Yield Spread Selection in Predicting Recession Probabilities:

A Machine Learning Approach

Abstract

The literature on using yield curves to forecast recessions customarily uses 10-year–three-month Treasury yield spread without verification on the pair selection. This study investigates whether the predictive ability of spread can be improved by letting a machine learning algorithm identify the best maturity pair and coefficients. Our comprehensive analysis shows that, despite the likelihood gain, the machine learning approach does not significantly improve prediction, owing to the estimation error. This is robust to the forecasting horizon, control variable, sample period, and oversampling of the recession observations. Our finding supports the use of the 10-year–three-month spread.

JEL classification: C52, E32, E43

Keywords: Yield curve, estimation risk, density forecasting, machine learning

1 Introduction

The term spread is a well-established parsimonious and high frequency indicator of recessions, and it is particularly useful for policy-makers and financial market participants. On average, the yield curve is gently upward sloping and concave. However, over the past 50 years, recessions have often been preceded by a flattening or even an inversion of the curve. Motivated by this stylized fact, numerous empirical studies have documented the ability of the slope of the yield curve or the term spread to predict future recessions.111 Stock and Watson (1989) and Estrella and Hardouvelis (1991) find evidence in support of the predictive power of the slope of the yield curve for continuous real activity variables. Since then, several works have reported the predictive ability of the term spread for recessions as well, including Estrella (2005), Rudebusch and Williams (2009), Ergungor (2016), Engstrom and Sharpe (2018), Johansson and Meldrum (2018), and Bauer and Mertens (2018a). In particular, Rudebusch and Williams (2009) show that a simple prediction model based on the term spread outperforms professional forecasters at predicting recessions three and four quarters ahead.

The literature on using the yield curve to predict recessions typically measures the term spread as the difference between the 10-year bond yield and the three-month bond yield,222 This term spread is analyzed by Estrella (2005), Estrella and Trubin (2006), and Stekler and Ye (2017). See also Bauer and Mertens (2018b) for a performance comparison with other term spreads. and tends to focus on quantifying the predictive power of the term spread at a particular forecasting horizon. The forecasting horizon is usually chosen at four quarters, where the predictive ability of the term spread is maximized (Estrella and Trubin, 2006; Berge and Jordà, 2011). Few studies have formally discussed criteria for selecting a pair of short- and long-term interest rates from a number of bond yields with different maturities. Moreover, using the term spread as a predictor implies that the coefficients of the short-term and long-term interest rates are constrained to have the same magnitude with opposite signs.

Government bond yields are determined by the sum of the market expectation and the risk premium. Given that the market expectation component is the expected path of future short-term rates and the policy rates are pro-cyclical, if the risk premium or its variation is small, the term spread contains much predictive information about future business cycles and future policy rates. However, the portion of the market expectation component in a bond yield differs across the maturity. In addition, liquidity risk premiums are strongly time varying, particularly in the short-term Treasury bill markets (Goyenko et al., 2011). Therefore, the predictive ability of the term spread can be sensitive to the maturity combination. For the same reason, the absolute regression effects of the interest rates on the recession probability are not necessarily the same, and the short- and long-term interest rates may have separate effects from the spread.

The question we address here is whether relaxing the restrictions on the fixed maturity pair and the coefficients can improve the predictive ability of the bond yields. This question is particularly important from a statistical point of view. If the answer is yes, then the choice of maturity pair should be included in the prediction procedure, and the short- and long-term yields should be used as separate predictors. However, if the answer is no, it implies the substantial estimation error, and the conventional use of the 10-year–three-month Treasury yield spread is justified.

To answer the question, we use a machine learning (ML) framework to search for the best maturity combination and the coefficients of the interest rates simultaneously. Specifically, we select two maturities from among the nine bond yield series based on a logistic regression with regularization for multiple forecasting horizons. Next, we validate the classification algorithm by comparing the out-of-sample prediction against the benchmark spread (i.e., the 10-year–three-month term spread).

Our two key findings are based on US data for the period June 1961 to July 2020. First, the optimal maturity pairs for most horizons vary from the (10 year, three month) pair. For instance, for the one-quarter-ahead recession prediction, (10 year, six month) is selected by the ML algorithm. The 20-year–one-year spread performs best for horizons of seven and eight quarters. In addition, the absolute effect of the short-term yield is found to be larger than that of the long-term yield. Second, and more importantly, we find that the prediction gain from the maturity pair optimization or separation of the regression effects is not statistically significant. In particular, the benchmark spread provides better forecasts than those of the ML approach for short- and medium-term horizons. These findings are robust, even when controlling for the leading business cycle index. The poor performance of the proposed approach indicates that the efficiency loss from the estimation risk dominates the likelihood gain. In summary, based on a comprehensive empirical analysis, we provide new and interesting evidence justifying the conventional use of the 10-year–three-month term spread.

This paper contributes to the growing literature on the application of ML to economic research and the controversy over its effectiveness. While several studies (Gogas et al., 2015; Döpke et al., 2017; Hall, 2018) claim outperformance of the ML method, Puglia and Tucker (2020) report that the prediction gain of ML, in recession forecast at least, is reversed when they employ a more conservative cross validation method to avoid possible overfitting. This study provides evidence in support of Puglia and Tucker (2020).

Stressing what we do not claim is also important. First of all, the disappointing performance of ML should not be interpreted as an evidence for rejecting ML in general. We use a particular regularization estimator and ML offers a much broader range of alternative prediction procedures. We do not claim that any alternative ML procedures are less adequate for the problem. Moreover, given that our interest is centered on the pair of short- and long-term yields, we restrictively use ML to improve the prediction of a spread, rather than the whole yield curve.

The remainder of this paper is organized as follows. In Section 2, we discuss our ML algorithm and data. Section 3 presents our findings, and Section 4 concludes the paper.

2 Machine Learning Algorithm and Data

2.1 Logistic Regression with Regularization

We let denote the binary recession indicator at month (one if a recession, zero if not). The -month-ahead recession probability at month is predicted as

where is the logistic function, is the Treasury yield vector of different maturities at month , is the corresponding coefficient vector, and is the intercept. Note that the sign of is deliberately negated inside so that the recession probability increases when the linear combination of the yields decreases. This ensures consistency with the stylized fact that a recession is typically followed by a negative term spread, defined as the long-term yield minus the short-term yield.

Our model differs from a traditional logistic regression in that large coefficient values are penalized during the maximization of the likelihood. This measure, called regularization in machine learning literature, prevents overfitting in the prediction problems with small sample size or large number of predictors. Specifically, we find and that minimize the cost function,

| (1) |

where is the norm of the coefficient vector, and is the log likelihood over the training period ,

| (2) |

The regression for continuous variables with the same regularization is well known as the least absolute shrinkage and selection operator (LASSO) (Hastie et al., 2009). The LASSO differs from the ridge regression, which instead uses the norm for penalty. The use of or regularization tends to make the coefficients smaller in magnitude as the regularization strength increases, hence the shrinkage regression. The shrinkage regression method has recently been adopted in economic forecasting. For example, Hall (2018) uses the elastic-net regularization (Zou and Hastie, 2005), where both and penalties are used for regularization; see Kim and Swanson (2018) for the effectiveness of the shrinkage method in predicting various macroeconomic variables.

Although the penalty makes the optimization more difficult than when using the quadratic penalty, it is attractive because it forces certain coefficients to be set to zero; see the graphical interpretation in Hastie et al. (2009, Figure 3.11). Therefore, it effectively simplifies the model by using only a small subset of the input variables, thus performing a feature selection. In contrast, the regularization does not set the coefficients to zero, although it does shrink the magnitudes.

The logit model with regularization is a natural choice of algorithm for this study because we aim to simultaneously extract two maturities and find their coefficients from the term structure, without any prior knowledge. We do not consider more complicated ML algorithms that make full use of the rates from all maturities. Indeed, previous studies have adopted methods such as support vector machines (Gogas et al., 2015) and boosted regression trees (Döpke et al., 2017). Their strategy for recession prediction is conducting a variable selection among a large number of macroeconomic predictors in a nonlinear fashion or using the entire yield curve information, while our study aims to search the best maturity pair of term spread.

Note the following with regard to implementation. Because the coefficient magnitude is in the objective function, equation (1), the optimization result depends on the scale of the input variables. Therefore, each feature variable is normalized using a z-score before the optimization (Hastie et al., 2009). In the remainder of the paper, however, the coefficients are reported in the original scale, unless stated otherwise. We use the regularized logistic regression in the scikit-learn Python package of Pedregosa et al. (2011) to solve and , given .333The class can be downloaded from scikit-learn.org In searching for , we geometrically increase the regularization strength as from a large negative integer value of . Then, we report the first value of at which the number of nonzero coefficients in becomes the desired number (i.e., two).

2.2 Competing Specifications

Suppose that the pair of Treasury yields at month extracted from the regularization are denoted by ( ), and are dependent on the forecasting horizon. The resulting predictive model is given by

We refer to the linear combination of the yields and a constant, , as a generalized spread of the ML pair. To evaluate the prediction performance of the generalized spread, we compare the proposed model with its three nested logit models. The first alternative model uses the term spread measured by the simple difference of the ML pair (hereafter, the simple spread of the ML pair). That is, the model is given by

where the absolute regression effects of and are constrained to be the same (i.e., ).

In the second alternative model, the conventional yield pair is used without the coefficient restriction, as follows:

where and are the 10-year and three-month yields, respectively, at month . The third alternative model is the benchmark and the most restricted version of the proposed model, in which the simple spread of the conventional pair is used as a predictor:

By comparing the proposed model with these nested frameworks, we separately identify the importance of the maturity pair selection and that of the coefficient restriction. Note that the model parameters are searched in order to maximize the log likelihood in equation (2) without regularization in the nested models.

2.3 Data

We describe the data used in the analysis. For the binary state of a recession, , we use the monthly periods of recessions defined by the National Bureau of Economic Research (NBER). For the yield curve , we use the monthly averaged constant maturities time series of the Treasury yields from the H.15 page of the Federal Reserve website. Our sample period is June 1961 to July 2020. For this period, we use three- and six-month and one-, two-, three-, five-, seven-, 10-, and 20-year yields. Because not all series are available in the early part of the sample period, alternative sources are used to fill in the missing data. The three- and six-month Treasury bill rates until August 1981 are taken as the secondary market rates from the same website. Because they are recorded on a discount basis, we convert them to a bond-equivalent basis, as in Estrella (2005). The two- and seven-year yields until May 1976 and June 1969, respectively, are obtained from the zero-coupon Treasury yield curve by Gürkaynak et al. (2006, 2007). We split the overall period into training (in-sample) and test (out-of-sample) periods at the end of 1995.

3 Results

This section reports the results of the best pair selection for a wide range of forecasting horizons, including its associated coefficients, and discusses the implications of these results. As a baseline examination, we use the period June 1961 to December 1995 for training (pair selection and coefficient estimation), and the period since 1996 for testing (out-of-sample evaluation). Then, we check the robustness of the findings by trying alternative training/test periods and handling the problems of imbalanced classification and missing variables.

3.1 Pair and Coefficient Selection Using Machine Learning

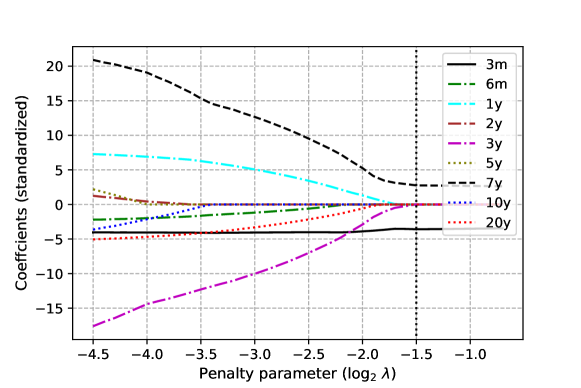

Figure 1 visually illustrates the best pair-selection process described in Section 2.1. As we increase the magnitude of the penalty parameter, , in equation (1), the coefficients of the features with little contribution to the likelihood maximization are set to zero. We continue increasing the penalty strength until only two yields survive. In the case of the 12-month-ahead recession prediction, three-month and seven-year yields survive as the pair that best explains the recession from June 1961 to December 1995.

Panel A in Table 1 summarizes the results of the ML analyses for the various forecasting horizons. There are two main findings. First, we find that for every forecasting horizon, one long-term and one short-term yields are selected as the best pair for recession prediction, and their coefficients have positive and negative signs, respectively. This confirms the use of the term spread in the past literature. However, unlike the conventional approach, the best prediction performance is achieved with a pair other than the 10-year and three-month yields. Specifically, when the forecasting horizon is relatively short (three or six months), the Treasury yields with 10-year and six-month maturities are the best predictors of a recession. For long horizons (18, 21, 24 months), the longest available term (20-year) yield and a short-term yield (three-month, six-month, or one-year, depending on the forecasting horizon) work as the best pair. These findings are roughly consistent with the notion that longer-term yields reflect information about a relatively more distant future.

| Horizon | Pair | log L | log PPL | EBF | ||||

|---|---|---|---|---|---|---|---|---|

| Panel A. Generalized spread of the ML pair | ||||||||

| 3 | (10y, 6m) | (0.453, -0.790) | 0.871 | 0.902 | 0.529 | -0.282 | -0.459 | 0.912 |

| 6 | (10y, 6m) | (0.773, -1.069) | 0.933 | 0.937 | 0.644 | -0.255 | -0.413 | 0.931 |

| 9 | (10y, 3m) | (0.926, -1.191) | 0.933 | 0.939 | 0.766 | -0.246 | -0.334 | 0.956 |

| 12 | (7y, 3m) | (1.039, -1.231) | 0.354 | 0.919 | 0.850 | -0.270 | -0.277 | 0.981 |

| 15 | (7y, 3m) | (0.893, -1.010) | 0.500 | 0.868 | 0.890 | -0.304 | -0.258 | 0.990 |

| 18 | (20y, 3m) | (0.428, -0.538) | 2.639 | 0.806 | 0.899 | -0.343 | -0.271 | 0.985 |

| 21 | (20y, 6m) | (0.402, -0.464) | 1.741 | 0.744 | 0.898 | -0.369 | -0.276 | 1.000 |

| 24 | (20y, 1y) | (0.383, -0.409) | 1.231 | 0.671 | 0.892 | -0.391 | -0.283 | 1.016 |

| Panel B. Simple spread of the ML pair | ||||||||

| 3 | (10y, 6m) | (0.956, -0.956) | 0.810 | 0.523 | -0.319 | -0.380 | 0.987 | |

| 6 | (10y, 6m) | (1.274, -1.274) | 0.879 | 0.657 | -0.279 | -0.353 | 0.989 | |

| 9 | (10y, 3m) | (1.396, -1.396) | 0.901 | 0.780 | -0.263 | -0.289 | 1.000 | |

| 12 | (7y, 3m) | (1.342, -1.342) | 0.892 | 0.861 | -0.280 | -0.250 | 1.008 | |

| 15 | (7y, 3m) | (1.119, -1.119) | 0.857 | 0.898 | -0.308 | -0.247 | 1.001 | |

| 18 | (20y, 3m) | (0.759, -0.759) | 0.791 | 0.916 | -0.341 | -0.252 | 1.004 | |

| 21 | (20y, 6m) | (0.599, -0.599) | 0.733 | 0.907 | -0.368 | -0.265 | 1.011 | |

| 24 | (20y, 1y) | (0.518, -0.518) | 0.669 | 0.903 | -0.390 | -0.273 | 1.026 | |

| Panel C. Generalized spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.407, -0.769) | 0.901 | 0.519 | -0.288 | -0.458 | 0.913 | |

| 6 | (10y, 3m) | (0.762, -1.094) | 0.940 | 0.630 | -0.258 | -0.416 | 0.929 | |

| 9 | (10y, 3m) | (1.031, -1.295) | 0.938 | 0.767 | -0.245 | -0.338 | 0.952 | |

| 12 | (10y, 3m) | (0.983, -1.162) | 0.915 | 0.836 | -0.271 | -0.284 | 0.974 | |

| 15 | (10y, 3m) | (0.841, -0.951) | 0.858 | 0.881 | -0.308 | -0.260 | 0.988 | |

| 18 | (10y, 3m) | (0.646, -0.738) | 0.796 | 0.893 | -0.341 | -0.263 | 0.993 | |

| 21 | (10y, 3m) | (0.438, -0.510) | 0.709 | 0.880 | -0.376 | -0.277 | 0.999 | |

| 24 | (10y, 3m) | (0.245, -0.292) | 0.619 | 0.877 | -0.403 | -0.297 | 1.002 | |

| Panel D. Simple spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.823, -0.823) | 0.794 | 0.521 | -0.333 | -0.367 | 1.000 | |

| 6 | (10y, 3m) | (1.158, -1.158) | 0.871 | 0.654 | -0.290 | -0.342 | 1.000 | |

| 9 | (10y, 3m) | (1.396, -1.396) | 0.901 | 0.780 | -0.263 | -0.289 | 1.000 | |

| 12 | (10y, 3m) | (1.258, -1.258) | 0.894 | 0.846 | -0.280 | -0.258 | 1.000 | |

| 15 | (10y, 3m) | (1.018, -1.018) | 0.850 | 0.890 | -0.312 | -0.248 | 1.000 | |

| 18 | (10y, 3m) | (0.786, -0.786) | 0.783 | 0.901 | -0.344 | -0.256 | 1.000 | |

| 21 | (10y, 3m) | (0.541, -0.541) | 0.697 | 0.890 | -0.378 | -0.276 | 1.000 | |

| 24 | (10y, 3m) | (0.305, -0.305) | 0.610 | 0.892 | -0.404 | -0.299 | 1.000 | |

Second, the optimal coefficients of the generalized term spread are close to, but different from . In predicting the 12-month-ahead recession using the training period up to 1995, the coefficients for the seven-year and three-month yields are 1.039 and , respectively. For all forecasting horizons, the coefficient of the short-term yield is bigger in magnitude than that of the associated long-term yield, suggesting that the short-term yield plays a greater role in recession prediction than implied by a simple term spread. Interestingly, we find that the larger absolute effect of the short-term yields is more pronounced, particularly when the forecasting horizon is shorter. For example, the absolute coefficient ratio of shorter- and longer-term yields is 1.744 in three-month-ahead forecasting, but this decreases to 1.382 , 1.184 , and 1.069 for six-, 12- and 24-month-ahead forecasting, respectively. This pattern implies that the ML approach may improve the simple term spread, particularly for shorter-horizon recession predictions.

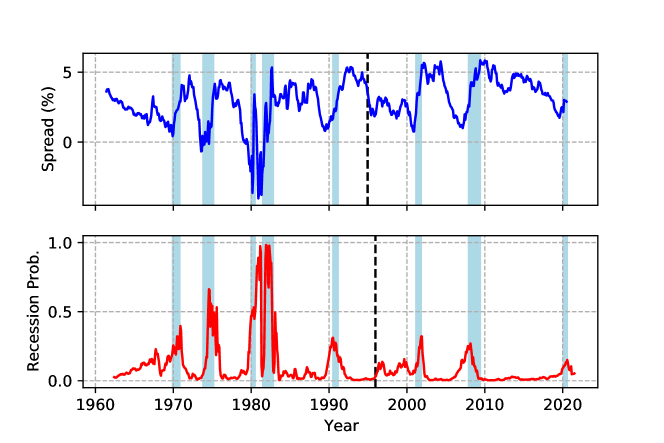

Figure 2 depicts the generalized term spread (upper panel) and the implied 12-month-ahead recession probability (lower panel). The shaded vertical bar indicates the recession periods, and the dotted black line divides the training (in-sample) and test (out-of-sample) periods. We observe clear spikes in the probability during, or ahead of, recessions. Interestingly, the most recent recession (starting March 2020) is quite precisely detected by the generalized term spread, despite the fact that we use the sample only until 1995 for the parameter estimation, and that the recession was officially announced in June 2020. This figure provides a visual validation for the generalized term spread in recession prediction.

3.2 Prediction Performance Evaluation

The key question we address in this study is whether the generalized term spread based on the machine leaning approach outperforms the simple term spread of the conventional pair. To this end, we compare the out-of-sample recession prediction performance of the four competing models; the results can be found in Table 1.

The predictive recession probability accuracy is measured by the log posterior predictive likelihood (PPL). The empirical Bayes factor (EBF) is the ratio of the PPL of an alternative model to that of the benchmark model. An EBF larger than one indicates stronger support for the alternative model than the benchmark model by the data. Table 1 shows that, for all forecasting horizons, the proposed model, (generalized spread of the ML pair), is not preferred to its nested competing models in terms of the log PPL. For the horizons of three, six, and nine months, the benchmark, (simple spread of the conventional pair), provides the best forecasts. Although (simple spread of the ML pair ) outperforms the benchmark for the other horizons, it is not statistically significant, because the largest EBF is at most 1.026. All EBFs are much less than , regardless of the horizon. Based on Jeffreys’ criterion, the evidence that any alternative model is more supported by the data than the benchmark model is very weak. Therefore, the prediction gain from choosing the maturity pair or relaxing the coefficient restriction is not substantial.444We also examine the relative mean squared error (RM) as an alternative forecast evaluation criterion as in Mincer1969 and Racicot et al. (2007), and reach the consistent conclusion. Specifically, we find that RMs are mostly greater than 1 and the smallest value is 0.964, meaning that the forecast error of a considered model is not much smaller than that of the benchmark model. The results are available upon request.

The poor out-of-sample prediction performance of the proposed model seems to arise from the inefficiency in the coefficient estimation, as pointed out in the equity return prediction literature (Welch and Goyal, 2008; DeMiguel et al., 2009). The pair selection itself, which is relatively less subject to the estimation error, could still be conducive to improving the recession prediction. We can easily test this conjecture by comparing the models (simple spread of the ML pair) and (generalized spread of the conventional pair). Given that the EBF measures the prediction performance of an alternative model relative to the benchmark, the reciprocal of the EBFs of (simple spread of the ML pair) presents the inefficiency from the pair selection. Similarly, the reciprocal of the EBFs of (generalized spread of the conventional pair) quantifies the coefficient estimation risk. The EBFs from the simple spread of the ML pair are larger than or equal to those from the generalized spread of the conventional pair, regardless of the horizon. As a result, the inefficiency is attributed more to the coefficient estimation than it is to the pair selection.

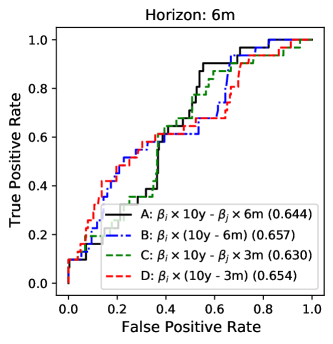

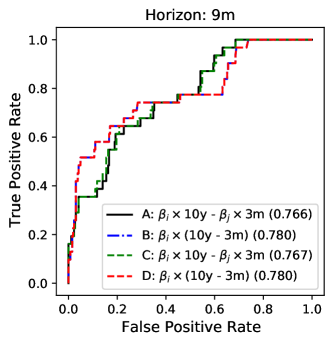

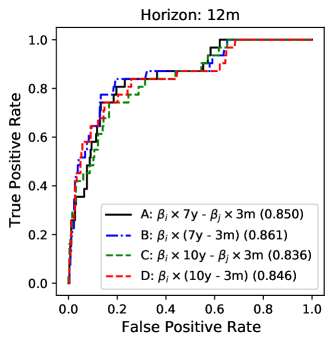

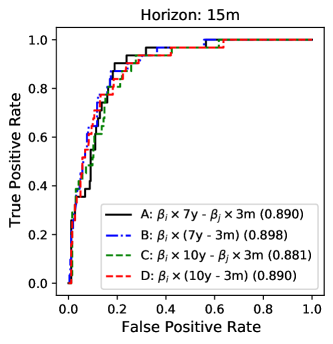

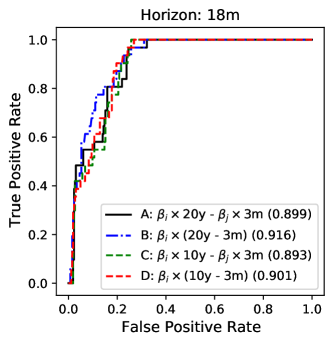

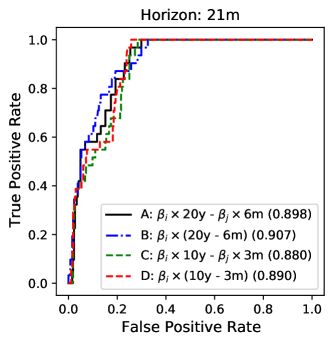

We evaluate the area under the ROC curve (hereafter, ROC-AUC) as a supplementary performance evaluation to the log PPL. The ROC curve presents a collection of the (false positive rate, true positive rate) coordinates for various decision thresholds between zero and one. The true positive rate is the ratio of correct predictions among real recessions (i.e., related to type-II error). The false positive rate is the ratio of incorrect predictions among real non-recessions (i.e., related to type-I error). Similar to the log PPL, the ROC-AUC captures the predictive power of the model without any specific decision threshold; the value is one for a perfect model, and 0.5 for a random guess. The ROC-AUC is an established performance measure in ML (Bradley, 1997), and has recently been used in the context of recession prediction by Liu and Moench (2016), Stekler and Ye (2017), Bauer and Mertens (2018b) and Tsang and Wu (2019).

Figure 3 depicts the ROCs for six forecasting horizons, and Table 1 reports the ROC-AUCs. These results provide evidence in favor of (simple spread of the ML pair) in terms of ROC-AUC. The simple spread of the ML pair in the test period exhibits the largest ROC-AUC in most forecasting horizons. Nevertheless, the difference between the ROC-AUCs of (simple spread of the ML pair) and the benchmark is not substantial in any of the horizons.

Although not intended, our findings validate the widely used, but seemingly ad hoc conventional term spread. Recall that we attempt to find the best yield pair for recession probability prediction without imposing any restrictions. The ML approach does not base its results on economic theory or academic norms, but only on the best (in-sample) prediction performance. However, the findings support the use of the conventional 10-year and three-month term spread surprisingly well, in that the pairs from the ML similarly consist of one long- and one short-term yields, and that the coefficients have the opposite signs with similar magnitudes in the absolute sense. Although the ML approach chooses a slightly different pair from the (10-year, three-month) combination and the coefficient ratio modestly deviates from one, the resultant out-of-sample prediction performance is not distinguishable from that of the conventional term spread.

3.3 Robustness Checks

In this subsection, we conduct various robustness checks to ensure that our findings do not result from a specific choice of training/test samples or oversampling and missing variable problems.

3.3.1 Training and Test Periods

First, we try alternative training and test periods. Tables 2 and 3 show the results when the training period extends to 2005 and 2015, respectively. Accordingly, there are fewer recession events in the alternative test periods. Although the specific choice of the best pair varies slightly, the three key findings remain unchanged: (i) the pair chosen using ML consists of one short-term and one long-term yields, with coefficients of opposite signs; (ii) (simple spread of the ML pair) seems to be the best in terms of the log PPL, particularly for a longer forecasting horizon; and (iii) the maturity pair selection or coefficient estimation separating the effects of the short- and long-term yields does not improve the predictive accuracy significantly. In particular, the largest EBFs in Tables 2 and 3 are 1.097 and 1.114, respectively. These EBFs imply that the model weights on the best alternative model are less than 0.53 in an empirical Bayesian model averaging framework. Consequently, the contribution of the ML approach to the improvement of the log PPL is at most marginal, if any.

| Horizon | Pair | log L | log PPL | EBF | ||||

|---|---|---|---|---|---|---|---|---|

| Panel A. Generalized spread of the ML pair | ||||||||

| 3 | (10y, 6m) | (0.414, -0.713) | 0.933 | 0.851 | 0.605 | -0.278 | -0.551 | 0.904 |

| 6 | (10y, 3m) | (0.597, -0.901) | 2.297 | 0.925 | 0.655 | -0.248 | -0.518 | 0.945 |

| 9 | (10y, 3m) | (1.174, -1.426) | 0.616 | 0.946 | 0.749 | -0.220 | -0.474 | 0.944 |

| 12 | (20y, 3m) | (0.486, -0.695) | 5.278 | 0.924 | 0.844 | -0.262 | -0.381 | 0.953 |

| 15 | (20y, 3m) | (0.659, -0.789) | 2.144 | 0.874 | 0.913 | -0.282 | -0.324 | 0.955 |

| 18 | (20y, 6m) | (0.573, -0.663) | 1.741 | 0.822 | 0.967 | -0.310 | -0.303 | 0.970 |

| 21 | (20y, 1y) | (0.636, -0.685) | 0.536 | 0.759 | 0.982 | -0.334 | -0.293 | 1.000 |

| 24 | (20y, 1y) | (0.397, -0.434) | 1.414 | 0.679 | 0.985 | -0.356 | -0.310 | 1.013 |

| Panel B. Simple spread of the ML pair | ||||||||

| 3 | (10y, 6m) | (0.907, -0.907) | 0.784 | 0.501 | -0.305 | -0.459 | 0.991 | |

| 6 | (10y, 3m) | (1.240, -1.240) | 0.870 | 0.582 | -0.266 | -0.461 | 1.000 | |

| 9 | (10y, 3m) | (1.606, -1.606) | 0.917 | 0.715 | -0.232 | -0.416 | 1.000 | |

| 12 | (20y, 3m) | (1.268, -1.268) | 0.903 | 0.802 | -0.253 | -0.368 | 0.965 | |

| 15 | (20y, 3m) | (1.023, -1.023) | 0.859 | 0.906 | -0.282 | -0.298 | 0.980 | |

| 18 | (20y, 6m) | (0.825, -0.825) | 0.809 | 0.966 | -0.309 | -0.280 | 0.992 | |

| 21 | (20y, 1y) | (0.750, -0.750) | 0.753 | 0.985 | -0.334 | -0.281 | 1.012 | |

| 24 | (20y, 1y) | (0.547, -0.547) | 0.677 | 0.988 | -0.355 | -0.294 | 1.029 | |

| Panel C. Generalized spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.399, -0.724) | 0.860 | 0.571 | -0.280 | -0.562 | 0.894 | |

| 6 | (10y, 3m) | (0.839, -1.142) | 0.926 | 0.637 | -0.244 | -0.551 | 0.914 | |

| 9 | (10y, 3m) | (1.217, -1.469) | 0.946 | 0.747 | -0.220 | -0.480 | 0.939 | |

| 12 | (10y, 3m) | (1.105, -1.290) | 0.926 | 0.838 | -0.244 | -0.377 | 0.957 | |

| 15 | (10y, 3m) | (0.864, -0.995) | 0.863 | 0.924 | -0.283 | -0.309 | 0.970 | |

| 18 | (10y, 3m) | (0.628, -0.746) | 0.799 | 0.969 | -0.315 | -0.296 | 0.977 | |

| 21 | (10y, 3m) | (0.412, -0.512) | 0.714 | 0.975 | -0.345 | -0.308 | 0.985 | |

| 24 | (10y, 3m) | (0.243, -0.315) | 0.634 | 0.977 | -0.367 | -0.329 | 0.994 | |

| Panel D. Simple spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.811, -0.811) | 0.775 | 0.478 | -0.313 | -0.450 | 1.000 | |

| 6 | (10y, 3m) | (1.240, -1.240) | 0.870 | 0.582 | -0.266 | -0.461 | 1.000 | |

| 9 | (10y, 3m) | (1.606, -1.606) | 0.917 | 0.715 | -0.232 | -0.416 | 1.000 | |

| 12 | (10y, 3m) | (1.407, -1.407) | 0.905 | 0.823 | -0.251 | -0.333 | 1.000 | |

| 15 | (10y, 3m) | (1.077, -1.077) | 0.851 | 0.920 | -0.287 | -0.279 | 1.000 | |

| 18 | (10y, 3m) | (0.811, -0.811) | 0.781 | 0.971 | -0.319 | -0.272 | 1.000 | |

| 21 | (10y, 3m) | (0.559, -0.559) | 0.695 | 0.979 | -0.348 | -0.293 | 1.000 | |

| 24 | (10y, 3m) | (0.342, -0.342) | 0.617 | 0.978 | -0.369 | -0.322 | 1.000 | |

| Horizon | Pair | log L | log PPL | EBF | ||||

|---|---|---|---|---|---|---|---|---|

| Panel A. Generalized spread of the ML pair | ||||||||

| 3 | (3y, 6m) | (0.398, -0.594) | 1.866 | 0.744 | 0.596 | -0.328 | -0.309 | 0.977 |

| 6 | (10y, 3m) | (0.302, -0.494) | 4.595 | 0.799 | 0.832 | -0.313 | -0.282 | 0.967 |

| 9 | (7y, 3m) | (0.923, -1.074) | 1.414 | 0.867 | 0.988 | -0.274 | -0.211 | 0.980 |

| 12 | (7y, 3m) | (1.033, -1.147) | 1.231 | 0.883 | 1.000 | -0.273 | -0.199 | 0.987 |

| 15 | (20y, 3m) | (0.609, -0.683) | 4.000 | 0.858 | 1.000 | -0.297 | -0.233 | 0.969 |

| 18 | (20y, 3m) | (0.481, -0.556) | 4.925 | 0.832 | 0.996 | -0.315 | -0.253 | 0.984 |

| 21 | (20y, 6m) | (0.509, -0.539) | 3.249 | 0.793 | 1.000 | -0.331 | -0.255 | 1.002 |

| 24 | (20y, 1y) | (0.631, -0.611) | 1.625 | 0.747 | 0.996 | -0.344 | -0.249 | 1.023 |

| Panel B. Simple spread of the ML pair | ||||||||

| 3 | (3y, 6m) | (1.102, -1.102) | 0.719 | 0.812 | -0.340 | -0.288 | 0.998 | |

| 6 | (10y, 3m) | (0.883, -0.883) | 0.791 | 0.902 | -0.314 | -0.248 | 1.000 | |

| 9 | (7y, 3m) | (1.337, -1.337) | 0.859 | 0.996 | -0.278 | -0.185 | 1.006 | |

| 12 | (7y, 3m) | (1.380, -1.380) | 0.876 | 1.000 | -0.274 | -0.177 | 1.009 | |

| 15 | (20y, 3m) | (0.993, -0.993) | 0.855 | 1.000 | -0.290 | -0.208 | 0.994 | |

| 18 | (20y, 3m) | (0.874, -0.874) | 0.828 | 0.988 | -0.306 | -0.232 | 1.004 | |

| 21 | (20y, 6m) | (0.725, -0.725) | 0.789 | 1.000 | -0.328 | -0.244 | 1.014 | |

| 24 | (20y, 1y) | (0.698, -0.698) | 0.748 | 0.996 | -0.344 | -0.244 | 1.028 | |

| Panel C. Generalized spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.291, -0.481) | 0.735 | 0.660 | -0.334 | -0.302 | 0.984 | |

| 6 | (10y, 3m) | (0.632, -0.795) | 0.809 | 0.864 | -0.306 | -0.260 | 0.988 | |

| 9 | (10y, 3m) | (0.984, -1.108) | 0.858 | 0.988 | -0.276 | -0.206 | 0.985 | |

| 12 | (10y, 3m) | (1.075, -1.159) | 0.875 | 1.000 | -0.276 | -0.197 | 0.989 | |

| 15 | (10y, 3m) | (1.022, -1.071) | 0.859 | 1.000 | -0.290 | -0.208 | 0.994 | |

| 18 | (10y, 3m) | (0.859, -0.910) | 0.828 | 0.992 | -0.309 | -0.240 | 0.996 | |

| 21 | (10y, 3m) | (0.648, -0.696) | 0.772 | 1.000 | -0.336 | -0.259 | 0.998 | |

| 24 | (10y, 3m) | (0.484, -0.518) | 0.714 | 0.996 | -0.359 | -0.271 | 1.000 | |

| Panel D. Simple spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.576, -0.576) | 0.699 | 0.814 | -0.348 | -0.286 | 1.000 | |

| 6 | (10y, 3m) | (0.883, -0.883) | 0.791 | 0.902 | -0.314 | -0.248 | 1.000 | |

| 9 | (10y, 3m) | (1.193, -1.193) | 0.854 | 0.996 | -0.280 | -0.191 | 1.000 | |

| 12 | (10y, 3m) | (1.230, -1.230) | 0.872 | 1.000 | -0.277 | -0.186 | 1.000 | |

| 15 | (10y, 3m) | (1.120, -1.120) | 0.857 | 1.000 | -0.290 | -0.202 | 1.000 | |

| 18 | (10y, 3m) | (0.953, -0.953) | 0.821 | 0.992 | -0.310 | -0.237 | 1.000 | |

| 21 | (10y, 3m) | (0.733, -0.733) | 0.764 | 1.000 | -0.337 | -0.258 | 1.000 | |

| 24 | (10y, 3m) | (0.542, -0.542) | 0.710 | 0.984 | -0.359 | -0.271 | 1.000 | |

Note that if the training period extends to 2005 or 2015, there are only one or two recession events in the out-of-sample data set. Thus, the prediction that recessions will be absent would be correct almost all the time. As a result, the AUC becomes close to one, particularly for long forecasting horizons, and may not work effectively as a valid measure of prediction performance.

3.3.2 Imbalanced Classification

The forecasting of recessions has a typical imbalanced classification problem in the sense that the period of a recession () forms only a small fraction of the whole sample period. In such problems, the trained models are heavily skewed to the majority class (i.e., non-recession), and the prediction on the minority class (i.e., recession) is very poor. An ML practice that avoids this issue applies a weight that is inversely proportional to the frequency of each class, which equalizes the importance of the two classes. If the ratio of the recession in the training period is , the log likelihood is modified to

| (3) |

where

This is equivalent to oversampling the recession observations times. Note that the original log likelihood, equation (2), is recovered when the recession and non-recession periods are equally balanced as .555 For the implementation, we use the “balanced” option for the class_weight parameter. Here, the ratio is understood as a model parameter inferred from the training period. As such, the same from the training period should be used for the log likelihood over the test period (i.e., log PPL).

| Horizon | Pair | log L | log PPL | EBF | ||||

|---|---|---|---|---|---|---|---|---|

| Panel A. Generalized spread of the ML pair | ||||||||

| 3 | (20y, 3m) | (0.231, -0.691) | 7.464 | 0.889 | 0.516 | -0.448 | -1.259 | 0.615 |

| 6 | (20y, 3m) | (0.576, -1.037) | 6.063 | 0.938 | 0.626 | -0.370 | -1.232 | 0.618 |

| 9 | (20y, 3m) | (0.440, -0.800) | 10.556 | 0.932 | 0.745 | -0.402 | -0.822 | 0.809 |

| 12 | (20y, 3m) | (0.361, -0.630) | 12.126 | 0.901 | 0.807 | -0.465 | -0.632 | 0.877 |

| 15 | (20y, 3m) | (0.622, -0.799) | 5.278 | 0.864 | 0.879 | -0.488 | -0.519 | 0.927 |

| 18 | (20y, 6m) | (0.720, -0.814) | 1.866 | 0.815 | 0.916 | -0.538 | -0.467 | 0.997 |

| 21 | (20y, 1y) | (0.708, -0.750) | 1.414 | 0.753 | 0.915 | -0.591 | -0.473 | 1.052 |

| 24 | (20y, 1y) | (0.413, -0.435) | 2.639 | 0.671 | 0.895 | -0.642 | -0.531 | 1.055 |

| Panel B. Simple spread of the ML pair | ||||||||

| 3 | (20y, 3m) | (0.827, -0.827) | 0.794 | 0.503 | -0.550 | -0.859 | 0.917 | |

| 6 | (20y, 3m) | (1.208, -1.208) | 0.871 | 0.640 | -0.457 | -0.866 | 0.891 | |

| 9 | (20y, 3m) | (1.384, -1.384) | 0.896 | 0.771 | -0.417 | -0.703 | 0.911 | |

| 12 | (20y, 3m) | (1.372, -1.372) | 0.886 | 0.844 | -0.432 | -0.562 | 0.940 | |

| 15 | (20y, 3m) | (1.102, -1.102) | 0.850 | 0.898 | -0.487 | -0.454 | 0.990 | |

| 18 | (20y, 6m) | (0.922, -0.922) | 0.801 | 0.924 | -0.540 | -0.436 | 1.029 | |

| 21 | (20y, 1y) | (0.846, -0.846) | 0.746 | 0.920 | -0.590 | -0.456 | 1.071 | |

| 24 | (20y, 1y) | (0.568, -0.568) | 0.669 | 0.904 | -0.639 | -0.501 | 1.087 | |

| Panel C. Generalized spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.642, -1.175) | 0.902 | 0.519 | -0.426 | -1.519 | 0.474 | |

| 6 | (10y, 3m) | (1.102, -1.655) | 0.940 | 0.631 | -0.346 | -1.443 | 0.501 | |

| 9 | (10y, 3m) | (1.354, -1.839) | 0.941 | 0.764 | -0.332 | -1.035 | 0.654 | |

| 12 | (10y, 3m) | (1.296, -1.599) | 0.916 | 0.832 | -0.387 | -0.655 | 0.857 | |

| 15 | (10y, 3m) | (0.979, -1.149) | 0.859 | 0.877 | -0.480 | -0.482 | 0.963 | |

| 18 | (10y, 3m) | (0.735, -0.845) | 0.796 | 0.893 | -0.554 | -0.467 | 0.997 | |

| 21 | (10y, 3m) | (0.478, -0.547) | 0.709 | 0.883 | -0.622 | -0.516 | 1.008 | |

| 24 | (10y, 3m) | (0.269, -0.310) | 0.616 | 0.880 | -0.668 | -0.576 | 1.009 | |

| Panel D. Simple spread of the conventional pair | ||||||||

| 3 | (10y, 3m) | (0.850, -0.850) | 0.794 | 0.522 | -0.555 | -0.772 | 1.000 | |

| 6 | (10y, 3m) | (1.270, -1.270) | 0.870 | 0.653 | -0.458 | -0.750 | 1.000 | |

| 9 | (10y, 3m) | (1.511, -1.511) | 0.901 | 0.779 | -0.409 | -0.610 | 1.000 | |

| 12 | (10y, 3m) | (1.513, -1.513) | 0.894 | 0.846 | -0.421 | -0.500 | 1.000 | |

| 15 | (10y, 3m) | (1.141, -1.141) | 0.850 | 0.889 | -0.492 | -0.444 | 1.000 | |

| 18 | (10y, 3m) | (0.851, -0.851) | 0.783 | 0.901 | -0.560 | -0.464 | 1.000 | |

| 21 | (10y, 3m) | (0.559, -0.559) | 0.697 | 0.890 | -0.625 | -0.524 | 1.000 | |

| 24 | (10y, 3m) | (0.320, -0.320) | 0.610 | 0.892 | -0.670 | -0.585 | 1.000 | |

| Horizon | Pair | log L | log PPL | EBF | |||||

|---|---|---|---|---|---|---|---|---|---|

| Panel A. Generalized spread of the ML pair | |||||||||

| 3 | (30y, 3m) | (0.632, -1.426) | 2.923 | 0.354 | 0.983 | 0.878 | -0.089 | -0.417 | 0.797 |

| 6 | (30y, 3m) | (0.364, -0.627) | 1.020 | 1.414 | 0.931 | 0.859 | -0.165 | -0.311 | 0.934 |

| 9 | (30y, 3m) | (1.005, -1.038) | 0.350 | 0.812 | 0.926 | 0.823 | -0.155 | -0.274 | 0.988 |

| 12 | (30y, 3m) | (1.091, -0.831) | 0.013 | 1.516 | 0.977 | 0.845 | -0.126 | -0.280 | 0.996 |

| 15 | (30y, 3m) | (1.752, -1.275) | 0.481 | 1.000 | 1.000 | 0.912 | -0.090 | -0.308 | 0.927 |

| 18 | (30y, 3m) | (1.375, -1.216) | -0.150 | 1.072 | 0.986 | 0.915 | -0.111 | -0.219 | 1.013 |

| 21 | (30y, 3m) | (1.130, -1.109) | -0.854 | 1.231 | 0.980 | 0.881 | -0.126 | -0.248 | 1.005 |

| 24 | (30y, 6m) | (0.688, -0.606) | -0.862 | 1.414 | 0.924 | 0.888 | -0.167 | -0.265 | 0.983 |

| Panel B. Simple spread of the ML pair | |||||||||

| 3 | (30y, 3m) | (0.886, -0.886) | 2.427 | 0.979 | 0.927 | -0.115 | -0.194 | 0.997 | |

| 6 | (30y, 3m) | (1.326, -1.326) | 1.262 | 0.939 | 0.848 | -0.150 | -0.268 | 0.975 | |

| 9 | (30y, 3m) | (1.510, -1.510) | 0.290 | 0.929 | 0.809 | -0.146 | -0.290 | 0.972 | |

| 12 | (30y, 3m) | (2.008, -2.008) | -0.499 | 0.964 | 0.821 | -0.101 | -0.300 | 0.977 | |

| 15 | (30y, 3m) | (2.307, -2.307) | -0.086 | 0.988 | 0.894 | -0.084 | -0.246 | 0.986 | |

| 18 | (30y, 3m) | (2.335, -2.335) | -0.505 | 0.990 | 0.903 | -0.084 | -0.235 | 0.998 | |

| 21 | (30y, 3m) | (2.090, -2.090) | -1.282 | 0.981 | 0.887 | -0.096 | -0.250 | 1.003 | |

| 24 | (30y, 6m) | (1.558, -1.558) | -1.291 | 0.916 | 0.897 | -0.139 | -0.244 | 1.003 | |

| Panel C. Generalized spread of the conventional pair | |||||||||

| 3 | (10y, 3m) | (0.438, -1.134) | 2.172 | 0.984 | 0.877 | -0.097 | -0.381 | 0.826 | |

| 6 | (10y, 3m) | (0.926, -1.278) | 0.968 | 0.938 | 0.792 | -0.148 | -0.350 | 0.898 | |

| 9 | (10y, 3m) | (1.300, -1.434) | 0.267 | 0.928 | 0.813 | -0.148 | -0.283 | 0.979 | |

| 12 | (10y, 3m) | (2.013, -1.708) | -0.132 | 0.981 | 0.832 | -0.096 | -0.323 | 0.954 | |

| 15 | (10y, 3m) | (2.273, -1.887) | 0.418 | 1.000 | 0.894 | -0.073 | -0.314 | 0.921 | |

| 18 | (10y, 3m) | (1.877, -1.838) | -0.224 | 0.984 | 0.894 | -0.097 | -0.228 | 1.005 | |

| 21 | (10y, 3m) | (1.630, -1.773) | -0.997 | 0.976 | 0.861 | -0.112 | -0.271 | 0.983 | |

| 24 | (10y, 3m) | (1.148, -1.188) | -1.057 | 0.895 | 0.878 | -0.157 | -0.259 | 0.989 | |

| Panel D. Simple spread of the conventional pair | |||||||||

| 3 | (10y, 3m) | (0.779, -0.779) | 2.453 | 0.974 | 0.939 | -0.123 | -0.191 | 1.000 | |

| 6 | (10y, 3m) | (1.310, -1.310) | 1.345 | 0.934 | 0.893 | -0.157 | -0.242 | 1.000 | |

| 9 | (10y, 3m) | (1.615, -1.615) | 0.394 | 0.930 | 0.821 | -0.146 | -0.261 | 1.000 | |

| 12 | (10y, 3m) | (2.222, -2.222) | -0.426 | 0.973 | 0.825 | -0.093 | -0.276 | 1.000 | |

| 15 | (10y, 3m) | (2.589, -2.589) | 0.057 | 0.998 | 0.892 | -0.071 | -0.232 | 1.000 | |

| 18 | (10y, 3m) | (2.371, -2.371) | -0.370 | 0.984 | 0.893 | -0.087 | -0.233 | 1.000 | |

| 21 | (10y, 3m) | (2.061, -2.061) | -1.179 | 0.969 | 0.869 | -0.105 | -0.253 | 1.000 | |

| 24 | (10y, 3m) | (1.366, -1.366) | -1.202 | 0.895 | 0.884 | -0.153 | -0.247 | 1.000 | |

Table 4 reports the result for the case when the training period runs until 1995. Because the ratio of the recession during the training period is approximately , the weighted regression is equivalent to oversampling the recessions six times. Under this test, our main findings remain unchanged. In particular, the superior performance of the simple term spread (Panels B and D) over the generalized term spread (Panels A and C) is more pronounced than in Table 1.

3.3.3 Control Variables

Finally, we repeat the analyses with additional recession predictors in order to account for the missing variable problem. Specifically, we include the leading business cycle indicator and ensure that the variable is always selected in the ML approach by excluding its coefficient in the penalty term.666 The US leading business cycle indicator is available from the Saint Louis Fed website. We also consider the 30-year Treasury yield, which makes our training period start from 1982. This examination shows whether the yield pair from ML has any additional predictive ability beyond that which the leading indicator already explains. It is also worth checking whether a pair with one short-term and one long-term yield is still chosen by the ML method, even when the leading indicator is already controlled.777 Because the 10-year–three-month spread is one component in the US leading indicator, we are ex ante agnostic about whether the pairs from ML are again composed of one short- and one long-term yield.

Table 5 shows that even when the leading indicator is included as a default variable, the pair choice from machine learning is rarely affected: for most forecasting horizons, one long-term and one short-term yield are still chosen, and the out-of-sample prediction performance is not improved significantly over that of the conventional 10-year–three-month pair. The weight for model averaging is again near 0.5, indicating that the performance of the pair from ML is almost equal to that of the conventional pair.888In an unreported analysis, we also examine alternative control variables such as the CBOE Volatility Index and the Pastor-Stambaugh liquidity factor, and confirm the robustness of the findings. With the alternative control variable included, the largest EBF is only 1.069, meaning that the gain from the generalized spread of the ML pair is marginal. We thank the anonymous referee for a helpful suggestion.

4 Conclusion

The ten-year and three-month term spread is widely accepted in estimating predictive recession probabilities. The contribution of our study is to provide a justification for using the conventional term spread to predict such probabilities. To this end, we formally and comprehensively test whether this prediction ability can be improved. Using the ML approach, we identify the optimal maturity pair, allowing for separate regression effects of short- and long-term interest rates. According to our empirical exercise, relaxing the restrictions on the maturity pair and coefficients does not improve the out-of-sample prediction ability of the yield spread. This is due to the dominant estimation risk, which is in line with the result of Puglia and Tucker (2020). Our finding is not sensitive to the forecasting horizon, sample period, oversampling problem, or control variable.

References

- Bauer and Mertens (2018a) Bauer, M.D., Mertens, T.M., 2018a. Economic Forecasts with the Yield Curve. FRBSF Economic Letter 2018-07. Federal Reserve Bank of San Francisco. URL: https://www.frbsf.org/economic-research/publications/economic-letter/2018/march/economic-forecasts-with-yield-curve/.

- Bauer and Mertens (2018b) Bauer, M.D., Mertens, T.M., 2018b. Information in the Yield Curve about Future Recessions. FRBSF Economic Letter 2018-20. Federal Reserve Bank of San Francisco. URL: https://www.frbsf.org/economic-research/publications/economic-letter/2018/august/information-in-yield-curve-about-future-recessions/.

- Berge and Jordà (2011) Berge, T.J., Jordà, Ò., 2011. Evaluating the Classification of Economic Activity into Recessions and Expansions. American Economic Journal: Macroeconomics 3, 246–277. doi:10.1257/mac.3.2.246.

- Bradley (1997) Bradley, A.P., 1997. The use of the area under the ROC curve in the evaluation of machine learning algorithms. Pattern Recognition 30, 1145–1159. doi:10.1016/S0031-3203(96)00142-2.

- DeMiguel et al. (2009) DeMiguel, V., Garlappi, L., Uppal, R., 2009. Optimal Versus Naive Diversification: How Inefficient is the 1/N Portfolio Strategy? The Review of Financial Studies 22, 1915–1953. doi:10.1093/rfs/hhm075.

- Döpke et al. (2017) Döpke, J., Fritsche, U., Pierdzioch, C., 2017. Predicting recessions with boosted regression trees. International Journal of Forecasting 33, 745–759. doi:10.1016/j.ijforecast.2017.02.003.

- Engstrom and Sharpe (2018) Engstrom, E.C., Sharpe, S.A., 2018. The Near-Term Forward Yield Spread as a Leading Indicator: A Less Distorted Mirror. Finance and Economics Discussion Series 2018-055. Washington: Board of Governors of the Federal Reserve System. doi:10.17016/FEDS.2018.055r1.

- Ergungor (2016) Ergungor, O.E., 2016. Recession Probabilities. Economic Commentary 2016-09. Federal Reserve Bank of Cleveland. URL: https://www.clevelandfed.org/en/newsroom-and-events/publications/economic-commentary/2016-economic-commentaries/ec-201609-recession-probabilities.aspx.

- Estrella (2005) Estrella, A., 2005. The Yield Curve as a Leading Indicator. Technical Report. Federal Reserve Bank of New York. URL: https://www.newyorkfed.org/research/capital_markets/ycfaq.html.

- Estrella and Hardouvelis (1991) Estrella, A., Hardouvelis, G.A., 1991. The Term Structure as a Predictor of Real Economic Activity. The Journal of Finance 46, 555–576. doi:10.1111/j.1540-6261.1991.tb02674.x.

- Estrella and Trubin (2006) Estrella, A., Trubin, M., 2006. The Yield Curve as a Leading Indicator: Some Practical Issues. Current Issues in Economics and Finance July/August 2006 Volume 12, Number 5. Federal Reserve Bank of New York. URL: https://www.newyorkfed.org/research/current_issues/ci12-5.html.

- Gogas et al. (2015) Gogas, P., Papadimitriou, T., Matthaiou, M., Chrysanthidou, E., 2015. Yield Curve and Recession Forecasting in a Machine Learning Framework. Computational Economics 45, 635–645. doi:10.1007/s10614-014-9432-0.

- Goyenko et al. (2011) Goyenko, R., Subrahmanyam, A., Ukhov, A., 2011. The Term Structure of Bond Market Liquidity and Its Implications for Expected Bond Returns. The Journal of Financial and Quantitative Analysis 46, 111–139. URL: https://www.jstor.org/stable/23018519.

- Gürkaynak et al. (2006) Gürkaynak, R.S., Sack, B., Wright, J.H., 2006. The U.S. Treasury Yield Curve: 1961 to the Present. Finance and Economics Discussion Series 2006-28. Washington: Board of Governors of the Federal Reserve System. URL: https://www.federalreserve.gov/pubs/feds/2006/200628/200628abs.html.

- Gürkaynak et al. (2007) Gürkaynak, R.S., Sack, B., Wright, J.H., 2007. The U.S. Treasury yield curve: 1961 to the present. Journal of Monetary Economics 54, 2291–2304. doi:10.1016/j.jmoneco.2007.06.029.

- Hall (2018) Hall, A.S., 2018. Machine Learning Approaches to Macroeconomic Forecasting. Economic Review 4th Quarter 2018. Fedral Reserve Bank of Kansas City. doi:10.18651/ER/4q18SmalterHall.

- Hastie et al. (2009) Hastie, T., Tibshirani, R., Friedman, J., 2009. The Elements of Statistical Learning: Data Mining, Inference, and Prediction, Second Edition. 2nd edition ed., New York, NY. URL: https://web.stanford.edu/~hastie/ElemStatLearn/.

- Johansson and Meldrum (2018) Johansson, P., Meldrum, A., 2018. Predicting Recession Probabilities Using the Slope of the Yield Curve. FEDS Notes. Washington: Board of Governors of the Federal Reserve System. doi:10.17016/2380-7172.2146.

- Kim and Swanson (2018) Kim, H.H., Swanson, N.R., 2018. Mining big data using parsimonious factor, machine learning, variable selection and shrinkage methods. International Journal of Forecasting 34, 339–354. doi:10.1016/j.ijforecast.2016.02.012.

- Liu and Moench (2016) Liu, W., Moench, E., 2016. What predicts US recessions? International Journal of Forecasting 32, 1138–1150. doi:10.1016/j.ijforecast.2016.02.007.

- Pedregosa et al. (2011) Pedregosa, F., Varoquaux, G., Gramfort, A., Michel, V., Thirion, B., Grisel, O., Blondel, M., Prettenhofer, P., Weiss, R., Dubourg, V., Vanderplas, J., Passos, A., Cournapeau, D., Brucher, M., Perrot, M., Duchesnay, É., 2011. Scikit-learn: Machine Learning in Python. Journal of Machine Learning Research 12, 2825–2830. URL: http://jmlr.org/papers/v12/pedregosa11a.html.

- Puglia and Tucker (2020) Puglia, M., Tucker, A., 2020. Machine Learning, the Treasury Yield Curve and Recession Forecasting. Finance and Economics Discussion Series 2020-038. Washington: Board of Governors of the Federal Reserve System. doi:10.17016/FEDS.2020.038.

- Racicot et al. (2007) Racicot, F.É., Théoret, R., Coën, A., 2007. Forecasting UHF Financial Data: Realized Volatility versus UHF-GARCH Models. International Advances in Economic Research 13, 243–244. doi:10.1007/s11294-007-9079-x.

- Rudebusch and Williams (2009) Rudebusch, G.D., Williams, J.C., 2009. Forecasting Recessions: The Puzzle of the Enduring Power of the Yield Curve. Journal of Business & Economic Statistics 27, 492–503. doi:10.1198/jbes.2009.07213.

- Stekler and Ye (2017) Stekler, H.O., Ye, T., 2017. Evaluating a leading indicator: An application—the term spread. Empirical Economics 53, 183–194. doi:10.1007/s00181-016-1200-7.

- Stock and Watson (1989) Stock, J.H., Watson, M.W., 1989. New Indexes of Coincident and Leading Economic Indicators. NBER Macroeconomics Annual 4, 351–394. doi:10.1086/654119.

- Tsang and Wu (2019) Tsang, E., Wu, M., 2019. Revisiting US Recession Probability Models. Research Memorandum 03/2019. Hong Kong Monetary Authority. URL: https://www.hkma.gov.hk/media/eng/publication-and-research/research/research-memorandums/2019/RM03-2019.pdf.

- Welch and Goyal (2008) Welch, I., Goyal, A., 2008. A Comprehensive Look at The Empirical Performance of Equity Premium Prediction. The Review of Financial Studies 21, 1455–1508. doi:10.1093/rfs/hhm014.

- Zou and Hastie (2005) Zou, H., Hastie, T., 2005. Regularization and variable selection via the elastic net. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 67, 301–320. doi:10.1111/j.1467-9868.2005.00503.x.