On the Expressiveness of Assignment Messages

Abstract

In this note we prove that the class of valuation functions representable via integral assignment messages is a proper subset of strong substitutes valuations. Thus, there are strong substitutes valuations not expressible via assignment messages.

1 Introduction

Strong substitutes valuations are an important class of valuation functions for indivisible markets, guaranteeing existence of a Walrasian equilibrium. They were introduced by Milgrom and Strulovici (2009) as a multi-unit generalization of the gross substitutes condition for single-unit markets (Kelso and Crawford 1982). Many different equivalent definitions of gross- and strong substitutes have been discovered, see for example Paes Leme (2017), Fujishige and Yang (2003) and Murota (2016). Intuitively, a buyer with strong substitutes valuation treats different types of goods as one-to-one substitutes, and in particular, there are no complementarities between goods.

In sealed-bid auction settings where bidders may be assumed to have strong substitutes preferences, it is of major practical importance that bidders can efficiently report their preferences to the seller. Explicitly reporting values for every possible bundle is not feasible in practice, since the number of bundles grows exponentially with the number of available goods. Thus, there is the need for a bidding language, allowing bidders to express their strong substitutes preferences in a more compact and intuitive way, while not further restricting the class of expressible valuations. Milgrom (2009) introduces integer assignment messages, in the following only called assignment messages, and proves that every valuation function expressible via an assignment message fulfills the strong substitutes condition. While this bidding language is quite intuitive, the question if bidders can express arbitrary strong substitutes valuations with assignment messages remained open. In this note we give a negative answer by proving that there are strong substitutes valuations not expressible via assignment messages. Our proof follows the lines of Ostrovsky and Paes Leme (2015), who showed that a related bidding language, called endowed assignments, for single unit markets cannot express arbitrary gross substitutes valuations.

As has recently been shown by Baldwin and Klemperer (2021) the Strong Substitutes Product-Mix Auction (Klemperer 2008, 2010) is capable of expressing arbitrary strong substitutes preferences. Thus, our result implies that the Strong Substitutes Product-Mix Auction remains the only known bidding language that allows bidders to express all such preferences.

2 Economic Setting

We consider a market with types goods . A bundle of goods is a vector , where is the number of units of good contained in . A negative value of expresses a willingness to sell goods of type . Bidders’ preferences are given by valuation functions , where is a finite set of feasible bundles with , and denotes the bidder’s value for receiving bundle . A price vector is a vector , denoting the cost per unit of good . Given a price vector , bidders seek to maximize their quasi-linear utility by choosing a bundle from their demand set

The utility of receiving such a bundle is called the indirect utility and is denoted by

We are interested in markets where bidders’ valuations satisfy the strong substitutes condition.

Definition 1 (Strong Substitutes (Milgrom and Strulovici 2009)).

A valuation function , where is strong substitutes, if its binary representation , where , in which every unit of every good is interpreted as a separate good, satisfies the binary substitutes property: for all price vectors with and any , there is a bundles with for all with .

If , we call gross substitutes.

Probably the most important feature of strong substitutes valuations is that they ensure the existence of a Walrasian equilibrium (Milgrom and Strulovici 2009). Assignment messages are a bidding language simplifying the task of expressing a bidder’s valuation function .

3 Assignment Messages

An integer assignment message as introduced in Milgrom (2009) expresses a bidder’s valuation via a linear program. It is determined by a set of variables for , where each variable is associated with one of the types of goods , and with a value . We assume that for each good there is at least one variable associated with it - if not, we can just introduce dummy variables with a value of . We define to be the set of all variables associated with good . Moreover, the bidder provides a set of inequalities. Each inequality is a subset of the variables and is associated with an integral upper bound and an integral lower bound , describing the linear constraints . The value for a bundle is given by

| (VAL) | ||||

| s.t. | ||||

Here, is the set of all for which (VAL) has a feasible solution, which clearly contains and is bounded and thus finite. The indirect utility can be expressed via

| (IU) | ||||

| s.t. |

The demand set of maximizers of is the set of all that can be written as where is an integral solution to (IU)111Strictly speaking, we would have to impose integrality constraints on the variables in (VAL) and (IU) at this point. However, Milgrom (2009) shows that both problems always have integral optimal solutions if the constraints have the required structure from Definition 3.. The set of inequalities may not be chosen arbitrarily, but must possess a certain tree structure. The following two definitions are taken from Milgrom (2009).

Definition 2.

A nonempty subset is called a tree, if for any with there holds or . For , we call the inclusion-minimal set with the predecessor of , if such exists. Conversely, we call each , such that is the predecessor of , a successor of . We write for the set of successors of in .

Definition 3.

The variables and inequalities define an assignment message, if is the union of trees, such that

-

•

for , only contains inequalities in variables associated with good : . Furthermore, and for all .

-

•

and for all . We also write .

Each tree for contains a unique element without predecessor, which we call the root of the tree. The only elements in that are no predecessors of any other element are the singletons , which we also call the terminal nodes. In the following, we write for the set of successors of in a specific tree.

Note that since , the trees can always be chosen such that they intersect only in the terminal nodes: and for with : if with and not a singleton, we necessarily have that . Moreover, since we assume that there is at least one variable associated with every good, , so is neither the root nor a terminal node of . Thus, we can remove from without violating Definition 3.

4 Strong Exchangeability

Ostrovsky and Paes Leme (2015) show that there are gross substitutes valuations that are not expressible via endowed assignments. They observe that all endowed assignment valuations satisfy a certain property, called strong exchangeability, and provide a gross substitutes valuation that is not strongly exchangeable, which is then consequently not expressible via endowed assignments. For two vectors and , denote by the set of indices with .

Definition 4 (Single-Unit Strong Exchangeability (Ostrovsky and Paes Leme 2015)).

A valuation satisfies strong exchangeability, if for every price vector and all bundles with a minimal number of items, i.e., , there is a bijection , such that and are contained in for all . Here, is the -th standard unit vector.

Proposition 1 (Ostrovsky and Paes Leme (2015)).

There are gross substitutes valuations not satisfying the strong exchangeability property.

Our proof follows the same lines: first, we provide a multi-unit extension of strong exchangeability, and then we show that all valuations induced by assignment messages satisfy this property.

Definition 5 (Multi-Unit Strong Exchangeability).

A valuation satisfies strong exchangeability, if for every price vector and all bundles with minimal number of items, there is a correspondence , such that

-

1.

For each , and

-

2.

For each and , we have and .

Remark.

In order to prove that every assignment message satisfies strong exchangeability, we show that computing the indirect utility of an assignment message valuation can be interpreted as a min-cost flow problem. Given the tree structure of assignment messages from Definitions 2 and 3, we can transform the indirect utility problem (IU) by variable substitution as follows: for each introduce a variable representing . Note that since for all , there are variables corresponding to the variables . If is not a singleton, is the disjoint union of all its successors , so

Similarly, we have

The constraints translate to . Using these observations, it is not hard to see that Problem (IU) can equivalently be formulated as

| (MCF) | ||||

| s.t. | (4.1) | |||

| (4.2) | ||||

| (4.3) | ||||

| (4.4) |

where instead of maximizing the objective function of (IU), we minimize the negative objective function to be consistent with literature on min-cost flows. The following lemma is a simple consequence of the variable substitution explained above, so the proof is omitted.

Lemma 1.

Let be an assignment message. Then if and only if there is an integral solution to (MCF) with for all .

It is not hard to see that each variable for appears exactly twice in the set of equality constraints of (MCF), once with coefficient , and once with coefficient : for example, if , where , is not a singleton, clearly appears with negative sign in one of the equalities in (4.2). If additionally , is also the successor of some element, so also appears in exactly one equation from (4.2) with coefficient . On the other hand, if , appears with positive coefficient in equation (4.3). This property can be checked in a similar way for all other variables. Thus, if we collect the variables in the vector and write the equality constraints (4.1)-(4.3) in matrix form as , is the incidence matrix of a directed graph, where is the set of arcs, and each of the constraints from (4.1)-(4.3) corresponds to a vertex in the graph. For any such vertex, is an ingoing arc, if appears with coefficient , and an outgoing arc, if it appears with coefficient . Consequently, Problem (MCF) can be interpreted as a min-cost flow problem where denotes the flow along arc . For details on min-cost flows, we refer to Ahuja et al. (1993).

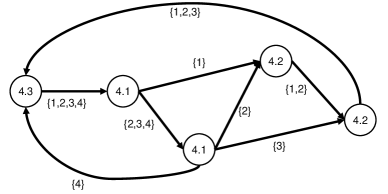

Example 4.1.

Suppose a bidder submits an assignment message in four variables , where and . The submitted inequalities induce the trees , and . The directed graph corresponding to the incidence matrix is shown in Figure 1.

In order to prove our main Theorem 4.1, we recall some properties of min-cost flows.

Lemma 2 (Properties of Flows (Ahuja et al. 1993)222Ahuja et al. (1993) generally consider only non-negative flows, as arbitrary flow problems can be easily transformed into non-negative ones by introducing backward-arcs. For the sake of brevity, we allow negative flows here. Note that the proofs given in their book for the mentioned flow properties do actually not require non-negativity.).

Let be a directed graph with vertex set and arc set . Let be a flow on .

-

1.

If is balanced at every vertex, i.e.,

for all vertices , then can be decomposed into finitely many cycles: there are subsets of arcs, such that each is an undirected cycle in , and balanced flows , such that . Moreover, we have for all and all . 333This follows from the construction in the proof of Theorem 3.5 in Ahuja et al. (1993).

-

2.

Suppose is an optimal solution to the general min-cost flow problem

s.t. for some given weights , supplies and bounds . Then does not contain any negative cycles: for an undirected cycle and a balanced flow on such that is a feasible solution, we have that . 444This is Theorem 3.8 in Ahuja et al. (1993). Since we allow negative flows, we do not need to introduce the residual graph of a flow problem.

Theorem 4.1.

Let be a valuation induced by an assignment message. Then satisfies the strong exchangeability property.

Proof.

Let be bundles containing a minimal number of goods and corresponding integral solutions to (MCF) with and for all . We are going to construct a correspondence satisfying the properties from Definition 5. Since and are balanced, i.e., , so is , and we can write where each is supported on a cycle by Lemma 2. We prove that the flows have the following properties:

-

(i)

and are optimal solutions to (MCF) for every .

-

(ii)

for every .

To see (i), we first note that is feasible for Problem (MCF): as and are balanced, so is . Concerning the inequality constraints (4.4), if , then it follows from Property 1 in Lemma 2 that . With a similar argument we can treat the case . Consequently, by Property 2, we have

With the same argument applied to , we get

so . Hence, the objective values in (MCF) of the flows , , and are all equal and thus optimal.

Let us now prove (ii). To that goal, note that, since and are bundles with a minimum number of elements, we have , so by Property 1 of Lemma 2 we have for all . Consider the flow of through the vertex corresponding to constraint (4.3), i.e., representing the equality

As is supported on a cycle, at most two of the appearing variables can be nonzero. Thus, since , either no or exactly two of the are nonzero, and since their sum equals , one must be , and the other must be .

Let us now define by

We check that has the required properties from Definition 5: let . Then there is some , such that , and for . From observation (i) above we have that is an optimal solution to problem (MCF), and the demanded bundle corresponding to that solution is . Similarly, the requested bundle corresponding to is , so Property 1 from Definition 5 is satisfied.

Theorem 4.1 together with Proposition 1 directly imply that assignment messages do not cover all strong substitutes valuations.

Corollary 1.

There are strong substitutes valuations that are not representable via an Assignment Messages.

Proof.

Each assignment message satisfies the strong exchangeability property from Definition 5. However, by Proposition 1 by Ostrovsky and Paes Leme (2015), there exist gross substitutes valuations that are not strongly exchangeable. Since gross substitutes valuations are a subset of strong substitutes valuations, and Definitions 4 and 5 are equivalent for single-unit markets, the result follows. ∎

Acknowledgements

I would like to thank Edwin Lock from the University of Oxford for his very valuable comments and suggestions.

References

-

Ahuja et al. (1993)

Ahuja, R. K., T. L. Magnanti, and J. B. Orlin

1993. Network Flows - Theory, Algorithms, and Applications. London: Prentice Hall. -

Baldwin and Klemperer (2021)

Baldwin, E. and P. Klemperer

2021. Proof that the strong substitutes product-mix auction bidding language can represent any strong substitutes preferences. https://elizabeth-baldwin.me.uk/papers/strongsubsproof.pdf. -

Fujishige and Yang (2003)

Fujishige, S. and Z. Yang

2003. A note on kelso and crawford’s gross substitutes condition. Mathematics of Operations Research, 28(3):463–469. -

Kelso and Crawford (1982)

Kelso, A. S. and V. P. Crawford

1982. Job matching, coalition formation, and gross substitutes. Econometrica, 50(6):1483–1504. -

Klemperer (2008)

Klemperer, P.

2008. A new auction for substitutes: Central bank liquidity auctions, the u.s. tarp, and variable product-mix auctions. https://www.nuffield.ox.ac.uk/economics/Papers/2008/substsauc.pdf. -

Klemperer (2010)

Klemperer, P.

2010. The product-mix auction: a new auction design for differentiated goods. Journal of the European Economic Association, 8:526–36. -

Milgrom (2009)

Milgrom, P.

2009. Assignment messages and exchanges. American Economic Journal: Microeconomics, 1(2):95–113. -

Milgrom and Strulovici (2009)

Milgrom, P. and B. Strulovici

2009. Substitute goods, auctions, and equilibrium. Journal of Economic Theory, 144(1):212–247. -

Murota (2016)

Murota, K.

2016. Discrete convex analysis: A tool for economics and game theory. The Journal of Mechanism and Institution Design, 1(1):151–273. -

Ostrovsky and

Paes Leme (2015)

Ostrovsky, M. and R. Paes Leme

2015. Gross substitutes and endowed assignment valuations. Theoretical Economics, 10(3):853–865. -

Paes Leme (2017)

Paes Leme, R.

2017. Gross substitutability: An algorithmic survey. Games and Economic Behavior, 106(C):294–316.