Optimal control in linear-quadratic stochastic advertising models with memory

Abstract

This paper deals with a class of optimal control problems which arises in advertising models with Volterra Ornstein-Uhlenbeck process representing the product goodwill. Such choice of the model can be regarded as a stochastic modification of the classical Nerlove-Arrow model that allows to incorporate both presence of uncertainty and empirically observed memory effects such as carryover or distributed forgetting. We present an approach to solve such optimal control problems based on an infinite dimensional lift which allows us to recover Markov properties by formulating an optimization problem equivalent to the original one in a Hilbert space. Such technique, however, requires the Volterra kernel from the forward equation to have a representation of a particular form that may be challenging to obtain in practice. We overcome this issue for Hölder continuous kernels by approximating them with Bernstein polynomials, which turn out to enjoy a simple representation of the required type. Then we solve the optimal control problem for the forward process with approximated kernel instead of the original one and study convergence. The approach is illustrated with simulations.

Keywords: Dynamic programming, Volterra Ornstein-Uhlenbeck process, infinite-dimensional Bellman equations, optimal advertising

MSC 2020: 60H20, 92E20, 91B70, 90B60

Funding.

The present research is carried out within the frame and support of the ToppForsk project nr. 274410 of the Research Council of Norway with title STORM: Stochastics for Time-Space Risk Models.

1 Introduction

The problem of optimizing advertising strategies has always been of paramount importance in the field of marketing. Starting from the pioneering works of Vidale and Wolfe [23] and Nerlove and Arrow [18], this topic has evolved into a full-fledged field of research and modeling. Realizing the impossibility of describing all existing classical approaches and results, we refer the reader to the review article of Sethi [21] (that analyzes the literature prior to 1975) and a more recent paper by Feichtinger, Hartl and Sethi [11] (covering the results up to 1994) and references therein.

It is worth noting that the Nerlove–Arrow approach, which was the foundation for numerous modern dynamic advertising models, assumed no time lag between spending on advertising and the impact of the latter on the goodwill stock. However, many empirical studies (see, for example, [15]) clearly indicate some kind of a “memory” phenomenon that is often called the “distributed lag” or “carryover” effect: the influence of advertising does not have an immediate impact but is rather spread over a period of time varying from several weeks to several months. This shortcoming of the basic Nerlove–Arrow model gave rise to many modifications of the latter aimed at modeling distributed lags. For a long time, nevertheless, the vast majority of dynamic advertising models with distributed lags had been formulated in a deterministic framework (see e.g. [21, §2.6] and [11, Section 2.3]).

In recent years, however, there have been several landmark papers that consider the Nerlove-Arrow-type model with memory in a stochastic setting. Here, we refer primarily to the series of papers [13, 14] (see also a more recent work [16]), where goodwill stock is modeled via Brownian linear diffusion with delay of the form

| (1.1) |

where is interpreted as the product’s goodwill stock and is the spending on advertising. The corresponding optimal control problem in this case was solved using the so-called lift approach: equation (1.1) was rewritten as a stochastic differential equation (without delay) in a suitable Hilbert space, and then infinite-dimensional optimization techniques (either dynamic programming principle or maximum principle) were applied.

In this article, we present an alternative stochastic model that also takes the carryover effect into account. Instead of the delay approach described above, we incorporate the memory into the model by means of the Volterra kernel and consider the controlled Volterra Ornstein-Uhlenbeck process of the form

| (1.2) |

where and are constants (see e.g. [1, Section 5] for more details on affine Volterra processes of such type). Note that such goodwill dynamics can be regarded as the combination of deterministic lag models described in [11, Section 2.3] and the stochastic Ornstein-Uhlenbeck-based model presented by Rao [19]. The main difference from (1.1) is the memory incorporated to the noise along with the drift as the stochastic environment (represented by the noise) tends to form “clusters” with time. Indeed, in reality positive increments are likely to be followed by positive increments (if conditions are favourable for the goodwill during some period of time) and negative increments tend to follow negative increments (under negative conditions). This behaviour of the noise cannot be reflected by a standard Brownian driver but can easily be incorporated into the model (1.2).

Our goal is to solve an optimization problem of the form

| (1.3) |

where are given constants. The set of admissible controls for the problem (1.3), denoted by , is the space of square integrable real-valued stochastic processes adapted to the filtration generated by . Note that the process is well defined for any since, for almost all , the equation (1.2) treated pathwisely can be considered as a deterministic linear Volterra integral equation of the second kind that has a unique solution (see e.g. [22]).

The optimization problem (1.3) for underlying Volterra dynamics has been studied by several authors (see, e.g. [3, 24] and the bibliography therein). Contrarily to most of the work in our bibliography, we will not solve such problem by means of a maximum principle approach. Even though this method allows to find necessary and sufficient conditions to obtain the optimal control to (1.3), we cannot directly apply it as we deal with low regularity conditions on the coefficients of our drift and volatility. Furthermore, such method has another notable drawback in the practice. In fact, its application is often associated with computations of conditional expectations that are substantially challenging due to the absence of Markovianity. Another possible method to solve the optimal control problem (1.3) is to get an explicit solution of the forward equation (1.2), plug it into the performance functional and try to solve the maximization problem using differential calculus in Hilbert spaces. But, even though this method seems appealing, obtaining the required explicit representation of in terms of might be tedious and burdensome. Instead, we will use the approach introduced in [2, 9] that is in the same spirit of the one in [13, 14, 16] mentioned above: we will rewrite the original forward stochastic Volterra integral equation as a stochastic differential equation in a suitable Hilbert space and then apply standard optimization techniques in infinite dimensions (see e.g. [10, 12]). Moreover, the shape of the corresponding infinite-dimensional Hamilton-Jacobi-Bellman equation allows to obtain an explicit solution to the latter by exploiting the “splitting” method from [14, Section 3.3].

We notice that, while the optimization problem (1.3) is closely related to the one presented in [2], there are several important differences in comparison to our work. In particular, [2] demands the kernel to have the form

| (1.4) |

where is a signed measure such that . Although there are some prominent examples of such kernels, not all kernels are of this type; furthermore, even if a particular admits such a representation in theory, it may not be easy to find the explicit shape of . In contrast, our approach works for all Hölder continuous kernels without any restrictions on the shape and allows to get explicit approximations of the optimal control . The lift procedure presented here is also different from the one used in [2] (although they both are specific cases of the technique presented in [8]).

The lift used in the present paper was introduced in [8], then generalized in [7] for the multi-dimensional case, but the approach itself can be traced back to [6]. It should be also emphasised that this method has its own limitations: in order to perform the lift, the kernel is required to have a specific representation of the form , , where and are elements of some Hilbert space and is a uniformly continuous semigroup acting on with and, in general, it may be hard to find feasible , , and . Here, we work with Hölder continuous kernels and we overcome this issue by approximating the kernel with Bernstein polynomials (which turn out to enjoy a simple representation of the required type). Then we solve the optimal control problem for the forward process with approximated kernel instead of the original one and we study convergence.

The paper is organised as follows. In section 2, we present our approach in case of a liftable (i.e. having a representation in terms of , , and mentioned above). Namely, we describe the lift procedure, give the necessary results from stochastic optimal control theory in Hilbert spaces as well as derive an explicit representation of the optimal control by solving the associated Hamilton-Jacobi-Bellman equation. In section 3, we introduce a liftable approximation for general Hölder continuous kernels, give convergence results for the solution to the approximated problem and discuss some numerical aspects for the latter. In section 4, we illustrate the application of our technique with examples and simulations.

2 Solution via Hilbert space-valued lift

2.1 Preliminaries

First of all, let us begin with some simple results on the optimization problem (1.3). Namely, we notice that and the optimization problem (1.3) is well defined for any .

Theorem 2.1.

Let . Then, for any ,

-

1)

the forward Volterra Ornstein-Uhlenbeck-type equation (1.2) has a unique solution;

-

2)

there exists a constant such that

where denotes the standard norm;

-

3)

.

Proof.

Item 1) is evident since, for almost all , the equation (1.2) treated pathwisely can be considered as a deterministic linear Volterra integral equation of the second kind that has a unique solution (see e.g. [22]). Next, it is straightforward to deduce that

Now, item 2) follows from Gronwall’s inequality. Finally, satisfies the deterministic Volterra equation of the form

and hence can be represented in the form

where is the resolvent of the corresponding Volterra integral equation and the operator is linear and continuous. Hence can be re-written as

| (2.1) |

which immediately implies that . ∎

2.2 Construction of Markovian lift and formulation of the lifted problem

As anticipated above, in order to solve the optimization problem (1.3) we will rewrite in terms of Markovian Hilbert space-valued process using the lift presented in [8] and then apply the dynamic programming principle in Hilbert spaces. We start from the description of the core idea behind the Markovian lifts in case of liftable kernels.

Definition 2.2.

Let denote a separable Hilbert space with the scalar product . A kernel is called -liftable if there exist , , and a uniformly continuous semigroup acting on , , such that

| (2.2) |

Consider a controlled Volterra Ornstein-Uhlenbeck process of the form (1.2) with a liftable kernel , , and denote and

Using the fact that , we can now rewrite (1.2) as follows:

where . It is easy to check that, is the unique solution of the infinite dimensional SDE

and thus the process defined as satisfies the infinite dimensional SDE of the form

where is the linear bounded operator on such that

These findings are summarized in the following theorem.

Theorem 2.3.

Let be a Volterra Ornstein-Uhlenbeck process of the form (1.2) with the -liftable kernel , , , . Then, for any ,

| (2.3) |

where and is the -valued stochastic process given by

| (2.4) |

and is such that

Using Theorem 2.3, one can rewrite the performance functional from (1.3) as

| (2.5) |

where the superscript in is used to highlight dependence on the -valued process . Clearly, maximizing (2.5) is equivalent to maximizing

Finally, for the sake of notation and coherence with literature, we will sometimes write our maximization problem as a minimization one by simply noticing that the maximization of the performance functional can be reformulated as the minimization of

| (2.6) |

In other words, in case of -liftable kernel , the original optimal control problem (1.3) can be replaced by the following one:

| (2.7) |

2.3 Solution to the lifted problem

The optimal control problem (2.7) completely fits the framework of dynamic programming principle stated in [10, Chapter 6]. More precisely, consider the Hamilton-Jacobi-Bellman (HJB) equation associated to the problem (2.7) of the form

| (2.8) |

where by we denote the partial Gateaux derivative w.r.t. the spacial variable and the Hamiltonian functional is defined as

It is easy to check that the coefficients of the lifted forward equation (2.4) satisfy [10, Hypothesis 6.8], the Hamiltonian satisfies [10, Hypothesis 6.22] and the term in the performance functional (2.6) satisfies [10, Hypothesis 6.26]. Therefore, by [10, Theorem 6.32] (see also [12, Theorem 6.2]), (2.8) has a unique mild solution : . Moreover, [10, Theorem 6.35] implies that for any

and the equality holds if and only if

| (2.9) |

Solving (2.9), we obtain , , which has the form

| (2.10) |

Remark 2.5.

In general, [10, Theorem 6.35] does not guarantee that exists on the initial probability space, but instead considers the weak control framework, see [10, Section 6] for more details. However, in our case optimal control exists in the strong sense and, as we will see later, turns out to be deterministic.

Since the shape (2.10) of the optimal control depends on , our next goal is to explicitly solve the HJB equation (2.8). The solution as well as the optimality statement are given in the next theorem.

Theorem 2.6.

Proof.

1. In order to solve the HJB equation (2.8), we will use the approach presented in [14, Section 3.3]. Namely, we will look for the solution in the form

| (2.14) |

where and are such that and are well-defined. In this case,

and, recalling that , we can rewrite the HJB equation (2.8) as

Now it would be sufficient to find and that solve the following systems:

| (2.15) |

Noticing that the first system in (2.15) has to hold for all , we can solve

instead, which is a simple linear equation and its solution has the form (2.11). Now it is easy to see that has the form and

2. The result follows directly from the item 1 above and [10, Theorem 6.35]. ∎

Remark 2.7.

Remark 2.8.

The approach described above can be extended by lifting to Banach space-valued stochastic processes. See [9] for more details.

3 Approximate solution for forwards with Hölder kernels

The crucial assumption in section 2 that allowed to apply the optimization techniques in Hilbert space was the liftability of the kernel. However, in practice it is often hard to find a representation of the required type for the given kernel, and even if this representation is available, it is not always convenient from the implementation point of view. For this reason, we provide a liftable approximation for the Volterra Ornstein-Uhlenbeck process (1.2) for a general -kernel , where denotes the set of -Hölder continuous functions on .

This section is structured as follows: first we approximate an arbitrary -kernel by a liftable one in a uniform manner and introduce a new optimization problem where the forward dynamics is obtained from the original one replacing the kernel with its liftable approximation. Afterwards, we prove that the optimal value of the approximated problem converges to the optimal value of the original problem and give an estimate for the rate of convergence. Finally, we discuss some numerical aspects that could be useful from the implementation point of view.

Remark 3.1.

In what follows, by we will denote any positive constant the particular value of which is not important and may vary from line to line (and even within one line). By we will denote the standard -norm.

3.1 Liftable approximation for Volterra Ornstein-Uhlenbeck processes with Hölder continuous kernels

Let , , the operator be the 1-shift operator acting on , i.e.

and denote a Bernstein polynomial approximation for of order , i.e.

| (3.1) | ||||

where

| (3.2) |

Observe that

and hence is -liftable as

with and .

By the well-known approximating property of Bernstein polynomials, for any , there exist such that

Moreover, if additionally for some , [17, Theorem 1] guarantees that for all

| (3.3) |

where is such that

| (3.4) |

Now, consider a controlled Volterra Ornstein-Uhlenbeck process of the form (1.2) with the kernel satisfying (3.4). For a given admissible define also a stochastic process as a solution to the stochastic Volterra integral equation of the form

| (3.5) |

where with defined by (3.2), i.e. the Bernstein polynomial approximation of of degree .

Remark 3.2.

It follows from [5, Corollary 4] that both stochastic processes and , , have modifications that are Hölder continuous at least up to the order . From now on, these modifications will be used.

Now we move to the main result of this subsection.

Theorem 3.3.

Proof.

First, by Theorem 2.1, there exists a constant such that

| (3.6) |

Consider an arbitrary , and denote . Then

Note that, by (3.3) we have that

Moreover, since are uniformly bounded due to their uniform convergence to it is true that

with not dependent on , and from (3.3), (3.6) one can deduce that

Lastly, by the Ito isometry and (3.3),

Hence

where is a positive constant (recall that it may vary from line to line). The final result follows from Gronwall’s inequality. ∎

3.2 Liftable approximation of the optimal control problem

As it was noted before, our aim is to find an approximate solution to the the optimization problem (1.3) by solving the liftable problem of the form

| (3.7) |

where the maximization is performed over . In (3.7), is the Bernstein polynomial approximation of , i.e.

where acts as , and with defined by (3.2). Due to the liftability of , the problem (3.7) falls in the framework of section 2, so, by Theorem 2.6, the optimal control has the form (2.13):

| (3.8) |

where . The goal of this subsection is to prove the convergence of the optimal performance in the approximated dynamics to the actual optimal, i.e.

where is the performance functional from the original optimal control problem (1.3).

Proposition 3.4.

Let the kernel . Then

| (3.9) |

| (3.10) |

where denotes the standard norm.

Proof.

We prove only (3.9); the proof of (3.10) is the same. Let be fixed. For any denote

and notice that for any we have that

where is a deterministic constant that does not depend on , or (here we used the fact that uniformly on ). Whence, for any ,

| (3.11) |

Now, let us prove that there exists a constant such that

First note that, by Remark 3.2, for each and there exists a random variable such that

and whence

Thus it is sufficient to check that . It is known from [5] that one can put

where and is a constant that does not depend on . Let . Then Minkowski integral inequality yields

| (3.12) | ||||

Note that, by [17, Proposition 2], every Bernstein polynomial that corresponds to is Hölder continuous of the same order and with the same constant , i.e.

whenever

This implies that there exists a constant which does not depend on such that

Plugging the bound above to (3.12), we get that

where denotes, as always, a deterministic constant that does not depend on , , and may vary from line to line.

Therefore, there exists a constant, again denoted by not depending on , or such that

and thus, by (3.11),

By Gronwall’s inequality, there exists which does not depend on such that

and so

∎

Theorem 3.5.

Let and be its Bernstein polynomial approximation of order . Then there exists constant such that

| (3.13) |

Moreover, is “almost optimal” for in the sense that there exists a constant such that

Proof.

First, note that for any

| (3.14) |

where . Indeed, by definitions of , and Theorem 3.3, for any :

| (3.15) | ||||

In particular, this implies that there exists that does not depend on such that , so, by Proposition 3.4, there exists that does not depend on such that implies

In other words, all optimal controls , must be in the ball and that . This, together with uniform convergence of to over bounded subsets of and estimate (3.14), implies that there exists not dependent on such that

| (3.16) |

Finally, taking into account (3.14) and (3.16) as well as the definition of ,

which ends the proof. ∎

Theorem 3.6.

Proof.

By (2.1), the performance functional can be represented in a linear-quadratic form as

where : is a continuous linear operator. Then, by [4, Theorem 9.2.6], there exists a unique that maximizes and, moreover, weakly as . Furthermore, since all are deterministic, so is ; in particular, it is adapted to filtration generated by which implies that . ∎

3.3 Algorithm for computing

The explicit form of given by (3.8) is not very convenient from the implementation point of view since one has to compute , where , . A natural way to simplify the problem is to truncate the series

for some . However, even after replacing in (3.8) with its truncated version, we still need to be able to compute for the given . An algorithm to do so is presented in the proposition below.

Proposition 3.7.

For any ,

where, and, for all ,

Proof.

The proof follows an inductive argument. The statement for is obvious. Now let

Then

∎

Theorem 3.8.

Let be fixed and , where denotes the operator norm. Then, for all ,

Moreover,

Proof.

One has to prove the first inequality and the second one then follows. It is clear that

and, if , we have that

where we used a well-known result on tail probabilities of Poisson distribution (see e.g. [20]). ∎

4 Examples and simulations

Example 4.1 (monomial kernel).

Let be fixed. Consider an optimization problem of the form

| (4.1) |

where, as always, we optimize over . The kernel is -liftable,

where , . By Theorem 2.6, the optimal control for the problem (4.1) has the form

where . In this simple case, we are able to find an explicit expression for . Indeed, it is easy to see that, for any , and ,

and whence

where is the Mittag-Leffler function. This, in turn, implies that

| (4.2) |

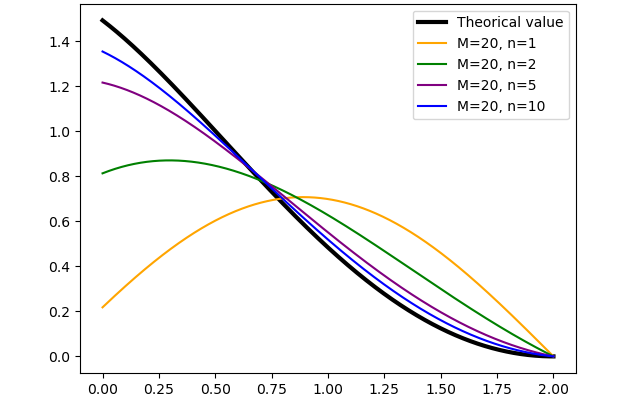

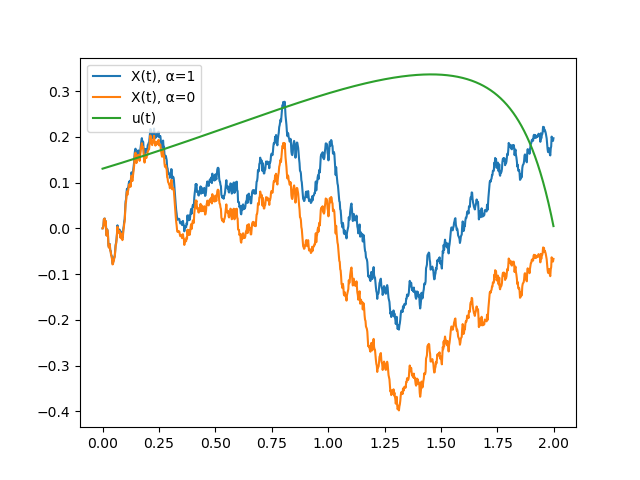

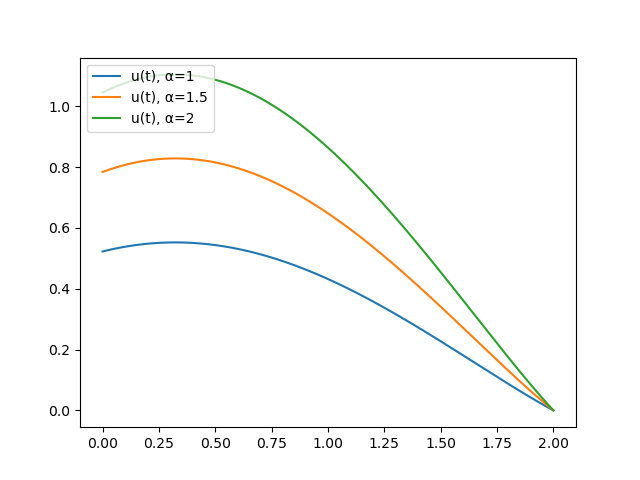

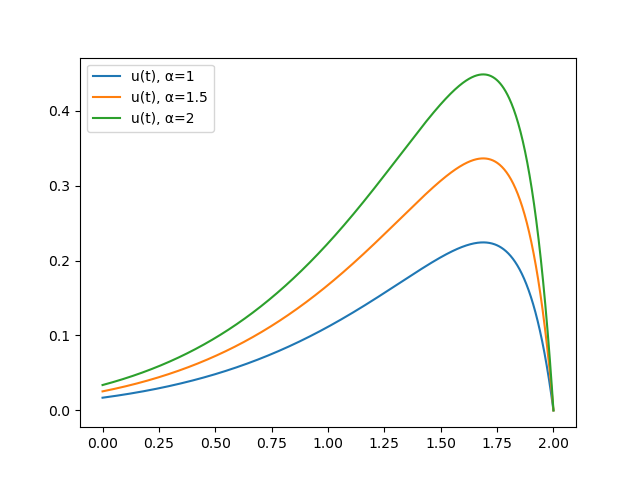

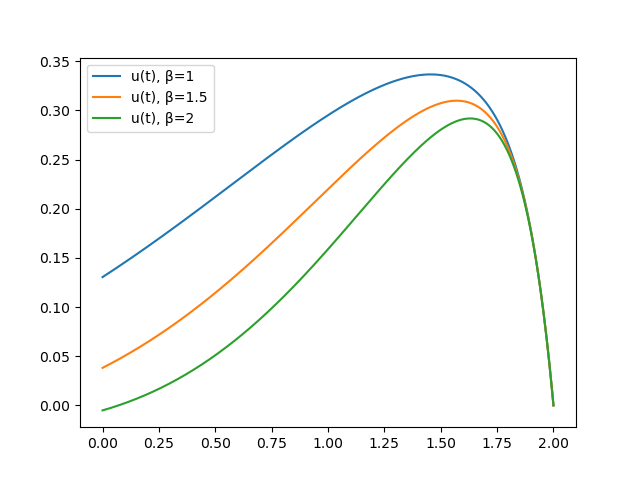

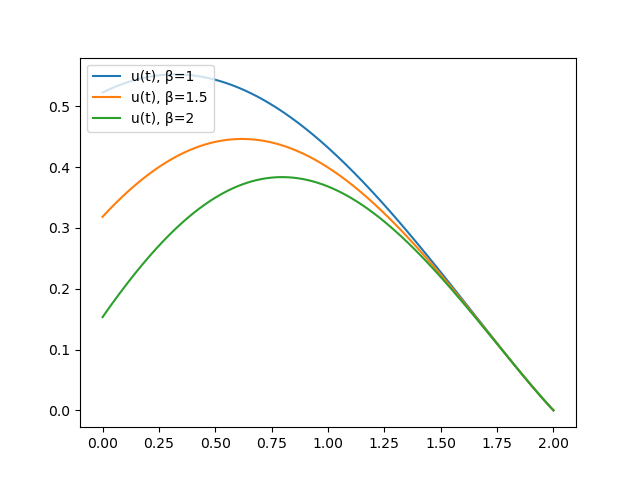

On Fig. 1, the black curve depicts the optimal computed for the problem 4.1 with and using (4.2); the othere curves are the approximated optimal controls (as in (3.17)) computed for and .

Remark 4.2.

The solution of the problem (4.1) described in Example 4.1 should be regarded only as an illustration of the optimization technique via infinite-dimensional lift: in fact, the kernel in this example is degenerate and thus the process in (4.1) is Markovian. This means that other finite dimensional techniques could have been used in this case.

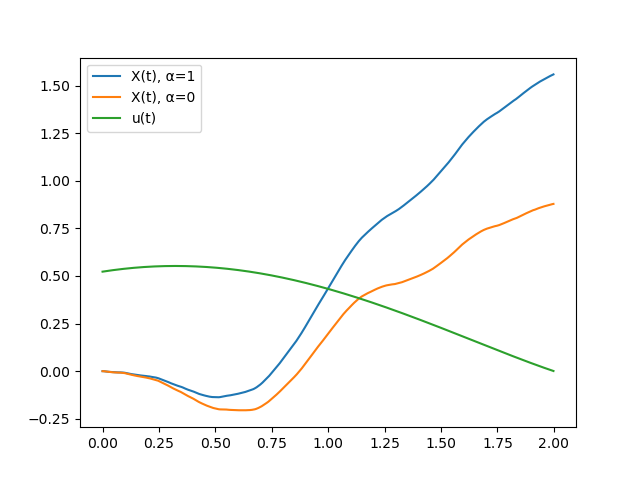

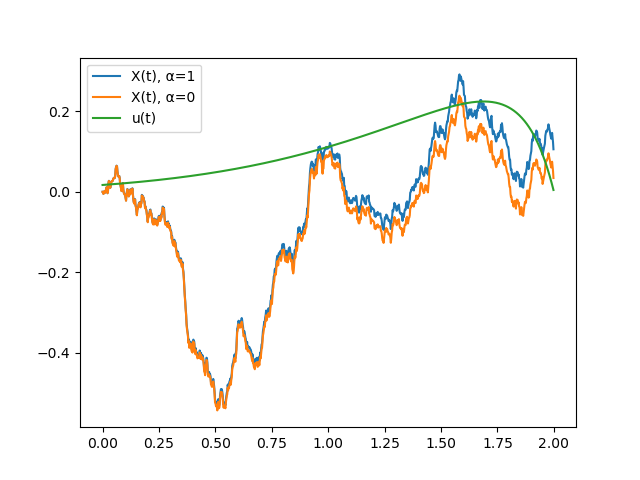

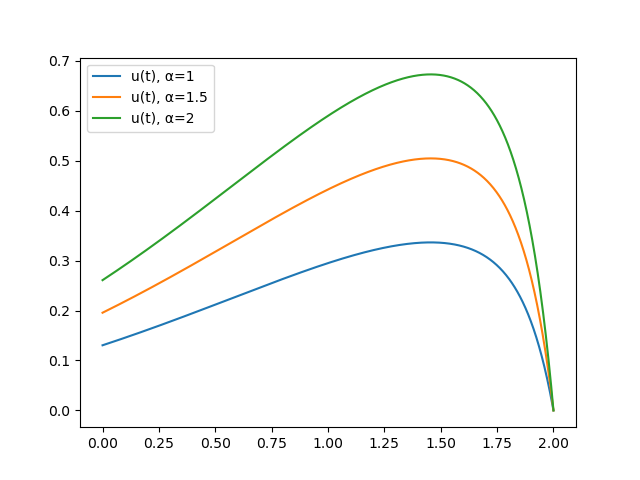

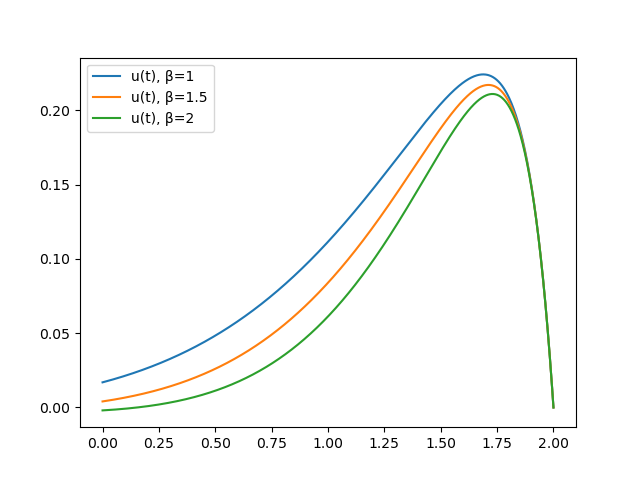

Example 4.3 (fractional and gamma kernels).

Consider three optimization problems of the form

| (4.3) |

, where the kernels are chosen as follows: (fractional kernel), (smooth kernel) and (gamma kernel). In these cases, we apply all the machinery presented in section 3 to find for each of the optimal control problems described above. In our simulations, we choose , , ; the mesh of the partition for simulating sample paths of is set to be , , .

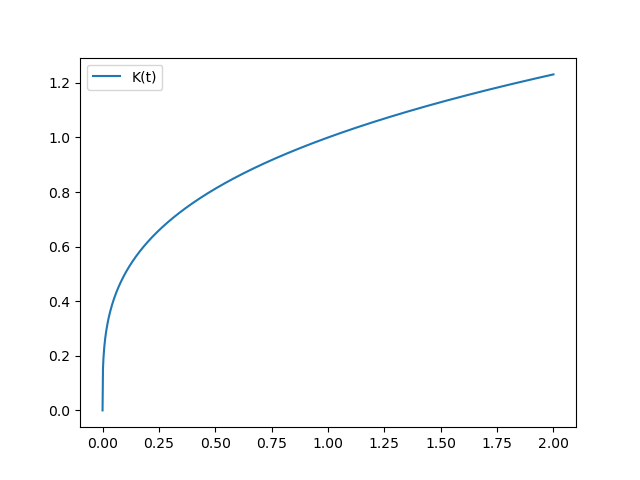

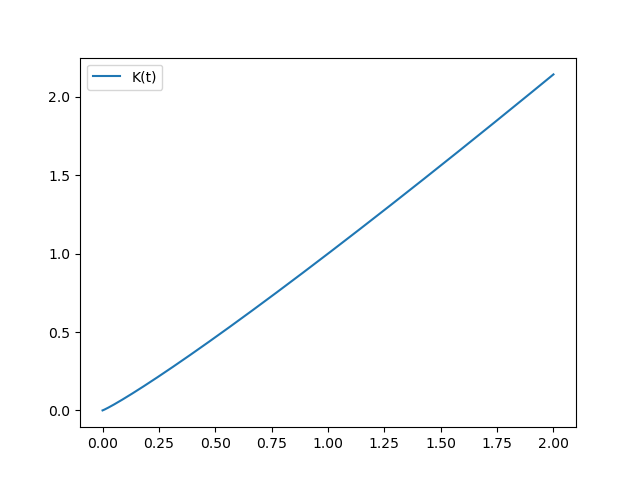

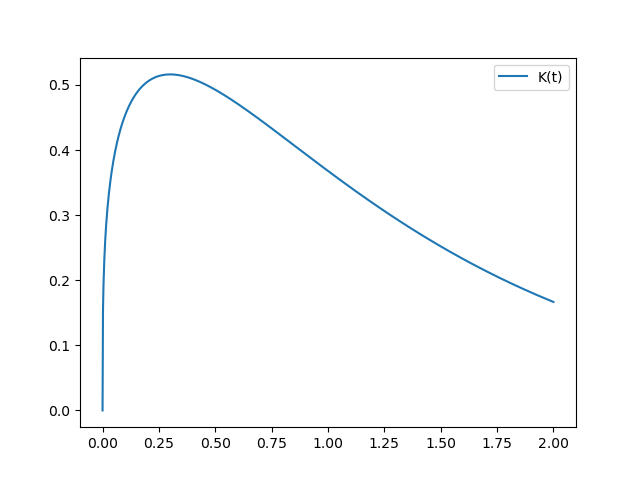

Fig. 2 depicts approximated optimal controls for different values of and . Note that the gamma kernel (third column) is of particularly interest in optimal advertising. This kernel, in fact, captures the peculiarities of the empirical data (see [15]) since the past dependence comes into play after a certain amount of time (like a delayed effect) and its relevance declines as time goes forward.

Remark 4.4.

Note that the stochastic Volterra integral equation from (4.3) can be sometimes solved explicitly for certain kernels (e.g. via the resolvent method). For instance, the solution which corresponds to the fractional kernel of the type , , and has the form

where again denotes the Mittag-Leffler function. Having the explicit solution, one could solve the optimization problem (4.3) by plugging in the shape of to the performance functional and applying the standard minimization techniques in Hilbert spaces. However, as mentioned in the introduction, this leads to some tedious calculations that are complicated to implement, whereas our approach allows to get the approximated solution in a relatively simple manner.

(1)

(2)

(3)

(a1)

(a2)

(a3)

(b1)

(b2)

(b3)

(c1)

(c2)

(c3)

(d1)

(d2)

(d3)

Acknowledgments. Authors would also like to thank Dennis Schroers for the enlightening help with one of the proofs leading to this paper as well as Giulia Di Nunno for the proofreading and valuable remarks.

References

- [1] Abi Jaber, E., Larsson, M., and Pulido, S. Affine Volterra processes. The Annals of Applied Probability 29, 5 (2019).

- [2] Abi Jaber, E., Miller, E., and Pham, H. Linear-Quadratic control for a class of stochastic Volterra equations: solvability and approximation. To appear in Annals of Applied Probability (2021).

- [3] Agram, N., and Øksendal, B. Malliavin calculus and optimal control of stochastic Volterra equations. Journal of optimization theory and applications 167, 3 (2015), 1070–1094.

- [4] Allaire, G. Numerical analysis and optimization: An introduction to mathematical modelling and numerical simulation. Oxford University Press, London, England, 2007.

- [5] Azmoodeh, E., Sottinen, T., Viitasaari, L., and Yazigi, A. Necessary and sufficient conditions for Hölder continuity of Gaussian processes. Statistics & Probability Letters 94 (2014), 230–235.

- [6] Carmona, P., and Coutin, L. Fractional Brownian motion and the Markov property. Electronic Communications in Probability 3 (1998), 95–107.

- [7] Cuchiero, C., and Teichmann, J. Markovian lifts of positive semidefinite affine Volterra-type processes. Decisions in Economics and Finance 42, 2 (2019), 407–448.

- [8] Cuchiero, C., and Teichmann, J. Generalized Feller processes and Markovian lifts of stochastic Volterra processes: the affine case. Journal of evolution equations 20, 4 (2020), 1301–1348.

- [9] Di Nunno, G., and Giordano, M. Lifting of Volterra processes: optimal control and in UMD Banach spaces. Report (2022).

- [10] Fabbri, G., Gozzi, F., and Świech, A. Stochastic optimal control in infinite dimension: dynamic programming and HJB equations. Springer, Cham, 2017.

- [11] Feichtinger, G., Hartl, R., and Sethi, S. Dynamic optimal control models in advertising: recent developments. Management Science 40 (1994), 195–226.

- [12] Fuhrman, M., and Tessitore, G. Nonlinear Kolmogorov equations in infinite dimensional spaces: the backward stochastic differential equations approach and applications to optimal control. The Annals of Probability 30 (2002), 1397–1465.

- [13] Gozzi, F., and Marinelli, C. Stochastic optimal control of delay equations arising in advertising models. In Stochastic Partial Differential Equations and Applications (2005), Lecture Notes in Pure and Applied Mathematics, Chapman and Hall/CRC, p. 133–148.

- [14] Gozzi, F., Marinelli, C., and Savin, S. On controlled linear diffusions with delay in a model of optimal advertising under uncertainty with memory effects. Journal of optimization theory and applications 142, 2 (2009), 291–321.

- [15] Leone, R. Generalizing what is known about temporal aggregation and advertising carryover. Marketing Science 14 (1995), G141–G150.

- [16] Li, C., and Zhen, W. Stochastic optimal control problem in advertising model with delay. Journal of Systems Science and Complexity 33 (2020), 968–987.

- [17] Mathe, P. Approximation of Hölder continuous functions by Bernstein polynomials. The American Mathematical Monthly 106, 6 (1999), 568.

- [18] Nerlove, M., and Arrow, K. Optimal advertising policy under dynamic conditions. Economica 29, 114 (1962), 129–142.

- [19] Rao, R. C. Estimating continuous time advertising-sales models. Marketing science 5, 2 (1986), 125–142.

- [20] Samuels, S. M. On the number of successes in independent trials. The annals of mathematical statistics 36, 4 (1965), 1272–1278.

- [21] Sethi, S. Dynamic optimal control models in advertising: a survey. SIAM Review 19, 4 (1977), 685–725.

- [22] Tricomi, F. G. Integral Equations. Dover Publications, 1985.

- [23] Vidale, M. L., and Wolfe, H. B. An operations-research study of sales response to advertising. Operations Research 5 (1957), 370–381.

- [24] Yong, J. Backward stochastic Volterra integral equations and some related problems. Stochastic Process and Applications 116 (2006), 770–795.