Robust Portfolio Selection Problems: A Comprehensive Review

Abstract

This paper reviews recent advances in robust portfolio selection problems and their extensions, from both operational research and financial perspectives. A multi-dimensional classification of the models and methods proposed in the literature is presented, based on the types of financial problems, uncertainty sets, robust optimization approaches, and mathematical formulations. Several open questions and potential future research directions are identified.

Key Words: Robust Optimization, Portfolio Selection Problem

1 Introduction

The portfolio selection problem (PSP) is a fundamental problem in finance that aims at optimally allocating funds among financial assets to maximize return and/or minimize risk. Different variants of the problem arise in reality due to the different risk attitudes of investors (risk-neutral vs. risk-averse), investment strategies, measures used to quantify risk (e.g., variance, VaR), methods used to calculate return (e.g., log-return) and planning horizon (single-period vs. multi-period), among other factors. Consequently, the PSP literature has grown considerably in terms of both size and diversity, allowing for several classification schemes to be employed.

An obvious classification is based on the risk measure to be optimized. Generally speaking, two broad classes of risk measures have been proposed: volatility-based and quantile-based. While variance has been the most widely-used risk measure in both theory and practice since the seminal work of Markowitz (1952), it has its deficiencies. First, it equally considers both positive and negative deviations around the expected return as undesirable risk, despite the desirability of the positive deviations for investors. Alternatively, downside risk measures that consider only the negative deviations of returns, like the lower partial moment (LPM), can be used. Furthermore, given that variance is a nonlinear risk measure, it leads to more complex formulations than those corresponding to linear risk measures like the mean absolute deviation (MAD) proposed by Konno & Yamazaki (1991). Related to volatility risk measures, Sharpe (1966) and Bernardo & Ledoit (2000), introduced Sharpe ratio and Omega ratio, respectively, to evaluate the performance of portfolios based on risk and return simultaneously. The most famous quantile-based risk measures are Value-at-Risk (VaR) and Conditional-Value-at-Risk (CVaR). The former quantifies the maximum loss at a specific confidence level, whereas the latter represents the expected value of losses greater than VaR at a confidence level. For details about quantile-based risk measures, interested readers are referred to Rockafellar et al. (2000).

Besides risk measures, PSPs can be classified based on investment strategies. For example, index tracking, first studied by Dembo & King (1992), is a passive investment strategy that tries to follow a market index. On the other hand, active investment strategies that involve ongoing buying and selling of assets are optimized by solving multi-period PSPs (see Dantzig & Infanger (1993) for an early example). Furthermore, hedging gives rise to a popular PSP in which an investment position is intended to offset potential losses or gains that may be incurred by a companion investment. Interested readers are referred to Lutgens et al. (2006) for a detailed account of financial hedging strategies. PSPs can be classified also according to return calculation methods. Goldfarb & Iyengar (2003) incorporated factors (macroeconomic, fundamental, and statistical) to determine market equilibrium and calculate the required rate of return, whereas Hull (2003) defined the Log-return as the equivalent, continuously-compounded rate of return of asset returns over a period of time.

Despite being a well-studied problem, a common feature of most PSPs addressed in the literature is that the problem parameters are assumed to be known with certainty. Ignoring the inherent uncertainty in parameters and instead using their point estimates often leads to suboptimal solutions. Two widely-used frameworks for dealing with uncertainty are stochastic programming (SP) and robust optimization (RO). SP focuses on the long-run performance of the portfolio by finding a solution that optimizes the expected value of the loss function. Despite its intuitive appeal and favorable convergence properties, SP requires the distribution function of the uncertain parameters to be known. Moreover, its risk-neutral nature does not provide protection from unfavorable scenarios, rendering it unsuitable for, typically, risk-averse investors. On the other hand, RO is a conservative approach that minimizes the loss function under the worst-case scenario (within an uncertainty set) and does not use information about the probability distribution of the uncertain parameters, making it an attractive alternative.

Given the rising interest in robust PSPs in the last two decades, several attempts have been made to review the growing robust PSP literature. Among the earliest reviews is that of Fabozzi et al. (2010), which concentrates on the application of RO on basic mean-variance, mean-VaR, and mean-CVaR problems, but does not cover more recent variants of the problem like robust index tracking, robust LPM, robust MAD, robust Omega ratio, and robust multi-objective PSPs. Scutellà & Recchia (2010) and Scutellà & Recchia (2013) also review robust mean-variance, robust VaR, and robust CVaR problems, but similarly, do not survey other robust PSPs. Likewise, Kim et al. (2014a) concentrate on worst-case formulations, while ignoring other important classes, including relative robust models, robust regularization, net-zero alpha adjustment and asymmetric uncertainty sets. Another review by Kim et al. (2018a) focuses on worst-case frameworks in bond portfolio construction, currency hedging, and option pricing, while covering a small number of references on robust asset-liability management problems, log-robust models, and robust multi-period problems. Recently, Xidonas et al. (2020) provided a categorized bibliographic review which broadly covers the area; their aim is to provide a rapid access to the topic for finance practitioners, and in general for those interested, but maybe not yet in the area.

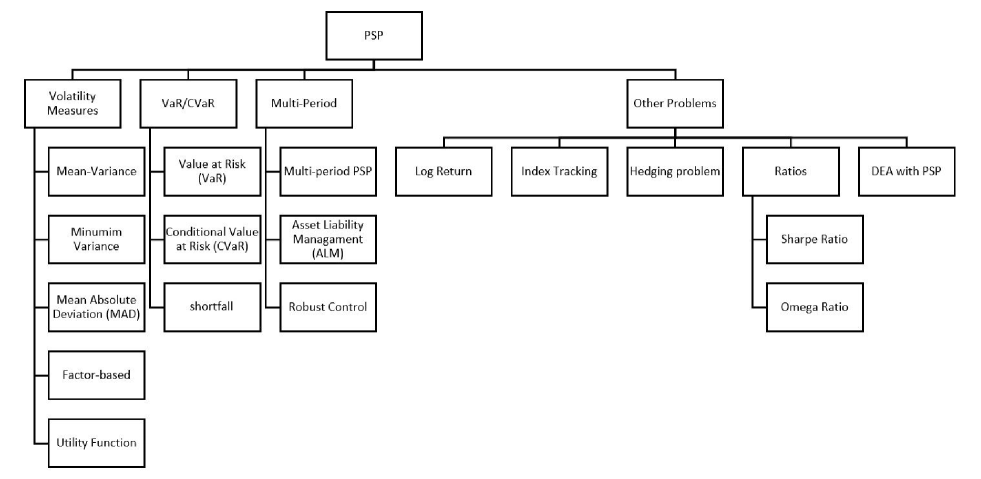

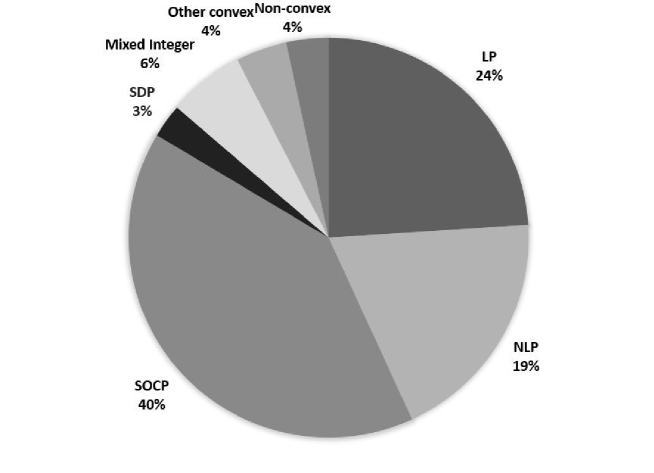

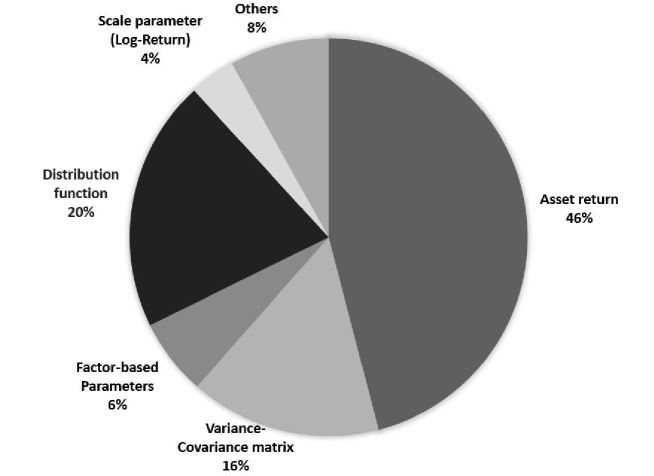

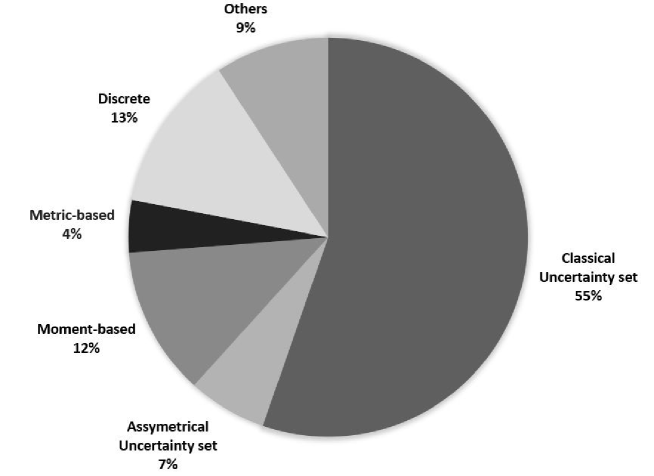

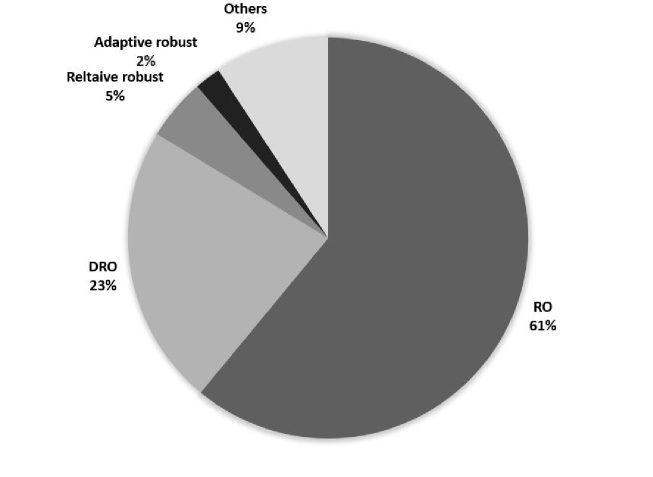

The main contribution of this review paper is a multi-dimensional classification of robust PSPs. The classification scheme of robust PSPs utilized in this review is illustrated in Figure 1. To put together the list of references to be reviewed, we first compiled two sets of keywords. The first set includes the following keywords related to financial problems: “portfolio selection”, “risk measures”, “VaR”, “CVaR”, “mean-variance”, “semi-variance”, “mean absolute deviation”, “index tracking”, “factor-based portfolio”. The second set includes the robust optimization keywords: “robust optimization”, “distributionally robust optimization”, “data-driven”, and “uncertainty set”. We then searched all pairs/combinations of the first and second keyword sets on both Scopus and Web of Science databases, and also using the Google Scholar search engine. The references retrieved from these searches were carefully screened to make sure that they are related to the robust financial problems. If a paper was deemed related to the scope of this review, we searched the references cited in it and those that cited it to find additional references to be included. This process was repeated multiple times until no new references could be found.

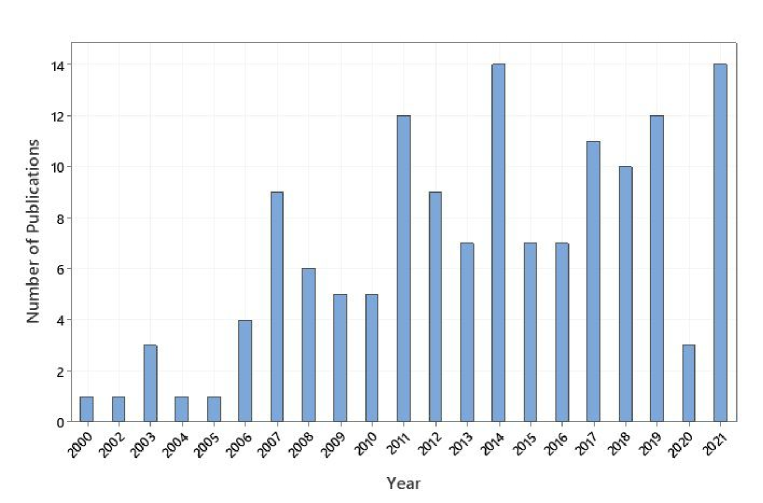

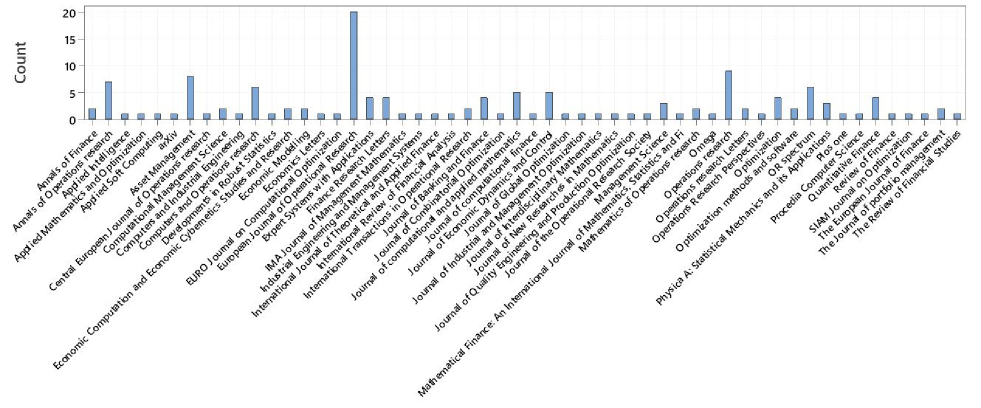

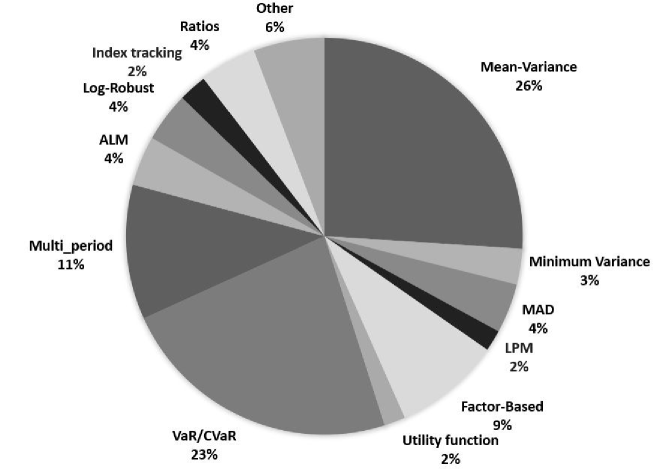

Figure 2 portrays a breakdown of the reviewed articles by publication year, spanning between the years 2000 and 2021. We note that out of the 142 articles reviewed, 14 appeared in 2021, thus were not included in any of the previous reviews. Our review focuses on articles published in peer-reviewed journals. These articles appeared in a large number () of finance and operations research (OR) journals. Figure 3 shows a breakdown of the reviewed papers by journal (sorted alphabetically). We note that most robust PSP articles were published in OR journals.

A major challenge when reviewing the robust PSP literature is the absence of a unified set of nomenclatures and notations for describing and formulating the problems. To be able to link and contrast different variants of the problem, we use, throughout our review, a unified set of most used notations, shown in Table LABEL:table:1. The notations that are used once are defined in the text. Our strategy for including mathematical formulas was to begin with the simplest and most general ones, then incrementally add new or alternative items (e.g., terms in the objective function, constraints, risk measures, levels of optimization) at their first use in the robust PSPs literature. We also chose to include formulas that are commonly used and that constitute significant contributions, leaving behind some outliers and minor changes for brevity.

| Symbol/Notation | Definition |

| Decision variable, the proportion of the available budget invested in asset | |

| Asset return vector | |

| Minimum asset return vector | |

| Maximum asset return vector | |

| Risk-free asset return | |

| Variance-covariance matrix of the assets | |

| Minimum variance-covariance matrix of the assets | |

| Maximum variance-covariance matrix of the assets | |

| Portfolio expected return | |

| Portfolio variance | |

| Vector of size whose components are ones | |

| Risk aversion coefficient | |

| Uncertainty set of , which has the same dimensions of the uncertain parameter | |

| Uncertainty set of , which has the same dimensions of the uncertain parameter | |

| Non-negative scalar that controls the size of uncertainty set | |

| Price of asset | |

| Exchange rate of currency | |

| Covariance matrix of the estimated expected returns | |

| Nominal distribution function | |

| True distribution function | |

| A random variable | |

| A positive semi-definit matrix | |

| A positive scalar | |

| Indices of scenarios | |

| Lower bound of decision variables | |

| Upper bound of decision variables | |

| Binary variable, if the asset is selected it takes one, otherwise zero | |

| , | Integer scalars that show the minimum and maximum number of assets in the portfolio |

| Indices of period | |

| Initial wealth of the investors | |

| Confidence level | |

| VaR | Value at Risk |

| CVaR | Conditional Value at Risk |

| Loss function | |

| , | Transaction costs (buying and selling) |

The remainder of this review paper is organized as follows. The next section provides a brief introduction to RO for non-specialists. Section 3 surveys robust PSP formulations based on volatility measures. Section 4 reviews quantile-based PSPs, which include Value at Risk (VaR), Conditional Value at Risk (CVaR), and their extensions with worst-case RO methods, relative RO and distributionally robust optimization (DRO). Furthermore, the relationship between uncertainty sets and risk measures, application of soft robust formulation with risk measures, worst-case CVaR and its relationship with uniform investment strategy, and robust arbitrage pricing theory with worst-case CVaR are also discussed in Section 4. Section 5 provides a review of RO in multi-period PSPs and asset-liability management (ALM) problems. Besides these two main problems, robust control formulations of investment problems are reviewed in this section. Section 6 reviews other financial problems that are not covered in the above-mentioned categories like robust log-return, index-tracking, hedging problem, risk-adjusted Sharpe ratio, robust scenario-based formulation, and robust data envelopment analysis. The last section provides conclusions and open issues in this context.

2 A Brief Introduction to Robust Optimization

This section provides a brief introduction to RO for readers who are not familiar with the topic. RO is a framework for dealing with the uncertainty of parameters in optimization problems by assuming that the parameters belong to an uncertainty set and optimizing over the worst realization in this set. The first RO formulation was developed by Soyster (1973) and used a box (hypercubic) uncertainty set that specifies an interval for each individual uncertain parameter. Even though this approach usually leads to tractable formulations, it is too conservative since it is based on the assumption that all parameters will take their worst possible values simultaneously, which rarely happens in reality. To overcome this issue, Ben-Tal & Nemirovski (1998) proposed an ellipsoidal uncertainty set that is centered at some nominal value and has a size (radius) that controls the conservatism of the solution based on the decision maker’s aversion to uncertainty. Nevertheless, tractable reformulations of RO problems with ellipsoidal uncertainty sets give rise to nonlinear formulations that, generally, have a higher complexity than the nominal problem. Later, Bertsimas & Sim (2004) developed a special class of polyhedral uncertainty set, referred to as budget, that enables the level of conservatism to be controlled while preserving the tractability of the reformulated problems. All of the aforementioned uncertainty sets are symmetric, meaning that they are based on the assumption that forward and backward deviations around the nominal value are equal. Chen et al. (2007) argued that this assumption is not valid in many practical settings and proposed an asymmetric uncertainty set that is particularly suitable for financial applications.

Despite the protection it provides against adverse scenarios, classical RO is still considered overly conservative and pessimistic by many practitioners. To alleviate this concern, several RO variants have been developed. Scherer (2007) proposed adding a net-zero alpha adjustment constraint to any uncertainty set to guarantee that for any downward adjustment in the uncertain parameter, there is an offsetting upward adjustment, thus reducing the level of conservatism. Kouvelis & Yu (1997) proposed a relative RO approach that uses a regret function under the least desirable scenario. Although this approach provides solutions that perform better, on average, than classical RO, it suffers from intractability since it results in a three-level optimization problem.

Another way to achieve less conservative solutions is to use available partial information about the distribution function of the uncertain parameters rather than completely overlook them. A framework referred to as distributionally robust optimization (DRO), that dates back to the seminal work of Scarf (1958), has gained considerable attention recently. It assumes that the unknown probability distribution of the uncertain parameters belongs to a set of distributions called the ambiguity set, and optimizes the expected value of the objective function, where the expectation is taken with respect to the worst distribution in this set. Clearly, the tractability, convergence and out-of-sample performance guarantee offered by the DRO solution obtained depends on the ambiguity set used. Generally speaking, there are two main types of ambiguity sets: moment-based and discrepancy-based. The former includes distributions that enjoy some parametric properties, e.g., mean or variance, whereas the latter include distributions that are within a certain “distance” (e.g., the Kullback–Leibler divergence or the Wasserstein metric) from a reference distribution. The interested reader is referred to Rahimian & Mehrotra (2019); Esfahani & Kuhn (2018); Delage & Ye (2010) and the references therein for more information about DRO.

3 Robust PSPs with Volatility-based Risk Measures

In this section, we review the application of RO in PSPs with volatility-based risk measures, which include mean-variance, mean absolute deviation, lower partial moment, systematic risk, Omega ratio, and factor-based portfolio models.

3.1 Mean-Variance PSP

The mean-variance PSP was proposed by Markowitz (1952). In its general form, it assumes risky assets, each has an expected rate of return denoted by the vector , whereas is the portfolio variance and is the variance-covariance matrix of the assets. In Markowitz’s model, the variance of the portfolio is the risk measure to be optimized. The decision variable of this mathematical formulation is , which represents the proportion of the available budget invested in asset . When , it means that short selling is not allowed.

Moreover, is the portfolio expected return, is the portfolio variance, and is the minimum required expected rate of return. Then, the minimum variance PSP is where , and is a vector of size whose components are ones. Another version of the mean-variance PSP, called the risk-adjusted expected return, takes the form . This formulation has the dual objectives of maximizing the portfolio return and minimizing its variance, where is a risk aversion coefficient set by the investor. In reality, however, the true values of the expected rate of return and the covariance matrix are not known with certainty.

3.1.1 Classical Uncertainty Sets for the Mean-Variance PSP

The general robust counterparts of the aforementioned PSPs are , and , respectively, where and are the uncertainty sets for the covariance matrix and the return vector, respectively. Tütüncü & Koenig (2004) used symmetric box uncertainty sets defined as and , where and are, respectively, the lower and upper bounds of the asset returns and and are the lower and the upper bounds of the covariance matrix elements while stipulating also that must remain positive semi-definite (PSD). It has been shown that, with these uncertainty sets, the robust counterparts could be tractably formulated as , and , respectively. Khodamoradi et al. (2020) used similar uncertainty sets for a cardinality-constrained mean-variance PSP that allows short selling. Swain & Ojha (2021) also analyzed the robust mean-variance, and mean-semi-variance PSPs with box uncertainty sets, where both the expected return vector and the covariance matrix are uncertain parameters. However, Chen & Tan (2009) argued that deviations of the expected asset returns from their nominal values are not symmetric, meaning that the upside deviation is different from the downside deviation, thus are not accurately captured by classical symmetric uncertainty sets. Instead, they used non-symmetric interval uncertainty sets for the expected vector and covariance matrix of asset returns. The element-wise uncertainty interval was defined as and , where and are elements of and , respectively, that represent the nominal values of mean and covariance, whereas and are the downside and the upside deviations for the mean and and are the downside and the upside deviations for the covariance, respectively. To propose a robust counterpart, optimistic and pessimistic values are defined as , and , respectively. Alternatively, Fabozzi et al. (2007) defined an ellipsoidal uncertainty set for asset returns as , where is the nominal return and is a non-negative scalar that controls the size of the uncertainty set. Hence, the robust counterpart can be tractably formulated as . However, the uncertainty of the covariance matrix was not considered, making the solution robust only against perturbations in the return vector. Pınar (2016) developed a robust mean-variance PSP with the same ellipsoidal uncertainty set while allowing short selling, which was also extended to the multi-period case.

Even though RO accounts for uncertainty in the problem parameters, Zymler et al. (2011) argued that if the uncertainty set is not set large enough, the solution might maintain its robustness only under normal market conditions, but not when the market crashes. Instead, they proposed using European-style options to hedge the mean-variance portfolios against abnormal market conditions. Two guarantee types were provided: weak, and strong. The weak guarantee applies under normal market conditions when the rate of the return is varying in an ellipsoid uncertainty set, whereas the strong guarantee applies to all possible asset returns by using the European-style options in the form of constraints in the optimization problem. Hence, the strong guarantee is not based on RO formulation but on the mechanism of options to protect the portfolio in market crashes. Ashrafi & Thiele (2021) also used the idea of strong and weak guarantees. For the strong guarantee, an option is used in PSP, whereas for the weak guarantee, a budget uncertainty set for asset returns is used. Hence, the problem can be reformulation as a linear program (LP).

According to Lu et al. (2019), an important drawback of the mean-variance PSP is that its inputs are computed using only historical market returns, thus specific earnings announcements cannot be used to support the portfolio selection process. To overcome this issue, Black & Litterman (1990) proposed the BL method, which consists of both a market model and a view model. Lu et al. (2019) improved the view model of the BL method by using fuzzy logic to make it quantitative. Moreover, they incorporated multiple expert views instead of just one individual expert view in their formulation. To handle the heterogeneity of data collected from disparate sources, they applied RO with an ellipsoidal uncertainty set for the mean return vector and the return covariance matrix.

Fonseca & Rustem (2012) asserted that an important strategy in the PSP is diversification, which may eliminate some degree of risk since financial assets are less than perfectly correlated. To make a portfolio more diversified, investors can invest in foreign assets. However, foreign exchange rates’ fluctuations may erode the investment’s return. Moreover, both the asset returns and the currency rates are uncertain. Hence, Fonseca & Rustem (2012) and Fonseca et al. (2012) proposed a robust formulation for the international PSP with an ellipsoidal uncertainty set, which leads to a non-convex bilinear optimization problem. The problem considers assets from foreign currencies, where and are, respectively, the current and future prices of asset , and and , respectively, are the current and future exchange rates of currency . Therefore, the local return of asset is and the exchange rate return of currency is . Using the auxiliary binary matrix , where equals 1 if asset is traded in currency and 0 otherwise, the international PSP is formulated as , where the objective of this formulation is to maximize the worst-case return within all realizations in the uncertainty set . A semi-definite programming (SDP) approximation is proposed to handle the non-linearity of the robust international PSP. Even though a robust international portfolio provides some level of guarantee against the uncertainty, investors might alternatively use forward contracts and quanto options (an exotic type of options translated at a fixed rate into another currency) to hedge risk. To make the formulation more practical, Fonseca & Rustem (2012) extended the robust international PSP with forward contracts and quanto options to reach a less conservative formulation.

Another classical uncertainty set used for robust PSPs is the budget uncertainty set proposed by Bertsimas & Sim (2004), which has the advantage of leading to tractable reformulations with the same complexity of the nominal problems. Sadjadi et al. (2012) considered a robust cardinality constrained mean-variance PSP with ellipsoidal, budget, and general-norm uncertainty sets and proposed a genetic algorithm to solve them. It was shown that using a budget uncertainty set has led to better rates of return compared to other uncertainty set types. Gregory et al. (2011) also tested a budget uncertainty set for the uncertain returns in a PSP to show the impact of the uncertainty set size on the portfolio return. The uncertainty set in this formulation is defined as , where is nominal value, is the deviation of return, is the random variable, and is the price of robustness that control the size of uncertainty set. The final formulation is . It has been shown that using the mean or the median of the asset returns as nominal values leads to the most robust portfolios.

Bienstock (2007) postulates that the solution methodology of RO is often chosen at the expense of the accuracy of the uncertainty model. Moreover, classical uncertainty sets might lead to overly conservative solutions. Alternatively, Bienstock (2007) proposed a data-driven approach to construct the uncertainty set by using uncertainty bands, each showing a different level of the return shortfall, which is an amount by which a financial obligation or liability exceeds the required amount of cash that is available. Hence, it is possible to specify rough frequencies of return shortfalls to approximate the return shortfall distribution. The robust models are formulated by allowing the uncertain parameter (asset returns) to deviate from the distribution by incorporating constraints related to the frequency of the return shortfall in different bands, an approach referred to as robust histogram mean-variance PSP. Although this formulation provides more flexibility than classical RO, the robust counterpart is an intractable mixed-integer program (MIP); thus, a cutting plane algorithm is proposed to solve it.

3.1.2 Robust Mean-Variance and Multi-Objective Solution Methods

Fliege & Werner (2014) studied a robust multi-objective optimization (MOO) version of the mean-variance PSP while considering minimizing the variance and maximizing the mean return of the portfolio as the two objectives. Two MOO methods were applied: the -constraint scalarization (ECS) method, which pushes one of the objective functions, namely return maximization, to the constraints, and the weighted-sum scalarization (WSS) method, which combines the two objectives into a single one by assigning proper weights to them. Both methods lead to the same efficient frontier in the nominal case, but not for the robust problem. Fliege & Werner (2014) defined the location characteristics of the robust Pareto frontier with respect to the non-robust Pareto frontier, and demonstrated that standard techniques (ECS and WSS) from MOO can be used to construct the robust efficient frontier.

Alternatively, robustness in multi-objective PSPs can be achieved by a resampling method without classical uncertainty sets, which provides a wider range for uncertain parameters and solutions instead of the worst-case scenario RO with a specific uncertainty set. This approach requires replacing the parameters in the fitness functions at every generation. Hence, the evolution process would favor the solutions that show good performance in terms of risk and return over different scenarios (see e.g., Shiraishi (2008), Ruppert (2014)). García et al. (2012) argued that one of the main problems portfolio managers face is uncertainty regarding the expected frontier derived from forecasts of future returns. Very often, expected frontiers lie far from the actual return, resulting in inaccurate forecasts of the portfolio risk/return profile. García et al. (2012) demonstrated that robustness of results can be achieved by avoiding optimization based on a single expected scenario that may produce solutions that are hyper-specialized and might be extremely sensitive to likely deviations. They tackle the problem of achieving robust or stable portfolios by using a multi-objective evolutionary algorithm that replaces the traditional fitness function with an extended one that uses a resampling mechanism and an implicit third objective to control the robustness of the solutions.

The formulations of Fliege & Werner (2014) and García et al. (2012) are based on differentiable functions. However, classical RO methods cannot be used on nonsmooth and non-differentiable functions. To address this issue, Fakhar et al. (2018) developed the necessary and sufficient optimality condition for a MOO problem with nonsmooth, e.g., non-differentiable or discontinuous, functions, and proved that strong duality holds when these functions are convex. Moreover, they introduced the concept of saddle-point for MOO under uncertainty.

3.1.3 Robust Optimization Based on the Estimation Error

Ceria & Stubbs (2006) demonstrated that the mean-variance PSP is very sensitive to small variations in expected returns. They, instead, proposed a formulation for the robust PSP based on estimation errors. In this formulation, three distinctive Markowitz efficient frontiers were introduced: the true frontier calculated based on the true, yet unobservable, expected returns, the estimated frontier calculated based on the estimated return, and the actual frontier calculated based on the true expected returns of the portfolios on the estimated frontier. To have a portfolio as close as possible to its true frontier, the maximum difference between the estimated frontier and the actual frontier was minimized. Ceria & Stubbs (2006) modified the maximum difference between the estimated frontier and the actual frontier by adding a linear constraint. They assumed that the true returns lie inside the confidence region , where , and is the inverse cumulative distribution function of the chi-squared distribution with degrees of freedom. Points on the efficient frontier are calculated by solving , where is the maximum acceptable variance. The optimal solution of this optimization problem is . By considering as the true, but unknown, expected return vector and as an expected return, the true expected return of a portfolio on the estimated frontier is computed as . Ceria & Stubbs (2006) assumed that is the optimal portfolio on the estimated frontier for a given target risk level. Then, the difference between the estimated expected return and the actual expected return of is . Consequently, the maximum difference between the expected returns on the estimated efficient frontier and the actual efficient frontier is computed by solving . In this formulation is fixed and optimization is over . Hence, the optimal solution is . Moreover, the lowest value of the actual expected return is . Finally, the maximum difference between the estimated frontier and the actual frontier is . Effectively, minimizing the maximum difference between the actual and the true frontiers leads to a robust mean-variance PSP with an ellipsoidal uncertainty set, while the covariance matrix of estimation error is also captured using an ellipsoidal uncertainty set. Garlappi et al. (2007) also claimed that the estimation error is ignored in mean-variance PSPs. They propose a robust mean-variance PSP that is a special case of the PSP in Ceria & Stubbs (2006) since asset returns are assumed to be normally distributed. Multiple historical data sets are used to estimate the random variable of asset returns. The problem is formulated as , where is the estimated return, is a vector-valued function, is a vector of constants that captures the investor’s uncertainty- and ambiguity-aversion. The additional constraint, representing the confidence interval of the normal assets return, shows that the decision maker accepts the possibility of estimation error. Garlappi et al. (2007) compared their results for different selections with the results of the traditional Bayesian models and showed that their models are risk-averse while the Bayesian models are risk-neutral towards the uncertainty in parameters.

3.1.4 Net-Zero Alpha Adjustment for the Mean-Variance

Scherer (2007) analyzed the results and models of robust estimation error by Ceria & Stubbs (2006) and robust mean-variance with box uncertainty set by Tütüncü & Koenig (2004) and showed that the results of the robust mean-variance PSP are equivalent to the results of the mean-variance PSP with Bayesian shrinkage estimators for the uncertain parameters (for more details about Bayesian shrinkage estimators , see e.g., Lemmer (1981)). The RO framework is criticized because it merely increases the complexity of the PSP while the solutions of the robust optimization, which depends on the choice of uncertainty set, are usually over-conservative. A method, referred to as net-zero alpha adjustment, is developed, by which adding a constraint to the uncertainty set ensures that for any downward adjustment in the uncertain vector, there is an offsetting upward adjustment. For example, with the uncertainty set , where is the covariance matrix of estimation errors and is a deviation vector, the constraint is added. Gülpınar et al. (2011) applied this method for a cardinality-constrained mean-variance PSP and found that adding a net-zero alpha adjustment to the ellipsoidal uncertainty set led to less conservative solutions than traditional robust mean-variance PSPs.

3.1.5 Distributionally Robust Mean-Variance

RO is a worst-case approach which assumes that the distribution function of uncertain parameters is unknown. However, partial information about the distribution function is often available, enabling less conservative distributionally robust optimization (DRO) formulations to be used. Several DRO models have been proposed for the mean-variance PSP.

Calafiore (2007) developed distributionally robust PSPs where two types of problems with different risk measures were addressed: the mean-variance PSP, which uses the mean and variance, and the mean absolute deviation PSP, which replaces the variance with the absolute deviation. Let us assume are possible scenarios for the outcome of random return vector , and is the probability associated to the scenario , where . Then, the expected value is defined as , where . A risk measure can be quantified as the variance: , where is the covariance matrix of , and . Another risk measure in this concept is the expected absolute deviation (EAD) . By defining as a risk aversion ratio, then the mean-variance PSP is , and the PSP based on the absolute deviation measure is . A discrepancy-based ambiguity set based on the well-known Kullback-Leibler (KL) divergence, which measures the “distance” between a nominal distribution vector and the unknown “true” distribution vector is used, defined as . Then is only known to lie within KL distance from , , where is the ambiguity set for the return distribution. This ambiguity set leads to a SDP formulation for the mean-variance PSP that is solvable using interior-point methods. The distributionally robust absolute deviation PSP is convex in the decision variable for any given distribution function. Consequently, a sub-gradient method combined with a proposed cutting plane scheme was used to solve the worst-case mean absolute deviation PSP in polynomial-time. Baviera & Bianchi (2021) also applied KL divergence in the mean-variance PSP. However, unlike Calafiore (2007), they considered continuous distribution functions for the asset returns.

A limitation of Calafiore (2007) is that, while the probabilities of scenarios are uncertain, the scenarios themselves are assumed to be known with certainty, which is not always the case in reality. Pınar & Paç (2014) formulated a semi-deviation PSP while considering uncertainty in both asset returns (through an ellipsoidal uncertainty sets) and in the distribution function of returns (through a moment-based ambiguity set). Both single and multi-period cases were considered.

As Ding et al. (2018) argued, the Kullback–Leibler (KL) divergence used in Calafiore (2007) is a special case of Rényi divergence with order one, hence they used it in a more general DRO formulation of the mean-variance PSP. Besides the risky assets having a multivariate normal distribution, they considered a risk-free asset with a fixed rate of return in their formulation. By allowing short selling and using as a target average return of the portfolio, the problem is formulated as . In the nominal case, the empirical distribution, obtained from historical data, is used , assuming that . Since there is ambiguity about the true distribution of returns, an ambiguity set is constructed that contains all distributions within a certain distance, measured using Rényi divergence, from the empirical distribution. Renyi divergence is defined as , where and are the probability density function under measures and , respectively. Hence, the final formulation of the distributionally robust PSP is . Their model was solved in three cases: only the mean return vector is uncertain, only the covariance matrix is uncertain, and both are uncertain. It is worth mentioning that even though the ambiguity set used in Ding et al. (2018) is more general than the KL-divergence, their formulations are special cases from the distribution function perspective since both the empirical and the true distribution function of the asset returns are assumed to be multivariate normal.

3.1.6 Relative Robust Mean-Variance

Hauser et al. (2013) suggested that some professionals such as investment managers are frequently evaluated against their competitors and not on the absolute terms (worst-case solutions). The relative RO is the best possible approach to handle this situation where a regret function (the distance to the “winner” under the least desirable scenario) is used to propose an intractable three-level optimization problem. Hauser et al. (2013) incorporated a relative robust formulation into the mean-variance PSP where the regret function is , is the decision variable, is the variance-covariance matrix, is an uncertainty set, and is the set of benchmarks. To solve the proposed model, a polynomial-time solvable approximation for the inner problem was developed. The formulation of Hauser et al. (2013) does not provide any control over regret value since the objective function is a regret function. Hence, Simões et al. (2018) extended a relative robust mean-variance PSP when a regret function is a constraint that provides more control over the regret value. Moreover, they defined proportional regret as an objective function, which is more perceivable by investors. Results show that the regret minimization seems to provide a greater degree of protection when it is compared to absolute robust optimization. Caçador et al. (2021) proposed a new methodology for computing relative-robust solutions for mean-variance and minimum variance PSPs. This solution methodology is based on a genetic algorithm (GA), allowing the transformation of the three-level optimization problem into a bi-level problem.

3.1.7 Robust Minimum Variance

In the mean-variance PSP, it is assumed that there is a positive correlation between the expected return and the variance, which means more/less risk (variance) results in more/less profit (return). However, Baker et al. (2010) showed that in a long-term investment strategy, low-volatility portfolios outperform high-volatility portfolios. Consequently, a PSP that minimizes just the variance of the portfolio (i.e., global minimum variance portfolio) might have a better performance than the mean-variance PSP. Maillet et al. (2015) showed that the optimal solution of the global minimum variance portfolio can be calculated by solving a least-square regression while the covariance matrix of assets is uncertain. Hence, a robust least-square regression is proposed where the uncertainty set is based on the Frobenius norm, leading to a second-order cone program (SOCP). Maillet et al. (2015) formulated the nominal global minimum variance PSP as , where is an estimate of the covariance matrix, leading to the closed-form optimal solution . They also showed that the optimal solution of this PSP can be computed as , where is the number of stocks, is an matrix having the following properties: and , where is the () identity matrix. can be calculated based on the least square regression formulation , where , and . Moreover, is calculated from . For the robust PSP, Maillet et al. (2015) assumed that the pair is uncertain and belongs to a family of matrices , where is a perturbation matrix while is the uncertainty set, is the Frobenius norm and . Consequently, the robust counterpart of the least square regression is . Monte Carlo simulation was used to test the robust formulation, showing that it dominates the non-robust one with respect to weight stability, portfolio variance, and risk-adjusted returns. To make the formulation of Maillet et al. (2015) more practical, Xidonas et al. (2017a) augmented it into the cardinality-constrained global minimum variance PSP using the approach proposed by Cornuejols & Tütüncü (2006), which uses scenarios instead of uncertainty sets to capture parameter uncertainty, making the formulation easier to handle. The problem is formulated as . Xidonas et al. (2017a) defined a set of scenarios, indexed by , that describe the assets’ performance, each has an expected return vector and a covariance matrix . They also defined as the minimum variance of a portfolio under scenario , which is calculated by solving the classical mean-variance PSP for . The final formulation tries to find the optimal solution in the worst-case situation as , where is the relative worst variance aggravation based on the robust solution.

The risk parity or the equal risk contribution is a new asset allocation strategy in which all of the underlying assets in the portfolio contribute equally to the risk. It has been argued that risk parity results in a superior Sharpe ratio than the mean-variance PSP (see, e.g., DeMiguel et al. (2009)). However, inputs of the risk parity formulations are often subject to uncertainty, which leads to sub-optimal solutions. DeMiguel et al. (2009) assumed that is a continuously differentiable convex risk measure, and are the risk budgets assigned by the investor. The risk budgeting problem becomes , where is the marginal risk contribution and is the risk contribution of asset , which has the optimal solution , where . Kapsos et al. (2018) used the variance of the portfolio, which is uncertain and belongs to an uncertainty set , to quantify risk. With that, the robust counterpart of the risk budgeting problem becomes , which is equivalent to , where is a normalization of decision variables. Kapsos et al. (2018) proposed three robust risk budgeting formulations, for which the covariance matrix of assets belongs to; a discrete uncertainty set, a box uncertainty set while the upper bound is a PSD matrix, or a box uncertainty set without restrictions on its bounds. In the last case, the formulation is transformed to a semi-infinite problem that is solvable using an iterative procedure proposed by the authors.

3.1.8 Other Extreme Cases of the Mean-Variance

Worst-case RO is an extreme case, which finds the optimal solution of an optimization problem for the worst possible situation. However, this approach is over-conservative. The goal of reducing the conservatism of RO solutions can be achieved by using other extreme cases than worst-case. Chen & Wei (2019) incorporated set order relations of solutions into a multi-objective mean-variance PSP with an ellipsoidal uncertainty set to show the relationship between optimization solutions and their efficiency by comparing multiple objective function values. These relations can be interpreted as extreme cases. The first relation, called “upper set less ordered relation”, is the best solution for the worst-case situation, which is equivalent to the robust formulation. The second case is “lower set less ordered relation” which practically means the best-case solution. Third, “alternative set less ordered relation”, is the intersection of the best-case and the worst-case solutions, i.e., . This study assumed that the distributions of asset returns are normal. Chen & Zhou (2018), however, argued that practical and theoretical evidence shows that the distribution function of asset returns has a fat-tail. Hence, they applied the relation structure of Chen & Wei (2019) and the idea of other extreme cases in PSP without the normality assumption by using the higher moments (skewness and kurtosis) in their formulation. Both Chen & Wei (2019) and Chen & Zhou (2018) used a multi-objective particle swarm optimization algorithm to solve other extreme cases of the mean-variance PSP.

Extreme cases (worst-case, best-case, and the intersection of the best-case and the worst-case solutions, can be implemented in different market conditions. Bai et al. (2019) considered different realizations of the uncertain parameters in different market conditions by dividing the market situation into bull market, bear market, and steady market. In the bull market condition, it is assumed that the best-case scenario will happen, hence a best-case formulation (i.e., min-min or max-max) is used. Conversely, in the bear market condition, it is assumed that the worst-case scenario will happen, leading to a typical worst-case RO. In the steady market, an alternative scenario, namely the intersection of solutions of the best-case and the worst-case scenarios is assumed to happen. In contrast to Chen & Zhou (2018) and Chen & Wei (2019), Bai et al. (2019) used a single objective mean-variance PSP.

3.1.9 Robust Mean-Variance and Regularization

An important criticism of the classical mean-variance PSP is its weak performance in out-of-sample data due to overfitting. It also has been shown that, for a large number of periods, the classical formulation of the mean-variance PSP amplifies the effects of noise, leading to an unstable and unreliable estimate of decision vectors. To reduce these effects, Dai & Wang (2019) proposed a sparse robust formulation for the mean-variance PSP, which places controls on the asset weights in the portfolio. The process of adding information to solve an ill-posed problem is called regularization. Dai & Wang (2019) defined as a vector of asset returns at time . Moreover, and are mean vector and covariance matrix, respectively. The portfolio variance is , where is a matrix whose row equal to . If the expectations are replaced by the sample average, then the model can be expressed as a statistical regression, which takes the form , where is the norm. If the size of is large, then it amplifies the effects of noise, leading to an unstable and unreliable estimate of the vector . To overcome this issue, a regularization is applied in the formulation as , where is the parameter for adjusting the relative importance of the norm penalty in the objective function. However, this sparse formulation does not consider return as an uncertain parameter. Consequently, two robust formulations of the mean-variance PSP with box and ellipsoidal uncertainty sets are proposed. The results showed that the sparse robust mean-variance PSP has better out-of-sample performance than other mean-variance formulations. Lee et al. (2020) extended the same concept to a robust sparse cardinality-constrained mean-variance PSP with ellipsoidal uncertainty set and norm regularization to achieve a better control over decision variables. This formulation results in a non-convex NP-hard problem. Hence, a relaxation to a SDP problem is proposed to make it more tractable.

Alternatively, it is possible to prevent the negative impact of noisy inputs by adding restrictions on the estimated parameters instead of restricting the decision variables. Plachel (2019) used the restricted estimators method with a box uncertainty set to derive a robust regularized minimum variance PSP based on the decomposition of covariance matrix proposed by Laloux et al. (1999). The proposed formulation was tested with the three major turmoils of the financial market (Black Monday, the Dotcom Bubble, and the Financial Crisis) and the results showed that the joint problem regularization and robustification outperforms the classical non-robust minimum variance and the non-regularized minimum variance PSP.

3.1.10 Robust Estimators for the Mean-Variance PSP

The classical mean-variance PSP is based on the Gaussian distribution assumption of asset returns. Based on historical evidence, Lauprete et al. (2003) showed that the returns of assets follow a heavy-tail distribution. Given that the uncertainty associated with the deviation of actual distribution functions from theoretical distribution functions might lead to sub-optimal solutions, they proposed a robust estimation that immunizes the estimators against uncertainty. DeMiguel & Nogales (2009) used two types of robust estimators (M-estimator and S-estimator) in the mean-variance PSP. M-estimator and S-estimator are based on convex symmetric and Tukey’s bi-weight loss functions, respectively. The S-estimator has the advantage of not being sensitive to data scaling. DeMiguel & Nogales (2009) analyzed the sensitivity of M-portfolios and S-portfolios’ (corresponding to M-estimator and S-estimator, respectively) weights with respect to the changes in the distribution of the asset returns. Results showed that these formulations are more robust than the traditional mean-variance PSP.

3.1.11 Experimental Analysis of the Robust Mean-Variance

Kim et al. (2013b) identified a gap in the literature about the experimental evidence of the robust PSP. They analyzed the robust mean-variance PSP with box and ellipsoidal uncertainty sets. Results showed that weights in the robust mean-variance PSP align with assets having a higher correlation with the Fama-French three factors model which bets on fundamental factors of assets. Interested readers are refereed to Fama & French (2021) for more detail about Fama-French three factors model. Kim et al. (2014b) also concluded that robust solutions of the mean-variance PSP depend on fundamental factors movements. In another analysis, Kim et al. (2013a) showed that robust equity mean-variance portfolios have four advantageous characteristics compared to non-robust mean-variance PSPs: (1) fewer stocks, (2) less exposure to each stock (the amount of money that the investor could lose on an investment), (3) higher portfolio beta, and (4) large negative correlation between weight and stock beta. Kim et al. (2018b) concluded that the robust mean-variance PSP leads to the most efficient investment strategies that allocate risk efficiently. Kim et al. (2015) also illustrated that the robust approach is the best method for formulating the mean-variance PSP while the market switches between multiple states.

Similarly, Schöttle & Werner (2009) analyzed the Markowitz efficient frontier of robust mean-variance PSP with ellipsoidal and joint ellipsoidal uncertainty sets. They showed that the efficient frontiers of both robust formulations are exactly matched with the efficient frontier of the classical mean-variance PSP up to some level of risk. This means that the classical mean-variance PSP is already robust without applying RO methods. However, the robust mean-variance formulation identifies the unreliable upper part of the efficient frontier.

Recently, Yin et al. (2021) proposed a practical guide to robust portfolio optimization based on mean-variance formulations. They assumed that asset returns are uncertain and belong to either box or an ellipsoidal uncertainty sets. By using practical examples, they showed that the robust mean-variance PSP with an ellipsoidal uncertainty set provides a more robust formulation than its corresponding problem with a box uncertainty set.

3.2 Robust Mean Absolute Deviation

Konno & Yamazaki (1991) argued that calculating the covariance matrix in large mean-variance PSPs is a challenging task. Hence, they proposed the mean absolute deviation as an alternative volatility-based risk measure that reduces the computational complexity of the covariance matrix. The MAD PSP is formulated as . This formulation can be transformed to an LP as . Besides being reformable as an LP, the MAD PSP has another advantage over the mean-variance PSP of not requiring the normality assumption for asset returns. However, MAD penalizes both positive and negative deviations equally, though positive deviations are desirable by investors. Moreover, in the classical MAD PSP, future asset returns are assumed to be known with certainty.

To handle the uncertainty of asset returns in the MAD PSP, Moon & Yao (2011) proposed a robust MAD PSP with a budget uncertainty set. However, Li et al. (2016) suggested that classical uncertainty sets do not capture the asymmetry in asset returns and, instead, proposed a robust MAD PSP with the asymmetric uncertainty set first introduced by Chen et al. (2007). Ghahtarani & Najafi (2018) developed a robust PSP based on m-MAD, a downside risk measure proposed by Michalowski & Ogryczak (2001) that penalizes only negative deviations. Chen et al. (2011a) proposed an alternative robust downside risk measure, referred to as lower partial moment (LPM), and used it, along with a moment-based ambiguity set, for single and multi-stage robust PSP that uses an -shape value function. An important advantage of robust LPM over robust m-MAD is that the former can be used also to develop robust VaR/CVaR formulations with moment-based ambiguity sets. To avoid the over-conservatism of worst-case approaches, Xidonas et al. (2017b) employed a robust min-max regret approach in a multi-objective PSP. The objectives to be optimized are expected asset returns and MAD. The proposed approach results in solutions that do not have to be safe according to the worst realization of the parameters, but to the relevant optimum of each scenario.

3.3 Factor-Based Portfolio Models

Factor-based models are financial models that incorporate factors (macroeconomic, fundamental, and statistical) to determine the market equilibrium and calculate the required rate of return. Goldfarb & Iyengar (2003) developed a robust factor-based model for a PSP where uncertainty is considered by its sources, namely fundamental factors. The basic formulation of a factor-based model is , where is the mean returns vector, is the vector of the factors that drive the market, is the matrix of the factor loading of assets, and is the vector of the residual returns. Uncertain parameters are the mean return, the factor loading, and the covariance of residuals that belong to uncertainty sets with upper and lower bounds. Goldfarb & Iyengar (2003) defined uncertainty sets for these parameters as }, , and , where is the column of and is an elliptic norm of with respect to . The return on a portfolio is given by . Both and are assumed to follow normal distributions, thus also follows a normal distribution. The robust factor-based model is developed based on two alternative assumptions. First, uncertainty in the mean is independent of the uncertainty in the covariance matrix of returns, which leads to a SOCP. Second, uncertainty in the mean depends on the uncertainty in the covariance matrix of the returns, which results in a SDP formulation for the worst-case VaR. It should be noted that the uncertainty sets in the robust factor-based models of Goldfarb & Iyengar (2003) are separable, leading to two important drawbacks: the results are conservative, and the robust portfolio constructed is not well diversified. Alternatively, Lu (2006) and Lu (2011) proposed robust factor-based models with a joint ellipsoidal uncertainty set that can be reformulated as a tractable cone programming problem. Additionally, Ling & Xu (2012) developed a robust factor-based model with joint marginal ellipsoidal uncertainty sets and options to hedge risks that generates robust portfolios with good wealth growth rates even if an extreme event occurs.

An important input to factor-based models is the “factor exposure”, which measures the reaction of factor-based models to risk factors. Kim et al. (2014c) argued that factor-based models are not robust against the uncertainty of risk factors such as macroeconomic factors. They proposed a robust factor-based model with an ellipsoidal uncertainty set that is robust against uncertainty and has the desired level of dependency on factor movements. This model manages the total portfolio risk by defining a robustness measure and a constraint that restricts the factor exposure of robust portfolios. Another evidence to support the use of robust factor-based models comes from Lutgens & Schotman (2010). They compared the Capital Asset Pricing Model (CAPM), the international CAPM, the international Fama, and the French factor-based models and showed that robust portfolios of factor models lead to better diversified portfolios.

3.4 Robust Utility Function PSP

Most PSPs are based on the return-risk trade-off concept. However, financial decisions might be made based on a utility function. Popescu (2007) developed a robust PSP for the expected utility function (the utility that an entity or aggregate economy is expected to reach under any number of circumstances) where the distribution function of asset returns is partially known and belongs to an ambiguity set with predetermined mean vector and covariance matrix. Natarajan et al. (2010) also proposed a less-complex robust formulation of the expected utility function PSP that uses a piecewise-linear concave function to model the investor’s utility. Besides the ambiguity set of Popescu (2007), Natarajan et al. (2010) considered the case in which the mean vector and covariance matrix of uncertain parameters belong to box uncertainty sets. Ma et al. (2008) incorporated a robust factor model with a concave-convex utility function to seize the advantages of both approaches. They assumed that the mean returns vector, the factor loading covariance, and the residual covariance matrix are uncertain and belong to uncertainty intervals. The robust counterpart turned out to be a parametric quadratic programming problem that can be solved explicitly. Biagini & Pınar (2017) proposed a min-max robust utility function for Merton problem. Merton’s portfolio problem is a well-known PSP problem where the investor must choose how much to consume and how allocate the remaining wealth between risky assets and a risk-free asset to maximize expected utility. An ellipsoidal uncertainty set is assumed to contain the drift from a compact values volatility realization.

4 Robust PSPs with Quantile-based Risk Measures

This section reviews robust quantile-based PSPs, which include PSPs based on the Value at Risk (VaR), Conditional Value at Risk (CVaR), and their extensions with worst-case RO, relative RO and distributionally robust optimization (DRO) methods. Furthermore, the relationship between uncertainty sets and risk measures, application of soft robust formulation with risk measures, worst-case CVaR and its relationship with the uniform investment strategy, and robust arbitrage pricing theory with worst-case CVaR are also discussed.

VaR is the maximum loss at a specific confidence level. In other words, VaR is the quantile of a loss distribution function, which is neither a convex nor coherent risk measure. A coherent risk measure is a function that satisfies the properties of monotonicity, sub-additivity, homogeneity, and translational invariance which provide computational advantages for a risk measure (see Artzner et al. (1999) for details about coherent risk measures). CVaR is a coherent risk measure that denotes expected loss greater than VaR for a specific confidence level. Let be a loss function. For a given confidence level , the Value at Risk is defined as , where . Conditional Value at Risk is the expected loss that exceeds , mathematically defined as . Rockafellar et al. (2000) proved that CVaR can be formulated as an optimization problem by defining an auxiliary function , where and . They also proved that CVaR can be reformulated as an LP when using discrete scenarios for asset returns. An important input to these formulations is , which is often not known or only partially known. Considering the ambiguity of leads to worst-case VaR and CVaR formulations.

4.1 Worst-Case VaR and CVaR

Ghaoui et al. (2003) were the first to propose a tractable reformulation for the worst-case VaR, defined as , where . The distribution function of asset returns is assumed to be partially known and belongs to one of the four moment-based ambiguity sets: 1) the first two moments (mean vector and covariance matrix ) of the loss distribution function are known and fixed. 2) the moments of the loss distribution function are known to belong to the convex set, , assuming that there is a point in such that . By introducing , the worst-case VaR for this case is formulated as . 3) polytopic uncertainty set defined as the convex hull of the vertices . The polytope uncertainty set is then constructed as , where and . By assuming that , the worst-case VaR is formulated as , where . Ghaoui et al. (2003) showed that this formulation can be transformed to a SOCP model. 4) componentwise bounds for moments. Ghaoui et al. (2003) also considered the worst-case VaR when the return of assets in the loss function is based on the factor model , where is an -vector of random factors, is the residual (unexplained) return, and is an matrix of sensitivities of the returns. The covariance matrix of returns is stated as , where is the diagonal covariance matrix of residuals and is the covariance matrix of factors. Two cases of parameter certainty are considered: uncertainty in the factor’s mean and covariance matrix, and uncertainty in the sensitivity matirx. In contrast to Ghaoui et al. (2003), the factor model of Goldfarb & Iyengar (2003) assumed that uncertainty in the mean is independent from that of the covariance matrix, leading the expected value of error term of the factor model to be equal to zero. This uncertainty structure leads to a SOCP reformulation, compared to the SDP reformulation of Ghaoui et al. (2003).

It is argued that the worst-case VaR is unrealistic and conservative. Therefore, a way to enforce the worst-case probability distribution to some level of smoothness was proposed by adding a relative entropy constraint (i.e., KL divergence) with respect to a given “reference” probability distribution. Whereas Ghaoui et al. (2003) assumed that the return of assets follows a Gaussian distribution, Belhajjam et al. (2017) argued that the distribution function of return is asymmetric. Hence, extreme returns occur more frequently than would be under the normal distribution. Hence, they proposed a multivariate extreme Value at Risk (MEVaR) formula based on a multivariate minimum return that considers extremums of returns, i.e., the lowest and highest daily returns. Since there is no guarantee that uncertain parameters belong to a symmetric uncertainty set, Natarajan et al. (2008) applied the asymmetric uncertainty set introduced by Chen et al. (2007) to develop a worst-case VaR measure. Results show that Asymmetry-Robust VaR (ARVaR) is an approximation of CVaR. Similar to Ghaoui et al. (2003), Natarajan et al. (2008) assumed that asset returns follow a factor model. Moreover, an asymmetric uncertainty set for the worst-case VaR leads to a tractable second-order cone program. Another less complex method to consider asymmetric uncertainty is to use interval random uncertainty sets. Chen et al. (2011b) developed a worst-case VaR assuming that the expected vector and covariance matrix of the returns are uncertain and belong to interval random uncertainty sets.

Huang et al. (2007) demonstrated that the exit time of investment (or the investment horizon) which is traditionally assumed to be deterministic, can, in reality, depend on market conditions. Consequently, they considered a conditional distribution function of the rate of return based on different exit times instead of the unconditional distribution function previously used in Ghaoui et al. (2003). Three robust portfolio formulations were proposed: 1) a portfolio formulation with componentwise uncertainty on moments of the conditional distribution function of exit time. 2) a portfolio formulation with semi-ellipsoidal uncertainty set on exit time. 3) moments of the conditional distribution function of exit time belonging to a polytope uncertainty set for each exit time. Huang et al. (2008) also assumed that the density function of exit time is only known to belong to an ambiguity set that covers all possible exit scenarios. They developed two formulations: a worst-case VaR with no information about exit time, and a formulation with partial information about exit time.

Kelly Jr (1956) proposed an investment strategy in the financial market (known as Kelly Strategy), which maximizes an expected portfolio growth rate. From a mathematical perspective, implementing the Kelly strategy is synonymous with solving a multi-period investment strategy, making it amenable to robust approaches for handling uncertainty. Rujeerapaiboon et al. (2016) considered Kelly’s strategy under return uncertainty and proposed a formulation that includes the constraint , where is an expected total portfolio return, and is the confidence level. This chance constraint is, simply, the definition of VaR. In this formulation, the distribution function of asset returns is assumed to be uncertain and belongs to the class of moment-based ambiguity set introduced in Delage & Ye (2010). This ambiguity set leads to a SDP formulation for the worst-case VaR.

As mentioned earlier, VaR has a high computational complexity since it is not convex. Zhu & Fukushima (2009) proposed a PSP that maximizes the worst-case CVaR, defined as , with three cases of uncertainty set for the probabilities of discrete return scenarios: a mixture distribution, a box uncertainty set, and an ellipsoidal uncertainty set. The last case led to a SOCP, whereas the first two cases resulted in LPs. A mixture distribution is defined as , which leads to: , where . The box uncertainty set for probability distribution is defined as , whereas the ellipsoidal uncertainty set for probability distribution function is defiend as , where and is the nominal distribution. Doan et al. (2015) extended the worst-case CVaR formulation of Zhu & Fukushima (2009) by proposing a data-driven approach to construct a class of distributions for asset returns, known as Fréchet distributions, that leads to less conservative solutions than the worst-case CVaR. Moreover, Hasuike & Mehlawat (2018) incorporated the arbitrage pricing theory (APT) model, which is a multi-factor model, in a bi-objective PSP that aims at maximizing the expected return and minimizing the worst-case CVaR of a portfolio. Ghahtarani et al. (2018) proposed a robust CVaR formulation by considering the uncertainty of the return distribution’s parameters. They proposed a robust mean-CVaR PSP with a chance constraint when asset returns follow a Gaussian distribution with uncertain moments. Hellmich & Kassberger (2011), in contrast, developed a worst-case CVaR model with asset returns that follows a heavy-tail multivariate generalized hyperbolic distribution. Their formulation can also capture the asymmetrical nature of asset returns.

One way to alleviate the over-conservatism of the worst-case VaR/CVaR solutions is to use a data-driven joint ellipsoidal uncertainty set in which the first two moments of the distribution function of asset returns are in an ellipsoid norm. Lotfi & Zenios (2018) proposed an algorithm for constructing data-driven ambiguity sets based on an optimization model to find the centers of joint ellipsoidal uncertainty sets. In another attempt, Liu et al. (2019) used the data-driven moment-based ambiguity set introduced in Delage & Ye (2010) to propose a worst-case CVaR in both single and multi-period PSPs. In this formulation, for each period there is a separate ambiguity set. They demonstrated that a robust counterpart of the multi-period mean-CVaR PSP can be solved as a sequence of optimization problems based on an adaptive robust formulation. Kang et al. (2019) argued that the ambiguity set of Delage & Ye (2010) leads to solutions that are too conservative. Therefore, they altered it by adding a zero-net adjustment constraint. Huang et al. (2021) proposed a distributionally robust mean-CVaR PSP with a moment-based ambiguity set. Besides DRO, they used an norm to limit the weights (decision variables) of the, so called, sparse PSP to limit the impact of noisy data. Results provide evidence that a sparce mean-CVaR PSP has better performance than a non-sparce formulation with respect to net portfolio return, Sharpe ratio, and cumulative return. Moreover, Zhao et al. (2021) formulated a cardinality-constrained rebalancing worst-case CVaR with a moment-based ambiguity set. The proposed formulation enhances the portfolio diversification.

Huang et al. (2010) claimed that investors usually do not want to pay the price of full robustness to protect their portfolios against the worst possible scenario. In an uncertain environment, investors may rather choose a strategy that avoids falling behind their competitors. According to this point of view, for each choice of decision variables and each scenario, the decision-maker compares the resulted objective value to the optimal value obtained under model uncertainty described by the scenario. The difference or the ratio of these two values is a regret measure. To minimize these regrets measures, Huang et al. (2010) developed a relative CVaR formulation, mathematically described as , where . However, since the true distribution () is not known, decision-makers try to make the relative CVaR as small as possible by considering all possible values. Consequently, a finite number of forecasts for the distribution function of asset returns is considered. Results showed that the relative CVaR is less conservative than the worst-case CVaR for optimal portfolio return. Alternatively, Yu et al. (2017) proposed a relative CVaR and a worst-case CVaR by adjusting the required return from a fixed rate to a floating rate that changes according to market dynamics. Moreover, the formulation was extended by allowing short sale and adding a transaction cost constraint. Results showed that a relative CVaR yields slightly higher realized returns, lower trading costs, and better portfolio diversification than its corresponding worst-case CVaR model when the required return is fixed. Additionally, the out-of-sample performance of floating-return models compared to fixed-rate models is significantly better during periods when a market recovers from a financial crisis. Finally, robust floating-return models have a better asset allocation, save transaction costs, and attribute to superior profitability. Benati & Conde (2021) proposed a model that minimizes the maximum regret on the expected returns while the conditional value-at-risk is bounded under different scenario settings. To solve this problem, a cutting plane approach was proposed.

An investment strategy that is widely used in financial markets is the uniform investment strategy or rule, which divides the budget among assets equally. Pflug et al. (2012) demonstrated that the uniform investment strategy is the best strategy for investment under uncertainty. They proposed robust mean-CVaR and mean-variance PSPs where the distribution function of asset returns is uncertain and belongs to a Kantorovich or Wasserstein metric-based ambiguity set. Results showed that when the size of the Wasserstein ambiguity set is infinity, solutions of the robust PSPs are equal to the uniform investment strategy. Hence, the optimal investment strategy in a high ambiguity situation is the uniform investment or rule. However, Pflug et al. (2012) assumed that all assets are subject to uncertainty though it is possible to use fixed-income assets with no ambiguity or uncertainty in the portfolio. Therefore, Paç & Pınar (2018) extended the robust uniform strategy of Pflug et al. (2012) by considering both ambiguous and unambiguous assets. They showed that by increasing the ambiguity level, measured by the radius of the ambiguity set, the optimal portfolio tends to use equal weights for all assets. Also, high levels of ambiguity result in portfolios that avoid ambiguous assets and favor unambiguous assets.

Finally, Natarajan et al. (2009) established the relationship between risk measures and uncertainty sets. They showed that using an ellipsoidal uncertainty set for asset returns corresponds to the classical mean-variance PSP, whereas the CVaR formulation results from using a special polyhedral uncertainty set. As discussed by Ben-Tal et al. (2010), in soft robust formulations, a penalty function is introduced such that if uncertain parameters fluctuate in the uncertainty set, the penalty function equals zero. Otherwise, the penalty function takes a positive value. Recchia & Scutellà (2014) proved that the definition of a convex risk measure is also based on a penalty function that is called norm-portfolio models, where using , , and -norm result in an LP for a norm-portfolio model. On the other hand, using a euclidean norm results in a SOCP, whereas applying a -norm, proposed by Bertsimas et al. (2004b), for a penalty function with specific parameters leads to the CVaR formulation.

4.1.1 Worst-Case CVaR with Copula

Classical multivariate distribution functions make the worst-case CVaR computationally complex. One way to address this issue is to use copulas instead of multivariate distribution functions for asset returns. Copulas are multivariate distribution functions whose one-dimensional margins are uniformly distributed on a closed interval . One-dimensional margins of copulas can be replaced by univariate cumulative distributions of random variables. Hence, copulas consider the dependency between marginal distributions of random variables instead of focusing directly on dependency between random variables themselves. This characteristic makes them more flexible than standard distributions, and also an interesting candidate for the distribution function of the rate of return in the worst-case CVaR.

Kakouris & Rustem (2014) used Archimedean copulas to propose worst-case CVaR PSPs that avoids the shortcomings of worst-case CVaR PSPs based on a Gaussian distribution, which is a symmetric distribution for asset returns. There are three Archimedean copulas: the Clayton copula, the Gumbel copula, and the Frank copula. Kakouris & Rustem (2014) used a heuristic method to estimate copulas’ parameters in the context of a multi-asset PSP. However, simulating data from three Archimedian copulas has computational challenges. On the other hand, Han et al. (2017) claimed that the formulation of Kakouris & Rustem (2014) is static, making it unable to deal with the dynamic nature of the financial market. They, instead, proposed a dynamic robust PSP with Archimedean copulas by using dynamic conditional correlation (DCC) copulas and copula-GARCH model to forecast the worst-case CVaR of bi-variate portfolios. Results show that dynamic worst-case CVaR models can put more weight on assets with lower volatility, which leads to a less aggressive trading strategy.

CVaR calculates the expected loss based on just one confidence level. However, decision-makers might prefer different confidence levels based on their risk attitude. One way to increase the flexibility of CVaR related to decision-makers’ risk attitude is to use Mixed-CVaR and Mixed Deviation-CVaR. These mixed risk measures combine CVaRs with different confidence levels. Goel et al. (2019) proposed robust Mixed-CVaR and Mixed Deviation-CVaR Stable Tail-Adjusted Return Ratio (STARR), which is the portfolio return minus the risk-free rate of return divided by the expected tail loss (at a specific confidence level). Finally, a mixture copula set was used to consider distribution ambiguity, which resulted in an LP.

4.2 Robust Mean-CVaR/Shortfall PSP

Besides the worst-case VaR and CVaR, some researchers developed robust mean-CVaR PSPs where the distribution function of the loss function is assumed to be deterministic while returns of assets or weights of the mixture distribution function of the rate of return are uncertain. Thus, classical uncertainty sets are used to develop robust mean-CVaR PSPs. Quaranta & Zaffaroni (2008) proposed a robust mean-CVaR with a box uncertainty set that leads to an LP. Kara et al. (2019) also proposed a robust mean-CVaR PSP with a parallelepiped uncertainty set, developed by Özmen et al. (2011). The parallelepiped uncertainty set is practically a box uncertainty set while its elements are a convex hull of canonical vertices of an uncertain matrix. Elements of this uncertainty set are founded by the Cartesian product of uncertain intervals. An advantage of a parallelepiped uncertainty set over a box uncertainty set is that the lengths of intervals may vary among each other. Moreover, instead of a single price, it is possible to consider multiple and flexible varying prices of assets and also take into account likewise flexible returns. To reduce the conservatism of solutions of a robust mean-CVaR with a box uncertainty set, Guastaroba et al. (2011) developed a robust mean-CVaR with ellipsoidal and budget uncertainty sets, which lead to a SOCP and an LP, respectively. Besides the uncertainty of parameters, a mean-CVaR PSP has a multi-objective characteristic as it maximizes the expected return while minimizing the risk (CVaR). Then, a multi-objective formulation can capture the multiple-criteria nature of this problem. Rezaie et al. (2015) developed a robust bi-objective mean-CVaR PSP with a budget uncertainty set. An ideal and anti-ideal compromise programming approach was used to solve the proposed problem. This method seeks an answer as close as possible to the ideal value and as far as possible from the anti-ideal value of each objective. Ideal and anti-ideal values reflect investors’ perspectives of the real world.

Another development of a robust mean-CVaR is based on mixture distribution functions. There are three reasons for using a mixture distribution function for asset returns. First, it is a combination of multiple distribution functions, thus enabling different market conditions with different distribution functions to be considered. Moreover, it replaces the estimation of the distribution function by a calculation of the distribution weights in a mixture distribution function. Finally, since any distribution function can be simulated by using a mixture of Gaussian distribution functions, a mixture distribution function has high flexibility. Zhu et al. (2014) used a mixture distribution function for asset returns to propose a robust mean-CVaR PSP. The uncertainty in their formulation is about the weights of distribution functions. For considering the uncertainty, ellipsoidal and box uncertainty sets were used. The former leads to a SOCP and the latter results in an LP.