Continuous Mean-Covariance Bandits

Abstract

Existing risk-aware multi-armed bandit models typically focus on risk measures of individual options such as variance. As a result, they cannot be directly applied to important real-world online decision making problems with correlated options. In this paper, we propose a novel Continuous Mean-Covariance Bandit (CMCB) model to explicitly take into account option correlation. Specifically, in CMCB, there is a learner who sequentially chooses weight vectors on given options and observes random feedback according to the decisions. The agent’s objective is to achieve the best trade-off between reward and risk, measured with option covariance. To capture different reward observation scenarios in practice, we consider three feedback settings, i.e., full-information, semi-bandit and full-bandit feedback. We propose novel algorithms with rigorous regret analysis, and provide nearly matching lower bounds to validate their optimalities (in terms of the number of timesteps ). The experimental results also demonstrate the superiority of our algorithms. To the best of our knowledge, this is the first work that considers option correlation in risk-aware bandits and explicitly quantifies how arbitrary covariance structures impact the learning performance. The novel analytical techniques we developed for exploiting the estimated covariance to build concentration and bounding the risk of selected actions based on sampling strategy properties can likely find applications in other bandit analysis and be of independent interests.

1 Introduction

The stochastic Multi-Armed Bandit (MAB) Auer et al. (2002a); Thompson (1933); Agrawal and Goyal (2012) problem is a classic online learning model, which characterizes the exploration-exploitation trade-off in decision making. Recently, due to the increasing requirements of risk guarantees in practical applications, the Mean-Variance Bandits (MVB) Sani et al. (2012); Vakili and Zhao (2016); Zhu and Tan (2020) which aim at balancing the rewards and performance variances have received extensive attention. While MVB provides a successful risk-aware model, it only considers discrete decision space and focuses on the variances of individual arms (assuming independence among arms).

However, in many real-world scenarios, a decision often involves multiple options with certain correlation structure, which can heavily influence risk management and cannot be ignored. For instance, in finance, investors can select portfolios on multiple correlated assets, and the investment risk is closely related to the correlation among the chosen assets. The well-known “risk diversification” strategy Butler and Domian (1991) embodies the importance of correlation to investment decisions. In clinical trials, a treatment often consists of different drugs with certain ratios, and the correlation among drugs plays an important role in the treatment risk. Failing to handle the correlation among multiple options, existing MVB results cannot be directly applied to these important real-world tasks.

Witnessing the above limitation of existing risk-aware results, in this paper, we propose a novel Continuous Mean-Covariance Bandit (CMCB) model, which considers a set of options (base arms) with continuous decision space and measures the risk of decisions with the option correlation. Specifically, in this model, a learner is given base arms, which are associated with an unknown joint reward distribution with a mean vector and covariance. At each timestep, the environment generates an underlying random reward for each base arm according to the joint distribution. Then, the learner selects a weight vector of base arms and observes the rewards. The goal of the learner is to minimize the expected cumulative regret, i.e., the total difference of the reward-risk (mean-covariance) utilities between the chosen actions and the optimal action, where the optimal action is defined as the weight vector that achieves the best trade-off between the expected reward and covariance-based risk. To capture important observation scenarios in practice, we consider three feedback settings in this model, i.e., full-information (CMCB-FI), semi-bandit (CMCB-SB) and full-bandit (CMCB-FB) feedback, which vary from seeing rewards of all options to receiving rewards of the selected options to only observing a weighted sum of rewards.

The CMCB framework finds a wide range of real-world applications, including finance Markowitz et al. (1952), company operation McInnerney and Roberts (2004) and online advertising Schwartz et al. (2017). For example, in stock markets, investors choose portfolios based on the observed prices of all stocks (full-information feedback), with the goal of earning high returns and meanwhile minimizing risk. In company operation, managers allocate investment budgets to several correlated business and only observe the returns of the invested business (semi-bandit feedback), with the objective of achieving high returns and low risk. In clinical trials, clinicians select a treatment comprised of different drugs and only observe an overall therapeutic effect (full-bandit feedback), where good therapeutic effects and high stability are both desirable.

For both CMCB-FI and CMCB-SB, we propose novel algorithms and establish nearly matching lower bounds for the problems, and contribute novel techniques in analyzing the risk of chosen actions and exploiting the covariance information. For CMCB-FB, we develop a novel algorithm which adopts a carefully designed action set to estimate the expected rewards and covariance, with non-trivial regret guarantees. Our theoretical results offer an explicit quantification of the influences of arbitrary covariance structures on learning performance, and our empirical evaluations also demonstrate the superior performance of our algorithms.

Our work differs from previous works on bandits with covariance Warmuth and Kuzmin (2006, 2012); Degenne and Perchet (2016); Perrault et al. (2020) in the following aspects. (i) We consider the reward-risk objective under continuous decision space and stochastic environment, while existing works study either combinatorial bandits, where the decision space is discrete and risk is not considered in the objective, or adversarial online optimization. (ii) We do not assume a prior knowledge or direct feedback on the covariance matrix as in Warmuth and Kuzmin (2006, 2012); Degenne and Perchet (2016). (iii) Our results for full-information and full-bandit feedback explicitly characterize the impacts of arbitrary covariance structures, whereas prior results, e.g., Degenne and Perchet (2016); Perrault et al. (2020), only focus on independent or positively-correlated cases. These differences pose new challenges in algorithm design and analysis, and demand new analytical techniques.

We summarize the main contributions as follows.

-

•

We propose a novel risk-aware bandit model called continuous mean-covariance bandit (CMCB), which considers correlated options with continuous decision space, and characterizes the trade-off between reward and covariance-based risk. Motivated by practical reward observation scenarios, three feedback settings are considered under CMCB, i.e., full-information (CMCB-FI), semi-bandit (CMCB-SB) and full-bandit (CMCB-FB).

-

•

We design an algorithm for CMCB-FI with a regret, and develop a novel analytical technique to build a relationship on risk between chosen actions and the optimal one using properties of the sampling strategy. We also derive a nearly matching lower bound, by analyzing the gap between hindsight knowledge and available empirical information under a Bayesian environment.

-

•

For CMCB-SB, we develop , an algorithm that exploits the estimated covariance information to construct confidence intervals and achieves a regret. A regret lower bound is also established, by investigating the necessary regret paid to differentiate two well-chosen distinct instances.

-

•

We propose a novel algorithm for CMCB-FB, which employs a well-designed action set to carefully estimate the reward means and covariance, and achieves a regret guarantee under the severely limited feedback.

To our best knowledge, our work is the first to explicitly characterize the influences of arbitrary covariance structures on learning performance in risk-aware bandits. Our results shed light into risk management in online decision making with correlated options. Due to space limitation, we defer all detailed proofs to the supplementary material.

2 Related Work

(Risk-aware Bandits) Sani et al. Sani et al. (2012) initiate the classic mean-variance paradigm Markowitz et al. (1952); Gasser et al. (2017) in bandits, and formulate the mean-variance bandit problem, where the learner plays a single arm each time and the risk is measured by the variances of individual arms. Vakili & Zhao Vakili and Zhao (2015, 2016) further study this problem under a different metric and complete the regret analysis. Zhu & Tan Zhu and Tan (2020) provide a Thompson Sampling-based algorithm for mean-variance bandits. In addition to variance, several works consider other risk criteria. The VaR measure is studied in David and Shimkin (2016), and CVaR is also investigated to quantify the risk in Galichet et al. (2013); Kagrecha et al. (2019). Cassel et al. Cassel et al. (2018) propose a general risk measure named empirical distributions performance measure (EDPM) and present an algorithmic framework for EDPM. All existing studies on risk-aware bandits only consider discrete decision space and assume independence among arms, and thus they cannot be applied to our CMCB problem.

(Bandits with Covariance) In the stochastic MAB setting, while there have been several works Degenne and Perchet (2016); Perrault et al. (2020) on covariance, they focus on the combinatorial bandit problem without considering risk. Degenne & Perchet Degenne and Perchet (2016) study the combinatorial semi-bandits with correlation, which assume a known upper bound on the covariance, and design an algorithm with this prior knowledge of covariance. Perrault et al. Perrault et al. (2020) further investigate this problem without the assumption on covariance under the sub-exponential distribution framework, and propose an algorithm with a tight asymptotic regret analysis. In the adversarial setting, Warmuth & Kuzmin Warmuth and Kuzmin (2006, 2012) consider an online variance minimization problem, where at each timestep the learner chooses a weight vector and receives a covariance matrix, and propose the exponentiated gradient based algorithms. Our work differs from the above works in the following aspects: compared to Degenne and Perchet (2016); Perrault et al. (2020), we consider a continuous decision space instead of combinatorial space, study the reward-risk objective instead of only maximizing the expected reward, and investigate two more feedback settings other than the semi-bandit feedback. Compared to Warmuth and Kuzmin (2006, 2012), we consider the stochastic environment and in our case, the covariance cannot be directly observed and needs to be estimated.

3 Continuous Mean-Covariance Bandits (CMCB)

Here we present the formulation for the Continuous Mean-Covariance Bandits (CMCB) problem. Specifically, a learner is given base arms labeled and a decision (action) space , where denotes the probability simplex in . The base arms are associated with an unknown -dimensional joint reward distribution with mean vector and positive semi-definite covariance matrix , where for any without loss of generality. For any action , which can be regarded as a weight vector placed on the base arms, the instantaneous reward-risk utility is given by the following mean-covariance function

| (1) |

where denotes the expected reward, represents the risk, i.e., reward variance, and is a risk-aversion parameter that controls the weight placed on the risk. We define the optimal action as . Compared to linear bandits Abbasi-Yadkori et al. (2011); Kazerouni et al. (2017), the additional quadratic term in raises significant challenges in estimating the covariance, bounding the risk of chosen actions and deriving covariance-dependent regret bounds.

At each timestep , the environment generates an underlying (unknown to the learner) random reward vector according to the joint distribution, where is a zero-mean noise vector and it is independent among different timestep . Note that here we consider an additive vector noise to the parameter , instead of the simpler scalar noise added in the observation (i.e., ) as in linear bandits Abbasi-Yadkori et al. (2011); Kazerouni et al. (2017). Our noise setting better models the real-world scenarios where distinct actions incur different risk, and enables us to explicitly quantify the correlation effects. Following the standard assumption in the bandit literature Locatelli et al. (2016); Degenne and Perchet (2016); Zhu and Tan (2020), we assume the noise is sub-Gaussian, i.e., , , where is unknown. The learner selects an action and observes the feedback according to a certain structure (specified later). For any time horizon , define the expected cumulative regret as

The objective of the learner is to minimize . Note that our mean-covariance function Eq. (1) extends the popular mean-variance measure Sani et al. (2012); Vakili and Zhao (2016); Zhu and Tan (2020) to the continuous decision space.

In the following, we consider three feedback settings motivated by reward observation scenarios in practice, including (i) full-information (CMCB-FI), observing random rewards of all base arms after a pull, (ii) semi-bandit (CMCB-SB), only observing random rewards of the selected base arms, and (iii) full-bandit (CMCB-FB), only seeing a weighted sum of the random rewards from base arms. We will present the formal definitions of these three feedback settings in the following sections.

Notations. For action , let be a diagonal matrix such that . For a matrix , let and be a diagonal matrix with the same diagonal as .

4 CMCB with Full-Information Feedback (CMCB-FI)

We start with CMCB with full-information feedback (CMCB-FI). In this setting, at each timestep , the learner selects and observes the random reward for all . CMCB-FI provides an online learning model for the celebrated Markowitz Markowitz et al. (1952); Gasser et al. (2017) problem in finance, where investors select portfolios and can observe the prices of all stocks at the end of the trading days.

Below, we propose an efficient Mean-Covariance Empirical algorithm () for CMCB-FI, and provide a novel regret analysis that fully characterizes how an arbitrary covariance structure affects the regret performance. We also present a nearly matching lower bound for CMCB-FI to demonstrate the optimality of .

4.1 Algorithm for CMCB-FI

Algorithm 1 shows the detailed steps of . Specifically, at each timestep , we use the empirical mean and covariance to estimate and , respectively. Then, we form , an empirical mean-covariance function of , and always choose the action with the maximum empirical objective value.

Although appears to be intuitive, its analysis is highly non-trivial due to covariance-based risk in the objective. In this case, a naive universal bound cannot characterize the impact of covariance, and prior gap-dependent analysis (e.g., Degenne and Perchet (2016); Perrault et al. (2020)) cannot be applied to solve our continuous space analysis with gap approximating to zero. Instead, we develop two novel techniques to handle the covariance, including using the actual covariance to analyze the confidence region of the expected rewards, and exploiting the empirical information of the sampling strategy to bound the risk gap between selected actions and the optimal one. Different from prior works Degenne and Perchet (2016); Perrault et al. (2020), which assume a prior knowledge on covariance or only focus on the independent and positively-related cases, our analysis does not require extra knowledge of covariance and explicitly quantifies the effects of arbitrary covariance structures. The regret performance of is summarized in Theorem 1.

Theorem 1 (Upper Bound for CMCB-FI).

Consider the continuous mean-covariance bandits with full-information feedback (CMCB-FI). For any , algorithm (Algorithm 1) achieves an expected cumulative regret bounded by

| (2) |

where , and .

Proof sketch. Let be the diagonal matrix which takes value at each diagonal entry. We first build confidence intervals for the expected rewards of actions and the covariance as and . Here , , and and are positive constants. Then, we obtain the confidence interval of as , where is a matrix with all entries equal to . Since algorithm always plays the empirical best action, we have . Plugging the definitions of and , we have

| (3) |

where and is a positive constant. Since our goal is to bound the regret and in inequality (a) only the term is a variable, the challenge falls on bounding . Note that the left-hand-side of Eq. (3) is linear with respect to and the right-hand-side only contains . Then, using the property of sampling strategy on , i.e., Eq. (3), again, after some algebraic analysis, we obtain for some constant . Plugging it into inequality (a) and doing a summation over , we obtain the theorem. ∎

Remark 1. Theorem 1 fully characterizes how an arbitrary covariance structure impacts the regret bound. To see this, note that in Eq. (2), under the operation, the first -related term dominates under reasonable , and shrinks from positive to negative correlation, which implies that the more the base arms are negatively (positively) correlate, the lower (higher) regret the learner suffers. The intuition behind is that the negative (positive) correlation diversifies (intensifies) the risk of estimation error and narrows (enlarges) the confidence region for the expected reward of an action, which leads to a reduction (an increase) of regret.

Also note that when , the CMCB-FI problem reduces to a -armed bandit problem with full-information feedback, and Eq. (2) becomes . For this degenerated case, the optimal gap-dependent regret is for constant gap . By setting at this gap-dependent result, one obtains the optimal gap-independent regret . Hence, when , Eq. (2) still offers a tight gap-independent regret bound with respect to .

4.2 Lower Bound for CMCB-FI

Now we provide a regret lower bound for CMCB-FI to corroborate the optimality of .

Since CMCB-FI considers full-information feedback and continuous decision space where the reward gap (between the optimal action and the nearest optimal action) approximates to zero, existing lower bound analysis for linear Dani et al. (2008a, b) or discrete Lai and Robbins (1985); Degenne and Perchet (2016); Perrault et al. (2020) bandit problems cannot be applied to this problem.

To tackle this challenge, we contribute a new analytical procedure to establish the lower bound for continuous and full-information bandit problems from the Bayesian perspective. The main idea is to construct an instance distribution, where is drawn from a well-chosen prior Gaussian distribution. After pulls the posterior of is still Gaussian with a mean vector related to sample outcomes. Since the hindsight strategy simply selects the action which maximizes the mean-covariance function with respect to while a feasible strategy can only utilize the sample information (), we show that any algorithm must suffer regret due to the gap between random and its mean . Theorem 2 below formally states this lower bound.

Theorem 2 (Lower Bound for CMCB-FI).

There exists an instance distribution of the continuous mean-covariance bandits with full-information feedback problem (CMCB-FI), for which any algorithm has an expected cumulative regret bounded by .

Remark 2. This parameter-free lower bound demonstrates that the regret upper bound of (Theorem 1) is near-optimal with respect to . Unlike discrete bandit problems Lai and Robbins (1985); Degenne and Perchet (2016); Perrault et al. (2020) where the optimal regret is usually for constant gap , CMCB-FI has a continuous decision space with gap and a polylogarithmic regret is not achievable in general.

5 CMCB with Semi-Bandit Feedback (CMCB-SB)

In many practical tasks, the learner may not be able to simultaneously select (place positive weights on) all options and observe full information. Instead, the weight of each option is usually lower bounded and cannot be arbitrarily small. As a result, the learner only selects a subset of options and obtains their feedback, e.g., company investments Diadin (2019) on multiple business.

Motivated by such tasks, in this section we consider the CMCB problem with semi-bandit feedback (CMCB-SB), where the decision space is a restricted probability simplex for some constant .111When , the learner can only place all weight on one option, and the problem trivially reduces to the mean-variance bandit setting Sani et al. (2012); Zhu and Tan (2020). In this case, our Theorem 3 still provides a tight gap-independent bound. In this scenario, at timestep , the learner selects and only observes the rewards from the base arms that are placed positive weights on. Below, we propose the Mean-Covariance Upper Confidence Bound algorithm () for CMCB-SB, and provide a regret lower bound, which shows that achieves the optimal performance with respect to .

5.1 Algorithm for CMCB-SB

Algorithm for CMCB-SB is described in Algorithm 2. The main idea is to use the optimistic covariance to construct a confidence region for the expected reward of an action and calculate an upper confidence bound of the mean-covariance function, and then select the action with the maximum optimistic mean-covariance value.

In Algorithm 2, denotes the number of times occurs among timestep . is an indicator variable that takes value if and otherwise. is a diagonal matrix such that . In Line 2, we update the number of observations by for all and for all (due to the initialized pulls), and calculate the empirical mean and empirical covariance using the equations in Lines 10,11.

For any and , we define the confidence radius of covariance as , and the confidence region for the expected reward of action as

where is the regularization parameter, is the confidence term and is the confidence parameter. At each timestep , algorithm calculates the upper confidence bound of using and , and selects the action that maximizes this upper confidence bound. Then, the learner observes rewards with and update the statistical information according to the feedback.

In regret analysis, unlike Degenne and Perchet (2016) which uses a universal upper bound to analyze confidence intervals, we incorporate the estimated covariance into the confidence region for the expected reward of an action, which enables us to derive tighter regret bound and explictly quantify the impact of the covariance structure on algorithm performance. We also contribute a new technique for handling the challenge raised by having different numbers of observations among base arms, in order to obtain an optimal regret (here prior gap-dependent analysis Degenne and Perchet (2016); Perrault et al. (2020) still cannot be applied to solve this continuous problem). Theorem 3 gives the regret upper bound of algorithm .

Theorem 3 (Upper Bound for CMCB-SB).

Consider the continuous mean-covariance bandits with semi-bandit feedback problem (CMCB-SB). Then, for any , algorithm (Algorithm 2) with regularization parameter has an expected cumulative regret bounded by

where and for any .

Remark 3. Theorem 3 captures the effects of covariance structures in CMCB-SB, i.e., positive correlation renders a larger factor than the negative correlation or independent case, since the covariance influences the rate of estimate concentration for the expected rewards of actions. The regret bound for CMCB-SB has a heavier dependence on than that for CMCB-FI. This matches the fact that semi-bandit feedback only reveals rewards of the queried dimensions, and provides less information than full-information feedback in terms of observable dimensions.

5.2 Lower Bound for CMCB-SB

In this subsection, we establish a lower bound for CMCB-SB, and show that algorithm achieves the optimal regret with respect to up to logarithmic factors.

The insight of the lower bound analysis is to construct two instances with a gap in the expected reward vector , where the optimal actions under these two instances place positive weights on different base arms. Then, when the gap is set to , any algorithm must suffer regret for differentiating these two instances. Theorem 4 summarizes the lower bound for CMCB-SB.

Theorem 4 (Lower Bound for CMCB-SB).

There exists an instance distribution of the continuous mean-covariance bandits with semi-bandit feedback (CMCB-SB) problem, for which any algorithm has an expected cumulative regret bounded by .

Remark 4. Theorem 4 demonstrates that the regret upper bound of (Theorem 3) is near-optimal in terms of . Similar to CMCB-FI, CMCB-SB considers continuous decision space with , and thus the lower bound differs from those gap-dependent results in discrete bandit problems Lai and Robbins (1985); Degenne and Perchet (2016); Perrault et al. (2020).

6 CMCB with Full-Bandit Feedback (CMCB-FB)

In this section, we further study the CMCB problem with full-bandit feedback (CMCB-FB), where at timestep , the learner selects and only observes the weighted sum of random rewards, i.e., . This setting models many real-world decision making tasks, where the learner can only attain an aggregate feedback from the chosen options, such as clinical trials Villar et al. (2015).

6.1 Algorithm for CMCB-FB

We propose the Mean-Covariance Exploration-Then-Exploitation algorithm () for CMCB-FB in Algorithm 3. Specifically, we first choose a design action set which contains actions and satisfies that and are of full column rank. We also denote their Moore-Penrose inverses by and , and it holds that and . There exist more than one feasible , and for simplicity and good performance we choose as standard basis vectors in and as the set of all vectors where each vector has two entries equal to and others equal to .

In an exploration round (Lines 8-21), we pull the designed actions in and maintain their empirical rewards and variances. Through linear transformation by and , we obtain the estimators of the expected rewards and covariance of base arms (Lines 16-17). When the estimation confidence is high enough, we exploit the attained information to select the empirical best action (Lines 5). Theorem 5 presents the regret guarantee of .

Theorem 5 (Upper Bound for CMCB-FB).

Consider the continuous mean-covariance bandits with full-bandit feedback problem (CMCB-FB). Then, for any , algorithm (Algorithm 3) achieves an expected cumulative regret bounded by

where , , and .

Remark 5. The choice of will affect the regret factor contained in . Under our construction, can be regarded as a uniform representation of covariance , and thus our regret bound demonstrates how the learning performance is influenced by the covariance structure, i.e., negative (positive) correlation shrinks (enlarges) the factor and leads to a lower (higher) regret.

Discussion on the ETE strategy. In contrast to common ETE-type algorithms, requires novel analytical techniques in handling the transformed estimate concentration while preserving the covariance information in regret bounds. In analysis, we build a novel concentration using key matrices and to adapt to the actual covariance structure, and construct a super-martingale which takes the aggregate noise in an exploration round as analytical basis to prove the concentration. These techniques allow us to capture the correlations in the results, and are new compared to both the former FI/SB settings and covariance-related bandit literature Warmuth and Kuzmin (2012); Degenne and Perchet (2016); Perrault et al. (2020).

In fact, under the full-bandit feedback, it is highly challenging to estimate the covariance without using a fixed exploration (i.e., ETE) strategy. Note that even for its simplified offline version, where one uses given (non-fixed) full-bandit data to estimate the covariance, there is no available solution in the statistics literature to our best knowledge. Hence, for such online tasks with severely limited feedback, ETE is the most viable strategy currently available, as used in many partial observation works Lin et al. (2014); Chaudhuri and Tewari (2016); Chen et al. (2018). We remark that our contribution in this setting focuses on designing a practical solution and deriving regret guarantees which explicitly characterize the correlation impacts. The lower bound for CMCB-FB remains open, which we leave for future work.

7 Experiments

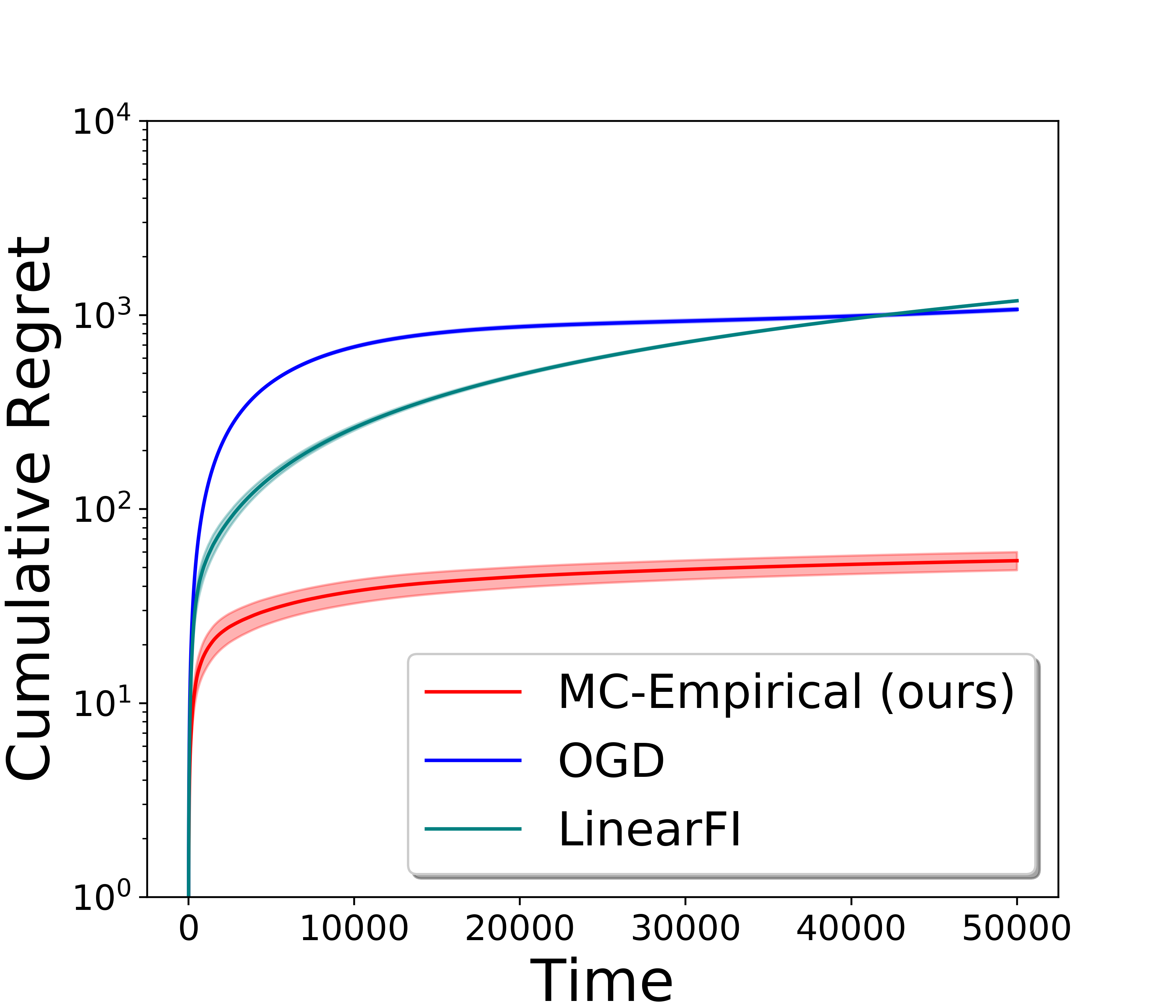

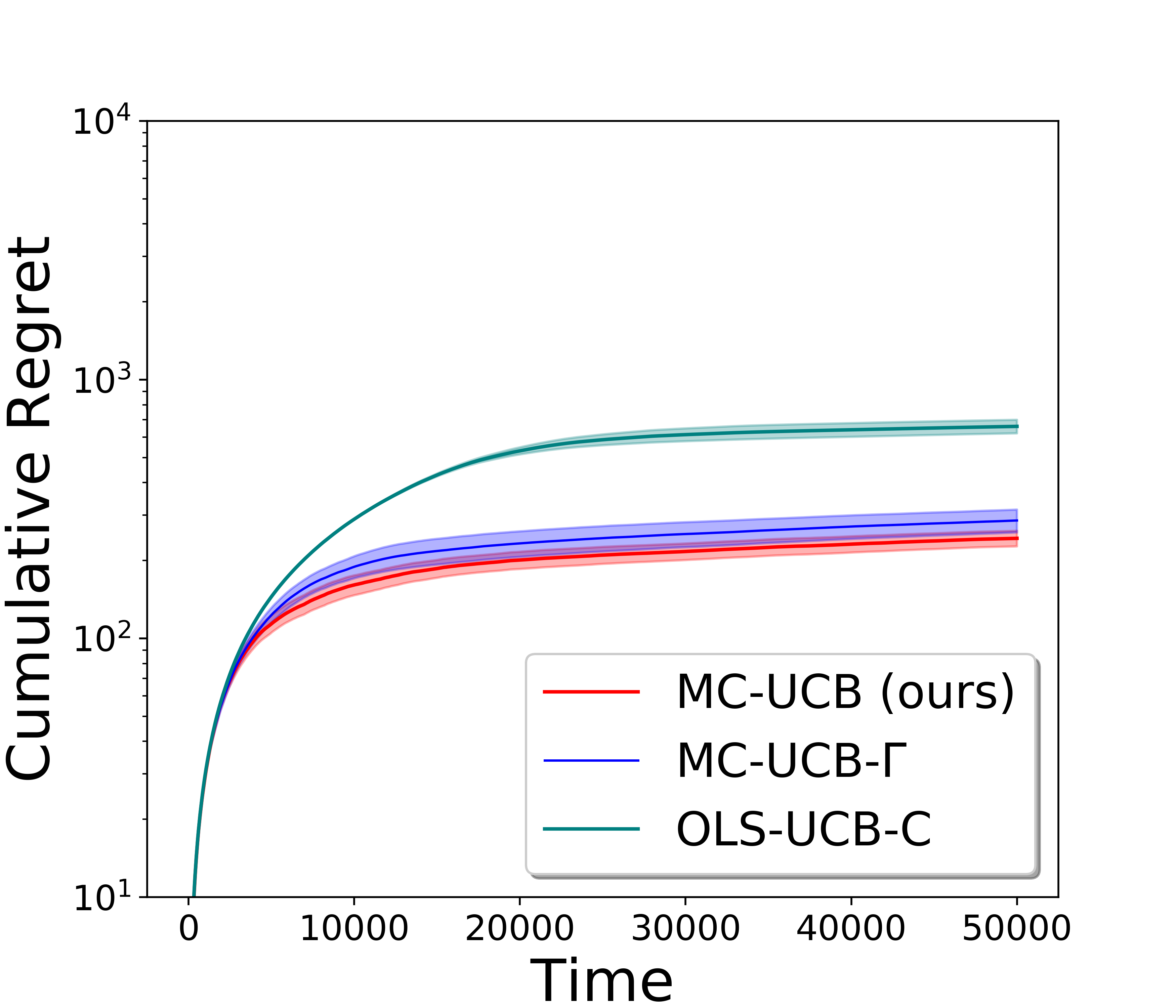

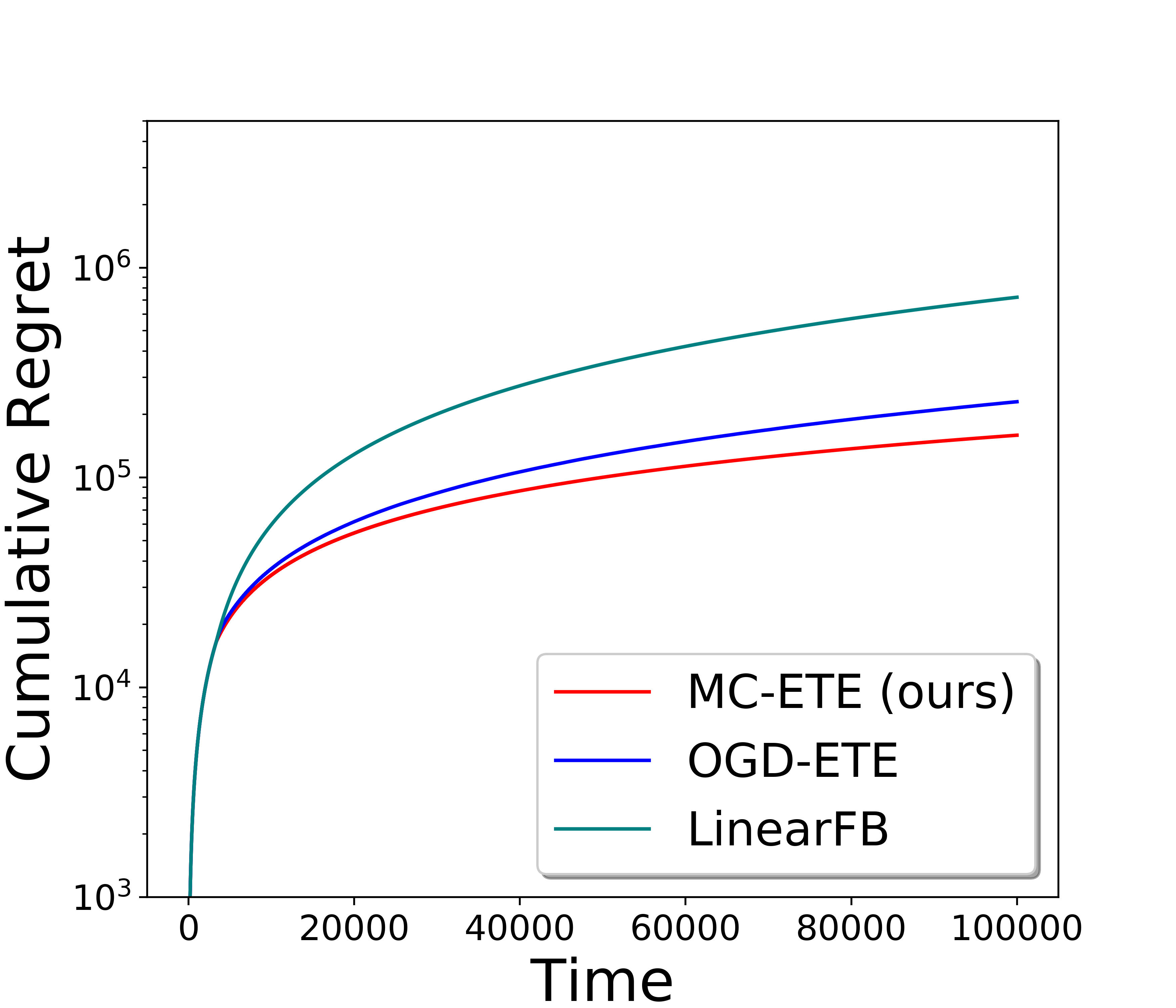

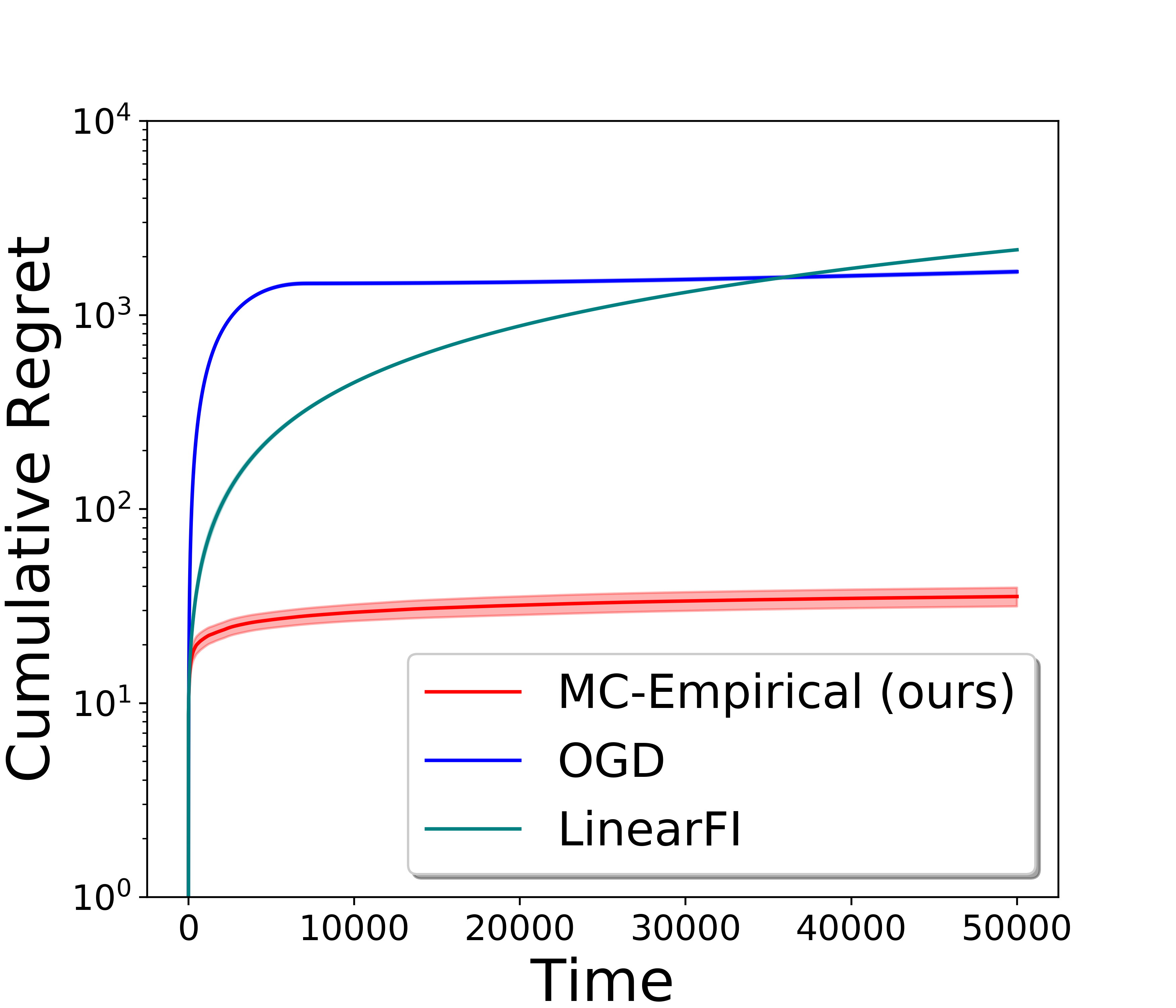

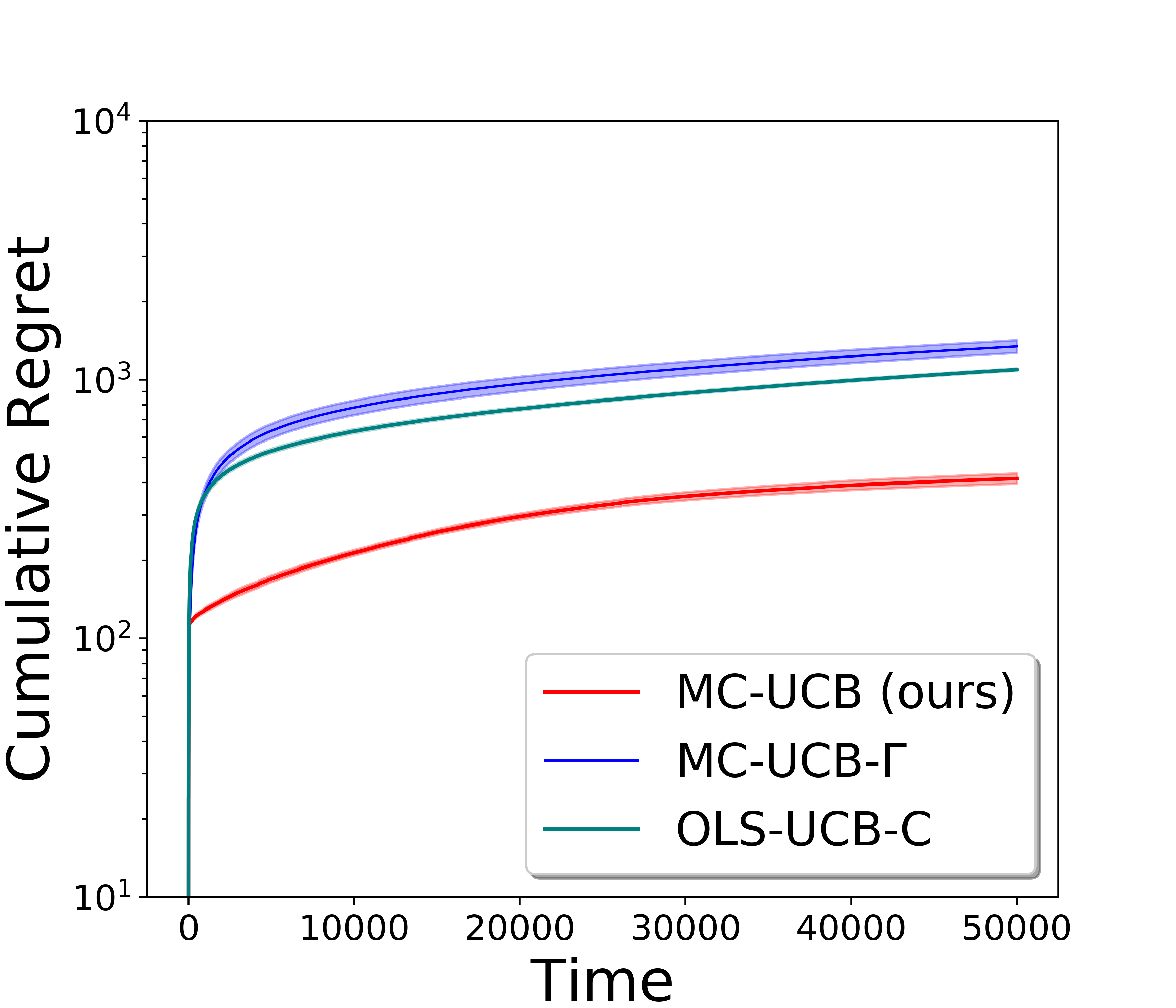

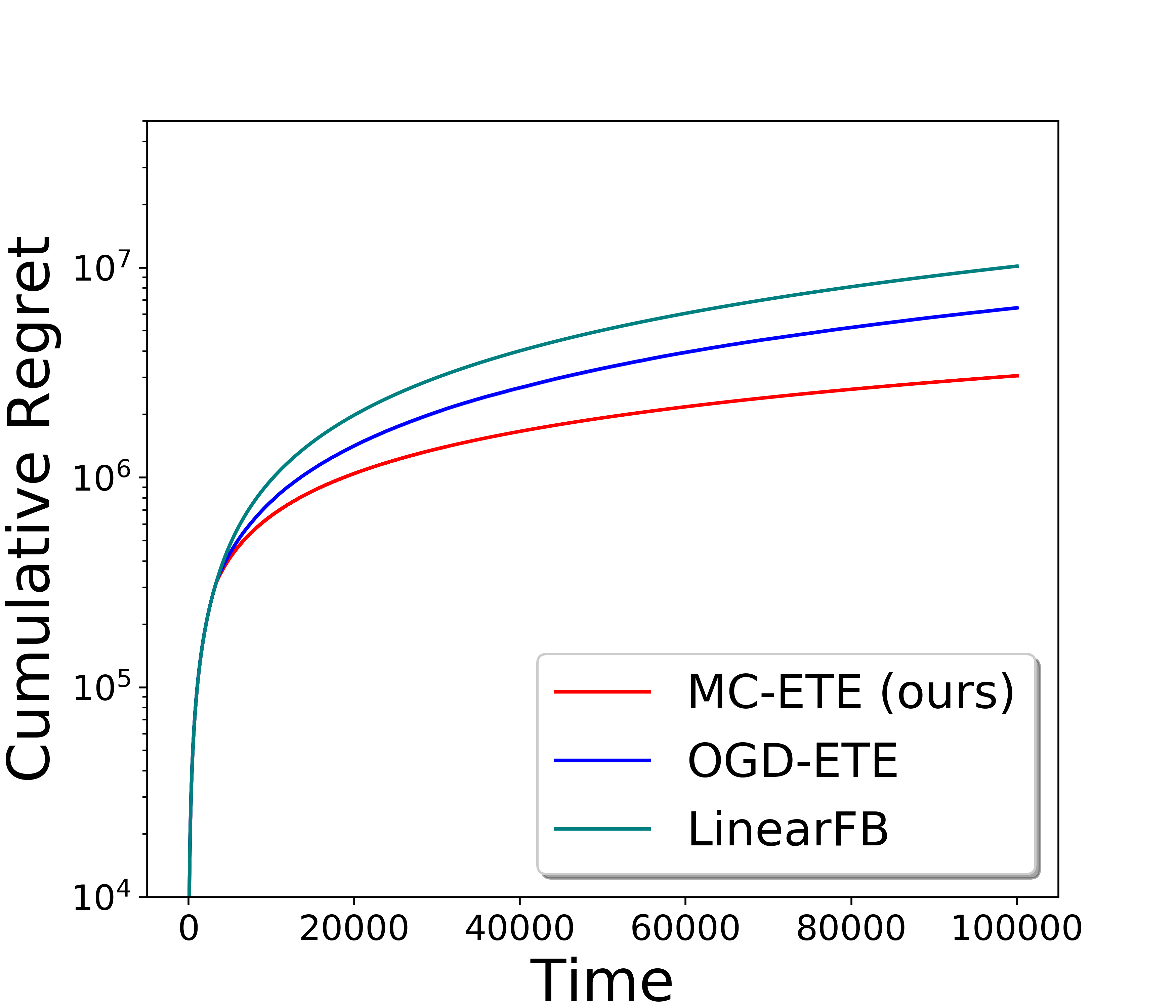

In this section, we present experimental results for our algorithms on both synthetic and real-world Leone (2020) datasets. For the synthetic dataset, we set , and has all diagonal entries equal to and all off-diagonal entries equal to . For the real-world dataset, we use an open dataset US Funds from Yahoo Finance on Kaggle Leone (2020), which provides financial data of 1680 ETF funds in 2010-2017. We select five funds and generate a stochastic distribution ( and ) from the data of returns (since we study a stochastic bandit problem). For both datasets, we set and . The random reward is drawn i.i.d. from Gaussian distribution . We perform independent runs for each algorithm and show the average regret and confidence interval across runs,222In some cases, since algorithms are doing similar procedures (e.g., in Figures 1(c),1(f), the algorithms are exploring the designed actions) and have low performance variance, the confidence intervals are narrow and indistinguishable. with logarithmic y-axis for clarity of magnitude comparison.

(CMCB-FI) We compare our algorithm with two algorithms Hazan et al. (2007) and . (Online Gradient Descent) Hazan et al. (2007) is designed for general online convex optimization with also a regret guarantee, but its result cannot capture the covariance impacts as ours. is a linear adaption of that only aims to maximize the expected rewards. Figures 1(a),1(d) show that our enjoys multiple orders of magnitude reduction in regret compared to the benchmarks, since it efficiently exploits the empirical observations to select actions and well handles the covariance-based risk. In particular, the performance superiority of over demonstrates that our sample strategy sufficiently utilize the observed information than conventional gradient descent based policy.

(CMCB-SB) For CMCB-SB, we compare with two adaptions of Degenne and Perchet (2016) (state-of-the-art for combinatorial bandits with covariance), named and . uses the confidence region with a universal covariance upper bound , instead of the adapting one used in our . directly adapts Degenne and Perchet (2016) to the continuous decision space and only considers maximizing the expected rewards in its objective. As shown in Figures 1(b),1(e), achieves the lowest regret since it utilizes the covariance information to accelerate the estimate concentration. Due to lack of a covariance-adapting confidence interval, shows an inferior regret performance than , and suffers the highest regret due to its ignorance of risk.

(CMCB-FB) We compare with two baselines, , which adopts Hazan et al. (2007) during the exploitation phase, and , which only investigates the expected reward maximization. From Figures 1(c),1(f), one can see that, achieves the best regret performance due to its effective estimation of the covariance-based risk and efficiency in exploitation. Due to the inefficiency of gradient descent based policy in utilizing information, has a higher regret than , whereas shows the worst performance owing to the unawareness of the risk.

8 Conclusion and Future Work

In this paper, we propose a novel continuous mean-covariance bandit (CMCB) model, which investigates the reward-risk trade-off measured by option correlation. Under this model, we consider three feedback settings, i.e., full-information, semi-bandit and full-bandit feedback, to formulate different real-world reward observation scenarios. We propose novel algorithms for CMCB with rigorous regret analysis, and provide lower bounds for the problems to demonstrate our optimality. We also present empirical evaluations to show the superior performance of our algorithms. To our best knowledge, this is the first work to fully characterize the impacts of arbitrary covariance structures on learning performance for risk-aware bandits. There are several interesting directions for future work. For example, how to design an adaptive algorithm for CMCB-FB is a challenging open problem, and the lower bound for CMCB-FB is also worth further investigation.

Acknowledgments and Disclosure of Funding

The work of Yihan Du and Longbo Huang is supported in part by the Technology and Innovation Major Project of the Ministry of Science and Technology of China under Grant 2020AAA0108400 and 2020AAA0108403.

References

- Abbasi-Yadkori et al. [2011] Yasin Abbasi-Yadkori, Dávid Pál, and Csaba Szepesvári. Improved algorithms for linear stochastic bandits. Advances in Neural Information Processing Systems, 24:2312–2320, 2011.

- Agrawal and Goyal [2012] Shipra Agrawal and Navin Goyal. Analysis of thompson sampling for the multi-armed bandit problem. In Conference on Learning Theory, pages 39–1, 2012.

- Auer et al. [2002a] Peter Auer, Nicolo Cesa-Bianchi, and Paul Fischer. Finite-time analysis of the multiarmed bandit problem. Machine Learning, 47(2-3):235–256, 2002a.

- Auer et al. [2002b] Peter Auer, Nicolo Cesa-Bianchi, Yoav Freund, and Robert E Schapire. The nonstochastic multiarmed bandit problem. SIAM Journal on Computing, 32(1):48–77, 2002b.

- Butler and Domian [1991] Kirt C Butler and Dale L Domian. Risk, diversification, and the investment horizon. Journal of Portfolio Management, 17(3):41, 1991.

- Cassel et al. [2018] Asaf Cassel, Shie Mannor, and Assaf Zeevi. A general approach to multi-armed bandits under risk criteria. In Conference on Learning Theory, pages 1295–1306, 2018.

- Chaudhuri and Tewari [2016] Sougata Chaudhuri and Ambuj Tewari. Phased exploration with greedy exploitation in stochastic combinatorial partial monitoring games. In Advances in Neural Information Processing Systems, pages 2433–2441. 2016.

- Chen et al. [2018] Lixing Chen, Jie Xu, and Zhuo Lu. Contextual combinatorial multi-armed bandits with volatile arms and submodular reward. In Advances in Neural Information Processing Systems, volume 31. Curran Associates, Inc., 2018.

- Cover [1999] Thomas M Cover. Elements of information theory. John Wiley & Sons, 1999.

- Dani et al. [2008a] Varsha Dani, Thomas P Hayes, and Sham M Kakade. Stochastic linear optimization under bandit feedback. In Conference on Learning Theory, 2008a.

- Dani et al. [2008b] Varsha Dani, Sham M Kakade, and Thomas Hayes. The price of bandit information for online optimization. In Advances in Neural Information Processing Systems, volume 20. Curran Associates, Inc., 2008b.

- David and Shimkin [2016] Yahel David and Nahum Shimkin. Pure exploration for max-quantile bandits. In Joint European Conference on Machine Learning and Knowledge Discovery in Databases, pages 556–571. Springer, 2016.

- Degenne and Perchet [2016] Rémy Degenne and Vianney Perchet. Combinatorial semi-bandit with known covariance. In Advances in Neural Information Processing Systems, pages 2972–2980, 2016.

- Diadin [2019] A Diadin. Analysis of a trade company investment project. Business and Economics, page 104, 2019.

- Galichet et al. [2013] Nicolas Galichet, Michele Sebag, and Olivier Teytaud. Exploration vs exploitation vs safety: Risk-aware multi-armed bandits. In Asian Conference on Machine Learning, pages 245–260, 2013.

- Gasser et al. [2017] Stephan M Gasser, Margarethe Rammerstorfer, and Karl Weinmayer. Markowitz revisited: Social portfolio engineering. European Journal of Operational Research, 258(3):1181–1190, 2017.

- Hazan et al. [2007] Elad Hazan, Amit Agarwal, and Satyen Kale. Logarithmic regret algorithms for online convex optimization. Machine Learning, 69(2-3):169–192, 2007.

- Kagrecha et al. [2019] Anmol Kagrecha, Jayakrishnan Nair, and Krishna Jagannathan. Distribution oblivious, risk-aware algorithms for multi-armed bandits with unbounded rewards. Advances in Neural Information Processing Systems, 32:11272–11281, 2019.

- Kazerouni et al. [2017] Abbas Kazerouni, Mohammad Ghavamzadeh, Yasin Abbasi-Yadkori, and Benjamin Van Roy. Conservative contextual linear bandits. In Advances in Neural Information Processing Systems, pages 3913–3922, 2017.

- Lai and Robbins [1985] Tze Leung Lai and Herbert Robbins. Asymptotically efficient adaptive allocation rules. Advances in Applied Mathematics, 6(1):4–22, 1985.

- Leone [2020] Stefano Leone. Dataset: US funds dataset from yahoo finance. Kaggle, 2020. https://www.kaggle.com/stefanoleone992/mutual-funds-and-etfs?select=ETFs.csv.

- Lin et al. [2014] Tian Lin, Bruno Abrahao, Robert Kleinberg, John Lui, and Wei Chen. Combinatorial partial monitoring game with linear feedback and its applications. In International Conference on Machine Learning, pages 901–909, 2014.

- Locatelli et al. [2016] Andrea Locatelli, Maurilio Gutzeit, and Alexandra Carpentier. An optimal algorithm for the thresholding bandit problem. In International Conference on Machine Learning, pages 1690–1698. PMLR, 2016.

- Markowitz et al. [1952] Harry M Markowitz et al. Portfolio selection. Journal of Finance, 7(1):77–91, 1952.

- McInnerney and Roberts [2004] Joanne M McInnerney and Tim S Roberts. Online learning: Social interaction and the creation of a sense of community. Journal of Educational Technology & Society, 7(3):73–81, 2004.

- Perrault et al. [2020] Pierre Perrault, Michal Valko, and Vianney Perchet. Covariance-adapting algorithm for semi-bandits with application to sparse outcomes. In Conference on Learning Theory, pages 3152–3184, 2020.

- Sani et al. [2012] Amir Sani, Alessandro Lazaric, and Rémi Munos. Risk-aversion in multi-armed bandits. In Advances in Neural Information Processing Systems, pages 3275–3283, 2012.

- Schwartz et al. [2017] Eric M Schwartz, Eric T Bradlow, and Peter S Fader. Customer acquisition via display advertising using multi-armed bandit experiments. Marketing Science, 36(4):500–522, 2017.

- Thompson [1933] William R Thompson. On the likelihood that one unknown probability exceeds another in view of the evidence of two samples. Biometrika, 25(3/4):285–294, 1933.

- Vakili and Zhao [2015] Sattar Vakili and Qing Zhao. Mean-variance and value at risk in multi-armed bandit problems. In The 53rd Annual Allerton Conference on Communication, Control, and Computing (Allerton), pages 1330–1335. IEEE, 2015.

- Vakili and Zhao [2016] Sattar Vakili and Qing Zhao. Risk-averse multi-armed bandit problems under mean-variance measure. IEEE Journal of Selected Topics in Signal Processing, 10(6):1093–1111, 2016.

- Villar et al. [2015] Sofía S Villar, Jack Bowden, and James Wason. Multi-armed bandit models for the optimal design of clinical trials: benefits and challenges. Statistical Science: A Review Journal of the Institute of Mathematical Statistics, 30(2):199, 2015.

- Warmuth and Kuzmin [2006] Manfred K Warmuth and Dima Kuzmin. Online variance minimization. In International Conference on Computational Learning Theory, pages 514–528. Springer, 2006.

- Warmuth and Kuzmin [2012] Manfred K Warmuth and Dima Kuzmin. Online variance minimization. Machine Learning, 87(1):1–32, 2012.

- Zhu and Tan [2020] Qiuyu Zhu and Vincent YF Tan. Thompson sampling algorithms for mean-variance bandits. International Conference on Machine Learning, 2020.

Appendix

Appendix A Technical Lemmas

In this section, we introduce two technical lemmas which will be used in our analysis.

Lemmas 1 and 2 give the concentration guarantees of algorithm for CMCB-SB, which sets up a foundation for the concentration guarantees in CMCB-FI.

Lemma 1 (Concentration of Covariance for CMCB-SB).

Proof.

Lemma 2 (Concentration of Means for CMCB-SB).

Consider the CMCB-SB problem and algorithm (Algorithm 2). Let , and define and for . Then, for any and , with probability at least , we have

Further define . Then, for any and , the event satisfies .

Proof.

The proof of Lemma 2 follows the analysis procedure in Degenne and Perchet [2016]. Specifically, assuming that event occurs, we have for any and

Hence, to prove Lemma 2, it suffices to prove that

| (4) |

Recall that and is a diagonal matrix such that for any . For any , let denote the diagonal matrix such that for any and for any , and let . Let be the vector such that for any .

Let be a positive definite matrix such that . Then, we have for any that

Let , and . We get

Since , we have

Thus,

Hence, to prove Eq. (4), it suffices to prove

| (5) |

To do so, we introduce some notions. Let be the -algebra . Let be a multivariate Gaussian random variable with mean 0 and covariance , which is independent of all the other random variables, and use denote its probability density function. Define

and

We have . In the following, we prove .

For any , according to the sub-Gaussian property, satisfies

which is equivalent to

Thus, we have

Then, we can obtain

which implies that is a super-martingale and . Thus,

Now we prove Eq. (5). First, we have

| (6) |

Then, for some constant and for any , we define the set of timesteps such that

Define a diagonal matrix with .

Suppose for some fixed . We have

Let . Then, we have

where matrix has ones on the diagonal. Since the determinant of a positive definite matrix is smaller than the product of its diagonal terms, we have

| (7) |

Appendix B Proof for CMCB-FI

B.1 Proof of Theorem 1

In order to prove Theorem 1, we first have the following Lemmas 3 and 4, which are adaptions of Lemmas 1 and 2 to CMCB-FI.

Lemma 3 (Concentration of Covariance for CMCB-FI).

Proof.

Lemma 4 (Concentration of Means for CMCB-FI).

Consider the CMCB-FI problem and algorithm (Algorithm 1). Let . Define and for . Define . Then, for any and , the event satisfies .

Proof.

In CMCB-FI, is a diagonal matrix such that . Then, Lemma 4 can be obtained by applying Lemma 2 with and that the union bound on the number of samples only needs to consider one dimension. Specifically, in the proof of Lemma 2, we replace the set of timesteps with for , which stands for

This completes the proof. ∎

Now we are ready to prove Theorem 1.

Proof.

(Theorem 1) Let , denote the confidence radius of covariance for any , and be the matrix with all entries equal to . For any , define and .

For any , suppose that event occurs. Then,

Therefore, we have

This is because if instead , we have

which contradicts the selection strategy of in algorithm . Thus, we obtain

| (8) |

Now, for any , we have

and

where denotes the maximum diagonal entry of .

For any , and , Eq. (8) can be written as

| (9) |

Next, we investigate the upper bound of . According to Eq. (8), we have that satisfies

| (10) |

Thus, satisfies

Rearranging the terms, we have

| (11) |

Let and . Define function

where and .

Now since

by letting , we have

Therefore

Thus, we have that, satisfies

| (12) |

where .

Below we discuss the two terms in Eq. (12) separately.

Case (i): Plugging the first term of the upper bound of in Eq. (12) into Eq. (9), we have that for ,

Recall that

Let . For any horizon which satisfies , summing over , we obtain the regret upper bound

Case (ii): Plugging the second term of the upper bound of in Eq. (12) into Eq. (9), we have that for ,

For any horizon which satisfies , summing over , we obtain the regret upper bound

Combining cases (i) and (ii), we can obtain

Let . Letting and , we obtain

which completes the proof. ∎

B.2 Proof of Theorem 2

In order to prove Theorem 2, we first analyze the offline problem of CMCB-FI. Suppose that the covariance matrix is positive definite.

(Offline Problem of CMCB-FI)

We define the quadratic optimization as

and as the optimal solution to . We consider the KKT condition for this quadratic optimization as follows:

Let be a subset of indexes for such that . Let and we have . Then, from the KKT condition, we have

| (13) | ||||

| 0 | ||||

Since this problem is a quadratic optimization and the covariance matrix is positive-definite, there is a unique feasible satisfying the above inequalities and the solution is the optimal solution .

Main Proof.

Now, we give the proof of Theorem 2.

Proof.

(Theorem 2) First, we choose prior distributions for and . We assume that and , where and takes probability at the support and probability anywhere else. Define and . Then, we see that and .

Thus, the posterior of is given by

The posterior of is still , i.e., is always a fixed identity matrix.

Under the Bayesian setting, the expected regret is givenn by

Recall that is the optimal solution to . It can be seen that the best strategy of at timestep is to select the optimal solution to and we use algorithm to denote this strategy. Thus, to obtain a regret lower bound for the problem, it suffices to prove a regret lower bound of algorithm for the problem.

Below we prove a regret lower bound of algorithm for the problem.

Step (i).

We consider the case when and both lie in the interior of the -dimensional probability simplex , i.e., and . From Eq. (13), satisfies

Rearranging the terms, we have

which is equivalent to

| (14) |

Similarly, satisfies

| (15) |

We first derive a condition that makes lie in the interior of . Recall that . Define event

According to the principle for Gaussian distributions, we have

Conditioning on , under which Eq. (15) hold, it suffices to let

which is equivalent to

| (16) |

when . Let be the smallest timestep that satisfies Eq. (16). Thus, when occurs and , lie in the interior of .

Next, we derive some condition that make lie in the interior of . Recall that .

Step (ii).

Suppose that occurs and consider . Then, and both lie in the interior of , i.e., and . We have

Let and thus . Let . Then, we have

Let . For any (), and they are mutually independent among .

Fix , and then we define event

From the c.d.f. of Gaussian distributions, we have

From this, we get

When , .

Step (iii).

We bound the expected regret by considering the event and . Specifically,

In the following, we consider an intrinsic bound of the expected regret and set the problem parameters to proper quantities. Since the expected regret is upper bounded by and

we conclude that the expected regret is lower bounded by

Choose and . According to Eqs. (16) and (17), we have . Therefore, for , the expected regret is lower bounded by .

∎

Appendix C Proof for CMCB-SB

C.1 Proof of Theorem 3

Proof.

(Theorem 3) Denote , and the matrix whose -th entry is .

For , suppose that event occurs. Define for any . Then, we have

According to the selection strategy of , we obtain

Thus, for any , we have that

Let for any . We first address . Since for any and ,

we can bound as follows

Next, we obtain a bound for .

Finally, we bound .

Recall that . Combining the bounds of and , we obtain

According to Lemmas 1 and 2, for any , the probability of event satisfies

Therefore, for any horizon , we obtain the regret upper bound

where and for any . ∎

C.2 Proof of Theorem 4

Proof.

First, we construct some instances with , , and .

Let be a random instance constructed as follows: we uniformly choose a dimension from , and the expected reward vector has on its -th entry and elsewhere, where will be specified later. Let be a uniform instance, where has all its entries to be . Let and denote the probabilities under instances and , respectively, and let . Analogously, , and denote the expectation operations.

Fix an algorithm . Let be a random variable vector denoting the observations at timestep , obtained by running . Here denotes no observation on this dimension. Let denote the distribution on support which takes value with probability 1.

In CMCB-SB, if , we can observe the reward on the -th dimension, i.e., ; otherwise, if , we cannot get observation on the -th dimension, i.e., . Let be the distribution of observation sequence under instance , and is the distribution conditioned on . Let be the distribution of observation sequence under instance . For any , let be the number of pulls that has a positive weight on the -th dimension, i.e., the number of observations on the -th dimension.

Following the analysis procedure of Lemma A.1 in Auer et al. [2002b], we have

Here the first equality comes from the chain rule of entropy Cover [1999]. The second equality is due to that given , if , the conditional distribution of is , where "" refers to the subscript of instances; otherwise, if , is deterministically. The third equality is due to that and only have one different entry on the -th dimension.

Let with subscript denote the total variance distance, and denote the Kullback–Leibler divergence. Using Eq. (28) in the analysis of Lemma A.1 in Auer et al. [2002b] and Pinsker’s inequality, we have

Let denote the maximum number of positive entries for a feasible action, i.e., the maximum number of observations for a pull. Performing the above argument for all and using , we have

and thus

Letting , the expected reward (linear) term dominates , and the best action under has the weight on the -th entry and elsewhere.

Recall that . For each pull that has no weight on the -th entry, algorithm must suffer a regret at least

Thus, the regret is lower bounded by

where the last equality is due to .

Letting for small enough constant , we obtain the regret lower bound .

∎

Appendix D Proof for CMCB-FB

D.1 Proof of Theorem 5

In order to prove Theorem 5, we first prove Lemmas 5 and 6, which give the concentrations of covariance and means for CMCB-FB, using different techniques than those for CMCB-SB (Lemmas 1 and 2) and CMCB-FI (Lemmas 3 and 4).

Lemma 5 (Concentration of Covariance for CMCB-FB).

Proof.

Let denote the column vector that stacks the distinct entries in the covariance matrix .

Recall that the matrix

where denotes the -th entry of portfolio vector in design set . We use to denote the -th row in matrix .

We recall the feedback structure in algorithm as follows. At each timestep , the learner plays an action , and observes the full-bandit feedback with and . Then, during exploration round , where each action in design set is pulled once, the full-bandit feedback has mean and variance . For any , denote the empirical mean of and the empirical variance of .

Using the Chernoff-Hoeffding inequality for empirical variances (Lemma 1 in Sani et al. [2012]), we have that for any and , with probability at least ,

Let denote the -th row of matrix and denote the -th entry of matrix . Since , for any , we have

In addition, since is the column vector stacking the distinct entries in , we obtain the lemma. ∎

Lemma 6 (Concentration of Means for CMCB-FB).

Consider the CMCB-FB problem and algorithm (Algorithm 3). Let , , and , where . Then, the event satisfies .

Proof.

Recall that the matrix . and is the Moore–Penrose pseudoinverse of . Since is of full column rank, satisfies .

We recall the feedback structure in algorithm as follows. At each timestep , the learner plays an action , and observes the full-bandit feedback such that and . Then, during exploration round , where each action in design set is pulled once, the full-bandit feedback has mean and variance . For any , is the empirical mean of and is the empirical variance of .

Let be the diagonal matrix such that for any and . Let be a diagonal matrix such that for any , and thus . Let be the vector such that for any timestep . Let , where denotes the noise of the -th sample in the -th exploration round.

Note that, the following analysis of and the constructions (definitions) of the noise , matrices and super-martingale are different from those in CMCB-SB (Lemmas 1 and 2) and CMCB-FI (Lemmas 3 and 4).

For any , we have

Let , and . Then, we have

Since , we get

Thus,

Hence, to prove Eq. (4), it suffices to prove

| (18) |

To prove Eq. (18), we introduce some notions. Let be a multivariate Gaussian random variable with mean 0 and covariance , which is independent of all the other random variables and we use denote its probability density function. Let

and

where is the index of exploration round. We have . In the following, we prove .

For any timestep , is -sub-Gaussian and is independent among different timestep . Then, is -sub-Gaussian. According to the sub-Gaussian property, satisfies

which is equivalent to

Let be the -algebra . Thus, we have

Then, we can obtain

which implies that is a super-martingale and . Thus,

Now we prove Eq. (18). First, we have

| (19) |

Then, for some constant and for any , we define the set of timesteps such that

Define as a diagonal matrix such that . Suppose for some fixed . Then, we have

Let . Then, we have

where matrix has ones on the diagonal. Since the determinant of a positive definite matrix is smaller than the product of its diagonal terms, we have

| (20) |

Now, we give the proof of Theorem 5.

Proof.

(Theorem 5) First, we bound the number of exploration rounds up to time . Let . According to the condition of exploitation (Line 4 in Algorithm 3), we have that if at timestep algorithm starts an exploration round, then satisfies

Let denote the timestep at which algorithm starts the last exploration round. Then, we have

and thus

Next, for each timestep , we bound the estimation error of . For any , let and . Suppose that event occurs. Then, according to Lemmas 5 and 6, we have that for any ,

Let . Then, we have

Let denote the event that algorithm does the exploitation at timestep . For any , if occurs, we have . Thus

The expected regret of algorithm can be divided into two parts, one due to exploration and the other due to exploitation. Then, we can obtain

Choosing and using , we obtain

where . ∎