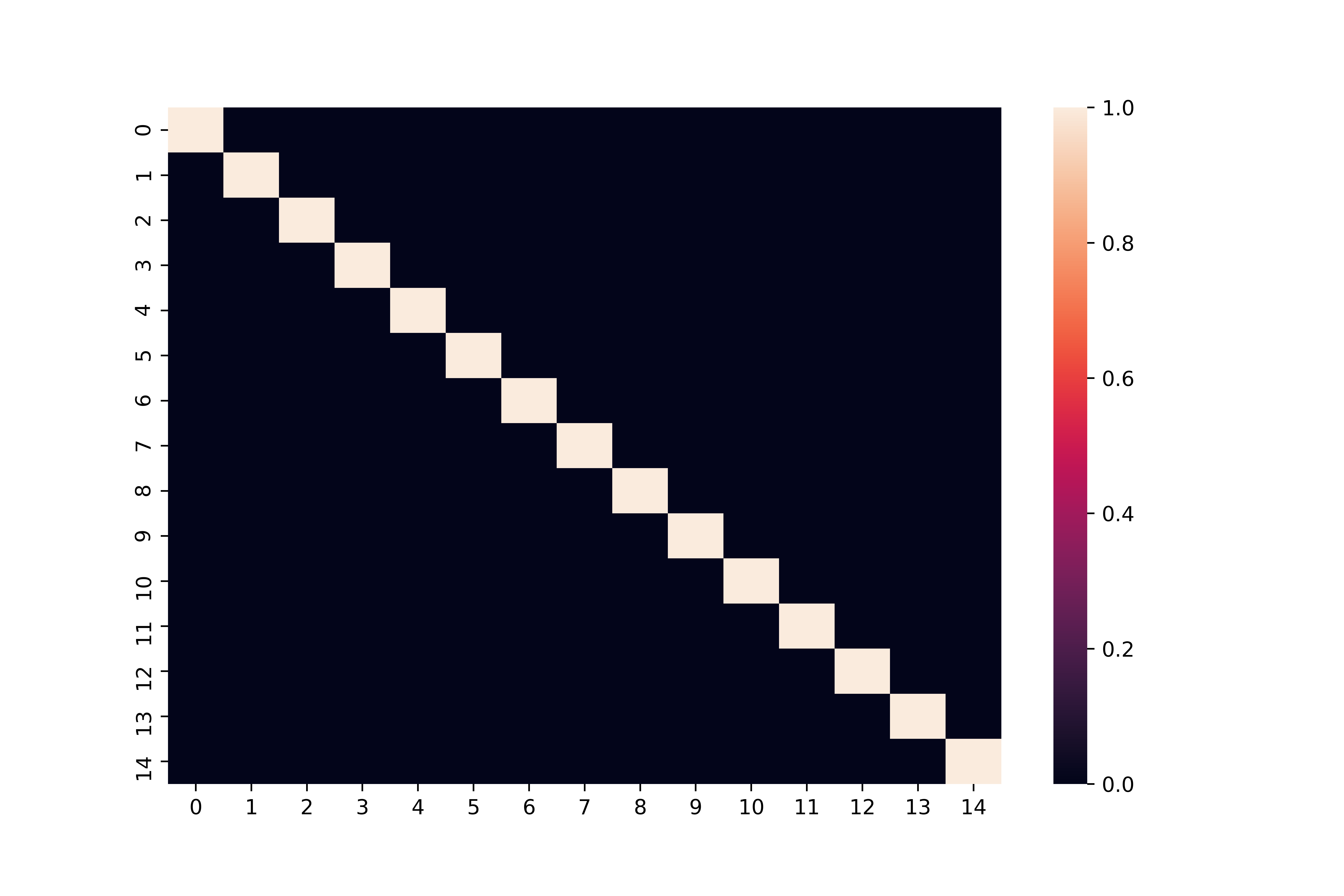

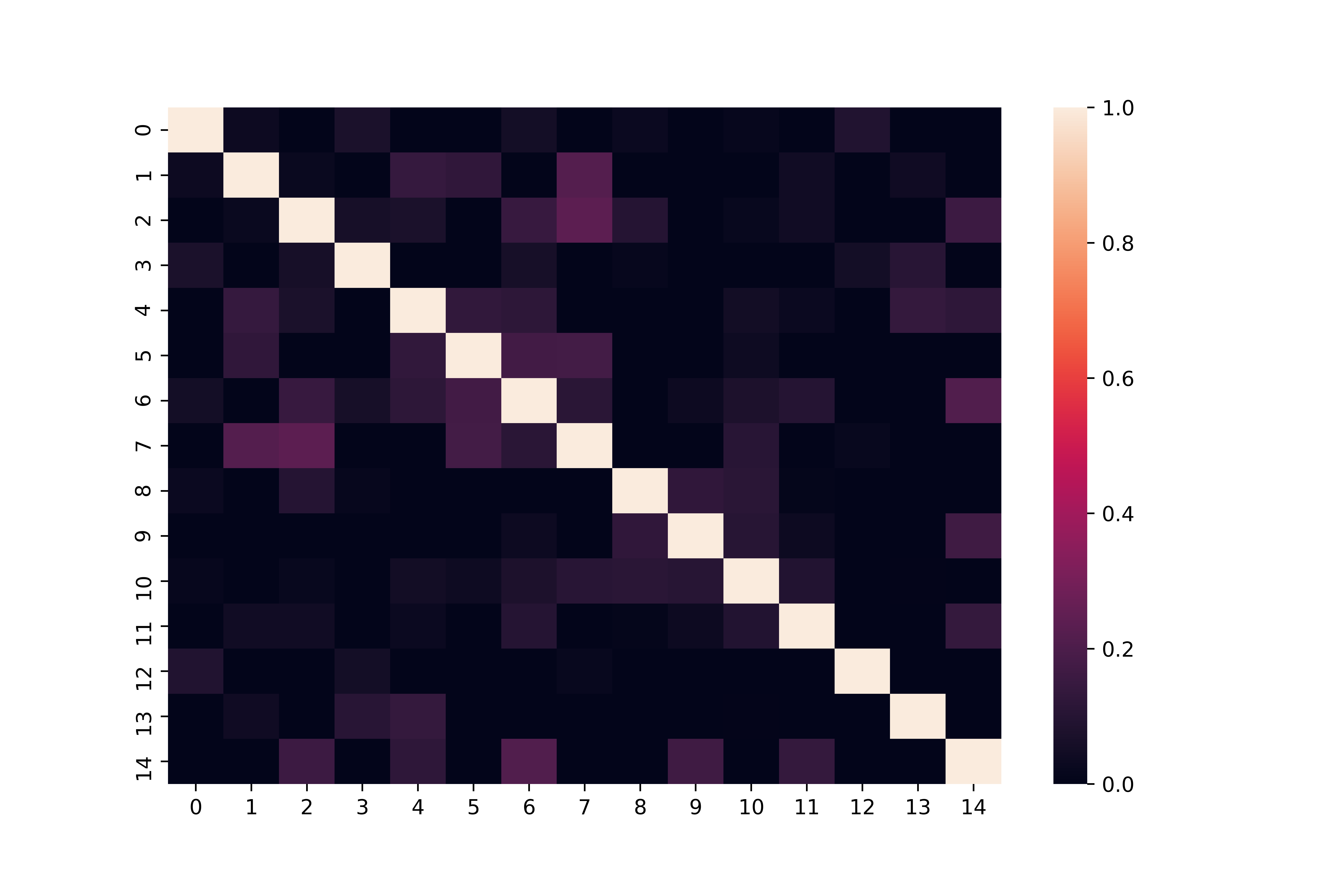

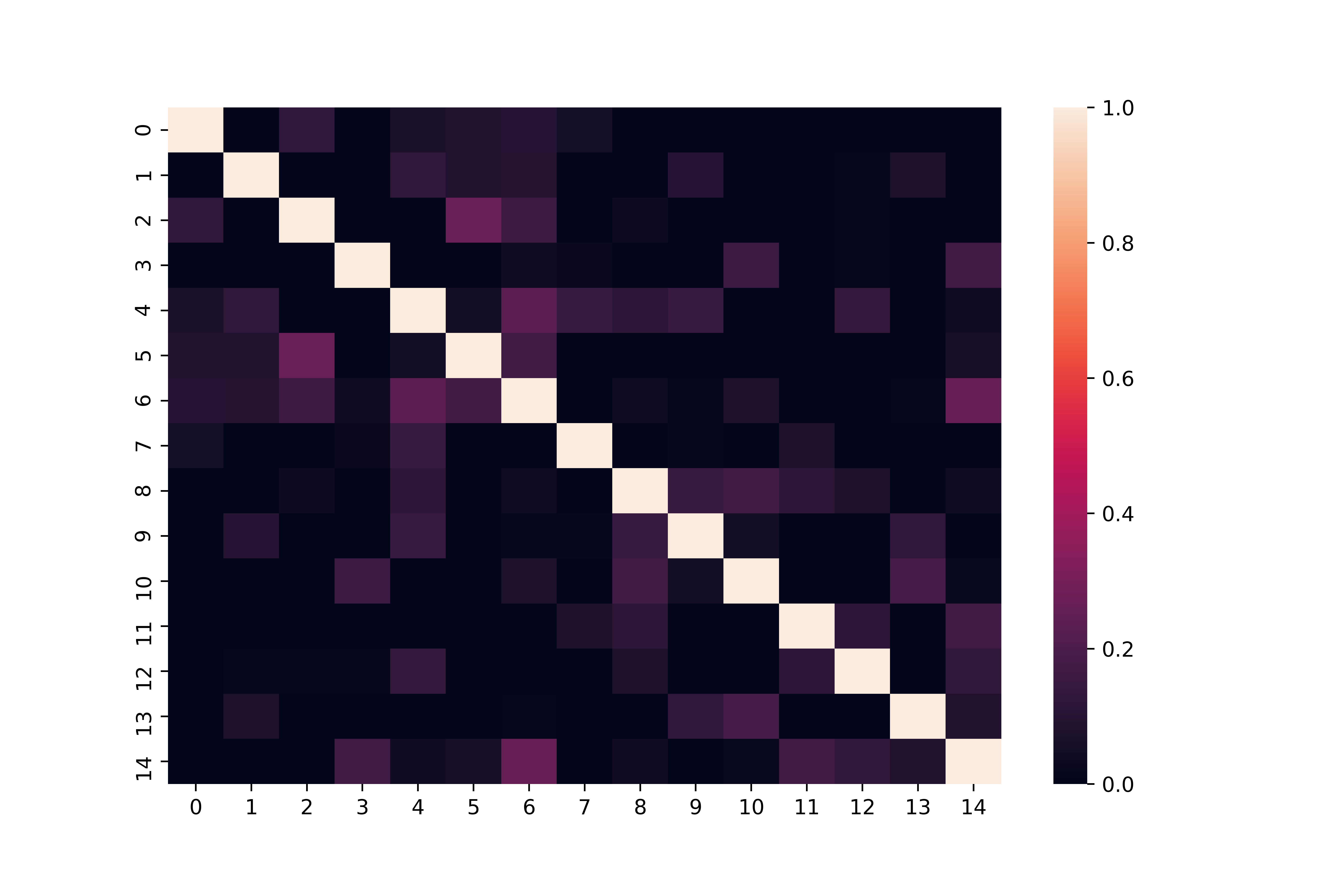

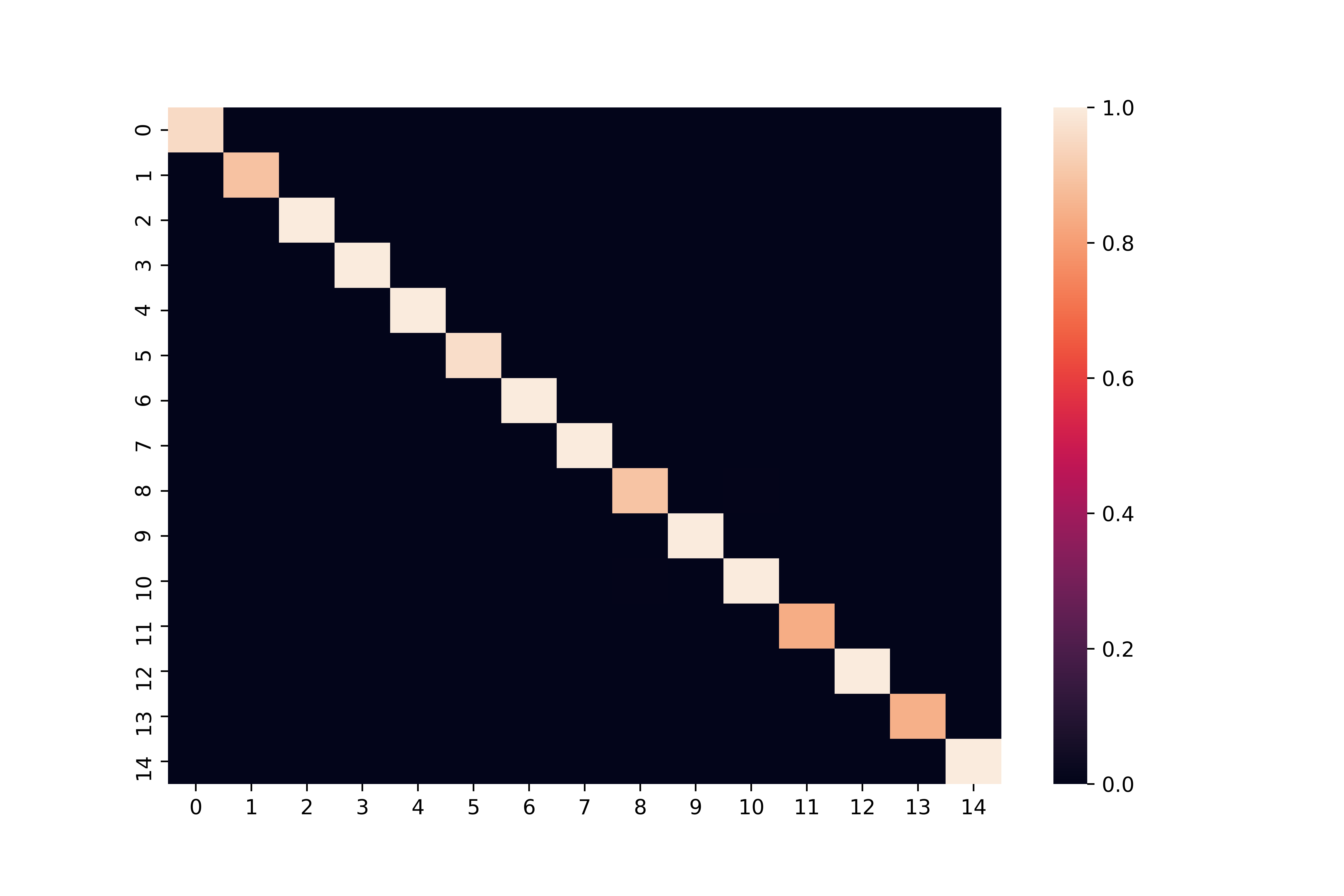

To compare the three models in terms of accuracy in the point estimation of and , we computed the Frobenius norm, as measurement of discrepancy between the point estimate and the true structure. Table 2 and 3 show the sample median loss with 30 replications for three models. The figures in parentheses are the standard errors. The smaller the value of the Frobenious norm, the closer the estimated structure is to the true one. In addition, in order to make the estimation results visually easy to understand, the posterior averages of and of each model in the 30th replication are shown in Figures 1 – 6.

First, regarding , the Frobenious norm of the proposed models (LT-NOWI, LT-HSGHS) have decreased to 1/8 or less of the Full-NOWI model for all designs and the estimation accuracy has remarkably improved in Table 2. This is because the columns of is not identified at all in Full-NOWI. On the other hand, this identification issue is resolved in LT-NOWI and LT-HSGHS and the structure of can be estimated well with the proposed method as shown in Figures 1, 3 and 5. Furthermore, for the -Diag case and the -Sparse case, Table 2 reports that the Frobenious norm of LT-HSGHS is less than half the value of LT-NOWI. This is because that the horseshoe prior in LT-HSGHS contributes to the estimation performance by shrinking non-essential elements to zero, while a large amount of non-zero entries still remain in for LT-NOWI as shown in Figures 1 and 3. However, the difference in the Frobenious norm between LT-NOWI and LT-HSGHS becomes smaller in the -Dense design because the sparse assumption of is not satisfied in this case.

Next, let take a look at results on . Note that the true structure of is the identity matrix. We examine how the estimation accuracy of changes across the structural designs of . For all designs of , the estimation accuracy is significantly improved in LT-HSGHS, the value of Frobenious norm is 1/3 or less in Table 3 compared with Full-NOWI and LT-NOWI. In fact, there are a lot of non-zero entries in the off-diagonal elements in Full-NOWI and LT-NOWI in Figures 2, 4 and 6. On the other hand, the posterior mean of in LT-HSGHS becomes the diagonal matrix thanks to the shrinkage effect. Also, comparing LT-NOWI with Full-NOWI, the Frobenious norm is slightly smaller in LT-NOWI for all designs. These findings suggest that the posterior distribution of is affected by the estimation of as shown in (10).

| -Diag | -Sparse | -Dense | |

| Frobenius norm | |||

| Full-NOWI | 10.587 | 11.588 | 12.620 |

| (0.534) | (0.743) | (0.723) | |

| LT-NOWI | 1.344 | 1.362 | 1.420 |

| (0.083) | (0.115) | (0.108) | |

| LT-HSGHS | 0.380 | 0.617 | 1.214 |

| (0.070) | (0.075) | (0.138) | |

| Notes: | (a) The smaller losses are boldfaced. | ||

| (b) The figures in parentheses are the standard errors. | |||

| -Diag | -Sparse | -Dense | |

| Frobenius norm | |||

| Full-NOWI | 2.550 | 2.447 | 2.352 |

| (0.139) | (0.138) | (0.136) | |

| LT-NOWI | 2.255 | 2.238 | 2.210 |

| (0.179) | (0.147) | (0.155) | |

| LT-HSGHS | 0.393 | 0.479 | 0.724 |

| (0.101) | (0.160) | (0.288) | |

| Notes: | (a) The smaller losses are boldfaced. | ||

| (b) The figures in parentheses are the standard errors. | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Conclusion

In this paper, we have raised a possible identification issue on the skewness matrix of the skew-elliptical distribution in the Bayesian MCMC method proposed by Harvey et al. (2010) due to label switching. To avoid this issue, we proposed an modified model in which the lower-triangular constraint was imposed upon the skewness matrix. Moreover, we devised an extended model with the horseshoe prior for both skewness matrix and precision matrix to further improve the estimation accuracy.

In the simulation study, we compared the proposed models with the model of Harvey et al. (2010) in the three structural designs of the skewness matrix and found that the proposed models with the identification constraint significantly improved the estimation accuracy of the skewness matrix.

Acknowledgements

This research is supported by the Keio University Doctorate Student Grant-in-Aid Program from Ushioda Memorial Fund; and JSPS KAKENHI under Grant [number MKK337J].

Conflict of interest

The authors declare that they are funded by the Keio University Doctorate Student Grant-in-Aid Program from Ushioda Memorial Fund and JSPS KAKENHI under Grant [number MKK337J] to conduct this research.

Ethical standards

The authors declare that the experiments in this paper comply with the current laws of Japan where we had conducted the experiment.

References

- Aas and Haff (2006) K. Aas and I. H. Haff. The generalized hyperbolic skew student’s t-distribution. Journal of Financial Econometrics, 4(2):275–309, 2006.

- Adcock and Azzalini (2020) C. Adcock and A. Azzalini. A selective overview of skew-elliptical and related distributions and of their applications. Symmetry, 12(1), 2020.

- Alodat and Al-Rawwash (2014) M. T. Alodat and M. Y. Al-Rawwash. The extended skew gaussian process for regression. METRON, 72(3):317–330, 2014.

- Azzalini and Capitanio (2003) A. Azzalini and A. Capitanio. Distributions generated by perturbation of symmetry with emphasis on a multivariate skew t-distribution. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 65(2):367–389, 2003.

- Azzalini and Valle (1996) A. Azzalini and D. Valle. The multivariate skew-normal distribution. Biometrika, 83(4):715–726, 1996.

- Barbi and Romagnoli (2018) M. Barbi and S. Romagnoli. Skewness, basis risk, and optimal futures demand. International Review of Economics & Finance, 58:14–29, 2018.

- Barndorff-Nielsen (1977) O. E. Barndorff-Nielsen. Exponentially decreasing distributions for the logarithm of particle size. Proceedings of the Royal Society of London. A. Mathmatical and Physical Sciences, 353:401–419, 1977.

- Bélisle et al. (1993) C. J. P. Bélisle, H. E. Romeijn, and R. L. Smith. Hit-and-run algorithms for generating multivariate distributions. Mathmatics of Operations Research, 18(2):255–266, 1993.

- Branco and Dey (2001) M. D. Branco and D. K. Dey. A general class of multivariate skew-elliptical distributions. Journal of Multivariate Analysis, 79(1):99–113, 2001.

- Carmichael and Coën (2013) B. Carmichael and A. Coën. Asset pricing with skewed-normal return. Finance Research Letters, 10(2):50–57, 2013.

- Carvalho et al. (2010) C. M. Carvalho, N. G. Polson, and J. G. Scott. The horseshoe estimator for sparse signals. Biometrika, 97(2):465–480, 2010.

- Fernández and Steel (1998) C. Fernández and M. F. J. Steel. On bayesian modeling of fat tails and skewness. Journal of the American Statistical Association, 93(441):359–371, 1998.

- Frühwirth-Schnatter and Lopes (2018) S. Frühwirth-Schnatter and H. F. Lopes. Sparse bayesian factor analysis when the number of factors is unknown. arXiv: 1804.04231, 2018.

- Geweke and Zhou (1996) J. Geweke and G. Zhou. Measuring the pricing error of the arbitrage pricing theory. The Review of Financial Studies, 9(2):557–587, 1996.

- Hansen (1994) B. E. Hansen. Autoregressive conditional density estimation. International Economic Review, 35(3):705–730, 1994.

- Harvey et al. (2010) C. R. Harvey, J. C. Liechty, M. W. Liechty, and P. Müller. Portfolio selection with higher moments. Quantitative Finance, 10(5):469–485, 2010.

- Kon (1984) S. J. Kon. Models of stock returns—a comparison. The Journal of Finance, 39(1):147–165, 1984.

- Li et al. (2019) Y. Li, B. A. Craig, and A. Bhadra. The graphical horseshoe estimator for inverse covariance matrices. Journal of Computational and Graphical Statistics, 28(3):747–757, 2019.

- Lopes and West (2004) H. F. Lopes and M. West. Bayesian model assessment in factor analysis. Statistica Sinica, 14(1):41–67, 2004.

- Makalic and Schmidt (2016) E. Makalic and D. F. Schmidt. A simple sampler for the horseshoe estimator. IEEE Signal Processing Letters, 23(1):179–182, 2016.

- Markowitz (1952) H. Markowitz. Portfolio selection. Journal of Finance, 7(1):77–91, 1952.

- Markowitz and Usmen (1996) H. Markowitz and N. Usmen. The likelihood of various stock market return distributions, part 2: Empirical results. Journal of Risk and Uncertainty, 13(3):221–247, 1996.

- Mills (1995) T.C. Mills. Modelling skewness and kurtosis in the london stock exchange ft-se index return distributions. Journal of the Royal Statistical Society: Series D (The Statistician), 44(3):323–332, 1995.

- Nakajima (2017) J. Nakajima. Bayesian analysis of multivariate stochastic volatility with skew return distribution. Econometric Reviews, 36(5):546–562, 2017.

- Nakajima and Omori (2012) J. Nakajima and Y. Omori. Stochastic volatility model with leverage and asymmetrically heavy-tailed error using gh skew student’s t-distribution. Computational Statistics & Data Analysis, 56(11):3690–3704, 2012.

- Oya and Nakatsuma (2021) S. Oya and T. Nakatsuma. A positive-definiteness-assured block gibbs sampler for bayesian graphical models with shrinkage priors. arXiv:2001.04657v2, 2021.

- Panagiotelis and Smith (2010) A. Panagiotelis and M. Smith. Bayesian skew selection for multivariate models. Computational Statistics & Data Analysis, 54(7):1824–1839, 2010.

- Peiró (1999) A. Peiró. Skewness in financial returns. Journal of Banking & Finance, 23(6):847–862, 1999.

- Sahu et al. (2003) S. K. Sahu, D. K. Dey, and M.D. Branco. A new class of multivariate skew distributions with applications to bayesian regression models. Canadian Journal of Statistics, 31(2):129–150, 2003.

- Wang (2012) H. Wang. Bayesian graphical lasso methods and efficient posterior computation. Bayesian Analysis, 7:867–886, 2012.

- Watanabe (2001) T. Watanabe. On sampling the degree-of-freedom of student’s-t disturbances. Statistics & Probability Letters, 52(2):177–181, 2001.

- West (2003) M. West. Bayesian factor regression models in the “large p, small n” paradigm. Bayesian Statistics, 7:733–742, 2003.

Appendix

As we mentioned before, Harvey et al. (2010) developed the Gibbs sampling algorithm for the multivariate skew-normal distribution (1), but it is straightforward to extend it to the multivariate skew-t distribution as Sahu et al. (2003) showed. Since it is expressed as a scale mixture of multivariate skew-normal distributions, skew-t distributed is expressed as

| (37) |

Given , the sampling algorithms for , , and in (37) are almost identical to the multivariate skew-normal case except that

Finally, with the prior , the full conditional posterior distribution of is derived as

| (38) |

where

Following Watanabe (2001), we may apply a Metropolis-Hastings algorithm to draw from (Appendix). For this purpose, we consider the second-order Taylor approximation of

within the exponential function of (Appendix), that is,

where

Note that is globally concave and has a unique mode. If we take the mode of as , we have . Thus the pdf of the full conditional posterior distribution (Appendix) is approximated as

Therefore we can use

as the proposal distribution of in the Metropolis-Hastings algorithm.