perpetual callable American volatility options in a mean-reverting volatility model

Abstract

This paper investigates problems associated with the valuation of callable American volatility put options. Our approach involves modeling volatility dynamics as a mean-reverting 3/2 volatility process. We first propose a pricing formula for the perpetual American knock-out put. Under the given conditions, the value of perpetual callable American volatility put options is discussed.

keywords:

volatility option, American option, callable American option, mean-reverting process15A15, 15A09, 15A23

1 Introduction

1.1 Review of the callable American option

A standard American option is a contract which gives the holder the right to exercise it prior to the maturity date. When it is exercised early, the holder gains the amounts , in the put and in the call, where denotes the price of the underlying asset. For the American option, the holder chooses an optimal strategy, say, the early exercise price, to maximize the value at any time prior to the maturity. Hence, the fair price of the American options leads to the solution to the optimal stopping problem for certain stochastic processes. The solution can be obtained by solving a free boundary problem (McKean, 1965), where the free boundary is regarded as the early exercise price (or the optimal trading strategy for the holder). So far, a considerable number of studies have been published to solve the free boundary problem arising from the American option pricing problem (for example, Geske and Johnson, 1984; Jacka 1992; Kuske and Keller, 1998; Merton, 1973).

A callable American option is an American option embedded with an additional feature that the seller may cancel the contract at any finite time (before maturity). At any time before expiry, the buyer can exercise the option early to maximize the option’s value while the seller can call it back to minimize the option’s value. Kifer (2000) first introduced the callable American option and analyzed the pricing problem based on the theory of optimal stopping games (Dynkin, 1969). In an illiquid market, it may not be possible for the seller to construct a hedge portfolio to compensate for the short position. Hence, recalling (or cancelling) the option is possibly the better hedging strategy. The strategic recalling can be regarded as an efficient instrument to limit risk when the seller expects stock prices to fall. Recalling such contracts might provide an effective way of reducing undesirable positions in turbulent times (Kifer, 2000). The cheapest super-hedging strategy for the seller of an American put option can be a trivial one consisting of an investment of K units in the riskless bank account.

Under the Black-Scholes framework, a considerable number of studies have begun to study how embedding the costly cancellation right of the seller to cancel the contract prior to maturity may affect its value. Kyprianou (2004) provided an explicit pricing formulas for the perpetual Israeli -penalty American put and the perpetual Israeli -penalty Russian put. Ekström (2006) explicitly determined the value of the perpetual game option by using the connection between excessive functions and concave functions. In the finite maturity case, Kunita and Seko (2004) first investigated the pricing problem of -penalty game call options and Kuhn and Kyprianou (2007) characterized the value function as a compound exotic option. Ekström and Villeneuve (2006) provided the price formula of the perpetual -penalty game call on stocks in the absence of a dividend payment. Yam, Yung and Zhou (2014) and Emmerling (2012) considered the pricing problem of the -penalty game call on a stock with a dividend payment.

1.2 Volatility options and Mean-reverting processes

With the rise and fall of stock prices, investors have been looking for financial instruments to reduce the variability of the price of their investment portfolios. To date, the American option has become a popular instrument for the buyer in relation to the variability of the price. For the seller, the callable feature embedded in the American option also reduces the risk of the price fluctuating sharply. However, according to empirical research, the volatility of asset returns will change over time. In addition to the price risk, the participants (buyer and seller) usually face the risk of volatility in the securities market. Options written on a security are designed primarily to deal with price risk. Positions in these options may not be sufficient to hedge all the uncertainties in volatility. Therefore, volatility derivatives become a natural candidate for hedging volatility risk. In recent decades, much of the investors’ interest in volatility options (or volatility derivatives) seems to have been responsible for the collapse of major financial institutions (e.g., Barings Bank and Long-Term Capital Management). This is because the collapses were accompanied by a dramatic increase in volatility. The volatility option is an instrument whose payoff depends explicitly on some volatility indicator. Today, one of the most popular volatility indicators is the VIX, which is the implied volatility of 30-day S&P 500 options.

Recently, VIX-related products (ETNs, futures and options) have become popular financial instruments, for both hedging and speculation. Brenner and Galai (1989) and Whaley (1993) proposed options written on a volatility index in the geometric Brownian motion. Based on empirical evidence, volatility is mean-reverting (for example, French, Schwert, and Stambaugh 1987; Harvey and Whaley 1991). Grünbichler and Longstaff (1996) assumed that the volatility risk premium is proportional to the volatility index and evaluated volatility futures and options based on the mean reversion square root process (MRSRP):

where denotes the index of the volatility at time . Several mean-reverting volatility models are now applied to price the volatility derivatives, such as the inverse square-root process (Detemple and Osakwe, 2000), log mean-reverting Gaussian process (Detemple and Osakwe, 2000), mean-reverting 3/2 volatility model (Goard and Mazur, 2013), 4/2 volatility model (Grasselli, 2017) and the generalized mixture model (Detemple and Kitapbayev, 2018). From a statistical/econometric perspective, several studies have indicated that the estimated value of the power of deviation is close to 1.5 (Bakshi et al., 1997; Chacko and Viceira, 2003; Jones, 2003; Ishida and Engle, 2002; Goard and Mazur, 2013). These results imply that deviations from the standard 3/2 model are meaningful for capturing the complex aspects of VIX behavior. Therefore, we model the volatility as a mean-reverting 3/2 volatility process in this paper. Goard and Mazur (2013) provided a closed-form pricing formula for the European volatility option in the mean-reverting 3/2 volatility process. The mean-reverting 3/2 volatility process is the reversed process of the MRSRP. Contrary to the MRSRP, Goard and Mazur (2013) also indicated that the mean-reverting 3/2 volatility process has a nonlinear drift so that it exhibits substantial nonlinear mean-reverting behavior when the volatility is above its long-run mean. Hence, after a large volatility spike, the volatility can potentially quickly decrease, while after a low volatility period it can be slow to increase.

With COVID-19, the VIX jumped 50% within a month and reached a record 82.69 on March 16, 2020 but was back down to 33.29 by April 27, 2020. However, the VIX surged 12% after President Trump tested positive for COVID-19. This means that the buyer and the seller must also face the huge uncertainty due to the different types of volatility in turbulent times. The right to exercise prior the maturity can help the buyer to reduce possible volatility risk and increase the profit from American volatility options. Recently, properties of the American volatility option have been considered by Detemple and Osakwe (2000), Detemple and Kitapbayev (2018) and Liu (2015). For the seller, an American option embedded with the callable feature will help the seller to reduce the risk arising from a dramatic increase in volatility and to decrease the hedging cost. When the seller expects the volatility to rise, recalling the option might provide an efficient way to mitigate the undesirable position. Moreover, the volatility option can not be hedged by holding a delta-hedge amount of the volatility index since the volatility index is not a tradable asset. Therefore, the callable American volatility option provides the seller with a useful instrument to construct a super-hedging strategy.

1.3 Setup

The -penalty callable American volatility option offers the seller an embedded costly cancellation option which permits the seller to pay a penalty in addition to the payoff at the time of the cancellation. In this paper, we investigate the valuation problem for the -penalty callable American volatility option in the mean-reverting 3/2-volatility processes. The mean-reverting 3/2-volatility process under the martingale measure is given as follows:

where , , are constants with and denotes the increment in the Wiener process under the martingale measure . The coefficient is positive and the volatility index always remains positive (Goard and Mazur, 2013).

Let denote the value of a perpetual callable American volatility put with a cancellation feature available to the short side of the contract with penalty . The payoff to the holder upon cancellation is when . Let and be two continuous functions with . A continuous time Dynkin game with two players, a buyer and a seller, is described as follows: the buyer chooses a stopping time and the seller chooses a stopping time . At the time , the seller pays the amount

to the buyer. Then the value of this game is defined as

where . The value satisfies

and is continuous (Ekström, 2006). Moreover, given and , the value satisfies

The infinitesimal generator of the process is given by

Let and be two independent solutions to the differential equation , where and . Then the solution is expressed as

The coefficients and are determined by the boundary conditions. Here, the function denotes the confluent hypergeometric function and is defined as

Since the first derivative of is given as

the first derivatives of the independent solutions and are obtained as follows

and

1.4 Main contributions

Let be the value of the perpetual American knock-out volatility put with barrier and rebate . If , the closed-form pricing formula is considered by the two cases, and . In the case where , the value is given as

where and are given as follows

The early exercise boundary is a root of the following equation

In the case where , the perpetual American knock-out volatility put will not be exercised early. The value is then given as

Let be the value of the perpetual callable American volatility put. Define

where is the value of the perpetual American volatility put. If , the value of the perpetual callable American volatility put is considered by the following three cases:

-

1.

If , the , for all .

-

2.

If and , then , for all .

-

3.

If , then for all .

The proofs and the numerical results are demonstrated in the following sections.

2 Proofs of our contributions

In the first three subsections, we first review the pricing problem for the perpetual American volatility put and then provide the pricing formula for the perpetual American knock-out put option. In Section 2.4, we show that the value of the perpetual callable American put is equal to the value of the perpetual American knock-out put in the given conditions. The numerical results are demonstrated in Section 2.5.

2.1 The perpetual American volatility put

Let

be the value of the perpetual American volatility put. Liu (2015) provided a closed-form pricing formula for the perpetual American volatility put by solving the following free boundary problem

with , and . The solution is given as

where satisfies the following equation

In addition, Detemple and Kitapbayev (2018) considered the American volatility put in the mixture volatility process, where the mixture process adds the mean-reverting square root process and the mean-reverting 3/2 volatility process. They show that the early exercise price satisfies the system of integral equations.

2.2 The perpetual knock-out American volatility put

An American knock-out option is an American option for which the holder receives a certain amount of money when the knock out occurs. For this option, the holder can seek an optimal strategy to maximize the option’s value before the volatility index reaches a certain price. Define

where . The function is regarded as the value of a perpetual knock-out put with barrier and rebate . Then as well as the early exercise boundary satisfies the following free boundary problem

with , and . To provide the pricing formula, we first consider the case where .

Theorem 2.1.

Let be the value of a perpetual knock-out American volatility put with barrier and rebate . If , the closed-form pricing formula is obtained as

| (1) |

where and are given as follows

The early exercise boundary is the root of the following equation

| (2) |

Proof 2.2.

If , the general solution to is written by using the two independent confluent hypergeometric functions as follows

where . Substituting the boundary conditions into the general solution yields the following linear system

and

Solving the linear system, the values of and can be determined in terms of , , , and . Using the high-contact condition , the early exercise price is a root of (2).

Since the value decreases to zero as tends to infinity, the buyer does not exercise the option prior to its maturity in the case where . Hence, the value of the perpetual American knock-out volatility put satisfies the following equation

| (3) |

with and . The value of a perpetual knock-out volatility put is obtained in the following theorem.

Theorem 2.3.

Proof 2.4.

If , the solution of is expressed as

Since as , the boundary condition forces . Hence, we have . Substituting into yields

This implies that for the case where .

2.3 Properties of the perpetual American knock-out volatility put

In this section, we consider the properties for on . We first consider the case where .

Theorem 2.5.

Let be a solution of , with and . Then we have for all .

Proof 2.6.

By letting on , then and . Applying the operator to yields

This implies that has no nonnegative local maximum at . Hence, we have for all . That is, on .

For the case where , we obtain two theorems that make . Applying to , we obtain

The roots of the first quadratic equation can be expressed as

Since , the solution

does not belong to . Thus, the desired root is

Hence, we have

Theorem 2.7.

Let be a solution of the following differential equation

with and . If , then for all .

Proof 2.8.

By letting on , we have then and . To show on , we apply the operator to and obtain

Since , we have . By the maximum principle, we have on if .

Theorem 2.9.

Let be the value of the perpetual American knock-out put with the barrier and the rebate . If and on , then on . Moreover, we have on .

Proof 2.10.

Let . Since on , we have

The boundaries of are obtained as and . By the maximum principle, we have on .

Moreover, if there exists a such that , then the value of rises to touch and falls down to . There must exist a such that , since and . This contradicts on . Therefore, we have on .

2.4 The perpetual callable American volatility put

A callable American volatility option is a contract that gives the buyer and the seller the right to seek an optimal strategy to maximize (for the buyer) and to minimize (for the seller) the option’s value. Hence the value of the perpetual callable American volatility option satisfies

where .

Let be the value of the perpetual American knock-out volatility put with barrier and rebate . Define

and

where is the value of the perpetual American volatility put. Then, we obtain the following result.

Theorem 2.11.

Proof 2.12.

The proof of Case 1 is the same as that for the callable American put. For Case 2, we have that and in . To show that on , it suffices to show that is the optimal strategy minimizing the option’s value. Suppose that the seller calls back (or cancels) the option at some particular price . Then, we have for all . However, we have if for Theorem 2.7 (or if for Theorem 2.9). This implies that cancelling the option at means that a lower value is obtained than cancelling at . Therefore, cancelling the option at any price is not the optimal strategy to minimize the option’s value under the given conditions. As a result, the value of a perpetual callable American volatility put is equal to the value of a perpetual knock-out American volatility put if . Based on a similar argument, we obtain that for all for Case 3.

2.5 Numerical results

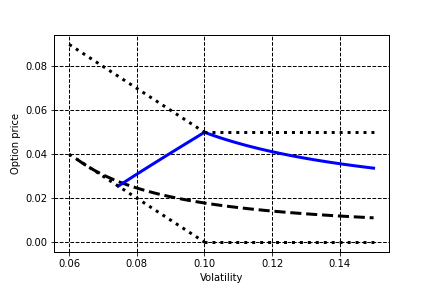

Let the values for the volatility of volatility , interest rate and strike be given as , , and . The graph of the case where (with , , ) is presented in Fig. 1. We find that the value of the perpetual American knock-out volatility put increases to the rebate in the neighborhood of when the rebate is greater than . Hence, the first derivative of is positive near as . However, the value of the perpetual American volatility put decreases from to zero as tends to infinity and . Therefore, the rational seller may not cancel the American volatility put by paying the penalty . This implies that we have for the case where just as in Theorem 2.11, where denotes the value of the perpetual callable American volatility put.

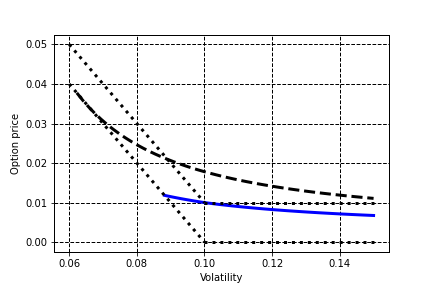

Based on the same values for , , , and , we consider the case where and on with . The graph is demonstrated in Fig. 2. The value of the perpetual American volatility put crosses over at and is greater than on . The value of the perpetual American knock-out volatility put is less than for all . Therefore, the rational seller will cancel the American volatility put by paying . This implies that we have on just as in Theorem 2.11 for the case where and on .

3 Conclusion

Volatility derivatives are an important innovation in the field of finance. For participants in the market, this paper introduces a callable American volatility put to reduce the volatility risk in turbulent times. Moreover, the callable feature decreases the hedging cost for the seller and increases the attractiveness for the buyer. An explicit valuation formula is derived for the case of the perpetual knock-out American volatility put and perpetual callable American volatility put. The numerical results demonstrate that the value of the perpetual callable American volatility put is lower than the value of the corresponding perpetual American volatility option.

References

- [1] G. Bakshi, C. Cao, and Z. Chen, Empirical performance of alternative option pricing models, Journal of Finance 52 (1997) 2003–2049.

- [2] M. Brenner, and D. Galai, New financial instruments for hedging changes in volatility, Financial Analysts Journal (1989) 61–65.

- [3] G. Chacko and L. M. Viceira, Spectral GMM estimation of continuous-time processes, Journal of Econometrics, 116 (2003) 259-292.

- [4] J. Detemple and C. Osakwe, The Valuation of Volatility Options, European Finance Review, 4 (2000) 21-50,

- [5] J. Detemple and Y. Kitapbayev, On American VIX options under the generalized 3/2 and 1/2 models, Mathematical Finance, 28 (2018) 550-581.

- [6] E. B. Dynkin, Game variant of a problem on optimal stopping, Soviet Mathematics–Doklady, 10 (1969) 270-274.

- [7] E. Ekström, Properties of game options, Mathematical Methods of Operational Research, 63 (2006) 221-238.

- [8] E. Ekström and S. Villeneuve, On the Value of Optimal Stopping Games, Ann. Appl. Probab. 16 (2006) 1576–1596.

- [9] T. J. Emmerling, Perpetual callable American call option, Mathematical Finance, 22 (2012) 645-666.

- [10] K. R. French, G. W. Schwert and R. F. Stambaugh, Expected stock returns and volatility, Journal of Financial Economics, 19 (1987) 3–29.

- [11] R. Geske, H. E. Johnson, The American Put Option Valued Analytically, J. Finance 39 (1984) 1511-1524.

- [12] J. Goard and M. Mazur, Stochastic volatility models and the pricing of VIX options, Mathematical Finance, 23 (2013) 439-458.

- [13] M. Grasselli, The 4/2 stochastic volatility model: A unified approach for the Heston and the 3/2 model, Mathematical Finance, 27 (2017) 1013-1034.

- [14] A. Grünbichler and F. A. Longstaff, Valuing futures and options on volatility, Journal of Banking & Finance, 20 (1996) 985–1001.

- [15] C. R. Harvey and R. E. Whaley, Dividends and S&P 100 index option valuation, Journal of Futures Markets, 12 (1991) 123–137.

- [16] I. Ishida, and R. Engle, Modelling variance of variance: The square root, the affine, and the CEV GARCH models, NYU working paper (2002).

- [17] S. D. Jacka, Optimal Stopping and the American Put, Math. Finance 1 (1992) 1-14.

- [18] C. Jones, The Dynamics of Stochastic Volatility: Evidence from Underlying and Options Markets, Journal of Econometrics, 116 (2003) 118–224.

- [19] Y. Kifer, Game options, Finance and Stochastics, 4 (2000) 443-463.

- [20] C. Kuhn and A. E. Kyprianou, Callable puts as composite exotic options, Mathematical Finance, 17 (2007) 487-502.

- [21] H. Kunita and S. Seko, Game Call Options and Their Exercise Regions, Technical Report of the Nanzan Academic Society (2004).

- [22] R. A. Kuske and J. B. Keller, Optimal Exercise Boundary for an American Put Option, Appl. Math. Finance 5 (1998) 107-116.

- [23] A. E. Kyprianou, Some calculations for Israeli options, Finance and Stochastics, 8 (2004) 73-86.

- [24] H.-K. Liu, Properties of the American volatility option on the mean-reverting 3/2 volatility model, SIAM Journal on Financial Mathematics, 6 (2015) 53-65.

- [25] H. P. Jr. McKean, Appendix: A Free Boundary for the Heat Equation Arising from a Problem in Mathematical Economics, Ind. Management Rev. 6 (1965) 32-39.

- [26] R. Merton, The Theory of Rational Option Pricing, Bell J. Econ. Management Sci. 4 (1973) 141-183.

- [27] R. E. Whaley, Derivatives on market volatility: Hedging tools long overdue, The Journal of Derivatives, 1 (1993) 71-84

- [28] S. C. P. Yam, S. P. Yung and W. Zhou, Game call options revisited, Mathematical Finance, 24 (2014) 173-206.