Sandwiched SDEs with unbounded drift driven by Hölder noises

2Department of Business and Management Science, NHH Norwegian School of Economics, Bergen

3Department of Probability, Statistics and Actuarial Mathematics, Taras Shevchenko National University of Kyiv

)

Abstract

We study a stochastic differential equation with an unbounded drift and general Hölder continuous noise of an arbitrary order. The corresponding equation turns out to have a unique solution that, depending on a particular shape of the drift, either stays above some continuous function or has continuous upper and lower bounds. Under some additional assumptions on the noise, we prove that the solution has moments of all orders. We complete the study providing a numerical scheme for the solution. As an illustration of our results and motivation for applications, we suggest two stochastic volatility models which we regard as generalizations of the CIR and CEV processes.

Keywords: sandwiched process, unbounded drift, Hölder continuous noise, numerical scheme, stochastic volatility

MSC 2020: 60H10; 60H35; 60G22; 91G30

Introduction

Stochastic differential equations (SDEs) the solutions of which take values in a given bounded domain are largely applied in several fields. Just as an illustration, we can consider the Tsallis–Stariolo–Borland (TSB) model employed in biophysics defined as

| (0.1) |

with being a standard Wiener process. If , the TSB process is “sandwiched” between and (for more details, see e.g. [17, Subsection 2.3] or [18, Chapter 3 and Chapter 8]). Another example is the Cox–Ingersoll–Ross (CIR) process [13, 14, 15] defined via the SDE of the form

Under the so-called Feller condition , the CIR process is lower bounded (more precisely, positive) a.s. which justifies its popularity in interest rates and stochastic volatility modeling in finance. Moreover, by [31, Theorem 2.3], the square root of the CIR process satisfies the SDE of the form

| (0.2) |

and SDEs (0.1) and (0.2) both have an additive noise term and an unbounded drift with points of singularity at the bounds ( for the TSB and for CIR) which have a “repelling” action so that the corresponding processes never cross or even touch the bounds.

The goal of this paper is to study a family of SDEs of the type similar to (0.1) and (0.2), namely

| (0.3) |

where where the drift is unbounded. We consider separately two cases.

-

(A)

is a real function defined on the set such that has an explosive growth of the type as , where is a given Hölder continuous function and . The we will see that the process satisfying (0.3) is lower bounded by , i.e.

(0.4) which can be called a one-sided sandwich.

-

(B)

is a real function defined on the set such that has an explosive growth of the type as and an explosive decrease of the type as , where and are given Hölder continuous functions such that , , and . We will see that in this case the solution to (0.3) turns out to be sandwiched, namely

(0.5) as a two-sided sandwich.

The noise term in (0.3) is an arbitrary -Hölder continuous noise, . Our main motivation to consider from such a general class instead of the classical Wiener process lies in the desire to go beyond Markovianity and include memory in the dynamics (0.3) via the noise term. It should be noted that the presence of memory is a commonly observed empirical phenomenon (in this regard, we refer the reader to [7, Chapter 1], where examples of datasets with long memory are collected, and to [34] for more details on stochastic processes with long memory) and the particular application which we have in mind throughout this paper comes from finance where the presence of market memory is well-known and extensively studied (see e.g. [3, 16, 37] or [36] for a detailed historical overview on the subject). In the current literature, processes with memory in the noise have been used as stochastic volatilities allowing for the inclusion of empirically detected features, such as volatility smiles and skews in long term options [11], see also [9, 10] for more details on long memory models and [23] for short memory coming from the microstructure of the market. Some studies (see e.g. [1]) indicate that the roughness of the volatility changes over time which justifies the choice of multifractional Brownian motion [4] or even general Gaussian Volterra processes [26] as drivers. Separately we mention the series of papers [28, 29, 30] that study an SDE of the type (0.2) with memory introduced via a fractional Brownian motion with :

| (0.6) |

Our model (0.3) can thus be regarded as a generalization of (0.6) accommodating a much flexible choice of noise to deal with problems of local roughness mentioned above.

In this paper, we first consider existence and uniqueness of solution to (0.3) and then focus on the moments of both positive and negative orders. We recognize that similar problems concerning equations of the type (0.3) with lower bound and the noise being a fractional Brownian motion with were addressed in [25]. There, authors used pathwise arguments to prove existence and uniqueness of the solution whereas a Malliavin calculus-based method was applied to obtain finiteness of the inverse moments. Despite its elegance, the latter technique requires the noise to be Gaussian and, moreover, is unable to ensure the finiteness of the inverse moments on the entire time interval . It should be stressed that the inverse moments are crucial for numerical simulation of (0.3) since it is necessary to control the explosive growth of the drift near bounds, and hence any limitations embedded in the techniques used to prove results on the inverse moments directly influence the convergence of the numerical schemes. These disadvantages of the Malliavin method mentioned above resulted in restrictive conditions involving all parameters of the model and in numerical schemes in e.g. [24, Theorem 4.2] and [38, Theorem 4.1].

The approach we have is to use pathwise calculus together with stopping times arguments also for the inverse moments. This allows us, on the one hand, to choose from a much broader family of noises well beyond the Gaussian framework and, on the other hand, to prove the existence of the inverse moments of the solution on the entire . The corresponding inverse moment bounds are presented in Theorems 2.6 and 3.2 and can be regarded as the main results of the paper.

This paper is organised as follows. In Section 1, the general framework is described and the main assumptions are listed. Furthermore, some examples of possible noises are provided (including continuous martingales and Gaussian Volterra processes). In Section 2, we provide existence and uniqueness of the solution to (0.3) as well as discuss property (0.4), derive upper and lower bounds for the solution in terms of the noise and study finiteness of and , . Full details of the proof of the existence are provided in the Appendix A. Section 3 is devoted to the sandwiched case (0.5): existence, uniqueness and properties of the solution are discussed. Our approach is readily put in application introducing the generalized CIR and CEV (see [2, 12]) processes in Section 4. Finally, in Section 5 we provide a modification of the standard Euler numerical scheme which we call semi-heuristic in view of the type of convergence and dependence on a random variable that cannot be computed explicitly and has to be estimated from the discretised data. The results are illustrated by simulations.

1 Preliminaries and assumptions

In this section, we present the framework and collect all the assumptions regarding both the noise and the drift functional from equation (0.3).

1.1 The noise

Fix and consider two -Hölder continuous functions , : , , such that for all . Throughout this paper, the noise term in equation (0.3) is an arbitrary stochastic process such that:

-

(Z1)

a.s.;

-

(Z2)

has Hölder continuous paths of the same order as functions and , i.e. there exists a random variable such that

(1.1)

Note that we do not require any particular assumptions on distribution of the noise (e.g. Gaussianity), but, for some results, we will need the random variable from (1.1) to have moments of sufficiently high orders. In what follows, we list several examples of admissible noises as well as properties of the corresponding random variable . In order to discuss the latter, we will use a corollary from the well-known Garsia-Rodemich-Rumsey inequality (see [22] for more details).

Lemma 1.1.

Let : be a continuous function, and . Then for all one has

with the convention , where

| (1.2) |

Note that this lemma was stated, for example, in [33] and [5] without computing the constant explicitly, but we will need the latter for the approximation scheme in section 5.

Proof.

Example 1.2 (Hölder continuous Gaussian processes).

Let be a centered Gaussian process with and be a given constant. Then, by [5], has a modification with Hölder continuous paths of any order if and only if for any there exists a constant such that

| (1.3) |

Furthermore, according to [5, Corollary 3], the class of all Gaussian processes on , , with Hölder modifications of any order consists exclusively of Gaussian Fredholm processes

with being some Brownian motion and satisfying, for all ,

where is some constant depending on .

Finally, using Lemma 1.1, one can prove that the corresponding random variable can be chosen to have moments of all positive orders. Namely, assume that and take such that . If we take

| (1.4) |

then, for any

and for all :

see e.g. [33, Lemma 7.4] for fractional Brownian motion or [5, Theorem 1] for the general Gaussian case.

In particular, the condition (1.3) presented in Example 1.2 is satisfied by the following stochastic processes.

Example 1.3 (fractional Brownian motion).

Fractional Brownian motion with (see e.g. [32]) since

i.e. has a modification with Hölder continuous paths of any order .

Example 1.4 (Gaussian Volterra processes with fBm-type kernel).

Gaussian Volterra processes

with the kernel of the form

where , and with , , such that

-

1)

, , ,

-

2)

,

-

3)

.

Under the conditions specified above, the process satisfies (see [27, Lemma 1])

and therefore has a modification with Hölder continuous paths of all orders .

Example 1.5 (multifractional Brownian motion).

The harmonizable multifractional Brownian motion with functional parameter : (for more detail on this process, see e.g. [6], [35], [19] and references therein). Namely,

where is a unique Gaussian complex-valued random measure such that for all

Also let satisfy the following assumptions:

-

1)

there exist constants such that for any

-

2)

there exist constants and such that

Then, according to Lemma 3.1 from [19], there is a constant such that for all :

and, since is clearly Gaussian, it has a Hölder continuous modification of any order .

Example 1.6 (non-Gaussian continuous martingales).

Denote a standard Brownian motion and an Itô integrable process such that, for all ,

| (1.5) |

Define

Then, by the Burkholder-Davis-Gundy inequality, for any and any :

| (1.6) | ||||

Therefore, by the Kolmogorov continuity theorem and an arbitrary choice of , has a modification that is -Hölder continuous of any order .

Next, for an arbitrary , choose such that and put

where is defined by (1.2). By the the Burkholder-Davis-Gundy inequality, for any , we obtain

Hence, using Lemma (1.1) and the Minkowski integral inequality, we have:

since , i.e. for all . Note that condition (1.5) can actually be relaxed (see e.g. [8, Lemma 14.2]).

1.2 The drift

Set . Let and , : , , , be -Hölder continuous functions, with being the same as in assumption (Z2), i.e. there exists a constant such that

For an arbitrary pair , denote

| (1.7) |

By we shall mean the set .

Consider the stochastic differential equation of the form (0.3), where and the drift is a function satisfying the following assumptions:

-

(A1)

: is continuous;

-

(A2)

for any there is a constant such that for any :

-

(A3)

there are such positive constants , and that for all :

-

(A4)

the constant from assumption (A3) satisfies condition

with being the order of Hölder continuity of , and paths of .

Example 1.7.

Let : be an arbitrary continuous function and : be such that

for some constant . Then

satisfies assumptions (A1)–(A4) (provided that ).

In section 3, we discuss the equation (0.3) in a slightly different setting. Namely, we consider as well as an alternative list of assumptions on :

-

(B1)

: is continuous;

-

(B2)

for any pair , such that there is a constant such that for any :

-

(B3)

there are constants , , and such that for all :

and for all :

-

(B4)

the constant from assumption (B3) satisfies condition

with being the order of Hölder continuity of , and paths of .

Remark 1.8.

We always assume that the initial value is a deterministic constant such that , if the drift satisfies Assumptions (A1)–(A4), and , if the drift satisfies Assumptions (B1)–(B4).

Example 1.9.

Let : , : and : be continuous and

for some constant . Then

satisfies assumptions (B1)–(B4) provided that .

2 SDE with lower-sandwiched solution case

In this section, we discuss existence, uniqueness and properties of the solution of (0.3) under assumptions (A1)–(A4). First, we demonstrate that (A1)–(A3) ensure the existence and uniqueness of the solution to (0.3) until the first moment of hitting the lower bound and then we prove that (A4) guarantees that the solution exists on the entire , since it always stays above . The latter property justifies the name lower-sandwiched in the section title.

Finally, we derive additional properties of the solution, still in terms of some form of bounds.

Remark 2.1.

Throughout this paper, the pathwise approach will be used, i.e. we fix a Hölder continuous trajectory of in most proofs. For simplicity, we omit in brackets in what follows.

2.1 Existence and uniqueness result

As mentioned before, we shall start from the existence and uniqueness of the local solution.

Theorem 2.2.

Let assumptions (A1)–(A3) hold. Then SDE (0.3) has a unique local solution in the following sense: there exists a continuous process such that

with

Furthermore, if is another process satisfying equation (0.3) on any interval , where

then and for all .

Proof.

The proof is based on careful approximation of the non-Lipschitz drift by some Lipschitz functions. The approximants are explicit and can be used for numerical purposes. Nevertheless, the proof is quite technical and we have set it in the Appendix A. ∎

Theorem 2.2 shows that equation (0.3) has a unique solution until the latter stays above . However, an additional condition (A4) on the constant from assumption (A3) allows to ensure that the corresponding process always stays above . More precisely, we have the following result.

Theorem 2.3.

Proof.

Assume that (here we assume that ). For any , where is from assumption (A3), consider

Due to the definitions of and ,

Moreover, for all : , so, using the fact that and assumption (A3), we obtain that for :

| (2.1) |

Finally, due to the Hölder continuity of and ,

Therefore, taking into account all of the above, we get:

i.e.

| (2.2) |

Now consider the function : such that

According to (2.2), for any . It is easy to verify that attains its minimum at the point

and

where . Note that, by (A4), we have . Hence it is easy to verify that there exists such that for all , which contradicts (2.2). Therefore, cannot belong to and exceeds . ∎

Remark 2.4.

-

1.

The result above can be generalized to the case of infinite time horizon in a straightforward manner. For this, it is sufficient to assume that is locally -Hölder continuous, has locally Hölder continuous paths, i.e. for each there exist constant and random variable such that

and assumptions (A1)–(A4) hold on for any (in such case, constants , and from the corresponding assumptions are allowed to depend on ).

-

2.

Since all the proofs above are based on pathwise calculus, it is possible to extend the results to stochastic and (provided that ).

2.2 Upper and lower bounds for the solution

As we have seen in the previous subsection, each random variable , , is a priori lower sandwiched by the deterministic value (under assumptions (A1)–(A4)). In this subsection, we derive additional bounds from above and below for in terms of the random variable characterizing the noise from (1.1). Furthermore, such bounds allow us to establish existence of moments of of all orders including the negative ones.

Theorem 2.5.

Let assumptions (A1)–(A4) hold and be the random variable such that

Then, for any ,

-

1)

there exist positive deterministic constants and such that

-

2)

additionally, if can be chosen in such a way that , then

Proof.

It is enough to prove item 1) for as the rest of the Theorem will then become clear. Denote and let

Our initial goal is to prove the inequality of the form

| (2.3) |

where

and is from assumption (A2).

Similarly to Proposition A.2 in Appendix A, we get (2.3) considering the cases and separately.

Case . For any : and, therefore, by assumption (A2), for all :

hence

Therefore, taking into account that , we have:

Case . From the definition of and continuity of , . Furthermore, since for all , we can consider

Note that , so

| (2.4) | ||||

If , we have that for all , therefore, similarly to Step 1,

so

whence, taking into account (2.4), we have:

| (2.5) | ||||

Now, when we have seen that (2.3) holds for any , we apply the Gronwall’s inequality to get

where

∎

Hereafter we provide further specifications on the solution bounds. For this, recall that, for all , the lower sandwich function satisfies

and the noise satisfies (Z2):

where is a deterministic constant and is a positive random variable.

Theorem 2.6.

Let assumptions (A1)–(A4) hold and be the random variable such that

Then, for any ,

-

1)

there exists a constant depending only on , , , and the constant from assumption (A3) such that for all :

(2.6) where

with

-

2)

additionally, if can be chosen in such a way that , then

Proof.

Just as in Theorem 2.5, it is enough to prove that there exists a constant that depends only on , , and the constant from assumption (A3) such that for all

and then the rest of the Theorem will follow.

Put

Note that is chosen is such a way that

and, furthermore, and . Fix an arbitrary . If , then, by definition of , estimate of the type (2.6) holds automatically. If , then, since , one can define

Since for all , one can apply Assumption (A3) and write

Consider the function such that

It is straightforward to verify that attains its minimum at

and, taking into account the explicit form of ,

i.e., if , we have that

and thus for any

where . By this, the proof is complete. ∎

Remark 2.7.

Remark 2.8.

The constant from Theorem 2.6 can be explicitly written as

3 SDE with sandwiched solution case

The fact that, under assumptions (A1)–(A4), the solution of (0.3) stays above the function is essentially based on the rapid growth to infinity of whenever approaches , . The same effect is exploited in the case of assumptions (B1)–(B4) and the corresponding solution turns out to be both upper and lower bounded, i.e. sandwiched.

Recall that , : , , , are -Hölder continuous functions, . Consider a stochastic differential equation of the form (0.3) with , being, as before, a stochastic process with -Hölder continuous trajectories and the drift satisfying assumptions (B1)–(B4).

In line with the previous section, we show that the solution exists and it is sandwiched.

Theorem 3.1.

Let assumptions (B1)–(B4) hold. Then the equation (0.3) has a unique solution such that

| (3.1) |

Proof.

The proof uses the techniques presented in Appendix A and section 2 in a straightforward manner, so full details will be omitted. Here we present only the kernel points.

First, let , with being from assumption (B3). For an arbitrary define the set

and consider the stochastic process that is the solution to the stochastic differential equation of the form

where

Observe that each satisfies assumptions (A1)–(A4). Therefore, by Theorem 2.3, each , , exists, is unique and exceeds . Furthermore, by the virtue of Theorem 2.6,

where is a positive random variable that does not depend on . In other words, each is, in fact, a unique solution to the equation

with

Now, following Appendix A, it is easy to verify that , , is correctly defined and is a unique stochastic process that satisfies (0.3) until the first moment of crossing , . The given claim follows by the argument similar to the one in Theorem 2.3. ∎

Similarly to Theorem 2.6, the bounds (3.1) obtained in the existence–uniqueness Theorem 3.1 can be refined.

Theorem 3.2.

Let be fixed.

-

1.

Under conditions (B1)–(B4), there exists a constant depending only on , and the constant from assumption (B3) such that the solution to the equation (0.3) has the property

where

with

and being such that

-

2.

If can be chosen in such a way that , then

Proof.

The proof is similar to the one of Theorem 2.6. ∎

4 Applications: generalized CIR and CEV processes

In this section, we show how two classical processes used in stochastic volatility modeling can be generalized under our framework.

4.1 CIR and CEV processes driven by a Hölder continuous noise

Let . Consider

where , are positive constants, , and the process is a process with -Hölder continuous paths with . It is easy to verify that for assumptions (A1)–(A4) hold and the prosess satisfying the stochastic differential equation

| (4.1) |

exists, is unique and positive. Furthermore, as it is noted in Theorems 2.5 and 2.6, if the corresponding Hölder continuity constant can be chosen to have all positive moments, will have moments of all real orders, including the negative ones.

The process such that

can be interpreted as a generalization of CIR (if ) or CEV (if ) process in the following sense. Assume that . Fix the partition where , . It is clear that

so, using the Taylor’s expansion, we obtain that

with being a real value between and .

Using equation (4.1) and Theorem 2.6, it is easy to prove that has trajectories which are -Hölder continuous, therefore, since ,

| (4.2) |

and

| (4.3) |

Note that the integral with respect to in (4.3) exists as a pathwise limit of Riemann-Stieltjes integral sums due to sufficient Hölder continuity of both the integrator and integrand, see e.g. [39].

Taking into account all of the above, the satisfies (pathwisely) the stochastic differential equation of the CIR (or CEV) type, namely

| (4.4) |

where the integral with respect to is the pathwise Riemann-Stieltjes integral.

Remark 4.1.

The integral arising above is a pathwise Young integral, see e.g. [20, Section 4.1] and references therein.

Remark 4.2.

Note that the reasoning described above also implies that, for and , the SDE (4.4), where the integral w.r.t. is understood pathwisely, has a unique strong solution in the class of non-negative stochastic processes with -Hölder continuous trajectories. Indeed, with defined by (4.1) is a solution to (4.4). Moreover, if is another solution to (4.4), then by the chain rule [39, Theorem 4.3.1], the process must satisfy the SDE (4.1) until the first moment of zero hitting. However, the SDE (4.1) has a unique solution that never hits zero and thus coincides with .

4.2 Mixed-fractional CEV-process

Assume that , , , are positive constants, is a standard Wiener process, is a fractional Brownian motion independent of with , , is such that and the function has the form

Then the process defined by the equation

| (4.5) |

exists, is unique, positive and has all the moments of real orders.

If , just as in subsection 4.1, the process , , can be interpreted as a generalization of the CEV-process.

Proposition 4.4.

Let . Then the process , , a.s. satisfies the SDE of the form

| (4.6) |

where the integral with respect to is the regular Itô integral (w.r.t. filtration generated jointly by ) and the integral with respect to is understood as the -limit of Riemann-Stieltjes integral sums.

Proof.

We will use the argument that is similar to the one presented in subsection 4.1 with one main difference: since we are going to treat the integral w.r.t. the Brownian motion as a regular Itô integral, all the convergences (including convergence of integral sums w.r.t. ) must be considered in -sense. For reader’s convenience, we split the proof into several steps.

Step 1. First, we will prove that the integral is well defined as the -limit of Riemann-Stieltjes integral sums. Let be a partition of with the mesh .

Choose , and such that and , . Using Theorem 2.6 and the fact that for any the random variable which corresponds to the noise and Hölder order can be chosen to have moments of all orders, it is easy to prove that there exists a random variable having moments of all orders such that

By the Young-Lóeve inequality (see e.g. [21, Theorem 6.8]), it holds a.s. that

where

with supremum taken over all partitions of .

It is clear that, a.s.,

and, similarly,

where has moments of all orders and

whence

as . It is now enough to note that each Riemann-Stieltjes sum is in (thanks to the fact that for all ), so the integral is indeed well-defined as the -limit of Riemann-Stieltjes integral sums.

Step 2. Now, we would like to get representation (4.6). In order to do that, one should follow the proof of the Itô formula in a similar manner to subsection 4.1. Namely, for a partition one can write

where is a value between and .

Note that, using Theorems 2.5 and 2.6, it is easy to check that for any there exists a random variable having moments of all orders such that

Furthermore, by Theorem 2.5 (for ) and Theorem 2.6 (for ), it is clear that there exists a random variable that does not depend on the partition and has moments of all orders such that , whence

Using Step 1, it is also straightforward to verify that

and

which concludes the proof. ∎

5 Semi-heuristic Euler discretization scheme and simulations

In this section, we present simulated paths of the sandwiched process based on a semi-heuristic approximation approach. One must note that it does not have the virtue of giving sandwiched discretized process and has worse convergence type in comparison to some alternative schemes (see, for example, [24, 38] for the case of fractional Brownian motion), but, on the other hand, allows much weaker assumptions on both the drift and the noise and is much simpler from the implementation point of view.

5.1 Numerical scheme and convergence results

We first consider the setting of assumptions (A1)–(A4). Additionally, we require local Hölder continuity of the drift with respect to in the following sense:

-

(A5)

for any there is such that for any , :

Obviously, without loss of generality one can assume that the constant is the same for assumptions (A2) and (A5).

We stress that the drift is not globally Lipschitz and, furthermore, for any , the value is not defined for . Hence classical Euler approximations applied directly to the equation (0.3) fail since such scheme does not guarantee that the discretized version of the process stays above .

A straightforward way to overcome this issue is to discretize not the process itself, but its approximation obtained by “leveling” the singularity in the drift. Namely, let , where is from Assumption (A3). For an arbitrary define the set

and consider the functions : of the form

| (5.1) |

Denote , and observe that

| (5.2) |

where denotes the constant from assumptions (A2) and (A5) which corresponds to . In particular, this implies that the SDE

| (5.3) |

has a unique pathwise solution which can be approximated by the Euler scheme.

Remark 5.1.

In this section, by we will denote any positive constant that does not depend on order of approximation or the the partition and the exact value of which is not important. Note that may change from line to line (or even within one line).

Regarding the process , we have the following result.

Proposition 5.2.

Let assumptions (A1)–(A4) hold. Then, for any , there exists a constant that does not depend on such that

Proof.

First, consider . It is easy to see that there exists that does not depend such that

therefore there exists such that

hence, by Gronwall’s inequality,

for some constant .

Since

we immediately get the following corollary.

Corollary 5.1.

Under assumptions (A1)–(A4), there exists a constant that does not depend on such that

Before proceeding to the main theorem of the section, let us provide another simple auxiliary proposition.

Proposition 5.3.

Let assumptions (A1)–(A4) hold. Assume also that the noise satisfying Assumptions (Z1)–(Z2) is such that

for some such that with from assumption (A3) and a positive constant . Then

Proof.

Finally, let be a uniform partition of , , , . For the given partition, we introduce

| (5.4) |

For any , denote

| (5.5) |

For each , define also the function : by

and consider

| (5.6) |

Remark 5.4.

It is easy to see that . Moreover, as . Indeed, by the definition of , for any fixed and

and hence . Now, consider an arbitrary and take with denoting the integer part. Then

for all . On the other hand, by assumption (A3),

for all which, by assumption (A1), implies that for each

i.e. . This, together with being decreasing, yields that as .

Theorem 5.5.

Proof.

Just like in the proof of Proposition 5.3, observe that

where

and note that the condition implies that

It is clear that

Let is estimate both terms in the right-hand side of the inequality above separately. Observe that

with defined by (5.6). Consider the set

and note that

i.e., for all the path satisfies the equation (5.3) and thus coincides with . Whence

By Theorem 2.5 and Corollary 5.1 applied w.r.t. ,

and, by Proposition 5.3, there exists a constant such that

Therefore, there exists a constant that does not depend on or such that

| (5.7) |

Remark 5.6.

The sandwiched case presented in section 3 can be treated in the same manner. Instead of assumption (A5), one should use the following one:

-

(B5)

for any , , there is a constant such that for any , :

where is defined by (1.7). Namely, let

where is from Assumption (B3). For an arbitrary define

and consider the functions : of the form

| (5.8) |

where

and

Denote , and observe that

| (5.9) |

where denotes the constant from assumptions (B2) and (B5) which corresponds to . In particular, this implies that the SDE

| (5.10) |

has a unique pathwise solution and, just like in the one-sided case, can be simulated via the standard Euler scheme:

| (5.11) |

Now, for each denote

and define

| (5.12) |

Similarly to the one-seded case, it is straightforward to prove that , .

Now we are ready to formulate the two-sided counterpart of Theorem 5.5.

Theorem 5.7.

Remark 5.8.

Theorems 5.5 and 5.7 guarantee convergence for all , but in practice the scheme performs much better for close to 1. The reason is as follows: in order to make small, one has to consider large values of ; this results in larger values of that, in turn, have to be “compensated” by the denominator . The bigger is , the smaller values of (and hence of ) can be.

5.2 Simulations

To conclude the work, we illustrate the results presented in this paper using the semi-heuristic Euler approximation scheme considered previously. Note that the scheme does not guarantee that the discretized process remains between and , but in practice the property of being sandwiched is not violated to a big extent (see below). All the simulations are performed in the R programming language on the system with Intel Core i9-9900K CPU and 64 Gb RAM. In order to simulate paths of fractional Brownian motion, R package somebm is used.

5.2.1 Simulation 1: square root of fractional Cox–Ingersoll–Ross process

As the first example, consider a particular example of the process described in subsection 4.1, namely the square root of the fractional Cox–Ingersoll-Ross process:

| (5.13) |

where , , and are positive constants and is a fractional Brownian motion with Hurst index . Note that such process is a convenient subject for testing our approximation scheme since [24, Theorem 4.1] gives an alternative backward Euler approximation method for it and one can use that algorithm as a reference for performance evaluation.

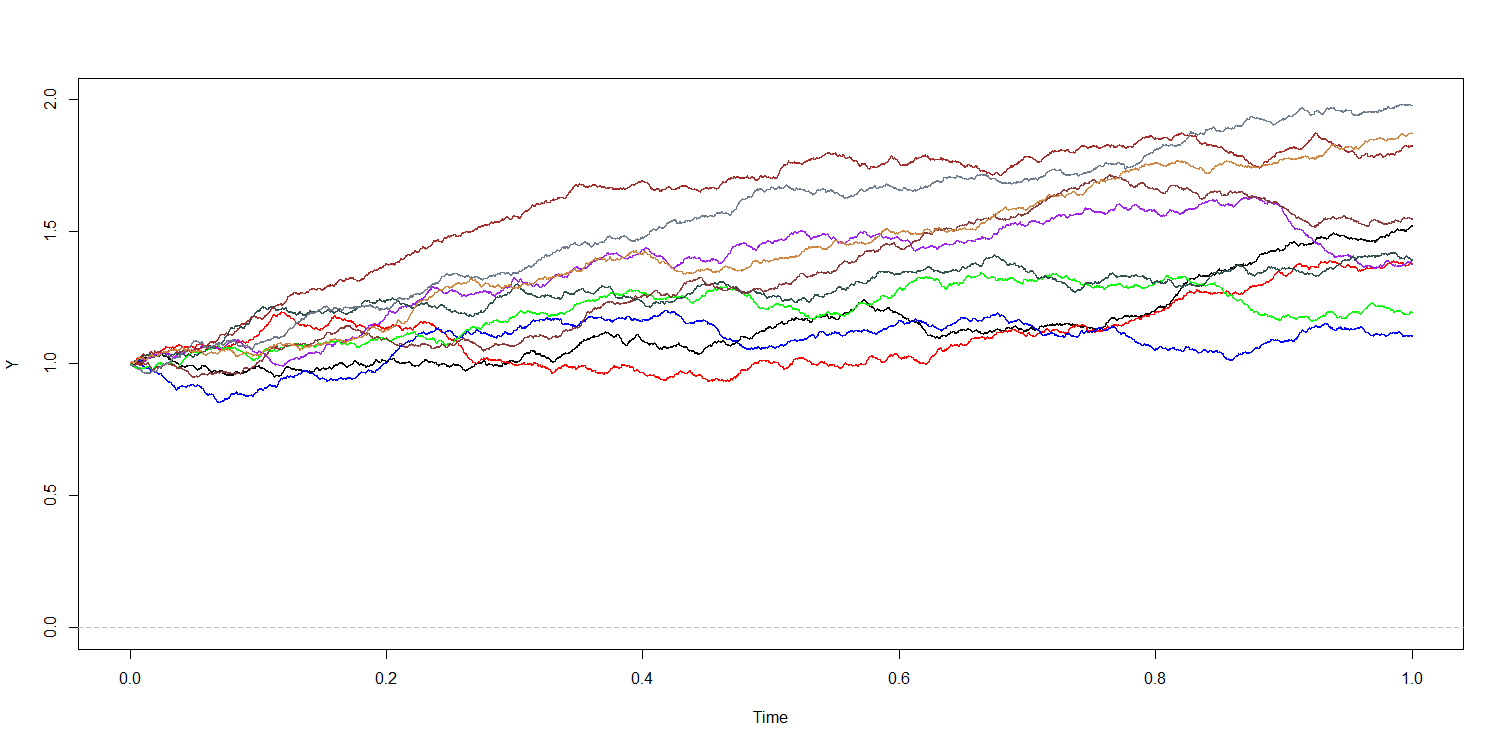

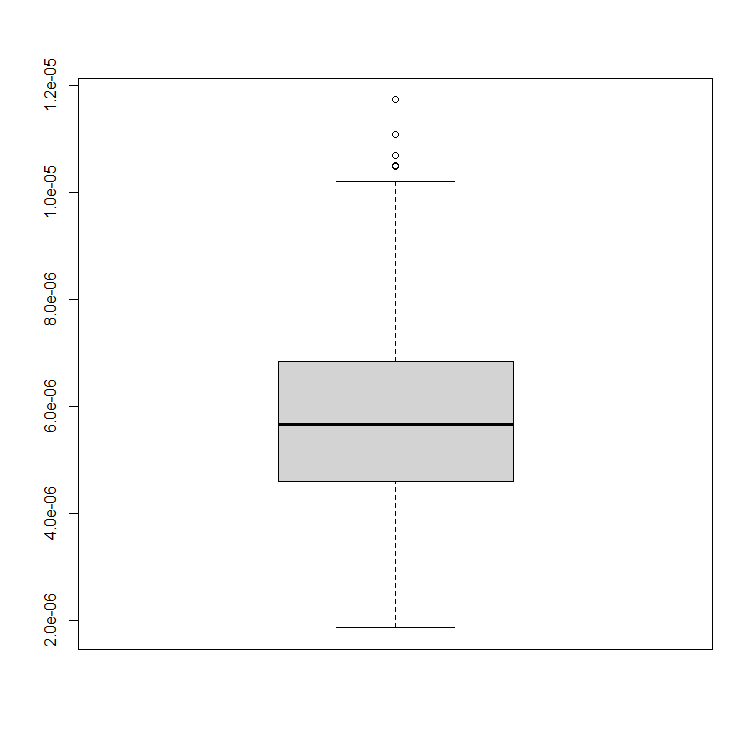

In our simulations, we take , , , , , , (these values of parameters satisfy conditions of [24, Theorem 4.1]). For the semi-heuristic Euler scheme, we take . We generated 1000 paths of fractional Brownian motion and used them to simulate the process (5.13) with the semi-heuristic Euler approximation method (10 trajectories are given on Fig. 1) and with the algorithm from [24]. On average, simulation time of one path using the semi-heuristic Euler scheme was slightly slower in comparison to the backward Euler scheme (0.08577108 seconds versus 0.03191614 seconds).

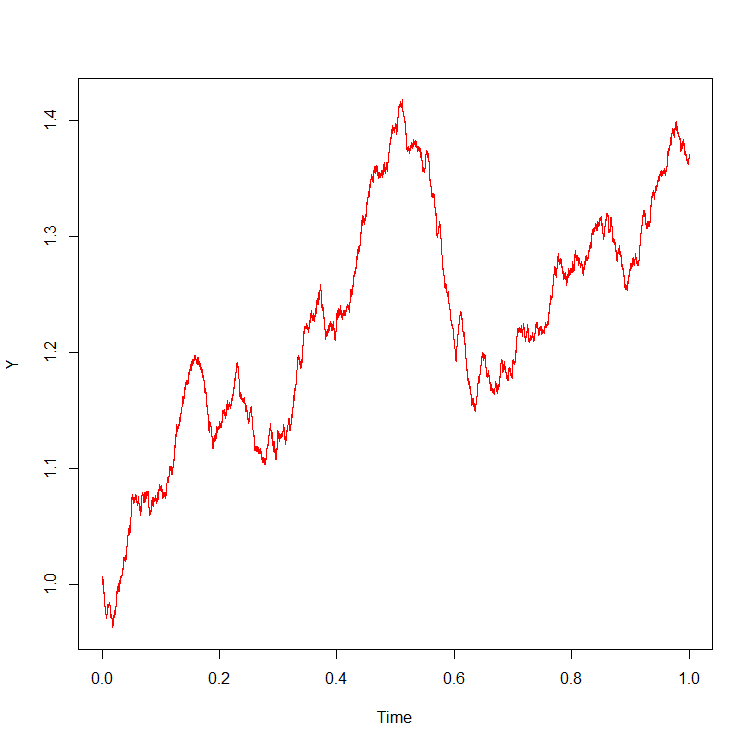

Afterwards, we calculated

| (5.14) |

for the corresponding generated paths ( above denotes the backward Euler scheme from [24]). The boxplot of values (5.14) based on 1000 simulations is given on Fig. 2(a). As we can see, both schemes give almost identical results with the value (5.14) taking values roughly between and . In fact, paths generated with these two methods are indistinguishable on the plots (see Fig. 2(b)) despite worse convergence rate of the semi-heuristic scheme provided by Theorem 5.5. Moreover, all 1000 paths of (5.13) simulated with the semi-heuristic method stay above 0.

(a)

(b)

5.2.2 Simulation 2: two-sided sandwiched process with equidistant bounds

As the second example, we take

| (5.15) |

with

In all simulations, , . Simulation of one trajectory takes approximately 0.1601701 seconds. All 1000 generated paths (10 of simulated paths are presented on Fig. 3) stay between the bounds without crossing them.

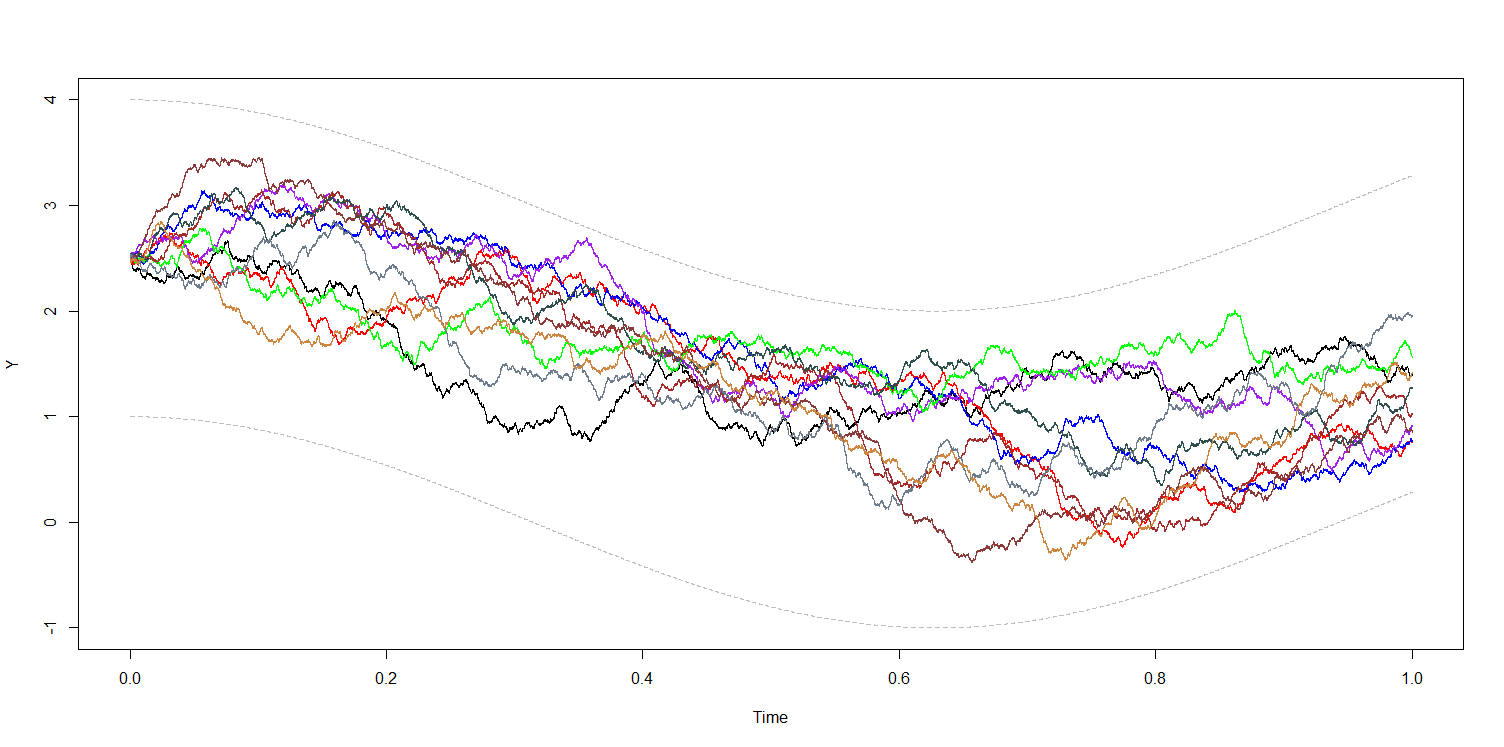

5.2.3 Simulation 3: two-sided sandwiched process with shrinking bounds

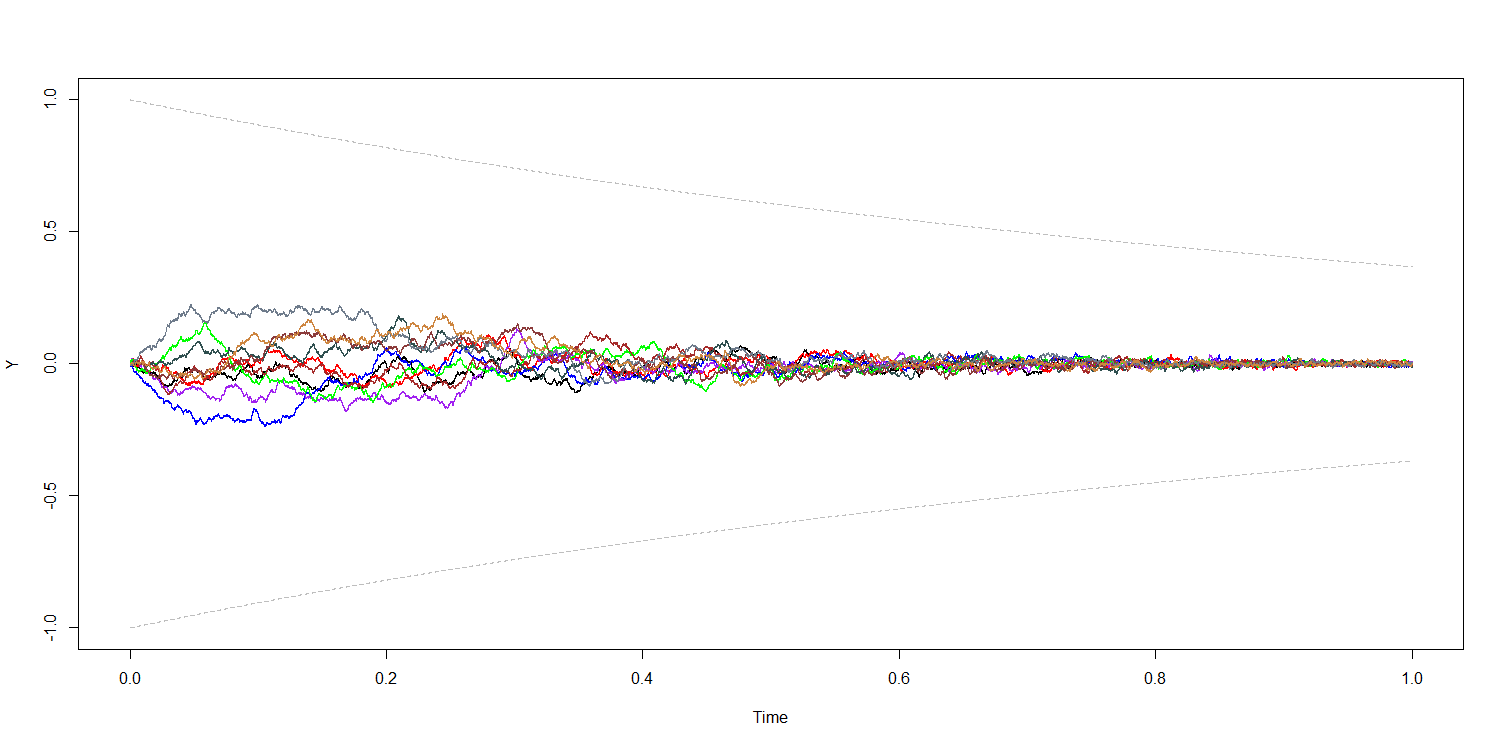

As the final example, we consider

| (5.16) |

with

Once again, , . Simulation of one trajectory takes approximately 0.1575801 seconds and all 1000 generated paths (10 of simulated paths are presented on Fig. 4) stay between the bounds without crossing them.

Acknowledgements

The present research is carried out within the frame and support of the ToppForsk project nr. 274410 of the Research Council of Norway with title STORM: Stochastics for Time-Space Risk Models. The second author is supported by the Ukrainian research project ”Exact formulae, estimates, asymptotic properties and statistical analysis of complex evolutionary systems with many degrees of freedom” (state registration number 0119U100317).

References

- [1] Alfi, V., Coccetti, F., Petri, A., and Pietronero, L. Roughness and finite size effect in the NYSE stock-price fluctuations. The European physical journal. B 55, 2 (2007), 135–142.

- [2] Andersen, L. B. G., and Piterbarg, V. V. Moment explosions in stochastic volatility models. Finance and Stochastics 11, 1 (Sept. 2006), 29–50.

- [3] Anh, V., and Inoue, A. Financial Markets with Memory I: Dynamic Models. Stochastic Analysis and Applications 23, 2 (Jan. 2005), 275–300.

- [4] Ayache, A., and Peng, Q. Stochastic volatility and multifractional Brownian motion. In Stochastic Differential Equations and Processes (2012), Springer Berlin Heidelberg, p. 211–237.

- [5] Azmoodeh, E., Sottinen, T., Viitasaari, L., and Yazigi, A. Necessary and sufficient conditions for Hölder continuity of Gaussian processes. Statist. Probab. Lett. 94 (2014), 230–235.

- [6] Benassi, A., Jaffard, S., and Roux, D. Elliptic Gaussian random processes. Revista Matemática Iberoamericana 13, 1 (1997), 19–90.

- [7] Beran, J. Statistics for Long-Memory Processes. Chapman and Hall/CRC, 1994.

- [8] Boguslavskaya, E., Mishura, Y., and Shevchenko, G. Replication of Wiener-transformable stochastic processes with application to financial markets with memory. In Stochastic Processes and Applications (Cham, 2018), S. Silvestrov, A. Malyarenko, and M. Rančić, Eds., Springer International Publishing, pp. 335–361.

- [9] Bollerslev, T., and Mikkelsen, H. O. Modeling and pricing long memory in stock market volatility. Journal of Econometrics 73, 1 (July 1996), 151–184.

- [10] Chronopoulou, A., and Viens, F. G. Estimation and pricing under long-memory stochastic volatility. Annals of Finance 8, 2-3 (May 2010), 379–403.

- [11] Comte, F., Coutin, L., and Renault, E. Affine fractional stochastic volatility models. Annals of Finance 8, 2-3 (July 2010), 337–378.

- [12] Cox, J. C. The constant elasticity of variance option pricing model. The Journal of Portfolio Management 23, 5 (1996), 15–17.

- [13] Cox, J. C., Ingersoll, J. E., and Ross, S. A. A re-examination of traditional hypotheses about the term structure of interest rates. The Journal of Finance 36, 4 (Sept. 1981), 769–799.

- [14] Cox, J. C., Ingersoll, J. E., and Ross, S. A. An intertemporal general equilibrium model of asset prices. Econometrica 53, 2 (Mar. 1985), 363.

- [15] Cox, J. C., Ingersoll, J. E., and Ross, S. A. A theory of the term structure of interest rates. Econometrica 53, 2 (Mar. 1985), 385.

- [16] Ding, Z., Granger, C. W., and Engle, R. F. A long memory property of stock market returns and a new model. Journal of Empirical Finance 1, 1 (June 1993), 83–106.

- [17] Domingo, D., d’Onofrio, A., and Flandoli, F. Properties of bounded stochastic processes employed in biophysics. Stochastic Analysis and Applications 38, 2 (Dec. 2019), 277–306.

- [18] d’Onofrio, A., Ed. Bounded Noises in Physics, Biology, and Engineering. Springer New York, 2013.

- [19] Dozzi, M., Kozachenko, Y., Mishura, Y., and Ralchenko, K. Asymptotic growth of trajectories of multifractional Brownian motion, with statistical applications to drift parameter estimation. Stat. Inference Stoch. Process. 21, 1 (2018), 21–52.

- [20] Friz, P. K., and Hairer, M. A Course on Rough Paths. Springer International Publishing, 2014.

- [21] Friz, P. K., and Victoir, N. B. Multidimensional Stochastic Processes as Rough Paths: Theory and Applications. Cambridge Studies in Advanced Mathematics. Cambridge University Press, 2010.

- [22] Garsia, A., Rodemich, E., and Rumsey, H. A real variable lemma and the continuity of paths of some Gaussian processes. Indiana Univ. Math. J. 20 (1970), 565–578.

- [23] Gatheral, J., Jaisson, T., and Rosenbaum, M. Volatility is rough. Quantitative Finance 18, 6 (Mar. 2018), 933–949.

- [24] Hong, J., Huang, C., Kamrani, M., and Wang, X. Optimal strong convergence rate of a backward Euler type scheme for the Cox–Ingersoll–Ross model driven by fractional Brownian motion. Stochastic Processes and their Applications 130, 5 (2020), 2675 – 2692.

- [25] Hu, Y., Nualart, D., and Song, X. A singular stochastic differential equation driven by fractional Brownian motion. Statistics & Probability Letters 78, 14 (2008), 2075 – 2085.

- [26] Merino, R., Pospíšil, J., Sobotka, T., Sottinen, T., and Vives, J. Decomposition formula for rough Volterra stochastic volatility models. International journal of theoretical and applied finance 24, 02 (2021), 2150008.

- [27] Mishura, Y., Shevchenko, G., and Shklyar, S. Gaussian processes with Volterra kernels. arXiv:2001.03405 (2020).

- [28] Mishura, Y., and Yurchenko-Tytarenko, A. Fractional Cox–Ingersoll–Ross process with non-zero “mean”. Modern Stochastics: Theory and Applications 5, 1 (2018), 99–111.

- [29] Mishura, Y., and Yurchenko-Tytarenko, A. Fractional Cox–Ingersoll–Ross process with small Hurst indices. Modern Stochastics: Theory and Applications 6, 1 (2018), 13–39.

- [30] Mishura, Y., and Yurchenko-Tytarenko, A. Approximating Expected Value of an Option with Non-Lipschitz Payoff in Fractional Heston-Type Model. International Journal of Theoretical and Applied Finance (June 2020).

- [31] Mishura, Y., and Yurchenko-Tytarenko, A. Standard and fractional reflected Ornstein-Uhlenbeck processes as the limits of square roots of Cox-Ingersoll-Ross processes. arXiv: 2109.13619 (2021).

- [32] Nourdin, I. Selected Aspects of Fractional Brownian Motion. Springer Milan, 2012.

- [33] Nualart, D., and Rascanu, A. Differential equations driven by fractional Brownian motion. Collectanea Mathematica 53, 1 (2002), 55–81.

- [34] Samorodnitsky, G. Stochastic Processes and Long Range Dependence. Springer International Publishing, 2016.

- [35] Stoev, S. A., and Taqqu, M. S. How rich is the class of multifractional Brownian motions? Stochastic Process. Appl. 116, 2 (2006), 200–221.

- [36] Tarasov, V. On history of mathematical economics: Application of fractional calculus. Mathematics 7, 6 (June 2019), 509.

- [37] Yamasaki, K., Muchnik, L., Havlin, S., Bunde, A., and Stanley, H. E. Scaling and memory in volatility return intervals in financial markets. Proceedings of the National Academy of Sciences 102, 26 (June 2005), 9424–9428.

- [38] Zhang, S.-Q., and Yuan, C. Stochastic differential equations driven by fractional Brownian motion with locally Lipschitz drift and their implicit Euler approximation. Proceedings of the Royal Society of Edinburgh: Section A Mathematics (2020), 1–27.

- [39] Zähle, M. Integration with respect to fractal functions and stochastic calculus. i. Probability theory and related fields 111, 3 (1998), 333–374.

Appendix A Appendix: Existence of the local solution

In this Appendix, we give a proof of Theorem 2.2 on the existence of the solution to (0.3) under assumptions (A1)–(A3) until the first moment of hitting by the latter. Note that it would be possible to prove this result using a modification of the standard Picard iteration argument, but we choose a different strategy: we approximate the non-Lipschitz drift of (0.3) by a sequence of the Lipschitz ones, obtain a monotonically increasing sequence of processes and prove that their limit is the only solution. Choice of such a method is explained by two points. First, without assumption (A4), the solution may hit and the limiting procedure described in this Appendix allows to see (up to some extent) what happens beyond this moment. Second, the pre-limit processes are very easy to simulate, so they can be used for numerical schemes.

Before going to the proof of Theorem 2.2, we will require several auxiliary results. Let , where is from Assumption (A3). For an arbitrary define the set

and consider the functions : of the form

| (A.1) |

.

Note that each is Lipschitz continuous, i.e. for all there exists the constant that depends on but does not depend on such that

Using this fact, it is straightforward to prove by the standard fixed point argument that the stochastic differential equation of the form

| (A.2) |

has a pathwisely unique solution.

In order to progress, we will require a simple comparison-type result.

Lemma A.1.

Assume that continuous random processes and satisfy (a.s.) the equations of the form

where is a constant and , : are continuous functions such that for any :

Then a.s. for any .

Proof.

The proof is straightforward. Denote

and observe that and that the function is differentiable with

It is clear that , , whence there exists the maximal interval such that for all . It is also clear that

Assume that . By the definition of and continuity of , . Hence and

As , , there exists such that for all which contradicts the definition of . Therefore and for all :

∎

It is easy to observe that for any and , whence for all and therefore one can define a limit , .

Proposition A.2.

Let assumptions (A1)–(A3) hold. Then, there is a random variable such that for any :

Proof.

Denote and consider

We shall first prove that for all :

with being a constant that does not depend on . Then the required result follows by Gronwall’s inequality.

For the reader’s convenience, we will divide the proof into several steps to separate cases and .

Step 1. Fix an arbitrary and assume that , i.e. for each .

Observe that for all

| (A.3) |

where is some constant that depends neither on nor on . Indeed, it is easy to verify using definition of and assumption (A3) that for all

Furthermore, by assumption (A2), for all

Using (A.3), for an arbitrary :

| (A.4) | ||||

Step 2. Assume . Consider

Note that and, therefore,

If , then , so . Otherwise, if , then, for any : which means that either or for all . In the first case, taking into account the monotonicity of with respect to , we have

i.e.

so

| (A.5) | ||||

In the second case, since , we can use (A.3) to obtain that

In any situation, for all :

| (A.6) | ||||

Proposition A.3.

For all : .

Proof.

Step 1. Fix an arbitrary and denote

.

Observe that, by assumption (A3), for all , and, by assumption (A2), is globally Lipschitz continuous. From Proposition A.2 we obtain that, for some constant that does not depend on and for all :

where is a finite random variable. Hence, since pointwise as , by the dominated convergence theorem,

Taking into account the convergence above and Proposition A.2, the left hand side of

converges to a finite value as for each . Therefore there exists the limit

| (A.8) |

Step 2. Let us now prove that

with being the Lebesgue measure on . Assume that it is not true. i.e. there exist and a subsequence such that for all :

In this case,

that contradicts (A.8).

This implies that , i.e. exceeds a.e. on .

Step 3. Assume that there is such that . Then, for all :

Fix an arbitrary and denote

Note that, due to continuity of and Step 2, . Furthermore, and for all : . Next, for an arbitrary :

therefore, for any :

| (A.9) |

with . However, , . Indeed,

and it is straightforward to verify that takes its minimal value on at

with

Furthermore, it is easy to see from Step 2 that , , so , , and therefore (A.9) cannot hold for all . The obtained contradiction finalizes the proof. ∎

For arbitrary positive and denote

where is from Proposition A.2, and observe that is a compact set and is continuous on it. Consider also

It is clear that because is bounded from below by continuous processes which start from the level .

Proposition A.4.

-

1.

is continuous at any such that .

-

2.

For any :

-

3.

and, furthermore, is left continuous at :

Proof.

1. Let be such that . Then there exists such that for all : . Furthermore, because of monotonicity with respect to and continuity of both and , there is such that for any : , . Furthermore, since for all and : , for all :

with . Therefore, if is such that

for any and : , whence

| (A.10) | ||||

From the choice of , for any and : , therefore, by assumption (A2) and Proposition A.2, there exists a constant that does not depend on such that for any

therefore, by dominated convergence,

which, together with (A.10), implies

Hence is continuous on and, in particular, at point .

2. Since is greater than on an arbitrary interval , it is continuous on this interval. Therefore, by Dini’s theorem, converges uniformly to , , on . Let be such that for all : , . For any and it holds that

so, if is such that , for any and : . Taking into account that

for any with , we have that, by assumption (A2), there exists a constant that does not depend on such that

whence on , . Now the claim can be verified by transition to the limit under the integral.

3. First, note that . Indeed, by Proposition A.3, for all and, if , then is continuous at and therefore exceeds on some interval , that contradicts the definition of . Now it is sufficient to verify that

Assume it is not true and there is such that

Note also that since, by Proposition A.2, is bounded from above by the (random) constant .

Let be such that for any : . Denote

and observe that and whenever .

If , for any there is such that . Let such and be fixed. Since , , there is such that for all :

It is clear that therefore, for one can consider the moment

From the continuity of , , so . On the other hand, from definition of and Proposition A.2, for all :

Let be such that

For any and :

and, therefore, we obtain that

i.e. for any :

which is not possible. The obtained contradiction implies that , i.e.

∎

Now, let us move to the proof of Theorem 2.2.

Proof of Theorem 2.2.

By Proposition A.4, indeed satisfies the equation of the required form. Let satisfy the equation (0.3) on . Then it is continuous on and therefore . Let and choose such that for all : . Then , , , where is defined by (A.1), whence

However, also satisfies the equation above and, since the latter has a unique solution, for all . Now it is easy to deduce that and for all . ∎